1/1/2015

guest Plus I'm not trilled with Tesla's questionable decision to limit journalists to just 10 minutes with the car for review. It is odd and limits the sort of thorough reviews people are expecting�

1/1/2015

guest I don't find it odd if your first priority is delivering the car to the thousands of people you have waiting. I find it refreshing. Journalists will get their turn when things cool down a bit.�

1/1/2015

guest This is not some noble attempt to be refreshingly different. This is a calculated move to avoid negative pub early on. Why not allow full reviews for a few select outlets?�

1/1/2015

guest I am not certain that this will be applied equally to all press - I think a limit needs to be set because anyone with a blog can get press credentials and a drive. I would not be surprised if major outlets have privately set up alternate arrangements.�

1/1/2015

guest Yeah, agree with that. What does Tesla have to hide? Let the car speak for itself. This is like Disney not providing movie critics with previews of "John Carter" and "Mars Needs Moms" coz' they knew that they had expensive duds on their hands.�

1/1/2015

guest You're speaking pretty definitively -- you have info we don't?

This could be true.�

1/1/2015

guest They are limiting the rides to 10 mins at a particular press event. The reason is because they only have so many cars and there will be a lot of press there. Tesla doesn't expect anyone to write a detailed review off this 10 min drive, that will come later when they have cars that they can spare for several days at a time.

This is no different than the 8ish min limit that each Model S reservation holder is going to get at the test ride events (when buying a normal car you can generally test drive as much as you want, and even take it home overnight sometimes).

They are doing the best they can with limited resources. Some members of the media (cough cough Jalopnik) just want to spin it like they are pulling the wool over our eyes.�

1/1/2015

guest To tie this into Investing, I believe investors want to see some thorough reviews of the car, which is industry standard once a car goes into production. If there were a few thorough reviews of the Model S and the consensus was very positive, then this would be a huge deal for the stock. But limiting the reviews as they are only serves to further cast doubt on the car. Why do that? Whether they really think there will be negative reviews or not, Tesla is clearly trying to tightly control the exposure of the car for whatever reason.�

1/1/2015

guest So that would be a "no" then? �

�

1/1/2015

guest As long as they allow more detailed reviews in short order, I'm OK with that.�

1/1/2015

guest I think by mid-July we will start seeing media outlets getting extended time with a Model S to do a proper review. I don't think this delay will have any affect on the stock price. Elon told us that customers would get the cars before the auto press months ago on a conference call.

Let's count the number of things that Tesla does that are not "industry standard". Yeah, I'm ok with that.�

1/1/2015

guest Who does he (Elon) really love, hmm. hmmmm

US!

'the media' is lame

why would you give them an awesome 'car' that they didn't pay for?�

1/1/2015

guest JP pretty much has his own EV gibberish thread of late.�

1/1/2015

guest Excellent write-up! Thank you for the level-headed analysis. I agree, and I think it's probably the case that most anti-EV people don't hate the planet, they're just uneducated. And over time, they'll learn.�

1/1/2015

guest I'm inclined to think that nothing much will happen with the stock price on the 22nd and for a time thereafter. Maybe after it's obvious that Tesla is going to meet it's delivery target for this year with no issues something will change, or with another major announcement.�

1/1/2015

guest Other than deliveries, we have the "major charging announcement" next month.�

1/1/2015

guest And, an announcement about a "battery swap system" (that Elon almost reluctantly alluded to, when asked, at the annual shareholders' meeting) at a later time.�

1/1/2015

guest New info:

�

1/1/2015

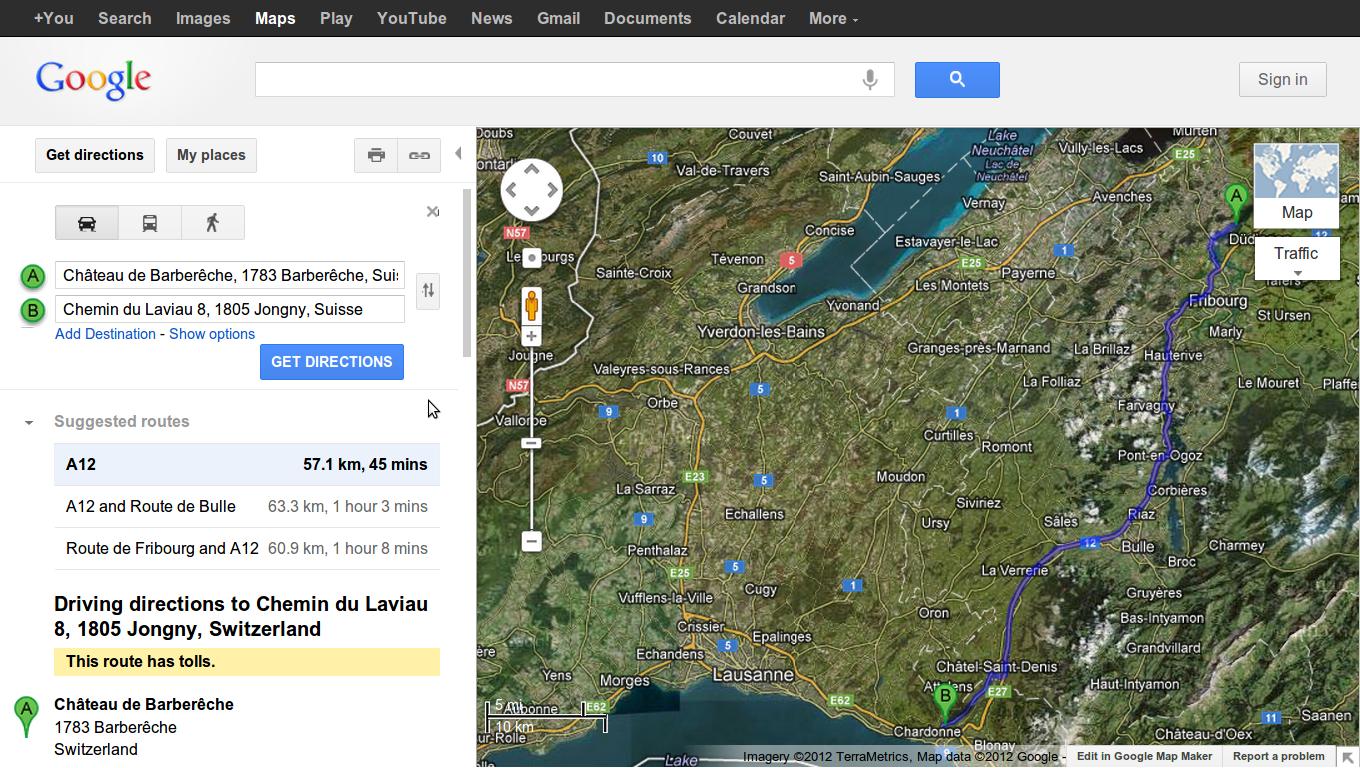

guest You mean Switzerland, I guess...

It's a one-and-a-half hour drive, from where I live. The next time I get into that region, I might take a small detour and have a look.

This sounds very strange to me. Maybe a company offering postboxes is located there... I don't know, sounds all very suspicious...�

1/1/2015

guest Oops, sorry

I'm sure this guy is a scam.�

1/1/2015

guest like you're sure we haven't seen the final interior? :wink:�

1/1/2015

guest Still did not see it, I'll answer your question next week �

�

1/1/2015

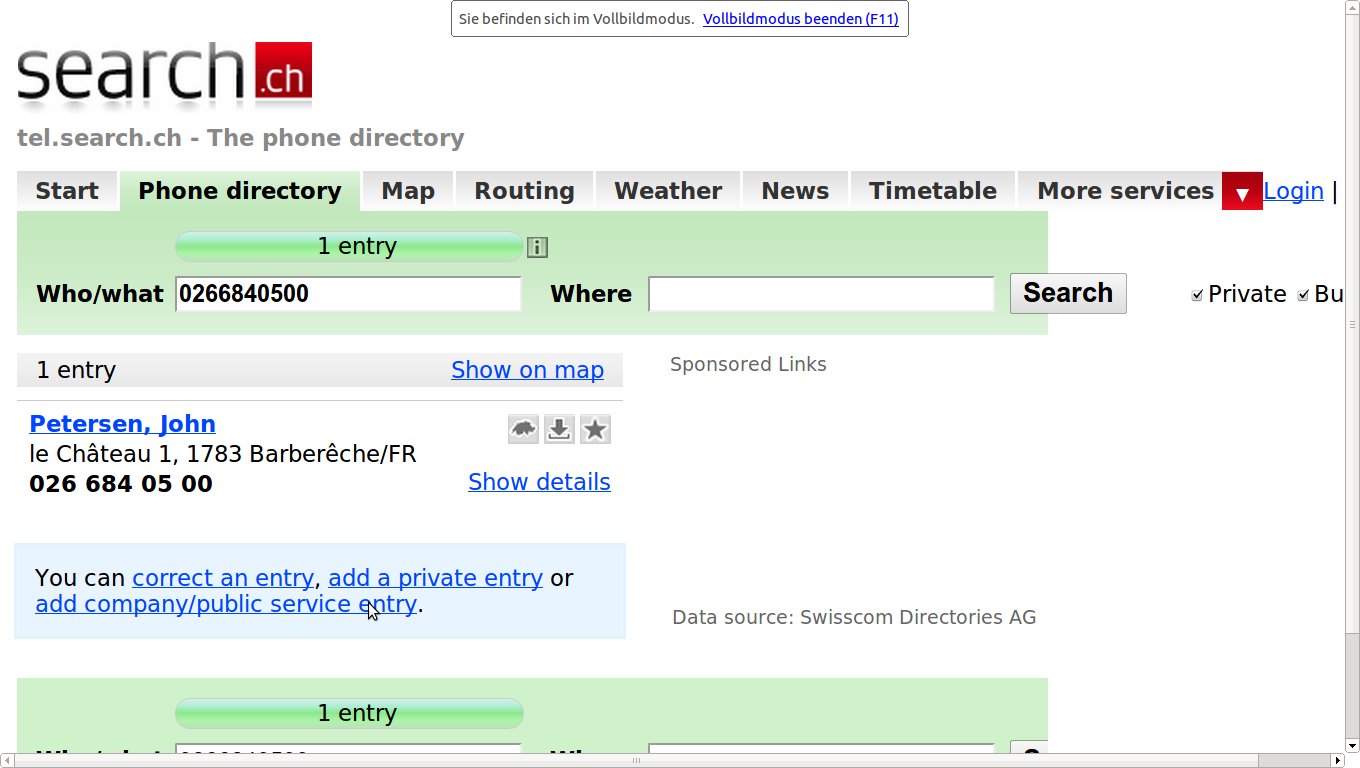

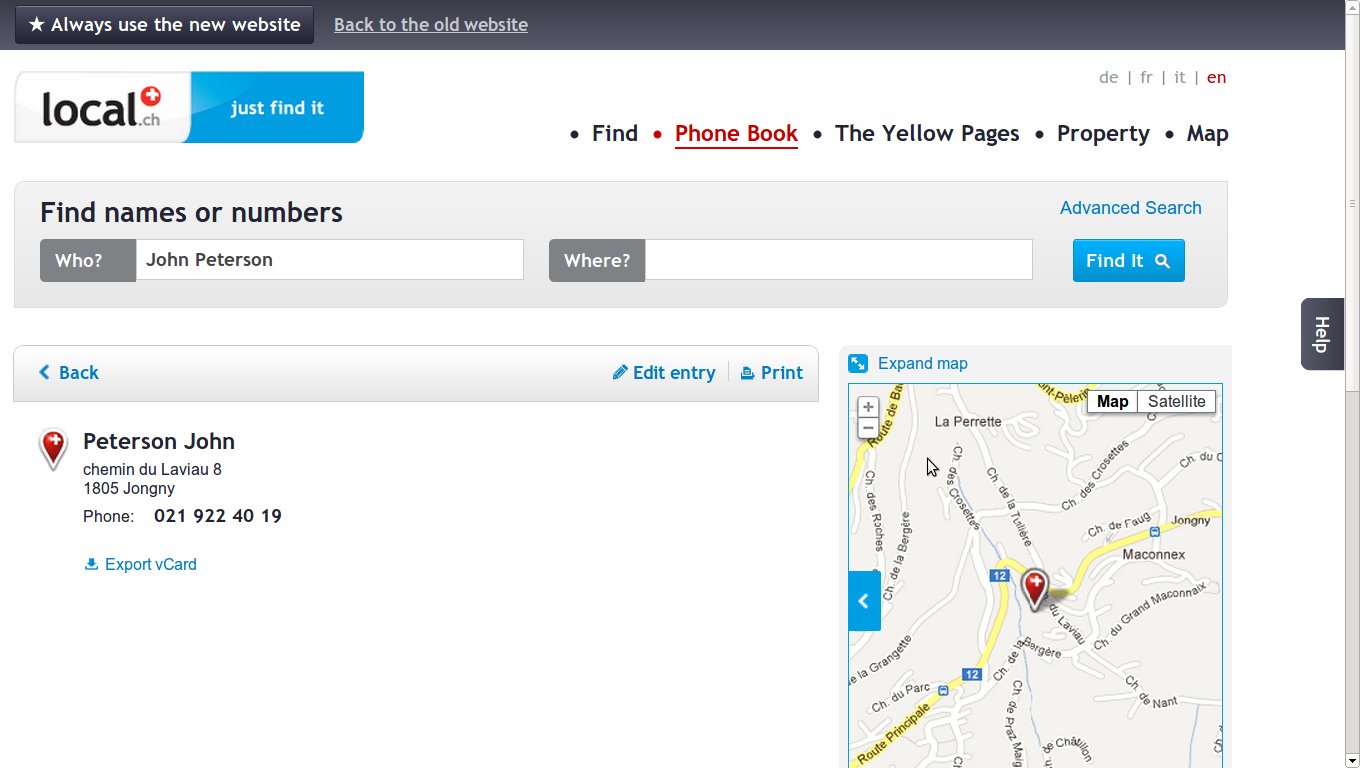

guest He has a listed telephone number for that address: http://tel.local.ch/en/d/Barbereche/1783/Petersen-John-WLVmxW0oWWiIgI7cUOsuyw?what=petersen&where=barber%C3%AAche�

1/1/2015

guest Did anyone ever attempt to call this number?�

1/1/2015

guest After all he is registered in the swiss phone directory:

And one single entry in that name, about 45min away from Chateau de Barbereche

Note to my self: I should stop stalking this guy now... :frown:

edit:some typos�

1/1/2015

guest Can you call the number and ask if he is the one writing the articles?�

1/1/2015

guest I think I probably shouldn't do that, I could loose my temper...

But why doesn't one of the more that 100 Roadster owners in Switzerland pays him a visit? Maybe a short ride in the roadster will convince him. (Not really I think)

My guess is, that this guy made some kind of fortune manipulating the markets.

Or he is getting paid by some really rich people/companies to dis EVs. (Not really -> attention! conspiracy theory alert :wink: )

edit2: BTW: According to his website, there are a couple of bio fuel companies among his clients.

edit:some typos�

1/1/2015

guest JP's bound to call all of us fanatical, stalking creeps in his next article

All hail St. Elon of Palo Alto!�

1/1/2015

guest I think, you're absolutely right. What we should do is to ignore him and his "articles". Everything else is just feeding the troll.

But it's so hard to resist...�

1/1/2015

guest I can't imagine any charging announcement or battery swap announcement that would significantly move the stock price. Let's assume it will be an announcement of an extensive fast charge network and available pack swapping, both which would be additional expenses for the company to implement.�

1/1/2015

guest What if the supercharge station have 4 things:

1. Supercharger @ 90kw/h

2. Solar panels

3. Swap station (recharged by solar panels)

4. Regular charge feed by the spare battery packs.

Just a suggestion....�

1/1/2015

guest Do you think most investors will see that as a huge benefit for the stock price? I don't. In fact I think much of the importance given to fast charging and long range is way over blown, and all of what you list will cost Tesla a large amount of money and not bring in additional income, unless Tesla is going to charge really high prices for fast charging, which over all will be a rare event.�

1/1/2015

guest Does anybody know how the quick swap will work? Will tesla rent you a battery while your own battery charges?

Have they released any details on the battery swap program?�

1/1/2015

guest Hype is what make people go nuts.

Mr Musk is all about Hype. Wait & see.�

1/1/2015

guest My take is that he (JP) is a lawyer, who believes in hybrids as someone might believe in the local boxing champion.�

1/1/2015

guest To an ev enthusiast like your self it's not a big deal but to your average consumer it will do a lot to calm their worries about "range anxiety". It may be a minor expense for tesla but it will probably help people who are still on the fence about buying a tesla to pull the trigger.

I doubt that the charging network is going to be too expensive for tesla to implement. A few charging stations strategically placed in major cities across north America and that's it. We don't need a charging station every 20 miles.�

1/1/2015

guest I agree that it will help quell the range anxiety, but will it have a big effect on the stock price... probably not. We need things like perfect delieveries for the first couple months and good reviews from the mainstream mags. Anything that is known to the media at this point is already priced into the stock.�

1/1/2015

guest Not by itself, most people will not immediately know what to make of it, how much infrastructure will be really needed, whether it will work as advertised, etc.

As Fr23shjive said, a 'starter-'network will not be too expensive, and as Tesla grows with Model S, the network will grow. The so-called "mainstream" expects the EV industry to build a charging infrastructure, for good reasons, and so, for as long as the EV industry hasn't done the obvious, it won't be taken very seriously. However that is just one of several requirements for the mainstream to change its opinion, and may not do as much just by itself. Though it might. You cannot predict at which point the mainstream will start changing its opinion (in a small sense I already see a change), but at some point it will.�

1/1/2015

guest Expect something big on 6/22.

This will be the big event, they will unveil every details. No choice, cars (or is it computer on wheels?) will be in the wild.

Can't wait �

�

1/1/2015

guest Not surprisingly, some folks here, being investors, are anxious to see the stock price go up. But I strongly suspect that Elon Musk is far more interested in getting as many cars to early reservation-holders as possible, than in giving the stock price a quick boost. He knows that creating news (e.g. by giving reporters lengthy car time) will have only transitory effect on stock price, while the real work of ramping up production, delivering cars, generating cash flow is what will build the company and create real growth. He's not going to cater to day traders by creating news that causes transitory price spikes.

He is giving journalists a peek, using a small number of cars (or one car???) to whet their appetite, and certainly as production ramps up and he can spare a few cars he'll give select journalists more time with the car. But if I'd put down a $50,000 deposit three or four years ago, I'd be upset if Tesla devoted the first two dozen cars to loaning to journalists for a week of in-depth reviews. I'd want those first cars to go to the long-suffering reservation-holders.

I don't think this is a ploy to avoid negative reviews. I think it's an effort to reward the people who trusted Tesla with massive deposits.

And as an investor in it for the long haul, I couldn't care less about what the stock price does in the short term. (Unless it drops to 25, in which case I'm grabbing another 50 shares.)

People who buy when they feel the price is low, with the hope of selling in a few days or weeks when the price is high, have a perfect right to do so. But they don't have a right to expect Tesla to create news that creates a price spike so they can pull a few easy bucks from the market, and if that is what they want, they have no sympathy from me.�

1/1/2015

guest You can also follow Jason Calcanis who is customer Sig #1 and a prolific Tweeter - @Jason�

1/1/2015

guest I'm already a follower �

�

1/1/2015

guest Accounting is mumbo jumbo to me

In the comment section of the latest JP rant, there's this financial discussion, which I don't understand:

To start:

JP responds:

then:

JP responds:

For starters, I don't know where the $123M in working capital figure comes from. The last quarterly shareholder letter says Tesla has $387 million in cash resources. This reflects $283 million in total cash on hand, including our DoE dedicated account, and the additional $104 million we had left to draw on our loan facility with the Department of Energy (DoE). and most importantly:

Can any of you accountants out there explain this to me?�

1/1/2015

guest Actually so far Musk is all about following through and doing what he claims, both with Tesla and Space X.�

1/1/2015

guest Not an account, but what they are apparently trying to do in that pseudo-conversation, is to create the impression that Tesla is financing itself with reservation payments. �

�

1/1/2015

guest Re journalists: any publication that seriously wants to review the Model S in depth could contract with one of the customers receiving his or her car on 6/22. That would be a nice scoop for the magazine that could pull this off.�

1/1/2015

guest Does any of that include the Toyota deal, the Mercedes deal, the CARB credits or the Solar City backup device (whatever $ that means)?

ETA

And what about merchandise? And the aftermarket Roadster bits? And the money they wil make as owners damage their Model S'.

And Roadsters are going off warranties so those will be more income for the repairs.

Any other revenue stream I'm missing?�

1/1/2015

guest Are the Founders Series allowed to do that?�

1/1/2015

guest I could be wrong, but the issue is short term - since the $40K deposit money is already "counted", when the cars are actually made the delta money Tesla gets, accounting-wise ($60K), is less than what it costs Tesla to build the car (75% of $100K). Which is why JP says: "Come the end of June working capital and stockholders equity will both be under $100 million and the auditors will almost certainly force a *going concern* disclosure in the next Form 10-Q."

That would certainly spook investors and cause a big drop in the stock price. Tesla says they have enough liquidity - who's right and can someone explain it to me like I'm a 5 year old?�

1/1/2015

guest The JP situation described above is largely nonsense, but it's way too late at night for me to type it all out. If no-one else explains it I promise to put in a longer post tomorrow.�

1/1/2015

guest Agreed, I've heard it asked/answered that reservation monies are not in accounts recievable (essentially) so it's not counted as revenue until non-refundable contract is signed and then the final balance when delivery is initiated.

Also, remember that TM still has monies to pull from their DOE account, which Elon stated they will utilize. I'm sure TM has double checked the math and law to know they have enough to support ramp, but I'll admit that it will be tight for at least one quarter (Q3) as TM will need to order supplies and continue hiring to support a huge ramp in Q4 but won't have deliveries of more than 2K cars. I'm far from an accountant but I'd imagine that TM works a deal with their suppliers to defer payment for this tight period with the understanding that their "conversion rate" of reservation holders to non-refundable and final deliveries is trending stable and very high.�

1/1/2015

guest Model X reservations�

1/1/2015

guest Carbon credits sales.�

1/1/2015

guest Tesla shwag sales.�

1/1/2015

guest I suppose two factors are relevant:

- the DOE loan has $104 million left to draw from

- after Q2, R&D costs, currently the main expense, will "decline substantially"�

1/1/2015

guest Well there is that little factor we never discuss. The fact that electric cars eliminate war. Which is expensive, costing us more than 50% of our taxes, overall.�

1/1/2015

guest I'm sorry but people will still find things to fight over even if every car is electric. They were fighting long before there was oil discovered.�

1/1/2015

guest I agree with this, but with no oil to fight over there will be fewer lobbyists--only the defense contractors and the military.�

1/1/2015

guest We'll fight for water.�

1/1/2015

guest I do agree that human nature is what it is - but we have a disturbing situation with oil in that we are beholden to region that fundamentally disagrees with our value system and way of life. We value individual freedom/choice and they value a specific interpretation of godliness. If we did not need oil, we would not be funding jihadist - I think wars would be reduced in scope for a generation.�

1/1/2015

guest As long as humans are greedy, politicians will promote war so that we can take other people's stuff. Water is indeed a scarce resource that we are presently squandering at an alarming rate. Golf courses in Arizona??? Give me a break! Canada has a lot of water, and plenty of very powerful interests here in the U.S. want it. I'm already against that war.

A 100% conversion from stinkers to EVs would still leave us demanding oil for other uses, and is decades away. And does not help Tesla's short-term cash flow.

I'm not an accountant, but the business of Tesla's accounting of the reservation money sounds to me like b.s. from the FUDsters. I'm sure the reservation money is properly accounted for as a liability, and that liability is drawn down as cars are delivered. Since Elon Musk does not strike me as the kind of businessman who would cook the books and lie about the company's financial position, I believe him when he says that Tesla has enough cash to get through early production and into profitability. Of course, the anti-Tesla FUDsters, just like anti-evolution fundamentalists and climate-change denialists, will always manufacture arguments; and the clever ones can manufacture dishonest arguments faster than they can be countered. The FUDsters have an advantage in the debate because they can say whatever they like. Honest people, like the scientists in the evolution and climate-change debates, have to use and document actual facts, which takes longer. Dishonest debaters can be impossible to keep up with.

I'm not worried about Tesla's liquidity. But as I've already said, I don't expect TSLA to move significantly for some time yet.�

1/1/2015

guest Thanks, NigelM, I look forward to it.�

1/1/2015

guest So true! The FUDsters also manage to sway people's opinions by preying on their emotions while suppressing their ability to analyze and think logically. And, sometimes, unfortunately, logic and raw numbers are too much for some folks (I recall an interesting article from the healthcare debate days: BBC News - Why do people vote against their own interests?)

Oh, water wars are a given; it's just that, so far, they've been confined to the developing world.

How about Lithium Wars when EVs are everywhere?! The defense industry might already be exploring how to work Bolivia etc. into the mix...�

1/1/2015

guest OK here goes; I have a background in large corporate management and leveraged financing but I'm going to keep this is as simple as possible (and apologies to anyone who thinks this is too simplistic)....

These are the Generally Accepted Accounting Principles (GAAP):

1. Revenue is the top line of your P&L and you subtract your costs until you have a net profit or loss.

2. Any business can easily sustain repeated paper losses so long as cash flow is sufficient to keep paying the bills. Sources of cash flow are many and include loans, deferring payment of expenses, cash from sales of course, and nice people who put down deposits against future purchases.

3. Deposits are not revenue as long as they are fully refundable. The company receiving the deposit hasn't provided any goods or services and has a liability to return the money if requested. However, as an interest free loan it is a nice additional source of cash flow.

Now in Tesla's case:

1. Q1 net loss of $79million (some of which may have been depreciation, taxes etc.), could simplistically be taken as Tesla burning through that much cash. Well, that's also not unusual in a company investing heavily in R&D (ever looked at Bio-Tech stocks?) as well as capital investments and short-term costs resulting from factory preparation.

2. However, Tesla finished the quarter with $387m cash available. So even if nothing changed and they didn't sell any Model S's they could carry on at the same rate for another 15 months or so. However, the R&D costs will decline significantly and the factory prep costs will fade; so even if the rate of Model S sales would be very slow and overheads weren't being amortized Tesla has enough cash to keep the business going for probably a couple of years.

3. Tesla does have a good deposit book and contracts for drive trains and other components as well as other sources of revenue, so suggesting that cash flow might be an issue is plain nonsense. It would be an issue if deposits were being reduced but revenue was not coming in.

The deposit scenario:

1. Tesla has $40k of my money as a deposit on a Model S. I now signed an MVPA for $100k and $10k of my money is now non-refundable. Tesla can take that $10k, book it as revenue and reduce the balance sheet liabilities (note that's important later on!).

2. Tesla delivers my car for $100k (minus the $10 already paid) and I pay them $60k plus the remaining $30k of my deposit. They can book the $90k as revenue and reduce their balance sheet liabilities by a further $30k.

3. Do this enough times and the P&L suddenly starts to look much healthier, losses are reduced. Do it on a ramped up scenario and they'll start to show profits.

Now how about those statements from JP and friends:

OK, thats fair enough. But then he says:

That's twisting things pretty ridiculously. Yes, they will book $100k in revenue, but they are receiving an additional $60k in cash flow. JP suggests that Tesla only gets $60k towards the $75k cost of building the car but the reality is that the cost of the car includes fixed and variable overheads and Tesla has already used some of the $40k deposit to cover those costs. In P&L terms they are receiving $100k for the car and not $60k. Does it crimp cash flow? No because they have received an additional $60k! Depending on how Tesla actually accounts for all their overheads and fixed costs (this is where I don't want to get into too much irrelevant detail) they might end up reducing their currently available cash pile of $387m, but it's worth noting that holding too much cash is poor financial management, you really want to use it (invest in future business), pay down debt (give it back to DoE) or give it back to shareholders (dividends or stock re-purchases).

Then JP's sparring partner weighs in:

Nonsense. Losses to date were driven by R&D...in other words a substantial amount of one-offs. Here's the note from Tesla's Q1 shareholder letter:

A good point to note is that if Tesla continues such a high rate of R&D costs then they deserve to get beaten up; but you can read for yourself that many of the costs were incurred one-time. The post goes on:

Common sense says that if Tesla has $387 in cash at the end of Q1 and $113.3m in reservation deposits it's not actually possible that all of Tesla's working capital comes from reservation holders. Also, if your customers were giving you $100m as in interest-free loan wouldn't you use it as working capital? That's just smart business and Tesla has stated that they use deposits for working capital. That said, in reality it doesn't matter a fig where the working capital comes from so long as Tesla has liquidity. In their spring 2012 investor presentation Tesla showed $493m of total liquidity.

You'd imagine that a reputable, financially savvy writer (journalist?) would correct those 2 pieces of nonsense that were posted in response to his article, right? Wrong:

At the end of Q1 Tesla Total Stockholders Equity was $154.8m; Q2 will probably not be pretty but JP ignores that costs will come down (see above on R&D and factory prep costs) and that as reservation payments become converted to revenue then liabilities will be reduced (remember back earlier in this post?), thereby improving the balance sheet. I very much doubt that Stockholders Equity will fall below $100m (as if it actually mattered BTW). Tesla had an end Q1 working capital of $123.2m but also noted in their Form 10-Q in May that:

So does anyone other than JP care that working capital might fall below $100m? Tesla has plenty of room to play before anything gets critical.

Finally, JP's "going concern" comment is really scaremongering. Sure auditors must look at this especially in a company with heavy investment costs based on future revenue; but Tesla has enough cash in hand even if losses continued unabated for 12 months, and they have plenty of liquidity moving forward, plus they have a reservation list of some 11,000 people waiting to buy their cars as well as future contracts with Toyota and Mercedes. The only disclosures or risk warnings necessary will be those that are already in the public domain.

In short, Tesla has plenty of cash and liquidity even if losses continued at prior levels (which they shouldn't), they have a great potential income stream, and they have so much cash in hand it's not surprising it's been floated that they could start early repayment of the DoE loans. Is there risk in here? You bet, it's been heavy upfront investment and there are all sorts of things that could go wrong. Q2 might not be pretty, but just wait for Q3 and I suspect we'll all be smiling.�

1/1/2015

guest Wow! Thank you, Nigel. That was helpful.�

1/1/2015

guest You, or someone, should post that to Petersen's blog as a response, or post it as an insta blog.�

1/1/2015

guest Yea, ditto. That was truly fantastic. I read every single word.�

1/1/2015

guest Thanks, but I don't think JP cares. He should have corrected the misconceptions instead of encouraging them and I have no need to get into an argument with someone who won't listen anyway. Time will prove him wrong and it's easier on my keyboard.�

1/1/2015

guest Toyota and Mercedes drive trains.�

1/1/2015

guest Yes, answered and returned via this # 412.668.4050

When you call petersen's European phone #�

1/1/2015

guest First - thanks so much! I've read it twice now and still haven't groked it all, but I'll give it another shot later. Funny how I can skim hundreds of lines of Java or Objective-C code and find/fix bugs, but reading less than 50 lines of accounting description makes my head spin. Second time through, I was proud of figuring out what "top line" meant!

To be fair, the Spring presentation was quoting liquidity as of Dec 31, 2011, so they burned through $106million during Q1 of 2012. I think that's why you said Tesla could go another 4 quarters and still have liquidity - and that's under the false assumption that assembly line ramp up costs don't decrease, which they surely will.

In thinking about what you wrote, I think we may have an explanation for the lackluster stock price given all the good news. You said that Q2 won't be pretty, so perhaps when Q2 financials are announced the stock may present another buying opportunity - that is unless the news surrounding the cars having been produced doesn't overwhelm it.

Thanks again.�

1/1/2015

guest Hey, you could show me computer code and you might as well be asking me to read Greek! My takeaway is that JP is not lying but he is effectively encouraging misunderstandings when his resume suggests he should know better; he's not stupid so one can conclude that he's following some ulterior motive.

Without going into detail you are correct in principle. The only caveat is that changes in liquidity are not purely related to "burning" through cash on one-time expenses. I would have expected to see liquidity hit by things like component purchases for products not on sale yet as well as for investments in tooling, apart from pure variable expenses.

Maybe. Share price is a reflection of how a company has performed, but also an indication of the perceived risk going forward. I suspect the top line won't look good, but if costs are down and Tesla can point to Model S deliveries starting problem-free then we could also see a spike. IMO this remains a volatile stock not for the faint-hearted. (P.S. I'm not a financial adviser! Buy or sell shares at your own risk.)

You're welcome.�

1/1/2015

guest Thanks, Nigel!�

1/1/2015

guest Can you explain what you mean?�

1/1/2015

guest Thanks, Nigel, for commenting on the various aspects of these questions! (Though you left me curious about the more complicated part...)�

1/1/2015

guest Many Thanks Nigel. So many smart people here to bask in.

R&D on the X with it's all wheel drive and the all new platform for the BlueGenlllstar may still be large.�

1/1/2015

guest R&D included the cost to build up manufacturing. The Model X will be built on the same line, which is already prepared for Model X, so remaining costs will be much lower (in 2013). Gen3 however is a different story, but even further in the future.�

1/1/2015

guest R&D costs also include component testing for everything from wear and tear to artificial aging, and potentially multiple cycles. How many components are there on a Model S? Powered seats...there's probably a hundred or more there alone. Crash tests, Beta's, you name it, many of those costs would have been in Q1 and many will carry over to Q2.

Agree with Norbert's comment above.�

1/1/2015

guest NigelM, thanks so much for you insights.

One thing that might be worthwhile here is to take a look at the recent Morgan Stanley research note. Like many stock research firms do, they have developed a model of the Tesla balance sheet for the current fiscal year. Theirs show R&D actually going up in Q2 (they estimate $82M in Q2), before going down in Q3 ($45M estimate) and down more in Q4 ($35M estimate).

So when you say Q2 won't be pretty, in terms of the balance sheet that is probably true. Morgan Stanley's estimate is a net loss of $113M, which may or may not cause a little dip in the stock price.

Most analyst firms maintain a price target for the stock in the range of $42-45, so that is my expectation for the stock price by year end.

Morgan Stanley's Model S unit forecast for this year is very conservative (3000 versus Tesla's guidance of 5000). So stock price could go higher if Tesla produces 5000 cars as they said they will, and there are no quality issues.�

1/1/2015

guest I agree. My personal view is that the Q2 balance sheet is largely irrelevant unless there's an earth shattering catastrophe. Leading indicators are far more important and that means three things in the short term:

1. Rate of Model S production

2. Incidence of problems (or not) with the Model S

3. Growth of the Mercedes powertrain supply deal

Don't forget that Q2 results probably won't be released until probably the second week in August; there's plenty of time for news to develop around the Model S deliveries before then.�

1/1/2015

guest Likewise. And Nigel, I hadn't been worried by JP's ranting anyway, but it's great to have someone who knows clarify the situation.�

1/1/2015

guest Somewhere I asked what the time frame is for these sorts of targets, and someone said 12 to 18 months. I think it's more realistic to expect the 42 to 45 price to be reached around the middle to end of 2013 than by the end of this year, though it's certainly possible, given the volatility, that it'll jump up sooner.�

1/1/2015

guest In the event that a squeeze could happen, I just put in a 30-day limit order to sell a portion at a ridiculously high price. I'm long TSLA, but I'd like to take advantage of a squeeze, if/when it happens.

(Please do not base any of your investment decisions on what I do ... that would be laughable. Seriously.)�

1/1/2015

guest Pray tell what that ridiculously high price might be?! I won't hold you responsible for any subsequent gains that we would have missed out on �

�

1/1/2015

guest $55 In my wildest squeeze scenario. Otherwise, I'll just stay long, tyvm. (I currently hold 3000 shares, this order is only for a portion.)

Again. Laughable (yes, I see some of you doubled over) to base your investment decisions on my actions.

�

1/1/2015

guest Anyone know the odds of a Model S recall are?

They seem to be quite common but the press will make a big deal about it if it happens the the Model S.

There was a tiny recall of the Roadster that tried to take off but never sprouted wings.�

1/1/2015

guest If that happens, I'll buy more. I can't resist a good sale. �

�

1/1/2015

guest How many shoes do you own?�

1/1/2015

guest Yeah. See? That's a problem.�

1/1/2015

guest New technology = high risk (mitigated by Roadster experience?)

Limited cars on the road (initially) = Easy to handle with Rangers and/or firmware updates

I'll be amazed if there's zero problems, but I would bet against a major recall.�

1/1/2015

guest I am hoping for some decent press and maybe an associated upgrade or two will trigger the short squeeze in the next two weeks. I would see the "sell" recommendations moving to "hold" while the dust settles. Might even get some brave analysts actually upgrade to "buy".�

1/1/2015

guest Maybe I should do the same. We had $40 without delivery, so $55 with delivery wouldn't shock me. Well, within 30 days might shock me simply because they won't have shipped much yet within 30 days.�

1/1/2015

guest I've been thinking the same thing Bonnie, but I have no idea what a possible spike value would be. Then I'd want to repurchase when the prices drops to a more reasonable value again.�

1/1/2015

guest

A squeeze in 30 days seems a bit soon. I think the squeeze will come when there is a confirmation of a good sales trend, end of summer maybe.�

1/1/2015

guest I agree - but it's possible. There have been a few unpredicted movements with this stock. Since I'm traveling a bit over the next month, I wanted to make sure *just in case*.�

1/1/2015

guest Meanwhile so many might be ready for a short squeeze, that the smallest spike might cause immediate counteractions (and maybe even cause a dip). Some Tesla skeptics who say what they think, used to claim that Tesla wouldn't be able to get production ready, now claim that there'd be problems finding new demand after the 10k reservations.�

1/1/2015

guest That should be a banner warning over this entire thread: Do not base investment decisions on what any of us are doing.

Wow. That makes my 200 seem piddling. I'm not going to follow your example, mainly because if I did sell any shares at 55 it would probably just go up from there. OTOH, just in case it takes another big dip, I've got an order in to buy another 50 if it hits $25.�

1/1/2015

guest Has anyone bought option contracts "just in case". I am long on 40 contracts for the summer - just in case...�

1/1/2015

guest Morgan Stanley's time frame for price target is 12 to 18 months. They infamously cut their price target to $44 from $70 on December 8, 2011 and the stock dropped 37% that day.

They raised it by one dollar to $45 on May 9th, few weeks ago, but does that mean the time frame moved out another 6 months?

If so, then you're right, it would be mid- to late 2013 to reach $45 but I don't think I can wait that long. I need to sell to pay for my Model S, unfortunately.�

1/1/2015

guest If you're preparing for that scenario, I suppose you should be equally prepared for the opposite scenario and put in a stop order to limit your losses. What if the stock plunges to $10 / share due to some unforeseen events? May seem unlikely to a lot of us folks, but it could happen. I don't know what your basis is, but you're sitting on about $90k worth of TSLA stock now. Would be unfortunate to see that lose $60k in value, or roughly the cost of a Model S.�

1/1/2015

guest I always have stop loss orders in place. Good advice for all.�

1/1/2015

guest The Q4 balance sheet is probably going to be the opposite of Q2... with everything between Q2 and Q4 being rather independent of any misinterpretations of Q2.�

1/1/2015

guest We may have a good week ahead for TSLA if the overall market stays Greek...er....green!�

1/1/2015

guest Q4 balance sheet will be a snapshot of how the entire year ends. Actually there is really no Q4 balance sheet, there will only be a 2012 balance sheet. Full year results will include H1 so will also reflect that performance.

If you mean that Q4 results could be the opposite of Q2 results, I agree.�

1/1/2015

guest Somewhere in this thread someone was explaining about options. WARNING: I could have the following all messed up: I think he was selling puts, with the notion that if the price dropped to X he'd want to buy shares. If the price fell, he'd get his shares at the price he wanted. If it didn't, he'd make a few bucks on the contract. I followed options prices for a bit, and did some research, and learned that it was all far too complicated for me. And the contracts are all in blocks of 100 shares, more than I wanted to mess with at a time (I own 200 altogether). And the brokerages won't even allow you to trade in options unless you convince them that you know what you're doing, which told me that they're probably even more complicated than I realized. I got my broker to send me a booklet about options. One glance was all it took to convince me that it was not for me. The person who was talking about them made it seem as though if you knew you wanted to buy shares at X price, you almost couldn't lose selling puts. But that just seemed too simplistic and I don't trust it.

I understand buying, selling, and limit orders. I'll stick with that.

But then, I'm not really a trader. I mostly own mutual funds, and except for occasional adjustments I just sit on what I have.

I really don't know anything about this, but my gut guess is that any time they state a target price, it's for the same 12 to 18 months out.

I know there are folks who bought shares of Tesla back when they put in their Model S reservation, intending to sell those shares (ideally for a profit, hoping for a big profit) to pay for the car. I presume the theory was that once the car was in production, the share price would shoot up. But this is essentially a medium-term speculation with a pre-determined must-sell time frame, in a very volatile stock. My own philosophy is that stocks and stock funds (in my case almost entirely funds) are long-term investments with no pre-determined sell time, and bond funds are for shorter-term money. When the market is good (if that ever happens again) I can move money, if needed, from stocks to bonds, to be converted to cash when needed. The volatile nature of stocks, and especially of TSLA, means there is significant risk that it will be down at the moment you must sell shares to buy the car. I wish everyone the best, but I would not have chosen that strategy.

I can certainly understand that advice for someone sitting on $90K worth of shares. With my piddling 200 shares, if it goes down I'll take my loss (I've lost far more on other bad investments, though I'm quite comfortable overall). Then I'll assess whether I think it's down due to a real likelihood of collapse, or because of market issues or unfounded public mistrust, and if it's the latter, at $10 I'd buy another 500 shares.�

1/1/2015

guest + 3% this morning - hopefully the start of a very good week. When do we officially hit short squeeze territory?�

1/1/2015

guest Should have bought some extra shares last week ... But besides that I'm glad it is going up again.�

1/1/2015

guest Cramer remains bearish today...that's why the stock went up.....:biggrin:�

1/1/2015

guest Not yet - I don't think. I've attached a diagram of a recent short squeeze that occured for sears holdings, Jan-Mar 2012.

@MileErlic�

1/1/2015

guest Cramer has always hated TSLA, but from his comments on the company I have a hard time believing that he has much work on it. I remember watching the day he said not to buy into the IPO. Glad I had done enough work on the company to disagree with him.

I think he will come around. He loves Apple and loves companies that build stuff in America. I think a visit to Fremont would change his mind, not sure how to get him there though.�

1/1/2015

guest  �

�

1/1/2015

guest Don't look now, but we've broken above the 50-day and 200-day moving averages in one fell swoop. I think this move, coupled with our proximity to the Model S launch, means the sale on TSLA is now over. Hope you got your fill.

Now to figure out where to start raising cash again for the next sale. Gut says to hold on until $40 before selling anything, but that is a long way from here. Need to do some analysis.�

1/1/2015

guest Large volume action is the criteria for a short squeeze. That said, price will usually lead volume - it's the rise in price that causes short sellers to "cover" (which simply means buying stock). The squeeze happens when more people want/need to cover than are willing to sell the stock. Supply and demand in brutal action.

Here's what I thought a pretty good article on Short Squeezes that helps you understand why people short stocks, and why and when they bail: PROFITING FROM THE �SHORT SQUEEZE�

A reasonable place to watch TSLA short action is: http://shortsqueeze.com/?symbol=tsla&submit=Short+Quote%99. To get more details requires spending $30/month, but even the free summary information is useful. Short interest has increased almost 4% in the last half month, but trading volume has increased more, reducing the "Days To Cover" number to 18.5 (I think it was mid 20's before).

Unlike Puts and Calls, shorts don't have a predetermined life span. If they borrowed to short the stock then they're paying some interest, but that's pretty minor.�

1/1/2015

guest Would be interested in results of your analysis. Thanks !�

1/1/2015

guest Yes, I meant the results.�

1/1/2015

guest �

1/1/2015

guest

There Here! Portland, Oregon�

1/1/2015

guest Hey! I"m here. Well, Beaverton. But here.�

1/1/2015

guest Welcome!!

MikeB -

Any ideas about the story of the trailer? Does it have something to do with the Washington Square store?�

1/1/2015

guest The episode of The Daily Show with Jon Stewart where he tore Cramer apart is a classic. Showed him for what he really is which appears to me mostly show and little substance. He was recommending, like many others I guess, companies that went under in 2008 even right before they went under.�

Không có nhận xét nào:

Đăng nhận xét