1/1/2015

guest It was discussed here years ago. I'm not motivated enough to look for it.�

1/1/2015

guest Good points Papafox. I'd not really thought about Tesla hiring away talent.

And of course Panasonic being involved doesn't have to mean investment. Here's a comment from one of their executives as a follow up to last week's reporting on Panasonic's position,

"In an email to BI, Panasonic spokesman Jim Reilly confirmed Tsuga's remarks.

Panasonic values the strong relationship it has with Tesla Motors and is looking at a number of ways to further strengthen that relationship, At this point, however, the company has not made a decision on any particular option"

(article didn't say who did the bolding)

PANASONIC: We Haven't Yet Committed To Elon Musk's Gigafactory - Yahoo Finance�

1/1/2015

guest Ahhh it hurts to read so much self bashing.

Maybe you were just unlucky to miss this boat, happens to all of us. There will be other boats.

Also, your feelings are universally shared (for different reasons), if that helps.�

1/1/2015

guest Causa's China investigation:

I was surprised to meet a Chinese backpacker who knows about Tesla. So We had a long discussion to satiate my curiosity. The take away from our discussion is this:

Everyone in China's urban centers knows about Tesla.

They know because of Tesla's pricing decision. Which give China a lot of "Face" and make them feel respected. This played more in putting Tesla on everyone's radar than did Tesla's technology.

They do not believe Tesla can build the supercharger network effectively because

BYD's previous failure at doing so, which prevents people from buying EV.

In China, people don't usually have garages and most travelling are done through pubic transport. It is only in between cities that they use car.

There is also capacity concerns. Will the chargers be able to handle the amount of people that uses it as there are a lot of people in China. Land for the super chargers are also going to cost a lot. Their thinking is this. Build the charger infrastructures first before you have customers. Just like every other project in China. So tesla's way of using car purchases to fund the super charger network. Might not work.

The car is already liked, But Tesla's fight in China is going to be about super chargers, not the car..�

1/1/2015

guest Thanks for the post. My other concern is if the 'Chinese elite', as many refer to them, will see the pricing (which I agree with) as making the car not 'elite' enough. Any thoughts/comments on that from other people you run into on your travels would be most appreciated. Thanks�

1/1/2015

guest Thanks for your helpful information.

Since I was born in China, I can add up some points based on your comments.

1: I have to say, almost 100% of the people who will buy Tesla spend most of their time in crowded downtown. People will not be bothered to drive out of a city and take advantage of SuperCharger, since I sincerely believe that the money they saved from public charging system is less than the toll fee they paid for taking highway.

2: Tesla may seek for cooperation with local gov. for charging solutions. Chinese gov. loves EV, since the air pollution is very bad at nationwide level, there is no exaggeration. They may be happy to leave a couple of parking positions for Tesla users at public parking lots, and equip the designed lots with SC. Tesla can not operate SC by itself, since the cost will be HUGE. However, they can rely on the gov., and benefit the gov. by promoting charging technology. If Tesla can make Chinese gov. happy, the perspective market would be very very bright. Many Chinese buyers, as far as I know, are frustrated about the charging solution. If SC opens in China, although in minimal amount, people will at least realize that there is a way to charge the car outside my garage, and it is FREE!!

3: No offense, I think an important reason that people like Tesla is the car is fancy. The truth in China is, BMW, Benz, Audi is everywhere. In some big cities, like Beijing, many porsche, Ferrari, etc can be seen on the road. What I mean here is people really do not care money that much when they really want to purchase a high-end car. Tesla attracts many eyeballs, because the number would be very limited in a fairly long time. This gives the owners opportunities to show off, which is the "Face" you mentioned.

4: It is really hard to say how large the percentage of those Tesla owners have their private garage. Your friend tells a fact from a general view, but we should realize that, the people who can afford a Tesla, should be much wealthier than the average.�

1/1/2015

guest I doubt I'll be able to run into the super rich. These are people who made enough in the economic zone to be able to afford traveling once a year. The super rich usually do a tour�

1/1/2015

guest How can the land of the Super Chargers be expensive? They usually set them up between cities.�

1/1/2015

guest Dunno. But it is something tesla has to do to convince the middle class to let them know it'll work. My guess is that lands are expensive everywhere in the east coast of China.�

1/1/2015

guest Yeah I am sure that property between Beijing and Shanghai is more expensive that between Los Angeles and San Francisco and between Paris and Berlin.

Anyways, they usually come to an agreement with hotel/motel/restaurant owners to put a supercharger on their property in exchange for bringing in wealthy customers.

China has a GDP per capita of $7k compared to $53k for the USA and over $100k for Norway.

The Chinese middle class can't afford a Model S.

The Global Upper Middle class that resides in China( about 7% of the 1.5 Billion Chinese) can afford this car and maybe the superrich Chinese may find the popularly priced Model S too pedestrian for their taste but it will be a very very long time before the average Chinese can afford a Model S.�

1/1/2015

guest I don't think wherewithal is the prime issue here. The points about charging infrastructure and range are pretty valid in my opinion though. The linked article sums up things nicely (I'm sure it's lurking somewhere else on TMC, but it is relevant here) demand in China is at the top of my burning question list for Q1 ER. I'm not expecting insane demand, but would be pleasantly surprised if it were there.

Also, if your figure is true. 105,000,000 is a lot of Upper Middle Class people. More than all of North America I'd wager.

Can Tesla Outsell Porsche In China? - Forbes�

1/1/2015

guest Most of the American and rest of the world still couldn't understand how wealthy for the top 5% of Chinese. Thanks for the 30 years economy booming and recent 10 years housing bubble, currency appreciation. Median family wealth in Beijing/Shanghai/Hangzhou/Shenzhen etc. eastern coastal cities can easily outcome upper middle class american. Thus there is no wonder why China becomes the world's largest market for any luxury items including cars, Chinese are pouring money overseas to boost house price in Sydney, London, Vancouvor, San Francisco, Los Angeles and New York. There are many luxury things in western world but they looks just dirty cheap by top 5% Chinese.

�

1/1/2015

guest

With just over 20% of the world's population China has a lot of everything.

And they are not WASPY old money that disdain flaunting their wealth.

More like NBA ballers, if you have it flaunt it type philosophy.

Yes, the addressable market is larger in China than North America, but not 700 Million Plus.�

1/1/2015

guest ZEV cars how have 20.3% market share in Norway, using March sales numbers. Model S represents 50% of this, and hence has 10.3% market share. All cars are included in this statistic (gasoline, hybrid, BEV, natural gas etc).

http://bil.bt.no/bil/Solgte-48-Tesla-er-hver-dag-i-mars-64659.html

1493 Model S registered in March.�

1/1/2015

guest I am using american Standard to judge who are their middle class. When I say chinese middle class, I usually mean about those that can afford Model E. China probably have more super rich than the states have upper middle class in raw numbers, but percentage wise it will always be lower.�

1/1/2015

guest This is people getting grossly carried away with the possibilities of the Chinese market.

What is superrich? American Standard? Those with a net worth over $50 million USD?

When people-analyst-economist usually speak of "rich" or " middle class" or "working class" they usually mean by local standards.

- - - Updated - - -

An increasing number are joining the ranks of the super rich. The number of Chinese with more than 3.03bn Chinese yuan ($500m) in assets will grow by 6% this year to 535 people, according to a recent report by Wealth-X, a Singapore-based company that collects data on ultra high net-worth individuals.

Other studies have shown that the country�s high net worth population � people with more than 10m Chinese yuan ($1.6m) � is also climbing. Between now and 2015, the country�s high net-worth group will swell from 800,000 people to about 1 million, estimates US-based global management consulting firm Bain & Company.

http://www.bbc.com/capital/story/20140203-the-rise-of-chinas-wealth-dragon

I would classify at least 30 million Americans as upper middle class.

CA alone has over 1 million $ USD millionaires.

BTW If you look at Forbes richest 400 Americans number 400 is worth $1.3B. As opposed to 535 Chines worth over $500M.

There are probably more Americans worth over $500M than there are Chinese.�

1/1/2015

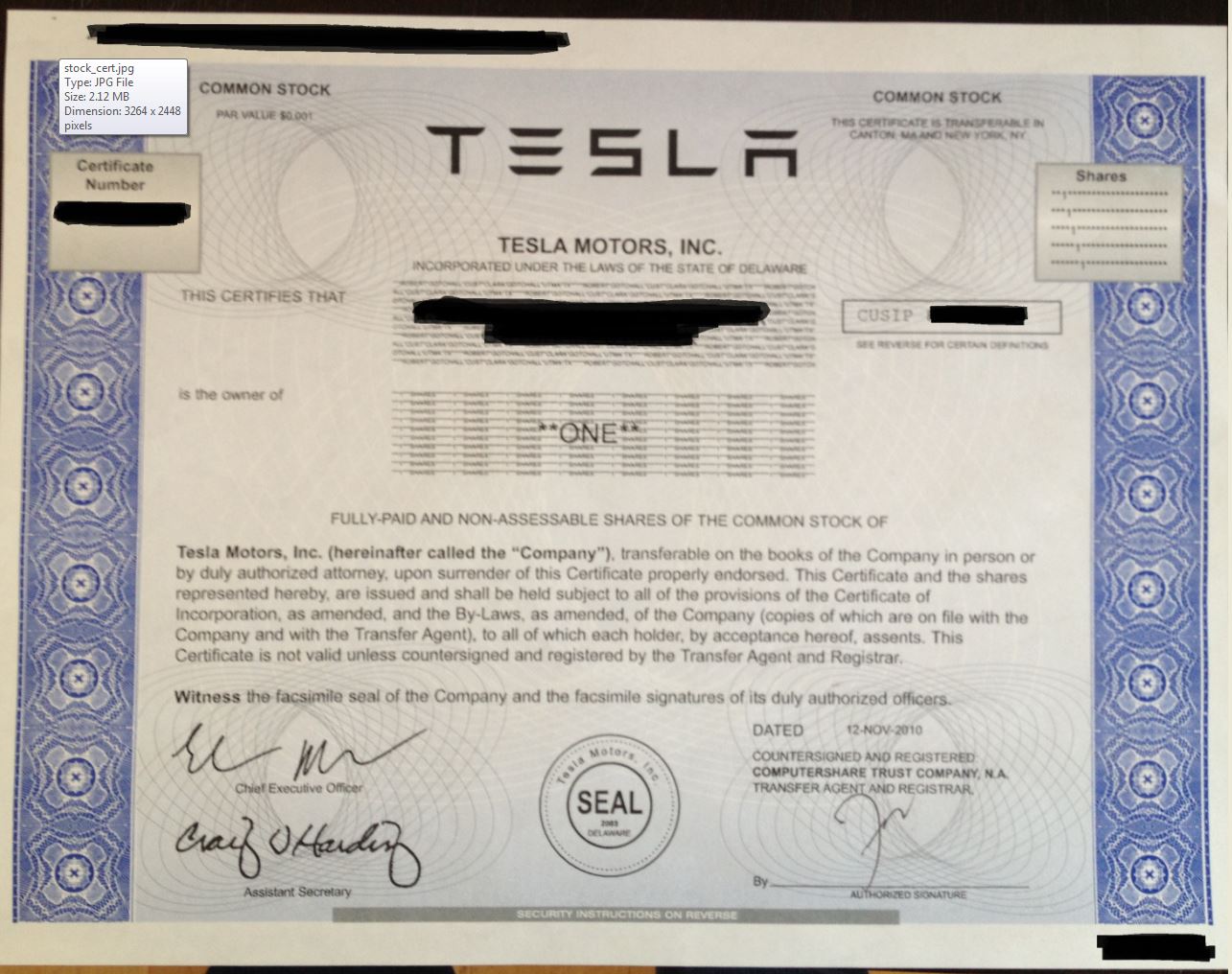

guest Anybody ever get a stock certificate for commemorative purposes from this Computershare Trust Company Tesla refeneces in the FAQ answer?

http://ir.teslamotors.com/faq.cfm�

1/1/2015

guest yeah I got one:

I paid about $40 for it so I wish I had bought 1000 instead of one, but oh well.�

1/1/2015

guest Very nice!�

1/1/2015

guest Smog alert: 'very high' air pollution levels spread across England - live | Environment | theguardian.com

Perfect timing for Tesla to start the deliveres in the UK.�

1/1/2015

guest FRANKFURT (Reuters) - German carmaker Daimler (DAIGn.DE) is taking over stakes in two battery cell producers from Evonik (EVKn.DE), making Daimler the sole owner of both companies.

Daimler buys electric car battery activities from Evonik

- - - Updated - - -

Ford + GE = Big Electric Vehicle Charging Station Rollout

Read more at http://cleantechnica.com/2014/04/03/ford-ge-big-electric-vehicle-charging-station-rollout/#2P0o21mOji83EBFK.99

http://cleantechnica.com/2014/04/03/ford-ge-big-electric-vehicle-charging-station-rollout/�

1/1/2015

guest Paulo Santos has another "peaked US delivery" article out at seekingalpha. Now we need to wait for a "peaked Norway delivery" one next I Guess..�

1/1/2015

guest I would think he'd be a little shy and embarrassed about writing such things now that he's said it several times and sales continue to grow. I remember when he defended his assertion that the Model S and EVs in general were just a niche market and would ultimately never go anywhere. He still has a lot of misinformation despite the fact that some of us have educated him on many things. It's funny because a lot of the other stuff he writes on SA is fairly intelligent (not related to TSLA or EVs).�

1/1/2015

guest He keeps "kicking the can" down the road to "next quarter will reflect the decline" �

�

1/1/2015

guest I think he doesn't care, as there are always new readers who don't know his track record. I know I gave him the benefit of the doubt initially, until other board members set me straight. Only then I proceeded to read his previous contributions and realized I'd been duped.

I once gave a guy on the street 20$ because he told me his car broke down and he had forgotten his wallet at home. Later I found out it was a running scam in the area. There's a sucker born every minute.�

1/1/2015

guest He receives a penny for every reader who clicks to view his articles. Tesla articles on Seeking Alpha are quite popular and can draw as many as 50,000 clicks, especially if they are negative. That's $500 to the author. He apparently considers that enough of an inducement to write seemingly new articles every week, even if they are little more than rehashes. Moral of the story: Don't click into his articles.�

1/1/2015

guest This! Paulo has earned his way into my Petersen bucket, of SA authors I ignore. If he does have an idea that would alter my investment thesis, then I expect somebody else will also be writing about it, and I'll see it that way. My time isn't the most valuable, but it's still what I have, and reading authors in the Petersen bucket has proven consistently to be a waste of that precious commodity (for me!).�

1/1/2015

guest WowThats more than 3X my most popular and 8X my average!

�

1/1/2015

guest In the era of clickbait/linkbait "articles" rising to the top of Google news feeds, starving "journalists" with loose morals are easily purchased for pennies. Seems like a bargain if you want to buy a little manipulation. Should we take up a collection? �

�

1/1/2015

guest Yup... as Tesla is delivering 50% of its production to China, we'll see both peaked U.S. and peaked Norway delivery articles. Good for 50,000 clicks.

Petersen's latest includes him referencing the flawed Hawkins paper again by stating that the greenhouse gas emissions from production could not be offset through the life of the car. Thoroughly debunked both by lay people and in research literature, but he's still stating it even after it was brought straight to his attention. If the bear story is so clear, why bother lying?�

1/1/2015

guest I read some of his articles and he seems like a dog with a bone. His bone is: no demand for Tesla. I wonder if he really believes his thesis.

Almost a year ago, he pointed to an arbitrage trading opportunity on Tesla, which was correct. He seems quite knowledgeable and I find his writing style very clear.

I had a few discussions with a Tesla bear. That bear is, like Paulo, intelligent and knowledgeable. It seems to me that reason and knowledge are often bypassed when sticking to personal biased opinions. We see and hear what we want to see and hear, especially when stakes are high. The other side of the coin is that perhaps we Tesla longs are biased, and time will tell who is right. On the topic of demand for electric cars, my view is that Tesla will be production constrained for many years to come.

[/QUOTE]I once gave a guy on the street 20$ because he told me his car broke down and he had forgotten his wallet at home. Later I found out it was a running scam in the area. There's a sucker born every minute.[/QUOTE]

Very nice of you. It is ok to be a nice sucker.:smile:�

1/1/2015

guest I swore I saw a post somewhere talking about the service center saying they were seeing a lot less warranty service or at least that it wasn't increasing with all the new deliveries. I wonder if they have worked most quality issues out by now with their new found leverage with suppliers and just gaining operational experience. Right now the reliability record is so-so but one benefit the long term investor sees in an electric automobile manufacturer is lower warranty cost due to higher reliability. It would be very nice if somewhere down the line Tesla comes out with the best reliability record on top of being the most highly rated car in Consumer Reports. My only evidence of this reliability improvement so far is that if you go to the Model S forum on the Tesla web page it seems like there are fewer posts about issues with the car. I'm wondering if anyone has any more substantial evidence.�

1/1/2015

guest This is something I am monitoring as well. I hope that in time we look back and see that there was a rough first year or so, not so unusual for a first "model year" and then a sharp decline in warranty work. Part of the value proposition of EV's is fewer things to go wrong, so we need to see that in the data.

I can say from the perspective of the 1-vehicle data set I am very familiar with (my car) I have had to go in for 3 reasons. 1 very large, 1 medium, 1 quite small. The very large one would be bad if it was common, but I am pretty certain it is very rare. The medium one was annoying abut a small cost part. The last one was essentially a badly written error message. I am holding on a few months without issue now. Fingers crossed, all the kinks are worked out. I look at this as a potential microcosm of the whole population.�

1/1/2015

guest I think the key item in looking at this is if the same problems are occurring on an ongoing basis. It seems that TSLA's model of taking out and replacing the whole component is allowing them to send back for analysis and quickly integrating fixes back into production. Windshield, sunroof, door handles, door seal, 12V (tough one), motor hum... I find this to be a very very positive set of developments.

Although it will take some time to play out (maybe another 3-4 years) I think there will be another shift in public perception of TSLA when there are multiple vehicles at 150,000 miles+ with relatively little service costs. I've taken a number of german cars to 200,000 miles and each one becomes something of a labor of love to replace parts that are not broken but you suspect will fail.�

1/1/2015

guest Good news for the EV movement overall. Mitsubishi aiming for 20% of its cars as EV or hybrid by 2020. Hopefully they can do it.

The Motor Report: Auto News And Reviews�

1/1/2015

guest Is this supposed to be a lofty goal? Not sure how this relates to TSLA Long-Term fundamentals, except to show that Tesla gets it while other automakers don't. Most of the reason they are aiming for 20% is because they have to comply with fuel efficiency regulations.�

1/1/2015

guest Didn't know where else to put it!

I agree it's a drop in the bucket relative to Tesla but any shift towards more EV's is a good thing to me.�

1/1/2015

guest Mitsu is anticipating that most of those will be hybrids. Not a very ambitious goal if you ask me. And they're not even doing it because they want to.�

1/1/2015

guest 2nd gigafactory

interesting color today at the end of the article about the new goldman sachs report:

the second new assembly plant is not all that surprising (i'm sure elon has mentioned the need to build an additional plant at some point), but i found it interesting that they are already talking about a second gigafactory...

surfside�

1/1/2015

guest thanks Surfside. This may be quite a find you've shared.

"Tesla's management believes that it will need to build a new assembly plant and gigafactory within the next four years, either in Europe or Asia."

(bolding mine)

I think we've all taken it for granted since the Gigafactory announcement that 500K would be total production for 2020. if this reporting of what Goldman Sachs said is an accurate reflection of Tesla's plans, by 2020, they could very well be looking at quite a higher number than 500K vehicles/year. again, this is basically third hand, an article about Goldman Sachs talking to Tesla, but this could be the first hint of substantial fundamental upside.

I strongly recommend reading the link from Surfside. there's a bunch of other details, but the other one that popped out at me was:

"Tesla is aiming for a gross margin of 25 percent on the Gen III as opposed to 30 percent for the whole company."

25% gross margin on Gen III would be great, perhaps one or two of the most bullish analysts have such a high number, but from what I remember none of them do.

I guess we'll here follow up on these two points on next month's call, if not sooner.

�

1/1/2015

guest this implies that Tesla is then aiming for the X and S to be upwards 35% gross margin?�

1/1/2015

guest Larken, yeah, if you read it literally it's implying some quite high X and S gross margins. I'm not so sure the sentence was written with precision. for one thing we don't know what year they are talking about and the proportion of Gen III to S/X will change quite a lot from 2017 forward, different proportions, of course, would back you into very different gross margins for S/X.�

1/1/2015

guest The statement in the article is actually incorrect. I reached out to Tesla IR and they clarified saying that the only GM target for Gen3 they've given is "at least 20%".

2014 1 QTR predictions/results - Page 17�

1/1/2015

guest I'll mention that 20% GM is higher than Elon said in the 2013 shareholder's meeting when he thought it would be around 15%.�

1/1/2015

guest That was before they were to produce own batteries. Gf could add to margin�

1/1/2015

guest thanks DaveT, and glad to hear you have a contact with someone in IR.

as written, the statement below sounds too good to be true, as it implies another assembly plant and gigafactory up and running in four years. I'm cautiously optimistic, that the article may have gotten it wrong, but that Goldman nonetheless was told something like another plant and GF to start construction within 4 years. Dave, this might be worth asking about... no worries if you feel like you've used up your quota of inquiries with the IR person for the time being.

"Tesla's management believes that it will need to build a new assembly plant and gigafactory within the next four years, either in Europe or Asia."�

1/1/2015

guest i think their overall margin depends on the ownership structure and accounting for the gigafactory (and how it will flow through their financial statements). if tesla truly owns the gigafactory (or has to consolidate the JV for account purposes), and the COGS of building batteries flows through tesla's financial statements, then tesla's margins will decline -- not increase. the battery making business is not a 30% gross margin business.

i'm with you steve -- i have a hard time believing a second plant and gigafactory will be fully built in four years, particularly given the first gigafactory won't be operational for another three years (in 2017). that being said, starting a second sometime in the next four years would mean it should be fully operational by ~2020, which would suggest potential capacity of up to 1 million cars in 2020 (which i think is still significant from a long term tesla value perspective).

surfside�

1/1/2015

guest actually the first one will be fully operational in 2020, the second if started, lets say in 2018, should be fully operational in 2024. so 1M in 2024�

1/1/2015

guest fair point that in 2017 the first gigafactory won't be capable of the full 500k production level (from the gigafactory alone). however, one other point to consider is that tesla will surely continue to buy batteries from panasonic's existing factories (which at that point will likely be able to support at least 75k cars per year -- more likely 100k).

surfside�

1/1/2015

guest Actually if you read the GF presentation, the factory is still unable to supply enough cells, just battery packs. So the pack - cell difference will come from Panasonic. I expect that second GF will start construction no earlier than 2018 and not add to car production until 2021.

P.S. My expectation is that the initial setup of the factory will be to move pack production from fremont to the factory using Pansonic supplied cells. The second step will be cell production.�

1/1/2015

guest good catch. the gigafactory will only produce 35GWh/year of cells, but produce 50GWh/year of packs.�

1/1/2015

guest We'll we hear a lot about the NJ and other semi-losses. Here's an important win from my home state.

Washington State governor signs pro-Tesla bill�

1/1/2015

guest Since WA has the highest market share for BEVs of any US state and the most pro-Tesla regulatory environment(BEVs being exempted from 8.8% sales tax) it will be really interesting to see how far Tesla can takes things in WA particularly when the Model E comes out.

Can Tesla beat BMW for market share in 2018? BMW had 3884 registrations in WA in 2013.

http://www.wsada.org/media/outlook.htm�

1/1/2015

guest I read that, too, but I am not quite sure about how to interpret that. Alternatives:

1) Produce 35 GWh/y cells, buy 15 GWh/y cells, build them into 50GWh/y packs (as you said)

2) Produce 85 GWh/y cells, build them into 50 GWh/y packs, and sell the rest of 35 GWh/y cells like like for photovoltaic storage etc.

Both interpretations don�t sound completely convincing to me. What is the current world wide li-ion cell production, as the Giga Factory is supposed to add a production of about that much cell capacity/year? Or is recycling of packs factored into the pack output number?�

1/1/2015

guest This weekend on ycombinator's Hacker News, I came across this particularly useful Total Cost of Ownership model for a Tesla Model S that, in one buyer's case, turned out to be cheaper than a Honda Odyssey minivan using NPV calculations including maintenance and gas.

He graciously shared his spreadsheet as well.

Further evidence that much of the TCO math the shorts love to deride is quite probably...actually correct.

As the public begins to grasp this fact even more, that enables Tesla to continue to keep margins high on initial purchase cost, because they don't need to recoup lower initial costs with maintenance. This strikes me as a good thing for long-term fundamentals to be sure.

Food for thought.�

1/1/2015

guest Am I the only one that reads:

Tesla's management believes that it will need to build a new assembly plant and gigafactory within the next four years, either in Europe or Asia.

Like this (bold addition mine)

Tesla's management believes that it will need to build a new assembly plant and complete the previously announced gigafactory within the next four years, either in Europe or Asia.�

1/1/2015

guest I don't think cells are of much value (low margin business) to sell. They can be bought anywhere (Panasonic, LG, Samsung, BYD etc.). It is the pack that is Tesla's special sauce.�

1/1/2015

guest Has anyone actually seen the GS report (regarding need for additional gigafactories or car assembly factories)? I'd prefer to see if it actually says what the benziga article claims. Don't always trust benziga or other media outlets as something is frequently lost in translation.�

1/1/2015

guest There was 47 page report on Tesla, by GS, issued to GS clients on 18/3. That report gives a new price target to TSLA, $200, from $170.

My guess is that the report is not made available to non GS clients. Below are links to a couple of different presentations of the same report.

Another take on the same report, by Cheat Sheet.

Goldman Sachs analyst Patrick Archambault takes a look at Tesla Motors Inc.�s (NASDAQ: TSLA) potential as a truly disruptive force over the long run and concludes the shares could � and we emphasize could � rise a lot, perhaps to as much as $478.

Benzinga article refers to a visit by GS analyst to Tesla on 8/4 and there seem to be no reference to updates to March report as a result of the visit. There was a 'note to clients' issued as a result of the visit. GS price target for TSLA is still 200.

The statement in Benzinga's article "Tesla's management believes that it will need to build a new assembly plant and gigafactory within the next four years, either in Europe or Asia." seems to refer to Tesla Management as the source.

�

1/1/2015

guest I read it that in addition to the Fremont plant and the US Gigafactory there will be an overseas assembly plant (like Fremont) and an overseas Gigafactory (like the one they are going to build outside San Antonio (hopefully)).�

1/1/2015

guest According to the article that was linked on TM twitter feed Elon apparently have remarked that total of TEN gigafactories will eventually need to be built. This means that there is a consideration given to TM producing 5 million cars per year.

Twitter / phxbizjournal: Our tech reporter gets behind ...�

1/1/2015

guest even more interesting (to me at least), the article specifically states that elon eventually wants to build 10 gigafactories in the United States

surfside�

1/1/2015

guest Looks like tesla filed patents on everything on their user interface from the window swap to the way the audio balance is controlled and the sunroof and everything bin between.

TESLA MOTORS, INC. - Patent applications�

1/1/2015

guest Pre China deliveries I suspect. The patents and 'hacker princess' may be busy after the deliveries begin.�

1/1/2015

guest My sense is that the Model E is what's standing between Tesla at $400-$500+/share and taking some of the market from non-luxury car makers, as opposed to the current ~$200/share competing with other luxury car makers.

If their $35k Model E is just like the $50k Model S , then other car-makers will probably move in on the ~200 mile EV market and limit Tesla's share of the market (both in terms of cars and battery production). But if they can pull it off, then their shares will jump again, probably closer to a market capitalization of a company like Honda.�

1/1/2015

guest This WILL NOT limit TM share of anything because at that point demand for EV will be higher than the production by all players for DECADES. Just think of it - there is more than 250 million passenger vehicles registered in US alone, while the yearly sales are at about 16 million. Do the math - it will take more than fifteen years to replace an ICE fleet with EV if ALL cars from ALL manufacturers sold in US are electric!

This is the reason EM said many times that he welcomes competition in EV space. The market is so enormous that there will be space for many manufacturers, without them limiting each other's share of the market.�

1/1/2015

guest Most analysts don't see the market as being that large. It could be, but I doubt it.

It will surely grow at a brisk pace, but production will scale with demand for EVs like it does with anything else, and if Tesla can't/won't make the Model E as affordable as they say they will, then that segment will be dominated by other manufacturers.�

1/1/2015

guest Yes. We've come to respect the almighty analyst

2012 Tesla Model S Electric Sedan: Industry Analyst Weighs In

�

1/1/2015

guest I didn't say the analyst, I said most analysts. And of course, there were many analysts who were wrong about Tesla, and about Toyota with the Prius, and so on...

With that said, show me a majority of analysts that think what you posited is even remotely likely.

Don't get me wrong, it'd be great if every vehicle sold from this point on was an EV or good PHEV, and if everyone put PV panels/super-insulated their homes, etc... But I doubt that'll happen.�

1/1/2015

guest So your challenge is for an individual summary of several hundred analyst to constitute a majority of analyst around the world?

At least a months work if working M-F eight hours per day.

A casual perusal of analyst reports will find they consistently underestimate the sales of BEVs and PHEVs the last 5 years.

Really, you doubt that ice vehicles currently on dealer lots will not be sold.

Nobody doubts that.

Elon believes over 50% of the new car market in the USA will be electric within 10 years.

The proposition here is that any "compelling" BEV, in other words with performance comparable to an ICE vehicle, will have demand outstripping capacity for the foreseeable future.

Therefore any OEM that jumps in will have their investment more than justified without impacting the profitability or sales projections of Tesla.

Any new competitor is an indirect collaborator of Tesla because they expand the market for BEV parts making it more likely that new electronic firms and automotive parts firms jump into the pool of companies competing for BEV parts business.�

1/1/2015

guest So great to re-read all the pre-Model S pessimism. Too bad most of the same authors are now pessimistic about the gigafactory and Model E instead of admitting how short-sighted they were.

When a majority of analysts are in agreement with the bulls on this forum, it will be time to exit my position.

Also, I love the pro-EV ads for the Leaf that I've been hearing, it's just free advertising for Tesla.�

1/1/2015

guest Information from Elon's Cross-country trip... after the gag order expired...

There are a number of places I could have / should have posted this; please reference this where ever you deem appropriate.

There are multiple assumptions and insights one can draw from this very obscure article.

Enjoy.

Tesla gets a charge out of Winslow, Arizona <--That is a clickable link.>

�

1/1/2015

guest Obviously those are not superchargers.�

1/1/2015

guest Yeah, sound like HPWC at 80 amps �

�

1/1/2015

guest Still great, just sloppy reporting.�

1/1/2015

guest There are also actual Tesla Superchargers in Winslow, AZ.

So these HWPC units are an additional plus. Kudos to Allan Affeldt! I will stay at his place next time I am in Winslow!

Good to support those businesses that are helping to rollout the infrastructure of the EV revolution!

Definitely helps TSLA long term.�

1/1/2015

guest Interesting read on Shale Oil/Gas production sustainability

Is the U.S. Shale Boom Going Bust? - Bloomberg View�

1/1/2015

guest Bloomberg article using the G-W word. We are clearly turning a slow corner- thanks for posting�

1/1/2015

guest FTC seems to agree with Tesla on the dealership issue

Calls it a "bad (public) policy" to force consumers into a dealer network, who are accustomed to Internet sales-- interesting. Not a good sign for those dealers and law-makers on how this would come down in a full on court and regulatory battle- Interstate Trade

Who decides how consumers should shop? | Federal Trade Commission�

1/1/2015

guest Indeed it does. I wrote the FTC about it a month ago. An FTC lawyer responded, "Thank you for your email. It has been forwarded to appropriate Commission staff members for review." Apparently I was taken seriously. This may soon lead to a White House response to the Tesla related petition. It may even result in the FTC or Justice Department bringing the case to the federal courts.�

1/1/2015

guest Nice move.

I would hope they will do exactly that�

1/1/2015

guest I feel lucky that there are people --- like you, Curt --- in the world, because I'm far too cynical and have - essentially - given up on the mass public to every do the right thing.

�

1/1/2015

guest I may be naive, but this issue of direct sales being banned in certain states has never concerned me when looking at the long term fundamentals of Tesla. IMO it's simple common sense that this goes against everything that America supposedly stands for, and the tide has turned environmentally for ICE vehicles. Listening to the dealer lead lobbyist in a couple of interviews over the past few months was like listening to a mentally challenged 3 year old, so much so that I never made it past the first 30 seconds.�

1/1/2015

guest Long Term Focus

I enjoy reading the short term threads on TMC, especially after a volatile week of trading. The euphoria or distain can reverse in a matter of days, hours or even minutes depending on the market. Individual investors think they can time the market. Without doubt if TSLA existed in a vacuum this would be true, and TMF readers certainly have knowledge on their side, however there are far too many external sources of influence which the individual investor has no control over. To name a few: geo-political, environmental disasters, broad market corrections, change in government product regulations and incentives, government market interventions, and weakening/strengthening of economies, not only domestically, but abroad. TSLA is one of the most erratic stocks one can invest in. Kudos for those who can tame this stock. I learned I simply can't and accept this. Thankfully I learned that one doesn't need to time the market, one just needs a longer time frame to view the market from. The "turtle wins the race" metaphor comes to mind. Why anyone would be disappointed in the share price action of TSLA for one day, week or month is inconsequential. Long term growth has been absolutely outstanding, and I can not think of another large cap stock better positioned for long term growth. Let's take a look at some numbers as of market close April 25th, 2014:

Time Frame Price increase over Time Frame

DOW NASDAQ TESLA

6 months 5% 3% 18%

1 year 11% 24% 290%

2 year 24% 34% 497%

Investment rules to sleep by.

1) Don't invest any more than you can afford to lose.

- rule of thumb is no more than 10% in any one stock, with rebalancing when thresholds are reached. I'm way overdue for some rebalancing.

2) Believe in what you invest.

- My next car will be an EV.

3) Invest in something good.

- A feel good stock thats "Co-ol" with two syllables. Even if it doesn't make you money, you still feel good for having participated.

4) Think long term horizon

- 5+ years. If you need the funds tomorrow, next week or next year, best to place it in a secure investment.

Why TSLA:

1) Their product

- High quality, consumer award winning satisfaction and design and performance.

- Zero maintenance (except tires and windshield blade wiper replacement), justification for higher one-time purchase price.

- Environmentally friendly (where I live Nuclear and Hydro are prime generators of electricity)

- Fosters removal of reliance on oil industry.

- Refuelling your car from home electrical outlet saves time (overnight charge, no driving off route to line up for gas) saves money (1/4 the price of gas at current levels and getting less expensive as gas will surely outpace electricity) and clean (have you smelled your hands after pumping gas?)

2) How they sell their product

- Direct sales to consumers, no paid advertising, no pesky sales people

- Fair pre-set pricing

3) High potential for growth

- Tesla is relatively unknown to date. With more recognition comes more growth.

- 35,000 vehicle sales projected for 2014 in a market of over 60 million passenger vehicles globally per annum (Worldometers).

- EV growth rate projected of 67% this year (IHS Automotive).

- High demand of it vehicles, evident by those putting money down for Model X site unseen.

- Reluctance of major ICE manufactures to produce compelling EV vehicles with 300 mi. range for fear of cannibalizing their traditional ICE brands.

- Additional vehicle types, model X, 3rd Generation, Truck...will allow a vehicle for all types of buyers, not just the full-size, luxury segment of the Model S

- Potential to expand battery pack supply to other auto manufactures (increase of and in addition to Mercedes and Toyota).

4) High potential for reduced expenses

- Battery Gigafactory

- Economies of scale ramping up production of ten of thousands of units to hundreds of thousands of units. Cheaper by the dozen.

5) Alternative business potential

- Gigafactory will allow production of storage battery for other applications (solar panels) and spawn new sources of revenue.

6) Forward vision

- Elon Musk, visionary, not afraid to lay out the road map of future expansion

- Infrastructure planned ahead with installation of supercharges. New markets to Tesla open up with each new showroom and supercharger station built.

- Embraces and welcomes competition, for the good of the EV revolution, not just Tesla. True competitors, when they arrive, will only serve to reinforce that EVs are the future of the passenger automobile, and far superior than traditional ICE cars.

Don't sweat the day to day stuff. Enjoy life. Keep your eyes focused on the prize. I look forward to seeing you all in your new EVs in the near future. Thank you all at TMC for your posts. Each one of you add credit to the EV discussion.�

1/1/2015

guest great points, one thing I thought of I hadn't realize before is that profit margins on the S and X may get significantly better from the scaling of the GigaFactory as well...perhaps 40% margins instead of 25-30%.�

1/1/2015

guest This is one if the reasons I think the Tesla model is the future if transportation. Hydrogen is extremely powerful and dangerous stuff.

I'm pretty sure this was not in the USA, so there may have been some safety standards that could have prevented this, nevertheless it shows what could happen in the event of a hydrogen fire.

Hazmat Highway to Hell with High Pressure Gas Cylinders (No Music) - YouTube�

1/1/2015

guest Maybe it's not hydrogen. The first report of it I saw said hydrogen. On the color charts orange is oxygen, so if Russia uses the same colors then it's probably oxygen.�

1/1/2015

guest But some of the cylinders were spouting gas that instantly caught fire, away from the main blaze. I don't see how oxygen could do that. Also hydrogen flame is blue. Looks like some other flammable gas to me, maybe acetylene? That produces a sooty smoke when burned in air.�

1/1/2015

guest In a change of subject for the long term thread; I'll post a new report out to provide some long term reflection. I know being locked in the world of Telsa-EV I sometimes forget how little ICE progresses;

US vehicles have reached 24mpg average (seems so yesterday); problem is EPA requires more than doubling to 55mpg in 10 years. Either they get on the EV train or they will all be re-selling refurbished Tesla. I don't see a way around it

A Looming Fuel-Guzzling Problem for Detroit's Profitable Pickups - Businessweek�

1/1/2015

guest AH! Just like in all the futuristic movies the cars are all the same, who knew it was going to be a Tesla! hahahaha�

1/1/2015

guest And they will all be painted flat black.�

1/1/2015

guest if you click through the link in that article about recent increases in CAFE requirements, the near term 2016 requirements look like an even bigger problem than the far-off 2025 requirements. hard to imagine how they are going to get to 34.1 by 2016. it will be interesting to see how it plays out, that is for sure.

surfside�

1/1/2015

guest good point- that would require fleet offering changes and/or purchasing Tesla credits (in some states)

OT

- anyone wanting to see video of Elon's report on the SpaceX landing of the boost stage rocket-

Reuters Insider

OT�

1/1/2015

guest This is like a lesson in how to make car electronics complicated, buggy and expensive to both manufacture and repair.

article on the new Audi TT dash electronics.

To make a car, Audi had to blow one up | The Verge�

1/1/2015

guest Elon gave some hints for 2014, 2015 production rate in Chinese TV interview. Second TV show when Elon visited China http://cctv.cntv.cn/lm/duihua/. Some interesting takeaways:

~11:20 Elon : this year we�ll almost double the production rate

~29:00 Elon: 3 years ago, we made 600 cars. Last year, we made 22000 cars. This year we�ll almost double production. Probably next year double again.

Given at the end of 2013, the production rate was approaching 600/week. Although the production rate guidance is approach 1000/week at the end of 2014. My read is the production rate will ramp up to 1100 or close to 1200/week at the end of the year.

Given 22000 cars produced in 2013. So double means 44000 in 2014, but let's give 10% discount to be safer, I think Elon is sort of confident to achieve 40000 goal for 2014. For 2015, the double means 80000, if we give another 10% buffer zone, I think 70000+ is the goal in Elon's mind.

"Double" in 2014 and "double" in 2015, it's still exciting years after stellar explosive 2013. I also want to quote vgrinshpun's analysis that Tesla production rate will eventually constrained by Panasoic cell supply before GF is up, vgrinshpun estimated that two full production lines will reach capacity by annualy run rate 110K+ in 2016. So it looks reasonble to project such "conservative" growth rate in next 3 years starting from 2014.

2014: ~40000, growth 80% YoY

2015: ~70000, growth 75% YoY

2016: ~110000, growth 57% YoY�

1/1/2015

guest thanks Maoing. According to Yahoo Finance of the 13 analysts they are tracking, revenue forecasts for FY15 vary from $4.5-$6.0 billion. If one assumes $100K revenues/vehicle, that suggests analyst estimates of vehicle volumes vary from 45,000 to 60,000, quite a bit shy of the 70,000 you inferred from Elon's comments with a margin for error. I suspect the analysts are actually using a bit higher revenue per vehicle, perhaps $105K as an AWD Model S offering is likely, and Model X, costing roughly $5-10K more than the Model S, will be something like 25-35% of 2015's mix. This suggests the analysts volume estimates are a couple thousand units lower than a 45K-60k range.

Yahoo Finance table with analyst estimates:

TSLA Analyst Estimates | Tesla Motors, Inc. Stock - Yahoo! Finance�

1/1/2015

guest I think you forgot a zero in each annual total:

2014: ~40,000

2015: ~70,000

2016: ~110,000

No worries.

Thanks for posting this information.

Although, I personally expect to see higher total annual numbers as from 2015.

These are exciting times for the car industry.�

1/1/2015

guest I'm expecting at least 75k in 2015 because whenever Tesla refers to Model X volumes, they clarify as volume comparable to the Model S. In 2015 Model S will be at 50k run rate at least and if Model X has half the year at that volume, thats 25k. So 75k. In 2016 I expect Model S and X supply and demand to stabilize so that number is whatever the market is for those cars. Maybe it is 100k, maybe it is 125 or 150k.�

1/1/2015

guest In other news, we're still burning the planet, Tesla Motors is still one of the most important ways to stop doing that, and when we are all driving GenIII's perhaps we can prevent Manhattan from being an undersea theme park:

Federal report: Warming disrupts Americans' lives - Businessweek�

1/1/2015

guest This is the perfect opportunity to address the White house Petition! :wink:�

1/1/2015

guest Benz, thanks for pointing out. I've corrected in original post. Also the growth rate is conservative estimation as I indicated.

�

1/1/2015

guest So Elon just mentioned that they are now seeing that they might go beyond 30% cost reduction on batteries for the GF. It seems they are calling directly to mining facilities who are totally surprised to get an end user caller, normally they only deal with exchanges so they are happy to help and reduce costs for Tesla.�

1/1/2015

guest Elon Musk: "The new more efficient production line to come online in July".�

1/1/2015

guest This is what I like most about TM. They are always looking at ways to do it better/more efficiently.�

1/1/2015

guest O/T but I remember reading about how Lockheed Martin had an internal incentive for employees when developing the prototype F35, the intial version of which was extremely overweight. Managers offered engineers $100 per idea and $500 for every pound of weight saved.

"Steven Twaddle, a materials engineer, realized that he could reduce the surface area of thousands of nut plates by using a high-strength adhesive, which saved 21.5 pounds. Aircraft performance senior staff engineer Brian Losos, who has worked on the JSF since 1995, came up with an idea to change the landing gear housing. Instead of a single door opening from the side, he suggested a two-door clamshell design. It would increase the weight, but the aerodynamic effect of removing the single dangling door, functioning as a sail in crosswinds, would allow a reduction in the size of the two tail fins. The change garnered him a $15,000 bounty."

I would be very interested to learn if Tesla was doing something similar to acheive those $5 and $100 savings Elon was talking about.

I'd be interested to learn if Tesla was doing something similar.�

1/1/2015

guest That's the way to do it. Start at the bottom of the whole chain. Very good.�

1/1/2015

guest They have something sort of similar in their patent bounty. If you get listed on a patent you get like a 6k bonus or something.�

1/1/2015

guest I know for a fact the Volvo used to do this in their Swedish factories. They'd calculate savings/cost reduction and whoever suggested would get 10% of one year's savings. Even if that ammounted to millions of SEK.�

1/1/2015

guest This is a big deal for the long term picture.

The interesting part is Elon has always looked at the fundamental "magic wand" cost, i.e. buy all the constituent raw materials off the London Metal Exchange and magically reorganize the molecules to the right configuration. Obviously the cost to do so is non-zero but it provides a baseline target to aspire towards. The current battery cost is somewhere between $150-$300/kWh range vs $60-$70 magic wand price. By potentially streamlining the supply chain from mining companies directly, the magic wand baseline suddenly becomes even lower by elminating several legs of transportation, warehousing, and transactional fees going through the LME (a very much for-profit exchange which surely takes its cut from facilitating the process).

Not only have they affirmed Elon's theorycrafting on 30% cost reduction, which may turn out to be even greater, they are starting to piece together the specifics to make it happen.�

1/1/2015

guest The funny thing is no one talks about how this will also reduce the cost for batteries in the Model S. They aren't exactly going to reduce the price although I'm sure there will be a redesigned interior. I don't see why the Model S/X line couldn't be 35% gross margin. There isn't exactly a competitor. Around that time the established car manufactures are going to complain that Tesla is being anti-competitive because they are being locked out of the battery market.�

1/1/2015

guest Good point, chopping 30%+ off of "a quarter of the cost" (for the battery) of the MS within 3-4 years is pretty sweet.�

1/1/2015

guest I was picking up the wife's Audi today at the dealer (annual oil change) and walked around - they had a whole stock of A6 and A7s for $75k. Almost impossible to find anything near the base price. Right now a well equipped 85 (tech, wall connector, sound, roof) is running around $81k after $10k fed + calif incentives. With better margins from the battery TSLA could lower the base price by $5 - $10k and come in under. Throw in electricity vs. gas and it becomes hard to justify a more expensive ICE.

Big difference - TSLA is riding down the cost curve (battery & solar) while Audi, BMW, Mercedes, etc. are currently riding it up (more CARB type requirements, greater drivetrain complexity, higher gas prices)�

1/1/2015

guest Not to mention maintenance. How much did the oil change cost? (Assuming it's not covered under a maintenance plan)

I love my Audi, but loathe operating it. Even a Diesel A6 runs minimum $75K up here in Canada. I can't wait until a number of comprehensive reports start coming in from MS owners indicating the true cost of ownership. I know there's been some very impressive preliminary findings, but it's usually once an ICE falls out of warranty where the big headaches occur. I spent $1100 on front brake replacement on a previous Audi because the rotors "are supposed to wear". I'd much rather have the MS' lifetime rotors, thanks.�

1/1/2015

guest Well, Tesla could sell them batteries. Not directly, but through a network of franchised battery dealers. This has always been pointed out as a superior mechanism to ensure competition and to protect buyers. :tongue:�

1/1/2015

guest This one was covered under AudiCare (2012 w/ 21k miles) but they did say that brakes are going to be needed soon. This is our third Audi, a 2002 A4 v6 previous and before that a 1992 100/ A6. The '02 died with a coolant leak into the engine at about 110k miles in 2012 at which point she got the Q5. The A4 was great car but what a b***h to die like that. It also had the CVT transmission which was something of a ticking time bomb. the 1992 lasted until 2006 (about 190k miles) when a head gasket leak fowled up the cats, and then the next set of cats. Both the '02 and the '92 had plenty of electrical gremlins.

And my least favorite part about Audis are that they consider replacing the water pump, timing belt and belt tensioner as "preventative maintenance" needed every 60k miles or so. That was about a $2500 job on both the '02 and the '92.

Needless to say buying the Q5 was not the greatest exercise in financial responsibility.�

1/1/2015

guest I still drive a 2001 Audi A4. The automatic transmission forgets what gear it's in every two minutes, and then can no longer shift (all the gears light up on the dash). I refuse to take it for any service other than oil change. So I end up restarting at every stoplight so I can get back in first gear. I'll probably lease a short range EV to tide me over until Gen3 when the A4 no longer goes.

Yes. I'd love a single gear EV. (currently have all of my money in the market).�

1/1/2015

guest Let's check on how the competition is doing...

GM Offers Cadillac Dealers $5,000 to Promote Test Drives of Plug-In ELR

The offer--dubbed the Demonstrator Allowance Program--comes as ELR inventories continue to grow. GM had 1,688 of the models in stock at the end of April or a 719-day supply, according to Autodata Corp. That means if the auto maker stopped producing the ELR now, it would take almost two years to sell the current models.

http://online.wsj.com/news/articles/SB10001424052702304655304579552203392469462

�

1/1/2015

guest Hey, they're just making more than they're selling, same as Tesla in Q1. Gotta fill those dealer pipelines :wink:

And maybe if the dealers would focus on selling cars rather than buying state senators, they'd be able to move these.�

1/1/2015

guest It would also help if GM focus on designing and building compelling electric cars. Apparently they are content with amphibious adaptations, until it becomes clear that electric cars are here to stay. At which time, of course, they will be kind off late for the party. Perhaps they are not so concerned, as Tesla will be there to sell them the powertrains, or, perhaps, licensing technology to them.�

1/1/2015

guest I am actually convinced they simply don't know how to make them. Not yet, anyway, and by the time they'll figure it out, as you say, it will be too late.

I think it was DaveT who said a while ago that this is like watching a train wreck in slow motion, and we have a first row seat. That's exactly how I feel. The innovator's dilemma in its full splendour. These are huge organizations, filled to the brim with the wrong technologies, wrong skills, wrong incentives, and wrong vision. A few of them are seeing it (Nissan, maybe BMW and Ford, I can't tell). The rest are busy pushing last century artefacts down customers' throats, milking them for service, buying senators to force Tesla into the same crappy sales model they are beholden to, and announcing Model S competitors that will only be available in 3 years for higher prices and with less range (but they'll SO be eating Tesla's lunch, or so Bloomberg TV is telling me.)

Most traditional automakers are in complete denial, just like the dominant phone makers were when they were hit by the iPhone and didn't even know what had just happened. By the time RIM and Nokia figured it out, they were already dead. The manufacturers who understand it are probably terrified, or they should be. They are incapable of transforming themselves without killing themselves.�

Không có nhận xét nào:

Đăng nhận xét