1/1/2015

guest Can someone explain why Tesla is cash flow positive (or should be by Q1 2013), but not profitable until end of 2013? Is it basically because reservation cash helps generate cash flow, but can't be booked as revenue yet, or is there more to it?�

1/1/2015

guest I did, here's the link for those that want to skip that step:

http://www.reuters.com/article/2013/01/14/autoshow-tesla-profit-idUSL2N0AJ0GX20130114�

1/1/2015

guest ELON states: shorts will feel the "STING"

For weeks now everyone going LONG and SHORT on TSLA is waiting on ONE single and

probably most valuable information withheld from ELON MUSK--what was the 4th

Quarter's production rate? Is it 0? 5? 10? 200? 400? With over 25 million shares

being shorted by TSLA, the longs are waiting for one of the most epic squeeze in

history should TSLA meet production estimate of 400 cars produced per week. On

the otherhand, if TSLA fails miserably to meet production targets, the shorts

will soon celebrate. So the question looms: has TSLA met production target? and

if so, why is ELON withholding information that might be beneficial to TSLA

shareholders?

While driving home, I asked myself a simple question: If

the TESLA MOTORS CLUB reservation holders are reporting that over 3,500 VIN

numbers have been produced, then why isn't ELON tweeting this spectacular news?

It is afterall, GOOD NEWS right? Could it be that TSLA isn't meeting production

target? Then it finally hit me, I recalled back during the summer of 2012 when

Elon was being interviewed and commented about short positions on TSLA. He

simply stated that "if you are shorting TSLA at the end of 2012, you are going

to feel the pain--believe me, this one is going to STING!" Yes, Elon used the

word "STING."

It isn't a big secret to investors by now that TSLA short

positions are extremely high. Everyone including TSLA and ELON knows this. As an

investor, just ask yourself one simple question: if you were the CEO of TSLA,

and you have met the 400 MODEL S production target, would you release that

information to the public immediately? Or would you wait and why? Investors like

you and I would simply say--HECK YEA! We'll release it ASAP because TSLA stocks

will rise immediately. However, you and I aren't geniuses like Elon, we tend to

act upon emotions and not logic. The man, ELON is too smart and too logical to

release this kind of information, he is thinking exponential rise on TSLA stock,

he is thinking--"I want to really give a BIG present to TSLA investors!" and

here's how withholding production numbers will benefit TSLA shareholders greatly

should ELON wait till February earnings call:

1. Since TSLA has been cash

flow positive for awhile now, TSLA shareholders are unlikely to sell their

stocks, the majority will simply wait till Feb. 2013 earnings call to anticipate

good news that can cause an epic squeeze. Which leads us to the next question,

how can an epic squeeze occur on TSLA?

2. An epic squeeze can occur for

TSLA by simply hitting production targets of 400 model S produced. However, an

even HIGHER squeeze can occur if you cause panic amongst ALL the shorts! Which

leads us to our next question. How do we create panic amongst ALL of the

shorts?

3. You will create panic amongst the shorts by withholding

information until its simply too late for them to act. A moment where all

shorts, realize its OVER and they ALL race for cover their positions. A moment

similar to the run on the banks during the great depression where all Americans

rushed to the banks to withdraw their money, causing banks to shut down and go

out of business overnight! Which leads us to the next question. So when is the

exact moment when ALL shorts realize its game over?

4. The moment where

all shorts realize its game over isn't at the 400 production target. It's going

to be the moment where TSLA suprises the market 2 months AFTER they've met

production target. The reason why releasing production targets 2 months after

the fact is because by then, TSLA has already moved beyond the point of meeting

production and they are on their way to hitting another milestone, which is

producing 5,000 model S for Quarter 1. Which brings the total model S production

unit to over 8,000 potential MODEL S produced. You see 8,000 is much greater

than 3,000. The moment when shorts realize "oh SHNAP, #$%$?" isnt at 3,000 model

S... its at a number far greater than 3,000. Its the number that ELON can simply

state during Feb's earnings, where he can state: we are on target to hit 8,000

MODEL S production for the 1st quarter. Which will undoubtely create a short

squeeze so high it will leave all TSLA investors with the biggest smile for

months!

So again, as CEO of TSLA just ask yourself: should I wait, or

should I release production numbers now? If its now, then its 3,000 model S

produced. But If I wait, its 8,000 MODEL S PRODUCED. Which one will create the

panic? You do the math!�

1/1/2015

guest As CEO of a publicly traded company, there is a lot that Elon can't say. In fact there was discussion of him getting in trouble for tweeting that Tesla was "cash flow positive." I don't know what the rules are but I'm pretty sure he's being a lot more careful about following the SEC rules. However, he did say in the Reuters article that they had achieved full production and that they would meet their 20K production for next year. He did not say but others have said that they are going to try and increase production beyond 20K. That would make perfect sense since they are effectively selling 400 cars a week and have been for a while now. Tesla needs to increase production to get the reservation list down to a manageable level.�

1/1/2015

guest Well it is 30 million in cash received last quarter that doesn't count towards profits.�

1/1/2015

guest From that article:

However I'd hope that they can demonstrate their ability to get there, much sooner. (Due to becoming cash flow positive, etc.)

- - - Updated - - -

Here is the quote:

Yay, it's (almost) official !!! I suppose this means the biggest hurdle has been taken.�

1/1/2015

guest Tesla promised to start X production by the end of 2013 and deliveries in the beginning of 2014. Now that looks like more then a half a year delay...

I also believe the are pushing back production of right hand drive S from mid 2013 to end of it.

What would be the reasons? Problems with R&D? Or demand for S is so huge that TM for now concentrates on meeting it?�

1/1/2015

guest Both of those (maybe not problems with R&D, but the cost), plus that the longer ramp-up for the Model S may have delayed everything else as well, a few months. I guess the plans all remain the same, just that everything happens a bit later.�

1/1/2015

guest Hmmm I don't know if it's been mentioned anywhere else, but it looks like Tesla's going to be showing 'an experimental concept from electric carmaker Tesla' at the Detriot auto show this week. That should give us another good boost! http://www.huffingtonpost.com/2013/01/12/detroit-car-show-why-atte_n_2463300.html?ir=Detroit I wonder if it's the Gen III. It could be the X, but I think that would have been explicitly mentioned as opposed to described as 'experimental concept'. I don't think the X is considered an experimental concept anymore....�

1/1/2015

guest upgraded roadster mayb�?�

1/1/2015

guest Also the Gen III used to be tentatively 2015-16 and now we're looking at three to four years from now (2016-17).�

1/1/2015

guest as far as changes to timeline... Zzzz, wasn't aware they'd said in past anything more specific than 2014 on Model X, but definitely was a quiet revision of Gen III a year of two out. perhaps we'll get a little more detail on causes of revisions coming out of autoshow in Detroit, or conference call next month.

we may never know details of why timeline changed, but Elon often speaks his mind. until then, I'll just speculate a little... even Tesla may have been caught off guard by demand for Model S. they may have had concerns in past about interest in the S peaking, and felt pressure to get the X and Gen III out ASAP to maintain revenue growth. with the significant likelihood of multi-year very robust growth in S demand, they may have seen the opportunity to put more breathing room in the strategic plan for X and Gen III. i.e., if S sales grow for next 3 years with increased visibility and geographical expansion, with a two year echo from X, why not establish brand and make profits an extra year or two and deliver a Gen III with that much better cost, range, and quality. and as another poster suggested, this frees more focus in short term to sort out increasing S production if they are going that direction.

all this is not to overlook (as I am confident the shorts will), Elon also quietly implied they've hit the 400 cars/week production level. :smile:�

1/1/2015

guest

This. Current demand already matches their 20k goal and the initial round of store openings isn't even done yet, let alone having any real effort to advertise or push growth in the non US markets, which collectively are far larger anyways.

Model S is a high margin product, and from a business perspective it makes sense to focus your resources on that and try to turn it into a smash hit.

Plus, I suspect that Musk is getting past the need to over promise on delivery dates, and then being forced into making brute force efforts to make everything work. There were sound business reasons to ship Model S when he did, but I'd be willing to bet that the last six months were not how he envisioned them.�

1/1/2015

guest Just overly ambitious I think, which was true with the Roadster release date and the Model S release date, so I mentally add 1-2 years to any initially announced date. The Model S moved a couple times as I recall. First it was 2009 or 2010 I think, then late 2011 (that was the day when I first looked at the website), then finally summer 2012.

I've been telling people 4-5 years for the Gen3 when they ask me about a more affordable model. If Tesla comes in earlier, that's awesome, but the scale of prep for Gen 3 is quite a bit beyond the Model S. Tesla has a factory with space, but they'd still need a bunch of new presses, robots, etc and complexities with suppliers that'll dwarf those of the Model S.�

1/1/2015

guest Hmmm when the car was revealed in March 2009 I don't think they ever mentioned it being ready the same year or even 2010. I thought late 2011 was always the target for the first signatures deliveries at which point the date changed to Mid 2012.

�

1/1/2015

guest Yea, it was way, way back. Google is hard to find on it at this point due to the huge number of more recent hits, but here's an example. It's so old, it was even touted as possibly being an REV. Basically, when it was little more than a concept, the "target" date was quite early. Gen3 is basically a concept now, so that's why I'm not surprised if it's initially hoped date is off by a couple years.

Tesla Whitestar to be offered as both an EV and a REV

�

1/1/2015

guest Pushing out dates can easily be that they are now focusing on under promising and over delivering.�

1/1/2015

guest Updated Model X?

http://www.autoexpress.co.uk/tesla/62306/tesla-model-x-revealed�

1/1/2015

guest Hello all!

I'm back! Whats up?�

1/1/2015

guest Well, we finally got ride of that 52 week low that was a little above $22. Now $25.52.�

1/1/2015

guest Welcome back.�

1/1/2015

guest Surprised to see sale by Daimler appointed board member. Anybody know what this means? So soon after he joins the board. Can directors sell anything this close to earnings report?�

1/1/2015

guest I would not think as bad as the R or the S. The G3 has the advantage of a building. They shopped NM and then jumped to NUMI and lost a year just in that shuffling. They have factory build team on staff and potentially working on the X and G3 build-out now. I would credit and delay of the G3 to waiting for battery tech to hit spec,�

1/1/2015

guest Posts about Solar City went here: Solar City IPO - Page 4�

1/1/2015

guest We've been waiting for you. No really significant developments. We're still waiting/hoping for a big short squeeze.�

1/1/2015

guest Finally something positive about TSLA from SeekingAlpha: Tesla Motors Set For Record-Breaking Q4 - Seeking Alpha�

1/1/2015

guest This has me more concerned than anything else. They are always wrong. You can ask them who is buried in grants tomb and they would get it wrong�

1/1/2015

guest Well, here I am....

On vacation and on a road trip in the US of A!

I left from Montreal about a week ago, visited 13 states so far, I should be in California beginning of next week

Anyone knows if they still give guided tour of the factory?

Only down sides to my trip so far: 1. I'm burning fuel and 2. Why is it so cold in this country?

Hello from Texas!�

1/1/2015

guest Tesla to open 25 new stores in 2013, first Chinese location this spring

More shops ensuring continued demand...�

1/1/2015

guest Grant is not buried in Grant's Tomb. Really.�

1/1/2015

guest Semantics ... he is entombed there but not technically buried as his remains are not underground. Nor are his wife's who is also there.

Buried has come to mean "laid to rest" in common usage when referring to the deceased.�

1/1/2015

guest Wow. The author obviously uses this web site and has been drinking the same Kool-Aid as the rest of us.�

1/1/2015

guest Or even more. Tesla shouldn't be expected to become profitable in Q1, only (hopefully) that the numbers will show that it is becoming profitable. For example, they'll surely have to do some more hiring and training, which AFAIK always incurs additional costs in the beginning. The dust of ramping-up surely hasn't settled yet. They probably still pay higher supplier prices until they become a regular "consumer" of supplier resources at production level. They may still be changing, improving, and adjusting production in many ways.�

1/1/2015

guest perhaps this is optimism on my part, but I find the news that Tesla will open 25 new stores in 2013 suggestive of a plan to increase production for the S, substantially.

they are near sold out for all of 2013 based on the waiting list. reservations were at about 80-90 per day in December (when you back out year end rush to beat price increase), or 30-35,000 cars per year, just in the U.S.

If the company is not planning to scale up production substantially, why would you get those stores in place in the next 12 months given you're production is well behind demand?�

1/1/2015

guest This is solid reasoning here. Wish I had more to invest on that dip.�

1/1/2015

guest So do I . Almost invested on Margin but took Citizen T's advice to never do that .... sure hope the next earning call goes well �

�

1/1/2015

guest Ugh, another Boeing 787 battery fire? All people hear is lithium ion. Of course batteries made by different company and packaged differently. Hoping tesla not hurt. Maybe they sell technology to BoeingBoeing�

1/1/2015

guest Any info on where the new Tesla stores will be placed?

Sent from my iPad using Tapatalk HD�

1/1/2015

guest Is anyone here as surprised as I am about how Tesla's stock is trading? Not the price level, but the volatility. Given that Tesla is an extremely ambitious startup in a crowded market, with a large short interest and small free float, its share price should swing like crazy. Especially as new information becomes available all the time. For example, recently there have been indications that the company reached its 2012 delivery target and that the company's cash position is OK. But the stock hardly moves! In fact, most days it more or less flatlines after a few hours of +-1% swings.

What's up?�

1/1/2015

guest i think its the silence before the storm�

1/1/2015

guest Tesla Motors Attracts Short-Term Option Bears | Daily Option Blog | Schaeffer's Investment Research

More bearish interest? Lets hope they are just wasting their money.�

1/1/2015

guest today over 34$ would be good.�

1/1/2015

guest That's pretty much always been the case. It has to break a 5% change before I even start wondering why.�

1/1/2015

guest You got your wish.�

1/1/2015

guest does anyone have any frame of reference for the amount of R&D money that will be needed to bring each of the next two cars, X and Gen III, into production?�

1/1/2015

guest A "close" over $34...�

1/1/2015

guest I very vaguely remember estimates of about $150 - $200 million for the Model X, some of which may already have been spent, as it will use the same production line as the Model S. That's all costs combined, including adding the additional production equipment, not just R&D. So I am a bit surprised that Elon said Tesla may have a profitable quarter later this year (as opposed to perhaps Q2), since that is when I'd have expected expenses for the Model X to make the bottom line perhaps go negative again (on paper). But I think it is a good thing if Tesla plans to be profitable for at least a whole quarter, and not just say 'we would be profitable if we didn't have these ramp-up related expenses and those future-investment related expenses'.

Costs for Gen III will probably be much larger since it involves building a new high-volume production line. So they'll perhaps "save money" for a while, before starting to build the new line.�

1/1/2015

guest Without getting into detailed accounting methods, they could capitalize certain R&D costs and certainly capitalize the new tooling costs without severely impacting the P&L. What those investments mean in terms of cash flow is a different aspect to consider.

On Model X, IIRC they're using the Model S skateboard and a number of the components plus they should be able to use the Model S firmware as a base for ~90% of the Model X firmware.�

1/1/2015

guest I think we're probably stuck in this range until we get news, probably in the form of earnings. That means that it might make sense to take some profits when we touch $35 again.�

1/1/2015

guest It seems shorts are starting to cover, and they might do more of that before earnings reports come in.�

1/1/2015

guest thanks Norbert and Nigel.

something to go on for X at $150-200 million. didn't realize they could capitalize R&D expense (I take this to mean amoritize). Nigel, on a rough level, do you think this would be as much as half of the R&D expense? would a reasonable assumption be any capitalized part would be spread over ten years?

for some reason I have the number $500 million on Gen III in my head.

fwiw, I ask this because I am trying to make my own estimates of eps scenarios for next few years. given the opening of more stores (despite demand well above supply), and Blankenship comment reported today that single line could produce 50,000 S and X, I strongly suspect production in '14 and '15 may be a multiple of 20,000 range for this year.�

1/1/2015

guest Nobert, I always appreciate your posts and this one is no exception. Thanks.

It's my firm belief based on his interviews that Elon's main goal with Tesla is to accelerate the mass adoption of EVs. Therefore, I think Elon is willing to keep spending aggressively to get to Gen III within a few years and produce hundreds of thousands of units/year. I think he'll only modestly produce profits in the next few years because he'll constantly throw the profit back into future lines.

In some respects, Elon is similar to Jeff Bezos in that they are very focused on long term goals rather than maximizing quarterly profit. Basically it's a "get big fast" strategy - large profits come much later. Unfortunately, founders like these drive "the street" bonkers.�

1/1/2015

guest Musk has been quoted recently, and the reactions have been interesting. It should be clear now that Tesla is not yet profitable, wasn't profitable in Q4 2012, and may not be profitable until Q4 2013. I think some were expecting profit in Q4 2012 because they'd make 2500 cars, which is a 10K run rate for the year and Elon had said they'd break even at 8K/year.

I think everyone has looked at TMC's delivery reporting and come up with a Q4 delivery number of 2500-2700 cars. Above or below that would be a surprise, and I'm personally looking for some Elon-spin on production rates, sales extrapolation, etc. The shorts are tired of promises, but Tesla's progress will enable promises more to be made.

What's interesting is the 2400 Jan 2013 Puts just purchased - which expire this friday!. Who is thinking Tesla is going to end up below $31.86 in even a week with earnings not scheduled to be announced until Feb? I would have thought the bears would be on the Feb or Mar Puts, especially since even with a good Q4 the stock could get punished then, along with everyone else, on upcoming debt ceiling debate.�

1/1/2015

guest Yes many are confusing cash flow positive (achievable in Q1) and profitable (not until Q3 or Q4)

Your thoughts regarding the recent short interest mirrors mine exactly. I currently holds Call expiring Mar to capture the feb 11 report, but I'm sweating it due to the timing of pending debt ceiling issue. Unless these are insiders that know something we don't , I can see no current prevailing reason to sort TSLA at all (given evidence of meeting prod and reservation goals). Something's up though because that kind of Put buy doesn't happen in the climate of current Tesla 'news'. If it does drop to those levels, I may have re-evaluate the risk of the stock in general�

1/1/2015

guest Unfortunately "the street" is stupidly focused on the short term, to detriment of itself and our economy. This is clearly the correct path for the company. People who call it a "loser" because it's not profitable have no clue what it takes to build a company. That includes many businesspeople, unfortunately.�

1/1/2015

guest due to this strategy, amazon used to be mockingly referred to as amazon.org. today their market cap is over $120 billion.�

1/1/2015

guest Maybe those who believed recent articles claiming that Tesla will need more cash to survive (ignoring the successful capital raise, not to mention the ramp-up of Model S sales, in Q4) ?

Tesla should have a good enough cash flow to prove those claims wrong, even though a "profitable quarter" will come only later. Tesla should be able to demonstrate that the major hurdles for becoming profitable have been taken, and that profitability is imminent in 2013.�

1/1/2015

guest I would not call that play totally unreasonable.

They invested ~$33k on Monday when price was around $33. They hoped share price would get to $31.50. With TSLA volatility - was it totally unreasonable to expect $1.50 swing one way or another in five days? And if price touched down $31.50 they would get their money back and make $70k+ in profits. The question is - what were the odds of $1.50 price drop? If it were 33% or more, they make money betting this way on the long run. Now that price gone up and it is Wednesday already, sure that bet do not look like a good one anymore.�

1/1/2015

guest Hope we will be able to verify this:

Tesla Says it Has the Cash to Fund its Plan | TheDetroitBureau.com�

1/1/2015

guest I missed that one somehow. Could you point me out to it?

EDIT: Opps, thank you Norbert!�

1/1/2015

guest good point, verification on this would help. especially as this piece was somewhat sloppy (i.e. stating Supercharging was only available for 85kwh)

�

1/1/2015

guest Except that won't become clear until report feb 11- they won't know any more info on that by friday when these expire;

Unless some inside info, I can only surmise they are counting on some sort of cross correlation to lithium battery issues with Boeing coming into play; Someone who works for the shorts is no doubt preparing an article along those lines to be released tomorrow�

1/1/2015

guest Yep. Relentless focus on the long term.�

1/1/2015

guest Yes, the second part of my comment was not directed at the Friday puts. Just at that those assumptions would be wrong. It appears at the Detroit Auto Show, George Blankenship has now been telling people that Tesla has enough cash going forward. (See article above.) So I don't think rumors in that direction will further propagate.

BTW, TSLA closed at $34.10, fulfilling above wishes. �

�

1/1/2015

guest Capitalizing R&D is complex, we'd need a lot of time and a seperate thread to really get into it, and there's different ways to interpret GAAP. If you can allocate some portion of R&D costs that delivers unique know-how which has a value then you can capitalize it as an asset on the balance sheet. The cash is going out but you can avoid it impacting your P&L. The proportion of R&D costs that can be moved to the balance sheet is dependant on how agressive you want to be in accounting practice and what your auditors will agree to.

BTW, another big part of the development costs is tooling and that can be capitalized as a depreciating asset on the balance sheet without impacting the P&L until you recognize the amortization in your COGS.

I'd suggest that cash flow should still be the focus of attention for the next 12 months over and above earnings. I'd also suggest that Tesla has it's focus on that and probably doesn't have serious eps forecasts for the next few years (alright, maybe for this year they do). Those are just my opinions, YMMV.�

1/1/2015

guest If true, it seems very unexpected. 20K/year might not raise BMW or Audi eyebrows, but 50K will get their attention. But I'm hesitant since it's not a direct quote. The interesting part to me is the "current production line" since that hints that all TM needs is enough reservations and they could ramp even further without undertaking serious cash flow issues.�

1/1/2015

guest Well, I suppose at some point Tesla will want to convince people that they are a surviving company. My impression is that "profit" in quarterly results seems to be generally taken as the more significant indication for a heathy company, compared to positive cash flow, even if cash flow is the more immediate necessity when navigating along the edge.�

1/1/2015

guest thanks Nigel. the way you explained it, I think I've got the logic of what would be allowed, as well as why it would be complicated (and pretty speculative of us) to try to anticipate the extent Tesla's management would try to make use capitalizing some of the expense.

off topic, congrats on your Model S... I enjoyed seeing your delivery story and photos last month.

�

1/1/2015

guest Based on nothing but speculation I think the stock might face a run up as q4 announcement is made. I am planning on unloading some on this expected upswing. Mainly feel this way due to all of the rumors of meeting production goals. I think enough people will buy ahead of announcement to move stock but we will see.�

1/1/2015

guest What is a good site to look at the current trades going on in a little more detail than Google's stock ticker ..... I noticed there was about a 40 cent jump a couple of minutes ago and was curious if there was somehwere you could look at what large trades were being made ... thanks for any input�

1/1/2015

guest we have a good start today. already +2%

i wonder why?? any info?�

1/1/2015

guest http://finance.yahoo.com/echarts?s=TSLA+Interactive#symbol=tsla;range=1d;compare=;indicator=volume;charttype=area;crosshair=on;ohlcvalues=0;logscale=off;source=undefined; gives a bit more volume information.

(Edited to correct URL.)�

1/1/2015

guest

thanks ... link did not work for me but I googled it and found it. That is a lot better It shows at 10:26 there was a 113,700 volume which along with a 40,000 volume seem to be the only two large trades of the day thus far. It seemed to drop the price after that .... does that make it safe to assume this was someone selling shares?�

1/1/2015

guest I fixed the URL above, sorry about that. Double-pasted the "http://" bit.

What I would guess about the big trades of the day is this. In the morning, a bit before 10am, someone placed a large buy order at market price. This started to run the price up a bit, and as the price started to go up, some limit sell orders triggered, until around 10:30 someone with a big holding decided (perhaps some automated trade, so don't read too much into the word "decided") to take some profit and fulfilled the order. The price then started dropping again as slower traders wanted to lock in some profit but there weren't so many takers.

Much more obvious is that in the afternoon, while the price was still up, a seller placed a large sell order at limit $34.50, and that kept the price at a plateau until it was exhausted at about 14:40.�

1/1/2015

guest snip...Yep, I got a notification and acted. Paid for the jump seats! W00t!�

1/1/2015

guest But Amazon didn't need tax payer money to survive...

�

�

1/1/2015

guest The hell they didn't. Tax breaks here in WA headquarters, leveraged no state sales tax over US, and non of that will ever be paid back as a loan�

1/1/2015

guest Ford took a loan over 4 billion in this program I believe. I know it was alot more than Tesla got.�

1/1/2015

guest Ford got $5.9 billion. So twelve times as much as Tesla. Ford gets to pay it back over 25 years too. I'm not sure what Tesla's new payback protocol is, other than they have to pay it back early.

I was also one of the people that took some profit today. I sold about 1/3 of my shares.�

1/1/2015

guest 1.200.000 sold in 10 minutes!�

1/1/2015

guest you may say 1,200,000 bought in 10 minutes hehe�

1/1/2015

guest man what an odd day.�

1/1/2015

guest Totally. I expected volatility today with the option puts in the news this week. Nice price improvement over the last few days, though. I'd like to see a run up over the next few weeks as we head towards Feb 11th. Regardless, I'm a long term investor.�

1/1/2015

guest not looking good for all those $32 shorts that bought for today's expiration�

1/1/2015

guest It's hard to imagine that the huge volume in 10 min. was a lot of small trades. I'd love to know who bought and who sold and the actual trade sizes.

Ya gotta wonder!�

1/1/2015

guest So any idea on how much or how many shorts lost out today? Is there a way to find out?�

1/1/2015

guest I don't know how this works, but the buyer and the seller must have had a deal before they offered the shares.�

1/1/2015

guest Something could have tripped a breaker. Maybe a short wanted to cover. Perhaps they will let them expire worthless. Who knows.�

1/1/2015

guest Nice pop into positive territory in the final hour.�

1/1/2015

guest Something about to happen!�

1/1/2015

guest don't get too excited. Little swing to positive was just covering, then selling as they will not hold positions over the weekend.�

1/1/2015

guest Closing with $34.52. So the puts who were gambling on at least as low as $31.50 by this Friday, lost their game.�

1/1/2015

guest Today's Volume

The conference call after the Rawlinson departure was a year ago. It could be those with the foresight to buy on that dip are reaping LTCGs.�

1/1/2015

guest Anyone care to venture a guess on whats up with the trade volume. We are at 3 times daily average. Something's cooking.�

1/1/2015

guest Tons of options expired/had to be covered/closed today. Just like today you can trade options for January 17, 2015, options that were closing today were traded for couple years.�

1/1/2015

guest I got back into Tesla today. Feb 37 calls. Just FYI.

next target is 36.45. Should be resistance pre earnings.

I expect it to touch the mid 36s in the next two weeks. Plan on selling the feb 36 strike calls into strength pre earnings, short spread for February.

then use the proceeds to buy tons of march 40 strikes on weakness pre earnings.

Hedged with tons of upside if they beat expectations and the stock runs. Should work even if they 'miss', stock pulls back for a few days (feb short spread expires) then runs as the reality sinks in, Tesla is here to stay and will be a very valuable company.�

1/1/2015

guest So you expect run to mid 36, then a pull back into earnings for the 40strike buy? Pretty tight call of events, no? From previous behavior, I think there might be significant short stops at 36. If so and it breaks thru that, may not pull back before earnings but instead squeeze higher right into them. If so, you might be better off just buying the march 40s now.�

1/1/2015

guest I'm a long term TSLA investor as well, and normally I keep a light hand on my stocks. But since mid December I've been extremely active in riding herd on the stock because of external factors have have me concerned (i.e. Debt Limit negotiations). And especially since I came back into the stock at the end of December, I've been doing some active profit taking where normally I'd just ignore the ups and downs.

Mostly, I expect to actively manage the stock until the conference call with the expectation that there will be excellent selling opportunities after that if the Debt Ceiling negotiations go bad. Right now, the Republican establishment looks close to collapse, but the leadership is extremely weak in the House and it still seems possible that they wont allow a clean vote. Until I know where thats going, I'm gonna keep playing momma bird with my shares.�

1/1/2015

guest That is more then 3250 upper estimate announced by TM few months ago.

Interesting that projection for 2013 and 2014 are on low end, only 18,500 and 22,500 units respectively.

Nissan Brings More Electric Vehicle Component Production to U.S. | Benzinga

PS. Not sure when JP made those estimates.�

1/1/2015

guest That's JP Morgan and not John Petersen (just for clarity).�

1/1/2015

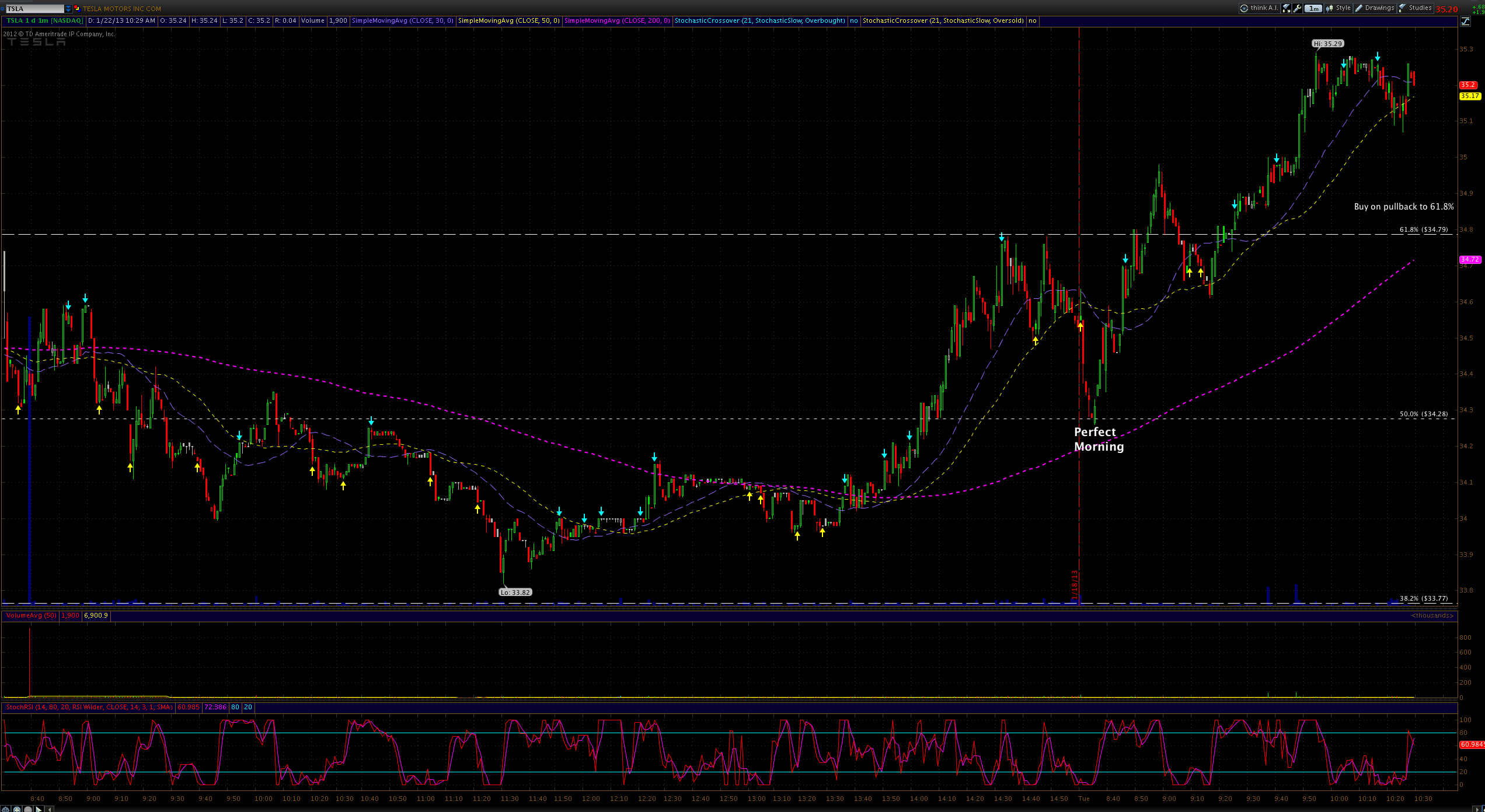

guest charts. Course everyone reads the Crystal ball differently.

�

�

1/1/2015

guest They probably got the 3400 number based on VIN reports. We know that's bad methodology though for a variety of reasons. Now we are likely to see a "disappointing" report from Tesla during the conference call.

Edit: Changed "Thud" to "They". Gotta love my when my iPhone decides to be mischievous �

�

1/1/2015

guest Good point and thanks for the charts. Looks like about a 2 week time frame to (b)reach 36 from here if it follows past trend. That's going to put it just days from the feb 11 report. In a normal chart flow, your right it would pull back, but that's going to be a hard pullback k owing that report is close. Consider that it may not happen or if so to a much less extend. I actually hope there is one to add some LEAP positions. But without an actual market pullback (a definite possibility given the overbought we are in) it may not happen. Just sayin....

Thanks for posting your insights. And charting. Very helpful�

1/1/2015

guest Today is going to be fun. We were up 50 cents even before the opening. There is at least one article saying that Tesla is at full production. The article says it's just a rumor and mentions the TMC to incorrectly say that all of next years cars are sold.

Tesla's Fremont Plant in California Runs at Full Capacity�

1/1/2015

guest Oh such a quandry... I want to get more in, but am not sure the price is where I want it. My goals are two-fold. I am long on Tesla, but am also wanting to play smart and build profit to help with an X purchase. My cost basis is $33 so I would prefer to buy below that.

Do you think we'll dip below that again? I originally wanted to buy closer to $30, but I'm thinking that might be wishful thinking.

Would love any insight from those seasoned investors, especially being this close to a quarterly call, etc.

Disclaimer: No worry. I will not be taking anyone's word as gospel and making rash decisions. I always compile information and make an informed decision from there. �

�

1/1/2015

guest This is the start of a pre earnings run to mid 36s. post that entirely depends on earnings. confirmed by this mornings action.

buying now is a good idea.

- - - Updated - - -

Its actually absurd how easy it is to chart Tesla.

Same Studies as yesterday, just the 1m ticks morning plus yesterday

Edit: Not seeing under 30 pre earnings. No way in Hell.

�

�

1/1/2015

guest The trick to having dual goals like this is to split your money (shares) into two camps. A portion that you hold for the long term, and a portion that you "play the game with".�

1/1/2015

guest

Yup. I have my tesla lottery account. Aggressive options. 3k start. If it reaches 100k I buy a Model X.�

1/1/2015

guest so funny:smile:�

1/1/2015

guest I would prefer to buy at 27.5 today. Seriously I believe the shorts are starting to be concerned. They have to buy 25 million share in under 3 weeks. The price is not stopping at 36 as someone suggested. It will pick up even more momentum after it passes 36. I noticed that European buyers are now finalizing. They have surpassed the stated 400 unit/week goal. They are still stating 2 month delivery as reservations past 16xxx finalize. I am never adverse to trading but be wary to trade now may lose large upswing opportunity�

1/1/2015

guest Heard it before but I sure hope you are right....

�

1/1/2015

guest Other thought would be inauguration speech question expect carbon tax now or even higher credit for electric. Thought Friday 3 million vol was option expiration but two days in a row of high volume. Curious about tomorrow�

1/1/2015

guest I am baffled. According to Interactive Charts Shorts went up again today. Do they not know the production rate and the reservation reservoir? Either they are badly informed or they are using altenative logic. Am I correct that the short analytics page is showing the percent of today's trades that were short not the cumulative short positions?�

1/1/2015

guest At this point they:

A. Somehow believe that Tesla is lying about everything or have rose colored glasses on.

B. Believe that the financial people can't do their job and don't understand how much profit can be made on the car.

C. History says that car companies fail - and so Tesla must fail.

D. Really haven't done their homework and listened to JP a little too much.

That's all I've got for why they're still holding out...�

1/1/2015

guest This chart only shows the percentage of sales that were short today. The overall percentage of float that is shorted could go down even when the former percentage goes up (for instance, if there are also a lot of shorts buying to cover). In the context of today's significant price increase on a relative lack of news, it makes sense that there would be a temporary increase in short sales.�

1/1/2015

guest Still short volume percentage was big today. I suspect its a blind reaction to add short on the print increase above $35. Otherwise seems really hard to rationalize�

1/1/2015

guest Everyone needs to realize that the conservative media in this country are still telling everyone who listens (roughly 30-40% of the country, and a much larger portion of investors) that Tesla is a dog and destined for failure. They are in a closed information loop, and the data that we see on how Tesla is largely past the point of danger (and well on the way to profitability), just doesn't penetrate.

It's nice to think that hardened Wall St. investors are immune to this, and tend to be data driven to survive, but in my experience its just not necessarily the case. I have many Wall St. media clients as customers, and almost to a person they were convinced that Romney was going to win, despite massive evidence that he was about to be crushed. If Fox News, and Rush Limbaugh and the Wall Street Journal are all assuring them that Tesla is a dog (which they are) then they will bet against the company because they believe it IS a dog, despite evidence staring them in the face.

We look at the recent story (Why you shouldnt invest in Tesla stock - John Shinals Tech Investor - MarketWatch) as obviously stupid and misinformed. But he is an actual reporter, and Marketwatch is one of the Wall Street Journal's main new media operations. That story was promoted as a "Top 10" story in December. As long as the conservative media machine keeps telling investors that Tesla is Solyndra, conservative investors will happily throw their money away on a short position that we all can see is nuts.�

1/1/2015

guest That's okay. If some people disconnect from reality, and bet their money on a fantasy, then other more rational people will benefit from their self-deception.�

1/1/2015

guest There are less inane people who believe that Tesla has unsound fundamentals.

I would encourage people to read this writeup on VIC: Member Login

(One needs to register with an email address to access it.)

This guy has a strong track record of calling shorts (GDOT, MOTR, SWSH, OCZ, BPZ, HDY). If you are long TSLA, the encouraging thing is that many of his criticisms are unfounded. Most importantly, he evaluates Tesla as if it were an entrenched car company and not a growth story. He acts as if their goal is to sell 20,000 cars/year in perpetuity (not just this year). He pretends that the operating expenses will remain $450M/year, as if they didn't just heavily invest in R&D for the Model S and a full production line. He complains about a reservation rate averaged out over a period of years before it was even clear whether the Model S would be a reality. He is troubled by "negative margins" in Q3. Etc.

While I disagree with most of what he writes, any investor in Tesla should be concerned with

- whether demand can be sustained (indeed, increased),

- risk of recall; Tesla does not have enough cash right now to make a big mistake,

- difficulty of achieving significant gross margins.

I suggest people sit down and try to justify Tesla's current 4B market cap to themselves. There is a highly non-trivial amount of growth already baked into the current price. Even if one suspects just a moderate chance of a significant misstep, this could make it rational to short the stock. Not all the short sellers are crazy ideologues. They might share your model with just a few probabilities going the wrong direction.�

1/1/2015

guest There is also probably some reaction to the Dreamliner/lithium FUD that is starting to spread. The anti-EV crowd is predictably jumping on this to spread bad information and further their agenda.�

Không có nhận xét nào:

Đăng nhận xét