Feb 26, 2014

Convert2013 I'm voting Nevada for the same reasons, and like Arizona, plenty of sunshine all year for those solar panels. ;-)�

Feb 26, 2014

RobStark Nevada has all the lithium Tesla needs for the first Gigafactory. Western Lithium is opening a new mine this summer. Once fully operational it will be able to supply all of the Gigafatory's lithium needs.�

Feb 26, 2014

GenIIIBuyer Outside Phoenix, Arizona. Final Answer.

edit: This is as exciting as guessing where TSLA will close in given week.�

Feb 26, 2014

bonnie My point, of course, is that other areas have a tech population.�

Feb 26, 2014

Convert2013 Everyone wants Tesla to come to their townBut cost of labor is much cheaper in the middle of nowhere than in an established city. Take Boeing for example. They moved manufacturing to Charleston, South Carolina a few years back for cheaper labor to produce a chunk of the 787 airplanes. They do have engineers in Charleston however not from the core set in design, development, and R&D (yet). Only enough to support manufacturing and production. So yes I expect some engineers to be located at the Tesla manufacturing and production site but the majority of workers will be technicians, assemblers, machine shop guys, quality inspectors, etc, with some engineering change and manufacturing engineering support.

�

Feb 26, 2014

FluxCap I know, right? I actually did buy and sell some gold back in 2010-11 for a profit, mostly took advantage of the "goldbug" fever over there. Poor guys. They need a big hug.�

Feb 26, 2014

Doug_G If you need experienced technicians and engineers they can be hard to come by in the middle of nowhere.�

Feb 26, 2014

Joel Bonnie - I'll bet you it's Nevada. Also, who says it's going to be a few day's drive? Looks like Tesla plans on using rail to transport the battery packs back and forth. Finally, since we are all speculating, how cool would it be if Tesla built a hyperloop from Fremont to Nevada?�

Feb 26, 2014

bonnie You're on. What's the bet?�

Feb 26, 2014

RABaby Pink slips�

Feb 26, 2014

bonnie Trouble maker.�

Feb 26, 2014

airj1012 These type of opportunities attract top talent. This types of factories have to be built in the middle of no where. Otherwise the land will be too expensive. As an example look at Google's/Apple's data centers. Notice that they are not in major cities for the same reasons. They've been able to attract top level talent outside of major cities because its such a great job. The same applies for Tesla.

Google - http://www.google.com/about/datacenters/inside/locations/index.html

Apple - https://www.apple.com/environment/renewable-energy/�

Feb 26, 2014

RABaby Since very young�

Feb 26, 2014

Robert.Boston I love Austin. Favorite sign seen on the sidewalk in front of a place there:

Coffee

Bacon

Whisky

(repeat as needed)�

Feb 26, 2014

Monsoon +1. LOL.�

Feb 26, 2014

Joel Lunch, dinner, or a drink. You pick:smile: We'll have to settle up at Teslive or TMC Connect whichever name it goes by these days (I'm assuming you're going).�

Feb 26, 2014

JRP3 I'm thinking either AZ or NV, with NV as a slight favorite. I'm with those that would not want TX to get it. No need to bribe them when time will eventually force them to change their protectionist ways.�

Feb 26, 2014

kenliles The 30% reduction is battery cost appears to be assigned to the factory and scale efficiencies. I'm wondering if (for GENIII) chemistry and current on going improvements that were know to provide 10%+ per year are on top of is! yielding a possible 50% reduction.

Thoughts?�

Feb 26, 2014

ckessel That happens to be the exact opposite of Tesla's strategy so far, which has been to locate in the heart of the talent even when all the "experts" said you couldn't be profitable in such an expensive location like LA or the San Francisco bay area.�

Feb 26, 2014

bonnie To be fair, they got a killer deal on the Fremont plant. That's why they are there.�

Feb 26, 2014

ckessel True, but Elon has spoken many times that he felt he could only do this in a tech heavy area. That they wanted to be in that sort of location because they needed those people. That's opposite of the "build it and they will come" philosophy airj1012 was advocating.�

Feb 26, 2014

Student_Forever Greetings to all!

I am in favor of Nevada as the location for Tesla Battery Gigafactory.

Reasons:

1) Proximity to raw materials -- You don't want to pay for transportation twice, i.e. to get the raw materials and then to ship the final product.

2) Shipment costs to the assembly plant -- Similar to the explanation in 1) but from the distance point of view. Reno, NV is just 9 hours away from Fremont, CA by train. So regular shipment is available. In contrast, it takes 2-days to travel from Phoenix, AZ to Fremont, CA by train according to Google Maps. (Similarly, by car it's under 4 hours from Reno, NV and 10+ hours from Phoenix, AZ.)

3) Business climate -- Many businesses including tech companies have moved their finance units to NV for tax reasons. TSLA does not need to spend money for lobbying or to work hard on political connections to get such tax treatment. That means less distraction for the management.

4) Investor / Fan buzz -- Las Vegas, NV has annual tech fairs and is able to attract thousands of people regularly. San Francisco, CA hosts dozens of tech events per year. Getting such fan base to travel to Reno, NV would be relatively easier than to AZ or NM in my opinion. In long-term, such steady attention flow would benefit the company to maintain high publicity. As they say it in Iowa, "If you build it, they will come."

5) Housing / Talent pool -- Some of the engineers from the Fremont plant might be transferred to the Gigafactory location. Relocation costs money upfront. Some people might prefer to maintain their affinity to California. For example, Elon Musk himself might want to maintain his residence in California because of his children going to school there. So Nevada is closer, cheaper, and is in the same time zone.

Why not Arizona or New Mexico?

* The sun might shine brighter in AZ and NM. However, with energy storage capacity, solar power might not be the only reason for location choice. In fact NV being on higher altitude, it might actually provide more UV radiation, which is what you need for photovoltaic cells should they go for solar panels from SolarCity.

* Higher altitude would also mean cooler temperature, which makes energy storage/output more efficient in the long run. In fact, average summer temperatures topping 100F in AZ and NM would work against you since lithium-ion batteries perform better under 85F. In a closed facility with large roof surface area, cooling down expenses might add up meaningfully. As a result annual average variable costs in AZ and NM would be higher than in Nevada.

* The only reason why I think AZ and NM became candidates was because of their renewable energy production. They mostly have power tower designs (aka heliostats) that use concentrated sunlight from multiple mirrors and then convert energy through steam generators (with temperatures at 1,000F). However, there is a new concern that the power tower design causes high mortality of birds (see Birds Fly or Fry at Solar Energy Plant | Ivanpah Solar | LiveScience). This might backfire from animal protection activists and possibly even the government. I don't think TSLA wants to face criticism about killing birds while they preach about protecting the planet...

On the other hand, SolarCity's uses photovoltaic solar panels. So they don't necessarily depend on high solar radiation but rather high UV radiation, which is greater on higher altitude like in NV (i.e. where the air density is thinner). Therefore, AZ and NM are not necessarily top candidates.

* Marginal cost of transportation from AZ / NM might be higher than from NV due to longer railroad distance. That defeats the purpose of efficiency gains from in-house battery production.

Also, I honestly would not want my high-value components to stay in transit for too long. Even if shipment takes two days, that means there is a risk of overnight accident or something else, God forbid. It's much more comfortable when you know that the cargo has been shipped in the morning and you have it at the assembly plant same evening, which is the case for Reno, NV -> Fremont, CA.

Why not Texas?

* The only reason I could think of building a Gigafactory in TX is if there were another assembly plant nearby, e.g. in Houston, TX. However, even that would imply export driven production. The facilities in Fremont, CA are sufficient for producing 500K vehicles per year. Until that production level is saturated, I don't see any need to stretch yourself thin across the country and across time zones.

Plus, there is this risk of factory shut downs during tornadoes and hurricanes. As the climate continues changing, there will be greater volatility of weather patterns. Such fluctuations create unnecessary logistical complexities and uneven shipment patterns, which would adversely affect production patterns at the assembly plant in Fremont, CA. With high degree of automation through robotics, you don't need to store large inventory of batteries on side. Instead you want to use that space for additional assembly machinery. In other words, you want the production process to be in sync across the whole manufacturing chain. Also, a smoother production pattern would make it much easier for financial planning, cash flow management, and hedging, all of which affect profit margins.

* The assembly plant in Netherlands makes it a compelling case to build the Gigafactory near Houston, TX so that you could ship those battery packs to Europe. Then why not build a Gigafactory in Europe?..�

Feb 26, 2014

Cosmacelf I think Tesla is under promising big time on the battery cost improvements. I suspect the 30% number is their internal worst case projections.�

Feb 26, 2014

brianman

http://www.teslamotors.com/sites/default/files/blog_attachments/gigafactory.pdf, page 3:

�

Feb 26, 2014

jdevo2004 Two things to consider:

A) Battery costs are dropping by about 8% a year. In three years that is about a 26% drop, so the 30% gigafactory savings is pretty conservative in my opinion.

B) The gigafactory will also be importing 15GWh of batteries from Japan and Korea to be placed into packs. It makes little sense to ship them across the ocean and put them onto a train for Texas only to be sent back in packs to Fremont. Nevada is the clear choice given the proximity to all of the Tesla based operations and distance needed to transport asian batteries to the facility by train.�

Feb 27, 2014

VolkerP Elon is a big fan of co-locating R&D engineering with production. Short ways and direct feedback are vital to the breakneck speed of innovation that keep Tesla ahead of the competition.�

Feb 27, 2014

justthateasy As far as location goes, I'm personally leaning towards Nevada, mostly for logistical reasons.

On another note, I sure hope Tesla doesn't build it in Arizona as I've personally boycotted the state and have no intension of spending a single penny in that backward state.�

Feb 27, 2014

AnOutsider Got a bad iced tea? �

�

Feb 27, 2014

Robertj Tesla battery factory huge influence on Renewables

Elon Musk just announced details of Tesla's plan to start pumping out lithium ion batteries like M&Ms at its planned "Gigafactory."

Obviously, it's big news for electric vehicles as this should bring down the cost of a very expensive component.

But it has equal and possibly greater significance for renewable energy.

We've explained that power storage is the key to unlocking widespread renewable energy. For renewables to be truly cost competitive with existing power sources, they need to be able to provide a continuous current flow, something difficult to achieve when the wind isn't blowing or sun isn't shining.

Which is why he's hailing Tesla's decision.

"If those prices comes down, our market expands, we can offer a lower priced product and put more storage in our system," he told us. "So this is very important."

Solar execs are comparing the current environment to where photovoltaic costs were in the last decade, just before their prices plummeted.

"At that point in time solar modules were very expensive, and the industry was pushing a couple of different alternatives: thin films were going to be photovoltaic of the future," said Tony Clifford, CEO of Standard Solar. His company also worked on the Maryland project.

But thanks to worldwide government incentives, he said, the price of traditional silicon ended up falling through the floor, paving the way for the current renewables boom.

In this case, of course, the marketplace is creating the demand for lithium ion batteries. But renewables will again be the beneficiaries.

"You're going to be able to drive costs out right across supply chain and see some significant cost reductions in storage technology."

A report from the Rocky Mountain Institute released prior to Tesla's announcement (spotted by GreenTechMedia) was even more extreme about the possibilities for cheaper storage.

"Whereas other technologies, including solar PV and other distributed resources without storage, net metering, and energy efficiency still require some degree of grid dependence, solar-plus-batteries enable customers to cut the cord to their utility entirely," they write. "The coming grid parity of solar-plus-battery systems in the foreseeable future, among other factors, signals the eventual demise of traditional utility business models," the authors wrote.

Tesla's announcement represents a major step towards a larger, cheaper energy storage market that could have huge implications for making renewables more widespread.�

Feb 27, 2014

GSP Link to the RMI study mentioned by Robertj. Elon is going to be a major disruptor in yet another industry, electric generation, transmission, and distribution.

The Economics of Grid Defection

GSP�

Feb 27, 2014

airj1012 Having headquarters in a large city is MUCH different than having a factory in a large city. Again space is the issue. If you're mentioning Fremont, that was a steal, and the property was not being used. I don't think there is an empty factory the size they're looking for that is just sitting idle right now. They're looking to build. Plus they still will need access to the natural resources.�

Feb 27, 2014

Rifleman Its a good thing most people do not boycott entire states due to their politics, otherwise I would not be buying a Tesla, as I do not approve of California's strict gun laws.

My theory is if you dont agree with someones politics, you have ever right to boycott them (for example, I dont buy anything from companies that give money to anti-gun organizations, if I can help it), but blanket boycotts of entire states dont really help matters much, as the target is too broad to get your point across.�

Feb 27, 2014

xhawk101 Agree�

Feb 27, 2014

fdog With such a large demand for solar, I'm curious how this will affect SolarCity (SCTY).�

Feb 27, 2014

ItsNotAboutTheMoney Well, the factory is going to be HUGE, its wind and solar demands would be huge and they'd want to ship the output to Fremont. Given all that, they'd surely want to locate it in West Texas, Mexican border or panhandle depending on which area gives the best overall total generation capacity of wind and solar, right?�

Feb 27, 2014

AudubonB Yeah, I'll admit at the outset to having a bit - but only a bit! - of chauvinism toward my new....part of the year....home state. That full disclosure aside, as I've enumerated elsewhere, one eyebrow-lifting reason Arizona has possibilities is that the monstrous (but not big enough!!!!!) plant Intel just completed in Chandler....they have mothballed. It might be possible for Tesla to pull another NUMMI there. Remember, Apple/GTAT just - four months ago - did the same, getting for a song the enormous* new plant that had been First Solar's

*"enormous" is synonymous with "picayune" in gigafactory-speak

I'm also a bit more favorably disposed toward solar electricity than wind, for a number of reasons.

Regardless, in the big picture I'll be delighted to learn of this project going ahead irrespective of location. All for a great cause.�

Feb 27, 2014

sleepyhead I don't like wind energy either because it kills birds, including bald eagles, it is noisy, and a bigger eyesore than solar.

Solar is much better than wind.

In west Texas though you have solar in the day and tons of wind at night.�

Feb 27, 2014

ItsNotAboutTheMoney I can understand complaining about strobing or noise, but personally I think wind turbines are beautiful. Definitely prettier than a water tower.

I was reading something that there's also good solar thermal potential in West Texas, and solar thermal can help to balance wind quite well.�

Feb 27, 2014

Norse I imagine the factory would not have a problem in storing electricity �

�

Feb 27, 2014

Zaxxon Ha!�

Feb 27, 2014

JRP3 While troubling the bird kill numbers are miniscule compared to other man made objects, like buildings.�

Feb 27, 2014

Norse Polypore likely to receive royalties following Tesla plant launch, says Wedbush

Wedbush predicts that Polypore (PPO) could obtain $20M in annual royalty revenue as a result of the launch of Tesla's (TSLA) giga factory. The firm says this royalty stream would be attractive for Polypore, and keeps a $28 price target and Outperform rating on Polypore.

Anyone know what this is? and the price target must be wrong trading at $32.50�

Feb 27, 2014

JRP3 Since Tesla seems to be planning to make the separator membranes in house they may license the technology from Polypore�

Feb 27, 2014

FluxCap Press starting to figure out how huge this is:

Musk's $5 Billion Tesla Gigafactory May Start Bidding War - Bloomberg�

Feb 27, 2014

772 Cross posting from another thread here, but is anyone interested in the convertible note offering? I've been trying to get more details about it. I sent an e-mail to Morgan Stanley, but they said they do not have the prospectus for the offering yet. Has anyone gotten a prospectus from another source?�

Feb 27, 2014

TSLAopt yes, great article. This marks the day that Tesla is no longer looked at as just an auto company but much more�

Feb 27, 2014

Benz About the location of the Gigafactory, I would suggest to take into consideration that a location with a low probability of occurance of natural disasters would be preferable. Just an idea.�

Feb 27, 2014

nvsblman

I live in Chandler and the city is actually working hard to build a 'tech corridor' in the hopes of luring more good jobs here. As much as I would like to see the GF come here, I'm concerned the politics might keep Tesla away. Mesa did just get the Apple facility, so maybe we'll get luck here? And there's obviously plenty of sun and open desert around to build a massive array of solar panels.

- - - Updated - - -

I thought about that for a minute too, but it's not really in a location to expand to the size Tesla would need (there are other Intel fab buildings around it), plus there's no room around it for a huge solar array. Though - this is a huge hypothetical - that plant practically borders an Indian reservation. Lots of open space there. There might be some incentives to building (either the GF or the solar array) on Indian land. But I'd put that on the longest of long shots list.�

Feb 27, 2014

Norse Wedbush reiterated an Outperform rating on Polypore International (NYSE: PPO) with a price target of $38.00. Analyst Craig Irwin thinks Tesla's Giga Facility could drive an attractive royalty stream.�

Feb 27, 2014

theganjaguru ... Maybe the Giga Factory is the reason why Apple met with TSLA last year, not to discuss buying TSLA, but to discuss being a partner with the factory. Apple has a green track record building green data centers and definitely has a thirst for batteries. Plus they seem to have a ton of cash they aren't doing anything with....

Oh, and if Texas is a finalist for the factory, they better quit with their anti TSLA NCDA loving ways.�

Feb 27, 2014

30seconds Maybe we will see the Tx Gov on TV in California saying how green Tx is and that new companies that care about sustainability should expand to Tx.�

Feb 27, 2014

Johan Isn't truth though that Texas is into whereever the money is? Yesterday it was oil, cattle and such. Tomorrow it will be solar, batteries etc. Nothing wrong with that?�

Feb 27, 2014

kenliles got up late this morning- I've scanned the boards, but just want to verify; we're still waiting for word on conference call (or equivalent) right?

never mind- short term thread verified still waiting.... move along�

Feb 27, 2014

theganjaguru

Texas is already becoming green when you look at wind power generation.

Gas 2 | Bridging the gap between green heads and gear heads.

RENEWABLE ENERGY: New power lines will make Texas the worlds 5th-largest wind power producer -- Tuesday, February 25, 2014 -- www.eenews.net

It must be all those MS's, they have Cali-cooties that make unsuspecting drivers want to do yoga and be green. Standard option for all MSs shipped out of state.�

Feb 27, 2014

sleepyhead Isn't this the case with every one and every state or country?�

Feb 27, 2014

macpacheco Except Elon wants to use solar energy, that pretty much dictates one of the states in the extreme south (bordering either Mexico or the Gulf of Mexico).

Solar in IL isn't a very logic thing, in the TX/AZ/CA/NM - Mex border it's a great resource.�

Feb 27, 2014

Johan Sure, I just meant my impression is that Texans have been generally good at adapting and going after the money without hesitation, perhaps more aggressively than others? Then again maybe these are just my prejudices from across the Atlantic?�

Feb 27, 2014

ItsNotAboutTheMoney No. Texas only cares about the integral, other places care more about the curve.*

* This analogy is used as a compliment to TMC members.�

Feb 27, 2014

airj1012 Didn't Elon say there would be a conference call this week to talk about the details? We're running out of days in the week!�

Feb 27, 2014

Toolie Please let it be TEXAS! I'm from Houston and would love it if they build the factory here. We have massive open land and no state tax. Model S are very common here now. I have a feeling it will be Austin. Austin is becoming SF. Austin also has apple and google campus.�

Feb 27, 2014

marvinat0rz Wow. I just realized how huge the implications of cheap battery storage are for the adoption of renewable energy. I'm sorry if this has been discussed throughout the last 45 pages, I don't have time to read through it all. Current battery packs, like the ones in the Model S, are optimized for quick, intermittent discharge at high power. Battery packs for the utility grid could be made larger in capacity, but with a load profile optimized more towards long battery life. I think this will be a requirement for using these packs in the utility grid.

Solar power is already close to cost parity with coal in many markets of the world. The only remaining problem is to cost-effectively store power for longer periods of time, so the power can also be used off-peak. I don't have the knowledge or capacity to run the numbers on this. Not sure if a 30% reduction in the cost of li-ion battery packs is enough to make the total installation cost competitive with coal-fired power plants. Have anyone on the Tesla board run these numbers? If this is actually the case, then the train is shortly leaving the station, and we are setting up for large-scale disruption of fossil electric power generation in the coming years.

I want in on this. Buying a solar ETF would certainly be one way of doing this. Owning Tesla is another - Tesla and partners running the gigafactory would of course be exposed to the profits of this business. I suppose Solar City or similar utility companies could also grab a large piece of the pie. Have I just realized something obvious which everyone else saw a year and a half ago? Has anyone run the numbers on this?�

Feb 27, 2014

FluxCap You may want to join us over in this thread:

Alternative Energy Investor Discussions (formerly SCTY thread)

You might also want to check out Sleepy's articles on CSIQ, JASO, SOL, SPWR.�

Feb 27, 2014

Neech

Texas represents too many things that Elon is against - oil and refineries everywhere, Keystone pipeline, fracking (Big Oil and Bad Air: Report Exposes Link Between Fracking and Toxic Air Emissions in Texas | Democracy Now!) - all air polluting companies in a state with a governor that does what oilmen tell him to do. Nothing personal, but I hope Tesla picks another state, Texas is not worthy of such a forward-thinking endeavor.�

Feb 27, 2014

sleepyhead I saw this two years ago.

And, yes it is obvious, but only to a select few. 99.99% of the people don't see it coming and have no clue what is going on. That is a reason why I have been so successful investing in solar over the past year, and will be at least until we hit another major recession.

- - - Updated - - -

Back on topic: The case for Texas:

http://www.fool.com/investing/general/2014/02/27/tesla-motors-dangles-a-5-billion-carrot-in-texas-f.aspx�

Feb 27, 2014

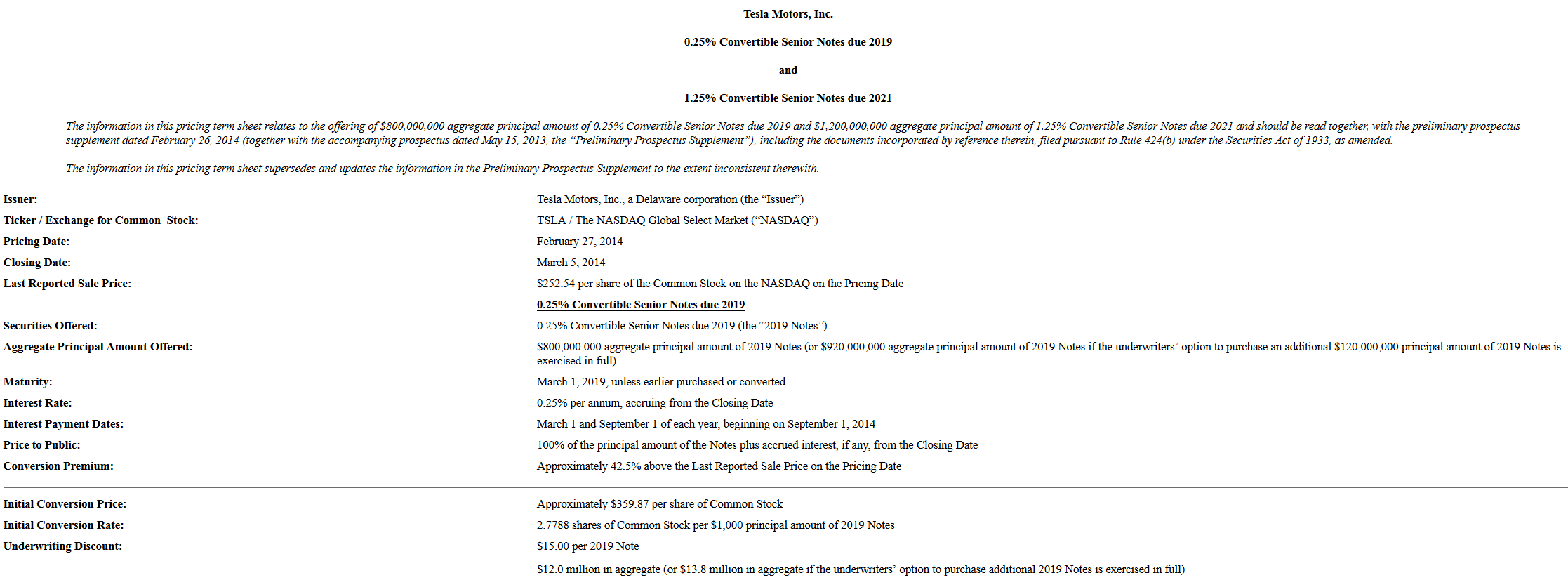

sleepyhead Looks like TSLA raised $2b and potentially $2.3b if over-allotment option gets exercised. Due to very strong demand they raised the amount raised:

Financial Times | Error | Akamai Error

5 year notes have 0.25% interest rate for $800m

7 year notes have 1.25% interest rate for $1.2b

conversion premium is 42.5% or $360 if you use today's close price.

- - - Updated - - -

Annual interest expense is $2m on the 2019 notes and $15m on 2020 notes. Even with over-allotment that is only $19.55m per year or about 0.1 EPS per year after tax benefit.

Overall, these terms are fricking ridiculously awesome.

Maximum potential share dilution is 6.4m shares on $2.3b raised, which is a little less than 5% dilution.

Pretty darn good terms if you ask me.�

Feb 27, 2014

DaveT It looks really good to me as well. Here are some quotes from the article you linked to.

�Tesla sold $800m in five-year notes and $1.2bn in seven-year notes as part of the deal on Thursday, according to a person familiar with the matter. The five-year notes will carry a coupon payment of 25 basis points and the seven-year notes will pay 125 basis points. Both bonds have an equity conversion premium of 42.5 per cent.�

�The company had originally sought to raise $1.6bn, but the deal was increased due to heavy demand from investors, according to a person familiar with the matter.�

�If underwriters, including Goldman Sachs and Morgan Stanley, elect to exercise an overallotment provision, the size of the offering could reach $2.3bn."�

Feb 27, 2014

TSLAopt

Would you you say its like the Convertible Bond is a very expensive 2019 or 2021 $360 Call option in a way? Where the holder pays a premium now equivalent to the full exercise price and receives 25 or 125 basis points per year on that and if their 360 strike is not met they will still get back the full 360 premium at expiration in 2019 and 2021?�

Feb 27, 2014

sleepyhead You can put it that way, but I would put it this way:

You are paying $360 for shares of TSLA today even though they are worth $250. You get paid 0.25% interest over 5 years or 1.25% interest over 7 years. You are also guaranteed to be able to sell your shares for $360 or fair market value, whichever is higher at expiration.

However you put it, it is a great deal for Tesla and a great deal for TSLA longs. Bad deal for TSLA shorts.�

Feb 27, 2014

mitch672 It's not a bad deal for the bond holders either, they get some return on their cash, and have a set price on TSLA shares in 5 or 7 years. TSLA could be much higher than $360 in 5-7 years, if things go to plan, it certainly should be.�

Feb 27, 2014

sleepyhead I wouldn't buy those convertible notes, no way!

I would rather buy the stock at $250 and take the risk of the stock being below $250 5 years from now. Better than paying $360 for it with a guaranteed floor.

Think of it this way, you are paying 42.5% for insurance that it doesn't go down. I am sure that you could buy the stock and a put option for a lot cheaper.

Smart money is dumb to buy these notes. Good for us shareholders though.�

Feb 27, 2014

772 I don't think it's quite that bad... The Jan '16 $250 put is ~$68.5. Consider you would have to roll over your puts at least once to get to 2019 and you've paid quite a bit.�

Feb 27, 2014

kenliles Maybe Dougie Kass would be interested in those

This sounds like a awesome deal for Tesla- Elon & team are financial masters. These term are half what I expected, and I was already considering they were going to be great. These are off the chart imho�

Feb 27, 2014

TSLAopt thanks Sleepy. Do you or does anyone remember the exact terms (ie. interest rate) on the Converts they offered last year...

just wondering if these are more favorable terms to TSLA now at 250 then those were to TSLA back then when TSLA was 90�

Feb 27, 2014

CapitalistOppressor I'm not sure I buy the notion that Tesla will have a particular need for additional access to the Texas market in 2020. By producing only 500k cars they are likely to be substantially supply limited on a global scale. So the entire premise of the article (that Tesla is somehow salivating at the thought of increased access to the Texas market) just seems not well thought out to me. Tesla wants that market opened up, but that is not the kind of thing likely to impact Tesla's bottom line for some time to come.

Essentially, I see the current Texas regulations as a disqualifier, but not as something that can be put on the scale to balance other economic incentives needed to sway Tesla's site decision. So if New Mexico offers business case "X", Texas needs to offer "X+Access".

On another note, I'm gratified to see that the costs and capabilities of this factory are right in the wheelhouse of the models we discussed last year in the Cost per kWh thread. The factory will be producing ~70% of the cells for 500k vehicles, so ~350k cars. I had projected the top range Model E at ~4,000 cells, so the fleet average would be slightly below that. Plug the numbers in and we get -

350,000x4,000x$4 = $5.6B

Anyways, here is a link to their regulatory filings from today, including the initial prospectus for the convertible notes (which will be amended when its complete) -

EDGAR Search Results

In many ways, this was a rather timid move on the part of Tesla. I'm not terribly impressed with the scope of their capital raise in relation to their needs. Tesla will have access to substantial additional funds based on profits from the S platform over the next few years, but they are still going to have to lean heavily on their "partners" just to complete this rather circumscribed effort by 2020.

In September, JB Straubel was talking 700k cars in 2019, so 500k in 2020 (which is not even completely funded) indicates they got a lot of pushback from the big money guys on Wall Street. But whatever happened, all we have is a down payment on a deal that hasn't even come together yet. I hesitate to characterize my response as "dismay" because it is at least a tangible step forward towards solving a major problem, but I am not terribly impressed.

If this is at the limit of what they are capable of doing (whether because raising the capital is a problem, or because of the complexity of the effort), then their growth is going to be substantially slower than I expected, and its super-duper difficult to justify their current valuation.

Anyone currently invested in this stock (which very much includes myself) needs to look at their model and see if they expected that Tesla would produce 500,000 cars in 2020, and further reflect on the fact that the deal necessary to make that happen does not yet exist, despite today's announcement.�

Feb 27, 2014

TSLAopt i respect your analysis of batteries and the business model as much as anyone on here CapitalistOppressor, and share your concern. It is easy to get overexcited on this...but I am confident in Elon to get this finished. Deals this big can't be put together all in one week or one month and is definitely a challenge....but if Elon can be the first to create a compelling electric car and figure out how to send rockets into space at a fraction of the price of anyone else....I am entirely confident he can get this deal done in the timeline they've put forth. I have full faith in Elon and Tesla to do this.�

Feb 27, 2014

CapitalistOppressor I am less concerned with whether this deal gets done (though I dislike the fact that its open ended right now), than I am with the implications of Tesla only being able to produce 500k cars in 2020. In my opinion, that is a real blow to the bullish case supporting the current stock price.�

Feb 27, 2014

ckessel This is a factory that's supposed to start coming online in 3-4 years. 2020 is 6 years away. There's nothing preventing Tesla (or Panasonic) from opening up similar factories in 2-3 years so they'll be up and running by 2020.�

Feb 27, 2014

TSLAopt yes, 6 years is a long long time in TSLA time....there will be lots of new developments, just remember how far we've come in the past 18 months...I could see another larger capital raise in 2-3 years to build two more Giga factories (China and Europe)...especially if they open up reservations for Gen III and turn out to get 500k reservations in the first month.

If they did that in 2016-2017 then their projected 2020 sales could easily jump to 1-1.5mm cars.�

Feb 27, 2014

sleepyhead I think I remember very well, but could be wrong;

They did 5 years at 1.5% and 35% conversion premium.

Now a 5 year is 0.25% (way better) and 42.5% conversion premium (also better).

Overall, it is a steal of deal.�

Feb 27, 2014

TSLAopt thanks, this signals to be more institutional bullishness in TSLA now at 250 then 9 months ago when we were at 90.

If there is some consolidation or pullback for a few days I would strongly consider selling some of my LEAPs or shares to by weekly or monthly options.�

Feb 27, 2014

CapitalistOppressor Of course there isn't anything preventing such a thing from occurring.

Except for an apparent lack of capital to make it happen. My worry is that capital will become available only as demand for the Model E becomes concrete, either because Tesla is itself hesitant to step out on the limb, or else because their backers on Wall Street (and Japan in the case of Panasonic) are hesitant to step out there with them. But until those commitments are made we are left with what Tesla says will be a capacity to produce 500k cars in 2020. Why not 2018, or 2019?

Until other "partners" body up to the table with tangible contributions, we have to confront a possibility where Tesla will primarily be funding this factory from cash flow (or future capital raises when the market lets them), and that explains the very slow ramp in capacity to 500k cars in 2020.

- - - Updated - - -

Just some quick math to demonstrate how inadequate this is from the standpoint of Tesla controlling their battery supply.

This factory will produce ~50GWh of completed packs, but only 35GWh of the cells will be produced there, so ~30% will be sourced from outside suppliers.

The ~$1.8b they are potentially raising today represents ~36% of the ~$5b that Tesla says it will take to build the factory. Since they will only be building ~70% of the cells needed, the $1.8b they are raising today is only enough to supply them with ~25% of the cells that they will need in 2020 (0.36x0.70), assuming this low production model which only supplies 500k completed cars.

The notion that Tesla is only directly addressing ~25% of their projected needs with this capital raise bothers me. When you also consider that those projected needs are so modest, it really makes me question why, if Tesla feels this is sufficient to their needs, am I using models that assume much higher sales?�

Feb 27, 2014

kenliles that mirrors some of my thoughts as well- I'll bet they fill it too including the overage;�

Feb 27, 2014

JRP3 Tesla did say 4-5 billion, so not necessarily 5 billion.�

Feb 27, 2014

FluxCap Good to see you back around, CapOp. Thanks for your thoughts.

I will say -- it would bother me, and the market, if they raised too much money and sat on the cash without spending it at this stage in their growth. That would just be bad corporate financial management. A capital raise is not an ATM for funding CapEx 10 years down the line. They will certainly be able to raise more money under Elon's leadership and at even more competitive valuations in the years to come. I'm sure you agree, unless you aren't quite as long the stock as you said above.

Does your spreadsheet model show 500k cars sold in 2020? How much revenue from that, if so? How much margin? What is your earnings multiple? I can't imagine a situation where a CEO would want to raise more money than he needs at a $250 share price when he and much of the market fully anticipate at least double that share price well inside the time horizon for which additional capital would be needed.

Also, spreading the factory stake around with other partners reduces risk and creates symbiotic relationships that make the whole stronger than the sum of the parts.�

Feb 27, 2014

Convert2013 LOL Marvina. Yes, many of us realized this and now have quite sizable %s in Solar. Join us before the rest of the market does if you want. �

�

Feb 27, 2014

kenliles I resemble that remark- have a Solar exposure approximately equal to TSLA albeit divided among 3-4 companies. Agree with Convert, no time like the present.�

Feb 27, 2014

Citizen-T CapOp, I hear you, but I'm with the other guys here. There's no need to raise more money than can be put to use right now. The only thing that TSLA has said is that this factory will be able to supply enough packs for 500k cars in 2020. They have no given us production numbers for 2020. I am completely confident that the second GigaFactory (probably in China) will break ground before 2017 when this one comes online. No need to raise capital for that one for at least another year. It would just be sitting in the bank.

This is actually why I really want to hear Elon speak on the subject. You know he just can't help himself in talking about these things. He'll give us a hint as to what is really going to happen in 2020.�

Feb 27, 2014

DaveT Gigafactory: The magic is in the free market

I think people have the notion that Tesla wants to own/control their battery supply. I think otherwise. In order for Tesla to fully control/own their battery supply, the costs will be prohibitive to the massive scaling required. ie., 5m cars a year by 2028 x 4000 cells x $4 = $80b in capital requirement from now until 2028. Further, I don�t think Tesla�s interested in owning every component process of the battery production process as a company can focus only one a limited number of things.

Allowing the free market system

The ideal solution for Tesla would be to somehow allow the world market for lithium-ion battery production to grow as fast as they want/need it to, but without themselves having to directly own it or control it (thus bypassing the $80b in capital requirement over 15 years from themselves directly).

This is what the Gigafactory is all about, in my opinion.

Here's how I look at the partner arrangement. Each "partner" is actually just a battery component supplier or manufacturer that's invited to own a piece of the actual building and land of the Gigafactory. Let's say the Gigafactory is 7.5m sqft and each sqft costs $100 to build. That would be $750m for the land and building. Let's add an additional $250m for all the solar panels, wind turbines and other building-related expenses. So, we've got a cool $1 billion to build just the building and power-source for the Gigafactory.

The $1 billion can be divided up according to how much space each supplier is going to need. I think of it like a flea market where each supplier gets an opportunity to buy their stall. The reason you'd want to buy your stall is because you will be in close proximity with final pack assembly and would save in shipping costs as well as logistics. There could be some other incentives as well.

So, let's say Tesla needs 35-40% of the factory to do module and pack assembly and some other things. So, they put in $350-400m of the $1 billion and they own a section/chunk of the Gigafactory. Each supplier is offering a "stall" or space in the factory to set up their company there. The space is actually purchased by the supplier. So, the supplier then ends of owning that part of the building/complex. Panasonic (or another battery manufacturer) would end of owning a big section of factory/complex for cell assembly, maybe 30%. So they put up $300m and Panasonic actually owns a big physical section of the Gigafactory carved out for them.

After all the suppliers pitch in money (total $1b), then it's up to each supplier to buy and bring their own equipment. In other words, since each supplier owns their space/section in the Gigafactory they also will fill that space with their own equipment. This is where the additional investment comes in from Tesla and the suppliers. Tesla fills their space with module and pack assembly equipment. Other suppliers fill their space with their own purchased equipment.

After all the equipment is in and production starts, each supplier is actually free to charge Tesla whatever they want and Tesla is free to buy from whoever they want, whether they reside in the Gigafactory or are not. In other words, it's a free market system.

The reason why a free market system works best is because Tesla can take advantage of market competition and market prices for every component. They don't need to be locked in to a certain price by each supplier. This will likely drive costs down even further over time.

The fear of missing out

Now, if a supplier isn't guaranteed a price from Tesla or even a certain volume by Tesla, then why would a supplier want to set up shop at the Gigafactory? Well, it's mostly out of fear of missing out. If they don't buy a "stall" in the Gigafactory and one of their competitors do (ie., Samsung), then they'll miss out on a huge opportunity to save on shipping/logistics and also maybe on bulk purchases of raw materials together with other Gigafactory suppliers. So, this fear of missing out will drive these suppliers to sign up and purchase their space at the Gigafactory.

Also, Tesla will be smart and will allow only one supplier of each component to have a space at the Gigafactory, so it's somewhat of an exclusive privilege as a supplier to be based at the Gigafactory. This will drive the "we can't miss out on this" fear even more among suppliers and will motivate them to pony up the cash and buy their piece of the building/land.

Now, this system might not work perfectly, and Tesla might need to give some minor incentives for these suppliers to buy their piece of the land/building. Tesla might need to offer minimum # of components/cells they will purchase and maybe a minimum price they'll pay for a certain period. But ideally, it's best if they don't have to offer anything but fear itself (suppliers fear missing out on an opportunity to a competitor).

So, what we've got is more like a business park, and that business park is owned by a bunch of different companies, each occupying their own buildings/space. Yet the benefit of being at the business park is proximity to their customer (ie., free shipping), easier logistics, and the opportunity to collaborate in bulk buying of raw materials with other business park occupants. Even though the price and volume of sales isn't guaranteed, the business park occupants are attracted at the opportunities they don't want to miss out on.

For Tesla, this is the best of both worlds. They don't need to pony up a ton of money for each Gigafactory. They just need to pay their share of their part of the factory (module and pack assembly). And by enabling suppliers to come together in this massive complex, they are enabling their suppliers to save money and to be part of a huge business opportunity. And by approaching the Gigafactory like this, they allow market dynamics and competition to continue to drive down the costs of components and cells.

The key to scaling

The key is that this first Gigafactory needs to work. It needs to draw in the suppliers (ie., each supplier purchasing their section of the building/land). And these suppliers need to be motivated (and also have the financial capabilities) to purchase equipment to fill that space and be ready for production in 3 years for Gen3.

Now, one of the reasons that these suppliers also will be motivated is because it's likely that Tesla is giving first shot to their current suppliers (ie., Panasonic and Panasonic's suppliers). This is why Panasonic recently visited Tesla together with its suppliers from Japan. Panasonic and these suppliers are currently receiving huge benefits by being Tesla's current suppliers. In other words, they are reaping huge revenue and profit gains already. They are in prime position to sign up for the Gigafactory purely out of fear of missing out on future revenue and profit potential.

If Tesla's current suppliers decline this opportunity, then Tesla can open it up to their competitors (ie., Samsung and others). In whichever case, I think Tesla would strongly prefer Panasonic to be the cell assembler in the Gigafactory but Tesla is the one in control and they call the shots. If Panasonic wants to be part of Tesla's future directly as their main supplier, then they need to bow to Tesla's demands. And I think it's in Tesla's best interest to make free market competition their main demand (meaning Tesla is free to purchase from anyone in the world and does not guarantee volume, price, purchases to Panasonic). However, once again I'm not sure if that's going to work 100% in the real world so Tesla might budge some and give some incentives/guarantees. But it's to their best interest that those guarantees/incentives they give to Panasonic (and others) be minimal at the most.

So, if Tesla is successful in setting up and launching the Gigafactory in this manner, then this is they key to how they will scale in the future. They will be able to set up more of these Gigafactories (again they're more like business parks) and enable the expansion of the world market for lithium-ion batteries without having to own or control that supply, which would take double or triple the capital they're already spending and would restrict Tesla's ability to scale multiple Gigafactories in a short amount of time (ie., to reach 5m cars/year by 2028).

If Tesla is able to pull the first Gigafactory off with this kind of free market arrangement, then scaling to 10 Gigafactories should be very doable in the next 15 years.

This is why I'm very excited about the Gigafactory.

However, this is just my speculation and guess on the behind-the-scenes arrangements and negotiations with suppliers. And also the reason why no "partners" have been announced yet (it's because they're mulling over this deal and opportunity. Ultimately the fear of their competitors jumping in will seal the deal for them). Tesla has likely given their current suppliers a deadline to make a decision before they open up negotiations/bidding to their competitors.

I also think that this partner arrangement/system won't be shared publicly by Tesla (at least in the near future) since I think it's actually quite genius and gives them quite an advantage.

One final note on the 500k cars in 2020 provided by Tesla. I think this is a conservative figure given by Tesla and they are internally projecting much higher. I�m expecting in 2016 (if Model S/X sales continue to grow and Gen3 reservations are very strong) they will announce another secondary to raise money for an auto factory and gigafactory in China. I could see the stock jumping 5-10% at the time on this news.�

Feb 27, 2014

SteveG3 six paragraphs down this article reports talk of the offering increasing to $2.3 billion. Tesla declined to comment.

Tesla's 619% Jump Makes It Hottest Stock in Two Decades - Bloomberg�

Feb 27, 2014

Familial Rhino There is another way to look at it. If I had $1 billion and wanted to make money in TSLA, I could buy 4 mil shares on the market at $250 with substantial risk that I lose a big chunk, or I can buy these notes with no risk*, and know that my money will be put into the GF. This dramatically increases the probability that the stock will go much higher, and I get to participate in the upside. If I had this much to invest, I'd take the second option.

*There is still the bancruptcy risk, of course.

- - - Updated - - -

(My post was in reply to sleepyhead; forgive the clumsiness)

�

Feb 27, 2014

DaveT I agree that the notes appeal to certain folks who are more risk-averse and see TSLA as a risky investment with straight common shares. For example, pension funds, college endowment funds, etc.

On a side note, it's amazing how much $1 billion can buy has changed in a year regarding TSLA stock. Today $1 billion buys you 4m shares or 3% of the company. Exactly one year ago, $1 billion could have bought you 28.7m shares or about 23% of the company.�

Feb 27, 2014

Matthias Buhl Hey Dave, thanks for the assessment and for sharing your thoughts!

At the moment all the talk seems to be about the potential supply partners for the Gigafactory. What I'm wondering is weather or not there ist also a good possibility of partners on the demand side of the factory. E.g. Mercedes and Toyota. They are already heavily invested in the Company and source battery packs and Drivetrains from Tesla. They have a large interest in Tesla being successful (Each has around $1,2b in stock) and at the same time don't want to be left behind in the race for their own mass market BEV.

I see this as nice potential for positive media coverage: Tesla Gigafactory feat. by Panasonic, Mercedes & Toyota

What are you're thoughts on that?�

Feb 27, 2014

DaveT I'm personally doubtful that Daimler or Toyota would be partners in the gigafactory since I don't think they have the priority or focus on EVs that's required to pony up money to set up their own module or pack assembly section in the gigafactory. It's definitely possible that Tesla could use sell battery packs and/or powertrains to Daimler or Toyota in the future but it's more important to Tesla to have their needs met in terms of cell supply.

Also, if the arrangement of the Gigafactory is like how I'm speculating it to be (ie., co-located business park) then Daimler/Toyota would add little value to the business park.

Actually, as I'm writing I'm changing my mind some.

If Daimler or Toyota could buy their own little section of the Gigafactory and set up module and pack assembly for their own cars (even if it's a fraction of the size of Tesla's portion), then this could be attractive to Panasonic and the other suppliers since demand is not just restricted to Tesla at the Gigafactory but to Daimler or Toyota, whom the suppliers might respect even more than Tesla. I remember reading an article this week about Panasonic saying the might be cautious with the Gigafactory investment because Tesla is still a "venture" company. Here's the quote:

"Panasonic is looking at various types of cooperation, including taking on some of the investment," the source said. "But Tesla is a venture business, so there's a need to be cautious in looking at the risks involved." (http://www.reuters.com/article/2014/02/26/tesla-battery-panasonic-idUSL3N0LU4IV20140226)

In Asia, "venture business" means a startup or young company. I don't know who the "source" is in the article so it's probably not Panasonic. But nevertheless having Toyota or Daimler's commitment to own a part of the Gigafactory and produce their own packs there could legitimize the Gigafactory even further in the eyes of Panasonic and suppliers. I don't think this is necessary, as Panasonic and suppliers are already profiting heavily on Tesla's growing cell demand so that will probably be enough to convince them to join the Gigafactory.

Lastly, Daimler and Toyota have no experience in battery pack or EV powertrain design and assembly, so it's probably unlikely they'd want to build their own section of the Gigafactory. Rather, they'd probably have to rely on Tesla to provide them with powertrains (ie., RavEV, B Class) which Tesla could do without involving them in the Gigafactory at all.�

Feb 28, 2014

airj1012 Do you guys think these are the only details we'll get from Elon in the near future? I thought I remember him saying that there would be a call this week.�

Feb 28, 2014

sleepyhead Thanks for your analysis, and even though I share some of your concerns, I disagree with your overall assessment.

It looks like Tesla is going to raise $2.3b and not $1.6. So $2.3b is enough to finance about 50% of the battery factory; but this is besides the point.

I think that you are ignoring the future free cash flows that Tesla can use to help finance the factory. It is not like you have to pay $5b today to be able to have the factory up and running in 2020. Tesla at best only needs a couple hundred million to a billion this year to secure land, get permits, and start the building process. That $5b cost will be spread over time all the way until 2020.

In the mean time Tesla will have a few hundred million dollars in free cash flow this year. Next year it might even be up to $500m+, and in 2016 you might see $1b+ of free cash flow. That right there is enough to fund the other $2b needed to build the plant. Then you have 2017 - 2020 cash flow that should easily be in the billions per year.

Lets say that I want to build a $1m home and have it ready by 2016. I do not need to raise all of that cash today. I can raise $200k today to get the land that I want, then as I start building the house for the other $800k, I will pay the contractors as they get the job done (lets assume that it will take 2 years to finish the home). I am not going to be paying for the cabinets today, since I will buy them only when they are ready to be installed sometime next year. Same goes for the contractor who is installing the cabinets; he will not get paid a portion until he is ready to start the job, and will receive full payment when finished. In the mean time I have my day job that allows me to raise money to pay these guys in the future.�

Feb 28, 2014

Benz I have always appreciated your posts very much, and I will keep on doing that in the future.

What I would like to say is: "No worries mate, it's going to be all fine".

As from this year we will start to see a rise in reservations for the Tesla Model S at a pace that we have not seen before. I will not be surprised if the total number of new reservations for the Tesla Model S in 2014 will be more than 50,000!!! And even double that many in 2015!!! And we will see about the same numbers for the Tesla Model X.

My point is that demand is not going to be the problem at all. The point is will Tesla Motors be able to produce that many cars? During the Conference Call of the ER of Q3 2013, Elon Musk spoke more than once about the "Real High Volume Next Generation Production Line". We will soon see what the meaning of that is. I hope that Elon Musk will reveal more about this in the next few Conference Calls of the coming quarters.

Don't worry, be happy.�

Feb 28, 2014

sleepyhead And for good measure you can see my post how there is a clear roadmap to a $500 - $1500 share price in 2020 based on 500k cars produced:

http://www.teslamotorsclub.com/showthread.php/23461-Articles-megaposts-by-sleepyhead/page26?p=592213&viewfull=1#post592213

$500 in 2020 is not a great return on investment, just above 10% per year but still better than market averages. But if TSLA hits $1000+ then it is a fantastic investment.�

Feb 28, 2014

ItsNotAboutTheMoney I think "no worries" is too much. I think CapOp's right in saying that Tesla's 500k could push back from some of the more optimistic projections. However, I think the cautiousness in Tesla's statements would be because of their partners' cautiousness. Tesla has to be able to deliver the Model E at target base (ahead of any competition) to really make demand explode. As soon as they can show they can do that, it would show up in reservations and at the point they'd be able to go back to their partners and say "OK, here are the reservation numbers, here are our sales projections for cars and solar, this is the current state of the competition in elecric cars and battery technology, are you ready for Gigafactory 2 in China?" So while the optimistic scenario would have 500k in 2020, it could well jump rapidly in 2021, as Gigafactory 2 and Teslafactory 2 come online.�

Feb 28, 2014

sleepyhead These notes may be appealing to a fund or money manager who doesn't want to lose money for his clients. But for the individual investor such as myself it is not a good deal, unless you have so much money that you are more worried about protecting downside rather than maximizing upside. Since I am still working, it means that I do not have enough money yet so I am trying to maximize returns. Here is another way to look at it:

If I buy $1m worth of TSLA shares today at $250 and the stock goes to $500 five years from now when the notes mature, I will have $2m or 100% return.

If you bought the 5-year notes today at $1m, then in 5 years you would only have $1.38m + a whopping $13,000 collected in interest, for about $1.4m or a 40% return.

40% in 5 years is not great, but 100% is. Then you have the greatest force in the world, compound interest, working on your side and before you know it I am retired at age 45 while you are still working till you are 60+.

Now if you don't believe that TSLA will be above $360 5-years from now then there is no point in buying those notes.

The premium 42.5% that you are paying for downside protection is EXTREMELY expensive. I would never buy these notes even if they sold then to me at below par value. I am not about protecting downside at this stage in my life; I am about maximizing upside.

Now if you are older and on the verge of retirement then it might be prudent to buy these notes.

Everyone's situation is different.

- - - Updated - - -

As far as Zacks goes, I was semi joking. But it seems like they have been extremely good contrarian indicators for the stocks that I follow (mostly solar).�

Feb 28, 2014

Familial Rhino I think we are in complete agreement.

In this post I was myself trying to understand what was in it for the bond buyers. I then realized that, for an entity investing in the $1b range, the risk profile would be vastly different from an individual investor's, so the notes might make sense. First, an institutional investor would like the $360 floor. Yes, the premium is huge, but this investor, while assuming he is very bullish, still wants to tread carefully. Second, and this is especially important, buying the notes directly contributes to the company's future growth by funding the GF, thus further minimizing the risk, whereas the same investment made on the open market would not help the company.

In contrast, as an individual, my money wouldn't put a dent in the company's prospects. Moreover, I am able to tolerate much higher risk. Like you, I wouldn't buy the notes either (in fact, my portfolio is aggressively invested LEAPS.)�

Feb 28, 2014

Benz "Tesla Raises More Money Than Expected, Offering Jumps From $1.6 To $2 Billion Due To Demand"

Link: http://insideevs.com/tesla-raises-more-money-than-expected-offering-jumps-from-1-6-to-2-billion-due-to-demand/�

Feb 28, 2014

FluxCap Finalized term sheet for offering is up:

Tesla Motors - Free Writing Prospectus - Filing under Securities Act Rules 163/433

�

�

Feb 28, 2014

Causalien Not speaking for others, but this is what I realized, as some of you must've realized too after 2013's rise.

As your net worth increase past your net earnings a problem arises out of the imbalance between your income and net worth. When your net worth is still small, losing 10% might be less than one week of pay, but when your net worth is a lot bigger than your income, losing 10% might be 10 years worth of savings. At this point, a portfolio needs to be more defensive. TSLA's bonds are attractive because we are relatively sure that it will not go bankrupt until 2017 while offering the potential for a 40% gain. That's about it.

I personally have some cash from a 120% gain in Lithium miners in the past week that I am at a loss of what to do with. TESLA's bond looks attractive, but I am already too saturated with TSLA. So if some company in some other sector offers a convertible bond with the same term as TSLA, I'd buy.

I am assuming that the underwriters are moving around their capital to keep TSLA's price stable for a bit so that they can finalize the pricing of the bond. I personally have maneuvered my positions until I don't feel greed nor fear at any type of movement and wait until the details of the bond issue. I will then buy call spreads based on the bond details.�

Feb 28, 2014

hobbes Just found this on the Gigafactory thread (thanks to Benz), looks good:

�

Feb 28, 2014

clmason Is this the first capital raise where Musk did not buy in?

I have not seen this mentioned on any of the info about the Giga Factory capital raise. I had a degree of comfort during previous secondaries that a new floor was set due to Musk buying millions of shares. Do any of you see this a risk that the bottom could fall out quite dramatically, albeit it may short term phenomenon?

IMO, TSLA is headed to great heights on execution of the master plan.�

Feb 28, 2014

Johan Last time it was partly stock offering and partly warrants/convertible notes. That time Elon bought stock as a vote of confidence and to keep his ownership percentage intact.

This time it's just warrants/notes and it would be strange for Elon to "lend himself money" (well really Tesla, but he's so deeply interconnected with Tesla personally) by buying these.�

Feb 28, 2014

FredTMC i thought the last last time was a mix of bond and preferred stock. This time is just the two bonds (2017 & 2019)

youre right though, no mention about musk making personal investment. Doesn't matter to me. I think it's more assured now that tesla is viable long term. I think that perception has improved since last secondary

- - - Updated - - -

+1. You beat me to it�

Feb 28, 2014

GenIIIBuyer Correct, you wouldn't want to see upper management buying Senior Debt positions. They could purposely run the company into the ground, and own the whole company through a bankruptcy re-organization.�

Feb 28, 2014

airj1012 I found the piece that I was looking for. Here is the audio from the Q4 earnings call that mentioned that Tesla Motors was planning to have a call about the Gigafactory next week (which is this week). Are they going to gives a real update? Time is running out seeing that its Friday!

Elon Musk - Q4 Earnings - Gigafactory Call - YouTube�

Feb 28, 2014

DaveT There will be no Gigafactory conference call.

I just heard from Tesla investor relations:

I emailed them earlier, "would like to know if Tesla is planning a conference call for the Gigafactory and if so when?"

Their email reply was, "In lieu of a call on Gigafactory, we instead decided to post this blog post and slides from our convert deal roadshow at this link, http://www.teslamotors.com/blog/gigafactory"�

Feb 28, 2014

FluxCap Thanks Dave. I was beginning to suspect that would be the case. The blog, PDF and press release were actually even more thorough than I thought the call would be, so I'm happy.�

Feb 28, 2014

airj1012 Although I'm a bit disappointed, thank you for that update. Time to get out of TSLA for the time being.

- - - Updated - - -

Those of you that do not know yet, Tesla just updated their Coming Soon and 2014 maps for the Supercharger. Big update.

http://www.teslamotors.com/supercharger�

Feb 28, 2014

hockeythug Has the lithium ETF LIT been discussed on here?�

Feb 28, 2014

JRP3 Apologies to our Texas brethren on the site but I really hope Tesla does not even consider Texas for the GF. http://www.cnbc.com/id/101456297�

Feb 28, 2014

palmer_md

This auto dealer association just does not get it. They don't realize that the law is going to be changed. If they fight it, they will not get the factory and still have the law changed on them. lose-lose.�

Feb 28, 2014

bonnie Prospectus is out, just digesting now. Anyone else?�

Feb 28, 2014

pz1975 I mentioned it in the Alternative Energy thread but this is probably a better place. I am following it now but haven't gotten in yet. I am curious as to whether RBI and WLC will crash back down after this current spike.�

Feb 28, 2014

772 I received a copy as well... reading now

101 pages... really? �

�

Feb 28, 2014

Krugerrand And then there were three...�

Feb 28, 2014

TSLAopt Am I reading the headline of that prospectus correctly in that they sold all 2.3bn worth of Convertible Notes?

Tesla Motors - Prospectus Filed Pursuant to Rule 424�

Không có nhận xét nào:

Đăng nhận xét