1/1/2015

guest It's unclear because as I said about about the work in progress cars (it would also apply to Finished Goods) "since you are just pricing the cost of goods there and not the labor/cost of putting those goods together, and certainly not accounting for them as their full retail buy-a-model-s price..."

If it included everything except for the retail markup you could dump off 27.7% off the ASP (which is around 105k) to arrive at a cost of 76k per car. That would equate to an inventory of ~6482 cars. I assume because it is finished, accounting wise they would equate the labor costs in there too, simply because if you lost that inventory, you would lose both the raw materials and the labor time invested that you already paid out wages for. What I wouldn't know is how much of that labor is accounted for in the "Work in Progress" assuming it was accounted for at all? But that would give you an interesting perspective of how many cars they are working on at the moment they pulled the numbers.

Anyway, we had talked previously about the finished goods inventory because bears try to say that Tesla is holding "inventory" back on purpose. What people don't realize is that assuming we had a perfect cut over, with an end of quarter push, right now, there would be 2,000 cars in transit at the end of the quarter (this is base on 1,000 a week production, and taking in the best case 2 weeks to make delivery from end of production to someone in the US). Most likely we are dealing with 3 or 4 weeks of production being caught up in transit so anywhere from 3 - 4 thousand. So what accounts for the other ~2,400 cars? well, there are show cars, test drive cars, loaner cars, stranded cars (cars which were ordered and then last minute canceled), etc. I personally had put together guesses on how many cars would be sitting around for these purposes when there were less stores and less service centers, and came up with easily over 1,000 cars at that time. This was like over a year ago, so it would make sense that this number would have continued to go up.

Final point, at no point do they seem to account for the CPO inventory... where is this? would it sit in finished goods as well? Or would it be like other assets that are listed elsewhere in the reporting? In either case they have a bunch of these cars sitting around now as well, and if you notice some of the CPO cars are qualifying for tax incentives, meaning they never actually had an owner previously...

Anyway, point is, assuming my ~6400 number is correct there is a logical reason for there to be that many cars just sitting around, and you should expect that number to only continue to go up.�

1/1/2015

guest Sigh... despite all the warning signs, the shorters did not see this coming. All the more reason to suspect that it is all bots shorting on algorithms now. A real trader would've seen what I've seen coming.

It seems like the real squeeze has not happened yet.

The tell tale sign that this was unexpected lies in the short term implied volatility. When I checked it on Wednesday, it was a meager 0.35. Which represent a volatility of the most stable period of tesla. A good trader would've checked this forum and knew that the number was already leaked. And the volatility should be >0.6. A good trader would've bought a straddle. Like I was about to buy, thinking there's probably one more day to do that before the official leak. (This is why, day trading and retirement does not mix well, you get too slow at trading). A bot, also cannot be easily changed to accomodate a new special day of increased volatility besides the earnings report date. No, that would imply going into the source code and changing the actual code. Which requires hiring back the programmer that they just sacked.

So Monday, squeeze, barring any bad news. The hedge funds should be frantically looking to buy any bad news right niw.�

1/1/2015

guest Or they will frantically try to create some FUD. Thanks for your observations. I agree we have not seen the squeeze. EM does have a flair about him and I was hoping for some big announcement on. July 4th. Design studio for X? Larger battery?�

1/1/2015

guest The man's got his hands full right now over in SpaceX land.�

1/1/2015

guest So they have CPO cars that aren't PO? Loaners and/or demos I guess.�

1/1/2015

guest Based on reported Q2 sales, it seems to me that there has to be Model X announcement soon to make the 2015 sales goal of 55,000 units. I don't see how Tesla can make their numbers without taking X orders in August, and producing some production cars Q3. I think anticipation of the next reveal has created some friction on Mod S sales, even for potential buyers who aren't considering an X. If August brings Mod X ordering, and autopilot is shipped, I think the stock will do very well.

I'm still expecting a dash upgrade, but I seem to be alone in that belief. Perhaps it will come in 2016.�

1/1/2015

guest You are not alone. The S may be due for a 'refresh' soon and it has been speculated that the X interior (dash included) will be slightly different from the current S and to keep production as simple as possible that the refresh of the s will include the new 'X dash'.�

1/1/2015

guest Any hint of a dash of upgrade would hurt current sales. This is one reason I'm confident in the August X reveal. They don't just disappoint with a another mod X delay, they increasingly risk mod S sales too. I'm completely confident in the desirability of the mod X. They have clearly demonstrated the core competence to do another great job.�

1/1/2015

guest Also it looks like the Model X may get seats with adjustable headrests. I know one person who declined buying a Model S for the sole reason that the fixed headrest aggravated neck problems for him, otherwise he loved the car. So he is holding out for a better fit in the Model X, but if the Model S were upgraded to adjustable headrests too, then he could be happy with either model.

I could see Tesla issuing the Model X first to see how car buyers react to the new interior. Then they could take that learning and apply it to a refresh of the Model S interior. From a total output point of view, they don't need to do a Model S refresh until after they have caught up with the Model X backlog. That is, if large numbers of buyers were opting for an X over an S for interior features that could come in a refresh, this is no loss to Tesla. They'd just make more of the Model X and keep the factory running at full tilt. Only once Model X production catches up with pent up demand does it become an issue.

Oh yes, many of us expect that the Model X may come with a larger battery pack option, say 100 kWh. I think the same issues hold with that innovation. As long as there is a huge backorder for the Model X, Tesla does not need to offer a Model S with a 100 kWh pack. Of course, everyone will know that it is possible and will becoming soon, but it is no loss to Tesla if people hold out for an S100. In fact, Tesla may do well to accept reservations for such a beast and let S85 buyers order with full knowledge of how long the wait for an S100 might be.

In any case, it will be fascinating to see how Tesla navigates these issues. They've got about 30k X reservations, so they could pretty much turn off manufacturing Model S for the first half of 2016 and not miss a dime of revenue. I'm sure there are plenty of other reason not to do that, but bearish worries about demand are not among them. "Cannibalization" is an irrational fear for shareholders. Indeed, nothing should delight more than for the Model X to be so superior to the Model S that everyone prefers the X. Think about it.�

1/1/2015

guest Hi,

New quote (I think we can substitute By the end of the first year of volume production of our Powerpack for "mass market vehicle"). Things continue to look better and better :biggrin::

Gigafactory | Tesla Motors

I think that they are making a substantial profit on Powerpacks produced in Fremont, but even if that is not correct I don't believe that means that the three related points I was making are incorrect:

1. That the GF will reduce pack costs substantially long about a year after they start production there.

2. That will have a major impact on the profitability of the MS-MX and stationary storage products.

3. We can deduce, from the Fremont $250 per kWh Powerpack prices that by beginning of 2017 TM should be able to produce M3 packs for about $140 per kWh. If they are selling the Fremont Powerpacks for barely breakeven and we deduct the 30% from the TM GF blog post we get $175 per kWh. Then if we assume a 5% annual increase in cell energy density (JB said the annual average is either 7% or 8%) that gets the price down to about $168 which is not too far from $140.

But I still think that they are making at least 15%-20% profit on Powerpacks produced in Fremont for these reasons:

1. If they are breakeven, and the TM blog figures are correct, and EM's figure of "probably 20% is a reasonable guess" is correct they are losing about 10% on the Fremont Powerpacks!

2. Based on the figures in the utility studies, if they raised the Powerpack prices by 20% to $300 per kWh the prices would still be disruptively low. It is safe to assume that the demand would still have been very high. I admit that I didn't know about the utility studies until after the launch but TM must have had similar information, since they had been working with utilities prior to the launch, and not being aware of that information would have been an epic failure of due diligence, before a major product launch, of products that AEM and JB are stating are a major emphasis of the company.�

1/1/2015

guest In fact, in one of the last conference calls (don't remeber if it was the last or the one before that) analyst Andrea James asked a question that was basically: Why are you building the Model X? I.e. as part of the master plan (low volume sports car --> high price car --> mass model car) where is the natural place of the Model X. Elon commented that this was actually a very good question and his honest answer was that Tesla in one way doesn't need to do the X, but they want to do it because they are committed to improving wiht only themselves as competition (let's face it, no-one else is even close to having a competing vehicle coming to market). Elon has spoken very highly about the X since it was first mentioned, saying it will be "really something special", that it will have features we really won't expect and that it will be even better than the Model S (he has said so in exactly those words). Let me find the quote from the conference call...

OK found it, it was from Q3 2014 call:

So basically the X will exist because it's an amazing car that should exist, not because it's a vital step to Tesla's further domination of the auto and energy storage industry.�

1/1/2015

guest I have a different take. Tesla needs to entertain everyone watching between now and the Model 3 release. Batteries alone are insufficient to have enough interesting things to talk about between 2012 and late 2017.

When you have made the new new thing, the choice is either to entertain with more stuff, or risk having everyone emotionally invested only in the Model S. Not only did Tesla have to make the model X, but they will need to wow us with something 18 months from now. Maybe the battery biz growth will be enough, but some tech toy aspect to the cars would be better.

I do think the model X was originally announced in a bit of a panic over sales. In one sense, the X wasn't really delayed. It is now being produced when it makes good sense to add a car variant.�

1/1/2015

guest The Model X will hands down experience more sales then the Model S over the next few years. Model X is far more compelling of an SUV to SUV consumers then Model S is as a sedan to sedan consumers. No entertaining happening here. Model X is damn good business.�

1/1/2015

guest 18 months from now will be mid 2017. Both Elon and J.B. have been clear that the Model 3 will go into production in 2017, by which I expect they mean late 2017. I am sure Tesla will start taking pre-orders for the 3 by the beginning of 2017 and when pre-orders cross the 100,000 mark before production even starts -- as they likely will -- that will be a pretty big "wow".�

1/1/2015

guest I thnk we could easily see 250k and more before production... Personally already have 10 family members waiting to press the reserve button when it goes live...�

1/1/2015

guest It's important to remember that the Model X (and there were even talks of a coupe model S) were originally put out there for the sole purpose of supporting Model S sales until the Model 3 could make it to market. This was because they only ever expected *GLOBAL* sales to be around 20k for the Model S. And yet here we are looking at ~50k Model S and that isn't likely to be the cap on demand. They pushed the Model X back when they saw how great the Model S did in the first full year pulling in slightly more than 20k. Then they knew they could basically hold off on the X until it was good and ready rather than rushing it to market.

Let's face it, the Model S was totally rushed to market. In fact the first like 100 or so were practically hand built just to say they had started delivery. I get the feeling that the Model 3 will be slightly rushed to market all over again... only the reason for the rush will be totally different from what it was with the Model S.�

1/1/2015

guest

I'm not trying to be that precise. Just making the point that people expect very high profile Tesla to be "doing stuff". They could not just start building the model S in 2012 and have no new products until 2017. Even if that progression made logical business sense, the Zeitgeist would turn against Tesla. This sort of business is engineering, but it is also a show. Musk gets this, and it is one of several reason he tends to over promise. (One other reason is to pressure employees to complete projects, I think).�

1/1/2015

guest The Model 3 has actually been pushed back like twice from its original timeline such that it wouldn't have been nearly that bad of a wait if they had done things according to the original plan.

It was originally:

Model S 2012

Model X 2013

"Gen 3" 2015

And presumably they were planning the coupe in 2014 which never came about? (Side bar: the coupe is pure speculation based on some leaked design photos of a Model S looking car with 2 doors. The company never officially, to my knowledge, admitted to working on a coupe.) This was back when they were also planning to have like 30-35k a year global sales from all the Gen 2 platforms combined. Once they saw how great the Model S was selling they pushed everything else to the side, told Panasonic they needed more batteries and fast (hence the second battery deal that was signed a couple years ago) and pushed hard on expanding production at the factory. This is also why they had to massively upgrade the factory across the board. The original final assembly line was going to handle everything on it to 35k a year... which got messed up by the large demand.

So sticking to the original plan and they would have had plenty to talk about and keep up the buzz if that is what you were worried about.

People complain about all the delays that Tesla has kept giving people, but lets be honest, as least the delays were the result of positive (larger than expected demand) things instead of negatives.�

1/1/2015

guest At least, in North America, SUVs are a bigger market than sedans, and they tend to be gas guzzlers. They are the profit makers for many automakers. So in terms of hastening the adoption of electric vehicles. The Model X is essential. To win in this segment will offset many more gallons gas and put the profit margins of EV resistant automakers into question. It's far more important to replace gas guzzlers with EVs than to electrify gas sipping metro cars. It's not about entertainment; it's about driving a stake into the heart of the fossil fuel industries.�

1/1/2015

guest I'm only worried about two things 1) A model X reveal in August to meet 2015 sales, and 2) Model 3 beginning production really really really by Q4 2017.

I think TSLA will break 300 with a timely X reveal. Especially because I expect a refreshed mod S with goodies like mod X side mirror cameras.�

1/1/2015

guest Should be in July�

1/1/2015

guest Hi,

One reason I decided to invest a large percent of our available money in one stock, is that I watched an interview with Mark Cuban (about 8-12 years ago), in which he described some of his investments. He believed that the internet was going to grow a lot, so he put a lot of his money in Netscape. Then when MS started to go after Netscape, he moved his money into something else. At the time I decided that if I ever believed strongly in a company, and I had cash available to invest, I would consider doing something similar.

My intentions were to invest most of our available cash in stock, which I did on May 1, at $231, about a month before I discovered this forum. I might have misunderstood the following post, but I took it to mean that investors buy and hold stock, and that using options is by its nature much riskier.

In a way that seems obvious, because generally with options you not only need to get the direction of the market correct, but you also need to get the timing correct. But that didn't feel quite right to me and I eventually figured out two methods to buy Tesla options that I feel are safe for me. Please note that right now this is all theory! I could crash and burn, so in a few weeks I might have a different opinion.

My first method (leveraged long term investing):

My first thought was to wait until September and buy Jan 2018 Leaps. I quickly realized that the problem with that idea is that a short term problem near the end of 2017 could wipe me out. I then realized that I believe that Robert has this nailed. I think he buys Leaps and about 6-8 month's before they expire he rolls them into Leaps that expire 12 month's later? IMO that's brilliant! Most of the safety of buying and holding stock combined with the leverage of options. One of reasons that I decided to post this is that I hope Robert will share some details on what he does and why. E.g. how does he decide when to roll his Leaps and why did he already roll his 2016's? How and why does he choose strike prices? Any other tips or advice? In any case, thank you very much Robert, both for causing me seek a solution, and for providing the answer.

My second method (the "counting cards" method for short term trades):

In Blackjack the dealer is required to take a card if his hand is 16 or lower, so when there is a higher percentage of face cards remaining the odds shift in your favor, so you should raise your bet. Each individual bet is a gamble but overall you are not gambling because the odds are in your favor. In the same way I think there are times that many members on this forum can identify, when if you raise your bet (buy short or medium term options) the odds are in your favor. The main reason that I decided to post this now is that I believe that the next 3-6 month's are an unusually good opportunity to profit (long) on Tesla. As I explained here:

http://www.teslamotorsclub.com/showthread.php/40245-TSLA-Trading-Strategies/page13?p=1060446#post1060446

I believe some of the biggest price increases possible will be triggered by the, MX Launch, the reaction to the MX (which I think will be strongly positive), and a successful production ramp. I also believe (despite all of the previous delays) that these are imminent (probably sooner, but by October or November). The reason for my confidence (what do I know?) that the MX Launch is finally imminent is that TM know more about this than anyone, and they clearly believe it is imminent:

http://www.streetinsider.com/Analyst+Comments/Tesla+%28TSLA%29+Optimism+Expected+to+Grow+into+Model+X+Launch%2C+Factory+Gearing+Up+-+Pacific+Crest+/10681668.html

�

1/1/2015

guest MitchJi, as you are fairly new to the forums you might not have noticed the thread inside the investors section for Options trading. There are actually two of them and both have valuable information in them on various aspects of options trading both as a subject and how it specifically relates to TSLA:

Newbie Options Trading

Advanced TSLA Options Trading

In addition I would check out the active trading strategies thread here: TSLA Trading Strategies

That being said, with any options purchase you don't have to hold through to expiry. You can choose to do so which can help you secure those shares at that lower price point which is helpful for tax reasons, or you can just sell them off and use the proceeds to fund a new round of options/stock. Some people will sell off some of their contracts and use that money to then fund buying the shares of the remaining contracts at expiry. It just depends on your goals. If you do not intend to keep those shares and exercise the contract, what I recommend is selling them off as soon as you have hit whatever targets you were looking for or if the stock hits a valuation that you feel is getting too risky and ready to change directions.

What Robert said about trading vs investing applies to both options and stock. There are plenty of people who "day trade" stock as well. The reason options are a bit better for traders is because you only have to wait 1 trading day for a sale to clear and allow you to spend that money again, whereas with stock it is 3 trading days. You also of course get a lot more leverage with the same amount of capital, just remember that goes both ways and you can easily go broke on options with very little price movement as you cannot hold options forever to wait for the value to recover (which is why LEAPS help overcome some of that, but they aren't without their own risks.) It was discussed back a year or so ago about using LEAPS as stock replacement, and that is perfectly fine, you just need to make sure you understand the risks associated with it.

Especially as we get near the ATH we are at a very risky time to be messing with options because while long term the stock is sound and the thesis is intact, short term... it is more iffy. And with stocks in general there tends to be a decent chunk of resistance to pull the stock over the ATH since the market has to decide if whatever caused the price of the stock to stop going up has fully cleared away and we are ready to push on ahead again. While our individual opinions might be aligned with a resounding yes, together we all collectively make up "the market" and unfortunately there are people who have a louder voice than us that really drives the stock price, including about 25% of "the market" collectively betting their farms on the failure of either the stock, the company, or both...�

1/1/2015

guest @MithhJi -- as @chickensevil correctly notes, a full discussion of strategy belongs elsewhere. Two observations here:

- As you correctly infer, I roll my LEAPs well before expiration, 6-8 months depending on market conditions. I do this in order to minimize my theta losses (time decay of the option value) while leveraging my capital (when the stock price rises, the value of a call option goes up by more on a % basis). BTW, I typically buy LEAPs that are fairly close to at-the-money strikes, which is a relatively lower-risk/lower-reward play than what many here do, buying very OTM LEAPs. Finally, all my options trades are in my IRA, so I don't trade with tax considerations in mind.

- You need to pay attention to different facts as an investor vs. trader. Investors should assess the long-run success factors of a company; if those are right, then you don't need to sweat the day-to-day price movements. (But you do need to keep an eye on whether the company is continuing to execute on its plan, and that the plan is still sound.) Traders care less or not at all about the company's overall arc to success; instead, they are trying to find gaps in information. For example, we on TMC collectively got the Q2 deliveries almost exactly right, so careful readers knew what the market didn't and could have profited from the strong uptick last week when Tesla formally announced the number. As an investor, I didn't particularly care that Tesla modestly over-achieved its delivery target (which I thought they sandbagged in the first place). But for those who day-trade, buying some weekly calls early in the week and then selling on the news would have been profitable.

�

1/1/2015

guest Hi chickensevil,

Thank you very very much for your detailed and informative reply! I have subscribed to both of the options threads you listed and 80 posts into the "Newbie thread". I have already learned a lot! I think they should both be stickies!

Thanks for that information also. I am clueless on technical analysis and I really appreciate the advice. But I believe that it is extremely likely that by Nov-Dec 2015 that the MX will be released, getting outstanding reviews, and the production ramp will be going well. Of course I could be wrong, but I have good reasons to believe that. I think that when we look back this will be seen as a time of a major positive transition for Tesla.

Hi Robert,

Thank you very very much for all of your help!

I decided to post it here because it was in response to your initial post on the thread and:

1. It this seemed like an appropriate place to thank you.

2. I thought that someone else might benefit from my thought process about that post.

3. One of my ideas is a method for a long term strategy, that was inspired by your post on this thread.

4. If my example of a short term strategy is correct the changes I describe will have a big long term effect on Tesla Stock.

It sounds like my interpretation of your strategy was correct :wink:.

Thanks Again!�

1/1/2015

guest Hi Emerson,

I think your logic is incorrect. The reason the MS sells so well in Norway is that competing ICE vehicles sell for so much more. In the US, the BMW 7 Series sells for less than $80k. If, for example, a BMW 7 Series for $280,000 in the US, then don�t you think more buyers would consider the Tesla Model S? You also didn't take into consideration that gas in the US costs about $3.50 per gallon vs about $8 in Norway.

http://insideevs.com/tax-exemptions-in-norway-cut-tesla-model-s-price-in-half/

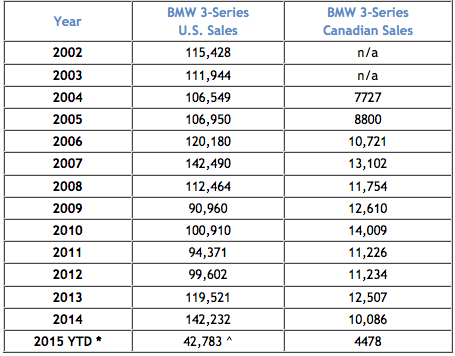

A better (but imperfect) way to estimate M3 sales in the US would be assume that M3 sales will be at least a little bit better than BMW 3 Series sales:

�

�

1/1/2015

guest I think you're underestimating the market for the Model 3 because you're comparing it to cars with similar sticker prices. What should drive demand is ownership cost. At $35,000, the monthly cost to own and operate a Model 3 will be about the same as a Camry or Accord (depending, of course, on how much you drive). That's a much bigger market segment that the base Model 3 can address.�

1/1/2015

guest Consumers put disproportionate importance on sticker price, though. So I think that is indeed the right comparison to make.�

1/1/2015

guest You guys are also like many Americans misinterpretating the Norwegian market. The alternative for the Model S isn't a BMW performing comparibly it's a BMW 518d (with 150 diesel horses) which starts at about 90% the price of the S70D. Add 4wd and comparable equipment and you are more or less at price parity. Though the car performs drastically different.

The same with the Model 3. A comparable car for size and Norwegian preferance would be a Ford Focus station wagon, which clearly is a regular family car. Those start at $48.5k with a 1.0L Ecoboost engine with 125hp. Most of the non-premium brands have similar pricing. A 318i touring costs about $38k with a 136hp engine and automatic transmission. So given these data it seems the Model 3 will sell well, assuming the VAT hasn't been added yet and the Norwegian $40k Model 3 has a decent equipment package.

Cobos�

1/1/2015

guest I would disagree with sticker/BMW 3 series as only comperable and agree with Robert on this one. There is good evidence of many current Model S owners paying significantly more for their Model S than previous cars and there are 2+ more years to educate people on total cost of ownership. If you think of where people were 2.5 years ago (think January of 2013) when it came to electric cars, supercharges, etc., a lot can be done.�

1/1/2015

guest Indeed, plenty of S buyers moved far upmarket from their previous purchases.�

1/1/2015

guest That is a justification many may use to buy 3 instead of Camry. Consumers rarely compare costs like businesses do.

There is another angle to it. Most (IIRC) buyers of BMW actually lease. A lot of times these are subsidized leases enticing consumers - and Tesla will find it hard to compete in this market. A similar MSRP BMW & 3 - will not have the same monthly lease cost. BMW can be discounted enough to negate any fuel cost savings.

- - - Updated - - -

Do we know what % ? Unless we have some numbers we can't predict what impact this kind of behavior may have on 3 market.

In general we know in mid-market consumers are a lot more price conscious.

The other thing I've seen that keeps consumers in mid-market from buying luxury vehicles is the feature comparison. While base 3 may be just a few thousand higher than a Camry - similarly equipped 3 will be much higher. Only the truly committed would forgo the comforts and get a base 3.�

1/1/2015

guest I wonder what percentage of BWM households have two cars? I do think (hope) that the model 3 will compete well for the #2 place in the garage. In the U.S., many families seem to have the kid hauler plus one other car. The model 3 would almost certainly sell very well on the U.S west coast today at ~$45K. Hopefully that is an indicator of future sales.�

1/1/2015

guest The total addressable market for the Model 3 is basically anyone in the market for a new vehicle.�

1/1/2015

guest Model 3 would be car #1 in a two car garage. The other one will be car #2.�

1/1/2015

guest It will be bought by people thinking they're getting "a second(ary) car". After owning it for a short while this thought will transform in to the Model 3 is the primary car and the ICE is the backup old technology.�

1/1/2015

guest Not sure if this is the best place to post this story. It might fit in here as the story illustrates that an increasing awareness of Tesla around the world is followed by an influx of new investment money. It is unfortunate that this story is about an investment scam.

Story link, Millions Feared Lost in Tesla Share Scam.

It is claimed that the Dubai-based Larosa Group scammed $2.4 million from eager to be Australian investors who were attempting to invest their money in TSLA shares through the group.

Many Australians wishing to invest may be lacking time or skills to deal with the administrative side of investing, hence this story is plausible.

The downside of the story is that people got scammed. The upside is that the story might be highlighting the trend: there are new eager investors around the world who wish to own this stock.

A gradual influx of new money might provide rising level of support.�

1/1/2015

guest This is how even Leaf has worked out for a lot of people.�

1/1/2015

guest  �

�

1/1/2015

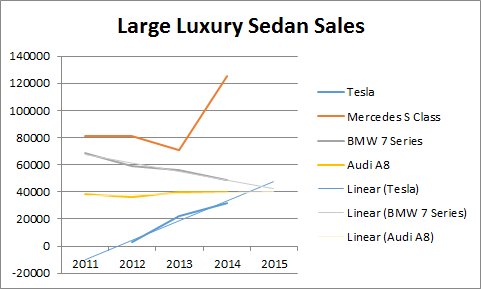

guest Rob, I don't understand that chart. What does "Linear" mean? Is it a trend line?�

1/1/2015

guest Yes it is a simple trend line in order to project the sales of the two brands. The implication being that Tesla and Mercedes is taking sales from BMW while audi is holding steady. I didn't realize Mercedes sold that many last year on their refresh. That gives me new targets and hope for the Model S. Now the new global market size I am looking for is 120k for the Model S.�

1/1/2015

guest It's a linear fit line to the small number of data points that is then projected forward. The Merc S class had an impressive showing in 2014 - that's up about 50% over 2013.�

1/1/2015

guest Yeah it is a linear trend line. That is my chart from here: Tesla Model S: On Track To Be A Best-Selling Large Luxury Car Worldwide - Tesla Motors (NASDAQ:TSLA) | Seeking Alpha�

1/1/2015

guest I had to do a little calculation on this. I figure that typical car uses about 40 gallons per month and at $2.5/gallon, that's $100/month. So I think consumers may be willing to finance an extra $100/month on a full range EV compared to what they would be willing to spend on a conventional vehicle. I know this does not account for the cost of electricity, but in consumer mental math people like simple round numbers to anchor on. So I think $100/month could stick as a rule of thumb.

So what does an extra $100/month buy you? On a 5 year loan at 3% interest, it buys an extra $5500. So a Model 3 at $35,000 might be compared to a Camry at $29,500.

But this comparison misses the point that if you sell the Model 3 after 5 years, the used car buyer also will be willing to spend more for it to save $100/month on gas. In the used car market this is even more important because the ratio of fueling cost to the value of the vehicle is even higher. So over the next 10 years of the car's life, the fuel savings is worth another $9000 in present value. This takes us out to 15 years of life, after that the cost of replacing the battery stops whatever value accrues to the original battery which was the source of the gas savings. So I think we can stop about 15 or so years out. This gets us to $14,500 price differential. Thus, our Model 3 at $35,000 may be comparable to a Camry at $20,500.

So I suspect that when Model 3 is first released, buyers will compare $35k to a $30k conventional car, but 5 years later, the comparison will be to a $25k car and 10 years later to a $20K car. Under this scenario, Tesla will not need to lower the price of the Model 3 to make it more competitive with less expensive cars. They simply need to build a vehicle that will hold its value, and I believe they will.�

1/1/2015

guest This simple but none the less correct analysis is spot on. I'd also add that in 10-15 years battery technology and pricing will have evolved more than even we might be able to foresee, but all this works even more in Tesla's favor.�

1/1/2015

guest @JHM, I always enjoy your posts and analysis. But I think a majority of car buying is done on emotion and whatever the buyer wants to buy. And I am pretty sure that there will be lots of buyers shopping in the $30k to $35k that will buy a Tesla Model 3, simply because it is a Tesla, regardless of the math. I know I am buying two! One for son, one for wife.�

1/1/2015

guest If TSLA does well enough in the next two or three years, I hope to buy one for my oldest daughter and one for my brother.�

1/1/2015

guest Yeah, there are alot of other factors at play. I thoroughly expect that the performance of the Model 3 will be far superior to a Camry. I just replaced my Camry with a Model S, and I can't imaging wanting to go back. I would spend $20k more for a Model 3 over a Camry any day of the week.

But the marketing question is how quickly will car buyers warm up to spending more on a Tesla than conventional cars. For me, a big factor in buying a Model S was the very high resale value. The advantage of buying the Model S in 2015 over 2012 was seeing how the 2012 and 2013 cars held up, plus autopilot. So with each passing year the resale experience reinforces the value all along the chain of new and used cars. Knowing the price of a 3 year old Model 3 will give the new car buyer greater confidence. Likewise, knowing the price of a 6 year old Model 3 will give the buyer of a 3 year old greater confidence. And so on. This is how demand for a model can grow over time. If a model really has solid long-term value, the total cost of ownership advantage will be realized over time. This is something to think about when bears make arguments about demand for the Model S peaking out. What they are ignoring is that the Model S has been demonstrating who well it ages, and this builds long-term demand. This is how demand transitions from early adopters to late adopters. Late adopters will be delighted to buy the Model S in 2020 because in their estimation it will have proven that it is a solid value. Some of us already know this to be true, but as an investor I am counting on late adopters coming on board in 5 to 10 years.�

1/1/2015

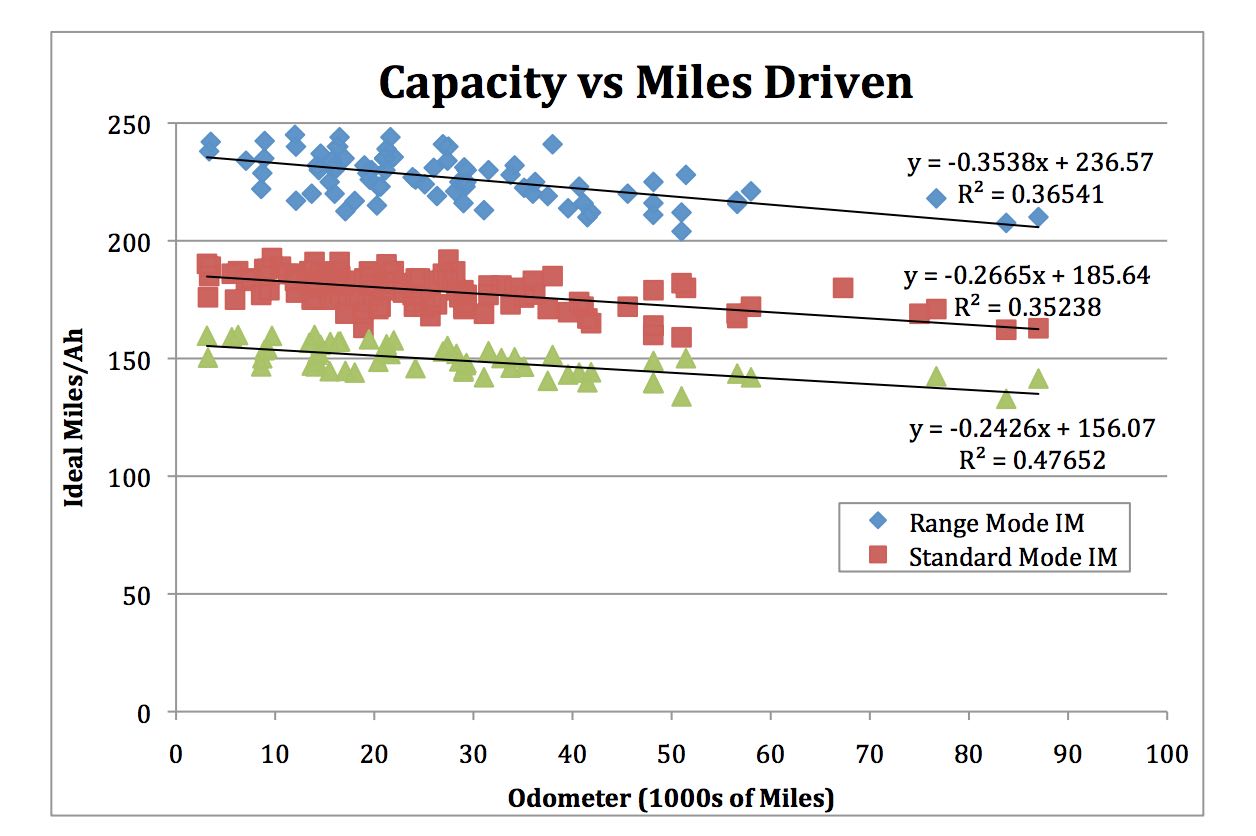

guest On the whole, I agree that resale value will become a selling point for Tesla EVs. For EVs, resale value depends on at least four key factors:

1. Retention of battery capacity over time. Thus far, Model S batteries have been aging quite well in all climates, so used buyers can be reasonably confident that they will see years of reliable service. On the other hand, used LEAF values have plummeted partly because of overly rapid capacity loss and Nissan's inadequate handling of the situation. (Hopefully the "lizard" chemistry in the 2015+ LEAF will prove longer-lasting.) I suspect that current Tesla resale values do not yet fully account for the excellent capacity retention that we've observed.

2. Technology advances. The more quickly each vehicle model improves, the greater the depreciation on older vehicles. By constantly innovating, Tesla Motors is, in a sense, their own worst enemy here. Preserving resale values is actually a good argument in favor of liberally providing enhancements via over-the-air software updates.

3. Miles/kilometers on the odometer. For an EV, mileage matters primarily because it correlates with additional cycles on the battery which generally affect capacity (1). We expect less degradation of future usability than is caused by mileage-related wear on the components of an ICE vehicle. While other EV components (aside from tires) do experience some mileage-related wear, this is arguably minor. The only caveat is that EV components like onboard chargers and inverters may or may not last the lifetime of the vehicle, and replacing them might be expensive (or maybe not, given sufficient volumes). Overall, because of ICE-based biases, I believe that the market is currently too hard on higher-mileage EVs at resale.

4. General wear and tear. EVs get scratched and soiled, and their upholstery gets damaged, just like ICE vehicles. People like shiny, new (or relatively new) vehicles.

In summary, as long as Tesla battery capacities hold up well over time and out of warranty repair costs stay reasonable, Tesla EVs should do better than ICEs at resale. I agree with jhm that it really comes down to operating costs.

Further, once we hit a tipping point in terms of EV consumer acceptance and adoption, ICE resale values could very well take a huge hit. Who will want a smelly, noisy, non-responsive, costly to operate ICE unless they absolutely need an ICE for some reason?�

1/1/2015

guest But a Camry at $29k will be very well optioned. 3 will be very bare. Most people will opt for Camry.

I think Musk is right. Model 3 target is people who buy low end luxury cars. It is not people who buy Camrys. Ofcourse a certain % of people always move between mainstream cars and low end luxury cars - those should be included in the target as well.

So, how much of that market can 3 capture ?

ps : The EV "enthusiast" market i.e. people who post on places like TMC and MNL is very small. We can't extrapolate larger population behavior from this tiny segment.�

1/1/2015

guest Based on the latest polling that was done, it would appear that people are willing to go up market by 60% for a tesla. So that is still a considerable amount of movement, if that even remotely correlates to the model 3 that is a huge market.�

1/1/2015

guest Link ? Are you referring to a TMC poll ?�

1/1/2015

guest A base Model 3 will not be bare relative to a $29k Camry.

It will be differently optioned. Some options not being a available in a Camry.

Most people will opt for a Camry because of innate risk aversion, conservatism(personality, not political), and availability.

But as the years go buy Model 3 will take more Camry buyers than Model 3 buyers go back to Camry.�

1/1/2015

guest Here you go: Analyst: Tesla owners are willing to pay way more for the Model S than a traditional car - Business Insider

"On average, owners were willing to pay 60% more for a Tesla," Dolev wrote.�

1/1/2015

guest Here is a more detailed digest of the Jefferies' note (Streetinsider.com):

�

1/1/2015

guest I think you missed my point about a comparison with a Camry. I did not spell it out fully, but what I had in mind was a base model Camry if it were priced at $29,500 and a base model Model 3 if it were priced at $35,000. And I am only focusing on the fuel efficiency differential. Clearly, there is a lot more to consider, but I'm really just trying to get at a rational premium one might pay for an EV over a comparable conventional car. So yes, initially a base model Camry in the low $20k will out sell a base Model 3 at $35k considering only the fuel savings. But over time, the market comes to properly value the total cost of ownership over the full life of the vehicle. This will take 10 to 15 years, but at the end of it I do think consumers will be willing to pay on order of a $15k premium for a comparable EV.

Having made that narrow point, I absolutely believe that the Model 3 will have many other selling points that encourage people to spend much more on Model 3 than the every thought they might spend on a car before. In time, it very well could replace the Camry as the number one selling sedan on the market. At least, I hope it will outsell the Prius. The first huge advantage over both cars will be awesome performance. This will absolutely spoil people for returning to gas cars. And I do hope they make a Performance 3 under $60k that does 0-60 under 2.9 seconds just to blow people's minds.�

1/1/2015

guest Thanks for the link. I generally do not trust proprietary polls with no transparency on methodology.

I trust stock analysts even less

- - - Updated - - -

This idea of over the years 3 would get a higher premium compared to ICE is far too optimistic, without knowing the long term durability of Teslas. For all we know it would be a nightmare to own an old Tesla. I for one would not buy an out of warranty Tesla.�

1/1/2015

guest The battery pack and powertrain (for most Model S vehicles) have an 8 year, unlimited mileage warranty. Most other parts should wear similar to ICE vehicles.�

1/1/2015

guest What will a 2012 Model S battery cost to replace in 2020? Will battery replacement make a refurbished car that has a good market price, or will it be too old fashioned as an EV? I think the answer here is "we don't know".

A typical Mercedes S series will be running fine in eight years. But maybe eight years is too long term, as cars have used up most of its value by then. Perhaps a better question is how 3 to 4 year old model S retain value.

All aspects of older Tesla cars is important, and it seems very difficult to estimate how it affects the long term value of the company. Eventually EV's may retain value better than ICE.�

1/1/2015

guest

I am interested in the reason you see for such a battery replacement.

As well as the cost per incident is important in this equation, the number of incidents is important as well.

There has to be some major incident for replacing an entire battery.

There are aggregation levels at least at cells and modules.

The repair cost of a battery usually reflects this and thus is only fraction of a so called worst case scenario.

A repair in 2020 will be a fraction of today's costs as well as cells are getting cheaper about 8% per year.

I would expect the resale value for a refurbished EV to be about the same as for a refurbished ICE with a similar repair (engine/gearshift repair).

Can you please elaborate why a refurbished car could get too old fashioned as an EV?!

I do not get your asumption:

"A typical Mercedes S series will be running fine in eight years."

Where do you have that from?

Thanks in advance for any information.�

1/1/2015

guest Yeah I don't buy it. I expect a Tesla Model S to be running, albeit with some degradation in range for much longer than an ICE. At about 9-11 years I found ICE's to be intolerable with the amount of repair/maintanence they required. ICE's just wear out and become not worth it. That is literally the reason I bought my EV. Tesla's are the only car in the world not designed to wear out and fail.�

1/1/2015

guest

Same here.

+1�

1/1/2015

guest Do you have any other lithium-ion devices you expect to work well even at five years?�

1/1/2015

guest I assume that you are aware of the different tech and qualitiy levels when you are talking about li-ion tech in general?!

Yes, I do not expect my low quality laptop cells to power my laptop in five years.

Yes, I do expect automotive grade battery cells to power an EV for five years, the simpliest and most basic reason is because there are some older EVs on the market that give a trend for that expectiation.

Is there any specific reason for you for being so pessimistic about EV battery lifetime?

And yes electric inverter and engine with it's gearbox are designed to last longer than an average complex ICE engine and it's complex gearshift / automatic gear.

Less moving parts, less bearings, lower tolerances acceptable and so on.

BTW still interested in your working background in large manufacturing, do you work in the automotive industry?�

1/1/2015

guest Not that are actively cooled and software managed.....

So, yeah I expect the pack will be around for well past the warranty.

Had 65k miles on my first S with less than 1% degradation after 2 years and it was an "A" pack. It has already gotten better.

What have you experienced with your S?�

1/1/2015

guest Do you have any other lithium-ion devices with active thermal management, built-in extra capacity to minimize the effect of wear, computer-controlled charging that optimally balances across all cells, all backed by an 8-year, unlimited use warranty?�

1/1/2015

guest Tesla has an eight year guarantee on the battery pack and will say privately that they expect the battery to last 15 years. At that point, I wouldn't be surprised if you could buy a replacement pack for a fourth of what ours cost new, with more range.

As an aside, RAV4EV Nickel metal hydride batteries were expected to last ten years. They are all degrading rapidly at this point. I think part of why Tesla chose Li Ion was because they could get more life from them, and so far, the degradation curves are better than expected.�

1/1/2015

guest Hrmm, why yes, there is this really awesome car I got to drive, maybe you have heard of it... it's called a Tesla Roadster. This one was produced in 2008 and thus making it 7 years old at the point at which I drove it, and it performed as good as the day it was made! The only hit was on a small battery degrade by a whopping 4% (yeah, not a big hit there for a 7 year old pack). So yes, I do expect the Model S to perform very well after 5 years, I expect it to perform well up to 15 years as that was the intended life they were expecting for these when they built it. But what do I know, cause I don't work in a major manufacturing factory like Fremont...�

1/1/2015

guest Yeah, to add to the dogpile, Tesla battery packs are also not designed to wear out. Laptop/phone/gadget people have an even better incentive to abuse their batteries and cause you to upgrade. Tesla has active thermal management, chemistry optimized for long wear, and charge is governed to not be too high or too low.

Can't tell if electracity is lazy or trolling...�

1/1/2015

guest In the next decade there probably will be a higher mileage upgrade. Hopefully what happens by the end of the decade will be the real possibility of value in repurposing the existing packs to decrease the cost of upgrades.

In addition to the Rav4, Chevy also made a mistake with the battery in the first two years of the Volt. It will be interesting if the Bolt has active cooling. I assume it will.�

1/1/2015

guest My Makita cordless drill and reciprocating saw work just fine (with its original passively cooled Li-Ion battery) for 6 years now. My Ni-MH hydride Makita cordless drill is also working just fine for the past 10 years (well past its warranty). If the batteries on either die for some reason, I just need to find a replacement battery, as the motor, clutch, and every other parts should still work.

I also have a 10 year-old compaq presario that still works (using ac adapter, because the battery's dead). I don't use it for actual web browsing, but that's an issue of tech changes.

You're confusing planned obsolescence of consumer devices with devices designed with longevity in mind. The batteries of your phone, and computer were never designed to live past the expected usefulness of the device.�

1/1/2015

guest But even if there is a mileage upgrade pack, you are under no obligation to buy it, and depending on the price point you might not want to buy it. And that is fine, because your pack will last well into the 2020s. Keep in mind that the current fleet average life of all cars on the market is 11 years old. This means people are ditching their cars on average after 11 years. If the pack is designed to last at least 15, this gives you at least an extra 4 years to sit on the model S should you *choose* to before you become more likely to either buy a new battery or buy a new car. But is anyone really going to complain about being forced to junk a well used 15 year old car??? (as in a car with over 200k miles on the odo.)�

1/1/2015

guest What was the mistake?

The RAVEV is approaching 15 years of age. So that doesn't really seem out of line.�

1/1/2015

guest Since all applicable data, and I do mean all, points to a long useable life for Tesla packs, any suggestions otherwise is...odd, to say the least. To be clear, there is no evidence backed argument pointing to a pack life less than the life of the average vehicle. Meaningless comparisons to highly stressed and constantly fully cycled laptop or cell phone batteries are, well, meaningless. However as a point of reference I had a lithium ion powered Samsung flip phone that I used for over 6 years, because I knew enough to avoid deep cycling it as much as possible.�

1/1/2015

guest Tesla guarantees that the car will work at eight years. They don't guarantee range in year eight, at least the last time I looked. Older roadsters look to be down to 80-85%. This includes many low mile vehicles.

Jeff Dahn, who Tesla is funding next year, has a good youtube lecture that emphasises the problem of unavoidable parasitic reactions that are not of function of cycles. I was told by a Tesla employee to expect more rapid drop in range after five years. After listening to Dahn's lecture I assume the increase is due to some of the battery additives losing effectiveness.

- - - Updated - - -

The roadster has a linear downward trend. The model S has a drop then a flat line indicating no loss of range. Either the model S has a miracle battery, or Tesla is reducing reserve capacity as the battery ages. We will se what happens as the cars get older.�

1/1/2015

guest So let's get this straight.

What you're saying is that a car with less mechanical complexity will have more service problems than a car with more mechanical complexity, that 8 year old luxury cars will be "fine" for that entire time and none of them will have expensive problems despite everyone with any sort of luxury car experience knowing that that is the opposite of reality, that a car with an 8 year warranty will crap out in 5 and leave the owner with a stranded asset that they can't possibly fix, that batteries will get more expensive to replace over time which is the exact opposite of the trend for the last 30+ years, and somehow you've found a bunch of Roadsters with low mileage and 20% battery loss but nobody else has seen or heard of these (mine is 7 years old with <5%, by the way).

Is that right? Is that what you're saying?

Then why are we all still talking about this? Because that's all nonsense. Enough of this nonsense, let's get back to reality.�

1/1/2015

guest This is an investment thread. I'm sorting through the possible hurdles TSLA may face becoming a large company, including what older battery performance may look like.�

1/1/2015

guest But yet you make reference to things that are either exactly the opposite of what has been proven to be true or is just plain wrong. It's like you know enough on the subject to talk about it if noone else was educated on it you would seem correct but around these parts those comments are going to get blown apart.

I too have yet to hear of Major battery degrade on the roadsters outside of one fringe case or two. There was that guy who drove his roadster all over Europe in like the first year of ownership who ended up with problems and I think one other person I have seen post on the forums... Out of what? 2500. Those anomalies are likely to happen. Otherwise everyone I have talked to with a roadster has experienced amazing longevity on their packs.

The Model S based on what data we have now for 3 years of driving is also holding up quite nicely.

And I'll have to rewatch the lecture again sometime, but I thought the findings of that research was that slowly cycling the battery vs quickly cycling the battery was what impacted the degrade more or less not partial charges. Because when they test, they don't do partial charges it is always deep cycles.�

1/1/2015

guest You're not doing a great job there buddy. You seem reasonably intelligent and good at picking things apart and trying to find pitfalls and hurdles, and I'm assuming that's how you're trying to approach a TSLA investment. A lot if the flak you're taking on these forums comes from the fact that while you are smart and creative in your thinking you don't know the product, technology or customer experience well enough. I'm sorry, maybe it sounds clich�, but the best thing you could do in order to understand TSLA as an investment is:

1) read up on the ACTUAL technology that Tesla has (not what other sources are saying about for example EVs in general, batteries in general, manufacturing in general etc).

2) buy a Tesla. Experienced living with it. Experience what it's like to be a Tesla customer.

Pro tip: other threads on this forum are an absolute wealth of information if you take the time to study them. For example the issue of battery degradation in Roadsters and Model Ss is so well documented and discussed on this site that those of is knowledgeable dismissed your conclusions quite ferociously, as you can see.�

1/1/2015

guest Since buying a Tesla could make you biased (I know it did for me) if you want to stay somewhat more subjective and get that side of things go to your nearest meetup of owners or wait around a supercharger and casually talk with owners about how they like or hate the car. Most of them will be pretty honest with you about how they feel. I know I will happily be honest about the very few negatives I have experienced and yet still champion the product to whoever will listen because it is that good. When your biggest sales guys are the customers you have to be doing something right.

I do highly recommend going for a test drive too, to experience the product. Again if you want to stay somewhat subjective by not buying it. But the customer experience is a big piece of why so many owners have said they will not buy anything other than a Tesla. Even if someone else made a model S clone... I wouldn't want to buy it.�

1/1/2015

guest Dude, you are getting on my nerves now. You say you are long term shareholder, but question everything this company does and on every other subject. That video is a couple of years old and in it he even doesnt know what Tesla added to make their battery chemistry so much better than everyone elses. You are twisting what happened in the video.�

1/1/2015

guest I call bovine excrement on this. I have one of those older roadsters and it is only down about 4%. I have never seen evidence of one down to 80% with less than hundreds of thousands of miles on it. Please provide a reference or stop making ridiculous claims.

Same comment. My roadster definitely did not have a linear decrease; it has had pretty much constant range for the last couple of years. Please substantiate or stop.�

1/1/2015

guest It's all good and well to play devil's advocate. Heck, we have so many cheerleaders we could use a few. But you invalidate the argument when you take outlier situations/ bad analogies/ worst-case scenarios and put them together like it's a possible or even a likely outcome. A perfect storm of ****-burger. Try not to sound so much like a writer for an SA/WSJ article and you will be taken more seriously.�

1/1/2015

guest We don't know whether 3 will get that long a warranty. S got that warranty in general because of concerns of drivetrain problems.

If 3 gets that long a warranty - I'd expect a Camry at 3 years (post camry warranty) to have a bigger difference in price compared to Model 3.

But we never know - premium cars generally lose more value sooner. So, who knows.�

1/1/2015

guest Has the plugin America survey on the Roadster range been updated?

- - - Updated - - -

The model 3 probably has to get a long warranty. The question is whether it can still be non-specific, like the S.

- - - Updated - - -

�

�

1/1/2015

guest Elec, your contention was that there are low mileage roadsters with outlying degradation (among other nonsense listed above). You keep posting even though we all know that's nonsense. You also know that's nonsense, because you just posted a graph about it.

Can you stop wasting everyones time now?�

1/1/2015

guest https://www.youtube.com/watch?v=pxP0Cu00sZs�

1/1/2015

guest Yes, that video also shows why you're wrong, just like the graph did.�

1/1/2015

guest Why ?

Long warranties are not free. It is one thing to offer long warranty on premium cars with big margins - and entirely different on cheaper cars. Esp. given market expectations of turning higher and higher profits quarter after quarter.�

1/1/2015

guest New data is added to the Plugin America surveys regularly. Last Saturday I heard Tom Paxton give his lecture about what the surveys for Model S and Roadster show based on his lost current data and battery degradation remains remarkably low and consistent with what he presented the previous year.

@electracity you really need to pay attention to the criticisms of your positions made in this thread. You ignore repeated requests for substantiation of your assertions and repeatedly offer outdated and debunked data and positions. It appears to me that you are deliberately trying to stir people up.�

1/1/2015

guest Or, as anyone who actually knows anything about lithium ion chemistry could tell you, capacity degradation curves are usually steepest in the earliest cycles, then tend to flatten out. They also know that most of the reported Model S capacity "loss" is actually a BMS/range calibration issue and that "loss" can be recovered by specific charge/discharge protocols.

No one is suggesting that Tesla packs don't degrade, only that all evidence points to a mild, acceptable capacity loss over a long period of time, providing a usable lifetime as long as or longer than conventional vehicles.�

1/1/2015

guest You're joking, right? You might want to educate yourself on Tesla's battery management system and a mountain of empirical data.

Patently false. Once again, you might want to do at least a little fact checking.

That's not what I got from that lecture.

Yes and thank you for posting the results which indicate pretty much the opposite of what you said earlier.

It does, in fact, have to get a long warranty. Correct me if I'm wrong but I believe some states are requiring the 8-year warranty but it's in Tesla's best interest to provide one because the cost will be much lower than the price premium.

To repeat your line, "This is an investor thread." Investors need accurate information and good data. While I appreciate having a bear in this thread (it needs one), a bear who posts repeatedly and verifiably false information is not much help.�

1/1/2015

guest Mr. Market is the one that determines the long-term value of used Model S. Go onto Cars.com today and see how well they are holding their value. The cheapest ones are selling for around 25% less than what was originally paid for the vehicle. That's truly impressive.

Once the banks get more comfortable with the higher residual values, the monthly lease payments will move lower, making the car even more affordable.�

1/1/2015

guest This is even more impressive when you consider that the net purchase price of the new car is at least $7,500 lower than the sticker, possibly more depending on the state.�

1/1/2015

guest As an adjunct to this, my latest laptop now has options to intelligently charge it's Li-Ion battery, with preference to default to charging to less than 100%, and I believe there's some more thermal monitoring going on as well.

I suspect that other manufactures are learning that even simple steps such as these may drastically prolong Li-Ion life... and that comparing the typical battery degradation curve of a laptop (or some other device) from previous generations may not allow you to extrapolate what one can expect from Tesla's pack that are already implementing such measures.

It may simply be that charging up to the last 5-10% of charge on a Li-Ion cell (and leaving it there... especially when hot, is responsible for 50-75% of it's degradation.

This was almost the exact scenario with my previous laptop if left plugged in: that battery was maintained at 100% for weeks at a time while the unit generated heat when running at full performance on AC power. The underside of the unit would get hot to the point of being uncomfortable to hold...

Is it any wonder why those Li-ion cells didn't last?�

1/1/2015

guest BTW, after 5 years of continuous use for work, my laptop still holds the capacity quite well. Most days I get thr' all my meetings without having to carry the cord.

BUT, I've to note that at some point Li batteries have catastrophic failure (the capacity doesn't go to 0% after 30 years of use - but a sharp decline after some years). So, if I were to look at the batteries for secondary use (not automotive) - I'd be careful. I don't think Tesla is counting on any secondary use for their profitability.�

1/1/2015

guest Yes, Tesla said it is better to recycle the used automotive batteries as the ingredients are all still in there and produce new batteries for e.g. storage purposes.

Question: Would you like to buy a 5 year old Leaf or Modes S battery for your home storage?

I would prefer a recycled new battery �

�

1/1/2015

guest Neither. I'd like the EV I've at any point to be useable as backup battery - but that's another story.�

1/1/2015

guest

Why would a Model 3 have lower warranties than cars with substantially inferior battery tech and especially TMS systems?

Even a Leaf has an 8 year battery warranty that matches Tesla's, not including the unlimited mileage. (Tesla's warranty has no guarantee of capacity, similar to that of the Leaf's 8 year battery warranty, while a Leaf has a separate shorter capacity warranty as well).

Smart electric car batteries have 10 year warranties (though it's partially paid for over time). Volts have a long-lived 8 year warranty and they suffer many more deep discharge cycles than pure EVs I"d imagine.

Even if a Tesla did have a 20% battery degradation after 10 years (heavily improbable this will happen), it'll still be an EV with a very, very long range. 60 kwh Teslas still manage to exist, so why can't an 85 kwh extremely degraded battery still function? A 180 mile EPA degraded 60 kwh Tesla would still be extremely useful when superchargers are more densely populated. Even if this happens we're probably talking 10-15 years out and 150-200k+ miles, with very few other components that need repair or replace. This would be when similar ICEs are replacing transmissions, brake pads (for the umpteenth time), engines in many cases, and other nasty breakdowns whereas the EV just has tires/fluids and minor mechanical wear.

If you have to ask yourself whether the tech will last or not, look no further than examples out in the world now. Look at Leafs losing 30% battery capacity in three years and 40k miles versus Teslas losing 8% in that same time period with 100k+ miles. Look at how well Volt batteries have done. Look at how well Gen II smart EV batteries have done, at how well Roadsters have done. Look no further than iPhones losing 40% capacity in a year. It's all about the tech, and Tesla is empirically among the best out there.�

1/1/2015

guest He only claimed to be a shareholder to add weight to his argument. He clearly has a bone to pick with all things Elon and everything he says should be discredited much like this guy Rogier van Vlissingen's Articles | Seeking Alpha Its like John Peterson back from the reverse stock splits.�

1/1/2015

guest Please see:

Development of High Power and Long Life Lithium Secondary Batteries

This is a research report from Panasonic battery engineers reporting NCA cells similar to Tesla's Model S cells. Note the 2nd graph with flattening capacity loss. This is with 60% DoD and out to 3,000 cycles while charging and discharging at 2C at 25 degrees C and 50 degrees C.

60% DoD is 160 rated miles for a charge cycle initially. At 3,000 charge cycles, with 88% capacity, we're looking at an average of 154 miles, so that's 3000 * 154 = 462,000 miles to hit about 88% capacity.

Of course, real world conditions are a bit different. The Model S can discharge at almost 6C in a P85D, but we never charge more than 1.7C. Also, most of us don't do 60% DoD. Even if we take the number Tesla recently gave at a PowerWall presentation... 1,200 charge cycles, with much deeper DoD. Let's assume 90% DoD, with 1,200 charge cycles meaning 80% capacity left. That's 85% on average per charge cycle. 1200 * 0.8 * 265 = 254,400 miles to hit 80% capacity. Using a high yearly average of 15,000 miles, that's 17 years.

Part of the Powerwall presentation was also the mention that the cells have a 12 year design life, but can last much longer than that. They warranty for 10 years but offer an extended warranty for 20 years.�

1/1/2015

guest They certainly cycle more often but they are also never allowed to use as large a portion of total pack capacity.�

1/1/2015

guest about 65% of the 16kWh pack, (10.3kWh)

- - - Updated - - -

Rogier's thesis SEEMS to be you should make buildings to European "Passiv Haus" standards so you only need 10% of the energy to run them, and roof top solar is a scam. English doesn't seem to be his primary language and the population is denser with less usable roof space, etc�

1/1/2015

guest Hi,

Something we seem to be forgetting is how quickly Tesla is reducing pack prices. The$125 per kWh price below is based on the retail price of Powerpacks. That means that Tesla will be able to make a profit selling 105 kWh MS-MX packs for about $13k. And JB said that he believes that battery prices are poised to plummet "off a cliff". I think that he at least sees some highly likely ways that that could happen. Maybe Jeff Dhan's work or maybe Tesla is talking to 24M. We should be talking about what is going to happen to Tesla when their pack prices decline to something like $60-$80 per kWh. But maybe that conversation belongs in the short term thread.

From Ars Technica:

Powerpack (very similar to the automobile package) 250 per kWh. JB said that the M3 batteries have 20% greater energy density than MS cells. Energy density and prices are almost the same thing. Plus 30% decrease by the end of the the first year of GF Production.

Total is about $125 per kWh.�

1/1/2015

guest The bigger question is what do other big OEMs do when the price falls. I'm sure they'll all come out with their long range BEVs.�

1/1/2015

guest And capacity increases. But that is years away and it's clear that tesla is continuing to invest in the future. Hard to imagine when big OEMs look to make a million mile power train an engineering goal.�

1/1/2015

guest Hi,

But they will have trouble doing that if their packs cost them $200-$300 per kWh.�

1/1/2015

guest The industry would be about 75% smaller if all power trains lasted a million miles.�

1/1/2015

guest What Tesla needs for the Model 3 design is the ability to retrofit any future sensor tech enhancements to the car. Basically design that takes upgrades into consideration. That would seriously shake the industry up.�

1/1/2015

guest Making sensors future-proof is probably a bridge too far. There is a lot of wire/harness/body integration that they can't anticipate needing. HOWEVER, I wish they would design in upgradability on the computers. Most of the in-car buses are standard and have been for a long time. They could make the central computers plug-and-play. The computing power of my car is about half of what it should be and that gap will become super apparant when they eventually upgrade and make it so the browsers are actually useable for instance, or allow video playback in park etc. In the same way that you feel a twinge to upgrade phones when you see how fast and responsive the new phones are, so it will be with these cars. But if you could pay $1500 and get the new computer, that would make the fleet very long lasting.�

1/1/2015

guest The sensors don't need to be future proof, just replaceable. So they need to wire every spot that could possibly need a sensor in the future. I'm pretty sure that they know where the sensors would go for full auto pilot (on ramp to off ramp hands free) at least.�

1/1/2015

guest Probably not. Powertrains already last in that range when they are heavily used, with an overhaul or two. There are enough improvements that nobody typically keeps a vehicle that long, although taxis and fleet vehicles sometimes do. Until now nobody has made batteries that act that way. There is that 244,000 mile Roadster with 77% of range left, though.�

1/1/2015

guest And if you look here:

http://www.teslamotors.com/about

By reducing the industry by 75% they are really going for this target.

(As others have pointed out, this is really not the case, but if it can help reducing the industry by even 10% it will help).�

1/1/2015

guest If you remanufacture then just about any vehicle can last forever.

I think the point is to make them last without remanufacturing.

Then people will keep them and not junk them.

The average new car buyer does want to remanufacture engines and transmissions. Would rather buy new.

But if you can count on a Tesla lasting 1M miles the same way you can count on a Lexus LS lasting 500k miles with only fluids, filters,belts and batteries then more 1st and 2nd Model S owners will keep the car for 1M miles.�

1/1/2015

guest Hi,

In my first post on Tesla Battery Pack costs I used an estimate of their costs to start my calculations. I got responses that that price was too low.

Then I used the sales prices of their pack. My results were similar, and the responses were similar as well. I got one response that that price was too low, because they are selling their Powerpacks at a loss.

It seems to me that I didn't do a good enough job of explaining my thinking, since the exact prices in my conclusions are almost irrelevant. When the Powerpack prices of $250 per kWh were announced I thought we could use those prices to reach several conclusions, and these are important for investors to understand (and most analysts are clueless):

1. Their Powerpack prices of $250 per kWh are below deeply disruptive and this market is huge:

Why Energy Storage is About to Get Big and Cheap | Ramez Naam

2. We can use the Powerpack price to get a much better idea of their car pack costs than were possible before.

3. Their prices are lower than we knew, and Tesla has been, and continues to hide them.

4. When you factor in the GF cost reductions at about the end of 2016 or mid 2017 their prices will be at least close to being disruptive, and definitely low enough that producing and affordable M3 is a slam dunk.

If this is correct (it should be) my most optimistic post GF estimates were too high ($180 x 70% = $126 per kWh based on selling prices, not costs) :

Tesla Motors Inc (TSLA) Drives Battery Costs Lower Than Most Optimistic Forecasts

One example of close to being disruptive is that with a 30% reduction in costs Tesla could sell the new 90 kWh pack in a 120 kWh version for the same price. That is a 400 mile range! I realize it might take a 2-3 years to increase the energy density to the point where that's practical, but they are getting close! I'm not sure where the "tipping point" is but I am positive that a 400 mile range makes the cut! Gas powered cars are on the way out, and Tesla is leading the way!�

1/1/2015

guest Perhaps, but it's worth remembering that the power (not energy) delivered by the stationary storage batteries is quite a bit lower than the power levels required of the automotive batteries. It would be reasonable to assume that the per-kWh cost of the stationary batteries is lower.�

1/1/2015

guest Hi,

When EM described the product he said that the Powerpacks for backups use a cell with more energy, and the Powerpacks designed for daily cycling use the same cells as the car packs.�

1/1/2015

guest The way I look at it is that if Tesla makes a drivetrain that can be used for 30 to 40 years instead of just 15 to 20 years. Then for the next 30 years or more every new Tesla is displacing a gas/diesel vehicle. Otherwise in 30 years many of the new Tesla would just be replacing worn out Teslas. So longetivity reduces the number of electric vehicles required to purge fossil fuel vehicles from the global fleet.

There are options for renovating older vehicles for a second life. At one extreme, the chassis can be removed from the platform and replaced with an all new chassis. Thus only the drivetrain is reused. The renovated vehicle could have all the latest features.�

1/1/2015

guest I don't believe that is correct.�

1/1/2015

guest I believe it was the same chemistry, not the exact same cells.�

Không có nhận xét nào:

Đăng nhận xét