1/1/2015

guest This is a real risk in the future, but for right now solar is so small that there is plenty of room to grow. I wrote about net metering being a risk a few pages back (or maybe in another thread) and how SolarCity was testing Tesla batteries to mitigate this risk. I think that battery technology will continue to improve to the point where this risk will be slightly mitigated.

This risk is political and things like this are impossible to predict how they will play out. You just have to understand that this is a real and possibly significant risk and follow the news, laws, etc. Once these risks begin to materialize, you will be able to take action accordingly in your portfolio and sell if necessary. In the mean time these are just upset utility companies fighting to keep the status quo to protect their profits, just like the dealerships are fighting Tesla.

Not a risk in the short-term, until you hear about state governments voting to repeal net metering laws�

1/1/2015

guest EU offers China a Compromise in Potential Solar Deal

Sounds like Europe and China are making significant progress in negotiating a deal to avoid implementing punitive tariffs on Chinese Solar Panel Manufacturers:

http://www.pv-magazine.com/news/details/beitrag/import-duties--further-movement-in-eu-china-negotiations-_100012079/#axzz2ZKJgBQnV

Just yesterday Reuters posted this article that they are far apart in a deal:

http://www.reuters.com/article/2013/07/16/eu-china-solar-idUSL6N0FM1KD20130716

A few days ago there were articles in the media that a deal is not likely to happen and that the punitive tariffs will go into effect on Aug. 6

BTW, the media has not picked up on the PV Magazine article yet. This sounds like good news to me, a deal including higher ASP's will benefit all solar companies in the world. ISO (in sleepyhead's opinion) a negotiated deal between EU and China is the only logical solution for both parties. With tariffs everybody loses! I expect a nice bounce coming in solar stocks, especially Chinese.

Here is a good Motley Fool article that adds a ton of value:

http://www.fool.com/investing/general/2013/07/17/can-chinese-solar-companies-make-a-profit.aspx

It shows that CSIQ and SOL are by far the best Chinese Solar Investments. Love simple calculations in articles like this one.�

1/1/2015

guest Sleepy,

Are you planning to hold onto your position through earnings on some of the solar stocks such as spwr, scty, sune, and csiq? Thanks!�

1/1/2015

guest Yes, I am holding my solar positions through earnings. SOL just preannounced a huge beat and I expect other companies to beat earning estimates as well. If these EU China negotiations go through then this will be a big boost for the solar stocks.

There has been a perfect storm of good news going on in the solar industry for the past few months and yet there are still so many naysayers; I mean everything is going right! Short interest is huge, so I expect a massive short squeeze coming our way in 3...2...1...

- - - Updated - - -

Another good article from PV Magazine on why punitive tariffs don't make sense for Europe:

http://www.pv-magazine.com/news/details/beitrag/europes-pv-industry-rallies-against-import-tariffs_100012065/#axzz2ZKJgBQnV

Favorite excerpt from the article:

"China is now under pressure to stop dumping imports or to make an acceptable offer for minimum import prices. This would have to be significantly higher than already announced proposal of �0.50 per watt for module imports and must take into account the full cost and a reasonable profit margin, Nitzschke adds."

Sounds awful to me. Now the Chinese Panel Manufacturers are going to have to sell at a price that allows them to make a profit.�

1/1/2015

guest http://mobile.bloomberg.com/news/2013-07-18/china-imposes-duties-on-polysilicon-from-u-s-to-korea.html?cmpid=yhoo

should i sell my rec stocks? What others stocks?�

1/1/2015

guest Weird thing is that REC is up.�

1/1/2015

guest I don't really follow the polysilicon industry, but I probably should since it is a raw material used to produce panels and is definitely a risk factor to solar companies. There is just not enough time in a day to read about everything, plus I don't see raw materials as high probability material risks. E.g. I don't see aluminum pricing as a significant risk to Tesla.

That said, this is just political posturing. China wants the EU to settle on a lower minimum ASP of Chinese panels so they are threatening their own punitive tariffs on wine, polysilicon etc. Once they settle with EU they are going to want to remove tariffs in US and settle there too.

What will most likely happen is that China will probably want to negotiate a minimum selling price for Polysilicon imports and that will actually benefit companies like REC since their margins will go up. This would also extremely benefit Renesola who just updated thier own polysilicon plant and put it back into service on July 1.�

1/1/2015

guest Gotta rebuy thengood I got renesola aswell then!

�

1/1/2015

guest Of course if they do implement punitive tariffs then this will hurt REC. So it is a big risk. I personally think that these countries will reach negotiated agreements, but I could be very wrong. I don't see EU, US, and China wanting to start a trade war. Basically I am betting on this theory, which imo is still the only logical outcome from all of this.�

1/1/2015

guest Navigant Research

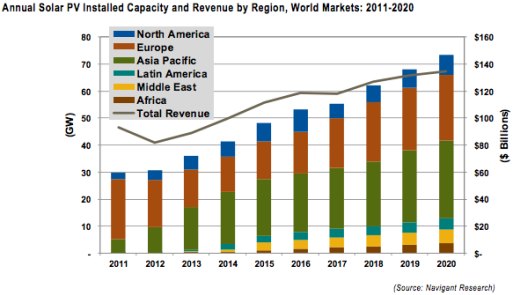

Here is an article I found about Navigant Research (a market analysis firm), who predicts that the solar market will install 436 GW's over the next 7 years (or about 62 GW's per year on average):

http://beforeitsnews.com/environment/2013/07/solar-pv-to-hit-grid-parity-134-billion-annual-revenue-by-2020-2474584.html

Last year there was about 30 GW's installed and the worlwide manufacturing capacity is about 45 GW - 65 GW depending on the source; this number is dwindling down quickly as manufacturers continue to go bankrupt. In about a year or two there will be enough demand to have all manufacturers running at full capacity. Margins have been expanding significantly over the past two quarters and will continue to do so. Solar module pricing is stabilizing as well and has actually increased slightly in Q2, which is a good thing for the manufacturers especially since manufacturing costs continue to go down.

The solar industry revolution is in its infancy right now and there are still huge returns to be had. I predict that three years from now there will be new entrants into the solar manufacturing market because margins are going to be so high that it will encourage new competition to come in.�

1/1/2015

guest Sleepyhead,

Is it worth buying SOL for long? I'v been lurking TMC for a while I own TSLA and SCTY. I am in love with model S and will be getting it next year. I missed out when you said to buy SPWR at 19.

Thanks�

1/1/2015

guest First of all keep in mind that Renesola just went up almost 50% in the past week and almost 100% in the past 3 weeks. It might be due for a correction, but then again it might go up another 50%. The big deal right now is the EU - China Solar Tariff negotiations. If they can settle on a deal then IMO Chinese Solar companies should go up another 50% in a very short time. If they don't settle, then the avg. 47% punitive tariffs will kick in Aug. 6 and Chinese solar will probably take a big hit.

Renesola has a lot of exposure to Europe and a negotiated deal would be a huge boost to the company. They are also diversifying into other higher margin regions successfully; just yesterday they announced that they got certification needed to sell panels in Japan. China implemented Polysilicon tariffs yesterday and that will benefit Renesola as well, since they just reconfigured their own Poly Plant and put it back into service on July 1st (almost all other manufacturers do not make their own poly).

This is still only a $300m market cap company with ~$1.3b+ in sales this year. They just preannounced a earnings beat by about 20%, with gross margins around 5%-6%. They need to get to about 10% - 12% margins to be profitable. Cost reductions in H2 should increase margin another 2% - 5%. So, in order to become profitable they will have to increase ASP's (average selling prices) and they can easily do that if they can expand in US and start growing in Japan. European ASP's have stabilized in Q2 and actually jumped up 5% from May to June. This is good for manufacturers. These new Poly tariffs will mean that companies like YGE, TSL, etc. will have to buy the raw material at higher prices, and they will have to pass it along to consumers, i.e. higher ASP's. Good for SOL.

Most importantly though is that if EU - China negotiate a deal that includes minimum selling prices of about $0.65 - $0.70 as discussed, then SOL instantly becomes profitable (as long as demand doesn't fall off the roof). If all this happens then I can see the company trading in the $teens within the next 12 months. A five or ten bagger is possible if everything goes right.

Note that if punitive tariffs are implemented then the stock may fall sharply, and after that I have no idea what will happen to the solar industy other than SPWR will be a clear winner. Even if minimum selling prices are implemented then SPWR will still be a winner. When ASP's go up everybody wins (except for SCTY), especially SPWR. When ASP's go down, everybody loses (except for SCTY). Even though SPWR would be the clear winner, chinese solar companies would probably yield the highest stock returns in the short run. These guys are priced to fail, and a massive revaluation would have to occur.�

1/1/2015

guest Thanks for the great feedback. I added SPWR and SOL.�

1/1/2015

guest I was thinking of investing in SPWR as a long term investment. Would you say this is advisable? I would likely hold the stock for a year and then sell. I would get more SCTY but I feel they have peaked until the earnings call and even then I am not sure buying stocks now would be wise, even if its longer term.�

1/1/2015

guest If you read the past 15 or so pages of this thread you will find my opinion on SPWR; I have made a series of very long, detailed posts on SPWR.

The short answer is yes. SPWR is my favorite pick, because it is the safest bet in the industry. This does not mean that it will yield the highest returns, but IMO it has the most limited downside. Best bet for risk averse investors. I still think that it has potential to yield some of the greatest returns too. Low risk, high reward!

If you want higher returns with higher risk then go with a couple of Chinese Solar stocks. Your best bet right now is to buy Canadian Solar or Renesola. I predict that both these companies will be profitable by Q3 and they will be instant multi-baggers.

If you like casino stocks and are comfortable with the fact that these companies may go bankrupt and stock prices to $0, then gamble on STP, LDK, RSOL. I can't recommend any of these stocks, but if the solar industry turns around as quickly as I am predicting then these stocks just might offer the highest total returns. If the turnaround isn't quick enough then these companies will go bankrupt.

I share the same sentiment on SCTY. I just sold some today to pick up some SOL.�

1/1/2015

guest Thanks for your input! I will go back and read your earlier posts as well, I agree that the solar industry seems to be making a strong come back as of late and I feel like now is a good time to consider stocks in it.

Thanks again!�

1/1/2015

guest China - EU close to reaching negotiated deal on Chinese solar panel imports

An article that just got posted to EV magazine:

http://www.pv-magazine.com/news/details/beitrag/agreement-expected-this-week-in-eu-china-trade-dispute_100012138/#axzz2ZmAm0tJd

A settlement is expected this week.

In addition, the many smaller, lesser known photovoltaic manufacturers that are currently responsible for the majority of Chinese module imports to the EU would probably fall victim to a minimum import price of �0.55 per watt.Sounds like the big companies such as YGE, TSL, CSIQ, SOL, and STP, LDK will be the big winners here at the cost of small no name Chinese manufacturers. This will further curb capacity, which should bode well for the industry gowing forward.

This would significantly strengthen the apparent consolidation process Beijing appears to be forcing on the Chinese photovoltaic industry.

?

Interesting times, lets hope they get this deal finalized soon.�

1/1/2015

guest This is great! Any news on when they will negotiate with the US? If they get a deal with EU and keep the 57% import tariff on polysilicon from US I think SOL might be golden!�

1/1/2015

guest What the hell is going on with SCTY? This is biggest loser in my portfolio. Everything else is winning, SOL, SPWR, TSLA. I know I'm long but damn!�

1/1/2015

guest Is it relevant that Solar City and Tesla are reporting earnings at the same time on the same day?�

1/1/2015

guest Tsla = aug7

scty = aug5�

1/1/2015

guest according to solar city's web site, earnings are after hours on 8/7.

SolarCity Announces Second Quarter 2013 Earnings Release Date and Conference Call Details (NASDAQ:SCTY)�

1/1/2015

guest isn't this good news?

http://www.solarcity.com/pressreleases/192/-SolarCity-to-Provide-Solar-Electricity-to-7-500-Military-Homes-at-Island-Palm-Communities-at-Multiple-Army-Bases-in-Hawai�i.aspx

market doesn't think so?�

1/1/2015

guest Now I Guess this is great News for the chinese solarpanels.

http://www.menafn.com/1093682397/EU-trade-chief-sees-speedy-end-to-China-solar-row

and

http://uk.reuters.com/article/2013/07/24/uk-eu-china-solar-idUKBRE96N0WV20130724

what to load up With Sleepy?�

1/1/2015

guest It may just be coincidence but the conspiracist in me speculates the possibility that one of the companies could report below expectations, and could soften the blow to the stock if the other company reports above expectations.�

1/1/2015

guest Solar is getting hammered. SPWR down big today.�

1/1/2015

guest For some reason these articles have not had any impact on the solar stocks. There can be several reasons for this, such as expectations of a resolution have already been priced in (last month's solar rally), the market doesn't believe it until they see it (which could spark and instant 10% - 50% rally) or the market simply doesn't like the conditions of the settlement.

IMO this settlement will be a huge win for the big Chinese Solar Companies. If you have a long term horizon (2-3 years) then load up on SOL, CSIQ, and possibly even TSL. There are other Chinese players that might do better, I don't have the time to research them all. CSIQ and SOL will be the first two to return to profitability and that is why I recommend those. The only reason I recommend TSL is because it is one of the better Chinese companies, but has been a laggard in last month's rally; this means it is next in line to go up.

Losers in this deal will be the small low quality Chinese panel suppliers as well as European EPC companies (that install solar panels).

- - - Updated - - -

Just another day at the office for solar stocks. This is normal behavior for them. I wouldn't call this getting hammered, because they usually go down 6% - 10% on a bad day. 2% down is a walk in the park for the sector. Welcome to the world of investing in solar.�

1/1/2015

guest The thing is if you look at most News articles it seems like they are not gonna make a deal. A Seeking Alpha article today said that talks had broken Down. One of thoose articles above are from a newsagency in the middle east, stating: "I trust that we can come to a solution in the coming days or coming weeks," EU Trade Commissioner Karel De Gucht said at a press conference in Beijing. Its weird that noone else has quotes from that press Conference

However the last article is from Reuters, but not yet picked up by to many yet.

"We are very close. Both sides want a deal," said one European source. "Even if an agreement is not in place on August 6, Chinese producers could choose to hold back their imports until there is agreement because we are so close."

I think and hope its not priced fully in yet. Like when Tesla said they made profit, but somehow ppl didnt belive it.

Im way more optimistic today then earlier regarding a deal. I just hope the market also realises this since I overbought August Calls on SOL �

�

1/1/2015

guest Yep, gotta expect the volatility in the solar sector.

Would recommend reading 10k annual reports and transcripts to quarterly earnings calls for all stocks you hold, esp. for those w/higher risk-reward so you know what you're getting yourself into.�

1/1/2015

guest Sleepy,

Thanks for your continued commentary on solar stocks. With the volatility in the solar sector, would you recommend holding stock as opposed to options in these companies, as the majority of them only have options expiring in jan 14 (as I recall, only spwr has jan 15 options).�

1/1/2015

guest Sleepy, Yeah i have been watching solars for a while. I was making the statement in regards to my blue chips which were up at the time. Well besides MU which ended 4% down on high volume for some unknown reason. No news at all.

On the dip down i brought in some more SOL and SPWR

MU tanks more tomorrow i think i will have to fallow the more buying i did on solar today on my blue chips tomorrow. (sold off the rest of my Intel to make these final few moves)�

1/1/2015

guest +1 on this. I would like to get in on SOL and was thinking leaps. I would rather have the Jan 15, but I don't want to sit around and wait because it sounds like there might be some big movement surrounding this spat between the EU and China. Sleepy, you mentioned a 2-3 year time frame, but do you think we will see significant movement in the next 5 months to justify Jan 14 options over outright stock?�

1/1/2015

guest Anyone buy Aug SPWR options for earnings?�

1/1/2015

guest Anyone else wondering when Elon will finally announce that he is establishing a holding company for Tesla Motors and Solar City?�

1/1/2015

guest Curt, did you sell your SCTY holdings recently? Just visited your website and noticed your only holding is TSLA currently.�

1/1/2015

guest I am considering selling 1/2 of my tsla sept calls to buy options for spwr, but further out in time in case the stock does not go up after earnings. Looking at either jan 14 or jan 15 otm calls. The question is, how far out of the money to buy.�

1/1/2015

guest Yeah, I did. It seemed enough of a dip to buy some "out of the money now, but in the money yesterday" calls.�

1/1/2015

guest The simplest way to make money in solar is with stocks, since hardly any of them have J15 leaps available. The solar revolution is just beginning and at least some of these companies will be multi-baggers (all of them already are if you got in a few months ago), I don't know when the market will eventually figure this out; it might take them 1 month, 6 months, or 2 years. If you buy J14 options, then know that you might be a little early in the game and the options could go to $0. That said, I think that J14 options are the sweet spot (march 14 if you can find them are better) and would recommend them to those who have excess capital and can afford to lose it.

If you want a "safe" play on Chinese solar then go with J15 TSl $10 or $12 for about $1.20 - $1.60. You will either lose it all or you will have a 10-fold return.

If you don't have capital to lose, then buy some stocks. Safer picks are SPWR and SCTY. Higher risk/reward picks are SOL, CSIQ, TSL. You can always throw in some JKS, JASO, HSOL, or even RSOL if you are feeling adventurous (I don't know much about the last four companies though so do your research).

If you are looking for your best chance of making a quick buck, then go with SOL and CSIQ, but remember that there is higher risk with these than with SPWR.

I actually did buy some SPWR Aug. calls a couple of weeks back. Mine are deep OTM and will probably expire worthless unless SunPower gives stellar guidance. I know that their H2 will be great, but they sandbag too much and will probably not give out good enough guidance to get the stock booming (although I expect an upwards revision from SPWR and virtually all solar companies in Q2).

I bought my calls thinking that SPWR will continue to go up leading up to earnings. It was doing great, but right now these EU China negotiations are holding all of the solar stocks hostage over the past week. We need this resolved by Friday, so that solar stocks can continue their upswing. In the mean time it is a good time to buy. Don't wait any longer!�

1/1/2015

guest Thanks Sleepy for all your great advice and analysis with regards to the solar industry. I'm already in on SPWR and I believe I will look to initiate on SOL tomorrow. I haven't done any research on Trina Solar, but will look into it as well.�

1/1/2015

guest If you are a very risk tolerant person, then I think that the risk reward trade-off in solar is pretty good.

E.g. If you buy SOL at $4, I would say there is a 50% that you will double or triple your money within 12 - 18 months, 30% chance you lose 50% or more, and 20% you end up somewhere in between. To me those are great odds and a risk that I am personally willing to take. If you don't have this risk tolerance then stay away from the solar sector, not many people are able to stomach these investments and will end up selling the moment the stock is down 20%; when instead you should be buying more. Psychologically it is really hard to do.

The alternative energy revolution is real: http://www.businessgreen.com/bg/analysis/2284204/eu-urges-g20-to-phase-out-fossil-fuel-subsidies

Maybe there are better ways to make money on this, but I will stick to solar stocks which are priced to fail but IMO will become profitable within a few quarters.�

1/1/2015

guest What are your feelings on just dumping some cash into TAN (Solar ETF)?

Mike�

1/1/2015

guest That is an awful idea. TAN is an ETF that has exposure to a lot of solar. Not all solar is good, since there is consolidation in the industry and many players will still go bankrupt. You are getting the good with the bad.

Create your own ETF:

SPWR, SCTY, FSLR, SUNE, GTAT, SOL, CSIQ, TSL, YGE, JKS, JASO, RSOL. These are mostly panel manufacturers/module sellers/systems builders/solar leasing. Therefore, you will need to research other solar sub-industries such as inverters and EPC companies.

I think that if you buy those 12 stocks, then you will have a good diversified exposure to the solar panel side of things. Buy these and hold for the long term. Some may even go bankrupt, but that means that others will succeed. In the end somebody is going to make it really, really big in the solar industry, and most likely there will be plenty of winners; many losers in the short run too.

With TAN you still have all of the downside risk, but you are limiting your upside potential.�

1/1/2015

guest Of interest: I have a solar system just put in by Solar City. The city of Ventura inspector came today to do the final inspection. He told me, "nice thing about Solar City is they do good work, they always get it right the first time, not like some of the other companies who have to come back again and again to get it done right".�

1/1/2015

guest Nice to hear. What panels and inverter did Solar City use for your system?�

1/1/2015

guest

Panels are Trina Solar, the inverter is an Aurora.�

1/1/2015

guest I'm getting exact same components installed by SolarCity in 4 weeks. They sent me all the plans and required documents and I'm just amazed of the level of detail that is required and the hoops they have to go through to get the permits. At some point I considered installing solar on my roof myself but seeing the amount of paperwork, I'm glad I decided to hand the entire project to SolarCity (and at zero cost to me, which by itself is just amazing!).�

1/1/2015

guest Thanks.

Just to save research time for some... Aurora inverters are made by Power-One which is being acquired by ABB.

Power-One, Inc. - Power-One's Stockholders Approve Acquisition by ABB Ltd.

ABB Profile | ABB Ltd Common Stock Stock - Yahoo! Finance

Trina Solar (TSL) has been discussed here before. Here's some slides from their last quarter's earnings presentation:

Q1 2013 Supplemental Earning Call Presentation�

1/1/2015

guest Hi Folks, I am new to Scty. Can someone point me to a few comprehensive analysis on Scty? Either on this forum or some other site.

If someone ask me the same question for tsla, I would easily point them to a few masterpieces. So masterpieces is what I am looking for. Thanks!�

1/1/2015

guest I'll leave it to others to recommend any "masterpieces".

But to start, listen to their Q1 2013 earnings call and you'll see how much momentum they've got going. Also, read their IPO prospectus as well. Their pre-IPO investor roadshow presentation was helpful as well.�

1/1/2015

guest But also keep in mind they've made massive gains in stock price very quickly. And they're soloar so prone to massive jumps up and down.

My advice for SCTY right now is: Careful.�

1/1/2015

guest Thanks! My gut feel(without much research) is scty is different than TSLA. It is way more speculative than TSLA. TSLA share holders seems have deeper belief in the company.

Regarding masterpiece, Ok I guess I am looking for competitive analysis why the stock has a lot more potential even given the rapid gain so far. It any articles you think can be a good starting point.�

1/1/2015

guest

Kevin,

Right now the risk reward is in favor of Chinese Solar stocks. Over the past 10 pages of this thread I have written a ton about SPWR as well as Chinese solar over the past 5 pages or so. I think that there are many good investments in solar right now.

A safe and good pick would be SPWR. High risk, but very high reward is CSIQ, SOL and possibly one day TSL. SCTY is just so hard to value and it has 10x less revenue than SOL, but has 10x higher market cap; hard to say how the market will value such a company.

SPWR has their earnings call this upcoming Wednesday July 31. If they had a good Q2, then it might just get the ball rolling in solar. Also read about my opinions on the EU China Tariff negotiations.�

1/1/2015

guest Thanks sleepyhead! I will read them up.�

1/1/2015

guest One big advantage that Solar City has over the competition is the Elon Musk connection. We've already seen a very healthy financing program offer from Goldman Sachs to Solar City customers.

As long as Elon is involved in SCTY, I bet GS will be pumping money into them. In addition, you'll be seeing Tesla batteries recycled through SCTY, supercharger panels, ect.

They will always be "high profile" in the industry.�

1/1/2015

guest This is true, so if you are in it for the long haul then buy and hold and don't look back. I am sure that it will do very well over time. In the short run though it is just so hard to value this company. It very well may triple by the end of the year, but it also may stay around the $30 - $40 range. It is just so hard to tell. At least with Tesla you can project what the cash flows and EPS might be a few years out. Can't do the same with SCTY that easily.�

1/1/2015

guest Chine EU negotiations at a stand still over 2 cents. Politics at its finest:

http://www.pv-magazine.com/news/details/beitrag/eu-trade-case--no-agreement-reached-for-now_100012170/#axzz2ZmAm0tJd

Just split the difference at 0.56 euros and call it a day. Funny thing is that EU has a lot more to lose than China if they actually do implement these tariffs. China knows this so they hung up the phone. The EU Commerce guy that is negotiating this with China knows that the EU will have to vote on these tariffs in December to make them permanent, and that they will vote not to. He is trying to save face by negotiating a deal so he doesn't lose the vote in December. EU is going to have to cave in and pretend like they always had a target of 0.55 euros...�

1/1/2015

guest Anyone concerned with Bernanke opening his mouth next week right before SPWR earnings and messing it all up? He did this to me on the MU earning and i lost alot of money on Week ending calls when the market sunk 3%+ in two days.�

1/1/2015

guest I think that Bernanke will not mess up again. Interest rates have gone through the roof since then and he will talk about keeping interest rates very low for a very long time. I think that Bernanke will be a catalyst if anything.�

1/1/2015

guest I bought some SOL this morning at opening at $4.185. I understand it may be risky but it's a small part of my retirement portfolio, I'm 27 years old, and I can afford to hold it until the solar revolution goes into high gear �

�

1/1/2015

guest I kind of see a lose lose happening on Wednesday which has me worried. If the job growth rate is down then that is bad for the market, but if it goes up it could hint at Tapering coming soon. I really dont see how the Market is going to spin anything positive that day.

This alot has my worried about my Tesla AUG $150 calls. I might have to sell out of them on tuesday and hope for a dip to buy them back thursday or friday.�

1/1/2015

guest EU - China agreement reached. Details TBD.

EU, China Reach Agreement on Solar-Panel Dispute - WSJ.com�

1/1/2015

guest

Is that good news for us SCTY shareholders? Too early and lazy to proess this news now sorry hahah�

1/1/2015

guest

Can't access it, subscribers only.

Here's an article from NYT

Europe and China Agree to Settle Solar Panel Fight - NYTimes.com

"On Saturday, officials at the European Commission said they could not give details of the deal, including the price that Chinese exporters would pay to sell their panels in Europe, until the arrangement had been formally approved by the commission. But a European Union official, who spoke on condition of anonymity because the deal had not yet been formally approved, said the two sides had agreed to a minimum price of 0.56 euros per watt (74 cents), which would base any potential surcharge on the amount of electricity generated by each imported panel."

Not sure how it's going to affect my SCTY, if any, but it should be good for my CSIQ�

1/1/2015

guest Equation is simple.. if similar rules trickle down to US, which I think it will soon, what is the SCTY cost to buying panels. Most likely, that price will go up. I think SPWR is a winner. SOL too is a winner.

SCTY is efficient in what it does though, so it may still be able to compete with other installers. Anyone has insight into current SCTY & SPWR cost/watt?�

1/1/2015

guest Where is the Like button? �

�

1/1/2015

guest The star icon at the bottom left of each posting can give reputation points to the author. That's probably not what you meant, but it's the closest thing.�

1/1/2015

guest Awesome! I bought SOL on Friday at $4.185only 750 shares but hey, it's something

�

�

1/1/2015

guest Awesome! Just how I predicted the deal got done. Now lets hope that my other prediction is correct and that this will mean a 20% - 50% rally in solar stocks, especially Chinese. In my opinion Chinese Solar should be up 10% - 30% on Monday, and SPWR, FSLR should be up around 10%+ as well. SCTY will probably tag along in the solar rally and have a nice gain, but this deal is kind of neutral for SCTY. That is how I think the markets should react, but what happens is a big unknown. I think that the solars might start off slow around +5% and then gather steam throughout the day.

This has to be positive news for the industry and for the globalization of the world's economy. Trade war avoided, should result in a huge rally in all of the global markets.

I loaded up on options on SOL, CSIQ, and SPWR, and bought several thousand shares of each company. I hope that the markets figure this one out and the stocks rally big time. If they don't then I will be loading up even more on SOL come Monday. IMO, this deal has basically guaranteed a profit for SOL in Q3 or Q4, and that they will be giving out some very nice guidance for H2 on their earnings call. I was going to buy some TSL next week and now it looks like it might be too late for that play.

Think about this for a second: SOL gets half its business from Europe, have their own Poly Plant (huge benefit after last week's Chinese tariffs on imported poly), and guided towards ~$0.52/Watt as production costs. Now they can't sell in Europe below 0.55 Euro cents which is about $0.74. This gives them a 40% Gross Margin in Europe. The rest of their business comes from high margin US and Japan. If my numbers are correct and SOL's sales don't decline by a significant amount in Europe then this makes the company instantly profitable and possibly even VERY profitable. On second thought this stock should probably rally about 50% - 100% on Monday (I know it won't happen, but it should - the problem is that hardly any analysts follow this company and no one knows how to value these companies). This goes for all other Chinese Solar companies as well: TSL, YGE, CSIQ, JASO, JKS, and even STP, LDK.

Exciting times indeed!�

1/1/2015

guest I am with you sleepy, I did just options on SPWR and SOL and now i really which i had more. I am going to wake up Monday and look at the market reaction. If its slow in the morning i am going to pick up a bunch more SOL $7.50 options and Maybe some more SPWR options as well, once again pending the market reaction.�

1/1/2015

guest The answer to that one is heavily tilted in favor of SCTY. But that is not the right measure to use, because you are selling energy and not power. The proper measure to use is Levelized Cost of Energy (LCOE) and on that basis Sunpower is very competitive. Just as good as or better LCOE pus significantly better panels than SCTY uses would skew the discussion in SPWR's favor.

Unfortunately for Sunpower though not many people understand this concept and Sunpower has to work very hard to educate people that "Hey, we are better and we are actually cheaper too." On a cost/watt basis it may seem like a different story and that is the metric that most people first look at; even though it is a misleading number primarily due to degradation, longevity, and efficiency.�

1/1/2015

guest Seems too soon to make definitive statements about panel longevity, no?�

1/1/2015

guest Actually no it isn't. SunPower has been in business for 30 years and they use higher quality materials and offer the best and longest 25 year warranty in the business (because they can). Their panels were originally designed for concentrated solar use, which means they need to be able to withstand more extreme conditions. Longevity, durability, and lower levels of degradation are a few reasons why SunPower panels sell at almost double the price of TSL, YGE panels that SCTY uses.

It is like saying that it is too soon to make definitive statements about quality/longevity or Tesla vs. Kandi/BYD.

There are also independent test labs for panels that are tested over a course of 2 to 6 months. They try to recreate the abuse that panels might take over a 30 year period in those few months. SunPower always crushes the competition in reliability testing.�

1/1/2015

guest Hey, Yingli also warrant their panels for 25 years. Because they can. And so virtually any other major manufacturer. Yingli for example guaranties that output after 25 years would be no less then 82% of rated power output for Panda panels. What is the SunPower power output warranty after 25 years?

As for efficiency, I'll quote: Yingli Solar PANDA is a new monocrystalline silicon module technology with n-type solar cells that have average ef?ciencies higher than 19.5%.

Not so huge difference with SPW. And SunPower basically lying in their marketing materials about what they face from competitors - 15% efficiency and similar BS. And since SunPower have no problem with being nonethical, trying to lie their way through, I would not read too much into "independent" testings that probably heavily sponsored by SPW. What really matters is terms of warranties, there are money at stake there, producer would eventually had to pay if panels wont perform.

EDIT: found SunPower warranty: 87% of rated power output at year 25. Yes it is better then 82% from Yingli, but judge for yourself how big of difference is it.�

1/1/2015

guest Sleepy,

With regards to SPWR, you have stated that these guys are �sand-baggers� when it comes to earnings estimates and forward guidance. They provided guidance of 0.05-0.20 for this most recent qtr, with current analysts avg estimate of 0.11. I think in one of your previous posts, you believe they will earn 0.15-0.20 for this qtr. If they provide their usual conservative guidance for the 2[SUP]nd[/SUP] half of the year, and with the entire solar industry likely to rally based on the EU-China deal on Sat, do you see additional upside to SPWR after earnings, if they earn 0.15-0.20 but provide only conservative guidance.

Also, with CSIQ and SOL likely to announce earnings in mid august (based on their prev earnings dates of mid may), do you think they will pre-announce their Q2 earnings if they are good.

As always, thanks for your insight.�

1/1/2015

guest Zzzz... I know that you are a SunPower hater, but this is the second time that you are spreading misinformation in this thread. Yingli's product warranty is only 10 years and SunPower's is 25 years. The industry tricks you into believing you have a better warranty than you do. Only SPWR actually has a real 25 year warranty:

http://us.sunpowercorp.com/cs/Satellite?blobcol=urldata&blobheadername1=Content-Type&blobheadername2=Content-Disposition&blobheadervalue1=application%2Fpdf&blobheadervalue2=inline%3B+filename%3Dsp_warranty_2.0_legal_doc_residential_en%2BFINAL.pdf&blobkey=id&blobtable=MungoBlobs&blobwhere=1300286163024&ssbinary=true

http://www.yinglisolar.com/assets/uploads/warranty/downloads/Multi_standard_110922.pdf

You also point out some numbers using Yingli's top of the line module, which is expensive and still doesn't even come close to SunPower's in terms of efficiency, quality or actual real world efficiency (not the 19% they claim it has, because when you look at that number SPWR's panels are 24% efficient).

Keep on hating on SPWR, while I keep on making money on SPWR. And what you wrote about SPWR mgmt, "since SunPower have no problem with being nonethical, trying to lie their way through" is considered libel.

I hope that you are short SPWR.�

1/1/2015

guest I only got problem that SunPower compares their product to lowers specs panels they could find that they actually are not competing with. That is very misleading and yes, I consider that lying.

Yes, there are many "top of the line module" offerings by competitors out there. As for Yingli warranty, I quote:

Yingli Solar further warrants that if, within twenty-five (25) years after

the Warranty Start Date, any PANDA Module exhibits a power output

less than 82% of the nominal power output for that PANDA Module as

specified on its original product label (the �82% Threshold�), and if such

decrease in power below the 82% Threshold is determined by Yingli

Solar to be due to defects in materials or workmanship under normal

application, use and service conditions, Yingli Solar will remedy such

decrease in power by, at its reasonable option, either (a) replacing or

repairing the defective PANDA Module at no charge to the Customer

for replacement modules or parts, (b) providing Customer with

additional PANDA Module(s) to make up for such decrease in power

so that the power output equals or exceeds the 82% Threshold,

provided, it is possible for the Customer to mount such additional

PANDA Module(s) or (c) refunding the difference between the actual

power output of the PANDA Module and the 82% Threshold, based

on the current market price of a comparable PANDA Module at the

time of the Customer�s claim.�

1/1/2015

guest Im not picking sides here as I don't have enough info, however, I just had 34 Yingli panels (contractors choice) equaling 8kw hours on my roof and they do have a 25 year warranty. They are also producing above spec. That is the extent of my knowledge on panels.�

1/1/2015

guest I just linked you a warranty sheet and yet you still seem to not be able to understand it. Here is another warranty sheet (identical?) for the PANDA product that you talked about:

http://www.yinglisolar.com/assets/uploads/warranty/downloads/PANDA_standard_110928.pdf

It clearly states:

1 LIMITED PRODUCT WARRANTY

Yingli Solar warrants to the original end user purchaser (the �Customer�)

that the PANDA Modules shall be free from defects in materials and

workmanship under normal application, use and service conditions

during the period beginning on the earlier of the date the PANDA

Modules were purchased by the Customer or one (1) year from factory

dispatch (the �Warranty Start Date�) and ending ten (10) years after

such Warranty Start Date. If a PANDA Module fails to conform to this

Limited Product Warranty during this ten-year period, Yingli Solar will, at

its reasonable option, either (a) repair or replace the defective PANDA

Module at no charge to the Customer for replacement modules or parts,

or (b) provide the Customer with a refund equal to the current market

price of a comparable PANDA Module at the time of the Customer�s

claim. This Limited Product Warranty does not warrant a specific power

output, which shall be exclusively covered under the Limited Power

Warranty below.

There is a 10 year product warranty, so if the product breaks after 10 years, you are SOL (S*** out of Luck) and your 25 year power warranty is worthless. Whereas SunPower offers a 25 year product warranty.

If Yingli sold cars then it is basically guaranteeing you that your car will achieve 30 MPG for at least 25 years. But if you car breaks down in year 11, then it becomes worthless and you have a piece of junk installed on your roof. Whereas SunPower is guaranteeing that you that the car will run for 25 years and that it will get at least 40 MPG.

You guys really need to understand the contracts that you are signing, especially when installing solar panels. Now if you you got a lease through SCTY and a Yingli panel goes bad, then SCTY will replace it and you are safe; but that is a cost to SCTY.

@sub - read your contract again and I would bet that the Yingli panels you installed have a 25-year "POWER" warranty and only a 10 year "PRODUCT" warranty.

- - - Updated - - -

Sunpower aquired a bunch of solar manufacturers in the past and they own those companies that make "commodity" panels and they used those panels (several different brands), because they are available and are able to legally test them and provide results without getting sued.

Yes, it is unfortunate that they compare their own panels to these cheap panels, but that is all the data they have to work with. Half of the world's capacity is of similar quality though, so SPWR is trying to show why they are better than the "commodity" panel business.

- - - Updated - - -

I did some research and found that you are a hypocrite for calling SunPower Management liars. You are using cell efficiency of 19%, when in fact Yingli's Panda MODULES are 16.5% efficient, which is what really matters and that is close to 15% (which is an average number for not top of the line modules):

Monocrystalline | Yingli Solar

Today�s average cell efficiency on commercial production lines exceeds 19% with up to 16.5% module conversion efficiency.

So who is the liar here? I find your post very ironic.

SunPower has 24.2% cell efficiency, which leads to a 21.5% module efficiency, which is still 30% more efficient than Yingli's top-of-the-line PANDA module.

The solar industry plays games with numbers and you have been fooled like many others. I am trying to help people understand solar panels, and you are not helping by calling SPWR mgmt liars. Clearly you don't understand the numbers either; and that goes for both warranty claims as well as module/cell efficiency.�

1/1/2015

guest Sleepy -

I was considering buying SOL and CSIQ options on Friday but decided to hold off, thinking that there wasn't any that that the impending EU-China deal would be completed over the weekend (poor decision...:crying.

I've read through this entire thread and have to say your insight has been incredibly valuable and accurate. If you don't mind me asking, what kinds of SOL and CSIQ options did you purchase last week and what kinds do you intend to purchase early on Monday?

Thanks in advance,

-tmont�

1/1/2015

guest SPWR Q2

I actually made a mistake and they guided towards $0.05 - $0.15 for Q2. Their Q1 guidance was for $0.05 - $0.20 and they delivered $0.22. Their last 3 out of 4 quarters they exceeded analyst consensus by more than 100%.

If SPWR delivers $0.15, then you have H1 at $0.37, which is more than half way to their FY guidance of $0.60 - $0.80 (as well as consensus of $0.77). They have said several times that they are expecting a strong second half of 2013 financially, and never said the same about H1. So if H1 is just ok, then H2 will be better, so they have to raise guidance. There is also some risk that they were able to shift some of the income from H2 to H1 and not have a great H2. I don't think this to be the case though based on the earnings call in May.

But wait, there is a tiny detail that nobody picked up on in the Q1 earnings call:

Additionally, as a result of the United States government sequestration being triggered, there were automatic cuts to the treasury cash grant program. This impacted the value of certain outstanding cash grants for some projects and leases. In light of this, we updated our cash grant expectation and took a non-GAAP charge of $25 million in the quarter to accommodate this change. We do not expect to record any additional charges related to the sequester and, if not for this charge, our Q2 result would have been significantly better than reported. The GAAP charge was $18 million due to the timing of revenue recognition.

I can't quite figure it out, I am not sure if they took this in Q1 or Q2? I tried hard to find it in Q1 10Q, but it isn't there. Maybe they really meant Q2, or maybe that is just a typo in the transcript. Either way though, this means that H1 EPS would have been a lot higher if not for the Sequester; $0.20 to be specific.

Now imagine H1 EPS of $0.57 and we are supposed to see a "strong" second half financially. I can see $0.60+ EPS for H2 happening, especially since everything has gone right since the last conference call. Euro-China negotiations will lead to higher ASP's and force EU to buy panels elsewhere and not only from China. This is good for SPWR. The whole industry has been booming a lot quicker too. The recent demand announcements from China, Thailand, Netherlands, Saudi Arabia, etc. are huge.

I think that SPWR will have to raise guidance for FY 2013. They guided towards $0.60 - $0.80 and they should be around $1 or more imo. If they don't raise guidance then the stock will not have much more room to run in the short run.

Unless something went wrong with the company that we don't know about (and this is a real risk), it has to raise guidance.

As far as CSIQ and SOL: SOL already preannounced two weeks ago and the stock has been rallying big time lately.

I will fill you in on a secret with CSIQ that nobody knows about and the market hasn't priced in yet:

On June 28th, they closed the deal on a 10 MW plant called Brockville 1, which they sold for about $50m - $60m. All of this revenue is recognized in Q2 (because of the accounting method they used - completed contract method, i.e. all or nothing). This will be a high margin sale as well.

I don't know what they guided to revenue wise in Q2, but in Q1 they had $264m in revenue. Q2 analyst consensus (for all 2 analysts) is $420m. So they have an extra 15% surprise up their sleeve. This bodes very well for CSIQ in Q2.

CSIQ is usually the first Chinese solar to announce earnings. Expect them to come out this week with an official release date. Their is a small possibility that they preannounce their earning if they are very good.

- - - Updated - - -

I actually think that TSL might be one of the biggest movers come Monday (only because of its big European exposure). That is why I was advocating TSL in the past and started looking into it as well. I was going to buy some TSL options this week, but it looks like that ship has sailed. CSIQ and SOL are still the best chinese solar plays in the short run though, and if the market gets it right then they will rally more than TSL. On the flip side, maybe I am completely wrong and the market doesn't like this deal and solar stocks come crashing down on Monday. Who knows?

The options I bought for SOL J14 $5 strike at $0.20/option. I bought a lot of them and now they are around $0.75/option. I might sell those and buy some $7.50 J14 options instead if I can get a 3 for 1 deal. Otherwise I will just hold on.

CSIQ I bought some J14 $16 options and they will be ITM shortly. I also bought some Aug $17 options when they were selling for $0.25. The stock still has to make a big run to reach my strike price, but if they announce earnings pre Aug 17 (which they should), then I am confident it will reach my strike price.

If solar stocks start out slow on Monday then it might be worth purchasing some CSIQ Aug options (at least slightly OTM). Some Sep calls for TSL, YGE, and SOL should work out good too.

Just remember that Chinese solar companies have done very well since April. With good news they still have room to double in a very short time. A hint of bad news will lead to profit taking and selling and you will lose all of your money on the options. If you want to play it safe then buy stock instead.

Options are extremely risky here. I am willing to take the chance because I think that I have a good enough chance of being right that it is worth the risk. One thing I can't afford is to be right and not take the risk with options (and sit depressed thinking how much money I could have made). If I am wrong and lose a few $thousand, I can live with the consequences knowing that I took the risk and tried. A few $thousand is a lot of money for money though, so I am taking a huge risk here.

It is probably too late to do anything now that the announcement is out. Even if the stocks start out only 5% up and end the day at 20% up, the volatility premium will be so high in the morning that the options will probably trade at the same price all day long in my above scenario. The only thing you can do in a scenario like that is to buy the stock early in the morning. If the stocks start the day 10%+ then it is too late to do anything significant. The time to buy was last week and I even wrote this on Wed, July 24:

"In the mean time it is a good time to buy. Don't wait any longer!"�

1/1/2015

guest Sleepy,

thanks for the detailed reply. I was reading the transcript from the spwr q1 earnings call from Morningstar's website:

SunPower Corporation SPWR Q1 2013 Earnings Call Transcript

"Additionally, as a result of the United States government's sequestration being triggered, there were automatic cuts to the Treasury cash grant program. This impacted the value of certain outstanding cash grants for some projects and leases.

In light of this, we updated our cash grant expectation and took a non-GAAP charge of $25 million in the quarter to accommodate this change. We do not expect to record any additional charges related to the sequester, and if not for this charge, our Q2 results would have been significantly better than reported. The GAAP charge was $18 million due to the timing of revenue recognition."

In the first line of the second paragraph, he uses the word "took" as in the past tense and goes on to say "our results would have been significantly better than reported", again key word is "reported"', also in the past tense. This leads me to believe that he meant to say q1 instead of Q2 as transcribed in the call. Lastly, he says "we do not expect to record any additional charges related to the sequester."

all of this points to the charges taking place in q1. Do you agree?�

1/1/2015

guest I agree with you but:

1. The earnings call was in May, so they could have "took" the write down in April, i.e. in Q2.

2. I searched through the Q1 10Q and could not find this charge anywhere in the SEC filing. Be my guest and look around. If you find it let me know.

3. They issued guidance for Q1 sometime in February or so, and the sequester didn't go into effect until March 1, so they couldn't have issued guidance knowing that the sequester would lower EPS by $0.20. And they crushed Q1 results...

This leads me all to believe that the charge will be in Q2 and they will still be profitable. Which will lead to huge second half of year financially.�

1/1/2015

guest Solar City Investor Discussions

Sleepy, thanks for putting in the work and valuable analysis! I am starting to follow the solar segment.

In your earlier post, sometimes you have H1 eps and sometimes Q1eps. What is H1 eps?�

1/1/2015

guest H1 EPS means first half as in Q1+Q2. H2 would be Q3+Q4.�

1/1/2015

guest Thanks sleepy. I remember seeing a ppt presentation on spwr. It is a link in one of your comment but I can't located it now. Can you post it again? I have half hour to kill.�

1/1/2015

guest Here you go.... SunPower Corporation - Investor Events and Presentations�

1/1/2015

guest Thanks ongba!�

1/1/2015

guest @sub - read your contract again and I would bet that the Yingli panels you installed have a 25-year "POWER" warranty and only a 10 year "PRODUCT" warranty.

- - - Updated - - -

You may be right about that, to be honest I didn't read it lol! Friend of mine from college has a solor power business so I took his word for it. I guess the good news is that at 10 years my system has paid for itself twice, worst case. Of course over 25 years it would have paid for itself 4-6x so I hope I don't have issues down the road, I doubt it.

I've been following this thread but i'm tapped out right now on cash with everything in TSLA and others that I don't want to get rid of, otherwise I would have tossed some cash into some of these solar stocks.�

1/1/2015

guest It's looking like no one cares about the agreement. A lot of the solar stocks are more or less flat...CSIQ +1.4%, SCTY +.17%, SPWR +1.2%...

SOL and TSL are both about +4%, but not near the reaction I expected.�

1/1/2015

guest Just load up with Jan14 options then �

�

1/1/2015

guest Well, I bought some CSIQ AUG options (slightly ITM). Not much as I want most of my money in TSLA as that is what I understand the best...Mostly bought them for fun. I probably should've bought more as CSIQ is now up 3.4%, lol...�

1/1/2015

guest It is just a tough day in the market. The NIKKEI tanked 500 points and the US market has been steadily going down since market open. Looks like Bernanke is holding the markets hostage over the next couple of days.

Solars are holding up remarkably well today due to the news. Some Chinese solars started the day at +10%, then came the market dip and profit taking. This is a good thing though, because if we see a good market tomorrow and/or the "official" details come out on the agreement, it should propel the stocks to move another 5% or so. Then if SPWR has a good report out on Wednesday, the solar sector can continue to rally.

I think that the solars will continue creeping up throughout the trading day barring any significant market correction. I wouldn't be surprised to see some 10% gains today in SOL, TSL, YGE, JKS, etc. and 4% from SPWR.

The markets will not revalue the Chinese solar companies until they actually see these elusive profits on paper. I know that they are coming, so I am long. It is just a matter of time before these companies double and triple again. The rise in Chinese solar has been gradual and is continuing strong. This has only just begun.

- - - Updated - - -

Just a note to those playing options:

CSIQ is the only Chinese solar company that has a chance of reporting earnings prior to the Aug 17 option expiration date. Most likely they will have results on Aug 14, but this is not a sure thing. Maybe they will postpone due to the EU settlement thing; I really don't know. All (or at least most) other Chinese will report after expiration date.

If you are trying to play the earnings season on Chinese solar then buy Sep calls. I bought some Aug. CSIQ calls, because I think they will announce in time. All other US companies should be good to go for Aug: SCTY, SPWR, FSLR, etc.�

1/1/2015

guest Sold higher strike calls against my TSLA sept calls to create a bull call spread and raise cash to buy jan 14 calls in SOL, SPWR, and CSIQ. Thanks again sleepy for your commentary!�

1/1/2015

guest Mr. Market really took the wind out of the solar sails, was hoping for more from the EU announcement. Looks like we are going to have a very Shaky market week with all the Fed talk on Wednesday.�

1/1/2015

guest Also have a catalyst with SPWR earnings on weds after the close.�

1/1/2015

guest ongba - You have done a lot of research on SPWR as well recently, correct? What is your view on the company?

I know that it might be skewed based on the things that I wrote in this thread, but objectively do you think that I am being overly optimistic about this company and the sector as a whole? Do you think SPWR will have good earnings and issue upward revisions?�

1/1/2015

guest Sleepy,

I have only been following the solar sector since April (initially SCTY as an additional play on elon musk along with TSLA) as I usually stick with the tech sector for my picks, but have been following SPWR since you wrote about it extensively over the last several months. I have viewed their presentation and have read many articles on the web. They do indeed seem to be one of the safer picks in the industry and I believe they will beat the estimates this weds (based on their record over the past several quarters). The question becomes 1) whether the sequestration charge is taken this qtr as I couldn't find clarification in their filings as well, and is it already priced in 2) how conservative will their guidance be, knowing these guys are low ballers and 3) the inherent uncertainty with earnings of any company. Like you, that is why I went with jan 14 options to give the stock some time to recover in case it drops for whatever reason, although I would love a significant beat, so that I can roll the winnings back into Tsla before its earnings on aug 7. I think you have done your homework extensively in the sector as evidenced by your success in spwr and tsla so I don't think you are too optimistic about the solar sector, plus you were a former analyst, so I think your reasoning is as sound as it can be. For the record, my entire portfolio now consists of 50% near zero cost (near risk free) tsla sept 115-135 bull call spreads, 50% jan 14 solar options, split 1/3 in spwr, 1/3 in csiq, 1/3 sol (the latter two mainly on the recent EU-China argeement). Hope this helps.�

1/1/2015

guest Yahoo has SOL earnings as Aug 19th�

1/1/2015

guest May be time to rename this thread and move it out of the TSLA subforum...�

1/1/2015

guest That is just an estimate. Yahoo also had TSLA's earnings on July 22. It is impossible to tell until they announce. So far all we know is:

SPWR 7/31

FSLR 8/6

SCTY 8/7�

1/1/2015

guest I agree.�

1/1/2015

guest I'd suggest keeping the thread in the Tesla Investors subforum because it's directed to Tesla investors [who are interested in other investments as well].

I like going to the Tesla Investors group and finding threads like this, but if it was moved Off-Topic I don't think I'd track/follow it as often as I'd like.�

1/1/2015

guest I agree with DaveT - if this citizen in this non-democracy had a vote, it would be to retain it. My own investments in the alt.energy sector are mostly those discussed here (TSLA, SCTY, SPWR and CSIQ, plus two outliers), and for my own convenience's sake I hope this thread and these conversations are not moved.�

1/1/2015

guest Maybe retitle the thread to "Investing in Solar City and other solar stocks"? I agree that this is still the right place for it.�

1/1/2015

guest Yeah, we should rename it, but aslong as we are in the renewable energy or tech-segment I think this should stick to the investor forum.�

1/1/2015

guest This�

1/1/2015

guest Agree with everyone else, please keep it in the investor subforum.�

1/1/2015

guest

So what if the title doesn't quite match the topic or the location of the discussion is in the wrong group.

All of the "regulars" know where to find it.

Do we really want more people to come here? Everybody here is courteous and helpful. I've been to many forums where they weren't.

Don't change a thing.�

1/1/2015

guest ReneSola to Report Second Quarter 2013 Results on August 15, 2013 - Yahoo! Finance

ReneSola" or the "Company") (SOL), a leading brand and technology provider of solar photovoltaic ("PV") products, today announced that it will report its unaudited financial results for the second quarter ended June 30, 2013 before the U.S. markets open on Thursday, August 15, 2013.

looks like my August calls might come in handy!!�

1/1/2015

guest That is great news for you; I bought J14 calls since I wasn't sure if they would report in time for Aug 17.. I think that the stock will make a run towards $5 before the earnings announcement and then it is all about guidance, since they pre-announced some of the earnings. I think I might have to buy me some Aug calls soon.

I agree with this. We have a very good community here and we need to enjoy it while it lasts. Five years from now there will be so many people on this forum that all of the "great" posts will get lost with the inevitable noise that is to come with future expansion; to the point where all of the great posters (pretty much everyone on TMC today) will slowly start dwindling away and stop posting here.

In the mean time let's enjoy what we have and let's all make some money. There is an alternative energy revolution going on around the world and 99% of the people don't even know about it. This is our time to invest and make some serious returns. I like it that we have a separate thread for investing in Tesla, one for Solar Energy, and one for other Cool Tech stocks. It is great the we are all helping each other out. If we change anything, I vote to change the name and keep the thread here in the investor section.�

1/1/2015

guest great! All we need now is CSIQ and TSL earnings dates and we should be set.

- - - Updated - - -

+1...outside of the old apple finance board and braeburn group, this is one of the better investment forums that I have come across over the last several years.�

1/1/2015

guest Sleepy,

you have stated that your portfolio is heavily concentrated in tsla and the solar industry. If I may ask, what is the makeup of your portfolio heading into SPWR earnings (ie almost exclusively in the solar companies, or split between solar and tsla)? Thanks.

- - - Updated - - -

Looks like Baird has upgraded SPWR today.

http://www.schaeffersresearch.com/commentary/content/blogs/analyst+upgrades+cisco+systems+inc+csco+sunpower+corporation+spwr+and+questcor/trading_floor_blog.aspx

"With earnings due tomorrow evening, SunPower Corporation scored a substantial price-target lift from analysts at Baird, who adjusted their estimate to $33 from $24. It's no wonder, given that shares of the solar company have surged nearly seven-fold in the last year, to trade at $26.16. Despite this monster uptrend, there remain some skeptics who are hoping to call a top. Of the 10 analysts following the stock, just four offer a positive rating of "buy" or better. Also, SPWR has racked up a 50-day put/call volume ratio of 0.44 at the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX). While this reading still shows a clear preference toward long calls over long puts, it is 2 percentage points from an annual peak. In other words, demand for long puts has rarely been greater during the past year, on a relative basis. Analysts are expecting per-share results of 11 cents for SPWR's second quarter, a three-cent improvement over year-ago figures."

Always makes me nervous when a firm upgrades this close to earnings. Are they playing catch up with spwr or are they upgrading to give themselves a chance to get their clients out?�

1/1/2015

guest looks like it may be the former as spwr and solar stocks in general are beginning to respond well to the upgrade....lets see what happens after earnings.�

1/1/2015

guest SPWR short squeeze???

or just massive earning run up?�

1/1/2015

guest Looks like it. Will need earnings beat and guidance upgrade tomorrow pm to provide additional rocket fuel for liftoff. Hopefully it will be a "release the kraken" monster type move.�

1/1/2015

guest ongba - I actually manage two portfolios (actually more than two but two major ones, the other portfolios are basically 100% SPWR or legacy mutual funds from previous employers' retirement plans).

1. 401 (k) - I can only go long stocks and can't short or buy options in it. So today I sold almost all of my SOL, CSIQ, and TSLA in it and now have about 80% of my 401(k) in SPWR. I bought in at $26.34 today in the morning; just crossed $28.00 - ka-ching. My plan all along was to ride the SPWR earnings and then flip all of it into TSLA and ride TSLA earnings, and then flip all of it into CSIQ earnings and/or SOL earnings whichever comes first. BTW, I am up in this 401(k) over 200% YTD, and that is without any leverage (margin) and without really having any TSLA in it until it crossed $110.

2. Personal Investment Account - I have about 15% in SPWR shares and 5% in TSLA shares. The rest is all Deep OTM options on SOL, SPWR, CSIQ, and TSLA; most of them Aug. too and some are J14. If I lose all of this money my wife might kill me, haha.

- - - Updated - - -

SPWR short interest is the highest of all solar companies and that is saying something; almost 30% of float. Massive short squeeze just beginning hopefully - it will all depend on what kind of guidance they give out; let's hope that they stop sandbagging and start throwing around some strong expectations.

SPWR CEO on Bloomberg a couple of weeks ago: "Demand in the U.S. has been phenomenally good." BTW, they get 70% of their business in North America.�

1/1/2015

guest sleepy: after following your excellent postings here for some time I went out on a bit of a limb and bought some Jan14 SPWR calls when the stock was trading around $23. As it rose I rolled them to the highest strike i could find which was Jan14 $39 calls. If SPWR rallies after their report tomorrow, how much would you like to see SPWR rise in the short term for you to sell those calls as opposed to holding them towards the end of the year? Thanks.

Edit: the Jan14 $39 calls are up 50% today.�

1/1/2015

guest I also bought my calls when the price was at $23. I bought Aug. $31, $32, and $34 calls; I also bought some J14 $39 calls as well. First of all I hope that they have good earnings and the price doesn't crash. If the price does go up then I plan on selling my Aug calls and holding on to the J14 calls. It all depends on how the market plays out. I will have to listen to the earnings call before I can give you a good price to sell at. If I think that there is more room to run, then I will hold on. If the price goes up too high then I might sell (there will be a time when the market realizes that solar is very cheap and only then will we see the massive gains I am predicting). It all depends on results though.�

1/1/2015

guest Sleepy,

Congrats on your success, esp with the non-marginated non-options account! I am planning on a similar strategy as yours (ie rolling from one earnings event to the next using mainly options). Let's ride this wave of unique opportunity to financial success as we must strike now while the bull market is still alive and well.

- - - Updated - - -

With the upgrade by Baird today, and the short squeeze, I have sold my positions in csiq and sol and moved the proceeds into spwr aug, sept and jan options.�

1/1/2015

guest How come you sold CISQ, and SOL? in anticipation for SPWR earnings?�

Không có nhận xét nào:

Đăng nhận xét