1/1/2015

guest Thanks for posting the energy density chart. I'd like to see how the other Tesla products stack up there. Those are the RAV4-EV and the original electric Smart. I'd expect to see those numbers sticking up above the rest. Then again, I don't know if this is battery pack weight or finished vehicle weight. We always seem to be able to offset the higher energies with heavier vehicles. Sort of like every PC I've owned (MIPS vs. the O.S.).�

1/1/2015

guest I forgot the RAV4 EV for some reason. Anyway, the RAV4 has a 380 kg battery with 42 kWh, which results in an energy density of 110.53 Wh/kg, which is lower than Tesla's original 2008 Roadster energy density of 117.78 Wh/kg, but still higher than the highest energy density on a non-Tesla EV, which would be the 2016 Chevy Volt at 100.55 Wh/kg.

Did some more research. Apparently the 36 kWh battery is part of a $600 upgrade, and 33.5 kWh is available to the driver. The original is 28 kWh.�

1/1/2015

guest How many of these "captured" companies sent a PowerPoint to Tesla some time ago?�

1/1/2015

guest Honestly I might call Apple first. More $/battery shipped. Apple could charge $100 to the end user for a double capacity battery option. Once I had captured the mobile market I would tool up for the larger other markets. But yeah, if I as just an inventor I would run to Tesla since they have the factory in production and could help me productize the invention.�

1/1/2015

guest Thanks for compiling this info 32no.

From the link you provided, MB is using Panasonic cells, Tesla battery. It does not make sense that Tesla will sell higher density battery and not use it in their models, so it is likely that the correct number for MB is 137.25 Wh/kg, or it might be the same as Tesla's model S.

One piece of good news in Benziga, and since we did not get a news section I will post it here.

Credit Suisse on Tesla: Check points to strong demand

The most interesting highlights

�

1/1/2015

guest 90%?

Where did he check?

I am willing to provide him 2013 S85P for 75%

Seriously if you check ebay there are 65-75k bids for S85-P85 with tons of extras.

The car holds value quite well considering you basicly get 7500 directly off the sticker�

1/1/2015

guest I know someone who sold his P85 to get a P85D, and got 95% original price (with 14K miles on it). Unheard of... and incomprehensible...�

1/1/2015

guest Did he get it on trade in for P85D?�

1/1/2015

guest a classic presentation from 2009

http://www.almaden.ibm.com/institute/2009/resources/2009/presentations/JeffDahn-AlmadenInstitute2009.pdf

I would add, that there could be cost benefit (and safety benefit) to transition from higher Ah to higher V cathodes

Cathode Anode Powders | NEI Corporation

so a LMnO / Spinel cathode would probably halve the LME (London Metal Exchange) cost for cathode and reduce the anode cost by about a 1/3, compared to a NCA equivalent.

However there is probably a minor power trade-off and definitely a longevity tradeoff.�

1/1/2015

guest I do not find that surprising at all. Car is upgradable, both hardware (battery) and software. The price of new models keeps going up, not down. People that purchased some time ago now find their models and options more expensive. Some people just want to jump the half a year long queue. That all translates into high resale value.�

1/1/2015

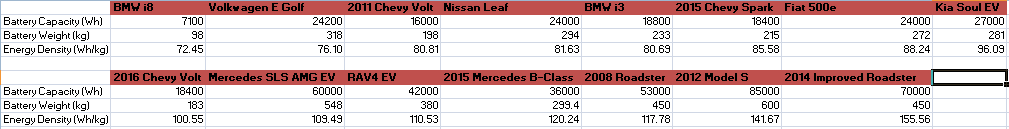

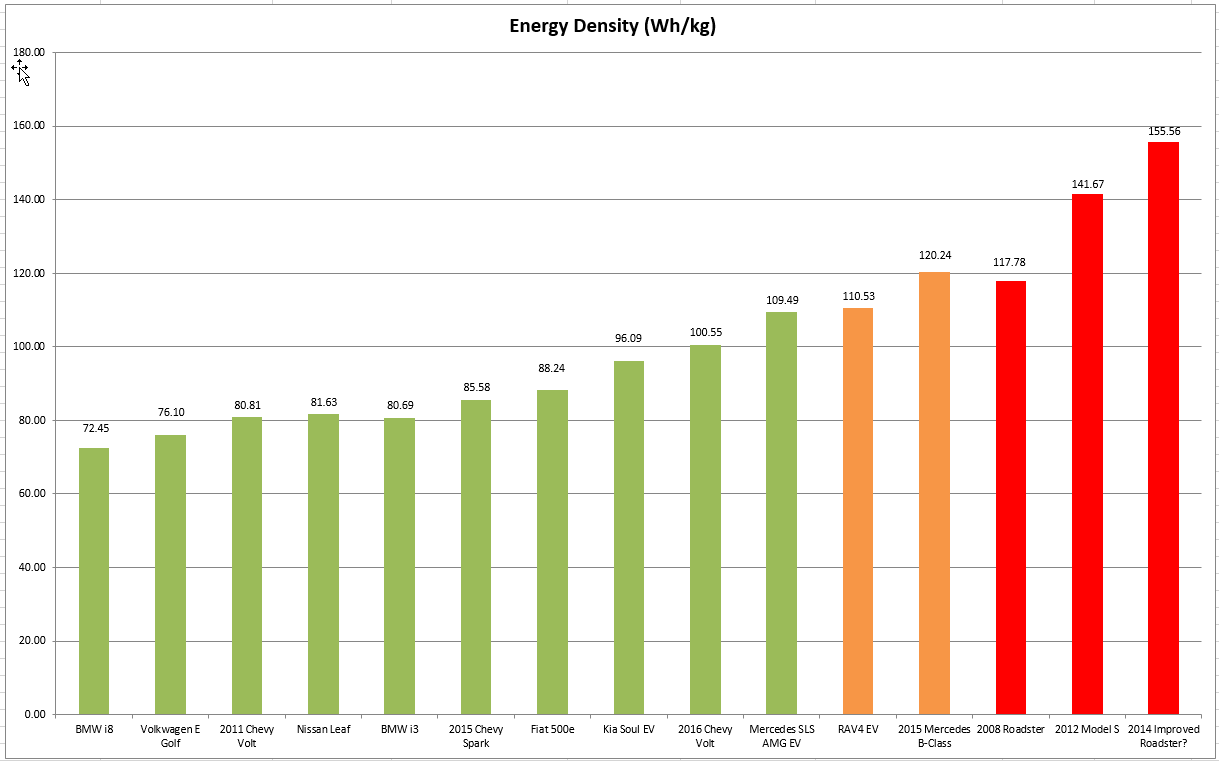

guest Ok, so I have an update for the data. I fixed the Mercedes B-class numbers (I found the correct weight), and I added BMW i8, Mercedes SLS AMG Electric, and RAV4 EV. I will add the sources later, but the SLS Electric data is from a post on Tesla Motors Club by the user "vgrinshpun".

Anyway, here are the goodies:

And the chart (Red is 100% Tesla cars, orange is Tesla inside, and green is non-Tesla vehicles):

The most interesting thing is that the highest energy density EV that Tesla wasn't involved with is the Mercedes SLS AMG (This car also happens to be the most expensive car on this chart at $435,000), and that car has 30% less energy density than what the Model S had in 2012, and more than 40% less than the recently upgraded Roaster.�

1/1/2015

guest I am loving it. Hugely entertaining to see the most famous "Tesla Killer" - BMW i8 - at the bottom of the chart, below the second lowest runner-up, Volkswagen E Golf.

Excellent idea to pull all of this data on one chart, 32no!

This chart should be posted in the comments section of every "Tesla Killer" article, accompanied by a simple question to the author: Does he know the energy density of the battery in the tesla killer du jour?�

1/1/2015

guest Great work!! Hopefully this hits the media. The more the public sees these types of charts, the easier it is for Tesla to sell cars.�

1/1/2015

guest I think the projected Roadster upgrade figure is off. Available information would seem to put the capacity of the upgrade Roadster cell slightly lower than what is in the Model S.�

1/1/2015

guest I am curious if you have specific information showing this. It seems that 32no's table includes data from the Roadster Upgrade blog post by Tesla Motors. It states that upgraded battery will fit 70kWh battery in the same package as the original battery, hence tha same weight (450kg) and the increased capacity (70kWh)�

1/1/2015

guest But wasn't this achieved by filling previously empty slots with cells? This is where the new mass comes in. Don't think you can use the new capacity but the old mass.�

1/1/2015

guest It is my understanding that the new battery will have the same quantity of cells as the original pack. The cells will also have the same format (18650), but each cell will have higher capacity.�

1/1/2015

guest 70 kWh / 6831 = 10.25 / 3.6V = 2.85 ah per cell. Or using 3.7V = 2.77 ah per cell. Using 75 kWh / 6831 = 10.979 / 3.6V = 3.05 ah per cell. Using 3.7V = 2.97 ah per cell. Model S 3.2 ah per cell. It would be odd if the new cell was worse volumetrically but better gravimetrically.�

1/1/2015

guest This is great. Awhile back I posted a formula for converting the ratio of two densities into into a number of year lead in technology based on the idea of doubling density every decade. For example, let's compare the i3 to 2012 Model S. I get:

10�ln(80.69�141.67)�ln(2)

=?8.1207249098

This indicates the i3 density is about 8 years behind where Tesla was in 2012. Frankly, I am shocked that the competition is so far behind. We often wring our hands about some breakthrough battery technology that will challenge Tesla, but seriously if the competing just copied Tesla's technology it would jump ahead 8 years. That would be a breakthrough. Just use the open source technology and follow the leader.�

1/1/2015

guest It makes sense to me that BWM is 8 years behind. Here's why: BMW will only use tried and true technology, well known, well tested, well characterized as to cycles and degradation, well...boring. It takes time for tech to become mainstream, safe, and boring. 8 years sounds about right. As long as they stick to those design parameters, they will forever be 8 years behind the leading edge. Not a surprise. If tomorrow a great breakthrough in battery density occurs, BMW will not adopt it until after 8 years of study when it will finally be declared "safe" for automotive use.�

1/1/2015

guest Elon mentions how Daimler saved tesla from bankruptcy in 2009, Elon will save Daimler in return when it becomes

apparent they need help to survive.�

1/1/2015

guest I'd love to see Daimler do a big JV with Tesla and Panasonic to build a Gigafactory in Europe. When it comes time to save Daimler, that's what they'll need.�

1/1/2015

guest The disconnect is that you are comparing the volumetric density of new Roadster cells and Model S cells and concluding that Model S cells volumetrically denser. The weight data in 32no's table, however, are for the whole pack, not just cells. So gravimetrical density included in his chart is on the pack level, not the cell level.

So the fact that gravimetrical density of new roadster battery pack is better than that of the Model S, while volumetric density of the new Roadster cell is worth than that of the Model S cell could be explained by the fact that the weight of the pack without cells for the Roadster is lower than for the Model S. This is logical result, and the main contributing factors are:

- geometry of the pack (the weight of the box-type casing for Roadster is lower than for "matress-type" casing of the Model S)

- functionality of the pack - Model S pack is a stressed member of the car body, while Roadster pack is not

- required protection - Model S has large, 0.25 inch thick ballistic shield made from aluminum plate. I am not sure pack in Roadster has one, but if it does, the ballistic shield would be much smaller due to the shape of the Roadster's pack.

- - - Updated - - -

Calculating the lag in years is an excellent way to have another visualization of the data presented in 32no's table, very simple and elegant.

This does not change the result in any significant way, but if one wanted to nitpick, the doubling of the density in ten years refers to the density of the cells, while the table includes density of the pack...

One mistake, however, is that i3 is not 8, but 9 years behind Model S: it went on sale in 2013, while model S went on sale in 2012 :biggrin:�

1/1/2015

guest

Good points.�

1/1/2015

guest It seems in this age of over-the-air upgrades playing it safe by hanging back 8 years is not going to cut it. Tesla will shave 0.1 second off the 3.2 second 0-60 time with just an OTA upgrade at no cost. The pace of innovation for digital cars is just that fast.�

1/1/2015

guest In this age of massive recalls and lawsuits no one dares put forth a new key drivetrain technology without years and years of testing.

So your lawyers have a leg to stand on in front of regulatory bodies and courts.

If not, autonomous cars would be on dealer lots yesterday.�

1/1/2015

guest Rob, do you think that Tesla is taking on too much liability risk by moving so aggressively with new technology? It seems that telemetry and OTA updates has allowed Tesla to mitigate alot of this risk. OTOH ten years of using a bad ignition switch design did nothing to help GM avoid deaths and millions of recalled vehicles. Old technology is not necessarily safer technology.�

1/1/2015

guest

Tried and true technology is generally safer than new technology. You can update software overnight but you can't update battery chemistry overnight.

Tesla is fly by the seat of your pants company. So far it has worked out for them with the under armor battery plating being the only safety issue.

When you have an ASP of $106k you can overengineer products. Less so when you go down market.

Tesla chose tried and true off the shelf commodity cells for the roadster. And has made small safe adjustments as time has gone on.

When choosing battery tech, even fly by the seat of your pants Tesla has been very conservative when it comes to battery tech.

GM had a very safe design. Decided they needed to lower cost and went with cheaper design against the advice of their supplier. Supplier reluctantly built defective ignition switch to GM spec. If GM went with older design suggested by supplier there would have been no problem.�

1/1/2015

guest Well, Ok, if you're correct, then Tesla really has no risk of technological competiton. Suppose some group came up with a major battery breakthrough, say a battery pack with 180 W/kg and at least as good as Tesla's pack in every other way. So it will be another ten years befor any major competitor touches it. If Tesla has access to it then, it can run with it in 2 - 3 years. That would give Tesla 7 - 8 years of uncontested advantage. On the other hand, if this technology is captured by a competitor, that may deprive Tesla to run with it in a few years, but it would at least give Tesla 10 years to advance their own battery pack to 180 W/kg and cut manufacturing costs before facing competion.

I think this goes to reinforce an argument I made upthread. Specifically, If you are the one developing such battery advances, then you really want to work with Tesla. Waiting 10 years for tradition automakers to bring your innovation to market is really not a good business plan for a tech company. It's even a questionable investment for an automaker to capture this technology. They basically would have to pay a premium over what Tesla would pay for it, but the only benefit for ten years is keeping the tech from Tesla. That's a really longterm investment while from a marketshare point of view Tesla is too small to worry about.

But how much would the technology for a 20% density gain be worth to Tesla? Tesla is willing to spend $5B for 50 MWh per year capacity. This tech would add abot 10 GWh of capacity. So that ought to be worth $1B for the tech. Of course, Tesla wants more than just one gigafactory, so the scale is actually much bigger. Thus, Tesla may be willing to pay even more than $1B for a 20% density gain. At this kind of money even if the technology were captured by BMW or GM, the parent company would be foolish not to do a deal with Tesla.�

1/1/2015

guest I'm not quite following this line of reasoning. Tesla used a tried and true commodity cell, but in the Model S they went and stripped all the safety bits out of it that made it tried and true and safe, and then repackaged them with their own pack level safety.

To me, that's not conservative, that's either innovative (if it works), or crazy (if it doesn't).

So far it looks innovative...but remember all the sparks that were flying about this approach just after the fires. (yes, pun intended). BMW made a great effort to explain to the ActiveE folks that their batteries cannot catch fire (different way less energetic chemistry), and are "automotive grade" (whatever that means), and aren't at all like those crazy Tesla laptop batteries.�

1/1/2015

guest

Sources for the chart:

Car Battery Weight Source Battery kWh Source BMW i8 98 kg 7.1 kWh Volkswagen E-Golf 318 kg 24.2 kWh 2011 Chevy Volt 198.1 kg 16 kWh Nissan Leaf 294 kg 24 kWh BMW i3 233 kg 22 kWh Chevy Spark 474 lbs/215 kg 18.4 kWh Fiat 500e 272 kg 24 kWh Kia Soul EV 660 lbs/281 kg 27 kWh 2016 Chevy Volt 183 kg 18.4 kWh Mercedes SLS AMG EV 1208 lbs/548 kg 60 kWh RAV4 EV 840lbs/381 kg 41.8 kWh Mercedes B-Class 660 lbs/299.4 kg 36 kWh Tesla Roadster (2008) 450 kg 53 kWh Tesla Model S (2012) 1323 lbs/600 kg 85 kWh Improved Roadster (same package as 2008) 70 kWh �

1/1/2015

guest They also went with a different battery chemistry, LiNiCoAlO2 instead of LiCoO2.�

1/1/2015

guest I'm sorry that I am late to this party.

I am curious why the RAV4EV Wh/kg comes in so low compared to the Model S. Since the second generation drivetrains were provided by Tesla, I understood that they used Tesla batteries as well. This second generation BEV RAV4 launched around the same time as the Model S. I seem to recall that part of the reason Tesla and Toyota went their different ways was because there simply were not enough batteries to supply both Tesla and Toyota anymore. I assumed that you compared Wh/kg by using cell weight instead of pack weight. What am I missing?�

1/1/2015

guest Toyota's and Tesla's engineers were known to clash often. I wouldn't be surprised if Toyota's engineers created a less energy dense battery for another trade-off, perhaps cell based BMS or something along those lines.�

1/1/2015

guest It was fairly often discussed that Tesla designed a higher powered, longer range vehicle that both Toyota and MB cut back because of cost and the idea that the "average" driver only needed 35 miles of range a day. An 80 mile range is sort of the balance point for most every EV between need, desire, and cost. Toyota and MB believed that people wouldn't buy an expensive EV. Plus, Toyota and MB wanted to make a decent profit. That raised the price even more.

On other threads, I see people trying to tell everyone that no one "needs" a 110 kWh battery in the S or the X. Many of us realize we don't "need" it, but we want it. My phone runs for two days. I hardly ever run it down to 50%, but there are times, there are times. And you don't want to have to go hunting for a charger. I pay for that privilege. Just like I paid a LOT for a car that goes more than 80 miles.

I used to own a car that went around 100 miles on a charge. After about 6 years of that, I was ready to save up and spend more. Glad I did.

But Toyota and MB have never driven EVs. Thus, they can never understand.�

1/1/2015

guest Thank you everyone for the clarification. I was waiting for the RAV4 EV to come out but I was seriously disappointed by the range and the fact that it couldn't be purchased in my state. I just assumed that they used fewer cells instead of inferior ones. No access to Superchargers and no dual charging was salt in that wound. I guess I'll just have to wait a bit longer for a vehicle like that.�

1/1/2015

guest Does anyone have any data on how well Tesla's manufacturing ramp is going for both the S and the X? In the medium term it's really their ability to ramp production that's going to matter since they are so demand constrained.�

1/1/2015

guest IDK, but Adam Jonas thinks they'll sell 10,000 in 2015. So ramping from 0 - 800 Model X per week in 25 weeks gets you to 10,000.�

1/1/2015

guest Yeah it wouldn't surprise me if 1200 of the EOY 2015 run rate is MS and 800 is MX and then they progress the final run rates upward to around 2500 giving a full 1200 for MS and MX with around 100 to float, maybe if demand continues to be strong they will fully push to 3k... But it is unclear if demand will be there to sustain that (I hope because that would be roughly 75k per model per year but trying not to get too ahead of myself)�

1/1/2015

guest This is a question that I am intensely interested in answering - not so much the specifics of what demand for S & X might be in 2015, but what do we think worldwide demand for S&X will peak at prior to Gen 3, and the steady state demand post Gen 3.

The whole nature of evaluating a company that is constrained by its ability to produce its product, rather than being constrained on how much it can sell by how much the public wants to buy - I can't think of any other industry or any other company to use as a case study. The closest I can think of is Boeing / Airbus as each maintains a many-year backlog, but that seems to be the nature of building airplanes, rather than a "build every single plane you can, and expand manufacturing as fast as you can for 10 years" situation

Apple sees situations like this periodically for very short periods (release of new iPhone).

Anyway, one idea that we can use to start estimating theoretical demand is to understand worldwide demand for large luxury sedans. Presumably, the limit of Model S demand is the current worldwide demand for large luxury sedans. To achieve that level of demand, Tesla would need to take 100% market share from all other participants in that market. So that probably won't happenWe'd need to fudge the number down by the market share we believe is achievable. I would look at California and Norway, with probably California a better representation of the limit of demand (incentives in Norway are so outstanding it tilts things badly). What is Model S market share in California, and what would worldwide demand be at the same market share?

Of course, then we'd need to subtract out demand for large luxury sedans from markets that aren't opened yet at a minimum, and we might be able to identify the markets that are unlikely to be opened by Tesla anytime soon (poor charging infrastructure, low expected demand for Model S, etc..).

And then we need to add into the demand Model S's apparently strong ability to pull buyers that wouldn't otherwise participate in the large luxury sedan market. I would really like to put a number on that, as it would help us have insight into future Model X (and Gen 3) demand.

Insight into theoretical Model S demand would also serve as an initial estimate into Model X demand.

I figure that the ideal data set will provide us make and model sales (registrations?) volume at the monthly (quarterly?) and country level of detail. The best data source I'm aware of today for this kind of data is goodcarbadcar.net - I'm trying to figure out if they have downloadable stats, or if I'm stuck pulling this stuff out car by car.�

1/1/2015

guest See I'm just shooting for "better than the MB S Class" at the moment which is why I safely put a cap around 75k for now. Because at least using the US sales as a dataset (which itself isn't fair because Tesla hasn't truly penetrated the US market fully. I won't even begin to consider that completed until they have a store in every state and every major city). But the US demand for MS vs S Class is that we are doing slightly better than them. Extrapolating that out you get around 75k globally.�

1/1/2015

guest Wasn't sure where else to put this: Want Elon Musk to Hire You at Tesla? Work for Apple - Bloomberg Business

Poaching talent from the most successful company in the world seems like a good long-term strategy to me.�

1/1/2015

guest Frankly, I'm not worried about the saturation level for Models S and X. The reason X has taken so long is tbat S proved to be a much better seller than was expected back in 2012. So the bigger X is, the longer we'll have to wait the Model 3, the Tesla truck, the new Roadster, and flying cars. Another thing we don't talk about much is how having multiple products should enhance sales efficiency. Multiple models will attract more people to test drive and improve the chance that the shopper will find a good fit.�

1/1/2015

guest I think biggest reason X delay is due to battery constraints. If Panasonic barely fulfilled S demand, X just wouldn't happen. Now with GF on track so far, battery constraints won't stop 3 development.�

1/1/2015

guest With a disguised version of Model X doing road tests out in Alameda, we can suppose that a Model X reveal could take place fairly soon if Tesla wanted. Many of us on this forum believe that Model X will be revealed with a somewhat limited lead time over the start of production date in order to avoid cannibalizing Model S sales. That lead time need not be as slim as what we witnessed in the "D" reveal, however, because while cold-weather buyers would shift in large numbers from S85 to 85D almost immediately, the demographics of X to S buyers are different (female vs. male, for example) and not as large a percentage shift would take place. Still, you should see at least some temporary dip in demand for Model S as people about to order that car re-evaluate the decision as the fanfare of Model X information is released. Keep in mind, too, that many Tesla cars are ordered by families, and preferences between S and X by the husband and wife may see a fair number of orders shift to the X.

We're likely seeing Tesla working out the Model X production process so that we do not see substantial delays as the car enters production.

Model X will be a big hit in North America, which is SUV territory. Model 3 will likely be a hit in Europe because the car is sized more appropriately for the tastes of European customers plus it'll be a big hit everywhere else because of its value. All models will continue to grow in appeal as the worldwide supercharger network matures. From what I've witnessed in Model D reveal, Tesla understands how demand for one model affects another and it will reveal products in a logical way to avoid any dips in demand that could affect production rate. Tesla needs the flexibility to shift some production from Model S to Model X as a major shift in demand from North America occurs. While I cannot predict the growth in demand for Model S over the next two years, I can safely say that the combination of demand for Model S and Model X will continue to grow at an attractive rate.

I continue to believe that Model 3 will become available in 2017 because the gigafactory will be producing batteries by then. Tesla understands the need to sell the gigafactory's products and will time Model 3 release appropriately. Since Model 3 will not necessarily involve new concepts (gull wing doors, all-wheel drive, etc.), it should be much easier to design than Model S or Model X.�

1/1/2015

guest From 'Marketplace' story posted in the Gigafactory section,

�At the price points that we're expecting to achieve with the gigafactory ... we see a market that is well in excess of the production capability of the factory,� says Straubel.

Hadn't heard a Tesla exec express that specific number before (though we all probably imagined this possibility).�

1/1/2015

guest I disagree on the waiting longer. More sales for S/X translates into more capital, translates into accelerated investment. Tesla will wants to get the Gigafactory built and up to capacity as fast as possible, and then start adding more. The best way to do that is to get Model 3 to market quickly.�

1/1/2015

guest I think the unexpected high demand in S has allowed Tesla engineers more time to streamline and improve the X. This delay has garnered more anticipation by shareholders, reservation holders and car enthusiasts alike; making the final reveal of the product much bigger than it would have been had X arrived on time.

Tesla isn't desperate enough to release the X without having first perfecting it, this clearly shows in their approach, unlike peers such as Fisker, who is now bankrupt and no longer exist. Fisker's rush to get its product to market ASAP was a Hail Mary attempt, Tesla is methodically planning a touchdown!

The gigafactory is our answer to 3, and guarantee that the worlds lithium supply will flow through our channel, making competition a no brainer.�

1/1/2015

guest I'm not worried about the Model X cannibalizing Model S sales, no more than I'm worried that the D option cannabalizes sales of RDW versions of the Model S.�

1/1/2015

guest Long-term, things are going exactly to plan. In 2012 Elon promised 20k cars in 2013....done. In 2013 Elon wanted to deliver 35k cars....and came close. Tesla would have accomplished it if they hadn't built the D, but I can't imagine anyone not wanting to build that. Demand is higher than ever with $257mil in customer deposits. The X is sold out for at least 6 months after production, and we haven't even seen a production model yet. Competition is nowhere on the horizon. 70% growth in 2015, with probably 50% growth in 2016.

The picture is clearer than it has ever been.�

1/1/2015

guest Agree, no great headline material from this one but they reiterated they're right on track. 200k/year rate end of 2015 with 30% GM sounds good to me. If the sale continues, I will keep buying.�

1/1/2015

guest The problem is execution. Tesla mentioned in the Q3 shareholder letter that it is fair to criticize their execution. For short term execution, it looks really bad they missed lower guidance, missed gross margin significantly, missed EPS significantly even with ZEV credits. Bad short term execution might indicate problems in the future. I'm very disappointed in Tesla and the management for this quarter's performance. They had so much forsight when they gave all the guidance for Q4, it was given in early November, yet they failed to give good guidance.�

1/1/2015

guest yes, that was 3-4 months ago, get over it. In 2012 Tesla had issues ramping up to 5k per quarter. With every passing quarter the problem becomes less and less of a concern. Unless they innovate something similar to the D, then the new technology would pose a ramp up issue due to unexpected high demands that could not have been extrapolated as there are no existing models to extrapolate from. Listen to the CC, D demand sounds outrageously high.�

1/1/2015

guest Yeah I think their focus as stated on the call is right where it should be right now. Which is, execution... They said they were slowing down their expansion for the moment to level out their OpEx so they can make everything run smooth again. I mean clearly they don't need to go crazy with OpEx if the demand is off the charts already and no sign of slowing down. So working out the kinks is the big focus and that makes sense. We will see what happens with the retooling happening this quarter and the paint shop coming up shortly thereafter getting production ramped is the thing to focus on for the next few months.�

1/1/2015

guest I'm with you on this one, there's no need for something more awesome than what's available in the D, focus on retooling and get back to demolishing guidance. Q1 may be much better than anticipated due to limited distractions and low target, the wild card right now is how the media will react and analyst model their charts? The decision to shut the plant down in Q1 was the correct path as we have the 1.4k backlog from q4 as a cushion. I think the buildup to q1 will be pretty sweet.�

1/1/2015

guest Sorry in advance for the long post, but so many issues are being misconstrued.

Tesla missed their projections for 2014 because of the release of the D model (small airbag issue as well as the new seats were requested more than projected). They could have chosen not to release the D model until much later, but no one in their right mind would want that...demand is through the roof and average sticker price is quite a bit higher. But what is important is that they produced the cars.....35,000 for 2014. The cars simply weren't delivered in time for a variety of reasons, however are delivered now.

Additionally, analysts need to look at non-GAAP numbers. Tesla receives the cash up front for 'leases' done through banks...it's not really a lease, but a loan. They have to report it as a lease because they are on the hook if residual values come in lower than forecast. But residual values are holding much higher than forecast, so it's a moot point. So to get an accurate picture of the cash flow situation, they issue non-GAAP numbers. To say they are losing money is simply a falsehood.

Let's look at what was said on the conference call:

Demand

Perhaps the most significant segment of the recent conference call was the update on the demand picture. TSLA currently is holding over $250 million in customer deposits, a new record. They have over 10,000 orders for Model S, a significant number given that Tesla is producing Model S at record rates. Model X orders stand at almost 20,000 firm orders�.for a car that hasn�t been built yet. These are astonishing numbers for a product that has an average sticker price of $100,000, with no advertising, no product placement and no discounts. Demand for the P85D is much higher than Tesla expected. Elon even eluded to having a �secret weapon� that would increase demand should they ever need it. Clearly demand is not an issue for 2015; and if demand ever shows signs of waning, Tesla has many options to increase demand. This is important since many news articles have concentrated on the sluggish sales in China. Although I believe China will become an important market for Tesla, it is obvious that for the foreseeable future production will not be able to meet demand.

Production

TSLA announced production of 35,000 cars in 2014, a 50% increase from 2013. They plan on producing around 60,000 cars in 2015, a 70% increase, with a higher average sticker price. Tesla has plans to increase production approximately 50% per year for the next 5 years with the introduction of the Model X in the 2[SIZE=-1][SUP]nd[/SUP][/SIZE] half of this year, and Model 3 in 2017. As production increases, economies of scale kick in and gross margins increase, with TSLA predicting a 30% gross margin on Model S by the end of 2015. For a company to have 50% growth rate with increasing gross margins for the foreseeable future is impressive.

Financials

TSLA is a high growth company in an industry that has high costs associated with growth. Building of the gigafactory, increasing production capacity, expanding the sales and service centers, and growing the supercharger network all have high initial costs. So although gross margins are fairly high and increasing, net profit will continue to be low to nonexistent as TSLA is using those gross profits to expand. The press loves to concentrate on net profit, which gives the perception that TSLA is losing money; however this does not paint the full picture. Thus, it is important to concentrate on (1) free cash flow, and (2) how TSLA plans on paying for the high costs associated with growth. Fortunately, TSLA gave guidance that in the coming years free cash flow will expand dramatically, and that the vast majority of CapEx will be paid for organically. In other words, the dreaded dilution of shares with multiple secondary offerings will not be the primary source of growth. So TSLA�s market cap is $24 billion with projected 2015 sales of $6 billion, or TSLA shares trade at 4x sales. This is a very reasonable multiple for a company growing at over 50% per year with expanding margins.

Tesla�s future is becoming clearer and more stable. There have been no f*res since the improvement to the undercarriage over a year ago; no significant recalls; and the resale value of Model S has remained impressively high, nullifying the resale risk of the lease agreements. Competition to date is nonexistent, and although several articles infer to the next �Tesla killer�, I believe there is plenty of room for several models of luxury electric cars in the future. Additionally, by the time any other car company introduces a compelling electric vehicle, Tesla will be firmly entrenched as the undisputed leader in electric vehicles with hundreds of thousands of vehicles on the road, and thousands of superchargers available for free to Tesla owners.�

1/1/2015

guest Lots of great points on this thread. Tesla followers are truely amazing! I'd like to add a few more points:

1. Earnings Issues: The issue is not Demand, not Production, not Marketing, nor Financials. It's Delivery! The model Tesla is using (direct orders and delivery to customers directly) is very difficult to manage in the global scale that the company is in now. We saw issues related to this in 2012 and 2013 within US. Now it's gone global, and the company is facing the same issues at grander scale. This is where better data modeling on the demand per region and forecasting is huge. Part of this is offset by utilizing reservations, with 2-3 months delivery time. That said, it is still not even touching the issues of shipping product globally from one manufacturing site, etc.

2. Forecasting: I don't have the exact figures to come up with a reasonable forecast, but here is what I'd try... Look at the whole market for vehicles in the mid-sedan range (roughly $20k+) to luxury (about $150k). From this list, look at the percentage of vehicles sold for luxury sedans, percentage of vehicles sold for luxury SUVs/CUVs. This should give a reasonable guidance of the long term market demand. If we assume 500k vehicles sold in 2020, then put the appropriate percentages to get the figures... then assume 2m in 2025. That said, I do understand that there could be a variation on demand for the EVs, compared to ICE, but this should work as a reasonable "rule of thumb".

3. Competition: I think the only real competition are future Tesla models! I have the S85, and the S85D is looking mighty attractive to me right now!Though, I cannot afford another high end vehicle in the family right now.

In full agreement with Hogfighter: "Tesla's future is becoming clearer and more stable."

- - - Updated - - -

Oh, regarding my Long Term expectations for TSLA...

Using a Price/Sales Ratio of roughly 8 (for trailing twelve months) model (as earnings don't seem to work in this high growth environment). With that in mind, here are the next 6 years (enjoy):

2014 (actual): Rev = $3.2B, therefore Market Value = $25.6B, therefore stock price is roughly $205 at 124.5M shares.

2015 (guidance): assuming revenue = $5.6B; Market Value = $44B; Stock $350 at end of 2015

2017: Rev = $13.6B; MV = $103B; Stock = $775

2020: :love:�

1/1/2015

guest Price to Sales of 8 is very high for a large company. Most are closer to 5 or less.�

1/1/2015

guest Tesla is going to become an electric car and battery storage company. Those two markets are going to be big. No other company currently has that roadmap. Generac is a company that makes generators of the type you use during power cuts, but they have no roadmap leading them into battery storage, even if it would make sense for them to expand into that. Ford, GM etc. are starting to make battery-powered cars, but don't have the intent to expand into the battery storage industry, and if they did they'd have a hard time finding the batteries. Perhaps Honda might be the closest, since they produce the Honda Fit EV and also are a popular supplier of portable power generators.

I was excited to hear Elon mention the stationary storage yesterday, though at first, I wondered why they would launch so early - pre-Gigafactory - with such a dearth of batteries around. I don't think Tesla has anything more profitable that they can do with 85KWh's worth of batteries than to put it into a Model S car and sell it for $79,900. Selling them in a home storage battery would be less profitable. But, I am reckoning they are going to bring in used Tesla Model S batteries - ones that have been returned under warranty, returned in leased cars, or returned from Model S owners who want to upgrade their cars to larger batteries (different thread altogether!) - and rework them for sale as home batteries. Perhaps, the up-to-2,500 Roadster batteries that are going to come back from owners may be refashioned into these home solutions, too. I project home batteries will be sold with a price that matches their measured, working capacity. Some batteries may have more capacity than others, resulting from the usage style from their initial deployment (my own P85 battery appears to have 97.7% of its original capacity), so this would be reflected in price calculations - rather like the calculations for Tesla's loaner and demo cars. Once the Gigafactory is up and running they will have the extra capacity available, as stated, to produce as many brand-new home storage batteries as needed.

Being in both businesses will bring Tesla economies of scale in battery production, but also expertise in deployment techniques, long-term charging & discharging problems, software expertise, and of course brand awareness. Expertise in one will be great to share across to expertise in the other.

After the Tesla Home Battery is revealed, analysts from multiple different sectors will be look at Tesla - homebuilders, energy industry, and automotive, maybe more. Could be a great catalyst for TSLA.�

1/1/2015

guest Martin, the fit ev has been discontinued. And their generators are gas powered. I'd say they aren't close.

Also, Elon and JB have said that there are few cases they've found where recycled batteries would work better than current batteries for home storage purposes, and that they don't expect to reuse batteries for home storage, that it would be more reasonable/cheaper/more efficient to use new batteries. This is sort of unfortunate because I would like to see batteries repurposed to low-draw applications, and I think that will still happen somehow, but perhaps not via Tesla. Oh well.�

1/1/2015

guest My guess on the secret weapon

I wager it's a trade-in program that will accept any brand of used car. Maybe doing this in conjunction with an established player like Carmax. I would trade in my BMW 3 series for a S60 in a heartbeat.�

1/1/2015

guest They already do this.�

1/1/2015

guest

This is fun. :love:

2014 (actual): Revenue $3.2B, Market Value = $25.6B @ 8x @ 125M = $205

2015 (guidance): R = $5.6B; MV = $42B @ 7.5x @ YE2015 = $336

2017 (@50%): R = $12.6B; MV = $82B @ 6.5x = $656

2020 (@40%): R = $34.6B; MV = $173B @ 5x = $1384

2014 (actual): Revenue $3.2B, Market Value = $25.6B @ 8x @ 125M = $205

2015 (guidance): R = $5.6B; MV = $39B @ 7x @ YE2015 = $313

2017 (@40%): R = $11B; MV = $55B @ 5x = $440

2020 (@40%): R = $30B; MV = $150B @ 5x = $1200

2025 (@30%): R = $111; MV = $444B @ 4x = $3552

2025 (@35%): R = $135; MV = $607B @ 4.5x = $4860

Apple 2/11/15 = $700B = $5600�

1/1/2015

guest I see you ran out of fingers and toes to count on. Me too!�

1/1/2015

guest Apple would be $5600/share if there were only 125million share, as Tesla has. Instead Apple has 5.82billion share, therefore the estimate comes out to about $126 (today's price). So, yeah, this calculation still seems to work... keeping in mind dmunjal's message: "Most are closer to 5 or less."

If Tesla can perform as they are stating, then I don't see any reason why 2025 wouldn't see a $3000+ price for it's 125million shares (assuming no dillution).�

1/1/2015

guest At some point, you have to look at gross margins. Apple is at about 45% and Tesla is about 30%. I would discount another 33% to the calculation and maybe another 25% to dilution. It takes stock to attract the best and brightest employees.�

1/1/2015

guest Metal Lease

All the talk about Musk's secret weapon has raised lots of ideas around leasing batteries. I want to share a related idea that exposes some pretty fundamental economic issues around advancing batteries. So we like this particular kind of lease or not it is at least a way to think more deeply about the value of batteries and sustainable growth.

So here's the idea of a metal lease. Suppose that an 85kWh pack has presently about $5000 in recoverable metal. That is if you were to recycle the battery and sell the metals you could recover about $5000. (This is about $60 per kWh. If someone has a better estimate please let me know.) In a metal lease, the lessee buys the car at a reduced price and has unlimited use of the battery, but agrees to pay a quartery payments until the battery is returned to the lessor for disposal. In essence, the lessee is merely renting the recyclable material and has an aggreed upon plan for recycling the battery. To put some hypothetical numbers to this suppose that the lessee recieves a $5000 reduction in the purchase price of th car for entering into this agreement. Morever, the quarterly payment is $50. This amounts to a $5000 perpetual bond with 4% coupon with the recoverable metals as the principle. The value this creates for the lessee is a lower front end cost of car (and on a $35k Model 3 $5k reduction could be a big deal) and peace of mind that they can walk away from an old battery anytime and know that it is properly repurposed or recycled. Beyond facilitating a sale, Tesla, the lessor gets two assets: a cash flow which can also be securitized for capital and the recovable metals. This metal asset is particularly interesting. As an EM maker, Tesla is short the metals needed to make batteries. This exposes Tesla to commodity price inflation. However, the metal component of the lease makes Tesla long on the very metals it needs for production. So the metal lease is a natural inflation hedge. Should competition in the EV market ever take off to such an extent that shortage of key metal drive up prices such a natural hedge may offer strategic value. The lease also exposes Tesla to credit risk, but this risk can be shed through securitization. One risk that is quite limited in this set up is the physical condition of the battery. If the battery is returned with residual useful life as a battery it can be reused or repurposed. If the useful life is completely spent, then it can be recycled and the full residual value of the lease is recovered. Only in extreme cases will recovery value be lost.

Now lets decompose the value of the battery itself. Suppose a price of $200/kWh, or $17,000 for the whole pack. Suppose gross margin is about 30% or $5000. So the cost of the battery is $12,000. The recovery value of $5000, and this leaves a non-durable cost of $7000. This non-durable portion includes the costs of manufacturing and nonrecoverable materials. For the most part, Tesla wants to squeeze every las cent of non-durable cost from the manufacturing process. The metal lease also creates a financial incentive to minimize the use of unrecoverable materials or figure out ways to make them more recoverable. This is smart both financially and environmentally. When we think about the Gigafactory eliminating about 30% of the cost this takes the total price from $17,000 to $12,000 and total cost from $12,000 to $8,400. But it does not really change the recoverabe value, still $5,000. So the nondurable cost is sharply squeezed from $7,000 to $2,400. So under the metal lease what the car buyer actually consumes is $2400 nondurabl plus $3600 profit to Tesla, $6000 altogether. This is less than $71/kWh consumed. Additionally the customer makes a modest $200 per year payment for the lease. In ten years this is a combined cost of $8000, or $94/kWh, to the customer. This actually looks quite affordable from a consumption point of view. Remember that the full price is $12,000, or about $141/kWh. We are able to squeeze out another third of this total cost to the customer through the mechanism of the metal lease, while Tesla hedges itself against commodity inflation.

But now lets take this one step further to see the impact of advancing technology. Let's assume that through technology density continues to double every decade. Suppose a customer buys a car and returns the battery in ten years. It gets recycled. Because density has doubled in this time, the recovered metal is now sufficient to produce two new batteries of the same energy capacity. The nonrecoverable materials have to be sourced new, but the recoverable materials are covered. So it matters quite a bit in the longrun how much of the battery can be recovered because that portion can double the supply of batteries every ten years. This supports a sustainable annual growth rate of 7.2%. However, let's suppose that 90% of certain materials can be recovered. Then upon recycling in ten years there are materials to make 2*0.90 = 1.8 times the capacity. This is an annualized sustainable growth rate of 6.0%. Longterm economic growth rates are likely to be around 3% or 4%. Thus, a 90% recovery rate coupled with decenial doubling is enough to satisfy perpetual growth in demand with a fixed amount of recyclable materials. In fact, if just 67% is recoverable, this is enough to sustain 3% annual growth in perpetuity. Additionally, note that if the usable life can be extended beyond 10 years, this will also enhance the sustainable growth rate.

Sustainable growth rates are well off into the future. In the present moment Tesla is attempting to grow at 50% rate. This is well above any sustainable rate, so new materials must be sourced from the earth or other markets. It is important nonetheless to have sustainability in sight. I think something like a metal lease can help an EV maker do the right things that lead most swiftly to sustainability. The metal value of the lease not only hedges inflation, but it also motivates the right level of R&D and business development to extract the greatest value out of used batteries. It is also beneficial that there are clear pathways to assure that batteries are recovered. Customers might not always realize that their old batteries contain highly valuable recoverable materials. This lead consumers not to value EV fully when buying a new one and not to secure that value when disposing of an old one. The quarterly payments on a metal lease remind the lessee that they are merely renting a portion of the earth but for a short time.�

1/1/2015

guest Interesting, but a few problems. 1. I didn't see any account of recycling costs/materials recovery/purification. 2. Packs should have useful capacity well beyond 10 years, maybe 20 years for stationary storage. 3. New technologies 10-20 years from now may not use any nickel and/or cobalt, the two most valuable metals in the current pack.�

1/1/2015

guest 1) Right, I glossed over that. I think of recovery value as net of the costs of recycling.

2) Actually, I am talking about a perpetual lease. The ten year mark was only for illustration. So the car owner can use it just as long as they want to. Once a battery is returned, Tesla goes through a triage to determine whether it can be reused, refurbished, repurposed or simply recycled. So any residual life in the battery is an added benefit to Tesla. This creates an incentive for Tesla to build packs that have residual value well in excess of recovery value.

Another interesting issue arises with long life batteries: is there a time frame within which it becomes more economical to recycle a useful battery simply because higher density technology would make better use of the recoverable materials? This is the question of obsolescence. Suppose you have a twenty year old battery with half its original capacity. Roughly, you could recycle it and get 8 times the current capacity. That would likely overcome the manufacturing costs of doing so. This is one of the reasons why the metal lease must have a lease payment to it. The lease payment makes sure that lessees do not sit idly on old technology. Waiting twenty years to replace your battery means you may be paying 4 times as much as you need to each quarter and only getting half the benefit. So as manufactures squeeze out more nondurable cost, it becomes increasingly economical to recycle and upgrade.

3) I wanted to avoid the complexity of a changing mix of metals. If the proportion of a particular metal goes up over time, then more of it may be required from the market until a sufficient volume is in circulation for recycling. If the proportion of a certain metal declines, then any surplus is sold back into the market. Metals that drop from chemistries because they are expensive will certainly hold their value. So trading surplus cobalt or nickel for a cheaper metal is financially beneficial to Tesla. In terms of a financial hedge, a metal lease should be robust to new technology as one always has the option of using older technology if it proves more economical to do so.

One other note, my comments about sustainable growth rates only matter once EVs have replaced all the ICEVs that they ever will. So we are looking ahead some 40 years or so. Pretty much as long ad EVs have ICE to replace, they will need to source metal markets for new material.

Additionally, we probably should expand this discussion to include all other large stationary and nonstationary battery packs. The metal lease idea works just as well for other battery pack markets.�

1/1/2015

guest Jhm: it's really difficult to see any apparent flaws in your concept apart from of course a huge disruption in energy storage technology or something like a full-on explosion of nanotechnological manufacturing (but that would change so many other things deeply too). Great thoughts!�

1/1/2015

guest Thanks. I would say one thing that works against this is the nuisance of having to make the quarterly payments and issues around selling the car. In fact, I proposed quarterly payments because monthly would be really small. If Tesla had other subscription services, it coule be rolled together. For example, the tech option ($4500) is now required to get autopilot upgrades. If they were to separate out the autopilot software, they could sell it on a subscription basis, say $200/yr, and reduce the tech package to $2500. There is even the possibility of offering Supercharger access on subscription, say another $200/year. Taken together these 3 items could whack $9000 off the purchase price for a monthly payment of $50. For most people that's comparable to gas money they'll save. Applied to the Model 3, this gets you into the driver's seat for as little as $26,000.

Morgan Stanley analysts say that software is about 10% of the value of a car these days but will become 60% of the value. Certainly Tesla is way out on that curve. But if this trend is true, we ought to see subscription pricing enter the auto market. Since Tesla obviates the need for gas money and have services worth paying for, they ought to lead on subscription pricing. It may even be reasonable to call the metal lease, simply a "battery subscription."

So if software is say 30% of the value of a Model S, remote servicing (TBA) 6%, battery metal 5%, Supercharger access 5%, and wireless access 5%, then as much as 50% of the value of the car could be sold on subscription basis. This could get you into a Model S 60 for $35,000 with a $300 monthly subscription. This may be a bit extreme on the subscription side. Something like $47,000 purchase plus $200 montly subscription may be more attractive. In any case, subscription pricing could remove substantial sticker shock and provide Tesla with a solid revenue stream which can be capialized as needed.�

1/1/2015

guest All these chatter about Apple and GM entering Tesla's turf is getting me excited for Gen3. In the past I've always felt that Gen3 will be late, however, due to the recent chatter, I believe Tesla will feel the urgency to bring Gen3 to market on time.. After all, GM is talking about the Bolt being 2 years away. The arms race is officially on!�

1/1/2015

guest I agree that Tesla plans to get the Model 3 out on time. Elon gave a 2nd half of 2017 forecast during the Q4ER. Recent statements that the initial Model 3 was going to be less ambitious also confirms a need to get the car done in a timely fashion. On the other hand, Elon doesn't like to turn a car loose until it is just right. Let's see how this one plays out. If the gigafactory starts producing cells and batteries in 2016, it's likely going to need Model 3 towards the end of 2017 as a destination for some of those batteries.�

1/1/2015

guest As work was windig down on the X, the design was locked and Beta production began, i believe most of Tesla�s engineers shifted focus to Model 3. Surely, there is a different set of engineers woking on minor tweaks for high volume production, but the core team must be all about 3 now.

So with that in mind, and 2,5 years to go before the launch of Model 3, i see no reason why Tesla's team of engineers would not be able to meet that deadline. Remember, the S was their first car from scratch, first time they had to scale production too and the X had that falcon wing, dual motor AWD electric and 3 row seat design that required lot of groundbraking work. Model 3 should be lot less complex compared to that.

The only real cloud on the horizon would be a delay in the gigafactory, but as of now, construction is slightly ahead of schedule and they are progressing well in securing large quantities of raw materials (as per the Q4 cc).�

1/1/2015

guest One thing I'd like to see. TSLA do is testing the demand of its Model IiI

It just feels like they are going ahead with building a gigafactory on faith without even the pre-order book.�

1/1/2015

guest If you can sell over 50k vehicles for an average $100k sticker price, you've got to feel fairly confident about the order book for a vehicle starting in the mid 30's.�

1/1/2015

guest 50k over 3 years @ 100k+.

I don't know. That's not convincing me yet. I think the demographic for the two are very different. Assuming Gen IiI buyers are mostly city dwellers. The China situation might be a testbed for Gen IiI adoption in my opinion.

A while ago I asked about city charging for Gen IiI buyers and the answer was that the supply will not be able to meet the demand enough from just the customers with a house that we won't have to worry about city folks for another 2 years. Well, now that we are promising 500k a year and China situation proves that it can affect the price, I think we need to revisit this. How do we test the demand? When do we need to test it?�

1/1/2015

guest Causalien, the train's already left the station. By raising $2bn for the Gigafactory Tesla's pretty much bet the company that there's a giant future in an affordable electric car. There again, that's been the core belief underpinning the company since it was founded. If autos are inevitably shifting to electric the long-term demand for a $35k electric car isn't 500k it is many millions.

How do you test whether autos are inevitably shifting to electric? You can't in any traditional sense. You can't send a survey, any more than Steve Jobs could or would have surveyed customers to see if they wanted a new type of cell phone with a screen you could control with your fingers. Sometimes it's about vision and conviction, two things that Elon Musk has a very convincing track record on. Every one of us who's driven a model S knows that there's a visceral feeling you get from the car that says loud and clear: this is the inevitable future of cars. Forget trying to meaningfully test the market. Just do what it takes to drop the costs (starting w the gigafactory) so that the car can be built.

There are products that are simple extensions of what people already have. And there are products that are revolutionary. The latter can't be properly market tested. But if you've driven a model S and you believe the economics story Elon and his team have woven around ongoing battery tech improvements and the incredible system-design scale of the gigafactory, you can still get pretty certain about the potential here. And that's why this forum and this opportunity are exciting. We all have a sure glimpse of the future that is not yet shared by many.�

1/1/2015

guest Yeah, unfortunately, I will stop investing in TSLA the day I get my car because by then I will be biased. I already violated my investing principals and let the Norwegians gave me a test in their Model S. Anyway, my spidey sense is worried about this right now.

But this topic probably won't come up till 2016. If I can think of it, some paid journalist is already thinking up the new headlines.�

1/1/2015

guest Blind Faith Price Targets

Sometimes super simple models can get you fairly reasonable results. I'd like to share a price model so simple it may just make you laugh, but let's see if it doesn't lead to something sensible.

I call this the blind faith model. At the recent CC, Musk provided us with a back of the envelope estimate of market cap, $700B by 2025. So let's take it as a matter of blind faith that the stock price will reach $5500 by the end of 2025. After all, Elon said it, and that's good enough for me. So if the stock price grows exponentially from here to there, where does that put the price in 1 year, 2/19/2016?

So let's take the last close price of 211.75 on 2/19/2015. 12/31/2025 is 10.86 years away. So the market is currently discounting Musk's estimate by 33.96%. To see this note that (5500/211.71)^(1/10.86) = 1.3496. This is an example of what finance quants call "calibration". It's a matter of fitting model parameters to market prices, something which fundamental analysts almost never do. But truly it is the market that determines the discount rate, and analysts are foolish to think they know better how the market values future earnings from any source. So given the last price, we obtain a 2/19/2016 BFPT of 285.73. Note 211�1.3496^1 = 5500�1.3496^(10.86 - 1) = 285.73. We remark that this PT is remarkably close to the consensus of analyst, and we can do the math on our smart phones in a fraction of the time!

What if we look back to some recent low prices to see how low BFPT can go for the same target date of 2/19/2016. On 1/20/2015, the market closed at 191.93. Calibrating to this, we get a discount of 35.87%, which leads to a BFPT of 267.43 = 5500�1.3587^(10.86-1). This turns out to be the lowest BFPT in the last 252 trading days. So this is a conservative PT. Now if you were to buy at 211.71, this would imply a conservative growth rate of 26.32% in one year. Thus the current price still has attractive upside to it for a one-year investment.

Finally, we can calculate BFPT values based on the last 252 trading days as a reference distribution. We can report any statistic of the distribution we may like such as max, median, average and last.

Last.... 285.73

Min..... 267.43

Median 346.41

Mean... 346.81

Max..... 424.39

You would want to sell if the price got to 425 over the next 12 month, but buying at current prices looks attractive. See what a little blind faith can do.�

1/1/2015

guest I'm struggling to understand why you think Model 3 is aimed at city dwellers. With a 200 mile range and Supercharger access, it will be a direct replacement for a BMW 3-series with superior driving dynamics and the operating costs of a Honda Accord. People like my sister and her husband are perfect targets: they have a BMW 325 and a Toyota Highlander. She puts about 150 miles on the BMW every day, while the Highlander sees lighter use, mostly around town or Boy Scout camping trips. The Model 3 will be perfect for her garage.

The economics of EVs are most compelling for people with long, regular commutes. City dweller like me can go days or weeks without needing to drive, or perhaps a short run to the big supermarket for heavy groceries. But if you drive 40 to 80 miles each way daily, the gas money you'll save on an EV is compelling, even at $2/gal. And there are plenty of Americans who have exactly this pattern, or perhaps shorter commutes where you burn a lot of gas sitting in congestion. (It used to take me 30 minutes to drive the 3 miles from my office to home in Boston.)

So I don't worry about demand for the Model 3 in the US, assuming that the design and execution of the vehicle is excellent.�

1/1/2015

guest

I wouldn`t entirely dismiss the point Causalien is making, Robert. I think he is bringing up what I have also been commenting on for a while now whenever this topic comes up: homes in the suburbs vs. flats.

I know there are exceptions, like in e.g. Hong Kong where even the rich live in high rises due to the lack of space/land, or people owning expensive flats in Manhattan. However, globally thinking, it would be hard to deny that there is some correlation between the income bracket you have and whether you own/rent a house or a flat. At the very least it would be a fair assumption that most high income households own a garage on their suburban property or can afford to rent one close to their high priced luxury downtown flat. On the other hand it would also be fair to say that many lower income families don`t own a house to being with and can`t afford to rent a garage.

Now whether this is already a Model 3 problem or will only become relevant when we get to a 20-25k price point for EVs, that can be up for discussion. However I bet that much more of the Model 3 owners will be parking curbside than Model S/X owners. With no judgment at all: if you can afford 100-120k for a car, I am pretty sure you can afford a garage.

Why is this important? One of the EV/Tesla arguments has been that you start your day with a full tank of "gas" and only ever need Superchargers on road trips. If you park curbside, though, that full tank in the morning is not happening - at least not until they put a 11kw+ charger by every parking spot.�

1/1/2015

guest Even if you think that half of the market for cars in the 30-50k range are parking curbside, that is still a vast addressable market. TM and even the other makers would be sold out addressing this market for 10-15 years....

In Texas, or in any of the big spread out states even poor people have garages or driveways. I don't think it is half.�

1/1/2015

guest Perhaps what he meant by "city dwellers," and this is what I took from that comment given his mentions about Chinese charging stuff, is "people who do not own a house with an attached garage." As we go downmarket we'll get more and more people who live in apartments, townhouses, who have communal parking, who do not have assigned parking, who park on the street, etc., because they can't afford parking or a house with a garage or they live in a city or whatever else. And as we want to raise volume, we need to address those people's needs.

But yes, I've said for a long time that EVs are great for people who drive a lot of miles and great for people who drive few miles. People who drive a lot of miles regularly save money on gas, and people who drive few miles have a car they can fill at home and is always ready and they don't have to worry about taking it to a gas station or the battery dying after a week of not being used or any number of other silly problems that happen to gas cars that don't get used often enough. You're right about the ideal customer, but the point is: how many of those ideal customers who are buying a car in the ~35k range have garages? If we're looking for young people, are they going to be able to charge the car? This is definitely something that EVs need to get around to addressing. EVs are already perfect for people with garages and there's no good excuse for a person like that not to have one as their primary car, but the question of how apartment-dwellers can make EV use as easy as home-dwellers is a question that still needs to be answered.

Now, maybe there's still plenty of market to sell 500k cars to people with houses by 2020, especially at the rate EV sales are growing. But it can only help to have apartments onboard as well.

Also, 150 miles *a day*? Thats 55k a year...or 39k if you only count weekdays. With mileage like that she needs to get into an EV right now because she'd be saving like 10 grand a year on gasoline....�

1/1/2015

guest Plus, milennials don't want to own cars at all, so the market will shrink overall, leaving a larger portion of drivers with garage access.�

1/1/2015

guest Yes and no. I wrote about this extensively in another thread concerning threats to Tesla.

My observation is that many Millennials initially prefer not to own a car if they live in a city, but as they get older and have children, this changes.

A high percentage move to the suburbs when their children reach elementary school age, because they want their children to attend good public schools. Only a minority stay in the cities, either because they can afford private school or are adventurous gentrifiers.

The net result in the near term is that the car market won't disappear anytime soon, because in most of suburban America, a car is still a necessity.

The long-term question is whether those who stay in cities as gentrifiers will be able to improve urban public schools to the point of general acceptance. I don't think we'll know the answer to this for 25-30 years.�

1/1/2015

guest Yeah I cringe when people say "millenials don't drive cars". What this means is that instead of 95% car ownership they are like 90% car ownership. (made up numbers) Lets not lose perspective.�

1/1/2015

guest The mission for "Mass Market" is to drive EV adiption to eventually replace gasoline. If Tesla cannot prove that an economic model for city dwellers will work, then it is up to apple to take up the mission. Someone will take it up because there's a rich consumer base living there. In between rich house owners with a garage and poor condo renters in the city are the rich condo owners in city. Dwellers who chose that life instrad of suburban life. In North America, it might not make sense as space is not an issue. Not the same in Europe and in Asia.

My argument is still the same, someone will use this argument as a weapon against TSLA eventually like they did with China. What is our response besides saying: the demand will be there? The demand is there in China, how did we botch it up so badly?�

1/1/2015

guest Many apartment buildings in cities do have their own underground parking garages. My observation is that this seems to mostly be upscale housing.

The parking/charging issue comes up for apartment buildings without dedicated parking, and for rowhomes with street parking only. I do know some city dwellers in the rowhome situation, but it seems like they don't drive their car more than once every 2-3 weeks. One person remarked to me that they had to remember to check to see if their car was still where they parked it.

The rise of sharing services like ZipCar reflects the reality that many city dwellers simply do not need to own a car. My suspicion is that the subscription/pay-as-you-go model is the future norm for those who seldom drive but occasionally need easy access to a car. How does this work for Tesla? Autopilot is the key. Tesla could establish a subscription service and have racks of EVs in a building near a service center. Someone pays a set monthly access fee, plus a cost per mile or km driven. When a car is ordered, it drives itself to pick up the subscriber. The cars charge on the racks when not in use (or could act as load levelers for utility company). Tesla would need to hire some human staff to check that returning cars are working and clean.

I think that the people who want to own their own Tesla will, in the near term, be people who can also afford housing that has available parking.

The subscription model works better for people on a budget or those who don't want the hassle of ownership.�

1/1/2015

guest I think the simple solution for urban dweller how lack parking with charging is the Supercharger network. Recently Tesla has placed a ten stall station at an urban shopping center called Atlantic Station in Midtown Atlanta. This area is surrounded by high rise condos and appartments. In the time it takes to do your weekly grocery shopping or work out at the gym, your Model S can load up over 200 miles range, which is more than adequate for weekly driving for someone who lives in Midtown. Additionally, destination chargers are going up all over the place.

I consider the urban EV problem technically solved. The rest is just rolling out infrastructure which Tesla is eager to do because it sells cars.�

1/1/2015

guest +1 on this.�

1/1/2015

guest Yep, i think malls are a good solution. They have to place urban chargers at places you normally spend a lot of time anyway. They could also deploy HPWCs at these sites at a fraction of the cost- it's like 200-250 HPWCs for the price of 1 SC. When you go shopping or watch a movie, the car is sitting idle for hozta anyway.�

1/1/2015

guest Customer Rewards Charging

I believe that EV charging will be free, fast and ubiquitous. Here's how.

Shopping mall charging plus 200+ range vehicles can solve the problem of getting a charge. Three things are needed: parking space, charging equipment, and power. The crucial question is who pays for what. With the typical Supercharger set up Tesla bears the greatest financial responsibility. They pay the full cost of equipment and power, even if they are leasing space at below market prices. They are able to get favorable leasing terms bcause they parking lot owner believes that increased foot traffic and visability will enhance sales at nearby stores and restaurants. With destination charging, Tesla pays for the equipment and the land owner provides space, installation and power. Again the land owner is willing to do this because they believe it is in their economic interest to attract patrons. In many cases, the relative slowness of a HPWC compared to a SC works to the advantage of the participating land owner. They desire the patron to remain for a long charge, several hours, and do not want to pay for too much power. In all these situations there is a combination of marketing benefit and cost controls. Businesses will participate when they perceive that there are adequate controls are in place to assure that marketing cost/benefit tradeoff is favorable.

Consider that my local supermarket, Kroger, has a customer loyalty program called KrogerPlus. When my family shops at Kroger, we earn reward points that are redeemable as discounts on gasoline. Depending on how much we shop week can get a discount from $0.05 to $0.70 per gallon. So for a week's worth of shopping I might typically get a reward of $0.20/gallon on 15 gallons, a benefit of about $3 for say $200 worth of grocery sales. This is about a 1.5% reward which is substanial for a low margin business like groceries. Kroger is willing to subsize my weekly gas bill because they believe it motivaes sales and loyalty and because they've got tight controls in place, the KrogerPlus card, to assure that the reward and sales are linked and in balance. Suppose for sake of arguement Kroger thought they could achieve the same marketing outcomes without the overhead of the KrogerPlus card. That is, suppose they just gave everyone a low price on gas under the hopes that customers would stick around and buy their groceries from Kroger. It that situation, Kroger is potentially subsizing lots of gas for customers who never buy anything else from the supermarket. Without direct linkage they simply cannot afford to offer much of a fuel subsidy. Maybe they could offer fuel at cost, but not much lower. So it is that customer reward programs provide the direct linkage and program controls that assure a business will get a favorable return on their marketing dollar.

The logical next step in the evolution of charging infrastructure is to support customer reward programs with all the controls that marketers require. Tesla or a third party could operate a custmer rewards program that businesses as different as supermarket and credit card issuer could participate in. Imagine as a consumer, you have an app on your phone or car that links up with all your customer rewards programs that participate in the charging rewards program. So you've got some reward points from your grocery market, pharmacy, online retailer, credit card, hotel chain, etc. You pull up to a RewardsCharger at a convenient location. The app allows you to access the charger for free. You redeem reward charge points for each kWh or minute of charge. While you charge, the app tells you which loyalty program is providing you with power, how much. The program is also able to reinforce their marketing return by sending you messages, video and audio while you charge. Yes, there is even an opportunity to pay for your free charge by simply being exposed ads. So while I am redeeming my KrogerPlus point, Kroger gets to tell me about wonderful things they have in store for me or they could simply thank me for being a valued KrogerPlus customer and wish me a nice day. Most consumers don't really like being bombarded with advertising media, but it pays the bills. This is what makes TV, radio, and many online services free to access. Loyalty programs are more compelling than simply selling ad space because there is much stronger customer engagement. The reward charging program would harness marketing dollars from a wide slectrum of businesses to provide free, fast charging everywhere. It basically answers the question of who pays and assures marketing controls such that participants can get a positive marketing ROI while subsidizing charging for everyone, everywhere.

Relative to gasoline, I think that electricity is cheap enough that customer loyalty programs should suffice to cover the full cost. This is important to consider in light of recent downturn in gas prices. One thing that's always better than cheap gas is free, fast charging.

My belief is that this sort of rewards charging program is inevitable. A company like Google could make it happen in a heartbeat once they perceive the opportunity. And such a program would definitely accelerate the transition to sustainable transport regardless how cheap gas might become. So it remains to be seen if Tesla will want to lead in this direction or wait for Google or someone else to beat them to it and define the parameters of the program.�

1/1/2015

guest I agree with Robert's key point that at the Model 3/Y's price point and practicality it'll be hitting suburban commuters where the low cost of operation, ownership exoerience and driving characteristics will have great appeal. I know that I'm hoping that it'll come in on target.

(I'm not suburban, but I'm an intercity commuter.)

Ultimately, yes, if they want to go beyond 500k per year they'll want to resolve the multi-unit dwelling problem, but that it is not really a major technical obstacle (although I think Tesla should tackle it). The next generation of PEVs will raise awareness and demand and then market pressure will get landlords and management on board and there could then be a rapid rollout.

It's on-street parking that's the real challenge, but I think that'll be overcome with a structured, government and utility-supported appraoch. By the time that's a limit on growth Tesla will either be gone or have a Chinese partner that'll be heavily supported by the Chinese government.�

1/1/2015

guest Paris (France) already has street charging for EVs. They look something like parking meters, very simple. Parking at those spots is limited to EVs while charging. If these spots were ubiquitous, it would open EV ownership to those who rely on street parking. Charging in parking structures is already well on its way, and NYC now requires newly created spots to be set up for future installation of EVSE.

@jhm, interesting ideas re loyalty points. While this could be one viable model, it can't be the only one. Real city dwellers don't shop reliably at one or two big stores, but instead patronize lots of little shops. I don't think free charging is essential to the success of EVs, though; it's charging everywhere? that's essential. And by "everywhere" I mean places that one is likely to spend an hour or more.�

1/1/2015