1/1/2015

guest Who is going to provide additional money to keep Tesla Motors operating?? A company needs to be cash flow positive or it will die on the vine.�

1/1/2015

guest As long as Musk talks about the GF, has good excuses for Model X, and shows nice photographs of the Model 3, the stock will go back up to $280.�

1/1/2015

guest Then why are you shorting it?�

1/1/2015

guest Correct. Yay.

... and with good reason, since there is a track record of follow-through.�

1/1/2015

guest Just invested in more TSLA. At today's price it's a bargain. I started buying a few years ago, though long after it broke $100. I plan on holding on to it for many years. I think short term investing is almost always a poor strategy.�

1/1/2015

guest Ever heard of massive sarcasm?

- - - Updated - - -

Tesla is crashing back to earth like every massively unprofitable, underperforming bubble stock.�

1/1/2015

guest Was this an example of that?

Oh. I guess not then.

Sarcasm works best, it seems to me, when delivered with some hint that way. And a dash of humour won't go amiss either. I haven't followed your persona closely enough to catch such a drift on a mere few words.

You may take that as constructive critisism if you like. :wink:�

1/1/2015

guest I actually believe this will happen within the next 6 months. But if not, that's fine as well. I have to say that the timing of your short position has been very good. Hope you don't wait too long to cash in. Maybe take some off the table along the way?

Eventually Tesla will get the Model X ramp going, and they have plenty of orders, so its simply a matter of getting the cars produced.

They are still producing and selling a lot of cars. Worst case scenario they either have to hold back a little on the timing of their growth, or do another investment round. Neither is the end of the world.

I would love to buy in around $100 to lower my cost basis. Maybe that is not impossible after all? I doubt it will happen, but its not out of the realm of possibility.�

1/1/2015

guest What is the stock of Tesla worth? I am trying to figure out how to invest profitably. Thank you in advance.�

1/1/2015

guest I'm sorry, but that made me laugh out loud. No one can answer that question, only predictions based on a future yet to occur. This thread along with the blind faith price targets thread is a good place to start. A lot of long-term scenarios are discussed in the short-term thread as well.

Blind Faith Price Targets

Short-Term TSLA Price Movements - 2016

You can also search for the 2015 short-term thread. I would recommend reading the quarterly shareholder letters and listening to the quarterly conference calls, as well as watching some of Elon Musk's and JB Straubel's videos on youtube. Long-term, Tesla has the potential to be the world's most valuable company or go bankrupt.

Welcome.�

1/1/2015

guest 75% chance you are responding to the reincarnation of valuationmatters�

1/1/2015

guest Haha, you may be right. In any case, it was worth delaying the cleaning that I would have otherwise spent that time (and this time) on. �

�

1/1/2015

guest I assume you are making a joke...�

1/1/2015

guest Gotta love some of the post over at the short term thread. Once short term traders make the wrong bet they start to blame everyone up to the CEO; of course they blame everyone but themselves. It's a hard learned lesson when trades don't go your way, but I've said it before-short term are for gamblers. Sentiments change quickly and in a matter of minutes a positive or negative note can blossom out of thin air. It's in your judgement to either weather the storm, cut your loses or join he bears and Fudsters.. Plan accordingly folks. The story of this company hasn't changed. I've been wrong on many occasions, but guess what? I can afford to be wrong as I have a long term plan.�

1/1/2015

guest Some of us know the answer to your question, but we're not allowed to tell. Sorry.:wink:�

1/1/2015

guest Actually it's priceless. And depending upon your assumptions that can mean either of two extremes and anything in between.�

1/1/2015

guest Regarding the long term outlook for Tesla:

Here in Norway, diesel cars were just banned from county roads in Oslo on particularly polluted days. Diesel cars comprise approximately 45% of the cars in Oslo or 127k cars. Plus you have a lot of commuters. We're probably only talking about less than 5 days a year, but still, I think this will really affect diesel sales, for the benefit of gasoline and electric cars. People generally want cars they can drive whenever they want.�

1/1/2015

guest I've said this before, but regarding the long-term outlook for Tesla:

The strong points:

-- The cars are great and will keep selling very well

-- Electric cars are just better than gasmobiles and will take over the world

-- I am not worried about technological 'teething issues'; even replacing 20,000 drivetrains will not cost that much really

-- Tesla has built up a fearsomely valuable brand and will keep leading in electric cars if they don't trash the brand

-- Tesla is way ahead of everyone else on several key design points

-- Tesla is way ahead of everyone else on the supply chain for electric cars

The weak point is the "soft side" of the company: communications and service

-- External communications are bad: unreliable and unhelpful

-- Internal communications are terrible; left hand doesn't know what right hand is doing; probably creates external communications problems

-- Legal department doesn't seem to do its research

-- Software department seems to be a black hole which never says anything to the service centers

-- Service has lots of individual good people but corporate policies are all over the place

-- Bait-and-switch on ranger service

-- Insufficient geographic coverage of service centers, creating entire regions of the country where people will either not buy the cars or be angry about lack of service

Elon's an engineer. He needs to hire someone with a complementary and completely different skill set (communications major or humanities major) as Chief Communications Officer, focusing first on internal communications, but also with the power to veto sudden external policy changes or press releases which have a likelihood of damaging Tesla's reputation. At the risk of sex-stereotyping, probably a woman. If he doesn't figure out how important this is, it could be very bad for the company.

This is not investment advice. Take of it what you will.

- - - Updated - - -

It's worth the future earnings, computed for each year, added up, (possibly plus the long-term steady value of capital) and discounted to the present day by the effective interest rate of your default alternative investment of choice. It's up to you to figure out what those future numbers are!�

1/1/2015

guest GAAP vs Non-GAAP question:

I understand that Non-GAAP accounts for all revenue realized for that period, while GAAP financing is force to spread out the leased figures over a longer period of time. (Feel free to correct this understanding if I'm wrong, as I'm just learning this part of things.)

The question is, are the number of vehicles delivered per quarter representative of all vehicles (Non-GAAP style) or all non-leased deliveries only (GAAP style)?

Let me also mention the reason for my questions. I'm trying to track the figures (like many here) and there were about 11,580 vehicles delivered in Q3 of 2015... with a GAAP revenue of $937m and Non-GAAP revenue of $1,244m. In that report it also stated there were 494 vehicles leased. So, what is the accurate ASP (average sales price)?

Would it be:

$937m/11,580 = $80.9k

$937m/(11,580-494) = $84.5k

$1,244m/11,580 = $107.4k

$1,244m/(11,580+494) = $103k

Another reason I'm asking is because this could change the real number of vehicles produced (if the last option above).

Thank you.�

1/1/2015

guest I made a comment yesterday on a thread that I started in July last year, Long TSLA, but bearish next six months. The title of that thread is now outdated and there's not much traffic on the thread either so I'm moving the comment here. Per below, the key question for me in the next 6-12 months is the durability of Model S demand. Any feedback on thoughts below appreciated.

@uselesslogin -- Good timing! I was just considering updating this post. Because of valuation, my bias for the next six months and beyond is now positive (though I would not say that I'm loading up, but I'm interested in feedback from others on this thread per my questions below). Assuming the company was profitable so that stock option dilution would be calculated into the fully diluted count, I think Tesla has about 147-148 million shares out. At $176, that's a $26 billion cap. If the stock fell another 30% from here, it would be valued at $18 billion. I think $18 billion would be a very compelling value for Tesla right now. Even with a scary, unanticipated hiccup on S sales, the company should get to $8-$10 billion revenue run rate in the next couple of years with lots of growth potential thereafter. Less than 2x sales for a company with very good prospects for profitable growth long term certainly seems like a compelling value. In short, there is still potentially downside from here near term, but I think that downside is in the 30% range (not 50%+ which is where I think we were six months ago).

Per @uselesslogin's comments above, I certainly did not get the reasons exactly right six months ago, but I don't think I was entirely off either. Together with a high valuation, my biggest concern was a temporary flattening or softening of model S sales in the shadow of the model X promotion and introduction (particularly given that even a successful X launched would result in low margins on those sales temporarily). This obviously did not happen as Model S sales were extremely robust in the second half of the year. At the same time, I don't think the concern was entirely unfounded as I think this is the reason that the company launched its very successful referral program in the fall -- it decided it needed to pull a demand lever and I think it's reasonable to guess that concern the X launch might negatively impact S sales had something to do with it.

From a fundamental standpoint, I think S sales growth in the next six months is still the key variable. The delay in the X ramp means that we are only somewhat farther along than where we were six months ago, just with a better valuation on the stock. Tesla needs continued robust S sales to support the profitability and cash flow of the company in the next six months. On demand outlook for Model S near term, I simply don't have a lot of conviction, but I'm curious as to the opinions of others on this forum. On the one hand, the response to the summer/fall referral program was pretty awesome (as was demand in Europe). On the other hand, the fact that Tesla came out with an enhanced financing deal recently seems like they are still pulling levers to ensure consistent demand and I'd rather see evidence of strong demand without the need to pull levers. We'll know more after the conference call next week for sure. But again, I'm curious as to what others think about the demand picture for the model S (next 6 months to a year).�

1/1/2015

guest Well, there's your problem. Where the hell are you getting 8% risk-free bonds? Sure, if I could get 8% interest in government bonds, Tesla *would* be overvalued.

Try it again with a 1% or 2% discount rate.

And I'd honestly like to see your results. I want to hear any reasonable bear case, because I might tend to be optimistic.�

1/1/2015

guest He's dead, Jim.

(I spotted his reincarnation the other day, though, so you'll have a chance to reengage the zombie if you really want to.)�

1/1/2015

guest I'm not sure I'd consider the referral program last year the same way you did. From my understanding, they are looking at ways to lower the cost to sell a car, as their current way could be fairly expensive (retail space, hired employees, etc.). This is not to compare it to traditional model, but just to look for ways to reduce the costs further.

Also, with the growth of sales in Q4, and the future potential of newer markets (like China), I'm not worried about the demand for Model S just yet.

In the short term, I think the biggest risk is being able to ramp up Model X quickly. They had difficulties with Model S in the beginning, and repeating it with Model X provides a poor expectation for management and execution capabilities... even with so many successes under their belt.

As for my expectations, I believe they will have about $8b in sales in 2016, leading to a $40b market value (assuming 5 times price/sale). With about 130m shares, that puts the price of stocks a year from now at about $308. Not a bad bump up from now. But, those are my guesstimates. �

�

1/1/2015

guest For fully diluted shares out, see the third quarter press release. For the three months 9/30/15, the diluted shares out are 142,747 on the column that shows profitability. However, that calculation is made without the full weighting of the new shares from the offering, which took place in the middle of the third quarter. Including all of the new shares from the offering, recent stock options issuance, and a higher stock price consistent with your 40 billion cap target, the fully diluted count should be more like 148-149 million, not 130 million. Assuming your $40 billion cap estimate is correct, the stock price would be $268 rather than $308 -- still a nice move from here, but a difference nonetheless.

On the more important issues, the bad news on the X roll-out is already baked into the current stock price. I guess it could get worse, but I'm assuming the incremental news there will be positive rather than negative. I do think the timing of the referral program was intentional, but regardless of the reason they got a sales lift, which they will be comping against fall 2016. Also, why offer a better deal on financed cars recently if there is no need to try to increase S demand? If I had more confidence on the durability of S demand over the next two years, I would be very bullish rather than simply positive on the stock at these levels.�

1/1/2015

guest OK thank you from a newbie.�

1/1/2015

guest I think both the referral and the recent discount on lease are methods employed trying to compensate for the slow ramp of X. Ideally, X would have picked up the growth last year but it turned out needed another quarter or two. To make up the growth, they had to push for more S sales, thus all those incentives. I don't think the natural demand for S is 17k per quarter right now. It will get there, but may be next year. It's just because they're missing probably 4 or 5 k of X per quarter for the last and maybe 1 or 2k this quarter so that they have to give some steroid to S.

�

1/1/2015

guest Is it Okay to look what I wrote less than I year ago, when TSLA was a little below 200

Long-Term Fundamentals of Tesla Motors (TSLA) - Page 250�

1/1/2015

guest I don't understand what you are saying. 4 months after that post we were around $280. So buy now and sell in June? Or are you concluding that you were right in the long term? I mean I would argue the jury is still out on that one. You have to wait at least until the end of the decade there. Or just telling people not to buy in? I mean heck, it has only underperformed the S&P by 4% since that post and only 2.5% behind the NASDAQ. So certainly that was not a particularly great time to sell. I mean I guess one would have theoretically been better off selling then and buying now but not by much.�

1/1/2015

guest My point is the same as it was in that post. Don't fall in love with some stock. They are all the same. Don't putt all the eggs in one basket.

Btw now that I started to dig my old posts I also found this which was posted almost two years ago

2014 1 QTR predictions/results - Page 18�

1/1/2015

guest Well that is fine - that makes sense. Of course you could have repeated that at the highs as well.�

1/1/2015

guest

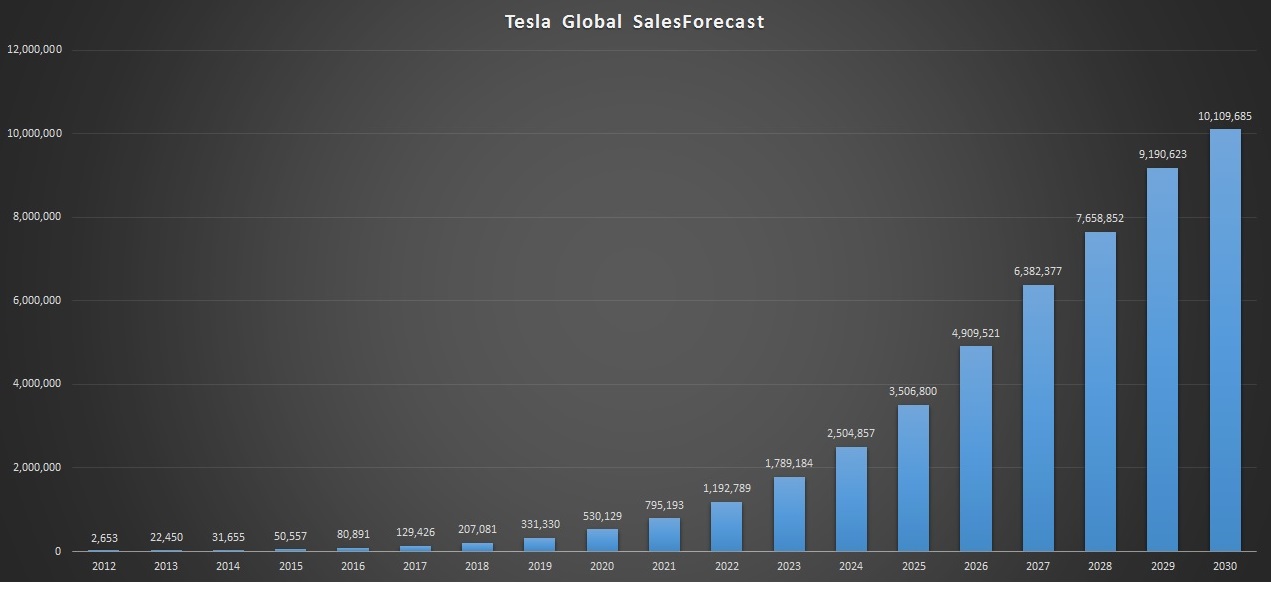

As a new buyer of Tesla stock ($180, $170 and $160) and a future Model 3 owner. I would like to share my sales forecast for 2016-2030 and general thoughts. Tesla is a tiny company, expensive based on today's revenue and free cash flow (FCF) or lack thereof. However Tesla has entered into a very, very large market of ~100m cars/trucks globally not to mention the power side of the business which could be even bigger total market opportunity. I believe one day it will be one of the greats. Should be an interesting ride. Load up if the stock gets to $120-$130 range and close your eyes till 2025. It is so tempting to go very aggressive into this stock at $150-160 but I fear the current market conditions it's going lower before it can stabilize and resume an uptrend. The slow ramp of the Model X may be the only excuse needed to drop substantially after earnings. As is well known Tesla is in risky period where they need access to large amounts of capital to build a base to be self sustaining. It is important in 2016 they transition into being self supporting through FCF once the Model X get's into volume production.

Long term Tesla should be a winner. Short term looks a bit dicey.

To give an idea what it will take factory wise to rival someone like Toyota who topped 2015 sales at 10.15m cars and trucks. Kind of humbling to see Tesla with only one primary factory in contrast to Toyota's global operations. They are just a baby just learning to walk among lumbering giants.

http://newsroom.toyota.co.jp/en/corporate/companyinformation/worldwide�

1/1/2015

guest

From an interesting SA article How Will We Fuel All Those EVs? The Coming Energy And Transportation Disruption

http://seekingalpha.com/article/3870626-will-fuel-evs-coming-energy-transportation-disruption�

1/1/2015

guest I was wondering what the fair price of TSLA is, and whether I should be worried about my investments or be confident that it's a good time to buy. With that in mind:

What happens if TSLA never grows out of the small niche player it is? Suppose they stop the high amount of CapEx associated with the Gigafactory, Model 3 etc. If they only manufacture 100K cars/year (something that is easily achievable in the next 18 months).

Say 50K Model X/S split @ ASP of 100K going forward and a 10% net margins... That would mean a yearly profit of 1B, or an EPS of ~$7... If they weren't ramping up aggressively there would be no need for additional capital, and therefore no more dilution. Even with a conservative 15x-20x multiple for TSLA, we get $105-$140/share.... That means we are quickly getting to the point where the stock is no longer pricing in the success of the gigafactory, model 3, energy storage and any new business that Tesla comes up with.... It's a great time to buy if we fall another $40... But at the same time, it doesn't give me a lot of confidence that my calls will recover any time soon.�

1/1/2015

guest There were some recent postings suggesting the recent decline of TSLA has not been significantly out of line with that of more-or-less comparable firms. I spent a little time thinking about this, and the most easily-manipulated - innocently or insidiously - datum for such would be the start date.

In my opinion, the most appropriate date should be that of TM's most recent capital raise. Shares are, of course, fungible but for sake of investor sentiment we can posit that these "newest" shares differ from more "battle-hardened" ones - certainly the specific investors who were the ones to pick up the new shares all bought in at one specific price.

TM sold 3.099mm shares in mid-August at $242; (net $238 and change to TM for a total capital injection of $738.3mm).

I compared the fortunes of those shares against those of other tech firms - not auto stocks. For the period ending Friday, 5 Feb 2016 we have, in rounded numbers:

TSLA -33%

overall market:

S&P 500 -5%

large-cap NASDAQ:

NSDQ 100 -10%

overall NASDAQ:

NSDQ Composite -15%

Top tech stocks...plus one other....

GOOGL +5%

AAPL -17.5

LNKD -33%

Again - this is from a specific start point but it is, I would argue, an extremely important start date. Ouch!

Six months is not a long holding period for many investors but not only is it for others but most of the fund world takes two quarters' worth of performance very seriously. And that large an underperformance from a secondary issue is very, very serious indeed.�

1/1/2015

guest Thanks for the link to my article! I had another article submitted to SA about Tesla's Model X ramp but unfortunately the editor is very picky about positive articles. I'll post it to my blog at some point today.�

1/1/2015

guest Dalal, Where is your blog? I'd be very interested in detailed analysis of X ramp. Thanks�

1/1/2015

guest They will try very hard to not become a nice manufacturer. And if they fail I suspect they will go bankrupt and be worth only what another manufacturer wants to pay for the assets they have. But they will have massive debts at that point. I don't think it makes sense to find a floor for the stock based on that. To some degree Tesla is dependent on the stock price too to be successful.�

1/1/2015

guest It is at S1dd.com | My Blog About Finance, Renewable Energy, Technology, Food and everything else - though that is not a detailed analysis. More of a its a no big deal long term.�

1/1/2015

guest Here's something that's been bugging me for a while, maybe folks here can explain. Elon's/Tesla's stated goal is to advance the transition to EVs by making compelling electric cars.

Ok, so how does autopilot advance this? Autopilot and it's sensors and software has almost nothing inherently to do with EVs. Computerized ICE throttle control is pretty advanced, there's not much EV advantage there to be had from the autopilot point of view. Everything else, brakes, sensors, steering, etc has nothing EV specific. Autopilot research projects have been done fairly extensively over years on non-EV cars.

Regardless, let's assume Elon thinks autopilot is the next huge differentiator in auto transport. Let's say Tesla succeeds and creates a really compelling autopilot in a way that moves the market. Doesn't that encourage other manufacturers to pursue autopilot? And if so, isn't that taking focus away from their transitioning to EVs?

If the goal is to push EVs, then Tesla should be taking all that money on autopilot and instead pushing the R&D on batteries and manufacturing even further, driving costs down, expanding their product line down market (e.g. 3 and Y either faster and/or released closer together) and creating completely dominant EVs. Push the market to understand that EVs are the dominant must-have feature. Make the market follow into the EV category.

I get autopilot is really nice and will, someday, be a key feature of every car, but I can't understand how Tesla's push for it now can possibly help their EV mission statement. If it wildly succeeds, it takes away the impetus for other manufacturers to get on the EV bandwagon and instead focuses them on autopilot. If it fails, it's an anchor or money pit holding Tesla back. If it's only a partial success, its payback time is measured in what, a decade? And what's the opportunity cost, the money that didn't go towards advancing EV-specific technology? There's no scenario with autopilot I see that advances the EV transition. I suppose from a purely financial viewpoint, a wild success at least gives Tesla a leading position in a future autopilot-focused market, keeping them alive to hopefully eventually get back to advancing EV adoption.

Any ability for autopilot to advance the EV cause seems tangential at best. If Elon wants to advance it, form a startup spin-off that has it's own VC funding. Hell, he could even be on the board...wouldn't be any different burden on his time than now since he's supposedly having autopilot report directly to him now.

So...what am I missing? Can someone make the link that pushing the market's adoption of autopilot somehow pushes EV adoption?�

1/1/2015

guest

When the model S came out, a big criticism of a premium car at that price was that it lacked features less expensive cars had. Elon always wants to be a leader in technology and he sees that doing that forces the rest to go along. This is especially true with the electrification of cars, but all aspects of building a superior car are included.

So the state of autopilot is now defined by what Tesla offers and it is no longer lagging any other auto company. I think that makes it a very significant feature that must be constantly leading edge when compared to the others. If someone wants a car with the latest safety and technology features, they have to buy Tesla. To me, that is a pretty compelling reason to advance autopilot. And if it is included in model 3, it puts Tesla so far ahead of the competition that comparing at equivalent prices makes any other wannabe a joke.�

1/1/2015

guest Tesla also needs to compete with existing ICE and almost everyone is working on something like autopilot right now. Tesla saw this as a coming technology and decided to get ahead of the curve, which they did. I suspect Tesla looked at what they could buy off the shelf and they probably felt they could do better. The Model S got hailed as the safest car every tested and that myth was pretty much put to bed, but active collision avoidance systems are becoming common in cars and will probably become a standard feature soon. Tesla had to do something, so why jump in on the tail end of the curve when they could move to the forefront with just a little more effort.

In effect autopilot has become another compelling selling point.�

1/1/2015

guest I think it has less to do with keeping up with the other auto manufacturers, than it does with putting together a set of technology that will, at some day in the near future, significantly shift the way people drive. I think this has to do with more than just calling your own car to you from your garage. More like the shared vehicle concept, etc. Seems to be going towards helping to electrify the vehicles and also to reduce congestion/traffic...

Maybe I'm thinking too much into this, but I think this tech has a huge impact on the success of Tesla, and where the whole industry moves in the future.

All that said, there is no way I'm giving up driving my own Tesla!!! �

�

1/1/2015

guest It could also be as simple as Elon wanting Tesla to make the safest cars in the world, and an autopilot that is statistically safer than a human driver helps make that happen.�

1/1/2015

guest Elon wants to make the most compelling cars -- only EVs of course because electric drive is the best -- on the market and offering Autopilot is part of what makes cars compelling, in his opinion. I agree. Autopilot right now, essentially "V1", may not be compelling to everyone, but you have to start somewhere. Many people find it very useful, and it will improve rapidly over the next few years, to the point where many more people will begin to think of it as "essential".�

1/1/2015

guest Ok, let's take that as a given. It certainly helps advance autopilot. My question is/was though, how does that help advance EVs?

If everyone thinks they have to focus their R&D to match Tesla's autopilot to compete then...well...they're not trying to advance their own EV programs and that is Tesla's mission statement.

I'm not dismissing the value of autopilot. I guess I'm questioning Tesla's priorities relative to their mission statement. Unless Tesla's given up on that mission statement I suppose.�

1/1/2015

guest Assisted safety is a huuuuge benefit, and differentiates the product and increases the moat.

moreover it might even give them pricing power in an industry that is very competitive�

1/1/2015

guest Tesla advances EVs by selling cells. Tesla has to compete on amenities, and driver assistance is something that companies have been working on for quite some time. Tesla were able to gain an advantage by taking risks with Autopilot that other manufacturers would not take.�

1/1/2015

guest Tesla has not "given up" on its mission statement. Again...Tesla wants to make the most compelling cars available. A key part of that is that they be EVs because that supports Tesla's mission. But a key part of making a compelling car is offering Autopilot, as I posted just up thread. Elon believes that in the not too distant future essentially all new cars will include or have autonomous driving as an option. So to keep up and make sure that Tesla offers compelling cars, developing and improving Autopilot is critical.�

1/1/2015

guest Ok, that makes sense, except Tesla isn't trying to "keep up". They're trying to lead and dominate. They've self-admittedly done and/or are doing a huge ramp up in hiring for autopilot. Elon's said so in tweets and interviews and said the autopilot team reports directly to him.

It's almost always much cheaper to get parity than it is to lead. It's the 80/20 rule in software where you get 80% of the benefit with the first 20% of the effort. Being the leader, pushing that R&D envelope, is expensive. I'm a software developer for 20 years now, I've been in that discussion over and over when features come up. "Is this a core part of our mission/product?" Yes, we lead. No, we buy/follow. Deciding if it's core...well, that can be hard and, sadly, incredibly political (company politics, not global).

Also, from a software viewpoint, detection is typically that 80% rule. Step 1 isn't that costly: detecting blind spots, detecting lane drift, and so forth. Step 2 where the software takes simple direct action is harder, but still relatively straight forward: if X is in front of the car, engage emergency brakes. Step 3, autonomous decision making (often called "self healing systems" in my world) is MUCH, MUCH harder. Huge software R&D expense.

Tesla had already made a compelling car, winning awards, leading sales in their class. Reaching parity makes sense to maintain that lead, showing that an EV is better and has no sacrifices. Doing that "Step 3" level of autopilot...I don't get how it helps. Tesla is constantly stating how they're production constrained. Well, spend that Step 3 money on taking care of production issues! They're always saying how the world will need multiple Gigafactories, how they're already sold out well in advance for Powerwall stuff. Fine, spend that "step 3" money advancing those items! Start lining up that 2nd gigafactory or pushing the first one faster.

I understand what people are saying. Safety, parity, those all make sense. What doesn't make sense to me is trying to dominate in an area that's not core to their stated mission. If Tesla was a normal ICE vendor, I could see it since it'd be what differentiates them.

Batteries, producing more EVs, leading those are all core to the mission of sustainable transport (and generation/storage). Leading on autopilot as core to Tesla's mission?....

Someone mentioned Tesla's big autopilot push as a "moat" around their product. I'm looking to see Tesla honor their mission statement of advancing sustainable transport. If Tesla can't keep enough "moat" to thrive by focusing on their core mission, then it seems like they've got the wrong mission.�

1/1/2015

guest re: Why Autopilot: Elon's view is that within about 10 years any car that can't drive itself will be seen as a quaint piece of nostalgia.

So in his mind 'Car' and 'Self Driving Car' are the same thing.

So Tesla start working on it. But due to their software/Silicon Valley approach and the advantages of an all-electric foundation, they realise they can hit it out of the park and do it much better than everyone else. They have so many advantages: always-on cars, software expertise, internet connected cars etc...

Seems to me non-electric cars are going to be at a distinct disadvantage on self-driving as the sensors and AI components get more numerous and complicated and need more power.�

1/1/2015

guest Their mission is "to accelerate the advent of sustainable transport by bringing compelling mass market electric cars to market as soon as possible."

https://www.teslamotors.com/blog/mission-tesla

Yes, you are right in that Autopilot do not have anything to do with EVs in general, but it does have something to do with "compelling (mass market) (electric) cars". They want to make EVs that customers may buy - not because they are electrical but rather in spite of that they are. This is why they make cars that are "insane" or "ludicrous" fast, and why they want to lead in automatic driving.�

1/1/2015

guest The way I see it, just about every car maker is working on some kind of autopilot right now. Tesla could have developed a system that puts them on par with Subaru and a few of the leaders and that would have been cheaper, but they would have been behind the curve in about two years because it is an area where the technology is advancing very quickly. They chose to bite the bullet and jump to the forefront, even though that was more effort.

JB Straubel has made a point in one of his talks that most car executives are afraid of software. When they were developing an EV compliance car with Mercedes, the engineering department refused to trust the software to prevent the motor from doing something too extreme, so they insisted on a big steel bar to prevent the motor from going too far. Tesla's solution was to be careful writing the code so that problem would never arise. Tesla trusts software more than other car companies, so they trust they can make an autopilot system that is more capable than the rest of the industry who spend a lot of time with CYA that slows everything down.

I do see your point with the last 20% taking the bulk of the effort. I've been an R&D Electronic Engineer/firmware/software guy for over 20 years. The low hanging fruit is the easy part to develop, going a step beyond is what costs you.

Ultimately it's probably all driven by Elon Musk's perfectionism. He's a big thinker and wants to do big things. A big factor in the Model X delay was the falcon wing doors which Musk insisted on. The door handles on the Model S was another thing that caused delays and was a pet sub-project of Musk.

In the end, Tesla is becoming a leader in self driving cars, which is a valuable asset.�

1/1/2015

guest Yes! Furthermore you hit multiple demographics with Tesla's combination.

Model S/X with AP: More established, likely older demographic who are funding the company (now and foreseeable future).

Future,

Model 3 without AP: Younger who want the Tesla performance in a package they can afford.

Model 3 with AP: Younger who want above and to be able to age with the car; and older with less resources, but who want to stay reasonably mobile with AP.

As stated by others, Tesla's AP is defined by it's ability to grow over time. So you are not stuck with yesterday's software technology. Considering how younger folks are more tech savvy I can understand Tesla's appeal to the next generation of car buyers/users since it constantly updates. That's what appealed to me. Could have got a Mercedes, Volvo, Audi, etc.. with similar features, but then would be stuck with what is out there now, and out of date tomorrow.

Furthermore, I am always impressed by the youngsters (12 year olds) commenting on Youtube or Reddit posts, and their passion/desire to own a Tesla. They will be the future of Tesla. I still remember my first ride in a BMW, and how I was impressed by it. I went on to buy BMWs when I could afford it for 10+ years.�

1/1/2015

guest I would say Tesla will make one of the most advanced self driving cars with several others, but definitely not years ahead of others. BMW's new 7 series knows all autopilot tricks that Model S/X knows except auto lane change, but it's not a big deal to catch up with that. Same story with MB's new E-class or Audi. They are really in each other's ass in respect of AP development, so I don't think this is gonna be crucial in the future.�

1/1/2015

guest Full autopilot does have something to do with EVs. EVs can go charge themselves over wireless charging spots or with some solution like the Tesla snake thing and chargers can be installed anywhere in any parking spot. Not so with liquid fuels.�

1/1/2015

guest I have a feeling that auto-pilot systems will end up on every car, because they will prove themselves to reduce the number of and severity of collisions, and the result will be that insurance discounts will offset a significant part of the cost.�

1/1/2015

guest I like the AP discussion, but can we bring this conversation back to the Long Term Fundamentals for TSLA?

I think $5,489! (okay, just trying to get attention...) :tongue:�

1/1/2015

guest I agree with you, HiTech. It was an interesting discussion, but I wanted to hear what long term investors were saying about the current sale on TSLA stock.�

1/1/2015

guest I'd say buying opportunity if you have the funds. I mean nothing fundamental has changed with the company since a few weeks ago, and if back then someone told you they had some shares for sale under $150 what would you have done?�

1/1/2015

guest If you can stomach some ups and downs this seems like the best opportunity for long-term investors since early 2013. Short-term problems with X launch and market downturn have created a great opportunity for LT investors. Added to my shares Friday for first time since 2012.�

1/1/2015

guest It is an interesting discussion overall for TSLA. They are fledgling = True, they are innovative designers =True, they are disruptors to the norm = True, they have convinced me of the VALUE of the product being a Model S owner.! Couldn't be happier but I look at the company based on standard Technical analysis it simply does NOT justify a share price anything like $US148 at present little own $280.00+. As a recession is upon us ( opinion ) the opportunist in me suggests that a probable fall of TSLA will see around $US101 is the coming stampede to the door during the next recessional crash. Given a new Product Gen3 appeals to a completely new and much large market segment the market share numbers prove meaningless however the company itself needs to be able to weather the recession as I would expect many keen buyers will crash out when their own line of credit dies. Sales of Model S and Model X will collapse for a time - its is inevitable. The real question is has the management factored in this blow in the cashflow. I look at the timeline for introduction and physical deliveries of the newer GEN 3 is likely to drop right in the middle of a recession that will see the very worst case conditions for initial orders. Combined with artificially low crude pricing the combination is very tricky. It doesn't dissuade me from the awe I have for the technology , reliability, lifespan that has been created and to that end I personally want to place orders for 3 x Gen 3's in RHD as soon as available but the key question is will they be there to be able to deliver?

An Aussies point of view.:biggrin:�

1/1/2015

guest Interesting perspective, but the whole point is based on world economy going into a recession starting now and that the oil prices will stay at current levels for another 2-3 years... which, I don't believe... though I could be a fairly optimistic person.

I do think that the fundamentals have not really changed much. Though, I'd like to have a clarity on how well they are executing with the MX release. I believe knowing this helps to understand how well they are able to manage/execute internally, as well as where their focus is for the next 6-12 months period.�

1/1/2015

guest Nobody seems to believe me, but I think oil prices are low right now to hurt the Iranians and the Russians who's economies are dependent on high oil prices. The Saudis are especially focused on getting rid of Iran's regime and the US wants Putin gone (as well as liking the idea of regime collapse in Iran), so they are cooperating to keep oil prices low to hurt those countries. Before Putin showed he was dangerous to his neighbors, oil prices were manipulated to stay high to hurt China. The Chinese were paying through the nose for oil.

I expect oil prices will go up again when Russia calms down and quits being a problem for the Ukraine and hurting China becomes the target again.

Thomas Friedman came to the same conclusion independently (I found this article after I had come to the conclusion the low oil prices were punishing Putin):

http://www.nytimes.com/2014/10/15/opinion/thomas-friedman-a-pump-war.html

�

1/1/2015

guest Just listened to the CC for the Q4 2015 earnings report. We are witnessing the next great American auto company about to take off. I would encourage interested shareholders to listen to the webcast of the conference call (recorded). Tesla Motors, Inc. Fourth Quarter 2015 Financial Results Q&A Conference Call | Tesla Motors�

1/1/2015

guest The company posted significantly higher guidance for next year. I guess we'll see how it plays out, hoping they wont underperform constantly like last year, but only time will tell. The model 3 orders are a good sign, but revenue and EPS could have been better... analysts are uneasy https://www.tipranks.com/stocks/tsla�

1/1/2015

guest If you are referring to delivery guidance? Tesla had not official announced guesstimates for 2016 prior to yesterday & their track record is poor in this area, 80-90k Model S&X delivery guidance was new info.

Typical financial guidance like revenue, EPS etc.. not provided.

New CFO no longer reporting Free Cash Flow & is now using Operating cash flow?

Gross margins?�

1/1/2015

guest I cannot imagine a worse situation than failed states in Iran, Russia or both. You might be right but let's not root for this outcome.�

1/1/2015

guest There is a history of global players mucking about and making things worse. I agree that failed states would be worse than we have now.�

1/1/2015

guest A while back there were mutterings of a European, not German, company that was interested in Tesla tech. Has anybody heard any update on this?�

1/1/2015

guest Perhaps this has been covered previously. Trying to understand this filing.

Tesla Motors - Amended Statement of Beneficial Ownership

Elon has the ability to purchase 8.8 million shares within the next 18 days? According to this SEC filing.

I'm sure the strike price on them are all over the place. But this is interesting. Perhaps the recent price drop over past few months was in anticipation of major "dilution" by him exercising these options. By him making the purchases when the stock was $200 and $150, it essentially confirmed that fear.

I know he's in it for the long haul. But those shares coming into existence + a corresponding decrease is stock value lessens the actual market cap reduction, correct?

Perhaps that explains some of this. Or I'm wrong? Help me out.�

1/1/2015

guest Yep as I read it thats correct- he would need to raise $1,332,570,337.28 based on the last closing price. Thats a big chunka change!�

1/1/2015

guest His strike prices is mostly in the single-digit $ range...�

1/1/2015

guest

It is still not 100% clear to me if these shares are new shares and will dilute or not.

The SEC filing states :

(a) Amount beneficially owned: 37,193,974 shares which includes (i) options to purchase 8,822,632 shares of Common Stock that are exercisable within 60 days of December 31, 2015 and (ii) 28,371,342 shares of Common Stock held by the Elon Musk Revocable Trust dated July 22, 2003. That can be interpreted as these that these shares are NOT new shares but already exist and will just transfer ownership to Elon.

(b) Percent of class: 26.5% (percentage ownership is calculated based on 131,424,866 shares of common stock outstanding as of December 31, 2015 and assumes that the shares of common stock underlying the stock options are deemed outstanding pursuant to SEC Rule 13d-3(d)(1)(i)).

Maybe someone who knows more about the definitions in these filings can comment.�

1/1/2015

guest related and in support of this discussion in the Short Term thread

-----

Quote Originally Posted by Intl Professor View Post

Here's an interesting article showing how flows and eddys, as physics alone, are examples of evolution. Why don't some of you smart guys apply these insights to markets as he has some interesting views of turbulence and eddies.

Rolling stones, turbulence connect evolution to physics

jhm posted response:

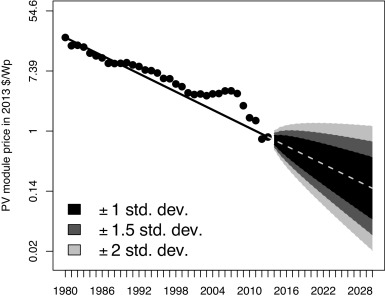

Very interesting. I think this applies perfectly to the idea of an experience curve in manufacturing. This curve shows how the cost of producing a unit decreases at a consistent rate with the doubling of cumulative number of units produced. For example the cost per kWh of batteries declines, say, 15% as the cumulative production doubles. (Not sure 15% is the right rate for batteries, but it is a pretty typical rate.) The cost of a good is the resistance or friction in production. As the cumulative volume doubles, the whole supply chain and manufacturing process learns and becomes more efficient. Imaging each little segment in the larger process also declining 15% as experience doubles. So if this experience curve applies to subprocesses, it certainly applies to combinations of pricesses. So the flow through the entire supply chain gets more efficient and the cost of goods come down accordingly.

One implication of the experience curve is that if annual production grows at about the same rate, exponential volume growth, then the doubling times come at a regular interval. Thus, according to the experience curve the price declines expontially in time too. The exponential decline in price can also encourage consumption to grow exponentially which feeds back to perpetuate exponential growth in productuon. So this is why technologies tend to diffuse at an exponential rate until some limiting factor constrains growth.

So Musk is a master of experience curve processes. At a high level he sees revenue growing at about 50% per year, with unit sales growing 60% or more. If unit sales grow 60% and revenue 50%, this allows unit prices to fall 6.25% = 1 - 1.5�1.6 in a year. Growing production 60% per year implies doubling ever 1.47 = log (2) � log(1.6) years. So every doubling brings about a 9.08% reduction in unit costs. So a 9% experience curve is built into the heart of this company. Tesla Energy will likely have a much faster experience curve than Tesla Motors (proper). In any case, the whole supply chain needs to flow at this pace as well.

It is interesting that bears frequently press the idea that if Tesla wasn't demand constrained, it would be growing faster. This underestimates the challenge of growing an entire supply chain along with Tesla's own manufacturing at rates above 50%. The growth in production needs to be balanced with achieving something like a 6% annual reduction in production costs. To try to grow faster can inflate costs in the short run and make doubling times harder to reach. This is fairly abstract, but I do think that Musk has given careful thought to setting a sustainable pace of growth for EVs. It is ambitious to be sure, but also careful not to try to grow too fast. The rate at which Tesla can grow and the rate at which it can reduce costs are linked.

So Tesla is freely flowing and evolving. Steadily declining production costs are the fruit of doubling cumulative production.

--------

A very extensive study newly released by Oxford would confirm this assertion.

With a migration of battery to Super-Capacitance storage, along with quantum solar solutions in the pipeline, I believe in 20-30 year timeframe electrical-energy will be a near-free commodity.

How predictable is technological progress?

�

�

1/1/2015

guest Not sure if this has been posted yet, but Tesla finally has the Tesla.com domain. When you search type in "Tesla.com" you'll be redirected to "Teslamotors.com". Hopefully Tesla will shift to Tesla.com and this will be significant as we all know that Tesla is not a car company after all.�

1/1/2015

guest I am an �extinguished professor� according to my Thai born wife. My primarily teaching assignments for over forty years were Soviet government and foreign policy, American foreign policy. Ph.D. fields included international economics, etc.

I couldn�t agree more and your comment reminded me of an old Russian proverb which goes something like this: �if you tangle with a bear you must be prepared to kill it.�

I give Obama generally good marks, and when a retired CIA director says he could not believe the concessions the Iranian�s gave to Obama, that�s very high and credible praise.

On the other hand, when he drew a red line on chemical weapons in Syria that was a mistake and he had to be bailed out by Putin of all people.

Another violation of the proverb�s advice was the hint Ukraine might become a part of NATO. There was a time under Gorbachev when he wanted to be a full-fledged member of NATO which was rejected and only partial relations were formed later but are defunct now. Obama�s assistant secretary for East European Affairs was caught using her cell phone in a Kiev square with rioters protesting the president who was forced to resign. Moral: don�t be caught by a KGB intercept of your cell phone while serving borscht, or whatever, to people who want to overthrow a country�s government on the border with a country that can start a nuclear war in a twinkling. This is not to condone what Russia is doing in Ukraine. I�ve travelled in both countries when they were both part of the Soviet Union and the locals seemed to get along with each other well enough. My Russian teacher, for example, was a Ukrainian and I was once asked where the post office was by a Leningrader, so his accent must have been pretty good.

Speaking of borscht. One of my colleagues was of Ukrainian extraction and at a party with the students� Russian club he waxed on about how his family had invented frozen food. �In the winter we would make a lot of borscht, then put it outside to freeze so we would have some later when we wanted.� Drunk as he I asked, �is that the origin of the expression��don�t eat yellow borscht?'� He didn�t think it was funny, obviously not a skier.�

1/1/2015

guest I have a question on the book value for the superchargers. According to the annual reports

As you can see, the average net book value for a supercharger location increased this year dramatically, from under $300k to nearly $600k. Anyone care to speculate why that is? Tesla also plans to open another 300 locations, would it be correct to assume the same average cost as in 2015, approx $175M over the full year?

When

Locations

Book value

Total cars on the road

Cost per car

end 2013

90

$25.6M

25100

$1020

end 2014

380

$107.8M

56780

$1900

end 2015

584

$339.2M

107440

$3160

Finally, looking forward, we can see that the cost per car sold is up quite dramatically each year. Assuming an additional outlay of $175M this year with an extra 80k cars sold, the average price per car sold for the supercharger infrastructure will be around $2700. Is it reasonable to assume Tesla is able to absorb $2700 additional infrastructure cost per model 3 sold? If not, what would a reasonable cost be?�

1/1/2015

guest Please add one (or two) more important column: "Chargers" (and "Cost per car/charger").�

1/1/2015

guest I'd love to and I could explain the big rise in cost per location but I am not aware if that information is publicly available for the different years?�

1/1/2015

guest Speculation:

- pulling numbers out of their frunks

- Superchargers build-out rate is ahead of demand

- Installation and operating costs are falling so they've reduced value to recognize that the network isn't as valuable.

- Basically halved the value per location.Code:Year Locs Book Book/Loc 2013 90 25.6 3.515625 2014 380 107.8 3.525046382 2015 584 339.2 1.721698113�

1/1/2015

guest Incremental book value / incremental station went :

end 2013 - 284k

end 2014 - 283k

end 2015 - 1134k

I've seen lots of reports of stations being upgraded to more chargers - especially in Europe.

Not sure how much this expains.

ItsNotAboutTheMoney you have your fractions upside down, unfortunately. They've almost halved the loc/book value :/�

1/1/2015

guest As of today they are showing 602 SC's with 3,519 chargers. https://www.teslamotors.com/supercharger�

1/1/2015

guest Me neither. But as we know a localisation may have one charger/two stalls or 6 - 8? chargers/12-14? stalls, so a pure "cost / localisation" or "cars / localisation" is more or less valueless without it. But "cost / charger" or "cars / charger" may have a meaningful value.�

1/1/2015

guest I agree, but there is probably a large fixed cost per location and then a relatively smaller variable cost per charger. Maybe that variable cost rises when the chargers are being added to an already present location, which has certainly been happening. Feels like the numbers could add up. I'm also remembering that I was told yesterday that charging plans for the UK are 'massive' in the near future, so I wonder if there's something in the works.�

1/1/2015

guest This morning's Barron's article about Tesla Cash Burn is reasonable in tone and reassuring to the twitchy.�

1/1/2015

guest You divided loc/book though in your table instead of book/loc. Book value per location has actually doubled!

- - - Updated - - -

I know of quite a few locations in France that were just two stalls on a mobile platform for a number of months. If that happened elsewhere I can see that the major costs came as they upgraded these to real superchargers.

Thanks! But we'd also have to know where they stood early this year to make a meaningful comparison.�

1/1/2015

guest Under map options click the way back button and you can see the evolution of the network from the beginning to now.

Also click "changes" and you can see dates when permits and construction for a particular supercharger where known publicly plus dates superchargers went live.�

1/1/2015

guest Sorry, I must be particularly dense today because I can't see where to click to get to the map options?�

1/1/2015

guest I think he mixed up with this map: http://supercharge.info/�

1/1/2015

guest Oh yes, sorry, duh.Code:2013 90 25.6 0.28 2014 380 107.8 0.28 2015 584 339.2 0.58

That's really not good to see.Well, it is a sales driver, and so far there's no real signs of a competitive build-out, but I don't think it'd be hard if anyone were actually trying.

�

1/1/2015

guest I hope at some point we'll get an answer. But I will speculate. Is it possible they have been adding batteries to a significant number of sites? I know power companies charge for peak power so it would probably save them a lot on the electric bill. It may have gone unnoticed since it might fit into the existing electrical shed. Anyway, I'm having a hard time figuring this out any other way because from what I understand they have to record the cost as the book value so they can't be inflating it but then again IANAA.�

1/1/2015

guest If they start loading batteries into the sites, they could monetize the stations and provide peak power to the host location businesses. Would be cool if they could actually break even on sites, by selling peak load electricity on site. For larger commercial sites, maybe they even partner with SCTY.

�

1/1/2015

guest Possible, yes. Likely, no. They mention in their reports that costs associated with running the superchargers are marginal, read basically zero. Adding $100M of batteries to supercharger sites to reduce cost from basically zero to half of basically zero makes no financial sense at all. Also, we have a pretty good idea of how supercharger site is built up. As far as I know none have weird additional cabinets that could potentially house the necessary batteries.�

1/1/2015

guest Not much active atm, so not to sure if this has been posted earlier. But it is pretty good news for EVs: Asia To See First Gasoline Squeeze In More Than 15 Years | Hellenic Shipping News Worldwide�

1/1/2015

guest I'm not entirely sure how this affects Tesla Motors fundamentals, but the value of the Tesla brand must have gone up a lot after last night. Model 3 is being discussed EVERYWHERE.

Model 3 is a headline "top post" at tech website Ars Technica. It was on the front page of MacRumors, despite not even being an Apple product. The New York Times, BBC, and USA Today all have front page articles on Model 3.

I'm seeing the same effect on social media and other message boards. If Model S was kicking the hornet's nest, then Model 3 is overturning a Tractor Trailer full of honeybees. The car community is buzzing over this, and there is a lot of debate and arguing over what Model 3 means for the automotive industry. Many enthusiasts are super excited about Model 3, but others are frankly resentful and angry that electric cars are proving themselves to be viable and better alternatives to gasoline cars. Stirring up this conversation is definitely getting people to consider electric transport, and I think it goes a long way towards helping achieve Tesla's long term goals.�

1/1/2015

guest Yes, the long-term picture looks more robust this morning in every way. Until this morning, we had hopeful glimpses of an amazing possibility. Now we can see that all the elements necessary to realize that possibility are snapping into place. Seeing the company actually commit to a $35k price point and 215 miles range (as opposed to predict it) is an amazing moment. And for anyone who doubted that those specs were enough to drive demand can just pick their jaw off the floor at what has happened. This is now, demonstrably, the tipping point moment. No doubt a massive amount of production planning ahead, but for anyone not poisoned by cynicism around renewables, there's a crystal clear road ahead that will take us to many hundreds of thousands of Tesla's sold within just a few years. Elon's 3-stage strategy is proven solid.

And then there's the raw human factor of delight at a gorgeous design. We all hoped it would come. But it wasn't clear that a design that gorgeous would be compatible with the raw specs needed for this vehicle. And now it is. That's huge.

Suddenly Tesla's valuation doesn't seem so high. A company that can generate $6 billion worth of orders in 24 hours on a single vehicle, mostly sight unseen, is today valued at just 5 times that number?

Based on the evidence of the past 24 hours, is it plausible that in 10 years time Tesla will still own less than 10% of the auto market, I find it hard to get to yes. Which means we're going to see YEARS of spectacular growth from this company. I've never been so confident in my Tesla holdings. 2018 leaps look to be an absolute steal.�

1/1/2015

guest I spent some time today reading comments on Model 3 articles from NPR, Ars Technica, and Car & Driver.

The $6 Billion worth of orders (now around $8.31 Billion as of Elon's last tweet: 198k reservations) is just the beginning. Based on the comments I've seen, most potential customers are still unaware of the advantages of EVs over gasoline cars. Many of the myths about charging, power plant pollution, and range still persist in the general public. EV proponents on the news sites however, persistently push back with correct info.

If demand is this strong now, it will be beyond comprehension once ordinary buyers accept and even desire an EV as their next vehicle.�

1/1/2015

guest OK, here's the case for that -- I don't really believe it, but here's that bear case. Suppose Tesla has trouble setting up its fourth and fifth factories and trouble sourcing materials for Gigafactory 2 and 3 -- delays in expanding, in other words. Meanwhile, other companies *finally* start to catch up. Consider Apple, Google, BYD, GM, Nissan, Audi, BMW, and various Chinese and third-world companies I don't know about yet -- suppose by 2026 they manage to make tolerable cars which are not as good as Tesla's but are signiifcantly cheaper. I could see Tesla being pushed below 10% of the global auto market, by being supply-constrained while others are not.

The thing is this: Tesla has now positioned itself at the *top* of the auto market as the *elite brand*. So even if they're under 10% of the market it will be the *top* of the market, with the best profit margins in the industry. I see *no* way for any other company to challenge that. Nobody can beat the brand identity Tesla has built, except possibly Apple or Google, both of which are way behind and huge execution risks.�

1/1/2015

guest I was a little stunned yesterday and today not to see the through-the-roof demand for the Model 3 reflected in the share price. I think there is such a deep-seated skepticism/resistance to what Tesla is trying to achieve that even getting hit over the head with a 2 x 4 is not enough to get many people's attention.

The two articles below are typical -- when Tesla gets 200,000 reservations in 24 hours, and half of the customers have never even seen the car, the LA Times headline is about the "stiff challenges" Tesla faces:

Tesla faces stiff challenges with Model 3

The Detroit Free Press article is even more comical. Buried way down on the business page (a couple rows down from "Detroit 3 sales rise in March") there is an article with the headline: "Tesla 3 Model Pricing Could Hinge on Smaller Tax Credit":

Tesla Model 3 pricing could hinge on smaller tax credit

I mean, really???? That's all you have to say????

As others have said, this is very reminiscent of of late 2012/early 2013, when it seemed blindingly obvious that with the Model S, Tesla had shown that a Tesla EV could be better than the very best ICE cars in the world. Even after all the car magazines raved about it and basically said just that, the stock stayed stuck for a few months. Eventually, the significance of the Model S started to sink in, and the stock started to take off.

The off-the-hook demand for the Model 3 is game, set, match for EVs and for Tesla. But it may take a couple years of ups and downs for that to completely sink in with many people. There is gigafactory-size denial in many quarters still.�

1/1/2015

guest I watched the same thing happen with Apple in the late 2000's. There seemed to be major lag due to skepticism about the iPhone.

Apple's share price did well in the early to mid 2000's, driven by the success of iPod, iTunes, and the Mac line. At the same time, companies like Nokia, Motorola, and RIM were dominating the mobile phone market. As ARM processors slowly became more powerful, I began to suspect that convergence would ultimately doom the iPod, and that Apple would be forced into the mobile phone market in order to retain/grow hardware revenues and defend iTunes Store.

Many people, including myself, were skeptical that Apple could go from 0% to any significant share in mobile phones, where they had no experience. From iPhone to iPhone 3G and then 3GS, Apple's stock price really did not reflect the growing potential of the iPhone line. Granted, the economic crisis of 2008 and associated macro conditions had a severely depressing effect on AAPL independent of the company's future prospects and actual financials. Something though changed around 2009 and then 2010 with the iPhone 4. The skepticism surrounding Apple and mobile phones all but disappeared, and even the emergence of Android did little to dampen the new reality. AAPL began to rocket upwards as iPhone went from "niche for the rich" to mainstream.

Share price often lags actual accomplishment, because the herd doesn't see the direction or the destination of a company. When they finally do understand, it becomes a a buying stampede as parties are willing to pay more and more for shares.

The key is to be positioned before the stampede happens. If in 2018-2019, Model 3 is a success and the numbers become impossible to ignore, TSLA will become vastly more valuable than it is today, assuming that macro events don't cause a disruption. This is why I encourage long term investing rather than trading. I believe there is a reasonable probability that Tesla will succeed within a general time period. I just do not know precisely when it will happen.�

1/1/2015

guest I think you hit the nail on the head. The bears may not hide in their caves until hundreds of thousands of Model 3s have been delivered and maybe not completely even then. Tesla will still need to invest massively in growth (Model Y, Model T (truck), etc.) so they will continue to make the argument that "Tesla loses $x0,000 on each car" -- ignoring that Tesla is just investing its profits in R&D, infrastructure buildout, production capacity, etc. I personally use 2020 as a rough horizon for when we should see a big gap upward in share price ala 2013. Could be sooner (even this year), but like you I prefer to be a long-term investor so I don't have to worry about the timing.�

1/1/2015

guest I mostly agree with you: this increases the Tesla brand. But I believe the above ratio is an exaggeration. According to Wikipedia, the average weight of a hornet's nest is 0.176 pounds. A tractor trailer carries up to ~22.5 tons of cargo, so that's about 45,000�0.176=255,682 times more. Tesla sells around 50K Model SX/yr right now, & will sell around 1M Model 3/yr doubly optimistically, only a 20x increase. So your exaggeration is somewhere around 12,784 times.

I think the natural human does not like the internal combustion engine, and only the weirdos that actually like the internal combustion engine have been able to be enthusiastic about the current ICE type of cars. I think the natural human has been dissuaded from being enthusiastic about cars because these disgusting dirty fuel cars have been the mainstay for generations. Therefore, the current batch of entrenched enthusiasts are wildly weird dirty fuel centric oddities that will be flushed out of the system due to the combination of, on the one side, slow attrition of death, and on the other side, normal people buying the new normal car, electric vehicles, then realizing how undisgusting they are after having gotten used to the normal electric car, then one day returning to the vicinity of a dirty energy car and getting IMMEDIATELY extremely highly disgusted. After a few experiences like that, individuals will realize that electric cars are relatively nice to be around, and natural car enthusiasts who would have naturally been sickened by dirty energy cars and gone to other hobbies will not be dissuaded at all by the electric vehicles in such a manner, and they will number far more than the odd people who love pollution.

So, I think you are exaggerating about how many people are "resentful and angry". They include entrenched enthusiasts and businesspeople, only, and number very few in comparison to the people who will have equal positions among the electric car markets. If you go looking for the comments of a dirty fuel car person, you will find them. Most automobile media is, as I described, self-selected pollution heads, because that's historical facts of market share, nothing more.

How much exaggeration? I'd guess 30x.

So, your two exaggerations are in opposite direction, so your net exaggeration is 436x in favor of Tesla. I'm excited about Tesla, but I'm being realistic.�

1/1/2015

guest You know the difference between a ripe pear and the left front paw of a Bengali Tiger?

No?

Take a bite. �

�

1/1/2015

guest As ICE manufacturers attempt to transition to BEVs, we should begin to see gradual or precipitous withdrawal of support from racing programs.�

1/1/2015

guest Really? Formula E seems to be getting more and more support. �

�

1/1/2015

guest I agree. I should have said withdrawal from gasoline racing programs. F1 in particular is super expensive and is primarily a showcase for engine building prowess.�

1/1/2015

guest Hmmm, the Long Beach Formula E doesn't seem to support this. It was significantly less crowded than last year, in particular there were almost no commercial displays except for Faraday Future, a few BMWs, and an NRG station that the person manning it knew almost nothing about.�

1/1/2015

guest Earlier this weekend I posted on the Short-term thread a long post concerning the overall situation regarding the world's various Sovereign Investment Funds and the unparalleled clout these uber-giants have. Link here: Short-Term TSLA Price Movements - 2016

Now, although it certainly is the case that any such fund's investment in Tesla Motors understandably would have short-term investment consequences, these portfolios are the embodiment of the long-term investor. So it is here that I link the just-released article from Bloomberg, in which Liam Denning muses that the supposedly shortly-to-be-unleashed cash trove of Saudi Arabia - $2 trillion - could be destined to purchase a piece of TM.

Saudi Arabia's Tesla Roadmap

The author spins a long game, and I am sure some of his colleagues like Cory Johnson may be accusing him of click baiting, but it's worth reading and spending a small amount of time pondering.�

1/1/2015

guest http://seekingalpha.com/article/3962789-tesla-model-3-love-first-sight

![[?IMG]](https://staticseekingalpha.a.ssl.fastly.net/uploads/2016/4/1/1580111-14595602464067492_origin.jpg) �

�

1/1/2015

guest From Elon's Twitter Feed:

Q: "Why small trunk lid instead of big hatchback like S&X? I ride a bike not a surfboard"

A: " Only way to get enough rear passenger headroom was to move the rear roof cross-car support beam. A bike will still fit no problem."

Q: "What is Model 3's aerodynamic coefficient?"

A: "hopefully 0.21"

EM: "Model 3 will be RWD, with dual motor AWD optional. Even RWD will have great traction on ice due to fast torque response of Tesla drivetrain."

Q: "Reveal cars were AWD?"

A: "yes, but production AWD will be a lot faster"

Q: "~5k upgrade like on model s for dual motor? Or less since overall cost is lower?"

A: "Less"

EM: "Wait until you see the real steering controls and system for the 3. It feels like a spaceship."

Q: "Really hoping back seats can fold down on the 3."

A: "They can. Will be great for road trips and camping."

EM: "Edge and contour refinement are ongoing. Even 0.1mm matters."

EM: "Air suspension dynamically adjusts ride height."

EM: "Our production ramp plan should enable large numbers of non X/S customers to receive the credit.... We always try to maximize customer happiness even if that means a revenue shortfall in a quarter. Loyalty begets loyalty."

EM: "There will be an optional tow hitch."

EM: "Matte black was surprisingly popular. Probably makes sense to bring it to production."�

1/1/2015

guest I believe a mod has warned posters not to discuss too much of Model 3 information in this short term investment thread. Such information belongs to Model 3 sub-forum. Your information is a duplicate found here: Info and Hints from Elon Tweets�

1/1/2015

guest This isn't the short term investment thread.

It is discussing a model that will come out no sooner than 18 months from now.

Long term.�

1/1/2015

guest Sorry, my mistake. I know there was a clean up in the short term thread specifically stating for all investment threads. Here it is: Short-Term TSLA Price Movements - 2016�

1/1/2015

guest The sovereign funds as potential significant TSLA investors would be very troubling to me and this issue raises a concern I have for the future of Tesla. With the huge number of reservations that Tesla now has for the Model 3, the threat to traditional automobile manufacturers and oil and gas interests is obvious. The sovereign funds in particular would have massive conflicts of interest as investors. Tesla would likely be worth more to them dead, or at least crippled, than alive. I would be very uncomfortable if the sovereign funds took a significant stake in TSLA, e.g. to the point they got board representation or otherwise could influence the direction of the company.

I have not looked into it, but is there anything stopping a third party from taking over Tesla in a hostile takeover? I can think of any number of entities who could do that in the guise of wanting to invest in the future of transportation, but end up stalling the transition to sustainable transport. I don't think Elon has enough shares to stop it, but perhaps I am missing something?�

1/1/2015

guest Many SWF have already made significant investments in renewable technologies like solar and wind. Others have little to no oil in the underlying economy.�

1/1/2015

guest 1. That a KIO or SIF or any of the other sovereign funds could successfully mount a hostile takeover is possible only in theory.

2. That they or any other hyper-deep-pocketed organizations would want to is even less likely.

3. Were it to occur I would rejoice, not mourn.

Here is why:

With few exceptions, the operations and structure of the funds are such that they are run quite independently of the forces that generate their base moneys. This is the weakest of arguments, as the conspiratorially-minded always can look to nefarious deeds by the Emir of Durka-durkastan as changing her mind, and so on.

More appropriately, as Crown Prince Mohammed has revealed, the O&G-based funds are actively and have a deep history of looking for opportunities to diversify away from their traditional revenue sources. These peoples are playing a very, very long game. The non O&G funds include the ForEx-rich centers like China, HK and Singapore. The latter two are far too-well experienced in the world of business to have any interest in such shenanigans; that leaves only China. I'll state unequivocally right here that the possibility that China would be permitted to a hostile takeover of a successful Tesla Motors is exactly zero, regardless of what political parties are in control of what portions of D.C.

Tesla's equity ownership is a lot less liquid than would be required for a hostile takeover. We can posit, first, that Mr Musk's 37% (is that the correct amount? I know it's close). Other insiders bring that to about 40%. Devoted "super-long" individual investors hold, at a guess, 5%. FMR controls about 10% and other US-based fund management companies another 20-25%.

Now, of these those fund management companies can and rightly should be considered swayable. Their fiduciary responsibility is to their fund shareholders, never to corporate management. Leaving them out, however, it remains all but impossible to amass a 50% stake. More fundamentally, however, is that there are no plausible scenarios under which a sovereign fund's representatives could be shown to claim a seat on a TM board. Such actions occur only during conditions of corporate weakness; never during strengths. And Tesla is definitely not the former, irrespective of any bear claims of cash flow crunches.

Most wonderfully delicious of all, however, is that Tesla long since has guaranteed, through a gaspingly audacious move, that a hostile takeover could not occur. Which is.....bear with me now and we'll take a walk down Improbability Lane:

1. Hostile Fund X mounts a takeover attempt. How much for the shares? $500 won't do it - that's a mere doubling of current prices. $1,000? Bare minimum but let's go with that.

2. Oops. There's a 30-million-odd short overhang. Mother Of Squeezes occurs; all of a sudden we're talking meltdown numbers here: let's bring the price to $5,000 per share and that's likely to be conservative.

3. Not only does my portfolio leap into the HolyMoly category, as do those of most on this forum, but Mr Musk is the cashed-out!!!! wealthiest person on the planet.

AND....

4. With it he and the rest of the critical management team walk away and make use not only of that capital but.......THE FREE USE OF ALL TESLA'S PATENTS to create a little company they're going to call, let's say, Tezla Motors.

QED

Have I placated your concerns?�

1/1/2015

guest Here is a view from a Rockefeller

Tesla Motor's Elon Musk is energy innovator in spirit of John D Rockefeller

Anyone who doesn't know John D. Rockefeller, the richest private person in entire known history, and Musk's parallels to him, should do some homework.

Here is a good start from trusty wikipedia - John D. Rockefeller - Wikipedia, the free encyclopedia

I long argued among my friends that Musk will out-beat Rockefeller. I am more confident now than ever before.

The opportunity here with Tesla happens once in a hundred years or so. Fundamental tectonic shifts to energy production/consumption.

The thing which many people may not grasp is - Tesla's Model 3 will capture oil revenues without ever selling oil (or even electricity).

When an average Camry buyer buys a Tesla Model 3 and tells himself, well I am paying a tad bit more here but I will break even once I discount the gasoline costs over the car's lifetime. What the buyer is effectively doing is, transferring all the future oil revenues into a one-time payment and giving it to Tesla upfront... Let that sink in for a minute.