Sep 11, 2013

ItsNotAboutTheMoney From my reading, the Suminoe expansion would add 300M cells per year for $1.3B of strong yen. Assuming 5k per car, that's 60k cars per 1.3B, If you're thinking 500k cars per year, 10B sounds like a high-side estimate, especially given the identixal tech. Less than 18 months to bring new lines online, so I think they'd be able ramp withou any problem.�

Sep 11, 2013

StapleGun Just to add a little more data to these calculations, here's a great article on the cost of battery factories originally posted by someone in CapOp's battery pack price thread.

http://americanmanufacturing.org/files/1-s2.0-S0378775312018940-main%20(4).pdf

The article roughly states that a new factory costs about $4 per cell that it will produce each year, which is consistent with the Suminoe expansion you mention. It also says that the same factory in China would be about 15% cheaper than the US though.�

Sep 12, 2013

CapitalistOppressor Lol. I just reposted this over there after having to look my original post on it up, and then did the same Suminoe comparison. Obviously we are on the same wavelength.

I don't think there is any way that GenIII happens without many billions of dollars worth of investment.

John Peterson's estimates of battery capacity includes a ton of generic producers from SE Asia, India, etc that have non-automated lines that produce low end, low quality batteries for local industry or second tier export markets (think 1.8aH batteries used in cheap toys instead of high quality laptop batteries).

I think the EnergyTrend statistics are much more reliable, because they survey only the big manufacturers like Panasonic, and they are estimating current production at ~660m cells per year from those sources. That data is much more on point for this discussion, because Tesla just can't utilize the kind of low end batteries you can get from some two bit manufacturer in Vietnam.

- - - Updated - - -

As to the suggestion in the OP, one issue would be whether the US would authorize an acquisition by Samsung. Any domestic auto manufacturer, including Tesla, is subject to review whenever foreign ownership stakes rise beyond a certain level.

I suspect that the Obama administration would work hard to find a domestic buyer if Samsung made a bid for Tesla.

For that matter, the administration has ~$5 billion available in the same advanced technology loan program that was used to fund the Nissan plant at Suminoe, A123 and Tesla itself. And they just put out the word that they want new proposals to use that money.

I wouldn't be shocked if Tesla is thinking about putting together a proposal on the scale of Ford's $4b loan that they took out to fund their plugin strategy.�

Sep 24, 2013

VolkerP Tesla can't go this alone

The recent discussion of battery supply shed a light for me on this: Tesla cannot go this alone. Let me explain.

1. Without expansion of global 18650 cell production capacity, Tesla is production limited to <50.000 Model S/X cars per year.

2. They already feel the pain and try to generate as much revenue per cell as possible (P, P+, price increases, incentive of quicker delivery for higher-optioned cars)

3. 3rd party 18650 manufacturers have little incentive to invest in new cell production capacity for ONE customer. What if Tesla goes bust?

4. From the limitation in 1., and an optimistic average life span of 20 years per Model S/X, there would never be more than 1 million Tesla EVs on the world's streets. A mere drop in the ocean and a far cry from a transition to sustainable transport.

So what must happen next? At the supercharger event, Elon stated "join us, or copy us."

(IMO he left out the 3rd alternative "or, go bust." :wink

One hunch is the fact that Toyota is licensing Tesla drivetrains for the RAV4 EV (although a compliance car in limited number), and Mercedes e-cell B-class (not sure what volume is planned here). Does this spur investment in cell production capacity? I have some doubts.

We need an established EV battery market for good. A healthy market consists of multiple suppliers and consumers. Volume and prices are reliable and predictable for all participants. Contracts for large volume and several years are closed on a regular basis.

But how could that market develop?

At least one of the incumbent players follows in Tesla's footsteps with the 18650 technology for a mass produced car. 18650 suppliers are confident enough in continued demand that they expand production.

Or, Tesla raises the cash to invest in cell production all by themselves.

What other possibilities are there?�

Sep 24, 2013

lolachampcar just off hand

-One or more major battery suppliers invests in Tesla and Tesla uses those funds to underwrite the supplier building out capacity.

-One of the major auto manufacturers realizes they can not re-invent themselves and yet there is a paradigm shift. They buy Tesla, underwrite battery capacity and lend their supply chain management to Tesla to help them manage the growth all the while keeping Tesla independent from the parent and preserving the no dealer foothold.

-Tesla limits G3 production to battery capacity as multiple vendors grow it within their (the battery mfg's) internal tolerance for investment.�

Sep 24, 2013

sleepyhead There is one very easy solution and that is to tap into another government loan.

This time for $5 billion. That would make me extremely happy as a shareholder.�

Sep 24, 2013

evmile Well if there is any good news tablets don't use 18650 cells and they seem to be replacing the laptops which do use 18650 cells.

So the other half of the world's supply may become available soon enough.�

Sep 24, 2013

Bobfitz1 I read the terrific article you posted link to on battery factory costs. If Gen III takes approx 4,000 cells, then 1/2 million cars annually need 2 billion cells annually. I think the article mentioned world production of 18650 is currently 6 billion per year. That seemed high to me, but rest of article seemed factual. Just going on memory of the article. So hopefully I'm not misquoting their figure for current world production.

Article made me suspect TM might invest a few hundred million to build an in house battery factory, just to keep Panasonic and Samsung on their toes and investing in more new factories of their own.�

Sep 24, 2013

vin5xxx Gigafactory or not the threat of future capacity concerns on 18650 availability appears to have receded. Elon says this is no longer a threat to Tesla's growth:

Cool story of a Musk fan getting to hang out with Elon for 30 minutes last week | Forums | Tesla Motors�

Sep 24, 2013

sleepyhead Sounds to me like it is time to buy some more TSLA.�

Sep 24, 2013

Ryo

Neat story. Perhaps I'm missing obvious but what does he mean by a "1% supplier"?

" Elon went on to say that any supply issues would be from a 1% supplier but he mentioned nothing specifically"�

Sep 24, 2013

Ludus Wow. This is the kind of entirely believable slam dunk post that makes reading these forums worthwhile. The original post was at the Tesla house forum but it got linked here quickly.

One of the perks of Tesla's new found market cap gravitas seems to be being taken more seriously by the big guys. Taking that issue off the table in the most natural way by having Panasonic and Samsung just commit to handling it is very positive news.

- - - Updated - - -

http://cleantechnica.com/2013/08/12/4-elon-musk-statements-from-friday-that-caught-my-ear/

Elon has made some statements about the 1% of suppliers who just can't cut it.�

Sep 25, 2013

lolachampcar If it is a no problem problem, then it is just a matter of making sure you own enough TSLA before they announce it �

�

Sep 25, 2013

wycolo Of course Samsung and Panasonic 'will handle it'. That is what they have been doing for a good while now: expanding their production. They are overjoyed that the 18650 will not soon be obsolete as they feared.

Will they hostile-ly takeover Tesla Motors? No way. Why is Elon not worried about these two players? Because they mesh perfectly into the business and will continue to do so. No culture of domination that might need to be satisfied. Only 'loose end' might be how to start producing cells in North America which would increase efficiency (reduce shipping costs).

--�

Sep 25, 2013

pGo Every time I look at the issue of giga battery factory, Apple display production issues come right in front.

It is easy to forget now but think about the production issues Apple had with the original iPhone or the ratina iPads. Apple even had to re-establish the display glass factory that was non-existent (corning used had the solution since years but had no buyer for it and essentially did not run a single piece of display glass through production). Then comes the production issues of display itself & RAM. Apple solved them by working with the suppliers - by investing in them while controlling quality and gradually increased yield.

The Gen 3 can be compared with the original iPhone launch. Apple announced the iPhone whole 6 months in advance - to gauge market reaction, demand, and then establish production pieces by showing them demand. Apple initially invested in RAM production with Samsung for iPods, and then later on with Sharp and as recently as a few months ago making a deal with TSMC for chip manufacturing.

Keep in mind that Apple didn't grow revenues on the first day. In fact, the first two months of iPhone launch, they only sold a few hundred thousands iPhones only.

If Gen 3 wows consumers in all aspect just as Model S, the giga factory issue becomes easier to solve. Looking at the Apple playbook, Tesla can do following.

1) Launch Gen 3 alpha/beta and a defined date of production

2) Wow the market in terms of style, specs, price

3) Create a feeling that everyone wants a Gen 3 from Camry buyer to a 3 series buyer

4) Make a reservation list of 50K (get 2.5K down) or so

5) Check market reaction, get a few B worth of funding (loans better than secondary)

6) Whatever the battery cell supply is, start production while talking with potential partners by investing in the little to increase yield

7) it does not matter if the production is supply constrained for 12-18 months as long as product & brand rocks (Check harley motorcycles for years) while focusing on ramping up.

This does not sound a huge problem to me now. The issue does remain in execution but looking at how Model S is being executed, I have full faith that Tesla can become another Apple in terms of production rampup & quality. A lot of us on this forum think that the battery supply issue needs to be addressed on the first day of Gen 3 launch. I think it needs to be fully resolved in a few years from initial production start. Earlier it gets resolved, better it is.

Another argument is that if production rampup takes longer, the competition may get a hand to come up with competitive product. That is always the case. They already know the capabilities of Gen 3 will be in terms of range and price. Launching HTC One X does not kill iPhone.�

Sep 25, 2013

VolkerP Wisely chosen your words you have.�

Sep 26, 2013

pGo Here is the first of many steps. Chillex people.

http://www.4-traders.com/SUMITOMO-METAL-MINING-CO-6491216/news/Sumitomo-Metal-Mining-Co-Ltd--SMM-to-Invest-into-Expansion-of-Lithium-Nickel-Oxide-Production-Fa-17297959/�

Sep 26, 2013

clmason Great find!

FTA: "The planned investment outlay is approximately 4.8 billion yen (US$48 million). After expansion, SMM's production capacity in lithium nickel oxide will increase from the current 300 tons per month to 850 tons."

Very good news.�

Sep 26, 2013

pGo Another article saying Panasonic will invest $200M into battery production expansion. 2nd of many steps

http://pulse2.com/2013/09/14/tesla-motors-inc-tsla-helps-bring-panasonic-corporation-6752-back-to-profitability-93477/

"Panasonic Corporation (TYO:6752) is planning to invest $200 million to expand their automotive lithium-ion production lines in Osaka and Kasai. Panasonic is now the leading supplier for lithium-ion batteries for plug-in and hybrid cars that are sold in the U.S. Panasonic now has a larger market share than LG Chem and Nissan�s AESC."

�

Sep 26, 2013

brianman Not me. Sign of weakness, and fuel for the counter-Tesla folks to rise up again. Tesla can stand on its own two feet, with investor from the private sector perhaps, at this point.�

Feb 12, 2014

Mario Kadastik Seattle I think your misgivings stem from the fact that you assume Tesla to be a car company. It's not. Tesla is an energy company that specializes in battery based energy storage and usage technologies and as a sideline albeit the main business right now they produce excellent electric cars. Tesla has already announced partnerships with SolarCity to provide battery backup modules for the solar installations as well as they have announced plans to come out with a large battery buffer systems for industrial usage latest by the end of this year.

So battery IP and tech is the main business of Tesla. The fact that majority of the batteries end up inside cars is the second component, but in no case should Tesla fully outsource the battery tech as that's their competitive advantage.�

Feb 12, 2014

AudubonB I, too, initially balked - and hard - at Tesla being the one to finance and control the battery giga-factory, but for exactly the reasons Mario has enumerated, I gradually but ineluctably changed my mind. That said, I still think you can make the case that in the short- and medium-term, if Return on Investment were the #1 criterion for your company to make its decisions, the factory might oughtn't be built. However, Mr Musk's stated goals being to alter the world's energy consumption paradigm, I now am a fervent backer of the project.

Now, as far as the Arizona desert as being too remote for its input (labor) or product (delivery to Fremont) - no, that is negligible. Take a look, for example, at Intel's newest facility, the 2013-completed hypermonstrous "Fab 42": it cost $5.2 bn - probably $1.7bn for the building alone; took 10.5mm man-hours and some 21,000 tons of structural steel (per Intel); I think it's some 2mm sq ft in size (can't find that datum on the spur of the moment), and it sits right in the desert, albeit at the edge of the ever-expanding Greater Phoenix megalopolis. But that's the sort of desert environment that can make sense: great transportation infrastructure right at hand (two Interstates, railroad, airport...and 5.Xmm people) - it would not have been anything at all for Intel to have hired the full contingent of 14,000 employees that were to have been working there.

It is staggering that Intel announced at the end of last month they're mothballing it before it ever cut a 450mm wafer. Holy moly. Wonder if it would suit Tesla, in the same way that Apple + NT Advanced Technology last fall picked up for a song the vacant 1.3mm sq ft First Solar factory in nearby Mesa.�

Feb 12, 2014

Krugerrand How quickly we forget that Tesla has been/had been at the mercy of a handful of suppliers for most of 2013 that stalled ramp up at various times. (And that's not referencing Panasonic.) There was the door handles not being coated properly, the long pieces of chrome trimming that not just anyone could produce, USB cable shipment that got delayed (remember the trip to the local Fry's to buy up their supply?), etc... Remember the frustration for Elon Musk?

Leaving arguably the most important part of the car, the batteries, out in the world for someone else to be entirely responsible for - not that Panasonic hasn't done an excellent job - and being dependent on (and having them on the other side of the world) is far riskier than having it in house. It is in this CEO's nature to want to control as many aspects as possible for obvious reasons. The Giga-factory was very likely in the back of his mind since the day the Secret Master Plan was conceived. Perhaps hoping it wasn't necessary, but planning for it just in case.�

Feb 12, 2014

bonnie I'm predicting the giga-factory will 1) be in Arizona or NM (dependent on the best business incentives) within a day's drive of Fremont and, 2) there will also be a Gen III factory built next to it (removing the single point of failure of just relying on Fremont).

There. I've said it. Let it be so.�

Feb 12, 2014

Krugerrand You got it wrong.

So Let It Be Written - YouTube�

Feb 12, 2014

gym7rjm Very good point Krugerrand, having complete control over the battery supply will allow a much smoother roll out of the model E and probably a much faster ramp up.

The devil is in the details of how the Giga plant is presented -- whenever it will be presented. If Elon is able to clearly explain how the plant will allow further and faster growth for the company, then wall street will like the investment. It's also unclear as to how much money Tesla will put into it if it is a joint venture. Many people were afraid that the secondary offering was going to be bad for the stock price, but Elon was ingeniously able to make the offering price a super strong support level.

Question, has the gross margin target for the Model E ever been formally talked about? I've only seen speculation. I could see a situation where alongside the Giga factory announcement, Elon would say that by building it they would be able to achieve a certain gross margin target well above industry standard. He could also formally raise the gross margin targets of the Model S and X. I think something like that would be received very well by investors because it would paint a clear path to raking in big profits.�

Feb 12, 2014

Krugerrand Most people are always afraid. It's quite obvious that Elon Musk is not one of them. :smile:

In the end, I don't see it mattering what Elon Musk says on the topic. It's going to happen, regardless. Some will understand what it's all about and understand the significance, those that don't will spin the Giga factory details into a negative, doom and gloom, and a bunch of what ifs. *shrug*�

Feb 12, 2014

ItsNotAboutTheMoney I don't see the Gigafactory changing anything other than putting the whole chain together on a single site:

The materials to make the batteries are heavy. Having lots of shipping adds cost. The need for new capacity provides the opportunity for consolidation. The potential for the factory to repurpose the aging batteries is, I think, a bonus, as it deals with an outstanding question.

# Section Description Company -1 Repurpose Aging batteries as solar PV back-up Tesla, Solar City 0 Recycle Recycle dead batteries Umicore? 1 Cell Manufacture cells Panasonic, others? 2 Battery Assemble cells into batteries Tesla �

Feb 12, 2014

keithz This is actually an amazing idea. They would be able to just ship out completed battery packs from the Gigafactory. And fill the ships with returned battery packs for repurpose or recycling.�

Feb 12, 2014

bonnie I stand corrected.

�

Feb 12, 2014

aronth5 Nope.

And then Elon said to JB "Make it So"

�

Feb 12, 2014

Krugerrand As much as I love Captain Picard, Rameses was the first AND he put it in stone. The Captain merely copied him.�

Feb 12, 2014

bonnie Stop squabbling. Let it be so.�

Feb 12, 2014

brianman Best line:

I'm not sure if the TMC voice on that one is bonnie or Nigel.�

Feb 13, 2014

Robert.Boston Moving ourselves back on-topic....�

Feb 13, 2014

AudubonB Okay, back on topic:

Californians may think otherwise, but I can attest that at least a significant fraction of Americans outside that state think it quite newsworthy that a nuts-and-bolts (albeit very, very high-tech) manufacturer decided to create a start-up in the Golden State (yes, I am extremely aware of the NUMMI bargain and everything else).

Regardless: concerning the potential for the battery giga-factory also being located in California, adjacent to the Fremont plant or otherwise: given the immense amounts of press regarding the state's dire and looking-worse-down-the-road water situation, how much water might be needed in a battery manufacturing plant? Ceteris paribus, can this be a deciding factor?�

Feb 13, 2014

ItsNotAboutTheMoney The or is the beneficial piece. It makes it much easier if you can centralize the complex decision and processing.

The key that JP-style resources-resources-doom-mongers miss is that while they'd need large annual volumes, if everything stabilizes they'd end up in an 10 or 11-year loop.

So, I guess, back to the thread title, if you want to invest off the back of the Giga factory, it's a matter of figuring out the key partners needed for large-scale, full-cycle operations, and eventually, hopefully, the Chinese company with whom Tesla will partner when they build the 2nd factory.�

Feb 13, 2014

Krugerrand Less than zero potential regardless of water, sunlight or anything else. This is a BIG factory being planned. GYNORMOUS, even. There isn't land of that size adjacent to the Fremont plant. And if Bonnie's declaration of a Gen III factory built along side the Giga Battery Factory, which sounds like a logical step...�

Feb 13, 2014

Robert.Boston I'd give Texas a very serious look. Texas has excellent infrastructure for building big things, a very business-friendly government, no personal income tax, and port facilities. The latter is important if Tesla were to co-located the Gen III and/or truck factory with the battery factory, giving Tesla an easy way to ship completed vehicles out to Europe.�

Feb 13, 2014

kenliles That would induce an interest revisit of the dealership laws in that exchange - just too much irony for the mind that they couldn't sell them there.

*Order in-line, buy in CA, build in TX, ship it across the border and import from Mexico. Might prove an interesting 'State' of affairs �

�

Feb 13, 2014

Blurry_Eyed I haven't seen much discussion yet related to Japan's vested interest in moving off foreign oil. They are highly dependent on imported oil and it seems to me that both Japanese companies as well as the Japanese government might be very attracted to buying an interest in a Giga factory (Thus mitigating some of the cash drain on Tesla). As the world moves more towards electric vehicles, I would think that Panasonic would want to be in a position to free up their domestic production of cells for local use as well as export use to buyers who might be willing to pay premiums due to constrained supplies and would want to have an ownership stake in a production facility that would be based in the U.S. and/or Europe and/or China.

Seems like any concerns the market might express over the cost of the factory and the cash drain and potential dilution that might occur would be a buying opportunity as I personally believe that there will be plenty of funding available to Tesla to build a factory and that such a factory will be another nail in the coffin for the big automakers which would help Tesla take market cap from the other automakers.

Additionally from a bull/bear standpoint, the bears always point out that once the big automakers decide to 'get serious' about electric vehicles that Tesla will be doomed. If the bears are also going to argue that battery constraints will limit the ability of Tesla to ever ramp up their vehicle production, then the big automakers will face even more of a constraint if they don't build battery factories. Tesla again is widening it's future lead by getting the Giga factory under way and under Tesla control.

I don't know enough about how the other big automakers secure their battery supplies and if they manufacture them in-house or outsource for them. But I would suspect they will not be able to ramp up battery production beyond a few hundred thousand vehicles because of such constraints with out a facility that they control. Tesla, being the biggest consumer (or at least on track to be - I haven't confirmed this fact myself) of laptop form factor cells now holds the clout to get first crack at the best battery tech and supply deals.�

Feb 14, 2014

jkeyser14 I think everyone is missing a big player in the gigafactory... Musk has stated that it would be solar powered. This is a shoe in for SCTY as a partner providing the infrastructure for a 1 GW installation. I bought my shares this morning before posting this.�

Feb 17, 2014

Cattledog More Giga Factory Info/Rumo(u)rs

Report: Tesla eyes NM for factory | Electric Power News | Energy Central�

Feb 17, 2014

Discoducky Could be onto something...

�

Feb 17, 2014

hobbes Interesting! However, therer is one thing I don�t quite understand:

Does anyone know what they are talking about? Hope it doesn�t mean they are building a small ICE into the pack.

For 85 kWh, +15% comes close to 100 KWh. Would be interesting for the X to do the same range as the S.�

Feb 17, 2014

Discoducky The whole article is speculation as TM did not comment so I wouldn't read anything into that.�

Feb 17, 2014

physicsfita Tesla does have a patent for a hybrid battery: Tesla Vehicle Extended Range Hybrid Battery Pack System�

Feb 17, 2014

Adm Tesla has been talking to many cities and states before buying the Nummi factory, I imagine they would be shopping around for the best conditions on the Giga factory too. Maybe NM, maybe TX, who knows?�

Feb 17, 2014

jkirkebo A hybrid pack could be pack consisting of mostly high energy density cells and some high power density cells. The high power part could help supply 400kW to the motors even with a smaller battery and be recharged by the high energy density cells when possible.�

Feb 17, 2014

pz1975 Maybe this is what they are referring to (article from Sept. 2013): New Tesla Patent: 400-Mile Battery Pack Using Metal-Air Lithium-Ion Batteries | CleanTechnica

Basically a hybrid battery pack with combination lithium-ion and metal-air where the Li-ion side would be used most of the time and metal-air only when needed on longer trips. This article is reporting the patent filing for this technology.�

Feb 17, 2014

TD1 As far as I know Elon they will select an area for the Gigafactory that is big enough to House a second Car production Factory in the future.

In addition to that it should have enough space to house a concentrated solar plant to power both factories.

So Gigafactory + Recycling facility + Solar plant + 2nd Production Factory, that will be a massiv industrial complex�

Feb 17, 2014

hobbes Cool, you and physicsfita beat me - I was searching and found the same info. I have to admit it�s all quite speculative, but hey, thats part of the fun. And why would the analyst make up such a detail out of thin air - he said the info was gathered at a couple of conferences his firm attended?!�

Feb 17, 2014

EV2BFREE Previously Elon mentioned building Tesla Trucks in Texas. That could have just been smoke and mirrors to get anti-Tesla legislation to not pass or he could have really meant it.

Texas is trying to lure SpaceX into the state(The Dallas Morning News | Options) so im sure they would try to compete for a Tesla factory also.�

Feb 17, 2014

kenliles Of course without dealership law changes the irony would be too much for the mind. You can build 'em here but not sell 'em.�

Feb 17, 2014

Cattledog Perhaps they'll circumvent by calling the whole thing a movable battery rather than a car. Duracell doesn't need dealerships, do they?

�

Feb 17, 2014

brianman "Let's make something with an additional point of failure and much higher complexity for a 10% improvement."

If that's the sales pitch, I can't imagine who the buyer would be.�

Feb 19, 2014

tftf Do you think we already learn such technical details tonight? I hope we get at least the rough numbers (location, timeline for construction, investment size) and (some of the) involved partners during the earnings/conference call.�

Feb 19, 2014

JRP3 I doubt we'll learn any such technical details.�

Feb 19, 2014

uselesslogin So, just throwing it out there. They are building a factory to double worldwide battery production and they are doing it with partners and part of this business is obviously grid storage. Doesn't it make sense for Tesla Motors to be a part owner in a new company, perhaps one called Tesla Energy? The other companies would also own part of this new company so the capital cost to Tesla Motors would be significantly reduced at the cost of sharing the earnings. It would sell battery packs to any car maker that wants them although only Tesla Motors would sell complete drivetrains. This is what makes sense to me and it is a much better solution for Tesla Motors than diluting their shares. I think it also speeds the electrification of transport because other car makers might be more comfortable buying only the battery pack and doing their own drivetrain.

Tesla's IP would be purchased by this new company so Tesla Motors wouldn't need to contribute as much capital (if any) to the venture.

This is just wild speculation though. I am very excited to see what we learn today.�

Feb 19, 2014

TSLAopt this is a great idea...perhaps SCTY would even have a piece of it too for providing the energy to run the factory with solar panels and their future need for energy storage devices from Tesla Energy�

Feb 19, 2014

tftf A new company could make sense if there are multiple partners involved (and multiple partners were hinted at by Tesla). However, I don't see large car competitors buying batteries from TSLA (or the new company) except for maybe Daimler or Toyota as current TSLA investors. Toyota execs not warming up to pure BEVs at the moment would only have Daimler remaining as a partner and/or future customer in my opinion.

Even if would make sense financially I don't see competitors buying from TSLA on principle / for strategic reasons. Also, batteries are heavy and expensive to ship, other companies (Nissand and also re-born Saab as it starts EV production in 2014) produce batteries directly in their main sales regions: Nissan in all three key markets (NA, Europe and Japan) and Saab in China.

As others mentioned, some partners for the giga factory could be from outside the auto industry (obivously Panasonic as a likely candidate, maybe SCTY, IT companies like GOOG...)�

Feb 19, 2014

uselesslogin Yeah, sorry, I agree with you completely for this decade. I was thinking though by the time the current manufacturers see they have to switch to electric 10 years from now they will likely come to New Co as a possible battery supplier for true volume production. I think at that point it could make sense strategically if the idea is to get electric cars to market as fast as possible. I don't think the ICE manufacturers are going to be serious about the switch until they see it hurt their bottom line. Also, by that time they will have at least one factory on every continent.�

Feb 19, 2014

Johan From Q42013 report: "This will also allow us to address the solar power industry�s need for a massive volume of stationary battery packs."

My quick and dirty analysis: "This will allow us..." Us as in Tesla. Meaning in the future Tesla will not be a car manufacturer but at battery manufacturer with among other things a car division???�

Feb 19, 2014

tigerade That is my impression. It sounds like they are going to do what they currently do for SolarCity... make battery packs for solar system. However this suggests to me that they will do it in a much higher volume once the Gigafactory comes online. If this is true, I consider it very good news. Solving the energy storage problem will be very helpful for solar energy.�

Feb 19, 2014

Citizen-T Sounds to me like SolarCity is definitely a partner.�

Feb 19, 2014

austinEV Not to be a spoilsport, but how is LiIon competitive for stationary storage? I always figured the value play was in accumulating degraded car packs that have lots of life but a dissatisfying performance in a car. I always thought that the other things, even lead-acid were superior for cost when do don't care about weight or density?�

Feb 19, 2014

Johan Really looking forward to more info next week. Capital raise to be announced at the same time?�

Feb 19, 2014

Johann Koeber I am sensing a Perfect Storm:

TSLA going up a lot after ER

then a week later a capital raise for the gigafactory

Tesla is growing strong�

Feb 19, 2014

AudubonB Remember, Austin, that Tesla never has said or really even indicated that it has any "loyalty" to Li-ion. There was, indeed, reference in the press conference about the Gigafactory being able to conduct basic research.

On the other hand, I was just comparing numbers on my 9,000 lb bank of Pb-Ca AGM batteries - these are the gold standard that are used by telecomm companies everywhere - and I think my Tesla's bank is better....�

Feb 19, 2014

JRP3 I think long term lithium wins over any other current technology, plus the fact that solar storage demand is going to outpace the availability of used EV packs, which probably won't exist in volume until ten or more years from now.�

Feb 19, 2014

kenliles I agree. The Li tech has improved more than the others in proportion and although not the prime target for storage, it's volume production and recycling now (and will) prove to more than match the now minimal technical deficiencies for storage systems.

The Giga Factory will further this trend and set it in stone. And other Li based solutions (like Air) won't apply themselves well for that market. li has large/easy supply chains- and Ni/Cobalt use looks to be reducing with newer Li based technologies down the road

By the way- did anyone notice- The Fremont Factory is targeted for GenIII- doesn't look as if the Giga-Factory will include that (unless surprisingly co-located there)�

Feb 19, 2014

tftf The only news about the factory I saw today:

(from the shareholder newsletter)

What I got from the CC is that they will absorb most of the cells for their own demand (?).

As for cost reduction, TSLA execs already talked about 30-40% on the European tour (I still don't know if that's on the cell or the completed battery pack level), I guess that's the "major" reduction.�

Feb 19, 2014

Krugerrand Yes. And?�

Feb 19, 2014

brianstorms SolarCity seems pretty obvious as a partner for powering the factory with solar.

Here's a wild and crazy idea: Google invests in Tesla on the gigafactory, drops in a billion or two. Likely? Absurd? We'll know soon enough.�

Feb 19, 2014

tftf That influences ongoing external battery demand for S and X (still coming from Panasonic Japan?) and their ability to ship cells/batteries to other customers. Since some people estimated the factory could also supply third parties.

I guess we will have to wait a few more days for that separate giga-factory announcement.

PS: I assume a small amount of production could be used for their current partners (Daimler/Toyota).�

Feb 19, 2014

772 If SolarCity can get their hands on cheap battery storage, that's going to allow them to sell/lease bigger systems (with better margins I'd assume). Win-win.�

Feb 19, 2014

Krugerrand How do you figure that? The Giga Factory is being built specifically in conjunction with the development of Gen III. That was clearly stated. Battery supply for Model S and X has long since been solved by the new Panasonic agreement and the subsequent reopening of previously closed battery lines.�

Feb 19, 2014

tftf Yes, that supply is secured. I meant switching over supply for S and X once the factory is ready. Maybe the batteries for these two "older" (by then) models continue to be supplied externally, it could also derisk the supply chain (more than a single location for battery supply).�

Feb 19, 2014

sub this is the least "short" I've ever heard you sound TFTF, there is hope. Looking forward to the rest of this week and next. How many poorly written bear articles with all the wrong facts as usual will we be subject to in the next few days?�

Feb 19, 2014

tftf I haven't changed my mind. I'm just waiting for more news on the battery factory for the time being (construction timeline, partners, location, investment size, a new legal entity or part of TSLA etc.)�

Feb 19, 2014

Citizen-T Thought:

Elon says that factory will provide packs for the stationary storage need that the solar industry has. He also says that Tesla will consume all the production capacity of the plant. These two statements seem incompatible until you also consider that he said that the factory will have recycling capability built in to it.

I'm guessing this means that Tesla will consume all newly produced battery packs for its cars. Spent packs will be returned to the factory for refurbishment and be repurposed as stationary storage for SolarCity.�

Feb 20, 2014

tftf

Nissan is already doing this in Japan with spent LEAF batteries:

Used Nissan Leaf batteries support solar energy system in Japan

So it's certainly a reasonable scenario.�

Feb 20, 2014

chickensevil Good luck, now seems like the worst time in the world to have any real short positions in the company. I hope you have been only "cautiously" short up until this point...�

Feb 20, 2014

DJ Frustration Anyone have any thoughts about this thread post Q4 earnings?�

Feb 20, 2014

EV2BFREE Elon mentioned that the gigafactory will be using wind+solar. We can assume the obvious solar partner will be Solar City but are there any ideas for a wind partner?�

Feb 20, 2014

justdoit I doubt they'll use wind. I think he said the factory will be using renewables like wind and solar. The way I read that was that he's just giving wind and solar as examples of renewables and not necessarily saying the factory will be using both. It just doesn't make sense why Elon would want to use wind when he's such a proponent of solar. Also, since this will be a large factory there should be a ton of roof space for solar panels.�

Feb 20, 2014

tander Robert is spot on. On top what he mentioned, putting it in Texas (and presumably creating a lot of jobs) could go a long way into solidly breaking into the Texas market (which is the largest auto market in the U.S.). The combination of Texas's business friendliness, Tesla's need to crack that market, and it's location as one of the sunnier states makes a lot of sense.�

Feb 20, 2014

Discoducky It would be brilliant to see a factory powered by solar by day and wind by night where raw materials or expelled batteries for recycling arrive by train or barge and new completed packs going out by the hundred thousands weekly. Can't wait for the details...hopefully next week.�

Feb 21, 2014

TD1 skip to : 14:30

Maybe Elon is putting Panasonic, Sanyo and Samsung in a headsup to compete for the gigafactory and thats why he couldnt confirm that panasonic is one of the partners.

JB Straubel | Energy@Stanford SLAC 2013 - YouTube

In the same lecture he said that Tesla need 3.5billion cells / year for 700k cars to build.

The whole car industry sells 100 million cars/year.

That means in a full EV world we would need a production capacity of around 500 billion cells/year :scared:.

That would be an increase by 14000% more then battery production compared to the whole world battery production of 2012.

We would need 139 additional GigaBatteryfactories, or some really big GigaFactories.

And according to his slides, tesla wants to sell 700k car per year by 2019, so by that time they would already hit the limit again and would need a second Gigafactory.

Exciting times.�

Feb 21, 2014

tftf A few notes on this: Sanyo is now fully owned by Panasonic. I guess the most likely partners beyond Panasonic/Sanyo could be LG Chem and Samsung. (There are only few other players in the EV battery space with the necessary size beyond these two and they are already smaller: GS Yuasa, Hitachi, BYD, A123 and NEC-Nissan.... However most of them don't do cylindrical cells).

As for the cell count, Tesla might switch to larger cylindrical cells (28650 instead of 18650), so I usually look at the GWh. The video you linked is indeed interesting and the numbers staggering:

10 million long-range EVs will require about 600 GWh in battery capacity (!). It's not just the raw materials and time to build these plants. The $ investments needed are gigantic over many years.

I kept pounding on these numbers for many months because many people seem to be underestimating the time needed to change personal transportation to EVs - even in a best-case scenario for EVs.

Finally, about the 100 million cars/year. This is a rough estimate for 2020 by industry sources. At the moment, "only" 65 million passengers cars are produced: Production Statistics | OICA�

Feb 21, 2014

TD1 I think you are right that increasing the EV production to 10million is a huge challenge. At the same time it increases the barriers to entry for other car manufacturers without their own battery plant.

Although at the same time Tesla will be able to deliver 700k cars to the market with their own plant, but 700k/year is not where Tesla wants to stop.

So I think Elon has already an Idea for a 2nd gen Gigafactory or an massiv expansion plan for a Gigafactory.

They could just put the Factory in an area where a lot of land is available and leave enough space to add more Factory lines in the future (2019).

It takes 18 Months to build a new production line from scratch, so that wont be the problem.

My guess is that the will build the the facilities for 39GW capacity but in the first year they will only setup a production line for 11GW and add year after year.

That will be healthier for the cashflow.

Ultimately there are still challenges but I think a lot of people on this board just trust in Elon and his team that he will or already has a good internal roadmap for the Battery factories.�

Feb 22, 2014

WS6_Mac It makes logical sense that Tesla will put the giga factory beside the GEN III production line. Logically speaking it should be close to Fremont.�

Feb 22, 2014

Krugerrand That's not logical as a) there is no land near Fremont of the quantity required for a factory of the size Elon Musk is talking, and b) if there was a hunk of land there, it would be too expensive, and c) California is too expensive in most every other regard concerning building a business of that size.�

Feb 22, 2014

WS6_Mac Close meaning Arizona or Nevada.�

Feb 22, 2014

LakeForest So... The shareholder letter says this(emphais mine) "Very shortly, we will be ready to share more information about the Tesla Gigafactory. This will allow us to achieve a

major reduction in the cost of our battery packs and accelerate the pace of battery innovation. Working in partnership

with our suppliers, we plan to integrate precursor material, cell, module and pack production into one facility. With this

facility, we feel highly confident of being able to create a compelling and affordable electric car in approximately three

years. This will also allow us to address the solar power industry�s need for a massive volume of stationary battery

packs."

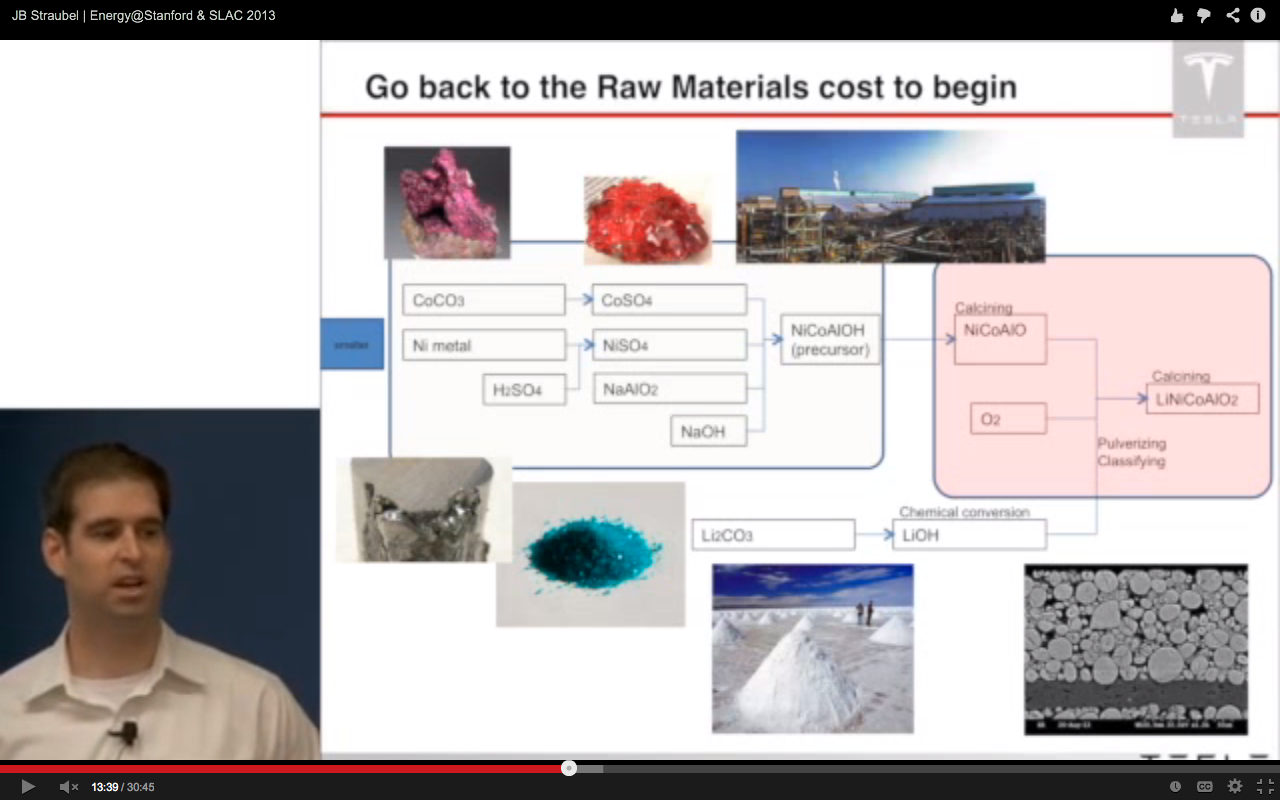

From JB's talk at Stanford, these are the elements that go into a pack, w/ NiCoAlOH labeled as precursor.So, the question is who makes the "Precursor" that is likely one of the other partners. The cell manufacture is Panasonic. �

�

Feb 22, 2014

Krugerrand Ah, okay. That is logical. :smile:�

Feb 24, 2014

tftf Is there a specific date for the factory announcements? I just saw "next week" (which would be this week now).�

Feb 24, 2014

Norse Hopefully we will get that info during the SCTY ER.�

Feb 24, 2014

Benz Interesting post by angstrom in another thread:

"The numbers don't matter right now. They haven't since early last year. At this point it's all about driving the cost of the battery packs down. The fastest way to accomplish that is using Solar PV which has the option to use the 30% ITC on the solar storage.

Tesla may crank out 40K cars this year, but that will be dwarfed by the stationary storage units. The story at Tesla since 2012 has been that they are supply constrained, not demand constrained. I expect we'll find out that the storage project has been growing in tandem with the Model S and now the former is about to eclipse the latter in production needs.

At the same time SolarCity will announce Q4 GAAP profit with projected continuous profits going forward. This will drive up the value of both companies. SolarCity will acknowledge income from the solar storage pilot projects and savings from acquiring ZEP along with Paramount Solar's backlog of customers and existing customers.

SolarCity fronts the capital to purchase stationary storage packs from Tesla matching SolarCity's growth. TSLA and SCTY both jump more than 50% followed by additional stock offerings which will be used to cover the cost of the Gigga Factory.

This symbiotic relationship drives the cost of the packs down 10 years faster than just building cars would. ITC goes away right around the time Tesla would be pushing the Gen 3 through volume ramp."�

Feb 24, 2014

Cattledog I personally doubt this. I think we might get a hint in this conference much like we did for TSLA and then have a press conference specifically for the gigafactory later in the week. If it's as important as we all think, we don't want it to get mired in the details of an earnings call.�

Feb 24, 2014

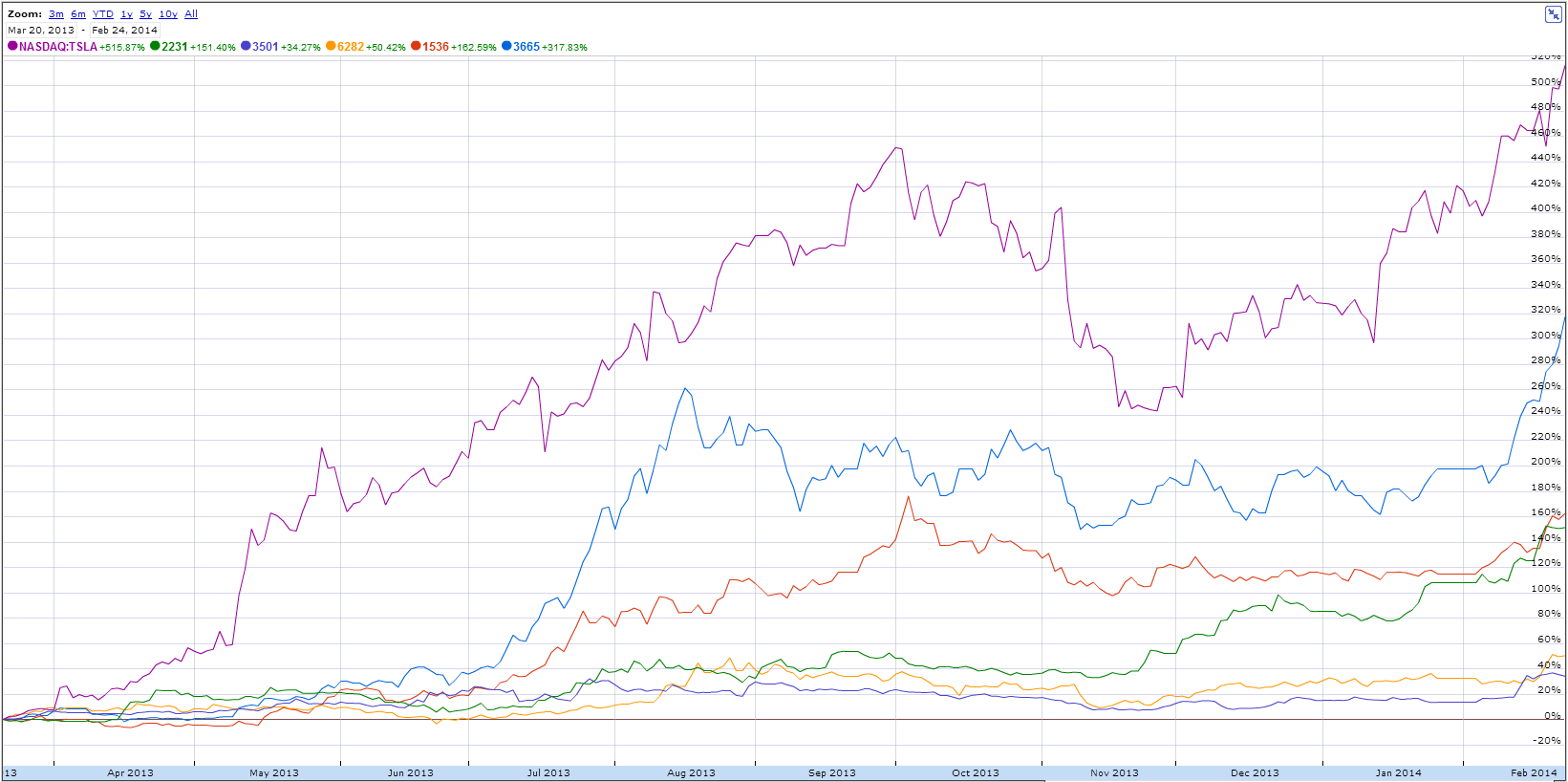

Causalien I choose to invest in the suppliers of TSLA critical components. Since I am now saturated with TSLA stocks in my allocation.

The most critical component are parts in the electrical motors. I remember seeing an article about it a long time ago and thought that Tesla has since brought that process in house. But it is not so.

Hoda 1536.tw supplies some critical parts of the electric motor. I believe this is one of those supply constrain part causing a limit.

I've also found 6282.tw and 3501.tw. They supply parts for the home charger and supercharger I believe.

There's also a company based in Cayman island. 3665.tw that makes car wireconnectors�

Feb 24, 2014

ItsNotAboutTheMoney Yes, I expect Tesla to line up a separate conference with all of their partners. It's would be big for everybody.�

Feb 24, 2014

772 Me too. I think Elon has said that the factory would get it's own call.

- - - Updated - - -

Another is 2231 (Cub Elecparts). Interesting that there are so many Taiwanese suppliers. How are you planning to play this? Since there are so many, I thought about the MSCI Taiwan index, but actually none of these suppliers are included in that index... are you just going to buy individual shares?

�

�

Feb 24, 2014

Causalien Yeah I went ahead and bought individual shares. The MSCI Taiwan index is way too diversified. With most of the weight in computer electronics. I think 10% of it is because of Asus or some big company that I forgot the name.�

Feb 24, 2014

bjwModelS Made an easy $750 today off of 15,000 shares of WLCDF. Thanks for the heads up �

�

Feb 25, 2014

Pastamosta Glad I could help! I hope it keeps feeding off this frenzy!�

Feb 25, 2014

keithz So when is this gigafactory announcement happening?�

Feb 25, 2014

ItsNotAboutTheMoney Supposedly this week. If the Nikkei's report is correct Panasonic's lining up its main suppliers to come in with it, so Tesla might be waiting for Panasonic's nod.�

Feb 25, 2014

tander CPUC Thought Leaders Series

Guess it will be then or before.�

Feb 26, 2014

Benz Thanks for mentioning this. There will be a live video webcast. We can all watch. I am already looking forward to it.�

Feb 26, 2014

Johan Panasonic stock up >5% today on the Nikkei, with it being an otherwise 0,5% down day on the index. Volume is almost double the normal.

Panasonic Corporation: TYO:6752 quotes & news - Google Finance�

Feb 26, 2014

Discoducky So Western Lithium is only currently building a demonstration plant in Germany to gather data on their low cost extraction for Lithium carbonate. I'm not sure that TM would bet on this paying out for the Gigafactory: http://finance.yahoo.com/news/western-lithium-initiates-planned-lithium-133000976.html

Seems like the plant that Canada Lithium built in Quebec is much more viable: http://www.canadalithium.com/s/QuebecLithium.asp�

Feb 26, 2014

Benz How likely is a delay of the Gigafactory announcement of this week (to next week for example)?�

Feb 26, 2014

FVO Besides WLC i buyed Rockwood months ago.

The Lithium has to come from somewhere...�

Feb 26, 2014

tander I'd say it's not very likely considering that Musk and Rive are speaking at the California Public Utilities forum tomorrow.�

Feb 26, 2014

Causalien By the way, Canadian Lithium is listed as TSE:RBI. I couldn't find it on the us exchange.

Anyone familiar with Lithium supply chains? I heard half of the world's LIthium is in Chile. Personally I think that it is because nobody bothered to explore for lithium in the rest of the world.

Also, are the price of importing Lithium from other continents going to be the same as locally extracted American LIthium?�

Feb 26, 2014

FVO That's not true. The largest deposits are there because of the Salar of Uyuni�

Feb 26, 2014

Benz Do you think/mean that Elon Musk will be talking about the details of the Gigafactory announcement at the California Public Utilities forum tomorrow?

Explain why you think that there will not be a delay.

Thanks�

Feb 26, 2014

Robert.Boston According to the U.S. Geologic Service, the world's lithium production and reserves looks like this:

The report also says about "World Resources":

Country 2012 Production Reserves U.S. (withheld) 38,000 Argentina 2,700 850,000 Australia 13,000 1,000,000 Brazil 490 46,000 Chile 13,000 7,500,000 China 6,000 3,500,000 Portugal 820 10,000 Zimbabwe 500 23,000 World total 37,000 (+ US) 13,000,000

Almost surely. Lithium is a commodity, which ensures a single price for the same grade of product. Transportation costs allows local producers to get a small premium.�

Feb 26, 2014

Causalien Numbers are conflicting.

Table says US reserves is 38 000 but the text says US has 5.5 million tons.�

Không có nhận xét nào:

Đăng nhận xét