1/1/2015

guest I have 50% of my Call-portofolio in SOL. most of them April 5 Calls. theyre at 1 dollar atm. CHEAP!�

1/1/2015

guest looks like alot of people had sale orders at $5 on SOL�

1/1/2015

guest options pretty much unchanged, Stocks are doing good tho �

�

1/1/2015

guest anyone can explain the -7% for SCTY ?�

1/1/2015

guest SCTY breaking down. It's crashing through big stop loss limits.�

1/1/2015

guest If you read through the last 40 or so pages of this thread you will see my explanations for why SCTY may struggle.

The reason it is struggling today probably has to do with the new share issue. They are diluting shareholders by almost 10% so it makes sense that the stock is going down 7%�

1/1/2015

guest Now might be the perfect time to initiate a straddle.�

1/1/2015

guest YGE upgraded: http://www.streetinsider.com/Upgrades/Ardour+Capital+Upgrades+Yingli+Green+Energy+%28YGE%29+to+Buy/8648768.html�

1/1/2015

guest Just curious what people are doing with their Sept. SOL $5 calls?... The stock seems pinned at $4.80. The option moved up some, but not as much as I had hoped. I am debating selling today before the volatility completely runs out. Of course, the hope in holding it would be it would continue to push up in the next few weeks, but I tend to get burned when I try to wring out every last cent.�

1/1/2015

guest I bought some yesterday for $0.20 and tried getting greedy early and selling 40% of them for $0.45. After that didn't work out I put a limit to sell 60% of them for $0.30 and it got struck on the SOL bounce to $4.90. So I was able to recoup about 80% of my investment and I am letting the other 40% of options ride for the next couple of weeks.

I feel like SOL has a lot of room to run in the next few weeks and normally I would have held on to the options. But that damn Syria conflict is on the horizon and there is 3 full days before the markets open again on Tuesday and I am afraid there might be some more selling next week. So I sold to protect my capital while still keeping some upside.

The stock will either run to $6+ or it will settle in the low to mid $4s over the next few weeks, it all depends on the markets. In the long run though, I can see SOL trading in the teen$ by this time next year. Short term options are definitely not the way to play these stocks. Buy and hold some shares if you want to invest in these companies.�

1/1/2015

guest Thanks, Sleepy. Yea, I have many shares which I've been holding for a long-time. Also have Jan 14 $5C options. So a smart man would probably cash in the Sept. $5's, and if there's a run up, at least I'll benefit with my Jan. $5's. Of course, gamblin' man would let it roll. Which is what I may do. Or maybe I'll sell half, which isn't a bad idea. I guess I should be satisfied with singles, but I'm always looking for that homerun. I've sold too early so many times, that it can eat you up. But, of course, better to sell too early than too late.�

1/1/2015

guest I really don't see SOL going down next week unless the whole markets go down, which is likely to happen in my opinion. If we have normal markets then SOL should continue its post earnings run. If it wasn't for the bad market today SOL would be above $5. Why would anyone want to sell SOL after a good earnings report like this unless out of fear.

If SOL starts tanking then I might have to liquidate my other half of the 401(k) and load up on SOL stock 100%.�

1/1/2015

guest As a LONG time holder in solar positions in general, I've been asking myself those kind of questions for a long time. It seems SO obvious to me that solar is the way to go for our energy needs. Somewhere I had this chart (couldn't find it) comparing how much energy we can get from solar vs our world needs. It's crazy -- it dwarfs everything else. Granted, just because solar is the way to go, doesn't mean any particular company will be profitably run, but it just amazes me how far behind we are.�

1/1/2015

guest Well... SCTY is still above 30$... SCTY investors are in panic mode. Today you could clearly see big investors bailing out at certain price points. We are down over 50% since the month's high on no major negative news.

I bought some more stock around high 30$ today. Bough with some of my TSLA profits.

In the long run I think this will be a good price. In the short term I don't really see it going down much more... most of the "new" investors in this stock got in around 35-40$ in the last few months. If they wanted to sell and cut losses I think they would have done so by now. What do you guys think?

Tuesday morning will be... "interesting"....�

1/1/2015

guest SOL at $4.77

SOL's Q2 earnings report was very impressive IMO. They beat all their pre-announced raised Q2 numbers. In their conference call (ReneSola Ltd. (ADR) (SOL): ReneSola Management Discusses Q2 2013 Results - Earnings Call Transcript - Seeking Alpha) a few things stuck out:

1. The shipped 849 MW of solar wafer and modules (up from original 700-720 MW guidance, and 760-770 MW raised Q2 guidance/pre-announcement).

2. They're sold out of inventory for the rest of the year (since August), and are now taking orders for next year.

3. ASPs are rising and will continue to rise into 2014. This is helping with revenue & GM.

4. They're penetrating the U.S. market and already have 50 employees in the U.S. and some warehouses.

Overall, they seem to be a very good place with demand for solar and their products picking up.

I'm not sure how SOL will do since it is pretty volatile. But I did pick up some options at market open only to see the price dip and my options dip even more. But I'm sticking it out (at least for now) because I like the SOL charts and SOL's strong ER/CC. The previous ATH for the past 2 years was $4.68. Today's open and ATH was $5.11. So, if SOL can break through the $5.11 resistance level, then it can go much higher IMO. However, the key is if it can break through or not.

My biggest mistake entering today at market open was not respecting that the stock had gapped up well above the previous ATH of $4.68. The $5.11 became a floating price point without much support. Now, if the ER was complete blowout (ie., they raised FY 2013 guidance by a significant amount), then I think the strength of the ER could have supported the gap. But as is, the strong ER wasn't enough to support the gap above the ATH of the past 2 years, $4.68.

So, it looks like SOL filled the gap today (today's low was $4.68). This can be a good signal (depends on how you look at it). Now that SOL has filled the gap, it can now consolidate and make a run for the new ATH (of past 2 years) of $5.11. This is of course, something doesn't derail it (ie., overall solar market, or overall market conditions, etc).

For TSL's (Trina Solar) run recently, I should have seen that TSL had a ATH (of past year) of $7.74 going into Q2 ER. The day prior to Q2 ER it closed at $6.78 and then gapped up a bit to open at $7.09. However, though this was a gap it wasn't a floating ATH (of past year), as there has been decent price in the 7s over the month prior. So, TSL was really primed for a run on a good ER, and it quickly took out the previous ATH (of past year) of $7.74 and was able to keep running.

Another incidence comes to mind and that's with TSLA's (Tesla) Q2 ER. It gapped from $134.23 the day of ER and opened at $154.35 (eventually hitting $158.88). However, with TSLA prior to ER the ATH was $145.73. So, TSLA gapped well above $145.73 post-ER and had it was "floating" in a sense. If TSLA's ER was a complete blowout, I think it could have held the gap, but since it was between good and great IMO, it wasn't enough to hold the gap, especially since it's a sizable gap between $145.73 and $154.35. So, TSLA closed the gap, going all the way down to $145.73 and eventually touching $135 (in probably what was an over-correction) before returning to new ATHs.

Anyway, today I'm reminded at how difficult it is to play earnings and how it requires a lot of skill, experience, knowledge. So, I'm giving myself some homework and will be reading some books on this:

Amazon.com: Option Strategies for Earnings Announcements: A Comprehensive, Empirical Analysis eBook: Ping Zhou, John Shon: Kindle Store

Keene on the Market: Trade to Win Using Unusual Options Activity, Volatility, and Earnings (Wiley Trading): Andrew Keene: 9781118590768: Amazon.com: Books�

1/1/2015

guest DaveT,

Trading earnings is indeed a tricky endeavor, especially when using options. In addition to choosing the right direction, one also has to contend with the actual earnings report (revenue, profit, margins, and guidance), analysts expectations such as whisper numbers as well as the markets' interpretation and reaction. On top of that, with options, one has to deal with expected move (which market makers will manipulate to options buyers such as ourselves to have them expire worthless), drop of implied volatility and time decay. When an earnings trade goes against you, options buyers often refer to it as the trifecta of pain (ie delta/gamma going against you, along with drop in implied volatility, and time decay).�

1/1/2015

guest This could be the main reason behind SCTY's sluggish performance lately compared to the rest of the solar industry.... While all other solar companies benefit from a rise in prices (>profits), SolarCity works best when panels are a cheap commodity.

If this is true: does anyone have any good sources of predictions for future prices/supply/demand of panels?�

1/1/2015

guest Until we have very cost-effective energy storage, solar will always be a marginal energy source. There is no doubt that it is an important piece of the puzzle areas like Southern California and the desert southwest, but in most of the rest of the country solar is simply not cost-effective as a wholesale energy generator. In Massachusetts the subsidies have to go up to hundreds of dollars per megawatt hour to make solar work. That is simply not sustainable long-term basis.�

1/1/2015

guest DaveT - thanks for your input it is always appreciated. I think that SOL will go up in a "normal" market, but I think that there is a good chance we are only half way through our market correction; I survived the first half so I can't sell now just in case the worst is behind us (it isn't).

I am impressed with all the reading you do. I am a very analytical person, but I don't apply any analysis when buying and selling stock. I have one simple strategy: buy low and sell high, all based off of gut feeling. Investing is an art and once you embrace that you won't need to read all of those books to get an edge. Now if I could only apply that same mentality to my golf game, I would be pretty damn good.

Two and a half months ago a lot of people were arguing that SCTY is a lot better investment because they don't make their own panels (which were getting cheaper every day back then) and I said to go where the puck is going to be and not where it is. Solar panels are only going to get more expensive, since supply is going down and demand is going way up. This is only just the beginning, as you can see DaveT posted that Renesola is sold out and taking orders for 2014.

Since you live in Boston, I am sure that you know a lot more on this topic than I do, but I still can't believe that you need "hundreds of dollars per megawatt hour to make solar work." Just back of the envelope calculation using conservative numbers to build a 1MW power plant:

Cost $3/Watt installed = $3 million

Useful life = 20 years

Fuel cost = $0

Maintenance = minimal

Annual electricity generation = 2GWh (probably more like 1.8 but wanted to use round number) or 2,000 MWh.

20 year production = 40,000 MWh

Cost per MWh = $3,000,000/40,000 = $75/MWh

Margin of error = =/- $25/MWh

So it costs about $75/MWh to produce electricity from solar. Here in Texas where electricity is really cheap there are companies that are signing contracts to buy energy from coal plants at above $50/MWh or $150/MWh from biomass plants, or $70/MWh from Wind, etc. Solar is very competitive and you don't need hundreds of dollars per MWh of subsidies. I am curious where you got this information from?�

1/1/2015

guest You also have to price in the fact that solar is not dispatchable, and needs fossil fuel backup.�

1/1/2015

guest I am not sure I am following? I just gave you the cost to run a solar power plant at about a very rough $75/MWh and even though it isn't dispatchable neither is wind and I know companies that pay $65/MWh to buy wind. So you will find people to pay $75 minus tax credits to get solar.

The only way solar is way more expensive in Massachusetts is if land is way more expensive (then you can install a Sunpower C7 tracker that uses several times less land) or bureaucracy is too expensive. It's possible it could cost $5/W to build there but that is still only $125 per MWh or $0.12/KWh.

I actually do financial analysis for an electric utility so I know a little bit about wholesale electric rates and power plants; if you guys are ever interested about that topic.

On the flip side you can produce electricity with a combined cycle natural gas power plant at roughly $30 - $40/MWh but this fluctuates with natural gas prices and can be as low as $20 when gas was super cheap 2 years ago or can go above $100 when gas goes to $10 (and it will eventually). Solar does not fluctuate and is way better for that reason, and when it does work it works at peak hours; if it is cloudy then a lot less AC's are running and a lot less electricity is needed so prices are naturally lower. It is the sunny hot days that get the real-time electric rates high (I worked as a real-time energy trader as well). Also when you amortize the cost of that combined cycle power plant at about $1 - $2m per MW of capacity built over 30 years you are actually paying a lot more than you think and solar is a lot more competitive.

Solar is not competitive everywhere today, but it is in some places such as Hawaii, India, and many others. Once nat gas goes to $6, everybody will be wishing they had built solar plants when they were still cheap. This is going to change a lot sooner than you think. Solar is getting a lot cheaper while other forms of fossil fuel energy are getting more expensive.

Solar is the future and you just have to see it. The only thing that will hold it back is a recession, but that will only delay the inevitable.�

1/1/2015

guest There is a story in Barron's this weekend entitled "Dark clouds over solar city". I don't subscribe to Barron's, so don't have access to the article, but this could lead to additional downward pressure on the stock next week.�

1/1/2015

guest http://seekingalpha.com/currents/post/1255322?source=feed_f�

1/1/2015

guest I'm suggesting that since solar cannot yet stand on its own you need to factor in the cost of having backup capacity, either in the form of other generating sources or backup storage, to get the true cost. A hot, humid rainy day can still have significant electricity demands, as can a freezing day in a snowstorm, or even weeks of such weather. Additionally when we get to widespread EV use, millions of EV's charging at night will not benefit from solar without massive storage. Affordable storage seems to be key for widespread solar power.�

1/1/2015

guest I agree with what you are saying, but you don't have to add any of those costs into my calculation. I was calculating the cost to produce electricity at a very rough $75/MWh and that is the final cost. There is no other cost that you have to add to this, if you can sell this electricity at $75 then the solar company is making their profit. Actually you would have to subtract government subsidies, so the true cost to the producer is even less.

I agree that if the world were to go to an almost exclusively solar economy then you would have to factor in the cost of storage too. But as it lies when you build a power plant there is no storage necessary; it will feed electrons into the grid whenever it is ready to do so. I understand what you are saying but it doesn't apply to my calculation, since I was just trying to figure out where Robert.Boston got the "hundreds of dollars of subsidies per MWh needed for solar" from.

My comment about peak energy had more to do with the fact that in Texas, we have a lot of wind capacity installed (Texas would be the 6 largest country in the world by installed wind capacity). 80% of it is installed in West Texas and it blows only at night over there. So we are getting this useless wind energy at night, when what we really need is solar to deliver during the day (the coastal wind farms accomplish this as well).

Another note about solar installation costs: Right now in the US the balance of systems costs are very high compared to Germany or other countries. So in the US you pay 20% - 30% for panels and 70% - 80% for installation that includes permitting, etc. In Europe those BOS costs are cheap so they pay about 50/50.

That is why EU is trying to get panels as cheap as possible, because they make up a big piece of the total cost. In the US panels only make up a small portion of the cost and that is why it makes a lot more sense to buy the best panels out there, i.e. Sunpower. And that is why SPWR is a lot more competitive in the US than it is in Europe.

These BOS costs can come down very quickly as long as the US bureaucracy allows these costs to go down, and that will make solar even cheaper than today and competitive without any subsidies.

Final note is that battery storage is cheap as evidenced by Tesla. It is only a few decades away, but I envision a lot of people living off the grid:

Install a 10KW solar system for $40,000 and then install a 200 KWh battery system, which should cost about $20,000 sometime in the next decade or so; I used Tesla's price of $10k for the 60 KWh battery as a proxy. Note: these are not today's costs but reasonable costs for the next decade.

So for $60,000 you have a house that is completely off the grid for 20 - 30 years until panels go bad (which they won't) or batteries lose charge (which they will). That is roughly $2,000 - $3,000 per year or $160 - $250 per month on electricity. And remember that this is enough to power your electric vehicles too so it is a very good deal.

Even if my numbers are conservative and you would have to pay $80k for such a system, it is still a very attractive option to live completely off the grid. Only a couple of years/decades away.�

1/1/2015

guest A good friend of mine just had a solar system installed by SolarCity. He is very impressed with all the work they did. they even re-enforced all the rafters on the roof, basically added 2 extra 2x6's on each rafter with out charging him anything extra. the best part is that his neighbors also want Solarcity to install solar on their houses. I think this will go viral. most people don't know that you can get a solar system without the huge initial expense. And when they hear about it from adds they don't believe it, they think there is a catch or it is some kind of scam. but when they see real people getting it done, then this is when they believe it. so I think as more people get it, more people want it. going viral I tell you.�

1/1/2015

guest I certainly see the future potential for millions of EV's plugged into the grid to provide a certain amount of frequency regulation and storage for demand response, as well as used battery packs for the same. I just think we will need a lot more inexpensive storage than they can provide, or some sort of inexpensive dispatchable power source, possibly LFTR's, though I'm not sure how quickly their output can be regulated.�

1/1/2015

guest Once they release a next gen battery for the model S there will be a huge supply of batteries as people upgrade to the newest tech. I think they will still be expensive because there will be many people/industries interested with batteries that big for sale.�

1/1/2015

guest A story in today�s issue of Barron�s newspaper predicting the end of times for SolarCity is the literary equivalent of a donkey trying to do calculus.

http://www.forbes.com/sites/williampentland/2013/08/31/barrons-takes-potshot-at-solarcity-misses-by-wide-margin/�

1/1/2015

guest Even if that's true, which is questionable since many are quite happy with the existing pack, it's a drop in the bucket compared to the actual storage needs of grid wide solar power.�

1/1/2015

guest Perhaps I can provide a Real-Life datum regarding battery storage:

As I have written before, we live off - way, way off grid. 80 miles to the nearest utility lines. I run a medium-sized hospitality business through a combination of PV electricity (4,660 nameplate watts) and a 30kW generator.

The electricity from both those sources is fed into a bank of batteries: nine tons of 1100Ah cells; mine is arrayed in a fairly efficient (as efficient as today's technology permits) 48VDC configuration. It gets inverted into 240VAC for use.

Now, that bank - the nine tons is a mass approximately seven feet tall by 30" deep by six feet wide - can run our operation, if we very meagerly consume, for three days with no further input.

The lesson to take from this is that battery storage has a very long way to go before even individual needs are conveniently satisfied. Grid-wide? Some other medium (flywheels, gravity-assist, hydrogen) may be more appropriate at THIS stage of development.�

1/1/2015

guest I'm hoping something like Jay Whiticare's Aquion Energy or zinc bromide

might become practical.�

1/1/2015

guest With my calculations you have about 300kw of battery storage (using ~940 standard solar batteries) or 5 model S batteries that have been depleted to 60kw. I'm not sure what the model s battery packs weighs though. What I am sure of though is that 5 used model S batteries would be way more cost effective and weigh a lot less that your current battery bank. I believe really using this though is still 15-20 years out though. But having our cars sitting around could help buffer the demand on the grid. Distributed generation is way more efficient than centralized. Most line losses are 10-17% by time the power gets to your building.

This leads to another revenue opportunity for Tesla. Create inverter/charge controllers than would manage the banks.

One of the biggest hopes in the industry (2years ago) has been compressed air. Using old mines and caves that are air tight and have massive storage capacity. I haven't followed the lates grid storage technologies though in two years so there may be something else that is on the horizon that I do not know about.�

1/1/2015

guest Compressed air has poor efficiency as far as I know.�

1/1/2015

guest @sleepyhead: My comments about solar requiring hundreds of dollars subsidies for megawatt hour is not based on some bottoms up calculation, but rather on the market price for solar renewable energy credits. If Solar were in fact at grid parity, then that market price would be zero. Conversely, if someone has a way of making power really cheaply using solar technology in New England, this is an enormous arbitrage opportunity for them.�

1/1/2015

guest SCTY is getting awfully close to the $30 barrier and breaking into the 20s. Currently at $30.25.�

1/1/2015

guest Yeah. I bought in at about 11 dollars so I am still sitting well, but this makes me nervous. I wonder if I should give it a few more months so its a long term stock or get out now?

Wonder what is pushing SCTY down so hard the past week or so. I think 40+ was too high, but below 30 is making me scared.�

1/1/2015

guest I was finally able to read through and study the CSIQ and SOL conference calls and earnings releases and here are my thoughts:

CSIQ - Earnings were good and guidance was really good. They basically said that they are going to be close to break-even in Q3 and that they have 3 power plant sales that could potentially close this quarter that are not accounted for in Q3 guidance. Note: CSIQ uses full acrual accounting (or completed contracted method) on a good chunk of its power plants, which means that they recognize 100% of revenue after the sale process is complete. In this case the 3 power plants are all running and are in the testing phase by the customer who will buy them for sure. It is only a matter of Q3 or Q4. Each plant is worth an additional $60m of revenue and about 20% gross margin. So if they sell all 3 in Q3 then they will have some ridiculously high EPS number above $0.50 for the quarter.

In any case CSIQ is looking to be profitable for FY 2013 and both Q3 and Q4 should both be profitable. They also have a couple of other plants to sell this year, and 18 in 2014. This means that 2014 will be very profitable for them and the analyst consensus is like $2.79 for EPS. With the stock trading at $13, you are getting a fire sale discount on this stock even after the recent runup. They only have 2 power plants to sell in 2015, but they are working on increasing pipeline and I am sure that new deals will be announced.

CSIQ is one of the better plays because it has a total solutions business and not just a module manufacturer, so they get higher margins, revenues, profits, etc. Kind of like SPWR, FSLR vs. the typical module manufacturer of STP, LDK, YGE, SOL, and almost every other Chinese player.

SOL - Great results, with really good guidance. They are all sold out for the rest of the year and are now taking orders for 2014. ASP went up to $0.63 from $0.61 in Q2 vs. Q1 respectively; wafers are sold for $0.23. Gross margin improved from -2% to 7.3%. They gave out guidance for Q3 ASP of $0.66 (which is 5% improvement going straight to gross margin) and Q4 of $0.68 (another 3% of gross margin improvement). They also said on the call that they will definitely see $0.70 ASP in 2014. $0.70 ASP in 2014 means an additional 11% of gross margin vs. Q2 or 18% gross margins (calculation is not that simple since SOL sells wafers as well as other products, but I am not even factoring potential cost savings).

They also said that they expect their microinverters Replus to add to profits starting next year and have high hopes for this high margin (20%) product. It is a future product. I feel like nobody is really listening to management as evidenced by the short length of the conference call as well as the number of analysts following these stocks.

Bottom line is that these companies are really cheap right now (rightfully so, because there is a lot of risk) and if the economy continues to expand these are going to be multi-baggers. CSIQ is more underpriced than SOL, but SOL has the short-term momentum in its favor.

These stocks are highly leveraged plays on the global economy. If you believe that the economy will improve then buy some shares and be prepared to hold for a few years to reap great benefits. Since LEAPS are not offered, you can easily get burned on options even if these companies do succeed. If you think that the economy will collapse then so will their stock prices.

There is also the risk of fraud, etc. since these are US listed Chinese companies and there have been cases of accounting scandals and fraud in the past.

My theory though is that the market has gotten badly burned by solar companies in the past and that is why these stocks are so cheap. These stocks feel a lot like SPWR 6 months ago, when it was in the single digits. SPWR was just turning profitable (non-GAAP) and they signalled that they would be profitable but the price was still really cheap (see it to believe it). Only after two straight quarters of profitability did the stock start going up.

I remember reading articles how SPWR is overpriced at market value above 0.5x Sales, and thinking that was a ridiculous thing to say since most "peer" mature companies would trade at 2x sales and growth companies at even 5x or 10x sales (see TSLA). Now SPWR is trading at slightly above 1x sales and I still think it is cheap. But the market will decide if it is cheap or not, because people got burned before I fear that they are not giving these solar stocks enough respect.

If CSIQ starts trading at 1x sales then we have a 4-5 bagger by next year, and if SOL starts trading at 1x sales we will have a 3-4 bagger by next year. Not saying that this will happen, but I feel like solar is the only industry in the world that gives you the opportunity to buy growth stocks at "priced-to-fail" valuations.

This might be the beginning of an energy revolution, yet nobody is buying into it. I am hoping that one day these stock start trading at 2x sales when these companies start showing consistent profits.

Let me know what you guys think about these companies. Am I missing something here? It looks to me that the only risk in investing in these companies is a global recession. The risk is real, but I would only give recession a 30% chance (and the stocks lose 50%), and a 70% chance that these stocks at least double by next year. I like those odds, but definitely not for the risk averse investor.�

1/1/2015

guest Count me in among the scared...I really have no clue of what's going on. I just don't see any support at all....�

1/1/2015

guest There goes 30$ on Scty.....�

1/1/2015

guest Looking back, I now think it was bad for this thread to be renamed and for the focus to shift from discussing SCTY to the panel providers. A lot of the discussion on SCTY disappeared and the few posting got drowned out by the flurry of postings about solar panel manufacturers, and as a result I feel we missed some clear warning signals on SCTY.

Wrt the solar panel stocks, it's easy for someone to hype stocks when they got in at a very low price and already have 5 or even 10-bagger in their hands. I will never ever listen to their buying advice again.�

1/1/2015

guest I have followed this thread ever single day the last months and I disagree. Yes, the focus has not just been on SCTY. But like With TSLA, you need to know what the other Companies do to make Your mind up.

Sleepyhead have done tons of work for us, and you can see what he has to say about SCTY...

Btw: YGE up 9%

SOL and JKS both up 15%

CSIQ up 6%

I have sold out alot of SCTY to buy in on these, so Im very happy with this thread.�

1/1/2015

guest I bought 25 options when SCTY was around 40 that were out of the money and are near worthless now but Today I bought 10 more that are near the money. I am betting that soon we will find a bottom and Someone had mentioned Solar City becoming profitable this year .... can anyone confirm this as a possibility?�

1/1/2015

guest what "clear warning signals" did we miss on solar city? They didn't quite have as good an earnings qtr as tsla, which is the current darling of the street, so scty tanked. Remember, solar stocks (including scty) have had tremendous gains during the 1st half of the year, so any disappointment in earnings and guidance would (and did) send the stocks tumbling down (see spwr). Also, sleepy and others have stated that scty was difficult to value compared to the other solar companies. Sleepy's analysis on solar, as well as tsla (especially the most recent tsla earnings quarter) has been spot on and he has disclosed all his positions in his posts. His contributions have been tremendous and welcomed in both the solar and tsla threads and in no way do I feel he was trying to hype and pump up his holdings. Also, with regards to buying advice, one must always do your own due diligence and research.�

1/1/2015

guest The only sell signal I've seen on SCTY was Sleepy saying he was more or less staying awayI'm happy with how this thread's been run lately. More SCTY discussion would be good, but that's not the thread renamings problem, that's the problem of people not wanting to talk about it.

�

1/1/2015

guest SOL at $5.48 and SCTY at $29.49

Here's some quick thoughts on price action today from various solar stocks. (note: I bought SOL calls last Friday and hold SCTY stock since Jan)

SOL (Renesola) had a great Q2 ER reported before open on Friday. It gapped up opening at $5.05 and hit a 2-year high of $5.11 before falling back and filling the gap (dropping to $4.68, it's previous 2-year high) before recovering some to close on Friday at $4.77.

SOL's price action was strong all day today, hitting new 2-year highs several times before closing at $5.48. Volume was high at 6.9m shares traded.

I'm glad that I didn't close out my SOL position on Friday when the stock dipped to $4.7 (after purchasing calls when stock was at $5.05). I actually cancelled my stop loss because I was super impressed by their Q2 ER and wanted to take a longer view on the stock (ie., was thinking of 1-2 week position, but took longer view of 1-2 months).

We'll see what SOL does tomorrow, but if it can take out it's $5.50 resistance level, then I'm expecting price action to be impressive.

TSL (Trina) and YGE (Yingli) also had huge days today, gaining 9% each. All three stocks were relatively flat during the first half of the day, and then took off the second half. (Some other solars did well too like JKS and CSIQ.)

The solar laggard of the day was SolarCity. It broke under $30, which was sad to see but didn't surprise me. It had recently broken a key resistance level, $32.66, on Wednesday and even before that it was trending down. I think there's several things going on. First, SCTY has diverged from the rest of the solar stocks in recent weeks. I experienced this on the day TSL reported Q2 ER. I expected the whole solar industry to be up from their earnings, so I bought TSL and SCTY on a short-term play. It was sobering, because TSL and all the other solar stocks went up that day, but SCTY was alone in the red (I closed my short-term play at the end of that day). I noticed this happened several times in recent weeks and was concerning.

A couple weeks ago, I had shared with my wife my plan to buy puts when SCTY hit $32.30. But when it recently hit that price target, I noticed it was very volatile and so I stayed away and decided to focus my efforts elsewhere (ie., on watching SOL/YGE earnings). But a few weeks ago, I was expecting if SCTY would break the $32.66 level then it would have a good chance to go under $30. I can see the stock going even lower, especially because there doesn't appear to be any near-term catalysts (except the secondary they're offering but that announcement doesn't appear to have helped the stock). Currently though I don't plan on selling my SCTY position (stock bought in January) because 1) My beliefs in the company and market haven't changed, and 2) I'll need to pay very high short-term capital gains tax.

I still like SCTY long-term but I can see the market sentiment turn against it for now. Here's how I see it. ASPs for panels have been increasing the past year and will increase over the next year as well. This helps solar manufacturers with their revenue and gross margins (ie., TSL, SOL, YGE, etc). Previously there was an oversupply in the solar industry, but now that seems to be turning around. With SOL announcing that they've sold out of 2013 inventory, it might mark an inflection point where oversupply is ending. As supply meets demand (or if demand is greater than supply), this will raise solar wafer, module, panel prices and will help manufacturers. However, since SCTY is an integrated installer rising component prices only raises it's costs and is disadvantageous to their business model. Cheap panels are in the best interest of SCTY, but when solar panel prices rise they need to factor in those costs to the prices they charge their customers. And since SCTY's biggest challenge is cutting costs, this poses a challenge to SCTY. (My belief is that SCTY can manage the rising solar panel prices because they're aggressive in their cost-cutting measures. But that's my belief and not necessarily the market's sentiment.)

Also, over the weekend Barrons featured a negative article on SCTY bringing up doubts on how it relies on government subsidies (ie., solar tax credits).

Combine these two factors, namely 1) rising solar panel prices and 2) doubt that SCTY can curb costs enough to overcome expiring government tax credits for solar. And then what you what you have is less-than-ideal market sentiment for SCTY. Yet you have rising positive market sentiment for solar stocks that have been previously undervalued but now are benefiting from rising solar component prices (ie., TSL, SOL, etc).

Update: I haven't been following JKS (Jinko Solar) closely, but decided to do some reading today. Last Wed they reported Q2 ER and they appear to be the first Chinese solar company to return to profitability.

JinkoSolar Holding Co., Ltd. (JKS): JinkoSolar Holding's CEO Discusses Q2 2013 Results - Earnings Call Transcript - Seeking Alpha

http://ir.jinkosolar.com/zhen/upload/201308140355479059.pptx�

1/1/2015

guest lol it has been a painful discussion as of late... I will start posting regular updates when my Jan 52.50 calls are in the money !

�

1/1/2015

guest Very good point. I think this might be a reason why SCTY is doing so bad. They arent on top of the chain when the others are sold out, and can increase the price.�

1/1/2015

guest Every stock goes through periods of up and down news cycles. SCTY is heading down for now, the sharks are jumping on board now like the barron's article- Nothing news worthy, just bringing up old facts to drive the price lower.

My opinion is that when SCTY crossed the 50 day moving average downward, there was the potential for for hard times but still the chance for a strong recovery of 40. Then when it crossed the 100 day moving average this week, I started scooping up shares for a rebound. My sentiment changed 180 degrees when Elon's purchase had no effect on the stock, and that scared me enough to make me close 80% of my position today at a hefty loss. I still have longer term options, but I'm looking for a day or two of strong volume and a hard price rebound as well as a change in sentiment before i grab shares again. I'd guess that will be in the 22-25 range, and essentially I arrived at that by saying "at what price would scty seem undervalued to nearly everyone". It's only after it becomes clearly undervalued that people realize it's a bottom, and then after that point they are willing to buy in at higher prices because they've now missed the bottom.�

1/1/2015

guest Do you feel that 22-25 is undervalued? I am a stocking newbie, just wondering what more seasoned people think.

�

�

1/1/2015

guest Well I honestly don't know. There isn't as much discovery about scty as there is tesla. I felt at 40 the stock was overvalued slightly because of the rising costs of solar panels and the rising interest costs that compete with SCTY financing, and that made 34-36 seem to be a reasonable discount. Then I felt with elon buying at 33 that it was a way of saying "33 is a discounted price to the value of scty". Given that the purchase at 33 did nothing for the stock, I think people are looking for a discount to elon's 33. 20% lower seems a like a steep discount and its where I'd feel comfortable acquiring shares beyond my core position.

Assuming that interest rates fall to 2.50-2.6 in the next few months, and that solar panels don't skyrocket in price beyond the current move, then I'd say this company will prob hit a 50-100 price in several years. However, the market is too short sighted to see that, and is selling on a panic.

That's my take, and without solid numbers to back the price targets.�

1/1/2015

guest Sleepy. I enjoyed reading your post and agree in many way. I believe we are looking at the market tip toeing around Solar right now because of the huge boom and bust that happened some time ago and they are still scared as well as alot of companies working to get back to profitability. I think that is the #1 short term player on stock prices right now, writing that black ink, growth shows its coming and people want growth toward profits before they jump in to these companies again. When they companies are profitable again, your going to see many people jump in.

I see this field playing out like Memory has of the past few decades. You had 50 memory companies and the market was flooded. Many companies and even countries went bankrupt because of the fall of the memory market, Last being Elpida in Japan which was a conglomerate of many other failed memory makers (Mitsubishi, NEC ect) Now Micron bought them making only 4 companies remaining.

We are going to see a very similar trend i would suspect in the solar sector. Long term, you are going to have to pick a few horses and see who is going to come out on top.

I can liken memory to solar again. Cheap and function was ok for a time until the big guys took the lead and had better products. Still Memory industry has been over cooked with product for some time and Memory is finally becoming profitable once again both by the consolidation down to 4 players and those 4 player being smart and not over supplying. The cycles in memory down to 4 players due to over supply and lower margins is something solar with go through a few times as well (this cycle has already started with cutbacks in production in the past).

Memory has been very cyclical as well as solar and you have to know when to get in and then back out again. I think we are at the starting gates for a large up swing but only the best companies will survive as the next down turn comes around and you will see Solar companies picking up bits of others, just like Memory. Like i said, you have to pick the winners if your going long term and i can see the winners in the industry by having a few things going for them. Complete system packages for reduced cost and control of their product, product quality vs cost (booth being the holly grail, duh) and in the short term, return to profitability. Return to Profitability will be able to fuel expansion and R&D allowing that company to pull out a lead. After this earning season knowing the top players is still a bit of a grey but i would continue to bet on SPWR (growth was projected low but they should come in above it). SOL is gaining steam with a chance to strike black ink in the new year. TSL has alot going for them and also looking for a huge profitability push soon (Solar city doing well also helps obviously since they are using their panels) and last player but not least in my top 4 I would bet on is CSIQ.

*More companies then my top 4 can and will continue to earn as this solar up turn comes around. I am just trying to think long term and figure out who will still be here if we see anther cycle downward. Cash will be king when it comes. Timing it will be the next play and it could be soon if we see a recession come into play.�

1/1/2015

guest Does Solar City have a patent on its approach to Solar Leasing? Methods of processing information in solar energy system - Patent # 8249902 - PatentGenius�

1/1/2015

guest You can bet that I am buying these solar stocks up. You see because I bought them in 2008 and saw my entire solar portfolio loose 75-90% I have been working in the solar industry for 6 years now and I have seen the cycles, been through them, and even been a part of them. Even when solar stocks were flying 3x higher than they are now the industry was not this hot. Look at Chinas policy for installing solar (to generate power for their country). They are going to dwarf the rest of the global solar industry. With their current plan within 3-4 years they will dethrone Germany, whom has been massively installing solar at a breakneck pace for 10 years. In 2010 Germany installed more solar in one city that the ENTIRE USA.

Look at their stock history, they have 4-5x the capacity they had 5 years ago and all of them are much more efficiently run and silicon is dirt cheap now. There is no reason any of them do not deserve a $30-50 share price again.�

1/1/2015

guest @mulder1231 - I am sorry you feel that way. I think that I am the only one here that ever posted anything negative on SCTY and quickly got bashed by others here for doing so. People would say that they prefer SCTY because "it doesn't make it's own panels" and I would respond that what seems like a positive today (it did seem that way two months ago) will be a negative in the future. The future happened a lot sooner than expected and now SCTY is suffering. I posted many, many risks for SCTY here but nobody really cared to listen.

The reason for SCTY's drop is that it was in a bubble that was caused by a very small float pre lockup expiration. The way bubbles work is that the stock goes up way too high (obviously), but what most people don't know is that after the bubble bursts the stock tends to over-correct and goes down a lot lower than it should. Therefore SCTY will over-correct and it will present a great buying opportunity. The only problem here is that nobody in the world (not even Elon Musk) can put a fair valuation on SCTY and it is impossible to tell when you are getting a good deal on the stock. It may fall to $25 or it may fall to $15, it is impossible to tell.

There are still "financial" people who think that SCTY will go bankrupt in a few years. There is a lot of risk associated with SCTY, but I think that it will survive and prosper. Still can't figure out how to value this company though, so investing in SCTY for short term gains is pure gambling. I will stick to other solar companies that I know for sure are undervalued.

@DaveT - I am glad that you hung on to your SOL calls from Friday. I actually read over the transcript from the conference call yesterday and I immediately bought some SOL options at market open because I had a feeling it would have a huge day today. I still think that this stock has more room to run, but did sell a small portion of stock and options late in the day to take some profits; even though I feel like this will be a huge mistake, I still have plenty of exposure to SOL.

Let me know what you think about JKS. I do not have as much time for research as I would like and therefore I have not researched JKS. What I like about the company is that they have a total solutions business (like SPWR, FSLR, and CSIQ) and that is why they are able to achieve such high margins. I feel like I missed out on this one, but it is still very cheaply valued so let me know if you think it is still a buy.

Thanks for sharing your research and opinions with us DaveT.

@fjm9898 - I like your comparison to Memory manufacturers. The solar industry has been consolidating and will continue to do so for the next few months. The thing about solar though is that there are not that many tier 1 manufacturers and hundreds of smaller tier 2 and tier 3 manufacturers. I think that you will do good by randomly picking a few tier 1 companies such as TSL, YGE, CSIQ, etc. Even a good company such as SOL has only been added to tier 1 a couple of months ago.

I don't think that there will be a clear winner in solar, but that a rising tide will lift all ships. The only company that has enough cash to crush the competition is FSLR, but unfortunately they have the wrong technology and a bad business plan. It looks to me like they are just trying to milk the status quo and will end up in trouble like Honda will in the next decade (left in the dust by TSLA).

A few final notes on the solar sector:

SCTY is highly valued and is going down because of rising panel costs and rising interest rates. Their recent secondary offering is not a positive catalyst for the stock, but is a negative and the market rightfully treated it this way. I am sure that Elon Musk will make a huge return on the shares he bought at $33, but that is because he will hold them forever. They issued shares for "general corporate purposes" among other things and that never looks good.

As far as US listed Chinese Solar companies, here is my opinion - I think that there is a 30% chance for a global recession in the next 12 - 18 months and these stocks will go down 50% if this happens. 70% chance that the global economy expands and these stocks will triple. My expected return can be calculated in the following manner:

(30% * -50%) + (70% * 200%) = 125%

I like 125% returns. I am happy to take the chance and roll the dice. Please do your own due diligence beforehand if you plan on investing. Reading transcripts from the conference call is the bare minimum, but at the same time it is more than enough to make an informed investment decision. It doesn't take much time to research a company.

It's pretty simple in my opinion: If you think that the global economy will prosper over the next two years, buy solar. If you think it will contract, then don't buy solar.

I still think that the tier 1 Chinese solar companies are priced ridiculously cheap and that if they reach consistent profitability their share prices will have to double at a minimum. It is just that the market doesn't believe this to be case, but I disagree with the market. My knowledge of solar is still limited and there are many things that I am missing in my analysis; but I am not worried a bit about that because IMO it is a simple matter of supply and demand. Demand will catch up with supply a lot quicker than anyone is expecting. I am actually worried that there will be a panel shortage in the very near future.

Solar is such an obvious solution to all of the world's problems and there is nothing that is going to stop this train. Now it is just a matter of battery storage technology catching up to make all other power plants obsolete. It is only a matter of time, but I expect all power plants to shut down by the end of the century.�

1/1/2015

guest Your last point is exactly why SCTY is positioned to reap the highest benefits in the long term. Solar panels will get better, and SCTY will always be able to take advantage of them. They won't be stuck manufacturing a lower grade panel, and thus will not be subject to competitive downfalls. Their partnership with TSLA (which primarily a car company today, will be a HUGE player in battery tech in the coming years, if not already) will give them, by far, the best exposure to the best battery tech.

To me, SCTY is STUPID cheap at today's prices. People are panicking and overselling as you stated because it's hard to think of a valuation for SCTY. That in itself tells me the potential is ridiculous, and thus I'm buying.

And of course, as long as Elon Musk.�

1/1/2015

guest This is already happening. Lead times are currently increasing. That is the first sign along with quarter over quarter price increases.�

1/1/2015

guest Can you give us an idea on what current lead times are and what lead times used to be?�

1/1/2015

guest I agree that SCTY will most likely be a very good long term player. But I see too many risks in SCTY, and if I was looking for a long term investment, I would put all my money in TSLA, which is a lot safer than SCTY.

In the short run, I think it is more likely that SOL reaches $1bn market cap than SCTY reaches $7bn - $8bn.

Theshadows - thanks for sharing your knowledge and expertise on this topic. Your posts are invaluable and are greatly appreciated.�

1/1/2015

guest Appologies, my wording was a little too strong when I posted at the close, being very, very frustrated with SCTY falling through the $30 level. And on top of that, the building inspector today didn't sign off on the installation for the stupid reason that the carbon-monoxide alarm had to be "hard wired" in stead of battery powered! (SolarCity guy got really mad at the inspector, I thought it was gonna turn into a fight, LoL).

I really appreciate all insights and opinions given here, but fact is that the discussion on SCTY has slowed down and just a few members pitch in. I remember there were more posts a while back. Do your own research disclaimers...yeah, if you have the time for it. That's why I visit these forums, because I don't.

I've posted some questions that went unanswered. I still don't know what to do with my Oct 17 $20 options. $27 will mean break even, $24 is loss, $15 is expire worthlessly. But, there are still 6 weeks to turn things around so I probably will keep them.�

1/1/2015

guest I think people are overreacting a bit to the recent underperformance by SCTY. It IPOed for less than a year and has been trending up until the last month.

The way I see it, it was undervalued to start the year and then became overvalued after the TSLA run-up and the Goldman financing deal. I think it is unlikely we'll see sub-20 again because that level will be too attractive - very few people were able to buy at those prices. We will see strong support in the mid-20s in my opinion.

In the short term, I see more potential in solar panel manufacturers due to supply and rising costs. But I'm bullish on the solar sector as a whole and I think the next run-up in solar will carry SCTY with it. In the longer term, I see SCTY as a $10b+ company as panels slowly become commodity. It will take a while for everyone to figure out how to value SCTY, but I think when we get to that point, it will be too late.�

1/1/2015

guest Which do you recommend?�

1/1/2015

guest With the volatile swings in solar and inherent risks associated with the sector in the foreseeable future, as documented in this forum, I would not play solar stocks with short term options. One can consider longer term options, LEAPS, or even shares. Choices are limited because only 3 companies have jan 15 LEAPs: spwr, sol, and sune. The other companies have options expiring in a shorter time frame. April 14 for scty, sol and csiq and march 14 for yge. I think it would be ok to use April 14 options but the safest choice remains jan15 or shares.�

1/1/2015

guest SPWR, SUNE and TSL are the Companies With JAN15 LEAPS.�

1/1/2015

guest When do SCTY Jan '15 calls go on sale? I see them in the E*Trade app but they don't seem to be trading yet.�

1/1/2015

guest thanks for the correction. I guess I was typing too fast on the ipad!�

1/1/2015

guest I was trying to search this thread for SUNE. Seems they dropped from a loss last earnings call. Do some of you feel a return to the 10+ in the long or short term? I am looking to invest more in a company. TSLA is pretty high right now and I am not one who has a crazy amount of money to throw away so I would like to get something below 30 dollars a share. I felt the solar companies we have been talking about look good.

I am new to investing so what do I know �

�

1/1/2015

guest

Just an educated guess, but likely in Nov or Dec.�

1/1/2015

guest It looks to me like SCTY J15s are already available today. No OI, since the bid/ask spread is huge.�

1/1/2015

guest Scty coming close to support around $27, from 200 day ma and consolidation area from early may. If it can hold in that area, could provide an attractive entry point.�

1/1/2015

guest Anyone buying SCTY at this level? I'm considering April '14 Calls @ ~$30 Strike. Thoughts from others on this?�

1/1/2015

guest I started dipping my toes into SCTY today. I actually bought some A14 $30 calls as well as some J15 $30 calls.

If it goes down more, I will buy some more. This downtrend can't last forever though, so I don't want to miss out because I got too greedy. I am happy with the price I paid today.�

1/1/2015

guest Just bought 5 more shares of SCTY today.It's really cheap, seems like a good time to accumulate.

�

1/1/2015

guest I don't see J '15 Calls available. Where are you buying them?�

1/1/2015

guest Schwab�

1/1/2015

guest Looks like SCTY now has weekly options as well. Does anybody know when that started? Was it today?�

1/1/2015

guest Hi dave, it wasn't today, as last week i did a buy write using the weekly's. Maybe last week?�

1/1/2015

guest Tigerade, 5 more shares? Doesn't the transaction fee dwarf the potential gain on buying 5 shares of scty?

I see in after hours it's up a wee bit. That's a good sign. I would like to think the downtrend is over and i was thinking about buying today, but in my experience it's always over 1 or two days after I think it's over. I also don't think we'll see a fast bounce up without a catalyst. Maybe 50 cents or a dollar, but not over 30 for a while. I'll be picking up leaps that are 2 dollars in the money (or maybe the april 2014 calls). I also considered picking up shares and selling calls 2 weeks out for 30 strike. I see 40 eventually but I could also see it languishing down here at 28 for a bit while there's turnover and accumulation.

Most likely I'll make my bid for mid 27 ish tomorrow,�

1/1/2015

guest You might end up being correct, but in my opinion there will be a fast bounce off the bottom and I would expect a 30% - 50% gain in a matter of days/weeks depending on how low SCTY goes. The lower it goes the more violent the bounce back up will be. I don't see any periods of consolidation before it recovers.

That's why I am comfortable buying at these levels, because even if it keeps going down below $25 (it won't) then it will bounce back quickly above $30 in no time.�

1/1/2015

guest I swapped my Oct 17 '13 strike $20 calls today for same number of Jan '15 strike $25 contracts. Pretty much an even swap. Also closed my Jan '14 strike $30 calls, but at a 66% loss.

If SCTY goes much lower I might buy more Jan '15 calls, to try to make up for the loss.�

1/1/2015

guest Guess I'm officially part of this forum

Nov '13 strike $31. Betting on a sharp turn around and a good earnings call sometime in November.

Also bought some SNE Jan '14 calls at $26, but obviously that doesn't pertain much to this forum �

�

1/1/2015

guest I got leaps on everything in solar �

�

1/1/2015

guest Good job. Don't be afraid to take some profits. Solar has been on an epic run in the past week, and a correction is inevitable. These stocks are still "cheap" so maybe the rally lasts another week or two, but I doubt it. People will start taking profits eventually.

It is up to you how, when, and if you want to take profits. But what I do is simply sell a higher strike option (same expiry) to create a delayed construct bull call spread (thanks ongba). Then you can re-deploy that same capital during a correction, and start the same process. You can do this over and over with the same capital as long as your market timing is perfect, haha.

Looks like SCTY is back! Either I called the trough correctly (with my money) or this is a dead-cat bounce. The only thing that worries me is that solars have been going up for 5 days straight and so has the general market in the past three days. I am worried that the market will correct tomorrow or early next week and bring the solar stocks down with it. So SCTY is not in a good position to rally, but if it does end up in the green when the rest of the market is going down you will know that the bottom has been set.�

1/1/2015

guest First time buying short term options, got some SCTY sept 13 30 calls for 1.10.�

1/1/2015

guest How do you guys manage the fact SCTY's options are so illiquid? I'm having a hard time handling such high bid/ask spreads. Any advice?�

1/1/2015

guest I put in limit orders in the middle between bid/ask. You have to overpay a little for options unfortunately, so you better be right.�

1/1/2015

guest It appears SOL has some major resistance at $5.80.

Then some one sold 72,000 shares and bombed it haha.�

1/1/2015

guest SCTY broke out above $30

SCTY had some serious resistance today at $30, but it finally broke out on its 3rd try. I think this might be a good sign if we can hold that number and continue gaining for the rest of the day.�

1/1/2015

guest I paid .10 above the ask price before the market opened this am. I wanted it really bad. I felt it had hit a really solid bottom. My exit plan is to sell half when it hits $31 (hopefully early next week) then ride the rest and try to time it near the top. Like I said, this is my first near term option trade so it's an amount I am comfortable loosing and considering tuition to "Options Trading 101". If it has a huge rally I might just exercise it�

1/1/2015

guest I think you can thank me for this, I showed some bad attitude on SCTY and finally sold all my short term options yesterday. Of course I get punished for my lack of patience todaybut rewarded too since I still have my core stock holding and some leaps :biggrin:.

�

1/1/2015

guest I really liked the strong rebound today, it appears that the sector recovered from the sell off. I saw the agreement to provide 2+ megawatts to east bridgewater and if that's adopted by other towns, it could really boost scty. I wasn't a fan of the fact that they first sell back to national grid at net metering and then distribute the power- personally, they'd be way better off by distributing the power directly and cutting national grid out... but that's not going to happen since nat grid owns the distribution.

Anyway, I'm glad for the turn around, still quite underwater on the position. I had sold off 80% of my position two days ago at 29.70 and when it returned to 29.70 I grabbed april calls. I am kicking myself right now for selling off and not loading up further, but also in my experience it seems that the first rally occurring after a long trend is not sustained without solid news. I'll be looking for a move to 31 then a return to 29 or below for 2 more weeks. Then we can make the real rally up.�

1/1/2015

guest Bounced back below 30$. The level has been retested twice so far with no luck. It still feels pretty solid though.... or is it just wishful thinking? I bought a JAN14 bull call spread 25$-40$ for 5$ today. Anyone else doing similar strategies?�

1/1/2015

guest Anyone can explain why in the past 3 days, SCTY was down $1.5, up $1.5 and down $1? Is there any real news affecting the fluctuation or just random?

I am too concentrated in TSLA so can't digest what is going on. I do have position on SCTY since earning and is taking away some buying power. I should not allocate that much for it.�

1/1/2015

guest Has anyone read this yet?

Germans Revolt Against Germany's Green Energy Revolution - Forbes

What do you think? If one of the greenest countries in the world is having trouble, what does that say to an even bigger country, us?�

1/1/2015

guest I think that around $29 is a reasonable and realistic basis for the current SolarCity, now that the hot air has been released. I believe the company's prospects are good and that we'll soon see the stock rising again. What are your thoughts, guys?�

1/1/2015

guest I have to sort of agree here. I'm actually looking for a $27 entry. I sold everything months ago at $33 and didn't believe in the massive bubble it made. Even when we got to 29 months ago I thought it was sort of silly...�

1/1/2015

guest Welcome back! Haven't seen you post in a while �

�

1/1/2015

guest Yeah, been a crazy month of travel over 5 different timezones around the world - western hemisphere mainly.

Haven't even had time to lurk really! But it's good to catch up and see what's happening around here.�

1/1/2015

guest It means that massive public subsidies for solar are going to end sooner or later. I'm really not bullish on LT prospects for growth in SCTY and it's competitors, therefore, unless the manufacturing costs continue to come down to bring the cost of solar to wholesale grid parity (not just the easier mark of retail parity, which has already been reached in many areas).�

1/1/2015

guest From what i have heard Germany swore after they lost WWII that they would be energy independent. That is their reason for investing so heavily in nuclear and renewables. With Fukushima they are now planning on getting rid of nuclear. The cost to install solar has dropped so much that if no energy received incentives solar would win hands down. Other countries especially eastern Asia are massively investing in solar infrastructure. This is why solar is so hot right now. If you want to learn more from the top trusted research firms in the industry visit solarbuzz and green tech media. Spend some time on those sites researching the industry before trusting the mainstream media. It's the same reason we all trust TMC over everything else.

- - - Updated - - -

For those that are interested in learning more about what energy sources are subsidized. Cleantechnia published an extensive report about 6 months ago comparing them.�

1/1/2015

guest Robert.Boston - I am curious why you are so negatively biased against solar? If anyone were to be biased against solar it should be me: I work for a utility that has zero solar exposure and would be without a job if solar took over.

You hardly ever post in this thread and when you do it is filled with negatively biased misleading information. Here are your last three posts in this forum:

Bolded emphasis mine. Solar does not need hundreds of dollars of subsidies, since it costs less than $100/MWh to produce, so this can't be true. When I pointed this out you wrote:

I don't want to get into a debate over this, but the reason the SREC's are so expensive is that you have to set the limit high to encourage utilities to invest in solar, otherwise they will keep the status quo, i.e. coal, nat. gas, etc. I know because I work for a utility, and it is a good old boy system, and people in this industry are extremely resistant to change.

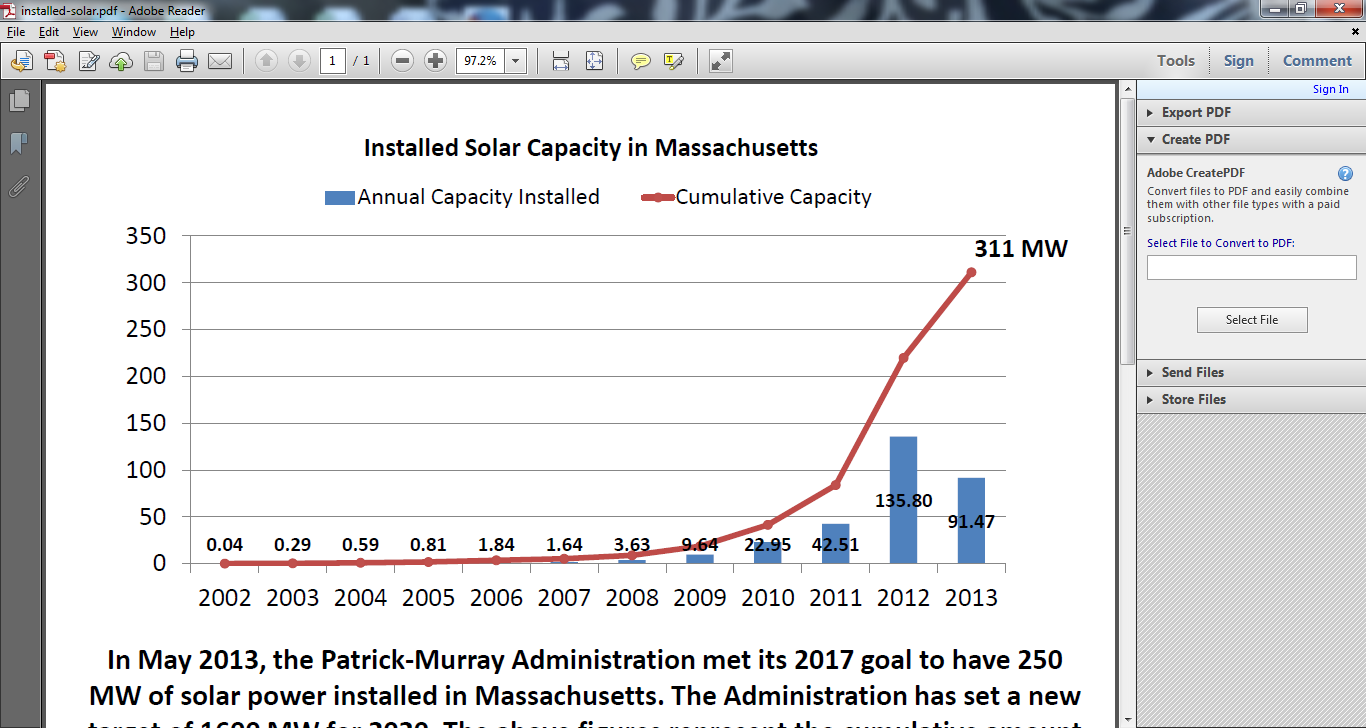

Look at EV's for example, the governments set the credits at $5,000 (which is relatively high) and none of the auto manufacturers cared to build EV's. You have to set the credits prices extremely high to encourage behavior and it has worked wonderfully in Massachusetts:

Just look at this graph on installed solar in Massachusetts; I believe these SREC's were implemented in 2010:

The SREC's are working.

Bolded emphasis yours. This is once again not true.

For residential installations, solar only has to reach retail parity because as a consumer you are paying retail prices. So if you want to install solar panels on your roof, you only have to pay less than the retail rate charged by your utility to make financial sense.

Solar Power Plants on the other hand are about 50% cheaper than residential solar, so it is a lot easier to reach wholesale grid parity.

I am going to have to agree with Theshadows on solar: If you take away all of the subsidies then it is the cheapest form of energy.

I guarantee you that once nat. gas hits $10 again (and it will) you will be wishing that the government had implemented a lot more subsidies into solar to encourage faster adoption.�

1/1/2015

guest I diverted a little of my TSLA capital over to SPWR over the last four days, getting my last bit in today during the dip this morning. Everything this week I bought was stock, but bought $25 LEAPS last week as I mentioned earlier in this thread.�

1/1/2015

guest I did my SPWR shopping during the Black Friday sale when it was around $21; all LEAPS. Might buy some more too. I have plenty of shares already.

- - - Updated - - -

BTW, the part that got cut off on that image I posted said that the new target for Massachusetts is 1600 MW installed by 2020 (from 250 MW by 2017). So I would say that the credits are working. They will revise their estimates once again in the near future.�

1/1/2015

guest @sleepyhead: I'm not against solar; to the contrary, it's a great technology and will be an important contributor to the de-carbonization of the power sector. BUT I see the success of companies like SCTY linked almost entirely to what I consider to be a major and unsustainable loophole in the structure of retail tariffs. All household PV installations benefit from one of two programs: net metering or feed-in tariffs.

As I've written elsewhere, net metering allows people to duck payment of their fair share of the infrastructure costs that are required to keep the system running: not only the cost of the wires that the household very visibly uses both to buy power by night and sell power by day, but also the costs of ancillary services, reserve power, installed capacity reserves, and system operations. No wholesale power producer is afforded this same special status, even those that are fully sustainable. By allowing some users to avoid paying these fixed charges, those without PV must pay more, encouraging yet more people to go solar to avoid paying the now-higher rates. This model isn't sustainable and so it will end: the question is when exactly.

The other model is what's been used in Germany, Japan, and Ontario (among many others): the feed-in tariff (FIT). In this model, solar is separately metered and paid a price well in excess of the average wholesale spot price of power. Everyone on the grid (except the seller) pays a premium price for power to cover this cost. As more PV is installed, the premium rises, sparking resistance among consumer and business groups -- resistance that has had tangible effects in Germany and is gaining traction in Japan and elsewhere. While FIT is a better model than net metering, the need for FIT highlights that solar isn't really at grid-parity. Otherwise, the FIT rate could simply be equal to the wholesale price.

And remember, these tariff perks are layered on top of generous tax subsidies for installing systems that lower the consumer's cost to about one-half of the full cost. Again, why exactly is the government subsidizing this particular form of renewable power so generously? And how long will these programs last as Congress is gutting federal programs to attempt to reduce the deficit?

We may disagree about whether all these layers of subsidies are good or bad, but as an investor one should note that there is a debate about these matters, and that the current success of the solar industry is heavily dependent on subsidies and tax savings. (As proof of this point, look at the solar adoption rate by state/county, and note the enormous differences going across which side of the political boundary you're on.) This regulatory/political risk is something investors should consider before making long-term investment in solar. I would also be concerned about installing solar if the payback period was longer than 4 or 5 years, the time horizon when I think we'll see many of these favorable tariff treatments vanish.�

1/1/2015

guest Solar breakthrough.

New connection between stacked solar cells can handle energy of 70,000 suns�

1/1/2015

guest Can someone translate this into layman terms?

Totally inaccurate rough guesses would be a good first start for discussion. Thanks.�

1/1/2015

guest It's better :biggrin:�

1/1/2015

guest Somewhat OT, and maybe old. But frecking cool! http://www.solarroadways.com/intro.shtml�

1/1/2015

guest Good post Robert and I agree with what you are saying and these are definitely risks for companies like SCTY, and to some degree the panel manufacturers.

But as long as there are governments out there implementing subsidies, there will always be demand for panels and that is why I think that investing in solar panel makers (especially those with full downstream business, such as SPWR, CSIQ, etc.) is a better bet than SCTY. Especially since the Chinese ones are really cheap.

Subsidies are necessary today, because solar is not yet cheaper than other sources of energy because nat. gas, coal, etc. get huge subsidies and it is impossible to compete with them without getting some sort of subsidies.

The one thing that you are missing in your analysis is that solar panel costs are getting cheaper every year, and a big chunk of the costs (at least in US) are the permitting/installation/bureaucracy costs and there is plenty of room for these to go down (so claims Sunpower's CEO).

Coal and Nat. Gas will only get more expensive over time, while solar should get cheaper in the future. It is very possible that in 5 years time solar will be competitive even without any subsidies.

Eventually the whole world is going to run on solar and currently I think that number is only a fraction of a percent. There is still plenty of room to run before these subsidies become an issue of unfair cost distribution.

There is still plenty of room for solar to run, I am not thinking about long term investments. I am talking about the opportunity to possibly make a big return in the next year, and then reevaluate the situation as fundamentals change. That is why you have to continuously research the industry and be on top of things if you want to invest in solar.�

1/1/2015

guest Solar is the easiest "Green Technology" out there to implement. Make no mistake, attitudes about pollution are shifting. People travel and they can see the difference in air quality. They will want solar just as much as they want electric cars.�

1/1/2015

guest Don't be so sure. Apparently Australia just elected a very conservative Prime Minister:

http://online.wsj.com/article/SB10001424127887324094704579062413951030326.html�

1/1/2015

guest Here's a question for those who follow the PV industry closely:

What technology/technique should be watched most closely for next-generation dominance? Single-crystal silicon? Polycrystalline? HiCZ (and what is that, any way)? What are the fundamental characteristics of each and what the limitations?�

1/1/2015

guest As one country cuts back on solar, two other countries step up to expand solar. Just look at all the headlines of countries setting huge renewable energy targets.

Three years ago all of the demand came from Europe. Now it is Japan, US, and China. US is just getting started and will not peak for another 2-3 years, when the tax credit is supposed to expire. China is also just getting started as it announced goal to install 35 GW's in the next 3 years, and will probably grow from there as long as they can get their transmission lines capable of handling this power.

Saudi Arabia and other oil exporting countries are going to install tens of GW's of solar, so that they can export more oil instead of burning it for electricity.

The global demand for solar is picking up very quickly. I remember reading a report just months ago that said 2013 global solar demand will be about 30 GW's. Two months ago I read estimates at 35 GW's. Now I am seeing 37 GW's, including 22 GW's in the second half.

Demand is going up, while supply is going down. IMO the case for investing in Chinese solar manufacturers is still excellent, and the only real risk is a global recession which doesn't seem likely based on the data we have today.�

1/1/2015

guest People are always looking for the next great technological leap in solar. The existing technology is 50 years old, it's just more efficient and doesn't degrade like it used to. The thing about waiting for the next great solar innovation is that it will likely be 10-15 years to get to market if it is viable. I first saw the solar roads thing 5 years ago. While it is cool it's not really practical. There has been no new movement on it since it was first announced. The cost is what needs to come down, and that it has.

With the demand that is coming the next few years, the price of panels is likely going to continue to rise until the manufactures can scale up production. It's kinda the same way it is with the batteries for Tesla.

Waiting on the next great solar capturing device (we have already been through thin film which was supposed to trump crystaline technologies) is like waiting on hydrogen fuel cell cars. It's a great idea but what we need an afordable solution that is in the market now. Waiting 15 years to get that 10kw solar energy system that is 5% better is 203 megawatts of renewable energy that could have made a difference today. (That's 675,000 Tesla Model S miles).�

1/1/2015

guest Anyone else notice that (most likely) a big institutional buyer scooped up about 100,000 shares of SPWR at 1pm EST on Friday? Not saying that it means anything, but maybe...�

1/1/2015

guest Anyone in the DFW area use solar city? Would love to get your thoughts about the process. Thanks!�

1/1/2015

guest So that's what pushed it over $23...interesting.�

1/1/2015

guest

All true, and thank you for the input. Perhaps I should have said I was looking more for input in the investment side rather than in the use side. But I very much like your admonition for prospective users to panel up now rather than wait for the next incremental enhancement in performance.�

1/1/2015

guest Anyway, looking really good in Asia today!

http://www.bloomberg.com/markets/stocks/world-indexes/asia-pacific/�

1/1/2015

guest Just landed in Japan and i see solar panels everywhere!�

Không có nhận xét nào:

Đăng nhận xét