1/1/2015

guest Very good advice.

My experience is that most players in the stock market (and in the options market) are taking much too high risks.

Keep you risk low, manage your risk and you will end up smiling. Honestly.

Even Nobel laureats were blown up by taking too much riask (read LTCM).�

1/1/2015

guest So what prevents you from selling 100 shares at a $38 covered call and simultaneously putting in a limit buy at $38 for 100 shares? Seems like you'd make .90/share regardless of what happens. I'm assuming I've misunderstood something...�

1/1/2015

guest You got the bis picture right. The fine print:

Slippage and fees, possibly overnight gaps.�

1/1/2015

guest With options, it's more about buy/sell than type of option. My guess is you can sell Covered Calls, which I just described.

But, if they'll actually let you buy Calls, then that's one way to bet that the price will go up. For instance, (this is just an example, not a recommendation!), you could have bought Jan $33 Calls for $3.50/share today. That means you're betting TSLA will be above $36.50 by Jan 2013 ($33 strike + $3.50 premium = breakeven point). If TSLA is above $36.50 any time between now and Jan 19, 2013, then you could exercise the option and buy the stock at $33. You could then hold the stock for more future gains, or turn around and sell it at the current market price for a profit. Or, instead of exercising, you could sell the Call to someone else for more than you bought it for (as the stock price goes up, the price of its Calls goes up).

Of course, the most straightforward thing is to buy the stock. The stock is volatile, so dips are plentiful.

The nice thing about buying Calls is that you can afford to buy more Calls than you can shares of stock, and the percentage increase of a Call is larger than the percentage increase in the underlying stock. That gives you leverage. The bad things about Calls is that they're time limited - when they expire they are worthless. Stock ownership doesn't expire and rarely becomes worthless. So if Tesla stays in its current price range for 9 months and than doubles, you lose the money you put into the Calls, but if you bought and held the shares they'd be worth double.

If you're thinking about buying Calls, look for long term calls. I think with Tesla today the furthest date you buy Calls on is Jan 2014. That gives you 18 months to be right. Of course, you pay more for that.

Is this helping?�

1/1/2015

guest EDIT,,�

1/1/2015

guest You haven't misunderstood anything. Outside of there not being (that I'm aware of) the equivalent of a trailing stop limit on stock sells for stock buys (the brokerage will simply buy the stock for you at today's cheaper price), you can do it manually. When the stock hits $38, you can (if you've got the cash) buy enough shares to sell for the covered call. But then if that's the top, you've got bought shares at the top. If the stock then falls, you've lost money on those shares.

Remember, options are not executed on the spot. Just because the stock hit $38.01 does not mean that the Call will be exercised. The person who bought those Calls at $0.90 wants to see $38.91 before exercising, and then there are calculations with the time value remaining on the option (which I've skipped to make things simpler).�

1/1/2015

guest [/QUOTE]Outside of there not being (that I'm aware of) the equivalent of a trailing stop limit on stock sells�

1/1/2015

guest EDIT,,�

1/1/2015

guest Thank you - good advice!

I learned a long time ago to never gamble with money I can't afford to lose. I have Sept contracts with a $30 strike price (I also have TSLA stock, but those shares I will hold much longer). I had hoped that the good press would have moved the stock higher, but I still like my chances of strong stock performance over the summer. Wish me luck.. On the 80% number, I think my percentage has been a little better than that (maybe 60/40) but when the 40% hits it has been a multiplier gain making up for 60% of time that I have lost money... Better odds than Vegas, but it is a gamble.�

1/1/2015

guest Been on vacation, but keeping my eye on TSLA. Seems like we survived that second run down to the 200-day and the trend is intact. I think it is safe to put on the cruise control now until I see the 200-day at $35 (which was the target I mentioned earlier).

There's been a spike in reservations over the past two weeks. My bull case calls for all of 2013 to be sold out by the end of this year, so I'll be watching that trend closely to see if it can meet that lofty projection. I'm starting to turn my attention to markets outside the U.S. Elon said that the 20k number represents about 10k from the U.S. and 10k from outside the U.S. Right now the U.S. reservation list is good enough to make that happen, but the foreign numbers have a long way to go. If Tesla can start getting to work on those markets soon, and we see the affect of that in the numbers, it'll make my bull case all the more likely.�

1/1/2015

guest If the overall market doesn't take a dive, the glowing article (and great front page placement) in the WSJ may help the share price Monday morning...�

1/1/2015

guest I just read that article, really nice review, and I had the same thoughts about a possible bump in share price. Though Dan did get the motor technology a little wrong. Tesla's AC induction should be asynchronous, not synchronous.�

1/1/2015

guest Yep. Wells Trade did me the same favor, and the more I learn, the more I appreciate it.

Excellent advice!

More good advice.

Being a Nobel laureate does not automatically make you a savvy investor. Scientists are sometimes very easy to con because they don't expect deception. That's why it takes an illusionist to detect scam claims of the paranormal.

Thanks to everyone above for the detailed explanations about options. I am very interested in such stuff, even though I've decided not to go that route. The more you try to make, the more risk you take, and it's greed that will ruin you. The problem I see with leveraged investing (which some of the discussion above touches on) is that the whole point of it is to risk more than you actually have, or to increase your risk in the hope of increasing your gain. There is a line from Pushkin's The Queen of Spades in which the principal character says "I refuse to risk the necessary in pursuit of the superfluous." I take that advice to heart. (Great story, BTW!)�

1/1/2015

guest TSLA trading decisively against the market today. Impressive. Imagine if it had the wind at its back...�

1/1/2015

guest TSLA is moving against the market since last Thursday. Can't wait too see the short numbers due out tomorrow after market close.

Did the short stay in for the production launch? If they did, will they stay for the real product launch where they unveil all the good stuff?

Any news of the product launch date? (or when they start delivering to average folks, to people they can't control? )�

1/1/2015

guest No official news, but on the Seattle Get Amped event thread, rumor has it the store manager is planning a Sig delivery this week or next:

�

1/1/2015

guest Yea, though it did the exact same thing in reverse last week on a day when the market was up.�

1/1/2015

guest Speaking of Vegas, well Atlantic City, I just visited the new Revel casino which is astoundingly luxurious! Later I was curious to learn more about it so I went to Wikipedia and found out that the project stalled in 2011 and construction ceased. To revive it, Governor Chris Christie provided (Not loaned!) 260 million state dollars as tax rebates over 20 years.

I don�t want to turn this overly political but I used to get pretty annoyed at comments arguing against the DOE loan or the $7500 tax rebates. Now I�ll just smile at the hypocrisy.

What would you chose to subsidize? Improving the air quality, getting off of foreign oil, strenghtening the manifacturing sector in the US? Or gambling?�

1/1/2015

guest It's about 7:00 a.m. Pacific Time. Nice little jump there, if it sticks. I'm $700 up. Of course, that means nothing if I don't sell, and I'm not selling. But it's cool to see it. �

�

1/1/2015

guest Jack Rickard on his latest EVTV episode made an interesting case for Apple buying Tesla. Basically he said they can easily afford it, and it gives Apple another enigmatic figure head in Musk to replace Jobs, and that the companies share much of the same customer base. I don't expect it to happen, and I'm not sure I want it to.�

1/1/2015

guest Tesla customers might be Apple customers, but the reverse is not remotely universally true. God knows I know tons of people with iPads, iPhones and such that don't give a crap about cars or are not remotely in Tesla's current market.�

1/1/2015

guest If you'd like to talk to him about it we are having a discussion about it here: Rumor: Apple buying Tesla�

1/1/2015

guest I am a Tesla customer, but I have declared my house an "Apple Free Zone". I went so far as to set up my WiFi router to not allow connections from Apple branded devices. If Apple were to buy Tesla, I might have to start looking at other cars (Let's just hope this does not happen, because I REALLY want a Model S)�

1/1/2015

guest I'm with you except that in his argument for this merger he specifically says that Elon should run the new Apple after the merger is complete, and with Elon at the helm, my opinion of Apple may be more favorable.�

1/1/2015

guest Wow you're like the opposite of a fanboy. Apple has been nothing but great for me. I hope Tesla continues to be good to me both in stock price and when I can finally afford one of its cars (at least 6 years out I imagine).�

1/1/2015

guest Those people are called "haters". I'm not saying Rifleman is a hater, I'm just saying that's what the opposite of a fanboy/fangirl is.�

1/1/2015

guest And when you are in love with your captor, they call that Stockholm Syndrome...

Back on topic: we are really teetering on the edge here. The fundamentals and technicals look good, just global headwinds holding us back. We should be hearing about that supercharger network soon. I hope that is a positive, I am a bit worried that the headlines are going to focus on how much money Tesla is going to need to spend to deploy it.�

1/1/2015

guest Of course they will. Just like they tend to focus on how you can't "fill up" in 3 minutes and with the range, you can't go on huge road trips, never mind that those trips are the minority of your driving.

Wish they would understand that you fill up with gas, what, once a week (on average - obviously, there are exceptions). Tesla's way, you just "fill up" at hom overnight. You're asleep... who cares if it takes 3-6 hours or something.

The supercharger network will be Tesla's next challenge to help people realize they all won't pop up at once, but it will help everyone's already 'mostly' uninformed impression once they start getting broad in deployment.�

1/1/2015

guest Wow, I go out for the few hours the market is open, and look what happens. Well, I did say "if."

Batteries: I have a high degree of confidence in them. But we need to realize that there is insufficient real-world experience to make absolute statements, and the car-buying public will need time, and will need to see how the batteries do over a period of years. The Toyota Prius, which had six or seven years on the road before the 2004 model went on the market, still took several years more to become mainstream, and that was with a long-established battery chemistry. The stock market will watch sales, and sales will rise gradually as the public gains confidence.

Wow, that is a level of hate I don't often see outside of discussions on politics or religion. I hate Microsoft, and I won't allow MS software on my computer or buy a device that runs MS software. But setting up a router to reject Apple-branded devices sounds extreme to me. Are you concerned that an Apple device will cause harm to your network, or do you just hate Apple so much that you reject people who own their devices?

I like Apple, mainly because OS X is Unix. And my first iPod was so much better than my first MP3 player. I had trouble with my Airport router, but I've been happy with my iMac, Airport Express (for travel), and iPod, and 3 out of 4 seems pretty good to me. And of course I love my Roadster.�

1/1/2015

guest there's no such thing...�

1/1/2015

guest +1 OS X is Unix works for me. I'm not really too thrilled with the direction they're taking the O/S but there isn't really any other viable choice (Snow Leopard was about perfect). Linux is too fiddly and doesn't have any commercial software and Solaris doesn't do desktops. For years, I used IRIX but a few bad moves by the executives at SGI killed that.�

1/1/2015

guest I mostly share your feelings about Apple, but if they did grab Tesla it wouldn't turn me away from Tesla. Unless they screwed it all up somehow.�

1/1/2015

guest :biggrin: Yes!

but it makes me understand how there can be some people who are Tesla Haters!

If it wasn't electric and just had a big screen I might hate it too�

1/1/2015

guest We plan to remain Apple-free. There used to be signs along the freeway here that prohibited the transport of apples.�

1/1/2015

guest Since u hate beyond your own election not to purchase, why not lobby for a law to prevent others from purchasing

There's no such thing as a free Apple

Apple rocks and so does Tesla�

1/1/2015

guest what??�

1/1/2015

guest Translation: He doesn't like Zex's dislike of Apple.�

1/1/2015

guest Now. I feel like I'm being toyed with.

Tesla, will you get this over with. I had enough.

Thank-you.�

1/1/2015

guest I think Snow Leopard is the one I have. (10.6.8) I saw no reason to get Lion. I like all cats, big and small, but I like tigers best, leopards next, and lions come after all the various striped and spotted cats. :biggrin:

I tried Linux before I got my Mac. I really like the idea of Linux, but I'm not techy enough to get it set up properly, and I couldn't get the codexes for steaming media or a program that would interface properly with my iPod. Several programs promised to do so, but none worked right. I even tried unsuccessfully to find someone who would install and set up Linux for me for a fee. Then I heard (five years ago, IIRC) that OS X is Unix, and that was good enough for me. Back in the day I had Unix on my PC-AT clone. (Microport's genuine AT&T Unix ported to the 80286.) I loved it.

I was annoyed that Apple would not support Linux with a Linux version of iTunes, but it seemed that nobody was supporting Linux except the GNU community, who do a fabulous job, but without resources couldn't provide what Apple can. (I still use NeoOffice.) I can understand people who refuse to patronize one company or another, but I am confused by Rifleman's going so far as to block Apple users from his network.

The market will open soon. I wonder what the roller coaster will do today.�

1/1/2015

guest When will cars be shiped to people??

Tesla?

Anyone?�

1/1/2015

guest You do know that going on about operating systems and then adding a throw-away reference to the thread topic isn't really staying on topic, right? :biggrin:�

1/1/2015

guest We make things so hard on you in this thread, don't we? :tongue:�

1/1/2015

guest Here.�

1/1/2015

guest Well, I guess he heard me cry yesterday night!

Two weeks it is

Brings us to 7-20 I guess, they seem to like Fridays...�

1/1/2015

guest Steph,

I seem to recall that you thought something was going to be happening with shorts last night.

Nothing noteworthy?�

1/1/2015

guest Just starting to wash a load now, they should be clean soon �

�

1/1/2015

guest Classic, with just a hint of potty humor, well done!�

1/1/2015

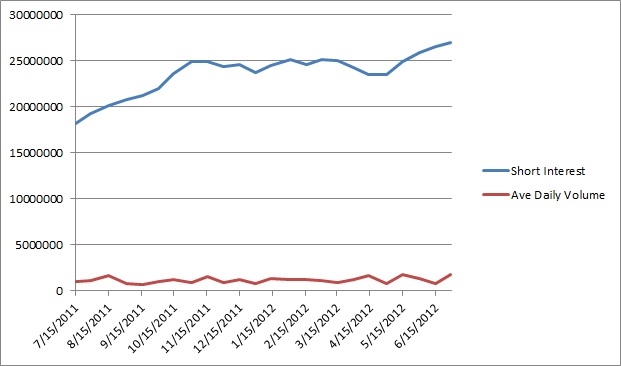

guest Yeah. Just lost my shorts after looking at the latest numbers:

TSLA Short Interest

Settlement Date

Short Interest

Avg Daily Share Volume

Days To Cover

6/29/2012

26,977,775

1,795,682

15.023693

6/15/2012

26,522,286

780,221

33.993299

5/31/2012

25,850,776

1,393,753

18.547602

Read more: Tesla Motors, Inc. (TSLA) Short Interest - NASDAQ.com

Shorts will loose their shirts.�

1/1/2015

guest Shorts are completly insane or is it me?

One of my favorite quote:

"A question that sometimes drives me hazy: am I or are the others crazy?"

Albert Einstein�

1/1/2015

guest Well, I hope it's the shorts that are, but I don't really understand anything. It just seems that expecting anything to happen in just a few weeks or a month is just gambling.�

1/1/2015

guest I'm not so sure?

with people on the right coast and central US being able to finally get a hands on S... should go a little crazy

Isn't this the first time the days to cover has dropped that low?

edit: I guess not the first, hmm .. but 1/2 of the previous days to cover #...interesting, what does it all mean? (I should have more Tsla?)�

1/1/2015

guest Days to cover don't mean much. It's an hypothetical number giving you an idea of how long it would take, with the average last 15 days volume, for ALL shorts to cover.

It's impossible to know the real number until it happend. And if it happend very suddenly, in an uncontrolled panic kinda way, it gets more interesting.�

1/1/2015

guest This is easily my favorite thread on the website, but I have one suggestion to make.

Anytime you start a post with something like "Wow look at what the market did" please include some facts, like the stock is up 3% in just a few hours, or shorts have increased by another 1 million. It's hard to read a post thats a few days old and then try to understand what the poster is referencing.

That's all from me. Back to making money!�

1/1/2015

guest Ok, I get it, you want us to do the dirty job so you can have it easy? You want us to feed you for free??�

1/1/2015

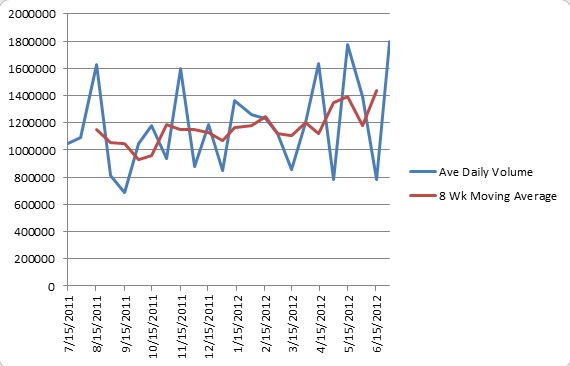

guest Days to cover in the long term is meaningless (as Steph says), it's only good if you're looking short term IMO. It's only a function of the average daily volume and when you look at that over a year, it's easy to see why the days to cover jumps about:

This is the chart that's meaningful:

1. Tesla needs to a much more serious trading volume if there is to be a sustained higher level.

2. Sooner or later, the short "bubble" will burst.�

1/1/2015

guest Not at all, but it's just confusing to follow sometimes. For example, Daniel said this earlier,

And I have little idea to what he is referencing. As a finance major, I love looking at numbers all day long, but when others have commentary I like to try to follow along with what they're analyzing as well.�

1/1/2015

guest That's a pretty scary graphic. If I was short, I woul pee in my panties just looking at it.�

1/1/2015

guest It was the stuff about computers that was the throw-away. The roller coaster comment was the topic of my post. :biggrin:

Only time will tell.

No, he just doesn't want to have to read the thread in real time. :wink:�

1/1/2015

guest I can do it for a fee. Here's my bank account number: [CENSORED BY MODERATOR DUE TO LANGUAGE]�

1/1/2015

guest We think very much alike. I have a pellet gun and I target anyone walking by my home wearing green. Saint Patty's is my favorite.

{that was sarcasm}�

1/1/2015

guest One day someone's going to lose a huge amount of money. "Huge" being relative in banking terms.....�

1/1/2015

guest Huge in Steph's term is... huge.�

1/1/2015

guest Yes; call it "thread welfare" if you like. Or calling it "making the thread more useful for people that don't read posts in real time".�

1/1/2015

guest In the finance world losses are measured on the following scale:

* Hmm

* Bad

* Awful

* Huge

* F*@#ing Huge

* WSJ

* Embarrasing

* Senate Subpeona

* Bailout....�

1/1/2015

guest Watch the language, Steph...�

1/1/2015

guest U want this account too?�

1/1/2015

guest Funny

And then... we all do it over again.�

1/1/2015

guest note : For last full year, while average trading volume virtually unchanged, stock price up 11%:

short interest up 48%!!�

1/1/2015

guest I particularly like that "embarrassing" is several steps beyond "huge".�

1/1/2015

guest Going back to @jason twitter post:

[email�protected]

Looks like @wsj believes the @teslamotors model s is the best car In the world.two weeks for #00001!!! Lexus GX 460: How Toyota Tried to Head Off Trouble - Drivers Seat - WSJ �

I think we are wrong. What he really means is: #00001 is now two weeks old.

Back to square 1.

We're screwed,�

1/1/2015

guest overanalyzing, Steph ... but then, that's what this thread is for �

�

1/1/2015

guest Why is this necessary Steph? The guy asked nicely if people could give a little more frame of reference in their posts since the stock can go from +2% in the morning to -2% in the afternoon, and you respond with an expletive?

�

1/1/2015

guest I love ya too man.�

1/1/2015

guest What? Did I miss something?�

1/1/2015

guest No idea. This guy is just weird.�

1/1/2015

guest I don't remember him ever being weird before, I think something got lost in translation. There were some jokes made that apparently didn't translate.�

1/1/2015

guest I guess so.

Edit: Try with a calculator.�

1/1/2015

guest He can hear you. Or read you. You know what I mean.

I'd assumed that the post was a joke, since Steph didn't do anything like that. That's my story, I'm sticking to it.�

1/1/2015

guest Articles like this may help raise some awareness. Without general awareness, the pool of stock buyers won't grow and won't see reasons to go buy (and drive up the stock).

Why Tesla is Beating GM, Ford and Toyota - Electric Cars - Forbes

Apologies for the on topic post :wink:�

1/1/2015

guest I'll give you a hint. This doesn't translate to "love you".�

1/1/2015

guest That's the story and we are sticking to it.�

1/1/2015

guest Back to topic.

How about this stock?

Pretty good hey!�

1/1/2015

guest He;s been a fan far a while

http://www.thephoenixprinciple.com/blog/2009/11/white-space-for-electric-cars-nissan-chevrolet-ford-tesla.html�

1/1/2015

guest You should be ashamed. :biggrin:

Clearly Adam Hartung is prejudiced by knowledge.�

1/1/2015

guest Smart guy. Very well written article almost 3 years ago.�

1/1/2015

guest Nice article! My comment:

�

1/1/2015

guest Ummm.......�

1/1/2015

guest Good article, though the top speed quoted is out of date. (I presume it had a faster top speed when the article was written and the early models had the two-speed transaxle to give it a higher top speed.)

We EV boosters love to talk about the lack of maintenance in EVs and the paucity of moving parts. But elsewhere we see long discussions about repair cost and frequency and speculation about what these cars will cost to keep moving after the warranty runs out, and whether $5,000 or $11,000 is worth it for a three-year extension of the warranty. Methinks we're being a bit schizophrenic here. My Prius costs me $34.50 for an oil change once every 5,000 miles or one year, whichever comes first, and my Roadster costs me $600 a year for maintenance plus $1 per mile for ranger travel. A dealership could be quite profitable selling cars at cost with maintenance fees like this. I gather they've rolled the first three years' service into the initial price for the Model S, but what happens after that?

I love my Roadster, and it's worth every penny. And if I needed a car as enormous as the Model S I'm sure I'd feel the same way about it. I didn't buy either the Xebra or the Roadster to "save money." But so far, these cars are not more economical to own and drive than either my Civic or my Prius. And the direct-to-customer model loses some of its appeal when there's a $560 travel fee for any non-warranty work, and if the car has to go in to the shop there would be additional delay as they arrange for it to be transported there and back.�

1/1/2015

guest The Model S customer is much less likely to buy the car if they depend on the Rangers for their service so the dollar per mile will be less of an issue. It will still happen but I think you'll find more customers (after the initial rush of enthusiasts) cluster around Tesla stores and service centers.�

1/1/2015

guest Where does "JP Morgan Chase" fit into this list? Is it included in Senate Subpeona?�

1/1/2015

guest These are missing because they don't really happen:

* I lose my bonus

* we close our gates�

1/1/2015

guest That still leaves the car far more expensive to maintain than a stinker, and based on speculation, major repairs after the warranty period will also be far more than a reliable (Honda, Toyota) stinker.�

1/1/2015

guest This has been posted elsewhere, but I thought it would be interesting to those that follow this thread as we've talked about the Model S as a fleet vehicle in the past.

Fleet Services | Tesla Motors�

1/1/2015

guest This stock just wants to go up, rest of the market be damned.

(TSLA is currently up 0.60% while the market is down more than 1%)�

1/1/2015

guest Is that just for Europe? I would prefer Tesla powered (not necessarily branded) fleet vehicles. Who wants to buy, what is for now a quite exclusive vehicle, and have a DOT/Taxi/etc. vehicle of the same thing pull up next to them? Great for the environment, yes. But, there is a small (sometimes large) bit of ego that would be a bit crushed by this. �

�

1/1/2015

guest Now (10:08am CST) at 4.2+% with large volume...�

1/1/2015

guest Quite the spike, wonder who just bought in? Looks like a large chunk to cause that...100K shares?�

1/1/2015

guest Still up $0.91 at 11:20 EDT. Is it finally going to do what we've been expecting, or is it going to start dropping again as the day traders take their profits?�

1/1/2015

guest finally decoupling from nasdaq is a great sign�

1/1/2015

guest I'm wondering how many shorts would get burned if it stays at $32 or $33 today even when the market as a whole goes down. That should be quite the indicator.�

1/1/2015

guest And down, down, down it sinks after the little spike. The stock just does not move with any persistence at this point. I have no idea what will move it other than thousands of cars delivered. Maybe that's what should move it, actual product shipping in non-trivial numbers.�

1/1/2015

guest Not a surprise, that move was parabolic, not sustainable. That doesn't mean we can't get back up there or higher today, just not in a vertical line like that.�

1/1/2015

guest Dropped a half a point, then shot up 2, then down around 3/4 as I write this, for a gain so far of 0.62. Bumpity bumpity. That high volume means somebody or somebodies wanted out and others wanted in. Shorts covering while longs took profit??? I don't pretend to understand it.

Not for me. I want to see electrics on the road. The only other Roadster I've ever seen locally was parked at the EV club display at a county fair about 3 years ago. I want to see more Roadsters. The hell with being exclusive!

Edit: P.S. There are no more Roadsters, but you get my point. The more the better,�

1/1/2015

guest This is a volatile stock, often on a daily basis. Anticipation of milestones events failing seems to drive down the price, which then rebounds even higher when the event is successful. With approximately 9.9% annual growth and the promise of future dividends TSLA should certainly be a "hold" for long term investors and may well be receiving even more "buy" ratings in the near future:

�

�

1/1/2015

guest It's a great gut-check for your real priorities isn't it?�

1/1/2015

guest German Mercedes drivers don't care that many/most taxis are Mercedes. My gut feel was always that (if asked) Germans generally are proud that their taxis are Mercedes.�

1/1/2015

guest Perhaps this is cultural and only an issue in the U.S., hence why the Fleet page is only on the EU version of the site.�

1/1/2015

guest Those times are long gone when Mercedes' reliability was legendary and fleet discounts where big. There even was a saying: I don't buy a Meredes. If I want to ride one, I'll call a Taxi.�

1/1/2015

guest I was wondering just that.�

1/1/2015

guest Also, Mercedes' status has much declined. Today, it needs to be an AMG variant or a Lorinser / Brabus tuned..�

1/1/2015

guest Does it make me a terrible person if the first thing I think on days like today is, "bite me JP"?

EDIT:

For those that are going to read this later, the stock is up more than 4% again.�

1/1/2015

guest No. �

�

1/1/2015

guest yes.. terribly thoughtful IMO;

looking forward to JP biting crow, but we have a way to go yet�

1/1/2015

guest He'll never eat crow, egos that big will never admit failure. He'll always claim Tesla's failure is just around the corner.�

1/1/2015

guest In reality, if (when) Tesla becomes a huge successful business he'll probably just stop talking about Tesla. Then if someone brings up his previous opinion on Tesla (and let's face, people have short memories, so this won't be often), he'll probably just say something like "I didn't say that, I just said..." and try to change the story.

This is what politicians do.�

1/1/2015

guest My favourite answer:

BOTH�

1/1/2015

guest Could it have anything to do with this?

Daimler Reduces Stake in Tesla Motors by 40 Percent | PluginCars.com�

1/1/2015

guest This is old news. Their dropping their stake is just a way for them to move money. It's just a form of cashing in. There is a lengthy discussion about this earlier in this thread.�

1/1/2015

guest New analysis that supports Elon's claim of at least 10% per year cost reduction in batteries. Although I thought Tesla's was already at $250-$30o per kWh

Battery technology charges ahead - McKinsey Quarterly - Energy, Resources, Materials - Electric Power

�

1/1/2015

guest Depends on whether we're talking wholesale or retail. Tesla is charging us $500/kW for the 40-60kWh upgrade and $400/kW for the 60-85kWh upgrade. Their cost? Unknown.�

Không có nhận xét nào:

Đăng nhận xét