1/1/2015

guest This is what I meant by valuation does not matter. The assumptions being made change the valuation drastically. Therefore the bigger question is whose assumptions are correct.�

1/1/2015

guest Yeah, and using DCF with a high discount rate while at the same time use conservative numbers for growth will almost always come to the conclusion that a growth stock is overvalued.�

1/1/2015

guest Funny, my expectation has always been 150k for the S+X combined (probably 75k+75k) and 350k (maybe "only" 300k)One unknown here is if we still are talking about just S+X+3, or if they have lunched the Y (probably) and/or the Roadster NG by 2020...

�

1/1/2015

guest Yeah, time will tell. I think Y is likely to be launched but maybe be at the same stage as the X is now. Roadster, I hope not if the Y is not ramped up as that seems the wrong way to use limited resources at that point. I think it should follow after Y.

If Model S sales grow 15% a year we are at 100k at the end of 2020 for S. X should have roughly the same type of demand if it follows the other premium car brands.�

1/1/2015

guest Mostly agree, except I think Model Y will be one year ahead of where Model X is now (at the end of 2020). With Model 3 production start in 2017 it is likely that Model Y will have a production start in 2019, and then be where Model X is now in the start of 2020. But as I said, it is an unknown by now.

At the current price/options I think it will be "roof" on the demand and/or production line for the Gen-II cars and/or battery cell production (available to the Gen-II line) at about 150k-200k if they do not build more giga/car factories. But that is unlikely in 2020 (but new giga/car factories will by then be under construction I guess). If the demand is the limit they may add some more options like more premium seats/interior, bigger batteries, quad motors etc on the Gen-II.�

1/1/2015

guest I'd like to see them develop the design and production of Model 3 and Model Y in parallel. Can't design sequentially forever (well you can but it will limit growth.) If they unveiled a Model 3 and Model Y together in two months, Katie bar the door. Can you imagine a 'just one more thing moment' where they reveal the 3, everyone's stoked, and then they roll a Y onstage? Blast off. They could go do a multi-billion $ capital raise after that for car factory 2 and GF2.

It's also practical - the two need to share more parts than S and X - they started with a soft goal of 60% commonality and ended around 30%. That's not going to cut it for the mass-produced 3 and Y - they need to be pushing economy of scale from the start.�

1/1/2015

guest By 2020 Faraday future might be out of business and their factory in Las Vegas might be up for grabs.�

1/1/2015

guest I had the exact same thought :smile: I doubt it will happen, not even sure if it should, but it would be an awesome moment. We do have good reason to believe that the 3 and Y are both being worked on currently.�

1/1/2015

guest I can see why your valuation is low and it is understandable for your position. However it is interesting to hear that you don't put a multiple on Tesla, but do on Amazon. I'd be much more inclined to see multiples with Tesla in the same regard as Amazon. I'm hoping Tesla has a much better stance on future profit margin due to Gigafactory model and Tesla Energy. But since both of these are not operational at the moment it might not be as apparent to investors.

We'll see how your hunch plays out and this 'resellers' theory. Hope you'll hang out and continue discussions.

I'm a bit more bullish in that I would contend that TM has the ability to keep their profit margin much higher than the competition, even in in significantly higher production flow. Maybe they are perfecting this now with Model X? I hope so. Will be interesting to hear the answer to the question "How much does Model 3 have in common with Model X in terms of production preparedness, supplier onboarding and flow as well as customized in-house part design?" if the question is asked of course.�

1/1/2015

guest Model 3:

If the demand is there for 200k S and X in total then batteries won't be a problem. Or it should not be. Panasonic is a huge company and can add incremental capacity of 15% a year to their cell production. As far as I understand it they were not willing to commit to 500 000 a year at the low price needed for Model 3 being a mass market vehicle. So I think it was more of a risk vs reward thing for them. Also Tesla can buy from another manufacturer if needed. IIRC they are going to do that for the Roadster batteries?

I do think there is a not so small risk that Tesla will not add production capacity for S+X and still output less than demand. For example they might prioritize Model 3 because of their mission. But I don't think batteries will be the main reason for lack of capacity improvements for S+X, but it could be the case.

Discoducky:

He is using DCF and in his case I assumes it means the model stretches to infinity. So there is no growth multiple. Otherwise if he is only calculating to say 2020 and still has no multiple then he is making a serious error.�

1/1/2015

guest Thanks Discoducky. I do enjoy these discussions and hope people understand that my decision to be short the stock is just a financial one. A healthy market has longs and shorts. I don't want to hear opinions just from those who agree with me. My short thesis is primarily based on my belief that it is far more likely than not that Tesla experiences delays getting to 500K (or even 300K) by 2020. Most bubble stocks eventually fall short of hyper expectations and settle back to a far more rational price. If/when this happens to Tesla, I hope it remains a viable car company because they have certainly accelerated the move toward EV. The world needs more options: ICE, EV, PHEV, Hydrogen, Mr. Fusion, whatever. Consumers need choices. And we need to reduce our pollution.

For similar reasons, I am pro-solar, just not Solarcity due to the leasing model. I own my large solar array outright. Solarcity is in a very thin margin business in which their return on investment is arguably not even equal to their cost of capital. Hence the massive accounting losses. If a company has to invent new accounting to justify itself, it usually (not always) indicates a big problem.�

1/1/2015

guest AFAIR there was an interview where this question was asked, and the answer was that ultimately about 100K each (S and X) world wide once they enter all markets and the adoption curve flattens out. There's a big delay between entering a market and people actually considering buying a Tesla (see China). If we're talking 5 years out it's hard to tell, could be that Model 3 will actually help with the speed of adoption curve. Folks in the luxury segment tend to be more conservative, but if there are Model 3's rolling around everywhere that changes perspective.

As for valuation, there are other forward-looking aspects as well. If they'll figure out how to drastically shorten time to market (tooling etc.) for new models, which they stated they're looking into, that'd separate them from the crowd pretty cleanly. They're currently leading in bringing self-driving to market, and this lead can widen since they're in a perfect position to iterate on the solution. A million mile drivetrain? Look at competition, batteries deteriorating left and right when even earlier Teslas are still going good. If we're looking at it from the skeptical perspective, we should be skeptical about competition's ability to deliver as well, so far they've proven quite inept. Who else is going to deliver 1M mile drivetrain? Imagine the publicity of the first Model S that worked as a limo for example hitting that and people waking up to the fact that this is here, now, for real.

As far as share price and valuation, I think being a short one has to consider the irrational exuberance of the longs as well. How long can it last? As long as Musk is around, it isn't likely to go away. Can you put a value on that?�

1/1/2015

guest Yeah, I have also heard the 200k S+X mature demand prediction. Can't recall from were.

I agree with you that it is more likely to be further improvements with Tesla with respect to competition than competition catching up the coming five years. After 2020 I think things will be different as the ICE manufacturers will realize they have to be really serious about EV if they want to stay around. The valuation is low currently if things continue the same way as it has.�

1/1/2015

guest Yes, I've thought the same things myselfAnd I really really hope they do, but trying to be realistic I can't believe they can... So I hope that they will manage to deliver the Model Y one year after the Model 3, and they really should. But they have yet to deliver a new model only one year after previous, so the most realistic scenario is Model 3 in 2017 and Model Y in 2019 (and that why that scenario was what I was talking about here...). But I hope they manage to deliver it earlier... If it's later I will be a bit worried. And if they do, we might see the RoadsterNG (or some other Tesla model) before the end of 2020.

- - - Updated - - -

You may very well be right here, I was just expressing my gut feeling based on a possible combination things that may hold back the expansion of Model S/X production/delivery. Nothing would be better then if I'm wrong and they do reach 100k+100k or higher �

�

1/1/2015

guest Looks to me reservation numbers on Model 3 are a substantial potential for an upside. It doesn't look probable that they'll demonstrably come up short unless there's some overwhelming macro event. But if reservations show very strong demand it'll be easy to make a case for raising capital and doing things like introducing an SUV equivalent right away, building a car factory and a battery factory in Europe and Asia etc. With how much money there is out there now chasing returns there will be no problem getting that funded.�

1/1/2015

guest Tesla has had a number of major schedule failures and the stock has remained strong. Both the S and X were late to market and the S had an even slower ramp to full production that it appears the X is having. I do agree that they probably won't hit 500K by 2020, but I think they will be in fairly good financial shape then.

I haven't looked much at SolarCity, but they aren't really doing anything cutting edge on the technology. They are in a crowded market of solar system sellers and leasers and there is bound to be some fallout in the near future. The end of this year is likely going to be grim for the solar industry as the federal tax credit in the US expires. The weaker players in that market are going to go out of business.�

1/1/2015

guest This thread is not about SolarCity or solar. There is one for that. The tax credit was extended recently for I think another five years.

�

1/1/2015

guest SC is opening their own Gigafactory in Buffalo to manufacture a new high efficiency solar panel.

It will not be highest efficiency panel but cheaper than direct competitors.

It is a dark factory because it will be all automated requiring no light for human eyes.

Humans will be involved in shipping. Receiving parts and shipping out finished panels.�

1/1/2015

guest Tesla guided all year for the sales ramp up based on planned production ramp up. I am sure they sold some discounted inventory cars as well, but that was also part of the plan.

The increase, if any, from Q4 to Q1 will be minimal, but again that is typical.

On another topic you raised, I am surprised you give no value to Tesla Energy. Musk claimed a minimum of 30% reduction in cost. That's where their margin will come from.

I am not sure how familiar you are with Tesla's history, but they have come through on every major announcement they've made. Have they come through on time? Almost never, but they still came through soon enough.

All that being said, they clearly have a lot of future growth baked in to their valuation. I have been waiting since my first purchase in March of 2014 for a big drop in the price so I could lower my cost basis. Has not happened yet to the degree the bears predicted, but maybe now is the time.�

1/1/2015

guest I agree, but I think the reason is pushing Model S sales Q4 2015 to cover lack of Model X deliveries. One reason for the Model 3 reveal could be for Tesla to be taking pre orders during bad Q1 news.

No reason Tesla can't have a great 2016 overall, however.�

1/1/2015

guest Rob:

You have a pattern of posting statements wherein it is impossible to distinguish what are facts and able to be confirmed through outside references, and what are suppositions of your own. The above #3418 is one such post.

* Are you making that "dark" statement as a known fact, with references, or is it your own surmise?

Thanks for any answer, and for considering how you create posts.�

1/1/2015

guest If the factory has no lights, I can see why they are placing it where they are. Kodak's main factory was in Rochester and they probably still make some film there, but they employed blind people to make the film. With Kodak having to downsize, I would expect the area has a pool of skilled blind factory workers who are unemployed. Even if the production line is mostly automated, they will need some workers to be on the line to deal with any issues that come up.

I'm glad to hear that Solar City is innovating and the tax break has been extended. I was sure it would die with this Congress. I might be able to get solar on this house before the incentive runs out after all. This time of year we'd get almost nothing, but in the summer we get blasted by the sun with a large SW exposure.�

1/1/2015

guest Interesting conversation.

To be clear, Tesla has the most experience in manufacturing batteries. However, they have never manufactured cells. Not to be confused with their highly sophisticated understanding of the current state of the art in cell manufacturing.

I don't rate the current scale of cell manufacturers as particularly impressive. We are looking at a two order of magnitude+ increase in production going forward. Certainly, their must be vast economies still available.

I don't rate the current scale of solar panel manufacturers as particularly impressive either.�

1/1/2015

guest I was wondering if you have a way of valuing the SuperCharger network that Tesla has developed and is developing. Does it have a value? I know right now it is probably a liability, but in the future the company would theoretically monetize the network; rent it out to non-Tesla vehicles, start charging for Model 3, etc... Does that affect your valuation of the stock as well? And if it does, how?�

1/1/2015

guest Goodluck being short TSLA, you could have been short anything in this market and make a killing, especially oil companies.�

1/1/2015

guest Question. Why have there been no in-depth reviews of Model X by independent expert car magazines such as Road & Track, Car & Driver, Motor Trend, Edmunds, Consumer Reports, etc.? Just seems weird. Not sure whether this is a positive or negative?�

1/1/2015

guest They're waiting for their Model X to be delivered.

�

1/1/2015

guest Tesla has many months of X production ahead of them to work through the order backlog. No need to provide cars to reviewers when order wait times are so long. No need to stimulate demand yet. Based on how great the S is, the X sells itself.�

1/1/2015

guest Not even a little.�

1/1/2015

guest Plus the X may not quite be ready for prime time. Ramp is not rapid, seems like a decent amount of delivery fixes needed, lots of owners waiting. Would be better to wait a few more weeks until these issues are sorted and do not become part of any review.�

1/1/2015

guest Thank you for stating the obvious truth, 30seconds.�

1/1/2015

guest

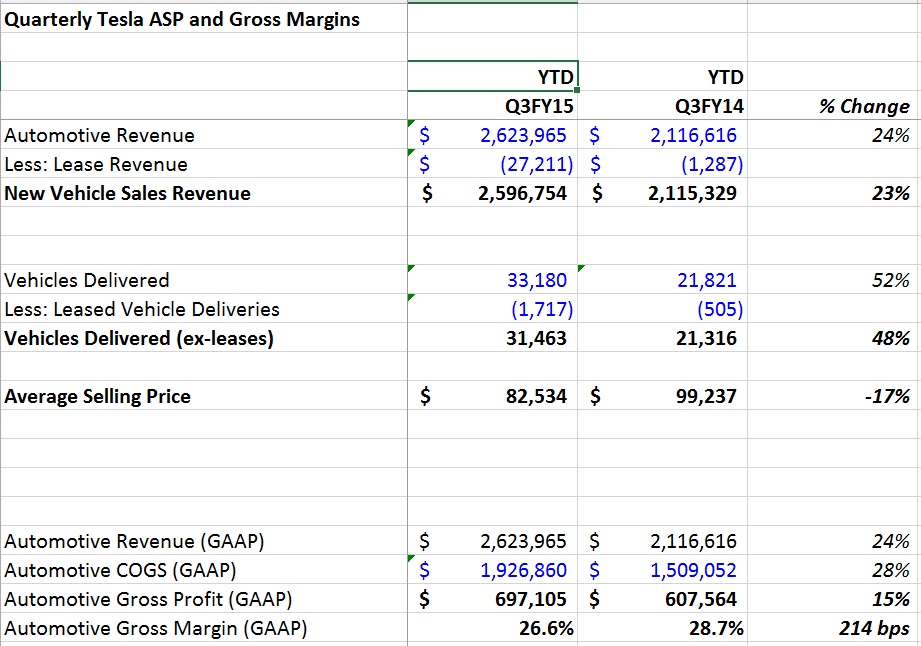

Perhaps I should have posted this here since it deals indirectly with valuation.

Interesting analysis I looked at. Note the 17% decline in Model S average selling price (ASP) in the first 9 months of 2015 compared to the same 9 months of 2014. And the corresponding drop in overall gross profit. This excludes leases which are an increasing percentage of revenue -- but that is a separate issue and not particularly bullish for Tesla.

Whether you are short or long, it will be fascinating interesting to see the ASP in Q4 FY15. Remember that the Model X had minimal deliveries (sales) in Q4 and thus will have almost no impact on revenue. So Q4 revenue will really be all about Model S pricing. If the company did it by discounting, it will be immediately obvious by simply doing the same math I have done above. Or if the company just did an amazing job selling more vehicles, then that will be apparent as well.�

1/1/2015

guest Standard procedure for Tesla -- they did the same thing for the Model S. Magazine review cars are essentially advertisements, and Tesla has tons of waiting customers so not much need to spend money to advertise. I get the sense Tesla doesn't have a team of people that handle getting cars to magazines to promote like the established automakers, they simply haven't spent the effort to do that type of stuff.

ASP decline is mostly due to the introduction of the 70. The 60 wasn't very popular and was around 10% of sales if I remember correctly. 70 is a much better vehicle, and customers are embracing it, with sales composing around 30% of Model S last I heard. Naturally ASP goes down when you switch to a mix that includes more, cheaper vehicles. Tesla was clear this would happen in their conference calls and letters.�

1/1/2015

guest Thanks trilson for your responses. I think you're correct on the reason for the mix shift. But it does not change the reality that for the first 9 months of 2015, gross profit grew a paltry 15%. Now admittedly, Q4 was a big quarter for deliveries. But it will be interesting to see the pricing when they release Q4 financial data.�

1/1/2015

guest So what are your revenue and gross margin forecasts for the company for FY 2016, 2017, 2018, 2019 and 2020?�

1/1/2015

guest I assume 2020 revenue hits $20.2 billion and gross margin of 19.8%. I assume in 2020 they sell:

75K Model S @ASP of $88K and gross margin of 25%

74K Model X @ASP of $88K and gross margin of 25%

150K Model 3 @ASP of $47K and gross margin of 10%

Most importantly I assume overall profit margin of 5.0% (after R&D, sales, admin, other overhead). Remember that is what F and GM can achieve with their economies of scale. I doubt Tesla has more economies of scale. But if you think Tesla can achieve 10% or 15% overall profit margins, that makes a huge difference in the valuation. I just think it is far more likely they struggle to ever get to breakeven.

Remember Tesla only sold 50K vehicles in 2015 and perhaps 75K in 2016. A lot of work just to get to the 300K I assume in 2020. Nevermind the Herculean task to get to overall profitability.�

1/1/2015

guest ...and their $150 billion in pension obligations--the elephant in the room. One of the many reasons valuing Tesla by analogy to the non-luxury American incumbents falls apart. You could just as easily model BMW's operating margin of 10%.

Now add dealer overhead to that vs. Tesla direct sales. Now consider that Tesla will be the most vertically integrated automaker once Gigafactory is online while Ford and GM continue to outsource drivetrain development and you can see why there is no inherent economy of scale advantage.

Your projection of 35% annual sales growth is also firmly on the pessimistic side but that's utlimately a matter of faith.

It is better to reason from first principles and model Tesla's cost structure at scale, rather than argue by analogy and say that their margins must ultimately be X% based on the margins of companies with completely different business models.�

1/1/2015

guest dha you make reasonable arguments. I don't disagree on the pension obligations. I just think it's going to be really tough to get from where they are today (major losses) to even come close to 10% overall profit margins. Yes Tesla will capture the "dealer margin" due to its direct sales model. But to date Tesla's sales spend is extremely inefficient measured by sales expense per vehicle sold (or leased). Now you could correctly counterargue that Tesla's sales will scale to support a massively higher sales volume. Yes and no. I have a feeling that sales costs will explode as revenue increases, and the jury is out as to how much their sales/R&D/admin overhead will need to increase. Again this is the crux of the question. Will this company ultimately produce 10% operating margins or 0% or 5%. Implications are huge for valuation.�

1/1/2015

guest Fair enough, but I think you may underestimate the extent to which current costs reflect development and anticipation of the 75% of the company's products that are not yet shipping in real volume.�

1/1/2015

guest

Even if you think Tesla will only grow 35% per year between now and 2020, how do you think the market will value Tesla as a 'still disruptive' automaker (not even counting Tesla Energy or potential self driving Uber-like service offering) growing production/revenues at or near 35% per year still for years 2021-2025+ while the other car companies all struggle to grow 5-10% per year?�

1/1/2015

guest It's not obvious and it may not be accurate. Why would Tesla provide a vehicle for review when actual customers have literally been waiting years for their cars? Any vehicle provided for review means another customer is delayed. What's the purpose of providing vehicles for review? To increase demand. Tesla has more demand than they can handle. So what is obvious is there are no good reasons and only bad reasons to provide a vehicle for review. Those of us following Tesla for a while know this and saw the same with the S release. We've also seen every bear attempt at negative spin, so please don't think you're going to fool any of us by doing the same. If you're going to be contrarian you'll have to try harder.

- - - Updated - - -

Why would you assume the higher priced Model X would have the same ASP and gross margin as the lower priced S?�

1/1/2015

guest Every once in a while, I like to take a little stab at fact checking. If something I read checks out, there's no reason to report it, but when it seems not to, I tend to post.

I thought the $150bn of pension fund obligations seemed a little high, even for a legacy like GM. I couldn't come up with any citations mentioning pension exposure of that size; here is the most recent article I found, which lays out $66bn in pension assets and $77bn in liabilities, for an unfunded obligation of $10.9bn. Certainly an uncomfortably large amount, but nothing like the $150bn.

Link here:

GM pension plan funding down in 2014 | Business Insurance�

1/1/2015

guest I went back and dusted off my old Tesla spreadsheet and got a 2016 valuation of $350. I used a discount rate of 8% from 2020, and valuation multiplier of 30x earnings. I assumed the following sales of each model in 2020:

50k Model S @ASP of 88k, gross margin of 25%, net profit 9% (Model 3 will cannibalize S and X sales)

50k Model X @ASP of 95k, gross margin of 25%, net profit 9%

300k Model 3 @ASP of 44k, gross margin of 15%, net profit 5%. (assumed sales expenses will be much lower per car than S/X)

Included in my valuation was $30 for Tesla Energy. I would have given that a higher value but they have to build another Giga Factory to do it which will require more dilution. I also assumed continued rapid growth and spending on R&D beyond 2020.

Not sure why we each came up with vastly different valuations. I'm long TSLA so naturally I appreciate your contributions in this thread.�

1/1/2015

guest I can see it taking some S sales, (not sure if it will be a significant amount), but I don't see the 3 taking any X sales. They would seem to be completely different market segments.�

1/1/2015

guest You're probably right. That only adds to the valuation. I think demand will be very strong for all their cars. I have no doubt about that. The 64 dollar question for me is how much dilution will be necessary. I've seen models that project Tesla's rapid expansion can be financed almost entirely with current profits for another 3 - 4 years. But they're manufacturing cars which requires a lot of R&D and capex to expand.�

1/1/2015

guest Am I the only one feeling the assumption of GM at 25% for S and X, 10-15% for 3 are too low? You guys do remember the CXOs will get a big bonus for having GM over 30% for a 12 trailing months period right? I think 30% GM is doable if they came with this bonus in the first place. Other bonus milestones include production of Model X, production of Model 3, and total production of 200k vehicles (or some other number, can't remember).

Edit:

I looked up the precise wording of these milestones set in 2014 and they are:

1. Completion of the first Model X Production Vehicle (marked as achieved in their last quarterly filing).

2. Aggregate vehicle production of 100k vehicles in a trailing 12-month period.

3. Completion of the first Gen III Production vehicle.

4. Achieve annualized gross margin of greater than 30.0% in any three years.�

1/1/2015

guest After seeing the above calculation, I went and looked at Q3 report trying to validate the calculation. I got a different conclusion regarding ASP. Here is the paragraph in Q3 report: �Automotive revenue was $1.16 billion on a non-GAAP basis, and comprises GAAP Automotive revenue of $853 million plus a net increase of $307 million in deferred revenue as a result of lease accounting.� The $307 M deferred revenue can be roughly estimated as the full price of the leased cars to be collected in the future. Assuming the full price to be roughly $100K, it implied 3070 leased cars for the Q. Assuming similar numbers of leased cars for Q1 and Q2, you end up with around 9k leased cars. This implies ASP ~= $2596M/2400 = $108k. I am long TSLA and I would be worried if indeed ASP dropped to 82K so if someone can validate the math here I would appreciate it.�

1/1/2015

guest valuationmatters:

If Tesla grows 30% a year up to and including 2020 then the market will not value them based on the bottom line. It would be valued from growth rate, gross margin and an estimate what profit they could make if they optimized for that. Compare with Amazon.

I don't expect them to post a significant profit for a long time. So your models are not worth much if anything unless you state your assumptions about other metrics like P/S, FCF, gross margin etc.

IMO, you are approaching this with the wrong tools.

Tesla Energy is not worth 0. For example, a 10% probability of it becoming a $200B business is worth $20B.

Similar with 20% probability for $100B.

You have to pick your numbers and motivate them. Right now you are at 0% for TE which is clearly wrong.�

1/1/2015

guest I think it is worth to mention here that the first Model S to be tested in the different magazines was Elons personal car, not a car "stealing" a production que slot from paying customers.�

1/1/2015

guest I think that everyone is missing the impact of the GF related cell cost reductions on the MS and MX.�

1/1/2015

guest Agree. As long as they don't have any competition in the premium BEV segment the ASP will stay high and cost go down.�

1/1/2015

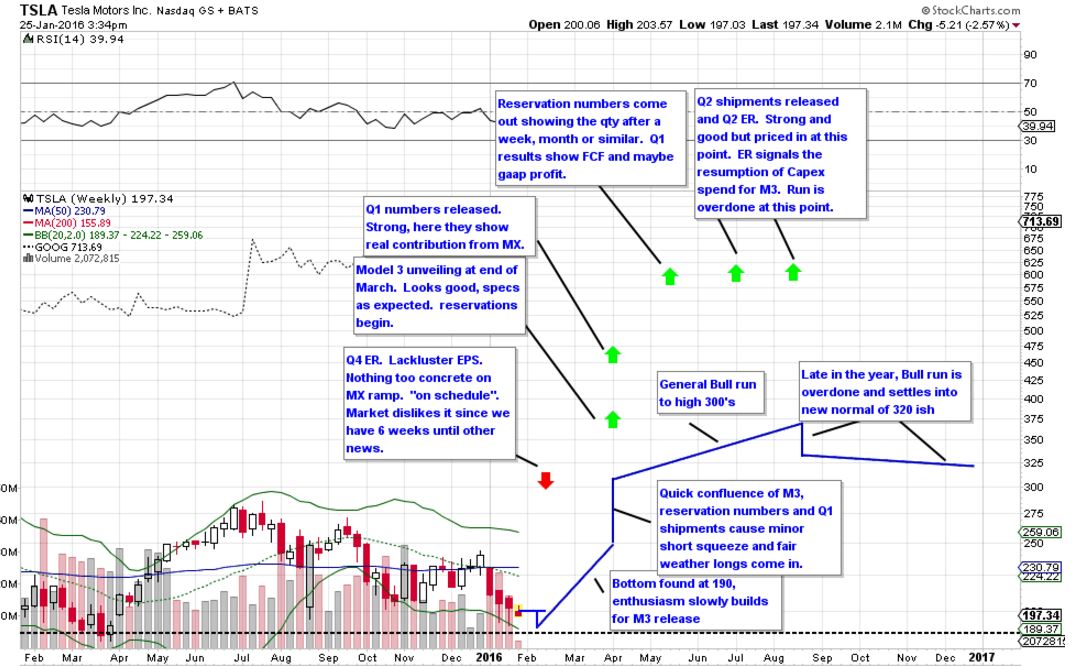

guest My 2016 future stock chart

For fun I drew a future stock chart of TSLA.

My basic premise is that there will be no big systemic, macro shock this year (even a 10% pullback wouldn't really change the story here). Also, Q4 ER will not be received well. We basically know the story now: 50k ish shipments. just a few Model X, still a fair amount of spending. EM/TM don't have a big incentive to punch this one up, so they have the option of downplaying Tesla Energy prospects or GF readiness. Better to tank the Q4 ER and set the trap for May. The good news they will telegraph is which qtr they are targeting for FCF, hopefully Q1!

Then the M3 reveal at the end of March will be a positive catalyst. Product announcements aren't usually big, but a non-ugly M3 will be a big relief/derisk. (For the record I expect some funkiness like an MX nose, but nothing too radical). Around the same time Q1 numbers will come out and they will be a beat, signalling a big market reaction that will start rolling into the expectation of a May financial beat and news about M3 reservation numbers. If so, it may be a May squeeze but I think it will be some warning earlier or something, with more Bull runs on good news in May and again for Q2 shipments. Around this time I expect a cap raise and the Q2 ER will be about resuming business as usual with capex on M3 tooling and possibly GF buildout. There will be a hard-to-trade top somewhere and a minor pullback in Q3.

After having drawn the above I realized I drew 2013 almost exactly. I think the parallels line up very well:

This is my plan for 2016. Not too crazy! Recall that in early 2013 they were coming off massive spend on the MS tooling, volumes were ramping, reviews had not come in yet, spending came down. EM seemingly bunched up positive news to burn shorts and raise capital on favorable terms. I see no reason the same could not play out here.

I know some people are thinking the Q2 ER will be the big pop, which may be depending on the speed of the MX ramp. I think they will hold down expenses and freeze most hiring for financial window dressing, and it will be for 1 quarter. My guess is it will be Q1 since that was their original goal, but it could be Q2 as well.

Thoughts? Where am I wrong?�

1/1/2015

guest I think this road map makes a lot of sense. Only things I want to add in are, following Q4 2015 ER, we may touch 180 again; I expect an announcement of partnership for a factory in China sometime this summer, may not be too relevant with price action though; the headwind from the general macro market that makes people more risk adverse and posing some difficulties in raising capital and limiting the ATH price (my guess is around 330-350, if we were in 2013, 2014, or even 2015, 400 is not too difficult, but we're in 2016).

�

1/1/2015

guest Good summary! I am uncertain about Q1. Model X is still not ramping up. Maybe they can keep selling a lot of Model S.

I have six major things that I think will influence the stock price 2016. i think all six needs to happen or atleast 5/6 for the stock to reach new highs.

Macro and general market

Not looking that good but not too bad either. I think China fear is overblown as they still grow their GDP. Remains to be seen how oil effect the rest of the economy.

X ramp up

Still problematic. There is not much good news here it seems. Annoying that we still don't have a steady state of production here.

S demand

Also remains to be seen how it will develop. But I am positive about it. I don't think it will surprise on the negative side.

TE and GF ramp up

Also looks like it is on track.

Model 3 reveal

This is really important. Especially number of reservations and that there will be no delay. No reason to think this would not work out well.

Cost/FCF

I think it is more likely it surprises negatively than positively.�

1/1/2015

guest I agree. I was calling for 190, but 180 is not crazy especially if the general market is still dour.�

1/1/2015

guest This is the long term fundamentals thread right? Was hoping we'd see more exuberance here than dour since from a long term perspective, we have got ourselves a sale today folks! What am I missing?�

1/1/2015

guest A much lower appetite for risk in the general market.

�

1/1/2015

guest Apple in the earnings release conference call mentioned several times the general market and economy as being weak. This could be them blaming their own result on that, but it is still not a good sign for short term.�

1/1/2015

guest Putting my money where my mouth is, today I freed up more cash to take advantage of this dark cloud environment. Fully agree there is widespread fear in the markets currently but I strongly believe the fundamentals of this company is only getting stronger, it's moat growing ever wider in all aspects.

I welcome any counter arguments as to why this is a foolish journey I'm getting more deeply mired in.�

1/1/2015

guest I agree the fundamentals of TSLA is getting stronger. Say its a B getting to A and a year ago it was C getting to B. However, in a more bullish macro market environment, the C can have SP of 300 because people are looking at growth and don't care much about negative eps and cash burn. While in a more cautious environment, even with better fundamentals, people still get pickier at the bad and pay less attention to growth, therefore putting a lower SP on a fundamentally improved company. The forward PS of TSLA now is about 2.7, not high at all for a growth company. While the PB of TSLA is 26.2, astonishingly high. In a bull market, people will look at PS and the growth rate and think TSLA at sub 200 a huge steal. But in the bear market, people look at the 26.2 PB and think TSLA should shrink 10 times before they consider it a safe investment. That's the risk appetite I'm talking about.

So I think there are three prominent thing needs to happen to avoid a meltdown in SP:

1. We are not in a major bear market. Not hoping for a bull market, a pig market or even a minor bear market is fine.

2. Get free cash flow asap, I did some calculations and found 2016 Q1 is very hard but not impossible though. However, if they can't get the X ramp up figured out this quarter, we have to wait another quarter and missing the 2016 Q1 FCF will be a big blow I think.

3. Technically, don't lose the SP of 180. There's no telling how deep we can fall if we break below 180.

�

1/1/2015

guest I don't think you will lose long-term with a stock purchase, or an ITM or NTM 2018 LEAP purchase. OTOH I was thinking similar thoughts when the SP got into the low 200's, now at $186.40 and I m happy that I waited (still waiting) to pull the trigger. So you might want to wait until the SP stops dropping .You might also want to consider the impact of the ER-CC if you think that will have either a substantial positive or negative effect on the SP.�

1/1/2015

guest I think now that even a crappy Q4 ER would trigger a relief rally and shorts covering. I was expecting a negative reaction the the Q4 ER, but that presumed a runup to that ER. Now, any news must sound good compared to the fear gripping the trading.�

1/1/2015

guest It's like someone else said when they quoted W. Buffett earlier; "Be fearful when others are greedy and greedy when others are fearful."

The fundamentals of Tesla haven't changed, so I think we are nearing the territory where the brave will be rewarded handsomely when this ship finally turns around.�

1/1/2015

guest I am getting to the point I might need to turn the computer off for a while. We are basically at the price that we were at when I was buying stock 2 years ago, when there was no Gigafactory, no dual motor, no autopilot, a model X that was no where near production, no model 3, no Tesla Energy, etc. TSLA is MUCH more of a sure thing now than it was 2 years ago, as much of the risk has been taken out by all the success and growth the last two years, so I can't wrap my head around the current stock price (regardless of the macro events). On the one hand, I'm wondering how anyone can be selling right now, and on the other I'm trying to not let fear turn me into a seller....�

1/1/2015

guest Because the stock was ridiculously priced as a massive bubble two years ago. Now it is just somewhat of a massive bubble. Returning to a normal valuation for a company selling 50-100k cars a year, losing more and more money, in a hyper competitive industry. Sorry to speak the truth. Looking forward to some hate. Love all you guys who believe the company is worth anything more than $5 billion.�

1/1/2015

guest Yes, companies growing 50% YOY always command price / sales less than 1 �

�

1/1/2015

guest Since you won't share your forecasts with us, why don't you let us know which public companies have a reasonable valuation?�

1/1/2015

guest Of course, you need to look at the future potential to properly value the company. The Model S is superior in driving experience and efficiency to all other sedans on the planet. The Model X is a 7 passenger SUV, that according to people that have driving both, drives like a Model S. So you have a 7 passenger SUV that drives like an incredible sedan. No SUV on the planet will come close to the performance of the Model X. The 70K+ SUV market is huge, and the Model X is so much better than everything else, that selling 100K/year of the X will be easy to do in a couple years. The Model 3 will easily sell over 500K/year in a few years, because there is no other car with the level of performance and looks that it is promising to deliver, in the $30-50K price range (ICE or EV). Add Tesla Energy sales, and you have a company with revenue in the future that will support a value over 30 Billion.�

1/1/2015

guest Good luck to you all. Love all you believers. Remember, massive losses which grow faster than revenue. Massive negative cash outflow that grows faster than revenue. Company trading at $30 billion value compared to $4.2 billion in 2015 revenue. Still in a massive bubble. This message board sounds like every other bubble stock. They all crash 90 percent. Tesla will survive but in a radically smaller form. EV's will do well. Just not Tesla.�

1/1/2015

guest Why is this your stance? It seems it is based on posted losses? Do you understand how Cap Ex and R&D are being used? Do you think those uses will not have a positive ROI? If not, how will EV's do well?

Tesla manufactures the best selling car in the only segment they compete in, at a healthy gross margin. What gives you reason to believe this will change, or that they won't be able to compete in other segments? I felt like you came here with an open mind but have become more bearish each day. I was interested in your posts previously, but simply saying good luck is less interesting and thought provoking.�

1/1/2015

guest You realize the "massive" negative cash outflow was done intentionally to expand for future growth. They hope to be cash positive in Q1 or Q2 this year. And for EVs to do well with oil under $40, they have to be better than a similarly priced ICE vehicle, so they attract car buyers that don't care about buying an EV just to save money at the pump, or about saving the planet. No manufacturer has an EV that fits that description except Tesla, and there is nothing on the horizon for at least 3 years (which probably won't be able to compete with what Tesla will be making 3 years from now).�

1/1/2015

guest You've obviously never worked for a startup company. They burn cash like crazy in initial stages.

Even if TSLA goes to $0 (zero) I'll be just fine. I only bought TSLA with money I could afford to lose. Most of my money is in Vanguard index funds, LOL.�

1/1/2015

guest Love you believers. Tesla is literally burning cash. Did you really think they were spending aggressively to capture market share and build a sustainable moat with such things as a global charging network and the largest battery factory in the world. �

�

1/1/2015

guest The bulk of Tesla's spending is all discretionary as opposed to fixed or mandatory talks. A lot of companies are forced to spend large amounts of their revenue on things like pension funds. The bulk of Tesla's spending is investment in things that will expand their business and it's all discretionary. If Tesla cut out spending on the Gigafactory, the Model 3, and the supercharger network, they would be instantly profitable, but it would be cutting off the long term growth of the company for the sake of short term returns.

This is the problem with American corporations and the stock analysts who reward them, all the focus is on how to make as much profit this quarter with very little thought about what the company is going to look like in 5 years. This bean counting is a contributing factor to why the US only leads the world in a couple of industries now. The biggest industry where the US has a big lead is the one industry that thinks like Tesla: high tech.

You say Tesla is literally burning cash. Obviously they don't have burn barrels behind the factory where they are dumping $20 bills. But I assume from your comment that you believe they are spending money with no hope of a return. That is the opinion of some, but it's the short sighted thinking that driver the US stock market and makes most US corporations mediocre.�

1/1/2015

guest You got me @dha. Very nice

- - - Updated - - -

He got you @wdolsondha got you good too!

�

1/1/2015

guest Sorry no hate from me. In fact I'd like to thank you for your input. I'm long TSLA and need shorts like you to help me see what I might be missing. I've got a few questions for you. I'm not saying you're wrong. I'm just doing my homework to see what I might be missing.

1) Why do you think Tesla should be valued as a company selling 50-100k cars a year? They are growing at 30%/year. Margins are high. Demand is high and getting higher as the public becomes more educated. Market studies indicate the Model 3 will have massive demand unless Tesla completely blows it (they never have). Why do you think growth will stop at 100k? Or stop in 2020? Your models assume no more growth after that.

2) Why don't you value their current development? Losses are due almost entirely to development that is the foundation for their future growth. Tesla has proven to be very good at innovation while controlling costs. That's why Toyota and Daimler originally partnered with them. I realize it's a bigger company now with more inertia so it will not be as good as it was in the past with innovating quickly and cheaply, but it's still a lot better than any other automaker.

3) You are right in stating that it's a very competitive industry. I agree that a lot of people in this forum have gone overboard in assuming Tesla has walled off most competition. The large automakers will act very quickly and decisively if a good part of their revenue is at stake. And unlike Tesla, they can afford to lose money on new EV models in order to gain market share. But Big Auto is already losing money on EVs and it hasn't slowed Tesla much. So my question is why do you think Tesla won't be able to compete in the future with BMW, F, GM? Is there some inherent or systemic reason they will fizzle out like some of the other fad startups you mentioned earlier?

Again I'm not necessarily disagreeing with you. You might have something I need to hear. Thanks.�

1/1/2015

guest I actually assume they will sell 300K cars by 2020 -- quite optimistic in my opinion. In that year I assume Tesla sells 75K of S and X each at a gross margin of 25%. I assume the remaining 150K sold will be Model 3, at a gross margin of 10% (I think in reality it will be near impossible to make any margin on the 3 for reasons discussed at length here and on SA). But my biggest assumption is that the company's long-term operating profit is equal to 5% of revenue. In reality I believe Tesla will have a difficulty ever breaking even due to wildly inefficient sales and R&D and overhead spending. Basically they have almost no economies of scale compared to other automakers. I have zero confidence in Tesla's ability to execute. And if the gigafarce made sense, another company would have built one in Korea or China. My financial model is a long-term discounted cash flow analysis assuming an 8% discount rate. Based on this all, the stock is worth about $30 per share. Note that if you believe Tesla will achieve 10% long-term operating margins, it results in a massive increase in the stock valuation -- to $280. So if you wanted to argue with me, you should tell me that my 5% long-term profit margin is far too low. So it is really all about what you believe the long-term operating margin will be. I think Tesla will have a tough time ever getting to breakeven. I believe Tesla Energy is a fanciful joke since they have virtually no sales to date and there are half a dozen giant Asian companies already doing it better.

I think this is incredibly wishful thinking. Their R&D spend is massively inefficient. The company is massively unprofitable and its losses are increasing faster than its revenue growth.

Feel free to read my numerous prior posts. I just think Tesla is a victim of its own arrogance and hubris. I'm all for EV's. And solar--in fact I love my solar panels (non-SCTY). But I am anti-arrogant companies run by megalomaniacs who are using shareholder money for charitable causes. That benefits society at the expense of naive Tesla shareholders. Mark my words, this stock will be under $100 in the near future. I will not gloat when that happens because many innocent retail investors will be crushed. The investment bankers and founders who sold their stock will already be rich and have moved on. Tesla will survive in much smaller form, likely post-bankruptcy. Model S is nice. Model X is ugly (inflated Prius?), and a disaster. By the time the 3 comes out, the company will be in distress.�

1/1/2015

guest Model 3 isn't here yet so let's put that aside. Gross margin 25% for S and X is basically assuming battery cost will not go down from what it is now. Thus implying the vertical integration in GF will have no effect on battery cost. Care to explain why do you think this will be the case?

�

1/1/2015

guest Read my old posts if you wish to see my full opinions. I much prefer to enjoy reading all the true believers talking about how the Model 3 is already better than this or that car, how Powerwall is already a huge hit (it has zero revenue to date), how Tesla will become Uber or assimilate Uber or whatever. So entertaining. Please continue. Can't wait for my puts to be worth millions.�

1/1/2015

guest Mind giving the link for the post explaining the long term 25% gross margin on S and X? Really curious about how you get to this conclusion.

�

1/1/2015

guest Latest quarterly gross margin was 26% I believe on a real GAAP basis.

X seems infinitely more complicated, so I think 25% for the X is incredibly optimistic.

Also, most car companies make gross margins more like 10-15%. 25% is again, incredibly optimistic.

Model 3 will never make money because its cost of sales will be 2/3 or 3/4 that of the S, while its price will be half.

Tesla's gigafarce is sheer arrogance of a bored billionaire. Anyone could throw billions into a non-economical boondoggle in the desert. Tesla is just dumb enough to do it. Asinine.

This company loses billions, and I believe they will continue to do so.

And the fans will do anything to justify it, make up excuses for burning money, defend the company as if it were holy. Meanwhile the billionaire will still be a billionaire. And you will all lose thousands. Sorry.

Pro EV, anti-arrogance, anti-Tesla.

Have we had an independent review of the Model X? Oh right, Tesla has no spare Model X's to provide. Besides, it's a conspiracy of all the [insert one of 20 different villians].

Delusions. The last big stock bubble after Solarcity (which is a blatant play on having a return on invested capital below its cost of capital -- actually hilarious -- again bankers get rich and you all get poor).�

1/1/2015

guest clear to me that you no actual knowledge on where tesla is spending money if you expect them to have a long term 5% margin.

good luck with your value based investing�

1/1/2015

guest I asked you this before and didn't receive a response, so I'll try again. What are the strikes and expiry dates for your puts? You are already beginning to gloat, so I think it's fair to lock them in for posterity. And I want to see you back here posting on the x date.�

1/1/2015

guest Sorry but I don't see any solid reasoning for your 25% long term gross margin estimate but quite a lot of emotional bashing.

Thank you for your post and goodbye.

�

1/1/2015

guest If you want to troll, you have to put in a lot more work than that. You only spent like a week here laying the groundwork for concern trolling and trying to warn of "potential risks" before delving into the kinds of "arguments" posted above. You should have put in a few months first so people might have actually taken you seriously. Now your credibility is shot. You'll have better luck on seeking alpha or something, you won't change any minds here.�

1/1/2015

guest You're right, I won't change any minds here. Which makes this a great website to read because no matter how bad Tesla fails, there will always be fans to support it. I'll just enjoy reading. Good night all!�

1/1/2015

guest Blow by blow.

X was complicated to design and to set up production for. What is your evidence that it's expensive to actually make? The base price is $5K more than S which isn't exactly pocket change and I think it's reasonable to assume that $5K more than covers the cost of materials and 3rd party components vs Model S. It's very complicated to make machines that make machines, but once that is done -- profit

Profit margin on anything that Tesla makes should be considered not against comparable traditional car manufacturers, but against the reality of how much it costs to make comparable electric vehicle vs. gas burner. I think this might be your biggest misconception. They get as much profit margin as can be had in a market where they achieve the same or better result using different technology vs. anyone else. There is next to zero room for squeezing more out of combustion engine, in fact there's less because of the tightening emission regulations. There's a whole lot of economy of scale and technology improvement left in EV. We're firmly in the low hanging fruit territory still. EV drivetrain will, with complete certainty, become cheaper. And so far Tesla is a company that is pushing that boundary.

Cost of sales, I don't even know what to say here. You think it's very expensive to run a web site that allows one to configure a car, then send that over the wire to robots at the factory and then ship it to a service center? And that is compared to independently run dealer network that has to make its own cut and has its own interests that aren't always aligned with interests of the manufacturer or customer? You can't be serious.

Ah I think I'm feeding the trolls now, sorry lost my steam responding to the rest of the statements.�

1/1/2015

guest Good luck to you all. I'll just let all you believers enjoy your confirmation biases and blindly hand over your hard-earned money to Musk at the next capital raise.�

1/1/2015

guest Well I guess there's value in such debates. I think that pretty much we need to start any bear case with a solid base of proof that

1. We're not quite there yet with EV drivetrain being better than an ICE at similar cost

2. Even if 1 is true or will become true soon, Tesla won't be able to capture the increasing pricing power vs. ICE (due to competing EV, incompetence, lack of capital, whatever)

If a bear case can't grapple with one or both of these, it's quite likely not worth looking into.

- - - Updated - - -

That's a bit insulting. You made some fairly broad statements but wasn't able (or didn't care to) to substantiate them on a more detailed level, and now you turn around and say there's a bunch of irrational fanboys here. Who's being irrational?�

1/1/2015

guest Actually their R&D spending has a proven track record of being quite efficient. This is especially true when compared to other automakers. What data do you have that would make anyone describe it as "massively inefficient"?

Tesla has some headwinds for sure. Their cost of sales is more than the dealer network that most automakers have. The industry will become more competitive and gross margins of 25% will be hard to maintain, especially for Model 3. They will continue to experience growing pains as an organization. But one of their problems is NOT "massively inefficient" R&D spend.�

1/1/2015

guest How do you calculate cost of sales? If you look at Ford's cost of sales alone sure it'll be lower. But in a competitive situation like we have here you have to compare vertically integrated Tesla's cost of sales vs. Ford+Dealer cost. And remember dealer won't be making most money on service anymore so they'll have to start making money on the sale itself. I don't think they stand a chance to vertically integrated model with online ordering system at its core (if it's run well enough).

Add to that that Teslas literally sell themselves for the most part (no advertising costs). Speaking of Model X and its delays and problems, how many Teslas do you think each of those doors opening in the parking lot would sell? That's probably hundreds of millions of advertising dollars right there.�

1/1/2015

guest I really enjoy reading this kind of posts. It makes (or at least should make) every TSLA investor to stop, think and re-evaluate. It also brings forward good argumenst from "both sides".Stop using the troll-argument on members with alternative views!

�

1/1/2015

guest Does anybody think that the recent reduction in share price will make Tesla a more attractive acquisition for a giant company like Apple or Google?�

1/1/2015

guest It isn't much of a reduction. If Apple wanted to make a hostile takeover of Tesla they could have done it last summer, they have the cash. I doubt any tech giant is going to go for a hostile takeover because they know Elon would likely just walk away if they were successful and probably take a lot of talent with him if that happened.

And Tesla is not open to a friendly takeover right now. Elon was talking to Google about it in early 2013, but when Tesla turned around, the deal left the table and Elon has not considered selling out since.�

1/1/2015

guest It's not the alternative views that brings the troll comment, it's the quality and presentation of the arguments. His are flawed and dripping with emotion. A few examples:

That's not quality analysis, it's pure emotional irrational hatred.�

1/1/2015

guest The logical structure and soundness of this argument are as clear as a crystal.

A crystal of crack.�

1/1/2015

guest Or a deliberate attempt to incite a reaction just for the fun of it. There is a word for that...�

1/1/2015

guest Moderator's Comment:

There are a lot of recent posts that are snip-worthy. As doing just that takes a good deal of work on the part of moderators, they'll stand - at least for the moment - but here's a shouldn't-be-necessary!!! set of warnings to:

keep your emotions under control,

and if you can't, then either

* don't post

or

* review your language before you hit <Send> and excise the inflammatory material.

<Snip> Bunch o' %$#!@ third-graders.... </Snip>�

1/1/2015

guest I'm going to have to step away from this section for a while. I don't like the way things are headed. One could argue if it is even healthy for this site long-term.�

1/1/2015

guest Ford makes 1.4 billion in a quarter and 7.4 billion for the year with a market cap of 47B

Tesla market cap is now about 24B

I don't know what Tesla should be worth today, but overvalued arguments are at least as valid a bull arguments.�

1/1/2015

guest Tesla has stated that its cost of sales is about $2,000 per car. That's much higher than your average franchise dealer network. Tesla has even stated themselves that their cars, in particular EVs, are harder to sell than gas cars. That's part of the reason dealers don't want to sell EVs. The situation will remain true until the public is educated. That will take much longer than 2020. Even if most customers would prefer to buy an EV by then, it will still take more time (more money) to sell one. Eventually the expense will come closer to Tesla's competition. For at least the next several years I see cost of sales to be a disadvantage for Tesla vs other automakers. Of course the legacy automakers have their own problems, but their cost of sales is lower.

A vertical sales model is not necessarily cheaper. Tesla will have to continue opening new stores and service centers when they are capital constrained.�

1/1/2015

guest Walmart makes >3B/Q and has market cap of 200B. Amazon makes nothing and has market cap of 300B. There is more to valuation than net income.

More comparisons:

TWX vs NFLX

ManPower vs LinkedIn�

1/1/2015

guest So I did some looking up. Average dealer advertising cost per car sold seems to be around $600. Now say Ford sold ~2.5M vehicles in 2014 and spent ~$2.5B in advertising in the same year. We're up to about $1600 per vehicle in just advertising alone. Still wanna play? �

�

1/1/2015

guest But Tesla gets the full retail price of the car. That said, I don't think direct sales is mostly about cost savings, but rather control.

In a recession Tesla will have a hell of a lot of overhead to support. Dealerships have obvious drawbacks, but also a lot of upside in finance, management, and risk sharing.�

1/1/2015

guest I do agree with you that overvalued arguments can be made here and I think Tesla might be a bit overvalued. However I do take issue with valuationmatters reasons. They don't appear to have actually done their homework and instead pretty much calls Tesla the plaything of a crazy billionaire.

I think some sound arguments could be made that the Model 3 is a step too far and what succeeded at the high end of the market won't succeed in the middle, or Tesla is going to have some trouble scaling up from 50,000 cars a year to 500,000. I do think Tesla's goal of 500,000 cars a year by 2020 may be too ambitious. However, I haven't seen any convincing arguments in this part of the thread on why these things may come to pass. What arguments I have seen are easily refuted and the last post was heavily laden with negative emotions about Tesla and Elon Musk himself. I have tried to make the point to valuationmatters that they are likely going to lose money on Tesla if they continue to base their valuation on the factors they are basing it on.

I've said a number of times, Tesla may fail. I can think of a couple of scenarios: something may happen to Elon Musk and the company loses focus and flounders, the economy could crash again, some catastrophic flaw could be found in cars already out there that turns the public against Tesla, the Model 3 could be a failure and drag the company under, or Tesla energy will be an albatross around Tesla neck that will drag them under. The Model 3 failure and TE are the only cases that may have signs now. The others are more point events that can't be predicted.

So if the Model 3 is on track for failure, how is that going to happen? What specifically are they doing wrong that will lead to that failure? So far everything I see, from an engineering and manufacturing perspective, they are on a solid track to produce something in the quantities they have predicted. The Gigafactory, rather than a folly, is a critical component of that plan. valuationmatters seems to think that the GF is a massive miscalculation and can't see how Tesla is going to lower battery costs with it. Unlike valuationmatters, I have read the biography of Elon Musk and I understand his character to some degree. Musk doesn't commit to anything until he has done both the science and the financial calculations and he sees a clear advantage to the plan he's committed to. He has started 4 successful start up companies with a lot of hard work, a bit of luck, but the biggest factor is every risk he takes is calculated to the 10th decimal point before he commits. If he believes the GF is going to lower battery costs by 30%, the only way that isn't going to happen is if something drastic happens that throw his calculations out of whack. He's done the painstaking math, I doubt valuationmatters has. Musk probably knows the process and materials needed to make batteries as well as Panasonic does at this point. That would be part of his research before doing the calculations.

As far as Tesla Energy failing, that's possible too. Solyndra failed because they went with one technology and the market went with a cheaper one just after they committed to their technology. With TE Tesla is wading into a space that is open to many other competitors that can adapt much quicker than in the car business. Battery companies would be their natural competitors. There is some spare Li-ion production capacity and some potential competitors might be working on their own battery storage solutions. Tesla's strength is they have learned a tremendous amount of institutional knowledge about how to fast charge Li-ion batteries quickly and they are most likely leveraging that technology into their stationary storage solutions.

valuationmatters dismisses the whole thing as a folly, but again I have some understanding of Elon Musk. He has looked at the renewable energy industry and identified the worst problem which is storage. Wind is intermittent and sunlight varies and doesn't shine at all nearly half the day. To make renewables more usable, some kind of storage solution needs to be built. Tesla is marketing to both energy producers as well as end consumers with solar arrays. It's a massive potential market for the energy producers alone. Yet valuatoinmatters gives it zero value because Tesla hasn't produced any systems yet. IMO, that's very short sighted thinking and if you are trying to come up with a long range target price for investing, it's a good way to lose money. The investors who make the most money are ones who can predict what will happen in the future the best and part of that is just following the data where ever it leads rather than dismissing possible upsides out of hand because the upside doesn't exist today.

Tesla is valued as high as it is because the majority of investors who have put money into the company see a high likelihood of massive growth over the next decade. It's possible they are over optimistic which has led to the stock being over priced, but I'm left unconvinced by valuationmatters reasons for their assumptions that went into the calculations. Many of the factors are not well thought our or seem to be based on some bias that will likely lead to their losing money on the deal.�

1/1/2015

guest valuationmatters is not interested in discussing the model he uses and the input to that model and what probability he assigns to events. He just repeats the same arguments and refuses to elaborate. It is interesting to hear the bear case but his model is not working.

I guess comparing valuation to other car manufacturers do have some value, but it has to be combined with other models. Tesla is a growth stock and not a value stock, which is different from almost all car manufacturers.

There is a not insignificant chance of them entering new markets, like the autonomous fleet service. Compare Amazon before AWS, Google with maps when it had no obvious commercial value, Apple before iPhone, Facebook before Instagram etc. You have to pay a premium for those unknowns that often comes from great management. valuationmatters puts all that at 0 in his model, including Tesla Energy. If you only value those companies conservatively with only the core business they will come out as overvalued.

From a valuation perspective you can definitely make a good case at this point that Tesla are fairly valued on the cars alone. Teslas valuation has gone down a lot with respect to certain metrics like P/S. It has been at 10 and now it is around 3. P/S and growth rate are the primary metrics I use for Tesla. This assumes though that they will not have a cash problem. I find their cash position and capital requirements hard to dig into (and also a bit boring).

�

1/1/2015

guest I had a few accounting related questions for those who are knowledgable in the area when it comes to Tesla's finances.. I'm sure nobody knows these answers for certain but I'd like to gage opinions regarding these areas.. thank you in advance for any responses.

1) How variable are SGA costs going to be over time as Tesla expands and produces significantly higher volumes? SGA expenses were 18% of revenues in Q3'14 and have risen each following quarter, most recently accounting for 25% of revenues for Q3'15. Will these costs continue to be a bigger expense in relation to sales long-term or do you expect SGA expenses to decrease in proportion to sales (< 20%?) as Tesla continues to grow?

2) Is the market not factoring in Net Operating Losses (NOLs) that Tesla can carry forward into profitable years? I've never heard anybody claim Tesla's current quarterly losses as an advantage going forward in respect to the deferred tax assets that they represent for the company. These can come into play and help Tesla reduce their taxable income once they are consistently profitable on a GAAP basis down the line.

3) Do you suspect that there will be a huge discrepancy between the book value and actual/market value of some of Tesla's assets? For example, Nevada is estimating that the economic impact of the Gigafactory will be in excess of $100Billion over the next 20 years, but the GF will probably be valued ~$2.5B on their balance sheet upon completion, then be depreciated immediately after. I understand the "economic impact" not really related to the value it provides to Tesla because it relates to local job/wage increases. However, the GF is so valuable for Tesla in so many areas and gives the company significant competitive advantages that I feel are being extremely understated.. and the GF is just one example of such an asset (supercharger network, intangibles, etc.) that is being misrepresented IMO.�

1/1/2015

guest 1. How did you come up with SGA being 24% since Q1'14 and 34% Q3'15? Based on the numbers in their reports, I got around 20% for 2014 and Q1, Q2 2015. Q3 2015 was 25%. And these are % of GAAP rev. If we account for leasing, the % should shrink by about 5%. For Q3 SGA, I'm not sure why it increased that much.

2. I don't think NOL will ever be considered as an advantage. But on non-GAAP basis, they are not NOL now.

3. Have no idea.

�

1/1/2015

guest 1) I think they will decrease. However, what is SGA and what is R&D and what is COGS are murky and up to the company. Overall cost should decrease as percentage of revenue (otherwise they are in big trouble). You have to adjust for lease and deferred revenue also with respect to SGA. i don't know what is driving the SGA, I guess it is Service Centers, warranties, show stores and opening national offices?

2) I don't think taxes matter at all at this point. They are not valued based on expected profits and if they will be profitable it will be a small one. So the tax effect I think can be ignored. Now if they do turn a significant profit 6-8 years from now then it is different. In general though I think the market ignores temporary boost in earnings due to taxes.

3) You are not allowed to boost book value just because an investment is worth more to you. The book value is the purchase value/cost of the assets that you are allowed to depreciate. And yes, book value is not a good measure. There are many items that are worth a lot of money but are worthless according to the book value. For example for airlines or freight companies that owns some of their fleet.�

1/1/2015

guest For the NOLs, I was referring to future tax advantages once they are profitable on a GAAP basis. I know this will probably be at least five years but it is something beneficial to consider down the line.

As far as the SGA expenses, I made a mistake in my model. Thank you for pointing that out, I have edited the original post.�

1/1/2015

guest I believe there are smart bears. But they seem to keep quiet.

The ones we hear most often are 1. paid shrills, 2. emotionally charged haters that repeat same arguments ad nausea, and 3. not too intelligent individuals

Smart bears(some hedge managers, Cody Willard), in my opinion are most likely to be combination of 1.righteous (Tesla spending government money), 2.driven by ego (I said that is too high valuation, and god damn, I must be right), and 3.opportunistic (even if I'm wrong, Tesla is high beta, there is money to be made on swings)�

1/1/2015

guest I wouldn't questions someone's intelligence. I've found that most silly behavior is driven by lack of wisdom or emotional thinking rather than lack of ability to learn.

I suppose some arguments could be made for Tesla taking government money. The state of Nevada made a deal for the Gigafactory, but it was primarily tax breaks which don't kick in until Tesla makes money and I think they practically gave away the land, but the land wasn't worth much to begin with. Tesla does benefit from tax breaks to end consumers (in the US and other countries too), but they get no money from the US government directly. The only money they did get was paid back a couple of years ago. Any argument that hinges on Tesla living on handouts from the feds is automatically discounted due to obvious lack of effort to get up on the facts.�

1/1/2015

guest I thought that most of the GF tax breaks are sales taxes.�

1/1/2015

guest Basically correct. They got a use tax exemption on equipment purchased for manufacturing. I never really considered it a tax break in the first place because most states already have a use tax exemption for manufacturing equipment.�

1/1/2015

guest Here are the details of the deal:

http://insideevs.com/official-1-3-billion-incentives-brings-tesla-gigafactory-nevada/

Most of these are spread out over many years which does dilute the impact to Nevada and the benefit to Tesla. the referenced article from the RJG was written before the deal was approved by the legislature said that Nevada was going to buy the right of way in the industrial park for $43 million (which is money in the pockets of the industrial park owners) and extend the road to Highway 50. I don't know if the deal made it through the Nevada legislature unchanged.�

1/1/2015

guest I think you are missing the 2 more classes of bears

1, robo bears, or near robo bears (spreadsheet procedural driven)

2, Perma bears, like Chanos who tend to follow the following

Value Traps: Some Common Characteristics

- Cyclical and/or overly dependent on one product

- Hindsight drives expectations

- Marquis management and/or famous investor(s)

- Appears cheap using management�s metric

- Accounting issues

so whether it is a natural gas producer or Tesla or an education company, the unemotional bears will sniff it out. 9 out of 10 times they may be right, the other 1 out of 10 times can be very expensive for them.

�

1/1/2015

guest There are also bears who harp on demand issues when the macros are bearish only to flip the switch and turn bullish once TSLA hits $200. Suddenly in this scenario, they tend to think Elon is no longer lying about demand. But once the macros changes again, oh boy... Here they come. They're all over the short term thread and you know who they are. If I had listened to their BS in 2013 I wouldn't have been here with all my doughs today.�

1/1/2015

guest Just something that came to mind pondering... I think some of the bears don't have enough imagination. If it doesn't exist today, they have a hard time conceiving that it may well exist in a year or two, so their inability to imagine the future clouds their analysis of the stock.

On the other hand some bulls for Tesla and/or other EVs have imaginations that aren't properly grounded in reality and seem to think that the entire world will be driving EVs by 2030 or something like that. Or they think that any car maker that can make a limited run of EVs can also produce millions if they just decide to turn on the spigot almost overnight.

Just observing how these threads whipsaw back and forth.�

1/1/2015

guest Tesla doesn't have to ramp to millions overnight (and I challenge you to find anyone who says that). They just have to ramp faster than anyone else. Given that the majors are doing everything they can to NOT ramp EV's quickly, it is a reasonably expectation that TM will get and keep a lead in EV market share, and EV market share will itself increase. It doesn't have to be binary all on, all perfect. Just a quickly growing company becoming a market leader in a quickly growing market space. That is a fine company and should be a fine investment in the long run. And yes, that is what Bear's don't imagine. If you think EV's have no future, TSLA is a pretty attractive short.�

1/1/2015

guest There are many articles out there claiming the "Tesla killer" is coming from car maker x and it appears the authors just assume that because GM can make 10 million ICE a year it's a trivial thing to make 1 million BEVs a year. The same sorts of things are said about BMW, Mercedes, Audi, VW, insert the brand name who has claimed to be working on an EV. These are more the EV bulls than the Tesla bulls specifically and I've seen a lot of people here on the forum believing these people. Ironically many people tend to be more bearish about Tesla's claims that they can produce 500,000 cars a year by the early 2020s, despite the fact they are the only manufacturer securing enough battery production to do that.

The Tesla bulls don't usually talk too much about production numbers. There are threads on this forum where people believe the Model S is going to have a complete redesign this year, or some feature that requires a lot of engineering is going to be appearing on the Model S this year. The reality is Tesla doesn't have the engineering resources to do a major redesign of the Model S right now. All their resources are focused on the Model 3 which is a make or break project for the company. The Model S may not see any significant re-engineering for several years.

On this investment thread most of the Tesla bulls are fairly realistic, IMO.�

Không có nhận xét nào:

Đăng nhận xét