1/1/2015

guest Yeah, I saw CSIQ fall to $16.99 AH, but volume only 4k total. Some poor bloke used a market order to sell CSIQ.�

1/1/2015

guest Ya I saw that too. Its like he set his sell price to the closing of price yesterday, not today. Big mistake, who ever it was.�

1/1/2015

guest Just want to say thanks to all of you for all the info on the solar industry in the past few weeks. It has been *helpful*.

�

�

1/1/2015

guest Well I guess its time plan for a bit here. We all agree that Solar might have real bright future, and the upside might be insane here. In Q2 I lost 80% of my options portofolio because of SOL, CSIQ, SCTY and SPWR.

The last 40 days I have done a 7bagger on that portofolio so I have learned my lessions Im now ready to step it up a notch. I guess we have all learned that alot of these stocks follow eachother. If one is green, most of the others are green.

So when we are gonna postion ourselfs before Q3 we need to be careful, even if its CSIQ or SOL we are holding. If LDK are the first to report, then there is probably no point in having tons of options on a winner.

Another thing is what companies will do more offerings. This will also screw your options plays.

JKS is up 1200% the last 14 months, so it beats even TSLA. But as with Tesla, solar stocks could go much further. The question is when. We should do some research here, so that we can position ourself good in Q3 and Q4. Because in 2014 I think this will take off.

But remember TSLA, alot of us dreamed of 200$ back in January, but noone saw it coming so soon.

Alot of people are talking about EV is the future, and I have agreed since I heard about the roadster, but more people agree that Solar is our future. So alot of people will buy in, especially institutions. And if EV is the future, that is a catalyst for solar.�

1/1/2015

guest Speaking about all of this. I was thinking about buying some CSIQ lottery tickets. Some Jan14 $30 calls. I am willing to bet if CISQ breaks above $20 a share soon, it could be a big return. At only 50cents a contract buying 5 or 10 would be fun to see how it plays out.

I had a Lottery ticket on FB - Jan 14 $65 i bought for 15 cents right after their Q2. Worth almost $2 now (probably going to dump day after Q3)

CSIQ seems to have so higher Prems for options then some of the others. YGE is at $7 a share and $10 options are 50 cents.

Like i said these would be purely lottery tickets and getting out in time before the delta takes hold will be hard, this is also assuming the stock even move up fast enough to get any gain out of them.

- - - Updated - - -

New idea on top of my last.

Take what i think are the top 5 Solars by possibility of moving up rapid and buy 5 Jan14 DOTM calls in each. Kind of like a bull call spread across the sector. That way if some dont pan out the others would cover them. Or i lose all 5 for a $1250 loss.

I am thinking:

CSIQ

JASO

SOL (already have Jan 7.50s)

TSL

YGE

SPWR (SPWR is on my list because I already own Crazy DOTM Jan $39s from Q2 earnings)

Anyone have any inside ideas on a better solar stock for rapid up movement?�

1/1/2015

guest I would have JKS on that list. I have options in all of these, but I change them every day. If I had 1250, I would buy SOL for the short run and go into CSIQ into earnings. TSL and YGE are thoose companies that might do more offerings, isnt that so sleepy?

Also guys, a very useful tool. Here is the china index of solar companies. Notice that GCL Poly is up, this could mean that DQ which also produces will go up. However it might also just reflect that solar went up for the US listed companies aswell, so dont be fooled by it. Anyways, its in the green, so tomorrow looks good.

http://solarpvinvestor.com/china-index�

1/1/2015

guest I looked at JKS but their premiums are real high. March $37 is still $1.45. Dec $37s is 60ish cents.�

1/1/2015

guest can you post the link you are referring to? I didn't see one. Thanks!�

1/1/2015

guest http://solarpvinvestor.com/�

1/1/2015

guest Are we talking options or long stock going into Q3 and possibly Q4?

Are TSL and YGE a bit too big for a lottery play (i.e. over 1 billion)?

I already have long stock for CSIQ, JASO and SOL with calls near the money. Also have a CSUN call that I think I should get rid of very soon.�

1/1/2015

guest Im going in with stocks, LEAPS and short-term options. Im now into 8 solar companies or something, guess it will be fewer when we go into earnings. CSUN is probably a sell, but you never know. The guy who tipped me off sold and used to money to buy HSOL.�

1/1/2015

guest I am talking DOTM calls for what could volatile stocks that have a good up swing.�

1/1/2015

guest Wished I got this tip too. It would have been really nice to sell around $6.50. I'm going into earnings with those three stocks and the APR calls. Still debating whether to do small Jan DOTM calls like fjm9898 suggested.�

1/1/2015

guest Yeah I also sold to late, regarding the calls I have no idea whats best yet.�

1/1/2015

guest @Norse - I know that YGE hasn't been in the market yet for a secondary and I think TSL hasn't either. Don't be surprised to see an offering and then your options are shot.

CSIQ may also go back for more so you never know, after all they registered for $200m mixed shelf offering and only raised $50m. I don't think they need more though. If they do need more it is because business is booming like crazy and they need to buy new capacity or fund new power plant projects but that would be stupid if they don't find a buyer to fund it first.

As much as I like solar, they have been going up like crazy over the past week or even more. I mean how long can this last? There has to be a correction some time right?

I would like to believe that a stock can go up 10 or 20 days in a row, but I don't believe that is possible. Are there any stats on this stuff.

Sooner or later these stocks will correct 10% - 20% and give a much better entry point. Then again if they go up another 50% before correcting 10% you missed out on the whole rally. That is why investing is hard and sometimes buying shares and waiting is a lot less risky and easier to make money than trying to time the market with options. I still play options, but I am very risk tolerant and understand the risks.

@fjm9898 - I think that you are looking at options wrong. You need to look at option cost as a percentage of underlying share price. You will then notice that YGE options are even more expensive than CSIQ.�

1/1/2015

guest I understand that Sleepy but i was saying JKS was real expensive compared to the rest of them for this Short term play.

Like i said this is purely a lottery play. No real math behind it. Its go buy some DOTM calls for cheap and see if one or multiple of these stocks takes off and make a multibagger. Its a pretty crazy and far out there play that most likely wont pay out at all. But image if the solars all continued to be red hot and all of them hit.

Not saying i am going to do it all yet either, it was plainly just an idea.

I have set up all the 50cent orders on all of these stocks and i am going to sleep on them and figure out which if any of these lottery tickets i am going to keep.�

1/1/2015

guest I think this is not entirely correct. The strike price will always stay the same. Only what you get for that price will change.

In your example the holder of one share would gain $26 "overnight" ($13 -> $39). He would triple his unleveraged money, while the holder of the $10strike-call would have also only tripled his HIGLY leveraged money. This cannot be correct. If in that example the underlying basically triples overnight, then the option must and will still have much higher leverage compared to the stock.

I suggest it would be handled as follows:

Let's assume SCTY bought TSL and every holder of TSL received one SCTY share.

If you had a call with a $10 strike price you would simply have the right to call 100 shares of SCTY for each contract for $1.000 (100 x $10).

If the deal would be 1 SCTY share for every 2 TSL shares, then the option holder would simply receive 50 shares for one contract, still at the same strike of $10.

Now, if it is not a merger, but a cash-buyout then the holder of the option will receive a cash payout.

Example: SCTY overtakes TSL via cash-payout. Let's assume, TSL trades at $13, SCTY pays $20 cash for every share of TSL.

The holder of the $10-strike-call will therefore receive 100 x $10 for each contract ($20 - $10 strike).

It is important to note here, that all time premium of the option will be lost in this case.

Example: Let's say you had a 2016-LEAP-call-option on TSL, strike $15 that was trading at 7$ at time of the buyout.

You will just receive the intrinsic value in this case ($5), and all extrinsic (=time) value will be lost.

http://www.ehow.com/about_6218376_call-options-adjusted-merger_.html

I think there could be some mergers in the future in the solar sector, but I believe, those will all be mergers, where the stockholder of company A will be paid with stock of company b, and not cash-buyouts (for the simple reason that most solar companies are not swimming in cash...)

I hope I am right, otherwise LEAPS on solar stocks would be even more expensive than they already are. If ever I would see the chance of a cash-buyout of a company I owned, I would sell my OTM-LEAPS and either go in (shortterm) ITM options or in stock.�

1/1/2015

guest Looking for some thoughts on a few things. I got hammered on solar options after Q2 and am holding some jan14 calls from preQ2, CSIQ17, SOL7.50 and SPWR39 (tip of the hat to fjm9898). The rest of my burgeoned portfolio of house money, thanks tsla, is now 48% TSLA, and 14% each of CSIQ, JASO, SOL and TSL. I am young, have a high income and thus have a high risk tolerance. I am very bullish on Solar and my gut is telling me to hold onto the options through Q3 at least. Wise play or should I sell the options ASAP and buy stock for the long haul?�

1/1/2015

guest Lol, pretty much identical story that I have. Im not sure what advice to give. I got 70% in stock, and 30% in options.

But I bet we all like this news on CSIQ. This will go into Q3, which means I am going to position myself for CSIQ having a good Q3.

http://phx.corporate-ir.net/phoenix.zhtml?c=196781&p=irol-newsArticle&ID=1860768&highlight=

And there it hit maintstream media. http://www.4-traders.com/CANADIAN-SOLAR-INC-36332/news/Canadian-Solar-Inc--Canadian-Solar-Completes-the-Sale-of-Two-Solar-Power-Plants-to-TransCanada-17315981/�

1/1/2015

guest Wow... Closed on last day of Q3. Thanks for sharing. By the way, when do you find the time to sleep? �

�

1/1/2015

guest Im currently between jobs, and have no kids, so I have plenty of time to do what I want. Also the time in Norway now is 13.40�

1/1/2015

guest This may be old news as you are all on top of these things....but CSIQ sold two plants: http://www.cnbc.com/id/101079862�

1/1/2015

guest This was exactly as expected. If you read my article you would know that they closed the sale of one plant on the last day of Q2 and announced it on July 2. Now they closed two plants on last day of Q3 and announced on Oct 2. These sales are to the exact same Trans Canada company.

Technically speaking this should not have any effect on the stock if you believe in even the weakest form of the efficient market hypothesis. I don't believe in it, but we will have to see what this news brings to CSIQ. Wall St. tends to be short sighted so I wouldn't be surprised if we break $20 very soon; I would say that maybe even today but the government shutdown will end up being a drag even on the solars sooner or later. Some good buying opportunities may come up in the next week or so. Solar has been pretty hot and profit taking will come one day.

This sale means an extra $100 million of revenue and $20m of gross profit in Q3 for CSIQ. The company will probably have EPS of $0.50 or so and that is what I see at a minimum for the company going forward at least until the end of 2014. If the solar industry continues to boom and CSIQ starts expanding capacity while signing new power plant deals, this stock might go really high next year.

Interested to see how the market reacts to this, but it has to be positive. I think we will see a bigger boost in the stock price once analysts start updating their Q3 models to include these sales (were not part of company guidance) or when CSIQ announces actual results.

There is always the chance that a lot of people in the market don't understand what these sales really mean and will blindly buy CSIQ thinking that they are signing new deals or something.�

1/1/2015

guest looks like the big loser this morning is TSL. I hope this is not the start of the pull back and it can recover.

Bought HSOL and YGE lottery tickets this morning on their opening dips. I did not own either of these prior which is why i bought some lottery tickets just to have some exposure.�

1/1/2015

guest Nice one with HSOL. I bought HSOL and CSIQ. http://www.pv-tech.org/news/hanwha_solarone_provides_solar_modules_to_citizen_funded_solar_project_in_g?utm_source=newsnow&utm_medium=web&utm_campaign=newsnow-feed

Really hoping for a STRI breakout today!�

1/1/2015

guest looks like HSOL was a dud.

What is STRI?�

1/1/2015

guest http://www.strsolar.com/ It's a gamble. They have as much money as they're market cap is and they are 85% inst. ownded. They make products for the solar industry and claims that 20% of the markets uses theyre product. They are now mass producing theyre gen2 product. That is all I know. Pure gamble!

Deutsche Bank analyst Vishal Shah lists five reasons that China's solar demand could exceed expectations:

http://www.renewableenergyworld.com/rea/news/article/2013/10/asia-report-five-reasons-why-chinas-solar-demand-could-surprise-you

Global Solar Installation Growth Set to Hit Three-Year High in 2014

http://www.pvmarketresearch.com/press-release/global_solar_installation_growth_set_to_hit_three_year_high_in_2014/5

Market revenue in 2014 will amount to slightly less than the all-time-high of $89 billion set in 2011.

�PV installations will accelerate in 2014 driven by low system prices, the creation of new markets in emerging regions and the continued growth in major countries such as the United States, Japan and China,� said Ash Sharma, senior research director for solar at IHS. �As the industry�s recovery accelerates and market revenue returns to near record levels, solar manufacturers will leave behind the turmoil of recent years and enjoy improved business conditions.�

Looks good. And guys, we really got to say thanks to sleepyhead who opened up our eyes and this thread for more than SCTY

And instead of losing money on SCTY past months atleast I have made alot on the other solar stocks�

1/1/2015

guest +1: Agreed. Never heard of CSIQ and JKS until Sleepy got me looking at them. So far, so VERY good. Thanks Sleepy!:wink:�

1/1/2015

guest +1 to sleepy!!!

SPWR flirting with a new 52 week high.�

1/1/2015

guest Many thanks to sleepy for his tireless and spot on research in the solar sector as well as tsla.�

1/1/2015

guest If you are looking to hold JKS long term then you will most likely make bank. If it was a short term trade or if you bought options, then you might start considering selling your position. JKS already doubled in value since it had its breakout trade just under 3 months ago. It is now going to bump up against what looks like resistance in the $26 - $30 range.

Long term it is still a good buy, so I would recommend holding and not worrying about short term volatility. That said, I currently don't have any JKS exposure but that might change in the future. I am looking at buying up the laggards right now such as CSIQ.

A word of caution to everyone:

Even though it looks like the solar industry will be booming big time, there are still many unknowns and a lot of volatility in the future. There will be capital raising, and there will be 20% corrections.

If you are looking to make money then buy and hold is the best strategy. If you are playing front month call options and lose all of your money then don't come to this thread complaining that sleepyhead or Norse recommended that stock. But do share your story so that others can learn.

Happy investing. This is just the beginning.

I am calling 2014 the year of solar! (I am not talking about stock market returns here, but rather in general; return to profitability, product shortages, huge demand, supply capacity shortages :scared:, rising ASPs, etc.).�

1/1/2015

guest Again, agree 100% with sleepy. IMHO, with options, you want to give time for the trade to work out, especially with a volatile sector such as solar. Although it is an adrenaline rush to see short term options triple or quadruple, in my experience, it always leads to a disaster sooner or later. I strongly recommend you choose options which are 6-12 months out, and create risk free spreads when possible. Would hate to see anyone lose all their money trading options.�

1/1/2015

guest I agree, I mostly have money in stock. In my option portofolio however I have 85% in LEAPS, but also some fun money for companies like CSUNE.�

1/1/2015

guest �

1/1/2015

guest Yo sleepy!The following errors occurred with your submission

- sleepyhead has exceeded their stored private messages quota and cannot accept further messages until they clear some space.

�

1/1/2015

guest I deleted some old messages�

1/1/2015

guest Well, we got a nice rebound allover the place now.�

1/1/2015

guest Are you referring to TSLA or solar stocks? CSUN is definitely not part of that team. :crying:�

1/1/2015

guest The solar stock. No I think CSUN is heading for the hills.

Btw. In the article I posted earlier today. Notice on very important thing.

"Shah predicts Chinese solar demand could rise to 13-15 GW in 2014. Combined with Japan's surging market (which he pegs at 6-7 GW next year), those two Asian nations could account for almost half of total global shipments next year, which he says could reach 50 GW. (Which, he adds, would create a shortfall of polysilicon of around 40,000-45,000 metric tons.)"

also, Solar continues to rise in California: http://www.pv-magazine.com/news/details/beitrag/solar-continues-to-rise-in-california_100012929/#ixzz2gbR9jbDv�

1/1/2015

guest I guess I should cut my losses with my CSUN calls soon. I wanted to see if it would bounce back a little by the end of the week.

As I mentioned before that I'm long CSIQ, JASO and SOL. I recently close my PNQI ETF position with some profit. Is it a good time to put that money towards SPWR or another solar stock? Or should I wait a bit for a correction on one of these stocks and add my position then?�

1/1/2015

guest I think SPWR is safe, And I would add JKS.�

1/1/2015

guest SPWR is going to be the long term winner in the solar indsutry. Everything I said about the company still holds true today. I am still buying SPWR, but focusing most of my efforts on the severely undervalued Chinese players such as CSIQ, which happened to issue a new press release today about selling 2 power plants to Blackrock:

http://finance.yahoo.com/news/canadian-solar-announces-sale-two-105500488.html

I didn't see this one coming, and I am not sure how they are recognizing revenues for this, but they did close the deal on Sep 30th. Is it cash accounting? If so, why would they pay before the projects are completed.

Should be another boost to CSIQ today.

Norse, do you have time to research this? Thanks�

1/1/2015

guest Well I guess we should as usual start with some good news: Perhaps this?

Canadian Solar Announces the Sale of Two Utility Scale Solar Power Plants to a Fund Managed by BlackRock

http://www.prnewswire.com/news-releases/canadian-solar-announces-the-sale-of-two-utility-scale-solar-power-plants-to-a-fund-managed-by-blackrock-226279211.html

up 4.2% premarket.

Will 2014 be good? Japan Installs 10GW of Solar PV Capacity, Set to Become World Leader

One question raised in the face of Japan�s ambitious expansions into solar energy, is its ability to support the demand. Supply shortages have already been met as domestic PV panel producers are unable to keep up with orders, and many are fully occupied until 2014.

http://oilprice.com/Latest-Energy-News/World-News/Japan-Installs-10GW-of-Solar-PV-Capacity-Set-to-Become-World-Leader.html

Still not convinced? 7 Reasons The Solar Revolution Is For Real

Read more: http://www.businessinsider.com/how-solar-surged-in-america-2013-10#ixzz2gf9MF2ru

Also, in Norway alot of powerful groups wants the oilfund to start invest in renewable energy. The oilfund does not invest in risk-stocks. (They have, or atleast had TSLA) So when the solar companies soon shows profit, I bet they will, along with other funds join. I think ALOT of people are watching this development guys. Even more then EV industry.

Hah you beat me to it. I guess the date is pretty signifigant here, tho I dont know. Good guidance is allways good aswell in growing markets.

Also, should be check out the japanese market? "The market is still dominated by Japanese manufacturers, BNEF said. About half of the modules imported from outside Japan in the three months ended June 30 came from Japanese manufacturers with plants overseas, according to the London-based research agency."�

1/1/2015

guest CSIQ and SPWR both up big Premarket.�

1/1/2015

guest I did some research and it looks like we don't know when the revenues will be recognized, but it doesn't really matter because if some are recognized in Q4 then we will get really good guidance on call. If later then we will get really good guidance on Q4 call.

The important information here is that Blackrock is the buyer. I am not sure, but aren't they like the biggest asset manager or one of the biggest in the world. This is great news, smart money is going after solar.

The train is about to leave the station. If you are still unsure then get in on the next pullback. I know it feels like there will never be a pullback, but they come sooner or later.�

1/1/2015

guest hmm Jaso and Hsol also want to join the party! Well everyone is invited here �

�

1/1/2015

guest Sleepy, once, again, a spot on prediction of csiq at 20 you made last week! You are a soothsayer for sure! Many thanks.�

1/1/2015

guest I agree. Nice one Sleepy (as always). Those CSIQ call are helping me power through the TSLA turmoil.

What do you guys think a good valuation for CSIQ will be? I have OCT18 calls and I'm thinking of getting rid of those before the time value bleeds away.... today might be a good day if they go up a lot and IV spikes. Any opinions?�

1/1/2015

guest i think csiq has room to run....technically, there is no resistance till 23-25. I would consider closing your October calls and rolling them to dec/jan.�

1/1/2015

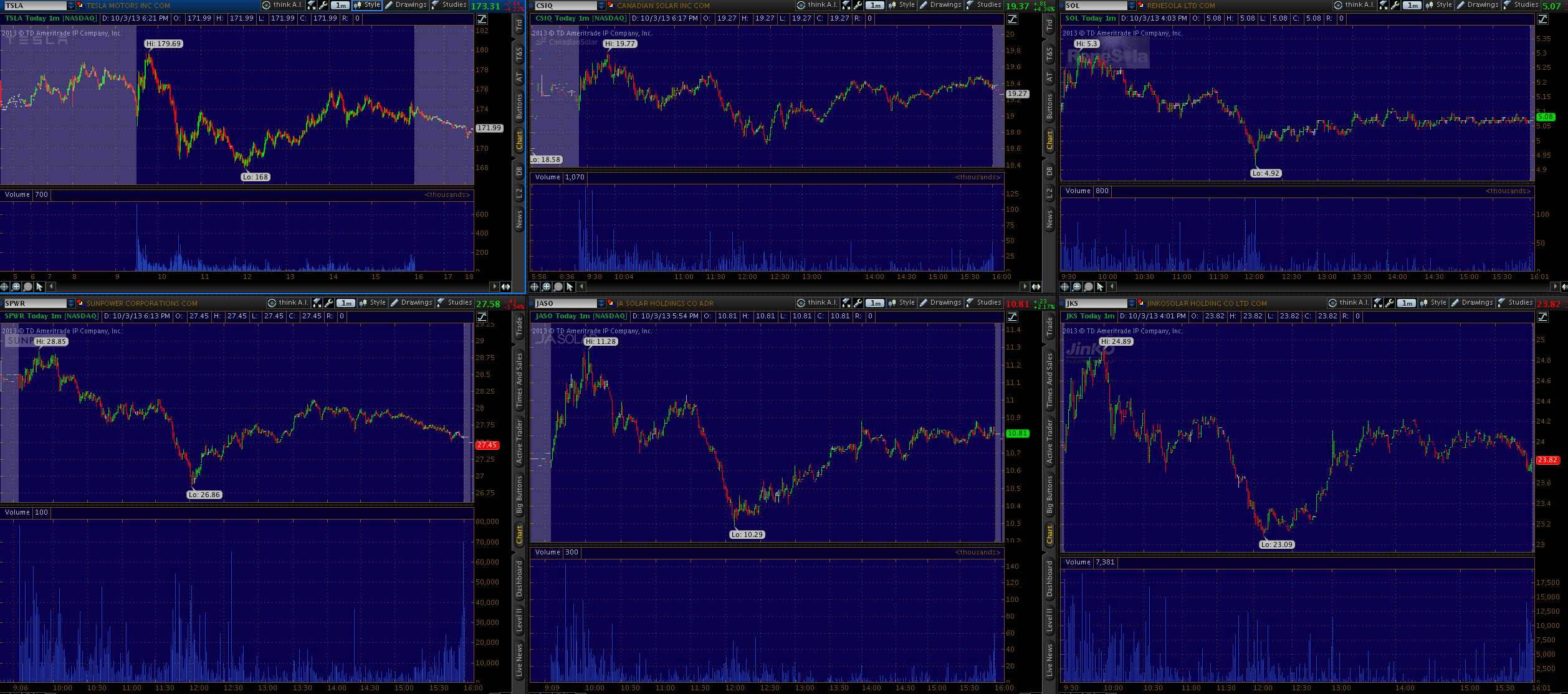

guest what happened at 11:30? I can't find any news that would tank the stock�

1/1/2015

guest Uhh besides Obama talking about debt ceiling and entire market plunging?�

1/1/2015

guest Overall markets tanked over fears of a potential us default in a couple weeks.�

1/1/2015

guest Markets tanking and solar in the green with no news stories out there (except for CSIQ), all this after a huge (epic?) run up in solar stocks over the past month.

Normally (read: two months ago) you would see solar stocks tanking 10% on a day like today. But not anymore.

I will let you all figure out what this means...�

1/1/2015

guest

I see that now. When i walked up to my computer at 11:50 and looked at the chart, it was a straight line downward, much steeper than anything else. In hindsight and looking at the charts right now it seems to make perfect sense. I stayed calm and things are looking good now.�

1/1/2015

guest Okey, long day. Been at a conference all day so my focus has been on TSLA all day long, obv dont know what the conference was bout eighter. Anyways, I took profits from SOL and HSOL and got some TSLA calls and stocks at 168.5$(bought back core pos abit to early at 180$.)

However, I hope alot of people got more CSIQ today, as me and sleepy did. But what really sux is that we didnt see this: Canadian Solar price target raised to $25 from $20 at Lazard Capital

Lazard Capital believes Canadian Solar's sale of two solar power plants should increase confidence in the company's 2014 earnings power. The firm raised its estimates and price target and reiterates a Buy rating on the name.

http://www.theflyonthewall.com/permalinks/entry.php/CSIQid1895595/CSIQ-Canadian-Solar-price-target-raised-to--from--at-Lazard-Capital

Their last upgrade to 20 was 2 weeks ago? I guess they are not talking about those power plants that we saw in the news today.

Why the stock stopped at 4% I dont have a clue. That must be daytraders holding it low while they mortage their house and cash out their childrens college fund. The upgrade also came while trading!. Im really annoying now that I didnt put more money in CSIQ, but I have alot stock and 35% of my options portofoli there. I really want to buy more tomorrow, but I really dont know what to sell, tho everything should be sold to buy this one atm.

Im not sure if I should sell SOL right now since they will benefit alot of the rising poly prices. I know some analyst have raised earnings target, so I should probably not have sold them.

Long day, little sleep. My buys for tomorrow are SOL and more CSIQ.�

1/1/2015

guest Norse, thanks for sharing. It was a tough indeed. As palmer_md pointed out earlier, some time around 11:30AM ET every solar stock in my portfolio took a nose dive. I believe it had to be the tension in DC around budgets, debt ceiling and the alike. Then at 2PM when things were about to get better, there was a report of shooting in DC near the US capitol building. That suspended one of the votes that was about to take place further delaying a plan to get things back on track in DC. I think that's why the market went down again in the later afternoon.

- - - Updated - - -

�

�

1/1/2015

guest yeah, and I think thats good for us, since we can get more cheap stock/calls. I am buying mostly JAN14 calls, and will buy more tomorrow.�

1/1/2015

guest Norse, sleepy, Dave T et al,

I used all of my remaining cash yesterday when tsla dropped to 174 and bought march 14' 250 calls. In hindsight, the better choice, of course, would have been to wait till today to buy tsla. The question I am currently wrestling with is to continue to hold these calls, or cut my losses and buy more solar (esp with the good news and upgrade on csiq). On one hand, buying tsla when I am feeling uneasy (ie buying in the face of fear) has often proven to be the right and profitable course of action, esp with earnings about 1 month away. On the other hand, I am beginning to see the enormous potential of solar that sleepy has been advocating for the past several months on this thread. The problem is, solar has been on fire over the last several weeks, and several of the charts look overextended, and thus, it would be more prudent to wait for a pullback, before adding to my positions in csiq, jaso, and spwr. Any thoughts or opinions would be greatly appreciated. Thanks!�

1/1/2015

guest I agree, I have been spreading alot over to solar. My options portofolio is 85-100% solar at all times. I have also recently dropped my TSLA portion down from 100%, to 80% and then 30-40% last week. I did however sell some solar to buy more TSLA today, Im not sure how smart that was.�

1/1/2015

guest I avoided a close call before last earnings report season on CSIQ with calls...was able to sell for some profit before what would've been a complete loss on them, unlike my SPWR calls which became a straight loss. Luckily it wasn't that much money relatively but I learned my lesson on doing short term solar options. So naturally I noticed that there are JAN16 LEAPS available on CSIQ and they seem very tempting. It's just too bad that DITM calls have such wide bid asks.... I'm thinking of grabbing a few of those and maybe some APR 14 calls to supplement my CSIQ stock.�

1/1/2015

guest Thanks to Norse and Sleepy, I bought APR 14 17 and 18 a week ago. They are doing great helping me offset my under-the-water TSLA calls. Hopefully those will be green too in a week or two.�

1/1/2015

guest I agree what APR 14 is the best one. I got some more JAN then APR calls, but thats cause I like to gamble. But we all noticed all the news that came out in the end of Q3, so Im hoping that will happen this time aswell. Im rather buying stock then buying JAN15 and JAN16.�

1/1/2015

guest Congrats! I feel the same way IRT TSLA with my solar stuff but all I have is stock that I bought at $14. I would be up like crazy if I had bought options instead...�

1/1/2015

guest It is hard to say. TSLA is on a pullback and solar has been on a tear. Buy TSLA and sell Solar sounds like a logical play, but solar is so undervalued that it is hard to say when the next pullback will happen. TSLA on the other hand is in a state of limbo and impossible to tell if it won't continue going down.

I would have invested less than 40% of my money on the first TSLA pullback to have some cash if it continues to go down to buy more. Chances are TSLA will recover from this fire very shortly and people will forget about it. There is a risk the markets tumble next week and TSLA goes even further down. I really don't know and that is why I am waiting till next week to get into TSLA.

I have loaded up on solar and I see this thing taking of to the sun any time. It might happen within a month or it might take a whole year, but solar is going up for sure. I am all in on solar right now and think that it has plenty of room to run.

- - - Updated - - -

Running out of time to respond to everyone, so I am trying my best. Very busy right now.

- - - Updated - - -

Solars have been going straight up so I wouldn't be surprised if they consolidate or even pull back for the next week or so. I don't know for sure, but I am going to wait to test my theory and raise capital to buy more next week.�

1/1/2015

guest Nice comebacks on all the stocks today.

Some technical guys are selling because alot of the solar stocks are at the top of the chart, but it might also break out.�

1/1/2015

guest One week of consolidation and then breakout.�

1/1/2015

guest Sold half of my CSIQ Oct Calls yesterday for a nice profit. Will probably sell the rest today. If we do consolidate next week I might get back into CSIQ.�

1/1/2015

guest "Finally, Lazard hiked its price target on CSIQ by $5 to $25 ahead of the bell. The shares, which closed at $18.56 yesterday, are pointed 3% higher in pre-market action, after Canadian Solar Inc. said it sold two solar power plants to a fund managed by BlackRock, Inc. (NYSE:BLK). What's more, CSIQ touched a three-year high of $18.69 during Wednesday's session, after the firm unloaded two power plants to TransCanada Corporation (USA) (NYSE:TRP). Despite the security's quest for new highs, short interest skyrocketed by 42.6% during the past two reporting periods. Furthermore, just one analyst even follows the stock, offering up a "strong buy." A short-squeeze situation or bullish analyst initiations could translate into a contrarian boon for CSIQ"�

1/1/2015

guest Sleepy,

thanks for your input as always.�

1/1/2015

guest Looks like the solar pullback is over. Lately the pullbacks have been lasting only 15 minutes, before bouncing back up.

I still see some uncertainty going into next week and that is why I expect a short 1-2 week consolidation period before taking off again once the "risk-on" trade resumes.

Remember that there is a lot of capital sitting on the sidelines, because people have been selling off in the past two weeks. Once the debt limit is raised I expect to see these markets in full rally mode again. Strong possibility that the idle capital goes right back into solar and maybe even TSLA once the dust settles.�

1/1/2015

guest Sleepy,

You have been advocating csiq and spwr in your recent posts. With these Chinese solar companies, they seem to move up/down in tandem. Is it worth diversifying by buying a bunch of them, or just stick to the ones which show the most promise? Given the recent run up over the last several days, which of the Chinese companies (jaso, jks, sol, yge, tsl)do you think are still attractive besides csiq? Thanks!�

1/1/2015

guest A rising tide lifts all ships in this industry. Go with the laggards, whoever has lagged the others the most in the recent past of 1-2 months.

Diversification is good. SPWR has the cheapest options so I would start there. But the Chinese will probably have the biggest returns as far as stock price is concerned; options are a different story.�

1/1/2015

guest Scty and spwr doing good today. Regarding the chinese I have sol, jaso, jks and obv csiq�

1/1/2015

guest I am heavy in Sol and CSIQ, sold my position in JKS to buy more CSIQ.�

1/1/2015

guest I am heavy in SPWR, SOL and CSIQ and I dable around in the rest. TSL has been my unexpected Rock Star. I bought a little TSL just because SCTY uses them quite a bit and the few options i own are up 300% since i bought them. Really wish i had more haha. (But i down own SCTY)�

1/1/2015

guest Not a good day for JASO.�

1/1/2015

guest I wouldnt look into it. Just a slow day for them is all. 1.5% is peanuts in Solar stock movements.�

1/1/2015

guest China and US cut back on wind power but boosts solar power

The slowdown in world�s two largest wind markets, China and the US, is opening the way for the rapidly growing PV market to overtake wind.

Module price index: pv-magazine

major manufacturers in China are under no pressure to sell. They are increasingly selling their products, often at higher prices, to clients outside Europe, some even achieving record quarterly sales figures.

Bond strategy: Sell Treasurys, buy … solar, like Buffett?�

1/1/2015

guest sleepy, you have any beat on TSL? This $16 price is showing major resistance.

i am not a chartist but a quick look at it looks like its consolidating to make a run at $20. i say that purely because of the $15-16 support i see in the fall it took back in mid 2011. The stock's history shows alot of sticking points and support points around each $5 increment. So it could have a break out to $20 brewing.�

1/1/2015

guest What is the best site to follow the market? I see different sites shows different volume and market caps. And look at JASO, Google says they have market cap of 86m, while yahoo says 405m.

Thanks for the links Borat99, I would also like to into solar the way Buffet does. Maybe we could get together and buy one after some profit in 2014? �

�

1/1/2015

guest These stocks just need to take a breather for the next week or so. They have been running very hot and consolidation would be nice. The stock more than doubled in a little over a month, so it needs to slow down.�

1/1/2015

guest Sharing links from SolarPVInvestor

Insight Into The Progress Of The Fossil Fuel Transition

PV Sales Rise to Record Heights of 9 Gigawatts in Third Quarter

http://www.cleanenergyauthority.com/solar-energy-news/pv-sales-9-gigawatts-q3-2013-100313�

1/1/2015

guest Well, all I can say about this forum is WOW. The information, opinion and discussion is fantastic. I sold two laggard stocks yesterday and purchased a large (for me) position in csiq. I have about 3/4 of my holdings in Tesla, with SCTY, KNDI and couple other minor positions filling out the rest. This past 24 months has been a crash course in investing (all of my money is in an IRA) and discussions at work about investing help distract from the day to day "grind" of life at a new car dealership. The end game for me is to build up enough cash to supplement retirement and of course purchase a Tesla. I feel the information here will allow me to reach my goals.

Thank you to everyone for this forum.

Mark�

1/1/2015

guest Yahoo! Finance is usually more reliable than Google Finance. TD Ameritrade also says JASO's market cap is 463.7M, which confirms my perception of Y! Finance.

Also, Norse, you may have already seen this from the other forum, but for other folks here...

Sun �Must Supply 10 Percent of Energy by 2025?

LONDON � Hard on the heels of the latest UN report on climate change, two UK scientists have proposed an ambitious plan to tackle the problem it graphically describes.

Their solution? A massive and urgent international program to increase the world�s production of solar energy � to 10 percent of total global energy supply by 2025, and to 25 percent by 2030.�

1/1/2015

guest I wrote a follow-up article on CSIQ and talked a little about its valuation and why I think it might be headed much higher:

http://investnaire.com/?q=groups/solar-energy-related-investment-csiq/csiq-will-double-again-lot-sooner-you-expect�

1/1/2015

guest Sleepy,

Do you have another link for your follow up article on csiq? I have clicked on it several times, but always get a "too many redirects" error. Also, if csiq is going to double, perhaps the best way to play is via call spreads, since IV is so high. One can consider the jan '15 20/35 for a little over $3, for potential of $12 (a 4 bagger) should csiq finish above 35 in jan 2015. What do you think?�

1/1/2015

guest Same issue here. Page won't load.

Call spreads seem like a good idea. But can't you also do a risk free delayed construct spread since premiums seem to be going up pretty fast? I really like this strategy and it works pretty well with TSLA.�

1/1/2015

guest Why not just post it here as a blog post?�

1/1/2015

guest "Hazardous levels of pollution

descended on the Chinese capital during its biggest sporting weekend of the year

so far, affecting competitors and spectators alike at an LPGA golf event and the

China Open tennis championship, which boasted such big names as Novak Djokovic,

Rafael Nadal and Serena Williams." http://edition.cnn.com/2013/10/07/world/asia/beijing-pollution-golf-tennis/index.html?hpt=isp_c2

Just now in Beijing. Global climate change doesnt matter, China goes solar cause they have big issues with local pollution.�

1/1/2015

guest I fixed the link and it should be working now. Let me know what you think:

http://www.investnaire.com/?q=groups/solar-energy-related-investment-csiq/csiq-will-double-again-lot-sooner-you-expect-0

Delayed construct is my favorite play, but as you said premiums are high now so it is better to do an intact spread instead of delayed construct (unless of course the premiums go even higher, but they are already high). CSIQ has nearly doubled in just six weeks and if we see a period of consolidation or a 20% correction, then you might see some serious volatility crush that will make your delayed construct that much harder to construct.

If you have to buy options now, then intact BCS is safer today. If you want to do delayed construct then wait a little for a period of consolidation and/or a 10%+ pullback.

I will look into it. For now, I would like to have complete control over what goes into my articles and be able to track how many people are actually reading my posts (and have the ability to advertise if necessary). These blog posts are very time consuming, and quite frankly I don't have the time to write as much as I would like. If I see that not many people are interested then I will stop posting these articles.

Update: edited the link, so it should work on mobile now.�

1/1/2015

guest You bet that the politicians are embarrassed as heck after this fiasco.

The only thing holding solar back in China right now is the transmission line infrustructure that is not able to support it. Once they get their act together I think that China will be installing 100s of GW's per year and will lead the world in moving to a solar economy.

Solar technology is still really cheap compared to the price of pollution. The stock prices are really cheap too.

BTW, I was expecting the solar stocks to get crushed today, but most of them are in the green now (except for CSIQ of course). It seems to me like these stocks are actually becoming "investible" (whatever that is supposed to mean, but I here it on TV a lot). The days of huge volatility (that we have seen just two months ago) seem to be over.

That said, I still fear that if the government shutdown continues dragging on, we may still see 10% down days for solar. Then again I was expecting the same today...�

1/1/2015

guest Yeah they should be embarrassed, and along with beeing self-supplied its a given that China will go allin on Solar in the future.

Very good article sleepy, will you wait a week until I have got all my options in and publish it on SA?

Canadian Solar Launches Financing Program Targeting Fast Growing U.S. Residential Solar Market

http://phx.corporate-ir.net/phoenix.zhtml?c=196781&p=irol-newsArticle&ID=1861892&highlight=

Might not be good news for SCTY tho.

I dont have to much money in SPWR atm, you have PT in mind there?�

1/1/2015

guest Thanks for the article sleepy! as always very good!�

1/1/2015

guest Canadian Solar is entering the US residential market:

http://www.bloomberg.com/news/2013-10-07/canadian-solar-offers-financing-for-residential-projects.html?cmpid=yhoo

Instead of leasing the system to residential owners, CSIQ will help provide financing (through banks) to purchase the entire system. Slightly different model than SCTY. SPWR has both options to lease and to purchase outright, but it sounds to me like they are more focused on expanding the lease option.�

1/1/2015

guest Yeah, isnt this REALLY good news?

Now possible to buy MAR14 36$ options. Dont think that was possible earlier.�

1/1/2015

guest I just want to add some thanks to sleepyhead; I invested in SPWR on the dip after last earnings because of all the information in this thread. I'm very pleased to be making a nice profit at the moment. I've been investing a little in Tesla since long before I discovered TMC, but I hadn't thought about solar stocks until I saw this thread!�

1/1/2015

guest Thanks. I am glad that somebody listened and bought some SPWR when it dipped all the way down to $20. You have to get greedy when others are fearful and that was the perfect time to buy SPWR.

- - - Updated - - -

CSIQ needs to take a breather. It was the hottest solar stock last week, so a nice little break will be good. A short consolidation period would be nice before the next run up.�

1/1/2015

guest CSUN taking off again.�

1/1/2015

guest I have noticed that too. I still hold a little bit of CSUN and it has given me a nice return. It sounds like a potential buyout target and I will hold on for a while. The risk is that the buyout wipes out all of the shareholders, because CSUN has relatively high debt and may not be able to refinance in time. Bigger players might wait till CSUN gets closer to a coupon payment it can't make and then buy their capacity for cheap, leaving the shareholders holding the bag.

I don't think that will happen, but it is a real risk since the company has a lot of debt due in the next 12 months or so.�

1/1/2015

guest argggg... I wasn't able to sell my CSUN MAR 13 calls this morning for profit since I had to do stuff at the airport. Now it's in the red again. I just don't have luck with timing.

What simulates the options price? Liquidity?�

1/1/2015

guest Good u didnt, much better price now �

�

1/1/2015

guest I sold half a good price when it hit 5.97. Not sure why the other half didn't get sold. Somebody must have undercut my ask. I just want to get rid of it because it's too risky for my stomach. Want to take the money and put more in CSIQ in the next few weeks or so.�

1/1/2015

guest What is the deal with SCTY? I have some options Nov @33, and just let it run without looking at it. Seems to be doing well last week.

What can I expect? No time to research.

- - - Updated - - -

BTW, has anyone looked into lithium mining company on the premise of huge lithium ion battery production ramp up create the need for lithium? It is tempting...�

1/1/2015

guest How many others have got CSIQ as their biggest share in the portofolio? Also look at this, and note the date.

http://www.streetinsider.com/Analyst+Comments/Canadian+Solar+%28CSIQ%29+Seen+a+First+Profitable+China-Based+Solar+Company+-+Nomura/8489305.html

I wonder what theyre next PT will be. CSIQ traded at 11$ when they had a 25$ target, 2 months and 27 days ago. Lets hope they do this again on thursday �

�

1/1/2015

guest I do at least in my 401k.

I have a 12 month $70 price target on CSIQ.�

1/1/2015

guest [FONT=Arial, Helvetica, sans-serif]Mine CSIQ position is only 2nd to TSLA. I also believe in the below statement based on the information you and sleepy has shared here. Looking to buy calls now.

[/FONT]�

1/1/2015

guest Hopefully today marks the start of a nice little CSIQ dip. You all have me sold on their stock so I'm just waiting for a nice entry point.�

1/1/2015

guest I hope so, but for people to get in with is we need the market to see what we see. If more analyst starts following solar then it will hopefully happen. But I also hope that you start sending your blogs or megaposts to Seeking Alpha. You will probably make some money on it aswell, by getting paid and obv boost your own stock.�

1/1/2015

guest Be careful, because that statement was wrong and JKS was actually the first company to turn profitable in FY13.

I am waiting a little to buy some calls since they are very expensive right now. Hoping for a short consolidation period/slight pullback before buying more calls.�

1/1/2015

guest Appreciate the advise, sleepy! Do you think what's happening today with CSIQ could be the start of a consolidation or is it just mirroring the market?�

1/1/2015

guest It's just mirroring the market. You might want to buy some calls now and more in a few days, when the debt limit dust settles.�

1/1/2015

guest Also my IRA: TSLA still the highest dollar amount with CSIQ a relatively close second. I may try my first option trade with a CSIQ call once our fiscal issues are at least temporarily resolved.�

1/1/2015

guest I was asking myself the same question. Didnt found anything fully exposed to lithium mining, but found this nice ETF from GlobalX called LIT. Its basically invested in all major lithium related companies. Doing great so far, steady climb since I got in at 11.42 (now between 13.20 and 13.50). Not really as interesting as playing options on TSLa/KNDI (thx kevin for that one!) but might be a good longterm, low volatility play.�

1/1/2015

guest Sleepy and others, What calls are you buying on CSIQ?

I started my position about a month ago with common shares and more recently bought some Nov 25 strikes for 0.60 each.

However, given the quick run-up in price we've had lately along with current market uncertainty (debt ceiling) I'm starting to think I should have bought longer term calls (maybe Jan15s).

Feedback appreciated.�

1/1/2015

guest If I remember right Sleepy has recommended only stock on solars, or LEAPS if you really want to do options. April calls are the "risky" ones. Anything sooner is gambling IMHO.�

1/1/2015

guest Pretty much this. If you want to make money then buy shares. If you want to gamble then buy options.

I was recommending CSIQ 3 months ago at $12 and $14 and then it went up to $16 briefly before Q2. After Q2 it tanked down to like $10.66. Everyone who bought options was upset at me, and even those who bought stock ended up selling at a loss (it is above $19 today). Me on the other hand, I was buying like crazy on that dip. If you want to invest in solar, you really have to commit to it and be ready to buy more on dips and not sell at a loss.

Therefore, if your intention is to buy CSIQ to "play" the earnings report then DON'T DO IT. This is a long term investment opportunity and it may take a while to develop with a lot of ups and downs in between. Be prepared to buy and hold if you want to get in.

That said, I do options but I have a completely different risk profile than 99.9999% of investors. I have several exit strategies and for the most part I am able to monitor my holdings all the time while the market is open. I have also spent about 20+ hours a week (a lot more lately) researching the solar industry over the past two years. I know what to expect and what a news story means for the industry. I know how to react to earnings and what to look for. Quite frankly, I will have a leg up on all of you guys if things don't go well and I might be able to get out with minimal losses, while some of you guys will lose all of your money.

If you really want to do options then go with LEAPS and make sure you hold them all the way to expiry. It really doesn't matter what strike price you buy, I can make a case for any strike but ATM is always the safest bet.

- - - Updated - - -

If you have to ask what expiration month to buy or what strike price to buy, then you probably shouldn't be buying options in solar. If you want to do options in solar then you should be doing a ton of due diligence and not trust the word of some random guy on the internet that uses sleepyhead as his handle.�

1/1/2015

guest I held all my CSIQ after that earnings fall but sadly did not buy any extra on the dip. up really well right now. The question is weather to hold my old CSIQ Jan14 $20s through earning or dump them before. I also have LEAPS in CSIQ

Sleepy i wasnt mad about CSIQ, i was mad about SPWR �

�

1/1/2015

guest SPWR did recover nicely. Sleepy no one should be upset with you. Silly IMo - your research advice and opinion are greatly appreciated �

�

1/1/2015

guest Exact same story goes with SPWR. I was buying up options when it was below $21 and kept buying more on the way up to create many risk free bull call spreads. I even wrote a few long posts about buying SPWR post Q2 at any price below $24, because that was an absolute floor price based on fundamentals.�

1/1/2015

guest I had a few short term calls for SPWR into earnings that i lost on as well as a Jan14. Jan 14 is slowly making a comeback. I bought more LEAPS in the dip and those has now covered the two Short term calls i lost out on in Q2. So Q3 going well would put me back in the money again on SPWR. If not then i will lose the Jan14 calls as well but still have my LEAPS and probably buy more to try and once again cover my loss on on the JAN14 Calls. But i hope it doesnt come to that and i can break even and get out of my JAN14s and ride my LEAPS for profit. So all in all i am looking really strong if SPWR delivers in Q3. Then my only laggards will be Intel and AMD which i will be dumping before earnings. They are both killing me. Old Tech is definitely not the place to be anymore.�

Không có nhận xét nào:

Đăng nhận xét