1/1/2015

guest Buy options. $23 Jan 2014 call options may be a bargain today around $8-9. If the stock is under $28-29 in January 2014, you start losing money fast until you lose everything if the stock ends under $23. But you double your investment if the stock hits $39-41 between now and January '14. And you are spending $8 per share, instead of $28.�

1/1/2015

guest IMO Renault will provide tough competition for Tesla in Europe.�

1/1/2015

guest I just picked some up at 27.62, partly due to chart technicals, and partly become I wish I could buy one of these cars.

I lurk on these forums a bit, because it seems like most of the negativity to this company is whether or not it can deliver sufficient quantity to keep floating. As far as I am concerned as long as the orders keep coming, that isn't the worst problem to have.�

1/1/2015

guest in a shoppingmall it's easy! rent more space! you rent as much or as little as you want!�

1/1/2015

guest For anyone interested in the Chinese market prospects you could also see this article (What Percentage Of The 120M China EV Bike Owners Will Kandi Technologies Convert?), focused on low price (crap quality apparently) EV Kandi, but it does say a lot about the potential market in China. 120 million electric bicycles! If even the 1% of the 1% can afford a Tesla and want to get one there will be people lined up for years of current production capability. And just think about in a few years when the Gen III comes (lower price) and at the same time increased wealth among chinese... I'm getting giddy just thinking of what will happen when Tesla opens their first stores in Beijing, Shanghai etc. �

�

1/1/2015

guest There are customer reports in the delivery thread about delays in expected deliveries. It's unclear if this is just natural blowback from earlier delays pushing things back by a week or an indication that Tesla has not moved far enough up from the 100 unit/week rate they had achieved by the beginning of the month. Realistically, to complete the Sigs in October they need to have already achieved (or ideally exceeded) something like 150 units/week.

If they have not we will start to see additional announcements of delayed deliveries over the next week or so.�

1/1/2015

guest It looks as if there may be some perceived delays due to some people getting in their configurations too late.�

1/1/2015

guest Getting close to adding to my long position. �

�

1/1/2015

guest Just made my first investment on TSLA: went long on November calls.

Cheers =)�

1/1/2015

guest I think the recent TSLA drop is due to the continued slow ramp. I�m S-1092 with a delivery window 10/14-10/28 and no VIN/delivery date yet. My prediction of all Sig�s built in Oct is staring to fade �

�

1/1/2015

guest They'll exchange the cars among the stores in circles. So mall customers will see something new each time they pass by, and eventually it'll click that there is something good happening inside. �

�

1/1/2015

guest read this, it explains why the delays!

Model S Delivery Update - Page 157

In short - no trucks & parts not delivered�

1/1/2015

guest Good motley fool review!

http://www.dailyfinance.com/2012/10/13/the-motley-fools-weekly-editors-picks/?source=TheMotleyFool�

1/1/2015

guest Well my initial thoughts were to buy in once Tesla had revised its production numbers lower for the year. It seems the stock has more resilience than I thought it would even after they released the new lower production numbers for this year a few weeks ago. My stand now is that we are going to see even lower production numbers than the revised statement calls for. Once it becomes clear that Tesla will achieve less than 2000 vehicles for this year I believe the stock will fall substantially. I will buy in under $20. Of course this is all my personal opinion but $20 is my feel good number to buy into this stock.�

1/1/2015

guest That's not gonna happen. Even if they did only get 2000 out the door this year, they've raised enough cash now that it doesn't matter. The fear before was that they would run out if cash if they didn't sell enough cars.

I bought in at $19 shortly after the IPO when they had little more than a prototype and a business plan to justify their market cap. Nobody can convince me that if they only sell 1000 of the best cars in the country this year that they are only worth as much as they were back then.�

1/1/2015

guest Im new to investing, but I personally don't see it going under 20 dollars. I also have faith that they will make it to at least 3k deliveries. Unless I missed something somewhere.�

1/1/2015

guest I agree, $20 would be a huge drop and it just doesn't make sense. They have plenty of cash to extend the ramp up out a great deal. There would need to be other factors (like a major recall) needed to undercut the stock that much.

Besides, the premise just seems flawed. 2,000 vehicles for 2012 implies that Tesla has hit a wall and their current production is the best they can do. There is zero evidence of that, and plenty of evidence that they are improving production week by week while also improving build quality. The constraints that Tesla faces to increasing production are not physical constraints. They are process constraints, and there is every evidence that they are gradually being overcome as Tesla and their suppliers learn lessons and apply them in real time.�

1/1/2015

guest Just placed numerous buy orders at market yesterday on Tesla. Yes you read correctly "numerous"�

1/1/2015

guest Possible bad scenario, Tesla misses the reduced numbers, and Romney wins the election. This double whammy might hit the stock price hard in the short term.�

1/1/2015

guest The continued slow ramp will hurt the stock ($20 would be unlikely but I could see $24.5). The reported delivery dates/vins have been very slow in the last few weeks supporting the theory that the line is no where near the 20K per yr mark, see:

Delivery Data

Total reported @TMC = 194 (10/13)

Form: https://docs.google.com/spreadsheet/...U3NYM1pYR2c6MQ

Results: https://docs.google.com/spreadsheet/...Ww5U3NYM1pYR2c

Google Docs by timdorr�

1/1/2015

guest Given that FMR has over $1.5 trillion in assets under management, $500m in TSLA is like buying a lottery ticket -- might pay off, probably won't, but doesn't cost much. Even though they do own 1/6th of the company.�

1/1/2015

guest I disagree. Fidelity doesn't gamble, they invest. Owning 1/6th of all outstanding shares shows a positive outlook, and probably a long term investment for their funds. "Peter Lynch" was spotted at the Natick store opening, he still works for them part time, he was there for a reason (there are no coincidences), he has a track record for picking winners (a small fund he used to run called "Magellan"). The thinking could well be "They could be the next GM or Ford, with a much better profit margin/upside potential", the downside, well its .1% of their AUM, as you said, but its still a lot of their clients money, the risk must be worth the reward or they wouldn't be invested with such a large position.

Nasdaq puts institutional ownership at %58.93: Tesla Motors, Inc. (TSLA) Ownership Summary - NASDAQ.com

That's 66,404,189 shares

Disclosure: I am long TSLA, and just bought 500 more on Friday in an IRA account, and yes, they are held in my Fidelity account, that is probably also a factor - clients who own TSLA who are Fidelity clients, also count as part of that share count.�

1/1/2015

guest What would be a good options buy today as a strategy to insure against further losses in case there is more trouble on the horizon short term?

My average purchase price for the TSLA shares I currently own is $30. I was going to sell to pay for my Model S which now looks like will be delivered Jan/Feb '13. I'm considering getting a car loan instead and holding for another year, but I'm risk averse.

Disclosure: I've never done options trading before, and not sure I quite understand it.�

1/1/2015

guest To protect stock you own, one standard strategy is to buy Puts. If the stock goes up, the money you spent is down the drain (like any insurance), but if the stock goes down, you get to sell your shares at the agreed upon price (or you could re-sell the Puts for more money and still hold the shares for the long term).

But, since you haven't traded options before your brokerage might limit you to selling covered calls on the shares you own (which you don't want to do with TSLA). It might be worth asking your brokerage for the options level that lets you buy Puts, since it's not a risky strategy in that your losses are limited to the purchase price of the Put options you buy.�

1/1/2015

guest +1

But do your homework first. Make sure you understand how this works before you start playing with real money. Plenty of resources all over the Internet.�

1/1/2015

guest Thanks smorgasbord and CT, I have just been approved for option level 2 trading at E*Trade. The trading choices that are enabled in the app under options trading are: buy open, sell open, buy closed and sell closed contracts. I'll have to study what those mean, but they're sending me a book in the mail as well. :smile:�

1/1/2015

guest You can mess with options, but just keep in mind they often expire worthless (as any insurance policy does). If you believe in TSLA, another strategy is to buy actual shares with money you can't spend for a long time anyway, such as in your IRA or 401K, if the stock moves down in price temporarily, it's not going to affect your day to day survival. I woud not use money I need to pay for things I need short term, TSLA could be a good long term investment, but it's highly volatile and risky as a place to park "needed money" in. The advantage of actual shares being you can wait out any market volatility, you still own the shares until you sell them. Sure you can get options to protect your position, but in the end, if they end up selling your TSLA position because of short term market volatility, you no longer have the shares, long term. Just food for thought.�

1/1/2015

guest Options can be looked at in different ways. A few are: as Insurance; Locking in profits, Limiting losses, or Gambling.

There are plenty of places online to help you understand and learn the basics. Just google "options tutorials" and you'll be on you way. You also might want to pick up a copy of "Options as a Strategic Investment" by Lawrence G McMillan. It's a great book to keep as a reference.

I am not in a position to offer any advice on what you should buy or sell in the options market. And since you're risk averse, you really need to take baby steps when you dip your toe into the water.

Cheers =)�

1/1/2015

guest FMR reports shares held in mutual fund accounts it manages and for which it has voting rights. Shares held in street name by its brokerage affiliate are not institutionally owned.�

1/1/2015

guest Options are complex and some reading is required to understand the mechanics of how they work.

I find that buying Calls or buying Puts is expensive. Instead, I write 'naked puts' or sell 'covered calls'. Generally, these strategies don't provide the downside insurance you are looking for but they do help you to reduce your cost base gradually over time.

Run some numbers on your cost base ($30.00 per share) and then add the premium for any Put options that you buy. That will increase your investment and if the strike price of the Put option is 'in-the-money' it will be expensive. In fact, buying Puts could crystalize losses such that the insurance could cost more than liquidating your position now.

Given the importance of the production, delivery and reservations in Q4, and the U.S. elections, you can expect significant company-specific and general market volatility. TSLA announces Q3 results on Monday, October 29 and they will probably provide guidance into the Q4 production, deliveries and reservations. The market could react violently to surprises in those key numbers.

As a general strategy, you may consider writing covered calls when TSLA approaches high points in the recent trading history and selling naked puts when TSLA approaches low points. You don't want to get called or put, just earn the premium at expiry and then keep playing the game.

As other have mentioned, do some reading so you understand how options work.�

1/1/2015

guest Boy I'm itching to buy some stock right now...what say you Citizen-T?�

1/1/2015

guest I'm getting slaughtered lol�

1/1/2015

guest It's uncertain. I think we could go lower, but not with a lot of confidence. On the other hand, we are definitely at the lower end of the range. It's hard to see how we could go too much lower without any news, I might just be getting greedy.

I'm happy with my position at this point, so I think I'm holding out for a better price, I'll take another look if we get under $27.�

1/1/2015

guest My (uninformed) hunch is that we could be seeing sub-$25 price levels as the Model S production delays persist in the lead-up to the Q3 earnings call and after (if the Q3 earnings and/or forecast for Q4 are weak, as they well might be given the delays).

Am sure all the posts about delays on TMC and the TM forums are being watched closely by investors at this point.�

1/1/2015

guest I think downward pressure is caused by the news that Tesla Motors got 4 lawsuits going on in different states right now. And that scare long time investors(mostly institutional ones) way more then drop from 5k to 2k short time total production rate. I mean, will TM get to that 400 Model S a week production rate on time OR three or four months later dose not matter long term.

But it is clear now that TM will get dozens of lawsuits in each state Tesla Motors was/will be reckless enough to open stores. Four just a beginning. On the long run, that is not TM that should win most. It is industry it facing just need couple wins out of many hundreds lawsuits to damage TM severely.

I would say rationally that reason should not place price of share below $27. Not speaking of $26. But sometimes market react irrationally. So might be even $25 possible at this stage, but I personally doubt that.

PS. Sorry you asked not me, but Citizen-T. I still feel like using your question as an opportunity to express my opinion. Hope you do not mind.�

1/1/2015

guest It's frustrating that they are getting lawsuits on something that shouldn't be a law to begin with. But that is the country we live in.

I think they have a good case though, they technically aren't selling the car itself. The argument could be made that they are selling the cars around the law, but in the end I think Tesla will agree to tone down their selling of a specific car and inform them of electric vehicles in general. I don't know, I can't think of another way Tesla can get around this dumb law and I am sure its a topic of a new discussion.�

1/1/2015

guest Are there threads available that are following the lawsuits?�

1/1/2015

guest With yet more people seeing delays recently, I'm definitely fearing Tesla isn't even going to come close to their reduced Q4 numbers and there will be a big stock hit. 6-9 months ago when I purchased my stock, Tesla had fairly consistently been meeting or beating expectations as far as reported progress. Ever since then they've over promised and under delivered. I've lost quite a bit of my faith at this point. I'm not sure I'd either buy TSLA or put down a deposit as things stand today.

I'm sort of stuck though. If I bail now, I've lost enough I couldn't buy my Model S if/when it does come out and I'd have to forfeit my $5k deposit (I'm already finalized). I knew that going in, but I figured if Tesla went south there wouldn't be a car to buy. If it didn't, then the stock would go up. It's in this bizarro world where the car might ship, but the stock is down.�

1/1/2015

guest I'm long and I think this is going to be pretty much like with the Roadster. Quite a bit of problems in the beginning, but after all Tesla beats expectations on quality and they get their problems sorted out. The financial results might not be that pretty the next quarters, but that doesn't really matter in a few months if the demand is still strong.�

1/1/2015

guest Short interest is still huge, and in spite of that, the price is holding up quite well given that the big ramp up hasn't happened yet. So maybe the increased shorts are balanced by increasing long term investments and decreasing attempts for quick profit.�

1/1/2015

guest Based on today's prices, here's a play � sell a Oct19$27 Put for $0.50 and then, after exercise, write a Nov16$29 Call for $0.90.

If your Put doesn�t get exercised this Friday, you pocket $0.50.

If the Put gets exercised and the stock price is in the same range, you get another $0.90. Your investment is then $25.60.

Then, if TSLA goes above $29 on Nov 16 you close the entire position for a gain of $3.40.

Alternatively, if TSLA continues to drop then your cost is at a maximum of $26.50.�

1/1/2015

guest A123 files for bankruptcy

Tech Currents - Seeking Alpha�

1/1/2015

guest That's only half the story. They've sold most of their assets to Johnson Controls. The A123 battery technology has found a better home.�

1/1/2015

guest Could be a good time to sell some Dec21$32 covered calls for $0.90 ...�

1/1/2015

guest If you sell it, you most likely make that $0.90.

But how about buying instead of selling? Imagine the possibility of price reaching $34 - $35 level! Yes, risky, but reward... And exactly month ago price was $32.50. So it is not totally unreasonable to expect share price going north of $32.90 in more then two months from now...

So I'm not sure what is better :biggrin:�

1/1/2015

guest Here is my thinking (please forgive the complexity)...

According to mulder1231, he requires liquidity at the end of January/beginning of February and his cost base is ~$30. He was asking how to use options. If he sells some covered calls at $32.00 then, if exercised, he gets $32.90 and realizes a gain.

Alternatively, if TSLA is 'in-the-money' as the option expiry date (12/21/12) approaches and he wants to take advantage of more upside, he could buy the Dec21$32 call to close his position and write (sell) another covered call that expires on January 18. If TSLA is around $32.00 (in-the-money) then the January18 calls will have a premium to the December price and he could raise the strike above $32 and probably sell a covered call for more than he pays for his December $32 call (to close the position).

On the other hand, if TSLA doesn't go above $32 then mulder1231 pockets his $0.90 and he is in the same position he is in now (i.e., he is long on TSLA and underwater, and he has to pay for his Model S).�

1/1/2015

guest Well they are two entirely different risks. And I'll be the first to admit that buying calls can be an exciting game to play, but just be aware that there is a pretty high likelihood of the stock not reaching that price in a short time frame. And if you hold your position up to expiration, you could possibly lose your entire investment.

Now with that being said, I'm taking advantage of the trading range of TSLA and planning on earning my Model X with slow and steady incremental trades of both puts and calls.

Cheers =)�

1/1/2015

guest Makes perfect sense!

I was actually answering your post without thinking of mulder1231... Sort of pointed out possibility of what could have been as earthling said "an exciting game to play". And in fact there was someone around this thread who were looking for high reward but high risk plays...�

1/1/2015

guest Bmek, thanks for the advice, this is exactly what I was looking for--an insurance play against TSLA going further south and not recovering in time, forcing me to sell at a loss.

Actually, I was also lucky to improve my position a bit as I had a limit buy at $27 which executed yesterday. So my cost basis is now $29.25 :biggrin:�

1/1/2015

guest Congratulations on that dip to $27. It lasted less than 10 minutes. Nice catch.

Cheers =)�

1/1/2015

guest OK, so I did the first step and sold a TSLA Dec21$32 covered call today. I just sold 1 option contract (=100 shares) since I'm new to options and don't want to risk too much.

Now what I originally thought, that this would provide an insurance against my TSLA shares being underwater when I need to sell them in December to raise cash for my car, actually is not true. The person who bought my 1 call option is not obliged to buy the underlying 100 shares from me. He/she will only excersice if TSLA is above $32 (in-the-money). If it's lower, let's say $28, he/she can simply let the option expire. And I would still be underwater with my shares, but gained a little bit from the premium I received for the option contract. (Which is what you indicated in your last sentence--I just didn't read that carefully enough.)

Is there anything I could do with options trading to guarantee that come Dec21 I can sell my shares at a profit?

I guess there is no such thing as a guarantee in trading...

(Sorry, I'm a novice and this option trading stuff is pretty hard to grasp at first.)�

1/1/2015

guest Here's where you're at:

1) If TSLA is above $32 on Dec 21, 100 shares will be called. You'll make $32 (strike price) - $30 (what you paid) + $0.90 (what you sold the call for) = $2.90/share

2) If TSLA is below $32 on Dec 21, then you've pocketed $0.90/share.

If TSLA drops to $25, all you've done is to reduce that drop by $0.90. So $25 is like $25.90, which is still a loss.

Nothing you have done is any sort of insurance. All you've really done is limit your upside to $2.90 by taking $0.90 up front. If TSLA goes to $40, you're still selling at $32.90. If TSLA goes to $20, you made that equivalent to $20.90.

Insurance costs money. The way to get insurance is to buy Puts, like I said earlier. But, it's not realistic to buy insurance for a price TSLA isn't achieving. Insurance will limit your losses, not guarantee a profit.�

1/1/2015

guest It would be nice to take an underwater position and guarantee a profit but ...

What you need to do is trade on the volatility in the market and lower your cost base and/or generate cash to buy a put option.

To start with, buying a put option is expensive, but doable. You would pay ~$4.80 for a January18 $30 put. Doing this trade today would crystalize your loss at a lower price than simply selling TSLA today. For you to 'win' on this trade, TSLA would have to rise above $33.62 ($28.82 plus $4.80).

A better play, which I recommended, is to write a December21 covered call for $32, which gives you $0.90. If TSLA rises in price, you could either (1) buy a January 18 $30 put and that would give you the insurance that you're looking for, (2) sell a January 18 covered call, or (3) sell the stock.

Given you are long on TSLA today, your position is underwater, and you require liquidity in January you may as well try to trade your way into a better position.

Starting with one contract is a good way to go.

Let's see what happens.

- - - Updated - - -

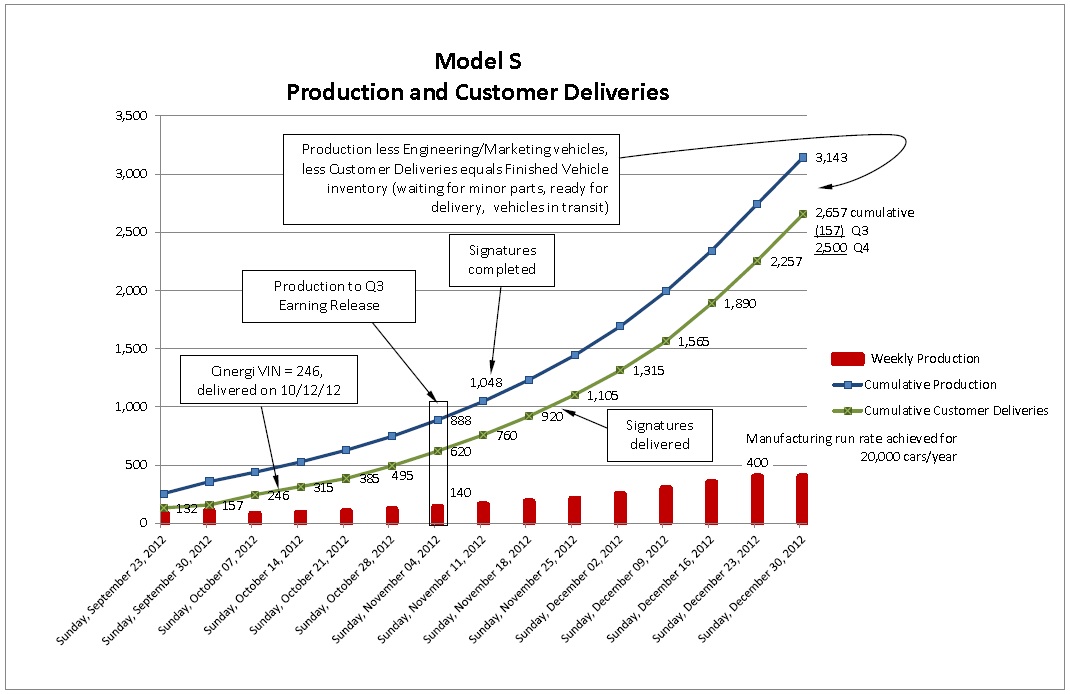

I posted this in another thread and, given its relevance, I'm posting it here too ...

With the focus on production and deliveries, I built a model that shows a scenario where the customer deliveries in Q4 are 2,500 vehicles.

This model has the Signatures completed the week ending Sunday, Nov 11 and delivered before Sunday, Nov 25. Also, this scenario has the manufacturing run rate of 400 cars/week achieved by year end.

We wil, obviously, see what happens.

�

�

1/1/2015

guest For any option or share trade on the market, there has to be someone who thinks the opposite is a better proposition. So it always depends on what you consider the likelihood of certain outcomes. If you want to limit your potential loss independent of the likelihood of certain outcomes, you'll also have to limit your potential gain in some other way. As far as I understand. EDIT: Meant: limit or reduce.�

1/1/2015

guest Nice graph. John Petersen would be proud. Hi John!�

1/1/2015

guest Maybe this'll help

Here's a simple little example of locking in profits:

I bought one share of stock for $30.:smile: The price of the stock went down to $28.:scared: I got scared that I would lose some of my money if the price did not go back up to what I paid. The stock price rose back up to $30 and I breathed a huge sigh of relief.:frown: Then the stock price started to go up, first to $33, then to $36, then to $39. WooHoo!:love: I was going to be rich! I started thinking of all the things I would buy with my new found wealth.

But then the stock price started going down.:crying: It went down to $35. At that point in time, for a cost of $2, I purchased a "put" with a "strike price" of $33. So now my total investment is $32. And here is what will happen...

- If the stock price stays at $35, I will have a $3 gain when I sell.

- If the stock is at $33, I will have a $1 gain when I sell.

- If the stock is less than $32, I will have a loss on the stock IF I sell. However...

- If the stock is less than $33, I will have a GAIN on the option at expiration. Or I could exercise the option to "put" the stock to the seller of the option and that seller (the market maker) will have to pay me $33 regardless of what the stock price is.

- If the stock price shoots to $100, I have made no obligation that will limit my upside profit potential.

So you see there is a way to use options as insurance to lock in profits, but that is only if you are already in positive territory with the stock.

Cheers =)�

1/1/2015

guest Thanks guys, I'm slowly understanding the plays.�

1/1/2015

guest Well there are guarantees, but it is at best zero sum game and really a negative sum game for the investor when you consider the infrastructure of the market, so you are really trading risk for reward. There have been many studies by mathematicians that support the net result on any bet in the markets are ultimately random, when knowledge (in my opinion belief of expressed knowledge) is equal. Any sane person knows, that concept of equal knowledge no matter how legislated is absurd, there will always be people who get news first. However so called "safe or guaranteed" investments guarantees loss when adjusted for inflation. You can blame the "Federal" Reserve and Rebubloodlican or DemiCripts for that.

So I think people should invest in stocks that the customers love or desperately need the product and you personally respect while on the flip side the company can make an honest profit with a competitive advantage. While weighing sentiment against your personal liquidity and risk profile. That way the numbers should "eventually" come out well.

But then again, I personally can't afford an s-series yet, so take my opinion with a grain of salt.�

1/1/2015

guest Hi everyone,

I am considering buying some shares in Tesla, a small amount - long - as I believe in the mission and the product.

I was just wondering what you think about buying before or after the upcoming quarterly report. I am not investing a huge amount, I'm a student but earned a little money over summer that I have set aside and want to put it to better use than sitting around in a current account.

Presumably there is normally a bit of a reaction to these reports? And judging by what Elon stated about 'cash flow positive' by the end of the month (or next month?), would that mean that the upcoming report will still show negative things or slowly becoming positive things?

A few possibly confused questions, I apologise. I have read quite a bit of this thread and hope this isn't too mundane to post here ;-)

Charlie -�

1/1/2015

guest The volatility of TSLA stock predicts exactly that: it is totally unpredictable. There have been ups and downs following such events.

Members on this forum claim an information advantage over traders that just do P/E evaluations and/or technical analysis. We speculated on major upswings following these events, e.g. "If every John Average gets the big picture from the supercharging event, stock will go ##!". But that never happened.

I for myself retreated to the opinion that the stock will move upwards in a sustained way only after a consecutive row of quarter results showing big profits for Tesla. And that might not happen for the years to come, since Elon is determined to throw every buck into R&D, expanding production, and EV infrastructure. Tesla's vast potential might be honored when Gen III cars hit the street in ten thousands a month.

My advice: Get in for the long term, with money you're not gonna need for the next 5-8 years. Potential is there to make a small fortune from $1k when you retire. �

�

1/1/2015

guest Generally speaking, options are not part of a 'buy and hold' strategy. By their very nature, options are used for trading as they have a finite horizon (to expiry). Thus, you shouldn't trade options without monitoring the position actively.

Another strategy is to use options to enhance investment earnings, especially in a buy and hold strategy with a volatile stock (e.g., TSLA). Again, the position must be monitored.

Given TSLA is trading ~$28.00, if it rises to ~$32.00 then, as expiration approaches, the option will become close to its intrinsic value (market price less strike price). However, the stock must be rising and the option one month out will have the same intrinsic value plus a time value. With a volatile stock, such as TSLA, usually you can raise the strike price by $1.00 and sell and new position one month out for more than it costs to close the existing position. Thus, you don't limit your upside, you raise it and push it out. However, sometimes it can cost you more to close the position and open a new position at a higher strike price.

As noted above, this scenario occurs when you stop trading the position and let the in-the-money expiration occur. This can happen when you require liquidity and don't have time to push the option out.

Absolutely. The funny thing about insurance is that, when you lose one hand, you win on the insurance. Conversely, when you win on one hand, you lose on the insurance.�

1/1/2015

guest Be careful trading ahead of a quarterly report. As a general rule of thumb, I don't trade this close to a report. You never know what might be said during that conference call or how it might be interpreted. You are right, they might announce that they are cash flow positive, but if that is followed up by "we might only get 1500 cars out this year" then God only knows what the stock will do.

You never can tell, so unless you have tremendous conviction, stay away from these couple days on either side of a quarterly.

Now, if you can stomach the volatility and don't plan on touching that money for a dozen years, then just go ahead and buy. The couple dollars that it might move between now and a few weeks from now is going to be trivial when you look at such a long period of time.�

1/1/2015

guest Given they're going to still be delivering Sigs at the end of November based on emails/dates folks are getting, it seems they'll almost certainly have to announce another major reduction in expected Q4 deliveries. It seems like a best case is they suddenly ramp to 400/week for Ps and ship only ~2500 cars in Q4.�

1/1/2015

guest I sold my entire stake in TSLA this morning, I think the market reaction to decreased deliveries could be very negative...�

1/1/2015

guest Seems you weren't completely alone. 8^|�

1/1/2015

guest Yep, I'm torn. I'm underwater right now so part of me hates to sell, but the other part is having a hard time envisioning how Tesla could have any good news in the 3rd quarter announcements. Maybe best to cut my losses and hope to pick up shares again later. Then I've got the bulk of my shares that hit the 1 year mark in January, so it'd have to drop by enough to justify giving up capital gains tax (on eventual positive value) vs. resetting the clock.�

1/1/2015

guest I didn't mean to suggest that I thought this was a possible outcome, just that you can really get blindsided by quarterly reports and conference calls.�

1/1/2015

guest Market reaction to just them taking the Roadsters in trade was not good (today). I say write covered calls and pocket the premiums. TSLA seems very resilient, it's the "energizer bunny" of stocks

Want To Trade Your Tesla Roadster In For A 2012 Model S? Now You Can�

1/1/2015

guest And what now if your fears do not materialize? The only reason to sell 100% of your position is if you are 100% certain the stock will go down and 100% percent certain that you are nimble enough to get back in. That is unlikely.

By all means, take profits if you fear a decline coming, but keep them proportional to your confidence in your predictions.�

1/1/2015

guest TSLA pushed their Q3 earnings announcement out by a week, from Monday 10/29/12 to Monday 11/05/12. This indicates, to me, that they want to provide positive news on production and customer delivery rates when they announce their earnings and give guidance on Q4.

We should know how the the numbers look for customer deliveries in another two weeks, which will be a better indicator of what to expect in the actual earnings call.

The markets will certainly react to confirmed news by TSLA, one way or another.

Oh, election day is Tuesday, 11/06/12. That may shake things up, too.�

1/1/2015

guest It is a good way to hide the news, or at least only have it on a one day news cycle. I'm long on TSLA but don't think its going to be a good news week for them. My gut says they are getting close to good news to report, but just not this month.

edit: if they can convey this confidence of future good news, then it won't hurt the stock too much.�

1/1/2015

guest Well, that depends on your tolerance and the bankroll behind your investing. Coming from a poker background, if you think a play is +EV then you should mathematically put as much into it as possible to maximize your profit. The caveat is having a bankroll sufficient to adapt to swings when you're wrong/unlucky.�

1/1/2015

guest Usually they report not only from the quarter but also give current numbers for many things they talk about. Given that apparently the situation is improving now or soon, the later the date of the announcement, the better.�

1/1/2015

guest That's great! Johnson Controls has been good for my portfolio. A solid respectable company that will definitely use any useable tech that A123 has come up with. IMO

- - - Updated - - -

Back OT, the only way I sell at a loss is if I need to take the loss to bump me down a tax bracket and if the company doesn't look like it will bounce back up very soon. I'm sticking to Tesla, and my avg. purchase price is around $26.00. If it drops lower than that, I'm probably putting more in. But of course, like any volatile stock, I'd never put money into Tesla I can't afford to lose!�

1/1/2015

guest One good news point may be that they are cash flow positive at that time. Also we should get a clearer picture on the ramp - hopefully positive!�

1/1/2015

guest Agree. It's looking more like a Romney win which will hurt Tesla, plus the likely announcement of slow production ramp up, could provide a major TSLA smack down. I've been considering selling in advance but will probably just hang on and buy more on the drop.�

1/1/2015

guest A change in leadership would likely create even more economic uncertainty than staying with the incumbent. I know that I'll hunker down for a long time if there is a change.

The impacts of the last Republican White House really instilled fear in my portfolio.�

1/1/2015

guest If Romney wins, Tesla will be slightly poorer as I'll be abandoning my reservation and holding all cash in hopes of financially surviving. Every Republican presidency for 30 years has started or escalated wars (W going for bonus points starting two) spending massively to do so.

Romney and/or his advisers have already stated they think we should attack Iran and perhaps Syria. He's already been promising to raise military spending. I'm tremendously nervous, more than at any point in my life. An economy on the edge already and the election of another war hungry president, an ugly combination.�

1/1/2015

guest On the flip side, attacks on oil countries only raises gas prices so wouldn't that make TM that much stronger? More than offsetting a Republican dictator...I mean president �

�

1/1/2015

guest Wow. You're kidding, right? If you base your car buying on who's in the white house, you definately are looking at the wrong car. I've bought cars over the last 45 years (at least 10 off the top of my head) based on my needs and/or wants and could care less who held the presidency.�

1/1/2015

guest

The best bet was to bet on oil with an oil president in charge.�

1/1/2015

guest High gas prices and a struggling economy tend to hurt high end vehicle sales. Remember what happened to Tesla and Roadster sales last time.�

1/1/2015

guest I'm just saying that when an administration comes into office from the oil sector, that's when to buy oil stock.�

1/1/2015

guest All of which were oil based. None of which were a new energy source and drive�

1/1/2015

guest This is a bit O.T., but I don't see how ANY woman can vote republican, Republicans basiclly HATE women, refuse to give them fair pay for equal work:

Senate GOP kills Paycheck Fairness Act - The Maddow Blog and Lilly Ledbetter Fair Pay Act of 2009 - Wikipedia, the free encyclopedia

They are against/opposed to a womans right to choose, they offer nothing to %50 of the voting public.

Arizona Daily Wildcat :: Republican Party platform erodes womens reproductive rights

"Get back in the kitchen, make me some diner, and keep the house clean" that's the message of the Republican party to women.

There shouldn't even be a question that Romney will be defeated, hopefully by a landslide.

Here's another good oneFor all the details on Mitt Romney's 5 trillion dollar tax plan visit ROMNEYTAXPLAN.COM

I'm keeping ALL of my TSLA, and if it has a temporary drop I'll double down. There's no question who the next president of the US will be.�

1/1/2015

guest It's not about not buying a Tesla if Romney wins, it's about not buying any car at all because my needs and/or wants will end up being redirected into trying to surviving the consequences.�

1/1/2015

guest Except for the $7500 rebate, I doubt anything will change with either president. The fact is we are in debt and the Fed has to weaken to dollar which will drive up oil prices. This is good for Tesla long term.

That being said, Obama will win in November. It's all about Ohio and the auto industry there. Points to Obama on that one. Ironic, isn't it?�

1/1/2015

guest A reminder: please keep the discussion on the topic of TSLA stock. Politics may occasionally be relevant, but some of the above discussion was clearly well off topic. Thanks - mod�

1/1/2015

guest Debating which big party is better, is like debating which is better a poop hamburger or a diarrhea milkshake.�

1/1/2015

guest Well that didn't work out.�

1/1/2015

guest Which is which?

Oh nevermind.�

1/1/2015

guest Both parties share a good deal of blame for the bankrupting of America.

The last chance we had to "save the country" was a gentleman named "H Ross Perot" and a third independent party

Now it's just picking the lesser of two evils, either way where heading off the cliff.

I happen to believe Mr Obama and the democrats will be better for my TSLA investment (to stay on topic)�

1/1/2015

guest Even there it's an obvious choice. Diarrhea is an unhealthy condition, solid poop is normal, so take the hamburger. Even with two less than desirable choices one is still usually better than the other. TSLA stock will likely do better with one of the choices, probably the one that doesn't consider Tesla a failure. �

�

1/1/2015

guest Okay, last warning. A throwaway reference to TSLA doesn't make it on topic. The next political post will send the entire discussion to Off Topic.�

1/1/2015

guest So, based on some posts yesterday with Sigs getting delivery windows in December, Tesla isn't going to come close to their reduced target. Tesla has pushed out their financials report, which as a software guys smacks of the move of pushing off a status update hoping to have less terrible news to tell senior management. It's never good news after that kind of delay, just hopefully not as bad. This will make multiple times in a row Tesla has missed numbers for the quarter.

I mentioned selling and I'm waffling on it. I mentioned if I sell and rebuy that resets my capital gains tax clock, which is unfortunate. I also have zero stock gains for the year as I don't invest in general, so I can't write off the losses if I sell. So, I guess I'm holding on to it, unless the stock would take such a big hit that it makes sense to eat the loss and reset the clock in order to get in at a lower price.

Not sure if I'm asking any sort of question, mostly musing on what limited information we have.�

1/1/2015

guest In order for the "selling and then getting in at a lower price" you can't really wait until the price has dropped, can you? This volatility is a b***h �

�

1/1/2015

guest Some believe TSLA is setup for a classic short squeeze, I would really hate to miss that opportunity if I sold my position, just before it happens. Could mean the difference to you of a substantial gain (just selling part of your position), versus a guaranteed loss if you sell underwater.

From SA: These Stocks Are Ready To Be Short-Squeezed - Seeking Alpha�

1/1/2015

guest I'm thinking if Tesla drops their target again then the stock may tumble pretty badly, beyond normal volatility ranges. With final Sig deliveries in mid December, Tesla may have trouble even reaching 2000. In one thread, I pessimistically said that while it's not likely to get that bad, I wouldn't bank on all Sigs being delivered this year, but if Tesla sees any further delays that's a real possibility. People talk about Tesla building 100 cars/week, but that was a tweet about one week and it was only on building bodies, not full cars. If suppliers and quality are the issues, it doesn't matter if they can build 500 bodies a week if they can't finish them.

I'm sure someone will say Tesla is under promising on the dates so they can over deliver, but that hasn't been the case so far and I don't see any reason to believe it's suddenly the case now.

- - - Updated - - -

Yea, that's why I bought back in January. And again in April. Then again in June or so. If it's going to happen, it's not going to be driven by a Q4 reduction.�

1/1/2015

guest I thought this was interesting

Tesla Signature Reservation Holders Receiving Personalized Attention | Hybrid Cars

The stock is being pushed down due to a variety of factors. Even with production delays, let's be real. Is this going to change the plan? No it won't they are still going to be churning out cars. It's just a matter of time. I think the delay causes were outlined very well in the email and this should say something about Tesla's customer service. I hate to draw out the comparison again, but Apple when it was coming out of bankruptcy focused on making a great product and provided great service even when they were on the brink of bankruptcy. The same principles apply here, but just with a more complicated product.

I am in for the long haul, I hope those of you who are out there and are shaky are as well.�

1/1/2015

guest One other observation: the market is generally down today, an it's October options expiration day as well, you can expect the stock price may be somewhat manipulated today because of the low volume and the options expiration, don't make any rash decisions - today.�

1/1/2015

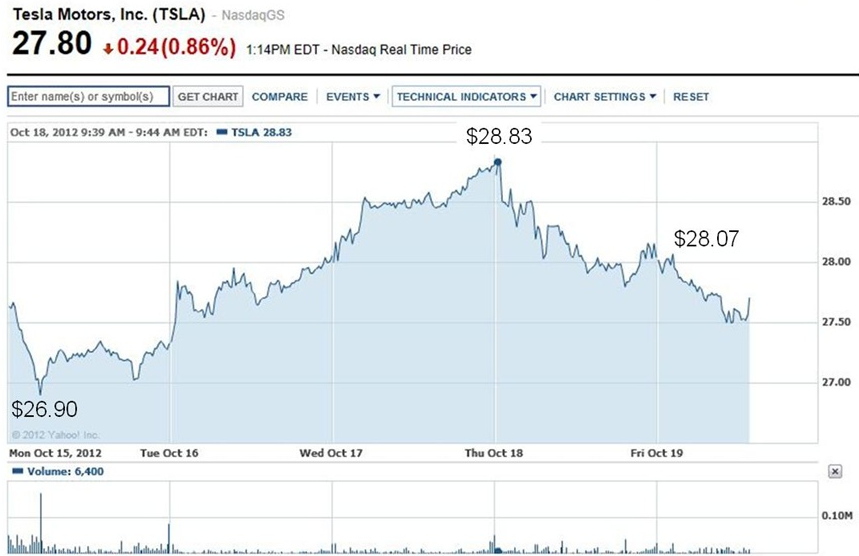

guest TSLA Volatility This Week

Options expire at close of trading today (really tomorrow); the volatility this week has been incredible. If someone, for example, had puts (or calls) with strikes at $27.00, $28.00 or (and?) $29.00, it could be very disconcerting. TSLA has been as low as $26.90 and as high as $28.83 this week. Any guesses as to which side of $28.00 it closes on today?

�

�

1/1/2015

guest +1 Very good point

And to all of you other kids preoccupied with potty-mouth talk, get out of here pronto. Now scat!:biggrin: (pretty clever double entendre, huh)

Cheers! =)

the stock goes up, the stock goes down, the stock will surely come back around...

�

1/1/2015

guest See, that's when I'd *buy*.

I have a price in mind, based on a back-of-the-envelope calculation: a future "typical" P/E ratio, an expected profit per car, an expected number of cars per year. Tesla's been selling for more than that price for some time, but it has been below that price a few times.

Value investing: compute your price and stick with it unless there's real fundamental news (like, an announcement that the factory is doubling production rates, an announcment that the cost of producing the car is 20% higher than expected, etc.)

- - - Updated - - -

The other thing is that news can be widely available, and people can just ignore it. If you have been studying an industry and/or a company intensively you may well understand it better than most of the people and companies buying and selling stocks -- that is when you can make purchases or sales with *superior knowledge*, even when the raw information is widely available. The same can be true if you have a superior understanding of economics (John Maynard Keynes made a *lot* of money speculating in stocks), or if you have the ability to predict government policy changes.

Or technological changes.

I've been in that position a couple of times. I spotted the problems with financial institutions before the 2008 crash (by intensive reading of their financial statements, understanding of their business models and behavior, and figuring out that they didn't really know what they were messing with -- they still don't) and dumped all my financial stocks at the right moment. Sadly, I do not feel that I am in such a position right now, so I haven't been finding any "better than average" new investments.

I missed one extremely good opportunity because I second-guessed myself; my back of the envelope calculations on eBay should have led me to buy it very early, but I didn't. Now I trust myself when I spot something.�

1/1/2015

guest I too saw the crash coming and sold most of my stocks and had my parents do the same. Frankly it seemed so obvious I don't understand how so many seem to have been caught by surprise. Unfortunately the recovery was not as clear and happened much faster than I expected so I missed out on a lot of potential upside by sitting on the sidelines.�

1/1/2015

guest With me it was the exact opposite- had lots of real-eatate and stock holdings; did not see what the banks were doing and unfortunately my stock was largely in Apple producing a dilemma - how could a company growing net billions per quarter continue to lose stock value- so I held all the way down before selling! (idiot).

But maybe for the same reasons you list about financials- I couldn't understand how people could sit on the sidelines while it was obvious the market (and stocks like AAPL, still growing by billions in a great recession) would recover rapidly so I was back in pretty early (albeit with less due to losses). Rode most of it up again. I think it really just depends on your life perspectives, knowledge base of certain areas, and of course a lot of luck- both good and bad...�

1/1/2015

guest Any explanation for the uptick for TSLA today despite a bad day for Dow? And, despite Romney's name-calling?

Is it this? And/or Elon's blog post?

Not that I'm complaining �

�

1/1/2015

guest I think it is what you cited... for anyone who did not click link, the "this" in gg's post was a Bloomberg article that the National Automobile Dealers Association's newly elected chairman basically said that any lawsuits will be up to the states to pursue (basically indicating NADA does not plan to bring lawsuit). I think that is significant, especially coupled with Elon's comments yesterday re lawsuits.

I'll toss in some speculation that last night generally was seen as more favorable to Obama's re-election, and general randomness.�

1/1/2015

guest This! :smile:

Agree though on the lawsuit issue, since that will scare some institutional investors a lot. But randomness is probably just as important, especially with the low volume we've seen yesterday and today.�

1/1/2015

guest Agree on randomness.

Plus a year ago, there was nothing but prototype and promise to start production next year. Now Tesla got favorable press, actual cars rolling off assembly line(a year ago some would not believed this would actually ever happen), service and supercharger networks expanding, new stores opening... And announcement of Model X.

And yet share price is below of what it have been a year ago! There is no good reason for that. We destine to go up. $28 is a very low point. Not to mention $27.�

1/1/2015

guest +1, but as an explanation: meanwhile people have become much more skeptical about the future of EVs (much more because of Leaf and Volt than because of Tesla). Tesla's present situation cannot yet counteract that.�

1/1/2015

guest I am new to investing, but I would imagine the reason its not 30+ is because of the delays. While its out of Tesla's hands, delays are delays. So people are playing the caution game I think.�

1/1/2015

guest A valid point.

Morgan Stanley, after release of 2nd quarter 2012 TM report predicted that TM will deliver 230 cars in Q3 and 2000 cars in Q4. Tesla outperformed Q3 prediction by delivering "over 250" cars:biggrin::wink:

Generally delays are priced into shares already. But they do not matter much. I mean will TM produce #5000 car by the end of this year or that would be delayed by 3 months (end of March 2013) dose not matter because that would indicate problem with production, as an opposite to demand constrained problems companies usually face. And Tesla production rate/supply chain problems will be fixed eventually.

Basic fundamentals that affect price, will Tesla get 200 millions or 400 millions gross margins next year? Will they produce 15,000 or 25,000 cars next year? Will gross margin percentage be 10% or 25%?

Depends on how we look at it, worst case scenario (15,000 cars, $65k unit price on average, 10% gross margin) is ~100M, best case (25,000 cars, 75k unit price, 25% gross margin) is 468M.

Current delays in production rate could be compensated by increased production rate in second half of 2013. There would be more then enough time to do it. AS LONG AS THERE IS DEMAND.

Now we can estimate earnings. It is rather realistic to expect that TM would be able to get 150M in 2013. With P/E around 20 that would justify share price of $26.54. P/E around 40 would give us $50+, and P/E 10 will justify $13 price per share. You can do the math for 200M or 300M.

Anyhow, dividends wont happen - I would expect CAPEX for year 2013 to be around 250M. Plus R&D expenses still growing. Etc. But by looking at Q1 2013 report, investors will get the idea of what gross margin percentage realistically reachable for TM. And another huge question, is there a continuous demand for Model S? That would be answered(to some degree) by number of reservations tracked here, on TMC site...

Sure, this is still oversimplification, you have to look beyond 2013, and even beyond 2014 to properly estimate fair value of the stock. But most crucial question marks will be answered in several months time frame. That would be demand and gross margin questions, not production rate.

My back of envelope calculations say that we will hit Morgan Stanly and Maxim Group $50 price target after Q1 report release(April 2013). Lots of assumptions here, so more like educated guess

As for short term fluctuations, it is all randomness. This or that fund decided to sell out or buy half a mil or million shared today... Barely connected to published news, but sure news to a degree create some downward or upward pressure.

Just my humble opinion:redface:

PS. Positive cash flow in November was a very bold prediction Elon Musk made.�

1/1/2015

guest The markets were down today and TSLA was up . . . I don�t think it was randomness as the markets were down and bucking that isn�t, generally, randomness.

Many believe that TSLA is, at the moment, an execution play. The big uncertainty at the end of September related to TSLA�s ability to generate cash and meet its DOE loan covenants. Having a successful follow on offering that put over $220 million of cash on the balance sheet eliminated the cash risk; the amendments to the DOE loan covenants eliminated the other concern.

Now, the spotlight is on execution. TSLA has a backlog of unfilled orders for the Model S from extremely patient customers. (OK, patience relative to other industries, notwithstanding the chatter in the Delivery threads.)

Can TSLA start producing high quality vehicles in higher volumes each week? Can TSLA manage its suppliers and coordinate customer deliveries? The Fremont factory is massive so they aren�t space constrained. Can they train their workers and get the fit and finish of the bodies and interiors to meet the high standards for premium sedans?

The markets were skeptical but positive .. then TSLA dropped their guidance for Q4 at end of September. However, Elon reiterated the 20,000 Model S sales for FY2013 and said that 400 vehicles/week would be achieved in Q4.

Thus, the biggest uncertainty is, �Can TSLA manage its manufacturing process and can they demonstrate explicitly that they can produce 400 vehicles/week?� There are multiple secondary risks, including TSLA�s ability to generate new reservations. And, possible cancellations of existing reservations. TSLA has already provided downward guidance on negative margins; cash flow should be largely be a function of customer deliveries, which depends on manufacturing. The focus is manufacturing and the speed of manufacturing.

TSLA pushed out its Q3 earnings release to Nov. 5 so they will have more of a positive story to tell and more certainty in telling that story. If manufacturing and customer deliveries are going well and trending nicely then the extra week will give additional confidence to the markets.

I believe the markets will react very favorably if TSLA confirms that it will meet the 400 vehicles/week production rate by December 31 and, in doing so, TSLA will meet the low end of their guidance of delivering 2,500 Model S vehicles to customers in Q4.

This will allow Elon to reaffirm the production of 20,000 Model S vehicles in FY2013. On the other hand, if TSLA is will not meet the production targets in 2012 then Elon will lose significant credibility in the markets. Anything that jeopardizes the 20,000 vehicles/year production rate will adversely affect the stock price. Probably quite violently, too.

Currently, things look positive and the markets are starting to adjust TSLA�s valuation, relative to the overall market, in anticipation of good news during the earnings call. Demand is strong and TSLA is manufacturing and delivering cars to customers. Production appears to be increasing slowly, but it is increasing.

As always, let�s see what tomorrow brings . . .�

1/1/2015

guest This Underriner chap is not done yet with Tesla:

U.S. Dealer Group Seeks Tesla Meeting on Retail Plans- Bloomberg

Classic greedy scumbags!�

1/1/2015

guest what the hell

why the hell is the stock fallin again 4%???? did something happen? is there any bad news?

did the markets not like elons statement about the tesla stores?�

1/1/2015

guest You sound an awful lot like someone else who used to post on this thread often. �

�

1/1/2015

guest but im far more optimistic) i just dont see any reason for that dumb move today?

�

1/1/2015

guest I have a large buy limit order in lower than where we're at ... here's hoping for more dumb moves.

�

1/1/2015

guest At what price? Why not sell some puts at that price point? You make a bit extra and there's a lot of premium in options right now. No lose situation.�

1/1/2015

guest the thing is that i dont need more dumb moves, we already had enough dumb moves, now it shall be show time, i wanna see the baby go up and up. i bought a good amount of shares when it was under 20$ last year. So it could go up again, there is plenty good reason for it..�

Không có nhận xét nào:

Đăng nhận xét