1/1/2015

guest EDIT,,�

1/1/2015

guest I wouldn't think they would consider selling credits part of the profit margin of the car. I could be wrong, but you aren't guaranteed to sell the credits, but you are the car. I would be really scared if they were banking on credits to be profitable. Because at 25% margins that means that they would be selling the car below cost, and using the $~35,000 to make up the difference, and provide the entire 25% margins.

If they put the credits in their margin numbers I am selling my TSLA stock immediately! I am sure they are counting on the money, but it is on TOP of their 25% margins.�

1/1/2015

guest I'm assuming that they aren't able to sell all 7 credits for each car. That would be best case scenario IMO. I don't know anything about the proper accounting practices, but my point is just that I'm sure that Tesla has some expectation for how much they will make from selling credits and that it is accounted for somewhere in the guidance that they have already given us.

I think that this news helps the stock because it makes the guidance they gave us more believable to more people.�

1/1/2015

guest EDIT,,�

1/1/2015

guest Also, the price of credits is set by supply and demand. As Tesla increases the supply, it will have to lower its offer price on the credits to sell them all.�

1/1/2015

guest Maybe. Demand is also increasing. Every year the percentage of sales that need to be zero emissions increases. Lots of moving parts.�

1/1/2015

guest We can probably expect a raging JP anti-Tesla blog tomorrow. He seems to have 2 or more a week and always puts them out whenever Tesla has any sort of good news.�

1/1/2015

guest Agreed!

I don't know which cars earn credits, or how many, but I'm going to guess that the Model S will earn so many credits that Tesla will be flooding the market and the price of credits will drop drastically. Tesla is the only car maker that will not be able to use its own credits and will have to sell all of them or lose their value. Other car makers can consume their own credits by balancing off their green cars with their stinkers. But not Tesla. Credits which fetched $5,000 to $10,000 when 500 Roadsters were generating them for the market and other companies were using theirs in house may drop to a couple of hundred dollars each when 20,000 Model S cars are generating 140,000 credits, all of which go on the market because Tesla has no use for them.

That billion dollars probably shrinks to a few million, and Tesla knows it and probably already knows what they're actually going to be worth.�

1/1/2015

guest EDIT,,�

1/1/2015

guest Yeah, if the Chinese elite can be weaned off their Audis and Buicks, it'd be a tremendous oppty for Tesla. If Tesla's retail store concept catches on, it might establish the kind of brand name cache that Apple enjoys in China.�

1/1/2015

guest Speaking of China. The consortium they largely own may have just purchased SAAB

Saab Automobile deal 'complete': report - The Local

ken�

1/1/2015

guest Speaking of China. National Electric Vehicle may have just purchased SAAB.

Saab Automobile deal 'complete': report - The Local�

1/1/2015

guest Maybe. But as the saying goes, diamonds are forever. Clean car credits have value only as long as the law supports them. If the government ever wises up and abandons the whole "cap and trade" concept, so that every manufacturer pays fines for its stinkers, and cannot buy credits from cleaner car makers, then the credits become worthless.

Also, I don't know if credits can be held over indefinitely. When you build a clean car, are those credits good forever? Or is there a use it, sell it, or lose it clause? And finally, diamond mines are very few, and De Beers has managed to create a consortium that strictly controls the diamond market. With more and more companies building EVs, clean car credits are going to proliferate, at the same time as gas prices rise and the market for stinkers decreases, so there will be less and less demand for credits.

I really don't think that clean car credits can be manipulated the way diamonds have been. They will have to sell them or watch their value disappear. And the number of EVs produced is going to rise geometrically, unlike diamonds.

(Off topic: I think diamonds are uninteresting. If ever get engaged, I'll buy my fiance an emerald ring. Much nicer stone. And if she really wants a diamond just because that's what everyone else has, I'll know that she'd be a dull person to grow old with.)�

1/1/2015

guest They are only valid for two or three years, then they expire.�

1/1/2015

guest I discovered the hard way: Emeralds have fissures and cracks. You can't drop them or bang them against anything without risking their integrity. I'd steer clear of them.�

1/1/2015

guest Petersen recently said that credits have dropped in value each year I believe.�

1/1/2015

guest I'd say the diamond industry is an example of not only restricting supply and artificially increasing prices but also artificially creating a demand as well. Unfortunately too many people buy into the hype. I agree with Daniel, I doubt I'd want to be with a woman who actually thinks a diamond ring means something. Probably why I'm single :wink:�

1/1/2015

guest You and Daniel....:wink:�

1/1/2015

guest I'll keep that in mind. They are pretty, though. Diamonds sparkle under the light, but that's about it. As a kid I got hold of a silicon crystal. A silicon crystal will scratch glass, so I went around "proving" to people that it was a diamond. No idea if anybody was dumb enough to believe me. The engagement ring thing is not likely to become an issue, though, since I'm a complete flop with women. They all think I'd make a great husband... for somebody else. Here's an idea for an engagement gift: a few hundred shares of TSLA. (Had to bring it around to the thread topic somehow. :biggrin �

�

1/1/2015

guest EDIT,,�

1/1/2015

guest Certainly more expensive. :wink:�

1/1/2015

guest I had to look up Danica Patrick. :love: Wow! I also had to look up "open wheel racing."�

1/1/2015

guest EDIT,,�

1/1/2015

guest +1....�

1/1/2015

guest We'll have to agree to disagree: cap-and-trade is a highly economically efficient way of achieving a goal. The logical goal is not to force each car company to achieve a particular target, but rather to collectively achieve a target.

As mentioned above emeralds are not durable; they should be worn for special occasions only. But I agree with your general view; my wife's engagement ring has a canary diamond because she loves yellow, but rubies or sapphires are good choices, too. As my daughter the geologist says, "Diamonds are geologically uninteresting. They're also unstable at standard pressure: diamonds are NOT forever! Give them a few hundred million years and they'll be gone."�

1/1/2015

guest I think that used to be the case but starting this year or next year the credits don't expire. I'll have to find a reference though.�

1/1/2015

guest The myth of exceptionality. There are plenty of places where people can be individuals, and some sub-cultures in America where they cannot.

Whether the current law puts a time limit on them or not, they're only good while the law makes them good. Change the law, change the game.�

1/1/2015

guest " Those issued from 2012 onward don�t expire, encouraging carmakers to try to sell more clean models than required" (Green-Car Credits: Automakers' New Way to Cash In - Businessweek)

Same article says they sell for between 5'000$ and 10'000$, and one model s generates 7 credits. That's 35-70 thousand USD extra for every single model s built. Could be that the lower range model s don't get 7 credits though. All in all there are 12 states that incorporate this law (including California, New York, New Jersey, Massachusetts).

This could be huge for Tesla! Tomorrow the market opens again and we are one step closer to the 22. Can't wait! Crossing my fingers for good news from the European countries that can't manage their finances.�

1/1/2015

guest I must be misunderstanding something or the credit value is not that high. $70K credit on a $70K car would be a 100% profit if they were selling them at cost. We know they are only claiming 25% margin sooooo...�

1/1/2015

guest same here, this seems too good to be true and if it is true TM could be profitable selling much less then they have publicly stated. Its good to be green!�

1/1/2015

guest +1. If that's is true then a majority of Tesla's income is going to be coming from selling credits.�

1/1/2015

guest It must have been a typo from the original article; I could see $5-$10k per Model S. But if it is true then we will all be raking in dividends shortly...�

1/1/2015

guest Took this from the annual report. Page 35. Looks like they do include the emissions credits in their margins.

They also list "emission credits" as an asset for $14,508,000.�

1/1/2015

guest I really don't think so. But I don't think the 40kwh and the 60 kwh generates 7 credits. Probably more like 4-5 credits per car. How many credits you get depends on range and charging time. And I only think you get credits on cars sold in states with this law.�

1/1/2015

guest As more automakers sell their own ZEV cars, the market for credits will collapse. The article says that Honda bought credits from Tesla because they couldn't sell enough fuel-cell cars. (Not surprising!) But now that they're going to start selling EVs, they won't be buying any more credits. Other auto makers will follow suit. That's probably why Tesla does not expect to sell (many) credits earned by the Model S. Once the demand has been filled, or disappears as other car makers no longer need to buy them, the income stream for Tesla from credits dries up.

The requirements to sell ZEVs increases with time, but the market for credits will depend on whether or not other car makers increase their sales accordingly. And how long it takes for GM to sue CARB again and get the requirement overturned.

So, yes, Tesla getting $35,000 for every Model S sold is indeed, "too good to be true." They got a nice little windfall from the Roadster's credits, but it won't continue. Certainly not at the rate of $35K per S.�

1/1/2015

guest Closed down .96 today at 29.12. What does TM have to do to get some love? Only good things have happened recently and have even had some analyst say it is time to buy. I am surprised. Not that it matters to me. I won't sell until late 2013 at the earliest and probably not even then.

I will just leave it to my kids.�

1/1/2015

guest EDIT,,�

1/1/2015

guest Hopefully the money will flow in tomorrow, after today's positive Morgan Stanley research note "Tesla Motors Inc 1Q12: Elon Shows Making Cars ain't Rocket Science".

They moved their 12-18 months price target from $44 to $45, a whopping $1 increase! :wink:

They also raised their Model S unit forecast for the year to 3,000 from 2,000 units (20 in 2Q, 980 in 3Q and 2,000 in 4Q).�

1/1/2015

guest Is that available to the public? Can you post a link if it is? Thanks�

1/1/2015

guest Motley Fool, The Auto Industry As You've Never Seen it Before.�

1/1/2015

guest Don't think so, generally Morgan Stanley research notes are for their clients only. But I'll ask them.�

1/1/2015

guest Tesla is now quoting 5500 units produced this year�

1/1/2015

guest Hey outsider, you must be an insider to have the Model S key as avatar �

�

1/1/2015

guest Source? I only ask because last year Tesla had often stated 5,500-6,000 cars but then they revised it to a more conservative 5,000 and AFAIK they've been using that ever since. If they've upped that number it would be real news.�

1/1/2015

guest I'm mobile at the moment, so I'll need to check at home, but pretty sure it was in or around the shareholder meeting.�

1/1/2015

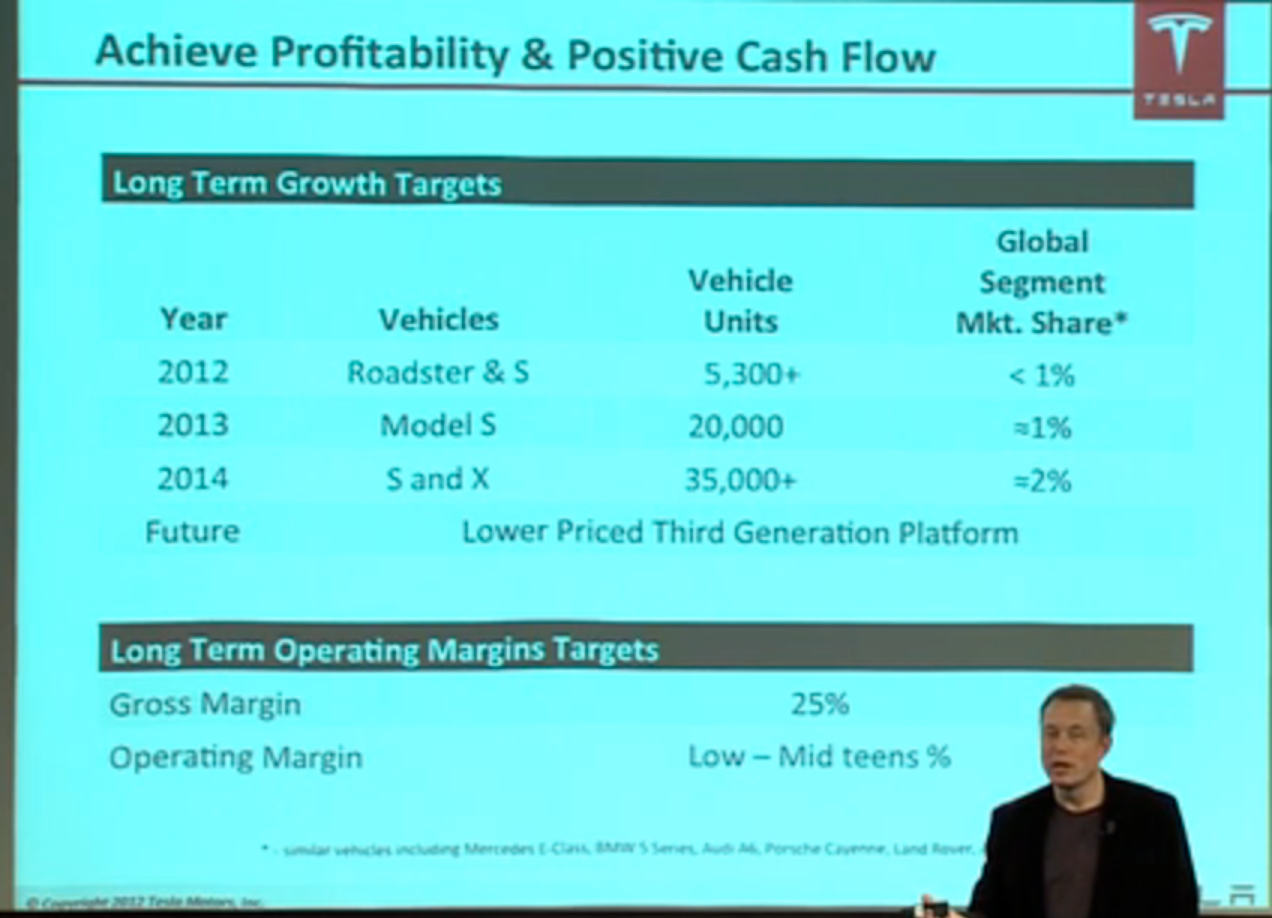

guest I think the number was 5300 in the shareholder presentation. Going to check now...�

1/1/2015

guest I saw the 5300 number and assumed it included a few hundred roadsters for overseas...�

1/1/2015

guest Yes. It is at 28:36 in the shareholder meeting video. It does say "Roadster & S".�

1/1/2015

guest 5000 units would be great, should move Morgan Stanley's target price up another $2 dollars...to $47�

1/1/2015

guest Woops, you're right Citizen-T. Here it is:

�

�

1/1/2015

guest Yay! My severance from my last job (just ended) ends up happening in 2 parts, part right now and part in 2 weeks, so I can dump some more into TSLA soon as it clears the bank transfer. Now I just pray the stock actually goes up...well, just after I buy preferably.�

1/1/2015

guest So for the record: Tesla's target to produce 5,000 Model S this year has not changed.�

1/1/2015

guest glad I dumped my TSLA shares on Friday. Can't go broke taking profits. I'm OK with profits totaling 1/3 of a Model S within the last 5 months.�

1/1/2015

guest Tesla's official partner for charger installation (and hopefully superchargers) is SolarCity. I think that is new today. Looking forward to the Inside Tesla today. Hopefully a lot of new information!

Charging Model S | Tesla Motors�

1/1/2015

guest General market conditions probably affect Tesla's share price more than news about Tesla itself. It would probably be a mistake to imagine that most trades of TSLA have anything at all to do with Tesla. Share price will rise as the company becomes more successful, but the daily swings are more the result of investor confidence in the market and the economy as a whole.

What's with that? Weren't they saying Tesla could not possibly succeed about a month ago? I pity the poor fools who take The Motley Fool seriously.�

1/1/2015

guest Who does Tesla have a battery agreement with?

It seems A123 has done something big (which has got their share price up 50% today alone) by annoucning a massive improvement in their car battery research, which they hope to have available soon. Could have a massive impact on Tesla.

A123 Seeks Rebound With Improved Electric-Car Battery - Businessweek�

1/1/2015

guest Tesla is with Panasonic for the cells in the Roadster and Model S AFAIK. I saw A123's thing on Fisker Buzz and it seems like they found a way to eliminate the need for temperature management in their cells, but the cells seem more geared toward hybrids and plugin hybrids than EVs.�

1/1/2015

guest It wouldn't be too hard to get A123's stock up 50%. Just saying...�

1/1/2015

guest As shocking as this is, they have more than one writer each with a different opinion �

�

1/1/2015

guest Some daily finance kids give T a big +

Motley Fool:

Why Tesla Will Spark an Electric Car Revolution - DailyFinance

The Revolution is coming!�

1/1/2015

guest Sounds like the Fool has really got on board...�

1/1/2015

guest They no longer wonder if Tesla will bring Model S to market. So that's all set and done. They already discuss the next big thing. Wow.�

1/1/2015

guest s e c documents show insider purchases of shares today by Jurvetson, Kimbal Musk...notably!�

1/1/2015

guest And they've driven the production car! They're so impressed they bought a few extra shares for profit taking...maybe.�

1/1/2015

guest Or maybe as a long-term retirement investment as Tesla just grows and grows.�

1/1/2015

guest They probably think that it's about as low as it's ever going to go and so they should get "cheap" shares now.�

1/1/2015

guest Also a strategic move that shows confidence.�

1/1/2015

guest I believe all of the above. I would buy more but got my last few at $27.5 apparently ( I was on vacation and didn't realize I set a buy order for 50 more ;> )

The car, business, and Elon seem like a pretty solid bet to me�

1/1/2015

guest Have an order in for $10k at the closing price today, so presumably that'll execute. That brings me to just short of 2100 shares, which I fervently hope will go up in price enough to pay for the entire car. If TSLA goes bankrupt that'll really suck, but it's hard to imagine a scenario outside of outright catastrophe that'll drive the stock down dramatically at this point. I really think us folks here are "in the know" far more than the statistical based traders.�

1/1/2015

guest Sorry man, that's from 2011 �

�

1/1/2015

guest The only thing that's bothering me is if we see a double dip recession or a long-drawn-out phase of stagflation (like in Japan in the past two decades) in the US and the Eurozone cookie starts crumbling at the same time.

This does not bode well for premium carmakers (let alone EV makers!). Less disposable income for the masses to spend on relatively expensive (upfront atleast) cars. So, once the early adopters are exhausted, if the western economies don't get better, I doubt if TSLA would continue to do well for too long.�

1/1/2015

guest You'll have 100 more shares than I do. I won't be able to afford the Model S unless TSLA really goes up. It's all or nothing with me. The amount I've invested wouldn't get me much more than the base model, but I want a lot more than that.�

1/1/2015

guest Not to mention the dramatic drop in gas prices that would cause.

On a happier note, we just broke through 200-day moving average which has provided a lot of resistance lately. If you aren't in yet, I don't know what you are waiting for, but I think this is the first sign that we are changing directions.�

1/1/2015

guest They say that there are lots of reasons to sell (planned sales, something came up and you need the money, bought on margin and are getting forced to sell etc.) but there is only one reason to buy: you believe the shares will be worth more in the future than they are today.�

1/1/2015

guest There has to be other manipulative reasons.�

1/1/2015

guest Like what? To show confidence in your own company at a critical juncture? Why? So that shareholder get bolder and drive up the price of the stock. Seems like the same reason I stated. To gain a controlling stake in a company? Why do you want a controlling stake? Because you think you could run it better? Why go to the trouble? To drive up the price of the stock. Seems like the same reason to me.�

1/1/2015

guest All excellent reasons. Still think there might be others.�

1/1/2015

guest Once again, TSLA is chasing the market. Market took a dive.�

1/1/2015

guest EDIT,,�

1/1/2015

guest You can buy stock as a hedge even if you truly feel it'll go down. Just to protect yourself against another position�

1/1/2015

guest

................. :biggrin:�

1/1/2015

guest After-hours buzz: Tesla Motors was initiated with a "buy" rating by Lazard Capital, with a price target of $42.�

1/1/2015

guest EDIT,,�

1/1/2015

guest Sorry, we are getting out of context now. This saying is only said of insiders, which is what we were talking about at the time. There's no way Kimbal Musk is just hedging a short position. By extension the same can be said of most any insider buying.�

1/1/2015

guest Just heard back from Morgan Stanley that it is OK to share the e-mail content. So here is the research note they sent on Monday:

Tesla Motors Inc.: 1Q12: Elon Shows Making Cars ain�t Rocket Science

Adam Jonas, CFA � Morgan Stanley

May 10, 2012

Tesla continues to show its ability to manage expectations and deliver on what it promises. 1Q cash burn was higher than we expected, but the follow through on Model S reservations and launch timing carried the quarter. Big risks remain, but each quarter demonstrates the company�s viability.

1Q results saw mostly positive developments. The key ingredients for a Tesla quarter are (1) reservation momentum, (2) launch timing/milestones and (3) cash consumption. Here�s how we rate Tesla on each:

1.Model S reservations/mth up 16% QoQ and 6% above our est. Impressive given no new store openings and first non-refundable deposits.

2.Launch timing pulled ahead to June from July. Only implies a few �tens of units� in 2Q, but suggests improved visibility on the launch.

3.The financial position deteriorated $28m more than we expected on lower profit and higher capex.

We are raising our Model S unit forecast: Our FY12 forecast rises to 3,000 from 2,000 units (20 in 2Q, 980 in 3Q and 2,000 in 4Q). For FY13 and FY14 we add 1,000 for a total of 16,000 and 19,000 units respectively. Our below-guidance forecasts imply a perfect launch quality.

In our opinion, Tesla could use a few hundred million of extra cash in their coffers. On our calculations, Tesla�s gross liquidity reaches a trough of $146m by the end of 2013. This doesn�t leave much room for unforeseen error either within or outside the company�s control. Combined with the positive early reception to the Model X and the apparent acceleration of the Gen 3 into 2016 (vs. our current 2017 estimates), the company may be better off in the long term raising more capital as an insurance policy for the unknown.�

1/1/2015

guest Bold emphasis is mine. Can someone explain what they're saying? They obviously know Tesla is saying 5000 units in FY12, yet they're just saying 3000. So, are they discounting 2000 because they think Tesla won't deliver on product quality?�

1/1/2015

guest Thanks for posting! Lot's of interesting info in there.�

1/1/2015

guest I think what they are saying is that with the high quality standard that Tesla is pursuing, Morgan Stanley believes that they can only deliver 3000 cars this year.

I'll e-mail Adam Jonas and ask him to explain what he is saying, and will let you know if/what he replies.�

1/1/2015

guest I follow the stock price pretty much every single day, and it seems like TSLA stock price changes about the double of the Nasdaq index. If Nasdaq is down 1 %, TSLA is often down about 2 %. However, yesterday was kind of special because Nasdaq was down while TSLA actually was up. I think that is a major change, and I bet this is just the start of several good weeks for Tesla.�

1/1/2015

guest I'm back!

Now an urban citizen, I moved on the Montr�al island and I have a garage waiting for my model X to arrive!

Been very busy in the last month, didn't watch market action very much, did not sell, did not buy. I am very surprised the stock is not up with all good info we are getting and with amazing no flaws launch of F9 & Dragon. IMHO next week will be huge, both for all the surprises we will get (and I think we will get massive surprises) and the possible short squeeze coming our way. Shorts are also back with a vengeance with almost 26M shares shorted on 5/31, this whole thing will now start to get very interesting.

BTW, I still believe we did not see the real interior yet

Cheers from the city!�

1/1/2015

guest I'm just going to say the obvious. We have no idea what makes TSLA tick. Market's up, TSLA is down, and there's absolutely no new bad news.

Analyst Upgrades: BBY, TSLA, and Z | Trading Floor Blog | Schaeffer's Investment Research

It's simply volatile.�

1/1/2015

guest

Wow 26M shares short - that's surprising! Not sure what these guys are thinking?

Following Tesla and SpaceX has been an interest of mine for quite some time, since it fits nicely with my personal experience as I have degrees in mechanical, electrical and computer engineering, B.A.Sc. (Mech) & Ph.D. (Electrical & Computer) and have been active in these areas for 30 years. From everything I've seen I can honestly say that Elon is the real deal, he is absolutely authentic. He is a very talented engineer and when he speaks he makes sense. From a technology point of view, I would just never short this guy.

This leaves business, marketing and selling. Maybe the shorts know something I don't? However, my hunch is that Tesla will sell these vehicles at a rate better than what is expected. George B. appears to have a handle on this. Also the buyers seem to have multiple motivations so owners are not only luxury car types, but also greens, early adopter etc... I am also very impressed that Tesla seems to have an answer to basically any objection that has been put out there. Impressive since the critics (i.e. big oil & big auto) are very powerful and have a high stake at preserving the status quo. Here's to disruptive technology and to the ingenuity of Silicon Valley. I wouldn't want to be a short in this game!

I agree with Steph it's going to get very interesting soon.�

1/1/2015

guest They are not thinking IMHO, they are playing a very dangerous game, they can loose big. very very big.

They have to buy 26M shares. They are betting for the company failure. When it becomes clear failure is not a possible outcome, they will rush to the exit like rats leave boats. There is not enough life vests. Smart one will the the first to leave, the others will be stuck there.

When will be the sentiment change? Next week? Possible.�

1/1/2015

guest I don't know, why would it? The info is up, and no one belives they will fail to deliver the first cars next week. If there's some surprises, they have to be huge, and I can't see that coming. The only thing that could make the stock go up is sales figures.

The stock may even go down big time depending on the election in Greece this sunday ... well not just the stock, the whole world economy might just ... well I bought some silvercoins besides my tesla stocks just in case ...�

1/1/2015

guest Welcome back, Steph! You are really taunting us again, aren't you?! A couple of Founders cars are already out there but, yes, we haven't seen shots of the interior of #1 or #2.�

1/1/2015

guest I asked the Morgan Stanley analyst to clarify his statement and here is his response:

We have assumed Tesla prioritizes quality of each unit over achieving their volume target.

The first few thousand units will be the most highly contented and complex specs delivered to their most important clients and to the media. They have to be perfect. We allowed some room for error for a slightly slower launch. Of course, a 2k unit miss looks huge vs the small numbers, but it's not so bad in our opinion.

I think if the car is perfect (ie - no recalls), the stock will be higher.�

1/1/2015

guest EDIT,,�

1/1/2015

guest I think we should not underestimate the disconnect between the performance of the company and the market's confidence in that company. I believe the stock will go up in the long run, but I don't expect that it will suddenly shoot way up. It will continue to bounce up and down on the vagaries of the market. The market is dominated by speculators, day traders, and technical traders, none of whom believe in the company's vision or care about the quality or early sales of the Model S, and many of whom believe the company cannot succeed because they buy into all the usual FUD about electric cars. Analysts who look at what the company is doing, rather than just the arcane statistics of the stock's historical price, are giving it a target of around $42, which when you get right down to it, is just $4 over its recent high point. I predict real movement only after it becomes clear that Tesla is close to paying off the government loan and will begin turning a profit.�

1/1/2015

guest We have a very unique situation here. WE know how Tesla will succeed. WE know how great it is. WE know Elon is changing the world. The world doesn't know that just yet.

When the word will be out, the car is real, they can touch it, drive it, when the news is front page on all main stream medias on Monday 6/25. All surprises revealed. This will be a shock to the world.

We don't know if it will go nuts, but on 6/25, I will be watching. �

�

1/1/2015

guest Another article from John Petersen:

http://www.altenergystocks.com/archives/2012/06/tesla_motors_automaker_or_graphic_novel.html

Is this guy real? Anyone knows this guy.

If I was a market manipulator, I would do exactly what he is doing: convince idiots on shorting Tesla while buying some cheep shares. Doing this does work, it's an old trick.

Tesla is the perfect candidate for manipulation: low number of shares, volatile, lots of unknown and a reveal date. The trick is to keep the shorters in until the reveal date (6/22). If the news is good enough, the shorts will try to exit in an uncontrolled fashion and he will make tons of money on that week (6/25)

In a sense, this guy is setting the stage for us. Thank-you Mr P, I couldn't do better myself.�

1/1/2015

guest A real aholee? or what

I find myself writing a lot of posts that I just delete, along with comments to him that I delete because it is pointless talking to a brick wall.

A real libelous D- bag, I think, yes

so much trash talk about Tesla it makes me sad.

Edited because I don't own a castle and like dirty language over dirt talking�

1/1/2015

guest Mod note: Regardless of the merits of your comment... please mind your language!�

1/1/2015

guest He seems to do it in such frequency that it makes him unmistakably a bad source. I guess what I mean is, if you are going to denounce a company try not to do it every 4 to 5 days. It just makes you look fake.�

1/1/2015

guest Don't forget his target audience is not us, it is idiots who think they can beat the market, because they think this guy is right.

He's playing a game. It's pretty clear to me.�

1/1/2015

guest He's been at it much more frequently than that of late. Every 2 or 3 days I'd say.�

1/1/2015

guest I might agree with you, Steph, except for one thing:

When people have left negative comments on his postings, he reacts emotionally. Very few people are so good at playing a game that they can also fake appropriate emotional outbursts. When he's attacked with logic, he clearly gets hurt and starts to take potshots at people, to the point of having some banned from posting comments. If he were playing a game, he wouldn't do that.�

1/1/2015

guest That's because the final countdown has begun.

10 days until launch (the stock that is)�

1/1/2015

guest I am very good at that kind of game, it's called trolling....�

1/1/2015

guest I agree with bonnie. He believes what he is saying. At least that is how it seems to me.�

1/1/2015

guest On a happier note: Tesla Motors readies to launch its all-electric Model S sedan - San Jose Mercury News�

1/1/2015

guest When does what he is doing become illegal and punishable?

Is everything he says strictly opinion and there are no lies about Tesla in any of it? Can you just constantly speak of a company as if it is fictitious dream of a company?�

1/1/2015

guest Trolling is an art. Writing comments where you sound emotional and provoke more reactions is the M/O of a troll.

It takes one to see one �

�

1/1/2015

guest To be a good troll, it takes four essential ingredients: calm, rationality, a good writing skill, and a goal.

EDIT: And a fifth: a fictitious character.�

1/1/2015

guest After a bit of research, I think the guy is fake...

His "Law firm" is here: http://www.ipo-law.com/

Domain info for this web site:

Registrant:

John L. Petersen Attn. At Law

Chateau de Barbereche

Barbereche 1783

CH

Domain Name: IPO-LAW.COM

Administrative Contact:

Petersen, John

Petersen & Fefer, Attorneys

Chateau de Barbereche

Barbereche

FR

1783

CHE

4126 684 0500 fax: 4126 684 0505

Technical Contact:

John L. Petersen Attn. At Law

Chateau de Barbereche

Barbereche 1783

CH

+4126-684-0500 fax: +4126-684-0505

Record expires on 25-Feb-2022.

Record created on 24-Feb-1996.

Domain servers in listed order:

NS1.BLUESKYSERVER.NET

NS2.BLUESKYSERVER.NET

Chateau de Barbereche is here: Fribourg : Le chteau de Barbereche

Sounds fishy at first glance...�

1/1/2015

guest IP info for ipo-law.com:

174.127.104.55

ISP: Hosting Services

Country: United States (US) - United States

Region/State: Utah

City: Providence

Postal/Zip Code: 84332

Metro Code: 770

Area Code: 435�

1/1/2015

guest I speak french and I read the history of this "Chateau de Barbereche"

No way in hell the owner of this place is that guy.

Anyone here from Sweden to check this guy out?�

1/1/2015

guest Predicting the Bump

Does anyone want to venture a guess on the impact to price on 22nd and the following week. How much press? Expected reception by automotive press.? Potential short squeeze? Anybody believe that we will reach the 52 week high or is it all priced in?�

1/1/2015

guest Some things to keep in mind:

People are very good at believing what they want to believe.

People want to believe that the status quo will continue, and that we are not desecrating the planet.

A lot of people believe, with all their being, that there is a god who ordains all things and will continue to provide us with oil.

People are slow to accept change.

EVs require a change in the way we think about transportation, and for the present at least, batteries are expensive and place limitations on EVs in terms of price, range, and time to "re-fuel."

A lot of people have a very contradictory and inconsistent view of science: On the one hand, they mistrust the pronouncements of scientists regarding the environmental effects of our behavior, but on the other hand they regard science as a kind of magic that can solve any problem. Thus they deny climate change, but absolutely believe that science will provide us a way to continue to drive our present cars.

Take all this together, and they do not believe that electric cars can work. The June 22 roll-out of a few tens of Model S, and even this year's delivery of a few thousand, will not flip their opinions like turning over a card. It will be a gradual acceptance, as they first recognize that an EV is not a golf cart, and then that it can have decent range, and then much more slowly they'll come to accept that they don't need TWO gas cars, and as prices very slowly fall and charge time very slowly declines, and charging infrastructure is gradually built up, there will be a gradual acceptance of Tesla's ability to succeed as a profitable company, ideally poised to be the leader in the field.

And as these realizations gradually take hold, the market will gradually value TSLA higher. There may at some point this year or next be a short squeeze, but short squeezes are by their nature brief spikes, good for profit taking, but useless to the long-term investor.

Tesla will grow and TSLA will rise, but it will be slowly, over the course of years, and will continue to be very volatile for a long time. And the gradual acceptance is not a bad thing, because Tesla will take time to increase production. If 10% of the population decided today that they wanted an S, Tesla could not meet the demand. Demand and production will grow together as early adopters provide cash flow and more EVs on the roads spur acceptance. Maybe in a decade TSLA will be 5 to 10 times its present value, adjusted for inflation.

Or maybe we'll trash the planet so badly that in a decade Mad Max will look like an optimistic vision.�

1/1/2015

guest Tesla events don't really seem to move the stock much. It's down 25% from it's high of $40 and things look better now than then, so I haven't been able to figure what causes the stock to move other than general market movement. Even then, some days Tesla doesn't move with the market at all.�

1/1/2015

guest Don't get your hopes up. Everyone knows the Model S is being released on 6/22. The markets have had plenty of time to react to that news. We'll need a surprise of some sort to get a real pop. The release is already cooked into the price�

Không có nhận xét nào:

Đăng nhận xét