1/1/2015

guest Shorts are pulling out.

Tesla Motors, Inc. (TSLA) Short Interest - NASDAQ.com

There are no sellers�

1/1/2015

guest this exactly�

1/1/2015

guest Koolaid, a few thoughts,

1. I've heard Elon say a couple of times in the past month (probably on earnings call), that they see sales being split fairly evenly between U.S., EU, and Asia. of course, you have to factor in how long for E.U. and Asia to catch up. I imagine E.U. catch up within a couple of years.

2. Your bullish case. as another poster put it, and you seem to agree, yes big volumes very possible ahead, but it will take more time than 2015. part of this is just human nature. it's hard to predict how quickly people will drop pre-conceived notions and switch to electric. it's hard to predict how widespread the bias against electric cars is. Gen3 will have the advantage of 3 or 4 years of Model S basically chipping away at bias, and wowing people. part of taking time to ramp up is simply logistics of production and sound business practices... Tesla has to somewhat temper their agressiveness so as not to overreach demand and have debt issues.

3. analyst's numbers not even close to your koolaid numbers... far more conservative. I saw this with another growth stock I had, and a fellow investor helped me out with this. imagine you work at say Morgan Stanley and Tesla is a company you cover. you have a $50 price target and a strong buy. if the company succeeds you were a Tesla bull, and you've done you're job well. if they succeed well beyond the numbers you modelled you were still a bull and had the right call on the stock. now, if you put in numbers for Tesla like drinkerofkoolaid, and talked about the stock being at $300 by 2020, you are a bull, and an outlier from all the other analysts. you've put your neck out. if Tesla fails, or succeeds but not to the extreme you've called... well, not good for your career. hope that makes sense.

I take from this that though it can be frustrating that "the pros don't get my company" this very distortion is exactly where we get an opportunity like buying Tesla at these prices. an opportunity from doing our own look at the company and having some courage to believe our own analysis where others are conservative.�

1/1/2015

guest Just in case Koolaid's fire does not burn hot enough here is more coal.

Will Tesla Disrupt? - Seeking Alpha

I realize how messed up the above sentence is...�

1/1/2015

guest Maybe all the above and they watched the National Geographic show on Tesla.�

1/1/2015

guest The interesting wild card is the super charge network.

Elon mentioned Tesla has plan to have the USA covered by the end of 2014. I have a hard time believing this wont create tremendous brand awareness. Most people have no idea Tesla exists or still view it as a company that only produces a 120k Roadster.

Motor Trend will change this for those in the know. However, I suspect word of mouth advertising combined with curious people posting pics, combined with the steam of reviews and a probable second motor trend car of the year award for the Model X will cause a massive shift in public perception. I think 200 per day in USA by the end of 2013 is very achievable based on the normal distribution of reservations across the USA. Currently Europe is primarily just clusters, with a few outliers. Part of this is financial incentives that make the Model S a terrific valid for a car in its league, the other part is an absence of any real brand awareness aside from those in the know. Deliveries in Europe are about 6 months behind the USA from what I heard in the stores I visited. This was a while ago, so it may no longer be true. The majority of stores I saw had no promotional material, and did not have a beta model or power train.

My suspicion is that once people begin to realize they can own a 50-70k car that has performance well beyond its price category, reservations will begin to flood in, especially once insurance companies and banks get with the picture. I read somewhere on here that insurance rates for the Model S are much higher then they should be due to the car being brand new. Is this true?

I doubt widespread EV adoption will happen soon, due to technology lag, among other problems ( i.e Public percrptikn/ comfort with EVs, Range Anxiety, Oil interests?)

However, I see no reason Tesla won't have a huge lead in market share in the immediate future. They are easily 3-4 years ahead of the competition and have many advantages. While 500k cars may sound like a large number it really isn't. Globally it would be less then half of 1% of the global New car market.

Arguably, the total cost of ownership is amazingly low. Annual savings of 3-5k (8-10 years), combined with virtually no needed repairs, means you are getting a 50-100k car for half of what a comparable car price wise would be. Once people are comfortable with EVs, I have serious doubts they won't come to their senses

On an aside, BMW sold 332,501 5 Series in 2012. Just an observation

I don't know if EVs will account for more then 5% of cars sold globally by 2020. In the case of Tesla, I'm not sure if it matters.

If I wanted to make a funny observation. If Elon plans to retire to Mars in 12 years, I suspect he intends for all of his companies to be "Mature" or to be "Approaching Maturity" before then. 500k cars would be terrific, however, I suspect he his personal goal is higher

Only problem I can see happening is if the NADA lawsuits are found to have Merit :/ Any supply shortages would only be short term problems.�

1/1/2015

guest I recall calling for $42/share by the end of this fall at some point last year. Going to need a few more days like this to prove me right. Good thing when we say "fall" with regards to Tesla we really mean "early spring of the following year". :wink:�

1/1/2015

guest Looked like a breakout day then in the last hour it nose dived.�

1/1/2015

guest Hardly a nose dive... it still ended up over 3%, with higher volume. But still not enough for me to call the start of a short squeeze yet.�

1/1/2015

guest Smells of profit taking. Wouldn't surprise me if it retests 31. This stock is crazy volatile. Seems to me that if Elon announces anything "unexpected" in the next week, the shorts will have a big problem. I have doubts that anyone would sell and they would be unable to cover :/

i still say that short of something very unusual happening, the stock should re-test its highs. Today's rally was likely a result of short volume decreasing.

Any note worthy events happening in next week or two?�

1/1/2015

guest I know. It just took a nice long stroll upwards all day with no serious drops, then suddenly gave back 50% of it's gain.�

1/1/2015

guest Maybe the shorts got active again at $34... it'll take more until they really give up. But their end is near. �

�

1/1/2015

guest Looks like about 120k shares moved at $33.89 at 2:36pm. Wonder if that was a short baling out.�

1/1/2015

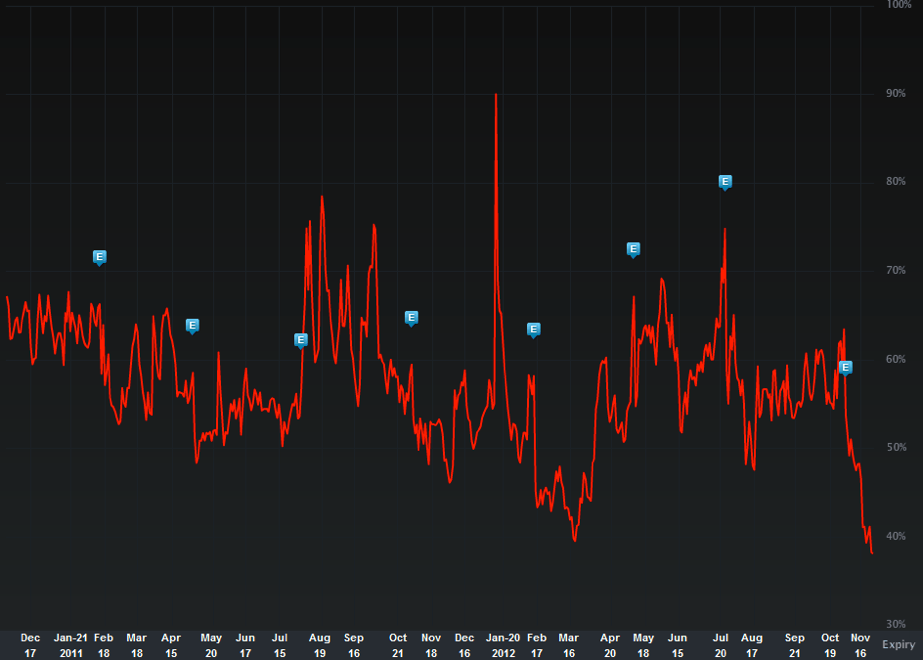

guest Looks like a lot of shorts bailed today. Interactive Charts�

1/1/2015

guest I guess the todays 5% spike hat something to do with the release of the Chevy Spark, lots of analyst must have overestimated the Spark and saw it a a part competition to Tesla sales but obv it not the case.

Chevy Spark guts revealed, we go eyes-on

And again they chosen the worst way to present a new car. Like they are doing it on purpose.�

1/1/2015

guest They've been trimming postions out since the model S started getting the avalanche of awards.

Today was very odd. Way too big a move for a no-news day, weirdly spaced volume, crushed in the afternoon, but did preform well at the close. That support trendline is now confirmed, the market tested it and then ran. I'm going to trim my postion into strength then add when it retests. Today caused quite a bit of daytrader twitter chatter.

The bid/ask was slightly bullish in After Hours. But we need some news to push much higher imo. Won't take much.�

1/1/2015

guest I don't think any serious analyst would expect the Spark to be a competitor to any of Tesla's products.

It's a sub-compact with sub-100 mile range that doesn't really present any sort of compelling reason to buy it. And, in the US, will only be available in California and Oregon for the foreseeable future.�

1/1/2015

guest News Today. Price Increase is now offical, base cost of model S to 59,900.

Let's see the markets reaction. Up in premarket, on no volume.�

1/1/2015

guest The really big news that should have the shorts running for cover: a lot of emails went out last night announcing that cars are ready for delivery. I got my notice (P1635), but more amazingly is that P3366 is going to pick up his car at a factory event this weekend. This completely resets my expectations as to how many cars Tesla will deliver in 2012, which is great news not only for us long-time reservation holders, but also for us shareholders. Cars out the door = revenue on the income statement & lots of free advertising as people start to see Model Ss in their neighborhoods.�

1/1/2015

guest I'd caution a bit as the P3366 delivery may be an outlier case for whatever reason. Also, they are still only delivering the 85kWh versions. There may be a good number 60kWh and 40kWh reservation numbers lower than P3366 (incl. myself) who will have to wait till Jan/Feb.

My prediction is that they deliver very close to the upper range of the 2500 - 3500 revised estimate for this year.�

1/1/2015

guest An annoucement stating or even just guiding to that number would be enough of a catalyst. Or something about reservation confrimations.

This price increase is going directly to their bottom line, so as long as demand isnt affect its a big postive. Helps get them out of negative gross margins lol.�

1/1/2015

guest Completely agree with mulder1231. I'm thrilled that so many people are getting their cars right now and happy for all of them, but I don't know that the current rate or deliveries or any 1 or 2 high numbers in that group necessarily changes the longterm outlook for most people. Trying to keep my expectations in check here.�

1/1/2015

guest Don't expect any announcements or any guidance. It's more than halfway through the quarter.�

1/1/2015

guest It's entirely possible that P3366 is part of the stored in inventory that built up while sigs were being delivered (besides those that were horribly delayed, and Canadian sigs). I expect that to make 3500 cars delivered by December 31, they will have to deliver what is already made quickly which may involve getting P3366 delivered now instead of trying to deliver cars in sequence of reservation.�

1/1/2015

guest The other interesting piece of news is that they're planning to send finalize emails to all the current reservation holders by the end of January. It's hard to say exactly what this means, but it certainly implies they're planning on increasing production beyond the 20000/yr (finalize emails are up to 9000 now, so thats an additional 5500 emails in the next two months for US deliveries only). Not sure, but since the stock dipped a bit this morning I increased my stake some. Tesla is confident as always, we'll see if they can deliver the volume now.�

1/1/2015

guest Just announced the price increases go into effect Jan 1. That is probably one of the reasons all the config e-mails are going out now.

New Tesla Model S Pricing Announced For Jan 1, Battery Pack Costs Too

- - - Updated - - -

New Blog too:

Blog | Enthusiasts | Tesla Motors�

1/1/2015

guest That and locking in $5,000 deposits (non-refundable after configuring) and setting up the production schedule to make all similar cars at the same time.�

1/1/2015

guest Rolled my December 30 Calls into January 35s. Same amount $ postion, but more then double the nominal amount of calls. Holding quite a few now (40).

Also, i'm on the bid for the Jan 14 15 strike puts @1.60. If anyone wants to sell me absurd expensive puts, get on it. You get like a 10% yied on cash or own tesla at 13.40. I just need it for margin purposes as I sell shorter dated puts.

Postion I rolled out of. Thanks Elon!

https://dl.dropbox.com/u/27431/Screen%20Shot%202012-11-29%20at%208.20.34%20AM.png�

1/1/2015

guest New Seeking Alpha Article.

Buy Tesla Motors For At Least 25% Upside - Seeking Alpha

Expect the comments to be rowdy, as usual.�

1/1/2015

guest Another one, from Nick Butcher: Tesla, Up to 11�

1/1/2015

guest Here is what Tesla said on facebook this afternoon

Charging North.... Canada, here they come!

I thinks this is the news�

1/1/2015

guest The real news (to me) is the battery pricing. Not in terms of today's stock price, but in general.

40kWh - $8,000

60kWh - $10,000

85kWh - $12,000

This is a critical announcement for a couple of reasons. First, Tesla is setting themselves up for huge losses if they aren't able to manufacture packs for that price and if demand for battery replacements turns out to be accelerated. Second, (and related) is that Tesla must believe they can manufacture battery packs at that price. They just announced that they will sell a 40kWh pack at $200/kWh and an 85kWh pack at ~$141/kWh. Even looking 8 years out, and even accounting for returns on the cash they get for this, that's still some serious gauntlet throwing right there.

By offering a pathway to a very high level of warranty coverage and service through 8 years, and very attractive battery replacement prices after the 8th year, Tesla is offering well defined, and relatively affordable, peace of mind for the life of the car. That should goose sales and boost service revenue as folks buy their way onto this hyper-extended warranty track. A lot of that revenue should turn out to be gravy that goes directly to Tesla's bottom line.�

1/1/2015

guest A TM detractor would be quick to point out that the offering of battery replacements could be a bit of desperation move. Essentially they are cash constrained right now and in order to address that they are willing to make a high risk bet that could bite them later. If too many people take this on and battery prices go up by very much then Tesla could be in trouble 8-9 years from now.

Of course, the other side of that is that if battery prices go up to much then Tesla is probably in trouble anyway so why not take the bet and collect the cash now when you need it.�

1/1/2015

guest I was also surprised at the affordability of the battery replacement options. However, I remember Elon Musk saying in an interview that even after 10 years that the battery packs have a decent value as recyclables (at least 10-20% of value). So, I'm guessing that Tesla is counting not only on the falling prices of the batteries but also on the ability to somehow recycle the old batteries (or at least battery materials).�

1/1/2015

guest You must know my mother. That would be her reaction. The first time I was invited to speak at a conference, her reaction was, 'My goodness, the company must be in a lot of trouble to be flying you all over the country to get sales!'.

Is there any way Tesla could offer a battery replacement option that wouldn't cause some to go negative?�

1/1/2015

guest Well, don't forget to factor in that Tesla gets to earn interest on that money for 8 years.�

1/1/2015

guest More importantly, with 8 year replacements, the life of the car is now the life of the owner!

- - - Updated - - -

It's a good point to make Steve, and those distractors will do just that.... Doesn't sound like a short term thinking company run by Elon Musk though, who runs another one targeting a Mars colony�

1/1/2015

guest Yes, this seems a very good price from the customer's point of view, even when considering inflation, recycling, and preference for near-term cash. I think it expresses an optimism about battery price development.

I haven't heard claims that battery prices might go up, not even from EV or TM detractors (except maybe JP). So while I'm sure the function of providing near-term cash plays a definite role, I'd see it simply as "optimistic".�

1/1/2015

guest I think so, they could offer a battery upgrade for the Roadster. That would show that battery replacements will be available in the future and give people a ball park cost. If their bet was wrong the liability would be limited as there are not that many Roadsters on the road. Right not the only "price" for a Roadster battery is $40,000 which does little to comfort those warry of electric drive.�

1/1/2015

guest Lithium price increase predictions:

http://lithiuminvestingnews.com/1727/lithium-prices/

http://www.newworldresource.com/s/AboutLithium.asp

So basically, when you go to sites that tout green energy, then everyone predicts falling prices. When you go to a site that advocates investing in lithium, everyone predicts rising prices. Shockingly everyone believes that whatever benefits them the most is going to come true. I really have a hard time finding a consensus.�

1/1/2015

guest Lithium is actually a very small portion of lithium batteries, so lithium price increases will have little impact on cell cost compared to all the other components.�

1/1/2015

guest

Never heard it put like that but yah, your right. Kinda hilarious actually. Someone will end up screwed�

1/1/2015

guest The portion by weight or volume is irrelevant to the discussion. All that matters is the portion of the total battery cost that lithium represents. But you raise a good point. I honestly don't know that. If you have any reference for it I'd be interested in seeing them.�

1/1/2015

guest About $3.50 per lb for lithium carbonate,http://www.newswire.ca/en/story/1016881/galaxy-notes-lithium-carbonate-price-rises-in-china max of about 1.3kg/kWh using ANL data http://evworld.com/article.cfm?storyid=1826 so 110kg or 243lbs for the 85kWh pack, $850.50 max of total pack costs, possibly half that.�

1/1/2015

guest You could have both battery price decrease, and Lithium price increase, at the same time.�

1/1/2015

guest There is a difference between lithium carbonate and lithium metal

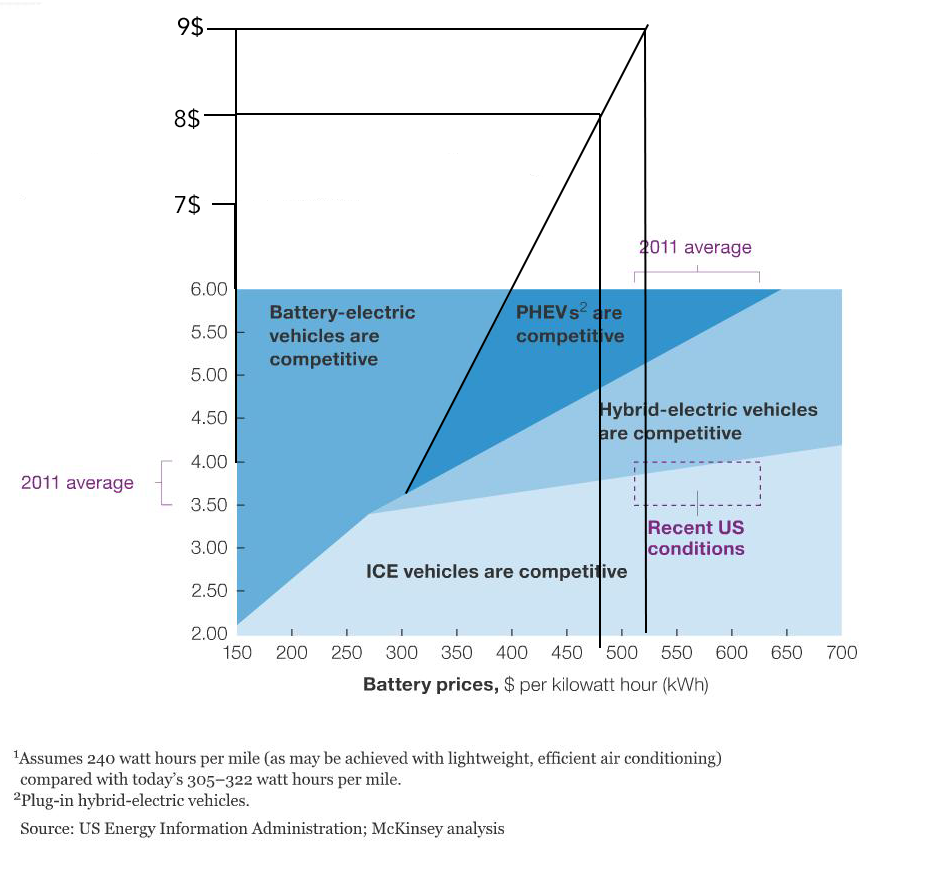

This is a very good study done by McKinsey

Battery technology charges ahead - McKinsey Quarterly - Energy, Resources, Materials - Electric Power

they predict the price dropping from 500$-700$/ kWh today to 200$ in 2020

here a good sum up in German so you don't have to register, try google translate

Preissturz bei Lithium-Ionen-Akkus bringt Bewegung in den Automobilmarkt - vdi-nachrichten.com

so to me it looks like Musk is doing a very good bet here�

1/1/2015

guest (sorry couldnt edit my post because it was not displayd)

In addition to my Post and the Lithium prices concerns mentioned by others here and the panic that lithium trader are trying to create.

Energy Citations Database (ECD) - Sponsored by OSTI

This is a study done in 1975 that show that (in worst case scenario) it is possible to extract Lithium from Seawater with a price of 11-15$/lb and the amount of available Lithium on earth is way beyond what we would ever need even If we would use the Batteries to store solar/wind power.

The really expensive part is to turn the Lithium carbonate to Lithium Metal and it seems that they will improve in that field.�

1/1/2015

guest Or...they might have an agreement with cell providers to deliver them for years to come with an established pricing structure.�

1/1/2015

guest battery pack replacement costs in today's announcement caught my eye too.

it's a bold move, with Tesla basically taking the risk on the progress of batteries themselves. great for consumers. the confidence of such action does not come as a surprise.

really appreciated the poster who pointed out Tesla is somewhat mitigating their risk by getting the value of the used battery.

another thought. even if it takes more than 8 years for battery prices to get low enough for them to breakeven or get ahead of these replacement costs, it still can be a net positive for Tesla. the shifting of risk from consumer to Tesla gets more people comfortable with the S. in many ways the S is the greatest promotional campaign in history. years of jaw dropping at other's S's promotes the Gen 3 middle income consumers will be able to buy in 3 or 4 years. even if 8, 9, 10 years out Tesla loses some money on battery replacements for cars sold today, by 2021, they may well be selling 10 to 15 Gen 3 cars for every model S they sell in 2013, thanks in part to the model S's that were sold in 2013 (the model S's promotion of Tesla, and the model S's providing cash to get Gen 3 rolling in the next few years). in other words, in 2021 or so, losing a few thousand dollars replacing a single model S battery balanced against 10 to 15 Gen 3's sold is not a bad deal for Tesla.�

1/1/2015

guest This does sound very Elon...

- - - Updated - - -

Prices can drop when demand reaches the point when more suppliers go online.

- - - Updated - - -

To that detractor I would say that Tesla did the same thing with the Roadster so there is precedence. Also that Elon has strongly hinted that he knows exactly where batteries will be in five years out and bumped up the BlueGenlllstar development based on that knowledge so the risk is of a price rise is small.�

1/1/2015

guest I know, that's why I used data for lithium carbonate, which is used in cells.�

1/1/2015

guest The thing I don't get is ... why do we expect the price of batteries to go down ... at all?

Based on the simple rule of supply and demand. When demand rises, prices rise.�

1/1/2015

guest Unless technology advances and volume production increases drive prices down while specifications improve, as with a lot of technology. Think computers, flat panels, cell phones, etc.�

1/1/2015

guest please read the MCKinsey report they put alot of effort in it and are explaining in detail why the prices will go down.

Battery technology charges ahead - McKinsey Quarterly - Energy, Resources, Materials - Electric Power

�

1/1/2015

guest I think someone is going to find a negative, regardless of how a battery replacement option is presented. BUT, I do feel Tesla should be very clear on their battery degradation estimates over time. You know the detractors will automatically say that the tesla battery will NEED to be replaced after 8 years because the original is "dead". Maybe, just maybe, that will help to at least minimize the "Oh whoa! wait! I'll HAVE to replace my battery because it will go dead!?" argument.�

1/1/2015

guest Great article. Here's a link to the full article w/o needing to register, Battery technology charges ahead Green Business Review .�

1/1/2015

guest I extendet the graph from the McKinsey report for the EU folks

for the ones that are skeptical, http://benzinpreis.de/international.phtml?kontinent=EU&s=2

site is in german but self explanatory, some countries have almost 10$/galon

I think the potential growth in this markets is underestimated so far.

And this graph doesn't count the full TCO advantages of EVs

�

�

1/1/2015

guest This drop is caused by

@DetailsR4Devils: $TSLA Negative report out now new short recommendation on valueInvestorsClub calling it a timely and compelling short. he did IOC, OCZ, SWSH

It could get bumpy. Guys respectable and generally right. Although I disagree and remain bullish�

1/1/2015

guest Like any technology product - they get better at making them. When I was a teenager LCD displays were these tiny (< 1") low-contrast monochrome things with horrible resolution and slow response. Over 30 years of continuous refinement in both materials and production technology and we now have huge yet relatively inexpensive flat screen color TVs with spectacular images. It's not ludicrously fast improvement like silicon chips have done, but slow steady improvement gets you there.�

1/1/2015

guest I'd like to know their reasoning on their new short recommendation. Anybody read the report?�

1/1/2015

guest Or think solar panels. (Or Ford Model T.)

I suppose from a market price perspective, this can more easily happen in situations where lower prices will create even more demand. Especially (but for example due to competition, not only) if the demand is likely to increase to a degree that this will increase the total profit (= profit_per_unit * volume).

- - - Updated - - -

And of course this requires a situation in which supply is not restricted by a finite amount of resources. (Which some claim Lithium is or will be, while most claim it will not be in any practical sense.)

- - - Updated - - -

It seems difficult to find a link to that report. Perhaps behind a pay-wall or so.

I'd guess a reason might be that the share price has gone up while gas prices in the US are currently going down (on average). I think there is an over-estimation of the short-term effects of possible gas price savings on the EV market, specifically on Tesla's market. Especially among those who are skeptic of electric cars becoming a valid market, but also even on this forum.�

1/1/2015

guest Here's my from earnings till now hourly chart. Looks pretty good here, but probably will see some downside early next week

https://dl.dropbox.com/u/27431/Screen%20Shot%202012-11-30%20at%2010.37.04%20PM.png�

1/1/2015

guest Wired some extra money to my broker, hoping for a dip on Monday or Tuesday �

�

1/1/2015

guest Heh, I wired my "extra money" to Tesla on Friday to pay for VIN P01536!

Back on the replacement battery pricing: it's great that Tesla is offering certainty, as it takes yet another argument out of play for the nay-sayers. But if you do the math, with even a modest decline (2%/year) in battery prices, this guarantee is at best a break-even proposition for customers, and it's a clear win for Tesla--which has a pretty high cost of funds these days. I am assuming that the remaining portion of each battery -- say, 70% after 8 years -- has good value as grid-scale power storage. We've already seen Tesla and SolarCity team up to create solar-powered UPSs, so that's a pretty obvious market for "resale" of old batteries. (An 85kWh battery should still have about 60kWh of useful storage after 8 years.)�

1/1/2015

guest It's at least a good maximum "worst-case" for those concerned the nay-sayers might be (partially) right. I think it is an even better insurance in case it can be cancelled for a refund (minus some fee).�

1/1/2015

guest Now this is looking like the start of a short squeeze. Volume up, trending up, on a down day. Hold on tight to those shares!�

1/1/2015

guest Bought some more at $33,90 and then it went down so tried to buy more (had another order at $33,50) but then it started to go upoh well, not a bad day so far!

�

1/1/2015

guest Just sold my Chevron and bought more TSLA. There seems to be some poetic justice in that. If you go strictly by the numbers, Tesla is NOT a buy right now. Schwab gives it an F investment rating, as they would if the stock was at $25. A lot of people avoided Apple for the same reason. The technicals weren't there. But if we had just opened our eyes and noticed that our children and all of their friends were carrying iPods, the message was clear: this is the future. The signal that it was time to buy Apple was when the iTunes store opened. That was the line that divided Apple's past from its future. With Tesla, this line could be the unveiling of the first Supercharger or the COTY award in Motor Trend. We'll recognize it more clearly in a few years. Sure, Tesla's stock will likely get kicked around some more, right up until the fundamentals catch up with the dream. TSLA is a long-term play, 5 years at least. This time, I'm not going to be one of those people who look back and say, "if only."�

1/1/2015

guest For those that care: I took some profits today at exactly $35. Only my first sale since the bottom, so plenty left to appreciate.

Remember how annoyed you were last time the stock was down and you had no cash to buy more shares? I know right now it feels like it's going straight to $250, but it won't. Believe me, I know it is hard, but now is the time to start raising the cash you'll need later.

Buy on the way down, sell on the way up...�

1/1/2015

guest I did the same.�

1/1/2015

guest @Citizen-T, you read my mind, I actually had a dream two nights ago it hit $170, but the dream was me looking at the past month of activity and it was off it's peak. You can almost never pick the peak, but you can take profit on the run up.

I sold a 1/3 of my shares just now.�

1/1/2015

guest Picked up a few more shares today.�

1/1/2015

guest in three months time, made a quick 7k after selling my shares at 34. not bad for a noob eh? intend on following the trend and buy under 30 again. although, it is just a matter of time til it peaks past 40 and until that day, i await with an avid hunger! rawr�

1/1/2015

guest Wow, looks like you really nailed it today.�

1/1/2015

guest Me too. I had a sell limit at $35.00 for 5% of my TSLA. After reading your post I checked my brokerage account and it says "Executed".

I hope it's shorted enough that it shoots way up so that I can take more profit and still buy back more shares than I have now.

Maybe we're some of those that kept TSLA from shooting up even more. But, I doubt my trivial amount had much to do with it.�

1/1/2015

guest Eh. I'm still in for the long run. Timing the market is nearly impossible. I thought about selling half today but said forget it. Not worth the stress�

1/1/2015

guest I agree, what's more likely to happen is, it gets away from you. You sell on the way up, great, now your waiting for it to "have a bad day" and drop to $29-$31 range, only problem, it might never happen... Hard to say. My shares are in my IRA account anyway, so just let them appreciate. The hardest part of investing is letting your profits multiply, but it's the only way to own a "100 bagger" �

�

1/1/2015

guest Something was announced at 2pm today regarding Auto Sales. Is the only explanation for the jump at that moment that I can find. Anyone notice anything unusual?�

1/1/2015

guest My TSLA is mostly in my IRA as well. I'm retired and over 71, so I had to sell some anyway. I'm just glad it happened with a profit rather than having to sell at a loss if I'd waited too long.�

1/1/2015

guest Sure, profit is always better than a loss. Good for you... I'm almost 53, can't start distributions until 59 1/2, I'm hoping TSLA is $75-100 by then and has already had one or more 2:1 splits by then. Essentially they will have paid for my Model S and beyond at that point.

�

1/1/2015

guest BTW, still no sign of Steph.

Bonnie, is he still spending all his time working in Canadian politics? IIRC, he's in Quebec.

- - - Updated - - -

Sigh. Once can hope and dream.�

1/1/2015

guest I'll let him know that his name came up. Not sure what he's up to right now.

�

1/1/2015

guest If you made $7K in 3 months that means your initial purchase was about 1,000 shares you bought in for $27,000. Not quite a "noob" by my definition... or this particular kind of "noob" comes with balls of steel.- I'm changing your name to Kick-Ass-Noob-Investor

�

1/1/2015

guest Another Great day. Perfect setup to test the high 30s later this month.

I picked up a few more jan 14 15 strike puts cause someone was on the ask at 1.55. Margin Purposes. Going to sell march 32 or 33 puts if we pullback.

Not sure how many people here have seen the Date/implied volitility relationship with tesla puts. It's very very easy to play since the longer dated put implied volatility is +50%.

Here's the curve.

https://dl.dropbox.com/u/27431/Screen%20Shot%202012-12-03%20at%206.08.54%20PM.png

If you have the margin, sell march puts and hedge profits with january puts. The march puts are going to decline in value even with no price movement bc of differences in implied volatility with given dates.

Doing Jan 14 / March 13 Makes a P&L like this. (value of sold put march, at current market price). Beautiful part about this trade is that it needs about 300 dollars of margin for 400 dollars of profit. With Tesla's support in the upper 20s, I'm confident. and It's repeatable in 3 months, and again, and again.

https://dl.dropbox.com/u/27431/Screen%20Shot%202012-12-03%20at%206.19.37%20PM.png�

1/1/2015

guest Dated Nov 28: Tesla Motors Pops as Volume hits Multi-Year Lows

With low volume, this certainly is NOT a short squeeze.�

1/1/2015

guest No but it could signal an impending one. People aren't willing to sell, others want to buy, price starts heading up.�

1/1/2015

guest Today's volume was significant�

1/1/2015

guest Yea, I was going to say today's volume was listed as 2x "average".�

1/1/2015

guest Yeah, I should have indicated the date of the article was last Thursday. I corrected the post.�

1/1/2015

guest I'm a noob investor and trying to understand your strategy. I understand the basics of put/call options. Basically buying a call option gives you the right to buy at the strike price on or before the expiration date, and buying a put options gives you the right to sell (short) the stock at the strike price on or before the expiration date (and make a profit by buying it back at a lower price) - but what do you mean by "I picked up a few more jan 14 15 strike puts cause someone was on the ask at 1.55."?? Does that mean you bought or sold the put option? Does that mean you 'bought' the put Jan `14 @ 15 strike price option, e.g. the right to sell the stock at a price of 15? At least that's the way I interpret it, but like I said I'm a bit of a noob when it comes to options and I don't really know option-speak very well. Did you mean something else or do you really think the stock is going to drop that low in the next few years to make a profit by selling the stock at a price of 15?�

1/1/2015

guest That's ok, I clearly know even less as I wasn't even sure if it was actually english.

�

1/1/2015

guest I wish Tesla would take the cash out of my account for the car I got on Saturday. I just want to use it for stock, seeing it sit there. I think people who are getting cars a little later and using some stock money are lucky to be waiting a bit. I think I sold 30% of what I had for my deposit and it has gone up a couple of dollars now.

Rock solid car

cant wait for the next gen or the one after that �

�

1/1/2015

guest K so after basic puts and calls, you gotta understand spreads. bull or bear and calendar.

This has simple examples of bull and bear spreads, for both calls and puts.

Verticals - Basic Option Spread - Hedging Strategies - Options Spread Trading

This has examples of bull and bear calendar spreads (i.e. postions at different time strikes)

Time Spreads Diagonals - Diagonal Spreads - Time Spreads - Option Spread Trading

What I'm doing is a long put time spread but the shorter dated put is not at the same price as the longer dated put, i will sell as tesla pulls back to support (mid 33s). This is a diagonal which can be read about at the bottom of the time spread explanation page.

"Using a diagonal spread, is simply another way to modify a bull vertical spread or bear vertical spread and for a trader to optimize his or her market objectives based on an analysis of implied volatility levels."

Thats essentially what I'm trying to do, because front month implied volatility for puts on tesla is dramatically lower then implied volatility for longer puts, I'm trying to capture this decay. So sell the March puts, buy them back in january/february when IV has decayed, sell august puts, buy back in march/april when they have decayed, sell july puts, buy back in june/july when they have decayed, etc. Should be able to do it able 3-4 times before Jan 14. The Jan 14 15 strike calls act as the hedge in all of these trades, reducing my margin to a much smaller amount then if I was doing naked puts.

Again, Here are the current IVs for puts of different strikes at different months.

https://dl.dropbox.com/u/27431/Screen%20Shot%202012-12-03%20at%2010.09.53%20PM.png

Whats key is difference in IVs. They are dramatic, which should not happen in a 'perfect market' because they are exploitable. This decay is also what makes Tesla incredibly expensive to short with puts.

Here are the current IVs for puts on SPY (sp500 ETF)

https://dl.dropbox.com/u/27431/Screen%20Shot%202012-12-03%20at%2010.11.39%20PM.png

Much less difference in month IV, a strategy like mine would not work here. There is no decay to capture.

Basically, this strategy will work incredibly well if Tesla trades in the 28-40 range for the year. It will work very well, but not as well, if tesla slowly declines to the mid 20s and establishes a trading range there. It will be slightly, but not significantly profitably if tesla skyrockets fast. If it tanks sub 20 within 2 months, complete loss on my set margin (Because I have to purchase tesla stock because the shorter dated puts are exercised) but the Jan 14 15 strike puts save me from loosing more $ then in my account.

Basically this postion is that Tesla's going to establish a range >40 and stick with it. If it goes <40 my naked call postion is soooo profitable. i'll be happy either way.�

1/1/2015

guest My plan exactly : just since 10 days now, my jan 13 calls are up just over 100% . Gets me a few "free" options on the car, and I am hoping the my June 13 call will pay for some more. I was holding 500 shares until early nov, but needed the cash to put more into ORT (another favorite of mine) and decided to keep some skin in the game with calls. I added Jan 14 calls today. Might have paid a bit much...

Agelson trades are too ballsy for me, but intriguing ...�

1/1/2015

guest The Jan 14 calls have so much premium you might as well just hold less stock. But call spreads work 35/45 Jan 14 spread has about a 1:2 risk/reward which is good.

Here's the P&L of a Jan 14 Call spread vs just a Jan 14 naked call, assuming about the same amount of capital risked (3.20 vs 3.90)

Spread: https://dl.dropbox.com/u/27431/Screen%20Shot%202012-12-03%20at%2010.32.20%20PM.png

Naked Call: https://dl.dropbox.com/u/27431/Screen%20Shot%202012-12-03%20at%2010.33.31%20PM.png

If you think its going to 100 just buy the calls. Otherwise, spreads cause IV is high.

- - - Updated - - -

Yah there should definitely be one more run (probably to 36) before a pullback if we close above 34.25 tomorrow.

30m

https://dl.dropbox.com/u/27431/Screen%20Shot%202012-12-03%20at%2010.53.16%20PM.png�

1/1/2015

guest Cash flow positive

Twitter / elonmusk: Am happy to report that Tesla ...

Sorry everyone who sold today. This is big. Gapworthy�

1/1/2015

guest Elon is the king of proclamations. Bet they were positive by less than a hundred dollars.. �

�

1/1/2015

guest They were wiating for your check, Eric. �

�

1/1/2015

guest I got out today too with my last bits of my TSLA play money. I've been selling when I get >10% positive, buying back in on the dips, will probably get back in when it dips under 32 again. (made 20-25% this year, only holding TSLA for about 6 months of it)�

1/1/2015

guest Welp, I don't suppose they will be sub-30 any time soon.

I wanted to purchase more. Good news either way I suppose.�

1/1/2015

guest Congratulations Tesla and Elon!

This should be a first (at least on this scale) for the business side of the electric car future. And the beginning of Tesla as a profitable company.�

1/1/2015

guest As long as it's on the plus side of zero �

�

1/1/2015

guest That's how it always starts ...�

1/1/2015

guest This is not purely TSLA related, but I received my "finalize email" tonight, and have finalized. The estimated delivery window is "February / March 2013". I only reserved on July 2nd, and my reservation # is P10010 so they seem to be really pumping up production... I am getting the 85KW, but non-performance. Just an FYI, I think they will make 20K deliveries in 2013 without any issue. Very happy with my long TSLA position as well, glad it's in my IRA, so I can leave it grow.�

1/1/2015

guest In this case, I am not sure that it matters if they are positive by $1 or $1,000,000, the fact of the matter is that being cash flow positive means that they have crossed "the valley of death". Things are looking up �

�

1/1/2015

guest That's fine with me. If my only problem is that the stock rockets higher and I only have 85% of the position I wanted, that's a high quality problem. I need more problems like that. Elon could have just as easily announced more delays today. Raising cash was the right move, I'd do it again.�

1/1/2015

guest Isn't it wierd that TSLA is down in premarket? I'm kind of sitting here hoping for the short squeeze that everybody is talking about to begin.�

1/1/2015

guest A watched short never squeezes :biggrin:�

1/1/2015

guest There desperate now. this came out premarket.

StreetInsider.com - Tesla (TSLA) Said to Be Under Federal Investigation for Buying Foreign Parts

of course, no mention of Elon's comment last night anywhere

It's going up today, once news gets around.�

1/1/2015

guest Funny how "ICE" is investigating them.�

1/1/2015

guest Right. That's big news.�

1/1/2015

guest

It's completely irrelevant, but its getting more attention on stock sites then the cashflow postive comments.

Twitter / StockTwits: $TSLA so far trading flat despite ...

I'm buying the crap out of this dip. On the bid for dec calls, variety of strikes.

EDIT: Most got filled on that dip. This is absurd. Now incredibly long Tesla, lets see how this goes.

Huge volume today so far�

1/1/2015

guest Here's an article about Elon's comment: Tesla Was Cash Flow Positive Last Week, CEO Musk Says - Businessweek�

1/1/2015

guest Here's the update from my broker.

10:04 AM EST, 12/04/2012 (MidnightTrader) -- Tesla Motors (TSLA) shares are down 1% following a report by the Washington Times claiming the company may be under investigation. According to an article in the paper, the U.S. Immigration and Customs Enforcement (ICE) is cracking down on Tesla for using foreign parts in the construction of its vehicles. Specifically, ICE wants to know whether or not Tesla was using its foreign trade zone status to bypass federal loan requirements that companies accepting funding must use domestically produced parts. In 2010, Tesla entered a $465 million loan with the U.S. Dept. of Energy.

Price: 34.28, Change: -0.34, Percent Change: -0.99

MidnightTrader - Stock News, Earnings Alerts, Pre-Market, After-Hours, Trading Ideas (C) 1999-2012 MidnightTrader, Inc. All rights reserved.�

1/1/2015

guest Two things that confuse me about that article. 1) Aren't almost 100% of the components in a Fisker produced abroad? I could swear the car is produced in Finland. 2) I did read somewhere that indeed Tesla does not qualify under NAFTA. I couldn't get a clear answer on why, however, I suspect it has to do with the battery being sourced from Panasonic. I asked someone at Tesla about it, and they basically said it didn't meet the technical minimum. I don't believe this was a secret? Where is the problem?

Another (article?) that seems very oddly written.

Elon Musk Says Tesla Has Stopped Burning Cash - Corporate Intelligence - WSJ

As an investor, I definitely agree that he should have issued a real press release instead of tweeting it. However, there is nothing wrong with him making the announcement that way (I think?), and frankly, it's been his style all along. Consistency is a good thing.

Part of me wishes that the media would "Report" on what is happening at Tesla, rather then "Make mention" of things that will satisfy what the public wants to hear.

What scares me is that the left leaning media are very pro Auto Unions, and the current status quo in the industry, partly because that's how their audience thinks. Until this perception changes, I don't think we will start seeing many newspapers giving much attention to Tesla, simply because it's not what people want to hear.

My bet is they are playing it safe in what they report, and are appealing to what they perceive as their base. Also, they don't want to call Tesla a winner until they report being "Profitable" to avoid being wrong. You're never wrong if you overgeneralize

Then again, a reporter is obviously never wrong, since even if the facts are incorrect to the point of being slanderous, they can simply say they had a bad source. Malicious intent is very difficult to prove. Sadly "Most" contemporary "Newspapers" are in the business of "Selling" news rather then "Reporting" facts

Even though being "Cash Flow Positive" is a monumental achievement, I don't think it will get much coverage. However, It's always possible that I am wrong.

Interestingly, as an investor who believes in Tesla, I am thrilled that people underestimate Tesla. It gives so much more upside for the stock once the shorts are "Proven" to be wrong

Only problem I see happening is if the ICE and NADA aren't found to have a valid case

If this happens, I will lose all faith in our legal system. Not only would a victory for the ICE be ironic, it would also be a terrible blow for free enterprise :/

I'm an independent pragmatist :/�

1/1/2015

guest Here's my analysis on the issue.

The paper is Washington times

The probe was started last year

DOE refuses to crack down on it.

GM also has foreign parts

The paper is not Washington Post nor WSJ nor Barron's.

There's a barrage of similar news in the usual channel pointing to the same article the pattern indicates it's paid by traders.

There is a market maker with a huge short on TSLA jan 35 options. This was expected. But waaaay too weak. I was expecting something bigger.

It worries me that Elon is commenting on cash flow during the quiet period. Anyone know if what he did was not against the rules?�

1/1/2015

guest Some blurbage from the article. In short, I'm not sure why it's even come up as it doesn't sound like Tesla's loan has any such limitations to investigate:

�

1/1/2015

guest Here's the buy American provision for the DOE. Which I think the article is trying to leverage to create fear. Because nothing like a government crackdown can create the amount of fear needed. notice how it says "applies only to Public works and infrastructures".

Buy American Provision

This Web page contains guidance for financial assistance recipients regarding Buy American Recovery Act provisions under projects funded by the American Recovery and Reinvestment Act of 2009 and administered by the Office of Energy Efficiency and Renewable Energy (EERE).The Buy American provision in the American Recovery and Reinvestment Act of 2009 (section 1605 of Title XVI), provides that, unless one of three listed exceptions applies (nonavailability, unreasonable cost, and inconsistent with the public interest), and a waiver is granted, none of the funds appropriated or otherwise made available by the Act may be used for a project for the construction, alteration, maintenance, or repair of a public building or public work unless all the iron, steel, and manufactured goods used are produced in the United States.Please check this page regularly, as the Office of Energy Efficiency and Renewable Energy will provide updates as further guidance is released.�

1/1/2015

guest I thought the "Quiet Period" was the 90 days after an IPO? Is there another definition for this phrase?�

1/1/2015

guest does not apply to the DOE loan and agree that it smells of desperation. I hope the DOE clears the air with a statement.�

Không có nhận xét nào:

Đăng nhận xét