Feb 19, 2014

callmesam ?I will be live blogging the conference call at 230PM PST. If you have any thoughts or suggestions before we go live, please post them now.

Here is the link to audio:

Tesla - Events Presentations

LINK TO REPORT:

http://files.shareholder.com/downloads/ABEA-4CW8X0/2967652535x0x727013/9885dd26-2e82-4052-b171-3685fd8150b3/Q4%2713%20Shareholder%20Letter.pdf

Here are some links to previous blogging done by me on TM:

Tesla Motors, Inc. Third Quarter 2013 Financial Results QA Webcast - LIVEBLOG | Forums | Tesla Motors

Live Blog 2012 Shareholders Meeting June 4, 2013 | Forums | Tesla Motors

Live Blog Tesla Announcement April 26 - Elon Musk | Forums | Tesla Motors�

Feb 19, 2014

bonnie thank you!�

Feb 19, 2014

callmesam I'm getting excited. So in order of items affecting the future of Tesla:

1. Gigafactory

2. EPS

3. Chinese Demand

4. Supercharger status

5. Model X status

6. 6.0, AWD MS

7. Gen III�

Feb 19, 2014

MikeC Thanks buddy!�

Feb 19, 2014

callmesam I will cross-post this post (as primary) on TM Model S forum.

Thanks for the encouragement from everyone. I will endeavor to do my best. It's especially hard to keep up with the analysts who ask 3 run-on questions at a time.�

Feb 19, 2014

callmesam From The Report above:

"To further enhance the driver experience, new Model S customers will now receive free data connectivity and Internet radio for four years. As an added benefit to our existing Model S customers, the free four year period

starts on January 1, 2014. To be fair to all, in rare cases a customer may be charged for extreme data use."

- - - Updated - - -

"For the quarter, non-GAAP revenue was $761 million, up 26% from Q3. GAAP revenue for Q4 was $615 million,

up 43% from Q3."

- - - Updated - - -

Both Toyota and Daimler powertrain programs remain on plan and contributed $13 million of revenue in the quarter. Q4 sales also included $15

million of regulatory credits revenue, but no zero emission vehicle (ZEV) credit sales.

- - - Updated - - -

"We expect to deliver over 35,000 Model S vehicles in 2014, representing a 55+% increase over 2013. Production

is expected to increase from 600 cars/week presently to about 1,000 cars/week by end of the year."

- - - Updated - - -

"Very shortly, we will be ready to share more information about the Tesla Gigafactory. This will allow us to achieve a

major reduction in the cost of our battery packs and accelerate the pace of battery innovation. Working in partnership

with our suppliers, we plan to integrate precursor material, cell, module and pack production into one facility. With this

facility, we feel highly confident of being able to create a compelling and affordable electric car in approximately three

years. This will also allow us to address the solar power industry�s need for a massive volume of stationary battery

packs."�

Feb 19, 2014

Dborn Anyone who can, PLEASE ask about pricing and deliveries to Australia. That is WHEN CAN WE EXPECT TO SEE PRICING ON THE WEB SITE?�

Feb 19, 2014

NigelM Mod Note: Thanks @callmesam. Thread temporarily sticky. I'll leave it like that for a few days.

Comments and discussion here - Q4-2013-results-data-points-projections-and-expectations�

Feb 19, 2014

callmesam It's starting . . . replay will be available later today.

- - - Updated - - -

bla bla bla GAAP v non-GAAP . . .�

Feb 19, 2014

carrerascott Gigafactory information coming next week, along with capital raise information.�

Feb 19, 2014

callmesam Adam Jonas MS: Opportunities in the battery business . . . pull in fresh capital to plan for force majeur?

Elon: That's a smart move. Will talk about that next week about the Gigafactory. I can't say much right now, but your advice is good.

AJ: Would a capital raising be a prerequisite?

Elon: I think it's necessary to have it occur in three years. It's not necessary if we allow that time frame to expand.

- - - Updated - - -

John Lovalo: Cash flow?

Depak: I think that in 2014 we expect to generate significant cash flow. It's early to give clear guidance for 2015 but we see this a great year for accrual.

JL: What is a mid-term margin/operating profit longer term?

Depak: Our long term target OM is in the teens. That has not changed.

Elon: Emphasize reinvestment opportunities are significant for a long time. Our profitability, near term, will be less than that. Mid-teens is very achievable. Car business is $2T/year just in sales. Big ramp ahead for reinvestment.

JL: Distribution licenses in China? How were you able to deal with this issue?

Elon: Sales and Service is not a problem, only local manufacturing. They expect you to partner with a local entity. This is the early stages of selling in China. Short to medium term there is no need to partner.�

Feb 19, 2014

mulder1231 Love this from Elon about Model X reservations: "Sort of like fish jumping in the boat"�

Feb 19, 2014

AudubonB Elon (Model X): "The fish are jumping in the boat".�

Feb 19, 2014

callmesam Brian Johnson: $140M in deposits to $163M. Can we infer increase in order or change in mix?

Elon: Model X demand is VERY high. We dont' disclose exact numbers and there is no marketing. The "fish are jumping in the boat" We aren't even trying to sell the Model X.

Depak: that's on top of Model S deposits.

BJ: Where does the order book stand geographically?

Elon: Probably work to do in Europe, mostly because of a number of charging issues. it's one economic market, but not one charging market. That's slowing us down temporarily, but we'll address that in the near term.

Depak: Lots of demand in China.

Elon: Based on current trends, we will be unable to satisfy demand in China.

- - - Updated - - -

Ryan Brinkman: Drivers of margin expansion? COGS or supplier price reductions?

Depak: All of that and design improvements. As we expand production, our suppliers see cost savings. All that contributes to gross margin improvements.

Elon: 25% to 28% margin improvements just comes from scaling up and assumes that the mix of option uptake drops. We'll sell more of the affordable and still hit our higher margins.

RB: Incentives for Tesla in China? What kind of volume assumptions for China?

Elon: Not going to break out the market percentages. It appears that we will NOT be able to get everyone in China a car this year.

Depak: We are working with the Chinese Gov't but we are working on the assump0tion that we will NOT get any of the local incentives.

- - - Updated - - -

Andrea James: What is that status of partners and what will be the project pack cost reductions?

Elon: More than one partner. Panasonic is our primary currently. Default assumption that P will partner on gigafactory. There will be other partners for anode and cathode production. I don't want to talk now, but will talk next week.

AJ: 16% increase in deposits . . . what are you seeing?

Elon: At first we saw a drop in demand due to the fires. We were quite worried about it. But as consumers realized this was a media-driven thing. Our sales have improved and continue to improve. Consumers have started to realize that MS has a half-order of magnitude safety over gas cars and their fears have subsided.

When the fans are flamed by media, and without social media, we would have been in real trouble.

AJ: NHTSA report?

Elon: We anticipate a positive result. We have been cleared in Germany, Britain and Japan already. US is the lone holdout. We have provided info and we await their decision, hopefully soon.�

Feb 19, 2014

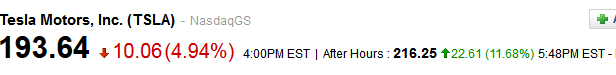

AnOutsider clearly people like what they hear

�

�

Feb 19, 2014

pz1975 Elon said he expects a positive outcome from NHTSA.�

Feb 19, 2014

callmesam Lynn Quai: 1000 cars a week . . . 2 lines? Shed light on what's getting you there? Will that max you out?

Elon: We are constructing a new line in the factory. The full answer is a little complex. Some are production constrained. Some are not. To get to the 1000 rate, we do need a new "final assembly" line which we are constructing. Shift over at the end of the 3rd Quarter.

The new BODY IN WHITE line is not needed, but it will be used for the Model X and S.

LQ: 1000 a week. That's not maxed out? Additional capacity beyond that?

Elon: Fair to assume we'll be able to go to higher numbers if the demand is there.�

Feb 19, 2014

Clprenz Fair guess that Model S demand will sustain 50k a year, Model X should Go beyond that gain�

Feb 19, 2014

Mario Kadastik WOWOWOWOW... Gigafactory will consume ALL of its own production and may need to still bring in cells from outside so no expectation for other customers.�

Feb 19, 2014

callmesam Len Kello: Evolution in demand from a year ago. Where can it be 2 years from now for the S? Loop that in with production expansion.

Elon: Difficult to predict. In relative terms, X will see as much demand as the S. Guess that X demand (speculative) will exceed S demand. As far as S demand if there is a global recession (macro factors). Seems likely to sustain demand at 1000 units per week of the S.

LK: Should we expect customer offtakes of the lithium ion batteries?

Elon: We'll have a dedicated call next week. The gigafactory will absorb all the cells it produces and we'll likely to need more production from outside factories.

LK: On the verge of profitability?

Depak: Should be profitable in Q1.

Elon: We could have aimed for a higher delivery number if we gamed delivery, by becoming a "contortionist". We decided to just produce cars. Our revenue number will be less than if we played games with domestic v intl markets. Q1 will be lower than it otherwise it might be.�

Feb 19, 2014

austinEV He really left the door open for a Q1 delivery beat. He basically said, "if we try at all we could deliver more."�

Feb 19, 2014

Krugerrand That's called cornering the world market. The implications....�

Feb 19, 2014

c041v As much as I want to believe that, I think you meant ~50k a year, based on the 1000/week comment.�

Feb 19, 2014

callmesam Dan Galves: Comment on 1000/week together with EU and Asia could be double US deliveries. If you take 12k units/quarter, 4, 4 and 4 between the markets?

Elon: Difficult to predict sales between markets. Best fidelity is that non-North American sales will be roughly 2X North American sales. We are trying to balance customer wait times. We did quite a few EU deliveries and slowed down US deliveries to make people as happy as possible.

DG: China charging. What's your view? People are mostly charging at home in the US. Is that viable for the Chinese consumer living in an apartment.

Elon: We've got some good solutions. WE'll talk more about that in the coming months.�

Feb 19, 2014

Doug_G I was wondering about that. When we had the tour at TESLIVE last year, some parts of the production facility were looking a little crowded. Makes a lot of sense.�

Feb 19, 2014

callmesam Patrick Archambau: OP EX. Is there still some ability to leverage? Or is investment cost offsettting fixed cost?

Depak: We are mindful of OPEX. We continue to be frugal, but will continue to invest. Not ready to give long-term guidance. We are trying to bring out OPEX down in the long-term.

PA: Did you give the US/Intl split?

Depak: No. We haven't done that in the past. [HOLD on mute . . . lol]. Most of the growth in q4 came in EU, US was steady. Increment went to Europe.

PA: Sounds like your expectations for the X are higher than we thought. How can we think about accretion of that platform? Presumably you've learned things and your supplier has learned things. . . tailwind?

Elon: Not sure I understand the question.

PA: You've learned a lot with X. Is there a margin tailwind just from what you've learned from the S?

Elon: Gross margins higher with the X? There could be . . . but we do expect the option take rate to reduce over time. If the option take-rate doesn't reduce then 28% margins will be higher.

PA: is there some kind of mix tailwind from the X launch from what you've learned in your supplier relationships?

Elon: Yes, but we don't want to predict any better than 28% margins.

- - - Updated - - -

Cullen Rush: Tac time? How do you see two shifts playing out and hiring?

Depak: Just to clarify. We are currently running two shifts. Different shops run on different times. We will continue to improve efficiency as we ramp up during the 2nd half of the year. No single tac time to report.

CR: We will be able to improve our labor efficiency over the course of the year.

CR: Trim line

Depak: Q4 to Q1, we are ramping up to EU and China. We could have delivered more to the US to increase profitability, but we didn't. That's why you'll see deliveries drop in Q1.

- - - Updated - - -

Cullen Rush: Tac time? How do you see two shifts playing out and hiring?

Depak: Just to clarify. We are currently running two shifts. Different shops run on different times. We will continue to improve efficiency as we ramp up during the 2nd half of the year. No single tac time to report.

CR: We will be able to improve our labor efficiency over the course of the year.

CR: Trim line

Depak: Q4 to Q1, we are ramping up to EU and China. We could have delivered more to the US to increase profitability, but we didn't. That's why you'll see deliveries drop in Q1.

- - - Updated - - -

Elon: HOpefully other manufacturers will adjust their practices not to gouge Chinese consumers. But not sure that they will. We are seeing VERY STRONG demand since we announced pricing. Our bigger challenge will be filling demand.

Q: Should we expect MS improvements in the future.

Elon: Don't want to comment on future Model S changes. We add features every month on a continuous basis.

- - - Updated - - -

John Albertine: Will any construction at the factory be for the GEN III?

Elon: We will learn from those lines, but the GEN III will have its own lines. It will be geared to a higher volume. We do anticipate producing GEN III in Fremont. When it was owned by GM/Toyota it was producing 500,000 vehicles per year.

JA: Has there been a shift to focus on the Gigafactory?

Elon: GF is there to support GENIII. Happening in parallel with the developoment of the GENIII. Part of one combined effort.

JA: No movement on 2017 launch?

Elon: No�

Feb 19, 2014

AudubonB Gigafactory: OK, where is a highly windy location in the portion of the US that gets great solar insolation? �

�

Feb 19, 2014

callmesam Craig Erwin Wedbush: Can you clarify something you saiid on the last call: lower environmental footprint to battery production? Solvent free or advanced recovery systems?

Elon: Current LI production is not bad. Panasonic factories in Japan are SUPER clean and have no waste. But we can take it a step further and heavy power by solar and wind + recycling of old pack. Look at the whole life cycle and be in the best possible situation from an environmental impact. Pack recycling is happening in Belgium and Vancouver. Not like they are sent to a landfill.

CI: ASP has been turning positive. You seem to be conservative. Do you expect the sequential increases or flattening?

Elon: Definitely flattening or slightly reducing, within a standard of 2(?) Prudent thing to assume to a reduction in the option take rate as we get into a mainstream market. We are trying to be conservative. But we want to protect the scenario where it is.

DONE!�

Feb 19, 2014

sleepyhead Thanks a lot for doing this callmesam!�

Feb 19, 2014

Zextraterrestrial You need to take a tour 'now' :smile:

..thanks for the thread.. I only managed to hear the last 5 min or so of the broadcast but looked at the after hours # a bit before and smiled BIG!�

Feb 19, 2014

RationalOptimist Incredible how lame the questions. Pretty much any of us on this forum could have asked better ones.�

Feb 19, 2014

AudubonB Wanted to make sure all who didn't hear this that there will be NEXT WEEK a detailed release of Gigafactory information.�

Feb 19, 2014

austinEV Yeah I think I need to reserve a factory tour.�

Feb 19, 2014

ckessel Thanks callmesam!

Somebody get this man an award for fastest transcription ever!�

Feb 19, 2014

callmesam We all do our part. I just have fast fingers :wink:�

Feb 19, 2014

tigerade Agreed. Boring questions. I was hoping to hear significant news on the Gigafactory but it looks like that won't be until next week.�

Feb 19, 2014

NigelM Nice job! Thank you.�

Feb 19, 2014

callmesam I have never posted to forums before. Thanks to everyone for all the work done BEFORE today's earning report.�

Feb 19, 2014

ckessel I would have liked to hear a question about how warranty costs are going compared to expectations.�

Feb 19, 2014

Bgarret You would have thought that someone would at least have said, "when next week?"�

Feb 19, 2014

CapitalistOppressor This is a given. The 30GWh of production that they seem to be targeting for the factory will not be enough to supply the 700,000 cars they plan to build in 2019. The Giga-Factory will be the first of many.�

Feb 19, 2014

Tempus Very much agreed. Got stuck in a work meeting and was unable to listen in. Was great to be able to read it all here. Really looking forward to the gigafactory call next week!�

Feb 19, 2014

davecolene0606 DG: China charging. What's your view? People are mostly charging at home in the US. Is that viable for the Chinese consumer living in an apartment.

Elon: We've got some good solutions. WE'll talk more about that in the coming months.

= solution for city dweller/condo/apartment in all world markets = last barrier to wide acceptance of the technology.

+ supercharger build out + Model X domination of SUV market + gen 3 + solar battery storage solution......

OMG! just astounding!�

Feb 19, 2014

kenliles not to mention the Solar storage packs-�

Feb 19, 2014

Johann Koeber T

hank you so much. For me the call was not easy to understand (English not my mother tongue), reading much easier.�

Feb 19, 2014

CapitalistOppressor I've been thinking they will go to New Mexico to make good on dissing them by choosing to buy NUMMI after having a deal already set up for a factory in New Mexico. Plenty of sun there, and there and the Texas panhandle (just across the border from New Mexico) has some of the highest quality wind production in the world.

- - - Updated - - -

Yes. They will have to do that as a part of their capital raise.�

Feb 19, 2014

Fast Laner Appreciate your outstanding job, callmesam.

@johann: i bought the lottery ticket and a few shares on the dip.�

Feb 19, 2014

CapitalistOppressor Awesome work by callmesam btw.

- - - Updated - - -

Yes. That said, they'll have to be careful about how much storage they divert, because their continuing ramp up of car production will largely be constrained by battery supplies for at least the next decade.�

Feb 19, 2014

kenliles yep- agreed; definitely going to be a (nice-to-have)challenge;

btw- great to see you around again; when you get over-exoticized come back more often!�

Feb 19, 2014

ItsNotAboutTheMoney Unless there are pri ary resource constrajnts, I'd expect Gen 3 success to allow for veeerrrryyyy rapid exoansion.�

Feb 19, 2014

GLDYLX Thank you, callmesam! Your flying fingers ROCK!

And thank you, mods for making this place such a fantastic community/resource!

Happy Wednesday!�

Feb 19, 2014

slipdrive There are likely very good production/demand fits with a giga battery facility coming online in say 2018. The plant output can immediately be taken up by say 60%storage/40%auto and then as Model S batteries start retiring, they can feed into the then established market for stationary applications. Eventually, the retired transport batteries fill most of the need for storage. The strategy gives me the biggest Tesla grin yet! This is an outstanding future for our battery paks. Electric utility peak shaving and deferring or eliminating combustion generation resources. FUDsters and NAYsayers will continue to do what they do. The facts will speak for themselves.�

Feb 19, 2014

joefee I felt that every ER...sold my trading position way to soon :cursing: ...TSLA hit another one out of the park!�

Feb 19, 2014

yobigd20 I wonder how that trader who bought $700k of put options feels right now.�

Feb 19, 2014

callmesam Like he/she has been repeatedly struck in the groin region.

Crotchbat!

Nerf Crotch Bat | Saturday Night Live - Yahoo Screen�

Feb 19, 2014

Causalien Ohhh? Source? I love a good drama show.�

Feb 19, 2014

yobigd20 Oh and CNN apparently thinks the Model X is a "hybrid" lol

�

�

Feb 19, 2014

NOLA_Mike The giant bet that Tesla will fall 75 percent�

Feb 19, 2014

yobigd20 Beat me to it. Yep. That guy. $700k down the toilet. That was one hell of a stupid bet.�

Feb 19, 2014

pz1975 Anyone see the Bloomberg interview with Elon? Can you give a summary?

On Stocktwits they are reporting it as very positive, but I'd prefer to hear the opinions from those on this forum.�

Feb 19, 2014

kenliles not only that, it's more for juice for our long as he will undoubtedly buy it back at a loss later this year (if he/she even can by that time)�

Feb 19, 2014

Causalien Not sure. But with options it is hard to know if it is actually a buy or sell unless you pour over the orders tick by tick. My guess is, some smart investor did a bull put spread and the market maker took the other side and subsequently balanced it with stocks. It is something I would've done if I am in all cash and want to take advantage of earnings while not being hugely exposed to large swings. Because c'mon. Why would you buy puts at 100/50 when you can buy puts at 200/150 if you are short.�

Feb 19, 2014

justaddsun Thanks @callmesam for spoon-feeding me the info while I was spoon-feeding myself some pasta! �

�

Feb 19, 2014

wishing_for_S Does anyone know if there was any discussion of the Model X launch on the conference call? The shareholder letter says that design prototypes will be on the road by the end of the year and "volume" production will begin in 2015. Was this clarified any further or did they leave it intentionally vague?�

Feb 19, 2014

Benz Interesting to hear that they will not be able to satisfy demand in China.

"Depak: Lots of demand in China. Elon: Based on current trends, we will be unable to satisfy demand in China."�

Feb 19, 2014

RobStark You are welcome Elon.

This is Elon tipping his hat to many a tmc.comers correcting FUD all over the net.

I am subtly trying to convince my sister and brother in law to buy a Tesla Gen III. She is due to buy a car in about 2018.

She has a dedicated Tesla hater at work.

I saw for dinner on Sunday. First thing she and my brother in law ask me about is "Tesla's Toronto Fire."�

Feb 19, 2014

Causalien Thank you Elon for the hat tipping. I am glad you read some of my jokes.�

Feb 19, 2014

Curt Renz Amarillo, Texas (pop. 190,000). Among US cities with a population of at least 50,000 it is the third windiest with an average of 13.3 mph. The two with faster wind speeds are both in Massachusetts. "Windy City" Chicago is not in top 100. It was actually a term used by 19th century New York politicians to describe the speeches of Chicago politicians.

Of course if Texas wants the factory, they're going to have to stop blocking Tesla's business models for sales and service.�

Feb 19, 2014

Mitthrawnuruodo Friend of mine is related to someone pretty high up at Tesla. I heard awhile ago that they were looking at either Reno, Nevada or somewhere in Arizona.�

Feb 19, 2014

MikeL Thanks to sam & all. Thinking of changing my user name to "FishintheBoat", or something :wink:�

Feb 19, 2014

yobigd20 Friend of a friend of my mother's sister's uncle's brother's cousin's neighbor's girlfriend's dog said it was going to be in a desert here or there or down there or up here. Yeaaaa that's credible.�

Feb 19, 2014

bonnie I'm willing to put good money on Arizona or New Mexico. Any takers?�

Feb 19, 2014

Mitthrawnuruodo I never mentioned it here before since if I were in your position I would think (but not say) the same thing. Since this was brought up I just wanted to stir the pot. Thanks.�

Feb 19, 2014

blakegallagher Take me with you I will carry all your bags and buy all your drinks

Thanks again callseam for doing this ... I came home after work to listen to conference call and for whatever reason am having a hard time getting it to play. I will listen to it in full tomorrow but this was a great way to get the info I needed tonight�

Feb 19, 2014

AlMc Depends a lot also on what state gives them the sweetest deal. No money to wager but...don't laugh too hard....Delaware has an empty GM plant (Fisker was to use) and an empty Chrysler plant. Far from California but low taxes/state gives great tax breaks to manufacturing and..maybe not a big deal but the best place to adjudicate for businesses in the US. This is why many large company's corporate headquarters are in Delaware.�

Feb 19, 2014

bonnie So are you saying you're willing to place a side bet with me?

�

�

Feb 19, 2014

brianstorms The gigafactory is gonna need to be:

� located right next to or very near a major freight railroad

� near a large enough city that there's available workforce / infrastructure

� lots of sun for solar power, perhaps wind a factor as well

Albuquerque would be a good spot. As would Amarillo. Maybe somewhere in AZ too.

I kinda hope it's Albuquerque. But I wouldn't be surprised if it's in Texas if a quid pro quo can be reached regarding the anti-Tesla auto dealership association.�

Feb 19, 2014

Causalien I bet Arizona�

Feb 19, 2014

RobStark I always thought Reno would be perfect.

Cheap land, good business climate, near new lithium mines( I know only 3% lithium in lithium ion batteries but still) and near Freemont.�

Feb 19, 2014

austinEV One time the wind stopped blowing in Amarillo, and everyone fell over.�

Feb 19, 2014

Cosmacelf I agree with a poster above: please someone ask about warranty repair costs versus expectations. Tesla does deliver great service, but it has got to be expensive...�

Feb 19, 2014

AudubonB There's a fine thread regarding the Gigafatory elsewhere; I brought up "wind & sun" here because of breadcrumbs Mr Musk dropped during the conference call.�

Feb 19, 2014

772 Those are good reasons... IIRC, Elon said he could see them doing up to 500k/yr at Fremont, so Model E wouldn't necessarily need a new manufacturing plant.�

Feb 19, 2014

SFOTurtle Actually, the generally pro-business Delaware corporate code and Chancery Courts that has considerable expertise in handling a myriad of corporate and shareholder lawsuits are why such a large number of companies are incorporated in Delaware and are therefore Delaware corporations in the legal sense, but relatively few actually have their actual headquarters in Delaware (Dupont being one notable exception).�

Feb 19, 2014

DaveT I don't bet against bonnie. I'm smarter than that.�

Feb 19, 2014

SFOTurtle Reno or Las Vegas also fit all of your criteria nicely.�

Feb 20, 2014

brianman Indeed.

- - - Updated - - -

Nice work, sir!�

Feb 20, 2014

CapitalistOppressor With the Texas Legislature out of session until next year I am skeptical that Texas is in a position to offer the kinds of policy and economic inducements that would be required to bring Tesla in. They had the opportunity in 2013 to play nice with Tesla and they booted it.

- - - Updated - - -

No. Any of the four corners states make sense, with the possible exception of Utah. My money is on New Mexico.

- - - Updated - - -

For betting types who like to be informed: Nevada is the main source of Lithium in the U.S.�

Feb 20, 2014

AlMc One beer. Lost my last bet so not a good track record. I already owe Nigel one.

- - - Updated - - -

I bought 10,000 shares of Western Lithium Mining yesterday because of this.......for the huge sum of $3,400 ( 34 cents per share)�

Feb 20, 2014

Causalien Awesome. A CDN company that I can benefit from.�

Feb 20, 2014

NigelM I have another bet for you.

Sony.....�

Feb 20, 2014

AudubonB Ouch. Good luck on W. Lithium, but I'm going to let you find the post where I showed why I'd never place my money there. On the other hand, I used to own Soquimich, and might again...�

Feb 20, 2014

AlMc What is the bet? :biggrin:

I remember that and thank you for the warning. I took some of my TSLA option gains and just thought I would have some 'fun' with them. I expect nothing. Just wanted to own 10K shares and I can't afford 10K shares of TSLA!�

Không có nhận xét nào:

Đăng nhận xét