1/1/2015

guest Also, you need to remember that "shorts" generally keep their positions for a "short" period of time.

Someone that is shorting today TSLA may not be making a bet on whether or not Tesla goes bankrupt, they might just be betting that we are at the top of the range and due to pull back. Or they might be betting that TSLA's earnings report is viewed as a "miss" by the market.�

1/1/2015

guest More nice movement up today.

Sent from my SAMSUNG-SGH-I317 using Tapatalk 2�

1/1/2015

guest $36? Maybe.�

1/1/2015

guest what are you guys expecting for the 12.feb lets say tesla releases the numbers that are well known on this board, production rate, reservation rate, etc.

How would the market react to that?

Do you think the market is taking unofficial numbers like the ones on this board serious or will the market be totally positive surprised by the current reservation numbers?�

1/1/2015

guest TD1 that's a great question.

I wish I had an equally good answer. my gut is we are in the midst of moving up prior to the earnings coming out, because so much is known.

if we do move up to 38 or beyond running up to earnings, I guess we'd sell off a little (and rebound) if all that's released is are stats you mentioned.

I am hoping there will be more in the conference call, that may even move the stock up further... either some kind of full year guidance for 2013 and possibly beyond or Elon's exuberance slipping out some bullish tidbits (my wish list: discussions going on at Tesla of taking production of S/X up to 50,000 on existing line near term, discussions of a second line, hints of new variations (i.e. station wagon),...)

to be sober about this though, a run up to $40 would be fun, but I wouldn't be surprised if such a run came back to this range. to me that's okay, I'm looking to hold 10+ years.

�

1/1/2015

guest It is important to remember that, especially for a company like Tesla, the guidance is much more important than last year's production numbers. If Elon says they only got 2500 out in Q4 but then says they are officially raising their target for 2013 to 30,000 units, nobody is going to care what happened in Q4.�

1/1/2015

guest If they are actually going to produce 30,000 cars this year, I hope they will keep quiet till it actually start happening. On the long run it would be better for stock price if they exceed their projections rather then set expectations early and then just meet those expectations.

On the other hand if TM want to expand faster and they would need to raise more money soon, then yes, sooner shares go up the better.�

1/1/2015

guest as much as I'd like to hear that they are planning to increase production, Zzzz I agree there may be advantages of keeping this quiet, and/or ambiguous. I see it more from a competitive point of view. the less Tesla (and demand for it's product) is on the radar, the more likely they can develop their lead on major manufacturers in this new market for EVs.

fwiw, I don't think they'd need to raise cash to increase production to the levels we are talking about.

�

1/1/2015

guest squeeze play against $36 short stops before close�

1/1/2015

guest 7 straight days of gains!

With that said, I took profits on my 600 shares in my IRA account that I bought 2 weeks ago at $32.89. I'm guessing there will be some others doing the same and we'll see a drop down to the $34 range, before another run up. Or, I might have just missed the ride up to $40.�

1/1/2015

guest Knocked over $36 for a few moments there... Hope for a $36+ close! Sen

Sent from my SAMSUNG-SGH-I317 using Tapatalk 2�

1/1/2015

guest You got it! $36 close and on an uptick!

- - - Updated - - -

You got it! $36 close and on an uptick!

- - - Updated - - -

You got it! $36 close and on an uptick!�

1/1/2015

guest Trimmed some at $35.99 today. Still own plenty of stock if we keep moving higher, but now I've got lots of cash to buy shares if we pull back. Right where I want to be.�

1/1/2015

guest I went in for 2000 shares on Jan 17th, 2012 @ $26.75.

Sold 1000 shares today at $35.95. All the proceeds are going towards my Model S (and TSLA's bottom line) which should be rolling off the line this week! 33% in a year is not bad �

�

1/1/2015

guest Congrats. I bet that feels good.�

1/1/2015

guest Shorts will care. Right now the shorts basically don't believe what Tesla Management has been saying. If you actually listen to the shorts (it's hard, I know), what they're saying is that Tesla is all promise and little delivery. Even if Tesla made 3000 cars in Q4, the shorters will come back and say, yeah but they originally told us 5000 cars in Q4. The only thing that will scare the shorts is when Tesla actually delivers on its promises. That's not just vehicle deliveries, but profit margins.

I think Tesla is going to come in at the low-end of their revised Q4 production guidance. I think in the conference call Tesla will say how great things are, how customers love the car, and how they're producing 450/week right now. I don't think that's going to make the stock do much of anything, especially since it's over $35 already - clearly the market knows what we know. And any conference call talk about ramping up to 25K cars won't help since the shorters simply won't believe them. It might actually embolden them.

What's ironic is that the more cars Tesla produces per week, the more the shorters are going to talk about how reservations aren't keeping up. They'll start predicting that demand will fall off in Q3 or whenever they thing Tesla will "catch up" to demand. So, they'll have a reason to stay in, thinking that demand will dry up and Tesla will belly flop with a factory making 450 cars a week but selling only 200 cars a week. Remember, 450 cars/week is 65 cars/day. With about 27 stores in the US, now that's 2-3 sales per day per store as a sustainable average. Probably need to do 5X that on weekends since weekdays have much less traffic.

At any rate, we're not going to see a short squeeze and I predict volatility will be around for a while.�

1/1/2015

guest nice.. that in itself will add to TSLA; Your executed plan is akin to mine for a Gen III in 4 years. I'm using LEAPS options to leverage larger gains from about a $28 start position.

Nice job...

- - - Updated - - -

I think I agree with this largely with a small exception. A large metric for longs (institutional and otherwise) is the profit/loss direction. As this turns around via inflection point now arriving, it will really help drive long buyers, which in itself will help squeeze out the trading shorts (the long term shorts will be just as you say). So I agree there likely won't be a big definable short squeeze, I do think this report coming up will turn a corner that will slowly squeeze shorts over the coming year reaching a crescendo at profit quarter�

1/1/2015

guest Stromtankstellen : Brüssel plant europäisches Lade-Netz für E-Autos - Nachrichten Wirtschaft - Energie - DIE WELT

its in german I couldn't find a english source

cliffs-

The European parliament wants to establish 500.000 EV station Europe wide till 2020

Today they will release all the details to these plans.

I think this is a very big step towards EV future and EV popularity.

I also think that in general the European market is the biggest for Tesla because of the the worldwide highest petrol prices (9$ a gallon).

So should give TSLA a good push.�

1/1/2015

guest Two high ranking officers have state factory at highest capacity. What does that mean? Are they at the 400 or 450 or higher? What is the factory capacity surely a lot higher than that given what Toyota/gm did with it. Or do they mean current shift or the capacity of the robots? Of course no numbers until feb. I am impressed that I got a two month window after finalizing my reservation. I did it with the 15xxx crowd. If true they are producing at higher rate than 450. That would be more like 600 rate�

1/1/2015

guest Spot on. As much as we can all be happy when we see some gains, nobody should forget that this stock is going to be volatile until the red ink turns black.�

1/1/2015

guest Nice start to the day! $36.55�

1/1/2015

guest Interesting action. Not what I expected.�

1/1/2015

guest Me neither. Yesterday I felt good about selling about a quarter of my position and taking some gains at 36 with plans on buying back in during the "inevitable" sell off this morning.�

1/1/2015

guest $36 was a stop for good portion of shorts. This action is part of some squeeze to clear them. That said it looks like plenty more shorts coming in. They aren't going to like what coming shortly (pun intended)�

1/1/2015

guest Pushing toward $37 now.�

1/1/2015

guest $37? Maybe.�

1/1/2015

guest What is strange is that short interest increasing with price increases last two days. They won't give up�

1/1/2015

guest $36.99 ceiling busted. $37.10�

1/1/2015

guest Also halfway to average daily volume less than 2 hours in.�

1/1/2015

guest Holy smokes batman!Breached $37. Its like music to the soul.

�

1/1/2015

guest Its not really that strange when you think about it. If you're convinced that Tsla will tank either because the company goes bankrupt or they can't meet their stated goals, the best time to sell short is when the stock price is at its highest.�

1/1/2015

guest Interesting. What source do you use to check short float? Also, do you know how often the info. is updated?�

1/1/2015

guest Agree. Look at NFLX today - up 40% because shorts bet against a good quarter. I suspect you will see similar upside in TSLA if report is good news.�

1/1/2015

guest In the light of +4.75% this morning I am not feeling as good about my move yesterday �

�

1/1/2015

guest You can't pick/sell at the top, it's impossible. You have some nice profit locked it, which is always nice.

You can buy back in on a correction, there's always been a pullback with this stock, eventually.�

1/1/2015

guest Of courseTesla putting my 60 kWh on a truck to Texas will be a nice consolation prize ....

�

1/1/2015

guest Www.shortanalytics.com. Click charts and put tsla in

- - - Updated - - -

Updated daily�

1/1/2015

guest That is a strange website. They could not even get volume right. Although there is a correlation between their volume and real one.

I wonder how they calculating short percentage...�

1/1/2015

guest tempted to cash out but from experience I've learned that if you try to time the market you lose... decisions decisions.�

1/1/2015

guest I'm holding my shares tight. Don't wanna sell them to a shorter just yet. ;-)�

1/1/2015

guest If you sell at a profit you don't "lose". A bird in the hand....�

1/1/2015

guest True... you lose out on a little more=D�

1/1/2015

guest Simple solution: Don't sell them all. Just sell some.�

1/1/2015

guest If you really believe it's the beginning of a short squeeze, hold on for the ride. Lack of sellers means that the people who are being forced to buy to cover just have to drive the price higher. Of course, knowing when to pull the trigger gets harder and harder. Look at Qualcomm (QCOM) at the end of 1999, for example... it would have been a great Christmas present, if only my options were vested.

I guess my strategy will be to start selling dribbles at mid 40s, and then re-evaluate. But I'm still mostly in for the long haul.�

1/1/2015

guest I already have 1000 of TSLA and 1000 of SCTY, I'm considering buy 1000 more of each, not sure whether to get in now or wait for the official earnings call.�

1/1/2015

guest definitely before IMO�

1/1/2015

guest Buying this close to the earnings call is not investing, it's gambling. Unless you live in Utah, go put the money on Black.

Always better to wait until afterwards in my experience. Or at least just buy 500 before, and see what happens after. If it goes up, great, you have 500 more shares. If it goes down, then you can buy 500 more at a better position. Also, try to not listen to the "the short squeeze is imminent" talk. If I had a dollar for everytime the short squeeze was forecasted in this thread, I could have two model S's!

Although my training is in neuroscience and not finance �

�

1/1/2015

guest In Utah, put money on Red?�

1/1/2015

guest No gambling in UT. Well, more like no Casinos, they gamble down there in a different way!�

1/1/2015

guest No, it makes tremendous sense if you think the price is going to go back down.

- - - Updated - - -

You made a 33% annual return; in all honesty it makes sense to sell the rest take the 37-38% return, be happy and wait....I know that statement might be "red meat" here but TSLA remains a volatile stock; that means down as well as up.�

1/1/2015

guest Mid 40's is my magic number range as well.

Two things that can kind of drive us nuts tomorrow.

- Dealers in MA are appealing the decision by the courts about Tesla Stores

- Toyota and BMW just announced a green partnership. I believe this can swing the needle in either direction.�

1/1/2015

guest There is nothing for them to appeal. The Natick board of Selectmen voted to give Tesla a MA dealers license. End of story.

stop crying over spilled milk, they lost, suck it up and move on. They really have no grounds for any appeal.

The judge has already dismissed the case as well. I never saw such a whiny bunch of losers �

�

1/1/2015

guest Looks like the Toyota-BMW is largely a co-development of fuel-cell by 2020 and some work to improve L-ion batteries over time... nothing there... moving on

Agree with Mitch above- from what I read, there's no standing under the law to bar a company that does not currently have dealerships that direct sales would compete against. Tesla has a license now issued for direct sales per their business model world-wide; these suits have virtually no where to go now- In fact, the Tesla lawyers will now use this ruling to bolster position in other states;

- - - Updated - - -

yep -looks like shorts started covering today as the $36 stop was crossed

http://www.shortanalytics.com/getshortchart.php?tsymbol=TSLA�

1/1/2015

guest I agree with all you guys are saying, but at the same time we can't escape the fact that the overall market doesn't know the nitty gritty and will react irrationally to headlines. If everybody acted rationally... we'd be sitting pretty lol�

1/1/2015

guest 37.22, insane.�

1/1/2015

guest Guys I have been trying to decide when to get in. At this point I think I need to wait. I have to believe there will be some sell off. However, i think this could blow up in my face if the Earnings Call contains the info I expect.

1- Met delivery targets for 2012

2- Production @ 400+ per week

3- Reservation demand continues even after price increase announcement

The only piece I think that may be detrimental is initial GM% may be a little low due to initial costs of rush deliveries in Q4.

Any thoughts? Wait, dip toe or go all in?�

1/1/2015

guest I believe a miss on 4th qtr not important. The most important factor rate of production. Gm important but of course ramp up inexperience employees all will improve and so will gm. I suspect the 400 cars per week is low. Reservation in the 15000s given feb march delivery dates. The 16000s getting April may dates. This despite starting to produce for Europe. Production most likely a lot higher than 400, maybe 500 or 600. Management statements that company is at full factory capacity very vague without knowing what that is. This site has been useful in past for following stats but less so now. Fewer posting (previously people with long waits nothing to do but post now less "community involvement"). Reservation number, who knows. Have to wait for report. A very positive report may provide Netflix like response (their short percentage of float half of tsla). Scared to be out and scared to stay in�

1/1/2015

guest PPL Thanks for your help! UGH :crying:�

1/1/2015

guest I would not get in at this point.

I think what is happening here is that the market has slowly come to realize what you just said. By the time we get to the actual announcement, I don't think there is going to be much more of a run-up. The market is pricing this information in already. With every passing day, the probability that there are more gains ahead as opposed to a sell-off gets slimmer and slimmer. I'd wait for the inevitable profit taking before stepping in.

That said, if you are really paranoid about missing a big move, I'd say go ahead and buy some; but by "some" I mean something on the order of 20% of the total position you would like to have. If you end up buying at a near-term high (which I think is pretty likely) then you'll have plenty of cash to add to your position when we sell off. On the other hand, if I'm wrong and the stock never looks back from here, you'd at least have some exposure to that.�

1/1/2015

guest You're in a pickle, that's for sure. There's good reasons for getting in now, and there's equally good reasons for waiting to see what happens at earnings call. One way to counteract that indecision is to get a few now, then wait and see what happens.�

1/1/2015

guest

Thanks Citizen-T you confirm what I have been thinking!�

1/1/2015

guest I think there is less of a chance of a surprise ala Netflix. Every detail about Tesla is being researched/discussed at length and critical information like reservations and deliveries can be extracted from TMC. It's hard to see how this information is not already being priced into the stock value right now.�

1/1/2015

guest That sounds a little ambitious. On the delivery and sequencing thread kindog just got his VIN of 4386. We are three and a half weeks into the new year and that number seems only about 1200 more than the end of last year. I'd say, at this moment, they are hitting their stride of full production. I'll toss out half a week production for the 60 kWh changeover/addition. I know they will increase more but I don't think it has happened quite yet. I'm very happy with full production - it's a hell of an accomplishment.�

1/1/2015

guest I am adding to my position daily. The stock has a lot of upside to its current value with production at capacity. This is just my opinion but I do reccomend that you read the analyst opionions of value. There are some short term risk for a pull back near term, little risk within the next 12 months.

On up days I buy and on down days I buy a lot.

Good Luck!�

1/1/2015

guest The factory was shut down for a week at the beginning of January. However, in general I agree that looking at reservation numbers to guess production is useless, looking at VINs issued is the only way to go.�

1/1/2015

guest Why was the factory closed?�

1/1/2015

guest Holiday for the employees.�

1/1/2015

guest I think you have to be a little careful judging production rates, we know they are batching CRAZY WILD, Al Sherman just got his notification email that he is almost done and ready to ship, he is in the 15000 somewhere. I saw a post of a factory tour that timed a car every ten minutes, thats 6 an hr , 48 a day, and 240 per week / shift, if they have two shifts thats 480 but I don't think i see two perfect shifts running, lets put a web cam accross the street at the ensd of the assay line and count, :wink: r�

1/1/2015

guest If you're thinking about buying or selling TSLA stocks here is my input. I've been playing the spread on this stock for awhile to calculate with 95% precision. TSLA has seen solid gains the last week, at its height, TSLA came up to about $37.50 yesterday with volumes at around 1.9 million the last couple days. Today, while being up throughout most of the day, the stock began to dip below $37, more alarming is that TSLA's after hour trading saw an even lower price! Additionally, volume today was dramatically lower compared to the last couple days at around 1.2 million. IMO the scared shorts have mostly covered, and investors are starting to cash out. I sold mine at above $37. Very likely will open much lower on Monday morning (I may be wrong, but again my track record so far is about 95% accuracy with about 20 trades). If you're thinking about jumping in, be patient sit back and wait a couple days before making a move. Self control is your best friend, don't be haste, sit back and observe...

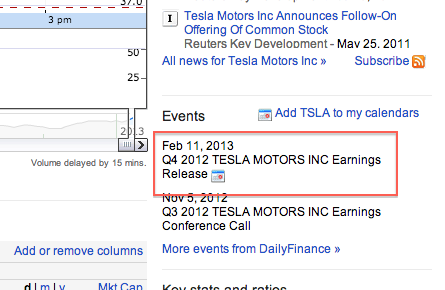

I will definitely have to rebuy no matter where the price is before Feb. 6th, as JB Straubel will be making his keystone speech in front of about 50 investment firms and giving TEST drives for MODEL S..... FEB 11th will definitely bring good news for sure... but keep in mind we only need 1 out of the 50 investment firm to buy up stocks and the shorts are toast! Combine that with positive 4th Q news on production will definitely be brutal for shorts... make a move before Friday next week IMO�

1/1/2015

guest @firstinflite Thanks for all the info. I sold mine too at 37.6--just by luck, got the highest price! Still it's a good experience for my first stock trade everSeeing as how I bought it at about 35.5, I made some money. Still it feels too much like gambling, but at least with info. like yours we can pretend it's not.

How low would you expect it to go next week?

�

1/1/2015

guest It does remain to be seen whether you sold it at highest price yet. Would consider waiting at least 2 trading days to make that claim. It had gone up so much over week I expected pull back for profit tatake before weekend but a penny was pretty small drop. Recommended to first he now sell short since he knows its dropping. Maybe you should too�

1/1/2015

guest True yes, I just meant before it started to drop off that day...�

1/1/2015

guest Well done of your first trade. It's always good to make a gain, large or small. I do not recommend you try shorting stocks (I think the other poster was being somewhat facetious). There's no reliable way to tell whether a stock will go up or down on any particular day. If you believe in Tesla and that they will succeed, go long and hold, hold, hold. The quick buck is tempting but steady compounding is, IMO, more reliable.�

1/1/2015

guest Short interest data out for jan 15th. Essentially unchanged. Greater than 50% of float short. Volume this week up but not enough to decrease short interest significantly should be interesting next three weeks. Funny how no one sits on fence. Shorts just as convinced as longs but answers will be coming out. I suspect conf call will settle issues. Which ever way it goes I recognize someone loses when someone gains. Hope there won't be bragging either way�

1/1/2015

guest Except shorts are hoping a company fails, a product is removed from the market, thousands of people lose their jobs, and a dream dies. I expect plenty of bragging and will gleefully partake in it when longs are vindicated. :love:�

1/1/2015

guest For exactly your reasons, I hope the shorts get what's coming to them, and we reap the benefits.�

1/1/2015

guest put another way, I hope they take it in the shorts�

1/1/2015

guest Significant and financially dangerous over-generalization, IMO.�

1/1/2015

guest I guess you are referring to short term trades? But, dangerous?�

1/1/2015

guest Clarification: assuming malicious intent from all short sellers is financially dangerous.

Firstly it means your mental model incomplete. Secondly it likely means you're more emotionally involved than you should be for a financial transation.�

1/1/2015

guest They want the stock price to drop as much as possible, they would be financially rewarded by the worst case scenario for a business. They are betting on it. The outcome I described is therefore in their best interest. I assume they are aware of that.

Yes I am very emotionally involved in Tesla being successful. Because of that I am probably more informed about the stock than any of my other holdings. I see that as a positive. I have not done anything foolish like put my life savings in the stock. I agree that it's usually better not to be emotionally involved in stocks.�

1/1/2015

guest I think we'll have to agree to disagree on this one.

If the company goes out of business ("drop as much as possible") then they have to go find another stock to go short next round. Thus, that's not the best case scenario for a short seller -- unless it's his last trade ever, I suppose.�

1/1/2015

guest TSLA has now entered a new period of postive cash flow and willl most likely continue this trend for a long time... it's important to note that cash flow postive cannot be found anywhere in TSLA's history since the inception of the company--making the stock highly unpredictable at the moment bc we're chartering unknown territory, breaking many resistence points.

The swings next week can go either way, but will most likely IMO be lower. I expect the price to drop to the low $36s and high $35s if we're lucky. Currently the market is still trying to find an equilibrium price as investors have been slowly cashing in and selling off their shares, and shorts finding a reasonable cover price. Historically, this stock has always had a pull back after 1-2 days of solid gains after large percentages of shorts covering.... after 7 straight days of gains TSLA is starting to lose momentum, and it has shown recently on Friday when the stock reached $37.50 and closed below $37.. therefore, I am waiting for a price drop Monday and maybe Tuesday as investors cash in, since shorts are betting against TSLA at the new highs, should the stock price falls Monday morning at 6:30 then the fall will accelerate even lower at a faster pace (2 - 4% historically)... but again, that is historically speaking, we are at a new era of very positve news waiting at the forefront and more people are starting to be aware of the existence of this company and its superior batteries making it unpredictable.. in short, if you bet on a stock based on its historical performance, sell TSLA fast and rebuy next week; if you are holding out hope that there will be new records being set by TSLA, then HOLD.

The wild card is whether insiders such as Gilbert, Blankenship, Deepak decides to hold or sell, if they sell (which they usually do at TSLA highs, then they will sell in large quantities, which can drive the price even lower creating a little panic amongst investors which creates more sales.... this example was seen a couple weeks ago when Mercedes sold over $1 worth of TSLA and the stock dropped about 4-5% in one day). Historically, insiders such as Gilbert and Deepak pull the trigger and sell very quickly, especially during squeezies. Sell and rebuy before Friday is my tactic, looking for low $36 or a little below that will make my day =) hope that helps.�

1/1/2015

guest I tend to agree overall. But I will hold what I have horizon any decline, then add to it for the report�

1/1/2015

guest Yep. I'll just add to what I got with any pullback�

1/1/2015

guest Insiders CAN'T sell quickly, especially near an earnings release. Their trades have to be planned and specified in advance. Now, it's possible that one of them has a standing sell order at, say, 36.50 after a certain date. Such an order might trigger and drag the stock down. But they can't just decide on Monday to cash out. Of course, non-insider holders certainly can decide that, and could drag the price down.�

1/1/2015

guest

Its unlikely that insiders will sell BIG holdings, but certainly 46,000 shares by Kroger Herald was significant enough to bring prices down 4-5% back on the 14th. So if anybody who plans on selling lets say 10,000 or more shares at one time during the next week will certainly bring prices down somewhat. The possibility is there and the market wont learn about it until 1-2 business days later. We'll see what happens, but the last sell was done by Kimbal Musk on the 22nd.�

1/1/2015

guest Observations

1. Yen getting cheaper will lower a major cost of the car...battery. Yen at 90, was 70 and still headed up. New Japanese gov stated goal is to increase exports by lowering value of yen

2. Oil prices headed up again. Yes, I am aware of projections BUT fracking will not go as far. Remember NIMBY attitude. Who wants contaminated ground water. You can drink bottled water but farming not done with bottled water. Look what people are willing to pay for organic foods. They will not tolerate contaminated crops and meats

3. Inside sellers? Musk sale was prearranged. Living his life style, buying his home creates expenses. The director who left exercised options that were expiring and he left. Don't expect any inside selling 2 weeks before earnings.

4. Small investors returning to market. Will not argue the wisdom just state the observation. As market approaches new high expect more to jump in. That huge component has been missing from market for five years�

1/1/2015

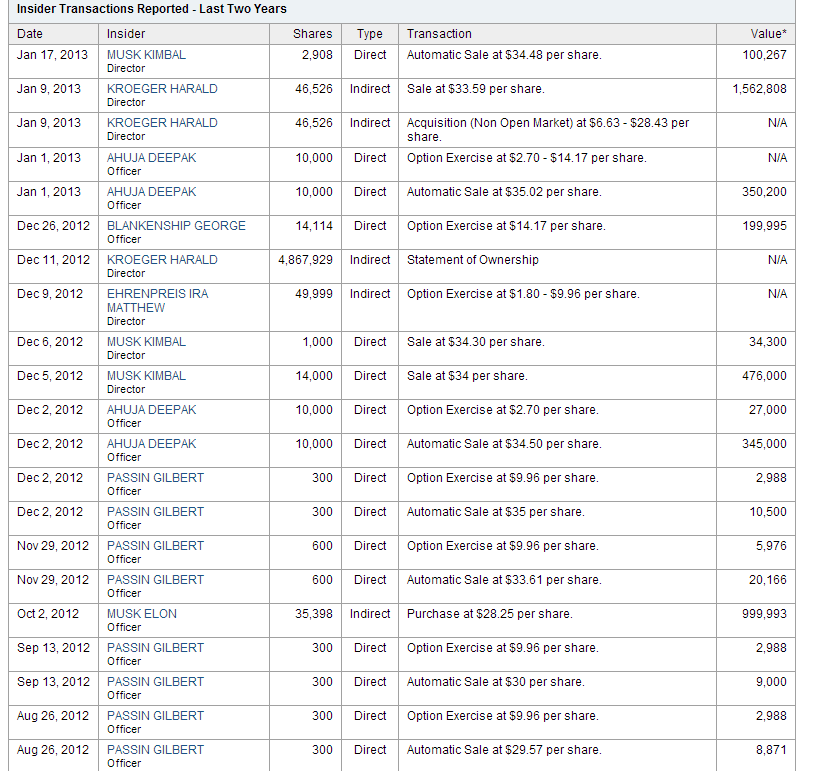

guest I agree with regards to insider sales, I've been trying to track this (no way to track it in real-time, since it's reported days or even weeks afterwards) and I have to say that it would seem that all the sales by insiders such as Elon Musk, Straubel, Passin, Blankenship, Ahuja are the direct result of options being exercised and then the equivalent number of sales being sold (at the given market price). If you see someone selling when the stock is up it's coincidence IMO. The only exception being Kimbal Musk i believe, who is actually selling stock when he wants to. Look at this screenshot from Yahoo finance, notice that most of the sales are "Automatic sale" and preceded by "Option excercise".

By the way, who is Kroger?�

1/1/2015

guest A daimler exec who recently joined the board I believe.�

1/1/2015

guest Musk to give Bloomberg interview on Bloomberg tonight at six. Does anyone know whether that can be watched over Internet!

?�

1/1/2015

guest New Dailer exec who replaced the old Daimler exec.

We're headed for $38. today!�

1/1/2015

guest This couldn't happen to a better company. Go Tesla. Go Elon.�

1/1/2015

guest It reads the CTO, so JB will make an appearance...�

1/1/2015

guest I'm very curious to get the take of those who last week were predicting today to be down. I know the day is just beginning, but things are movning in quite the opposite direction.�

1/1/2015

guest Quote from a Morgan Stanley research note this morning:

They've always been pretty conservative with their model, and pretty much on the mark. This may not be enough of a miss to push the stock down. They're also leaving their price target unchanged at $47.

Overall the research note was very positive, with expectation that reservation momentum is poised to accelerate. I'm just pointing out this one slight negative, to see what people here think about it.�

1/1/2015

guest I'm confused. Haven't 4200+ VINs been assigned?�

1/1/2015

guest Not in Q4 (the note discusses Q4 deliveries) and not necessarily delivered.�

1/1/2015

guest I am VIN 3245, delivered 1/17, but the car was built in December of 2012�

1/1/2015

guest Dumb question inbound, where can we find out info of when the Q4 earnings report conference call will be? Is there a specific date lined up? And how can I figure this out myself for the future? �

�

1/1/2015

guest This is where I go. Eventually Tesla will send out a press release with the details.

Tesla Motors Inc: NASDAQ:TSLA quotes & news - Google Finance

�

�

1/1/2015

guest Yeah, so yours doesn't count as a Q4 delivery. I'm sure there were a lot of people not ready to take delivery before Jan 1st.�

1/1/2015

guest New high? 38.10

Not necessarily. If it was on a delivery truck before the first it should be counted in Q4.�

1/1/2015

guest Nope. We have to break $39.95 to set a new high. Soon, very soon.�

1/1/2015

guest *Furiously knocks on wood*

- - - Updated - - -

Wow. I programmed some profit taking at $38.50. Didn't think it would get there.

- - - Updated - - -

I'm going to feel really foolish if it keeps on this track.�

1/1/2015

guest Volume isn't much greater than average this morning. Is volume generally associated with stock movement or mostly unrelated?�

1/1/2015

guest This is just why I'm reluctant to sell any without a really large price increase. I'm afraid it won't go down enough for me to re-buy.�

1/1/2015

guest Now that Tesla has a defined and steady cash flow, it will be interesting if the market reacts differently to TSLA's charge to a new high.�

1/1/2015

guest A high quality problem. You know what isn't a high quality problem? Not selling anything then having it go back down.

Take some profits people, no stock goes straight up. Keep most of your shares, but if you have no cash to buy when we inevitably move down, take a little off the table and put it in your pocket now.�

1/1/2015

guest True but I think the more important thing is not all of us are hooked up to the market 100%. So I've just been holding.

�

1/1/2015

guest Thats pure gambling.�

1/1/2015

guest Yes, $38.50 was too good for me to pass up as a selling opportunity. I'd feel bad if it kept going up to $40 today, but I'm pretty sure it will see the dark side of $38 again soon. And if not, the rest of my stash is still going along for the ride and I can take my wife out to dinner tonight.

- - - Updated - - -

Not pure gambling, any more than Poker is. If I was a major player I'd still sell some at $38.50 then get a friend to write an op-ed about how terrible exploding Tesla's are and then swoop back in to cherry pick the downside. Being a small player I just try to anticipate what the big boys will do.�

1/1/2015

guest I took a little bit of profit at $38, but am holding onto the majority of my stake for now. $40 here we go!�

1/1/2015

guest There's obviously risk, but pure gambling? I don't think so. Downturns in stock prices are inevitable, especially when taking time into account.�

1/1/2015

guest TSLA stock has paid for 10% of my Model S, so far. �

�

1/1/2015

guest No, pure gambling would be to sell all your shares because you bet it will be going down tomorrow. This is risk management. With every dollar higher that TSLA climbs, the probability of a selloff increases; to not mitigate against that risk IS gambling.

I'm only suggesting you trade some of the potential for future gains to buy the ability to be able to do something when the market inevitably turns on you. Just wait, when it happens this board will be flooded with cries of "I should have sold at $xx.xx! I wish I could buy more now, but I don't have any cash left!" Just read through the enormous history of this thread and you'll see it time and time again.

If you don't have cash now, raise some. If the price never again falls, good. But if it does, you can be happy about that too, because you'll be able to buy even more shares.�

1/1/2015

guest Same here, but my dream is eventually 100%...�

1/1/2015

guest I'd settle for 50%. �

�

1/1/2015

guest I'm sure you're joking, but there are some inexperienced investors on the list, so I'll just point out that market manipulation is a serious crime.�

1/1/2015

guest *cough* Goldman Sachs *caugh*

Must be nice to be an analyst who can upgrade/downgrade stocks, and have most of your company's revenue come from trading stocks yourself.

- - - Updated - - -

Also, regarding holding a long term position as opposed to selling some and waiting for a pullback, there's no right answer. Everyone has their own strategy. Some have a long position, feel very confident in it, and will let it sit.�

Không có nhận xét nào:

Đăng nhận xét