1/1/2015

guest ^ 8k down !! (took 2000 shares at $27.6 before earning) with 1K over margin, really hoping it goes back up tomorrow to avoid a margin call, holding as long as i can is the plan, if i must sale i would lose all the profit i have made in the past 4 months, that would suck the life out of me !! it will teach me not to play with margin so much thats for sure�

1/1/2015

guest The way I look at it is funds/institutions need to want to buy more SPWR (vs selling SPWR) for the stock price to go up. Currently I doubt if retailers have much power with the stock price.

Right now I don't see funds/institutions having incentive to buy more SPWR right now. There's no rush because of the relatively disappointing Q2 earnings report/call. I think funds would be more inclined to sell some SPWR rather than buying more right now.

I think what could entice funds/institutions to pick up more SPWR is if the price becomes cheap enough where they feel like they're getting a very good value. The question is how cheap does that have to be.

Another question is will funds/institutions view Q2 earnings as a minor speed bump that SPWR can quickly overcome and return to stellar growth prospects. Or will they see Q2 earnings as a huge warning sign that SPWR's growth trajectory has significantly slowed and as a result they're not willing to give the same growth premium as they were before, thus contracting their price expectations even more.

Personally I think the correct answer lies somewhere in between. But the markets can be brutal to companies who's growth trajectory has apparently slowed or even hints at slowing.

So it comes down to whether funds/institutions will remain believers in the growth story of SPWR and scoop up the stock while it's in the low 20s (current stock price is $24), thus increasing upward price pressure. Or will funds/institutions become skeptical of SPWR's growth story and let the price drop until the price becomes significantly lower (under $20/share or maybe even lower) to step in, or different funds/ investors step in as value investors.

Anyway, in my opinion things aren't as clear as we'd all want it to be. As there are many factors involved in how funds/institutions make their decisions.

If earnings aren't strong from other solar stocks then that could hit SPWR hard. But if earnings from other solar stocks are very strong than that will influence funds/institutions to remain believers of the SPWR growth story and step in and buy the stock.

Obviously there are other factors as well like analyst reports/upgrades/ downgrades.

Anyway, hopefully some of what I'm saying might be helpful to someone.

Update: looks like we're sharing our losses. I lost $2.2k of $11.5k invested in August calls but would have lost $8k if I didn't sell at market open and held till now (end of 8/1)

8/2 update: This morning I bought $800 worth of Aug13 21 strike puts. Plan to hold for a few days and sell.

8/5 update: This morning I closed out my Aug31 21 strike puts for a small loss.�

1/1/2015

guest Well well. Next up is SUNE and SCTY and then SOL? Anyone have a good feeling still?SUNE and SOL are cheap. SCTY, not so..

�

1/1/2015

guest I am down 20% on my SPWR Jan 14 options, but took the opportunity to double down on them yesterday. Like you said, paper losses only.�

1/1/2015

guest Unfortunately that's the nature of volatile stocks. While we all like TSLA's overall trajectory, even that swung from lows of ~$106 to highs of ~$136 just in July. SPWR, SCTY show similar percentage swings so paper losses today may become good again very quickly.�

1/1/2015

guest Yeah, and thoose Calls are really cheap today, too bad they`re already mine �

�

1/1/2015

guest S&P reiterates buy on spwr, price target increased from 9 to 34.

- - - Updated - - -

Would be nice if it could recapture the recent lows and 20 day ma around 25-25.5.�

1/1/2015

guest Can any of this be true?

got it from the yahoo message board.

this guy Kevin posted the following:

"Kevin Ryan

Shared privately - Jul 1, 2013

Warren Buffett has invested 2.5 Billion dollars into this Energy company.... (SPWR) Sun Power! Sun Power is owned by this company (TOT) Total SA.

SunPower Corporation (NASDAQ:SPWR) shows tremendous promise in the field. First-quarter revenues grew by about 28% year-over-year. Furthermore, the firm is improving its overseas prospects with recent power plant contracts in Japan. SunPower Corporation (NASDAQ:SPWR) is focusing on efforts in EMEA by working more closely with the company's parent, TOTAL S.A. (NYSE:TOT). It should be noted that Warren Buffett invested $2.5 billion into a solar plant slated to be constructed by the firm.

Obama has changed the rules at the Department of Energy to favor solar companies!

The US Senate three weeks ago passed a massive 17 billion dollar tax bill for solar companies!

Warren Buffett is Obama's financial advisor!

Sun Power (SPWR) will announce record financials in less than 35 days beating Wall Street again for the second quarter! (SPWR) will also increase guidance!

(SPWR) also has big news to announce shortly! New contracts!

SunPower Corporation (SPWR) -NasdaqGS

21.44 0.74(3.57%) 12:05PM EDT - Nasdaq Real Time Price

Price target on (SPWR) $100.00"�

1/1/2015

guest english.caijing.com.cn/2013-08-02/113122579.html

Chinese solar companies to get tax cut..�

1/1/2015

guest http://www.bloomberg.com/news/2013-01-02/buffett-utility-buys-sunpower-projects-for-2-billion.html

Buffet thing is true, never seen a price target like that tho.

My SOL August Calls needs more of thoose News �

�

1/1/2015

guest @Dave T - Good analysis on SPWR in the past couple of pages. Just wanted to point out that you incorrectly stated that without the $100m of revenue pull-in the company would have lost $80m; they pulled in revenue and not net income, they still would have beaten guidance without the pull in at least on a non-GAAP basis. And what "pulling in" really means is that they were able to finish a project ahead of schedule and recognize that revenue in Q2 vs. Q3.

I guess the lesson learned here is that you have to be careful with options when playing solar. The sector is way to volatile to put too much money into options. I think buy and hold might be the best bet. The Chinese players are still priced very cheaply, and if you believe that they will become profitable in the near future, you might as well buy some stock and hold on to it. In the mean time these stocks might go up 100% one month and then go down 30% the next month. Timing has to be impeccable with options.�

1/1/2015

guest Thanks Sleepyhead for the clarification.

I agree with the lesson regarding short-term options. Also, I think it's high-risk to play earnings unless we have some "first data" information (ie., ground level numbers on purchases/demand/production, etc).

Personally I see one of two main scenarios happening:

1. Solar earnings from other companies in next few weeks are stellar and it continues to fuel optimism in the sector. As a result, SPWR recovers very nicely on it's path up.

OR

2. Solar earnings are okay but aren't stellar, investor mood becomes more skeptical/hesistant, and there's a moderate near-term pullback in the sector.�

1/1/2015

guest Mod Note: discussion on residential solar install went here- Residential-solar-(awaiting-merge)�

1/1/2015

guest I was busted.�

1/1/2015

guest Anyone can explain the sick game they are playing? 0.00000% movement today on SPWR......�

1/1/2015

guest my thought exactly... and TSLA finished at 138 right on the dot....�

1/1/2015

guest My post got moved but I still like to get some comments.

I kind of stay away from the company I don't have direct first hand knowledge. Since I am interested in Scty, I sign up for service and and today is the installation day.

I talked to them about the products they are using. It is trina solar. I am still new to the solar landscape so i don't quite understand how they select the vendor. But they say they are using other vendors like Panasonic, Sanyo, just a couple of names that I remembered. No spwr, no fslr though. Any comments?�

1/1/2015

guest My understanding is that Sunpower has their own dealer network you need to go through to get Sunpower panels installed. With First Solar, I believe they don't do residential solar as they're more focused on solar power plants.

How was your overall Solar City experience? Was everything convenient? Did you experience any problems or issues? Any insights for SCTY investors?�

1/1/2015

guest What I was impressed is the sales process. They are using the tools and technologies on par with any high tech IT company, Remote Desktop sharing, personalized project proposal and online workflow management etc, though most of these tools are commodity nowadays. Still I would suspect their efficiency is way better than pge, as they label themselves as a mobile energy utility company.�

1/1/2015

guest How i picture SPWR this evening

I lost all my trust in the market after this unjustified drop

�

�

1/1/2015

guest That's good to hear about the tools/technologies that SolarCity uses. They've mentioned in their earnings calls that the cost efficiency gained through software (managing all aspects of the customer's experience) is one of their competitive advantages.�

1/1/2015

guest I have a Solar City system as do a few of my friends. We all have had very good experiences throughout the process. When the city inspector signed off on my system he told me, "Solar City always does everything clean and to the code, just the way we like it". He went on to tell me that Solar City gets it right the first time where most of the other installers (he didn't name any in particular) have to come back and fix a few things to bring it up to code.�

1/1/2015

guest Deutsche Bank predicts imminent upturn for solar industry

Looks like Deutsche Bank agrees with my enthusiasm for Solar; basically everything I have been talking about for the past couple of months:

Deutsche Bank predicts imminent upturn for solar industry - PV-Tech

Select Quotes:

The solar industry is on the brink of a sustained period of momentum

We believe the solar sector is at an inflection point and industry fundamentals are likely to improve further into 2014

�Despite the strong year-to-date performance, we believe the solar rally has legs. Demand outlook is improving due to strong demand from Japan, China, US and other emerging markets. The supply situation is also a lot better in our view - Chinese tier two/three supply cuts have accelerated over the past 18 months and supply from large Chinese companies such as STP, LDK has decreased sharply, particularly in markets outside of China,�

�With the potential resolution of EU/US/China tariff uncertainty, we expect relatively stable pricing, improving margins and further sector consolidation to drive gradual profitability improvement, which in turn could act as the next set of catalysts for solar stocks.��

1/1/2015

guest Hope to see a turn around before options expire�

1/1/2015

guest

The Bloomberg article is a bit old, Jan 2, 2013. But it's still new to me.

- - - Updated - - -

Groundhog Day.�

1/1/2015

guest You have earlier said that some of the stocks can do a 10 bagger but that there is some risk. With SPWR now have profit do you still see the risk? And do you still see the 10 bagger? Im still holding all my positions, I actually got more.�

1/1/2015

guest SPWR almost is a 10 bagger already - it was trading at $3.71 less than one year ago. Right now it has a $3bn market cap, so don't expect it to have a $30bn market cap or $240 share price in the near future. When I was talking about 10 baggers, I mentioned companies such as SOL who had a $250m market cap (now already at $370m) or CSIQ at $500m (now over $610m); these are your potential 5 and 10 baggers.

The biggest risk I saw in solar was that gross margins would continue to be depressed, which would result in net operating losses. Since ASP's have stabilized and are now actually increasing slightly, this risk is slowly going away (unless some other country "pulls a China" and floods the market with solar capacity in the near future). SPWR's results have confirmed this; they have raised gross margin guidance significantly from just two and a half months ago. They lowered GAAP revenue guidance (but kept non-GAAP in tact) and that is why the stock tanked. But manufacturing costs will continue to go down and the company will become even more profitable based on cost reductions alone. They are going to have to make a tough decision on whether to build a new manufacturing facility to increase capacity. I think they should do it since solar demand is growing very rapidly and capacity keeps dwindling down.

Even without a new manufacturing facility SPWR can continue to grow revenues if it gains traction with it's C7 Trackers. This allows them to get 6x more Watts per panel. An analyst on the call asked a question when we will start seeing some big C7 deals, and the CEO kind of fumbled on that one (although he said that C7 growth should be coming); that is another reason the stock went down. It is worth mentioning though that Apple just announced a 21 MW C7 tracker deal with Sunpower one month ago, so maybe it is a sign of things to come.

SPWR is still one of the safest plays in the industry and I expect the stock price to double in the next 1-3 years, based on production cost reductions alone. If the demand remains strong and the company does decide to increase manufacturing capacity, then this company still has a ton of room to grow and the stock plenty of room to run.

As far as multi-baggers go, look no further than Chinese solar companies. CSIQ is planning on returning to profitability for FY13 and SOL might not be too far behind. If these two companies become profitable, then all they need to do is to start trading at 1x Sales to become 3-4 baggers!

But if industry conditions were to decline (I think that only a deep recession could be responsible for such a situation) then both CSIQ and SOL can easily lose 50% off their current share prices. So that is your risk right now, namely macro-economic risk.

Some news on CSIQ this morning - sold five power plants for $277m (up 4% pre-market):

http://finance.yahoo.com/news/concord-green-energy-acquire-five-105500201.html

From the one or two analysts that follow CSIQ, Revenue expectations for FY14 is $2.8bn. If they can turn a 1% net profit margin or $28m in net profit, that equates to ~$0.65. Now if they can squeeze out an additional 2% then we are looking at $2/share in 2014; and probably a $50 share price to go with it.

These solar companies are very higly leveraged and once they become profitable it will only take a little bump in gross margin to yield huge EPS increases (SPWR is a good example). It works both ways though, so their is a ton of risk in these companies. My extensive research has lead me to believe that the scale is tipped in favor of becoming profitable and I am willing to bet (invest) on it.�

1/1/2015

guest Hoping for some recovery this week!!�

1/1/2015

guest even with today's gain the delta has my Aug calls by the balls, no growth �

�

1/1/2015

guest MY CSIQ AUG 17th $14 calls are up over 120% today so far...it's so tempting to sell! If only if I knew when they were reporting, that would make the decision easier.�

1/1/2015

guest Raymond James Analyst thinks that overcapacity is still a big issue. So there is your risk in solar:

http://blogs.barrons.com/emergingmarketsdaily/2013/08/05/solar-panel-oversupply-still-a-problem-raymond-james-says/?mod=yahoobarrons

I just wanted to point out that last year there was about 30 GW's installed. And just a few months ago forecasts for this year were about 29 GW's. Now the forecast for this year is above 35 GW's and growing. Yes, capacity is high (somewhere between 50 GW and 70 GW), but some companies will become profitable (like SPWR) and I expect that trend to continue.

The safest play in solar is buying stocks and not options. Buy and hold and don't look back. If you are worried about risks (which are real) then don't put in too much money into solar.�

1/1/2015

guest Thank you once again sleepy! I have alot og stocks in it. Some options still tho, I would go for sept rather than aug call, since its unlikely you will get ER before 17th(CSIQ). SOL have their before opening the 15th.�

1/1/2015

guest No coincidence that the rise of Solar and the EV are happening at exactly the same time. These two trends are going to feed each other for years to come.�

1/1/2015

guest Yeah, and even tho they all are up alot, the upside is alot bigger than the downside IMO.�

1/1/2015

guest Even though the upside in Tesla is huge, the upside in Chinese solars is even bigger in the short-run. The risk is significantly higher in Chinese solars though, so stick with Tesla if you are risk averse.�

1/1/2015

guest Or put just a little in chinese solar that you could lose and be ok with it but would be fun if it shoots up...that's what I'm doing.�

1/1/2015

guest http://www.nasdaq.com/press-release/canadian-solar-schedules-second-quarter-2013-earnings-conference-call-20130806-00066

Canadian Solar Inc. ("the Company", "Canadian Solar") (NASDAQ:CSIQ),

one of the world's largest solar power companies, today announced that it will

hold a conference

callon Thursday, August 8,

2013 at 8:00

a.m. U.S. Eastern Standard Time (8:00 p.m., August 8, 2013 in Hong Kong) to discuss the Company's

second quarter of 2013 results and business outlook.

Read more: http://www.nasdaq.com/press-release/canadian-solar-schedules-second-quarter-2013-earnings-conference-call-20130806-00066#ixzz2bCBOJ1B1�

1/1/2015

guest Seriously CSIQ? Seriously? I just sold my $14 Aug calls yesterday...Oh well, I can't complain about the 66% profit in one week that I booked...�

1/1/2015

guest I know right? I sold half of my Aug $17 calls yesterday thinking that the company will not report until after Aug 17; also took a 66% gain. I still have the other half though and some J14 $16 calls as well. I was hoping to load up on CSIQ after TSLA earnings but now it is impossible.�

1/1/2015

guest Yeah, horrible timing! I have some CSIQ stock in my IRA so at least I have some exposure still. I'm glad you still have some options left, I'm all outI thought about selling half but figured the money would do better in TSLA due to a known ER date as well as the fact that I think I have a pretty good grasp on TSLA as a company and not as much on the solar companies.

�

1/1/2015

guest Well, they are down today! Bloody Tuesday!�

1/1/2015

guest I know. What happened to the 20 week Tuesday win streak that we had earlier this year?�

1/1/2015

guest http://www.nasdaq.com/symbol/fslr/real-time Going Down, and theyre taking all the solar Stocks With them AH.

Btw, any guesses on SCTY tmrw?

Jim Cramer July 19: �If you want a solar, I�ll send you to First Solar. I didn�t like the way it finished the quarter, but I do like it now.��

1/1/2015

guest I didn't look closely but it appears FSLR's earnings report was not good (revenue much lower than expected) and they lowered 2013 guidance. This is not a good sign. Mood/sentiment around the solar sector can be very volatile as the sector tends to move together.

I'm expecting SCTY to report very strong earnings, but I think they're somewhat of an unique solar company as their challenge is similar to Tesla (they're not demand-constrained but production-constrained). SCTY has more than enough demand as they've been scaling their operations and financing to meet that demand. Tomorrow (I suggest listening to their conference call) I'm expecting a strong show of them marching toward profitability sooner than expected and more strong evidence of surging demand for their products. But if there's a pull-back in the solar sector due to souring investor mood in the coming weeks, then SCTY's stock price will likely get hit as well.

- - - Updated - - -

Update: I took a closer look (but didn't listen to their conference call) and FSLR's earnings don't seem like a complete miss. Overall they had reasons for their lowered revenue and they had increased gross margins and a decently optimistic outlook. So, I would say it's kind of disappointing but not devastating. But I haven't been following FSLR closely, so I can't really comment with much confidence.�

1/1/2015

guest I agree, I have no money in FSLR, but I have in some of the others, mainly SOL and SCTY. As you say, they are unique and they have been scaling up alot. Panels are cheap, and I really think they know what they are doing. However we might have to wait some time for them to surge. Who knows whats priced in ATM.�

1/1/2015

guest FSLR is a loser. Just 3 months ago they had an analyst day and they revised their guidance a lot higher, which lead to a 50% one day rally. Now three months later, they are missing targets and revising their guidance lower for the year.

I never did much research on FSLR, because they have outdated technology that used to be a lot cheaper but not anymore. I posted this a few pages back and I still feel like FSLR may potentially go out of business one day.�

1/1/2015

guest I know you did. I have stayed away because of what you said. I know how you feel about SCTY, but do you think they will do good tmrw? I have alot of Stocks there atm.�

1/1/2015

guest I am a solar installer and we have never installed fslr. I would be cautious of anything thin film based. When crystalline was expensive, thin film made sense. Now it can't compete because it requires more balance of system and labor to install, therefore the completed project usually is more expensive. As an installer I have had 3 consecutive quarters of price increases on panels. The prices bottomed in q4 2012. Look at Chinas solar energy plan for an idea of where the global industry is headed. I am expecting strong reports from csiq, tsl, yge, and sol.�

1/1/2015

guest SolarCity Q2 Earnings Conference Call is tomorrow at 2pm PST (5pm EST).

SolarCity - Events Presentations

This is 30 minutes prior to TSLA's conference call.

- - - Updated - - -

SUNE will announce Q2 earnings tomorrow morning pre-market. For the sake of the solar industry... I hope it's good.

"ST. PETERS, Mo., July 25, 2013 /PRNewswire/ -- SunEdison, Inc. (NYSE: SUNE) invites investors to listen to a broadcast of the Company's conference call to discuss second quarter 2013 financial results. The live webcast will take place on Wednesday, August 7, 2013 at 8:00 a.m. Eastern Time at www.sunedison.com. "�

1/1/2015

guest Yeah, lets hope these guys can turn the trend! Got even some Stocks in Sune aswell. If they both do good tmrw, then they might save my SOL, TSL and CSIQ Calls aswell

U still got any Dave?�

1/1/2015

guest I really don't know much at all about SCTY. I would ask DaveT, since he knows way more than I do.

Here is one thing I do know. Right now it seems like SCTY has a competitive advantage by not having to purchase their own panels. But I think that there is a remote albeit realistic possibility that this becomes a significant negative in the next 2-5 years. Remember, you have to see where the puck is going to be and not where it is. For that reason I buy CSIQ, SOL, and SPWR over SCTY.

Right now panels are cheap, but it looks like ASP's are slowly going up. SCTY buys from YGE and TSL, and that is because EU was a big loser for them, albeit still their largest market. Since the EU - China deal for minimum ASP's of ~$0.75 Europe has become a lot more attractive.

Also, there will be a panel supply and demand balance way sooner than people are expecting. This will ultimately lead to higher panel prices and panel manufacturers will be the big winners.

As far as tomorrow's earnings go I have no clue. I was trying to buy some deep OTM calls for Aug, but it was a complete gamble. I have not done any research at all on SCTY.�

1/1/2015

guest Here is a report on the global outlook for solar. http://www.solarindustrymag.com/e107_plugins/content/content.php?content.13059#utm_medium=email&utm_source=LNH+08-07-2013&utm_campaign=SIM+News+Headlines�

1/1/2015

guest With solar you have to be patient. Today might be a good buying opportunity, if CSIQ is able to turn things around tomorrow morning. I am confident that they will, but there is still a lot of risk. I think that if you buy some Tier 1 Chinese solars today and hold for many years, then you will do more than ok.�

1/1/2015

guest Today looks like the worst day for solar this year, market is bleeding like crazy, sune the most with 20% down but spwr as well with a second day 11% down. I just lost all the money i made in the last 4month, feeling like crap and hoping scty will change the trend�

1/1/2015

guest +1 to the feeling like crap statement.

I really need Solar to setup after this first solar hit. my Jan SPWR calls are down 75% now and its making me sick.

Hoping CSIQ can follow on the back of good SCTY report and prop the solars back up a bit.�

1/1/2015

guest I think that CSIQ earnings will be pretty good. But SPWR's earnings were pretty good too and look what happened.

That is ok, this just creates buying opportunities for me in solar.�

1/1/2015

guest I might buy some SPWR Jan 15 $40 calls today just for shits�

1/1/2015

guest I might do the same thing in the near future.�

1/1/2015

guest Me 2, Depends on if I still got any money tmrw.�

1/1/2015

guest That is why I wrote near future and not today. And also why I used the word might instead of will. :tongue:�

1/1/2015

guest I guess the hope of AUG17 recovery is down the tubes (SPWR)�

1/1/2015

guest that was expected Friday, it was never going to recover at that point. I still have a glimmer of hope that i can at least get something for my Sept calls if CSIQ and SCTY pop.

That being said i just bought some Jan15 $40 calls. Looks like Solar is tarting to recover so i just bought 5 for the hell of it even though i missed the bottom.�

1/1/2015

guest SCTY and SWPR have completely different business models than the rest of the tier 1 manufactures. They are completely different from each other too. Comparing these (as well as FSLR, which is a different technology) to the rest of the solar manufactures isn't really a good comparison IMO.�

1/1/2015

guest Yes we here know that.

However the market puts a blanket over all solar companies. A solar company is a solar company and they are all riding in the same boat. We always see this and it always happens. Good or bad news for one is good or bad news for all.�

1/1/2015

guest Bah, SCTY Down 14%. Down to 37.�

1/1/2015

guest Yup, Looks like i jumped on the SPWR rebuy and CSIQ train a bit prematurely. Lets just hope CSIQ pulls out a beat tomorrow.�

1/1/2015

guest SCTY will be a solid up tomorrow, just due to TSLA and nothing else.�

1/1/2015

guest Don't think so, SCTY down more than TSLA up in after hours currently (percentage wise) �

�

1/1/2015

guest I seriously thought SCTY could be the last bright spot in Solar so I put some calls on it. Looks like Solar momentum suffered a serious blow by the recent ERs by the top companies.

Hope SCTY can rebounds like they did last quarter.�

1/1/2015

guest I have a ton of CSIQ calls going into tomorrow. CSIQ is going to blow out earnings tomorrow morning. I guarantee you that they will beat analyst's revenue consensus by at least 15%.

Wouldn't be surprised with a 20% - 50% move in CSIQ.

Edit: There might be only one or two analysts following the stock, so let me rephrase: I guarantee you that CSIQ will smash it's own guidance of 380 MW - 420 MW shipped and 9% - 11% gross margin. Look for gross margin around 12% - 13%.�

1/1/2015

guest I need that for my Solar portofolioIf that happen I will ask ppl to take a look at SOL options aswell. They are getting really cheap atm.

�

1/1/2015

guest I bought SOL back at this price level a few weeks ago which were up big but SOL has been taking a beating with the rest of the Solar sector back down to what i bought them for.

I have only 5 Jan $20 options on CSIQ.

If i can get in before the pop i might grab up more CSIQ or SOL�

1/1/2015

guest "Solar City, which is chaired by Tesla CEO Elon Musk, also reported better-than-expected earnings after the closing bell, sending shares higher in after-hours trading." Thats from cnnmoney.com. wish it was true!

China is going places tho!

Trina Solar says second-quarter shipments to exceed its forecast

and CSIQ up 14% premarket

-------

Just to go down 10%. High 16.45. Now 12.81. Crap. I would have made alot of Money there!�

1/1/2015

guest Looks like the solar industry is a dud in this quarter. The market expectations were obviously a lot higher than reasonable, hence the sell-off. Just going to have to be patient with solar, since it may take a couple of years for these companies to unlock potential value. Buy and hold it is for me. I might pick up some more shares in the next few days and wait for greener pastures.

After all CSIQ did crush its own guidance and reaffirmed that it's goal is to be profitable in 2013. Oh well...�

1/1/2015

guest Looks like CSIQ isn't doing too well. Another buying opportunity?�

1/1/2015

guest Man Solar is taking a beating all the way around. Looks like i am out some more cash. I dont even think its going to recover in time for my Jan options now.�

1/1/2015

guest LOL. WTF is going on now?�

1/1/2015

guest ouch�

1/1/2015

guest Hard to understand.... Is this all just a follow on from First Solar's weak ER?

For a newbie such as me its just very hard to grasp what is causing this whole market sector to tank so precipitously, when the news seems positive and the signals overall of future growth are so strong.

I am holding and watching for now. Are big players or shorts driving the prices down?�

1/1/2015

guest That is the nature of solar. If you are a believer then buy and hold and ignore the volatility.�

1/1/2015

guest Very few funds own meaningful stakes in Solar City. Most of the trading volume consists of traders/momentum players, and funds accumulating positions. As more funds begin to accumulate, Solar City should go up. However, due to the high number of momentum traders, and panic sellers, the volatility will likely be very high, and I wouldn't be surprised if it falls more before taking off again.�

1/1/2015

guest A couple of you have noticed through my website that I do not currently own SCTY and sent me inquiries through TMC private messages. Below is my latest response:

Bought 3/11 & 3/25 @ 18.18 avg

Sold 5/30 @ 48.32

Bought 6/24 @ 33.43

Sold 7/16 @ 41.31

I sold the first time in anticipation of the IPO lock-up expiration. I sold the second time to get off margin for which there is an interest charge that share price increases must justify.�

1/1/2015

guest I too sold and bought back because of IPO lock-up. I just heard back from my tax guy, he says I need to pay my Estimated Taxes ASAP or I may be penalized at tax time.�

1/1/2015

guest Did he mention how much you might be penalized?�

1/1/2015

guest Here's some of my latest SCTY thoughts:

1. Solar sentiment - overall solar industry sentiment seems to be in limbo.

2. I listened to the Q2 ER conference call and read through their 10q (I highly suggest this any anyone invested in SCTY or solar). It seems like SCTY is doing okay. They're on track with their growth. Expenses seemed a bit high and I think they're going to need to tackle this (they recently hired a new VP to cut costs). Overall, though Q2 ER IMO was good but not great/fantastic and didn't surpass high expectations.

3. News out today that SCTY is acquiring Paramount Solar, which is already one of Solarcity's most successful channel partners:

SolarCity to Acquire Paramount Solar as First Step Toward Million Customer Goal - Yahoo! Finance

I look at this as a positive move. This should help cut costs and drive more customer acquisition.

�SolarCity has developed what I believe to be the best field sales and marketing organization in the solar industry. The national residential solar market has been growing between 60-70 percent annually, and we�ve been growing at twice that rate�144% year over year in the most recent quarter�and had three times the market share of our nearest competitor in 2012,� said SolarCity CEO Lyndon Rive. �Now we�ve found the perfect complement. Hayes Barnard and Guthy?Renker have built what I strongly believe to be the best virtual sales organization in the solar industry, with an extraordinary ability to acquire customers at a low cost. We expect the addition of Hayes, Ben and the Paramount Solar team to help us attain our goal to reach one million customers in the next five years at an even lower cost than was previously possible.�

Currently SCTY has 68,000 customers. I don't see how they're going to reach 1mm in 5 years. It just shows what kind of growth trajectory management is expecting. If they reach 1mm customers in 5 years, that will truly be incredible.�

1/1/2015

guest DaveT - How do you value SCTY? Do you have a similar valuation model to TSLA? Also, how much revenue per customer per year does SCTY receive on average? How does the revenue number compare to cash flows per customer per year? Basically I am curious what kind of cash flows does SCTY get from 1mm customers and are there any operating costs associated with retaining those customers? How high will the stock price go in 5 years if they do reach 1mm customers?

What is your opinion on the risks associated with SCTY, specifically net metering? It looks like there is a push in Arizona to modify or remove net metering, this will be a big bust for companies like SCTY, RSOL, and SPWR's distributed generation business. Can they mitigate net metering with battery storage? It doesn't seem very cost effective today, but hopefully in the future.

I would appreciate your input.�

1/1/2015

guest Whats going on with CSIQ today? Also I was wondering on your opinion which one solar stock too buy. Ive got $1000 im looking to put into one company in the solar industry but simply cannot choose which company too buy. Advise would be much appreciated (sleepyhead , DaveT etc)

(since its such a small amount I dont mind higher risk)�

1/1/2015

guest I would personally recommend SOL. Sleepy may or may not be with me on this. I have been on the SOL train (pun intended) for a while. The company stock price is low so with your small investment it could see the largest return. SOL has itself placed very well in the marketplace and can grow at a quick pace.

also they still haven't reported Q2 yet where I think the rest of the solar industry major players have. I have high hopes for SOL and they might still not have a great Q2, though I am reading the facts they should, but solar has taken a beating this earnings season no matter what the news it it seems

CREE just reported a decent quarter but flat outlook and got killed AH. I am going to try and jump on that soon. Just making that statement if anyone else here has and interest in the LED industry�

1/1/2015

guest No he did not, but he did say I will have to fill out Form 2210 http://www.irs.gov/pub/irs-pdf/f2210.pdf

After looking over the form, I will have him fill it out for me.�

1/1/2015

guest SOL is a good one. I bought 160 J14 $5 contracts for $0.20 a piece back when SOL was at $2.50; I already sold some of them for around $1. If you are looking for high risk/high reward then this might be a good one, because they have their own Poly plant and China just implemented a tariff on US and S. Korean poly that will hurt the other Chinese players. SOL also has large exposure to EU and will benefit from minimum ASP's. They also have little debt compared to other Chinese players.

On the down side they just preannounced their earnings with margins at 5%-6% which will not be enough for a profit. Hopefully they give good guidance going forward. I still think that almost all of the solar players had "good" earnings reports and the market just crushed them anyway: SPWR, CSIQ, etc.

If you want very high risk/extremely high reward potential then go with Chinese players such as SOL, CSIQ, or TSL. Maybe even JKS, but I don't know anything about that one other than its stock has been the best performer over the last month (so probably not a good time to buy).

Overall, my investment thesis has not changed on the solar industry. Solars are getting crushed right now and it is a good time to be buying. A lot of people had very high expectations going into this quarter and did not get excellent results they were hoping for so the stocks got crushed. CSIQ missed analyst (literally one or two analysts covering this stock) EPS number by $3m on $400m+ of revenue and the stock is down like 30% - ridiculous.

If you trust the analyst EPS of $2.50 for 2014 on $2.5b in revenue then you are getting a hell of a bargain on CSIQ at $11. If these numbers are true then CSIQ will be a 5 bagger by next year. I have not done enough research to know if this is even reasonable.

One thing is for sure though: Capacity (supply) is slowly going down, while worldwide demand is surging and will very shortly cause a shortage of panels worldwide.�

1/1/2015

guest Understanding Solarcity

I'll try sharing what I know though I have to admit it's limited. The specifics of SCTY's business model are somewhat confusing to me, though I get the gist of it. Prior to IPO I was really trying to wrap my head around how they're valuing leases, payments, etc and how to value the company but couldn't really figure it out. I became confident in the leadership and overall growth trajectory but confused about the specifics on how to model their valuation over time. I remember analysts were having a difficult time coming up with SCTY valuation as well around the IPO. Anyway, I eventually pulled the trigger (cost basis $14.50) mainly because the stock was rising and I didn't want an opportunity to invest in an Elon company get away (and Elon during pre-IPO had said that $13-15 for SCTY was a fair value for investors).

So, I guess I'll share some background and then go more into specifics.

First, I get a lot of my understanding of SCTY and solar from watching a ton of Elon Musk interviews and talks. He's bullish on solar as he thinks it will the one of the most popular ways to generate power in the future. When he suggested to his cousins to start a new solar company, the concept was to avoid manufacturing solar panels. He felt back then that China was/would subsidize the solar companies there and it would be too difficult to compete against them with panels. Further, Elon viewed the solar panels as more of a commodity item. They weren't that difficult to make. He saw the big challenge in solar was to integrate everything together in a cost-efficient manner - panels, inverter, racks, permits, installation, electrical work, monitoring, etc. So, when he funded SolarCity (and his cousins became CEO and COO), they sought to become the "Dell of solar". They wanted to pull all the parts together and integrate them in a very convenient, cost-effective manner for their customers.

Initially, this worked well. But over time, they encountered another problem and that was of financing. Not a ton of people could pay cash upfront for a new solar system. So, they started offering financing for solar systems, and things really started to take off.

So, in the beginning they were more like a construction company IMO. They would install the system, make their money, and move on to the next house. Later, when they started to offer financing, they wanted a way to benefit from the financing they offered in a long-term manner. So, they came up with a way to offer a 20-year lease to the customer (construction/components money provided by a 3rd party), the lease payments would go to SolarCity and then SolarCity would pay the 3rd party investor so they would get a decent return on their 20-year investment, and then after 20 years SolarCity would own the solar system on the roofs. So, after year 20, SolarCity would still be able to get payments from customers (if the customers wanted to continue) but they wouldn't have to pay a 3rd party investor anymore. So, it would be a ton of cash flow from years 20 on since the system is paid off. (I'm not sure if they've changed this more recently or not, but I think it's still the case they own the system outright after 20 years w/o obligation to any 3rd party.) So, the super long-term vision of SolarCity is to own the solar systems outright on a ton of houses and have this unending cash cow of a business. But in order to get there, they need to set up financing and make rather thin margins because they need to give the vast majority of lease payments to the original 3rd party investors in order keep existing investors and attract new ones.

This is why SolarCity now brands themselves as "selling energy." They're moving drastically away from solar system sales, and want to profit not just on the 20-year lease but even more so after the lease is over when they outright own the system. On another note, when they outright own the system the customer can benefit too because SolarCity can drastically reduce the costs of energy to the customer because they no longer have 3rd party payments to make from the financing. So, the customer gets much cheaper energy (than even during the 20 year lease) and SolarCity gets a ton of profit with little expense.

You can imagine the potential of this model when you think about 10 million homes with SolarCity solar systems on their roofs, and how after 20 years SolarCity would own the systems outright and the huge cash flow that can generate. For example, if SolarCity charges each house conservatively $100/month or $1200/year for electricity and expenses are $200/year for maintenance/monitoring. Revenue would be 1200 x 10mm = $12 billion a year with $2 billion in expenses. $10 billion profit. Multiply that by a 15 P/E multiple, then you've got a $150 billion market cap company.

But of course, this would take a very long time to achieve. Because not only would you need 10 million homes with SolarCity solar systems installed, you would need to wait 20 years until their leases are over before SolarCity can take advantage of outright ownership and huge profit margins. So, if it takes 15 years to get 10 million homes installed, another 20 years for lease payments (let's calculate 15 years because some would start during the 10mm home ramp-up), then you've got 30 years before they really start their amazing profit period. But that might be aggressive, so maybe let's say somewhere between 30-40 years. Amazingly, the Solarcity leadership really does seem to be thinking that far into the future. It's quite remarkable.

Now, I have my doubts if they're really going to be able to own the solar systems outright in 20 years. The reason being is because if raising financing becomes difficult, then they might need to hand over some of the post-20 year ownership/profit to the 3rd party financing parties who finance the 20 year lease. This will lower the crazy margins Solarcity gets then post-20-year-lease. And it could be possible that this is already what they're doing. I'm unclear on it.

Alright, so let's move on. How will SolarCity actually deliver on the 10mm houses in 15-20 years? Well, the whole business model of SolarCity is focused around convenience and cost-efficiency. They want to make it super convenient and cost-effective for the customer to switch to solar. That's why they've completely integrated the entire solar experience from sales, financing, installation, monitoring, and even post-installation energy efficiency home improvements. SolarCity uses their own people to design systems, install them, and fix them. It's all intended to create the most convenient customer experience, but also because over time it's the best way to drive down costs. In this way, SolarCity is very similar to SpaceX and Tesla Motors. All three companies integrate multiple aspects of their business and bring it altogether for a better customer experience but also to drive down costs.

Over time, SolarCity's competitive advantage will be cost-efficiency derived from integration. They will try to drive down costs in every angle of their business. Every penny will count. And they will be able to do this better than any of their competitors because they're the most focused on it. Other competitors don't have this 30-40 year vision and they aren't driven to complete integration like SolarCity. Over time, as SolarCity grows their cost advantage can grow too because they can take advantage of their current systems, personnel and also economies of scale. This is why SolarCity doesn't view other solar companies as their competitors. They view current electric utilities as their main competitors, and know that they need to provide a significantly cheaper source of electricity than them.

You mentioned net metering, and I do think this poses a significant challenge to SolarCity and all solar companies in the U.S. Currently net metering is helping to keep costs affordable for solar customers, but if net metering is revoked solar costs can increase (and they might need to install backup batteries, etc.). Solarcity is keenly aware of this challenge. Also, the federal tax credits for solar will be available until the end of 2016, after which solar systems could cost more to the end user w/o the tax credits. As a result, Solarcity's solution is to focus on cutting costs like crazy. They believe that they can cut costs (also helped by lower component costs as well) of the overall solar systems by enough to offset the effects of net metering removal and expiring tax credits. Whether they can do it remains a question. But nevertheless, they are religiously focused on it. If any large company in the residential solar installation sector can overcome the challenge of expiring tax credits and net metering, I think it's SolarCity.

I do think that there's opportunity in residential solar for straight solar system sales and installation. However, I don't see it likely for a large company to thrive in this space because it's a one-time revenue job. After a certain point, I think you might reach a saturation point where it's difficult to find cash buyers of new solar systems. So, I'm looking at the cash solar system sales and install business as a niche market. The main market will be leased/financed solar systems.

Regarding revenues and cash flows, I'm less clear on this aspect of their business than the concepts I've shared so far. Basically, it appears that everything starts with financing since demand for their systems isn't a problem. So, Solarcity raises investment funds (largely banks, companies, etc) and promises (or asserts) a certain return on investment. Depending on the type of fund (joint venture, lease pass-through, sale-leaseback... for more info see page 20-21 of Q2 10q) Solarcity ends up receiving payment from their solar customers and giving a portion of that payment to the fund investor. However, it appears more complicated than that because Solarcity can lease the system to the fund investor, and then the fund investor sub-leases it to the customer (lease pass-through). Or they Solarcity sells the system to the fund investor, then leases it back from then and sub-leases to the end customer (sale-leaseback). Or the fund investor acquires the solar system together with Solarcity (joint venture) and it's then leased to the customer.

In Solarcity's Q2 results summary:

- Estimated Nominal Contracted Payments Remaining of $1,409 million at June 30, 2013, up 15% from $1,222 million at March 31, 2013.

- Retained Value forecast of $662 million at June 30, 2013, equating to retained value per watt forecast of $1.27/W at June 30, 2013.

My understanding is that the estimated nominal contracted payment remaining is basically the amount of remaining payments SolarCity is to receive over the course of the 20-year leases. Basically, it's revenue. Then, SolarCity needs to pay the fund investors.

Retained value is what they're attributing to as the value of their portion of the 20 year lease payment but also of the value of the solar system after the 20-year lease is over. This is probably a better metric in trying to value the company. However, I'm unclear exactly how they're calculating the value of the solar systems in 20 years (it might be in the 10k/10q somewhere). Also, because some or much of the retained value is so far out (ie., 20+ years), then we need to discount that in whatever valuation modeling we do.

In their Q2 results, they say they have 54k energy contracts (64k total customers, I'm assuming that's because of cash sale systems). If the retained value is $662mm and we divide that by 54k energy contracts, then we've got $12,259 per contract in retained value. But I think this is skewed because commercial contracts are decreasing, while residential contracts are rapidly rising and residential contracts would be significantly lower. I would imagine the retained value on a residential contract would be between $5000-10000.

So, if SolarCity had 1 million customers (not sales, but energy contracts) and each of those contracts had a retained value of $5000, then the total retained value would be $5 billion. However, much of that sum would be very long-term (ie., post lease), so we would need to discount that value somehow in our modeling. But nevertheless, if Solarcity reaches their "1 million customers in 5 years) goal, then it's not far-reaching to see how they can have $5 billion in retained value in their leased/financed solar systems. If we up the average retained value to $7500/system then it would be $7.5 billion in retained value if they reach their 5 year goal. If we were trying to figure out a valuation, we would also need to factor in growth and future revenue that they will generate from new system sales. So, in 5 years how would I value the company if they did have 1 million contracts and they were growing strong? Hard to say. Maybe 10-20 billion. But that's a rough guess. I'd probably discount the $5-7.5 billion in retained value to $3 billion or so because it's so far out but one the other hand it's fairly reliable of an asset because it's not going anywhere. Then, I'd factor in current and future revenue into the valuation. If their on a trajectory to reach 10 million customers within 10 years after that point, then I'd say you'd need to tack on at least $10-20 billion to the valuation, so $13-23 billion. This is pretty much a random guess though and could be much more, or it could be less (Note: would love feedback here). The valuation multiple probably largely depends on how strong the growth trajectory is at the point of reaching 1mm customers.

It's interesting because SCTY doesn't seem to have made a big deal of this "1 million customer goal in 5 years" goal in the past. In fact, this is the first time I've seen mention of it. It's quite astounding because 1) it's a large # of customers (currently they're at 64k), and 2) it's a very short timeframe, just 5 years. Honestly, I don't know how they're going to accomplish this. It's quite mind-blowing.

Let's take a minute to track to model what this "1 million customers in 5 years" goal looks like. At the end of 2012, they had 40k energy contracts. By end of June 2013, they had 54k contracts. So, let's say they add another 36k contracts in the second half of 2013.

2013 - 50k new customers (total 90k)

2014 - 80k new customers (total 130k)

2015 - 120k new customers (total 250k)

2016 - 190k new customers (total 540k)

2017 - 270k new customers (total 810k)

2018 first half - 190k new customers (total 1mm)

Basically, Solarcity needs to grow like a weed in order to have any chance of reaching this "1 million customers in 5 years" goal. It almost seems crazy to even think about it, yet alone attempt it. this just goes to show the confidence in SolarCity's management (or their insanity):

1) They believe the residential solar industry is going to boom

2) They believe they can offer the most-compelling product (cost and convenience) to attract this kind of demand

3) They believe they can scale their company to meet this demand

Without these three beliefs, I don't see how SCTY management would even entertain such a lofty, crazy goal. Further, just entertaining a crazy "1 million customers in 5 years" goal means that the management really believes strongly in these three beliefs I've mentioned.

It's kind of strange to me that Solarcity doesn't promote this goal more to their investors. Their quarterly reports and conference calls seem very focused on what's going on this year, and they don't really point to a clear 5 year goal like this. It almost seems like they want to downplay things a bit. But then again, if they were trying to downplay things then why would they mention this goal in their press release today.

On another note, it's amazing how long-term in view Elon Musk's companies are - SpaceX (colonization of Mars), Tesla Motors (electrification of entire auto market), and SolarCity (moving energy to solar). All of these companies goals are 20-40 years out. It's truly astonishing.

Alright, I'll end with a few disclaimers.

Please everyone, do your own research. Read the annual reports, quarterly reports, etc. and make up your own mind. Who knows, I could be making up everything if you don't see the facts yourself. Do your research and get as close to the companies you're considering to invest in as possible before making a decision (if it's a long-term investment). And remember I'm just an opinion.

Also, though I was bullish on SCTY when I bought and I'm bullish on SCTY long-term, I just want to be clear I'm not suggesting a specific price to buy at or time to buy. Getting in at the right price is extremely difficult to do. Sometimes you wait for it to dip, but it goes up. Other times you buy, and then it goes down. Buying and timing strategies is a whole other discussion. Further, the solar industry can be fickle too and sentiment can change in either direction. So, rather than a recommendation to buy SCTY I'd rather people take this as a conversation starter. I'd like to learn more about SCTY and also I'd like to see if there are major holes in my thinking. I'd love for others to chip in time and research and come up with a better way to model SCTY's valuation as well.

A few final random thoughts. It appears that SolarCity seems to be moving toward PPA (power purchase agreements) with their residential customers. I'm unclear if this is just a repackaged lease or if this somehow differs from a 20 year traditional lease. Would love if someone who knows can clarify.

Lastly, their insider ownership seems strong (see proxy statement). And Elon Musk owns 27% of the company.�

1/1/2015

guest Dave, as usual great info. I have two points/questions. One, where does the 20 years to pay off each system number come from? I recently installed an 8kw system on my house and it will have paid for itself 3-4x within 20 years. That would change their long term numbers significantly, even if it's a 10 year average pay off.

Also, one issue I've heard happening with leased systems (I paid cash for mine) is that In some cases home owners are having a hard time selling their house because the new buyer has to qualify and take over the solar lease. I don't know if this could have any affect on the growth of the business.

I'm not invested in any Solar stocks, still enjoy the education however. Thanks.�

1/1/2015

guest Hi sub, the 20 year period is the length of the customer lease. So, let's say the customer is paying $100/month over 20 years on a lease for the solar system. The customer pays Solarcity monthly but basically that money is split between the lease financing party (fund investor) and Solarcity, but most of the money will go to the fund investor because the fund investor put down the money to pay for the system and install.

Regarding home ownership transfer, in Q1 ER CC Lyndon Rive mentioned how they try to make it easy and simple to transfer the solar system lease when selling your home. I've called SolarCity and asked them about this, and they said it's fairly simple. Just some papers to transfer the lease, but the new owner has to have decent credit. I think though Solarcity has lowered the level of credit required in recent months, so it's easier to transfer the lease.�

1/1/2015

guest Dave, that is the masterpiece I was asking forremember? Thanks!

�

1/1/2015

guest Thanks, I figured it was something like this causing the 20 year payoff. I wouldn't think the lease transfer would be a frequent issue considering the new home buyer qualified or paid cash for the house, wasn't sure if that had been mentioned however.�

1/1/2015

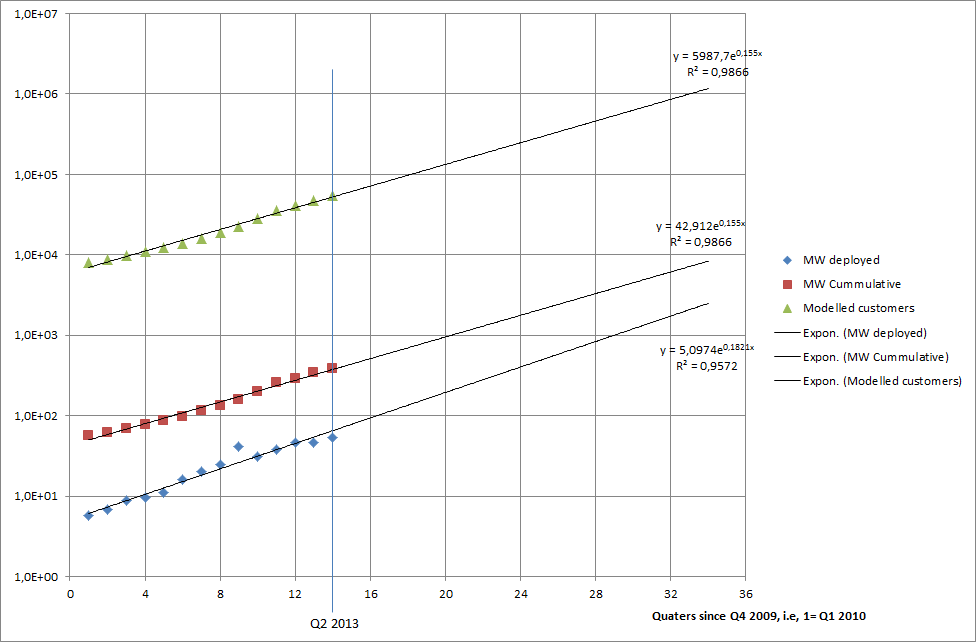

guest Certainly very optimistic to think that they can grow like this, but just based of the exponential growth in the past, this is indeed the trajectory that they are on! Very simplistic exponential forecast below, based on MW data available in their reports, and a guessed crude allocation of yearly MWs in 2010 and 2011, and assumed 4kW average system and a simple continued ratio of residential and commercial customers as in Q2 2013. Not very good, but you get the basic picture. One should not imply that this is possible just because they managed to grow like this in the past, its a huge challenge, but I can understand why they have it as a target. In 5 years this model do point at on the order of 1 m customers...

�

�

1/1/2015

guest Thanks for your answears fjm9898 and sleepy, much appreciated!�

1/1/2015

guest Great post DaveT. I had a few comments to make, but since it took me two days to finish reading your postI will probably forget everything I wanted to say.

1. Retained value per residential customer can be easily calculated by using the average system size (I am sure they provide this somewhere - Sunpower does and theirs is about 8.5 kW) and multiply it by $1.27/W value that SCTY provided. SPWR has better panels so their retained value is $1.75/W. Therefore SPWR's retained value is close to $15,000 per residential customer.

2. I don't really understand the concept of retained value. In Sunpower's case it kind of makes sense to me because their panels have 25 year product warranties (will probably last even longer because of the high quality) and they tested annual degradation to be only 0.13% (they guarantee less than 0.25% degradation per year to be conservative). I am sure that some panels will still fail before 25 years.

In Solar City's case they use Trina and Yingli panels that only have 10 year product warranties and 0.5% or less guaranteed degradation. After 20 years, the degradation might be significant and a significant amount of panels could potentially fail. I think that SCTY and SPWR take these factors into consideration and that is why SPWR uses a retained value that is 40% higher than SCTY.

That said, I still don't understand the concept of retained value. Nobody is going to want to keep the old panels on their roofs since there will be newer technolody by then and people will want new panels (or whatever is popular 20 years from now) and will sign a new lease if necessary; kind of like upgrading your phone. I can see some people willing to keep their old systems, since they can go month to month or maybe get a discount.

This whole retained value concept has too many moving variables and unknowns to precisely determine a value such as $1.27/W (which btw increased from $1.25/W from last quarter). SPWR also says that a 1% reduction in financing costs will increase their retained value by $0.40. This is great, but what if interest rates go up? I think that rates will be going up in the future if anything. New solar REIT's, MLP's, etc. are not going to make this business model significantly better in the future compared to today's environment if interest rates go up.

3. I have heard of one company that gave customers in Arizona, that previously signed contracts but do not have panels installed yet, the option to back out of the deal because of the new push to remove or heavily modify net metering policies. I think Colorado is also looking to modify net metering rules.

4. PPA vs. Lease - this is just my guess, which could be completely wrong:

With a lease you promise to pay Solarcity $X per month for 20 years and Solarcity promises a minimum of Y Wh's produced and each year that Y value declines. If the panels produce above Y then the customer benefits from this and gets to keep the extra generation. If the panels produce under Y Wh's then solarcity has to make up the difference. This is a risk to SCTY, especially since these panels are not tested and could degrade a lot more than promised after 10 years or so, or the failure rate may be high.

With a PPA Solar City would offer the customer a set rate of $Z/Wh and then the customer would pay SCTY a monthly bill based on how many Wh's were produced during the month times. This is a better model than lease, because with lease the customer keeps the upside while SCTY is exposed to the downside. With PPA SCTY is still exposed to the downside, but gets to keep the upside.

5. I still don't know how to value SCTY and if their growth path is even sustainable. This sounds like a very capital intensive business with very little payoff in initial years. If financing dries up, state laws change, there is a panel shortage (I know it sounds crazy today), or other business models pop up then Solar City can get hurt. I am not saying any of this will happen, but to me it sounds like SCTY's business model will not fare well in a recession.

6. I don't think that SCTY will get to 10 million homes, because there is only like 70 million homes (off the top of my head, so I might be wrong on this) total in the US. I highly doubt that they reach that amount any time soon if ever. This would require a lot of favorable law changes to get this kind of demand. I live in Texas and there is no incentive to put panels up even though we are at the risk of facing several roliing blackouts per year, starting in a couple of years due to inevitable capacity shortage from growing demand. Hopefully the politicians get their heads out of their asses but I doubt they ever will.

7. There is (IMO very reasonble) backlash from the utility industry that people with solar panels are being unfairly subsidized for transmission line use by those that don't have panels. I feel like this will allow utility companies to keep the status quo a little bit longer than necessary. Until at least battery technology is cheap enough to live completely off the grid at least.

8. 1 million homes requires something like $30b in financing and that is a lot of money. Especially since the market made a huge deal out of the $500m they received from Goldman Sachs.

Overall, I think that there is a good chance that Solar City reaches a $10bn market cap, but the risks are a lot higher than with TSLA.�

1/1/2015

guest Solar sector took a beating second half of the day �

�

1/1/2015

guest Yeah. Red days for us atm. Lets hope Renesola can do what the others couldnt.�

1/1/2015

guest i woundnt bet on it.�

1/1/2015

guest You're forgetting to account for Solar City being able to write off the depreciation of the Solar Systems being leased.

Solar City has a contract with the DOD to install Solar systems on 120,000 Military homes. Getting to 1 million may be easier than it looks.

http://www.solarcity.com/pressreleases/104/SolarCity-and-Bank-of-America-Merrill-Lynch-Move-Forward-with-Project-SolarStrong--Expected-to-Build-More-than-$1-Billion-in-Solar-Projects.aspx

�

1/1/2015

guest I thought that JKS already had blowout earnings and yet the stock started up like 15% to finish only 4% ahead. I don't know what to say other than the market is still pricing these companies like they are going to fail. Buy and hold is the only way your are going to beat the market with these stocks.

Renesola might be another sell the news event; although I am hoping for the opposite.�

1/1/2015

guest Hey sleepy, buran, koolaid and others. Thanks for the feedback on my earlier post. I'll give some time later to read and reply. Right now I've focused all my time/energy on the TSLA dip.�

1/1/2015

guest Well all my august calls went straight to hell now as they are gonna have ER on the 30th instead.�

1/1/2015

guest CSIQ announced offering of common shares.

Whole of the solar market is down about 7%�

1/1/2015

guest Thanks for the detailed posts, DaveT and sleepyhead, providing some good insights and opinions. However, I think everyone here is extremely disappointed with the turn of events in solar lately. After sleepyhead made his case for SPWR on this thread and drummed up support for other solar stocks like SOL, CSIQ, etc. many (including me) bought into the rosie scenario that was painted several weeks ago and expanded our portfolios with stocks or options in these other player, expecting big gains after earnings. Heck, even the term 10-bagger was dropped a few times.

Boy, what a back down to earth into reality experience this has been! Now my question is: what to do with the CSIQ and SPWR calls options that expire come Jan '14. CSIQ strike $14, SPWR strike $17. Sell at a loss but at least get some of my money back, or let it sit in the hope they recover? They very well could expire worthlessly if current trends continue... Any advise is appreciated.�

1/1/2015

guest I have seen sleepy say atleast 50 times that it was big risk. Im a buyer for sure, just dont know when. Leaps or buying stocks is probably the best thing.�

1/1/2015

guest This looks like a general "risk off" trade to me. All the high fliers are getting hit hard: TSLA, the solar stocks, the 3D printing stocks, CREE. These are all stocks that have enjoyed 100-300% gains YTD and now they are getting crushed. I think investors are getting worried about the overall market/economy and are taking cash out of risky names while they wait and see.�

1/1/2015

guest For you following CREE I just want to let you now that i bought into it this morning on some $100 Jan 2015 calls on the expectation of a recovery and then into next year a good amount of growth

Still debating grabbing up some more CSIQ at this highly dressed price tag.

Edit, looks like i missed CSIQ up 10% already.�

1/1/2015

guest Anyone what Obama will do for solar except for tweeting?

Anyway a good sign that Solar is beating the market.�

1/1/2015

guest I'm kind of curious how they come up with the $1.27/W (or $1.75/W for SPWR) retained value. In other words, what's their formula and what are the factors that might change the retained value calculations?

I think I might have found the answer: http://files.shareholder.com/downloads/AMDA-14LQRE/2353825079x0x646813/565c5ab8-c8bc-4c6f-8e7b-eae74c4e63ef/Roth%20Presentation%20FOR%20FINAL%20REVIEW%20v4.pdf

�Retained Value under Energy Contract� represents the forecasted net present value of Nominal Contracted Payments Remaining and estimated performance-based incentives allocated to us, net of amounts we are obligated to distribute to our fund investors, upfront rebates, depreciation, renewable energy certificates, solar renewable energy certificates and estimated operations and maintenance, insurance, administrative and inverter replacement costs. This metric includes Energy Contracts for solar energy systems deployed and in Backlog.

�Retained Value Renewal� represents the forecasted net present value of the payments SolarCity would receive upon Energy Contract renewal through a total term of 30 years, assuming all Energy Contracts are renewed at a rate equal to 90% of the contractual rate in effect at expiration of the initial term. This metric is net of estimated operations and maintenance, insurance, administrative and inverter replacement costs. This metric includes Energy Contracts for solar energy systems deployed and in Backlog.

Cumulative Retained Value as of December 31, 2012

Total Retained Value* - $502m

Retained Value Under Energy Contract - $259m

Retained Value Renewal - $243m

Total Retained Value $/watt* - $1.18/watt

I think I remember Elon mentioning this in a video interview but he said that the old solar systems in 20 years on roofs would be worth a lot because in his opinion the panels are very robust and can last 30 to 40 years (or more). So, basically he doesn't see the need for a lot of maintenance, repair or replacement. Further, Elon views the panels as a commodity item that will approach closer and closer to the cost of the raw materials (with markup for the commodity producer). Thus, new panels will cost significantly less in 20 years than now, if the panels on the old systems need replacement.

However, most of the solar panels on old systems will likely do just fine and there probably won't be a need for replacement. Since the energy needs to the household are being met with the current panels, they will likely be met with the same amount of panels unless there is severe degradation or if the household needs change. In both circumstances, it will probably be easier just to add some new panels to the existing system and leave the old ones alone.

I don't know much on this, but it would appear the removal of net metering policies (along with expiring federal tax credits) could be a big, big challenge for the U.S. solar industry. I like SolarCity's management's response (ie., in conference calls) when asked about this. They reply that they're confident they're be able to keep up their growth (despite removal of net metering and expiring federal tax credits) because they have a plan to reduce costs as much or more than those expiring incentives.

That makes sense. It looks like they've been promoting PPA more of late to their residential customers. I definitely would like to know the % leases and % PPA and from SCTY's business model how they differ.

I found part of the answer on slide 7 of this pdf (http://files.shareholder.com/downloads/AMDA-14LQRE/2353825079x0x664578/add6218d-90ec-4089-9094-4259533d473e/SCTY_Investor_Presentation_-_May_2013.pdf)

"Roughly 45% of Installed Base of Operating Lease Contracts Are PPAs that Are Variable Based on Production, While Around 55% Are Leases Based on Fixed Monthly Payments."

I do agree that a lot of their business model depends on their ability to secure financing. If financing dries up, their whole current business model goes down the drain. However, I have confidence because people (ie., funds/institutions) always need "safe" place to keep their money and grow faster than the pace of inflation. SCTY has been trying to create a new type of asset class with their 20-year solar funds. They're claiming that default rates are super low because people pay for their electricity even before paying their mortgage, because w/o electricity they can't function in the house. I think there's some validity to this.

Also, the beginning is usually the most difficult time to attract financing, and SCTY seems to have passed the early test. The more funds they raise, the easier it will likely get as they have more evidence of past successes.

If there's a recession, safer asset classes usually do quite well, so it's possible that it won't affect their funds� unless it's a severe recession and financing around the world dries up (ie., 2008).

On page 6 (http://files.shareholder.com/downloads/AMDA-14LQRE/2353825079x0x646813/565c5ab8-c8bc-4c6f-8e7b-eae74c4e63ef/Roth%20Presentation%20FOR%20FINAL%20REVIEW%20v4.pdf), there's claiming an addressable market of 45mm buildings. I'm assuming that's both residential and commercial. And they're saying, "The addressable market expands as retail electricity costs increase and installation costs decline."

Currently, I think SCTY is in 10 states (so they're forecasting their addressable market in those 10 states to be 45mm buildings). And they're also predicting retail electricity costs to increase (and also their costs to decrease), thus they're anticipating that total addressable market to grow over the coming years.

I could see backlash from the utility industry. But also there's pressure on the state and federal levels for the governments to promote renewable energy production. It's probably reasonable to expect net metering privileges to be reduced but not completely removed.

I like SCTY's management approach as they see it as mainly a cost issue, where they need to reduce costs more than the potential cost increases of net metering removal and expiring federal tax credits.

On a side note, they've already started testing and deploying some Tesla battery storage systems in some of their systems. It's very limited right now because of cost. But over time, I can see this increase. I would imagine recycled Model S (and Gen III) battery cells would end up in Tesla battery storage systems for solar systems.

Yeah, $30b is a lot of money (relatively at least). There is a lot of money out there (ie., pension funds, university funds, companies, etc) and I think it'll come down to if SCTY can provide an attractive investment vehicle with good return and low risk. It'll be a challenge, but I think it's not out of the question.

When they raised $500m from Goldman recently, here was a quote I found interesting: (SolarCity and Goldman Sachs Create Largest U.S. Rooftop Solar Lease Financing Platform

)

�We are excited about the opportunity in distributed solar, which has the potential to both lower energy costs and create jobs,� said Stuart Bernstein, Global Head of Clean Technology and Renewables at Goldman Sachs. �Our firm has set a target of $40 billion in financings and investments in renewable energy over the next decade, and we believe SolarCity�s range of distributed solar solutions targeting a wider customer base will help us move toward a low carbon energy future.�

Here are some of my latest thoughts on valuation. I think with Solarcity it depends on a few things. First, if they can really reach 1mm customers in 5 years, I think their revenue growth will be off the charts. Probably at least 10-15x current revenue in 5 years. If that happens, then their market cap will likely respond with a large increase (though it's difficult to tell how much).

Another thought on valuation is there could be a tipping point where SCTY starts to appeal to funds/institutions and they start investing more money into the company. It looks like 28% of the float is owned by funds/institutions. If that significantly increases, then I can see SCTY's price significantly increase.

When I compare SCTY with other solar players, I think SCTY's advantage will/can be growth. I'm by no means an expert in solar, but from the 10 companies or so I did preliminary research on (ie., read annual reports, quarterly reports, etc), I haven't found another strong solar player that is on track and planning to grow revenue 10x in the next 5-7 years. If SCTY reaches a point (not sure when exactly that point will be) when it becomes more evident that they're on track to that 1mm customer goal, then I could see them launch into recognition as the solar industry's clear leader. When that happens, I can see funds/institutions start increasing their position in SCTY and SCTY's stock price respond.

There are still a ton of risks and most of them have to do with costs (ie., expiring federal tax credits, net metering, financing, etc). But what gives me some assurance is that I think SCTY has the right approach: they're religiously focused on driving down costs through an integrated approach. Slide 10 in this pdf (http://files.shareholder.com/downloads/AMDA-14LQRE/2353825079x0x646813/565c5ab8-c8bc-4c6f-8e7b-eae74c4e63ef/Roth%20Presentation%20FOR%20FINAL%20REVIEW%20v4.pdf) shows how SCTY is looking at their competition (among solar companies). I think in terms of an integrated approach (sales, design, permits, financing, install, monitoring, repair, etc) SCTY is the clear leader. And I think if they're able to drive down costs the way they're planning (and secure the financing they need), then I think they're likely to extend their lead in the U.S. residential/commercial solar market.�

1/1/2015

guest Thank you for your thoughts DaveT.

Btw SCTY April Calls are available tomororw.

Also the white house has solar panel aswell!

http://www.fool.com/investing/general/2013/08/18/the-white-house-goes-solar.aspx�

1/1/2015

guest

Thanks, DaveT! This cleared my head a lot! �

�

1/1/2015

guest Thanks DaveT. There are two other revenue streams for SCTY that you may of missed (or I missed in your long post).