1/1/2015

guest I bought some at around 34$ after the expiry...I've been selling and re-buying little lots since. I got some more today taking advantage of the low prices and betting on some good news tomorrow. We'll see...

- - - Updated - - -

Well there is some risk involved: there could be something about subsidies/tax incentives being reduced/substituted by something else... and we know how sensitive the market is to those kind of things... it would sink both stocks pretty bad.

Just something to keep in mind before hitting the buy button a little too much....�

1/1/2015

guest Well, if they substitute With tax like in Europe, thats just as good. If theres carbon tax and more tax for gasoline, both Companies will benefit, even thou they dont get the Money directly.

Obama cannot be reelected so he can do some unpopular changes, which are needed. I really think he wants to be remembered as a guy that helped the climate for the better, and the US has not been up to date With the

rest of the western world.�

1/1/2015

guest I have a question for someone that went with this company for solar panels. Which is better/cheaper, the SolarLease or PPA program?�

1/1/2015

guest I would go with Sunpower if I were you. Why would you want to put cheap Chinese made panels on your roof. They have higher degradation, perform worse in various climate conditions, etc. Who knows how good they will be in 10 years time. With Sunpower you will get the best, highest quality, most efficient panels in the world. And financially speaking you will be better off too compared to going with Solarcity. Not to mention that you will get a much bigger system (in Watts) per sq. ft of roof space.

Lease is a liability if you want to sell your house. But if you go with Solarcity, then lease is the only option. No way would I ever purchase those cheap Chinese solar panels. If you go with Sunpower then definitely buy; you will get the tax credit and a 25 year warranty. The panels will probably last longer than that too.�

1/1/2015

guest Well, thank you for the info, but I dont know the difference in the quality. Plus, I dont have the money to buy them when installed, thats why I was going with Solarcity because of their lease plan. Im also a shareholder of the company. Does Sunpower lease as well?�

1/1/2015

guest Sunpower does lease as well. You have to be careful when leasing, because the actual math is a lot more complicated then what they show you on paper. E.g. Solarcity may offer lease increases of 2.9% per year, while Sunpower only does 1%.

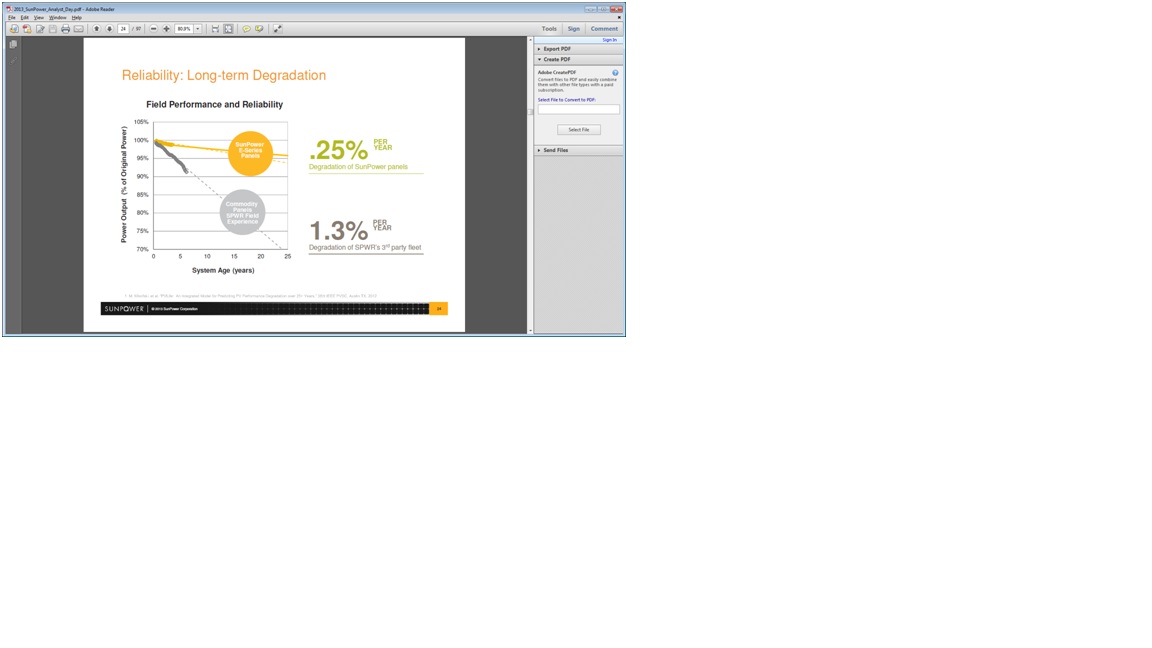

Solarcity guarantees less than 0.5% degradation per year, while Sunpower does less than 0.25%. These sound like small numbers, but if you consider that Sunpower panels will have a significantly lower initial degradation vs. up to 5% of some competitors, and then tested to less than 0.13% actual degradation per year this will add up over 20 years. If Solarcity panels (which are made by Chinese companies Yingli and Trina Solar) have more than 0.5% degradation, they will make up the minimum to reach your guaranteed production number. But if Sunpower actually has 0.13%, then your panels will be producing significantly more than your minimum guaranteed production number. Once again this stuff adds up over 20 years. Both companies may guarantee you say 12kWh per year, but chances are that Sunpower will exceed that number by a higher amount than Solarcity.

Say you are promised 18,000 KWh per year from your 10 KW system. If you apply 0.5% degradation that will get you 343,400 KWh over 20 years. If you apply a 0.25% degradation you will get 351,600 KWh over 20 years, which is 8,200 KWh more from Sunpower than you would get from Solarcity. This is an additional $1,000 - $2,000 saved over 20 years. If actual degragation of Sunpower panels is 0.13% (as tested) then you will get an additional 12,000 KWh and potentially save up to $3,000. Remember electricity rates will only go up in the next 20 years. My understanding is that Sunpower is very conservative in their estimates, so that 18,000 kWh in year one may actually be 20,000 kWh, while a Solarcity system might only give you 19,000 kWh in year one.

Say Solarcity offers you $1500 per year lease with 2.9% annual increases. Sunpower only offers 1% annual increases, which means that you can start out paying $1800 per year and still be better off over 20 years. Factor in lower degradation and you can start at $2,000 per year lease and still be better off over 20 years vs. a $1500 per year lease on a comparable system from Solarcity.

My point is that the lease documents are tricky and they can fool you easily. I would go with Sunpower because they are significantly better (best in the world) panels, and will also perform better in extreme temperatures or if the sun's angle isn't the best, etc. They are innovators, and you will most likely be able to upgrade to even better panels 10 years down the road while extending the lease contract. It is a US company (even though panels are made abroad), and not Chinese made commodity panels that may or may not hold up for 20 years; this is not yet tested in the real world.

I own both Sunpower and Solarcity shares. I think that both companies will do really well in the future. But if I had to go with panels on my roof, I will definitely go Sunpower without a doubt. I am actually going to install Sunpower panels within the next 12 months on my own roof (already signed up on the list, but have to replace roof first).�

1/1/2015

guest So if Sunpower is so much better "without a doubt", why on Earth did WalMart and the US Army go with SolarCity?�

1/1/2015

guest You guys are way too defensive when it comes to Solarcity. I am here trying to help you guys make money in the stock market by bringing up investment ideas such as Sunpower. And I am trying to get you guys to consider installing Sunpower panels instead of blindly installing Solarcity (who buys commodity Chinese panels) to save you potential headaches and money. All I get is thankless and defensive responses:

This sounds like a rebuttal that a 12 year old would write. Tell me more about those two deals and I will tell you why they went with Solarcity. I would bet that you don't even know the details, but there could be several reasons they went with Solarcity:

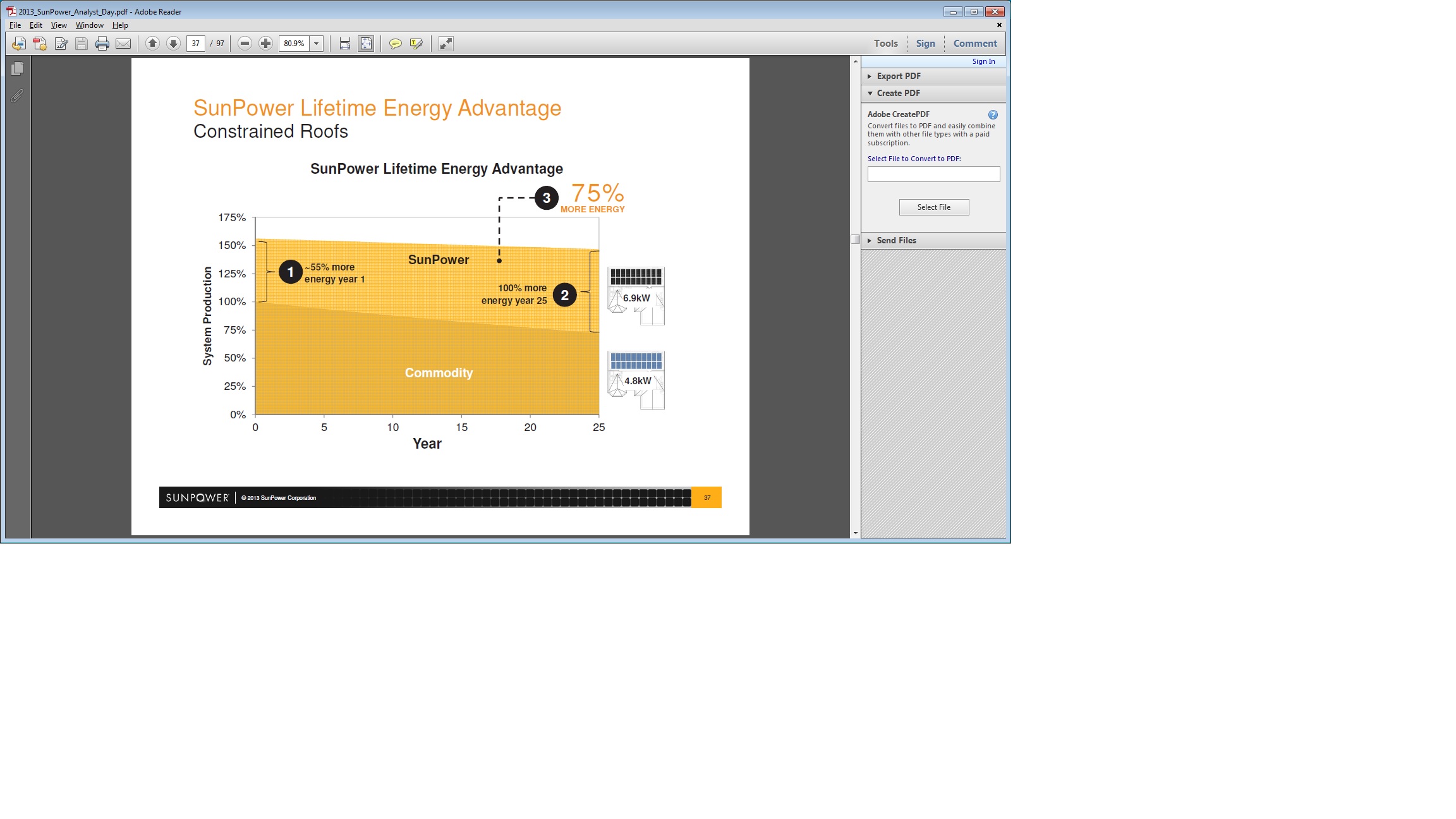

1. Walmart does not have limited roof space like you do on your own house. They don't need to fill entire roof. SPWR is much more valuable when roof space is limited!

2. Walmart's management is short term oriented and a solarcity system may be cheaper over the first few years, which will equate to better profits over the next few years, which means higher bonuses for the executives and better short/mid-term shareholder returns.

3. Military housing is the same thing. Lower initial lease payments, and we will worry about raises later...

4. Why did Verizon go with Sunpower? Why did Buffet spend over $2bn on a Sunpower Power Plant? See how pointless such a rebuttal is?

Solarcity has a real good business model, but if you calculate Levelized Cost of Energy (LCOE) then Sunpower comes out on top. Fortunately for Solarcity and other competitors nobody understands this concept and Solarcity is perceived to be the low cost provider. For that reason I own SCTY shares as well as Sunpower. I still have faith that eventually people will figure this out and Sunpower will come out on top, but if I am wrong then Solarcity will be the clear winner, hence I own both companies.

Once again, I am trying to help you guys. No reason to get defensive.

I would bet that 90% of the people on this board who own SCTY shares could not explain to me how their business model works, what they need to accomplish in order to become profitable, or how one simple residential lease contributes to the top and bottom lines of Solarcity's Income Statement (over a 20 year period). I know that I sure as hell can't. But I can value Sunpower and know that it is significantly undervalued if you believe in the solar growth story; even after its 300%+ return in the past few months.�

1/1/2015

guest Hey now, I thanked you for the first bit of info you gave me. This is all very informative and I'm glad you spoke up. I will look into Sunpower. Do you know how the managemnt of the company is run? Do you like who is in control? Thats something I look at when investing.

Looking at their website it says they have dealers that you buy their product from. So they dont actually install it like solarcity? And they have a two tiered system of dealers - elite and premier. That sounds laughable......�

1/1/2015

guest Well there are several thankful people, but most responses I get are defensive without much elaboration.

Management is obviously not as good as Elon Musk, but I don't know much about Lyndon Rive so I couldn't compare him to SPWR CEO Tom Werner. I know that Sunpower has a great business plan and I would encourage you to listen to their May 15, 2013 analyst day presentation (it is on their website in investor section) and don't forget to download the slides. I heard the CEO speak several times and he sounds like a great leader. They understand their shortcomings and they are working on fixing them. E.g. right now it takes 6 months from when you sign a Sunpower Lease, including 3 weeks to get paperwork done, to when it finally gets installed. They want that down to 30 days in 2014. And by 2015 you will be able to order and setup financing on-line in 15 minutes and have your system installed within 15 days.

They have great innovative products, such as C7 Tracker that allows them to build a 1 MW system using only 170 KW of panels, while using 7 times less land. There are many things going in Sunpowers favor now.

Solarcity has the advantage in residential leases because it has the backing of Goldman Sachs and Elon's connections with them and this is HUGE! The only bottleneck in residential leases is financing. SCTY just announced a $500mn deal with Goldman, but that will only get you about 15,000 homes which is peanuts compare to SCTY's market cap. SPWR announce a deal with US Bancorp for $100 million, which is even smaller peanuts and they said they ran out of financing after installing only 2,100 units in Q1. This is a huge upside to solarcity and they might dominate the space if this keeps up. I am hopeful that Total S.A. (France's version of Exxon?), who owns 66% of Sunpower, starts funding some of these projects for Sunpower, but who knows).

I am long both companies and own both. I think Sunpower will be the winner, but don't want to miss out on Solarcity if I am wrong (which is very possible). One company will return 200% returns from today and the other 1000% returns. I don't know which it will be, therefore I own both companies although slightly skewed towards Sunpower.�

1/1/2015

guest What I like about SolarCity is that they keep everything in house, no dealers to do the sale, or consultants to do the permitting, or subcontractors to do the installations. From my personal experience, the employees who came to my house for the assessment were all well educated young professionals. They represent the company extremely well, it gives you the feeling that, yes, this company is the future, and they are here to stay.

Of course, one might get the same feel from SunPower, I don't know because I never had them over to look at the situation at my home--just went with SolarCity because of the Elon connection and it has been a great experience working with them so far.

Regarding the choice of panels, in my view I prefer a solar lease company who actually doesn't design and manufactur their own panels, but instead uses the most reliable panels that have been on the market for a while, like SolarCity does. They may not be the panels with the absolute highest output, but I prefer reliability versus a few more watts and a maintenance guy on your roof all the time.�

1/1/2015

guest SCTY often uses Chinese made panels, which are indeed less expensive than SPWR modules. But, as SCTY is the owner, and you get to use the power...do you care? Really? Do you care if your power company uses Siemens or GE generators? If the panels don't perform its SCTY's reputation and money on the line--and it really is money to them, as they do have to pay you back for kWh that aren't generated as per the agreement, and as they often sell SRECs, non-performing panels are a direct assault to their income stream.

I agree, I really like SPWR panels. But that said, the high wattage modules are cutting edge and quite expensive. IF you have a small roof, then they can make a lot of sense. But if you have enough space, the extra cost may not be worth the extra power. And don't forget, SPWR panels aren't domestically produced, so the "made in USA" factor isn't in SPWRs favor either. And financially speaking, for me I was better off with SCTY.

SCTY has several options, including outright buy. If you ask them, you can even lease and STILL get the SRECs. It's all in what you ask for. I found SCTY to be the most flexible and cost effective. Can't hurt to ask both companies and compare. For me, I pre-paid upfront, so for about 1/4 the cost of purchasing outright, I get to use all the power from the panels for the next 20 years, with no additional costs, including inverter replacement and panel repair. Would I have picked different panels and inverters if I were buying it for myself? Yep. Would I have over engineered it and spent more than I should doing that? Yep. But I discovered after thinking long and hard, all I really want is cheaper electricity, and after crunching the numbers from several different vendors, pre-paying from SCTY made the most sense for my situation.

Well, to each his own. If you like SPWR panels, buy 'em. But, if you don't really care about who makes the panels or the inverters, and you trust SCTY to back them up and be around for the next 20 years to service them, then it makes sense to give SCTY a call. To me, pre-paying for 20 years worth of power made the most sense. I could buy outright for 4 times the price, and still get the same amount of power in the end. The only down side I could find was that I didn't get to pick the panels and the inverters. I decided to trust SCTY to engineer it to work for them, and that works for me.�

1/1/2015

guest This statement is, to put mildly, very inaccurate. Solarcity uses mostly Yingli and Trina solar panels. These companies have been in business for only 15 years, and their only goal over the last several years has been to decrease costs; including using cheaper materials, production techniques, etc. Chinese solar panels are not reliable at all. I would encourage everyone to read this article from the NY Times about solar panel defects by Chinese Manufacturers (they also mention a US manufacturer, which is most likely First Solar):

http://www.nytimes.com/2013/05/29/business/energy-environment/solar-powers-dark-side.html?pagewanted=all&_r=0

When it comes to reliability, Sunpower panels are by far the most reliable panels on the market.

If you don't like that Sunpower uses a dealer network that is fine, but don't go saying that Solarcity uses more reliable panels because that is just incorrect. The Sunpower Dealers do all the paperwork for you just like solarcity does, only difference is that it is not in house. I can understand if you don't like this, but negatives are also offset by some positives: e.g. dealers are not on Sunpowers payroll, so this will help their net profit margins, and also allows them to scale much quicker (especially globally), which Solarcity may struggle to do since it requires huge capital investments for them.

Like I said, I like both companies and I am trying to educate you guys on other options to invest and make money. Some of Solarcity's strengths may become weaknesses in the near future. Right now there is an oversupply of panels on the market, which is a huge benefit to Solarcity. But the industry is consolidating, companies are going bankrupt, and capacity is coming off line. Demand on the other hand is only increasing. What happens if 2-3 years from now demand exceeds supply? All of a sudden Solarcity's biggest strength will become it's biggest weakness and the company could potentially suffer. This would hugely benefit a company like Sunpower who would make killer margins on its own products.

There are so many things that people are not factoring in when it comes to investing in the solar industry. The market is very reactive to this industry because it does not want to get burned again. I on the other hand am a very proactive investor. I have been buying SPWR on the way down starting at $7, then $5, then $4, because I knew it would turn around and eventually it did. Right now the company is only fairly valued if you consider no/small growth from the company (less than 10% per year); i.e. IMO it is grossly undervalued. But the solar industry is just getting started and I expect huge returns.

Solarcity will get huge returns too, but I cannot say that it is undervalued even after making a 40% correction.�

1/1/2015

guest 1. That is a point I am trying to make. If Solarcity guarantees you 12,000 KWh/year they will pay you the difference if the Chinese Panels underperform. But if Sunpower guarantees you 12,000 kwh then there is an extremely high probability that you will get that amount and then some more, because they are conservative in their degradation number on the lease contract and their panels will outperform (not to say chinese panels won't, but I have my doubts especially after 5-10 years based on some research I have seen). Chances are you will get a lot more than 12,000 and probably over 13,000 with Sunpower. 13,000 is better than 12,000, and you get to pocket the difference. This is one point that absolutely nobody takes into account when comparing Sunpower and Solarcity leases, but will make a big financial impact.

2. I agree that Sunpower is mostly beneficial to those that have limited roof space. Solarcity may be a better option if you have a big southern facing roof.

3. What I meant to say is if you are going through Solarcity then do not buy the panels (it shouldn't be an option to seriously consider); Lease them or PPA instead. If you are going through Sunpower then you may be better off buying because you get 25 year warranty and the panels will probably last 40 years or more.

Solarcity and Sunpower are both good options depending on your individual situation.�

1/1/2015

guest Thanks for the additional insights into Sunpower, I may take a closer look at them. I never said their panels are unreliable, just repeated what the SolarCity guys told me, and that is that they don't use the newest panels, only the tried and proven ones that have been on the market for a few years.

Regarding SolarCity being undervalued or not, my motto is that highs are eventually going to be tested again, unless there is something major going the wrong way for the company. I don't think your scenario of demand exceeding supply would be one of those. SolarCity is a major buyer and all a supply shortage would do is increase the cost of the panels to them. Which they would probably pass through to the consumers of their services anyway.�

1/1/2015

guest My research also had me deciding on Sunpower panels (and did not have the stock but will soon) I just wish Solar City would install Sunpower panels so the Elon triad gets a boost.�

1/1/2015

guest Press release from White House this morning about Obama's carbon reducing plans, http://m.whitehouse.gov/the-press-office/2013/06/25/fact-sheet-president-obama-s-climate-action-plan�

1/1/2015

guest

No carbon tax yet? Just carrots, same as in the past, and no sticks? Bad...�

1/1/2015

guest I think that the President sweating out there in the heat is very complementary to this speach.�

1/1/2015

guest doing good for SCTY atleast. Big buy and big up: 7.19%�

1/1/2015

guest What is considered a "small" roof? My house is about 2,200 sq ft.�

1/1/2015

guest I had miscalculated the start of the speech (damn time zones). Watching the graph jump like that so unexpectedly was an even sweeter surprise!�

1/1/2015

guest If that is a one story house then you will have more roof space than two story. You need southern facing roof space for best efficiency and you cannot have tree shade. East or West facing roof will deliver considerably less power.

A sunpower x-series panel delivers 345 W of peak power and takes up 17 sq. ft. If you want to put up a 10,000 sq. ft system on your roof you will need at least 500 sq. ft. of souther facing roof space. If you use an average Chinese panel that delivers 250 W, you will need 700 sq. ft.

To look at it differently: if you only have 500 sq. ft of space you can put up a 10,000 sq. ft. Sunpower System. But if you use Chinese 250 W panels, you can only put up a 7,200 W system.�

1/1/2015

guest Well I just found out that Solarcity only uses TXU in my area and we just switched to Gexa Energy in the Winter because TXU wanted 12 or above for the rate. Sucks. Maybe Sunpower will work......�

1/1/2015

guest Speaking of panel reliability: Sunpower just issued a press release about third party panel testing proving that they make the most reliable panels on the planet:

SunPower E20/327 Solar Panels Earn Unprecedented Rating for Reliability after Completing the Atlas 25+ Program - MarketWatch

Fortunately for Solarcity people don't really understand solar panels, LCOE, degradation, performance in extreme conditions, etc. Therefore Solarcity will do just fine, because people will never really understand this technology.�

1/1/2015

guest Hahaha. Thanks for the info, but you are harping on SCTY big time. You must have this hatred for their popularity deep down inside eh? Seems like you think SCTY is like a LEAF and Sunpower is a Model S.�

1/1/2015

guest Haha, I don't hate solarcity. I love the company, their business model, and what they are trying to do; hence I own the stock. I just don't like that they use Chinese Panels. The Chinese solar industry went from basically nothing 5 years ago to something like 80% of the worlds capacity today. They dump their panels on the rest of the world putting other companies out of business. Sunpower shares used to trade at $160 and then went down to $3.71 in 2 years. First Solar went from over $300 to $13 in just 2 years. This is all because of Chinese dumping. Q Cells, the biggest solar manufacturer in the world (German) went bankrupt and out of business because of China.

China has basically decimated the world's solar industry all through dumping. They get $billions and $billion from the government and yet even today their gross margins are still negative (classic definition of dumping) and some companies have higher net losses than they do revenues.

Solarcity is indirectly supporting the Chinese dumping strategy by purchasing their panels, and that is the only thing I don't like about the company. I wish they would get their panels elsewhere.

If this keeps up then China will put everyone out of business and then the rest of the world will be stuck with cheap panels. There will be no more companies left to innovate and the solar industry will not take off as quickly as it should.

Solarcity is great, but China not so much.�

1/1/2015

guest I see. Makes sense. But at least here in the US, don't you think some of the domination by China is because of the extreme legislation that is blocked mostly by Republicans......Our polictians seem to be stuck in the past, sombody has to move the world forward. I remember reading months ago First Solar starting a project in Syria because they know oil will be depleted in years to come....or something like that.�

1/1/2015

guest Well, Sleepyhead, it might be that SPWR shares went from $160 to $3.71 because of those nefarious Chinese...

or it might be that because there was no way in Hades the stock should have been at $160 in the first place...

or it might be because, after all, a silicon cell is a silicon cell is a silicon cell....and, ya know...that dratted thing called Commodity Pricing comes into play and those who are in the commodity-supplying business ought realize that Fungibility is the order of the day and their product for turning photons into electrons really, truly is no different from anyone else's and so it will be the Least Cost Producer who rules the day and the devil takes the hindmost.

So, you can talk all you want about how Subpower's panels are better and longer lasting and more efficient than the next fella's....but talk don't hold much water. Not in the world of commodity pricing.�

1/1/2015

guest Other than the huge run-up that happened for SCTY in May in anticipation of the SuperCharger announcement, over the last 6 months SCTY and SPWR are tracking pretty closely.

�

�

1/1/2015

guest What you wrote about commodity panels is what most everyone thinks about solar panels; and that is why a company like Solarcity will be very successful at least in the near/mid term, and long-term if these commodity panels stand the test of time which at this point is not proven. All Chinese solar companies make ~15% efficient commodity panels, while Sunpower makes 21% efficient panel with significantly lower degradation, better durability and reliability because it is copper plated. Consider these slides:

For those that have a constrained roof (and a high percentage of homes do have constrained roofs) Sunpower is a clear winner. On Slide 2 you will see that a Sunpower panel can produce 55% more energy in year 1 and then due to lower degradation 100% more energy in year 25. Nobody really understands this and Sunpower is trying to educate people on this topic. Enough people understand this concept and Sunpower basically sells out all the panels it can make, which is 1GW/year but will expand to 1.5GW/year in 2 years.

I agree with you that cost is a big factor, and Sunpower is a little behind. But costs are falling so quick that in 2-3 years efficiency will rule. Right now a SPWR panel costs something like $1 and a commodity panel $0.60 to make. At 21% efficiency vs. 15% efficiency you might be better off buying a commodity panel TODAY. But Sunpower's roadmap is to reduce the x-series panel cost by 35% by 2015 and increase efficiency to 23%; so at $0.65 you will get a 23% efficient panel. If commodity panels go down even to $0.40 at 15%, Sunpower will be the clear choice. It costs about $5/Watt to install panels on your home today and once panels get that cheap in 2 years, efficiency will rule.

In order to make money in stocks you have to be able to look into the future. Obviously there are a lot of things than can go wrong for Sunpower in the mean time, but the way I see it SPWR will do very, very well and that is why I own the stock. Solarcity will do very well too, but it is a much more volatile/high risk play. I will put most my money in the less (but still highly) volatile SPWR, but I still own a good chunk of SCTY shares as well.

If you want to buy SCTY shares then great, you will probably make a killing. But if you want to put solar panels on your roof, Sunpower is a no brainer. Would you rather buy a Kandi/BYD or a Tesla vehicle if your only goal is to go from point A to point B over the next 20 years? Both cars will work, but which one has a better chance of performing 10 - 20 years down the road? I would bet that Tesla's battery degradation will be a lot lower than Kandi's/BYD's? Just like SPWR panels will have lower degradation vs. commodity panels.

Here is a link to Sunpower's Analyst Day event (first one in 4 years). If you don't want to listen then at least download the slides and take a look at them:

http://investors.sunpowercorp.com/events.cfm

Side note: Has anyone done any research on Sun Edison (SUNE) formerly known as MEMC something... (WFR?). I have a gut feeling that this might be a good solar play as well, but don't know much about the company.�

1/1/2015

guest Ok sleepyhead, that convinced me to make a small initial investment in SPWR, now the race is on! :biggrin:�

1/1/2015

guest Is the "copper plated" technology proprietary and patented by SPWR?

Is it possible that the efficiency of the commodity pannels will increase the same 23% by 2015? If yes, the situation will be the same as today.

If/When SPWR panels beat the commodity panels, SCTY can just switch to SPWR panels.

So it looks like SCTY is a winner here. They can use the whatever panels they like. As you say yourself "you might be better off buying a commodity panel TODAY", so SCTY uses them TODAY. If it makes sense, they will use SPWR panels tomorrow. At any time, SCTY reduces the risk and increases the profitability, so SCTY looks like a winner to me, compared to SPWR.

Comparing Kandi/BYD glorified golf cars to Model S is ridiculous. There's no analogy that can be transferred to SPWR vs SCTY.

If you want an analogy, you can compare something like different roof materials. A more durable but more expensive roof material compared to a less durable but a cheaper one. Then it would be interesting to see which roof material is more successful in the market.�

1/1/2015

guest Thanks for the link. I took a look at the PDF, very interesting....I might have to invest in this company as well.�

1/1/2015

guest 1. Its not just the copper plating that makes the panel; copper plating is just complementary to their design for longevity. I am not an engineer nor expert in this field. I just go off of independent tests, research, articles, company press releases, etc. I have done a lot of research on the solar market in the past year, since I had 100% of my money invested in Sunpower (I did pretty good). I am sure that they have intellectual property, but they use higher quality materials which are more expensive. There are some companies that have their own technology and make very efficient panels like Sunpower's (some Japanese Companies?).

2. Commodity panels are commodity panels and the only thing that really differentiates them is price. That is why there is such a race to "who can cut costs quicker". This leads me to believe that there might be some quality issues in the future (just my personal speculative opinion). They all have about 15% efficiency and will not go up much unless you complete change the technology which will lead to higher costs. Maybe they can get up to 16% or 17% (although I am not sure), but definitely not 23%. When it comes to solar panels, it is a lot easier to reduce costs than to increase efficiency.

3. First Solar makes something like 12% efficient panels, which are cheap. They are very competitive in the power plant business, but not so much in residential. They just purchased a startup called "Tetrasun", because they claim they can make 15-20% efficient panels at the same low cost as their thin film panels. They want to enter residential and distibuted generation business.

4. I agree that it would be great if prices go down and SCTY starts buying SPWR panels. I hope that this happens. Yes, this will make SCTY the clear winner, but only in residential and some commercial applications. But don't forget that SPWR has a power plant business (just sold one to Buffet for $2-$2.5bn). Obama yesterday announced 10GW of new power plants - clear winner here will be FSLR and SPWR in second place. SPWR will also leverage the contacts of its owner Total S.A. (French Oil Giant) to gain business globablly; especially in Saudi Arabia who wants to get electricity from solar so that they don't have to burn oil and can export it instead.

Yes SCTY will be the clear winner in residential, but SPWR will be better than SCTY in power plants and will do better globally as well. That's why I own both companies.

The biggest reason I own SPWR right now is that they just turned profitable and are expected to do about $0.80/share in 2013. This is about a 20x PE ratio, which is a steal for a growth company (note: these guys are sandbaggers just like Steve Job and Elon Musk, so I personally expect over $1 EPS for 2013). They have about $2.6bn in revenue and will only have about $100mn in net profit to get to $0.80/share.

If they can grow their revenue to $3bn and get $200mn in 2014 that will be about $1.60/share and a $40 stock price. If the economy doesn't tank (which unfortunately is a realistic possibility) they will have 50% more capacity in 2 years time and by 2016 they should be making $4bn in revenue. Imagine $500mn in profit and you have $4/share and a $100 stock price. That is my investment thesis behind Sunpower and it will materialize if we don't hit another major recession.

Chinese companies are losing money quickly and with recent tariffs in place, etc. they will have to start selling panels at higher average selling prices. They have negative gross margins and will go out of business soon if something doesn't change (STP, LDK). They have to start selling these panels with positive gross margins, because the Chinese government will stop subsidizing these companies to lose even more money. This should allow other global manufacturers to start increasing margins.

Edit: I agree that my analogy was bad. My point was that people ignore degradation on solar panels, but make a big deal out of it in their EV's battery. I just don't get why.�

1/1/2015

guest What do you guys think of Canadian Solar (CSIQ) ? Stock is up 13% today.�

1/1/2015

guest Canadian Solar is one of the better Chinese Solar companies (don't know where the "Canadian" came from). Chinese solar companies are priced to fail and there will be many 10 baggers (900% returns in the future) in there. The risk is high though, since some may go out of business. I have owned chinese solar companies in the past but have not made any money. I think that Trina Solar might be a potential Chinese winner as well.

I keep trying to get into these Chinese stocks, but I just don't know when to get in. They are going to take off big time, but I feel that this is 1-2 years away. In the mean time I keep my funds in TSLA, SCTY, SPWR because those are winners right now. I don't want to tie my funds to chinese companies now and miss out on big returns from other companies.�

1/1/2015

guest I think this is one of those industries where a rising tide lifts all ships. I'm spreading my investments across the whole industry. Solar has been coming for a long time (kinda like Tesla) but I think we are at an inflection point right now.�

1/1/2015

guest The whole talk about how SunPower cells are 21% efficient while rest of crowd is just 15%... It is very misleading and not close to reality.

SunPowers cells should be compared to monocrystalline solar panels, and they generally got 17%-19% efficient cells. With many actually exceeding 19% efficiency. Like cells from AOU, Sanyo, Jiawei...

And if you compare 21% to multiple cells on a market that are "only" 19% efficient, the difference is not that striking, as in the case if you would be comparing them to 15%. And yes, there are lots of offerings of monocristaline cells from China. But last time I have heard, most of SunPower cells were not produced in Western World too. Their biggest plant located in Indonesia or Philippines - somewhere there.

And such choice, basically sunpower lying outright, by choosing not the panels they actually compete against on the market, but lower end of polycrystalline solar panels, place a shadow on that whole crappy presentation SunPower pulled out...�

1/1/2015

guest Just wondering, what do you have? and have u researched alot? I myself have TSLA, SPWR, SCTY and REC(Norwegian)�

1/1/2015

guest The reason Sunpower is comparing its panels to "commodity" panels that are 15% efficient is because people don't understand why they should pay $1 for a Sunpower panel when they can get a "commodity" chinese panel for $0.60 (like the ones solarcity uses). Investors don't understand this either, and Sunpower held an analyst day to try to convince analysts/investors that they are going to succeed.

There are other manufacturers that make almost as efficient panels as Sunpower, but their costs are a lot higher than "commodity" panels (just like Sunpower's) and will not take away business from Sunpower in the US. Whereas the cheap Chinese commodity panels are taking away business from Sunpower in US, and that is why they compare their panels to commodity panels in their presentation.

Tesla is guilty of worse things in their presentations: such as using 300 mile range on Model S and comparing it to Nissan Leaf's EPA estimated of 73 miles. They should have used their own EPA estimated range of 265 miles instead.�

1/1/2015

guest Does Sunpower get any ongoing revenue from the solar power plants they build? Or is it just a one-time revenue item (ie., like a construction company would bill)?�

1/1/2015

guest

With power plants you have to follow Revenue Recognition principles. GAAP and IFRS principles differ, so Sunpower is not profitable on a GAAP basis. But they are profitable on an adjusted basis, which they use IFRS as a basis and then take out one-time items such as restructuring, and take out employee stock compensation (I disagree with taking this out since it as an actual cost to shareholders, but many companies do this).

To answer your question you get to recognize revenues as certain milestones are achieved. So if they sold the $2.5 bn Antelope Valley Project to Buffet's Mid-American Renewable energy, they won't recognize the entire revenue until the project is completed in like 2 or 3 years or so. They started construction on it this year, so they will be recognizing revenue as they build the project over the next 3 years. Maybe they use percentage of completion, maybe something similar. But it is still better for P&L than a 20 year residential lease.

Important to note that Sunpower expects to be profitable on a GAAP basis sometime in the next 1-3 quarters and this should give the stock a good boost.�

1/1/2015

guest The analyst presentation linked above explains this really well around 1:45:00 in.�

1/1/2015

guest Here is a good Bloomberg article that just came out on Solarcity. It talks about the risks associated to Net Metering and how Solarcity plans to implement battery storage to combat those risks in the future:

http://www.bloomberg.com/news/2013-06-26/solarcity-says-batteries-reduce-risk-of-utility-backlash.html?cmpid=yhoo�

1/1/2015

guest nm.�

1/1/2015

guest Here�s a letter I received today from Jan Schakowsky who represents my suburban Chicago district in Congress. It�s not a form letter. It�s in response to my notification to her of SolarCity�s initiative in Nevada and my suggestion that Illinois should seek similar involvement. SolarCity currently does not service Illinois despite Chicagoland being a huge market.

_________________________________________

Dear Mr. Renz:

Thank you for writing to express your support for solar power and incentives to speed its implementation in Illinois and across the country. I appreciate hearing from you, and I agree with you.

I agree that Illinois can be a leader in solar energy development. Illinois has some of the best research universities, entrepreneurs, and workers in the world, and our state should leverage those advantages to attract the green energy jobs of the future. I have spoken with state and local elected officials about this, and I will certainly ask them to investigate the Nevada initiative and see whether it can be replicated in Illinois.

I will do whatever I can to help attract solar, wind, and other advanced green energy companies to our state.

Again, thank you for reaching out to me about this important issue. Please let me know if I can be of any further assistance to you in the future.

Sincerely,

Jan Schakowsky

Member of Congress�

1/1/2015

guest Congrats to all you SCTY longs on the rebound. It didn't quite get to my buy-in level (close) so I missed the boat on this new bump. MUSK ETF FTW!�

1/1/2015

guest Curt -

I beat you to the punch in re-establishing my SCTY position...by about 48 hours....which means I was sucking wind for that time as it appears you got in quite close to that recent low. Good job - well done!

Now let's hope we can get a bit steadier a gain than was occurring back in May. That was a really frantic period.

All: take a very, very close look at claims that "our product is different", and read peer-reviewed work on PV panel technology and associated efficiencies. Make up your own mind whether or not a marketing claim is something akin to New! Improved! Tide. Now with SuperSuds!!!!

�

1/1/2015

guest Cheers!

Regarding the SPWR vs. SCTY debate: I've personally only invested in SCTY so far... those are two VERY different companies. SCTY is a bet on solar power IN GENERAL. You don't really care who produces the panels, you only believe in solar as a viable energy source. SCTY will buy from whoever produces the best panels in terms of price/efficiency ratio. It's a "pure" bet on solar as a whole.

SPWR on the other hand is a PRODUCER of solar panels, so you aren't really betting on solar as an energy source in general, but on a specific producer and thus hoping they'll win against the competition of other producers. I don't know if that will be the case.... I would need to see some kind of sustainable and definitive advantage which so far I haven't seen (but I haven't researched the company much).

Maybe we could put together a few names of the best solar panel producers and invest in all of them hoping to hit the majority of the winning ones.... that would reduce the risk of investing in single panel producers.

BONUS question: does anybody have any predictions/good estimates for SCTY's Q2 to point me towards? When should they be released?�

1/1/2015

guest I'm afraid I disagree with your analogy. I don't think that SPWR and SCTY are actually comparable, and certainly they aren't in direct competition. SCTY is a company that leases resources (roofs) and invests in equipment (panels) to make money on a consumable (electricity) using an innovative financing model. It's more comparable to leasing farmland, buying tractors and growing stuff on the land, than manufacturing solar panels.

(Oh, BTW, I'm long both, and enjoying it immensely.)�

1/1/2015

guest Recent SolarCity Press Releases:

June 26 � Lightweight Mounting for Commercial Buildings

http://www.solarcity.com/pressreleases/188/SolarCity-introduces-LightMount%E2%84%A2-for-Commercial-Buildings.aspx

June 25 � SolarCity on Walmart Roofs in Maryland

http://www.solarcity.com/pressreleases/186/SolarCity-Introduces-Energy-Explorer-to-Make-Energy-Efficiency-Simple-and-Free-for-Every-Residential-Solar-Customer.aspx

June 25 � Software to Monitor Energy Usage

http://www.solarcity.com/pressreleases/186/SolarCity-Introduces-Energy-Explorer-to-Make-Energy-Efficiency-Simple-and-Free-for-Every-Residential-Solar-Customer.aspx�

1/1/2015

guest SPWR doesn't just produce panels. They also sell/lease full solutions (like SCTY). The difference really is that SPWR only sells systems that use their panels. Well, that and that SPWR does power plants.�

1/1/2015

guest I completely agree with this statement. But my line of thinking is that Sunpower is currently undervalued and Solarcity is "overvalued". Solarcity would be the better investment if both companies were fairly valued, but it already has a good chunk of growth baked into its market cap. Sunpower is valued like a mature company (like an Apple or Microsoft) when it is a growth story. That is why I have more money in Sunpower right now. I feel that a 20% increase in revenues could cause a 100% increase in net profit. Sunpower in the short run (next 2 years) looks very appealing to me. Solarcity looks better to me in the long run though 5-10 years.�

1/1/2015

guest

+1

This is exactly why im long scty, im sure spwr are selling great products but there are so many things that can happen and so many technologies that can change the game. SCTY on the other hand can pick and choose their supplier as much as they want and are not locked in with one technology, which makes it a safer bet on the general solar industry overall. This and the Elon Musk connection which it will benefit substantially from both in its ability to raise capital and also in its ability to generate free PR and penetrate the publics mind so that they will both buy their products and stock.�

1/1/2015

guest Great idea! Just two days ago I noticed there was little activity on this thread. Since then we've filled 6 pages of really good discussion. I learned a lot from the SPWR versus SCTY exchanges. A special thanks to sleepyhead for his passionate debate and detailed responses. And for the suggestion to add SPWR to the portfolio, I already made a few bucks after opening my initial position today :smile:.�

1/1/2015

guest If I do buy some SPWR shares now at $20, is it worth it? I know it was at $160, but that was awhile ago. I bought my Solarcity shares around $10.

Also, I agree, thanks for the valued debate from sleepyhead.�

1/1/2015

guest In the long run $20 should be a good price for SPWR. But remember the stock has gone up 6% yesterday and 7% today (add another 3% from Wednesday's bottom). Anything can happen in the next few days. If you don't buy now then wait for a pullback and buy before their Q2 earnings. Company guided for 5c-20c per share, and the analyst consensus is at 10c. Remember these guys are sandbaggers like Elon. I think they might raise guidance for the rest of the year (but this is pure unsubstantiated speculation) on my part.

The correction in the general market may not be over yet. If things get ugly again then Sunpower will probably go down another 10%-20% from here. It is hard to say.

- - - Updated - - -

Here is what will happen to Sunpower tomorrow. It will open and start going up in a straight line pretty quickly to about $20.90 or 3% within the first 3-5 minutes. Then it will go straight down for a few minutes to about 20.40. Then it will go back up to 20.60. If it can retest that 20.90 then it will be another big day of gains. If it only goes to 20.60 and starts coming back down then it will probably be a down or flat day for Sunpower.

This is assuming that we have a flat or positive day in the market. If the market gets scared again due to some minor economic news then Sunpower and other solars will give back a good chunk of gains from the past two days.�

1/1/2015

guest And Sunpower is mostly owned by Total (French oil company). They have access to very low cost money. I recall an article that made this point that it provides Sunpower with a financing advantage in the areas where Sunpower competes directly against Solar City.�

1/1/2015

guest Thanks for all the good advices so far, got in on SPWR some days ago because of you.�

1/1/2015

guest Just like I said yesterday evening. The stock started going up for a couple of minutes after market open and reached $20.79 at 9:32 EST and then went straight down to $20.36 by 9:35. It is 9:39 right now and the stock rebounded to $20.60. If it can retest that $20.79 and break through then it might be off to the races today again.

I wish I could do short-term trades but my broker won't allow for that becuase you have to wait 3 days for cash to settle �

�

1/1/2015

guest why the 3% down in the afternoon today, this is non sense�

1/1/2015

guest There was an article this afternoon, Securitization And MLPs Can Help Solar Developers Cut Funding Costs - Seeking Alpha , which if you just skim it could look like it was saying that SCTY will be facing increased competition in their financing model. The way I read it is, "Solar City got it right!". At worst, they might lose some share of a much bigger pie. I think (predict) there will be a rebound tomorrow. (I wrote that before I checked the after hours, and they were up a bit.)�

1/1/2015

guest ^ how can a single minded article result in such a big drop, unlikely imo, big investor are playing their emotion card me think...�

1/1/2015

guest Well other solar stocks also moved down around the end of the day. I guess it might have been caused by profit taking after the big run up of the last few days. The first sellers made the stock tumble through some stop loss orders.�

1/1/2015

guest Killing it today. Trading in sympathy with TSLA again?�

1/1/2015

guest To me it feels like the stock needed to go up from the low 30s.... and the positive TSLA movements just helped investors make that buy decision even more.�

1/1/2015

guest Sympathy with Tesla, could be.

Also I have noticed a lot of articles in the last several days about SCTY testing and deploying large TSLA batteries, and how this will ease conflict with utilities, as it will reduce the phenomenon of using the grid as storage. Utility companies have been balking at this because of having to buy the excess power during peak use, which gets expensive by reducing margins for them.

Maybe its more like synergy with TSLA?�

1/1/2015

guest I Agree... I think investors see that the two companies are quite complementary and may have a lot of opportunities for collaboration in the future that would turn out to be mutually beneficial.�

1/1/2015

guest Curt - are you seeing an opportunity with the downward pressure this afternoon?�

1/1/2015

guest I highly doubt tomorrow will be negative and even more by end of week, no reasons for it unless major news�

1/1/2015

guest

I bought back SCTY on June 24[SUP]th[/SUP] after having sold on May 28[SUP]th [/SUP]to avoid the inevitable pressure on the price before and after the IPO lock-up expiration. Then SCTY had a nice run-up for a week. Apparently there are still IPO investors looking for opportunities to realize their gains. Trading activity is expected to be exceptionally light on Wednesday and Friday, which would have made it difficult for them to find buyers of large blocks of shares. So they seem to have chosen today. Indeed, that may have presented others with an opportunity.�

1/1/2015

guest i heard there will be a job report announcement this friday ? what is that about? i don't see any official news about it�

1/1/2015

guest Happens every Friday.�

1/1/2015

guest lol, wasnt aware, where can i find more details about it ?�

1/1/2015

guest I assume you are not referring to something specific to SolarCity. On the first Friday of every month at 8:30 am ET the US Labor Department issues a report of the previous month's changes in nonfarm payroll and the unemployment rate. Here is a link to the report issued on June 7th: http://www.bls.gov/news.release/empsit.nr0.htm�

1/1/2015

guest The jobless claims is the one that happens every week, and that one is on Thursdays (Except for the one issued today, because tomorrow is a holiday). The jobless claims number is the most important economic indicator to look at because it comes out closer to real-time than any other indicator. It is only one week delayed vs. almost one month for the jobs data and 2-3 month delay for the quarterly GDP report.�

1/1/2015

guest Man, all this talk makes me feel even more left out. I have been eyeing SCTY since it's been it was at $18 but didn't know how to value it so I stayed away. My Roth IRA has been all mutual funds so I think I need to change that quick. I am only 27 and don't need the money for 40 years so I might as well put it in SCTY and SPWR, even if there is short term potential to the downside. I don't want to miss any more big moves.�

1/1/2015

guest There will be big moves in solar stocks over the next month or so due to earnings releases, European tariffs, Chinese plans to move to solar etc. The question is in which direction will they move, and I am confident that they will go up.

When I look at the solar sector it is still significantly undervalued. Some companies are priced to fail (and they won't fail), and none of the companies are yet priced like growth stocks (which they are). The only company in the entire sector that is not priced on fundamentals, but rather on potential future growth, is Solarcity.

Yes, solarcity will probably turn out to be a great investment, but there are so many other stocks that can do just as well and possibly better in the short run.�

1/1/2015

guest Yeah it was hard for me to know how to value SCTY before investing. Prior to IPO I read through their IPO prospectus, watched their roadshow presentation and researched the market. But with SolarCity it was difficult to see how much revenue they'd generate over what kind of period because they're deferring revenue with leases and post-lease they own the panels/system. The company seems to be very, very forward looking... more so than most any company I've been exposed to. It seems like they're thinking 30+ years out and building relentlessly with focus and execution.

Anyway, I eventually invested because I remember Elon Musk saying that he thought the original IPO price of $13-15 was a fair price for investors (though it IPO'ed for lower). I was hoping to get it under $10 when it IPO'ed, but it keep rising. I eventually got in at $14. Since then, I've been following all their quarterly earnings calls and they seem just so confident. It really seems like they're in position to exceed guidance for pretty much every quarter for the foreseeable future. There's really just that much demand and they're the market leader in residential solar.

After Q1 earnings when the stock was $30-35, I was really wanting to put more money into it but I completely ran out (purchasing TSLA options and such). Then, the stock made a run to $50+... and then came down after the lock-up expiration.

I think getting in at SCTY when it was recently under $35 was a super investment. Even now, if you're holding long-term, I think it could be a very good investment. Again, I think they're going to beat Q2 earnings and they're headed to profitability by the end of the year.

The main reason I have more money in TSLA than SCTY (other than I know TSLA and believe it in more) is that the solar sector tends to be a bit volatile and trendy. People used to love solar stocks, then they hated them, and now they're starting to love them again. I'm kind of worried in a few to several years if we have a downturn if the mood will sour again and solar stocks will be hit hard. Probably. But I'm sure the good ones will be much more established by then and will weather the storm. SCTY is probably one of them.�

1/1/2015

guest I have maybe asked u this before, but since u seem to follow solar Close, what other than sunpower Stock do u recommend?�

1/1/2015

guest Well, you called it. SPWR up 10.24% today, FSLR and SCTY near 2%. I sat and watched on my phone thinking "Somebody said this was going to happen."�

1/1/2015

guest I would like to be invested in SolarCity. I like that they are a play on Solar without the risk of being in the solar panel manufacturing business.

But I just cannot bring myself to pay for a stock that is trading at over 10X revenue.

Market Cap is about $2.9 billion.

Sales revenue for 2014 is about $200 million to $270 million.

That is really expensive. I realize it is growing fast and might grow into that valuation, but the stock does appear to be priced very expensively.�

1/1/2015

guest So I put in a sell order on Wednesday last week to sell some mutual funds in my Roth IRA with the intent to buy SCTY and SPWR with the money. I put the order in too late for the mutual fund selling to happen until COB Friday, AFTER SPWR went up 10%. Now I get to decide whether to wait for a dip or just buy now and not look at it for a couple years, haha.�

1/1/2015

guest I have done a bit of research on solar and came to the conclusion that SPWR was the safest and best pick, therefore up until recently I held virtually 100% of my money in SPWR; after the 400% run-up, I decided to "diversify" and bought a bunch of TSLA since I realized that it is actually a safer pick than SPWR, albeit with smaller return potential (at least in the short-run). Recently I bought a little bit of SCTY after it pulled back into the mid 30s, but whereas SPWR is undervalued, SCTY is overvalued so I think SPWR still offers the better risk/return profile.

I don't believe in FSLR because they are basically a pure power plant builder, and their panels are not very efficient. With their $4/share EPS and $40 stock price the market is valuing this company like a mature company and I think they got it right. Plus other more efficient Chinese panels are catching up in price with FSLR and I can see FSLR as potentially going bankrupt in 5-10 years. They do have the strongest balance sheet in the industry though. They also recently purchased a startup called Tetrasun which supposedly has the technology to build very efficient panels at a low cost to compete in the rooftop segment and to compete with SPWR, SCTY, etc. This technology is not proven though: if it works it will be great, if it doesn't then the company is toast in the long-run.

SUNE - Sun Edison (Formerly MEMC Electronic - WFR symbol). I haven't done much research on this one, but I have a feeling it might be a winner too based on a gut instinct. I will stick with SPWR though.

High risk/high reward pick is RSOL or Real Goods Solar. They have a similar model to SCTY but with a $70m market cap vs. $2.9b market cap of SCTY. They are on the verge of missing a debt payment which is small and can put them into bankruptcy. But I have a feeling they will get financing from some bank and it will become a non-issue. Don't really know hardly anything on this company, but it has potential to be a 10 bagger if everything goes right. Highly speculative play. If anyone does research on this company please report back to me.

Wild Card - Chinese Solar stocks. I have a feeling that these stocks are about to take off and yield huge returns. Some companies like Canadian Solar CSIQ have already gone up 400% or more in the past few months; but is still cheap. The problem I have with Chinese Solar is that I bought into a few stocks a couple of times and always ended up not making any money. It is hard to say if they already bottomed, but if you have a 10 year time horizon then it might be worth putting some money in Chinese Solar today. They might have already bottomed, but it is impossible to tell. I can also envision a scenario where I buy some Chinese Solar only to watch them stand in place while SPWR and TSLA continue going up. It is all about timing with these stocks, but they are very cheap.

As it stands I still have more than half my money in SPWR, a big chunk in TSLA and a smaller position in SCTY. I will rebalance my portfolio based on price movements. E.g. if Spwr goes up another 50% and SCTY goes down 50%, I might put all my money in SCTY. I am not afraid to take risks though. Diversification is for those who don't know what they are doing or for those that have too much money (read: $millions) to risk losing it all. Problem with my stock picks is if we hit a recession then these stocks will tank more than the market. But I think that the US economy is only starting to take off and is on the verge of doing very well.

- - - Updated - - -

I bought some SPWR last week at $21.10 and then more at $22. Earned more than 10% in two days on those purchases, even though I wasn't sure if the run-up will continue just like you. I pulled the trigger because I figured that after earnings are released in a month or so the stock will be way higher than $22 anyway (note that I am bullish on their earnings but if they do disappoint then the stock will tank). I am glad that I pulled the trigger, but at $24.50 I am not sure if I would pull the trigger that easily. The stock has run up 40% in the past week or so and it will correct eventually.

SCTY has not had a big run up in the past week though, so if you are looking at a long-term investment then it might be a good time to buy. Remember though that I personally cannot recommend this stock because I don't know how to value this company. You are betting on continued growth (which will happen) and continued high valuations (which will continue in a bull market, but not if we hit a recession).

Just last week someone posted a very similar question after the stock went up from $17 to $20. He was wondering if he should get in now or wait for a pull-back? I told him in the long run $20 is a good bet, but in the short run it has hard to tell when a correction is coming. I hope he bought at $20.

I have been pushing this stock since a couple of weeks ago when it fell to $17-$18, and I was very confident it was undervalued back then. At $24, it will have to beat guidance and analyst estimates this quarter in order to continue its rise. I think that it will, but I could be wrong. If they only meet guidance for the rest of the year then the stock is probably fairly valued at $24.

My investment thesis in SPWR is that this is only the beginning and it is only starting to take off. Last year when it was trading in the single digits $, I told my friend that it is going up to $50 in 3-4 years. He kept watching it go up and finally bought in at $13, which was basically the top. He watched it go down to $9 but held on and today is reaping the benefits.

Now I think that the stock will reach $50 within the next 12 months. If there is some "irrational exuberance" (like with Tesla) in solar stocks in the near future (like there was in 2008), then I can easily see SPWR going up to $100 - $200 in 2 - 3 years. Note that this scenario is not very probable, but I still see it as a small albeit realistic possibility.

I think that Solar is only starting to take off. Look at all the "experts" that keep bashing the industry, this is a good contrarian indicator just like with Tesla 3 months ago. Once everyone becomes bullish on solar will it be time to sell. I put my money where my mouth is, so if I am wrong then I will feel (probably much more than) your pain too.

- - - Updated - - -

It was European tariffs on Friday. Rumor is that Europe and China are making progress in negotiations to agree on a minimum selling price in Europe. China supposedly proposed $0.65 even though some make and sell (at a loss) below $0.50 right now. Rumor is that Europe will seek a higher price than $0.65 though.

No matter the solution in Europe, it will be good for Sunpower. If you have to pay higher prices for Chinese panels then you might as well buy highest quality Sunpower panels, especially since they are coming down in costs quickly. Lets say that Europe and China settle on a minimum price of $0.70; sunpower can probably reach those prices (at least as far as cost to produce goes) in a couple of years and become a no-brainer choice.�

1/1/2015

guest Thanks for your advice! It's my IRA and I'm only 27 so now's the time for me to be a bit more risky.�

1/1/2015

guest Such a jump with no news? Not that I mind the near 8 percent change today...�

1/1/2015

guest I got in this morning at $24.16 for SPWR and $39.31 for SCTY. Even though SPWR went down a little today I feel relieved for finally pulling the trigger and buying. It's my IRA so I'm taking the long term view (and not trying to get too happy about SCTY's awesome rise today).�

1/1/2015

guest Thanks for the advices once again sleepyhead!�

1/1/2015

guest I gotta thank you too sleepyhead. I wanted to pick the best of the solar stocks and with your evaluation on Sunpower I decided to buy Jan 14 Options and those have since doubled. Way outperforming SCTY though I expect them to catch up in the next couple months.�

1/1/2015

guest I actually bought some more SPWR today as well. A few hundred shares at $23.62.

- - - Updated - - -

It's good to be investing in both companies. They will both do well in the long run, but if one is outpacing the other than it might be prudent to shift some money to the underperformer. I am actually doing this now with SPWR and TSLA. I shift money back and forth; when one of the stocks corrects I put more money into that one if the other one performed well recently. I do this in my 401k though, so I don't have to worry about taxes. In my personal accounts it is buy and hold for now.�

1/1/2015

guest Germany Sets 23.9 GW Solar Power Generation Record! | Inhabitat - Sustainable Design Innovation, Eco Architecture, Green Building

Green Energy Technology June revenues hit 20-month high

This might explain why Solar City rallied into the close.�

1/1/2015

guest but why only solar city was hit ? first solar didnt move a bit !�

1/1/2015

guest Bloomberg video with SunPower CEO Tom Werner:

http://www.bloomberg.com/video/sunpower-ceo-n-america-solar-demand-phenomenal-t7TE8MMkQ~~n_M6W4D0pUA.html?cmpid=yhoo

Lots of interesting information!�

1/1/2015

guest Here is another Bloomberg article with a lot of interesting quotes from SunPower CEO as well as some Analysts:

Cheapest Solar Panels No Longer Best, SunPower CEO Says - Bloomberg�

1/1/2015

guest Very interesting Bloomberg interview with Baird Analyst Ben Kallo. Download the audio file and listen:

http://www.bloomberg.com/news/2013-07-10/baird-s-kallo-says-solar-investors-are-upbeat-audio-.html?cmpid=yhoo�

1/1/2015

guest I have some good shares in SCTY at 11, I was thinking of dipping into SPWR. What price point do you guys think would be a smart move to buy some shares in this company? Should I purchase if it drops to 20 or do you think that is going to even happen at this point?�

1/1/2015

guest Earnings are about 3 weeks away and there is no way the stock is going down to $20 before earnings without some kind of big correction in the market. If you think the market will correct in the next 2 or 3 weeks then wait before getting in.

I think the time to buy SPWR was yesterday when it dipped to $23 a day after reaching a new 52-week high of $25.30. I bought in yesterday and think there is a better chance that the stock will be above $25 by earnings than below $20.

That said the market has had a 4 day winning streak so it is bound for a down day or two in the next few days.�

1/1/2015

guest Read a bunch of the links littered around these parts and your very helpful posts yesterday. I'm in at $23.19 in my Tax-free account.�

1/1/2015

guest Sleepyhead,

Thanks so much for your posts on SPWR. With the expected strong second half of 2013 as hinted by the CEO, where do you see SPWR in terms of stock price at the end of the year, barring any major recession or black swan type events?�

1/1/2015

guest Geesh, another great day for solar stocks. Up 11% for SCTY and 4.8% on SPWR since I bought in on Monday. I was silly having that retirement money originally in mutual funds while I'm nowhere close to retiring.�

1/1/2015

guest Del Webb Unveils Solar Powered Homes in Florida With SolarCity Nasdaq:SCTY

Solar City partnering with Del Web on a couple of communities ... Would love to see this rolled out to a greater extent�

1/1/2015

guest ongba - first of all it is important to note that the solar industry is basically a binary at this point. If it continues to grow and expand then the whole sector will be going gang busters for the next year or so. If on the other hand it stalls out, then there is still too much capacity on-line and a few more big companies would have to go bankrupt and the others would tank 50%+. The latter scenario would only postpone the great returns that the solar industry is inevitably going to yield. For the record, I believe that the solar industry bottomed out 6 months ago and the big growth phase is just beginning.

When I value companies I try to look at how much these companies are going to be worth in the future not how much they are worth today. Kind of like when Wayne Gretzy was asked what the reason for his success and he replied, "I skate to where the puck is going to be, not where it has been."

Note: I use adjusted numbers just like Wall Street does and not GAAP numbers. I can explain why, but if you do not understand this concept then you probably should not be investing in the stock market.

That said, let's dissect SPWR's EPS estimate for the year at $0.65 - $0.80 for FY 2013. If it reaches these levels this year and the company promises some minor growth in 2014 to $1/share then you can put a 20 - 25X PE ratio on the stock and end up with a $20 - $25 stock price at the end of the year. Lets say that things end up a little worse than expected and my absolute worst case scenario is a stock price of about $16 by the end of the year. That is why I was advocating everyone here to buy SPWR when it was at $17 - $18 just one week ago (and many did buy it). You were basically getting a free option on a pretty successful growth stock. Remember a big recession or black swan event and SPWR could be in the single digits again.

Here is my base case scenario: SPWR beat earnings expectations by 189%, 127%, 29% and 267% in the past four quarters respectively. These guys are sandbaggers (and righfully so) and I expect them to earn $0.15 - $0.20 for Q2 vs. their guidance of $0.05 - $0.20. Add this to the Q1 number of $0.22 and you get $0.40 in H1. SPWR called Q2 a "Transition Quarter" and said that they are expecting good things financially in H2. Let's say $0.60 for H2 for a round $1/share for 2013. Now consider that panel costs will go down 20% by next year and efficiency will go up another 5%-10%. And with $3bn in Sales in 2014 all they have to do is improve gross margin by 2% to get additional EPS of $0.50/share in 2014. Let's say that they guide towards $1.30 - $1.70 for Q4. At these growth rates, we are looking at a 40x PE ratio and a $60 stock price within the next 12 months.

Here is my irrationally exuberant scenario: Lets start with the numbers - SPWR with $2.7b in Sales in 2013 and a 20% gross profit margin for $550m in gross sales. $380m in expenses and $80m in interest expense and you get about $100m in net profit. Not sure how to estimate taxes because they had huge losses, so maybe they won't have to pay any taxes at all, maybe they will pay more than expected. In either case fiddle around with my numbers a little and you still get the $0.60 - $1.00/share in 2013.

You can see that these numbers have huge leverage built into them!!! if Sales grow 15% in 2014 to $3.1bn and gross profit goes up to 25% then we are looking $800m in gross profit for 2014. Expenses are going down as well as interest expense because they just refinanced some bonds with cheap 0.75% convertibles. So let's say expenses are $400m. Take out some taxes and other items and you still have $300m in Net Profit or $3/share! Slap on a 40x PE ratio and we are talking $120 SPWR Price.

Considering that the Chinese are negotiating "high" minimum selling prices to Europe means that SPWR should gain good business in Europe and become profitable there again soon. They already have huge margins in US and the CEO just said yesterday the the "US demand is growing phenomenally". And that the other high growth/high margin Japanese business is growing really quickly as well. Basically $100 SPWR by next year is not out of the picture. Unlikely, but reasonably possible.

They just need to bump up margins a tiny bit, bring costs down a tiny bit and that yields huge bottom line growth. This is a highly leveraged play on the Solar Sector, and since it has just started going profitable it will be very easy to go from $20m net profit per quarter to $40 net profit per quarter; very easy! Works both ways though, but remember I am betting on growth.

I am extremely satisfied with the risk/reward ratio for SPWR. At $25 I stand to lose 40% of my investment if things go very bad, and can gain 400% if things go very well. And my base case is 100% return in 12 months.

I might be irrationally exuberant, but I digress. Short interest is piling into this stock and I think that the shorts are idiots. Or maybe I am the one who will be incredibly wrong. Either way it is going to be a very fun ride for me over the next couple of months. Loving every minute of it.�

1/1/2015

guest I picked up some at $23. Now I wish I had bought more.�

1/1/2015

guest Haha. I picked up some short-term Deeeeeeeeeep OTM call options when stock was at $23 a couple days ago. Now they more than tripled and I wish I had picked up A LOT more. Hindsight 20/20...�

1/1/2015

guest Same here, at least it's in my Tax-free account. OTM calls would have been the right move, but my tax-free account doesn't allow for such moves... yet.�

1/1/2015

guest How about starting a separate thread for SPWR. As an SCTY shareholder I'm interested in discussion of SCTY. Recently almost every time that I see the SCTY thread has been updated, I come here and find the thread hijacked by more posts about SPWR. Let's split the discussion into two threads.�

1/1/2015

guest If there is a mod who wants to pull out all of the SPWR posts and create a new thread then I am all for it.

Option 2 would be a start a solar investment thread (or rename this one). It seems like the Solar City discussion has died down recently in this thread. And IMO there are several possible investment opportunities in Solar that are worth discussing (not just SolarCity or Sunpower); whereas there is only one Tesla. 2 options:

1. Rename this thread "Solar Industry Investor Discussions" and discuss all solar investments here. I would vote for this option.

2. Keep a Solar City investor thread open and create a separate solar investor thread for other solar companies. This imo will create redundancy though, since all solar companies are very closely linked and it is worth discussing this topic at an industry level and not company specific level.�

1/1/2015

guest +1 Curt�

1/1/2015

guest Sleepyhead,

Thank you for your detailed response on SPWR and this wonderful quote from one of Hockey's greatest players. It was a favorite quote of one of the most legendary aapl traders who posted on the AAPL Finance Board Forum. This gentleman started with $10,000 and traded AAPL options, mainly straight LEAPS calls and call spreads, from when Steve Jobs returned as CEO to 2010 and was able to grow that to 30 million. Like you, he always tried to predict where a stock will be in the future, not the current price, and was very successful. Do you mainly hold shares in TSLA, SPWR, and SCTY or options? With your recent estimates, I feel more confident in opening up a position (2015 LEAPS) on SPWR. Have a good weekend!�

1/1/2015

guest 1. Rename this thread "Solar Industry Investor Discussions" and discuss all solar investments here

Nice Call on ur other tips sleepy. I bought some SUNE and CSIQ. Now to find out if I should hold em.�

1/1/2015

guest Does anyone here own/lease a SolarCity system?

I'd like to get some feedback on the whole process.

Thanks.�

1/1/2015

guest I have a friend that sign up for a system, he also got a Tesla P85. The waiting list for Solar City is long. I think he started the process around the end of May and installation may only start in August. Looks like Solarcity is very busy.�

1/1/2015

guest I Have a SCTY installation on my roof. It was installed July 5th. I began the process early May. The entire process was seamless and as simple as my Model S purchase. Given the 3 choices of no money up front, some money and all the money up front with no payments for 20 years, I went with $11,600 up front for a 4.4 kw system, no payments for 20 years. SCTY had recommended a 3.9 KW system at $10,000 but after spending my life as a frugal electricity user, I decided for $1600 more ($80/yr), I can start leaving lights on etc. My electric bill was about $180 since my Tesla arrived. Up by $80.�

1/1/2015

guest All solar lease companies are suffering from lack of financing, and that is the bottleneck. SCTY's recent announcement of $500M from Goldman Sachs is only enough for about 20,000 homes. Sunpower put up "only" 2,100 new lease systems in Q1 because they ran out of funding, and said the demand was there.

This is a very expensive proposition and you need about $25B in funding just to do 1 million homes.

- - - Updated - - -

Solar stocks going bangbusters again today, since China announced that it will install 35GW of Solar Systems by the end of 2015. That should help alleviate some of the capacity glut for the solar manufacturers. Especially good for Chinese Solar Companies. My favorite there is Canadian Solar. Still high risk but I finally bought into it last week after it went down 12% on a fraud investigation news story.

- - - Updated - - -

SUNE up 10.5% and CSIQ up 15.5%.

I don't know much about SUNE but from all the solar research I have done, it seems like nobody talks about this stock but those that do have nothing but positive things to say. I might have to research that company a little bit to see what is going on.

In the mean time I saw an article come out about the SEC filing a claim against Chinese arms of the Big 4 Accounting firms not releasing documents to the SEC to conduct a fraud investigation on some US listed Chinese companies. Accounting firms say that Chinese privacy laws forbid them from releasing such documents to the SEC. Canadian Solar was part of this investigation for fraud (this was 3 years ago), so the stock tanked 12% that day and I actually sold some TSLA to buy CSIQ.