May 8, 2015

Lessmog Sure. Are all of them competitive to batteries, leaving no room at all for little old us?

IMO, Tesla has hit on a spanking new line of industry here. Even a small portion of the electric energy market must be worth several fortunes.

Brilliant.�

May 8, 2015

eloder None of them are competitive, or else you'd see solar and wind hitting 100% new installations in many parts of this country and the world. Unsubsidized wind is much cheaper than coal right now, subsidized solar is cheaper than coal--simple economics would make these forms of generation #1 if a competitive solution existed now.

The commercial market is definitely not a concern. There's a rather large commercial market out there right now, using inferior solutions that already last (in best case scenarios 3-4 years at maximum with far fewer shallow cycles. Data centers, cell phone providers, and other critical service commercial businesses are already forced into buying an inferior solution now and this market alone could max out gigafactory production with ease.�

May 9, 2015

ZachShahan Utilities have various needs: peak shaving, frequency regulation, backup, and more. At a reportedly lower price for a quite proven and familiar technology, I think Tesla will find more business than it can serve for awhile, but I certainly think other storage companies with better features for some of utilities' needs will find plenty of business as well.

- - - Updated - - -

Yes, exactly. And I was thinking this before, but since it was emphasized by JB in the CC, I think it's a really important one: this is a familiar technology, whereas many competitors and startups with competing prices are bringing new technologies to these utilities. Utilities are quite conservative.

Also, partnerships are key, and Tesla has built some strong partnerships over the past several years.

- - - Updated - - -

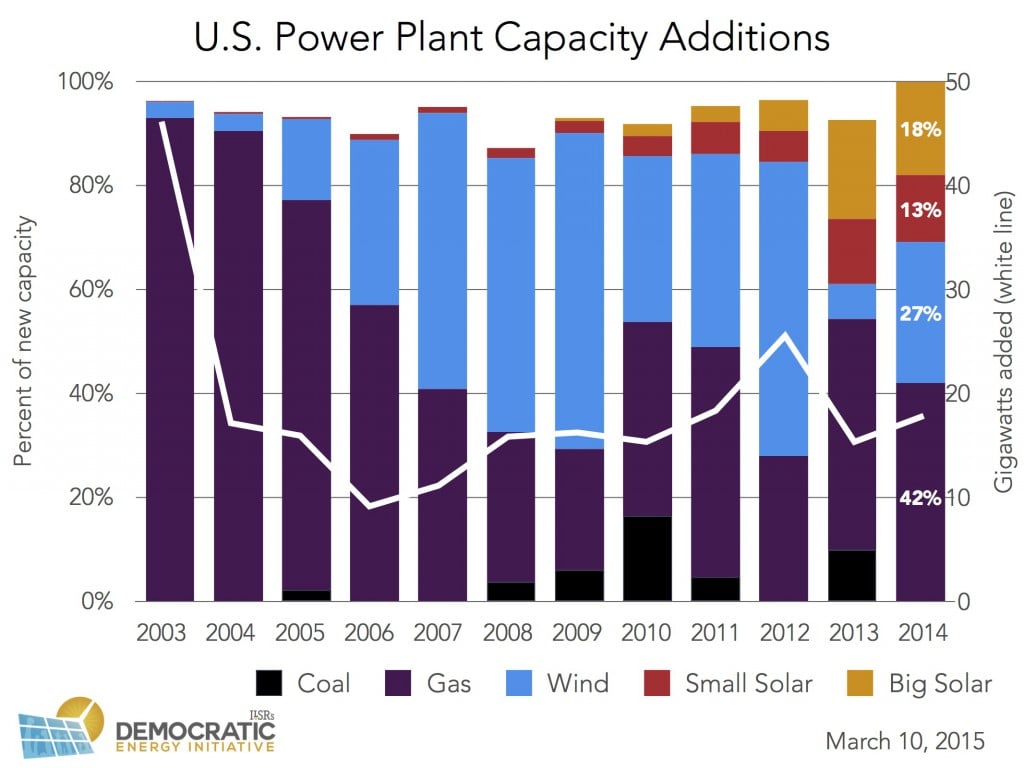

Well, over 50% of new generation capacity the US installed in 2014 came from wind and solar, and it's even a much higher % so far this year (and yeah, coal can't compete, but natural gas has been the #1 single source of new capacity for a couple of years). But yeah, it's not until you get to ~20-30% market penetration of renewables before storage really needs to complement it. In places like Germany and Australia, storage is becoming very important since they are hitting %s like these, so it's no surprise Tesla is first targeting those markets and Hawaii. And there's plenty of $ to be made in those early markets.�

May 9, 2015

ZachShahan I think Tesla's direct words are worth including here to clear up some confusion:

Tesla Energy for Utilities

For utility scale systems, 100kWh battery blocks are grouped to scale from 500kWh to 10MWh+. These systems are capable of 2hr or 4hr continuous net discharge power using grid tied bi-directional inverters.

Systems support applications including peak shaving, load shifting and demand response for commercial customers while offering, renewable firming and a variety of grid services at utility scales.

Tesla Energy for Utilities is designed to:

- Firm up renewable generation by reconciling the intermittency of power from these sources and storing excess capacity to dispatch when it�s needed.

- Increase resource capacity. Tesla Energy for Utilities acts as on-demand distributed power generation, contributing to the overall generating capacity while adding resiliency to the grid.

- Ramp Control. Tesla Energy for Utilities can act as a buffer while the power output from a large generation source is ramping up or down, delivering power instantly to smoothly transition output to the required level.

- Improve power quality by preventing fluctuations from propagating to downstream loads.

- Defer costly and time-consuming infrastructure upgrades.

- Manage peak demand by deploying power within seconds or milliseconds.

- - - Updated - - -

At 2 MWh of capacity, 5000 cycles, and $250/kWh, that's $0.05/kWh, which is very competitive. Even at 3000 cycles, that's $0.08/kWh.

(Of course, the total capacity doesn't really matter for this equation, just the $/kWh. Could be 10 MWh or 500 kWh and the result is the same.)�

May 9, 2015

ZachShahan Am taking a closer look at $/kWh generated (not capacity) using various assumptions gathered from Tesla, and the same for some top competitors. You can view & comment on the sheet here, but the results I've gotten so far on the utility-scale side of things are $0.05/kWh for Tesla, $0.05/kWh for Imergy now (with an assumed 30-year lifetime even though cycle life is reportedly unlimited), $0.03 for Imergy based on a projected capacity cost of $300/kWh (down from $500/kWh), and $0.02 for Eos Energy (which has won and implemented some pilot contracts, and is supposed to have a commercially available product in 2016).�

May 9, 2015

SebastianR Interesting. I'm not sure the comparison holds perfectly well - for instance Imergy gives only 5 years of warranty (10 years extended warranty) so I'm not sure if unlimited cycles is really 30 years of lifetime. At face value, the Imergy solution is twice as expensive in terms of $/kWh storage so the business case really depends on the cycling profile.

A lot of stuff that happens at grid / utility level is also "just in case" - so at least for that portion, Tesla should be dramatically cheaper.�

May 9, 2015

jhm Well, if the warranty is good for 10 years, at 3 cycles per day, that's 11k cycles. It seems like that should work fine for the utilities. By the time they need to replace the batteries, the price will be half what it is today. The acual facilities set up for batteries may last for many decades, and those facilities may be half the cost of the original installation. Utilities buy lots of fuel that only last for 1 cycle, so I'm not sure why a Powerpack that yields 5000 cycles would be a problem. It's important that the packs are designed so they are easy to install, maintain, and replace.�

May 9, 2015

Lessmog Sensible to focus on first principles, here too!�

May 9, 2015

surfside solar and wind have been over 50% of new power generation for the past 5+ years:

surfside�

May 9, 2015

jhm Global Electricity Market

On April 30, Musk claimed that 900M Powerpacks, 90 TWh of storage, would suffice to enable 100% penetration of renewable power generation. To put this into perspective, in 2012 global power capacity was at 5.55 TW. Given the rate of growth in recent years, I suspect the current capacity is about 6 TW. Thus, 15 TWh of storage represents about 15 hours of storage at peak output.

I am trying to understand what this path to 15 hours of storage may look like. Clearly it is going to take many year just to produce these batteries. Even at some future steady state, a 10 year life cycle on batteris would imply a need of about 9000 GWh per year just to replace old batteries. Suppose that Tesla and other stationary batter makers reached 50 GWh annual capacity in 2019. The industry would need to grow 50% annually for 13 years to reach this 9 TWh capacity milestone by 2032. This can of course happen if the economics are favorable. Also note that the rate of growth should not continue much beyond this milestone or else the industry as a whole risks over shooting long-term demand. Realistically, I think this give Tesla another 7 to 10 years to keep growing at close to 50% a year past 2025, Musk's $700B market cap target year. Good news for anyone worried Tesla may have to slow it's growth after 2025.

So quantitively we see that it will take about 2 decades to get enough storage online to wean the world off of fossil fuels for power. But qualitatively how will the grid change. Consider that in 2012, there was 5.55 TW of capacity which generated 21,532 TWh of energy of which 19,710 TWh was consumed. This works out to an average daily utilization of 10.6 hours of generation for 9.7 hours of consumption. Apparently, most generation capacity is not being utilized anywhere close to 24 hour per day. Naturally solar has a utilization of about 5 hours per day owning to the rotation of the earth, and wind is intermittent too. But wind and solar capacity in 2012 was still a tiny portion of total capacity. So a mere 10 hours of utilization reflects more on the traditional fleet than new renewables. Alot of this lightly utilized capacity is just there for peak power needs. As the first "hour" of battery storage is deployed, about 6 TWh, I suspect that fossil peakers will be the first capacity displaced. Consider that 6 TWh should provide +/- 2 GW of power/load, respectively. This could potentially retire 2 GW of fossil peak capacity. The remaining 4 GW of (mostly fossil) generation capacity will have 50% better utilization, about 15 hours per day. I figure that, given growth trajectory above, this first hour should be installed by about 2028. I would also point out that the +2 GW of battery discharge is mostly what put 2 GW of peak plants out of business. The -2 GW of battery charge is load to absorb a surplus of upto 2 GW of solar during sunlight and base load at night. So while grids without batteries can handle upto 1/3 renewables (about 2 GW ), with thus first hour of batteries another 1/3 can be integrated. Thus, renewables can provide maybe 4 GW of power by 2028. While this may be true from just an excess power point of view, it probably does not work from an energy point of view. Hypothetically if you had 4 TW of solar, you'd get around 20 TWh on an average day. You would need to store about half of that, so now we are looking at needing around 12 GWh of storage. That's the second hour of storage, and it arives in about 2030. So the milestone here is about that about 2/3 of power generation is renewable. There is a qualitative difference between the first hour and second hour. The first hour need heaving cycling batteries, say 2.5 cycles per day to put fossil peak power generators out of work, while the second hour is more focused on daily cycling to capture the daily supply solar energy. We can envision this theme continuing where incremental renewable capacity is the driver of incremental battery installation. Eventually you get to a place where back up power to cope with weather and seasonal supply are the drivers of incremental energy storage.

I hope this stimulates some thoughts. I'd like to hear more ideas about how energy storage needs may evolve over time.�

May 10, 2015

vgrinshpun I'l try to do some convincing :smile:

First, I do not believe that above calculation of the longevity of Tesla batteries is correct. The basic assumption that the morning and afternoon peaks will require 2.5 cycles per day is not accurate, because the full cycle of the battery is a charge from 0% state of charge (SOC) to 100% SOC and then discharge 100% to 0% of SOC. The utility grade batteries will not be seeing such duty cycling on a daily basis. The thing that is missing is that batteries need to be sized to take largest historical peak, plus margin, plus allowance for future increase in peak capacity. The average peak over a period, say one year, will be fraction of the largest peak of the year, so average cycling of the battery will be a fraction of the total battery capacity, i.e much less than 2.5 cycles per day.

During the ER Elon mentioned that Power Packs have design life of about 15 years (warranty is less at 10 years). At 3,000 to 5,000 cycles life expectancy the battery will last 15 years if daily cycles will be limited to about 0.55 to 0.91 cycles. (3,000/15/365=0.55 5,000/15/365=.92). So in order to last about 15 years above daily discharge cycles will need to be 0.55/2.5=22% to 0.91/2.5=37% of your assumed 2.5 cycles per day.

In another words, if one assumes that average daily peak is about 22 to 37% of the maximum peak that the battery is sized for - a very reasonable expectation - the Tesla Power Packs will easily last 15 years.

Regarding the expectation of utilities, while the power plants overall life expectancy is indeed 30-40 years, a lot of components would need to be replaced during this life span. The closest example are lead acid batteries used in DC systems and UPS of all large power plants. Their typical life expectancy is 15-20 years.

Also, Tesla actually mention the control of the batteries for various tasks, including peak shaving multiple times. During one of the presentations by JB, there was couple of presentation slides discussing use of Tesla batteries at the Fremont factory, complete with the power profiles of the factory before and after, showing how software controlled batteries allowed to shave peaks. Elon discussed this at one of the ER CC (I believe Q4 2014). Finally, JB indicated that power packs will have a master computer per several power packs, in addition to the BMS contained in every one:

�

May 10, 2015

vgrinshpun It seems that Tesla's revelation that they basically have 3GWh (about 1.5GW for a two hour discharge power rated battery) and $800M worth of orders in just one week after the "Missing Piece" presentation need to be put in further context so we can grasp the epic significance of this. So I thought that some stats on last year's energy market are in order here:

- Total US deployment of Li-Ion batteries for energy storage in 2014 was 43.3MW. Tesla one week orders eclipsed last year US deployment more than **34** times.

- According to US US Energy Storage Monitor report from GTM Research and Energy Storage Association (ESA) US Energy storage market was to grow 250%. Tesla one week battery orders, even assuming that some of these orders might have been overseas completely blows this projection out of the water.

- The same report estimated 5 year growth (in 2019) produce market sized at 0.861GW. Tesla one week orders blew this number out of the water as well.

- The installed weighted average cost of the Li-Ion battery based storage in 2014 was $2,064/kW. Tesla Power Pack cost is $500/kW ($250/kWh). **Conservatively** assuming that installation could double this cost means that total estimated cost of the installed Power Pack is about two times less that average installed price last year.

I truly believe that we've witnessed a birth of new enormously more valuable company during the "Missing Piece" presentation.�

May 11, 2015

32no What do you guys think of this? Apparently Tesla batteries will be sold under the name Panasonic abroad.

Also, where is that announcement from Enel Green Power?�

May 11, 2015

MikeC It looks to me like they are confusing Panasonic's energy storage pack with Tesla's Powerwall that happens to use Panasonic's cells. The picture is clearly not a Powerwall. That would be like saying that Mercedes is selling the Model S under Tesla's name because Tesla supplies the batteries for the B-class.�

May 11, 2015

Bgarret Excellent article on Tesla/Kendall-Jackson partnership. If they have 21 Powerpacks at $25,000 each, or $525k cost plus installation...and they look to save $200k/yr (don't know if that is just their share?), then their ROI crossover on the batteries alone is about 2.5 years. Not sure about other costs, but even at 50% of PowerPack costs would lead to an ROI of 4 years. Not bad.

Tesla batteries pair well with wine-making - MarketWatch�

May 11, 2015

trils0n Interesting that Tesla paid for the Kendall-Jackson installation. 200k seems to be their split of the savings. I wonder if splitting the savings is going to be one of Tesla's method of installation/financing, kinda like Solar City, or if it was just for the pilot project.�

May 11, 2015

JRP3 I can see the FUD spin now: "Telsa has to give away batteries!!!111"�

May 11, 2015

Bgarret So cynical....and after only 7,777 posts. �

�

May 12, 2015

theschnell I would just like to make note that grid power is not currently being supplied to my house by the utility. It's been off for about 10 minutes. It would be really nice to have a power wall right now...

Ok, power back on, but it was really weird having the power out, not knowing why it was out, nor how long it would remain off. While I was overall pretty chill about it, it is weird and if it had interrupted my day I would have been really frustrated. I think the hardest part is having no idea when it will come back.�

May 12, 2015

Bgarret You know you are the belle of the ball when other companies mention you in their earnings report "optimistic" that Tesla will work with us....

"Hi, Elon....call me! It's Manz. Let's have coffee sometime :love:."

Manz 'Optimistic' It Will Take Part in Tesla Energy-Storage Push - Bloomberg Business�

May 12, 2015

atang To me, this is great! The start of the avalanche!!!!! Thanks for posting. :smile:�

May 12, 2015

jhm I've had another thought about the notion that utilities have a preference for making investments with a 30 to 40 year time horizon. It seems that would make sense if the utilities could count on a stable regulatory environment and stable technology over 40 years. But batteries throw such stability into serious question. We simply do not know how power generation and distribution will evolve as a result of low cost batteries. We don't even know who will own these batteries or what they will be used for.

Consider this all EV scenario. Suppose that over the next 30 years all motor vehicles will be battery electric vehicles. Consider that prior to the EV, a typical US household uses about 30 kWh, but when this typically family has 1 or 2 EVs, they need an additional 10 to 30 kWh per day for charging. So now typical consumption is say 50 kWh per day and this family has about 100 kWh of storage in their cars. Suppose through a combination of renewable energy generation, there is generally sufficient power for home and business use at the time of use and there is enough surplus energy produced to charge up all the EVs every day. In such a scenario is sufficient numbers of homes and businesses can be induced to charge at times when surplus power is available, then this solves the problem of matching variable power generation to variable demand. What is shocking about this scenario is that neither stand by power nor stationary energy storage are needed to any great degree. The 100 kWh of EV storage per family is pretty much sufficient storage for the whole system, and 20 kWh of load can be shifted anytime around the clock.

What this scenario illustrates is that stationary storage, like peak power plants, may simply be a transient need to facilitate match power generation with power consumption. So if I am a utility and am trying to decide what sort of peak power plant to build for the next 40 years, I may be erroneously assuming that any sort of peak power plant will be needed over the next 40 years. What happens if the combination of aggregated EV charging and aggregated distributed battery storage makes obsolete the economics of any sort of peak power plant in 10 to 20 years? This potential for obsolescence is a serious risk if my financing is based on a 30 to 40 year time horizon. I think this argues in favor of a battery peak power plant where the batteries will have a useful life of 10 to 15 year and where I can scale up or down the number of battery packs as needed. Packs such as Powerpacks can be redeployed or upgraded as needed. This sort of plant gives the utility lots of flexibility. For example, let's say that a few years into operation this battery peak plant, the price for stand by power plummets and it is discovered that placing Powerpacks on commercial sites has much better economics. Then the plant operator can can sell Powerpacks with poor marginal return in the peak plant to businesses that need them at commercial sites. So it is easy to scale back and redeploy without having to take huge asset write down losses. I am not aware that any fossil fuel plant can give utilities this kind of flexibility. It seems to me that if any utility wants survive the coming disruption, they seriously need to scrap the idea of a 30 year plan. They need to be nimble and focus on assets that give them flexibility. Fortunately, batteries and microgrid technologies give them this kind of flexibility. So utilities should build things like battery peak power plants, not because it will pay off in 30 years, but because it can be totally reconfigured in 5 years.�

May 13, 2015

Robertj NZ Power Utility considers push using Tesla battery into Australia

Vector says Tesla storage a game-changer, mulls push into Australia : Renew Economy�

May 13, 2015

ggies07 Interesting idea....I like it.�

May 13, 2015

jhm At the Powerwall unveiling, Musk explained that 90 TWh of batteries would be needed to eliminate fossil fuels from the world's power supply and 200 TWh to remove fossil fuels from both transportation and electrical power markets. This suggests that long term transportation batteries may remain a larger market than stationary, 110 TWh to 90 TWh. But the situation becomes a little more complex when you consider that the mobile batteries must at a minimum connect to the grid to recharge. If the charging of mobile batteries can be coordinated, it can provide huge stabilization to power grids around the world. Consider 2 billion vehicles with an average of 60 kWh each that need about 10 kWh of charge each day. So that is 120 TWh of mobile batteries with 20 TWh of daily charge load. For the most part it does not make sense to charge mobile batteries from stationary batteries. This may be needed exceptionally for high speed charging or emergencies, but not for the bulk of daily charging. It is simply not efficient. What makes most sense is to cultivate charging infrastructures that make the most of surplus renewable power as it is being produced. Absorbing surplus power in real time provides most of the benefits of stationary storage. So perhaps the combination of 120 TWh of mobile storage with aggregated charging could reduce the need for stationary from around 90 TWh to 60 TWh or less.

I suspect this was the line of thinking that lead Tesla to assume that only 30% of the GF capacity may be needed for stationary. This ratio may prove to hold up well in the long run, while in the short run the stationary market may grow more quickly. The batteries simply need to go where they can deliver the highest return on investment first. This will do two things: it will expand battery production rapidly, and it change the way power is generated and distributed. As the price of batteries comes down an increasingly wider market will open up. It's perfectly fine if right now the economics of the Powerwall does not work out. There are many other places that will get much more value out of a Powerwall unit, and they should get those units first. Moreover, in the long run, it will make sense to have 60 kWh EV in every garage, and if regulatory hang ups do not impede, this 60 kWh mobile battery may well contribute more to reducing the cost of grid power than a Powerwall unit anyway. So I am not at all disparaging stationary storage. I am simply trying to understand the value how EV serve a dual purpose of providing transportation and grid stabilization. So we need to press for regulatory reform that properly values distributed batteries because the batteries in EVs actually will contribute much of this value.�

May 13, 2015

kenliles good thoughts jhm... Consider though that energy is transitioning to a technology over that time frame (away from current production, distribution, loading etc.)- In the 30-40 year time frame, Half or more of that 10kWh per day for auto will be transformed locally by the car itself- (PV will be imbedded in the car surface paint and stored in Super Capacitors while the car sits in the sun all day). We need to throw out all conventional energy thinking from the current model- Production largely disappears, Distribution largely disappears, Transmission largely disappears, Utilities largely disappear. The markets we were once accustomed to will become moot- energy of each device (including home) will be largely imbedded in the device itself, including it's cost- hence (nearly)free - Energy consumption is going to be a non-issue; Excess Energy sink will become the most important piece of the equation... imho�

May 13, 2015

32no

Tesla PowerWall app leaked

Sourcd: Tesla Eye Candy, Exhibition 1 | Aftermarket Accessories for Tesla Model S�

May 13, 2015

Robertj Vector NZ Power Utility head "biggest changes are likely to occur at utility scale

Most energy markets suffer what is know as the �twin peaks�, the morning and afternoon energy demands that push usage to its highest levels.

They used to be separated by a plateau of day-time usage, but that has now been eroded by solar energy to the point it now looks more like a duck, and wholesale prices � which once peaked during the day � are now going into negative territoty.

That has changed the economics, the dynamics and the culture of the energy industry, and McKenzie says that will be accelerated by the introduction of cost competitive storage.

�Everything has been built to cater for those twin peaks,� McKenzie told RenewEconomy in an interview late last week.

�The last baston of the energy sector was never being able to store at scale. Being able to access that will make a hell of an impression. It will smooth those peaks �. and take those peaks out of the system. That will bring down the overall cost of generation.�

McKenzie says the biggest changes are likely to happen at utility scale, but residential storage will also have a place for customers who want to manage their costs, and to control their loads and demand.

From renewenergy australia article�

May 13, 2015

jhm Yep, an awful lot can change over the next 30 to 40 years. I think what you are suggesting is a scenario where power is highly localized. I certainly see a lot of potential in that direction. So just as I questioned whether there would be much of a need for peak power plants, we might likewise question there will be much of a need for long distance power transmission. Batteries provide an essential hub for a microgrid, while transmission lines connecting a microgrid to other grids are completely optional. An intelligent micro grid battery integrates whatever mix of energy assets may be available to the microgrid. But the transmission line is just one potential asset. If the transmission line can deliver cheap power or critical back up power, then it may be worth the cost. Clearly there are presently populations that are under served by grid. The economics of transmission just do not work in these areas. And this is where microgrids can leapfrog the grids in the same way that cell phones have leapfrogged landline telephones. Clearly there has always been a market for phones in these areas, but the transmission costs of landlines was out of scale with the demand. But cell phones did not require so much capital outlay to serve remote or impoverished communities. So I am very optimistic about microgrids creating much more favorable economics at small scale. I think that intelligent batteries will enhance the economics and performane of microgrid. While the battery in a vehicle might not be ideal for serving as an energy hub, it will be advantageous for the microgrid to integrate these assets when available. Mobile batteries can even serve as means to transport energy and to provide back up power. So definitely mobile and stationary storage can coexist in a mutually beneficial way. It's not clear if long distance transmission lines can continue to create enough value to pay for their upkeep.�

May 13, 2015

Lessmog That would make Tesla REALLY disruptive. Also create new chokepoints -- although more distributed, if that makes any sense.�

May 14, 2015

jhm What new chokepoints do you envision at this point?

I think Hawaii is an import state to watch. There are no transmission lines connecting the islands. So each island is a small grid. So if the introduction of solar and batteries can lead to a lower cost of electricity, then it will vindicate the move toward smaller grids. So I am eager to see this unfold.�

May 14, 2015

theschnell Power off at my house again...�

May 14, 2015

Lessmog I was thinking that as long distance power lines get increasingly neglected, they will tend to go out of order more and more, here and there. Cf railroads - a lethal accident in PA only the other day, and we have had more than one serious incidents in Sweden over the past year or so that kept trains off-line for days or weeks, due to neglected upkeep of infrastructure because "someone else" should have paid for it and every entity was more busy raking in money.�

May 14, 2015

jhm Got it. Yeah, if transmission lines become unreliable through neglect, then they will cease to be a good back up resource. So all they will be good for is really cheap power when available. It seems this would lead to a death spiral. Makes me wonder what value could be recovered by taking down lines and recycling the metals. Copper investors might be concerned.

I might add that as transmission lines fall into disrepair, remote power generators will have stranded assets, literally. Such operators may need to pick up the cost of delivering their product to market. I believe it is a free market falacy to think that ratepayers are the ones who are under obligation to pay for underutilized infrastructure. Rather, if you produce a good, it is your responsibility to get it to market. The buyer is free to buy locally or to pay prices high enough to cover the cost of transmission.

Remember that transmission is currently about 31% of the powerbill. Microgrids, therefore, have the potential to cut power bills by 31% by simply disintermediating remote power generators. So it is incumbent on these operators to produce power so cheap that it can be grossed up by 31% and still compete with local, distributed power. That is a tall order considering that the cost of solar keeps coming down every year. On the SolarCity thread we had this debate about utility solar having an installed cost of like $1.90/Wp, while SolarCity's total cost is about $2.84/Wp or installation only (excluding SG&A) is $2.09/Wp. The argument was that utility solar would win the day because it is so much cheaper than rooftop. But gross up remote solar by 31% for transmission and 11% for distribution, and we're taling about $3.28/Wp for utility solar. So I think the transmission model is already in serious trouble. What's left is some sort of moral argument that owners rooftop solar and other distributed energy resources have an obligation to pay for transmission infrastructure of which they make little use now and less in the future. But leaving aside moral arguments intended to protect the interests of incumbent power producers, the economic model is broken.�

May 14, 2015

Lessmog jhm, we seem to be on the same page.

Used to be, in Grampa's time, that government ran all (well, almost all) railroad from sleepers to conductors. "Statens J�rnv�gar, SJ".

Then it was split up so a division of govmt got responsibility for rails, signals, etc (Banverket), while a number of operators got to run traffic where they put in the lowest bid, for a limited time, with leased rolling stock. Since other needs were more pressing, Banverket had insufficient funding from govmt budget to actually keep the lines reliably open, especially when winter turned out to bring snow and ice blocking switches, or summer heat made sun curves and power lines sagged and started brush fires. And of course, the temporary operators saw no pressing need to maintain the hired trains, so wheels tended to be not quite round and beat up the rails for all.

Even as some lines were being built out, thieves stole tons of copper so neither power nor signals were reliable and no trains could run; the investment was useless.

So, the great populace decided it was too much trouble to chance a train and took a bus or went by car or flew instead. Which increased the financial pressure on operators to only bid on the most lucrative connections between the biggest cities (and also complicated buying tickets from multiple vendors with byzantine pricing).

In short, the Tragedy of the Commons.

And I am not a Socialist! Actually, the former Chairman of SJ, Ulf Adelsohn who used to be the leader of the Conservative party, resigned over this fiasco -- he saw it coming.

Back on topic: Stationary Power Storage, Solar and other local renewable distributed generation and power management have a very bright future, in my view. And Tesla is at least one lap ahead.�

May 14, 2015

LargeHamCollider +1

char char�

May 14, 2015

jhm Sounds like a real mess. Government contracting is ripe for abuse all over the place. The City of Atlanta thought they could get rid of there water works group and replace it with a contractor. This seemed to save the city money until water mains started bursting all over the place for lack of proper maintenance. It's hard for contractors to have a sense of ownership for long-term problem. So they make money in the short term by allowing long-term decay in infrastructure. So ultimately the government holds the bag on long-term neglect.

I do think the issues with localization of power has a different dynamic, however. It is motivated by individuals and business finding more economical ways to source power. In the case of Atlanta's water fiasco, there was not alternative. The whole city still depends on the same pipes for water. But if transmission lines fall into disrepair because they get little use owing to better alternatives, then such decay is economically beneficial and governments need not feel obligated to prop it up. Of course, utilities will expect governments to bail them out when their assets prove worthless, but it does not truly serve to common good to do so. There is another sort of trajedy of the commons, where everyone is expected to pay for something that no one really needs. I am really not a conservative politically, but it seems that if there is a way for people to save money on energy by sourcing local resources and minimizing transmission and distribution costs, then how is it in the common good to prop up an infrastructure that wastes money and energy and largely pollutes the environment? I really do believe the common good will be better served with microgrids and local renewable energy.

As for trains, I think they have a tremendous future. Well maintained they are the most efficient way to ship goods over land. So this is infrastructure that is largely worth maintaining and using well.�

May 14, 2015

blakegallagher While this might have been the case in the Atlanta water fiasco this is not the case with all contractors. There are a lot of dishonest or untrained contractors but if you ask around you can find some really honest ones too !

As a contractor that one rubbed me a littleCheers

�

May 14, 2015

Lessmog To me the problem seems to be with incompetent buyers, who don't know how to specify what is important, besides price. So we get what we paid for, not what we need, from the lowest bidder.

This has bitten me too, as the second lowest bidder :-/

But we are creeping off topic, sorry about that.�

May 15, 2015

jhm Sorry, did not mean to slight all contractors. It's just a risk that some contractors cut corners, and it's a risk that some politicians cut bad deals and fail to monitor results.

- - - Updated - - -

http://www.greentechmedia.com/articles/read/battery-storage-pays-back-in-less-than-five-years-sc-finds

Not sure if this was posted already, but it looks promissing.

Does anyone know how many kW the 100 kWh Powerpack can deliver? The article mentions a 1 MW system for $1 million. I'm not sure if that would be 20 or 40 Powerpacks. 40 would cost $1 million, but leave no allowance of other costs of installation.�

May 15, 2015

Ampster ....and contracts are written without any reference or oversight about maintenance. So it is not always the fault of contractors.�

May 15, 2015

Johan Jhm, I think a 100kWh PowerPack was said to be rated at maximum output at 200kW (corresponding to a 2C discharge rate).

I think some calculations we're made about some projects being announced at "3MW" and it was concluded that would need 1,5MWhs of PowerPacks.�

May 15, 2015

30seconds anyone calculate how a powerpack installation would stack up against a Bloombox?�

May 15, 2015

Johan The Bloom has nowhere near the versatility of a battery: can't go from charge to discharge in the blink of an eye.

Actually it's not primarily a storage device but rather a (clever) pass-through technology that will for example turn Nat. Gas into electricity with a higher efficiency than a regular NG turbine power plant.

Boombox talks about their installations in the form of power processing capacity (kW or MW as with Yahoo's facility) not power storage capacity (kWh/MWh).

So not really comparable or rather not really competing for the same market.

You could put a Bloombox in front of your battery pack, if you have some inputs like Nat. Gas, liquid bio diesel, liquified coal (remember Audi's "new" invention?). But if you have solar, hydro, wind, nuclear, fusion or some such input the Bloombox is pointless.�

May 15, 2015

30seconds Thanks - I was just trying to figure out how the Powerpack would integrate into one of Apple's large server farms which have Solar and Bloom installations�

May 15, 2015

austinEV It is fun to think about if batteries got say 2x or 3x more power density. At some point it would be viable to simply SHIP or TRUCK power around. Tanker ships and tanker cars for electricity. It would be an enormous boon to be able to ship say cheap, renewable geothermal from iceland and "unload" in England or Canada. Then really remote projects would be viable like tidal projects or remote wind/solar.

And obviously, the ships, trucks and trains could also run on their cargo.�

May 15, 2015

jhm Wow, that is a lot of power for the money then, $125/kW. That is excellent for high frequency applications. I hope we can get confirmation. I was thinking 25 kW to 50 kW.�

May 15, 2015

Ampster I think that is short term peak power. The Powerpack still contains only 100kWh of energy. $250/kWh.�

May 15, 2015

bonaire No, it is half the power of capacity. 100kWh would be 50KW of constant power, or less. This fits the need of the Sgip program in california which requires two hours of outputting at stated power rate. Come to think of it, some larger homes in the US would be better off with a 100kWh power pack over multiple powerwalls. Frequency response systems would be better off with specialized equipment offering 1C or higher micro output/charge cycles. Meaning charge a minute, discharge a minute, like that. Like driving in city traffic. But peak load shaving is sustained and either 1/2C or 1/4C.�

May 15, 2015

austinEV I had totally thought about that. $25k isn't outrageous for a fair number of people. With that you really could run your luxurious home (with 40kW solar) offgrid.�

May 15, 2015

jhm Yeah, this is more like what I was thinking. So at 50 kW, we get a price of power at $500/kW.

So the 1 MW battery in the article below could run $500k for the battery and $500k for the other installation costs, for a combined cost of $1M. This frequency regulation application could pay for itself in 2 to 5 years, which suggests a 100% ROI in 10 years or less. So with that sort of return, the big risk is that the frequency market gets saturated too quickly with batteries and drive down the market price for this grid service. It that happens, it's nice to know you could potentially redeploy your Powerpacks to better markets if saturation kills return. Although if competitors deploy packs incrementally until the return is less attractive than other opportunities, then the market can saturate without without over supply.

Battery Storage Payback Takes Only a Few Years in PJM, SC Finds : Greentech Media�

May 15, 2015

Ampster This market has many more dimensions than I realized. I am load shaving for hours at 1kW and there are utility level grid application that are dealing in hundreds of megaWatts for only a few minutes.�

May 15, 2015

blakegallagher .

I really don't think saturation would be a factor in any market for awhile. There is so much demand they are only responding to people who also want to be dealers for the batteries (I have not heard any analyst discuss this upcoming Tesla Dealer Network) It seems very unlikely that any market would give enough power packs to completely shift the cost curve. Although I concede that over a 10 year stretch that might not be the case. Hopefully by then they can actually meet battery demand so maybe you would have massive changes in TOU charges or demand charges. In the mean time Tesla would have to sell A LOT of batteries for that to happen. If they avoid shipping a huge percentage of orders to any one area it should avoid this happening for a long time. After the Oncor report in Texas the amount of batteries that Utilities across the Nation will want to order will be staggering.

I bet that as soon as they get the Gigafactory operating enough to believe they can hit the mark they are planning for they will announce at least one more Gigafactory. Exciting times!�

May 15, 2015

Johan Thanks for correcting me. So it's not 2C but 2^-1 C (1/2 C) for sustained discharge. I had it twisted in my first post. It could still be that the packs could give higher peak power but not for sustained periods of time. If we can get firm confirmation on these specifications it will be important, since in the news some projects will be specified in power output (kW) while others will be specified in storage capacity (kWh).�

May 15, 2015

Johann Koeber I was thinking about just that.

No luxurious home, but 30 kW solar. Add the powerpack and we might get through 300 days per year. Some winter months we might need the grid. But our draw from the grid will be minimal and more than offset by delivery to the grid in summer.

Offgrid doesn't seem possible for us without another form of generation.�

May 16, 2015

Johan If you could manage 75% of the year on solar alone and then in the remaining winter months solar would contribute but not be enough then having a (bio)diesel or nat. gas generator for the remainder might be acceptable. It would result in a total off grid solution.�

May 16, 2015

Matias When Model S 85 kWh pack can deliver 400 kW for short time, I guess 100 kWh Power pack should be able to deliver 200 kW for short time. Why not?�

May 16, 2015

Johan Yeah that was my thinking but they may have designed both the in/out wiring (it's probably the same wiring) and cooling to cap discharge rate at about max charge rate. And we know that max charge is always quite a bit lower than max discharge rate likely also has to do with life of the batteries, warranty, cycling capacity and so forth.�

May 16, 2015

bonaire Have you seen the web site for the california SgIP program? Self-Generation Incentive Program

The spreadsheet there, for weekly projects,lists out AES projects. For most 1MW projects, the eligible costs are well above $1000/W. And the incentives are enormous. $1.75/W of power for current projects and it was more in the past. A 100KW project gets $60,000 in incentive money in recent line items and that is low compared to prior projects. This is why the 100kWh-50KW price at $25K is shocking. It becomes free in CA for the battery components of the system. Unless the new Powerpack dwarfs the savings of the prior systems designs, the balance of the system costs for a site are well above equal to the price of batteries. Maybe the power pack is just that, batteries and BMS. Then you add more to it like good charge inverters and output DC to AC inverters and other work. Labor and government filings and all that raise prices too.

anyone think that the $25K price of the power pack is "after incentives"? I think it is the cost to the installer company, not the end user. Just as powerwall cost to installer is 3000-3500. It just seems extremely good, almost selling the batteries at cost plus the price of the cabinet. Selling something at cost into a highly incentivized market seems a little out of place in today's capitalistic world. Has there been any talk of margins on the powerpack? One interesting part of this new business is nobody has seen the details of a real project cost breakdown and profit components going to the installer and the vendors involved. The danger here is that we are looking at only one component of a larger deployment. The price of batteries has been one thing holding utilities back from doing more Li-Ion demand response systems and now the fit does seem to be better as peak load shaving devices for hot states like CA and AZ. The primary problem there is air conditioner load ramp up across the region when it gets hot.

$25k wouldn't get a home setup for batteries. Full system would be more costly, but not much more - maybe $35k. You need something like the Schneider XW or XW+ inverter, some sort of charge controller for the grid signal to let the solar actually work off grid, and if some loads are big, like air conditioning, possibly another second schneider to handle that. They are about $3k each. So, to take a suburban home completely off grid, it is something on the order of $50-55k with all the solar included. Anyone ever do a system before and know the details? One member here from PA was posting saying he had clients waiting on powerwall to take themselves off the grid. Is that still happening given the specs on the powerwall? Or would you use a powerpack?

larger suburban homes use about 1500-2000 kWh a month if they have electric hot water and kids who like to take long showers, who use washers and driers and cook a few times per week and use comfortable AC in the summer. That sounds like a job for the powerpack. One concern I have is battery longevity over 10 years and a larger battery makes more sense to cycle 30% daily and not 80%. I would much rather have a Model S 85kWh battery installed under a sub floor or crawl space than four or five power walls mounted for display. A single MS battery would be fine for a home off grid solution. And I think some guys have bought salvage crashed MS to do just that. I also think that V2H (Vehicle to Home) also known as V2G should be a solution Tesla provides leadership on in the near term. People really do not need elaborate new battery storage systems if they already have a giant 85kWh battery, or two, in the garage. The inverse of HPWC is needed. Something to step down the HV battery to 48V for use by home AC inverters such as the schneider I mentioned. A HPWI, or high power wall inverter, would do that, connected to the schneider as its output. For standby only, to start, but could be smarter eventually to handle two way charge and discharge.�

May 16, 2015

Cattledog I think Elon said about 20% gross margins eventually for storage products.�

May 16, 2015

JRP3 Different cell chemistry, and the need for higher cycle life.�

May 16, 2015

jhm You're right. The whole market is huge about 90,000 GWh cumulative installed, and I suspect the cumulative installed by the end of 2016 may still be less than 5 GWh. So even starting with 5 GWh in 2016, this installed capacity needs to double more than 14 times. To do that, the manufacturing capacity needs to doublenat about the same rate too. It's going to take more than 14 years to double 14 times. Try to imaging doubling Gigafactory capacity every 12 months for more than a decade! Arguably, we are looking at 20 to 30 of intense growth.

Tesla will have their hands fully innovating and ramping up productive capacity in this space. I think this is part of what Musk means when he says that he views Gigafactories as a product. Tesla needs to scale up the production of new GFs. Doing one every couple of years is not going to cut it. There is a whole supply chain just for the tooling of GFs that also must scale. I suspect this is what the Riviera, now Tesla Tool and Die, acquisition is about. Musk needs to cultivate a deep supply chain that can scale. Critical suppliers may need to double every year or two, but lack the financial means to do so. They may have the financial means to grow at upto 20% per year, but growing 60% or more per year is completely out of reach. This incidently is why SolarCity does not work with independent local installers, they simply cannot grow fast enough to keep up with a company that doubles business every year. So SolarCity does its own installation so they can finance it for hypergrowth and maintain consistent practices across the franchise. So Riviera may have been a terrific company, but Tesla needs a tool and die producer that it can finance and structure for hypergrowth. At some point taking control of equity in supplier makes sense. I'm raising this issue because we need to think through the challenges of scaling into this massive undeveloped market. This is where the strategy gets really interesting.�

May 16, 2015

Lessmog That would be wk057. Interesting thread!

Plan: Off grid solar with a Model S battery pack at the heart - Page 32�

May 16, 2015

bonaire Jhm, where can we read about the 90,000 GWh need? Is this to replace all worldwide coal plants with solar plus batteries? How does nat gas and nuclear factor in? The current total US solar installed base is 20GW and most of it is used immediately, causing reductions in auxilliary power plants mid day. If solar were shuttled into batteries, then you currently could store and recover about 60 GWh per day off that 20 GW. Remember, 80-90% efficient, so a good amount is lost to charging losses. Now, store energy at night and use in the daytime improves baseload efficiency and reduces fossil fuel daytime burn for auxilliary power plants using NG and other fuels.

What has to be done is a smoothing of the deployment such that solar PV usage is still helping the grid while battery storage is powered by well off peak energy sources. In addition, battery storage works wonders in island nations and areas where small villages cannot get grid power. Islands use diesel generators now and such grids and microgrids are exactly where renewables and batteries work best.�

May 16, 2015

jhm I'm using Musk's numbers from the April 30 Powerwall/pack unveiling. He said that 900M Powerpacks (90 TWh) would be needed to replace all fossil fuels in electricity generation worldwide and 2B Powerpacks [equivent] (200 TWh ) to replace all fossil fuels in both transportation and electricity.

I also figure that the global power generation capacity is about 6 TW with average utilization of about 10 to 11 hours per day. So relative to current capacity, 90 TWh is about 15 hours of storage. I think if you work with a mix of wind, solar, bioenergy and other renewables as available, 15 hours of storage should be enough to smooth it all out and match consumption. Globally that would mean generating 66 TWh per day. Solar alone would require many more hours of batteries. Wind and solar production complement each other though the day and night and the seasons. Bioenergy provides fuel based back up to deal with seasonal and extreme weather gaps. Hydro is very helpful too where available. Tidal is easily integrated with batteries to overcome the 11 hour cycles. The essential thing is that the cost of batteries come down to overcome the operating cost of fossil fuel generation. That way renewables with practically no operating cost will suffice to charge batteries with the resulting cost of discharged power being lower than burning any fossil fuel. This sets up the necessary economic condition to eliminate fossil fuels.

How we get to that end state is another question. So we're in agreement that the near term is about stabilizing the grid and boosting the penetration of solar and wind. Commonly, we speak of stabilizing the grid SO THAT more intermittent renewables can be included, but I think this is rhetoric aimed to lay the burden on renewables. The reality is that intermittent demand has always required grid stabilization and that this situation has benefitted fossil fuel generators with opportunities to make above baseload rates. Take away peak rates, stand by and ancillary services and there is little profit left for fossil fuel generators. The problem with solar and wind is not so much that they destabilize the grid, but that they can generate power at below baseload rates which throws off the profitability of baseload and peak providers which need reliable stretches peak prices. So the key thing that batteries accomplish is that they stabilize the grid to such an extent that peak rates will be removed. They provide energy arbitrage that will minimize the spread from peak to trough prices throughout the day. Fossil fuel generators who currently rely on peak power rates for long-term solvency will be deprived of profits when peak rates are arbed out of the market.

I recently read (AES Energy Storage Targets $30B Peak Power Substitution Market : Greentech Media) that about 60 GW of new peak power capacity is added every year at a.cost of about $1000/kW. So that market would be about $60B. Now the Powerpack enters that market at $500/kW with 2 hours storage. I suspect this will compete very well. And we will know that Tesla is making a difference when the GW of fossil peaker capacity starts to decline. Tesla could take this $60B market with 120 to 240 GWh of Powerpacks per year. Moreover, the batteries used for peak replacement also provide frequency regulation and dispatchable load to handle any over supply from renewables. So the battery peak replacements will actually produce much more value to the grid than what a fossil peak plant could ever deliver. So once Tesla and other battery makers have put a halt to virtually any new fossil peak plant, they go down the path sending old peakers into early retirement. This may require more than 240 GWh of Powerpack capacity. So with as little as 5 gigafactories (250 GWh capacity) in addition to what is needed for vehies, Tesla could start turning fossil peak power plants into stranded assets. How long might this take? Suppose Tesla reaches 50 GWh of stationary capacity by 2020 and continues to expand at 50% annually. Then they hit 250 GWh by 2024. My impression is that Musk wants to move faster than that with competitors not far behind, so it could come as early as 2020. What is really cool here is that the economics work even without government incentives. So how about that for a peak theory projection? Fossil peakers become stranded assets sometime between 2020 and 2024. This could also be tough on oil and NG prices.�

May 16, 2015

Johan I agree with you jhm: regardless of how fast renewables can grow we will definitely see "hybrid fossil plants" (coal+batteries, nat. gas+batteries) soon. I like to call these "plug out hybrids".�

May 16, 2015

jhm Yeah, it's a curious question where these batteries will sit. I suppose we'll see them all over the place, even in coal plants. At least, existing plants have alot of infrastructure in place to minimize intallation costs, and helping with ramping up and down will make these plants more competitive. We might not actually see very many exclusive battery peak plants. Why develop all new facilities, if there are existing facilities that can site and install at lower cost? This is one thing to keep in mind when thinking about the fully installed cost of Powerpacks. If you've already have a solar installation with all the power electronics and a little space, it's cheap to add Powerpacks. Tesla could even design packs that sit right under mounted solar panels for no additional space needed. So I expect batteries to be well distributed. The locations that make the most economic sense will install the most.�

May 16, 2015

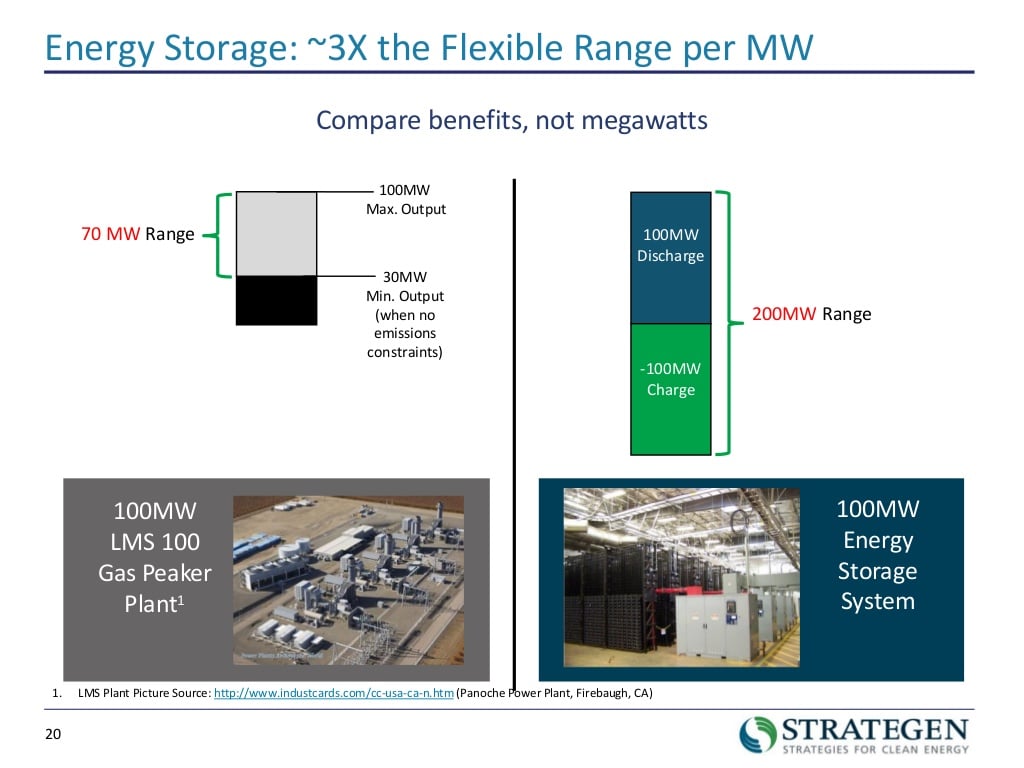

Johan I keep coming back to this picture from the Stratagen report (posted by Vladimir some pages back). It really graphically shows how you could build a say 5MW continuous Nat. Gas. Power plant that operates at close to or at 100% of capacity at all times together with at daily cycled battery pack, instead of building either a 5MW plant + a peaked plant OR building at 10MW plant operating at between 50-100% capacity during a 24h period (with a lot of its capacity being untapped for a large portion of a 24h period).

�

�

May 19, 2015

jhm Johan, it's a great illustration showing how the dynamic range, to borrow from a musical term, is much greater with a battery. In principle, any baseload plant, say coal or CCGT, could be paired with a suitable size battery to transform it into a peak plant with near 100% utilization.

So 100MW battery has a 200MW range from -100MW to +100MW. So that works out to $250 per kW range. But if a traditional peaker costs about $1000/kW, but only has 70MW range from 30 to 100 MW, then this is a cost of $1429 per kW range. So if what you need is range, Powerpacks really deliver a lot for the money.�

May 20, 2015

Johan Exactly, dynamic range is a good term (I associate it with photography). As batteries start making their way in to the large scale production and distribution markets the benefits will be highest in the beginning, in the economic sense you just calculated. As more and more batteries come in to place the need for peak generation and supply/demand balancing (smoothing of the duck curve) will be less and less and hence the economic benefit will be smaller for installing the 100th GWh as opposed to the first or second GWh in a given market. However, this decrease in economic benefit should coincide nicely with the price coming down and availability of batteries increasing which all-in-all should allow for the battery market to keep growing until more-or-less saturated (if it ever gets saturated, considering humanities ever increasing hunger for energy, especially as energy becomes cheaper and available without that much damage to the climate and environment).�

May 20, 2015

neroden I'm not sure he's accounting for the reduction in electricity usage in developed countries due to efficiency improvements such as LEDs. And I'm not sure he's calculated the energy usage in transportation correctly either; we know that electric cars are much more efficient than gasoline cars. I guess what I'm saying is that Musk is probably making an overestimate of the requirements.�

May 20, 2015

jhm Yes, I very much agree. It's hard to know what amount of energy will be demanded 20 or more years out because of leapfrogging utilities, lower cost power, and EVs. So any forecast would want to start there and work backwards to the production mix and battery penetration. So I think aggregate demand for electricity will go up. But I am not so sure that 15 hours of storage will be needed on a global basis. It has to do with production mix. I think about 2 hours of storage will gain economic benefits just about everywhere and will largely knock out the need for incremental peak power. Beyond that we'll need to see how markets evolve. The cool thing is that batteries present a very flexible way to bring arbitrage into power markets. With the means to arbitrage comes new market efficiencies, and this will be transformative. So how much arbitrage is needed to lead to arbitrage free prices? Thats what is hard to say. Maybe something less than 15 hours will suffice. But as efficiencies are gained and prices come down, the amount demanded globally will increase. So either way, it works out to a very big market.�

May 20, 2015

bonaire Heh, i don't know if I have ever heard Elon use the word conserve or conservation in any energy ideas. It does seem to be larger number to stimulate a market. As CEO that is expected, but ask any EV owner and they probably use less electricity after "going EV" than before.

in the big picture, factor in the millions of homes piping in NG for winter heating and many suburban homes using trucked in Propane. To replace such fossil fuels, one must go to either carbon neutral wood pellet stoves for winter heating or resistive. Replacing a propane burning furnace with equivalent solar pv and batteries and you will find a huge market for solar and batteries but a lot of people who really cannot afford those products. I do not think humanity can yet plan to remove use of fossil fuels. We can extend the way we use them and flatten the demand curve such that maybe we halve the consumption of NG and Distillates while conserving and shifting.

but again, batteries do not generate energy. They are a net user of energy due to their charging losses. JB's presentation to PG&E indicate 80% rt efficiency of their larger power storage system at 1/2C cycling and 89% at 1/4C. With those type if numbers, a wide scale education plan to get people to conserve first is important. The US and similar first world countries use far more power per capita than many emerging markets who themselves want to increase their energy use as they grow. This means less coal in the US and more in India and China, etc. We are just moving the demand offshore, it seems.

What I would like to see as a sizable accomplishment and a proof of concept. Turn off the NG pipes to Buffalo, NY where the solar city gigafactory is going in. Install a giant 3GW local solar array and some windmills on lake erie and ontario. Then run Buffalo on electricity only through two consecutive full year seasons. If that is easy to do, then extend it nationally. But these fuels have made us rely so much on them that renewables will be deployed for decades in a catch up race to keep up with population growth, demand growth and our desire to have many first world services. I read that gasoline demand is going up 3% this year in the US. Renewables in total in the US are creating less energy per year than contained in 3% of gasoline (a guesstimate but I could go research to determine).�

May 20, 2015

ev-enthusiast First sign of Tesla Motor's cost advantage (large scale LiIon production in Gigafactory) having an effect on competitors ratings:

Morgan Stanley downgrades Origin and AGL due to Tesla Powerwall (link).

Interesting.�

May 20, 2015

drinkerofkoolaid I think people forget that there are very significant incentives (for companies and individual people) to install residential and commercial storage units, where the power comes from Solar instead of the grid. In some cases, the incentives equal or exceed half the price of the product.

Although other companies sell grid storage, none of them are producing systems at the scale Tesla is, and almost all of the non-Tesla systems cost more than Tesla's. Also, 99% of people probably have no idea what any of the other companies are.

Large-Scale Energy Storage to Reduce Load in New York City : Greentech Media

http://www.renewableenergyworld.com/articles/2013/04/irs-confirms-that-batteries-qualify-for-the-energy-tax-credit-but-imposes-limitations.html

https://www.kpmg.com/Global/en/IssuesAndInsights/ArticlesPublications/Documents/taxes-incentives-renewable-energy-v1.pdf�

May 20, 2015

Jonathan Hewitt Tesla Motors Inc (TSLA) 7kWh Powerwall May Payback Investment In 6-Years In Australia: UBS

http://www.bidnessetc.com/43270-tesla-motors-7kwh-powerwall-may-payback-investment-in-6years-in-australia-u/

"According to calculations by UBS�s analysts, if the project is reaping such a return, it means that the Powerwall will be adopted by the mass-market sooner than expected."

Everyone is still focusing on the Powerwall and not the Powerpack...�

May 20, 2015

jhm Morgan Stanley sees 2.4m Australia homes with battery storage : Renew Economy

Morgan Stanley slaps a "caution" tag on AGL and Origin, utilities in Australia. They face earnings reductions and asset write-downs stemming from the potential for 2.4 M homes in that country to install Powerwall units.

This is really big. This is what we've been talking about.

So note well that banks and other investors are going to take seriously this potential for write-downs. With this, it will become increasingly difficult for these utilities to get financing. New peak power plants are a risky bet. The best response tor utilities may be actually to increase feed in tariffs, perhaps on a variable basis to achieve effective peak power without new plants.

Judging by this I think that Australia may be a good candidate for the next Gigafactory. Powerwall demand could be as high as 25 GWh over multiple years. Powerpack demand could be 5 to 10 times as much, 125 to 250 GWh. One 50 GWh GF could have annual local demand in in excess of supply for 5 or more years. Making a few GWh of auto batteries would also make sense.�

May 25, 2015

bonaire I really like the powerpack. For a larger suburban home, it actually makes sense to get a powerpack @ 100kWh than powerwalls in-series.

If PowerPack is used for load shaving and arbitrage, then it is using the same cells as the 7kWh powerwall for daily cycling. $3K per powerwall is 8 powerwalls @ $24K to an installer. One powerpack is said to be $25K (to an installer) and is 100 kWh. I just don't see why the powerpack is not offered for larger home use. Even someone with an 8KW solar array could charge that up over the course of two days. Given the physical size of the Model S battery itself (giant pizza-box scenario) - it seems that a PowerSlab could be done for homes where the need to put up a visible powerwall is not as necessary as enclosing an 85-100 kWh "slab" in sub-flooring somewhere in the home. Current 40-80 kWh standby off-grid battery solutions usually use up good amounts of floor and racking space. A PowerSlab could be installed in a garage, perhaps, right underneath where you would park a car. Just cut a sizeable six-inch depression into the flooring or plan for it up front during construction. Only issue with code would be "what if it floods?" and I suspect it would need drainage or sump or some such thing. I think if you want to take a large home off the grid, you would want a powerpack. Another aspect of going off-grid is that the battery is able to take the 30% Federal Tax Credit as would a Solar PV array. Makes it almost a no-brainer in states with high power costs like Hawaii or CA.�

May 25, 2015

Paracelsus "I really like the powerpack. For a larger suburban home, it actually makes sense to get a powerpack @ 100kWh than powerwalls in-series."

Great comments bonaire, and my thoughts exactly. I am very much hoping to be able to purchase a 100 kWh powerpack to take our Northern Idaho farm off the grid with a combination of solar and wind for the very reasons you mentioned. Winter weather here requires both, and we need several days of reserve capacity and the ability to charge from a generator for those long stretches of dreary calm NW winter days if we are not using firewood. Most rural properties like ours can simply place the powerpack in a shop building and backfeed the house from the shop when there is not garage space. My work takes me to rural facilities across the Pacific NW and Alaska where the powerpack can create the flexibility to look at projects in a new light, including many facilities that have multiple housing units and/or a bunkhouse unit on station. Many of these facilities currently use fuel-oil or propane for heat because there was no way to store intermittant renewable opportunities, and of course there is always the concerns & risk of transportation and storage of fossil fuels at logistically difficult locations. I am confident that facilities concerned with mitigating these spill risks will make the transition now that they can rely on stored energy for several days at a time if necessary.�

May 25, 2015

daniel Ox9EFD It depends what you want to do with it. The powerpack, from my understanding uses the NCA chemistry. That's the lower cycle life chemistry (around 3000 cycles in normal conditions from what I know). So if this is about daily cycling, as in, going off grid, you might be better off with stacking 7 kWh (NMC) units. If this is for backup there is no way a normal home would need 100 kWh unless you have no solar, and expect the grid to be down for 2-3 days. Which might be the case if there are more super-storms in the east coast.�

May 26, 2015

bonaire Daniel, I think homes wanting to go off grid have a different formula. If you have say a 8-10KW solar PV array, you want batteries about 5x or more that capacity. Meaning - if you have cloudy days where the array only puts out 10-20 kWh, your batteries do not get cycled per day. Also, a larger system cycles fewer times - lengthening the lifespan. Hence the driver who has an MS 85 who drives 50 miles a day and four times a year does road-tripping. Going off grid in a larger home would require a system that allows for daily at-most 30-40% depletion of the cells and then re-filling using Solar PV in the mid-day. A larger system doesn't work as hard nor deplete as far. An 8KW solar array can output 50+ kWh on a good solar day. Lose 12% or so round-trip and that is usable 42 kWh or so. That is a good amount for a home but some homes use much more and still want to be off-grid - especially in HI and CA where per-kWh prices are .30 or more at times. This is why I think the powerpack fits a need that hasn't been discussed yet. I would rather have one 100kWh box in the basement than 9 7 kWh units on the walls. And it is a similar cost (to the installer - $25K versus $21K). Some homeowners have pool pumps and heaters, dual AC units, lots of lighting, game rooms, etc. Not the typical home but not uncommon in the suburbs.

Lower cycle life is below 3000 cycles. Isn't the statement about the 10kWh unit said to be best for once a week cycling and a lifespan of 15 years? That is under 1000 total cycles. The 7kWh system should be about 3000+ cycles, the higher cycle life.�

May 26, 2015

jhm Bonaire, you sold me. 8 7 kWh packs gets you just 56 kWh for $24k. But for $25k you can get 100 kWh. That's a huge step up for the money. Additionally on a daily basis you may only be cycling 20 - 30 kWh depending on lifestyle, so even with the "weekly" chemistry this battery should last a long time, owing to shallow cycling. Another plus is 50 kW of power when needed. If you needed to charge a car quickly at night, you'd want this much power. Now if only Tesla had the technology to charge DC direct at 50 kW...�

May 26, 2015

daniel Ox9EFD Home quick charging... Interesting idea.�

May 26, 2015

jhm Are residential demand charges the next big thing in electricity rate design? : Renew Economy

This is worth discussing. Adding demand charges to residential rate plans could be a real boon to stationary storage. I does appear to be more equitable than add fixed charges and motivates load management.

Specifically regarding Powerwall units. Suppose that demand charges are $8 per peak kW demanded in a month. One Powerwall unit supplies upto 3kW for a short duration and 2 kW sustained. So a unit could shave say 2.5 kW in an average month. That is savings of $20/month or $2400 over 10 years. So this savings goes a long ways to cover the full cost of the unit.

Also keep in mind that California utilities are paying $190/kW/year for standby power. So $8/kW/month for demand charges offsets the standby cost at almost half the cost, $96/kW/year. So this is a really good deal for the utilities and all ratepayers to drive down the cost of standby peak power. So we need this kind of price mechanism to properly motivate behind-the-meter installation of batteries and solar.�

May 26, 2015

AudubonB Well, you'd have sold me, too....if you'd been there on time (TM, of course. Not you).

My battery bank, of which I've mentioned and depicted before, is 16 massive AGMs (550 lbs each) totaling 1100Ah * 2 strings * 48V = 106kWh. And even though I got the deal of the century for them in the best Bush Alaska trading fashion, it cost me an awful lot more than $25K. I won't say how much, but the appropriate string of 7kWh PWalls would have been a better buy.

That said, Tesla has not revealed the PowerPack's operating characteristics in cold weather (Alaska-cold, that is), and these fellas have come through with shining electrodes. wk057, if you're looking for new misadventures, why don't you send up your entire off-grid system and we'll let it suffer through next Oct-Apr here and find out in May how it held up..... �

�

May 26, 2015

bonaire You just need to use the proper heating element in the liquid TMS system which will heat the cells from within if the ambient temps drop. Those who work with other Li-Ion chemistries indicate that some level if Ion Plating occurs when charging below 30*F, give or take. Hot and cold can be somewhat troublesome. Sure, Musk says "it will operate anywhere the cars operate" - but we know the cars also have battery system heating cycles to warm up the cells. Which is what it is all about - using the right TMS and BMS to keep cells happy in the outlier temperature zones.

AudubonB may need 100 kWh of AGM but wouldn't you size the kWh capacity smaller in Li-Ion since more, deeper cycling is possible with Li-Ion? You most likely went 106kWh because of limiting the depth of discharge (DoD) on cloudy days, etc.�

May 26, 2015

AudubonB I went with 106kWh 'cuz that's how many batteries were available.....Overall, it's worked out pretty well with our (now quite on the small-ish size) PV arrays, our guest+our consumption pattern plus overall usage, our 30kW backup diesel, and our annual variation. When we did use it in the winter (last two was a "no"), the minuscule solar input was, in fact, almost able to keep up with our ridiculously-diminished demand (no guests, no need for freezers, all our heat is woodstoves, all our lighting now is LED so our water well (super-shallow, thus low consumption) and items like dishwasher accounted for most of our electron consumption, all while maintaining a vestige of a North American lifestyle. So we'd run the genset for 3-5 hours about once a week, which is something it's good to do on a regular basis anyway.

�

May 26, 2015

jhm The Island

Here's an interesting piece I stumbled upon. People in Sri Lanka are contemplating whether a new coal plant in their country is really a good idea, especially as Tesla's Powerwall product creates a new alternative to meet peek power needs with stored renewable energy.

I think it is good for us to have some sense of what Tesla's stationary products mean to countries like Sri Lanka. A lot of hope is extended. This work is really important to countries that are trying to advance economically. We may see a lot of openness to trying new things.�

May 27, 2015

bonaire A 100MW base load plant can create up to 2400 MWh of power per day. The coal plant, I guess, would be a base load plant for them?

To match that, they would probably need 600 MW of nameplate solar PV to create an average of maybe 2500-2700 MWh per day and the round trip losses of batteries may lead to something like 2200-2300 MWh usable, give or take. The good thing is, no trains or boats bringing in tons of coal per-day.

I don't know what coal plants cost but 600 MW of battery backed utility-scale Solar PV would be roughly 3.6 Billion USD or less in costs. I suppose they would use either Chinese or similar lower-cost products. IF the coal plant is 500MW, then multiply the same products by 5 ($16B). The ongoing costs of maintaining the large solar arrays would be much lower than a coal plant.

Solar PV is roughly 1 MW per 7 acres. I think a coal plant would be what, 100-200 acres and higher depending on the size of the tailings ponds and other effluence management.

They have a plant called the "Lakvijaya Power Station" which has three 300MW turbines for 900MW total.

Lakvijaya Power Station - Wikipedia, the free encyclopedia

900MW for what appears to be $1.4 per nameplate watt. If Solar + battery were to be considered, it may be in the $4-5/W range. But the ongoing cost of coal would go away. The trade-off is space and ongoing maintenance of inverters, modules and batteries (with inverter and battery replacement after 10 years or so)

Would be interesting to see a Solar + battery baseload plant used somewhere like there or India or other locations needing such equipment and who have space to install it.�

May 27, 2015

jhm Bonaire, I think you are missing the point that they have a narrow peak in the evening to cover. This is not about baseload. Distributed solar kills the need for baseload, but it can leave a narrow peak in the evening and perhaps a smaller peak in the morning. Pairing distrusted stoarage with distributed solar should suffice to sort this out and does not financially commit the region for decades to paying for a coal plant that has become obsolete before it is built.

The author makes the point that the grid has 4000MW of generation capacity, but its one time peak usage was 2073 MW. The Lak Vijaya coal plant already suffers from low utilization. Adding another coal plant would lower the utilization and compromise the economics of both plants.�

May 27, 2015

jhm Duke Energy to build 2MW battery storage system at old coal plant : Renew Economy

Here's a nice use for a retired coal plant. It seems this should minimize installation costs for batteries. No need to acquire new land and outfit it with high power connections to the grid. Just clear some room for batteries and supporting hardware and plug them in.

We've seen proposals for new battery storage plants where the total installed cost is about twice the cost of the batteries. It seems that retrofitting a retired plant like this must have a substantially lower installed cost.�

May 27, 2015

bonaire Battery storage systems may actually be fitting to be placed inside of mines. With constant air temps in the 50s, very little AC cooling would be necessary. I'd like to see batteries close to cities rather than in remote locations because they could be charged at night when long-lines are cooler and more efficient and the batteries would output during the afternoons when the temperatures are higher and the need to transport power is lessened by the localized batteries.�