1/1/2015

guest Cool! �

�

1/1/2015

guest Wow.. this is a terrific read. Thanks Flux!

The comparison given is against other auto makers. It would be interesting to see if it is possible to compare against a different industry since the major autos are not R&D intensive at the moment. Maybe go back in time and compare against early computer startups or the like.�

1/1/2015

guest Yeah overall fantastic post, but I think the one that should be highlighted over everything as techmaven mentioned is the R&D chart. I didn't realize how little everyone else was spending in R&D... that to me is a sign of a company (referencing the other big autos) that has no future.

- - - Updated - - -

Even more surprising the closest other firms on spending 7267 (Honda) and 7269 (Suzuki) is very shocking to me... Also equally shocking is the total lack of R&D budget from the likes of GM and BMW how are they even funding the Volt and the i series cars?�

1/1/2015

guest Thanks, guys. I'm glad you like it. I thought the leveling-off SG&A expenditures as a % of operating expenditures was a particularly revealing chart as well:

�

�

1/1/2015

guest At the very least the liquidity chart sorta shows why other companies can't put forth a lot of working capital toward coming out with something that attempts to break the mold... over half of them are below the 1.5 mark of being considered "healthy". That means that one wrong move and these companies are likely to go under... again...�

1/1/2015

guest I heard that funding comes from the Marketing department budget.�

1/1/2015

guest This is also driving home what has been said many times, in many different places, you cannot really compare Tesla to it's "peers"... I am sure if you took the same thing but did it with Tech stocks like Amazon and Netflix, you would also get very similar crazy charting... So I totally agree with the conclusion of TSLA being an Island on its own.�

1/1/2015

guest A lot of R&D (e.g BMW) was pushed to the supplier side during the last years, might be difficult to make that visible.�

1/1/2015

guest That just seems like a poor line of thinking... "our innovation and core research is only there to keep us alive"... That is entirely what that screams to me. I am going to spend 10 million here on some TV commercial advertising... and 10 million over here on product placement in entertainment... 10 million over here on sports branding and competition... oh yeah and we can also throw 10 million toward coming up with new designs cause that will help us get sales too right?

Such a terrible thought process... or am I looking at this wrong?

- - - Updated - - -

But you still need someone, presumably at BMW, sitting there to put together the i3 and i8... designing the car's look, what it will be made out of, its overall target goals for how they want the car to be... etc... Unless, like GM, they outsourced that (which would actually explain why it feels like a different product that doesn't feel like a BMW... no offense, but it doesn't). But wouldn't that still be a line item under R&D, I am just going to throw X number of dollars to a third party company to come up with something for us.

And the reference to GM was regarding how they handled the EV1, at the least... I don't know what they did when it came to the Volt. All that was A1 if I am not mistaken... GM really didn't have anything to do with the EV1 other than funding.�

1/1/2015

guest BMW used in 2013; � million 4,362 in Research and development expenses. I hope they used all of it for EV development

For those who are interested, here are BMW,s Financial statements 2013:

http://www.bmwgroup.com/e/0_0_www_bmwgroup_com/investor_relations/finanzberichte/bmw-ag-jahresabschluss-2013.html

=> Download BMW AG Financial Statements 2013.

Page 5/32;

BMW AG

Income Statement

in � million

Notes 2013 2012

Revenues

14 60,474 58,805

Cost of sales

� 47,067 � 46,252

Gross profit 13,407 12,553

Selling expenses

� 3,528 � 3,684

Administrative expenses

� 2,141 � 1,701

Research and development expenses

� 4,362 � 3,573

Other operating income

15

and expenses

16 542 703

Result on investments

17 373 598

Financial result

18 � 328 � 99

Profit from ordinary activities 3,963 4,797

Income taxes

19 � 1,629 � 1,635

Other taxes

� 45 � 31

Net profit 2,289 3,131

Transfer to revenue reserves

20 � 582 � 1,491

Unappropriated profit available for distribution 1,707 1,640

�

1/1/2015

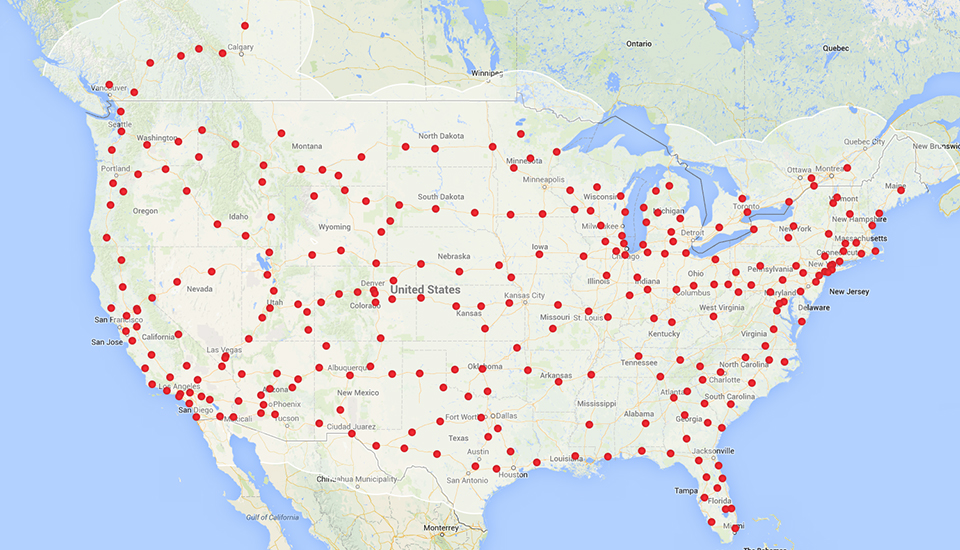

guest Currently average distance between chargers in USA is 80 mile.

Average distance between gas station in USA is 6 mile.

If Tesla can get to 10 mile average distance between chargers, and increase charge rate to 200-300KwH, it's the end of "Range Anxiety"

In order to get to that point, Tesla needs to have 64x current charger station count. I think that instead of creating all 64x more charger station, Tesla could build 8x more charger station, but also multiply the number of stall by 8x. That way 8 x 175 current station count = 1400 station. Most station currently have between 4-6 stalls. Tesla needs to reach 16-20 stalls in each station (just like most big gas station)

End of 2014 = ~150 superchargers in USA, 300 Worldwide

End of 2015 = aim for 300 superchargers in USA, 700 Worldwide

End of 2016 = aim for 600 superchargers in USA, 1200 Worldwide

End of 2017 (gen 3) = aim for 1200-1400 superchargers in USA, 2500 Worldwide

2018 = double # of charging stall, install solar powered and stationary storage in 25% of superchargers

2019 = double # of charging stall again, 50% of stations solar and battery powered

2020 = double # of charging stall again, 75% of stations solar and battery powered

There is no more Range Anxiety. People who live in an apartment will also be served. That will be the electric revolution that we need.

Couple all that with ChaDeMo charger. Plus the appearance of Solar Canopy + electric charging in parking lot. That will be the ideal infrastructure for the electric revolution. No more excuse to not go electric.

The math is also very simple for gasoline savings too. Buy Model 3 for $35K to $40K. use it for 10 years, save $20-25K on gas, truly just buying $15K car. That's the entering the area of no competition. Not to mention if they introduce Gen 4. for $25-30K, with fuel savings $20-25K, it's essentially free car over 10 years.

Sell net-zero energy home package. Solar Panel + Stationary storage + Model 3 car for as low as $600/month for 72 months + extra charge for excessive usage.

This may read too over the top, but anyone who ever played Sim City knows that this is the future of energy. No more fossil fuel, all clean energy.�

1/1/2015

guest That math is not correct, the map is two dimensional, so you would need to have roughly 64x as many chargers to result in an 8x decrease in average distance between them.

Regardless, it is irrelevant. EVs are charged at home and do not need to "fill up" at public stations as often or as quickly as gas (though the quicker the better, and the focus will remain on quick charging). Charging at home is preferable to having to go somewhere to charge. Thus we won't see as many Superchargers as gas station, nor will we need to. One thing I look forward to is society reclaiming wasted real estate used on gas stations and putting it to better use. Also, do note that even today, you are always closer to a plug than a gas station, even if that plug is only 120v.

The problem of apartment dwellers is real and there will have to be a solution (ca has passed laws regarding installing charging stations in apartment communities) but for those with dedicated parking, your theorized amount of charger penetration is unnecessary.�

1/1/2015

guest ZOMG.. I'm an idiot. This is what happened when u r no longer at school.. �

�

1/1/2015

guest Yeah, I see street parking getting chargers (maybe wireless?) and for garages you could just throw out a bunch of 14/50 plugs along the walls of the garage... or make it all wireless too... but by the time you need 100% charging (because we are 100% electric) I am sure that charging will be a whole new game.�

1/1/2015

guest I think there's enough off-street parking to grow the market enough that it can trigger a shift in view. I think it would be good to have a solution packaged that can make mass installation of charging in multi-unit dwelling easier.�

1/1/2015

guest Yeah, I'm sorry I was not trying to say that it needed to happen like... Tomorrow. We have time for all of that. I mean even getting your condo/apartment/whatever on board with putting in one or two chargers that should meet the demand for the time. The more tennents that want it, they can install more.

Really street parking would be my only real concern. But I get the feeling that auto driving will solve some of this as well.

Again there is plenty of 35k budgeted people who can get the car and have zero issue charging so it is just something that will need to be solved eventually.�

1/1/2015

guest The US Interstate Highway system extends 47,714 miles. 1000 SC stations should be more than adequate if well placed. Note placing stations near interchanges can serve multiple routes. So average distance between could be less than 45 miles. The interstate system does not cover all highway one would potentially want to cover, but I think it is a pretty good guage for covering loner distance travel. Unless Tesla also pursues metro residential SC strategy, which they seem to be trying in the UK but not the US, they may never need more than about 1200 stations in the US. Actually I think 600 would be more than adequate, but for convenience and to handle high volume use, as many as 1200 may be needed.�

1/1/2015

guest Is the gigafactory included in the R&D spending?�

1/1/2015

guest Probably more CapEx than R&D at this point.�

1/1/2015

guest what and when are the chances that TSLA will be added to the S&P500?�

1/1/2015

guest I think the S&P 500 will be very late to the party. They require GAAP profits for 1 calendar year before adding to index. Which will probably be just prior to Model 3 launch..�

1/1/2015

guest I didn't know about the GAAP profits requirement for S&P 500 inclusion. Requiring a minimum of 1 year of GAAP profits - I could see Gen 3 being out for awhile before that happens. The scale of the build in front of Tesla, and the scale of the opportunity - I can easily see Tesla running right around break even for a long, LONG, time to come. (Gen 3, pickup truck, actual demand generation in the US, sales and service centers around the world, Superchargers around the world, GF #2, 3, 4, ...).

This investor hopes that's what we see happen too (foot on the floor, and hold it there for years!)�

1/1/2015

guest It makes a lot of business sense for Tesla to be spending now, as much as they can.

Tesla needs to grow and establish their world footprint whilst it has the winds of macroeconomic growth blowing into its sails.

Once these winds change direction, Tesla has to be ready and able to sail into the winds.

In other words, I agree with you, we are unlikely to see profits for at least few years. Consequently I am delaying my hope for TSLA to be included in S&P 500.�

1/1/2015

guest About S&P 500 inclusion -

Based on today's closing price, TMC's market capitalization is $32.72 billion. By my read of the S&P, that places it 137th in market cap, so 363 members have a smaller presence in the market than has Tesla.

Now market cap is not everything, but it without question is one of the fundamentally most important criteria for this list. What I haven't been able to determine is how many US companies of that market cap and larger also are not S&P members....but it cannot be more than a handful.

A partial list of S&P 500 members whose market cap is smaller than Tesla's, as of 25 August:

Eaton

Delta

Norfolk Southern

General Mills

Archer Daniels

CBS

Johnson Controls

Travelers

Deere

Wellpoint

Hess

Big names!!!!!

On edit: I haven't anything more recent than the year-end 2013 list for the FT 500 list of global securities; by that list, Tesla would rank approximately 270th.�

1/1/2015

guest This link is from April when TSLA had less than an 18 billion market cap and would have ranked 3rd on the list of largest companies not included in the S&P. Unless the others shot up by more, which is not likely, TSLA would now be #1 on largest not included:

Candidates to Join the SP 500 - 24/7 Wall St.�

1/1/2015

guest Some of the names in that article, RABaby, include Las Vegas Sands - now at $55.45bn; Alexion Pharm., now at $33.74bn - and still not in but bigger than Tesla; the chemicals giant LyondellBasell at $57.87bn is in that article but at time of writing already in - that article was incorrect.

It appears that low-free-floaters like GM and others don't pass the S&P Member test. Perhaps Mr. Musk's large position is one reason TSLA is not in the 500????�

1/1/2015

guest I think Tesla insiders hold less than 40% of the float, condition for inclusion in the index is less than 50%.

Most likely Tesla is not part of the index yet because it does not meet one of the conditions for inclusion:Companies should have 4 consecutive quarters of positive as reported earnings, where as reported earnings are defined as gaap net income excluding discontinued operations and extraordinary items.

�

1/1/2015

guest Yeah, I believe this has been brought up before and the consensus was that it would not happen until we get GAAP positive. I heard rumors about them possibly changing the GAAP accounting rules regarding lease accounting which would actually help Tesla's reporting in that their "Guaranteed Resale Value" isn't technically a lease. But I have no clue how true that is. In any case, given how much money Tesla is likely to be spending, we have been fortunate to have a non-GAAP profit, IMO.�

1/1/2015

guest Below are pertinent excerpts from S&P�s index inclusion guidelines for 2000 and 2014:

General Criteria for

S&P U.S. Index

Membership

September, 2000

INTRODUCTION

One of the most frequent questions we get at Standard & Poor�s is, �What are the criteria

for being added to an S&P Index?� First and foremost, S&P Indices are not rules-based; all

changes are fully discretionary and are determined by the Index Committee based upon public

information. Companies may not apply for inclusion�

FUNDAMENTAL ANALYSIS

The profitability criteria are four quarters of positive net income on an operating basis.

Sometimes, Standard & Poor�s will include a company that would be profitable except for a

loss due to a merger or acquisition�

CONCLUSION

These are the main five criteria used by the S&P Index Committee to identify Index

candidates. Please keep in mind that a company meeting all of these criteria is not assured of

being added to an S&P Index. Likewise, the fact that a company might not meet all of the

above requirements does not mean that it cannot be added to an Index...

S&P U.S. Industries

Methodology

July 2014

Financial Viability. The sum of the most recent four consecutive quarters� as-reported

earnings should be positive as should the most recent quarter. As-reported earnings are

Generally Accepted Accounting Principles (GAAP) net income excluding discontinued

operations and extraordinary items�

Index Committee

...In addition, the Index Committee may revise index policy covering rules for selecting companies,

treatment of dividends, share counts or other matters...�

1/1/2015

guest Based on your expertise Curt, do you see the S&P adding TM to their index before 4 consecutive GAAP + quarters?�

1/1/2015

guest The 2000 guidelines appear to be more lenient than those implemented last month. It really depends on the committee members. How much weight do they want to give to market capitalization? How much allowance will be given to what appears to be a successful growth company that is pouring revenue into R&D and expansion?

I have a friend who is a senior executive at S&P. I asked him whether the index committee would consider Tesla Motors. He answered that there is a wall preventing discussion between his research department and the committee, so he can�t comment. I don�t know any of the committee members, so your guess is as good as mine.�

1/1/2015

guest What's the goal of the S&P 500 exactly? If it's meant to be a proxy metric for overall economic business health, then any high growth company in the early stages wouldn't be a good fit for that goal. I'm just throwing out a discussion point, as I have no idea what S&P's goal is.

I supposed asked another way, is there a reason that we would want TSLA added to the S&P?�

1/1/2015

guest I was just about to ask the same question! All I can add is, does S&P have any kind of mission statement wherein they tell us what they're trying to achieve with this?�

1/1/2015

guest From the introduction to the 2014 guidelines:

S&P Dow Jones U.S. indices are designed to reflect the U.S. equity markets and, through

the markets, the U.S. economy. The S&P 500 focuses on the large-cap sector of the

market; however, since it includes a significant portion of the total value of the market, it

also represents the market. Companies in the S&P 500 are considered leading companies

in leading industries...

- - - Updated - - -

There is normally a pop upward in share price on the announcement that a company soon will be included in the index. S&P 500 and other related ETF's would be forced to buy. Other funds requiring or preferring S&P 500 stocks may also do so. The effect usually becomes muted by the time the company is actually added to the list. In the long run such inclusion may inspire more confidence from shareholders, lenders, suppliers and customers.�

1/1/2015

guest The funds that track the index would buy TSLA if it becomes part of the index. These funds have a lot of inertia when selling and buying, as their positions are much larger in comparison to individual investors. I would expect TSLA to loose a lot of its current volatility if these funds start buying in.�

1/1/2015

guest Yes, I would guess we go up 5-8% the day it gets announced�

1/1/2015

guest I don't think the upward bump on that day would be of such a significant magnitude. I think- and this is conjecture- that the index funds don't accumulate TSLA on the day of the announcement. They buy either in advance (by getting a head notice) or they buy in the following weeks. I think the pop on the day is due to the good will that the inclusion causes, but not from the actual funds buying.�

1/1/2015

guest No front running/insider informing. That would land the perpetrators in jail along with the payment of hefty fines. S&P is very careful about this. This is from the 2014 guidelines:

Announcements are available to the public via our Web site before or at the same time they are available to clients or the affected companies.�

1/1/2015

guest (I did not where to put this so Mods feel free to move this post)

I am kind of surprised to see this so soon:

London to trial wirelessly charged hybrid buses

Transport for London announces new trial to test hybrid buses capable of wirelessly charging batteries at stops

http://www.businessgreen.com/bg/news/2362064/london-to-trial-wirelessly-charged-hybrid-buses

�

1/1/2015

guest The auto industry has begun to cannibalize old car parts for new clean tech purposes, and according to the latest news from the Energy Department it looks like old tires can be gobbled up, digested, and spit out for use in lithium-ion batteries. The new technology could help solve a looming crisis in the lithium-ion battery market as rising demand for electric vehicles threatens to squeeze the supply of critical materials, including graphite as well as lithium.

Car Eats Self, Solves Lithium-Ion Battery Crisis | CleanTechnica�

1/1/2015

guest This is really awesome! I wonder if the same is true vs synthetic graphite?�

1/1/2015

guest Wouldn't effectively reduce the true float since these shares will not be sold?�

1/1/2015

guest Lets do some longterm speculation:

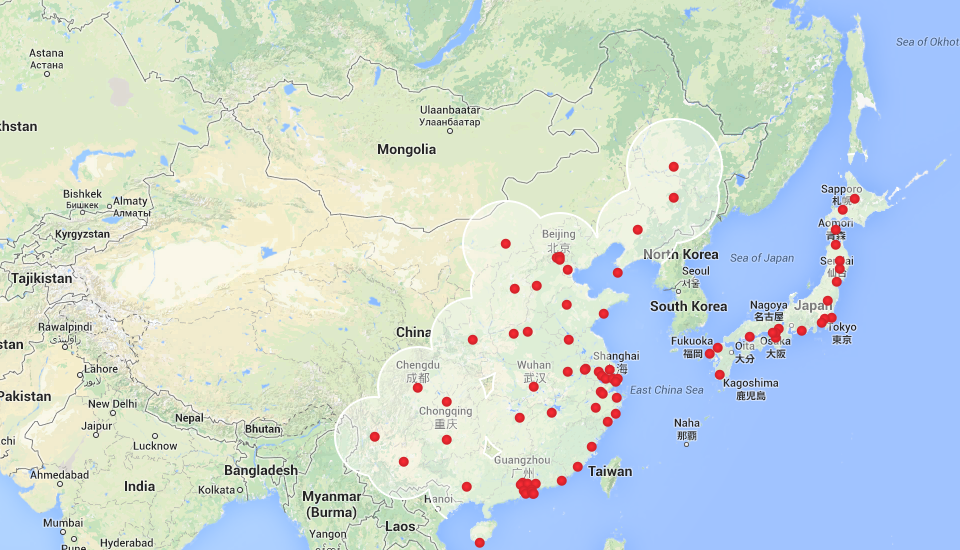

We know that the second Tesla car factory will be build in china, as Elon mentioned it a couple times already, and it just makes sense to cover the asian market from there.

A 33B valuation has a second factory already priced in I guess.

As we know Elon he thinks always one step bigger then we could imagine.

So we can assume that the Second factory will be quite a big project. 1Million cars /year at least.

With that we would need a second Giga factory, double the size as the US GF.

Lets assume that the demand will stay strong and even keeps rising.

How soon can we expect the second CF+GF in china?

My guess is that by the end of 2016 we will here such an announcement.�

1/1/2015

guest ZEV laws being implemented in an increasing number of jurisdictions would be good for TSLA.

You can help by signing a petition for ZEV in Quebec. (Deadline in 12 hours). Link in the thread in the environment forum:

http://www.teslamotorsclub.com/showthread.php/35356-Please-sign-petition-for-ZEV-law-in-Quebec-Only-12-hours-left�

1/1/2015

guest Does anyone know what Tesla's internal rate of return is or what they target? As a shareholder, what do you think this target should be?�

1/1/2015

guest A $33B valuation does not even include first GF, not even mentioning the second. According to Stifel Nicolaus (the firm that produced quite skeptical reports on TSLA, up to the latest one) TSLA is worth $400 per share (slightly less than $50B) just based on Model S/X production, without accounting for Model III and GF:

To that end, we note our call does not hinge on Gigafactory timing, nor Model III pricing/volume expectations for 2020 and beyond. We are focused on the Model S and X alone.

http://www.streetinsider.com/Analyst+EPS+Change/Stifel+Nicolaus+Upgrades+Tesla+Motors+%28TSLA%29+to+Buy%3B+Sees+Defensible+Niche+in+Luxury+EV+Market/9796182.html�

1/1/2015

guest It's quite possible to not have an IRR defined within Tesla, and at this stage it's not needed. IRR is one metric conventional 'management' uses to evaluate different projects to determine the best use of scarce capital. It's most useful for entities with a pile of cash pondering what potential projects would be worthwhile. Tesla has a very clear vision to bringing Gen3 to the mass market and developing stationary storage, and the (highly profitable overall) production expansion of those will keep them capital constrained for years.�

1/1/2015

guest If you are trying to grow a business on positive cash flow basis or nearly so, then cash flow is the scarce factor that you want to put to optimal use. A target IRR can be the basis for determining how much credit you need as leverage to achieve an acceptable growth rate in cash flow.

My specific concern is to model how much credit Tesla may need to finance equipment in multiple gigafactories. Based on recent info on the Sparks Gigafactory, I expect that Tesla will need to install $100 of equipment to make 1 kWh/year of battery packs and replace every 5 years. This is an equipment cost of $20 per kWh. Given a particular target IRR, I can determine the net cash flow per kWh, or return on equipment, that Tesla needs to finance the expansion of the Gigafactories on a positive cash flow basis. For example, suppose the cost per kWh is $130 including equipment replacement and target 55% IRR. Then, Tesla must have a 40% annual return on equipment. This implies a selling price of $170 per kWh and roughly a 30% gross margin. But what if the market demand will only bear $150, a 15% gross margin on battery packs. Then two options remain: 1) accept a lower IRR and grow Tesla at a slower rate than shareholders expect, or 2) finance a portion portion of the equipment. Financing about half of the $100 equipment investment with a loan at about 8% interest would achieve 55% IRR.

So the target rate of return is helpful in determining how to price products, finance, and structure deals. While it is no substitute for vision and strategy, it is critical to achieving success in the most financially efficient manner possible. It will be critical to optimizing the floor space in Gigafactory especially where multiple product lines, deals and markets will compete for floor space and cash flow.

My own view is that IRR needs to be at 50% or above as this is what will double shareholder value ever 18 months. An IRR 36% is required to double every 24 months. Is it fair to assume that most shareholders would prefer Tesla to double within a two year time frame?�

1/1/2015

guest Panasonic will be purchasing the equipment to make battery cells.

Is the equipment to make battery cells really $100 per 1 kWh/year of battery packs and this machinery only last 5 years?

$20 per kWh?

The cost seems high and the durability of the equipment seems absurdly low.�

1/1/2015

guest I agree.�

1/1/2015

guest Maybe it is the expected rate of improvements in technology and chemistry which make upgrades necessary this frequently?�

1/1/2015

guest I don't think most of the line machines are chemistry specific unless there is a radical change. Maybe they are factoring in such a change.�

1/1/2015

guest Tesla has repeatedly borrowed for growth and they'll do so again. With Tesla target markets with exponential growth possibilities and TSLA being priced quickly on future performance potential they should be able to borrow again using convertible notes.

If Tesla focuses on cash flow, it's cash flow including interest payments.�

1/1/2015

guest That's a good question, but is more of how much capex vs. cash reserves they are comfortable with at any given amount of time. Again, I think it could be answered without a determined IRR. For example, if we look at one extreme (unlikelihood aside) of how they could be attributing the Gigafactory using your numbers, say it costs $170/kWh (with a $30 cut to partners) including depreciation/amortization and they use that price as the 'fair price' it goes to Fremont at. In other words, they make 0% return from the Gigafactory, but it enables the Fremont facility to be massively profitable with a high gross margin on vehicles.

In this example, the gigafactory would have failed any and all IRR tests with a 0% return, but still be a massive net boon and worthwhile project for TM as a whole. This logic could be extended to subsequent gigafactories.

Of course, some real non-zero GF margin has to be defined since the product will be going to non-automotive uses, but it will be up to management to choose how they want to define the margin that best suits their accounting needs over time, and they don't necessarily need to justify the gigafactory within its own IRR context because it's a strategic supply chain asset and not an independent silo project for the company. Same reason why they don't necessarily have to specify NPV, ROI, ROE, and other metrics too.�

1/1/2015

guest Random question, does anybody know where to find what percentage of AAPL stock is owned by retail investors vs. institutional? and the same stat for TSLA?

Maybe a couple of other comparisons as well (e.g. FB, TWTR, and MSFT) I'm interested in.�

1/1/2015

guest Yes under finance.yahoo summary page to reach stock can go to key statistics and find what your looking for�

1/1/2015

guest Tesla Motors Longterm Growth

2015 Supercharging Locations...............Anticipated Growth???? I'm guessing Europe.�

1/1/2015

guest I have been reading up on the subject.

I think Tesla is using the most conservative accounting based on worst case scenario.

It is highly unlikely, but yes, that they would need to refurbish the plant with new machinery in 5 years due to a radical new battery technology. Solid state perhaps? As the current machines could handle any new slurry chemistry.�

1/1/2015

guest Ah, I hadn't thought of it that way. Thanks! That makes a lot of sense.�

1/1/2015

guest Thanks for your comments. I'm working this out in the Gigafactory financial modeling thread. I even have a spreadsheet that shows how this works. My basic aim is to develop a model under which massive growth can be sustained with minimal dilution of shares. Other insights also emerge. For example, when pricing battery packs for sell apart from Tesla vehicles, it is importand to factor in a rate of return on the Gigafactory that is at least as high as the rate of return on auto manufacturing capacity. Otherwise Tesla runs the risk of investing too heavily in batteries compromising the growth opportunity in autos. Internally how tesla prices batteries used in its own cars makes little difference, but batteries for other segments exposes one to certain tradeoffs.�

1/1/2015

guest I published another article on Seeking Alpha about Tesla's demand in the long-term (2020). Here is the link: Analyzing Tesla's Demand And How It Will Drive The Stock - Tesla Motors (NASDAQ:TSLA) | Seeking Alpha

Here is the text (Because I know SeekingAlpha has a login wall):

The Lux Research Report

- Lux Research's predictions regarding Tesla's demand shows a lack of research and extrapolation, and is based on assumptions on how the rest of the EV market will do.

- The Model X already has 20k pre-orders and is growing at a rate of 40-45 per day. The Model S "refresh" and Model 3 release will generate even more demand.

- Tesla's valuation is based on Tesla being able to achieve their targets for 2020, and will remain that way until Tesla gives investors a reason to be less confident.

- Although Tesla will likely not have a demand problem for a long time, there could be problems with ramping up production, recalls, and not being able to sell directly.

- Tesla will not have a serious threat from competition until the competition develops a fast charging network as well as a Gigafactory that allows them to mass produce batteries cheaply.

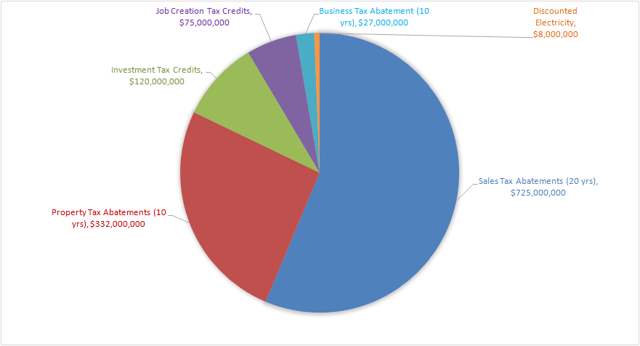

As Tesla (NASDAQ:TSLA) climbed over $280 per share in the first days of September, Lux Research released a report about Tesla's Gigafactory. The Gigafactory made news recently after Tesla announced that it would be built in Nevada. The state offered an incentive package worth $1.28 billion, with a breakdown like this:

(Source) (click to enlarge)

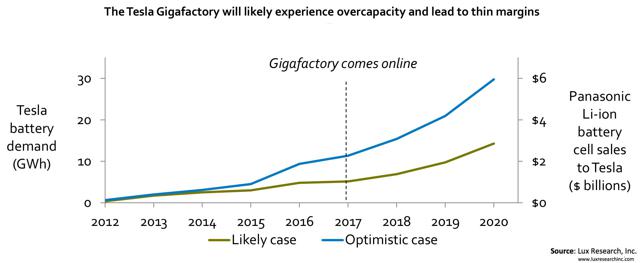

Previously, there were concerns about funding for the Gigafactory, and these concerns should be mitigated by this huge tax incentive package. But Lux Research brings up a different concern: overcapacity. According to Lux, Tesla will only be able to sell 240,000 vehicles in 2020, resulting in a 57% overcapacity in the Gigafactory. After publishing the report, the Lux Research Analyst went on Bloomberg TV to explain the reasoning behind the report. He said Lux predicts that in 2020, there will be 440,000 EVs sold globally, and that Lux assumed Tesla would take a little more than 50% market share with 240,000 vehicles.

There are multiple problems with Lux's assumptions. In 2013,220,000 electric vehicles were sold worldwide, whereas in 2012,120,000 electric vehicles were sold worldwide. This means that Lux is predicting that the growth in electric vehicle sales will slow down drastically from 85% to a measly 10.5% per year (average over the next 7 years). An even bigger flaw is the fact that Tesla's demand is not a function of overall electric vehicle sales. Tesla is a disruptor in the industry, as it is the first (and only) compelling electric vehicle that competes with gasoline vehicles in its class. In fact, Tesla outsold the Mercedes S-class, the second best selling car in its class, by almost 5,000 vehicles in 2013. Just like Apple in the smartphone market during 2007-2010, Tesla will probably remain a leader in the market due to competitive advantages that I laid out in my previousarticle. If Tesla does manage to do this, it is not unlikely that they will capture much more than 50% market share in 2020.

Lux Research also commented "The Gigafactory will only reduce the Tesla Model 3's cost by $2,800, not enough to sway the success of the planned lower-cost EV". This is inconsistent with other numbers in the report. According to their report, Tesla currently has a cost per kWh of $274, which is a lot less than the $397 that they predicted in 2012 for the 2020 timeframe. Here is the graph that Lux research provided:

(Source) (click to enlarge)

This graph shows a cost per kWh of $200, which goes along with Tesla's conservative estimates of 30% cost reduction in battery pack costs in 2017. These savings amount to much more than $2,800. Using the $274 per kWh estimate, Tesla's 60 kWh battery pack costs $16,440. If the Gigafactory gets costs down to $200 per kWh, then the 60 kWh battery pack would cost $12,000, which is already a savings of $4,440, and there are even further savings as the Model 3 will probably have a smaller battery pack due to its smaller size.

Lux Research's analysis is lacking because it bases its prediction of Tesla's demand on their ultra conservative prediction of total electric vehicle demand in 2020. Also, their numbers for battery savings are inconsistent throughout their report. On top of this, Lux Research predicted in 2012 that battery costs would reach $397 per kWh by 2020, and acknowledged in this report that Tesla's current battery costs are $274 per kWh, which is 30% less, 6 years ahead of time. Overall, it seems that Lux Research didn't do the job well. In order to better understand Tesla's high valuation, it is necessary to analyze and extrapolate Tesla's future demand properly.

Model S, Model X, Model 3, and How They Will Drive Demand

It is well known that on Seeking Alpha, authors often mistakenly talk about Tesla's current model, the Model S, having peaked demand (when in reality it is just peaked deliveries). Tesla has a constantly growing amount of customer deposits ($228 million in the last quarter), and over the last few months, wait times have been increasing (averaging 3 months in US, 4-5 months everywhere else). This shows that demand has not peaked unless Tesla is lying on their balance sheet about customer deposits and hiding cars in warehouses to artificially increase wait times.

Also, the phrase "peaked demand" implies that Tesla cannot generate any more demand. However, Tesla is currently opening stores at a very slow rate compared to Supercharger and Service Center expansion, has no budget for advertising, and has operations in only 14 countries. As Tesla ramps up production, they will come closer to being demand constrained, and when that happens, Tesla will be able to generate more demand simply by opening more stores, advertising, and expanding operations into more countries. Also, Model S demand can be increased by simply offering new features that many buyers need in order to be confident in purchasing the Model S. For example, Supercharging stations and destination chargers might drive demand as more and more of them open. Another possibility is that Tesla introduces an all-wheel drive version of the Model S, which would appeal to drivers in harsher climates, as well as drivers who like sporty vehicles (AWD would increase performance). With all of these future developments, the demand for the Model S could potentially grow to 70,000 units worldwide per year, which is a similar volume to the Mercedes S-Class and the Lexus LS. A base case for the Model S would be 55,000 units per year, which is on par with the BMW 7 series. If the Model S flops, a bearish case for its sales would be 35,000 units per year, which is a similar volume to the Mercedes CLS-class and the Audi A8, which are less successful models in the ultra-luxury sedan market.

Tesla is currently ramping up production of the Model S in order to shorten wait times as the Model X comes online and adds thousands of customers to the waitlist. Currently, the Model X has 20,510 reservations, and the count increases by about 40-45 per day. This rate will probably increase as Tesla reveals more about the Model X and offers test drives, and in all probability, the Model X will have 30,000+ reservations by the time it enters production. The Model X will lure many consumers as it will be one of the highest performing SUVs on the market. Other desirable features for consumers include higher safety, more cargo space, and unique doors. The Model X could potentially reach 100,000 units worldwide per year, which is a similar volume to the BMW X5 and the Mercedes M-Class. In the base case, the Model X would probably sell around 55,000 units per year, as demand is expected to be similar if not more than for the Model S. A bearish case for the Model X's sales would be 35,000 units per year, which is similar to the BMW X6 and Audi Q7 sales volumes, which are at the bottom of the market in the ultra-luxury SUV market.

Finally, the Model 3 will be the main driver of demand for Tesla. The Model 3 will be attractive to many buyers because it will be at the $35,000 price range, and after gasoline savings and maintenance savings, it could be comparable in cost to vehicles in the $25,000 price range, yet have the performance and luxury of vehicles that are in the $35,000 price range (if Tesla executes properly). Another reason that the Model 3 will have a strong allure is the fact that it will be an almost completely American made green vehicle due to the fact that Tesla is going to build its batteries in the Gigafactory which will be located in Nevada. The Model 3 could potentially sell in similar volumes to the BMW 3 series, which would be 500,000 units per year. A base case for Model 3 demand would be 400,000 units per year, which is competitive with the Audi A4 and the Mercedes C-Class. However, if the Model 3 doesn't live up to expectations, sales would still be high because it will be an electric car with a 200 mile driving range, and thus will be acceptable to many buyers. Based on this, a bearish case for the Model 3 is 150,000 units per year.

In total, if Tesla executes well and receives demand akin to the most successful models in their price range, Tesla has the potential to have demand of 670,000 cars in 2020, which would mean that Tesla would have to open a new assembly plant and not enter the battery storage business yet because of such large demand for their cars. In the base case, Tesla would be selling 510,000 units per year in 2020 as their Model S/X/3 compete with slightly less successful models in their respective price ranges. The base case is in line with what Tesla projects in 2020 currently.

However, Tesla could become a niche player, and the Model S/X/3 might only appeal to buyers because they are electric and environmentally sound. In this bearish case, Tesla would sell only 220,000 cars in 2020, which would be comparable to Porsche, which sold 165,808 cars in 2013. All three of these cases have some conservatism built in because the sales are based on sales of other models in 2013, and don't account for growth in automobile sales between 2013-2020. Also, all three cases are based on sales of other cars in the price range, however, electric cars are cheaper to operate, so shoppers in lower price ranges might step up. Furthermore, the cars on which these sales projections are based on are competitive in their price range because they offer superior performance, luxury, and/or safety. Because Tesla's cars are electric, their sales will get a boost from people who are concerned about the environment. Although these projections all seem overly ambitious, they actually have a variety of conservative assumptions built into them.

Competition

Although there is a very real possibility that Tesla will have competition, it is unlikely and will not take market share from Tesla. Competition is unlikely because Tesla is ahead of everyone else with their Supercharger network, and also because no other company has plans to build a Gigafactory that will allow it to reduce prices for their batteries and allow them to manufacture their cars on a mass scale. Also, even if other companies overcome these obstacles, their electric cars are more likely to take away market share from other ICEs rather than Tesla. In other words, if GM introduces an electric car that sells 200,000 units in that year, it is likely that most of the people who buy that car are switching from a gasoline car rather than a Tesla, which means the electric car market simply increased by 200,000 cars that year.

Tesla Motors Valuation

So what does each of these cases mean for Tesla's valuation? In all three cases an average selling price of $105,000 for Tesla's Model S and X and an average selling price of $45,000 for Tesla's Model 3 is fair. Also, for all three cases, an annual increase of 2% in the amount of shares is also a fair assumption, resulting in 140 million shares in 2020. Also, all three cases will assume an annual discount rate of 10%, and a tax rate of 25%.

The bearish case would result in $14.1 billion in revenues. Using an 8% operating margin would yield $1.128 billion in operating profits and $846 million in net profits. A P/E ratio of 25 is fair because Tesla will probably be expanding their model offering in order to try to maximize production in their factory. This results in a market capitalization of $21.15 billion, which is a per share price of $151 in 2020. Discounted back to 2014, this translates into a share price of $85, which represents a 66.5% downside from today's price.

The base case would result in $29.55 billion in revenues. Using a 15% operating margin would yield $4.433 billion in operating profits and $3.325 billion in net profits. A P/E ratio of 20 is fair because Tesla will probably have accomplished most of their growth, but will still be growing faster than the rest of the industry. This results in a market capitalization of $66.49 billion, which is a per share price of $475. Discounted back to 2014, this translates into a share price of $268, which represents a 5.5% upside from today's price.

The bullish case would result in $40.35 billion in revenues. Using a 15% operating margin would yield $6.053 billion in operating profits and $4.539 billion in net profits. A P/E ratio of 20 is fair because Tesla will still be expanding their selection of models and will be entering the stationary storage business. This results in a market capitalization of $90.788 billion, which is a per share price of $648. Discounted back to 2014, this translates into a share price of $366, which represents a 44% upside from today's price.

The Risks

The potential is high for Tesla, but it comes with a fair share of risks. If Tesla fails to keep consumers attention as they release new models, or they do not execute as well as they had with the Model S, they will probably end up in the bearish case. But these are moderate risks that are accounted for in the valuation model. However, there are larger risks that could damage the company severely enough to force Tesla into bankruptcy. For example, if Tesla continues to ramp up expenses, but production ramp up stutters, then Tesla could burn through their cash and be forced to file bankruptcy. Also, Tesla has a risk of facing recalls like all other auto manufacturers, and this could damage the company's finances. Also, another problem could be more states making it illegal to sell directly. Consumers may not want to adopt online ordering of cars, and thus Tesla would not be able to sell through stores and struggle to sell online.

These risks are unusual events, and should not be priced into the stock because they are dependent on Tesla's own execution. Tesla has been executing well, therefore these events shouldn't be priced in. On top of that, these unusual events are negative risks, and for lack of a better word, positive risks exist as well. For example, Tesla might become the leader of electric car development by producing batteries, developing drivetrains for other manufacturers, and selling rights to use their charging networks. Tesla can also potentially strike gold in the stationary storage business, or sell even more cars than the bullish case in this model. But these events are also unlikely in the 2020 timeframe, or at least there is no clear path laid out publicly. Just like the negative risks, these events should not be priced into the stock until there is a clear path towards them.

Conclusion

The Lux Research report did not do sufficient research and extrapolation and did not gauge Tesla's potential demand properly. Gauging Tesla's demand must be done by comparing it to ICE cars in the price range and extrapolating sales from that data. Next, we take the cars that are doing the best in those markets and take the cars that are doing the worst in those markets as bullish and bearish cases for Tesla's models. The bearish case is that Tesla will be selling 220,000 cars in 2020 and will become a niche player like Porsche with a $21.15 billion market cap. The base case is that Tesla will be selling 510,000 cars in 2020 and will become a premium automaker like BMW with a $66.49 billion market cap. The bullish case is that Tesla will be selling 670,000 cars in 2020 and will become a high volume premium automaker like Daimler with a $90.79 billion market cap. Although Tesla faces many risks, they should not be priced into the stock, just like surprise revenue streams shouldn't be priced into the stock.

�

1/1/2015

guest Thanks, 32no. I would add that the rate of growth in the customer deposits is exceptional. IIRC, it grew by about 40% over the last two quarters. That's an annual rate of 100%. And I would stress that customer deposits measure aggregate demand in dollars, the willingness to forego no other return on the dollars deposited than to hasten the date of delivery.

I'm glad you posted this on SA and here. Thanks.�

1/1/2015

guest Thanks 32no. While we're on the subject of research, I haven't seen much in the way of good market studies on the future of BEVs. Most of it is seriously flawed. There currently are not any good choices for a compelling EV that you can buy today for under $50,000. I've been driving a Tesla since early 2011 and talked to a lot of people who can't afford the car I drive. But they see the benefits. About half the people I talk to say they're ready to buy a BEV now, or the next time they replace one of their vehicles, if only it would go 200+ miles and have supercharging capability. That's a LOT of potential Model 3 buyers. While my informal conversations are no substitute for a real market study, I think Tesla will be production constrained for a long time. 500,000 Model 3 cars in 2020 won't begin to satisfy demand.

I think Tesla's biggest risk is growing pains. Elon says the same thing. We've already seen it. Doubling in size every year is extremely hard. When asked what is Tesla's biggest hurdle going forward, Elon said at TESLIVE 2013 "...being able to ramp up quick enough."�

1/1/2015

guest

- The Tesla CEO also expects the company to start generating strong "free cash flow beginning in Q3 of 2015" and could pay for the construction of its planned gigafactory without additional borrowing.

http://seekingalpha.com/news/1988595-musk-expects-fully-autonomous-vehicle-in-five-to-six-years�

1/1/2015

guest Presumably because that's when the X is ramped up and shipping at full speed. I'd have been surprised if that wasn't the case in Q3 given the timelines Tesla has laid out for the X in the past.�

1/1/2015

guest What do people think of the following scaling argument?

I've heard that about 25% of the S 85 is the battery pack. I'm wondering how this 4 to 1 ratio of car price to battery price could hold up. So the S 85 starts at 81000, which is $950 per kWh, which is 4 time 237.5 per kWh for the battery. The S60 starts at 71000. Scaling up $950 times 60 gets to $57000. I think this would be a fabulous price for the S60. After the US federal tax credit of $7500, this would net out to $49500. Of course in the current supply constrained situation, the is no need to lower the price. But what is interesting is that the body of the car may simply be over priced relative to the battery. For many reasons the S85 just feels like more value for the money. So scaling seems to make some intuitive sense.

Now let's play this game with the M3. First, reduce the battery cost per kWh by 30% per Gigafactory. This is $166.25 per kWh. Give this car a 50 kWh battery for $8312.50. Scale up by 4 and get a price of $33250. Not to shabby. This leaves about $16625 for the cost of the body to allow a GM of about 30%.

I know that lots of people have worked up much more detailed pricing models than this, but what I am after is a fairly simple rule that I can use to extrapolate prices out 10 years or more. Suppose the price of batteries continues to come down about 7% per year. Could we continue to see the rest of car price for the same size battery come down by the same rate? If so, base models would continue to be about 4 times the price of the battery. Imagine when battery packs hit the $100/kWh price. You could get an economy car with 50 kWh for $20k or a more luxurious car with 125 kWh starting at $50k. Of course people can load up on more options, but it would be nice to guage the base price in such a way. And it would be nice to have a gradual price reduction over time. Some day that S85 could start at $34k and Camry would be a forgotten memory.�

1/1/2015

guest Elon's recent suggestion of 500,000 cars by 2020 got me thinking. I know JB had a slide in a Stanford presentation that offered 700,000 cars by 2019, and Nummi theoretically caps at 500,000, and the gigafactory is built around this number too. I had recollection of 500,000 by 2019 and I dug it up from a Seeking Alpha post:

This prediction came when the company closed at $55/share. Hope he's right.

http://seekingalpha.com/article/1381001-tesla-motors-full-analysis-its-only-mistake-outlook-and-elon-musk#comments_header�

1/1/2015

guest Running of the Bulls

During the recent dip I mentioned to a friend that has been sitting on the sideline waiting to get in that it might be a decent opportunity to start buying in. The next day they responded that their broker talked them out of it based on a recent report by John Lovallo and John Murphy of BofA / Merrill Lynch. The report, published Sept 3, is titled "Running of the Bulls" and attempts to discredit many of the bullish points Tesla has going. Here is the thesis of the paper:

?A page extracted from the bull thesis and why we disagree

In our view, the bull case on Tesla's stock is predicated on numerous, seemingly

unrealistic expectations for margins, volume, scale, cash flow, and success in

ancillary markets. In this report, we explore several key beachheads of the bull case

and attempt to illustrate why the underlying assumptions appear stretchy.

They then go on to dispute in detail these major bull points:

"Tesla's auto gross margin is among the industry's best" - Tesla does not calculate gross margin the same as other OEM's in the industry. i.e. They are including Cafe/GHG credits and excluding R&D and engineering expenses. adjusting for these two factors, Tesla is really only at 12.2%.

"R&D/Vehicle is elevated because they are a start up" - They see spending be high for many years and do a comparison with Porsche at 117k vehicles/yr in 2011 noting the similarities in costs - Tesla @ $12.9k/vehicle and Porsche @ $12.4k/vehicle. Next they show BMW at 2mm vehicles/yr had costs of $4.4k/vehicle; in the best case scenario Tesla won't produce that many cars so they wont come close to BMW's cost/vehicle by 2020 because they wont have the proper economies of scale.

"Warranty Costs will decline" - They don't see these costs going down since Tesla is a new company and trying to make cars in volume. They calculate that warranty costs were $283/ vehicle in 2Q14 and extrapolate that over 32 quarters tesla will be looking at $9.1k in theoretical warranty costs per vehicle, thus eating up 68% of 2Q gross margin per vehicle.

"Cash flow will improve in the coming quarters" - Tesla burned $240mm in free cash flow in 2Q. They foresee ramp in costs associated with Model X and Model 3, and lots of capex on the Gigafactory. Projecting $2.4bn cash burn over next 10 quarters. They were skeptical that Panasonic would commit more than $300mm to the gigafactory. They foresee another significant capital raise on the horizon; and because of their B- credit rating it will be harder to get favorable terms for future capital raises.

"Stationary Storage is a massive opportunity" - Cycle life for stationary packs should be between 3.5k and 15k (10-40 years). They estimate the useful cycle life for tesla packs to be theoretically 1,460 cycles.

I haven't seen this report referred to on the forum yet, so I thought it would be good to share. I think it is nice to read this stuff so we can see what angle the short thesis is coming from. The report is more detailed than my quick outline so if any regular forum members want to see the whole report please PM.�

1/1/2015

guest For starters.

VW and Porsche merged in a complex cross holding deal in 2011. And they were intertwined in a carnal embrace before that. Porsche hides much of its R&D in VW and simply gets VW tech,parts,platforms etc. Porsche is not an independent company. Comparing an independent Co, Tesla, to a brand/subsidiary is bogus.�

1/1/2015

guest Even with R&D expenses accounted for in gross margin calculations, Tesla is still inline with the rest of the auto industry despite having volumes that are smaller by several orders of magnitude. But the thing is, it is unfair to say that Tesla is unprofitable because on a GAAP basis and then also say that their gross margin is not industry leading. This is because other automakers amortize their R&D expenses over time and thus recognize them as cost of goods sold rather than an operating expense like Tesla does. So if Tesla did amortize their R&D, they would be spending less on R&D per quarter because of the amortization of costs, and thus would be turning a GAAP profit while having gross margins that are inline with the auto industry and growing. People who spread FUD should pick one - not profitable on a GAAP basis or no-better-than-average gross margins.

Point is, Tesla is different, and comparing them to everyone else in the auto industry on anything other than demand is futile.

Well, as RobStark said, Porsche is a subsidiary and Tesla is independent. Also, R&D is mostly engineering work for future products and capacity expansion. Because Tesla is currently pumping out models at a blazing fast rate as well as trying to expand capacity also at a blazing fast rate, you see incredibly fast growth in R&D expenses which seem to consistently eat up all of the operating profits. However, these costs will slow in growth as Tesla becomes a more established company.

Again, Tesla is different, comparing to other companies is futile.

They don't see costs going down because it is probably in their best interest not to see such things, even when in plain sight (which happens to be the case). Tesla has a new model with inevitable occasional defects, and reducing defects by fixing errors in the relatively new production line will offset any growth in warranty costs. Once Tesla introduces a new model, warranty costs will go up again, and will follow the same downward trend later on as defects are reduced.

The numbers for the warranty costs seem as made up to me as Lux Research's numbers of only 240k sales in 2020 and only $2800 savings in batteries.

Again, a silly argument from BofA/Merrill Lynch. First of all, $240 million was the operating expenses, and free cash flow was -$177,347,000. Second, Model X/Model3 engineering costs are operating expenses, not CapEx, so the real CapEx is in expanding production capacity for the Model X/Model 3 and realizing that production capacity. However, Model X ramp will simply take the place of the Model S ramp as Tesla starts to produce close to their demand at a given time, which means that there will be little to no net increase in costs. Therefore costs will increase temporarily as Tesla adds capacity to their plant in Q3. Also, lots of CapEx on the Gigafactory is not a problem because that's what Tesla raised cash for... Also it is known that Panasonic will be paying in installments, and somewhere someone posted an article that Panasonic will invest $200+ million per year from 2015-2020 on the Gigafactory. It makes sense that Panasonic has only contributed $200 million so far because Panasonic will be doing equipment installation and not initial construction of the plant.

Tesla guided for $750-950 million in CapEx for 2014, so lets take the middle of $850 million and subtract the CapEx for 6 months ended on 6/30/14 ($317,049,000) to get $532,951,000 in CapEx for the next two quarters. Then let's assume that Tesla will spend $750 million on construction and $500 million on battery pack equipment in 2015-2016 for the Gigafactory. Also, let's assume another $1 billion in CapEx in 2015-2016 for realization of Model X production capacity and expanding Model 3 production capacity. This brings the total estimated (by me) CapEx over the next 10 quarters to $2.8 Billion, which means that only $400 million of operating profits is considered in BofA/Merrill Lynch analysis. To put this in perspective, this is only $0.32 per share average over the next 10 quarters (Q4 2014-Q3 2015 will experience huge growth in operating profits as Tesla goes first to 13,000 units per quarter, and then edge towards 20,000+ with the Model X).

Anyway, it's ok for Tesla to spend $2.8 billion in the next 10 quarters because they have $2.7 billion in cash currently, and expect to have strong operating profits by Q3 2015 (per Elon Musk), which will add more cash. So no, a capital raise will not be necessary unless there are extra costs or Tesla fails to make operating profits.

I'd like to see these calculations and why they think cycle life for stationary packs SHOULD be between 3.5k-15k. When Tesla gets costs per kWh down to around $170 (thinking 2017-2018), it would only cost $1700 to replace a 10 kWh residential unit every 4 years (1460 cycles), which works out to a cost of about $400 per year, much less than what the average home spends for electricity ($1200+) per year.�

1/1/2015

guest Analysts' role

Thanks for posting gym7rjm, interesting points.

The main issue I have with some of these analysts is that they seem to apply their own thinking to Tesla and base their analysis on expectation that Tesla will follow their thinking and some established business practices and standards.

Everything about Tesla is so out of the box and out of the established ways of doing business. Trying to evaluate Tesla business potential using boxed thinking is bound to be faulty, at least for me.

I will not go through the analysis point by point, but just for example, the argument that Tesla might find it harder to raise capital due to poor credit rating, I find that unlikely.

My evaluation of that specific point is that Tesla�s creative thinkers will find effective ways to raise money. They have done it in the past and will be able to do so in the future, if there is a need.

Recent (not the first) euphoria in share price that required CEO�s intervention to cool it down suggests market�s willingness to flow more capital to its darling stock.

Some analysts seem to have the power to move the market just by expressing their opinion. I would be surprised if analysts� market moving power survives far into the future.

Each investor is as capable as any analyst of conducting their own research and evaluation work. If that holds true, then analysts are obsolete. These smart people will be hopefully applying their significant skills to more useful and more creative purposes.

My expectation for market moving power is to become much more aligned with creators and people that participate in value creating and value adding activities.�

1/1/2015

guest This company, or just about any company, that is production constrained, with order backlogs, growing rapidly and good margins will not have any trouble financing in the current market. I am pretty certain that most of the investors in the first convert deal would be happy to add more. Surprising to see this from a major bank analyst when his own bank is leading debt/equity financing for much dodger companies without much problem. B- is a huge step up from some of these other deals.

its good that the analysts are not all unreflective cheerleaders, but a lot of this report seems to be written out of fear�

1/1/2015

guest Have always believed what musk says. He will TAKE AVANTAGE of money if thrown at him but there are no plans to raise any now and giga factory will not need a raise of funds�

1/1/2015

guest Recent nobel prize winning economist Gene Fama and his partner Ken French have pretty well demonstrated through careful research that analysts and fund managers aren't worth the paper their reports are printed on.�

1/1/2015

guest Quite true. They know about as much about medicine as the markerters who make pharmaceutical comercials, or as much about organic chemistry as a buiseness oriented oil executive. (As opposed to a physician or a chemist in the examples mentioned).�

1/1/2015

guest Wait so his broker turned him off of TSLA over one analyst report? That is quite sad... Maybe he should at least have been told about all the other reports out there instead of directing him to the most bearish report out there... Isn't BOA the one that still has a PT of like 70?

This is like saying, yeah you should use a cellphone because some guy, somewhere, said that it causes cancer and they are using these phones to read people's minds...

Please direct your friend to at least consider some other opinions vice just the most outlandish report out there. Heck, I would rather him consider investment off the GS report than the BOA one... At least GS sees a future, even if that chance is slim (in their eyes)�

1/1/2015

guest The last full gs report, when they first set the 200pt, is actually quite good to read all the way through. A bunch of interesting possibilities for the future in there. He's being conservative but the analysis is good. It's where the multiple future cases comes from (maytag, apple, ford, etc).�

1/1/2015

guest �

1/1/2015

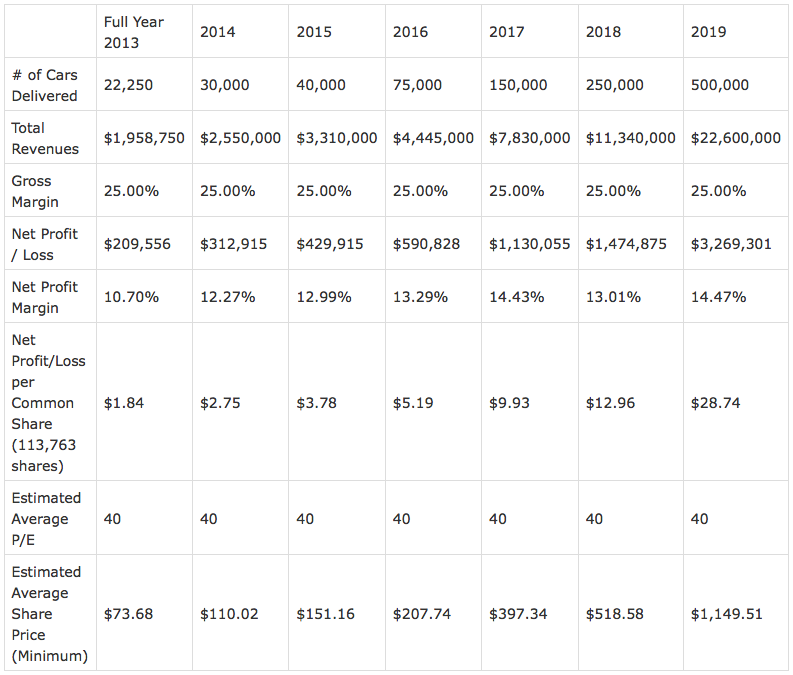

guest The table is a good exercise to understand how the fundamentals of Tesla will intersect its stock price in the future. I don't agree with some of the assumptions used in it. I will try to put my own together on a Google Sheet and share it.

Maybe others could make copies of it with their own views so we can compare.�

1/1/2015

guest No way will the price be $88k per car in 2015. We're already above that and the Model X is going to be a bit more money than the Model S. It won't be 88k in 2016 either as Tesla pumps out the backlog for the Model X in that year and expectations are that X will outsell the S based on industry numbers of SUV's vs Sedans. Any significant volume of Model 3 won't be seen until 2017 (if things go as Tesla plans).�

1/1/2015

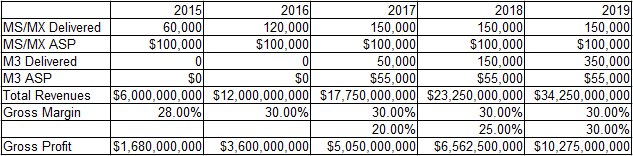

guest There is a lot wrong with that chart, but for being published in 2013, it was pretty dang good!

The GM is off since they are shooting to beef that up to 30%. I don't think they will have an 88k ASP (unless something terrible happens) in 2015/2016 it will likely be north of 100k. So with that in mind I would suggest 60k @ 100k ASP would be revenues of 6BN in 2015. For 2016 It will be at least 100k, lets go 20% higher (which just parodies the 50k to 60k difference) which would be 120k delivered at 100k ASP would put us at 12BN in revenue for 2016. Then in 2017 we can drop our ASK down to something like 88k as we bring Model 3 online and the gigafactory.

So 2015 @ 6BN in revenue, and lets assume 28% GM, would put gross profits at 1.68BN.

2016 @ 12BN in revenue and assume they are finally able to hit the 30% GM would put gross profits at 3.6BN

Where I fail is trying to get a guess at their net profit margin, since I am sure they plan to be mostly break even on this since they are going to keep spending all the money they get on further expansion.

Just my guess, they will exit 2016 at 150k a year run rate, and lets just assume that is the theoretical cap for demand of MS/MX so from 2017-2019 that is all they make, and lets continue to carry forward an ASP of 100k. That means for these years you are looking at a revenue of 15BN, GM on this will remain 30% giving 4.5BN in gross profit just from MS/MX.

Now for M3, I am going to assume they have a slow release in 2017 of only a measly 50k units. Let's assume a lower GM of 20% and an ASP of 55k, that gives 2.75BN and 550M for revenue and GP respectively. 2018 they ramp up to 150k M3 holding the 55k ASP, and 25% GM. giving us 8.25BN and 2.06BN for revenue and GP. 2019 they hit 350k units (this is theoretically possible and stated by elon that they could hit this in 2019 in his latest CNBC interview), at 55k ASP and 30% GM coming to 19.25BN and 5.78BN in revenues and GP.

So, adding both values up this gives us:

2017: 200k delivered, 17.75BN revenues, 88.75K ASP, 5.05BN GP, 28.5% GM

2018: 350k delivered, 23.25BN revenues, 66.43k ASP, 6.56BN GP, 28.2% GM

2019: 500k delivered, 34.25BN revenues, 68.5k ASP, 10.28BN GP, 30% GM�

1/1/2015

guest I just spent the past hour doing some math, and my numbers are scarily close to yours. Totally agree that net profit is a crapshoot as they will be spending to fund growth for the foreseeable future, as we would want them to do. Stock dilution is a subject for another thread....�

1/1/2015

guest Ok, I took a shot at reproducing the table with a few more features. I broke out S / X from Gen III, so that you can enter separate volumes, ASP, and GM. I also added share dilution as a fixed rate over the timeframe (2014 forward). And I started with the current number of shares.

The first tab is my rough example shot at filling it out. I made a second tab with a blank table so others can fill it out themselves. Just fill in the green cells. Make additional tabs as needed.

Anyone with this link should be able to edit it. Let me know if it works.

TSLA Valuation - Google Sheets�

1/1/2015

guest Just to make it a bit easier to read, here are my numbers in a bit more digestible of a format.

- - - Updated - - -

Thanks for the chart, looks like you cover just about everything, it is interesting to see your estimate vs mine, I thought I was being conservative. Seems like we are both more conservative in some areas and ambitious in others, but it seems like the only major difference between our two thought processes here is how quickly they hit 500k. I am betting on Elon meeting his more ambitious goal of 500k by 2019.�

1/1/2015

guest He has stated many times publicly 500k cars by 2020. I agree there is a good chance to beat that, but I thought I would use it as a baseline.

I was really just throwing numbers up quickly to make sure the sheet worked. I am sure I would adjust it with more time, thought, and discussion.�

1/1/2015

guest I think the GM numbers we are talking about here are too high. Tesla has stated that they don't expect 30% GM out of model 3.�

1/1/2015

guest I had S / X GM topping out at 30% and Gen 3 topping out at 20%.�

1/1/2015

guest I have a feeling that Model S/X production will exceed 150,000 worldwide by 2019. There's over 20,000 deposits for the Model X, and it hasn't even hit the road yet. There's a 3 month wait in the U.S., a 6 month wait in China for the S. With no advertising.

I suppose that's why I'm long the stock.�

1/1/2015

guest There are over 20,000 deposits and people haven't even seen the final version which is apparently quite different from what was unveiled in 2012.�

1/1/2015

guest If there was no Model 3 / Y coming, I would agree with you. I was also not proposing a best case scenario.

That is why I made a separate tab for others to fill in the numbers they believe so we can compare. So far nobody has taken me up on it. I did lock my sheet because some people were changing my numbers.

I will post the link again to see if anyone will bite with the extra "D" traffic we are going to get. TSLA Valuation - Google Sheets�

1/1/2015

guest Under the hypothesis that D is a dual motor option for MS, what could be the impact on gross profit. Baseline, assume $100 ASP and 28% GM. Suppose the D option is $10 on any MS at a cost of $5. If 20% of orders opt for D, then ASP is $102 and gross profit per car is $29. So 40% option rate would take GM to about 30%. I'd expect the option rate to be between 20% and 50%. So we are looking at incremental profit of $1000 to $2500 per car, or $13M to $33M on 13000 deliveries. That's a nice ball park.�

1/1/2015

guest I think that you're excessively optimistic. You should expect that the Model 3/Y will kill S/X sales.�

1/1/2015

guest Why should one expect that? If demand (in aggregate dollars for Tesla products) is growing 50% or more per year, there is plenty of new demand for Gen2 cars to offset any switching from Gen2 to Gen3. You seem to be making the assumption that aggregate demand will not grow much.�

1/1/2015

guest I tried to back out the volumes from the assumption that Tesla would max the capacity of Fremont in 2020 at 500k vehicles. If they maxed production and had four models S/X and 3/Y, what would be the ratio of uptake that would cap the 500k production? My guess was 135k S/X and 365 3/Y. I could be wrong on the ratio.

The timeframe for production capacity beyond 500k is very grey until firm plans for another factory exist.�

1/1/2015

guest Limiting capacity to the Freemont plant has interesting implications. No capacity to grow in 2021. Moreover, gains in 3Y compete with capacity for SX. This implies declining revenue and declining profit. Basically, it's not sustainable. The only way to sustain growth is to get more factory space. If 3Y are not priced high enough to pay for the expanded capacity, then they probably not be worth doing at all. It certainly won't do anything to bring EVs to the masses.

So given this absurdity, you may want to consider two scenarios: one with expanded capacity and the other without. You also may want to build up your assumptions about revenue growth and unit growth in SX, then back into the implied volumes of 3Y to make this work. I might try out myself.�

1/1/2015

guest any opinions on the Oil price in the influence on TSLA?

If WTI Crude drops to:

-80

-70

-60

-50?

Also the implications for the world economy of such prices.�

1/1/2015

guest no immediate or near term effect, perhaps it would have an effect once Tesla starts pumping out millions of cars but that is a long way off�

1/1/2015

guest Actually, I believe it will affect sales at the Gen3 level if we have a significant gasoline price drop (maybe that is what you said in a different way). Many people I know that are looking at a Model3 are not doing it for the environment but for the savings on electricity vs gas. It would also have a positive impact on our economy.�

1/1/2015

guest i agree partly, I think Model 3 "demand" might drop from 2-5 million cars per year to 1-3 million cars per year for example if oil drops significantly where gas becomes cheaper to run the car than electricity from the even more expensive utility companies by that time (more people will have solar but I doubt the majority of people will have solar until the end of the 2020s decade), but keep in mind tesla Superchargers will still be free and more plentiful by that time.

however, because tesla won't be able to produce more than 1-2 million cars per year for a while it won't affect them until that time if oil was to drop significantly, that will be well into Model 3 territory by then.

this is all just my oracle-like opinion. I also think TSLA stock price will be 1500-2000 by then and could potentially be impacted with a temporary over-reaction to the stock price if there was a sudden very significant drop in oil that lessened demand enough where Tesla would have to put the breaks on production bc it would be the first time they aren't production constrained.�

1/1/2015

guest Man, I like that number!! The economic impact is huge with gas price reductions: 'every 10 cent per gallon savings translates into $13 billion increase in our economy'...Drop in gas prices benefits US drivers, economy.�

1/1/2015

guest Western oil production (North America, North Sea) average cost is over $60. If the price hits $70 supply will begin to contract.

The $1 Trillion annual wealth transfer from industrialized countries to non-industrialized countries will shrink significantly and boost economic growth in the industrialized countries.

In the industrialized world only Canada and Norway are net exporters of oil.

The UK became a net importer in 2013.�

1/1/2015

guest It seems I have not explained myself very well. I believe Tesla will expand to have vehicle factories and battery factories in Europe and Asia. One or both of these factory pairs will be set to come online around the time Tesla maxes out the Fremont factory and GigaFactory.

But for the purposes of taking stabs at the dark on stock prices 6 years in the future, I decided to bound the problem by limiting to the output of Fremont and the GigaFactory. These are the only two factories Tesla is currently expanding into. I think the proper way to look at the optimist/pessimist cases, is if Tesla reaches this capacity in 2019, 2020, or later. I believe they will attempt to maximize these facilities before expanding production to other continents.

The 2020 P/E in my rough guess baseline case was 50. That is still triple other automakers. I believe that represents the fact they will still be aggressively expanding, and a chance that they build a significant second business in stationary storage.�

1/1/2015

guest I get where you're going with this pessimistic scenario. I was just noting that this bound capacity assumption is in fact pessimistic. It basically means that M3 does not have the economics to support its expansion. Under that scenario, I think Tesla would be prudent to be a profitable niche player. So in that case, any growth it could muster in the high end vehicles would displace 3Y so as to maximize earnings under constrained factory capacity. (This is basically how the Model S 60 is treated right now. Always last in line.) So under this scenario, you could have SX take up the majority of capacity, perhaps 400k SX and 100k 3Y. This is still a very pessimistic scenario because it implies little growth opportunity beyond high end segments.

All the best, James.�

1/1/2015

guest A few more thoughts about this pessimistic scenario. What would make the economics of M3 not work? There are three basic elements: 1) compelling design, 2) low cost the battery pack / drive train, and 3) low cost glider. Clearly, Tesla has a grip on how to make a compelling drsign. The Gigafactory addresses achieving a low cost drive train. The weakest link in my mind is if Tesla can achieve enough manufacturing efficiency in making the gliders at scale needed to satisfy global demand. While Tesla may have a cost advantage on battery packs, it may not have the same competitive advantage on gliders. Moreover, the glider could easily be more than 2 times the cost of the drive train. So if cheap gliders prove to be the hold up, Tesla could easily contract with other manufacturers. This would also alieviate the need for more auto factory space.�

1/1/2015

guest I still think that I have not been clear about what I see as optimistic, baseline, and pessimistic. Stage 1 of Tesla would be to hit 500k vehicles per year, maxing out the Fremont factory and the GigaFactory.

Do you agree that they will max out Fremont before brining another vehicle assembly plant and battery plant online?

Optimistic would be hitting this number in 2019. Baseline would be hitting this number in 2020 (because of many public statements from Musk). Pessimistic would be reaching the production volume in, say, 2022.

I have no doubt that Model 3 is going to change the way people think of Tesla (and all vehicles in the $25k to $50k price range) forever. I have little doubt that Tesla has the engineering and design prowess to deliver on the expectations for Model 3.

I look at the engineering and financing difficulties of developing two more Fremont factories and two more GigaFactories. The risks are they will be on continents far away from their core engineering center, in places separated by 8 to 10 time zones with language barriers.

As of today, ~30% of the investment community does not believe Tesla can even build one GigaFactory that is located 4 hours from their factory. The descriptions of the factory are "biblical". 1 mile long, 70 ft tall building, packed full with high end automation equipment. These things don't drop out of the sky like a CVS does across the street from a Walgreens.

Tesla will build all of this, but these activities will be 4 - 8 years from now. Getting to Step 1 will massively reduce the risk of all this future growth. Step 1 is where I stopped my valuation table.�

1/1/2015