1/1/2015

guest Citizen-T, Production ramp-up probably won't happen in Sept. and Q3 earnings will be announced in Oct, so I'd be a bit concerned about lack of news to push the stock higher by then. I hear what you're saying about Supercharger, but I don't see that as a stock price booster. TSLA might just track the market for a little while. And the way Musk and Ahuja sounded on the call, they will be doing some kind of capital raise later this year or early next. My guess is they'll try to combine the raise announcement with a production achieved announcement, so maybe Jan. Just guessing here, of course.

FWIW, looks like we might be able to do a split synthetic long at Jan '14 for close to even at $28 for the Call and $25 for the Put. Depending on how conservative you are, that's pretty nice downside protection at $25 while still capturing all the current upside from $28.�

1/1/2015

guest The stock is the same price it was 20 months ago. It hasn't exactly been rocketing. Roller coastering perhaps.�

1/1/2015

guest Agree with you 100%, but mostly I'm just trying to capture the spring higher because I believe we are oversold. It's not so much a call on some stock moving events, though QE3 and Supercharger event wouldn't hurt. Whatever I buy, I don't really intend to hold it to expiration. I'm just trying to leverage up to extract some cash out of a short term move, then I'm going to use that to buy more shares when the price is right.

At least, that's the plan.�

1/1/2015

guest +1

But at the moment they realize they are wrong, it's a domino effect, almost immediate.

One good example, when everyone realized the US real estate market was unsustainable, the reaction was brutal, all sales stopped at the same moment.

They realized there were no more greater fools who believe an asset class would go up forever.

We have the same bubble in Canada, it is bursting now. Sales have brutally stopped beginning of July. You should read and hear the comments on Canadian real estate boards, clearly in denial phase. Fear is here, blood is already flowing.

Same will happen with the shorts. They cannot imagine a world whitout oil, just like they don't realize a house is not an ATM�

1/1/2015

guest I just sold some Mar $20 Puts for $2.45. That's for a $17.55 stock price break-even! Shorts are in full force today and stock is trying to stay above $28.�

1/1/2015

guest Wow. I would love to meet the person that bought those. I mean, seriously? $17.55? In March? I've got a bridge I'd like to talk to that guy about...�

1/1/2015

guest Yeah, it did kind of feel like taking candy from a baby - hard to decide how much to really take.

I'm still tempted on the Syn Long LEAP. Based on Bid/Ask a Jan '14 $28 combo will PAY you $1.45. That's a break-even of $26.55, with unlimited upside and downside from there during the next 17 months. Really hard to resist someone paying me to bet on Tesla with a zero point of $26.55....�

1/1/2015

guest Anyone else looking at cash flow and balance sheet? I see an additional $21m in reservation payments during the 3 months and at $5k a pop that would be ~4k reservations......? Just wondering where those 4k reservations are.�

1/1/2015

guest Some could be Model X sigs (10x a normal reservation)�

1/1/2015

guest If you think $28 is underpriced today, the company will survive to 2014, and that it will stay flat or go up between now and then:

January 2014 puts @ $28/share have an $8.30 premium�

1/1/2015

guest Market is up.

TSLA is down another two and a half point.

The end of the world is coming.

Edit: (Just realize we are in 2012 and December is coming soon)�

1/1/2015

guest I thought of that but then the Model X tally must be waaaay off. Even if there's 100 extra X-Sigs in Q2 that's still only the equivalent of 1,000 reservations at $5k plus the 1,500 announced Model S reservations at $5k....that's nowhere near $21m. What are we missing?

(BTW, isn't an X-Sig reservation $40k?)�

1/1/2015

guest Do we realize that the number of shorts is more than 50%(!) of the float? If that 50% needs to be covered in a few days (or in a single day?), the rise in volume would be staggering! Quite a few people are in this for the long run, so I wonder if it would be at all possible to cover that larger a float!

The number of shares for sale I estimate to be significantly less than the official float because I expect shareholders (companies) to have bought TSLA for strategic reasons and not just for the money.

I can't find any historical examples of short squeezes on companies with such a high short/float ratio. I'd love to see how such a squeezes would play out. Anyone?�

1/1/2015

guest You're right, ot doesn't add up... And yes the sign is only x 8�

1/1/2015

guest Not whithout emptying the ask bin, I'm on the bottom of that bin.�

1/1/2015

guest $500/share right? �

�

1/1/2015

guest I don't feel that's enough premium for the time span. You're talking tying up money (or margin buying power) for 17 months. I'd prefer to do something like the Jan '13 $26 Puts for $4.10. That's half the payout, but only 1/3 the time. Assuming they expire worthless, we're talking an over 32% annualized return with a stock price break-even of $21.90.

My thinking going with the LEAPs is for the Synthetic Long - The Puts pay for the Calls and you get to capture all the upside that might happen during the next 18 months with no upfront costs (actually, they'll pay you to get in!). Puts either get you some fixed cash or buying the stock more cheaply, but you miss out if the stock takes off.�

1/1/2015

guest I can't find any either. We are in uncharted territory.

History in the making.

This story has the potential to be one of the greatest event in stock market history, the fun thing is, i'm in this time �

�

1/1/2015

guest I am really glad it dropped, I missed the last dip below $30. Picked up more today, and more if it drops lower. (please!) I had been down to my core position and wanted more to play with when we hit $40+ in a month or two.�

1/1/2015

guest Check out this post: Are you also investing in Tesla?�

1/1/2015

guest Well, if the cookie monster empty the entire cookie jar, he will find me.

Will he find you too early?�

1/1/2015

guest Thinking of putting in a limit buy order for this afternoon before close - maybe at around $28. I'm not particularly worried about the macroeconomic environment as TSLA never really trades alongside what the overall market is doing (see today).

I fear it will drop even further though, although there has been a pretty dramatic run-off recently!�

1/1/2015

guest EDIT,,�

1/1/2015

guest What's the catalyst(s) that will do that? In a couple of months (say end of Sept), we'll have 500 cars shipped and maybe a Supercharger announcement. Are you expecting more than 500 cars?

On the downside, Tesla is going to have a scary-looking Q3 balance sheet, with low cash on hand - unless they do a capital raise which will dilute shares and drive the price down. Personally, I've pushed my time frame out to Jan 2013 for a big boost in the stock. And, that's assuming Tesla comes close to shipping 5000 cars.

I think we now have time to let this play out. The stock is holding above $28, but external factors could drive the whole market down and take Tesla with it since there won't be any Tesla-specific news to prop the price up. Much as I'm tempted to let someone pay me for a 17 month long position in Tesla at $28, I'm thinking we could easily have larger dips in the upcoming months.

Of course, I've been way wrong before.�

1/1/2015

guest Interesting. Any idea how the short/float ratio was in that case? The float (in absolute numbers) must have been way higher that for TSLA. I'm still looking for a short/float ratio > 50% (preferably for a small-cap stock) as is the case for Tesla right now.�

1/1/2015

guest It has nothing to do with financials. It's a state of mind. People see the future in the rear view mirror. This means if it's not in the past, they don't believe. Model S is now in the past. Let them realize it. It may happen any moment now, the more cars on the road, the more it will be in the rear view mirror.

Once it's there, watch-out. It's very sudden and brutal.�

1/1/2015

guest Even if we assume all that is true, that doesn't help us pick a timeframe for our options. So not really a useful way to look at it.�

1/1/2015

guest One thing we don't know for sure is the size of the float.

I am calculated in the float but I ain't a float, I'm sitting comfortably on my shares. Technically, i'm in the float cause I have a bid. But it's a crazy bid. How many like me? And some people are crazier then me (even if some say otherwise) .

That's what make this a potential earth shaking event.�

1/1/2015

guest The most tricky element about predictions is time. I agree with Steph that it's a state of mind. I would be very surprised if an actual significant event would trigger a short squeeze. Just as with tornadoes certain criteria increase the odds, yet they remain extremely difficult to predict.

Worst case - for Steph - is that the short positions are gradually covered, and even that is not an improbable option!�

1/1/2015

guest Only time will tell, the timing is impossible to predict, but all data I have point in that direction. (And I really did my homework on this one)�

1/1/2015

guest In understand what you're saying, but that's not what I get from definitions of "float" I find on the web. What I most commonly read is that you are in the float because you don't have restricted shares nor own more than 5% of TSLA.

The actual (free) float required to cover the shorts is therefore (much) less than the reported float.

Unless I'm mistaken, in which case I would gladly be corrected.�

1/1/2015

guest I like writing some August 18, 2012 $27.00 puts that sell for $1.25. Beyond that time, the market risk with the U.S. elections, etc. is huge and TSLA will move with the markets. If the puts are exercised then the stock can always be sold, probably above $25.75 and still come out ok. Perhaps earn a premium in the short term. Thoughts?�

1/1/2015

guest Are you insane?�

1/1/2015

guest No, I think that the analysts (the ones that are not shorting the stock) will be raising their TSLA target price as the plan falls into place. I think Morgan Stanley has had TSLA pegged at around $40/share when they were still estimating 3000 cars this year, and it seems like Tesla may be at least close to 5000. I read the transcript of the Q&A and they seemed fairly impressed with Tesla's strategy and agreed with the decision to have a more exponential rollout. There will always be extreme targets (high and low), but I think a LOT of investors base what they do on these analyst ratings. Obviously global concerns like the Euro will affect the price, and it could still go either direction, but lately there seems to be a bit of positive movement on that front.

A second catalyst could be mainstream media getting on board; after non-Founders get their cars, even if Tesla hasn't given MotorTrend et al. longer-term test drives, there will be a Sig holder who will make some cash by lending her car, and we will see some reviews. And from all accounts there is no reason to believe anything beyond "spartan interior" will be a big issue (and maybe not even that). Even if not all reviews are glowing, Teslawareness will be growing and new investors will be jumping on board.

It could be sooner, it could be later, but Tesla is clearly not vaporware like some still seem to think, they are not having cash flow issues, and it is very probable (barring a direct asteroid hit on the factory or on Elon Musk) that the price will at some point be above $40 at some point this year. And like you, I'm prepared to be wrong, but I'm also preparing to be right (so I don't miss out on a great opportunity). If it drops again in a few months, I'll be adding to my "play pile"!�

1/1/2015

guest Steph is from Montreal, bmek; it doesn't always come out politely, but he means well. �

�

1/1/2015

guest No we are simply just rude around here.�

1/1/2015

guest There's not a lot of downside protection there, so I would only do it if my alternative was to buy the stock today.�

1/1/2015

guest That's not going to happen anytime soon. The Q3 500 car plan is a "better do." The 2500/month for Nov and Dec plan is a "show me." So, Dec. is the earliest I would expect anyone to raise estimates because Tesla is really going to make 5000 cars in 2012. Unless Elon likes the quality so much that he ramps up even sooner than Nov.

While Tesla isn't having cash flow issues now, it is a worry - hence the talk in the conference call about "cushion." If there's a bigger hiccup in production, it could be trouble for them. My guess is a capital raise is a quarter away, and that they'll try to do it with a private placement, rather than just issuing additional stock. Maybe Toyota or Daimler or Panasonic is willing to throw more money at Tesla for a bigger piece of the pie.�

1/1/2015

guest The DOE loan agreement was amended to require Tesla to set up a restricted cash account for the first three repayment installments. Those amounts are shown on the balance sheet. During the conference call, Elon intimated that he might make the first installment that is due in December early. He might as well since the cash has already been restricted and it would be good PR and could give the share price a pop.�

1/1/2015

guest Who cares about loans or financials.

Did you see what these guys have done?�

1/1/2015

guest When investing, one thing I am looking for is irrationality in a large group of people.

Irrationality is your friend when you detect it and you don't let yourself get caught in the game.

Irrationals are loud mouths, they do believe very strongly they are right and no argument can change their mind until the day reality bites them where they wouldn't want to be bitten, the wallet. It's just like religion.

We've seen irrationality at it's best with the .com bubble. I knew it, didn't participate, my mistake.

Then came the US housing bubble, it's interesting to read pre-bubble blogs ( Bubble Meter )

The housing bubble is not only an American thingy, it's all over the western world, including Canada (see it unfolding here: Book and Weblog The Troubled Future of Real Estate )

I sold my house in 2008, happy renter since, will not be caught in that bubble either.

Fast forward to today, it is completly irrational to bet against Tesla, so here I am, once again, betting against irrationals.

Even today, with absolutly amazing reviews, they bring the stock down.

At this time, in my honnest opinion, the only possible outcome is: disaster.

Bite this.�

1/1/2015

guest What's your feeling about the book After shock by David Wied.emer (grammar inserts to prevent google lookup)�

1/1/2015

guest My thinking is that there isn't a lot of downside in TSLA to the end of August and earning $1.25 is ok in a month. To lose capital will require the stock to go lower than $25.75. I am believe in TSLA and would like to take advantage of the premium with the huge volatilty that is embedded in the option price at this point. Perhaps a bit too risk adverse, but probably not insane (yet).�

1/1/2015

guest You can read as many books as you want, if you can't detect irrationality, it won't help. It's very easy to get caught in the game, especially when main stream medias are on the side of the irrationals. Remember housing? Price will go up forever. Remember real-estape pumpers on TV? I do.

No book will tell you in advance what next the irrationals will do. That's why it's fun, when you know about a group irrational behavior, use it.�

1/1/2015

guest Money in garbage.�

1/1/2015

guest Not read it ... no intention of going beyond the online bullet points ... SCARY as hell if correct. And IRRATIONAL too. Hence my question.�

1/1/2015

guest Just by reading bullet points, it looks like another doomer, making money on uncertainty and fear.

Lots of those being printed these days.�

1/1/2015

guest Try this very rational book: http://press.princeton.edu/titles/8973.html

This time is not different.�

1/1/2015

guest Have you read that book Steph? I found it full of data, but not very informative. At least to me. For example, it talked about countries that had hyper-inflation, but it didn't talk about how ordinary citizens coped or not with the inflation.

Back on topic, I sold my VZ stock to get some more TSLA at these great prices! Hopefully, TSLA will be much higher before the next VZ dividend and I can re-balance.�

1/1/2015

guest I did read this amazing book, no opinions there. Make your own.�

1/1/2015

guest Interesting summary of today's option activity: http://www.schaeffersresearch.com/marketcenters/optionscenter/content/bulls+bears+take+sides+on+tesla+motors/default.aspx?ID=112120

�

1/1/2015

guest Again I ask, what is causing this insane movement? How are analysts so ignorant of reality that they can feel this quarter and next quarters earnings bear any reflection on the company? Was half expecting a bunch of downgrades this morning from "Analysts"or perhaps I should say "Short sellers", hoping to make the stock break down below the $28 level. How can anyone make any mention of current earnings/revenue as relevant? This is as bad as suing the past 8 years as a measure for future earnings. They are not running low on cash, and are maintaining their guidance for 2012. There really ought to be laws prohibiting malicious articles, the likes of Peterson. Was really hoping Elon was going to make the surprise announcement about the Super Charge network at earnings. What happened to the big July announcement? WTH was the insane accumulation a few weeks about?

TSLA Stock | Tesla Motors Inc. Stock Downgraded (TSLA) - TheStreet�

1/1/2015

guest Don't you get it? They don't care about the company "Tesla", they have already sold the stock in the $30+ range, and they are trying to "shake" the tree, and get people to sell, how else can they buy the stock back for less money, and cover their shorts? This has been going on since the beginning of companies being publicly traded, there is nothing new going on here. This is just a game to them, and ONLY about maximizing their profit. I suggest no one feed them, don't sell, starve them out. They look for ANY "bad" news (or what could be perceived as bad news) to accomplish their goal. After Tesla delivers a large number of Model S, they can become profitable fairly quickly, so they use every opportunity to make money... Watch, after they are done shorting the stock and have made money on the way down, there will be only "buy" recommendations, as they seek to maximize their upside direction, they will need buyers to sell their long positions to. It's a big game, any company with high volatility is just a vehicle for the prime brokerages to "churn and burn", it's always been this way, the trick is to go along for the ride, or stay out of the game if you don't have the stomach for it.�

1/1/2015

guest From the TheStreet page (emphasis mine):

Computers don't know that Tesla has been investing in and setting up a production line for a Model S, etc.�

1/1/2015

guest Thank-you for being such a good sample of the histeric population.�

1/1/2015

guest Computers: Dumb as chickens.

I have both computers and chickens, both need reboots.�

1/1/2015

guest Volume back to a normal pace, price up.

Where did the sellers go?�

1/1/2015

guest The analysts saying that revenues are less than expected is asinine at this point. If the company was selling cars at the rate of 20,000 and the revenues were less than expected, then it might make some kind of sense. I just wish I had more money to invest in TSLA at this price level.�

1/1/2015

guest Ditto.�

1/1/2015

guest Today is the 27th.

It's official.

I was wrong.

(They don't like beer)�

1/1/2015

guest um..my chickens are smart, and manipulative

my computers not so much.

Soo many shorts out there that are dumb as computers and have no clue what's outside of their hard drive

you can't just keep changing ratings when a company has only been going very positively forward towards VERY large profits.

just jump off a bridge please and leave us alone already

edited 4 Steph (..I meant, on a bungee :wink: not necessarily tied to anything)�

1/1/2015

guest Now now... let's not get to a point where you end up in prison...

(If they need a little push, I'm there)�

1/1/2015

guest The suggestion that the US government could (see: First Amendment, United States Constitution) or even should outlaw articles on the internet you don't like is pretty crazy.

(cough**Iamthecaliflower)�

1/1/2015

guest I'm a little disturbed with the vehemence folks are classifying short sellers as idiots and manipulators. If you've got lots of positions in the stock market, some will fail and some will succeed. I think a great many shorts are ignorant of the details of Tesla and are making a bad decision, but that doesn't make them idiots. They also may be playing Tesla as a high return, high risk gamble position (seems true regardless of if you're short or long). Venture capitalists have a very high rate of failure in their investments, but are diversified typically amongst many long shots so the fact a position is a long shot isn't inherently wrong.

I'm pro-Tesla, but the level of zealotry here in the last few weeks concerns me. I don't want this thread, or board, to devolve into a "with us or against us" mentality.�

1/1/2015

guest At this point in Tesla's history, the cruel and horrible reality is if you are short, you are an idiot.

That is a firm belief.

Edit: I'm Steph and I approve this message. (Awaiting prison sentence)�

1/1/2015

guest It's not "with us or against us", it's much more basic, it's called "market manipulation" and it happens with many highly volatile startups that are publicly traded, nothing new under the sun. Doesn't mean we can't hope their first born is struck down by god �

�

1/1/2015

guest Who's more of an idiot? Me who bought some above $35 a few months ago, or the guy who shorted last week above 35$... lol

�

1/1/2015

guest As firm as you saying Tesla is not shipping the Model S interior?

As firm as you saying the Supercharger announcement is happening today?

Need I go in?

There are a variety of reasonable reasons to be short Tesla. Understand them, do not flat-out deny them. You do so at your own peril.�

1/1/2015

guest Nope.

The other thingies were pure speculation. I lost.

The only time I said I had a firm belief on this board was the idiot call.

I maintain my position.�

1/1/2015

guest I'm long TSLA for now, but I short stocks all the time. In fact I normally post higher gains from shorting than going long. There is no more manipulation with shorting a company than investing in it. It didn't take a rocket scientist to see that it would trade down going into this earnings, and that it will trade up as production and deliveries accumulate, so why not capitalize on it.�

1/1/2015

guest Go on, short Tesla.

If you win, you'll be a financial genius.

But for now, if you do it, read my opinion on the subject a little higher.

Short sellers are probably shorting Tesla because they want to recup losses they had by buying Facebook @ $38.

And they are buying wounderful condos in Montreal, Calgary, Toronto and Vancouver for investment as we speak. And buying fast not to miss the bangwagon.

Last thing. What are the risks shorting Tesla one might ask? Risk is you may make $20-30/share. Nice profit. Risk of losses in $: unlimitted. Yeah, great deal!�

1/1/2015

guest Sorry for the long post.

Ok, so there has been a lot of talk here in this thread about the looming short squeeze and how most investors don't understand Tesla "like we do". I also believe there will be a short squeeze, or maybe a more gradual exiting of the shorts over time without a huge squeeze.

But I think it's also important to look at the company from a more fundamental/value investor perspective. I made a crude spreadsheet (link below) to try to predict the share price for the coming years. I would like any input on this and for those who find it of interest please edit/correct the spreadsheet (it's on Google Docs) and try inputting your own numbers and see what you come out with.

Ok, so income wise I figure in the years 2013 and 2014 it will be two main incomes: Margin on sales from Model S and X + income from sales of powertrains/technology (in the Q report called "Development Services"). The Model S and X are so similar, similarly priced, probably with quite similar margin that I think they can be seen as a whole. It's hard to know if the margin is higher or lower on the smaller or larger battery models, maybe lower on the 40 kW? I would think that options has higher margins. I believe that at least in 2013 and 2014 they will sell cars that tend to be towards the higher price rather than the lower, with big batteries and with many options. Remember that the $7500 tax credit benefits the consumer and no cost to Tesla. There might be other sources of income as well, such as new deals for sales of powertrains, sales of other technology/patents etc. but this is hard to predict.

Main expenses will be of course continued R&D even though this should be substantially decreasing (much of the R&D of the Model X will have been done already and is embedded in the R&D for Model S) until Tesla starts developing the Gen III vehicle fully (timing of this?). Next big expenditure will be establishing and running more stores and service centers, and a larger administrative organization as a whole (in the Q report called "Selling, general and administrative"). The next, and to me very hard to predict, main expense is the Supercharger network - how this plays out has a lot to do with if/who they team up with, who it's financed etc. (we will know more in september). We mustn't forget the paying back of the DOE loan which starts in dec 2012 and according to Q1 letter must be finished in sept 2019, which gives you about 7 years to pay back $465M with low interest rates, about $70M per year.

Oh yes and taxes. I'm no good with corporate tax in the US but I would assume that in the coming years Tesla will be able to use depreciation and such to avoid paying taxes (with the substantial investments they have made in the factory etc).

Further, to predict the share price you'll have to put a P/E number on the whole shebang - and this is not easy. It's hard to classify Tesla as a company. Is it a technology company? Hardware manufacturer? Software company? Car producer? Bit of everything I guess... I think we can all agree that they are market leaders, cutting-edge, and with great growth potential which should boost the P/E number. For reference here are some current P/E number (yes I know, all over the place):

Ford 1.88

GM 5.59

Toyota 32.83

BMW 7.62

Daimler 7.30

Volkswagen 3.44

Nissan 9.33

Honda 21.39

Apple 13.59

HP 7.09

Dell 6.85

Google 18.60

Yahoo 18.07

Microsoft 14.77

So a quite conservative estimate for 2013 with the following inputs: 20k vehicles sold, average consumer price $75k, sales from powertrains etc $30M, R&D at $100M, Stores/selling/adm at $100M, DOE loan payment at $70M, Supercharger network $30M and a P/E of 15 gives a share price of $14.97.

Just increasing the nr of vehicles produced and sold to 30k (possbile according to Elon) gives a share price instead of $41.70 in this model. So an increase in production will have a huge bearing on profit and thereby stock price is my belief.

In an optimistic model where they sell 30k vehicles and a mean price of 80k, still with 25% margin, with increased income from sales of powertrains/technology to $50M and other income of $50M (for example sale of CO2 credits in EU by pooling with another manufacturer) and all of this making the company so attractive and with such great growth potential that the P/E goes to 25 gives a share price of $102.

So please, any corrections and comments on this model is much appreciated.

Link to spreadsheet (anyone can access, anyone can edit, please don't delete everything): https://docs.google.com/spreadsheet/ccc?key=0AgwMomnB2tT-dEg3b2pKSlRqdGlYYWItWWhaOVhsbnc�

1/1/2015

guest Unfortunately, the fervor with which you express pure speculation far exceeds that used by others expressing facts.�

1/1/2015

guest That was long...

Nice analysis but....

I think your approach is fundamentally wrong. You can't base your share price prediction on profits. This is a growth story. You should use Price to sale ratio instead and you will come-up with the same crazy numbers as I did in a post earlier (too lazy to search for it)

But thanks, you are getting there �

�

1/1/2015

guest Don't ever trust anything you see or hear on the internet.

My speculation is on the timing of events, I am not an insider, i know nothing other than what you know, which is: squat, zero, zip, null�

1/1/2015

guest I'll end my participation in this nonsense by saying that you should think hard about whether it's a good thing or not that there's a whole thread named after you.�

1/1/2015

guest - ahem -

Please respect each other's views, no personal attacks.

The food is bad in prison and I hear that repeat offenders get longer and longer terms.�

1/1/2015

guest Just a quick note to say that you should not deduct loan principal payments as a subtraction to net earnings - they are a subtraction to free cash flow, but should be ignored for earnings and applying a multiple to those earnings. And if you are attempting to put a multiple on free cash flow, then you have to determine what maintenance capex (r&d) expense is, vs that part that is required to grow.�

1/1/2015

guest Yeah, I know, it's pretty silly to have a post with my name.

But in the other hand, it's convenient, it serves two purpose, I can say crazy things there and it is also used as a dumbster, a kinda garbage where mods have fun filling with my comments they don't find funny.

Just don't attempt to make sense of discussions there it's a bit all over the place �

�

1/1/2015

guest Okay. I'll be away until tomorrow evening, but I'll want feedback from all the armchair quarterbacks on what is causing the recovery that started today about 12:30 p.m. EDT. Closed at 29.51. NASDAQ, DOW and S&P have had a significant increase all day.�

1/1/2015

guest Markets: Olympic games.

TSLA: Hit major resistance. Start of general sentiment change?�

1/1/2015

guest I'm not sure what it means yet, but I think I'll like this new word.�

1/1/2015

guest Yes.

Dumbster: A place holder for dumb comments.�

1/1/2015

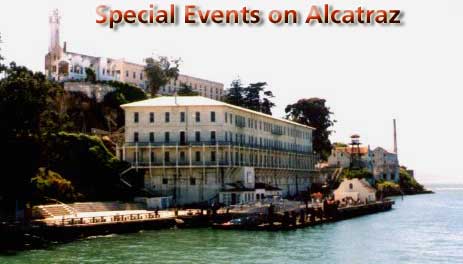

guest Here in CA, people pay to spend a night in prison: http://www.nps.gov/alca/planyourvisit/permits.htm

Mods: OK to move/delete this post�

1/1/2015

guest I'd say the recovery followed an irrational sell off.�

1/1/2015

guest Worst National Park EVER.�

1/1/2015

guest But it really does sound fun! I would try to come back swimming to see if it's really that hard...�

1/1/2015

guest I think you mean support, and yes I agree.�

1/1/2015

guest Sorry about my french

And the Olympic answer was for: "got no clue, could be Greece, sPain, Italian mafia, Ben, the weather, act of one of the god" YGIAGAM�

1/1/2015

guest Anybody else noticed that after hours trading is really spotty for TSLA? Some days they have it, some days they don't.�

1/1/2015

guest Trying to figure out short term trends in a new stock will drive you batty.

There is no rhyme or reason, you have a lot of people placing bets on both sides. You also get people that believe in the company and the promise it holds. Many people short or place calls on the stock based on intuition or gut feelings. At some point, which can seem random, those have to be covered.

Don't sweat the daily ups and downs �

�

1/1/2015

guest EDIT,,�

1/1/2015

guest Does that mean the interior will not be the same as what we now about?

That would be awkward... �

�

1/1/2015

guest EDIT,,�

1/1/2015

guest Beefed up might mean they have two people working on it instead of one part-timer or it could mean they have thirty people now working on it--just no way to tell. I'm quite a ways down the line so my hope is that they will get it right by the time my number comes up.

Basically:

Chrome and glossy = bad

No lights and mirrors = bad

No convenient hidden storage = bad

No usable cup holders = bad

None of these things should be that hard to fix (at no extra cost to the customer--even if they have to take a 1% gross profit hit--about $900 per car--on the first 5,000 cars to do so). The plain-ol black would look darn attractive if it was a matt finish.�

1/1/2015

guest EDIT,,�

1/1/2015

guest Sure you do. Actually, your view probably matters more because there is a reason you haven't become a reservation holder and it's important for Tesla to find out why. In my case the things I don't like are fewer than the things I do like--but that doesn't mean I don't want improvements (and will continue to whine about what I don't like). And there's always the possibility that something will tip me over the line the wrong way. I don't think that's likely though.

That is my hope too.

The worst thing about the Model X is the screen placement. It looks just right for vandals or kids to pull off and is an invitation for thieves. Everything else seems fine assuming you can live with the lower range.

Right. I'm sure that will be the case. If I was twenty years younger I would definitely wait for the GenIII (and if I was $10M richer I would have a Sig Performance:biggrin.

�

1/1/2015

guest EDIT,,�

1/1/2015

guest Steph,

I think you might be confusing after hours trading with something else. FYI, after hours often has much higher volatility than traditional trading hours. The highs and lows of after hours are usually more extreme than that of daily trading, in fact the actual high and lows of most stocks are hit in extended hours which are not listed in quotes. So you can often pick up shares at a significant discount or short them at top highs.�

1/1/2015

guest Woohoo!

I got those options when we were at $28.15. Up 5% the next day. Good end to a rough week.

Put in a couple sell orders at various prices because I'm going to be cruising this week. Good luck everyone, I expect us all to be millionaires by the time I return.

Would be nice to offset my blackjack habit at least. �

�

1/1/2015

guest Very nice. I picked up one contract for March at 31 but most of mine expire in December. I could really usethe stock to be above 35 by then�

1/1/2015

guest How are you guys trading the stock today? Selling off? Or do you guys think it is another great spot to enter?�

1/1/2015

guest Not a good time to sell off in my opinion but then again i am new to this. It's a good time to buy based on recent prices�

1/1/2015

guest The stock should begin climbing as reservations are consummated. In the foreseeable future there isn't really reason for a significant downward trend unless there is a hiccup of some sort or until/if they do a capital raise (probably stock offering) which will likely cause a short term decline (although it could go the other way).�

1/1/2015

guest Tesla stock - Kind of toy for some people ???

the tesla stock is doing some weird up and downs lately. Whats going on there? Is the misbelief over the stock still there? Friday +5% for no reason, today -5% for no reason. Or is there a reason that i dont know of? Im starting to believe, that the stock is some kind of amusement tool for some people, who are manupulating the stock this way....

Any thoughts??�

1/1/2015

guest @yngwie_2012 - Welcome to the stock market.�

1/1/2015

guest I think that's just normal volatility. It's kind of amazing really, a company that has been losing money for 10 years, finally on the cusp getting in the black.�

1/1/2015

guest When you read a lot of the articles about Tesla stock that recommend a buy, sell or hold stance, this one for example, just talk about the various metrics about a company that speculators use to try to evaluate the health of a company at a glace. With a company like Tesla though, most of these metrics are totally useless since they're not selling their primary product yet. Listen to past quarterly investor Q&A calls, you'll hear questions from national investing firms about why revenue and US sales had dropped so severely a full quarter or more after the Roadster had sold out in the US. Instead of looking closely at the business plan and detailed information, many are trading on cookie cutter statistics that don't necessarily matter at this point in the company's plan.

Of course this is all from the eyes a investor who's long on Tesla, and views these dips as buying opportunities.�

1/1/2015

guest The last time we had a big sell offs like this was when that big investor sold off all of their shares and when the stock was downgraded by one of the investment analysts.

I wouldn't be surprised if we find out tomorrow that there was a downgrade by another investment analyst or some other semi-major news. Sometimes the stock has its ups and downs but sell offs this big are usually the result of some bad news.�

1/1/2015

guest I don't see the volume.�

1/1/2015

guest Earnings reports for q2 was just released which I think is driving down the stock. With all the news positive and negative I expect the stock to move quite a bit for the next few weeks.�

1/1/2015

guest Much as I like Citizen-T's thoughts, we seem to regularly blow through whatever 50 day, 200 day, 314.7 day averages the statistics seem to favor.�

1/1/2015

guest Wise man once say 'buy on the down and sell on the up' :wink:�

1/1/2015

guest EDIT,,�

1/1/2015

guest Yep, I'm holding tight. The dogs are all sleeping in the sunshine, not a care in the world.�

1/1/2015

guest EDIT,,�

1/1/2015

guest picked up another 5 august 28$ calls today and another 35 shares(for the retirement acct).�

1/1/2015

guest Officially at its lowest point since the January Exec panic sell off. Great buying opportunity in my mind, wish I hadn't already pumped my spare cash into it earlier this week.�

1/1/2015

guest I wonder how the test drive tour is doing, it would be great shareholders if S orders start piling in and that info gets released. Better yet would be unequivocal word that they've started the ramp up, I wasn't too clear after the conference call if they had stopped production entirely for now or if they were just going really really slow.�

1/1/2015

guest EDIT,,�

Không có nhận xét nào:

Đăng nhận xét