1/1/2015

guest Oh absolutely I do believe they are different. But to a common investor, heck even professional, if you're financial interests are at heart shorting can very quickly turn into an emotional game where you want the company to fail so you can make money. There's just about as much short interest as you can get right now which tells me something about sentiment which can fuel hatred.�

1/1/2015

guest Yeah, Musk left out the DOE loan terms (eg, Debt/EBITDA ratio) that Tesla wouldn't be compliant with if they didn't raise money. He was wrong to do that, but I'm not going to speculate on what caused that omission. I think Ahuja has his hands full keeping Musk's comments appropriate, but I disagree with your accusations of hidden agendas, etc.

Tesla is working its collective butt off to be successful by producing the best product they can. Over at SeekingAlpha, our friend Petersen is moaning how Ford won't spend $100 to put a better battery in their start-stop vehicles because their bean counters told them it'd be cheaper to deal with those customers who complained about failures under warranty. That kind of not respecting your own product is the kind of thing I believe Tesla would never do.�

1/1/2015

guest Tesla is the best of its kind - without the Roadster we would presumably not see any Leafs, Volts and co. It really made people think "cool stuff, I give it a try as it seems to work". Without this company I do not see much hope moving the EVolution forward. Daimler e.g. is financially heavily depending on Abu Dabi.... if Sheik XYZ tells them to skip their EV ambitions (or even to not support Tesla any more) then they will do so. Big Oil has his network for sure, and they follow the market very close.

I am glad the product seem to be delivered in good quality state as this essential going further. I hope they can sort their supply chain issues as this is the only concern I have... once they can produce a decent number of cars per day (>35), (and I think they actually could if there was no supply-bottleneck) I guess we will see this company on track as well as a more stable stock (around 37$)

As it looks now it will be a bumpy ride in Q4 for TSLA

- - - Updated - - -

Could well be that Tesla needs the cash as well to get alternative supply or even manufacture the "critical 1%" itself as Elon stated several times that this was the hardest part to get..... so how complex can that 1% be? Could it be done in-house? Would be interesting to know which suppliers do not deliver.�

1/1/2015

guest I have. Many dealers of ICE cars are overtly hostile. They see EVs as a threat to their business model - sell car cheap and milk the maintenance.�

1/1/2015

guest Abu Dhabi -lol�

1/1/2015

guest Same here Doug...and, they're correct, it is a major threat to them...

�

1/1/2015

guest The DOE Loan Facility, as defined in the 09/25/12 prospectus, is popping up and being commented on in various articles. I decided to take a look at it and, not planning on going off topic (too much) in this thread, noted the following ...

The DOE holds 3,085,011 warrants exercisable at $7.54 and 5,100 exercisable at $8.94 per share. It strikes me that the DOE will work with TSLA to ensure these warrants have value. Considering the DOE loan was $465 million, the warrants have an intrinsic value of ~$63 million at $28.00 per share. The warrants vest and are exercisable in quarterly amounts from December 15, 2018 through December 14, 2022. The amount of warrants that vest each quarter depends on the average outstanding balance of the loan during the prior quarter.

What does this mean to the DOE and to TSLA?

My interpretation is that the DOE wants the loan to be repaid and then the warrants go away. Everyone is happy (see below). The loan has the highest probability of being repaid if sales of the Model S and subsequent models are robust. The DOE wants to see sales of electric vehicles increase across the U.S. and see the Fremont plant meet much of that demand. The DOE does not gain by creaking a shaky financial footing for TSLA as that could adversely affect (i.e., hurt) sales of the Model S and jeopardize the repayment of the loan.

The implications of the DOE loan to TSLA affects their EPS and, correspondingly, increases their cost of capital. To the extent the loan is paid down, the vesting of the warrants is reduced. It is in TSLA's best interest to pay down the loan and replace that debt will lower cost capital. Further, any restricted cash sitting on TSLA's balance sheet is, by definition, restricted to repay the loan so they may as well accelerate the payments. However, it does hurt their balance sheet ratios that are tied into their loan covenants.

Clearly, a complex situation with many interrelated components.

The bottom line, to me, is that it is best for TSLA and the DOE to work together on amending the terms of the loan as TSLA's business evolves. Each party has incentives to work together and get the loan paid off. We are seeing the results of the two parties working together to amend the terms of the loan although most observers, and reporters, may not understand why the terms are being amended and what those amendments mean.

Oh, when articles make references and comparisons to the Solyndra loan my skin crawls as there is a criminal investigation underway into the actions of that company and claims of financial fraud.

Full disclosure - I am long on TSLA and 'play' the volatility at times selling naked puts (to increase my holdings) and selling covered calls (to monetize gains).�

1/1/2015

guest aznt ++++�

1/1/2015

guest Nice analysis. There is more here than meets the eye.�

1/1/2015

guest The offer is out: 28.25 per share.

Tesla expects to receive net proceeds of 192M$

Elon Musk is buying 32,398 shares for 1M$

Total number of shares rising to 112,687,773, or 113.726.634 if the underwriter exercises its options to the max.�

1/1/2015

guest Interesting,

so they are desperate for even more money.

In the beginning there was a talk about 120-140 million,

now it�s a "little" more....

Now let�s hope for some life infusion from Daimler/Abu Dhabi,

maybe even positive news would help the stock.

What definitely seems the case, that the new B Class "Electric Drive" stems from their cooperation, tho no news ATM how many they really plan to bring to market.

At least the car is real and @ Paris Auto Show, alive and kicking:

b klasse electric - Google-Suche

Maybe the drivetrain of the new SLS "Electric Drive" (former E-Cell labeling)

is also something from Palo Alto, tho this would be spectacular news and Elon would�ve banked the PR on that.

*praying*

C�mon guys�

1/1/2015

guest

I have as well. Politically leaned far right with anti-eco sentiments, usually misguided with false information and a myopic unwavering ideology. They would consider Tesla's failure a victory.

Back at the Factory launch EVent in Oct 2011 Elon on stage talked about forces (oil?) that were (are) fighting them. I wish I knew what he was specifically referencing. At the time I figured that it would come out in the press later but nothing emerged.

- - - Updated - - -

Thanks for this analysis!

Also, the insuring of Tesla's success is part of the greater and ultimate goal of electric transportation and all of it's benefits to the USA. Obvious, I know but the core reason for the loan in the first place is worth a mention.�

1/1/2015

guest Sold my GE stock (purchased at $12 a share) and threw more money in TSLA at $28.06. With all that I've got hinged in EVs all ready, I'm going to throw even more in it. If EVs and V2G take off, I'll be in great shape, if not, well, I'll have a lot of work to do.�

1/1/2015

guest Which is stupid because their success would help alleviate the country's dependence on foreign oil from unfriendly places like Venezuela - something I'm sure they would appreciate greatly. Unless of course the far right are all in the pockets of the oil companies...�

1/1/2015

guest It is good to see TSLA increasing cash with a follow-on offering. Having up to $221.6 million additional cash on the balance sheet will allow management to focus on working with suppliers and employees to ramp up production and the offering should reassure potential new buyers and existing reservation holders that TSLA is financially viable.

The markets were expecting an offering although there was some uncertainty regarding the size and timing of such an offering. For example, the Morgan Stanley report dated 09/17/12 included the following:

'On our forecasts, Tesla�s liquidity gets to uncomfortable, but not critically low levels. We think a modest influx of new capital (not exceeding 10% of the current market cap) would be sound risk management and would be well received by investors.'

So ... having addressed and resolved cash requirements and liquidity in the near term now swings attention to the production projections in Q4, and the rate of net new reservations.

Of course, there is always market risk and the effect of the 'Fiscal Cliff'.

There remains significant volatility ahead.�

1/1/2015

guest Great analysis - Thanks for sharing your perspective.�

1/1/2015

guest OK, can someone tell me why the stock is now trading at $29.66?

BTW, March $23 Puts are going for $3. That's a 28% annualized return, or you buy the stock at $20. Either way seems like a win to me.�

1/1/2015

guest Because worries about financing had driven the stock down and now those worries have been removed? Maybe? I can't pretend to understand the daily price fluctuations of most stocks.�

1/1/2015

guest My thought too. Sold a bunch at 29.80. The offering happens next week and it's not possible for me to understand why the stock wouldn't again be traded at or below the offering price.�

1/1/2015

guest There is no guarantee that the stock will fall down to or below the offer at 28.25 allthough it probably will. I`ve been through many offerings where the stock seems disconnected from reality �

�

1/1/2015

guest IPOs yes (FB comes to mind) but with this follow on I feel confident it will be traded on the open market at $28 come next week (oct 3rd)�

1/1/2015

guest On a tangent, I was thinking about various lots of TSLA that I've picked up over the past few months some of which I intend to go long on while I may want to sell some others in the near future to take some profits. I had kind of raised this before but, essentially, I wanted to understand the tax implications of selling a subset of my TSLA holdings at various points in time.

This is probably not news for many of you active investors, but, was very enlightening to me:

Fool.com: Identifying Stock Sold for Tax Purposes

Of course, if I can always sell above my highest purchase price ever, FIFO vs. specific identification shouldn't matter as long as they are all in the same time bucket (long-term or short-term)... I think �

�

1/1/2015

guest Possibly not. The amount being sold is only equal to about 1 day's volume. It won't have a huge effect. IMO�

1/1/2015

guest Remember that capital gains are 15% this year and 20% + 3.9% or 23.9% in 2013.�

1/1/2015

guest that's the long term rate, the over the last few months mention means short term which is more like 25-35% this year, 28-39% next year�

1/1/2015

guest It may be that many are expecting what IIRC is called an "up-round", that is, a stock offering during which the stock price goes up.

That's what happened during Tesla's last offering. We were discussing it at the time, as Elon had made statements that at his previous companies, he also did several up-rounds. He seems to be good at that.�

1/1/2015

guest Where do you get "desperate" from? It's just sound management.

Actually, I am very encouraged by how events are proceeding. As I stated last week, if Tesla can get good terms for their secondary the net result could be to increase the value of the company. If Tesla was in dire shape the offer price would have been lower, and there would have been fewer shares. As it is the offer price was higher than the actual market price of the stock at the time of the announcement.

Maybe some of the real investment types in this thread can comment (my expertise is in newspaper publishing/consulting and software development/deployment), but in my experience if a company is offering a million shares at a given price, but then decides to offer 2 million shares at the same price, thats an expression of strength, not weakness and is a very good thing overall.

There are two reasons that I can think of off hand why this is true. First, 1 million shares @ $1/share means your company is worth $1,000,000. 2 million shares @ $1/share means your company is worth $2,000,000. Being desperate to be worth $2,000,000 instead of $1,000,000 seems pretty sane to me.

Second, Tesla worked with its underwriters (Goldman Sachs) to determine the offering price and how many shares. They do this by polling the market to determine demand and then plug it into their models. Basic economics rules everything, and the price of anything (including Tesla) is determined by the interaction of supply and demand. So selling more stock at the given price is an indication of strength, not weakness. We'll see how it goes when the shares actually hit the market, but the fact that the market is pricing the stock at ~$29 in anticipation of the new issue is a very good sign.

Everyone (including me) has been concerned about a gun to the head scenario (as painted by the shorts) where Tesla gets taken to the cleaners during a secondary. This is not that scenario. From what I can see, the net effect of this offering is that Tesla will have a higher market cap with little (if any) real dilution to existing shareholder value.

And in exchange for making their company more valuable (with little, if any, dilution of shareholder value), management will get a hefty new chunk of capital to work through their short term production issues while continuing to fund their new product development, retail rollout and SuperCharger deployment. Yes, they sound desperate as heck. I'm terrified for their prospects :wink:

Anyways we'll see once the secondary hits. If the price drops to ~$26 that would be an expected (to me) level of dilution for this many extra shares. At ~$28 or more thats basically no dilution from a shareholder standpoint and a big win for the company.

Tesla Motors Increases Stock Sale - WSJ.com

- - - Updated - - -

That's what I am thinking. If the secondary comes in above $28/share thats basically free money from both a management and shareholder perspective. Considering the problems it solves, it tends to support the idea that the price of the stock is being held back by short term issues which this offering does a fair bit to mitigate.�

1/1/2015

guest Some of the upward pressure after the announcement and initial drop might also be the result of the supercharger network. That really will be significant and already is for a huge base of potential customers near the west coast.�

1/1/2015

guest With regards to the follow-on offering: While the current shares undoubtebly are being diluted by the addition of new shares, at the same time fresh capital is being injected in to TSLA at a time where they really need working capital so that the company as a whole will be more robust and have the new cash on the books. Therefore maybe the net effect on the share price should be unchanged, or even increase as this takes off some of the pressure? I think it should be very positive. One thing to consider that is important IMO is that right now everyone is just focusing on the production rate and sales of the Model S and of course this is the most important thing in the near term, but by rasing capital now TSLA will be able to "keep up the pace" when it comes to development of the Model X and more importantly the Gen III. Tesla is currently years ahead of all the competetion when it comes to bringing products to the market (As this is being written more Model S's are being produced and delivered - they are out there on the streets, working well, being recieved very positively by owners and press) - you cannot even start to compare the Model S to a LEAF, MiEV, Think, etc. (that is the actual current competition). It's so important in the somewhat longer run for Tesla to keep their headstart. This capital raise will allow them to not slow down their agressive game plan in in the longer run that is where the real value of the current follow-on offering lies.�

1/1/2015

guest More doom and gloom from our pal John Petersen, who oddly enough predicts his own company to be a "winner" in the 4th quarter (sure John, we are all just waiting with baited breath to get back into lead acid battery technology):

Energy Storage: Q4 2012 Winners and Losers | Alternative Energy Stocks�

1/1/2015

guest At least he discloses his interest in Axion this time. He hasn't in past articles I believe.�

1/1/2015

guest jpdone!�

1/1/2015

guest So, for the ignorant (i.e. me), what happens to the offering if the stock price changes significantly up or down between now and the actual offering? I'm not talking transitory volatility, but what if it's at $25 or $35 on the actual follow on offering date?�

1/1/2015

guest I'm going to increase my position in Tesla, but I really don't understand this offering. Does this offering mean that I'll get the stocks if I put in an order at $28.25? Or will the stocks be sold at market price, but not any lower than $28.50?

It would be great to hear from some of the experts here on the forum about how they think the stock price will develop and what would be a good time to buy more shares.

I'm reading this thread every single day. Thanks to everyone who is posting here!�

1/1/2015

guest Hi everyone. Long-time reader and Tesla fan. First time poster.

I don't claim to understand how this offering works, but I am thinking, if Goldman Sachs and clients are spending $225 mln on TSLA shares at $28.25, wouldn't that be a very strong support level for the stock? Especially after the decreased expectations for Q4 are already priced in.

I just sold some $27 Oct 20 put options for $0.83 for an annualized gain of 66% (if I'm calculating it correctly). If the price dips below, I'm getting 200 shares for $26.17, which I don't mind at all. I probably could have gotten a better price if I didn't wait until today.

What do you guys think? I can't afford a Model S yet, but I can afford to invest $5-$10k in Tesla stock and I am looking for riskier plays with higher return than holding the stock. I got some cheap $30 call options for Oct right after the bad news came out last week and am hoping to make a nice return there (breakeven would be at $30.75). The majority of my investment in TSLA is in less risky $30 Mar '13 and $20 Jan '14 call options.

If the stock is below $20 in January of 2014, I am probably not getting a Model S anyway, because the Tesla factory was attacked by angry Martians.�

1/1/2015

guest Large scale investors have already purchased the stock at the quoted price. Anything we can buy will be at the market price. In theory the market can go down as they sell their inventory, but they likely wouldn't have agreed to the price they did if they didn't expect to make money.

- - - Updated - - -

Just to expand on that, my understanding is that several big Fidelity funds were players in buying up the secondary. Along with Goldman of course which can purchase another ~600k shares over and above the shares already released.

Also, the shorts I listen to are pissed about how well this offering went for Tesla. They expected the offering to come in much lower, and I presume their positions reflected that.�

1/1/2015

guest That comment just made my day. I think they just saw the ocean recede. Tsunami of hurt will be arriving soon.�

1/1/2015

guest short term capital gains are taxed like regular income, so it's dependent on what tax bracket you're in.�

1/1/2015

guest http://www.thestreet.com/story/11725817/1/tesla-motors-inc-tsla-todays-featured-automotive-winner.html?cm_ven_int=morefrombox

�

1/1/2015

guest These people are all so shmucky

Why is today an article? it has been like this many times over the year. Bad stock news day or a Tesla storm coming?�

1/1/2015

guest Probably a feel good piece to welcome the new TSLA shareholders who bought up the secondary offering (can you say mutual funds?)�

1/1/2015

guest My guess is that someone had space to fill om a blank page.�

1/1/2015

guest Slow stock news day and they've calculated that Tesla stories drive page views. That article wasn't even written by a person. It was automatically generated by a computer algorithm.�

1/1/2015

guest More none-news from, SA, real slow news day...

Tesla In A Trading Range - Seeking Alpha�

1/1/2015

guest What is the take here (Citizen-T) on selling above $30.5 and buying when it drops to $28? Has the writer already seen Elon's announcement today?

P.S. From the time stamp on mitch672's posting, it seems that he hadn't.�

1/1/2015

guest Uplifting news from Elon this afternoon:

Tesla Motors CEO and co-founder Elon Musk says in a blog post that the luxury electric car company will be cash flow positive next month.

Mr. Musk used a blog post on Tesla�s website to break the silence imposed by Securities and Exchange Commission rules governing what companies can say during a share offering. His aim, as he put it, was �to clear up some misconceptions that arose last week as a result of our filing a public market financial prospectus.�

"...our production rate in the last week of September was roughly 100 vehicles, four times greater than our production in the first week of September as we overcame supply constraints."

Elon Musk: Tesla to Generate Cash By November. - Corporate Intelligence - WSJ�

1/1/2015

guest I've thought about trying to do that and I'm fairly sure I'd make money on it. My fear though is that last time I sell as it hits 30.5 before rocketing up permanently means I'll lose out on more long term gain than I got on all the little short term ones.�

1/1/2015

guest seems TSLA was up .50 in after hours trades, so the news is out. I would expect it to move up a liitle bit tommorow, but it is in a tight trading range now.�

1/1/2015

guest Here a link to Elon's blog post itself:

An Update from Elon Musk | Blog | Tesla Motors

To me, this means that Tesla made it. (To put it simply).�

1/1/2015

guest Suck it shorties! :biggrin: Sorry, couldn't resist.�

1/1/2015

guest Too much news flying for me to trade right now. I'm happy with my positions and intend to sit tight for a while and let things calm down. I don't see any certainty in any direction.

If you do make a move just make sure that the amount you sell is proportional to how much confidence you have in the price dropping. Don't sell it all.�

1/1/2015

guest Nice...we are all doomed

oh, not Tesla though. I have a little faith in a few people still, but not 99% of America, sad.�

1/1/2015

guest I don't think the market has accounted for this news yet (TM being cash flow positive in October as well as a production of 100 cars/week).

Going out on a limb, but I hoping for $34 by Friday end of trading day.�

1/1/2015

guest I don't think the market has accounted for it yet, either. However, just for the record, being "cash flow positive" is expected for "end of next month", which is end of November.�

1/1/2015

guest I wouldn't sell more than 20% in any case. However, I'm guessing that by this time next month we won't see it drop as low as $28, unless there's some real disaster. I'll do what I have been doing. That's hold until there's a significant increase. Not just a few dollars per share.�

1/1/2015

guest It appears that Elon's remarks in the TSLA blog are what the markets expect, nothing more nor less.

This lack of reaction indicates that the current situation meets expectations. Given the amount of positive remarks there may be some downside if production doesn't continue to increase and meet expectations that Elon has set for Q4.

The release of financial results for Q3 and updated guidance for Q4 should prove to be interesting ...�

1/1/2015

guest I still think we won't make that large of a jump in that short of time without cash flow positive actually being shown at the end of the quarter or next as opposed to just being said.�

1/1/2015

guest I predict that Romney will have to do a correction and reversal of his erroneous Tesla comments (which will refocus investors on the Tesla �success� story) thus moving toward Disco�s $34 target price !�

1/1/2015

guest +1. Almost any news in the last year provides only transitory blips in the stock, leaving it to wander between the high 27's and low 30's most of the time.�

1/1/2015

guest I think Elon's blog yesterday did make a difference. the stock was up close to a dollar in after hours.

I think Romney's performance last night dampened today's performance.

there is the general idea of Romney being more tied to existing ICE/Oil model, and now it looks significantly more possible he can win. perhaps there's also the specter that he, and really more so the right in the media, may try to tar Tesla some more. as others have suggested, this could end up turning around in Tesla's favor if "Tesla is no Solyndra" story rises above tarring, or wow, what if Romney reverses and acknowledges Tesla is just the kind of growth/job creator this country needs. I'd rather not see Tesla treated as a political football at all, and hopefully last night was just a short passing bump into this campaign.�

1/1/2015

guest Hopefully in the next debate Obama can correct Mr. Romney with the facts about Tesla's success. A good point to make that a few failures are inevitable when pushing new technologies but the successes are worth it.�

1/1/2015

guest The President's stock is down , but still given about 70% chance of winning.

http://iemweb.biz.uiowa.edu/graphs/graph_Pres12_WTA.cfm�

1/1/2015

guest If my target is to break 100 how long would you guess it could take?�

1/1/2015

guest End of 2016? When they will be mass producing Gen III model, provided it would have good gross margins. Plus Model S & X would still sells good. With smaller SUV then X on horizon/soon to be launched.

Before that they will have to invest heavily into development of X, then expand/retool factory and supply chain for X. Then make even bigger investments into Gen III.�

1/1/2015

guest If Tesla sticks with the mission to accelerate the electric revolution, they will never rake in profits. All money will go into R&D or infrastructure projects. They have the Gen III platform and the worldwilde rollout of Supercharger network on their hands as the next thing. When Elon is done with cars, he might start development of electric planes and hyperloop system.

Tesla will never just make cars with 25% gross margin and pour the money over the shareholders. The remarkable thing will be a sustained R&D budget that grows along with the company and will exceed the efforts of major competitors perhaps in 2017.�

1/1/2015

guest Wow. Talk about a opening the door to mass speculation. I guess I can throw out a WAG backed up by made up numbers

Current market cap is ~$3bln. At a P/E of 10 that would imply ~$300mil/year in earnings (which do not exist yet). I suspect that Tesla needs to sell something close to ~20k/units per year to make that kind of scratch. Because 20k/units is Tesla's current yearly goal that is acts to support the stock at $30/share, at least to the extent that investors expect the company to be able to produce and sell that many cars.

However, it also looks like profit might increase rapidly the more cars they build above that number. To get to $100/share you probably need to make a yearly profit of ~$1bln. If 20k units pays the bills and gets you $300mil, and if you get to pocket your ~25% margin on every car after that it looks like you need to sell ~35,000 $80,000 cars to make ~$700,000,000 in profit. So that works out to ~55,000 units/year.

I feel comfortable with Tesla's estimate of ~20k units in 2013, and 30k in 2014 should be possible based on natural growth and the addition of the Model X. After that its harder to predict.

By the end of 2014 we should see the SuperCharger network substantially built out and maybe 40 more retail stores. Current stores are maybe selling 2-3 cars (reservations) per day, per store. If you assume 70 operational stores that could support between 50-77k cars based on current performance. So based solely on that, and before factoring in the Gen3 rollout you could see ~$1bln in profits in 2015.

There are capital costs for expanding capacity to support Gen3. The current factory can presumably build ~60k Gen2 (MS, MX) vehicles working around the clock. Gen3 will likely need extra capacity. Those investments will reduce profits, but it would likely be discounted by the market because they are one time investments. Plus, if Tesla is visibly executing in 2013 and 2014 it will likely come to be seen as the growth stock that it is. It's entirely possible you could see euphoric prices that bump the price above ~$100/share in 2014 as investors start to realize what it means to be a shiny new, high margin car manufacturer.

- - - Updated - - -

I actually agree that Tesla wont send their profits back the their investors as dividends. But those investments you mention will raise the price of the stock. That is basically exactly what it means to be a "growth" company, except that in this case Tesla will be investing to change the world.�

1/1/2015

guest Thx! Considering buying a ton. Just wanted to know people's thoughts.�

1/1/2015

guest Speaking of P/E... Qualcomm for example have P/E over 20 for ages. And have market capitalization bigger then Nissan and Daimler combined. Why invest into Qualcomm instead of Nissan or Daimler or even Intel? All three not just well established and profitable companies but they have P/E less then 10! But the way market see it, Qualcomm have HUGE potential for future grows. And because of that potential P/E could be on unsustainable level.

My point, it is not really required for Tesla to produce big enough profits to get P/E to around 10. Even half or 1/3 of those profits might be good enough to drive price of shares to $100/share level... As long as market would believe that Tesla have a potential for enormous grow. P/E could be well in the 20-30 range when $100 price will be reached.�

1/1/2015

guest Finally a positive article on SA about Tesla: Why Tesla Has It Right And GM, Ford And Nissan Have It Wrong - Seeking Alpha�

1/1/2015

guest I totally agree. I used 10 P/E because its conservative. Once a company is on a growth path you'd expect the P/E to go higher because you need to price in future growth.�

1/1/2015

guest NYT DealBook's take on Tesla's cash flow outlook:

Cash Flows Are Critical for Tesla - NYTimes.com�

1/1/2015

guest Elon buys more TSLA: Top Buys by Top Brass: CEO Musk's $1M Bet on TSLA - Forbes�

1/1/2015

guest Discussions about legality of Tesla Stores has been moved to Tesla Stores - Page 34�

1/1/2015

guest If Tesla is able to become cash flow positive in November or December what is everyone's thoughts on what that will do to the stock? I would assume if all other indicators (incoming reservations, no recalls, more positive reviews) remain strong that the cash flow positive moment could be the potential turning point for the stock that we have all been anxiously awaiting. Would love to hear other investors thoughts on this.

Blake

- - - Updated - - -

http://rumors.automobilemag.com/feature-flick-tesla-model-s-out-drags-bmw-m5-175305.html�

1/1/2015

guest A combination of (a) cash-flow positive, (b) solid ramp-up in deliveries, and (c) continuing increases in reservation rates will make an enormous difference in the stock value. Point (a) alone won't be as powerful; it has to be seen as sustainable.�

1/1/2015

guest I think until we see documented cash flows in consecutive quarterly statements, and even more so, showing profit in consecutive quarters, we will see blips in the stock price, but nothing like the breakout I think most hope for. Also, as stated on this thread recently, Tesla is so young in the game, they will be putting so much of their cash and profits back into R&D and production for upcoming (Model X) and future (Gen III and on) projects, I would expect a gradual valuation increase over YEARS as opposed to months or quarters.

- - - Updated - - -

Exactly.�

1/1/2015

guest +1

For me at least, cash flow positive just means they aren't drawing down cash reserves. It's nice because they aren't in imminent danger of insolvency but a non-factor in terms of return on capital. The key issue for the next 6-10 months is production rate. After that monthly sales rate is the final (and most important) leg of the stool that Tesla needs to turn to profitability going forward.

Edit: Production rate+Gross margin actually. It doesn't help to build more cars if you don't get your margin where you need it to be.�

1/1/2015

guest Did the short interest on TSLA decline for the first time ?�

1/1/2015

guest A good piece about TSLA on the Fools: http://www.fool.com/investing/general/2012/10/09/the-most-misunderstood-stock-on-the-nasdaq.aspx�

1/1/2015

guest When this happens there will be the "short squeeze" we have all been waiting for �� which will drive the pop in TSLA.�

1/1/2015

guest The Most Misunderstood Stock on the Nasdaq (TSLA)

�

1/1/2015

guest California grants Tesla $10 million to build Model X

http://www.forbes.com/sites/toddwoody/2012/10/10/california-grants-tesla-10-million-to-build-the-model-x-electric-suv/?partner=yahootix�

1/1/2015

guest Love this quote from commissioner Carla Peterman:

�

1/1/2015

guest Might get us a boost tomorrow - we'll see.�

1/1/2015

guest [note - I don't know if this should be in a new thread]

There is plenty of volatility in the market and TSLA is even more volatile. From my observations of the various threads, there are a number of people that are holding their final payment in TSLA stock. Given the resources available on the TMC bulletin boards, I believe we can understand company-specific risks by analyzing the data surrounding the market expectations. Essentially, we should be able to understand if certain expectations will, or will not be, met.

Understanding what is ahead could help people make their own decisions to remain in TSLA or switch to cash, prior to their final payment. I do believe that most of the participants in TMC are long on TSLA and, for multiple reasons, want to be part of the increasing adoption of electric vehicles in the U.S. and abroad.

The key expectations in the financial market appear to be on (1) meeting production levels; (2) the net growth rate in reservations (new reservations less cancellations; and (3) earnings and cash flows. There are other elements of TSLA�s business that we have insight into, including the overall demand for electric vehicles, Supercharger network developments and the value of the Supercharger network, and the value of the TSLA brand.

While some analysts and readers may be bearish and on the short side, given certain information and knowledge, they may change their perspective and (short) position.

It would be good to have some quantitative and qualitative information on the production rates. Somewhere, someone in the TMC network must be calculating the production rates per week, which can be compared to the expectations that Elon and TSLA have set with the markets. It would be nice to know what we at TMC believe the expectations are for the end of Q3, including the number of finished cars in transit and finished cars waiting for minor parts in the Fremont Factory.

People on TMC share their reservation numbers and cancellations. Also, the cancellation of a Model S and a new Model X reservation (i.e., simply switching Model S to Model X). There are other indications of the interest in the Gen III. There are certain expectations that TSLA has set, and expectations that analysts have so they can create financial models to forecast results. Of course, these expectations are adjusted by TSLA�s actual results and TSLA�s guidance.

Regarding earnings and cash flows, I�m not sure we have much insight into these elements except for the impact of production, inventory and net new reservations. Regarding gross margins, we at TMC can understand the configurations being delivered and what the average selling prices are. Generally, more vehicle options results in higher margins. Offsetting the margins are the overtime shifts at the Fremont Factory.

The overall demand for electric vehicles is difficult to calculate, including actual global sales. It would be very interesting to see an analysis of the �installed base� of electric vehicles in the U.S. and forecast at what point will there be more TSLA branded vehicles on the road compared to Chevy Volts, Nissan Leafs, Fiskers, etc. If TSLA produces well built, stylish, advanced cars without a serious mishap then the demand for TSLA vehicles will continue to increase as more and more people become exposed to the brand and the actual vehicles. For example, the cumulative number of Roadsters in the U.S. should be eclipsed by the number of Model S�s on the road before, say, the end of November.

We can probably provide more insight into the Supercharger network by reviewing each of the public sites. Many people, including the TSLA sales people, do not understand the Supercharger network and there have been some insightful comments and videos posted on TMC.

The value of the TSLA brand is not understood at this point. I would propose that brand loyalty is extremely high, noting the conversion from Roadsters to Model S, to Model X reservations. Apple�s latest iPhone demonstrated how fierce brand loyalty is monetized quickly with new products and how protecting, to some extent, existing customers with software and operating system upgrades continues to build the brand.

Let me hypothesize � TSLA�s �installed base� of Roadsters could become stranded in the legacy charging or TSLA may choose to offer some type of �upgrade path� to the Supercharger network. What are they going to do? Given time, upgrades will be made for the Model X, then Gen III. How will TSLA treat its installed base of products, and customers? Insight into how TSLA will keep its products current can increase, or decrease, the value of its brand.

Speaking of the TSLA brand and total sales of electric vehicles in the U.S., shouldn�t financial analysts understand the value of TSLA not spending a huge amount on television and other advertising to build its brand? Compare the amount of advertising for the Chevy Volt and the Nissan Leaf to the pennies that TSLA spends. While some analysts may focus on book value, having insight into the value of intangibles, such as the brand, can help these analysts value TSLA stock.

Those are my thoughts. I could see having some threads on Production Rates, Reservation Rates, Supercharger Locations (one thread for each location), etc.

Please post your responses and any ideas on how to take this forward (or dismiss it).�

1/1/2015

guest For me, the two most important metrics that I've been trying to keep on top of are production rate and reservation rate.

Determining the production rate at this point is akin to Kremlinogy. It's easy to model what Tesla must do in order to meet the goals they have set, but those models can fail at prediction because reality has a tendency to intrude. Based on the tea leaves it looks like Tesla produced between 100 and 150 car last week. The model says that 150 is short of what their goal is, but not drastically so.

A recent announcement that one customer had his window pushed back suggests this is the case. A build rate of 100 would imply many more notifications of a delay. But this is all supposition based on speculation.

Reservations is much more straightforward because we get actual data and there are fewer confounding variables. My recollection of the Sept 23 announcement is that net reservations at that time were averaging more than 30 per day. Plug in the gross reservations since then and we can monitor this activity fairly closely.�

1/1/2015

guest I think much of the information you seek is already being compiled in various threads. Sometime when I'm not mobile I might dig them up. Some of these threads are quite sophisticated with forms and spreadsheets with the data.

One thing that you didn't mention that I have been very interested in for more than a year now is the "viral" affect of Model S. More specifically, I hypothesize that every car that makes it onto the road will sell some number of new cars for Tesla. Maybe this is because the owner gives his friend a test drive, or because they pick their client up in it, or maybe some one just passes it in the mall parking lot and, curious, looks it up.

The question: how many new reservations are the direct result of a single Model S making it onto the road. If it is less than 1 we've got a reservation cliff coming up as we burn down the existing backlog faster than reservations are coming in. If it is just 1, we've got a sustainable business case for now but might struggle to fill Model X production. If it is greater than 1, things get really interesting. Greater than 2 and we've got exponential growth that is going to result in the death of at least one major automaker.

It might be time to try to quantify how many sales each new owner is generating. At these very early stages of the curve, exponential growth is going to be hard to detect by just looking at the overall reservation count.�

1/1/2015

guest Excellent idea. Though sometimes it's hard to know whether the person you gave info to will eventually buy. Just today I was wearing my Tesla shirt and someone asked me about Tesla. They knew about the Roadster but had never heard of the Model S. I gave them some basics about the car and told them to go to the website. The price was not an issue and they already drive a Prius. My instincts say that they will consider buying one but I'll probably never know for certain.�

1/1/2015

guest < 1% of America knows about Tesla IMO, and in even in California. maybe some have heard of the roadster but think Tesla is pretty much out of business, from my experience. Advertising is huge

Just tell people to test drive one, regardless if they can afford it or not! at least they will understand the difference between a real car and all of the POS' out there.�

1/1/2015

guest My belief is that the majority of new sales will be driven through the retail stores. Seeing a Tesla on the road might get a person into the store, but I think most potential sales will need a store to close. So for me the big issue is opening new stores. Ultimately I'd like to see each store selling ~2 cars per day. If Tesla can manage that we should see really decent sales growth during the next few years.�

1/1/2015

guest As long as they can keep the quality up and resolve any problems quickly when they do arise with the end user, then I believe that we all have a winner here. For me, all of press reports that are appearing now that the S is populating the roads is enough to drive sales for the near term.�

1/1/2015

guest Hard to do since TMC is largely filled with "salesmen of the year" types.�

1/1/2015

guest I know. Need to discount it somehow if the info comes from TMC. Not an easy task, but getting a leg up on an investment rarely is.�

1/1/2015

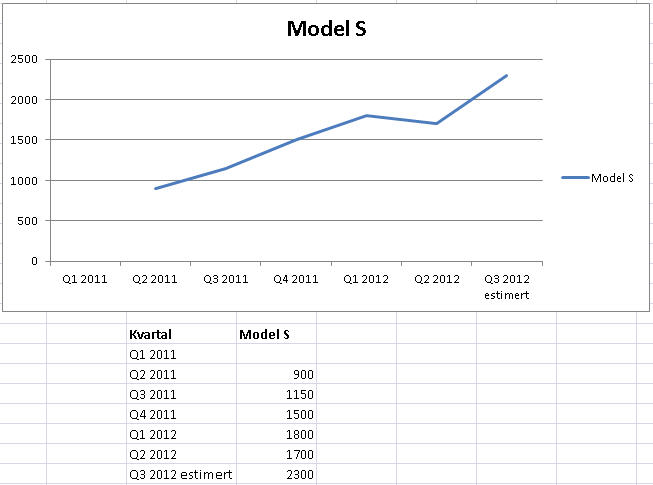

guest I did a highly unofficial comparison of the number of reservations from september 27th until 9th of october, and came up with 55 new reservations per day (47 if 15% cancellation is subtracted). These numbers are based on numbers reported in the "reservation tally" thread. This is a big step up from the rate of 25-30 about a month ago.

Also made this simple graph from the numbers from shareholders letters:

�

�

1/1/2015

guest Interesting... 50 reservation a day is a very good number. That is 350 a week. They need 400 per week to get to 20k a year sale target. But!

1) Right hand drive model for UK, Japan, Australia was not launched. Sales will grow there after it will become available.

2) 9+ months till car delivery is not helping. That would be addressed as production ramps up.

3) I think TM need to work more closely with EU local media, while they did a great job in US/Canada... Like look at Spain. A country with strong green policies and public opinion favorably(at least in comparison to some other countries) treating America. And one marker on reservation holding map? Seriously? But there is not only Spain out there.

So overall, potential for grows of Model S sales rate is very big. If reservations already are coming at 50 per day level - that is very impressive.�

1/1/2015

guest My suspicion is that cancellations have been significantly higher than the historical average in the past couple of weeks. The 60kWh SuperCharger issue produced a lot of publicly reported cancellations, and those public data points were validated by the high level PR attention the issue received from GeorgeB and the eventual mass e-mail walkback of the policy.

The numerous public cancellations and rants (and don't forget the service plan issue which is still simmering) are similar to any other data we get here, in that they represent only a small sample of what is going on in the larger reservation universe. I would guess there were dozens of additional cancellations that were in addition to the normal background rate.�

1/1/2015

guest Absolutely, but I must emphasize that these numbers are uncertain. When Q4 is done we`ll see the viral effect. I do not think the estimate can be more than 5-10% off, so even if the numbers are uncertain they show a solid growth! In my opinion reservations will quickly (they are about to) exceed their production goals for 2013, so the question is not "if" they`ll sell 20.000 cars in 2013, it`s how many they are able to produce.

We`ll see in the beginning of 2013 how the cancellation rate has been. As I understood more than 65% of the buyers has so far reserved the 85kw pack? Also, the numbers I`ve based the estimate on are from the period 27th of september till 9th of october, which is after the 60kw/supercharger issue occured, and right about when it was "fixed". In other words, buyers dont seem to be put of by the 60kw/supercharger issue. I feel confident that the cancellation rate will drop when buyers won`t have to wait a year (some have been waiting several years) to receive the car, and sales will accelerate when more pepole realize that the Model S is`nt somewhere in the future. The car is here!

I agree that Tesla needs to steer clear of any PR disasters. I large scale recall would set the company back severely, allthough when they`ve made it this far the hypothetical error that results in a recall must be of a fundamental character to really threaten the company. Given the time and money spent to develom the Model S, I think the chances of a fundamental error are quite slim.�

1/1/2015

guest Even though only a small percentage of Model S reservations are posted to the reservation map, it will be a helpful resource to validate that each Model S generates new sales - if the new reservations tend to cluster around existing reservations, it's a good data point that there is a viral effect.

In fact, look at where Roadsters are currently in operation -- that's where the Model S are, for the most part. The viral effect didn't start with the first delivery of a Model S. It started with Roadsters. And Model X reservations also go up as more deliveries are made.�

1/1/2015

guest Personal anecdote; it was the Get Amped tour that generated my reservation. (I also spent far too long watching videos of other other people's test drives). I've never seen a roadster.�

1/1/2015

guest I suspect that's correlation rather than causation. Major pop centers, west coast centric that might have heard of Tesla, west cost is full of engineering types, etc. Just anecdotal, but while I'd heard of the Roadster I paid it little mind since it was, to my mind at the time, a 2-seater millionaire's toy. I'm not saying that mindset was correct, just that even for someone like me in tech that likes gadgets and is in an eco-aware state like Oregon, the Roadster still wasn't making inroads as a legitimate daily car.

I think it was the Leaf actually that made me aware of the Model S. I think I was talking to a buddy about the Leaf, but it was ugly and short range and he said Tesla's coming out with a sedan. Now, it's possible he was more aware of the Roadster and so perhaps my sale was Roadster generated in the seven degrees of Kevin Bacon sense.�

1/1/2015

guest Don't discount the number of hours/events that Roadster owners have put in giving out cases of Tesla brochures/talking about Tesla/introducing people to the Model S at EV events, schools, neighborhood events, test rides/drives, etc. I personally have three friends with Model S reservations and one with Model X - they wouldn't have made those reservations without my Tesla EVangelism.(And those are just the reservations I know about - I have no idea how many are from a result of the EVangelism.)

I am not saying it is because of Roadster owners, only saying Roadsters are part of the viral effect. We have not been quiet owners.

- - - Updated - - -

Oops - forgetting my own Model X sig reservation! Driving a Roadster definitely made me want to go 100% electric. �

�

1/1/2015

guest Another personal anecdote about viral spreading of Model S. My wife, who is still skeptical about the whole EV thing, has talked to people about Tesla (I guess I am wearing off) and socializes in much much more affluent crowds than I do. And she has drummed up interest in at least two people who had 'heard' about Tesla, but are now actually looking at getting a car seriously.

I don't think I have any 'sales' yet. But I certainly have a quite a few potential sales out there. And most of my social circle a Tesla is probably slightly out of reach.�

1/1/2015

guest Each store open generates new sales.

Each new great car review contributes to sales. Multitudes of good reviews compound sales.

I rembember in the 70's when a band appeared on Satuday Night Live record producers noticed that sales of that band's album went of the next day by 10s of thousands. Go figure�

1/1/2015

guest Tesla needs to be gathering viral data when they receive reservations, not leaving it to TMC. They need to do their best to understand where these reservations are coming from. Where did the interest begin? Reading an article? Seeing one on the road or in a parking lot? Talking to a Tesla owner/reservist? Talking to a non-owner, but enthusiast? etc. They could come up with 5-10 rather simple questions to get a very good idea of the "viral effect".

And if TM is reading, my company could certainly help with that data and analysis. �

�

1/1/2015

guest Tesla appears in this story about hot insider buys:

http://www.stockpickr.com/5-stocks-insiders-love-right-now.html-20?puc=CNNMONEY&cm_ven=CNNMONEY

Go buy more stock!�

1/1/2015

guest Maybe; but there was also a story about a Tesla Ranger that had to take like two planes and a several hour car ride to service a Roadster out in the middle of nowhere. The only other Tesla anywhere nearby was directly across the street.

Only anecdotal, but that story is actually what got me to start developing this thesis.

- - - Updated - - -

Well no, a new store opening or a multitude of good reviews doesn't "compound" sales. It gives them a kick, but that is nothing like going viral. A new store will increase sales in that area, and sustain them, but it won't sell twice as many tomorrow as it did today, and twice as many as that the day after. Same with a review, when it first comes out it might give sales a kick, but that won't even be sustained much less compound.

A truly viral effect like what I'm talking about will accelerate (or "compound") until the market becomes too saturated.

10s of thousands of records is nice, but I can show you YouTube videos of cats playing the piano that racked up millions of views and never appeared on Saturday Night Live. We are talking completely different leagues here.�

1/1/2015

guest You are reading too much into my comments. I was just trying to point out key motivators for bumps in sales.

The use of the word compound was only directed at reviews. One review make make X sales and another review may make X sales but when you have many good reviews the sum is greater than simple addition of thoses X's.�

1/1/2015

guest Fair enough. I'm a little more specific about what I mean by "compound". Agree that multiple good reviews would result in more sales than the additional of sales from each review individually, but I wouldn't call that compounding.�

1/1/2015

guest Curious what you would call it. I'm stuck.�

1/1/2015

guest Maybe "amplified" (i.e. more like multiplication than raising something by a power of 2).�

1/1/2015

guest I've always thought that 'compounding' just meant 'adding to', as in 'then this happened, compounding the problem' ... never thought of it as raising by a power of 2.�

1/1/2015

guest I don't want to get too hung up on one word, and mods are going to get on us soon, so one more comment then I'm done. =)

I don't necessarily mean a power of two. I do mean parabolic growth that you get from repeatedly applying some change to the result of the previous iteration. Look at "compounding interest" as a very common use of the term that I would agree with.

Certainly it is used much more loosely in common speech. I'd take issue with a lot of uses of "compounding the problem" where no compounding is actually taking place.

"First Bob hurt his hand, then Larry got thrown out of the game, compounding our troubles." - I see no compounding going on here. Amplified for sure, the loss of two key players is a bigger deal than the loss of either one individually x2.

"It started out as a harmless rumor, but each time it was told, it got a little worse (and further from the truth), compounding the issue." - Yep, definitely compounding going on here, good use of the term.

I'm a bit more intense about language than a lot of people though. I cringe every time I hear someone say "I could care less." They obviously meant to say "I couldn't care less." Another topic entirely, just saying, I'm more intense than most on this and I willfully concede that.�

1/1/2015

guest Interesting piece on top institutional investors in TSLA:

Tesla Motors's Top Institutional Shareholders for Q3 2012 | Wall St. Cheat Sheet

FMR LLC alone has almost 16 million shares!�

1/1/2015

guest TSLA's Internet Sales Model Can Scale, Complemented by TSLA Stores

The issue with �store front� sales is that the model doesn�t scale. That is, to a large extent, there is a linear relationship between stores and sales. Sales per square foot are, generally, a function of the location with desirable locations having more sales per square foot.

TSLA is using the Apple store model to increase sales per square foot, and using technology to increase the resulting sales per square foot even more. Consider a �traditional� car dealership and think of their sales per square foot. Now, compare the TSLA stores and the small (relatively tiny) size and the corresponding sales per square foot.

Even under optimal circumstances, the sales per square foot only scales in a linear fashion.

Contrast the physical store sales, even with the TSLA model, to selling through the internet �

Someone sees a Model S through a personal acquaintance (or otherwise), then happens to get a ride or speak directly with an owner. They like the car and are curious. Those individuals just need to use a PC, iPad, smartphone, etc. to visit teslamotors.com and they can learn all about the vehicle. They can design their car, price it, know that the cost won�t vary by TSLA store, and put down a deposit on their credit card.

No line ups. No waiting. The web site handles plenty of simultaneous users.

In short, the internet �scales�.

Both models help each other. The TSLA stores are complementary to the internet, and the internet is complementary to the TSLA stores.

Viral marketing is the �icing on the cake� that creates awareness, interest and the internet can handle the traffic to educate potential buyers and turn that interest into a reservation. Viral marketing is less effective with store fronts that don�t scale.�

1/1/2015

guest It doesn't have to be doubling. It could be any other multiplying factor repeating itself. Up 50%, then the new value up 50%, etc.�

1/1/2015

guest bmek (and others of course) - thank you for your insight.

There is one topic that hasn't resently been touched upon that I believe will be more important than many are thinking as of today: International (i.e. outside of North America) sales.

I believe that the markets in Europe as well as Asia are potentially much greater than many "US-centrics" understand.

Europe:

This is where I am and where I think I have to most insight. The total population of Europe is about twice that of the US (731 million). However, some of these are in poorer and less developed parts of Europa. Also, in Europe the number of cars per person is lower than in the US (America 812 vehicles/1000 people [only topped by Monaco] while in Europe: Germany 634/1000, Norway 578/1000, UK 525/100 for example). The more affluent and developed parts of Europe (Western-Northern) has about 421 million inhabitants (please, no offence to anyone, I included the following countries: Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Italy, Netherlands, Norway, Poland, Spain, Sweden, Switzerland, UK) which is more than the US and Canada together at 347 million people. Factors that speak in favor of high EV adoptance: These parts of Europe are technologically mature and densley populated, the eletric grid is robust, especially some parts of Europe have a lot of renewable electricity available, electricity is relatively cheap especially in comparison to petrol or diesel (which is relatively a lot more expensive than in the US). Also traditional ICE cars are generally more expensive here than in North America. A German living next door to the BMW, Audi or Mercedes factory will pay more for his german car than an American would. A Swede pays more for his Volvo than an American, etc. Some governments in Europe are doing more than others to promote EVs, with tax breaks and other stimuli, but in the countries where there is little of this as of today I think a lot may change in the coming years. Europe in general is taking on the responsibility to reduce CO2 emissions more whole-heartedly than the US, IMO, and I would not be surprised if in a few years there will be measures on the EU level to promote EVs (it's all about reaching "critical mass").

Asia

Consider China (this is also true for some of the "Tiger Economies" of south-eastern Asia): Population 1.35 billion people. In 2011 there were 83 motor vehicles per 1000 people. This number has been growing rapidly and China has an explosive growth of middle- and upper class. Let's say that for now just 1% of the population are in a position to even consider buying a car, still that's 13.5 million people who are looking to buy their first ever car. Next year it might be 2%, the year after 3% etc. Anyway, many of these are people do not have the "burden" of much experience with ICE cars. They don't have the brand affiliation og traditions of ICE cars. They are more "native". I believe they will be much more likely to buy an EV. Think of it this way: ff you had never seen a car before, never driven one before, knew nothing about combustion engines or eletric cars and you were presented with one of each, isn't it clear you would pick the EV? The modern chinese don't have to go through the same gradual technological switch we're seeing in the west - there aren't thousands of car dealerships, millions of gas stations (especially in more rural areas) etc. They can just make a quantum leap straight in to the future. They are expanding their electric grid very rapidly anyway. It seems the governement there has got it right - they understand that Chinas future growth will require a lof of management of CO2 emissions and other environmental effects, and they get the fact that if "the average chinese" is going to own his own car in just one or two generations, these cannot be ICEs, since that would be such a huge additional burden with reagards to emmisions. Yes, for now, a lot of electricity is generated in a dirty fashion (coal etc.) but given some time I believe China will be doing a gradual switch to sustainable energy.

To sum up: Don't underestimate demand and future markets outside of North America. As of now Tesla has no real domestic competition, but really no real competition from European or Asian automakers either!�

1/1/2015

guest �

1/1/2015

guest Damn I wish I had more money to buy more. Wonder what the downward pressure is today.�

1/1/2015

guest No volume. I don't think it's much more than that.�

1/1/2015

guest The store moldel worries me when Tesla has three cars for sale.

With floorspace filled with a Roadster, an S, an S roller, an X and a Bluegenlll, Tesla has some decisions to make.�

Không có nhận xét nào:

Đăng nhận xét