1/1/2015

guest And you reckon they will get 25-28% profit margin on GenIII? I don't think so.

2017 for GenIII - first production will not be 80k. They will do the same as they have done with the Model S, slow to make sure everything is OK, then ramp it up.

I also don't see GenIII selling that many vehicles after an additional year. At the margin you quoted either.�

1/1/2015

guest What about ongoing costs of fixing warranty problems in cars?

I've had 2 door handles replaced ( granted my is a very early VIN ) and had some other minor issues. I don't know what is typical - or how to estimate what that cost is per car.�

1/1/2015

guest As you guys have been commenting, that was based off my predictions, which are quite optimistic. Whether gen3 comes out in 2015 or 2017, it doesn't matter what year it comes out, long term That is where my price target is.

For profit margin, I predict that because of batteries prices going down 8% per year, that means it will cost the same as the current 85kwh and be 109 kwh to go

Which means it will cost 27,000 for a 85kwh battery in Gen3. and 19,000 for a 60kwh. I predict they will be able to go 215 and 280

What P/E do you think Tesla will have in the coming years? I don't personally think the warrenties will have an affect on the profit, since Elon has continued to reiterate that the Model S is going to last.�

1/1/2015

guest Today the Markewatch online website of the Wall Street Journal picked up on the Longboard presentation promoting TSLA. The reporter includes video commentary: http://blogs.marketwatch.com/thetell/2013/04/30/tesla-is-the-next-apple-or-google-hedge-fund-argues/

A couple of what appear to be highly frustrated shorts are providing multiple negative comments in response to the article.�

1/1/2015

guest Ummmmm, did I read that right? Looking ahead: Tesla could have 1600km range car in the works, whoa...

Tesla Motors Inc (TSLA) May Be Working On a 1,600km Range Car - Insider Monkey�

1/1/2015

guest Yes, Phinergy had been mentioned before. The issue currently is it uses replacable metal plates (they need to be changed out every 1,000 miles currently), it also requires that water be added every 200 miles. The metal plates are also not cheap, currently the energy costs are near .50/KW for the metal air battery. It might be ready for prime time in 2017, is the estimate. I think Tesla has been working on this independently of Phinergy...�

1/1/2015

guest Meantime, the cost and availability of Lithium may shortly improve considerably, helping to lower cost of Tesla battery tech.

This article in, of all places, OilPrice.com seems especially interesting because the project being discussed proposes to combine lithium extraction with carbon sequestration.

New Wyoming Lithium Deposit could Meet all U.S. Demand�

1/1/2015

guest Indeed. Someone took the metal air patents that Tesla filed and made the leap connecting them to the somewhat recent announcement from Phinergy, (which frankly looks completely impractical), and ignored all the other work on metal air chemistry. I don't think there are any ties between Phinergy and Tesla.�

1/1/2015

guest +1. This doesn't relate well at all to Tesla's patents and interests in application of the air based solution. If they're working with anyone, it would more likely be IBM�

1/1/2015

guest Another good take on the long-term fundamentals of TSLA:

What Is Tesla Motors Worth?�

1/1/2015

guest Maybe another reason for the 5 part announcements.

http://seekingalpha.com/article/1372551-tesla-motors-long-now-short-later?source=forbes

�

1/1/2015

guest Yes, the Phinergy "link" seemed like a particularly idiotic logical leap to make. The actual patent for a hybrid battery setup was kinda interesting though.�

1/1/2015

guest Tesla's long-term growth trajectory... $100 billion in 10 years?

Tesla Motors Could Be A 100 Billion Dollar Company in 10 Years | Ivanhoff Capital�

1/1/2015

guest The Amazon analogy

There once was a company lead by a visionary and competent CEO. You could tell straight away that he wasn't the build-and-flip kind of guy, he was The Real Thing. Even though nobody before had built a customer offering such as he was envisaging, he obviously knew what to do. There were complex operational issues involved - issues of costs, margins and logistics. And there were huge, established companies that at first scoffed at the newcomer, then slowly came around to copying it and trying to crush it. At first, people did not notice the stock much, but as people bought into the vision it sky-rocketed in a short while. Some said it was a bubble, others bought the stock to hold through the volatility. Clearly it was priced on the CEO's vision, not on fundamentals.

I am, of course, speaking of Amazon.

The reason why I am bringing this up is that you would be forgiven if you thought that this description of Amazon in 1999 was actually a description of Tesla. The interesting thing about Amazon is that everyone was right. If you bought the stock at a typical 1999 price of $70, by today you have close to a four-bagger. However, you would have to stick with the company through an 8-year dip before seeing it return to $70, and another 3 years to get your 3-4-bagger. In the mean time, those who shorted the stock at $70 could cover at $7-8 two years later, making arguably more attractive returns. All this while the company was making no big mistakes in executing on its vision.

Despite the similarities with Tesla, it is not trivial to draw conclusions from the comparison. It is clear in retrospect that the company could not support its typical 1999 valuation of $32bn in the short or mid term. But looking back at the share price, a buy-to-hold strategy at valuations of $10-15bn were clearly good - getting out of the dip in 2003 and making a 8-12-bagger by 2013.

I want your comments on what lessons could be drawn. As I see it, both short and long strategies could be valid in Tesla right now, depending on the investment horizon. The Perfect Investor, of course, bought Amazon in 1997/98 because of believing in the company, sold in 1999 because he saw it was overinflated, and then bought the dip in 2001 or 2002. However, trying to achieve that in Tesla runs a significant risk that the dip will never come (or, more likely: You sell at $90, it goes to $180, the dip goes to $120 and you don't get back in because your waiting for it to go lower when it doesn't).

What do you think?�

1/1/2015

guest Some belated words of wisdom on Tesla from Cramer: you can't put value on this stock:

Cramer: Placing Value on Tesla - TheStreet�

1/1/2015

guest Before things get crazy, well, more crazy, I tried to reflect on this whole situation. My guide thus far has been the SA article written by Sal Demir on April 29th. He predicted $73.68 by the end of this year and $110.02 by the end of next year. We have zoomed right by the first one and are half the way to the 2014 estimate. I was going to be real happy if those estimates were achieved but they were blown away, short squeeze or not. I'm still trying to keep those numbers in the back of my head as they are a good rock solid value if things decide to go south at some point, because as Cramer has said TSLA is a cult stock and can not be valued anymore, haha.

Sal left a comment on his article saying he was going to write a new article. I can't wait to read it!

http://seekingalpha.com/article/1381001-tesla-motors-full-analysis-its-only-mistake-outlook-and-elon-musk#comment-18897021�

1/1/2015

guest Wow, Cramer wants to buy a Tesla. That's a serious endorsement even if he's being fuzzy on TSLA - it says a lot...�

1/1/2015

guest If they still have the best technology in 10 years, I dont see a reason why it should be less than 100 billion dollar in ten years. Some people talk about hydrogen beeing better for enviroment, but I think electric car has proven to be the best type of car. In my opinion I think states should regulate this because of the invorement. If more countries does like Norway, then Tesla would be the biggest. If Tesla can produce mass-market cars, I think we in Norway would have 50% electric cars in 2020. Then again, we produce oil, so it might be hard for our economy, good thing I got Tesla shares. I think the general public will force states to be electric-friendly in the future.

Tesla is also a good stock if the US economy fails, since I think Europe will be the bigger market. If the dollar drops in value, cars would be cheaper in Europe, and Tesla will hopefully completely dominate. That is, if they still have the best technology. One thing we should keep in mind is that if technology in Solar power gets better, Tesla would have a much better chance of success.�

1/1/2015

guest I would also suggest to take a look at the insiders take on market capitalization - see my post linked below.

Short-Term TSLA Price Movements - Page 79�

1/1/2015

guest My year will be made if Cramer buys a Model S. I've been tweeting at him for years about Tesla every time he said something negative about it on the show. I could tell he just hadn't done the work on it that he teaches his viewers to do. I thought that was a shame because if he did, then he would have known what we all did. Looks like it has now caught his interest and he is spending a lot of time on it.

Another thought: Cramer has a rule that he doesn't talk about stocks below a certain market cap on his show. I don't remember what it is, but it might have been $10B. The reason is because of the "Cramer Effect". He has too much power and in a small cap stock he could crush it or shoot it to the moon if he talks about it on the show.

If Tesla is above that market cap now, and he really likes the car that much, we could be seeing a steady stream of good press on Mad Money from now on.�

1/1/2015

guest Dude, that is spot on, though im typing from one of those toys right now, but spot on.�

1/1/2015

guest I'm the first to dispute the Musk/Jobs comparisons, but geez, Jobs did more than "make toys".

Setting aside the Macintosh, just look at what he did with NeXT, Inc. The NeXT computer, and more importantly, the NeXTSTEP operating system, is still the basis for what Apple is today. MacOS X and iOS are basically the latest generation of NeXTSTEP.

iPads might be considered "toys", but tell that to the airline pilots who carry them with them now and use them in-flight. Or the doctors who use them to review medical records. Or the teachers who use them with their kids to learn stuff.

The "toy" argument could equally be lodged at the Tesla Model S.�

1/1/2015

guest Exactly. And event at NeXT it wasn't just creating a BSD based OS "for the rest of us" but they pioneered new things in programming languages, compilers and object oriented programming in general. These things are amazing assets to the world today too and millions benefit because of them.

Having the vision for a computer people would use every day at home, realizing the value in a graphical user interface, hiring people like Jef Raskin to take the concept further and create accessibility, changing the way music is sold which has enabled may independent musicians the ability to distribute their work among all the other things is pretty amazing. iPads are reshaping the way humans learn and engage their world creating a more democratized world of education for more people. It's pretty amazing.

Apple and Steve Jobs are responsible for a whole lot more than "toys". What's great is many of these amazing tools are not only revolutionary to the world, but they're fun too. Musk is going the same thing with Tesla. Building machines that change the world for the better and are also damn fun to use.�

1/1/2015

guest SJ vs Elon

I'm not sure an attempt to elevate one above the other is worthy of either. They are very different people both with great achievements. Jobs changed and disrupted multiple industries with both technical ability and phenomenal marketing and communications skills, breaking the mold of corporate structures and focus etc.. Many of Jobs achievements, Elon has smartly used and built upon. Elon is a brilliant engineer/scientist and business/financier. Elon's path is strong, but has yet to accomplish even a fraction of Job's business accomplishments (I anticipate that will change, but it hasn't to date, just as we don't know what more Jobs could have accomplished if he lived longer). Both were aspirational to change the human race, but in different ways. Jobs built businesses that bridged technology to the humanities/emotional side (extremely difficult). Elon is building businesses that bridge technology to humanities greatest problems and aspirations. Arguing that one is above the other diminishes both. And the only reason they are compared at all is because of their business acumen. It's quite possible that measured by contribution to the human race, neither will ever hold a candle to Einstein or Mozart, both of whom were utter failures in the business community.

Instead, I propose we celebrate the massive accomplishments of Jobs and concurrently cheer Elon as he makes his own independent mark. I'm glad to exist in a world that benefits from the results of both, part of a species that produced them both, and living a life that celebrates them both.�

1/1/2015

guest <moderator nudging the topic back OT>�

1/1/2015

guest With all this noise in the media lately about TSLA trading without consideration for valuation, I'm a bit confused. Looking at a projection for 2017 earnings, there's a fairly easy estimation for future valuation.

Here are the long term numbers I modeled last year, and why I bought a boatload of TSLA:

2017

200,000 Gen 3 sales x $39,000 avg sales price x 0.17% gross margin

30,000 Model S&X x $80,000 ASP x 0.25% gross margin

That puts us right at $2B in profit. Subtract out $600M in operating expenses and you're left with $1.4B in earnings. With 116,000,000 shares outstanding, that puts us at $12 EPS. Applying a 15 P/E, a bit above Ford and GM but well less than other growth companies, you're at $180/share. It seems that a company with as solid a business model as Tesla and good chance of hitting its targets down the road is hardly overpriced at $100 now.

Am I missing something in my (admittedly) simple model? It would seem that if anything my numbers are a tad bit on the conservative side, with Elon recently suggesting that unit sales for X&S combined could top 40,000 and margins could "approach Porsche over time" - i.e. 50%. Gen3 sales numbers are a big wild card, but I think Tesla's longstanding estimate of 200k is quite doable considering how good of a car they've shown they can make and how much of a vacuum there is for a great sub $40k car that happens to be electric with real (200+ mi) range.�

1/1/2015

guest Intellectual Property licensing? My best guess.

Elon's stated goal is moving the automobile sector to entirely electric power trains. Tesla electric motors, control systems, batteries, and Supercharging technology will be extremely difficult for automakers to replicate, doubly so without running afoul of patents.

I think the real money and margins are in licensing. Think "Tesla Inside" like the old Intel slogan, except that other automakers would license the power train designs and build them at their own facilities. I believe that this could provide Tesla with future margins that considerably exceed the 17-25% that they are expected to achieve building their own vehicles.�

1/1/2015

guest Agreed, so many computers benefit from intel inside regardless of brand. Similar to how many different clothing and footwear companies use Gore-tex inside their products. With "Tesla inside" of Toyota and Mercedes EVs, I'm just hoping one of the big three does the same... what ever happened to that GM rumor?

Tesla Pops on GM Rumor (Update 1) - TheStreet

This would be big if it comes to fruition...�

1/1/2015

guest I think it was just a rumor. Frankly GM has such a large investment in their own technology I can't see them using Tesla's since they aren't targeting cutting edge performance vehicles. It's not that hard to build a reasonably good motor and inverter, and they have their own version of an actively managed battery pack which seems to be holding up well in the Volt. They could scale it up to EV size if they wanted to.�

1/1/2015

guest GM also has an even better drive unit in the Spark EV. The efficiency from battery DC power to mechanical power at the axles is very good, with a large sweet spot on the efficiency vs. torque and speed map.

GM also may have brought the A123 Spark battery design and manufacturing in-house during the A123 bankruptcy. However they need to catch up with Tesla's $/kWh advantage.

GSP�

1/1/2015

guest I think that GM will run into problems if infrastructure standards go Tesla's way. There is nothing that can realistically compete with the 120 kW SC, and I don't see anything on the horizon either. Nobody will have a Supercharger network like Tesla's.

In a hypothetical situation where Toyota and Mercedes Benz get on board with Tesla's standard, I can see other automakers following. Nobody will want to be stuck with slower tech.�

1/1/2015

guest Toyota, Daimler, GM, and others need a 200+ mile car first. Once they have that, they can either join or copy Tesla's supercharger network, as Elon has pointed out.

They could stick with 100 kW versions of Frankenplug or CHAdeMo DC fast charging, but would have to settle for second-class status compared to Tesla's faster and sleeker 120 kW connector. I think we are most likely to see yet another DC connector standard, that can go to maybe 200 kW, or for Tesla's plug to eventually become the industry standard.

Tesla's technical leadership in range and charging speed will definitely contribute to the long term value of TSLA stock.

GSP�

1/1/2015

guest One advantage GM has is by using high C rate cells such as the A123's in the Spark they can actually charge faster than a Tesla. If the Spark has say a 20kWh pack I think it could theoretically charge at 6C with a 120kW supercharger.�

1/1/2015

guest Yes, but we all know battery cost is a huge factor and was A123's big problem. High cost batteries are fine for compliance cars, but not for volume production. Their volume production plug-in is using LG Chem cells.

Unlike the other car manufacturers, Tesla has an approach to the technology which starts with one question: how do we replace all cars with electric cars? The rest of the strategy comes in logical steps.

A: make affordable cars people want.

Q: how?

A: make cheap batteries with large capacities.

- Provides ICE-beating performance, ride and handling.

- Covers the majority of miles with home charging

- Allows for rapid charging.

Q: What about long distance travel?

A: We'll build a network of chargers on the Interstates and major highways.

Q: Won't that cost a lot of money?

A: Not that much. We'll use up-front fees to pay for the network. We'll put the network on the Interstate and closed highways so people only use them on long trips (and charge at home for everyday use.) We'll eliminate financial management costs by making it free at the point of use. People will be using them at weekends so electricity will be relatively cheap but we can add solar and battery banks and offer grid management to offset costs further. It just has to pay for itself nationally so we can take advantage of different markets.

Q: But that's still going to be slower than gasoline, right? Some people won't like that.

A: Well, we'll keep trying to speed it up, but there are helpful factors. First, people love free. Second, you can walk away from the charger so you can plug in, go to the bathroom, get a drink or snack and your car is charging, so your perceived wait time isn't the whole time. But yes, time is an issue, especially if we get the high volumes I'm aiming for. That's part of the reason we'll make the packs swappable.

Q: swappable?

A: Yup, drive into the box, a machine removes your battery, installs a fully-charged battery and you drive off. We'll make it faster than gas.

Q: that'll be expensive!

A: Well, it won't be free, but we'll try to make it cheaper than gas, but that still gives us reasonable margin. The electricity required to do it will be relatively cheap. (You can move a car a mile on less than 0.4kWh!) But, we 'll have to come up with a simple, reliable way to move batteries in and out of an underground storage bank. Install/uninstall will be challenging, but we really want to do that for vehicle or battery assembly anyway. And if we're building battery banks for swapping and cost-management for charging we have to get the batteries in and out. Re-use makes stuff cheaper.

Q: Ok, so let's say you make it cheap, what about the fact that people won't know what pack they're getting.

A: Well, we'll keep their pack for the return trip if we can. Yeah, tricky on the logistics, including on Interstates with split rest-stops, but we'll work on it. Hopefully over time people will stop being wedded to their batteries. We'll let people keep better batteries, of course, for a fee. That'd provide a simple battery upgrade/exchange mechanism.

Q: OK, so let's say you can oull this all off. What about all of those people without a driveway or garage? Where are they going to charge?

A: Uh, where they park their car. Parking lot, street. Build something awesome and people will find a way to own it. People live in houses that were originally built a long time ago without electricity, central heating, running water, cable or telephone. Things change.

Q: Wow. Well, I think you're crazy, but I hope you can do it.

A/Q Thanks. Aren't you going to ask me anything else?

Q/A Huh?

A: Dude, I mentioned battery banks at least twice and all you can can think of is cars.

Q: OK... so what 's the deal with these battery banks?

A/Q: If we can build cheap, large batteries, put them together in banks then manage them well to maximize useful cycles we can do what?

A/Q ****! You can put them everywhere! Who'd use peak electricity? No more clock-resetting short outages or crappy wholesale rates on PV excess. You be selling them to renewable generators and to utilies to balance the grid. Maybe some people can get rid of their crappy gasoline generators. OK, now I understand your approach. Can you actually do it?

A: Maybe.

Q: I hate to say this, but I think you're giving me a slight man-crush. Do you get that often?

A: Actually, yes. I think JB gts jealous of it sometimes.

Q: Who's JB?

A: Exactly. I'm just a rich geek. He's a guy I man-crush on.�

1/1/2015

guest I never understood why A123 cells were so expensive, other than that's what they could charge for the performance. They are just a variation of LiFePO4 chemistry, which is one of the less expensive lithium ion chemistries. I'm hoping that the Chinese who now own A123 will work their magic and drive the price down.�

1/1/2015

guest What kind of investment will it take to be able to manufacture 200k cars/yr? To acquire that kind of assembly capacity will require diluting the stock.�

1/1/2015

guest Mod Note: some posts went to snippiness.

Huh? You're entitled to your point of view, but it's not helping your argument to throw out statements such as this.�

1/1/2015

guest I've never seen a forum with such heavy handed moderation, it like the "thought police" are here

(Gentlemen, place your bets, 3 minutes until this post is in snippines place your bets... )�

1/1/2015

guest Agreed. Even my complaint about the moderation just ended in snippiness. I thought snippiness was for removal of personal attacks? I didn't even direct that at anybody.

http://www.teslamotorsclub.com/showthread.php/7777-snippiness/page27?p=371328#post371328�

1/1/2015

guest Nigel was right to move it.�

1/1/2015

guest Ok. I'll back off. Sorry Nigel.�

1/1/2015

guest May I request the mods to try to keep this thread confined to its title, please??????�

1/1/2015

guest Mod Notes:

Some posts went here - Presidential-power-(or-the-lack-of-it)-over-energy-policy

The whole devils advocate position went here - Devils-advocating

(Feel free to ignore that second one if you wish, I just want to avoid it escalating into a discussion on whether someone is just short or is trolling.)

Let's get this thread back on track. It's an investor discussion and the subject is "Long Term Fundamentals of Tesla Motors". :smile:

- - - Updated - - -

We do our best, but that's largely up to the members. :wink: Anyway, I've cleaned up so we can get back OT now.�

1/1/2015

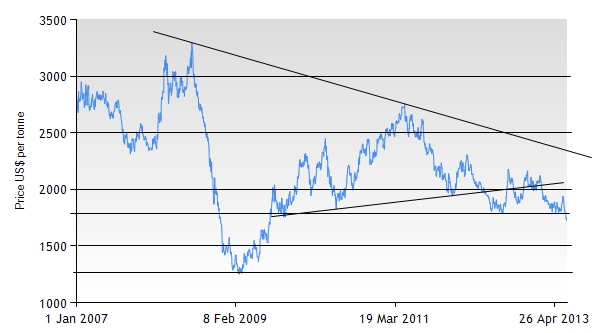

guest Aluminium prices dropping 35% since summer of 2011, and will maybe drop 30% more.

�

�

1/1/2015

guest Who wants to be the 100,000th person to sign the petition?

View attachment 24918

Only 1,000 left to go. Will be hit by end of the day.

BTW, anyone has the complete list of petitions ever reach 100,000? I want to compare this for historical significance!!�

1/1/2015

guest At Last, a New Business Model for Tesla - Karan Girotra and Serguei Netessine - Harvard Business Review�

1/1/2015

guest arent Tesla suppose to renew the deal With Daimler and Toyota this month?�

1/1/2015

guest I Believe!

What has changed for TM since my first post of February 3rd, 2013 (below captioned)? Only for the better. TM share price of $50, $100 or $150 is irrelevant at this stage. I believe EVs are better vehicles than ICE and we are at the cusp of this transformation. I believe TM will be a big player in the EV market. I also believe it will take many years. Be patient. Invest wisely by spreading your risk. Do your own detailed research from wide variety of sources. Don't invest what you can't afford to lose. Enjoy Life. Sleep well.

"TM is still in its infancy and prone to dramatic swings in share price over the most trivial of affairs.

What we know:

Fact: Battery cost will reduce, its size decrease and performance improved year over year (y-o-y), on a much greater scale than advancements over ICE.

Fact: Economies of scale will decrease TM manufacturing price y-o-y.

Fact: Supercharge stations and other electric source fill up stations will increase y-o-y

Fact: Most of my friends have never heard of Tesla or TM (I am a professional Project Manager). With greater recognition comes greater opportunity. No Dave, it's not a fish.

Fact: Expanding global reach will increase y.o.y.

Prediction: The price of Oil will continue to rise.

Prediction: Model X will outsell the Model S, by replacing all the SUV ICE >$100 fill ups at the pump. Some would rather spend that money on a nice meal with the family (not everyone enjoys eating in their car).

Prediction: TM will be profitable in 2013 with 20k production.

Prediction: Model X in 2014, Gen.III in 2016

The rest is noise.

Sit back, turn off Bloomberg and Yahoo Finance and enjoy life and those around you. The Tesla training wheels have just come off. This is a long term hold for 2016 horizon. Tesla is the future, and the future is coming whether we like it or not. I Believe!"�

1/1/2015

guest With so much enthusiasm from overwhelmingly positive sentiment in the forum, I am starting to concern how to grasp the longer term of TSLA price.

The run-up of July is a surprise to me. Before entering July, I was under the impression of Q2 is so-so, so let's hope the TSLA does not have a major pull back.

Instead it is another 30%(or more?) run-up for July.

Back in June, I felt I am in sync with the price movement. I deeply believed the $92.8 price of secondary offering is a solid resistance point, a bottom price I can base on to trade. When TSLA got close to $90-$95 range, I did not hesitate a bit to pull off some trades and won big.

Now I have to admit I am a bit lost. Though I am pleasantly surprised by the strength of TSLA, I couldn't fathom quite clearly what drives the rise. Obviously TSLA has been enjoying remarkable favorable daily press and media exposure, which to a large extent drives the stock. However all of that can be fickle and the sentiment could reverse. I am looking for the next line of resistance/bottom price, a solid price that back up by hard evidence. E.g, the $92.8 price is backed by hard evidence: the big money thinks $92.8 is a good price and jump in.

I don't have any justification to name one. Some may say two digits vs three digits is a psychological barrier but I don't want to risk money with this kind of pseudo argument. So what is your bottom price and justification?

Obviously there are many investors just buy-and-forget, and that is all good.

This is for those who care about hedging, i.e. if you buy puts, at what strike you would buy? and those who are interested in capturing major pull back: when you will put the trigger adding more?�

1/1/2015

guest Most analysts still publicly think Tesla is and will always be a niche player. However, most analysts have indirectly hinted that if Tesla can sell 500,000 - 1 million vehicles annually in the future, and effectively manage costs, the stock is worth $500-$1500.

I don't think there is too much enthusiasm priced into the stock. I do agree the stock could correct sharply like it did when Goldman Sachs urged caution, due to a pause in momentum, however I think it will rebound very quickly due to buyers who see the perma bull case. The stock is trading based on enthusiasm, and the high probability that Tesla will report a massive earnings beat, however, and the momentum can be paused by any negative reports from credible sources. I expect a steep correction to happen eventually, since nothing can go up every day without profit taking eventually kicking in, especially when some people are up 400% - 1000%.�

1/1/2015

guest As far as long term goes...buy and hold! It does not matter what the current price is. It will be much more in a few years. I don't think that is your question, though.�

1/1/2015

guest I kind of agree the sky is limit for TSLA. It is still early in the historical run.

However when the stock runs up so fast and furious, one has to ponder how far it will fall, if any. So the question what do you think the bottom price would be for TSLA. We know it did dip below $110 briefly, would that be it?�

1/1/2015

guest Either whatever the closing price is on Wednesday, or $92.24.�

1/1/2015

guest Ok let me throw this into the mix. If you did see there were some price increases and unbundling of options from the standard configurations. Why would they raise prices so much?

A). Because demand is so great they can get the prices that they are now currently which will increase margins.

B) or because the demand isn't there and therefor they need to generate more revenue per car to increase profit.

Either way, how would each one of these effect or "telegraph" about 2Q results?�

1/1/2015

guest Effect of price increases.

There are other threads that talk about the fact that Tesla has introduced a bunch of new/old/unbundled options. The bottom line is that a Model S configured like our Sig P85 is now something like $10k more expensive (I haven't bothered to actually add it up). Someone said a fully-optioned car is $132k. Anyway, that's just background for what I wanted to discuss.

I think this is enormously good for Tesla the company. Clearly the Model S is worth more than people were paying for it, otherwise this move would be suicide. "The value of a thing is what that thing will bring." So it will improve the gross margin on the average sale. That will be reflected in the profit, and so on.

The potential downside is of course reduced sales. But I'm not worried about that. They're about to open two new huge markets, in Europe and China, and at the moment they seem to be constrained by production, not demand. Also the "viral effect" of seeing Model Ss pop up everywhere is, I think, increasing demand in their existing market (North America). What demand there is doesn't seem very price-sensitive; less than 3% of customers went for the 40kWh Model S.

But why not just, or also, increase production? Well, at TESLIVE Elon mentioned battery supply issues. Maybe they literally can't increase production to the level of, say, running a full second shift. There's no point building electric cars without batteries. Maximizing profit on the ones they can build makes a lot of sense. Anyway, it leaves more room for Gen III based platforms to be optioned up too.

Long term, then, I think the effective price increase is great for the business. Go Tesla!

Oh, and it increases the resale price of ours, too! Not that there's a snowball's chance of us selling it in any near future.�

1/1/2015

guest I am just a bit confused why discussion of config price increase come to this thread? I do remember seeing them somewhere, perhaps in the short-term thread?�

1/1/2015

guest Because of the potential for increased margin, kevin.�

1/1/2015

guest If any of you "Teslanaires" want to offer me $500,000 for my Sig then we have our snowball. Otherwise, agreed. �

�

1/1/2015

guest Hi Kevin, I brought this up because it directly effects the long term profit, sales, and demand of the car(s). The economics of raising or lowering the sale price of them effects many aspects of the balance sheet as well as the income statement. Not trying to ruffle feathers.�

1/1/2015

guest

It's clearly "A" (IMO) since Tesla clearly is production constrained. Per other comments, this is a good thing and its part of their master plan for getting to 25% GM without the ZEV credits.

In interms of TSLAs Long Term price potential, one thing that has giving me a lot of confidence is the CEO stock compensation plan.

The last of ten milestones is producing 300k cars and at that level the market cap of TSLA based on the plan is $43B. Currently, the market cap is $16B. So, basically the stock will need to triple for Elon to realize the tenth milestone.�

1/1/2015

guest Yeah, and Elon will need that money to go to Mars.

(and isn't it crazy that I am not joking...)�

1/1/2015

guest Actually Elon said that his money would be the last out with regard to Tesla. (see link, Elon Musk: )

He's going to need money from somewhere else to get to Mars. �

�

1/1/2015

guest I think there's a few different "bottom" prices to consider.

1. Realistic possible bottom price if Tesla continues to do well (ie., demand high) and economy doesn't go into recession.

2. Realistic possible bottom price if Tesla continues to do well but economy goes into recession.

3. Realistic possible bottom price if demand for Model S/X doesn't grow as expected and economy doesn't go into recession.

4. Realistic possible bottom price if demand for Model S/X doesn't grow as expected and economy goes into recession.

And then all of this will change after Q2 earnings results as well.

But for now, here's how I personally view these scenarios at this current moment (pre-Q2 earnings). Again all this will change after Q2 earnings, probably. Also note: realistic possible bottom price is different theoretical. Theoretically it can go to zero, but realistic bottom assumes not all the worst-case possibilities that a theoretic bottom price would)

1. Realistic possible bottom price if Tesla continues to do well (ie., demand high) and economy doesn't go into recession.

I'd say $110 since it was recently tested and passed the test.

2. Realistic possible bottom price if Tesla continues to do well but economy goes into recession.

$90.

3. Realistic possible bottom price if demand for Model S/X doesn't grow as expected and economy doesn't go into recession.

$90

4. Realistic possible bottom price if demand for Model S/X doesn't grow as expected and economy goes into recession.

$75

This is for the current moment but as the stock price increases and new information is released (ie., Q2 earnings), then these numbers will likely increase.

For now, the economy looks like it's in decent shape and Tesla is doing well, so probably only scenario #1 really matters right now.�

1/1/2015

guest If SpaceX develops rapidly reusable rockets that is an even bigger profit margin and even bigger lead on competitors than anything Tesla has. SpaceX is the better investment if we could actually buy into it. That being said while I'm sure he is not selling before Gen III hits the mainstream since there is no possible way to actually be the last one out unless the company goes bankrupt I'm pretty sure he was only speaking about the next 5-10 years in that quote.�

1/1/2015

guest Although since it only takes 90 seconds to do a full swap, therefore potentially 45 seconds to do a new install, there might be a good reason to build a bunch of cars even if they don't yet have enough batteries. However I don't think they are battery constrained yet. I assume they are running both shifts at about the same level and continuing to speed up the lines as they feel comfortable.�

1/1/2015

guest Since Elon owns 35 % of the shares, shouldn't the stock going up strengthen Tesla's financials, and by definition the stock. Elon's net worth keeps increasing, and he has made it clear he intends to invest the majority of his fortune in Tesla, Space X, and Solar City. Every time Tesla doubles Elon receives tons of stock via options. Eventually he will own 50 % of the float, and he has made it clear he won't sell.�

1/1/2015

guest Elon owns approximately 27% of the company and can get an additional 5m shares in a CEO incentive plan (with 10 milestones). It will be difficult for him to ever own more than 31% of the company.

You should check out their definitive proxy statement. It has a lot of good info:

Tesla Motors - Definitive Proxy Statement�

1/1/2015

guest I know this has been posted before but i wanted to refresh this topic:

Tesal could be free of the convertible bonds as early as this year's end: Tesla Motors - Current Report

Conversion price should be around $161.88. Conversion may take place only after sept 30th (and at least 20 consecutive trading days). If things go our way shares will be trading significantly above that conversion price after Q3. This would safe Tesla Motors millions in interest and therefore add to overall profitability.�

1/1/2015

guest Hi maekuz, what page in this doc that you linked to has the info about the $161.88 sept 30th info?�

1/1/2015

guest The interesting thing is not the first date they could be exercised, but the last. Why would anyone exercise early? (Unless there are dividends, which are still some years down the road).�

1/1/2015

guest I am sorry, I posted the wrong link. I edited my post and inserted the correct link: Tesla Motors - Current Report

The document states a conversion price of $124.52 and a strike price of 130% of that.

- - - Updated - - -

You would get a ~32% return @ $164.88�

1/1/2015

guest Can you state the page number and section?�

1/1/2015

guest The initial conversion rate of the Notes is 8.0306 shares of Common Stock per $1,000 principal amount of Notes (which is equivalent to an initial conversion price of approximately $124.52 per share). The conversion rate will be subject to adjustment upon the occurrence of certain specified events but will not be adjusted for accrued and unpaid interest. In addition, upon the occurrence of a �make-whole fundamental change� (as defined in the Note Indenture), the Company will, in certain circumstances, increase the conversion rate by a number of additional shares for a holder that elects to convert its Notes in connection with such make-whole fundamental change.

Prior to the close of business on the business day immediately preceding March 1, 2018, the Notes will be convertible only under the following circumstances: (1) during any calendar quarter commencing after September 30, 2013 (and only during such calendar quarter), if the last reported sale price of the Common Stock for at least 20 trading days (whether or not consecutive) during a period of 30 consecutive trading days ending on the last trading day of the immediately preceding calendar quarter is greater than or equal to 130% of the conversion price on each applicable trading day; (2) during the five business day period after any five consecutive trading day period in which the trading price per $1,000 principal amount of Notes for each trading day of such period was less than 98% of the product of the last reported sale price of Common Stock and the conversion rate on each such trading day; or (3) upon the occurrence of specified corporate events. On or after March 1, 2018 until the close of business on the second scheduled trading day immediately preceding the maturity date, holders may convert their Notes at any time. Upon conversion, the Notes will be settled in cash and shares of Common Stock (subject to the Company�s right to pay cash in lieu of all or any portion of such shares).

I think its p. 3 and 4.�

1/1/2015

guest So, everyone is groaning about the TSLA's valuation being too high. Honestly, I can't blame them. At this point it escapes any kind of reasonable fundamental analysis. That doesn't mean it can't go higher, of course it can. We just can't make the numbers work out to justify the stock price. Even looking pretty far forward into the future and allowing for really good margins the math just doesn't work. BUT, the one thing that I never see in anyone's analysis is revenue from supplying drivetrains to other manufacturers.

DB just laid out for us not too long ago how far behind the other big auto makers are when it comes to EV technology. It'll take a huge investment of capital and time to reproduce what Tesla has achieved with the Model S platform. Tesla has taken the first big steps to demonstrating that a market for these cars exist and has built THE electric car brand. I have a feeling that given a few more quarters of proven demand, there should be at least one big auto that steps up and says, "I want a 'Tesla Inside' branded car on my lots."

Imagine what would happen to valuation calculations if tomorrow Toyota said, "We've entered into an agreement with Tesla to build the next generation of trucks on a Tesla designed/supplied power train." Or what if Subaru wanted that Model X style AWD system. It wasn't too long ago that many people believed that the only way Tesla was going to survive was by supplying drivetrains and battery packs to other manufacturers. But, for some reason that revenue stream has completely dropped of the radar.

I think the chances of seeing "Tesla Inside" models has only increased in the last several quarters. If I look at 2017 and see not just GenIII, but also at least one big power train client...the valuation doesn't look bad at all. In fact, it looks cheap.�

1/1/2015

guest Elon confirmed demand for the Model S in North America is currently 20,000 annually. (This could eventually increase to 40,000?)

Demand for the Model S in Europe will likely ultimately be at least 20,000. (This could eventually be 40,000?)

Demand for the Model S in Asia will likely ultimately be at least 20,000. (This could eventually be 40,000?)

Elon has stated initial demand for the Model X is 30 percent higher than initial demand for the Model S. (Global demand = 78,000 - 156,000?)

There are currently 0 analysts expecting anywhere near this kind of demand. Any bets on when analysts will begin revising estimates?�

1/1/2015

guest Once again I totally agree. This might be one of those things that might sneak up on people. Toyota is in the midst of reinventing itself so this could really be in the cards. I have a strong feeling what is going on at Tesla right now is there are Toyota manufacturing engineers on site helping Tesla with operations and streamlining things. Toyota has a reputation of working directly with its suppliers to improve processes and efficiency, and then increasing its stake in them when they are comfortable. Right now though, what's more realistic is another joint venture on a sports car or the next iteration of Camry.

Personally, I'd love to see something like a sports car with the Tesla platform and handling characteristics of a BR-Z/FR-S/S2000. This would be an absolute killer in the market, but cost prohibitive at the moment.�

1/1/2015

guest Tesla has a market cap of around 17.5B. Porsche has a market cap of like 21B.

That alone makes me comfortable investing in Tesla. Porsche only sold 30,000 vehicles, across all models in the US last year. If the battery cell constraints can be figured out, I really believe Tesla can absolutely explode, and there is still plenty of room in the stock price for growth. I've underestimated TSLA every step of the way(and missed out), and I just can't bring myself to pull anything out yet.

I talk to people who would never spend more than 12k on a car, and they are trying to figure out how to save up (and incur large amounts of debt :frownto get a Tesla. The product is killer, and I think Elon will surprise us.

�

1/1/2015

guest I think Porche owns VW..�

1/1/2015

guest Other way around.�

1/1/2015

guest here's some figures that should put the potential of the company into some perspective and why I believe that this is a strong play in a disruptive technology.

Assuming that the July Model S deliveries are ~1800 units that is about the same as the COMBINED sales of the A8, BMW 7 series and Mercedes S Class. I think this is a valid comparison given the price as well as the size of the cars. I know alot more people would be interested in a Tesla that was more the size of the 5 series and had a starting price of $50k (the actual starting price of the 528i).

Audi US July Sales

A8: 452 units

A7: 645 units

A6: 2061 units

BMW US June (not July, can't find them) Sales

7 Series: 855 units

5 Series: 4484 units

Mercedes US July Sales

S Class: 577 units

E Class: 5,605 units�

1/1/2015

guest Maybe not. Tesla's main advantage is it's pack density, and cost. However that pack density is around 150wh/kg, the BMW i3 is around 96wh/kg for comparison. That's a large difference but if one of the OEM's gets a cell chemistry that closes that gap somewhat it cuts into Tesla's advantage.

If Tesla has concerns about sourcing enough cells for it's vehicles how can they also source enough cells to build packs for others?�

1/1/2015

guest A new chemistry that has as good or better density than the 18650 cells AND is cost competitive with them? Yes, Tesla is several years ahead whether the competition chooses to use a new chemistry or chooses to try to replicate Tesla's strategy.

Clearly that is a problem that is going to need to be solved with or without a drive train client. How much easier is it to get Panasonic to build a new factory to support one of Toyota's models vs. Tesla's Gen III. I think it gets easier to add more capacity when it isn't being built for just one customer, especially if some of those other customers are big, safe, automakers.�

1/1/2015

guest +100�

1/1/2015

guest +101�

1/1/2015

guest The case for a $20-30b current TSLA valuation

Actually I think a case for a current valuation of $20-30b for TSLA can be made without looking 5+ years out.

Let's take 2015 and let's project 40k Model S and 20k Model X. I'd say those are decent projections considering Model S will likely sell 32-36k in 2014 IMO (demand is higher but production capacity is limited, but by 2015 production capacity should be greatly increased.).

Let's do an ASP (average selling price) of $90k per vehicle (I think this is reasonable because Model X will be slightly higher cost with 4x4 options).

2015 Revenue: $5.4 billion (this is not including any ZEV credits, etc)

Gross Margin: $1.62 billion (assuming 30% since the Elon Musk ceo incentive plan calls for 4 consecutive quarters of 30% gross margin and this needs to be reached prior to Gen III to have a realistic shot at it)

Net Profit: $810 million (assuming half of gross margin. Even if this number is lower than 1/2 gross margin because of large genIII capex expenses amortized, then that's fine because it will just raise the P/E investors will give because GenIII is imminent.)

So, in 2015, what kind of P/E multiple will investors give considering the company is growing very fast (probably $2b in 2013, $3.4b in 2014, $5.4b in 2015). I'd say investors will give at least a 50 P/E, and I think that's very conservative. With GenIII imminent I could see investors give a 100 P/E or more at that time. But let's take the more conservative 50 P/E for now.

2015 Market cap: $40.5 billion (50 P/E X $810m 2015 profit)

So now we need to apply a discount because we're purchasing TSLA stock today and there's some uncertainty in reaching those 2015 numbers and we need a decent investment return. So, let's apply a 40% discount (now this is arbitrary and really depends on how bullish you are on the stock). But I'll say 40% discount because Gen III is still looming in 2015 and provides a huge upside if successful.

Presently justified market cap: $24.3 billion ($40.5 billion 2015 market cap - 40% discount)

In terms of stock price, that's approximately $200/share (almost 120m outstanding x 200/share = $24 billion).

So, with TSLA at $155 right now, I think there could be a case that it's still undervalued (this is my current investment hypothesis, and the reason why I'm not selling anything right now).

Now, if Tesla reveals a Gen III prototype and the Gen III vehicle becomes increasingly more believable, I think it's likely that the P/E multiples that investors are willing to give for TSLA will increase, thus justifying an even higher stock price.

Side note: A lot of people are saying that you can't value TSLA because it's a speculative/momentum stock, but I tend to disagree. I think you need to make a solid case for valuation of any stock you own, or how else I'm not sure how else you know you're making a long-term good investment (other than if you're just going with the current momentum/swing in which case you need to exit before that changes).

Another side note: Just to clarify, I'm not saying the stock is going to jump to $200+ right away or that it's not going to go down from here. Short-term movements are extremely difficult to predict (even long-term ones are too). I also think people need to see either 25% gross margin or close to it (from autos, not ZEVs) to really start believing in the profit-making potential of the 2015 (and beyond) Tesla Motors.�

1/1/2015

guest Nice analysis. I am thinking along similar lines.�

1/1/2015

guest not uncommon for asian companies to build new factories to support future industry growth. its really the story of the transfer of the FAB industry from silicon valley to asia in the 80s. Panasonic doesn't (and probably won't) build a factory to support a single automaker, what they probably will do is their own demand forecasts, make a bet on if cars will be electric or not in 10 years, and then build to a % of future expected capacity. The orders will come later and they have the balance sheet to build now. Also common strategy in biologics (non chemical drug) manufacturing where plants run in excess of $1B to build and take 4-6 years to become operational. If they can get 50% commitments before plant start up then business model is working great (remember - they are usually built so that day 1 production is not 100%).

take a look

Samsung BioLogics

�

1/1/2015

guest I think a P/E of 50 is not "conservative" given how constrained their growth is. It is not a internet company, they can't just double the number of servers to handle more demand. Investors pay for growth rate, and Tesla just can't grow fast enough to justify a CRM or AMZN or NFLX type P/E. I'd use something more like 25 for "conservative".

That said, I don't disagree with most of your analysis. I'm also not intending to sell any of my common shares. I'm just pointing out that there's a revenue stream that everyone forgot about. I think there is a significant possibility that Tesla is able to tap that revenue stream in the future (pre-Gen III) and if you include that in your valuations, then the current stock price looks cheap.

- - - Updated - - -

Okay, but who else uses 18650 cells in their car batteries? There is little chance anyone is going to try it without Tesla's help, they are too far behind to start from scratch going down that path.�

1/1/2015

guest I agree. The only missing link is that whether EV = 18650. Even if cars are electric in 10 years, Tesla may still be the only customer for 18650. So it would be good for Tesla (for the long run) if someone else also bet on that format.�

1/1/2015

guest Totally understood. I just have been hearing from so many other places how you can't justify TSLA's current stock price if you look just a few years out, and I wanted to share how that's not necessarily the case.

Actually, if you analyze other stocks and revenue growth you'd be surprised at how "conservative" a 50 P/E is for a company that's growing as fast as TSLA will be in 2015. So, in 2015 (looking back) you'll have revenue $2b in 2013, 3.4b in 2014 (70% annual rev growth), $5.4 in 2015 (59% annual rev growth). Again, for a company growing over 50% in annual revenue in one of the largest markets on earth, conservatively investors will give 50 P/E (but probably much, much higher).

You mentioned NFLX, let's look at their annual growth rate and P/E.

NFLX - 2.16b in 2010, $3.2 in 2011 (48% annual rev growth), $3.6b in 2012 (12.5% annual rev growth), $4.34b in 2013 est. (20% annual rev growth), $5.08 in 2014 (17% growth rate).

So for about 20% annual growth rate (current and future), what kind of P/E do investors give NFLX? Currently 300+ P/E. Just one of many reasons I'm not fond of NFLX.

If you run the numbers for CRM and AMZN, you'll see TSLA's revenues are growing and will grow much faster the next few years as well.�

1/1/2015

guest > Or what if Subaru wanted that Model X style AWD system. [Citizen-T]

LOL wouldn't it be the other way around?!

--�

1/1/2015

guest Yes, new chemistry that has higher density & costs less. Usually they go hand in hand. Let us assume Envia's 400w/kg battery becomes commercialized and available in EVs by 2017. What happens to Tesla's moat in that case ? Then you have Nissan's NMC that will be coming online in 2015 or so.

Toyotas of the world have figured out how to build reliable cars in large volumes and make money. It takes time to get there for a new manufacturer.�

1/1/2015

guest Yup, and an Envia type density is not even necessary. Today Tesla is using 250wh/kg cells, that end up with a pack density of 150wh/kg. A non CoO2 containing chemistry comes along, like one of the LiSi or LiS flavors, even if only around 250-300wh/kg levels, but without the need for such extensive cell support and only drops to 200-250wh/kg at the pack level. Easier assembly and fewer components needed to coddle the cells, plus less expensive cell materials, i.e. no Ni or Co, and Si and S are cheap. For example Oxis already hit 300wh/kg two years ago and are targeting 600wh/kg by Gen3 time: http://www.oxisenergy.com/html/technology.html�

1/1/2015

guest Some meanderings on long-term stuff...

No-one is anywhere near close to Tesla. If another manufacturer simply tries to become competitive by starting off where Tesla did, they'll never catch up. Sure, the electric motor and inverter stuff in the Model S is neat, but it's achievable by others; it's the battery that is the key advantage. The car manufacturers who have looked into this have seen how hard it's going to be to get to where Tesla is now. The public is going to start learning about it over the next few years, and just as a "hemi" is understood by most people to be a thing that improves engine power, the vagiaries of electric car motors and batteries will become learned, known and appreciated by more and more non-experts. This will help to solidify Tesla's lead and brand value.

Let's consider some other situations that could cause trouble for Tesla in the long run. They're mostly about the battery; how about:

1) in a future scenario where still no-one else is making electric cars, Tesla can't get enough batteries from Panasonic+Samsung to supply all the cars they want to make.

2) in a future scenario where lots of other manufacturers are all clamoring to make electric cars... Tesla can't get enough batteries, they're just lost in the shuffle of big companies - some of which are willing to pay more

3) Another large entity buys Panasonic, purely for their battery-making capabilities. They initially supply Tesla but that cuts off over time.

4) Some sort of international trade war erupts which, for whatever random reason, stops Tesla from importing enough batteries from outside the USA.

5) Tesla tries to open its own battery factory - right here in the USA!!! But can't import enough raw battery materials to make it useful in the fight against competition.

6) prices of the raw commodity materials for batteries start to get manipulated due to increased demand for batteries - more than there ever was in the laptop computing era - and Tesla has no special powers to compete against the other car manufacturers.

I assumed none of the materials in the Tesla battery pack are "rare earth" because I simply don't know the composition. But if any of them are - and this continues to be important as battery chemical technologies change - then Tesla could be in a world of hurt and subject to the whims of non-US governments (who even now work to guard their rare earth commodities), or see world mineral prices ebb and flow over time with announcements about yearly production targets. (Perhaps this wouldn't be a factor for Chinese buyers of Tesla cars, since they live in a country where there are a lot of rare earth elements) Consider a trade war that would threaten the production of EV batteries! Oil producers and gasoline-lovers would love that :|

Who would buy Panasonic? The market cap is about $20billion. They haven't been doing that well recently due to the decline of their electronics businesses (even though they make the best TVs). Their stock fell to about $5, a low of at least 35years, in December 2012 (though, interestingly, it has roughly doubled since that point, somewhat in tandem with the fortunes of Tesla Motors). Had another firm bought Panasonic in December 2012 when the market cap was $10billion, things could be very different for Tesla.

The first thought about who might buy the company based on this thread and this forum would be car companies... but hardly anyone is looking that far ahead, which has been a lucky break for Tesla. If BMW, Porsche or Ford were able to buy the company, including its battery IPs, they could ride on the coat-tails of Tesla for a while and produce batteries for them (Panasonic already produces batteries for Ford too). Eventually when things got critical for their own electric car programs, they could cut Tesla off.

Other target companies might be the conventional electronics companies... like Matsushita, Samsung etc.. Each of these companies all have heavy industry divisions which could continue the battery stuff easily. They may also bring some nationalist loyalties to their local car manufacturing companies, which could spell trouble for Tesla.

My final mental meandering on this would be Apple, Inc. - who do a ton of electronics manufacturing, and it has long been rumoured wanted to produce a car. If they purchased Panasonic and/or tried to acquire Tesla, it would use up only a small fraction of their $175billion cashpile. (yes I know about Elon saying he will never sell... this is just meanderings)

Anyhow, I think Panasonic's independent status is of great value to Tesla, and in case Panasonic does not grow stronger, Tesla needs to build up some redundancy to mitigate the effects of an acquisition. Occam's Razor principle here indicates Tesla building their own battery factory would help with this.

It's interesting to note that Panasonic's stock started rising in December 2012 and there was a blip in April, after Tesla posted a profit. There is tons of potential upside in Panasonic, and one can only expect them to make more and more batteries... it might be a good derivative stock play!

�

1/1/2015

guest http://www.valuewalk.com/2013/08/tesla-motors-inc-tsla-model-s-demand/

As I said earlier, I think Model S will be big in Europe. And yes, a smaller and cheaper car would sell alot aswell, but I think most of us want more than 200 miles of range.�

1/1/2015

guest Nice to see talking heads pundits on CNBC from both a technicals and fundamentals viewpoint loving TSLA -- "not surprised if it would triple" -- a fun clip:

Is Tesla overheated? | Watch the video - Yahoo! Finance�

1/1/2015

guest Then, how come no OEM is talking about them - nor are they talking about any big OEMs ?�

1/1/2015

guest Obviously I don't know, but it's probably that they are still improving, and proving, the product. The ongoing cycle life testing suggests just that.�

1/1/2015

guest Articles like this have me a little worried about the long term return on my investment....

http://www.dailyfinance.com/2013/08/15/why-im-thinking-about-shorting-tesla/�

1/1/2015

guest Anyone who tries to figure out the margin on a gen 3 $35k Tesla using Volt doesn't know what he is talking about. The problem with all these "analysts/writers" is that they have little idea what EV market is like (or will look like). They all woke up just months ago and realized there are actually some EVs being sold ...�

1/1/2015

guest 7) A competitor commercializes a next-generation battery technology superior to Tesla's�

1/1/2015

guest You disregarded the most likely scenario - there are other chemistries that catch up or overtake Li-Cobalt. They are safer too - so you don't need cell level guarantees against thermal runaway. Once battery becomes a commodity - then traditional car making skills become important. That is where traditional OEMs excel in.�

1/1/2015

guest Can't help thinking that Tesla are on top of that situation. Elon has said a few times under questioning that the current battery is the best combination of size and performance and he expects that to continue for a while; you can't make those sorts of comments without constantly researching whatever is out there.

Sure, if by some slim chance GM finds the next state-of-the-art battery technology all by itself and Tesla can't compete, I guess that'll become an issue for stockholders. But Elon will be happy, because all he wants is to eliminate gas-burning cars. As long as that happens, he doesn't care if Tesla is at the top of the pile or not. Not really the best news for investors :|�

1/1/2015

guest Elon himself said he thought it would be about 15% at the shareholder's meeting. The thing I don't get is if someone thinks they will sell 100,000 Model S/X how do they pin the Gen III number at 150,000? I mean a $35,000 car is half the price. It is way more affordable. Also, 25% gross margin is the target for the end of this year. They didn't say they would stop there. I would think they could get to 30% gross margin. Still, there are plenty of risks but for me I want my money in Tesla because a company like Tesla makes the future brighter.�

1/1/2015

guest Another car company is unlikely to make an advance in battery tech. Such an innovation is likely to come from a startup.

Any such company would want to pitch Tesla, as it is the largest consumer of batteries.

As long as they remain open to new possibilities, Tesla will know about advances first.�

1/1/2015

guest Here's the potential problem. Tesla is closely involved with Panasonic and the 18650 format, and Tesla wants increased production. To get that Tesla may have to commit to X number of cells for X number of years. Meanwhile lets say the Envia chemistry works out for GM, who isn't sharing, suddenly Tesla is stuck with a less desirable battery chemistry and format. Not only is their advantage gone but now they are at a disadvantage.�

1/1/2015

guest Very true. However the established cell manufactures such as Panasonic and Samsung will be more likely to actually bring new technologies to high volume markets. Startups can innovate and invent, but do not have manufacturing expertise, which can be the most important skill for a cell manufacturer's survival.

GSP

- - - Updated - - -

JB Straubel has stated that the first two things that Tesla asks from potential cell suppliers are their (10- year?) technology roadmap and cost roadmap. That way they know if worthwhile improvements are in the pipeline before committing to a long term contract. This is also useful to know before committing to buying Gen 3 factory tooling, which will depend on lower cost and higher volume cells.

GSP�

1/1/2015

guest Problem is a tech breakthrough can jump over planned road maps. As for production, look at GM or Nissan. If something like Envia works out then GM can have LGChem do the production, and similarly Nissan has a lot of battery production capacity in house. Both LGChem and Nissan battery production is under utilized at this time. I do hope Panasonic has something special waiting in the wings because the 4ah cell we know about is only a volumetric improvement and not gravimetric, which is more important.�

1/1/2015

guest I just hope that Elon doesn't turn out to be Tesla's Achilles heal in the end. I am worried that he is using Tesla to force other companies to go electric, with no ambitions of beating them to a pulp and become the largest manufacturer in the world. We, as investors, need Elon to be a Capitalist and find ways to make Tesla (and himself) as rich as possible. For example, by the time other car companies catch up, Tesla will have Superchargers all over the world. I want him to charge Ford customers the cost of a tank of gas to fill up their EVs while on road trips. Hopefully he sees the money making opportunity of being the next Exon Mobile as much as he sees the possibility of making a difference as a car manufacturer.�

1/1/2015

guest Exactly. A 200 mile $35k car will sell a lot more than a $75k car. Infact, I think the sales of S/X will go down once the Gen 3 comes on board. Even many of the current S owners would have actually bought a Gen 3 if it was available.

Margin on Gen 3 would depend a lot on their cost & execution. Both are difficult to estimate now.

A good question to Elon would be - come 2017, if you can't sell Gen 3 for $35k with 15% margin, would you still sell for $35k with less margin or would you sell for higher @ 15% margin.

Another thing that would impact Gen 3 sales is what the competitors are going to do. One approach, apparently preferred by many here, is to assume competition will be completely absent. A nice feeling - but not prudent (or even realistic). Leaf is not going to have the same range in 2017 as it did in 2011. What happens if Nissan sells $25k, 150 mile range Leaf ? Will that impact a $35k 200 mile range Gen 3 ? If so, how much ?

The largest selling model in the world is Ford Focus. It sold about 1 Million last year. Prius sold about 400k worldwide. Elon would be very happy if they can come close to matching Prius.

- - - Updated - - -

I know that is the wet dream of a lot of folks - but the chances are extremely low. Even with 500k sales, Tesla would still be a small player and Fords of the world have no reason to capitulate. They also have a lot of lobby power - they will get uncle Sam to foot the bill for a country-wide charging network (to an extent that has already happened in some parts of the country). In other parts of the world where people are very welcoming of governments taking active role in economic life, there will be very good networks setup in the public domain.

One more thing - Tesla has a particularly nasty problem with "destination" charging. They can't easily put up charging stations in expensive urban areas (unlike other OEMs who have dealers in urban areas).�

1/1/2015

guest As much as I like Tesla's innovation, I think marketing, segmenting the consumer space, is something they will consider traditionally.

Nissan is a good brand, but not premium. Audi, Mercedes, Volvo, BMW - these are each other's competitors. The Leaf is not a Gen3 competitor, just like no Nissan model is a BMW competitor.

I think BMW will be Tesla's main competitor for the time being. They are the No.1 premium car brand in the world (AFAIK), and they have demonstarted they are willing to evolve towards hybrids and EVs (even if the i3 is way inferior to Tesla's technology). If anyone, they can be a threat, not Nissan. The i3 is the electric 3 series. My biggest worry about such a late Gen3 intorduction is that the i3 will be at its 2nd if not 3rd generation by 2017/18.

As for becoming the next Ford, VW or GM: even if Tesla could make a - 15-25k EV, i'd prefer them creating a new brand for that. Releasing much cheaper, less premium cars would damage the Tesla brand in the premium segment. Now don't get me wrong, I'd love them to do a 15k car, and i would also expect it to be of good quality, but they would need a more mainstream brand for that. Expecting Gen3 to sell like a Focus would be unrealistic. But it should sell like an A3, a C Class or a BMW 3 series.�

1/1/2015

guest Agreed, already there was a dust-up over Elon's laughing when the BMW i3 was mentioned during Quarterly Earnings call... now, some quasi "fighting words" from BMW when asked about Tesla vs. the upcoming BMW i8:

BMW Sees No Rival in Tesla as It Readies Plug-in i8 - Bloomberg�

1/1/2015

guest Has anyone done some detailed back of a napkin analysis of why Tesla needs 3 to 3.5 years to come out with what will substantially be a down sized Model S? While I guess we can speculate they need to wait that long for the more advanced batteries they expect will allow Gen III to come in at 35K, putting that aside, does a company with all the advanced design tech and now experience with developing 3 EVs, need 3+ years?�

1/1/2015

guest I didn't really see them as fighting words. He said the i8 will be in a different market than the Model S and won't compete with it. I agree.�

1/1/2015

guest The average product development cycle of a new car (the Gen 3 still considered a new car- tooling for new body, new motor, new wiring, other TBD additions) is 4 to 5 years, considering they have devoted resources and all technologies in hand to start with. Tesla is still a small establishment. I don't believe they have fully dedicated resources working on the Gen 3 as yet as engineers are still busy with the Model S and Model X. Further the battery technology for Gen 3 may still be different than the S, however I don't know this for a fact. Finally, but not least, they are working with Panasonic to reduce the price of the Gen 3 battery pack, which will take time for Panasonic to evaluate and finalize.�

1/1/2015

guest Elon has said that only 10% of "executive time" is currently spent on Gen3. With the cash raise, they have enough to fund development of the X, and then profits from the S and X will be used to develop Gen3. If Gen 3 was their 100% priority, I'm guessing they could get it done in less than a year. I think they are focusing on making Gen2 efficient and profitable and building infrastructure (galleries, service centers, superchargers, brand awareness, etc.) as they wait for batteries to drop in price.�

1/1/2015

guest I'm pretty sure it is a combination of

1) Wait for the natural, annual reduction in battery cell cost to make a cheap battery feasible (this is the big one)

2) Gradually gain experience and build in-house expertise for large-scale manufacturing

3) Offset the development cost of the G3 vehicle by letting high-end vehicles pay for component development

4) Build a brand as a premium carmaker, which is probably the cheapest and most reliable way to make people buy your stuff

5) Build enough capital to pay for the development and scaling in manufacturing

Right now, a compelling electric vehicle is just borderline technologically and economically feasible. The Model S is the demonstration of this. When battery costs have fallen enough in 3-4 years to make a compelling low-cost electric vehicle possible, Tesla will be the only company in the right position to capitalize on it. This is a textbook example of the entrepeneural lesson "often, someting is a bad idea until suddenly it isn't". The "something" in this case is electric vehicles. When it becomes obvious that "suddenly" has hit, it will be too late to go for the first-mover advantage. This effect can be seen in every major technology startup during the last 20 years.

A lot of people, myself included, are shocked how popular and compelling the Model S really turned out to be. And I agree with you that at this point, I wish that G3 development could be a couple of years faster. Although Tesla has the first-mover advantage, others have started the race. I think most the points on my list are holding Tesla back from executing the G3 vision sooner. Crucially, there isn't enough capital, there isn't enough expertise/staff and the perfection of component development hasn't hit its peak yet. But batteries are still too expensive, and this is an external factor which is holding everyone back from achieving a compelling low-cost EV. It is also why the big carmakers are cancelling EV programs left and right. It just hasn't sunk in that electric will be the superior, sensible way of doing things in a couple of years. We have front-row seats to a massive paradigm shift in automobiles.

Also I think we are staring ourselves blind at the Gen3 vehicle. If Tesla is indeed as successful with G3 as the current stock price expects, we won't be talking about 200,000 vehicles/year in 20 years. It'll be more than that if Tesla maintains the technological lead and management does its job properly. In that regard I think that the current $150/share is about right, but it is a price which will be surrounded by huge volatility. This is a 10-year race.�

1/1/2015

guest I invested in TSLA, and I stretched so much to buy a Model S, precisely because Elon is not the type of capitalist you describe.�

1/1/2015

guest But they don't need charging stations (assuming you mean Superchargers) at destinations. Anything north of a 110V will do for destination charging, and for long term airport parking, even 110V is fine.�

1/1/2015

guest Never heard of Infiniti ? I guess Infiniti is not that big in Europe ...

Not that it matters. If Nissan has an EV with comparable range for less than Gen 3 - it would be a big threat to Tesla as it would be a substitution product.

- - - Updated - - -

Not really. When I go on a day trip to Portland or Vancouver, BC - I need quick destination charge to be able to come back the same day.�

Không có nhận xét nào:

Đăng nhận xét