1/1/2015

guest Excellent post. The part I'll add is that though it is bad for overall adoption of EVs and the climate, low oil/gas prices will anesthetize (like that dsm363?) the ICE manufacturers for awhile. 12 months? 24 months? Who knows. But it will slow their already tepid steps into EVs and that will create a wider gap between Tesla and the rest. I bet if oil had dropped dramatically 9 months ago and not 9 weeks ago there's a good chance we'd never know that the Chevy Bolt even existed.�

1/1/2015

guest This is an intesting point. The less effort automakers put into developing electrics, the harder Tesla must push to make up for it. We may have to launch the Tesla Truck just to kill the high margin business of the industry. In a cheap gas environment, it may be essential for Tesla to compete directly with the high margin gas hogs.�

1/1/2015

guest Just to reiterate, TM makes a great widget: it is premium priced, they have sold all the widgets they can make in 2014, they have sold all widget Xs for 2015--yet to be even made. TM intro premium upgrades to their widget which sold well.

Furthermore for those long here, the lower cost widget 3 is merely a function of cost to the battery, and likely they have excel spreadsheets which show them this.

Finally, TM business is about selling widgets, not servicing them. IF this basic analysis was applied to other auto manufacturers if this would hold true for them? But as far as making a premium product TM has done a great job in showing us how to do it.�

1/1/2015

guest Ask GM how long the wait is to drive away with a sweet Cadillac ELR.�

1/1/2015

guest Fisker dead.

Cadillac ELR dead on arrival.

Building a world class EV is not as easy as it looks, even for a giant player like GM.�

1/1/2015

guest Neither of those are EVs though, and that's the whole problem. It's a lot easier to make one car than to try to shove two cars into one body.�

1/1/2015

guest A new Roadster would make sense, but the engineering aim should be to make it capable of being driven on a track. But there's more potential income in making electric commercial vehicles, and Tesla's large battery model gives them an advantage.in this space.�

1/1/2015

guest Early last year when Musk was in England for the UK launch he expressed an interest in forming a design group in England. I can't remember the name of the specific city. It's the automotive center of the UK. A Tesla design group would facilitate adaptions to European markets such as right hand drive, but would also design entirely new models like a new roadster or other concepts that would be well recieved in Europe. I wonder whatever happened to this idea. I think there is some merit to it. I would like to see Tesla have the design and engineering bandwidth to develop more than one car at a time.

BTW, in Detroit at the owners only party, Musk admitted that they do not have any schematics on the Model 3 yet. It sounds like they won't make much progress on Model 3 until Model X is well into productions. As a consequence, delays for the Model X have become delays for the Model 3. I think realistically they need 3 to 5 years to design a new model. So a second design group in Europe sounds like a really great idea to me.�

1/1/2015

guest As a final year engineering student in the UK I would warmly welcome this. Could be in Birmingham? Or, as FOX viewers will now call it 'That city in the UK where non-mulsims don't even enter'�

1/1/2015

guest One might argue that GM was not trying to build a world-class EV with the ELR, but rather do some classic GM badge re-engineering to ride Tesla's coattails. The Bolt seems like a more earnest effort.�

1/1/2015

guest I didn't think they were riding Tesla's coattails, I think they were trying to see if they could extract more value from the Volt Gen 1, while trying to introduce PHEV into the Cadillac line-up.

What became clear to them (which is why I think that they're not planning ELR 2), is that they'd need more performance to sell in numbers and get the margin they want, so instead they'll have Cadillac hybrids and, in the future, a Cadillac BEV. From my understanding, the redesigned transmission in Volt 2 could be used in hybrids.�

1/1/2015

guest I'm glad I got some high-voltage response to the truck idea! There is, many thousands of threads past, one dedicated to a Tesla truck but no one can argue that at least the concept is appropriate fodder for discussing in the Long-Term thread. I have developed a fair number of thoughts regarding Ideal Design but for the most part am not open to showing them in open forum, not so long as designers other than Tesla can view here.

By the way, although horsepower certainly is important for heavy vehicles like pickups, for pulling what you really are interested in is torque. And that is precisely where these electric motors utterly excel, both in terms of their absolute number as well as in their inherent nature of providing effectively max torque across the entire speed band. An electric truck is so absolutely superior in all regards to an ICE truck that, were sentimental reasons and sticker shock not factors (which they are), one could make the case for their being a value at possibly twice? the price of a conventional pickup.�

1/1/2015

guest AudubonB, are you willing to share your ideas with Elon? I think Musk really likes to come out with special innovations that set Tesla apart, things like the receding handles and falcon wing doors. So if you've got something really cool that could be the hook to get trucks on the drawing board.

More broadly, my thinking has been that if cheap oil continues to be a factor and a challenge for the Model 3, then there may be a compelling reason to put a truck on the fast track. How that coordinates with the Model 3 timeline, I don't care. The important thing is that if cheap gas is pushing us into a period where consumers are only willing to pony up cash for the big and powerful, then Tesla needs to be in that market. Certainly, the Model X should do well in such a buying climate. The Model S should be fine, but midsized sedans might be a pretty lack luster segment to be in. High power trucks will do much better and offer both high volume and high margin. Midsized sedans are lower margin to begin with, so if the volume is not there, it could be a real dissappointment, too much headwind. So Tesla would do well at least to have truck designs as a back up. They may want the option of launching a truck as early as 2019, if they are not overwhelmed with Model 3 orders.�

1/1/2015

guest The problem is that trucks are going to need a lot more battery per mile, which will drive up the price, which makes it harder to compete in a low oil price environment, (if it continues). F150's range from $30K to $50K, which is Model 3 pricing. A Tesla truck would be at least twice that.�

1/1/2015

guest I've had my Model S for two years. Unfortunately my business and arctic travels require my owning a Dodge Cummins 4WD (now unbearable to drive!). I'll be the first to put my money down on a 1/2 ton or 3/4 ton EV truck, even at double the price! Hell, 3 times the price!�

1/1/2015

guest One moderating factor here is that low oil prices will also bring down other commodity prices. Looking back to 2008 metal prices (when oil was at a low point), aluminum was down 25% from today, copper down 35% and nickel down 45%. So with the gigafactory squeezing out the non-commodity, manufacturing costs of batteries and the commodity price coming down another 25% or so, we could arise at a really low battery cost. Basically, once battery costs come down to commodity pricing, then the oil versus battery comes down to comparing two different baskets of commodities. They will be highly correlated. So if the correlation is high enough, you have in EVs a natural hedge against cheap oil. The end game economically is that the premium of transportation fuel markets over electricity markets will be eliminated through battery enabled arbitrage. But the commodity price of the batteries themselves are a function of oil prices. So longer-term I have no worry about EVs losing out to cheap oil. Cheap oil makes for cheaper EVs. And, yes, cheap oil also makes for cheaper ICEVs, but the long run equilibrium tilts in favor of cheaper electricity. Oil can never be cheaper than electricity; otherwise, electricity could be made more cheaply. The really key thing is that Tesla squeeze out as much non-commodity cost as possible in making batteries; economics will take care of the rest.�

1/1/2015

guest With the Gigafactory coming on line, battery prices become less of a roadblock, of course. And there's been more of a move lately toward "luxury trucks". At the top of the range is the Cadillac Escalade truck with a base price of $64K.

I think Tesla needs to design a truck that has great aerodynamics (for a truck) without looking dorky. That's really the key. For long distance freeway driving, weight doesn't significantly affect range unless you have a net elevation gain and/or steep grades. Perhaps an air suspension would be particularly important here, to enable substantially raising the truck in day to day driving (for those who like riding high and for rough conditions) and lowering it for long freeway drives where range is important.

Admittedly, aerodynamics would still be a problem on the freeway if towing a big boat while carrying dirt bikes in the bed. Assuming long trips with non-aero loads aren't made with great frequency, the "workaround" could simply be to spend more time at Superchargers. Maybe Tesla could sell aero trailers and aero "camper" shells as accessories.�

1/1/2015

guest But I bet you could sell a lot of trucks even if they have only a 160-mile range. Sure, not every use case, but I believe that are a lot of commercial pickups that drive in a limited radius. Gas mileage on pickups is nearly as bad as in luxury cars, but what's important is that the owners tend to be much more cost-sensitive. Cutting your fuel bill from $200/week to $50/week is a big deal for commercial operators. You could pay $25k-$35k more upfront and still come out ahead in terms of total cost of ownership.

Add to the compelling economics the better torque and ability to power tools without a generator, and there's a lot to like. Sure helps that Tesla already has a flat bed!

BTW, this idea has been thoroughly explored in older threads on TMC, particularly

Tesla Pickup Truck�

1/1/2015

guest People who use their trucks as work trucks are often not going a lot of miles with them. This is especially true in commercial and fleet applications. And in those cases, saving on fuel costs can be a big deal to whoever is doing the books. Notice that every truck ad these days touts their 20mpg or whatever.

A contractor will put a lot of miles on a truck, but they're all local miles, to and from job sites, to Home Depot, etc. Trucks can also plug in at job sites (which have HV outlets) or can have outlets so people can plug their tools into the truck.

Plus trucks are expensive. And there's less pressure on price because people write them off as business expenses.

So yeah, there's plenty of market for a nice, somewhat expensive, non-200kwh truck. I have no idea where that number came from. And I'm sure Tesla could make an economically compelling truck in the not-too-far-future, but it's not coming before Model 3, so that might as well be forever in Tesla Time.

What Tesla does need to work out is a good fleet maintenance program...or start releasing info on servicing their cars. Since fleets often do maintenance in-house, they may not want to outsource this unless Tesla has an attractive program for it or something. Maintenance would be another boon of having an EV fleet as long as there is a solution to that issue.�

1/1/2015

guest Well, of course I would be, other than that the idea of going to the top seems presumptuous. Perhaps some one or ones in design; possibly Diarmuid O'Connell. I have been around the block enough times to know not only that a number of my ideas never have been used in or envisioned in any production or custom-fabbed pickup but, more importantly, are ideally suited for an EV pickup. Really, really different stuff, cool stuff, hugely useful stuff...and practical stuff. They could make this EVTruck a platform that could catapult Tesla into a whole galaxy of otherwise NeverBeCaughtInATesla motorists, and spell a world of hurt for FordChryslerGM.�

1/1/2015

guest I wonder if anyone on TMC has any contacts that might be helpful. If not, I suppose you could contact investor relations to advise you on how best to share your ideas with design staff at Tesla. I do hope you find some ways to put these ideas out there.

Just a thought, have you heard about how Musk is crowdsourcing the design of the hyperloop? He's got people from all over collaborating for no more than shares in the businss if they ever make something. I'm not sure that's called for here with Tesla, but it shows something about how Musk is able to organize people for problem solving. It seems that crowdsourcing for new product feature concepts could be quite powerful. I would love to see that sort of engagement.�

1/1/2015

guest Idea on battery swapping concept

I find battery swapping a really fascinating idea - it makes EVs better than ICEs in yet another aspect (refueling quicker) and would give Tesla yet another edge over its competitors if implemented on a large scale. But even with the beta test at Harris Ranch now underways, from his recent comments it sounds as if Elon is not quite convinced about the future of this technology.

I see the one central problem (assuming it works reliably from a technical point of view) with battery swapping in having to return the same battery to its owner or otherwise set up a complicated payment system taking into account the different age/fitness of battery pack turned in and picked up which makes everything unflexible (having to go back the same way to pick up your battery or having to pay a differing price every time). But is that really necessary?

My idea is that Tesla could set up the service such that they guarantee everyone using it that they always get a pack as good or better as the one they turned in. The average increase in battery value over all those exchanged would be part of the fixed service charge. In the beginning, when only a few people are using it and there are not so many packs in store at every swap station, the age/fitness differences of the packs going in and out would be statistically relatively large, but as soon as it is widely adopted and more packs of different fitness are available at the station, you could more and more closely match the pack coming in. So the financial risk from statistical fluctuations in the matching would be larger per pack in the beginning, but not cause a problem because of only a few ones exchanged. Later, you can be pretty sure to have the right pack for everyone and calculate the fees quite exactly. Shouldn�t be too hard to model that if you have the distribution of the battery fitness of all packs (which I am sure Tesla does).

In addition, this way Tesla could keep the fitness level of its customer�s cars up which would add to the long-term value of the product. People might not have to be afraid of having to spend a big chunk of money on a new battery if they own the car for a really long time.

Caveat: on the long run, you have to store quite a few batteries at every swapping station - I guess that store would have to be handled by a robot, too, to make it efficient (kind of like a tape robot which was used for retrieving magnetic backup tapes in IT).�

1/1/2015

guest Yes, and that's always been a crucial problem for the swapping concept. There have to be enough batteries on hand for peak demand periods, and batteries are the most expensive component of an EV, so the cost of those batteries need to be added to the cost of each car. I think 400+ mile packs and a bit faster recharge times will basically eliminate the need for swapping for most people. If you really take a lot of longer trips than that and can't spare the 20 minutes or so for a fast charge then you probably need a plugin hybrid.�

1/1/2015

guest I think Elon Musk also sees the issue as a diminishing problem, which is why he's so reluctant to invest in swapping. But, to be able to handle the peaks that high-density rapid-refueling systems can handle will be a serious challenge. So I see swapping as a necessity, but something that might be deployed as a mobile temporary solution.�

1/1/2015

guest In Detroit, Musk mentioned that he could see battery swapping working for commercial trucking since businesses would place a premium on high speed swapping. That still leaves open the question of who owns the pack. My view is that in the commercial trucking space you want to go with leaving. So Tesla would own the pack and lease them to truck operators.

What's more, it is not necessary that the tractors actually be electric. Consider the possibility of placing batteries on th underside of trailers and use that to power the wheels of the trailer. The tractor would be outfitted with a controller that controlls the motors in the trailer. Of course, if the tractor were electric too, then power could be routed from tractor to trailer or trailer to tractor, depending on how much energy is available in the respective packs. This sort of system would open up a lot of options for charging logistics. For examples, trailers could be charged while loading, unloading or not in use, whether or not a tractor is present. So if Tesla owns and leases out the packs, then truck operators need only to acquire eTrailers with baterry dock, motors, and controller and tractor fitted with eTrailer master controllers. So the incremental cost of the hardware over the cost of a conventional tractor and trailer could be quite small, maybe around $2000 for tractor and $5000 for trailer. All the other operating cost is embedded in the pack leases and charging. So operator would need to see that the energy boost from this system is enough to save them $100 or more on each month to make this a compelling package. I think this could pencil out much better than that.�

1/1/2015

guest 200 mile packs and fast recharge time will eliminate the need for most people. 100 mile packs and fast recharge times will eliminate the need for most people. 51% of people do not need a 400 mile pack with even faster than 20 minute recharge. That's more like 1%. 5 if you want to be super generous and count one time over the life of the car as "need".

We've already far beyond eliminated the need for most people.�

1/1/2015

guest I NEED a 400 mile pack. :smile:

I don't suppose people NEED to go over 35 mph, either. But they do.

Before cars, horses made about 10 mph, and people seemed to be happy.

I also have the largest phone battery I can get. I never run out of charge, all day reading or whatever. I don't need it, but I like it. How's that?�

1/1/2015

guest *sigh* Not according to most people, so, there's that....The few who agree with you are free to buy as small a pack as they want.�

1/1/2015

guest You said most people need. People may think they want something else, but no, "most people", as in 51%, do not "need" 400+mile packs and faster charging. And no matter how many times you claim that everyone in the world drives a thousand miles a day and all the driving statistics are wrong and you're the one person who knows the truth of the matter because you've apparently done some sort of secret study which nobody else is privy to, that's not going to change that most people's needs are well beyond filled by the cars which are already on offer.

Now, why do they "think they want" something else? Because of ICE industry shills, who for some reason are being cooperated with by people who should know better such as yourself, who constantly tell them that despite the fact that the current offerings would save them time, money, stress, air quality, health, global conflict, lack of driving pleasure, etc. etc. etc., they better not bother and keep destroying the world because the one casual roadtrip they've never taken and are never going to take might take 20 minutes longer that one time. Why don't you go buy that VW which gets 700* miles on a tank of gas instead until EVs finally have "big enough" batteries which of course will always be just around the corner and never now (*as long as you're driving 25mph and don't stop for 30 hours because that's totally normal right).

Yes, a majority, 51%+, are well past having their needs met by what's on offer. Faster and more available charging should (and will) always be a goal, and you have an argument for the 1-5% of the population who actually might "need" that (which, btw, isn't met by the majority of gas cars, which do not have 400+ mile tanks on average). But not for "most people."

At least we both understand that swapping is niche, with few practical benefits and a lot of logistical/cost nightmare to it.�

1/1/2015

guest Right now, on a relatively balmy winter weekend in the mountains of SoCal, there's a constant flow of traffic drawn to the ski resorts, nice scenery, and pretty lakes. Generally, visitors come from all over the region, from San Diego to LA and beyond. Do people *need* to visit these mountains? Arguably they could do without. But when they do, they want their cars to be able to make the trip with a minimum of bother, and not everyone will have a place to charge once they get here. With 200+ miles of range, today's Tesla vehicles can do it, though a Supercharger stop (in traffic and crowds) is often necessary. With a LEAF, only the most dedicated will make the trip. For the many millions of drivers in this region, more range wouldn't be a bad thing. Remember that most people have little sense of urgency as to climate change and cutting their personal fossil fuel consumption.

The fewer compromises involved in switching from ICE to EV, the better.�

1/1/2015

guest Somewhere in your rant you missed the fact that I never said most people need 400 mile packs and I never said everyone drives 1,000 miles a day. I said "I think 400+ mile packs and a bit faster recharge times will basically eliminate the need for swapping for most people." That includes people who don't need or want 400 mile packs as well as those who do, everyone is covered by the availability of larger pack choices, without the need for swapping.�

1/1/2015

guest Hey it's Groundhog Day again with the FANGO range argument! I should set my clock by it.�

1/1/2015

guest <sigh>�

1/1/2015

guest I usually stay out of discussions like this and I probably will regret saying anything, but since everyone is always ganging up on FANGO and seem to have a contrarian view, I would like to say my 2 cents. I think FANGO has brought up some very valid and interesting points throughout this reoccurring topic.�

1/1/2015

guest If people are buying Leafs with 100 mile range, M3 won't have issues selling with 200 mile range. Sure the 200 mile range isn't for everyone, but it's good enough for 90% of the population. I personally would never pay for a bigger battery, it's useless for my driving habit. It's extra money I am better off doing something else with, like buying more shares in Tesla stock. My round trip to work everyday is approximately 30 miles. On weekends I drive 100 miles round trip from OC to LA. In the past 10 years I've taken one road trip bc I fly everywhere. As much as I like driving, the thought of driving 400 continuous miles never creeps through my mind. There's better things to do with my time than driving.�

1/1/2015

guest I think what people need is not objectively measurable. If they only use supercharging for 1% of their trips, you could say they don�t need it statistically. However, if they feel they need it, they�ll base their buying decision on it.

The question is: do you offer people only what you know they will mostly use or what they feel they need? I would go for the latter. I am not saying build a swapping station at every supercharger. But like at the 10 most used ones for long distance travel wouldn�t pose too much of a financial problem and take away many peoples fears (as irrational as they may be).�

1/1/2015

guest How often do people need to go 0-60 in 2.8 seconds, or over 200mph? Should probably buy a car which can do those things, just in case, right? Only thing is, they're all a million dollars.

You can offer people "what they feel they need" - 400+ miles, apparently - and make a car which is lousy or too expensive, or both, which by the way we've heard Elon and JB say many times because it's true, and it wouldn't sell very well at all. If Tesla had offered a Model S starting with 400+ mile range, costing twice as much base and weighing 5600+lbs, do you think we'd all be talking here right now?

The auto industry has spent plenty of time designing by focus group. They get a bunch of people together, ask them what they think they want, and then make a Homer-mobile designed by a clueless public. At some point someone who knows better needs to step in and say "no, we're not doing that, you guys don't know what you're asking for."

Wild fantasies about what people think they want and what they actually will ever use need to be reconciled at some point. Which is where we reach a cost equilibrium between what people would like to have and what people are willing to pay for. Right now, the Leaf doesn't even have 100 miles of rated range, and has quick charging capability but not quite so quick, and yet it's the best-selling EV in the world by quite some way. Clearly much of the public understands that 100 miles plus quick charging is suitable for their needs. But the same 2-3 people, who inexplicably spend so much time on an EV forum, are constantly talking about how unsuitable EVs are for the general public because most people couldn't possibly get along without a 400 mile battery. And having these sorts of "advocates" sure isn't helping anything - it causes people to write off the entire idea of EVs, Tesla or otherwise, before even giving them a second thought, which is why the ICE industry pushes range and recharge times so hard, constantly reminding consumers of them. And some of us happily oblige. "With friends like these..."

Tesla is certainly not going to sell a million Model 3s by 2020 if the general public continues to be led to believe that 200 miles isn't even enough for a minority of their driving.�

1/1/2015

guest You prove my point. In truth there is no need for much more than a 10 second 0-60, and there is no need for a top speed greater than 80mph, yet most cars exceed both. Why? Because people don't feel comfortable with "just enough".

The number of people who have bought a LEAF is tiny compared to the size of the market, it's a drop in the bucket, and it's far under what Nissan projected. We are still completely in the early adopter phase, so saying it's the best selling EV isn't really saying anything. In fact much of the public clearly does not understand that 100 miles and quick charging takes care of most of their needs, since most of the public are not buying LEAF's, or any other EV.

What FANGO constantly ignores in all of these arguments each time I point it out is that "200 miles of range" is really not 200 miles of range because it can be drastically reduced by unfavorable conditions. If 200 miles was always 200 miles, and if fast charging points were ubiquitous and under 10 minutes then his opinion would be a bit more valid, but none of those conditions exist today nor are they likely to for a long time, and maybe never. So the reality is selling "200" mile EV's that end up being 120 mile or less EV's in a snowstorm with a 45 minute refueling time if you have access to a supercharger is not going to work with the general public.

Additionally the general public has no knowledge at all of the discussions we have here, so the idea that our honest discussion of range issues is somehow discouraging the unaware public from buying EV's is beyond ridiculous.�

1/1/2015

guest Moderator's Note

Please re-read your posts before hitting the Submit button. If you've written about another member, then revise. Posts should talk about facts, ideas and opinions, not about the person expressing them.

Thanks for your help in keeping the discussion civil.�

1/1/2015

guest I agree with this 100%, and I never intend to drive 400 continuous miles. But I think it's worth reinforcing my previous point, that "400" mile pack does not exist in all conditions. It's cold, it's windy, it's snowing, there are elevation changes, and for some reason you weren't able to start out with a full charge, maybe a breaker blew in the middle of the night. So now you have a 180 mile trip and even with your "400" mile pack you're going to be cutting it close, and those are the worst conditions possible to be faced with running out of charge.

When talking about range we always have to remember that pack ratings don't exist in the real world. In some conditions you might get more and in many conditions you're probably going to get less.�

1/1/2015

guest How about the sentiment "Choice is good" in the range discussion? Granted, Tesla did not find enough buyers for the 40kwh version of the car to justify its continued production, but I bought one because of price point and it serves my needs well on an island that is about 40 miles long. Can a 200 mile range work fine for most drivers if superchargers are plentiful and quick? Yep, I suspect so. Should Tesla some day offer a 400 mile range car for those who want or need (Alaska, Northern Canada, etc.) it? Yep. Choice is good.�

1/1/2015

guest Choice is definitely good. I'd argue that right now the focus for electrifying transportation 'quickly' is to concentrate on what the majority need/think they need rather than having choice for all.�

1/1/2015

guest So two things to add to the discussion...

First: pack degrade. We all know that as the cars get older the packs slowly don't hold as much as when they were new. If 80% loss is "reasonable" to expect before the car is crushed or the battery replaced then a 200 mile pack is now looking like 160. Then add all the other things on top that JRP3 and other have mentioned mentioned... Cold weather, hilly terrain, weight from passengers and luggage, and generally not doing a "range charge" for most all of your driving. Note that a standard 90% charge on a fully degraded pack would be 140 miles. So really you have lost close to 30% of your daily range, which is what I have seen some people voice concern about with their roadsters.

Second: I don't honestly know what type of household people were raised in or what luxuries people currently enjoy but I personally grew up in a household of 7 with an income of less than 30k a year for the household. And I will tell you, one of the things we did NOT do... Like ever... Was fly anywhere. Even taking old ticket pricings into account you were looking at close to 2,000 for 7 people to board a plane and go to a "reasonablely cheap" stop. Then add in whatever you were spending at your destination and you could quickly see how that wouldn't be panning out on our salary. Now obviously my family would not be the market for even a 30k car... Because that would be nearly impossible for us to have been able to afford, but if we are considering that all cars MUST go electric. Then you can assume that we would at some point find either a cheap new car or a used one. I can tell you, a 100 mile car would not work for us. Because when you live on the poorer side, and you do things with your kids you focus on things that are also cheap to do. So we did road trips to places that were cheap or free... And back then gas prices were also a LOT better (so really its compatible to cheap electricity today.)

Point is, there are a lot of people, especially today, who do not fly... And likely never will, because flying is a luxury they cannot afford. Then add in the millions of people who live in the country as well, where it is not uncommon that the closest big city is 100 miles away or more and how in the world do you plan to move these poorer people into electric vehicles? Is a 400 mile cheap pack needed today/tomorrow to make the next million or so cars sell? Of course not. But to think that they won't be needed at all is not thinking about transitioning EVERYONE to electric. I am not looking at this from the 1% either... It is a considerable number of people who live greater than 100 miles from a major metropolitan area.�

1/1/2015

guest Choice would be wonderful, except that there are some people on this board who seem to think that there shouldn't be choice, and who are constantly arguing against lighter packs and reasonably sized packs, as if they will never be of any use to anybody. Note that my original post said that "100-200 mile packs with fast charging are more than enough for most people," and that we did not need 400+ mile packs for "most people" to have their needs met - which means, in fact, that "most people" could get along fine with the cars currently on offer (which have 90-265 mile packs and all have quick charging). This is a fairly simple and true statement which nonetheless was overreacted to, as usual.

As for canceling the 40kWh - which was being anti-sold and delayed and it wasn't clear that it would ever come out (surprise, it didn't) and the mix of buyers at the time skewed high since it included a disproportionate amount of Signatures and got just as many sales as Tesla allowed it to. If it weren't for the fact that the company is still supply constrained and the larger packs have a bit higher GM, it would have been Tesla's worst decision. As it is, it's fine enough. But it certainly didn't help adoption, which is the explicit goal of Tesla.

So I presume that when the Roadster comes out with it's 400 mile battery, and isn't all of a sudden the best-selling car ever, it's going to mean that we need to add more range, because 400 isn't enough in the eyes of the public? Or might there be other issues related to supply, selling constraints, choice, price, and consumer education happening gradually instead of immediately that limit those sales? The last of which is something that we can certainly discourage, and some of us seem to actively do. "The public" doesn't even look at EVs, doesn't have any idea what sort of choice is on offer, because the only people who could be selling them, us, often aren't doing so. Nobody's running ads (except Nissan), nobody's dealers actually try to sell them (except Tesla), and the public in general is completely ignorant of what they can do. And yet the Leaf still makes up more than 50% of pure EV sales.�

1/1/2015

guest I disagree that it didn't help adoption. I think the reality would have been an expensive, limited-range (with no Supercharger access) large car with no significant amenities and with underwhelming performance and it would not have sold well at all. Had Tesla been making the battery with the same cells it might have been worth continuing, but with the different cells the low take rate and high demand for other models made it more hassle than it was worth.�

1/1/2015

guest

When you continue to argue from absurdity it rather points out the weakness of your arguments. How can a car that is no longer sold become the best selling car ever? How can a car that retailed for $110K+ become the best selling car ever? What does any of that have to do with the range of the car? Answer: Nothing.

What the public "knows" about EV's is they have limited range and cant fuel up quickly. Until the public "knows" at least one of those is no longer true adoption will be slow. The only affordable EV for the general public is the LEAF, and considering it's price point compared to the Model S, the LEAF sales volumes are frankly quite poor. The fact that the Model S at three times the price, only on sale for about 2 years, is at about half the sales volume of the LEAF, which has been on sale for about 3 years, speaks volumes. Not to mention that plenty of LEAF owners complain quite a big about the limited real world range of the vehicle.�

1/1/2015

guest You know, if you actually bothered to read the things you were responding to, you'd see that the next couple sentences addressed that. It's almost like there's some considerations other than range! Does this mean you've finally come around to reason? Or were you just trying to be contrary and accidentally agreeing, without actually thinking about what you were saying?

Yes, and thanks to the tireless advocacy of knowledgeable people like yourself, they will continue to "know" this (thanks for the quotation marks there, they're very applicable), and continue not to buy EVs no matter how suitable they are, just as you seem to want.�

1/1/2015

guest Yes, my rational discussion of range reality on this enthusiast forum is killing EV sales.I should be telling them that the 80 mile range LEAF, which can drop below 50 miles under many conditions, is really all the vehicle they need, because FANGO said so. When they say 50 miles of range in the worst conditions isn't enough I should tell them they are wrong. And when they drive 26 miles to work and can't make it home I'll tell them to call FANGO so he can tell them they really are sitting at home in their living room, not stuck on the side of the road.

�

1/1/2015

guest Is that the same rational discussion where you make up numbers (100 = 26? how interesting) and don't read the things you're responding to? Just making sure we're reading the same discussion here.�

1/1/2015

guest Ahem! Step back please folks before it all ends up in snippiness. First and final warning.�

1/1/2015

guest That's not how I remember the events. Regardless, in the end not enough people ordered the 40. It was that simple. 4% was the stat Tesla gave. The decision to then cancel the 40 was easy for Elon/Tesla to make, since Elon already considered it (and I quote) 'hobbled'. Clearly buyers didn't want to pay the price for the amount of mileage. The Model S wasn't a compelling purchase unless it had at least the 60kWh battery and even then the 85kWh battery is the clear preference for buyers. Some of that popularity can likely be attributed to performance.�

1/1/2015

guest Indeed the same people who would have bought a 40 would have caved for a 60 since that was all that was on offer... And clearly even with the demand of two groups the 60 barely justifies its existance.�

1/1/2015

guest I came here for long term fundamentals. What I got was.....something else.�

1/1/2015

guest How do you remember them? Because those were the events. When a company actively tries to tank a product, the product tanks. Not surprising. As a short-to-mid-term business decision maybe it was fine. But if they end up doing the same thing to the Model 3 it will not turn out well at all. So I hope Tesla realizes that.�

1/1/2015

guest I think I already explained what I remember happening. But...okay, if you insist we'll go along with the actively tries to tank a product for the sake of moving along. How does the active tanking of an expensive, premium, large sedan that was mileage and performance hobbled have anything to do with the Model 3, which is intended to fall in a totally different and much larger segment that is far more price and efficiency (mileage) sensitive connect? Oh, never mind. �

�

1/1/2015

guest Like I said, "As a short-to-mid-term business decision maybe it was fine. But if they end up doing the same thing to the Model 3 it will not turn out well at all. So I hope Tesla realizes that." It sounds like you agree.�

1/1/2015

guest No, I don't agree. I believe Tesla was correct in not producing the hobbled Model S 40, just as I believe Tesla would be correct in not producing a similarly hobbled Model 3, ie. a Leaf, a Volt, any 'city only' EV.�

1/1/2015

guest So one post ago you said that things would be completely different, and now you say that things would be completely the same? Do you think the Model 3 should start at 45k, then? And that the significant price hike would have no effect on the "far more price sensitive segment" which it targets?�

1/1/2015

guest No, a post ago I was trying to connect the dots for you on what I thought and failed.

Where does the 45k come from for the Model 3? I'm still hearing 35k from Elon/Tesla before incentives. Do I think most people will buy the 35k base Model 3? Nope, probably not. I think the majority (more than 50%) will option out the Model 3. There's a difference between a more price sensitive segment and the 'most' price sensitive segment. Tesla is aiming for the former and always has been. The car will be compelling enough that I believe they will pull buyers from the latter segment as well, just as they've pulled buyers from lower price segments already for the Model S (and likely Model X).

I believe Tesla will make the right decisions needed to reach their end goal, and I believe they've shown more understanding of what it's going to take to electrify the industry than anyone else. I understand you don't.�

1/1/2015

guest The 45k comes from raising the base price of the car by 10k, which is what happened with the Model S (in fact, more than that, but we'll stick with 10k for now, just discussing the 40kWh elimination). What I said is that if they did the same thing to the 3 as they did to the S, things would not work out nearly as well.

Do you think that raising the base price of the Model 3 by 10k is a good idea?

Fantastic, then we're in agreement once again! Because I understand that you don't.�

1/1/2015

guest Folks, it seems to me that trying to assume details about a car that's 3 years away is going to result in a particularly futile discussion whichever side you're on.

Tesla's target/plan is Model 3 with ~200mi range and somewhere around $35k. Nobody knows much more detail than that and we can pretty much guarantee that nothing is set in stone right now.�

1/1/2015

guest They didn't raise the base price. They chose not to make a model option that virtually nobody wanted. Why didn't people want it? Because they inherently understood what Elon/Tesla already knew; it wasn't compelling enough, it was hobbled. Not enough mileage, not enough performance.

IF, virtually nobody wants the base 35k Model then I'd expect Tesla to adjust accordingly. You seem to be assuming, though, that it's a forgone conclusion.�

1/1/2015

guest Nigel, thank you for injecting some much needed reality into this topic.

It's way to early to be arguing about a car about which so little is known. At this point all I am confident of is that Tesla will produce a 200 mile EV for under $40K. It will have a flat battery pack in the floor, and a touch screen, and four wheels. ;-)�

1/1/2015

guest I will say that if Tesla raises the base price it will only be because they have to, and it certainly is a possibility. I'll be happy if they can just keep it under $40K.�

1/1/2015

guest The Boston Consulting Group ranks Tesla Motors amoung the top ten most innovative companies of 2014.�

1/1/2015

guest Hmm...they ranked Tesla #7 and Toyota #8. What "innovation" has Toyota offered recently?�

1/1/2015

guest Exactly. Any pricing statement made 3 years out should be prefaced ceteris paribus.�

1/1/2015

guest Something to do with smoke and mirrors and future "concept" cars. Toyota is way ahead of Tesla there.�

1/1/2015

guest Hey hey hey, who said anything about 4 wheels!�

1/1/2015

guest Yeah, could be a 6 wheeler! I believe something along the lines of the vehicle JRP3 builtTotally going to win over the masses!

�

1/1/2015

guest Zero wheels, hovercraft!�

1/1/2015

guest Bring it

�

�

1/1/2015

guest How about a 3 wheeler like the Reliant Robin:

reliant robin - Google Search�

1/1/2015

guest I started replying to a recent post in the China thread, and quickly realized that my response was far too broad for that thread, so I've moved it over here.

I'm with you jhm about Tesla not being demand constrained. I think part of the difficulty many or most of us have is how do you know what the actual demand is when the product is production constrained and has/will be over an extended period of time? One way of thinking about it - for those who have an MBA or some other flavor of business school, what (if any) is the classic case study for a company that experiences a multi-year or even decade plus production constraint? Outside of maybe airplane manufacturing, I can't think of anything even vaguely happening along these lines. The point being that as far as I can tell, we don't know what a business in a sustained production constraint actually looks like! Tesla is the case study.

We know that Tesla has projected for 33k deliveries in 2014, so let's use that number. Is there anybody here who believe that worldwide demand for Model S + Model X in 2014 was 33k units (I see the 2 as being an interchangeable unit of demand for Tesla, at least at some point later in 2015)? Of course not - we know there's 10-20k units of Model X demand based solely on crazy people (like me) putting down deposits months or years in advance. We also know there is a multi-month backlog of Model S orders - orders that are being filled at an increasing weekly pace (production).

If Tesla had built 66k Model S + X in 2014, would that have satisfied demand? If so, then we'd know that 2014 demand was somewhere between 33 and 66k units. I have my doubts (I think it would not have satisfied demand). But my doubts aren't the point - the point is how do you assess what level worldwide demand is, when you have so many headwinds to demand generation in a production constrained environment? For Model S, as the wait time increases, the number of orders will naturally decrease (people don't want to wait). That MIGHT translate into an actual missed sale, and it might just translate into somebody who decides they don't need a new car this year, but next year that decision could change. The company could advertise, which would presumably stimulate demand.

We've also seen a dynamic with Model S where sales don't satisfy demand - they create demand. I haven't seen this studied to my satisfaction, but it certainly seems like the more cars that are sold in California and the more common Model S gets to be, the more demand there is for the car. Clearly that's an early market dynamic and will taper as the market saturates, but there's an awful lot of the world where that hasn't played out yet. And what does "market saturate" even look like?

To get a better handle on current demand dynamics, the limits on what demand could turn into, and how this might project into the future and Model 3, it seems to me that one change we need to make as long term investors is to be clear that Tesla and Model S aren't IN the worldwide automotive market (yet). Thinking and comparing Tesla / Model S to the worldwide automotive market makes as much sense as thinking of Ferrari as a participant in the worldwide automotive market. Yes, both sell in many countries, and yes both are automobile makers. But there are many segments (frequently but not always based on price) that neither participates in at all. And those segments are huge. (And this isn't a surprise to anybody).

For the Model S, I believe we'll be better served looking at the worldwide market for large luxury sedans (which immediately removes all of the other BEVs from the Model S market, as I believe they should be). Some questions that I keep thinking I would like to investigate (and then get tired thinking about all the work):

- Is the large luxury sedan market growing overall?

- Is that market growing faster in the countries / markets that Tesla participates in?

- Whatever the recent market baseline growth, has Tesla's participation changed / increased that growth rate?

-- My hypothesis here is that Model S represents such a compelling product, that it is bringing people into the market that wouldn't otherwise participate, and doing so in large enough numbers to grow the market measurably. I further believe, but haven't studied it well, is that Model S is not only growing the market, it is also taking market share from the incumbents.

-- I further believe that if we went back to your model jhm of how EV's and Tesla grow to consume the whole market, we could use that model but run it against the worldwide "large luxury sedan" market, and possibly gain insight into timelines and % impact that Model 3 will have when it begins production.

- What is the market share / units like for the other manufacturers? - For each make, are they growing or shrinking before and after Tesla's entrance in any particular market? (I figure there will be variations within the countries, and understanding that variation may help us predict which countries we expect Tesla to do well when they open there).

- Between the large luxury sedan and luxury SUV markets, this analysis might provide insight into the ceiling on Model S demand. Clearly there is an absolute ceiling of 100% market share of the expanded market Tesla has helped create (my hypothesis).

I'm thinking that the right level of detail for this analysis, if it can be found, is quarterly data (can be generated easily using monthly data that seems to be common in the auto industry), by country, market segment, and make / maker (I'm thinking VW Group will have at least 2 or 3 makes in the pile - have to think about this one a little bit).

Ultimately when attempting to understand demand, we are still constrained by having no evidence of the actual demand level. Maybe we can substitute a demand model for something that addresses market dynamics and changes in the relevant market, and be able to build a model around that and project it. H'mm - this sounds like something I could turn into a thesis for my Masters degree if I really wanted to ...

Along these lines, one reason to build this model around Model S is to then have a baseline to line up Model X as it comes to production and as it's volume builds. Do we see substitution of Model S orders for Model X orders / deliveries? Does Model X affect it's market faster or slower than Model S? (I suspect faster, as there is more effort going into manufacturability of the product prior to release than Model S had). Model X as a separate product in a separate market from Model S may provide additional insight to the impact we can expect from Model 3 and it's market. Wouldn't it be nice to have an estimate of expected growth in the market, along with market share Tesla might achieve over time?�

1/1/2015

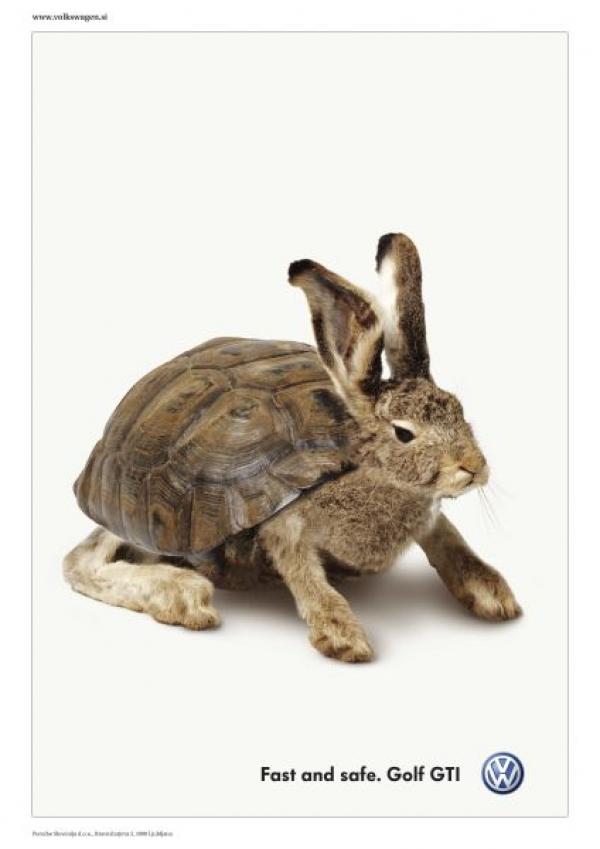

guest Adiggs, thanks for spelling this out. I do think we are witnessing something quite unusual in Tesla. What we see is a huge established auto market and an intrusive new set of technologies. The analogy that comes to mind was the intrusion of rabbits into Australia. You would think that a few cute little bunnies could do no harm to such a large land, a continent. Surely you would think that predator species would make short work of helpless little furballs. But it turned out that rabbits had no natural prdators in all of Australia to hold there numbers in check. So the rabbits just multiplied and spread and multiplied and spread. The whole continent was inundated with rabbits.

So we have to ask whether Tesla has any natural predators in the whole auto industry. Notice the fixation of the media on identifying that might remotely compete with Tesla as a "Tesla Killer". I suspect this fixation is symptomatic of a a general anxiety that Tesla may in fact have no natural predators. The problem is two-fold: 1) the auto industry has never had to compete with compelling electric vehicles before much like Australian dingoes that are perfectly capable hunders for Australian prey, but not experienced with rabbits and 2) the only way to compete with a superior technology which is steadlily coming down in cost is to adopt that same technology or come up with something better. I don't believe the auto industry has some superior technology to tap into. If it did, why would it not already be on the market. So the best they can do is to try to match the technology. The analogy here is that the only way to compete with bunnies in Australia is to become a bunnie and compete for food. Yeah, it's a strain, but Musk has been trying to get the rest of the industry to take up the technology and run with it. Apparently it is hard to convert auto execs into bunnies. So we have the irony that the only Tesla killer possible is another Tesla. So the bunnies multiply and their numbers grow unchecked. This gets us to the heart of whether Tesla will will remain supply constrained for two decades. When rabbit overran Australia the only thing that slowed them down was their reproductive cycle (supply constraint). There was plenty of food and territory to move into (a huge addressable market), but even quick little bunnies can bread so fast (annual growth rate).

Now eventually an invasive species is going to run out of habitat and food. So market saturation will eventually slow Tesla's growth rate. So we can think about Teslas product line, addressable markets, segments and territories. It will be a long time before Tesla has a broad product mix that addresses ever desirable segment and there is ample room for geographical expansion both into new continents and countries and within counties already entered. So there is huge potential demand in markets simply not addressed by Tesla at this moment. I think the Models S and X are particularly good products for North America. If the uptake is tepid in certain parts of Europe or Asia, this may simply mean that these markets are looking for different products. Perhaps Europe prefers smaller cars that fit on smaller roads. Does this mean that Tesla is demand constrained in Europe? No it means that Tesla is too supply constrained at the moment to produce a new model that is the right fit for Europe. This is why I think it would be great if Tesla had a design group in the UK to address the European markets. This design group would work with the same Tesla technology and package it in models Europeans will find most compelling. If you've only got black and white cars to sell, but somebody wants to buy a green one, is that a demand problem or a supply problem? You could take it either way, but Tesla dropped brown and green because the complexity of offering those options was too much of a drag on optimizing the number of cars they could build. We should also ask why is it taking so long to launch the Model X? Demand has been so high for the Model S that addressing supply constraints was more important than tapping into the demand for a new Model X. Suppose that the market for Model S was 20k per year. Had that been the case, development of the Model X would have been accelerated, and it would have been critical to have launched it last year or earlier. The slow pace at which demand is addressed wih new products is a kind of supply constraint.

So we can get into the weeds about product development and specific market acceptance of those products, but I'd like to offer a little short cut to thinking about addressing the whole market. Let's visit the consultants friend the 80/20 rule. Consider the most expensive 20% of cars sold. It may well be that 80% of the revenue the auto industry is in this top 20% segment. If the average revenue per car is say $20k, then the average revenue in the top 20 segment is about $80k per car. Tesla, if it chose to, could focus all of its effort to addressing only the top 20 segment and capture say 25% share of that segment within 15 years at an annual growth rate of 40%. This would only be 5% of the entire market, about 5 million cars per year, but it would command 20% of the total market revenue. That's $400B in annual revenue and $120B in gross margin. I think investors would be pretty damn pleased with that. The point here is that it is not necessary for Tesla to address the whole market, it can focus on just a choice 20% and do just fine. Of course, it can continue to address lower segments like the next 20%, so there is plenty of growth potential after 15 years of growing at 40% per year. This is a sensible business model, but it leaves open the question of who will make decent EVs for the other 80% of the maket not being addressed. This is where it is necessary for the likes of GM and Nissan to make entrylevel EVs. If Musk can get GM to own this, then Tesla can continue to stay comfortably in the top 20. Moreover, the ICE makers do not really want to cannibalize their existing ICE business in the top 20. Even the i3 is pretty nonthreatening to its core business. This situation leaves Tesla pretty uncontested in the top 20, which is what gives them the opening to capture a quarter or more of that segment. One of the best things that could happen for Tesla shareholder would be for the Chevy Bolt and a longer range LEAF to do really well up against the Model 3. What this could do is clear out the demand for an affordable Model 3 so that Tesla does not get bogged down with low end versions priced under $45k. Instead, it can focus on Model 3 versions priced over $50k. The volume may be a bit lower, but that allows ever supply constrained Tesla to make more Model S and X. Furthermore, Tesla can set its sights on a high end truck and release a really high end Roadster. If Tesla gets stuck having to make 500k cars per year under $40k. This will be low margin per car and could really drag on Tesla as a supply constraint. This sort of thing could put the truck and new roadster off for many years. This is why we need GM to make a really good Bolt. Of course, Musk is not going to spell this out because that would be really bad PR. But as long as Tesla is supply constrained, shareholders will be well served by maintaining a high ASP and high GM per car. GM, OTOH, has huge capacity and would prefer not to disrupt it high margin business, so something like the Bolt makes good sense for them. GM is much more demand constrained, so a different strategy is better for them.�

1/1/2015

guest Great read, great analogy. Someone brought a dozen bunnies to Australia and that number essentially blossomed to tens of millions within a short time frame, sounds like Tesla bunnies to me.�

1/1/2015

guest I like the usual tech analogies to consider tesla 10+ years from now. That is tesla is taking advantage of a new technology that is finally hitting parity with existing technology but has the ability to improve more quickly - that is creating a superior product at a lower cost. At that point incumbents either shift or go out of business. It can happen very very fast once this point is hit.

When looking at the torque and horsepower requirements of an automobile I think it is already clear that an electric motor is superior to internal combustion (i.e., high torque, high torque at 0 RPM, light weight, energy efficiency, ease of manufacturing, ease of control, cheaper to make, less complicated, less moving parts ...). However the combination of electric motor + large rechargeable battery is not as compelling as ICE+gas across most vehicles due to high cost of battery, longer refill times, battery availability (supply), battery weight, ...

But batteries are becoming cheaper and increasing capacity faster than ICE motors are becoming more powerful and more efficient.

This is the basic bet of Tesla. That they will be the only one, or maybe one of a small number of massive battery suppliers once this tipping point is passed. At this point demand will not be 5 or 10% of the global market but more like 50-75%.

I think Elon looks at the Model 3 and believes that somewhere around 2023/2024 he will even be able to sell the base $35k version and make a 20%+ gross margin. And if he builds enough battery factories and designs the manufacturing / assembly to be implemented in multiple locations he can sell millions by 2025. Just look at the Model S - they can swap the battery in minutes, they can swap the motor in a couple of hours, they can download software automatically. You don't think that by the time the Model 3 comes that there will be even more improvements in the engineering? After all the Model S is only their first clean sheet design.

Tesla is working on a scale that auto analysts and finance types just really can't comprehend. Even though Elon keeps trying to tell everyone.�

1/1/2015

guest The place where the electric technology shines brightest is in performance cars right now, and it'll rapidly be expanding into most other areas. It's no wonder that the first Tesla was the Roadster, which showed off the great handling and acceleration. The next niche to fill is the luxury sports vehicle because the technology is still somewhat expensive but falling fairly fast. Thus Model S. We see creativity with seats and doors with Model X and the SUV crossover falls to the new entrant. Next comes moderately priced upper-end vehicles such as those that Model 3 will compete with. Plenty of people considering the Toyota Camry will give a look at Model 3, too, and some will make the jump because of much better performance, energy economy, and long-term value. A pickup truck comes along and then DaveT's Tesla for the masses makes its appearance when the battery technology is cheap enough to jump into the ring and take on the Camry for a straight fight. Looking forward to witnessing the evolution of Tesla.

I think the reason Elon mentioned millions of Teslas by 2025 is that he wanted to give the industry the heads up that it needs to move now or be left behind in a big way. If the auto industry continues to give Tesla the cold shoulder with reciprocal charging agreements, if the industry truly believes that fuel cells are a better alternative to BEVs, if the industry continues with half-hearted efforts instead of producing cars that a truly competitive with Tesla's, then Tesla is indeed going to cover the planet with electric cars like bunnies multiplying in the outback.�

1/1/2015

guest Some amazing posts here, well worth the read.

Thanks a lot everyone for your thoughts and the valuable information!

I could not agree more on what was mentioned in the posts above.

Reminds me of the good old times the secret master plan came out and was made available at the TM web site.

Oh my dear, there have been some major roadblocks up on our way to year 2015, but they have all been removed properly.

As of today the secret master plan keeps turning reality.

As everybody knows, time is running out for the competition �

�

1/1/2015

guest HAHAHAHA! I watched that segment on Top Gear, was hilarious! I don't know how they ever sold those cars... because that was a terrible design.�

1/1/2015

guest Fully agree with you. For my part, I think it's just fascinating to know that at some point this year there will be 100,000 Teslas driving around :smile:�

1/1/2015

guest I don't think it is necessary to design cars in Europe to make them desirable for Europeans. Tesla's designers are an international group with international experience. It is not rocket science. Look at the top sellers in Europe VW Golf and Polo. Ford Fiesta and Focus. Audi A3, BMW 3 Series, and finally MB E Class.

The mistakes OEMs usually make thinking how their cars are different from the domestic competition is either wrong or unimportant. VW's insistence that cars don't need Big Gulp sized cupholders or mainstream American's preference for a softer more comfortable suspension. VW engineers insistence that their way is correct and American's wants are wrong keeps them with a tiny percentage of the market.

That Europeans prefer smaller to bigger cars, that Europeans prefer estates to SUVs and vans to pickups is not a secret. American car companies insistence on designing small cars for small people because bigger people should buy bigger cars has run them into some trouble. Designing Golf's and Mini's where 6'7" Germans and Brits fit has been a problem for American brand competitors.�

1/1/2015

guest Good thoughts. I hope Model 3 is on target for Europe.�

1/1/2015

guest jhm here is evidence that rabbits have a very dangerous and some people might say insane predator in Australia.

Warning, cruelty to animals on display

�

1/1/2015

guest all those allegoric metaphories about bunnies, etc are cute n all, but tesla is still selling in the five figures, per year.

come back when it's selling half a million. elon says 2020.

until then, all these analogies are just that:

cute.�

1/1/2015

guest Certainly true.

This being the long term investing thread, the point to me is to see if we can understand the important forces at work in this system, and thereby arrive at a projection of what the industry, Tesla, etc.. will look like when Tesla is selling hundreds of thousands of cars, or 2020, or whatever point farther in the future makes sense to the different participants in the thread. Ultimately, if Tesla is going to be expanding like bunnies without a natural predator, I would rather buy today when it's not obvious, than wait 5+ years and buy when it has become obvious to more and more people.�

1/1/2015

guest Somehow I don't think that any traditional car maker is as clever or daring as this fellow.�

1/1/2015

guest It's not just a cute little metaphor. The same sort of mathematical population dynamics model that an ecologist might use to understand and predict the invasion of bunnies in the Outback an econometric Ian such as me can use to understand and predict the diffusion of a new technology such as Teslas in the $10T auto industry. In fact we have posted and discussed such models upthread. For me, it is easy to see the world through mathematical models, but for many it is helpful to see some concrete examples of population dynamics at work to better appreciate the path Tesla is on. If cannot grasp how Tesla can go from making 33k cars in 2014 to making 2854k in 2025, then you do not understand how exponential growth at 50% per year works. We are here to help, and we can explain it in terms of cute little bunnies or brutal mathematics.

Come back in 5 years if you like, but remember that models are more than just metaphors or anologies; models are expressions of first principles thinking.�

1/1/2015

guest Don't forget that when the bunnies multiple, their predators do, as well:

Lynx-Snowshoe Hare Cycle | Environment and Natural Resources�

1/1/2015

guest I do appreciate how mathematical models can be used to explore the implications of the growth goals established by Tesla. Thank you, jhm, for your efforts here. While no one can definitively predict the future, what you have demonstrated is the plausibility of Tesla meeting its goals.

Of course, Tesla faces a multitude of risks. Putting aside for a moment the incredible challenge of increasing production by 50% per year, one can question whether demand growth will be as strong as hoped for. Clearly, Tesla is doing the right things to set the stage, by building a compelling product, developing the Supercharger network, promoting destination charging, fighting legislative battles (in the U.S.), and opening new stores. No other automaker seems to have the vision necessary to execute such a plan.

The biggest unknown in my mind is, how readily will consumers adopt a paradigm shift in "fueling" and driving? People can be very slow to change behavior, particularly in big ticket purchases, even when change is highly beneficial. For a great many car buyers, inertia favors simply returning to the Lexus, Acura, BMW, or Cadillac dealership and just buying another ICE; not much new thinking is required to do this. This is why Tesla is right to make their vehicles so compelling that they cannot be ignored. Mitigating this risk is the fact that, as demonstrated up thread, Tesla only needs to address a small fraction of the automotive market to reach its goals. Even so, there is a tremendous amount of demand growth that needs to happen. My guess is that it will happen, but not quite so quickly as hoped for, and demand could easily turn out to be Tesla's primary constraint. While my personal time available to post is limited, I'm very interested in what other investors think.�

1/1/2015

guest That sort of misses the point of the bunny/Australia metaphor, where apparently there aren't enough predators to combat the growth.�

1/1/2015

guest VW?

Volkswagen Golf Gti: Print Ad by Pristop�

1/1/2015

guest Could it be possible that Tesla could be churning out cars faster than they currently are? I know Musk says no, but what if they just always want to ensure they have a backlog, thus never admitting they have a demand problem?�

1/1/2015

guest Your scenario would mean Tesla is willingly giving up revenue to maintain the illusion of scarcity, while simultaneously pouring billions into building a huge battery factory to help them meet a demand they know isn't there. That doesn't make any sense.

And there's your answer right there.�

1/1/2015

guest That punchline deserves visual display

I agree with the jhm's bunny analogy. I do not see Tesla's growth hampered by competition in the foreseeable future. Also, I do not see much risk in their ability to sell cars or have a sufficient demand.

I see the real serious obstacle to growth is the car business ability to grow at such steep rate. I am amazed to read on these threads how casually people assume that Tesla can "just put on extra shift" or similar to increase the output.

Business of manufacturing and delivering cars is a complex system with many equally complex components that must work in almost perfect synch to produce and deliver cars. The growth of such complex system requires many synchronous changes to system components.

Some of these changes are physical changes to plant and equipment. Physical changes, like building new facilities or incorporating new machinery, is a long and risky process, with many steps involved.

Some of the changes are not physical, yet they may be equally complex and risky to pull through and commission.

Most of the changes involve people. Each person carries a risk of disrupting the complex system by a small misstep. Hence each component system must have overseeing control system which must be developed and put in place.

So far Tesla have been doing amazingly well in scaling up the output. I will be very happy with 50% growth y/y. Growth may not be so linear as at some stage they will build few new plants.

Regarding TSLA, 10-20% sp y/y growth will make me more than happy.�

1/1/2015

guest Let me put the question differently. What do any of us think that Tesla could do to grow production any faster? I think the Gigafactory is the fastest path to scaling up the battery supply chain, but maybe in the interim Tesla could buy cells from other than Panasonic. Or maybe that is too expensive or too risky. How about the auto factory? They're going to need more of those too. Should they already have projects lined up? Should they outsource the manufacture of chassis? Would that be risker or more expensive?

So I don't know what would really speed things up, but here's something to consider. Tesla has open sourced all their patents. If an entrepreneur saw a shorter path than the one Tesla is taking, she could run with the patents, hire smart people to design new models on this, and even collaborate with Tesla on charging infrastructure and developing critical supply chains. With all this she could grow her business faster than Tesla and gain a bigger share of the new EV dominated auto market. She'd be a faster bunny than Musk. I'd really like to see it, and I would love to invest in it. I think it's a pretty tall order, however. Just having another entrepreneur who can come close to keeping up with Tesla would make for a fantastic investment. If someone had a plan to follow Tesla's technology and grow capacity at just 30% per year for the next 15 year, I'd be right there, and I think Musk would like to have a few more bunnies in the patch.

Another angle on this is simply if an entrepreneur saw a better way to solve any hold up Tesla faces, they could make a business around solving problems for Tesla. Tesla wants to encourage a lively ecosystem. So there are huge opportunities for budding entrepreneurs.�

1/1/2015

guest You nailed it. I've been saying the same thing since the beginning of this thread. Growing a complex manufacturing business by 50% yr over yr for many years in a row is virtually impossible. Tesla has executed exceptionally well at handling this growth. They've had a lot of hiccups, for sure but not the chaos I would have expected. Elon has consistently said managing extreme growth is Tesla's biggest challenge. As for demand for 500k cars by 2020? It will far exceed that. It probably already does but nobody offers a compelling affordable EV.�

1/1/2015

guest It may be difficult to understand complexities or complex systems without being a part of such complexities.

I think there were chaotic moments in Tesla around D Introduction, no doubts there will be more chaos as Tesla grows in complexity. It is extraordinary to witness how chaos turns into a symphony as people learn to deal with problems and take control.�

1/1/2015

guest Chaotic moments with the D intro? LOL you should have been around for the Roadster days. They were still expanding back then by over 50% every year!�

1/1/2015

guest Now I am jealous

Some of us thrive on chaos�

1/1/2015

guest Thank you. You are correct that mathematical models really only set out plausible scenarios. There are a lot of twists and turns along the way.

You are definitely correct that a lot of demand has got to be created along the way. One of my frustrations is that many people seem to think about demand as some sort of fixed quantity that people are willing to buy. This is wrong in two ways. First, at a given point in time, demand is a relationship between prices and willingness to pay. Demand is not a single quantity. If Tesla were to cut all their prices by 10%, would demand go up? No, the willingness to buy would go up, but this is at a lower price point. Demand is a curve, a function of price. (Being supply constrained means that lowering prices will not increase sales despite the fact the more people are willing to buy at a lower price) What constitutes a demand increase is when buyers are willing to spend more than was the previous case. So this gets us to the second way that demand is not fixed willingness to buy at any particular price can go up or down over time. I can use myself as an example. Over a year ago I first test drove a Model S. I l was very impressed with the car, but felt is was much more car than I needed and was not willing to spend $80k for it. Had a standard 85 been priced at $45k I would have easily bought it. So my price point was somewhere between $45k and $70k. Well today I have an order $90k order for a Model S 85 to be delivered in March. What happened? If my pricepoint was less than $70k a year ago, why is it over $90k today? Several things: the Supercharger network is much better developed in my region and continues to expand into locations that matter alot to me. Tesla added Autopilot and the D option. A Tesla store opened just a few miles from my home. I've observed how Tesla treats customers and enhances existing products over time and so have greater confidence buying from them. My personal finances have improved and I feel better about my employment. Our existing cars are aging so that annual repair bills are going up. And finally, I'm tired of waiting for Model 3 to come out. I want a Tesla now. So all of these factors have conspired to add at least $20k to what I was once willing to pay. I point this out in detail because these are the sorts of things that contribute to demand creation. Some of these things are within Tesla's power to enhance like building out more superchargers and treating customers well. Other things are beyond their control like my personal finances and employment situation. So it behooves Tesla to focus on the things it can control and target prospects who have the means to buy their product. So as Tesla builds out sales, service and charging infrastructure, it is in fact creating demand. Consumers in proximity to those resources become more willing to pay higher sums for Tesla products. As consumers become willing to pay more, some of them cross a tipping point where they actually decide to make an order. Launching new products is also critical for creating demand. For example their are consumers who are willing to spend over $70k for an SUV who would not spend $40k on a sedan. So such a person may be willing to spend $90k (before incentives) on a Model X but would never sink that cash into the Model S. From Tesla's perspective, they are just as willing to sell one or the other and to price them comparably, but to the consumer the choice increases what the are willing to pay.