1/1/2015

guest It still is. Most of the quality discussion now is going on at The Contrarian Investor Discussion Board. Do stop by! �

�

1/1/2015

guest Recent report on massive solar panel shortage has sent a bunch of Chinese solars way up in the last week. Lots more info (and conversation) seems to happen over on Sleepy and Norse's site The Contrarian Investor on this subject, if you are interested.�

1/1/2015

guest As Flux indicated there is more chatter/info on solars over at Sleepy's site. I frequent there/not posting much though. I had a substantial position in both JKS and JASO....sold everything with their run up to earnings. I may miss the big move we have all been waiting for but there are better opportunities I feel and I grew tired of waiting for their big moves. Still have good amount in CSIQ, SPWR and a little in SCTY but I am done with SOL, JASO AND JKS.�

1/1/2015

guest Interesting article about huge UBS solar / EV report that just came out:

Do bank analysts dream of electric cars? | FT Alphaville�

1/1/2015

guest Very interesting, FluxCap; thanks for sharing.�

1/1/2015

guest If your area provides net metering for solar (ie you can "sell" excess energy back to the grid at the retail rates, which are highest when solar is generating electricity), what is the economic point of have battery storage?�

1/1/2015

guest At least two points:

- Net metering will not last forever - it is a measure to encourage solar adoption.

- As the percentage of solar increases, net metering will no longer be practical. There are also significant technical problems in having a large percentage of solar on the grid without batteries, e.g. as seen in Hawaii.�

1/1/2015

guest Also emergency backup if the grid goes down.�

1/1/2015

guest Did you mean with or without batteries?�

1/1/2015

guest You're welcome, Curt!�

1/1/2015

guest Incidentally, I am currently theorizing that a hugely successful AliBaba (BABA) IPO today could open the floodgates to retail investors in the Chinese solars and other Chinese tech companies. This could bode well for the likes of CSIQ, JASO and others.�

1/1/2015

guest A solar power system often doesn't generate enough surplus energy during the daytime to completely cover the cost of an owner's electricity needs at night. The net effect can be that they still have to pay something to the electric utility.�

1/1/2015

guest Without, sorry!�

1/1/2015

guest Anyone put in for shares for the upcoming Vivint Solar IPO, if demand is strong & prices at $18 or higher I will take my shares.

Vivint Solar, No. 2 US Solar Installer, Sets IPO Terms to Raise $370M : Greentech Media�

1/1/2015

guest So yeah, VSLR is trading. Quite an unfortunate macro day to IPO, maybe a bargain time to buy?

Also this is of interest:

Analysts See China's Renewable Energy Sector Returning to Fast Track Growth - News - ReneSola - Green Energy Products�

1/1/2015

guest Alright, VSLR price back down to IPO level. Good thing? Good buying opportunity?�

1/1/2015

guest Solar has really killed my portfolio this last year. As an example, I bought $25 strike J15 SPWR a year ago, which seemed fairly conservative way back then. SPWR is now looking like it might reach back close to it's 52 week low. The chinese solars have been particularly bad.

I would have been far better served to just keep everything in TSLA and never diversify. Hell, I would have been better served diversifying into a market index fund.

I certainly think solar is the future, but from an investment perspective, not good. Ah well, hindsight and all that.�

1/1/2015

guest I was just thinking that SPWR will be getting a larger percentage soon. I got hammered with solars this year too. Last year I did better with them than I did TSLA.�

1/1/2015

guest Same here ckessel, but my tsla dwarfs my solar. Oddly I'm still close to breaking even on my spwr though. And will probly add to it soon.�

1/1/2015

guest Is there something special about JASO that the news isn't carrying? I thought it was just going with the herd during this long decline, but the herd stopped crashing today and JASO is still down big.�

1/1/2015

guest So is Jinko. Two of my larger solar investments �

�

1/1/2015

guest I believe I read (will look for it after work) that JASO is getting large increase in shorts and they are trying to drive the price down.�

1/1/2015

guest It's certainly succeeding. JASO is at its lowest point in nearly a year and half.�

1/1/2015

guest I don't see a legit reason for it either. I bought s truck load of $8 leap calls earlier this week.�

1/1/2015

guest I bought calls in JASO too, Jan16 LEAPS but higher strike for more delta... I think this drop was utterly exaggerated... herd mentality and all that. I didn't buy a truck load though �

�

1/1/2015

guest I would be buying more SCTY but I am very cautious because I am very overextended and every down day I am sweating a margin call. The correction in Solars is an overreaction for sure and I think in the 1-2 year time frame all the solars are great buys right now. That being said the only company I have done extensive research in in SCTY.�

1/1/2015

guest Any comments on the markets response to CSIQ?�

1/1/2015

guest It sucks

Down 8% on a great ER. Go figure.�

1/1/2015

guest I dont own CSIQ, wondering if I need to add that to my portfolio today.�

1/1/2015

guest I added more J17 $30's and picked up some J15 $30's. Totally unwarranted drop.�

1/1/2015

guest Almost all the solar options I have are turning to poo (no CSIQ anything but might just get some stock). This unwarranted drop in solars has been going on for months.�

1/1/2015

guest I considered playing my 4 strikes out long strangle a few minutes after open this morning but didn't. When csiq leveled off at 29 I bought a few calls thinking the selling pain was over. Guess not. My strangle play would have worked nicely though.�

1/1/2015

guest I sold a 2017 put and used the proceeds to do some short term speculation buying calls that expire next week. I don't get the drop at all. If I understand correctly they moved a project from Q4 to Q3 which gives them a big beat this quarter but obviously lower revenue next quarter. The market constantly surprises me. Hopefully it will be a short term bounce otherwise I'll be waiting a while to get my money back.�

1/1/2015

guest I can't figure it. I did buy some protective puts yesterday but they only 'protected' about half the paper loss on the J15 LEAPS I have.�

1/1/2015

guest I think that there was a few reasons for the decline:

1. CSIQ is completely incompetent in managing FOREX. It lost $20m on forex and this is not the first time it lost $20m. It seems to lose huge amounts on forex every other quarter. Currency hedging is not that hard to do, so investors lose confidence in CSIQ when they see that the company has no idea how to hedge this exposure; or maybe they simply just don't care.

2. GM came in at 22.9%, but they are guiding for 17%-19%. Q4 is typically the strongest quarter for solar, so if GM is going down then investors start to worry.

3. Q4 Revenue guidance came in below analyst consensus, and coupled with GM guidance it could be hard for them to beat EPS estimates as well.

I think that CSIQ is a good buying opportunity here and I will be looking to add some next week if weakness continues. I have some CSIQ, but it really isn't my first choice from solars; although it might become my first choice if it dips even lower from here.

Short term stock movements are noise and you really need a long-term investment horizon in order to justify investing in any company, and solars especially. If you like CSIQ 3-5 years from now, then use weakness to buy some and hold. If you are trying to play solars short term for the ER's, then you are gambling and it will be a crap shoot. Sometimes solar stocks go up post ER, and sometimes they crash on ER; there really is no rhyme nor reason why the stocks act the way they do post results...�

1/1/2015

guest Nice to see you back! :wink:�

1/1/2015

guest Kandi had an investor conference today in SF and will be launching a 300 mile + pure EV car next year amd are expected to produce 200K cars around 2016 time frame. Interesting times for the EV, especially in China where they really need it even more. I have a boat load of KNDI shares, hoping that bet will win huge like TSLA in 2014. I have been out from Solars since March but seems like a good time to get back in again.

My Model S is running like a champ!�

1/1/2015

guest I've been in and out of KNDI with very small positions a few times over the past year in a trading account of mine. I haven't been impressed with the company during that time. The company doesn't meet my criteria for a major long-term holding since I'm not convinced in the management's ability to execute and I found it difficult to gauge how compelling their cars are.�

1/1/2015

guest Good to hear from you Sleepy. I would buy some of your points, if it weren't for the following:

1. They hedged $15.4 million of their $20.9 million currency loss this quarter - they were pretty proud of it and it does show a little additional maturity of their management and Forex understanding.

2. They addressed the drop in GM in Q4 with tariff effect (1-2%), potential Forex (1%) and slightly lower mix of project revenue (4 Canadian projects vs. 5).

3. If you take the midpoint of their guidance (which is conservative) at $950 Million and 18% margins and $80 million of expenses/interest/Forex you get $1.52 in earnings - exactly in line with consensus analyst estimates for Q4. What's more, add $1.52 to the other 3 quarters and you get $4.25 + in earnings for the year, well over analyst estimates of $3.54 and leaving CSIQ with a current P/E of 6.7.

As for other thoughts - they didn't move a project from Q4 to Q3 - it was the opposite. They moved Ray Light out of Q3 and are now not specifying when they will realize revenue from this project and they substituted William Rutley's sale to TransCanada, which had been on their books since 2012. The tactic they used for Q4 2014 and Q1 of 2015 was to give themselves more flexibility with project recognition. They had scheduled 7 Canadian projects to be realized in Q4 in their investor presentation in August, but in their earnings release they bumped Gold Light to Q1 of 2015 and left Liskeard 1 and Ray Light as unspecified for expected COD/Recognition. I think they did this so they could move revenue from 2014 - 2015 if they wanted and smooth out their earnings. Just as Q4 is usually good, Q1 is usually wretched.

There may be a "real" explanation for what happened yesterday, but we haven't heard it yet. Most stocks leap if they beat by pennies and raise overall yearly guidance - CSIQ beat by 50% and $.69, raised their yearly guidance, showed restraint and conservatism, greater management effectiveness, good visibility for future earnings, paid down millions in debt, opened new markets, were upbeat about not only their record earnings and revenue, but the prospects going forward.....and got their asses handed to them.

In this, Sleepy was right about maybe the most important point - short-term options in Solar are asking to have someone else play with your money whenever they want, regardless of results.�

1/1/2015

guest So sleepy & bgarret - JKS is my largest solar investment and doing miserably. What is better now, more JKS under 22 or CSIQ at 27? Sunpower is also around 27 right now. Jaso is under 8. Basically all my solars are a bloodbath.

Edit:

Bah - order to buy csiq at 27 executed and still dropping �

�

1/1/2015

guest SPWR apparently issued soft guidance for 2015 and tanked.

I believed in solar. Still believe I guess, but it's been a pretty crappy investment over the last year. Straight NASDAQ index would have crushed nearly every solar (csiq, spwr, scty, etc). I bought $25 SPWR J15 LEAPS just over a year ago when SPWR was about $33, paying just a $2 premium. I thought that was a pretty conservative buy since I had 14 months, but right now I'm looking at a gigantic loss and with SPWR guiding for a light 2015 I'm not sure there's much reason to think it'll recover before J15.�

1/1/2015

guest I had my crisis of confidence and after the sting of GTAT and now sold out of solar. I hope this means it is the bottom for everyone else. I never got around to researching or learning much about the solar companies. It just doesn't interest me. In the meantime there is a ton of competition in solar which means in most cases that erodes the earnings across the entire sector. Now, that isn't to say that solar stocks aren't priced ridiculously irrationally low but since I don't really know the ins and outs I can't hold on with as much confidence as I hold on to TSLA. I have lost a good percentage of the money I made on TSLA but am still ahead of the game.�

1/1/2015

guest Their product is certainly no Tesla, but once the Chinese government begins to build EV charging infrastructure in large numbers, the lower to mid-end pure EV market will pickup (it already has significant over last year), out of which they should capture a decent market share (~25%). Their leader Hu has political ties with the PRC and its a different world out there. Execution I agree is not as good, but the Chinese government can force things to happen due to their pollution crisis. They have already limited sales of gas powered cars in big cities. It looks like next year they should be able generate about $1 billion in revenues +/- with their sales for car share, expected direct sales to consumers, and international sales. I am planning to hold for 2 + years, but doing weekly DD.�

1/1/2015

guest JASO still make one of the very best panels on the market, with regards to conversion percentage and warranties. I still believe them to be seriously undervalued with regard to future potential. As a long term play I'm not worried. JASO has their Q3 earnings next week Nov 18th. Today might be a good day to buy, but I've learned to stay away from the options in these solars, even the LEAPS. They are too easily manipulated due to low volume, the bid/ask spread can be ridiculous and even a 2017 LEAP may be to near in to the future for them to take off for real. I only hold stock and look at days like to today like a buying oportunity.

The price of oil at a historic low doesn't help much either, but we should all know that the current oil price is a temporary situation and does not reflect the real market economy of oil.�

1/1/2015

guest Here Comes the Sun: Americas Solar Boom, in Charts | Mother Jones

At first glance the solar industry seems like a great investment, and I was very close to pulling the trigger on some stocks myself a while back. But then I realized that the industry's greatest strength, the incredibly fast falling prices (increasing its competitiveness in the energy sector), might also be its greatest weakness as an investment. Even though the amount of solar panels in KW output has been increasing at a fast rate for years it doesn't translate well into earnings growth for the companies as the price reduction negates a large part of the increase in sales. Another thing is the immense competition in the space, margins are paperthin and companies loaded with debt, cant see how the industry can break out of this commoditized state.

Just a counter to the otherwise pretty bullish thread, the solars have been beaten up pretty badly lately, it might have created an opportunity I don't know, but the play isn't as great as it seems at first glance.

Edit: I think Tesla is in a better position to capitalize on the upcoming solar boom with it's batteries than the solar industry.�

1/1/2015

guest Which is odd because the most money I've made from solar is the company that gets ragged on the most: Solar City�

1/1/2015

guest One more strength of Solarcity. The genius of Solar City is the simplicity they have to scale up. They double their residential installations every year and will install .5 gig this year, 1 gig next year, 2 gigs after that,etc,etc

When I listen to the other companies earnings calls I get an appreciation for how hard it is to locate and execute on major projects all over the world.

Edit: It is also worth noting that Elon and Lyndon think there will be a panel shortage in the next few years and that will bode well for all the panel manufactures bottom line.�

1/1/2015

guest Thought about it some more. I ended up buying back in but now I am 100% stock and spread across more companies. I won't earn as much money on the upside but I've been getting far to greedy lately and paying the price.�

1/1/2015

guest The bit about "spread it across more companies" got me curious, so I put in a bunch of solars into Google's finance chart: SCTY, CSIQ, SPWR, JASO, TSL and compared them against straight NASDAQ going back 1, 2, 3, 4, and 5 years (roughly, the granularity on the scroll bar isn't precise). I didn't cherry pick anything intentionally; I just entered ones that I remembered we talk about here.

(NOTE: JASO had a 1:5 reverse split in late 2012, I'm not sure how the Google finance graph handles that)

1 year: NASDAQ beats them all handily.

2 years: 2013 is a great year for solars. CSIQ crushes everything. SPWR and SCTY do really well. Most solars are winners over NASDAQ.

3 years: SCTY, SPWR, and CSIQ are still the big winners due to the great 2013 year. NASDAQ beats everything else. JASO is down 12% over this 3 years span. The only solar I picked that's negative (does the 1:5 reverse work into that?).

4 years: SCTY is the again the big winner. SPWR and CSIQ beat the NASDAQ slightly. The other solars (TSL, SOL, JASO) are hugely negative.

5 years: NASDAQ crushes everything except SCTY. SPWR and CSIQ are positive (thanks to 2013), but underperform NASDAQ. TSL, SOL, and JASO are again hugely negative.

2013 was a huge growth year for solar stocks and if you managed to time that, you're rich. For a buy and hold, on a 5 year scale, almost every solar is worse than a NASDAQ index. And if SCTY wasn't in your portfolio when it went public, your solar portfolio doesn't look good.

Is there good reason to believe the next 5 years will be different than the previous 5 years? I really don't know. I missed the huge 2013 run up. Is there going to be another such run? Is it going to be big enough to outpace NASDAQ?

Mostly musing...as I watch my various solars and wonder if it's misguided to think 5 years from now I'll outperform the NASDAQ.�

1/1/2015

guest The problem with five year windows is they can be very different depending on which one you pick. If you choose March 2009-March 2014 you will probably see solar absolutely destroying the NASDAQ. That being said the variability in this case shows high volatility which can be difficult to time and may lead to under-performance more often than over-performance.

For the next five years the theory is that we are hitting a tipping point and demand is going to be so high that margins will be high despite the industry being somewhat of a commodity. This is further reinforced by the currently low PE ratios. In theory part of the low price right now is the idea that the higher margins are only temporary and will disappear in a year or two especially with all the competition. However, one thing that gets me to stay solar is that the recent drop seems to be correlated with the drop in the oil price which makes absolutely no sense. Oil could be $30/barrel and it won't affect the solar industry. At this point though I don't hold any more than I did before so it has become a fairly small part of my portfolio thanks to all the losses.

If solars can establish a track record of decent margins and earnings the return should be quite good. But I can't say with any certainty that they will even though I think they will.�

1/1/2015

guest I just tried that. NASDAQ killed them all. Extend it to mid-2013 and SCTY and CSIQ beat the NASDAQ because that's when solars went bonkers in 2013.

Take a 5 year span and scroll it around. There's very few points where solar beats NASDAQ aside from SCTY being a notable exception and CSIQ/SPWR holding their own (but often not drastically different than NASDAQ).

Yea, that's my thinking too, but running those graphs makes me wonder if, as an industry, it really going to do better than the NASDAQ. Certain vendors, certainly. But which ones? Which ones will go bankrupt?

Say, 2 years ago, you put a bunch of money into TSLA, Fisker, Coda and whoever else in the EV market (granted, it's not public stock in some cases, so it's a difficult comparison). How many of those were complete losses? If you averaged total losses with something like Fisker against TSLA, how much would you beat the NASDAQ?

Just thinking out loud here, not advocating any particular investment.�

1/1/2015

guest 1. You are correct that they hedged $15m of the $20m loss and the net loss was only $5. For some reason they wrote "net foreign exchange loss" was $20m, but that number did not include the "hedging" offset; for that reason I missed the actual forex impact, which is only $5m or so loss. I take back what I said about them being "incompetent" in FX hedging; they used to be, but it looks like they solved that issue. They hedged 75% of their exposure which is perfect from an accounting standpoint. You never want to hedge 100%, since you run the risk of overhedging if your projections turn out to be incorrect.

2. I am sure there is a good reason for drop in GM, but the market doesn't care. Most players do not listen to conference calls or even read the press releases, they only read the headlines. It isn't fair, but that is how the market works in the short run. This is also how buying opportunities are created.

JKS had 27% GM one quarter, then it fell to low 20's and the stock is getting punished. JKS still has some of the highest GM's in the business, but all the market sees is declining GM.

3. I agree with you here again, but the market doesn't care. They saw $1.76 in Q3, but "only" $1.52 in Q4; sell, sell, sell.

This is exactly what happened to JASO in Q4 last year. They crushed the estimates and delivered guidance that was weaker than Q4, but stronger than Q1 projections. The stock was up as much as 20% pre-market and then up 14% in actual trading that morning. Then it started declining and ended that day down 5%. Exactly the same treatment was given to CSIQ for those exact same reasons.

Overall, I agree with all of your assessments and think that CSIQ is still a good investment. I am just trying to find reasons why the market treated the stock the way it did. I think another reason is that they guided significantly lower ASP's. I know that there is a very good explanation for this as well (less US sales that have high ASP's due to tariffs), but the market doesn't care short term.

I think that the reason for the sell-off is a combination of:

1. Weaker sales and EPS guidance for Q4 vs. Q3

2. Weaker GM guidance

3. Weaker ASP guidance

4. Crashing oil prices, but more importantly cheaper natural gas prices

I am going to add some CSIQ on Monday, since I don't have a lot of it and I just paid $30 last week. I am happy to buy at $26 here.�

1/1/2015

guest All solars kind of trade together and it really didn't matter which one you bought in 2014. There was some differentiation in stock movement in 2013, but 2014 is painting all solars with a similar brush, give or take.

I never liked JKS, because they are a "cost" leader and that is not a differentiator that I like investing in. They did well in 2013, because they were able to cut costs faster than others, but now others are catching up and the cost gap is closing.

They had a great idea of keeping their high IRR, high FIT Chinese solar projects on their books, but they sold of 45% equity portion to a private equity firm for $225-$250m in cash; I also believe that the PE firm gets same 45% equity in future projects too (but not sure on this one). This was a huge bummer for long term shareholders, but they needed to raise capital since their BS was very weak.

I think that there is also some kind of lawsuit by shareholders against them for dumping toxic waste into rivers. I invest in solar companies because they are "clean". I couldn't care less about "green" companies that pollute other parts of the planet.

I like solar companies that differentiate themselves in this commodity-like sector:

SPWR - Highest efficiency, highest quality solar systems. Just bought a microinverter company to integrate them into their solar panels, so that they produce AC power on your roof and no reason to install big inverter on side of house. Should cut soft costs and make the system more efficient. I like that they can create a yieldco structure and get more benefit than any other company can from a yieldco, because their systems will create significantly more energy over the life of the system due to lower degradation, better performance, and better longevity. I have a SunPower system on my roof and it generates 20%-30% more energy than the NREL calculator says that it should; that is a big deal.

JASO - focus on higher quality cells and modules than Chinese peers. They need to move faster into downstream though. They missed the boat on power plants, so hopefully they can move faster into DG and learn from their mistakes. They are best positioned with their higher efficiency panels, and higher percentage of mono panels. TSL is very similar to JASO in this regard. I like JASO a little more, because their management doesn't stretch the truth like TSL does and is more conservative.

CSIQ - Made a big push into high FIT solar projects. This should allow the stronger to get stronger as they start raking in the cash from these project sales. This will allow them to reinvest that cash (that peers do not have). CSIQ has opportunity to become a huge player in the future if they play their cards right.

SCTY - I like SCTY as a company and they have ability to become a big company and one of the best solar companies in the world. I just don't like the stock and business model. I think that there are many risks to their business model, especially if we hit a hard recession when financing dries up. They are constantly diluting shareholders and their share count seems to double every 2-3 years. The stock has a high valuation and that limits potential upside. I still think that it can be a home run, but I don't like risk/reward ratio. I will be looking to add SCTY during next recession when the stock tanks; and it will tank, just like all other solar stocks and possibly a little more than others.

I think that the best time to get into SCTY is right before their battery business starts taking off, which should be around 2016-2018 time frame. I am expecting a recession to start in 2016-2017, so getting in SCTY in 2018 is what I plan on doing once it hits rock bottom. It is a great company and was a great stock investment last year. It will probably go up, but I think that upside is limited and you will quickly lose that gain once the market tops out in a couple of years. At $50 it is a pretty good value, but make sure to cash out before the market top happens. Then get back in at the bottom if you can time the market this way. I will just wait till that bottom happens...

There are other opportunities in solar as well, and I will be exploring those derivative plays in the future. There are a bunch of ways to make money in the solar revolution that is to come over the next couple of decades. We just have to find them before the market does.�

1/1/2015

guest what just happened to spwr??????

Huge spike, may have just been the result of a buffett-is-buying-rumor.�

1/1/2015

guest Liz Claman on Twitter:

I think she thought Warren had invested in SPWR last year when it actuall was that one of Berkshire's utilites bought a SPWR project in 2013.�

1/1/2015

guest it looks like someone bought 10,000 option contracts out of the money just after that was announced. I must admit to being quite satisfied if that was an algorithm that mined twitter and just got screwed.�

1/1/2015

guest JA Solar Announces Third Quarter 2014 Results - MarketWatch

JASO with some pretty good results this morning, up 8% pre market.

Board authorized to buy back up to $90m in shares in the open market. They must know that the stock is undervalued. $90m will get them over 25% of outstanding shares at current market price...

- - - Updated - - -

SunEdison and TerraForm Power Sign Definitive Agreement To Acquire First Wind For $2.4 Billion

SunEdison and TerraForm Power Sign Definitive Agreement To Acquire First Wind For $2.4 Billion - MarketWatch

Very interesting acquisition. Looks like SUNE is going all-in on renewables.�

1/1/2015

guest It'd be great to see JASO react to the ER. The stock seems like it usually just blithely ignores ER and meanders on some path no one can see �

�

1/1/2015

guest Finally some good news for JASO. I have been buying LEAPS in JASO in the last month and just yesterday got me some Jan17s. Good stuff.�

1/1/2015

guest I'm skeptical today's movement has anything to do with JASO's ER. TSL is up by the same percentage this morning as JASO and TSL's ER isn't until next week.

Don't get me wrong, I'm happy to see JASO (and solar in general) move up, but it doesn't look like it's related to more than the market in general.�

1/1/2015

guest http://www.streetinsider.com/Corporate+News/Walmart+Selects+SolarCity+%28SCTY%29+and+SunEdison+%28SUNE%29+for+Massive+Solar+Project/10038038.html

Walmart Selected Sun Edison and Solar City for their next large wave of solar installations.�

1/1/2015

guest I keep rubbing my eyes: JASO over $9 and my J17 LEAPS are green......can't be!:biggrin: Obviously I am not complaining.�

1/1/2015

guest 9.22 in pre-market. Onwards to old highs! I got some JASO Jan17 $12 LEAPS when we where trading in the $7s. The Bid-Ask spread on those right now is ridiculous (Bid 1.1 Ask 5.0) �

�

1/1/2015

guest Wow, that's amazing. Haven't looked at my JASO stock in awhile, but that's a nice development. I'm still holding my CSIQ and JASO for the long haul.�

1/1/2015

guest JASO didn't respond much differently than the other solars after the ER and I was a bit disappointed. Then again, JASO hasn't moved in relation to the ER with any reliability for some time, so that wasn't much of a surprise.

However, since then JASO been consistently moving up independent of either the market or it's solar brethren, so the ER and the proposed stock buy back seem to be helping.�

1/1/2015

guest The oil drop has all but destroyed some of my positions. The Jan2015 $25 SPWR LEAPS I bought over a year ago seemed pretty conservative at the time as they were well ITM. Approaching a total loss and it was about 1/3rd of my portfolio. The other items aren't doing any better, but at least they are 2016/2017 LEAPS.

And damn the timing, double ouch. I'll have to cash some out within 30 days to pay my kid's winter quarter tuition. I suppose, in hindsight, I should have stuck with TSLA and rather than shift anything to solar. Solar's swings make TSLA's movements look calm and predicable.

I'm just not sure what timeline looks good anymore for solar. There's enough oil production out there to depress solar stocks for years. Seems like it'd be reckless for the producers to crank production at such a rate, but given the folks in charge of oil production...�

1/1/2015

guest I'm taking a beating also but I'm only holding CSIQ shares so I can just sit on them. Ouch.�

1/1/2015

guest I really don't understand how cheap oil reduces solar sales or profitability. Does it somehow reduce the cost of coal or other commodities used to produce electricity? Oil is only about 1% of the electricity production mix. To me the biggest problem with the solar industry is that there are too many players in it and it may be a commodity. So competition drives the prices down and it is hard to differentiate. If solars can continue to demonstrate stable earnings they should do well from here especially since the prices are now so low.�

1/1/2015

guest Yea, that's certainly the advantage of shares. Easier to ride out the storms. I felt, with the SPWR $25 LEAPS, that it seemed pretty conservative given the stock was something like 32-33 at the time.

What this drop has me wondering is how long can things stay down given the deep pockets of the oil producers and the political (non-market) side that influences things?

If solars were depressed for a year or two, how many of the companies we discuss would go bankrupt before solar turned around? If some places feel they could push off buying solar power plants for a couple years, wouldn't that put SPWR in a serious hole since much of their incoming is from building and selling power plants?

Just musing here. Maybe things will recover next week �

�

1/1/2015

guest Agree, oil and solar don't compete. Lower oil prices should lower transportation and materials cost for solar producers.�

1/1/2015

guest Sadly, we have not yet convinced the market of this. I agree, but the market does not, for now.�

1/1/2015

guest That doesn't seem quite true. When I visited Antigua, the entire island's electricity is powered by oil, which astounds me given the wind and sun access they have.

while Antigua is unusual in that it's 100% oil, a number of places generate part of their electricity through oil plants. If oil is cheap, those places have less incentive to switch whatever portion is oil based electricity to something like solar.�

1/1/2015

guest Perhaps less ?incentive, but it's still a good buy. Running diesel generators costs about 30 cents/kWh; solar is far, far cheaper.�

1/1/2015

guest Given that solar + batteries should also be low maintenance, even the shipping overhead shouldn't be able to hold them back, as long as the battery price can be reduced.

I'm sure that solar installers won't have too much difficulty getting employees to volunteer to do the installations.�

1/1/2015

guest Can someone explain to me what I'm getting wrong here? SPWR is about 26 bucks right now, yet I just got an order of jan '17 20-30 leap spread for 4.50..and probably could have gotten them a bit cheaper since it executed immediately. Shouldn't those be worth 6 dollars right now, at minimum?�

1/1/2015

guest I'd say this is a case of the tiny exception proving the rule. I'd guess 99.99% of oil use does not compete with solar.�

1/1/2015

guest I agree the pricing seems weird, a 33% upside if the SP stays the same and a potential upside of 122% on a significantly smaller rise in the SP compared to what it would take to lose it all, not sure why this is the case.

Why did you chose to go long SPWR? Personally I have no skin in the solar game right now but I am starting to consider it. The company I have found to be the most interesting is FSLR, which nobody here talks about even though they must be the biggest american player. They are the most profitable solar company trading at the cheapest multiple, both on earnings and revenue. They have almost no debt and have shown consistent growth with an expected great next year too as they have prepared for a 46% in increased production if the demand is there, which they expect. The P/E is expected to come in at 17 for this year, and a mere 10 next year according to analyst estimates provided by yahoo finance, why is this company so heavily discounted compared to its peers when every data point shows strength?�

1/1/2015

guest

Most oil isn't used for electricity if that's what you're getting at, but that's not my point.

Oil that is used for electricity production would be direct competition with solar. And, when oil is expensive, probably a prime candidate for replacement by solar based on costs, more so that other electricity generation forms. If oil is cheap, those places aren't as likely to use invest at this moment in a replacement solar plant.

Given the size of the oil produced and the size of the solar market, that'd be a non-trivial amount of solar installations that low oil prices would impact.�

1/1/2015

guest Yes, but as we've both pointed out it's a tiny market, so I'm not understanding how a tiny market can influence the demand for solar. As far as I know the largest volume of solar installations are happening in areas with little to no oil fired generation.

http://pureenergies.com/us/blog/top-10-countries-using-solar-power/�

1/1/2015

guest Here is Lyndon Rive's take on Oil Price effect on Solar

What Does $75 Oil Mean to the Solar Industry? : Video - Bloomberg�

1/1/2015

guest Nobody talks about fslr because it's thin film. About 1/2 the efficiency. Solar is all about reducing soft costs. Panels with half the efficiency use 2x the racking and about 1.5x the labor. Also take up 2x the real estate. Thin film used to have a price advantage to offset the added installation costs. That's gone now.

We have never installed a thin film panel and I doubt we ever will. I also do not personally know of any other integrator / EPC contractor that has either.�

1/1/2015

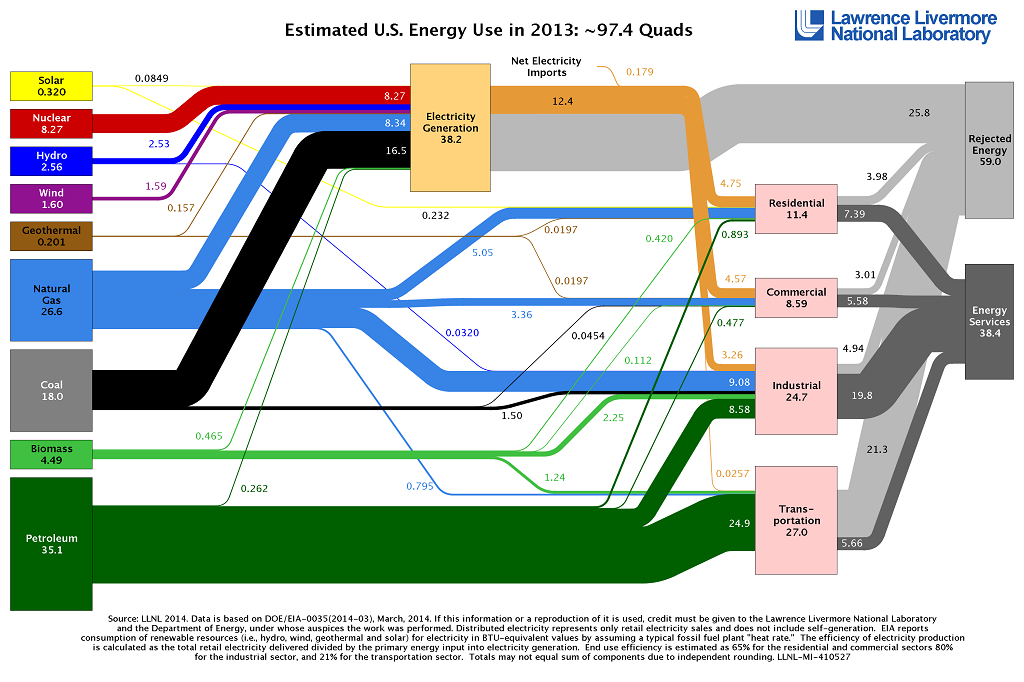

guest Here is a really useful chart for thinking about energy use / sources in the US.

It shows pretty clearly how little petroleum is used for electricity generation, and how much for transportation.

�

�

1/1/2015

guest It looks like yesterday was the bottom for solar stocks. Right now they all seem ripe for a buy in.�

1/1/2015

guest Thanks, I liked that one. I've gotten leery of Bloomberg reports, but that one had some meat on it. That's the first time I've seen an interview with Lyndon Rive.

All solar installations likely to have battery storage within 10 years (according to Lyndon). That'd be cool. We'll see. I suspect Lyndon mirrors his cousin Elon in optimistic timelines

As JRP3 notes, Lydon also says oil doesn't impact solar much. Well, in practice. The perception is clearly otherwise and I guess until that changes, solar stock prices will be battered around by oil prices. Perception is slow to move though. As Lyndon also points out, solar installations at home provide lower cost right now in a great many cases, though he's probably talking primarily about the US market and US energy prices, but I'd guess that statement is true outside the US as well.�

1/1/2015

guest I see, they bought a company though (Tetrasun was it?) I think for the reason of getting into the higher efficiency game, perhaps they will catch up in that department?

What do you think about SPWR? They actually seem pretty interesting with a whopping 10 GW of backlog, that is insane, I guess they must be very competetive to have that kind of demand, they do talk a lot about having the best cells too. They are introducing a new technology, LCPV I think it's called, it should be a lot easier to ramp up and very capital efficient, can you or anyone else explain this new technology to me, like why does it hold these advantages? Seems like all they need is an ability to scale fast and efficient as they are production constrained right now (sounds familiar) and they could really take off. Their yieldco/holdco also seems interesting as they hold the Sunpower advantage (as they say), apparently they should generate $70-80M in cash available for distribution per year from the 640MW they currently have in their "holdco" (it just means they hold the assets instead of selling them right?). I guess it also shows their competetiveness that they have such great demand in China.�

1/1/2015

guest I finally added to our solar investments for the first time this year,taking advantage of Monday's bloodbath by increasing our CSIQ holdings at $22.35. I'm not enormously hopeful of the short-term health for some of the more highly-leveraged names, but CSIQ is not so indebted.�

1/1/2015

guest This interview and speech by UC Berkeley physicist will make you pleased that your investments in alternative energy may even be saving mankind!

Michio Kaku -- The True State of Fukushima - YouTube�

1/1/2015

guest Tough year for solar ahead? http://finance.yahoo.com/video/story-solar-low-oil-prices-125855150.html�

1/1/2015

guest PV competes with grid electricity, and grid electricity is most priced off natural gas and coal, not oil distillates.

Natural gas prices are falling, but its move this year has been more muted and is dwarfed by the decline from its $8 level in 2009. Here's the forward price curve for July 2015 and January 2016 delivery:

During the same 2009-2014 period that natural gas (and, hence, wholesale electricity) prices have been declining rapidly, PV has come on strong. The federal tax credit for solar ends on 12/31/16, so I expect to see two very strong years as people rush to install PV before then. It's hard to imagine the current Congress extending that program.�

1/1/2015

guest Interesting inflection point for solar?

Rooftop solar is now cheaper than the grid in 42 American cities | Utility Dive�

1/1/2015

guest This comparison relies on preferential treatment of customer-site power compared to grid-interconnected power. There are a lot of threads discussing this bias over in the Energy, Environment & Policy thread.�

1/1/2015

guest Any solar investors left? CSIQ longs? 22% up today!

- - - Updated - - -

Although for me still a ways to go before I even get back to where I started.�

1/1/2015

guest CSIQ Long here! It was just few weeks ago that I sat staring at my under water CSIQ thinking why didn't I sell at $40 and seriously considering just taking the loss so I could put my money to better use somewhere else. So I am quite happy to be back in the black. Now comes the hard part. Hang on for the ride or sell.�

1/1/2015

guest SPWR is doing nice today too. I also have some jaso and sol common.�

1/1/2015

guest Like you, useless, I have a basket of solar plays; CSIQ is the largest position after SCTY. Nice to have a bit of a reprieve after the thrashing from the past quarters.�

1/1/2015

guest Yes, it seems like a long time ago that we saw 'green' with the solars. Massive short squeeze going on with CSIQ.....I am happy to have some.....but wish I had more (esp calls):wink:�

1/1/2015

guest Pretty much the same here, still holding my solars.�

1/1/2015

guest Nice to see CSIQ back in the territory where it belongs... Glad it's my second largest holding after TSLA.�

1/1/2015

guest same here. I'm confident in solar just like I am in TSLA, not worried for the long run. I'm still a bit underwater with my CSIQ.�

1/1/2015

guest Solar Wind = 53% Of New US Electricity Capacity In 2014

Nice to see that 55% of new US electricity capacity in 2014 is renewable. 43% is natural gas. Any incremental electricity demand EVs may pose is more than met by renewable energy.�

1/1/2015

guest Welcome to the solar-electric century. Invest accordingly.�

1/1/2015

guest I own SCTY, CSIQ, JASO, & SUNE expecting one of these to be a home run, its always the one I don't own that rips higher & in this case its Hanergy, UGH!

Hanergy Rises to Record as Volume Surges Amid Mainland Buys - Bloomberg Business

HNGSF: Summary for HANERGY THIN FILM PO- Yahoo! Finance

0566.HK: Summary for HANERGY TFP- Yahoo! Finance�

1/1/2015

guest Canadia Solar (CSIQ) is also up about 14% today, despite missing the market expectations.�

1/1/2015

guest Love it, my biggest solar holding way back in the green. Apparently the market is liking the talk of a Yieldco. Oil prices rising is helping too.�

1/1/2015

guest YGE ended up 10% for the day. It's been about three months since its been at this number.

Anyone think CSIQ will hit a new high during this run up?�

1/1/2015

guest Extremely delighted with today's performance of CSIQ (+14.6%), ReneSola (+14.0%), YGE (+10.0%), JKS (+7.3%) - and this on top of the similar performance of SPWR and FSLR last week.

Lump: I cannot see any feasible way ever of being able to learn enough about Hanergy in order to be able responsibly to make an investment decision about that company. Caveat emptor!�

1/1/2015

guest What a great day to be a buy-and-hold CSIQ owner since $19. Good times.�

1/1/2015

guest Nasty, dirty stuff, and actually good sign things are going well for solars:

Utilities wage campaign against rooftop solar - The Washington Post�

1/1/2015

guest Thanks, I finally got a chance to look into Hanergy, still undecided but leaning towards purchasing some in my wives account :wink:.�

1/1/2015

guest CSIQ, JASO and nearly all the solars were way up today -- anyone know why?�

1/1/2015

guest Dunno. JASO won another big solar farm project apparently, this time in Central America. Other than that I don't know. Someone wanted some solars today. Maybe another big player has finally seen the (solar) light? They'll all come around eventually, when they get done with all their silly 20th century stocks that they are still emotionally attached to

With all the big solar project contracts won it really does look like JASO has the edge when it comes to quality and efficiency per dollar.�

1/1/2015

guest Chinese installation target for 2015 - 17.8 GW...no requirement for distributed vs. utility scale. Also, 5 GW was awarded in Egypt - 3GW to long time CSIQ partner.�

1/1/2015

guest IMO it is the belief by the market that China's central government will be adding stimulus to try to help boost the slowing economic growth.�

1/1/2015

guest That would explain why SPWR didn't partake in the 7% rise all the Chinese solars got�

1/1/2015

guest France decrees new rooftops must be covered in plants or solar panels | World news | The Guardian

Viva la France?�

1/1/2015

guest Nice.

And I love Nice France�

1/1/2015

guest Sleepy, where are you? The Chinese solars are alive and kicking!�

1/1/2015

guest Not sure how much he holds right now. May DITM JASO J17s finally are green! Good luck to all solar investors.�

1/1/2015

guest Anyone keep up with microinverter companies like Enphase? Would that be a good company to invest in? I know they have most of the market share....or someone like SolarEdge who just had their IPO? I don't know much about these companies, so I wouldn't know where to begin.....any pointers? Thanks!�

1/1/2015

guest Micro inverters are still a technology that has to prove itself. Large solar installers tend not to favor them due to longevity issues and the hassle of replacing them when they fritz out. Also there are newer technologies coming, for example, AC coupling to allow solar to be a backup power source, and it isn't clear how micro inverters would handle this.�

Không có nhận xét nào:

Đăng nhận xét