1/1/2015

guest UNLV, Tesla Motors Form Research Partnership | News Center | University of Nevada, Las Vegas

�

1/1/2015

guest I am quite bullish on stationary storage, but there are two other considerations. The gross margin on batteries for Tesla vehicles will likely be higher than for Powerpacks and Powerwalls. So a Gigafactory is worth doing for a mix of auto and stationary packs, but not exclusively for stationary (or everybody would be building one).

Second, I'm not sure that the tooling for Powerpacks and Powerwalls is the same for auto packs. If they are different, then you can't cheaply switch from one to the other on the same line. So the investment in lines for auto packs definitely needs to wait until the auto packs are needed.

So a big question in my mind is what fraction of the first Gigafactory is still set aside for auto packs. Originally it was 35 GWh, leaving just 15GWh for stationary. But with all this enthusiasm about Powerwalls, it seems this could shift. Either we need more capacity in the Sparks campus or another GF campus. I'd sure like Musk to tells us what the plan is. I don't think we can back away from 35 GWh for auto. So if we are really going for stationary, we need to commit capital to more capacity. So yes, I'm quite bullish, which is why I want more capacity.

If Musk were one to play the shorts to finance the second Gigafactory, I could see lack luster performance in Q3 setting a bear trap for a blow out in early Q1, leading to an opportunistic capital raise at an ATH above $350. But of course, Musk does not play such games.�

1/1/2015

guest While Tesla Motors is in deep trouble <irony here> for sure for the next years as there is (to sum up some press articles and forum posts):

- no demand

- sticker price too high or too low

- vehicles not attracting enough customers

- not leading tech any more

- fear of a cold winter 2015/2016

- nosecone gone

- Tesla Motors loosing money on every car they make

- not enough food at Model X reveal event (Tesla Motors shame on you!)

- Tesla Motors only a toy of a crazy billionaire

- there are soooo many other cars better & cheaper currently available at other companies right now (like Apple)

Traditional car companies are the way to go in the future:

They are doing really good and do not have such issues as bad as Tesla Motors currently has.

There is a raid currently going on at Volkswagen Group offices in Wolfsburg, Braunschweig and other cities in Germany (link, google translate)!

- Prosecuters and state criminal police searching for analogue and digital documents at Volkswagen Group offices as well as at private appartments of Volkswagen employees for proof who was involved in this exhaust fraud.

- Now there is proof that Volkswagen Group wrote special piece of SW to detect NEFZ cycles and other cycles in Europe in addition to the SW detecting US cycles (link).

- Prosecuters do not like that there are news about exhaust gate every day and Volkswagen Group does not fully admit what they have done with this exhaust gate.

- Volkswagen US manager Michael Horn is invited to Congress in Washington today

- Horn informed the Congress further that VW had withdrawn the application for authorization for the vehicles of the model year 2016 in the US.�

1/1/2015

guest Hilton announced a major EV charging program, stating goal of deploying EV charging stations in 50 US hotels by end of 2015, expanding to 100 hotels by 2016.�

1/1/2015

guest ev-enthusiast, You make a good point. There are quite a bit of contradictions to what people are complaining about.

On a different note though, the implied comparison to VW, or other companies is not that relevant. The pessimistic mood is 'relative to' expectations. Tesla has sky high expectations, with some (shorts might say - lot) of the expectations already priced in. If tesla doesn't stand up to these expectations the mood goes sour, the stock falls a bit. In the long run it doesn't matter at all. This volatility is just part of the game. But nevertheless in a short term perspective, the pessimistic mood and the price-reaction is valid/legitimate (imho).

- - - Updated - - -

On the other hand VW is doomed. The P/E of 5.39 says as much.

Market is clearly pricing that VW is in a bad state. Maybe not completely pricing in all the badness and the potential to go bankrupt (which I think is likely) but it is certainly not pricing VW the same way as Tesla.�

1/1/2015

guest Thank's for your post.

I agree, comparisons are always tricky and especially in this case with Volkswagen Group and Tesla Motors.

These two companies are very different, I think I don't have to talk about the differences here.

While I agree that expectations and mood and not only financial figures might have an impact on a SP of any company, I have the impression that in this case this impact is pretty big.

As far as I know there was no material news out after the Model X Founders first deliveries and the SP declined drastically even days before the event.

There was even positive news out, like demand for Model S and X accelerating, or first deliveries finally taking place!

If they had postponed the Model X Founders first deliveries event, I would have expected such a SP reaction, but given the context I have the impression that this is overblown.

Just a simple question, not personally of course:

In case you bought shares on September 23rd at $261 what changed your mind that you decide to sell these share for $225 now?�

1/1/2015

guest Yes agreed, clearly a buying opportunity. But unfortunately I am tapped out �

�

1/1/2015

guest No buying opportunity for me here as such wild SP swings on so little information makes it too difficult for me to put my money in the stock.�

1/1/2015

guest Is the model x in its present configuration,

that is, complex engineering and difficulty to manufacture a structural mistake?

Would have an extension upward of the model s been sufficient ?�

1/1/2015

guest Are you trolling?

No offense, just a question.�

1/1/2015

guest yes i take offense�

1/1/2015

guest Update on Volkswagen Group exhaust fraud:

Volkswagen US boss Michael Horn in Congress admitting that he knew about this exhaust fraud only since this September (link, sorry video in German only).

Blaming "a bunch of SW engineers" for putting the SW to work.

Pretends that no management was involved.

But as fas as we know there was a second group of SW engineers at work in Germany programming the SW to detect European test cycles like NEFZ.

Looks like criminal investigations will take several days.

Investigators now have a room on their own in the Volkswagen offices.

This will get again more interesting during the next days.�

1/1/2015

guest Great posts ev-enthusiast! I've decided to cancel all my newspaper subscriptions. You provide the best coverage of all the news that's worth knowing about! :smile: And a fun read to boot.�

1/1/2015

guest Incredible new ICE innovation has me worried about EVs: Castrol made a thingy where you can change the oil in your car in 90 seconds by just removing a box. It could be available in five years. I think we've found what has been weighing on TSLA stock price lately.

Oil changes in 90 seconds? Castrol claims breakthrough

"The new system, which Castrol has dubbed Nexcel, must be integrated into vehicle engines at the design stage. That means it won't hit mainstream cars for another five years � about the length of time between major model changes for many automakers."�

1/1/2015

guest I've never heard anyone make the case that avoiding oil changes is in the top 10 reasons why EVs are better than ICE. And even in the "innovation" you cite, one isn't avoiding oil changes, they just take less time at the shop. I'd still have to find an hour to drive to the shop, have the work done, pay for it, and drive home; and the cost is probably going to be similar. Tesla vehicles have no oil to change, and no amount of innovation is going to improve on that.�

1/1/2015

guest I am quite certain the original post was sarcasm. Can't tell if you're being sarcastic as well, but not doing oil changes definitely is in my top ten reasons for owning an EV. They are such a hassle, especially if, like me, you only take newer vehicles to the dealer, which is 30 minutes away. By the time they do the change, it's nearly two hours out of my day, not to mention $50 or $60 down the drain.�

1/1/2015

guest Definitely in my top 10 reasons as well. Maybe even top 5. For my wife I think it was top 2 or 3!�

1/1/2015

guest Interesting that after decades of operating, Ferrari is now choosing to go public. IMO this decision to raise additional funds is for a transition to electric. Who knows, but looks like they might be joining the EV party.�

1/1/2015

guest Well, there's nothing that can't be made cheaper by making it a little worse.�

1/1/2015

guest My understanding is that Ferrari isn't getting any of the funds. Fiat Chrysler is selling part of their stake and distributing the proceeds to existing shareholders.�

1/1/2015

guest I was being sarcastic. I don't think making minor tweaks to ICE engines will help them in the long-run against EVs. And the fact that "Nexcel" is coming in maybe five years makes its all the more laughable.�

1/1/2015

guest While I have been sceptic during the last years about Germany introducing subsidies for BEVs it looks like times are changing because of the exhaust fraud.

German government reported to talk about:

- making exhaust rules stricter

- enabeling already existing fine dust driving ban areas in cities for NOx emissions

- introducing direct subsidies for sales of BEVs to reduce their sticker price

We will see how this pans out as the German government will decide on these kind of measuers end of this year.

(link, link)�

1/1/2015

guest Volkswagen Group exhaust gate keeps exploding, quick update:

- Now up to 30 persons of middle and upper management involved in this multi-year fraud (link)

- Diesel ICE EA189 was checked several times during several years in production in different markets around the world

- Last week Volkswagen Group CEO Matthias Mueller said "only a small group of persons involved in the fraud" is no longer valid.

- European Union gave Volkswagen a 3bn low interest credit during the last years for development of environmental friendly engines to reduce EU CO2 emissions, currently investigating if Volkswagen has to pay back this money

- Some Volkswagen vehicles sold in Germany during so called "Abwrackpr�mie" some years ago do not qualify for EURO4 exhaust rules. Germany currently investigating if Volkswagen Group has to pay back some subsidies they received for these sales during that time.

�

1/1/2015

guest @ev-enthusiast:

Thanks for the updates. FYI, for me at least (on tapatalk) the links bring up a blank Google translate page ready to type or paste an URL.�

1/1/2015

guest Thank's for the hint!

Added quote for the most relevant part.

Link works here with firefox!�

1/1/2015

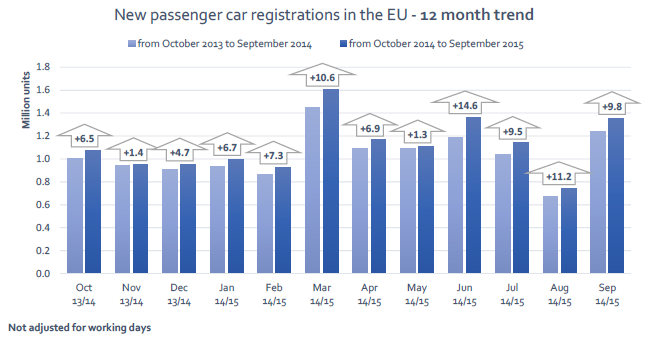

guest European new car sales up for their 25th consecutive month (ACEA).

Up 8.8% over the first three quarters this year.

Up 9.8% during September only.

This should support European sales for Tesla Motors.

�

�

1/1/2015

guest I applaud the German government for not having any conflict of interest in this and cracking down on VW hard. I would not have expected this from any government in the world. It might hurt now, but certain people are attracted to this justice.�

1/1/2015

guest I have to admitt that the German federal state of Niedersachsen owns about 20.2% of Volkswagen Group (google translate link, btw the follwoing three links are the same links as this one as the same article is the source for the follwoing statments).

There is a good reason for that and there is quick look back in history needed to understand that.

Volkswagen Group was founded in 1938/1939 in the city of Fallersleben in Germany on request of Nazi Adolf Hitler with the families of both Porsche and Piech being involved heavily and from the beginning (google translate link). E.g. Ferdinand Porsche at the front right on this image taken during laying of the foundation stone of the Volkswagen plant by Nazi Adolf Hitler (May 26, 1938):

Use of financial assets of battered unions and forced labor have been the financial basis of Volkswagen company during the Third Reich (google translate link). Volkswagen produced a lot of military stuff like even V1 rocket during the war.

After World War II, Volkswagen Group was restructured as a stock corporation with the German federal state of Niedersachsen owning a bit more than 20% of the Volkswagen Group shares. Together with a spechial 'Volkswagen law' the German federal state of Niedersachsen is able to block management decisions initiated by other members of the Volkswagen Group board of management (google translate link) in order to keep an eye on the company.

I have to admit that I did not remember all these details, please read here to get more details (maybe you don't, as this is really ugly Nazi stuff).

That being said I do not really know how German government officials will behave during the next days weeks.

German minister for economics Gabriel e.g. said that he fears about workers at Volkswagen Group now afraid to lose their jobs.

Gabriel already mentioned that maybe German government will help Volkswagen Groupby paying subsidies in form of German 'Kurzarbeitgeld' (what would be for the wrong reasons, obviously) to get through this trouble, we will see.

I have the impression that some people realized that this mess simply got way too big to be ignored by the German government.

In fact this is the biggest official recall by German KBA authorites ever.

News:

- In France authorities started investigations with an unannounced visit at the local French headquarters in northern France in 'Villers-Cotter�ts' and 'Roissy' north of Paris last Friday (google translate link). Investigators took documents and hard discs with them. 1 million diesel vehicles with ICE EA-189 sold in France.

- As it became known during the weekend, Volkswagen Group violated European law, thus other European countries are expected to join France during the next days. German Minister for Federal Transport Minister Alexander Dobrindt informed his 31 European counterparts with a letter about these news. - Volkswagen Group's exhaust switch is officially violating article of the EU Regulation no. 715/2007. Volkswagen Group now has to expect legal consequences, claims for damage and criminal proceedings throughout Europe.

- Biggest issue might be that German authority KBA is now able to cancel the certificate of registration for the vehicles already on the road!

- The German Federal Motor Transport Authority (KBA) now ordered a mandatory recall for all VW vehicles with manipulated engine software in Germany.

- German authorities found that diesel ICE (and even the top of the line EURO6 diesel ICE) pollute the environment by a factor of a multiple more when used under full throttle than allowed, exhaust cleaning simply reduced under full throttle (google translate link):

�

1/1/2015

guest

What follows will be a test of integrity. We are all watching.

I paid a �50 fine for not having the right metro ticket in Berlin but that's because I understand ow the law is black and white there. If this is not resolved with justice in mind and that all is fair. My lerception of German gov fairness will change.�

1/1/2015

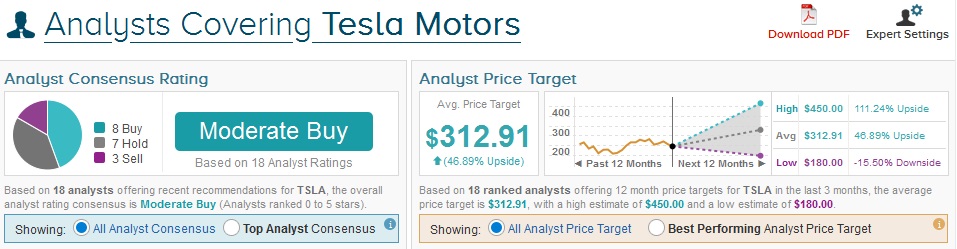

guest Interesting- a few weeks ago I would have said that Tesla was the "hottest" stock out there but it looks like several analysts are turning to the sidelines... https://www.tipranks.com/stocks/tsla There are more analysts who are bearish/neutral on the stock than there are bullish!�

1/1/2015

guest This is what I see on the web page you have linked:

�

�

1/1/2015

guest I did some quick back of the napkin calculations that I wanted to share. Remember Elon Musk saying that Tesla could match Apple's market cap. in 2025? If that actually turns out to be true, we can try to look on some numbers of how good Tesla is as an investment.

Todays market cap:

TSLA: ~28 B USD

AAPL: ~650 B USD

Over ten years, that means your average return is ~37 % each year.

If you invest 100 000 USD today, you'll have: 2.33 M USD in 2025.

But, what if you could keep that 37 % for 50 years. (Some crazy speculations here). Then you would be the wealthiest man on earth by far with 686 B USD. Yeah, I know, there is no way you will get 37 % for 50 years. And most of us will probably not be here in 50 years. But, there is actually a possibility that we can get 37 % for 10 years. Good luck!�

1/1/2015

guest @erha: check this out (really worth the read)�

1/1/2015

guest Thanks, Newb. I remember reading about that a year or so back. I need to look more into itIt would be cool to make an app or something that tells you if it is a good buying opportunity according to the Blind Faith Price Target. (Somebody might have done this already.)

�

1/1/2015

guest Now pencil out the production capacity Tesla would need to build by 2025. Estimate the capital and time needed to add capacity. If Tesla could contract with Foxconn to assemble millions of cars, then they certainly could have an enormous market cap by 2025.

Apple was able to take the phone market from Nokia in just a couple of years due to the nature of consumer electronics. Tesla already has the market cap of a fairly large auto manufacturer. Is making 300,000 cars in 2020 good enough to even maintain the current price?

For these reason, I don't believe the correct strategy for Tesla is to build the $35K car anymore. Being the Audi of EV is the strategy that probably maximizes shareholder value. They can't scale to be the Toyota of EV with a Lexus division. Toyota is likely to be the Toyota of EV.

I don't think it is in Tesla's DNA to be an economy car builder

Declare victory with the Bolt, and build upscale EV that push the envelope. A smaller Model S is what the world wants to buy. A $35,000 model 3 that sells well will tie up capacity for years that Tesla could use to build cars with better margins.�

1/1/2015

guest You seem to be ignoring the fact that the ASP for the 3 will be much higher than $35K, the SUV/CUV version will have even higher margins, and finally, the 3 platform will provide the base for the next version of the Roadster, with probably their highest margins ever. You've left out significant portions of the total plan.�

1/1/2015

guest Tesla is not about making money. Making money, for them, is a consequence of making compelling vehicles and products. From the very beginning, when it comes to vehicles, they have said they plan on moving from the top (expensive) to the mass market. The Model 3 will be mass market since it will sell 500K vehicles a year, that doesn't mean that it will be an economy car like the Bolt and the Leaf 2.0. The Model 3 has been said to go up against a 3 series BMW (which sells 500K a year) which is also a premium vehicle.

Next I'm repeating something I've mentioned before but I really doubt that Tesla wants to be GM, Ford, or Toyota. If you build tens of millions of cars a year you will be so big that you will lose the ability to innovate as much as Tesla seems to want to do. A company that large becomes too bureaucratic. It would make sense if Tesla focused on building compelling vehicles that are considered the very best in their class such as the Model S has done and soon the Model X. The vehicles don't have to be the least expensive, just compelling. If that leads to selling millions then I'm sure Tesla will not be against it but I would be shocked if that is their plan.�

1/1/2015

guest I presume that half the model 3 will be in the 35-40K range. As long as the model 3 is production constrained, those cars are taking up slots can can could be used to produce high margin cars. If the EV market "takes off" Tesla will likely be production constrained for years.

Is Tesla really a mass market company? I don't see the resources. Are tesla stores and the supercharger network really setup to scale fast in units sales, assuming Tesla is even capable of scaling production to keep up with an EV boom?

If Apple produces a car with a steering wheel, it won't be a to compete with the Bolt. It will be a mid level car. Apple is a premium product.

Tesla is currently pursuing a goldilocks strategy: That the EV market is good enough to stimulate demand for hundreds of thousands of cars, but not so strong as to bring in the majors into EV a big way.�

1/1/2015

guest

Very good points. If Tesla become the Toyota of EV, it will be nice but the mission will be a failure. What tesla excel at is creating its own category. The comparison with apple of cars is more correct. It will probably be showing the mass market something that they'd want to own that they didn't before.

Who thought the poor masses would fork out $500 for a smart phone before the iphone.

Model 3 will be a EV, Autopilot, sportscar.

My guess is that it'll be even more of a big hit once autopilot enables people to be permanently on the move instead of needing a residence. Then we all have to ponder the worth of owing a $300 000 condo vs a $35000 car.

In my city, there's already a big crowd of people living in cars. Autopilot, super charger access will solve a lot of problems. As a free nomad, I'd like to program my car to go to another city at night and stay on highway + auto charge. Wakeup in another city work out and then boot up my computer to work.

10~20 years. Too late for me to enjoy, but this will happen.�

1/1/2015

guest Presumably Tesla will do what they've pretty much always done - prioritize the production of higher margin cars. Buyers of lower margin cars may be subjected to longer wait times. However, I don't think the market for the Model S and Model X is going to be nearly large enough to absorb all production capacity. Further, the correct response to a sustained production backlog is to find ways to increase production, not produce fewer models.�

1/1/2015

guest Toyota will be the Honda of EVs and if they delay much longer in this foolishness with FCEV they will be the Mazda of EVs.

Audi sells in the $31k-$200k range. Tesla with Model 3 will sell in the $35k-$145k range. With new roadster Tesla may reach up to $200k.

So Tesla is already planning to start upmarket of Audi.

Elon has already talked of "millions by 2025." Audi is part of VW Group.

BMW is independent and will sell past 2M units this year. 2.3M units if you include Mini. They also have Rolls Royce.

So by 2025 Tesla should be BMW sized circa 2015 and if there are not at least two legacy automakers with a firm foothold on the $15k-30k BEV market Tesla will probably go down market again.

Tesla has/will not have a problem raising capital on Wall Street if the need arises.

Tesla has not had will not have problems scaling up distribution beyond legal/franchise dealer issues and has not and will not have problems scaling up Supercharger Network. It does not need to scale up Superchager Network and service network to keep the last marginal customer in Tinbuktu happy but scale up fast enough to keep demand ahead of production. While expanding production as fast as possible while keeping quality control in check.�

1/1/2015

guest I suppose this is correct. Something like a policy that base cars don't exceed 20% of production unless there is excess capacity.�

1/1/2015

guest I doubt it. Especially for the first few years, which will prioritize the more expensive models. I expect very few base model, no options, 3's to be sold.�

1/1/2015

guest If they produce and sell 500k of them per year, I don't care what the Average Selling Price is.�

1/1/2015

guest In that context how does the following make sense?:

http://www.cnbc.com/2015/10/23/tesla-ceo-says-could-start-china-car-production-in-2-years.html

Does this signify that Tesla thinks that either the Chinese government and/or a local partner is going to invest in this? And does it make sense to produce cars in China without a Chinese GF?�

1/1/2015

guest At first? probably. It already makes financial sense to ship the batteries from Japan to the US, why not ship the batteries from the US to China or Europe? At least... until they can warrant expanding to new battery production. Heck, they could even potentially reroute the Japanese cells to China which should be a shorter route and hopefully cheaper. But they are already paying decently to ship the cars themselves overseas, and the lower level market is much more sensitive to price fluctuations such that reducing those costs is very important to furthering EV sales.

Also the more of the product that is made *NOT* in China the more profits Tesla wouldn't have to share with their local partner... Just an extra thought there.�

1/1/2015

guest Oops!

�

1/1/2015

guest Which they also confirmed that the Model 3 would ship in two years... Model 3 ships and then they open a factory a month or two later.

The responses on twitter was because of people thinking they would outsource the whole business to China or some such. Because people are always happy to point out that Tesla is nothing but one giant government subsidy and if they took it all to China that would be icing on the cake.�

1/1/2015

guest If you are an investor, you will care that the Model 3 average selling price makes more than a 10% margin. Tesla has the market cap of a much larger manufacturer. If their car and battery biz evolves into typical modest margins, the current stock price is not supported.�

1/1/2015

guest There has been a few posts in the short term thread expressing an interest in hearing a bearish valuation in more details. Now I don't consider me a TSLA bear, but I have come a long way from my very bullish view a year ago to being pretty neutral now on the stock, and that is even though I still believe electric cars are the future and will gain close to 100% market share within 15 years (sales). One of the main thing that has changed is that I have lost my faith in our lord and savior Elon. The X launch has simply had too many delays, it seems very amateurish and it adds to the thesis that Elon simply is way too optimistic about his projections. Other optimistic projections was the missed yearly delivery last year, this years missed delivery, the 2k/week production at the end of this year and the cash spend. The $2B raised last year should have covered Tesla's part of the gigafactory but those money was spent way before the gigafactory was up and running, resulting in another cash raise recently. Another data point that has made me lose faith in Elon is him saying TSLA will reach a $700B mkt cap in 10 years, that is just incredibly unlikely, the car industry is very different from the smartphone industry.

Another thing is the S demand plateauing, I thought it had longer legs and so did Elon I assume when he was talking about the 2/week runrate EoY. I don't think the X brings that much extra to the table so I don't expect it to double Tesla's demand or even close to that, the S is a large car too with possible seating for 7. S demand has been around 45k/y in 2015, say the X increases demand by 50% (which I even think might be on the high side) that brings the total demand to 67.5k/y. With the demand reaching a plateau this year and a very significant market share I don't expect it to go much higher (we will also start seeing competition in a few years), but lets say it inches closer to 80/y by 2020, that is around $8B in revenue. With all these things not panning out for Tesla as they had hoped I am going to discount the Model 3 sales to 300k by 2020 (which would still be a significant feat considering where they are today), that is $13.5B assuming a $45k ASP, which brings the total to $21.5B in auto sales in 2020.

Now on the margins a lot here are expecting something like a net profit margin of 15%, but I am starting to think that is way too optimistic. If you look around in the industry the net margins are 2-8% with the weighted average probably around 4%, the auto industry has cut throat competition as the competetive advantages are hard to come by. Now some might argue that Tesla does have a competetive advantage be it the supercharger network or over the air updates or battery technology. But the thing is that the first two are easy for competitors to match as these companies are huge with huge budgets. Also on the battery front I am starting to question if Tesla will have any advantage at all in 5 years as LG is looking to be a giant in the space with supply deals already with some of the biggest manufacturers and Nissans CEO claiming that LG has the best car battery tech out there (even though Nissan themselves have inhouse battery production). So to conclude the margin part I think modelling an 8% net profit margin long term would be the be the highest you could realistically go at this point which would give Tesla $1.72B in net profit in 2020. Given that they will still be a young company given the industry and have a history of growth I think a 25 P/E would be reasonable in this scenario resulting in a $43B value of their car business.

On Tesla's stationary storage business I am definately bullish on the market opportunity but just how big it will be I don't know. I do believe though that it will be a low margin industry with high capex so I'm just going to throw a $10B valuation out there for this part. That leaves us with a total TSLA mkt cap of $53B in 2020 compared to $27.6B today (according to Google Finance), I do believe though that we will see some dilution though, so perhaps a 60% return in 5 years adjusting for dilution if my model holds true which clearly isn't bad but I think there are better opportunities in the market.�

1/1/2015

guest I'm not sure why everyone thinks Tesla is trying to be Toyota, Honda, etc. because they are launching a car with a 35k base price.

As someone switching over from BMW to buy a Tesla, it's pretty clear to me that they will be taking a "3 series" approach. Tesla is a "premium" brand like BMW and I doubt they are trying to build Corollas here. 35k will get you the shortest range, bare bones, cloth interior car - like a BMW 320i. I don't think this will be the bread and butter from the time of launch. These will likely option up to 55k or so, with increased performance/range/interior - like a BMW 328/335i. Then there will be a performance model that tops out at 70-80k - like a BMW M3. I suspect the "early adopters" here will be drawn to the higher end midrange model or adding the performance model as a second car to complement their Model S/X. As these prove out to be solid cars and increased battery tech provides longer range at reduced costs, the masses will be drawn to the lower cost base models. My guess is an initial average sales price of ~55-60k, moving down to 45-50k over time. I'm quite bullish long-term, so long as Model 3 doesn't experience significant delays.�

1/1/2015

guest Perhaps you should do a bit of research before you make a post like that. BMW sold 2.12M vehicles last year with automotive revenue of 75B euro, that is 35.5k euro ASP. BMWs net profit margin was 7% last year, or 4.4% if you look at the "Total comprehensive income attributable to shareholders of BMW AG".�

1/1/2015

guest I think you may be underestimating the storage aspect of the business. Elon expects storage to initially occupy about 1/3 of gigafactory capacity and that energy storage revenue will eventually surpass automotive revenues. I think it was the Q1 ER where he also said long term storage will account more more than double the automotive sales. Although it's very hard to determine exactly when the powerwall/powerpack sales will near vehicle sales, Tesla's energy storage should definitely account for at least 1/3 of the market cap by 2020.

Also, I agree with most of your calculations regarding vehicle sales and their contribution to market cap, but you're leaving out other sources of revenues. For example, they will bring in major revenues by owning their own sales and service network. This source of revenue will increase significantly with the number of Teslas on the road growing rapidly each year as well as older models needing more and more service.

If Tesla grows at a pace that Musk seems to think it will, then the company will still be growing almost 50% annually for at least a few years after 2020. He also believes that in ten years the market cap will be reaching current Apple territory. Something tells me he has more tricks up his sleeve to spur this growth (maybe ride services, supercharger partners, etc.) because no auto-maker has a market cap of over $200B. If this is the case, a 25 P/E is still very conservative given the fact that this is a very slow growth industry. If they're still growing anywhere near that pace in 2020 and the market cap is only ~$50B, the stock would actually be super cheap and probably see outstanding growth from that point on.�

1/1/2015

guest I thought you were trying to refute the post above you . But I don't get your logic. Your point from listing those numbers is ?�

1/1/2015

guest Cool story, but your stats don't disprove any of my projections (reminder: it's a projection). You are posting worldwide BMW sales while my post focuses on US 3-series sales, which I think Tesla Model 3 will track in a general way. Of those 2.12M BMWs sold (does this include Mini and other low price items as well?), only 142k US 3-series were sold in 2014. I don't have the ASP stats on this particular cross-section of sales - if you do, I'd like to see them. Your 35.5k Euro number is almost meaningless in this context, especially when considering European affinity for smaller/cheaper BMWs that aren't even sold in the US and are likely dragging down the average number. I'll also note the 35.5k Euro ASP is pretty close to the 45K USD average guess I gave above. Continue to suggest that Tesla and it's valuation should be directly compared to mature car companies, though. Perfect logic, indeed.�

1/1/2015

guest @ludicrous

I guess where our investment theories diverges is amount of faith we have in Elons word. I would argue that the data is showing that Elon simply is way too optimistic in his projections like I argued in my OP, in pretty much every major category from cash burn to demand and new product launch Elon has been way too optimistic, at some point you have to start discounting his longer term projections.

- - - Updated - - -

My point was that even though BMW is a premium brand their ASP and margin isn't that high.

@esk8mb

I assumed you point was that Tesla will achieve a higher profit margin because they are a luxury brand like BMW but the reality is that even BMW doesn't have a high margin. But reading your second post I'm not sure, are you saying that Tesla will have a high ASP in the US therefore my point is moot? How does that make any sense? You argue that BMW has a high ASP in the US, sure but how does that prove anything? How much do you think BMW is worth? Are you just saying random things?�

1/1/2015

guest Elon I think was pretty silly with that 700 billion mkt cap.

At the first opportunity to show discipline he pulls out

a complex model x and messes things up. Hope we can overcome

this situation, and hope is not a strategy.�

1/1/2015

guest I agree. The point I'm trying to make is that such a bold statement requires some sort of belief that Tesla will do something to reach a number anywhere near that. In order to do so, they will need to introduce new revenue streams that are currently unknown. I just simply don't think $700B is anywhere near reasonable with their currently planned product line (even energy products, newer models such as roadster 2.0, etc). Elon knows they will have to do something very different and extraordinary to become the highest valued car company and I just think he has some unannounced tricks up his sleeve.�

1/1/2015

guest Where is this profit margin red herring coming from? I didn't mention margin at any point and I certainly didn't ever say "BMW margins are high so Tesla's will be too." You are the one going off on random tangents. Let's try this again, slowly.

Common argument: Model 3 is in trouble as a 35k car. Look at these calcs, if they act like Toyota then Tesla is only worth x billion with ASP 35k!

Me: 35k is totally stripped and that won't be the typical Tesla M3 buyer, especially early buyers for x, y, z reasons. Reasonably upgraded models with better range (i.e., the initial hot sellers until better battery tech is out) will go for 50k I'm guessing. I think they will follow the 3 series pricing model, where you can buy the bare bones for 28k or whatever, but it options up to 80k+ with perf model. The higher end Tesla models will sell more at first to early adopters and eventually cost conscious buyers will be drawn in if the car is a success, driving down ASP over time. Using 35k ASP in your modeling is a mistake.

You: BMW has a low profit margin with a ~40k USD ASP, you are wrong.

Me: What? My point is BMW's ASP for 3 series models is not equal to the price of the lowest model bare bones no option 320i, so don't project a 35k ASP for Tesla Model 3, it'll likely be appreciably higher, especially in the critical early stages.

You: BMW is a premium brand with low margins!

Me: ????�

1/1/2015

guest

I used $45k as ASP on the Model 3, not $35k.

"Where is this profit margin red herring coming from?"

I assumed you disagreed with my model on some other level than just misreading the numbers I used, specifically on the margins since you talked about brand. Perhaps you should read my posts more slowly next time.�

1/1/2015

guest In 2014 BMW sold roughly 1/4 the units of GM but had roughly the same net profit.

As of today

BMW has a $60B market cap and GM $55B market cap.�

1/1/2015

guest Is this a response to any of my arguments? Clearly there are margin and ASP differences in the industry, and Tesla will have to achieve a profit margin equal to the highest in the industry to be a good investment. In other words the margins of BMW is already priced in.�

1/1/2015

guest Not in particular. Just some data points.

Premium vehicles have higher margins than mass market vehicles.

BMW earns roughly 4x per unit than GM while their ASP is not 4x. Similar numbers for Mercedes-Benz but with a higher ASP on less volume.

BMW also is manufacturing at near full capacity and is using contract manufactures to assemble some of their vehicles.�

1/1/2015

guest @Perfect Re:demand

Where are you getting the demand plateau from? You say the MS demand is capping out at 45k a year and yet I don't see any evidence of this. If it were to sit around that level wouldn't you expect the wait time to drop back down? At one point wait times were around 1 month and yet currently they are at a little less than 2 months. This despite the fact that they are likely ramping product of the S up this quarter along with comments that demand for the S has gone up yet again after the release of the X. I can also tell you, as someone ordering a new car right now that my poor sales guy has been putting in a lot of overtime due to all the people he is trying to work with. The reason for this most recent surge is due to the public release of autopilot (I am one of those that have been won over to upgrade on this release) both new and old owners are coming in to play here. It has also been a solid three years since they started delivering the S to the general public and so I expect repeat buyers to start really coming in to play as people hit that 3 year mark. Especially those who bought with the residual value guarantee.

I would wager that WW demand for the S is currently closer to 60k... Maybe a bit higher, since if you compare markets in places like the US and Europe we are seeing Tesla outsell all Luxury brands except for MB where they are sometimes ahead and sometimes behind depending on the country. Tesla has no where near the stores and visibility of MB, so I would expect the number to go beyond them across the board at some point. We still don't have proper coverage of the US nevermind the fact they are expanding into the Middle East, Mexico, and Eastern Europe... But nope, your right, demand is plateauing... Would love your evidence here of this.

The 2k number was based on production capabilities. As has been stated by the company, this is where the weakness lies. Their ability to ramp as quickly as everyone would like them to. Forgetting the X entirely, why have they truly been stuck on small gains on the S production this year? The factory, as it was originally designed could only support 40k a year. The first bottleneck to fix here was the final Assembly which has allowed them to hit roughly 50k in production capacity... This is because the new bottleneck is the BIW line. In addition to upgrading this line, they have added upgrades to pretty much the entire factory: motor assembly, paint, pack Assembly, and even their suppliers have moved to larger locations off site instead of operating in house.

Where did the 2B go? Well a good portion of that has gone toward the gigafactory. But they have had to pay for the factory expansions somehow. The paint shop was one of the more expensive ones if I am not mistaken but the benefit here is that they won't have to touch paint again for a long time since that, along with stamping is now able to hit 500k a year.

I won't fight you on some of your other comments because we just don't have the data in either direction. Since they aren't even pulling out a 1% net profit right now, I would be happy to just get to that point. Whether they can pull off 15% remains to be seen, but given their very high GMs I would think it to be attainable assuming they can continue to pull those GMs off on new models.

As for valuation, since you see only 300k by 2020 that is going to drive the price down, but the position he was stating the 700B from was also in the same breath as delivering "millions" of cars by 2025. So not only are they planning 500k by 2020, but continuing that 50% growth rate through 2025. We have seen comments even recently that hints this is still in the plans given they are looking at local production in China and Europe at some point.

You might be right on the 300k a year by 2020, if they can't ramp production correctly. But I don't think it will be due to demand. There has been research that indicates that every 5k drop in price doubles the market size although the studies I saw stopped at around 60kk. If we use 60k as the base though, and lump all MS sales into the 60k and above category, dropping down to 35k would indicate that the number of sales on the M3 sedan is going to be pretty off the charts easily hitting 500k or more annually.�

1/1/2015

guest That's what most people still believe and what Tesla communicated back in Feb 2014 when it raised the money.

But only very little of the $2bn raised in early 2014 actually went into the Gigafactory (GF)!

You don't have to believe me, check their filings:

1. Tesla's most recent 10-Q shows how little of the $2bn was actually spent on the GF. Since Tesla raised money again in 2015 (twice!) and we know the cash at hand on the balance sheet the result is obvious.

2. Tesla's two most recent 10-Q documents even likely contain errors with regards to GF expenses (I pointed this out several times in this forum and got no answer), but the gist is clear:

Only about 10% of the money raised in 2014 was spent on the GF and the entire GF project is obviously far from finished (basically an empty hull building as of summer 2015, besides the current building structure is only 15-20% of the intended 2020 building size).

Tesla and/or Panasonic will therefore need to somehow raise an additional $4 to $4.5bn combined to complete the full Gigafactory by 2020 (which brings the investment to the original total of $5bn until 2020).

It amazes me no sell-side analyst covering TSLA so far asked about these open gaps and why so little of the money raised in 2014 was actually spent on the GF project.

This topic will come to the table one day and it won't be pretty. We will see how the new CFO will answer these questions...�

1/1/2015

guest @Chicken

My evidence on the demand plateau is very simple and unambiguous, the wait times may go from 1 month to 2 months and back over time, but for the most part is has been around 2 months for a year while the sales have been 10-11k/quarter. Therefore the demand can't have been higher than around 45k over the last year, unless Tesla is selling vehicles on the side and not including these in their filings. And in spite of this plateau and an increasing competition over the next couple of years I would say I was pretty generous in my model expecting the X+S demand to reach 80k/y in 2020. The 300k Model 3 sales were on top of those 80k so 380k in total, not that far from their goal given the steep ramp, so still room for both coming in below this number and ofcourse above.�

1/1/2015

guest Wait Time ? Demand / Production Capacity

If wait time is constant, the either:

1) Demand and Production Capacity are both constant

2) Demand and Production Capacity are both decreasing

3) Demand and Production Capacity are both increasing

We know that weekly Model S production increased 15% from Q1 of this year to Q3 based on Q1 shareholder letter and meeting Q3 guidance. You can fill in the blanks from there.�

1/1/2015

guest Sure the demand has been increasing slightly and would have to in order to reach the 80k by 2020 in my model. But I would argue that the demand i practically plateauing, the demand growth was almost 1000% in 2013, 40% in 2014 and now 15% in 2015, the trend is clearly a plateauing growth. There is a nice regional sales distribution if you scroll down around half here Tesla Model S - Wikipedia, the free encyclopedia it clearly shows the saturation of the american market with the growth in 2014 and '15 fueled by expanding to new markets.�

1/1/2015

guest

The word "plateauing" means flat / zero growth. The word you're looking for is "decelerating" as you agree that demand is still growing albeit at a decreasing rate (2nd derivative is negative). I don't think you'd find too many Tesla bulls who would dispute this. There is obviously some limit to the market for a $100K luxury sedan, but we have not reached that limit yet.

Also, growth in 2015 is much higher than 15%. The production increase I cited is over only 6 months, so that's 32% annualized if Q4 is a miss and much higher if it is not.�

1/1/2015

guest Did you know that people sometimes uses words in a practial sense? Like say you just finished a huge meal and say "man, I can't cram down even one more bite", but actually it is very unlikely that it is physically impossible to cram down another bite. Do you want to continue discussing semantics?

Sure the growth will be higher than 15% YoY, but most of this demand growth happened last year. When this year begun production was 10k/quarter and waiting times were the same they are today, so this year demand has only grown slightly. One could even call it plateauing compared to the very fast growth of recent years combined with the downward trend.

Edit; looks like I misunderstood your growth comment a bit. I assume production was flat in Q3 with deliveries being flat so the 15% growth would be over 3 quarters or around 20% annualized, which is starting to be significant even considering the speed of deceleration. But another thing to keep in mind is the first implementation of demand stimulus, so measures of increasing growth further are diminishing.�

1/1/2015

guest It is not semantics and I am not being pedantic. A figure of speech like "can't cram down a bite" is completely different than using imprecise language to describe numbers. The word "plateauing" means something very different than what you're describing, and has been used by many Tesla bears who claim that demand has completely ceased to increase (peaked). I apologize if English is not your first language as your profile says you're in Denmark.

That's not even true. Tesla would have to miss Q4 guidance by thousands of units for growth to be lower than it was last year.�

1/1/2015

guest Yes YoY growth will probably be around 50%, but most of this demand growth happened last year. We have already gone over the demand increase for the first 3Q of this year which is around 20% annualized shown by the production numbers and waiting times.

Edit; another relevant factor to keep in mind when thinking about demand is the scaling back of subsidies to BEVs, Denmark and I believe Norway too have recently seen cuts to subsidies. I believe California will remove their is it $5k subsidy too for high income families. The $7k federal tax credit will also be gone in a few years.�

1/1/2015

guest I would like to inject some consideration for a bit of a different dimension here. What automotive company can compete with Tesla on how agile and productive their culture is? Sure Germans are brilliant engineers but they're a bit too proper to duke it out with a scrappy fast moving disruptive competitor, in my opinion. The big three? They'll go bankrupt again and ask to get rescued, and get their way. Doesn't mean they'll be a real competitor. Who the hell worth anything wants to work for them anyway?

Bottom line, for me, is -- who's capable of producing results in the long term? As much of a skeptical realist as I am, I don't see anyone other than Tesla getting the job done. I'm excited to see what the future actually holds!�

1/1/2015

guest Norway is allowing local governments to discontinue the right of BEVs to drive in bus lanes. Other incentives including the big financial ones are up for review in 2017

California has a $2500 incentive and it is cancelling it for individuals than make over $250k per year or $500k for married couples that file tax returns jointly. That is about 20% of Tesla's current customers. If you are in this income bracket and are inclined to buy a Model S but decide to buy a German F segment car instead because the $2500 rebate has been eliminated for you then you should punch yourself in the face. The vast majority of Model 3 and Model Y buyers will qualify for the CA rebate.

The US Federal $7500 incentive begins to be phased out once 200k American Tesla owners file for the incentive. That is at least 2-3 years away.�

1/1/2015

guest Demand is no where near peaking. Tesla hasn't even entered a lot of the major markets. Look at places like the Middle East, Israel, Dubai, Abu Dhabi, Mexico, Korea, Singapore, Jakarta, Moscow, etc. The biggest market for 100k+ cars hasn't even been touched by Tesla yet. There is still plenty of demand growth for 50% growth of Model S sales worldwide.

Tesla still isn't even in the largest luxury car market for cars over 100k (Dubai and Seoul). South Korea is the #3 market in the world for the Mercedes E class and the #5 market in the world for the S class. Same goes for the A8, Jaguar XJ, and other 100k+ plus cars.�

1/1/2015

guest Another reason why demand has not peaked: Tesla does not currently do any traditional advertising. They can surely drive up demand with that in future if needed when they have more production capacity in place.�

1/1/2015

guest Every further expansion comes associated with tons of cap-ex and op-ex because of Tesla's highly integrated sevice and "free" charging model.

Just look at Tesla's sales in China vs headcount, office space and SC roll-out so far. No wonder Tesla got rid of of about a third of its workforce there to keep costs down for now.

The traditional car sales model can scale much faster (and leaner) using third-party distributors.�

1/1/2015

guest Don't feed the short propaganda

repeat 50 times�

1/1/2015

guest Does that refer to my post? These are facts, not propaganda given Tesla's distribution model.

Have a look at the number of cars Tesla sold in places like China, Japan and Australia in 2014 and 2015.

Now compare this revenue to the headcount, office/service space and SC stations in these countries.

The entry into AsiaPac markets has been a giant money pit for Tesla so far.

Tesla is spreading itself very thin and I don't see why they entered these markets so early...the low-hanging fruits are in places like Norway and CA.

Why not focus on those regions for now and provide superior service (instead of cutting back on ranger service and upsetting their early adopters, see eg. this recent thread: Tesla Valet service goes POOF!!! )???

If Tesla has a huge advantage in the EV space over ICE entrants as the bulls claim they could wait with further geographic expansion until the Model 3 is ready for sale, no?�

1/1/2015

guest Thank you for pointing that out Papa logic. I come here, as most people here seem to have a better grasp and more in-depth knowledge of financials than I do. I have not seen Papa's point re: cash raised vs cash spent (and what's leftover) addressed. To me it is way more concerning than the demand argument. What are peoples thoughts with repsect to how much capital has been raised for gigafactory vs spent vs planned to spend vs needed in future?�

1/1/2015

guest If the traditional dealer route is so much more effective, why did the traditional manufacturers (Ford & GM) try to get rid of that model. It may not require as much capital from the manufacturer, but dealer costs are consistently estimated at 25% of vehicle costs. Tesla's model is not free, but US manufacturers have tried in the past to consolidate dealers under their ownership. The large body of law was developed protecting dealers from the manufacturers and did not happen in a vacuum.�

1/1/2015

guest absolutely agree with this point you make, tesla should have not spread itself so thin geographically,

and moreover in my view this suv has been unnecessarily complicated when a simpler

version would have been sufficient .�

1/1/2015

guest Whether or not I get angry at Elon for spending all the gigafactory raise on Model X R&D depends on whether or not the production can be ramped up while the margins maintained. So that decision comes later as we are in execution phase.�

1/1/2015

guest Interesting to note the huge store increase plan in western Europe. Yet only one upcoming store shows in the U.S.�

1/1/2015

guest I don't think the direct sales/service model is flawed by definition. Other new EV entrants (Apple, Faraday Future...) will likely choose a similar model.

The problem I see is TSLA using this model in new markets with weak (at least in the short- and mid-term) sales. It's very cap-ex intensive and obviously only justified by soft metrics (eg. "building the Tesla brand in strategically important markets like China") and not hard numbers (ROI) for now.

Even if Tesla (Model S and X only) achieves 100k sales per year before the Model3 is launched (quite a bullish assumption), these "weak" countries will only contribute a few hundred or thousand sales.

What if Tesla concentrated on strong markets (CA, other CARB states, Northern Europe etc.) for now and forgot about the rest until the Model3 is ready?

Where is the value of catching a few hundred sales in places like Japan or Australia (again, before the Model3 is ready) after factoring in cap-ex and op-ex in these countries?�

1/1/2015

guest I actually agree with tftf that the move into China may have been premature, as I've stated previously. However in the long run it may prove to have been beneficial to get a foothold there early and for Tesla to be involved in working with government officials and giving input into charging standards and infrastructure. Elon and Tesla are playing the long game and have likely calculated many moves in advance. I'd think their next big move in Asia would be Korea, seems as if it should be a good market for the S/X, unless there are regulations and tariffs of which I am unaware.�

1/1/2015

guest Demand growth tends to come in waves not a constant steady increase. There are local peaks and valleys so to speak but the Y/Y trend is probably one of the better more stable measures. This takes out seasonality and any improvements which would take a while to see pan out.

I posted in the China thread about the Y/Y comparisons. We are on a path to meet or possibly exceed last years demand growth. I don't think the growth from 2012 - 2013 is a fair one since they weren't even producing decent numbers until Q4 2012. If you take that quarter and then Q4 2013 you will see a quarterly jump from 2400 to 6900 is better at only 187% (as opposed to 1000% or whatever) and that was with a drop in production they didn't expect with a blowout quarter that included a dumping of all the inventory. Dropping out the ~2900 in inventory sales and the jump looks more sensible at a 66% increase... Which is actually more in line with the rest of the production increases.

Basically their increases seem to be focused toward a 50%+ growth Y/Y which is a really sensible growth scale. If I recall their first three quarters combined Y/Y increase is sitting around 53%. As was stated they would have to miss guidance by thousands to fall under the stated 50% growth projection. If you are disappointed at this point in that 50% growth then you should have been complaining about it back around a year ago when they said this was what they were targeting for growth through the end of the decade.

For reference:

33,000

49,500

74,250

111,375

167,062

250,593

375,890

That is basically the Bear case as I see it through 2020. (Which is actually in line with your bear case)

They essentially need to do 50k deliveries this year, and hold a Y/Y average increase at 59% to hit their goal of 500k by 2020. That isn't that many extra percentage points. But I think the important thing is ramping production more than anything.�

1/1/2015

guest Korea would be the best next market for tesla. 50 million people in an area the size of Ohio. No charging problems and one of the largest markets in the world for luxury cars. Also there are incentives up to 15k for electric vehicles. Gas is $8/gallon in Korea and the full lease amount can be written off for taxes. Mercedes has 20 dealerships/service centers in Seoul alone.�

1/1/2015

guest I see Korea has a 4% tariff on American cars that is due to be eliminated in 2021.

It used to be that if you bought a foreign car in Korea you were much more likely to be audited by the tax authorities but that seems to have waned.

What about other non tariff trade barriers? Will Tesla have a fight with dealers over direct distribution? Are there byzantine "safety" rules that hamper foreign auto companies?

It seems that BEVs were not allowed on highways but that law is not enforced?

If the only issue is a 4% import tax it seems stupid that Tesla is not already there.�

1/1/2015

guest Not anymore, tax is one of the main reasons expensive foreign cars sell really well here. 100% of the lease is deductible so you either spend the money or pay more taxes to the government. Everyone that is self-employed or has their own business leases a foreign car(that's why the luxury car market is #5 in the world despite being a small country).

The dealership angle might be an issue. I think almost all foreign car companies use a Korean company for distribution, sales, and service. There are no safety rules that hamper foreign car companies.

The law against BEVs on the highway is outdated. It was made when electric cars were considered golf carts. There are alot of BMW i3's and EV soul's on the roads. Restrictions on highway use are not enforced. In fact, EV's get lower prices for tolls and public parking lots.

It does seem stupid that Tesla is not already there. There are already over 200 BMW i8's in the country.

http://www.reuters.com/article/2015/03/09/southkorea-autos-luxury-idUSL4N0W510N20150309

I think Korea is the 4th largest luxury car market (cars over 100k) in the world.�

1/1/2015

guest Expanding into these markets is demand insurance. If they hadn't laid the groundwork for these markets bears would be screaming that they are totally dependent on the CA/ northern Europe markets and any hint of saturation would leave them flatfooted.�

1/1/2015

guest Plus needing time in China to figure out how to do business seems to be the norm. No way Tesla could plan to arrive in China at the optimal moment. They went in and took their lumps. Hopefully we will see some volume later next year.

I like how they are spread over Germany. Good way to get the German majors moving faster on EV.�

1/1/2015

guest I wonder if the VW scandal widening to Porsche will help X sales.�

1/1/2015

guest And took some lumps to one car! :scared:

I like your thinking re: Germany. Remember also Elon's low-key, friendly chat with the minister, Sigmar was it? He got to drop a few thought-seeds there.�

1/1/2015

guest FB latest quarter revenue $4.5B, non-GAAP margin 54% ,market cap $300B

TSLA quarter revenue $1.2B, non-GAAP gross profit $0.32B market cap $30B

They are valued almost identically, well if you believe TSLA will grow faster than FB, then it seems a no-brainer to short FB and long TSLA.�

1/1/2015

guest Not a great comparison.�

1/1/2015

guest Regarding FB. Teens have no money. Adults have money. Teens have moved on to Instagram. Adults just discovered FB.�

1/1/2015

guest I think you mean Snapchat, but yes same difference. Interesting that Tesla is the car teens aspire to own. Not BMW. Not Mercedes. Not Porsche. Tesla.

I can't tell you how many times I've taken my car to the exotic car show at Redmond Town Center and teens bring their parents over to show them what a Tesla is and i hear they've been talking about it non-stop from their parents.

Long term, those are your future Model 3, S, and X owners.�

1/1/2015

guest 2020 for current teens. If Y can be released by then. It'll satiate the desires of all those young men who wants a hot rod. Man, I want to step out of a roadster with a falcon wing door so badly with the spotlight from the door shining on me.

In 2 years we will need the students that are currently in University and all young adults to jump on board. That's our target audience for 3.�

1/1/2015

guest I think the Y is supposed to be the mid-sized CUV not the new roadster.

That being said, I was thing what they should call the new roadster, and it should be called the Tesla Super.

Why? Because then they would have "Super S3XY" as their car line up �

�

1/1/2015

guest Hi,

My LT ER-CC thoughts:

EM's statements above, combined with his decision to be more cautious about announcing schedules indicates that the design of the M3 is close to complete, and they have already taken and are currently taking steps to derisk potential M3 ramp issues.

Stationary storage:

Exactly like their cars!

Can anyone understand the number, it sounded like $2.5B?

IMO the number above is not important beyond giving us a rough idea of the expected scale, because they believe (based on the huge response, the knowledge that their SS products are very high quality and are priced disruptively) that they will be able to sell as many units as they can produce for the foreseeable future.

Their pack prices are much lower than almost everyone, even here in the TMC Investment Forum realizes. I have even been asked to not post my opinions (which are the results of careful analysis) on this topic. I believe that within 3-5 years their cost for 250 mile range EV drive-trains will be less than for ice engines with transmissions.

That's an important step, yielding at least a 5% reduction in pack prices.

I believe that a major reason that these signings were made public was to help these companies procure funding in order to ramp production. An example of taking forward looking, clever, low cost steps to insure future supplies of a critical resource.�

1/1/2015

guest Wait, who told you to stop posting comments on pack prices? I think we all like to engage in a little pack price speculation now and then. If you are going to provide in depth analysis on anything I am all for it! I love when people post something that took hours of research to put together

We really need to take another look at where we feel TM is at on their pack prices, and where they will be in 2017 and again in 2020. Because there have been quite a few new comments from the company on this front which I think changes that game for us and I would agree that they are likely lower now and in the future than most are planning for. The big number is under 100$/kWh, I would not be surprised to see this achieved before 2020.

As to the second piece I highlighted, I would agree with that being the stated reason for doing this. If I was seeking financing to do exploration and mining projects, and I had a deal signed with Tesla Motors and their Famous battery factory it would do a lot to assure would be investors that their money is well spent since TM has assessed all available lithium sources and settled on one of two choices (or possibly both?)�

1/1/2015

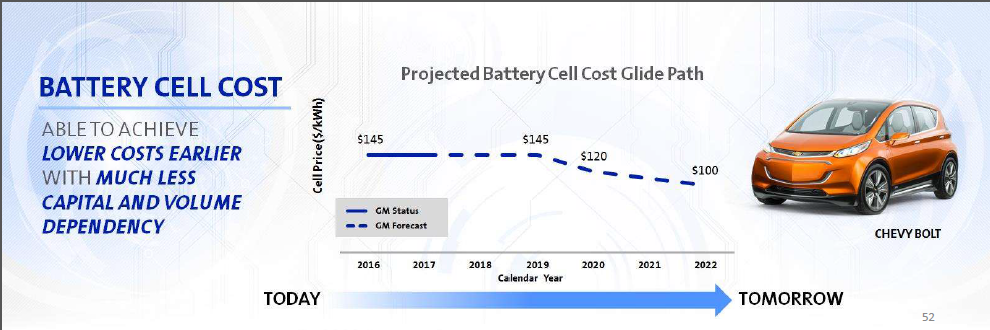

guest Beyond the cost of a single cell, is there a lot of scope in the rest of the pack assembly to win in cost structure vis - a - vis other manufacturers? If so, how? If we compare a 2018 Bolt vs a 2018 Model 3 would it be fair to expect cell pricing to be $145 vs $120/kWh?�

1/1/2015

guest It's not meaningful to compare pack prices between EV's. In one car the pack could be part of the structure, in another car the pack might needed additional structure. Plus, the manufacturers would never release the costing to allow a good comparison between brands by outsiders.

Cells are near commodity, however.

As far as cells, I don't believe Tesla can build a new battery factory and have substantially lower cell prices by 2018. If lower prices happen, it will be later. What will really be happening in 2018 is Tesla recovering cash flow from previous capex in the gigafactory.�

1/1/2015

guest Don't know the answer to your question, but you got me thinking about the $145 GM cell cost, which I always found kind of suspicious. I don't recall this article being posted here, but it says that LG was angry that GM disclosed the price they were paying for cells, and LG sells them for at least $100 more to everyone else: LG Chem With GM For Disclosing $145/kWh Battery Cell Pricing - Video

This slide also showed that GM's cell cost will be $145 through 2019, while JB has said that they expect $100 range by 2020: Tesla Projects Battery Costs Could Drop To $100/KWH By 2020 - HybridCars.com

With JB and Elon dismissing this as an issue on the recent conference call, I think this is marketing by GM more than it is any erosion of Tesla's cost advantage.�

1/1/2015

guest The one link that I need to pretty convincingly demonstrate how much Tesla's pack costs are ahead of the rest of the industry is I read a post, pretty sure it was on TMC, that discusses a video of JB talking about the cost reductions when they start producing cells at the GF. He talked about the cost reductions from the cells vs the cost reductions due to the GF.

If someone could either post or PM me the link I would appreciate it.

Thank You!�

1/1/2015

guest AFAIK, Musk has never made a single dollar of profit from manufacturing anything, and Tesla has never made a single battery cell. Who is doing the "marketing"?. Big, established corporations are very conservative making forward looking statements. Cost data is extraordinarily central to manufacturers. The chart you see is probably worst case, not optimistic.�

1/1/2015

guest This is highly disingenuous, since I'm sure you know why Tesla hasn't made a profit yet, and SpaceX by all accounts is profitable. And if Tesla's contribution to the battery tech is as inconsequential as you claim, it's on you to point out where those superior batteries from the competition are. Oh, wait, they are in the future.

All the Model S cars currently on the roads. The product speaks for itself.

Yes, manufacturers being conservative is why they announce a new Tesla killer every other week, all for 2018 and beyond. It's not that they can't manufacture them yet, they could do that at any time, they're just being conservative. Got it.

Look, I see a lot of proof that established manufacturers can build millions of cars with last century's tech for low margins. I see no guarantee that they are able to compete in this century. I'm sure some will figure it out, but the jury is still in session, judging by what they've been able to come up with so far.

The proof that Tesla can do what they set out to do is in their deployed EV fleet. People who say it cannot be done should not interrupt those who are doing it.�

1/1/2015

guest GM is. The slide is from their Global Business Conference. Tesla does not disclose their cell or pack costs.�

1/1/2015

guest Commodity cells have commodity pricing on the open market.

Tesla is buying cells with made to order chemistry at massive scale compared to any other buyer.

It is highly doubtful they are paying the same price as Fry's electronics for their 18650 cells.

- - - Updated - - -

BTW I came here expecting a discussion on Elon's comments at the Baron Conference that it is not out of the question that Tesla will one day be bigger than GM.\

Elon did not specify Market Cap, Revenue or Units sold.

Also 500 mile BEVs are about a decade away.

http://insideevs.com/elon-musk-question-tesla-larger-gm-500-mile-evs-coming/�

1/1/2015

guest Not to mention Baron's own market cap estimate of 120B by 2020I'll take that number, time to buy more shares. A 4 year return of 400% is pretty good I would say.

�

1/1/2015

guest I'm interested to know why Tesla's in house sales and service centres should cost them more than using a dealer network. The dealers do put money up front to equip their stores but then reap the rewards of their investment by buying cars in bulk from the OEM at below market rates and selling them at a premium to customers. The more cars they agree to buy up front the lower the price. The point however is the difference is what funds the dealer network and pays for their investment plus generating a nice healthy profit. If you strip that out then the profit in the dealer network becomes the OEMs. Upfront investment will of course be higher, but in Tesla's case the vehicles are significantly simpler and almost certainly require less investment.

There is an additional but related problem that dealerships make a lot of money from servicing which on a BEV should be a lot lower (much lower level of consumables for one thing). There is therefore a disincentive for them to promote BEV sales over ICE whether under the same roof or within the same business network.

The laws protecting dealers from OEM competition in the US came about because the dealers could not be competitive against an OEM store because they had less margin to sell and it amounted to unfair competition. If that wasn't the case then the laws wouldn't have been enacted - does that not support the Tesla model

I've read Bob Lutz's comments but while I have a huge amount of respect for him personally, in this case I think the Tesla model is so far away from the Ford/Chrysler/GM one that he's been steeped in that I think he's unable to see the wood for the trees.

I would be very interested if anyone can explain why using a dealer network would make financial sense.�

1/1/2015

guest I'm no insider to the car business, but I think it's a cash flow thing. For a manufacturer, the faster you can get your money for the finished goods, the faster you can plow that back into building more stuff. Dealers buy the newly built cars from the factory, which gets the builder their money. In most cases the dealer is probably buying the cars on a line of credit hoping to flip the cars as fast as possible to make as much as they can. But the builder doesn't care that much as long as enough dealers stay in business selling their cars, the individual dealers are taking the risks that the cars won't sell. If a dealer buys a bunch of sub-compacts in Oklahoma and all the people walking into the dealer want pickups, the dealer made a bad move and might go bankrupt, but there is another franchise in the next town over that bought a slew of the right vehicle and they sell out.

I do see one point Bob Lutz has. The dealer system does buffer the manufacturer against downturns in the market. A short downturn would be rough on dealers, but the factory may only slow down production a bit for a little while. With a direct sales model like Tesla has, it works great as long as the demand is there, but if demand gets soft, there is no inventory buffer and the ripples get back to the factory much faster. Tesla has never really had to deal with that, and who knows what will happen when it does. If there isn't another financial crisis like 2008, it will probably be a while before Tesla has to face that question. Right now there is a huge pool of potential customers who want a Tesla, but can't afford a Model S or X, but could afford a Model 3 when it comes out. If they don't make any major mistakes with the Model 3, demand will probably outstrip supply for years after introduction.

As for the laws against competition in the car business, some of the laws are fairly recent. For example the US state of Georgia did a major overhaul to protect car dealers as recently as 1999. The dealers were probably getting concerned in the 1990s because people could shop for cars on the internet. Some US states allow car brokers who will shop many dealers throughout a region and arrange to have the car shipped to you from the dealer which is the cheapest. A lot of these laws came about to shut down brokers. It does make dealers in cities where expenses are high compete with dealers in rural areas. Here in Washington State, the sale taxes can vary quite a bit from county to county and the county with the lowest tax rate has dealers for every car you can imagine. The last time my SO bought a car, she got the best deal from a dealer in that county so we drove up there to pick it up (about 50 miles for us). She saved about $500 in sales tax alone, plus they sold it to her a little cheaper than the local dealer would.

Back in 1992 I talked to a broker when I bought my last car, but I ended up going with the local dealer which was about the same price that round. The broker was working with a dealer 120 miles away who would ship the car to me so I didn't even have to go there.

My state isn't as protectionist of car dealers, so I don't think Tesla has had any problems here. The laws vary quite a bit from one state to the next.�

1/1/2015

guest Dealers are in many ways a franchise model. The benefit is capital investment and local management. In a high volume, low margin business it is understandable that car sales follow this model. With the internet and EV's with lower service requirements (cough), it is understandable that Tesla would be interested in selling direct. But we will see if they are really interested in selling direct in secondary and all foreign markets.�

1/1/2015

guest Trade Journal Automotive News interviews Cadillac Brand Boss Johan De Nysschen.

"Sticker prices on the (Cadillac) CT6 (full size) sedan, for example, range from $54,490 to $84,460 at the top of the range, including shipping. That's far below the pricing on the BMW 7 series, which has comparable size and power and runs from the low $70,000s to around $100,000.

De Nysschen said he would rather price the CT6 to sell than be forced to ladle out incentives, which has become common in the market for midsize and large luxury sedans. He said average incentive spending in recent months has equaled a lofty 17 percent of transaction prices in those categories. "

http://www.autonews.com/article/20151128/RETAIL/311309995/cadillac-wants-its-new-vehicles-to-earn-prices

Gee, I wonder what might be causing full size-mid size luxury sedan prices in the United States to collapse but not compact midsize or full size luxury SUVs/Crossovers/Trucks. Nor compact luxury sedans.�

1/1/2015

guest Big mystery indeed. Could there be some unknown factor, let's call it "X"?

:wink:

�

1/1/2015

guest I would call it "SX".�

1/1/2015

guest Be prepared for some misunderstandings from what we will call this "unknown factor" in a few years time �

�

1/1/2015

guest Heres Why Tesla Will Kick Google To The Curb - Gas 2

�

1/1/2015

guest Mobileye reigns, tesla is at the forefront in adapting their technology.�

Không có nhận xét nào:

Đăng nhận xét