Oct 23, 2013

bonaire A loaner sold is perhaps two registrations, correct? And they sold a lot of loaners in Q3. The interesting item is that the loaners are still considered as new cars for tax purposes, correct? Since they weren't yet given a title.�

Oct 23, 2013

cfOH My best Q3 delivery guestimate is 5600 to 6400 cars. Yes, that's a pretty wide range, but even the low end is more than Tesla needs to keep above the pace of its initial guidance.�

Oct 23, 2013

Robert.Boston Presumably the sale of a loaner is considered a used-car sale, so there shouldn't be double-counting in the data.�

Oct 23, 2013

ckessel Why subtract? Every loaner/showroom at this point is replacing a loaner/showroom sold, so it should be a net even except for a) new service centers and stores, and b) expanding service centers. But those two caveats can't come close to 500 more loaners than existed before.�

Oct 23, 2013

StapleGun Thanks, looks like the total cars not registered is a very low % then.

Good point! This might let me produce even more refined results.

The key thing I still need to know is in the US what is the average time between delivery and registration.�

Oct 23, 2013

Norse Norwegian "Vi menn" visited the factory in Freemont and met Patrick Jones. He said they produce 500 cars a week and they thought they would produce 23 000 this year.

He also said GEN3 is coming in 2017 and there have been talks of Model S AWD, but not atm.

http://www.tv2.no/underholdning/broom/sjokkert-over-teslafeberen-i-norge-4141354.html�

Oct 23, 2013

Clemsons2k Who said they are only producing 500 per week? I can't read the page lol.�

Oct 23, 2013

AlMc Thanks for the post. I would add that '500 produced per week' might be the 'official statement' that all staff are allowed to share. I hope (and suspect) that by the end of Q3 they were more in the 600/week level.�

Oct 23, 2013

Norse I hope that aswell AIMc: they do not quote anyone on the 500 a week. But Patrick Jones said 23 000 this year.

I would not expect Tesla to spoil anything to a small norwegian magasine.�

Oct 23, 2013

ggr The loaners I've had (in California) have all had "DLR" (dealer) plates on them. These are registrations that are not attached to any particular car, and can be moved around. There's a relatively small number of these, and the number just increases slowly as the fleet grows. So I don't think there is any significant number of duplicate registrations. I think a similar situation apples in most states.�

Oct 23, 2013

Zaxxon This jives with what I've heard, as well. Loaner/test drive cars are not sold as used in the US, as the buyers are still eligible for the federal tax credit. More than one person has confirmed this here, although I don't have links handy.�

Oct 23, 2013

c041v I ventured over to the Model X Tally thread and ran a few numbers.

The two closest data points for the start of Q3 are on;

14-Jun:#4076

07-Jul: #4417

If you count the days they were reported on, you get 24 days or 14.2 reservations per day. Interpolating to the start of Q3 (01-Jul) that would put the reservations number somewhere around #4317.

That last data point for Q3 is;

30-Sep: #6005

Which means that there was approximately 1,688 reservations made in Q3. I checked the spreadsheet for the various totals for EU and Canada, but there is not enough detail to link the reservation #'s with the relevant quarter dates. Looking at the overall numbers, it looks like EU and Canada add 15% to the US total and 10% of the overall total is Signatures. I used the overall to date numbers to get the blend of EU, Canada and Signatures.

So, we get combined reservations totaling;

1,688 US Production * 115% (EU and Canada) = 1,941 - (10% Signatures) = 1,746 Production reservations and 195 Signature reservations

1,746 @ $5,000 = $8,730,000

195 @ $40,000 = $7,800,000

For a total Model X reservation revenue of $16,530,000.

I hope the math is correct on this. I'm aware that it's not huge in terms of the overall quarter, but I feel like if reservations do count as revenue, it's a number worth knowing.�

Oct 23, 2013

GenIIIBuyer it is not recognized as revenue until the X is delivered. However, that cash would flow through to the statement of Operations cash flow number.

edit: thanks for running those numbers. Amazing that X R&D is almost halfway funded through reservations. Think reservation system is large reason why more capital will not need to be raised for X and Gen III production.�

Oct 23, 2013

c041v Ah, thanks for the clarification. I couldn't recall how the reservations were accounted.�

Oct 23, 2013

Krugerrand That's a real interesting point and something a lot of people have overlooked. And what will be the reservation amount for the GenIII - $2500? $1000?�

Oct 24, 2013

Mario Kadastik Might be nothing and really doesn't blow anything open, but in the press release about the german stuff there's such a little sentence:

Taking the 2012+2013 Q1-2 numbers we get 12 700 cars. I guess Tesla didn't want to give away the total number of cars, but it puts a definite baseline that they delivered more than 2300 cars in Q3 �

�

Oct 25, 2013

marvinat0rz The Nissan Leaf is now the most-sold car in Norway in October, according to national newspaper Aftenposten. The Model S is in the 42nd place, as expected.�

Oct 25, 2013

Norse This is great news IMO. Tesla just sold 53 cars the first 21 days of the month, compared to 616 in the whole september. This means they are holding back as expected! And no, demand still skyhigh. Still big waitinglist.�

Oct 25, 2013

ItsNotAboutTheMoney I wouldn't lay down $2,500 since I'd just want base+heat(pump+seats+mirrors) and I have absolutely no doubt that my low config would see me waiting at least a year to get it. But I'd be willing to lay down $1,000 to get a bleacher near the front.�

Oct 25, 2013

Norse I would pay 5000$, and I do not think I am alone here.�

Oct 25, 2013

AlMc Agreed. The demand for this will be huge, especially if TM has been delivering on SC roll outs and lived up to guidance over the next year. You may see the deposit amount decreased to $2,500 at some point, like they did with the S.�

Oct 25, 2013

Krugerrand I'd think it would be at least $2,500 to start, possibly lowered later. There should be more than enough people wanting the car right off that I think that they could, indeed, ask for $5,000 and still have a huge waiting list.�

Oct 25, 2013

kenliles I'd put $5000 down without a problem- I think they might choose a $2-$3000 number though�

Oct 25, 2013

JRP3 I'm torn. I'd put the money down in an instant but for the fact that I'm probably going to be getting a fairly basic model and I expect a deposit won't move me up the line very much.�

Oct 25, 2013

hershey101 I'm not sure I follow... Why would they "have to" pre-announce earnings if they had a 20%+ beat? Is this a regulatory thing?�

Oct 25, 2013

blakegallagher

I think you will significantly reduce your wait time for a basic model. I think it is very likely to get 100s of thousands of reservations before cars actually start rolling off the line. Even if you are getting a bare bones model I think if you reserve within the first week you will get your car much sooner than if you wait until production starts. Unless they surprise even the biggest bulls like myself the wait-list for gen 3 will be huge. They should go with a 2-3k deposit so they can cast a much wider net IMO.�

Oct 25, 2013

TSLAopt Anyone else have any predictions?

I will take a simple stab at it per my below research (a, b, and c) on threads 1 and 2 within this forum cited below

Facts:

5150 cars delivered in Q2

Data Points below could imply Q2 deliveries of (6205 + 6070)/2 = 6137.5

This is 987.5 higher than actual deliveries. 83.9% of 6137.5 = 5150

Applying the same principles above for Q3

Data Points below could imply Q3 deliveries of (7932 + 9066)/2 = 8499

83.9% of 8499 = 7131 reported deliveries for Q3

MY ESTIMATE Q3 DELIVERIES is 7131

(based on above formula using the below data points - 2b below I am least happy with as a data point)

1a)

VINs I see delivered on the last day of Q1 on this thread are 7924 and 8714 (8319 average and will use ths number)

Model S Delivery Dates and Sequencing - Page 234

1b)

the highest VIN I saw delivered pre Q2 endng was 14524 from this thread:

Model S Delivery Dates and Sequencing - Page 267

1c)

the highest VIN I saw delivered prior 9/27 is 22456 on the same thread

Model S Delivery Dates and Sequencing - Page 307

2a)

Highest VIN I saw delivered pre Q1 ending on this thread is 7845

Model S Delivery Update - Page 479

2b)

Highest VIN I saw delivered pre Q2 ending was on this thread actually the same person as thread #1 with 14524 so I won't use that same datapoint is 1b above. Next highest VIN after June 30th reported on this thread is VIN 15562 but took delivery on July 10th so not using that either as its too far of an outlier. However, the closest VIN delivered just two days prior to end of Q2 is 13915 so will use this data point

Model S Delivery Update - Page 534

2c)

Highest VIN I saw delivered pre Q3 ending on ths same thread is 22981

Model S Delivery Update - Page 590

Important assumptions I have made are:

-same proportion of cars in transit at end of Q3 as prior quarter(s)

-same proportion of VINs produced that are just for showrooms/loaners or skipped during Q3 as prior quarter(s)

Homework for anyone to try and improve this estimate:

Perhaps someone could go a step further and PM the people who reported their deliveries on those threads at the end of each quarter but did not volunteer their VINs. If we could get several more VINs at each of these data points I think it could be a more accurate estimate, excluding the fact that my assumptions noted above could be off.�

Oct 25, 2013

Convert2013 good stuff. Although I am comfy around 6500, I will stick to the higher numbers as I have them on the list just because of what I'm hearing from Elon about his plans for next year- that 1/4 of the factory is now being used, etc.�

Oct 25, 2013

AlMc TSLAopt: Thanks. I hope you are right with > 7,000 Q3 deliveries. I think it is a bit high (Obviously opinion, not fact, as none of us knows the actual number). Reasons I believe it more in the 6-6,500 range. First, I would suspect with more cars produced Q3 vs. Q2 there are more cars in transit. Second, there are more Service Centers and Showrooms in Q3 vs. Q2. This requires more cars dedicated to those areas and each Service Center probably is busier with more Model Ss on the road so they need more loaners at each of these locations.

Just my 2 cents. But I like your > 7,000 number better than my number as a TSLA holder:wink:

****As much as I want a huge beat on deliveries/production and the GM. I really want to hear some good stuff on guidance: Supply chain is not an issue; GM close to 25%; Model X reservations so big they are moving up production date; China reservations larger than expected; European demand exceeds expectation; Maybe even discussion of impending deal with a Chinese Company to build another factory in China to take care of the Asian market.�

Oct 25, 2013

BruceH I think we should just apply the most reliable data source, which is from Mr Musk that they started the Q3 with ~ 500/W and exit with ~550/W. Just saw a picture taken from some Chinese tourist indicating the production rate as of today (not very clear though), which pretty much supports the 550/W at the end of Q3. �

�

Oct 25, 2013

aronth5 Its going to be important to get a early reservation in IMO to be sure you get the tax credit. $5k seems too high and since it is supposed to be an affordable car that should also mean an affordable reservation amount, $1k - $2.5k�

Oct 25, 2013

DaveT Do you have a link to this?�

Oct 25, 2013

BruceH Sure:

http://www.weibo.com/dennythecow

However this is a Chinese version of twitter and you prob. won't be able to see it unless you register. Since the guy clearly visited the factory today as indicated by various photos he took, as I attached here, I wouldn't doubt the validity of the number. Besides the indication of the production rate exiting Q3, I think we are on track for the guide 600/W production rate, at least.

�

�

Oct 25, 2013

AlMc Not doubting it is authentic but the pix taker must have quickly snapped this as cameras are not allowed and the ONLY thing I can read says 570. If that is this week then 'push' at end of quarter could have been 590/600 per week. It is a data point...but what point....�

Oct 25, 2013

DaveT I personally don't think VINs can be accurate in giving us estimates of cars delivered. We don't know how many VINs were assigned that weren't delivered prior to Q3, so it's really tough to reach any reasonably accurate conclusions.

Further, it appears that people are getting their VINs assigned relatively shortly after they confirm, but the wait time has grown for U.S. customers (from roughly 1 month to 2 months - this is very approximate). So, it looks like VINs are growing faster than actual cars delivered. So anybody using VINs for Q3 delivery estimates will likely be overly optimistic IMO.

My current Q3 estimates are 5500-5800 cars delivered. This comes from 6300 cars produced (12 weeks x 525 cars/week avg) minus 200-500 cars on the boat to Europe minus - 200 loaners/store cars minus extra 100 cars in U.S./Canada transit.

I was originally thinking Tesla didn't have any cars to Europe on the boat at the end of Q3, but reading over the EU delivery thread it appears that several people have received their Model Ss delivered in mid-October (thus meaning their cars were on the boat at the end of Q3).�

Oct 25, 2013

EarlyAdopter Oh thank you random Chinese tourist.

I can make it out quite clearly. It says:

This Week's Production Numbers

Weekly Goal

Mon

Tue

Wed

Thu

Fri

Sat

Sun

Total

Assembly

570

Plan

114

114

114

114

456

(Factory Gate)

Actual

115

115

103

116

449

Difference

1

1

-11

2

-7

Paint

570

Plan

114

114

114

114

456

Actual

120

116

115

110

461

Difference

6

2

1

-4

5

Body

570

Plan

114

114

114

114

456

Actual

119

104

119

115

457

Difference

5

-10

5

1

1

�

Oct 25, 2013

AlMc

Thanks. Excellent vision on your part. Looks like this is 114/day with 5 day work week. Do they work Saturdays as well? Some Saturdays near end of month/end of quarter?

So, as Dave T suggested: average 525/week X 12 weeks= 6,300 for Q3 for production.�

Oct 26, 2013

mrdoubleb Well, we know they left Q2 with 550/week and the picture taken shows a 570 target at the end of Q3 - and it shows it being met. So I see no reason not to think 550-570 cars are being produced per week - that's 110-115 per day. Now I seem to remember 1 US weekday-holiday in Q3, so depending on whether they took the 1st week of the quarter off or not, we had 60 or 65 workdays. That gets us 6600-7475 cars. (The range is 110x60 in the worst case to 115x65 in the best case).

I fully agree with Dave's guesstimate of 200-500 "on the boat" and 200 lonaers (not sold), so, going with figures in the middle, I'd say 60 days X 113 cars minus 550 in transit or serving as loaners gets us to 6200 sold. And remember, most of the early EU deliveries should have been Sigs, plus we now have extra winter, etc. packages, so we should have a higher ASP than Q2.

6200 (but even 6000+) cars sold should "surprise" Wall Street, so I still think we will have a nice rally for the stock.�

Oct 26, 2013

NStar I just found a bigger version of the picture in that guy's weibo (Chinese twitter) account and can confirm that all the numbers in EarlyAdopter's post above are exactly correct. this was taken yesterday, almost 4 weeks after the end of Q3. DaveT's estimate 525/week x 12 weeks = 6300 production for Q3 seems more reasonable.�

Oct 26, 2013

TSLAopt Davet,

I agree with you that by itself the assignment of VINs is not a reliable indicator. That is sort of my reason for my Q2 analysis first to show a metric on HOW unreliable the VINS are and how I came up with my magic PROPORTION (83.9%) number noted below. I first looked at Q2 actual deliveries (5150) and compared it to the difference between actual delivered cars VINs at start of Q2 to end of Q2. 5150 turns out to be 83.9% of that number. Therefore, I took that same PROPORTION (83.9%) and applied it to the difference between actual delivered cars VINs at start of Q3 to end of Q3.

i think the 83.9% PROPORTION is key for my estimate, and am tempted to do the same thing for Q1 to see if its also close to 83.9% but there were no cars being made for Europe at the end of Q1 and if I remember correct they had a lot of temp workers in Q1 so those two things combined I'm not sure if that would make a completely different PROPORTION number or not.

If you or anyone can tell me what they think the fallacies in using this 83.9% PROPORTION method are then please let me know�

Oct 26, 2013

RationalOptimist What's odd about that pic is that there are columns there for Sat and Sun. Presumably those are at least sometimes used. On that production rate, working six days a week = 684 cars, and if they are geared up for 7 day, you get to 800. So the Q is what does 570 as 'goal' mean? That might mean "get there and we're done", or it could perhaps mean "this is the goal we agreed at the start of the quarter... but it's there to be smashed wide open".�

Oct 26, 2013

AlMc I have absolutely no problem with your rationale for 83.9%. But we still are assuming that this percentage translates from one quarter to the next. I hope your numbers are right as it would be a blow out number even for the most optimistic people on this forum and will make a couple new Teslanaires.�

Oct 26, 2013

blakegallagher I highly doubt there will be any tax credits on the Gen 3 .�

Oct 26, 2013

AlMc Blake....Will TM have sold over 200,000 vehicles before Gen III or do you feel there will be a shut down of the tax credit program? At the end of this year TM will have sold maybe 25-30K cars domestically, and if they hit their 40-50K goal in 2014 probably 30-35K of those are domestic. I just don't see it hitting 200K in domestic production/consumption before Gen III. I can see the first 50K of Gen III still being available for the credit.

So, it probably will be very important that once the reservations open up that US purchasers get in line asap.

Just my thoughts. Al

There may be no incentives left if people rush in to order an S or X, increasing demand, as TM gets close to announcing the reservation list for Gen III will be opening. Might be good marketing tool for TM to get people buying the higher GM cars before gen III comes out.�

Oct 26, 2013

Cattledog Yes, we're a long way away from it, but recall the mad dash to reserve cars at the end of 2012 when Tesla had annouced a price increase effective 1/1/13. (This next sentence is all from memory, too lazy to check the math) Reservations went from the 50-60s per day about a month before the deadline, to around 100/day the week before to several hundred (I believe) on 12/31. If somewhere in mid-2016 Tesla announces there are only got 20,000 credits left, I bet that juices the reservations. And that might be when a 4-year old Model S could use the juice.�

Oct 26, 2013

gym7rjm If it is timed correctly and gen 3 production ramps up quickly then quite a lot of gen 3 cars could qualify for the rebate. There is a wind down period after the 200k vehicle is sold where the rebate drops in value. First drop is down to 5k for 6 months and then to 2.5k for yet another 6 months. The loophole that Tesla could take advantage of is that there are no restrictions on the number of vehicle that qualify during this wind down period. The timing might not work out perfect, but there could be a situation where a significant number of gen 3 cars qualify.�

Oct 26, 2013

Convert2013 Exactly. What we need to take away from this sign is PRODUCTION CAPABILTY. It's pretty clear that Elon has successfully crunched out 570 cars in 4 days and that equates to a current weekly production capability of approximately 1000 cars/ week. Not sure when they idle the plant for maintenance and tooling for production increases, most likely 3rd shift when there is no production. He is setting up for a massive demand storm for 2014.�

Oct 26, 2013

Lessmog No, actually 570 in five days - 114 per day or approx 800 in a seven day work week. All other things equal. Which they may not be at all times. Still pretty impressive, especially since they seem to have hit the week's target surprisingly consistently.�

Oct 26, 2013

GenIIIBuyer Isn't this TV usually off during tours?�

Oct 26, 2013

BruceH Apparently this Chinese guy didn't mean to "probe" the production info, he was just another tourist, took a bunch of pictures, still cited the 500/W and 21000, and amazed by the automated factory, that's all.

Attached are the link of the Chinese Twitter (weibo) website of this guy and the clearer pic of the TV:

�

�

Oct 26, 2013

Sus The factory runs 5 days/week (not 7 days). So with 114/day, the production would be 570/week, not 800.�

Oct 26, 2013

brianman I suspect the confusion is that the 570 number already incorporates this projected value, rather than just being a sum of the Mon-Thu data.�

Oct 26, 2013

Convert2013 OK so looks like this was taken last Thursday and still doesn't show the data for Friday just yet, and that makes sense. You are correct. And yes still impressive.�

Oct 26, 2013

Blurry_Eyed Here is a datapoint for everyone, just saw VIN # 253XX ready for delivery here in the Northwest.�

Oct 26, 2013

ckessel Well, that 570 throws cold water on any hopes of a blowout quarter. Good sure, but if it's just now at 570 then that puts a pretty hard cap on the max cars built in Q3.�

Oct 26, 2013

MikeC Yeah, now I'm confused about those factory reports of ~550/week from June. Definitely lower than I was thinking.

Do we have confirmation that this tour happened last week or could it have been earlier?�

Oct 26, 2013

bonnie I'm not sure how people got to the point of expecting more than this. This (570) is a phenomenal number and should be celebrated! Manufacturing is a complex dance and you don't get to a number like this without a lot of effort.

Congrats to all the folks on the line and supporting functions who made this happen.

Here's to seeing 600/week by EOY.�

Oct 26, 2013

DonPedro This.

I think that unwise use of VIN data led some people to expect completely unrealistic numbers. When Tesla were able to increase from 4,900 in Q1 to 5,150 in Q2, the market was very happy. So if they can do another jump to 5,400 in Q3, that should be celebrated.

I think this thread had established that we can expect something even better - probably as high as 6,000. That would truly be a blowout (especially with the expected 20% automotive GM and $101k ASP).�

Oct 26, 2013

BruceH Indeed. Actually I thought this would be a solid number as I was posting the pic. Assuming an average of 525 and a fair assumption of transit cars we get a delivery of 5500 to 5800, as DaveT estimated, and I don't see the 5800 unreachable if Tesla did push it a little harder by various means. Personally I will rather push this just to make the company looks consistent in terms of profitability and growth. Given the price level of just ~10% higher than Q2 earning day close, I think TSLA is fairly valued, if not undervalued. 570 shows well on track for the guided 600 EOY, and the dramatic expansion in almost every aspect in my personal opinion is barely priced in as of today.�

Oct 26, 2013

azure1979 If Average production rate is 105/day(525/week) in Q3, total production number of Q3 is 6720 cars.(105 x 64days = 6720 cars)

5150 cars delivered in Q2. Production rate would be 95/day(475/week) and total production number of Q2 is 6080 cars. 930 were not delivered in Q2.

4950 cars delivered in Q1. as same way, total production number of Q1 is 5184 cars. 235 were not delivered in Q1

I think 235 of Q1 is included in 5150 of Q2 and 930 was shipped to EU at end of Q2. If US of Q3 sales is same as US of Q2(5150 cars), My current estimate is 6080(930+5150) cars delivered.�

Oct 26, 2013

NStar Yes In that guy's weibo account there is EXIF info of that picture and 2013-10-25 13:08:30 was the picture taken time. He did say the tour took place "today" in his weibo "tweet" dated 10/26 (which has to be China time, 15 hours ahead of Tesla local time)�

Oct 26, 2013

DaveT Alright guys, here's a summary of the latest in discussion:

1. Tesla started Q3 at under 500 cars/week. This is very clear in the Q2 shareholder letter (http://files.shareholder.com/downloads/ABEA-4CW8X0/2010772170x0x682962/f9e27702-90ed-4516-a16e-dc720c411089/Q2'13%20Tesla%20Motors%20Shareholder%20Letter.pdf):

"During Q2, we improved our production rate by 25% from 400 to almost 500 vehicles per week."

"Almost 500" is open to speculation, but my estimate is that they ended Q2 at about 490 cars/week production.

2. According to the Chinese tourist pic, it's now clear that Tesla is at about 570 cars/week (as of this past week) production rate.

It's already late-October and if they're at 570/week, my estimate is that they ended Q3 production at about 550 cars/week production.

3. So, my current estimate for Q3 production is 520 cars/week (avg of 490 and 550) x 12 weeks = 6240 cars produced minus 200-500 on boat/transit to Europe minus 200 loaners/store cars minus 100 cars U.S./Canada transit = 5440-5740 cars delivered in Q3.

*note: factory rested on first week of July so there was only 12 weeks in Q3 of production.�

Oct 26, 2013

vgrinshpun The design rate of the Model S/X production line is about 80 cars per shift. Since Tesla factory currently operate two shifts, the corresponding " as designed" rate would be 160 cars per day or 800 cars/week. During the Q2 ER the average gross margin guidance for Q4 was 25%. It is unlikely that this guidance can be achieved with two shift production output that is significantly lower that "as designed" output. Because of this I think that Q4 production will have to be higher then 600 cars/week if 25% gross margin guidance will be met.

Regarding the 570 cars/week production, I agree that this is an incredible achievement and should be celebrated, not mentioned as a disappointment in any way. I, however, think that the average weekly output is currently higher than that :smile:. Consider, for instance, what Elon mentioned in Germany, i.e. that current rate of cars produced for USA is about 400 per week. Based on interviews Elon did during the Geneva auto show, the European deliveries in 2013 were to be 5,000 to 7,000 cars. This corresponds to average European production output of 208 to 291 cars/week. The total would then have to be higher than 600 cars/week.�

Oct 26, 2013

DaveT TSLAopt - here why I think your PORPORTION method is faulty. Some time Q3 there appears to be a significant increase in the pace of VINs released. This is in all likelihood due to European shipments starting and Tesla releasing VIN numbers to European customers. So, if you can imagine in Q2, there was a steady order flow of 500 new confirmations per week, and Tesla could issue VINs at that pace. Furthermore, they could deliver at around that pace as week. So, VINs issued could relate to deliveries in some way (still although not accurately because order rate might have been slightly faster than delivery rate. However, in Q3 there was a significant boost in the pace of order confirmations due to Europe. So, for example while in Q2 we might have had 500 order confirmations per week, in Q3 we might have had 700 order confirmations per week (i.,e 500 U.S./Canada, 200 Europe). However, Tesla was not able to ramp up production/delivery to meet the increased order confirmation rate. In fact, they still could only produce/deliver cars at around the 500 cars/week rate. As a result, since most VINs are issued shortly after order/config confirmation the number of VINs issued in Q3 significantly outpaced the number of cars delivered in Q3.

While you might be able to see some high VIN # cars delivered in Q3, that doesn't give us a good indication of how many cars were delivered because there was a significant number of VINs being issued but delivery not scheduled until much later. As a result, starting Q3 we have a significant "VIN waiting list" (ie., cars that have VINs issued but delivery is schedule 2 months later in U.S. or 3+ months later in Europe). In Q2, the "VIN waiting list" was much, much smaller due to their production rate being closer to the order confirmation rate.

So, in summary the 83.9% PROPORTION method doesn't work because there was a significant boost in VINs in Q3 that weren't delivered due to production rates falling behind order confirmation rates significantly.�

Oct 26, 2013

bonnie I don't think they've yet achieved 600/week. Mid-Sept they were at 550. We all start taking pieces and bits of quotes and some VIN numbers and the hair of a unicorn or two and talk ourselves into fantastical results ... let's just wait for the earnings call on Nov. 5th. I'd love to be wrong, but I'd be shocked if they even came close to 600, much less achieved it. I think the real number will range between 550 - 570 for EOQ, most likely at 570.�

Oct 26, 2013

DaveT The Geneva Auto Show was in March 2013, I believe. So that's a really long time ago. I don't think European deliveries will be 5000-7000 cars this year. It will be far less. I would imagine Tesla producing an average (over the quarter) of 400 cars for U.S. and 150+ cars for Europe currently. The 570 cars/week (current rate) is by far the strongest data point we have. I agree with Bonnie that our expectations/hope should be for Tesla to hit 600 cars/week by the end of the year.�

Oct 26, 2013

vgrinshpun As a lot of other posters on this thread, I think that 2014 production guidance will be one of the most important metrics during the Q3 ER call. One of the pleasant surprises in Elon's QA in Germany was his prediction of possibly delivering about 200 cars/week for German customers, or about 10,000 cars per year. This is unbelievably high number! German auto sales market is approximately 25% of the European market ( best-selling-cars.com/europe/2012-first-half-car-sales-by-european-country/ ). If one assumes European penetration the same as in Germany, Tesla might be planning annual rate of 40,000 European deliveries by the end of 2014.

Considering that US and European auto markets are approximately equal in size, the US annual rate would have to be also in the vicinity of 40,000 cars year.

There will have to be also planned sizable Asian deliveries by the end of 2014.

So will the guidance for 2014 during the Q3 ER be as high as Elon's target for Germany suggest it will be?

- - - Updated - - -

Dave, how do you think Tesla can achieve average 25% margin during the Q4 with the two shift operation output at 75% of "as designed" rate?

- - - Updated - - -

I am having hard time to believe that Tesla will deliver less than 5000 - 7000 cars to Europe. After all both Elon and Guillen (interview with German Manager Magazin) stating that Tesla is doing everything possible to deliver cars to European customers who waited so long. I would not dismiss Elons words during the Geneva auto show so easily.

- - - Updated - - -

http://www.investopedia.com/terms/m/mosaictheory.asp

A method of analysis used by security analysts to gather information about a corporation. Mosaic theory involves collecting public, non-public and non-material information about a company in order to determine the underlying value of the company's securities and to enable the analyst to make recommendations to clients based on that information.

Definition of 'Mosaic Theory'�

Oct 26, 2013

bonnie Pretty sure that the mosaic theory doesn't include the hair of a unicorn or two.�

Oct 26, 2013

vgrinshpun I was using only Elon's quotes and company gross margin guidance. Not sure where unicorns came from... :smile:�

Oct 26, 2013

bonnie The unicorn reference was admittedly made up... but I don't think that using quotes and gross margin guidance from different points in time will necessarily lead to a solid conclusion. My numbers come from other sources. But again, Nov 5th will prove out what the numbers actually are.

�

Oct 26, 2013

BruceH Are we firmly gonna have the production guidance during the Q3 ER call? I just checked the last years' shareholder letter and it seems the next year's guidance was on Q4?�

Oct 26, 2013

Mitthrawnuruodo According to teslamotors.com/supercharger - there is currently 31 supercharges, and 45 additional superchargers to be operation in America by FALL 2013. I find it very doubtful there will be even 50 by the end of the year. Dissapointing. My optimistic side hopes the Elon mentions at earnings, oh by the way investors, we opened 40 additional superchargers overnight. Too bad that is unlikely.�

Oct 26, 2013

PeterJA 1) Fall lasts until December 21.

2) Why is it "very doubtful" that multiple Superchargers are being built at once?�

Oct 26, 2013

ggr As well as the estimates of cars that were actually produced this quarter (Q3) and making allowance for cars being shipped, won't there be sales of cars that were built last quarter but were in transit to Europe? Or did we conclude that they weren't really in transit?�

Oct 26, 2013

Mitthrawnuruodo I guess my point is we appear to be behind on superchargers, based on quick math or a chart. Confirmation or a backpedal on the supercharger roll-out may effect the stock price.�

Oct 26, 2013

Citizen-T I think you confuse owner disappointment with shareholder disappointment. If they guide that demand is insatiable and tell us that the didn't build as many Superchargers as planned, no investor is going to be pulling his hair out screaming, "why did you not spend more money!"

BTW, I'm not sure what your quick math was, but my observation has been that the rate of Supercharger openings has not been linear. If you accelerate the rate over time you can certainly make the remaining stations fit into this year. That doesn't mean that they will, just that it can be done.�

Oct 26, 2013

PeterJA My point is: how do you know we're behind? Are you assuming a steady rate of completion? (which was not the case in Norway; all six there opened at once) Or do you have some information that construction has not started (or cannot be completed in time) for the missing ones in the US?�

Oct 26, 2013

Mitthrawnuruodo No I have no personal knowledge of my own, I have just been watching the progress on the supercharger map and some whispers of the deployment on TMC. It seems as if they have several in progress and I agree the growth won't be linear, but all the same accomplishing the 80+ superchargers and then the next wave of Winter 2013 seems insurmountable. Citizen T, your observation of the investor impact seems logical, thanks for that.�

Oct 26, 2013

Clprenz I think my final bet will be: 6250 cars delivered, based on tourist photo and some unreasonable gap between VINs and production capabilities. Either way we should see a nice bump into 200+ post earnings. With all the pessimism in the past week, I would start buying options. But not all of them. Right before earnings will have quite a premium though�

Oct 27, 2013

Mario Kadastik I think the same doubts were there for the Summer 2013 numbers and then Tesla opened a huge number of them in the final weeks overachieving the promised number. I wouldn't be surprised at all if the same thing happens with the Fall 2013 numbers so expect multiple openings in December happening in row. And from following the TeslaMotors FB and Twitter feeds it seems they are opening a supercharger every few days, at least they constantly alert to those events in the past weeks so I have at least the feel that it's a constant progress happening.

What I'm somewhat surprised didn't materialize is that Elon promised on Thursday to reveal the six German superchargers and the initial press release did contain an interesting image of all German superchargers by 2014, but I've not re-checked if the press release actually does have the six that are to be opened pretty much very soon or not?�

Oct 27, 2013

NStar How many have been delivered to Europe so far? I could be wrong but I thought it's ~1000 according to the spreadsheet tracking Europe registration number in Q3. it seems not possible to deliver 4000-6000 to Europe in Q4.�

Oct 27, 2013

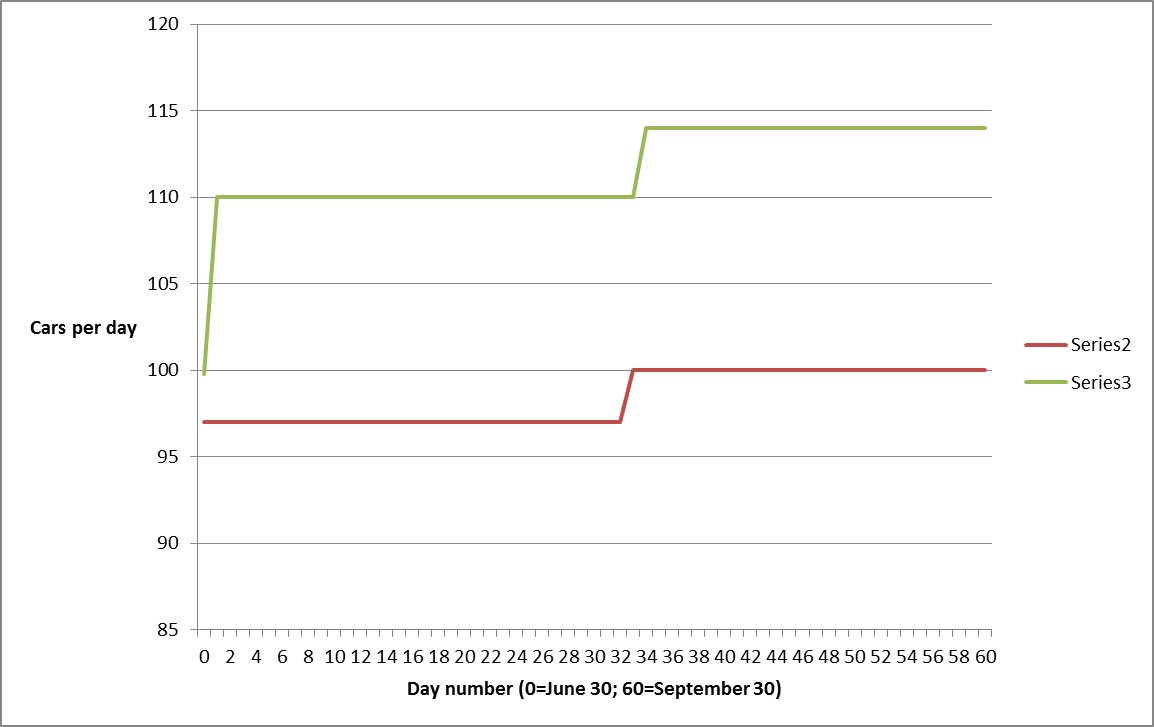

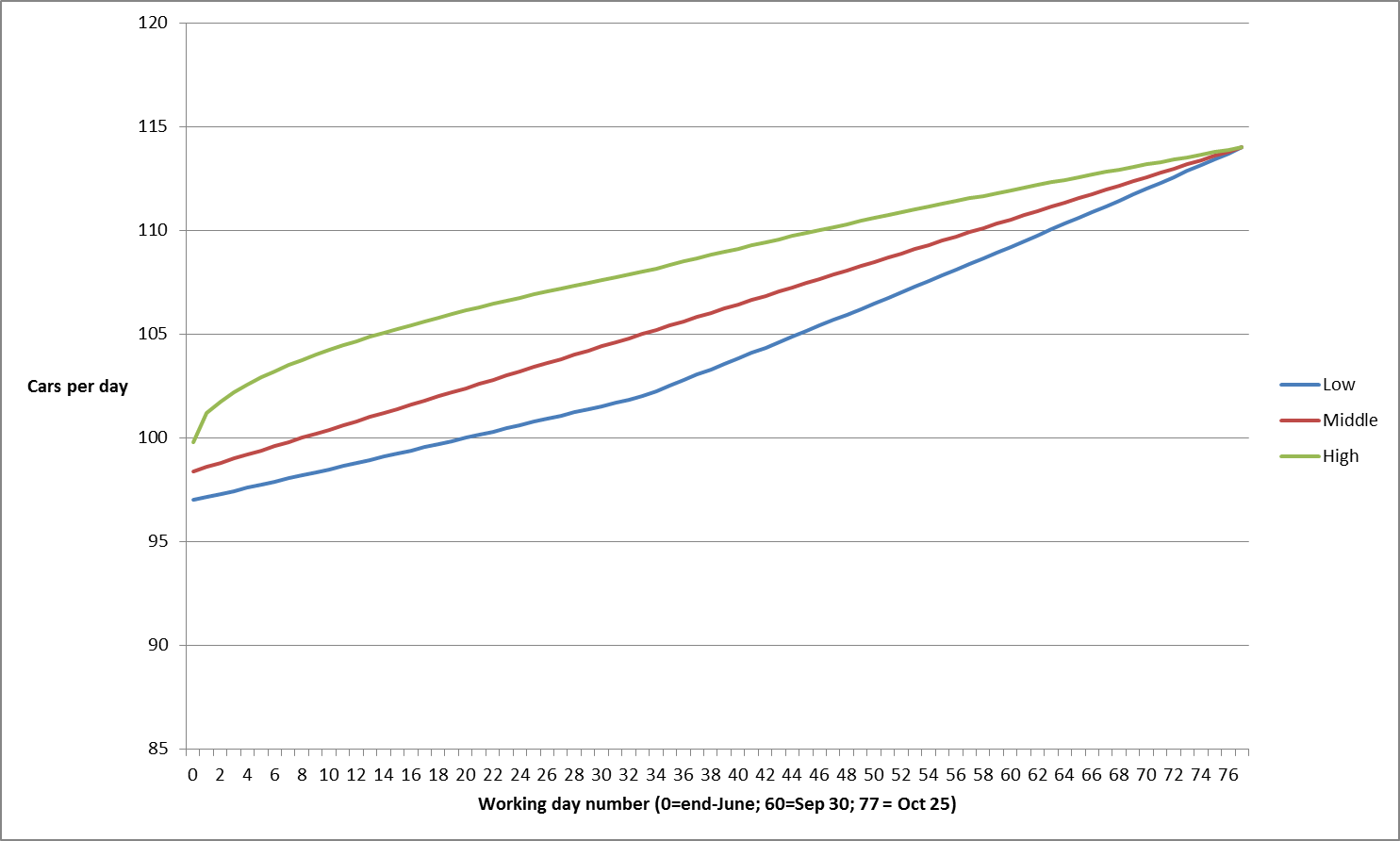

DonPedro Updated analysis

I start with just two assumptions:

1. The production rate data points are correct (Q2 shareholder letter - "almost 500" = 485-499), Aug 20 video of EM and the Chinese tourist pic)

2. Tesla's production rate has never gone down week-on-week in the period from end-July and Oct 25

Then I can with certainty say that the production has been 5756 and 6480. These are my "absurd low" and "absurd high" numbers. They are absurd because the production rate is not gradual - it assumes the theoretical worst and the theoretical best scenarios between the known data points:

In the scenarios above, I have assumed that when EM said that production is "between 500 and 550" on Aug 20, it could be anywhere in that range. For the further analysis, I am assuming that if it were between 500 and 510 he would say "approx. 500" and that if it were between 540 and 550 he would say "approx. 550". Therefore I will narrow that range to 510-540. Here are the "realistic" scenarios:

As you can see, I have assumed different scenarios for how production increase happened over the intervals as well (exponential, linear and square root, respectively).

This gives the following production estimates:

Low: 5,921

Middle: 6,051

High: 6,225

The great fit of the linear middle scenario gives me strong confidence in it.Now the question is what the difference between production and deliveries is. Based on the extremely low deliveries reported in October in Europe, I would not 100% rule out that there was no increase in cars in transit to Europe. We have to assume some increase in show room cars (if not loaners), so let's say 50 for that. This means that the most optimistic realistic scenario is that we have to subtract 50 cars from production figures to get deliveries.

On the other hand, there were some deliveries in Europe and could be quite a bit more than the anecdotal evidence gives an impression of. I would say that it would not be unrealistic to assume an increase in cars-in-transit of 300-400. For loaners and show room cars, those could possibly have increased by as much as 100-150. In total, let's say that the maximum adjustment is 500.

Based on my gut feel, I will say that the "middle" scenario is towards the low end of the range - so 150 cars.

This gives the following scenario matrix for deliveries:

Low production Middle production High production Low correction 5,871 6,001 6,175 Middle correction 5,771 5,901 6,075 High correction 5,421 5,551 5,725

The bottom line: I am going to go with an estimate of 5,900 cars delivered. Furthermore, there is more of a downside than an upside to this figure, as the table above shows. 6,200 would be very surprising - I think the only way that could happen is if Elon was sandbagging in the August 20 video. However, that seems unlikely, since the Aug 20 data fits well with the two other data points.

Discussion of conflicting data:

I think VIN based analysis is fatally flawed by some assumptions that are completely baseless (either "proportional" or "the pipepline is filled up"). I think the huge discrepancy between the VIN data and these pretty firm data points, clearly the VIN data must be discarded.

On the other hand, the registration numbers collected by Maekuz still provides significantly higher estimates than the figures above. We have not been able to get any information on the original source of that data, so we cannot know if it is reliable or not. While this data reduces my certainty about my estimates above, I will not disregard solid data based on data of unknown quality.

- - - Updated - - -

Updated Q3 P&L projection:

Note about the projections: The uncertainty about ZEV credits and R&D expenses makes these projections highly uncertain. My range for non-GAAP EPS is $0.16-0.38.

Cars and CARB credits 5900 cars x $101k ASP 595 900 ZEV credits Guesstimate 25 000 Development services Guesstimate 1 000 Total revenues

621 900

Gross profit 21% GM ex. ZEV 150 349

R&D expenses

55 000 Selling, G&A expenses

60 000

Net income (non-GAAP)

35 349 Net income/share (non-GAAP)

0.29

Revenues (non-GAAP) 621 900

Deferred due to lease accounting 137 000

Revenues (GAAP) 484 900

Net income (non-GAAP) 35 349

Deferred profit 27 000

Stock based comp 22 000

Non-cash interest on convertibles) 1 800

Net Income (loss) (GAAP) -15 451

EPS (GAAP) -0.13

�

Oct 27, 2013

ModelS8794 Do we have any confidence on work days in the quarter? The Chinese pic indicated open slots for Saturday and Sunday work, so there are likely at least some weekend shifts occurring. Whether the quarter is 60 or 85 days, or somewhere in between, remains an open question IMO.�

Oct 27, 2013

DonPedro That is a great point. I have assumed 5 working days a week and observance of public holidays. (Very useful working days calculator here).

While the existence of slots for Sat and Sun does not prove that there has been weekend work, we cannot dismiss that possibility. Every Saturday or Sunday worked would add 100+ cars to both production and deliveries.

Does anyone have any data on this issue?�

Oct 27, 2013

bonnie They were working weekends when first getting the line up and running. To the best of my knowledge, Saturdays and Sundays have not been production days for a very long time. Not to say they couldn't use those days, but 1) you can't work people like that, and 2) you need some down time to perform equipment maintenance or you'll quickly have other problems.

There have been no recent reports (in last six months or so) of production running during Saturday or Sunday factory tours, so that would support a five day work week.�

Oct 27, 2013

MikeC DonPedro, did you account for the first week of July being taken off?�

Oct 27, 2013

Citizen-T In my mind there is no doubt that the factory puts in extra hours toward the end of the quarter. We have seen spikes in deliveries at the end of every quarter. I would imagine they justify this by giving the factory off the first week of the next quarter. This isn't a wash as the manufacturing team needs that down time to make changes to the line anyway.

In other words, I'd assume at least 2 but perhaps as many as 4 or 5 extra days of production in the quarter (be they from working late or from working weekends). I don't think that your typical factory line worker gets 4+ weeks of vacation a year. It makes sense to me that those hours are being made up elsewhere.�

Oct 27, 2013

Lessmog It doesn't seem that way to me. His first diagram leaves out one day at the beginning, probably 4 July. Looking at my calendar, Q3'13 was 13 work weeks plus one day (30 Sept). First week (including 4 July) was off-line, factory re-tooled for Europe etc. One Monday was a holiday, I think (Labor Day). So that leaves exactly 12*5 or 60 days if no production on weekends. Which we don't know.

Otherwise Don Pedro's analysis looks, well, analytical ;-)

- - - Updated - - -

That also makes sense to me.

But, dear Citizen, this is sort of spooky, in the season of ghosts and ghoulies:

�

Oct 27, 2013

FredTMC The San Juan Capistrano permit has taken forever and a day. I don't think this is TMs fault at fault. I believe permitting is typically the bottleneck in many places. As we know, once they break ground it takes a couple weeks. That's it.�

Oct 27, 2013

Convert2013 Wow, lots of inputs.

I don't think deliveries in the high 5Ks vs mid 6Ks will make a difference anymore on market reaction. Various articles have been out on these numbers and Q3 is likely already priced into TSLA. I think the market will dance to current production capacity (Q4 guidance), and High Level 2014 guidance on production goals and/or sales goals with some breakdown on the major markets. Hope Elon brings it home with some WOW numbers.

(current production capacity is based on 7 days a week- otherwise Sat & Sun wouldn't have shown up in that screen pic. All major auto companies have 7 day production for certain plants, some even all 3 shifts. There's a fine balance in trying to produce too many cars in a shift (quality control) vs spreading it out over shifts/days).�

Oct 27, 2013

DonPedro Yes. I did not want to make the writeup too busy, so I didn't explain the numbering. Day 0 in the charts is June 30, and day 1 is July 8 (the first working day at the factory in Q3).

- - - Updated - - -

Yes, I arrived at the same number. Used the working days calculator for the period from Jul 8 to Sep 30 to arrive at it.�

Oct 27, 2013

DaveT They can achieve 25% gross margin at 75% shift rate because they're aiming for over 30% gross margin in the near future IMO (see Elon Musk CEO incentive plan 2012 where stock options are given if they reach at least 30% gross margins for 4 consecutive quarters).

European shipments were pushed back (originally they planned to ship cars Q2). It's evident that they shipped almost no cars to Europe during Q2 (see Maekuz' registration spreadsheet to see almost no European registrations in month of July). I don't see any way Tesla can reach 5000 European deliveries in 2013. I think it will be more around 3500-4000 max.

- - - Updated - - -

DonPedro - I think you're being a bit optimistic in your adjustment numbers.

It's pretty evident that Tesla didn't ship any cars to Europe at the end of Q2. Thus we had Q2 production at 5450 and deliveries at 5150. However, at end of Q3, it is evident that they had cars in transit to Europe. In the EU thread, there are some people in Germany, Sweden, etc. that have received their cars in mid-October, meaning that their cars were in transit at end of Q3. Further, there's an article stating that Norway had 40-50 registrations in October (I think during the first 3 weeks, so it's probably more). I think it's reasonable to say that Tesla had 200-500 cars in transit to Europe at the end of Q3. I think anything less than that is very, very optimistic.

Also, Tesla opened new stores and service centers in Q3 and they need to send cars to those places. Further, Jerome did mention that he would have more cars a service loaners. So, I think we need to apply around 200 cars going to service centers and stores.

I'm also applying an additional 100 cars in transit to U.S./Canada to my estimates, but this is up to debate.�

Oct 27, 2013

ModelS8794 This seems right but is directly conflicted by the Chinese weibo pic, which shows a 570 weekly target and 113 daily target.�

Oct 27, 2013

clmason Has a community consensus been agreed to in regard to share price movement as a result of q3 earnings? If not community, what's your personal opinion?

I see a lot of discussion about deliveries, revenues, margin, etc. but not too much about share price movement. Thanks in advance.�

Oct 27, 2013

DonPedro I am open to that criticism. My current thinking is as follows: Even though cars-in-transit were low after Q2, it was very clearly non-zero (based on reports in June of people seeing lines of cars marked for the EU, and of people seeing their cars in production on MyTesla). This "feels like" ~100-150 cars. So that is my starting point.

By late October, there were around 60 registrations in Norway. There days, it seems to me that Norway accounts for half of EU deliveries (which is also consistent with your estimate of 3500-4000 deliveries in EU, as the Norwegian country manager is on record estimating 2000 in Norway). So 60 in Norway and 60 elsewhere gives around 120. Then there are many deliveries later where I wonder whether they were produced in Q2 or Q3. So the number could be 120 or it could be much higher. To form a hypothesis about that, a first data point (although weak) was that I heard zero reports in early-to-mid October of people seeing their cars in production on MyTesla. However, what really convinced me was the following logic:

1. The deliveries dropped extremely in October

2. There is only one possible explanation: Tesla intentionally minimized the cars-in-transit

3. If this was what they did, they must have wanted to have that figure as low as possible

4. If they wanted it as low as possible, there is no reason why the figure wouldn't be 120. Why would they do this, but do it half-assed?

In any case, I think a number higher than 400-450 would be hard to reconcile with the complete standstill to which deliveries came in October. So while I tend towards a very low adjustment for cars-in-transit, I feel the real range is something like 0-300 (with both extremes feeling "not right").

Assuming they opened 20ish new locations (is this ballpark?), five cars at each would mean a 100 car adjustment. Whether they increased the stock of loaners or not is anyone's guess. I thought they would, but then I also thought they wouldn't game the quarter by pulling down EU deliveries (which they obviously did). If they are so keen to inflate numbers, would they prioritize more loaners? Assuming they did, the figure could indeed be the 200 total that you propose. I honestly don't know.

To qualify for an adjustment, this figure would need to be a net increase in the number of cars in transit to North American destinations. Why would there be such an increase? Actually, we might have a decrease here, since EU deliveries may have slightly reduced the NA volume.�

Oct 27, 2013

Mario Kadastik I think that pretty much answers the weekend question:

�

Oct 27, 2013

bonaire Who can get on the ER call and just ask plainly for the company to post monthly sales and production numbers? Why is this so complicated?�

Oct 27, 2013

ggr At the one year anniversary of the San Diego store, today, the manager (Peter) said that the San Juan Capistrano supercharger should open in the next couple of weeks, and that the delay is due to permits and was out of Tesla's control.�

Oct 27, 2013

fjm9898 just an random thought.

EU car's finish work is happening in the Netherlands. Can we confirm just how much work is being done there? Are they just slapping the battery in and shipping the car out or are they doing more?

Hypothetically, if its more work then would that help speed up production even more since a % of the work is being done else where. So ramping only ~75 cars a week production through the quarter would not be as large of an accomplishment.

Even more hypothetical, what if that 570 run rate does not include cars being finished in the EU factory. Obviously this would be way off on a limb. However, the only way i can see this as possible is if the VIN data actually is correct because your talking about alot of cars. (also the great work done here shows registrations in the US not large enough to make up the gap from ~6000 cars to ~8000 for this crazy idea to be true)

i know those last hypos were tin foil hat suggestions. But i would like to get confirmation just how much is being done at the EU plant. thanks.�

Oct 27, 2013

aznt1217 We need to beat the most bullish case on the street to get a win IMO. Jeffries upped target of 5500 cars in Q3 delivered, that's who we need to hit/beat. We're also going to need to see more gross margin progress which I believe we will.�

Oct 27, 2013

hershey101 Okay, here are my two cents:

6300 cars produced, 5700 cars delivered at an ASP of $98,500 and GM of 20%

Assuming R&D and CapEx amounts to $100M you get a profit of $12.29M (excluding ZEV)

That means a profit of $.10/share...

Not terrible, but not great. Stock price after 3Q results: ~$180.... So basically I see 0% chance of recouperating my losses on the $190s and $200s..�

Oct 27, 2013

FredTMC excellent news. Fits my assumption�

Oct 27, 2013

Citizen-T In predicting the market's reaction, let's not forget that we live in a somewhat over-informed bubble here on TMC. We thought that "every knew" that Tesla would post a profit in Q1, remember? I personally was shocked by just how much Wall Street was "surprised" by the Q1 results.�

Oct 27, 2013

mershaw2001 I'd like to volunteer my thoughts on your predictions: I don't think that cars made will have that much of an impact beyond what the run rate is next year. If we make 6500 and only guide 40k next year, that's not anything as good as 6000 and guiding 60,000 next year. Also, cash on hand (how much of the 750 million that was raised is left) will indicate whether tesla might end up needing to do a secondary, and that's a key factor (even tho elon said he wouldn't need to).�

Oct 27, 2013

Convert2013 Valid and important question. It would not be cost effective to build them out in NUMMI and tear them down again before shipping.. but not sure how it's being handled. We all need to understand this.

- - - Updated - - -

Agree 100%�

Oct 27, 2013

chillong i had a very similar idea. albeit very unrealistic and most probably in dreamland, but what if the EU-production is not included in this 570 number? what if they altered the production for EU cars and only produce parts now and the assembly gets done in NL? this could explain Elon's latest comment about using 1/4 of the NUMMI plant.�

Oct 28, 2013

DonPedro As far as I understand, the work in NL is minimal. I believe it is just slotting in the battery and maybe mounting the wheels. It's just a compliance exercise.�

Oct 28, 2013

TSLAopt yes, but perhaps legally to stay in compliance, they are not allowed to say the cars are completely built/assembled in the US that they send to Europe. Despite physically much needing to be done, that screen shot doesn't necessarily show what's physically assembled...if the legally assembled amount differs from whats physically assembled then I would suspect that screen shows the legal number.

anyone else have any thoughts? Perhaps anyone with an international law background?

even if this is the case, I assume Norway doesn't count since its not part of the EU and the official final assembly can take place in the US for the Norway cars still.�

Oct 28, 2013

DonPedro Yes.�

Oct 28, 2013

techmaven I would expect that the number reflects the physical count - far harder for the system to sort out the legal count. I believe, from earlier comments, that the cars are essentially built in CA then disassembled for transport and then reassembled in NL.

The big assumption that is truly an unknown is whether or not the plant was running higher than 570/week going into the end of Q3. There could be any number of reasons why the plant is running lower this past week.�

Oct 28, 2013

fjm9898 This has nothing to do with the NL plant. NUMMI is massive and they are only using 1/4 of the space, that is all. Elon making a statement saying they are only using 1/4 is just saying we can ramp up production in the current facility for some time without having to buy a second facility. They just need alot more money to buy the equipment to fill NUMMI and that wont happen until Gen3 gets ramped up. (NUMMI is said to be capable of between 300,000-500,000 car production rate a year, hence only 1/4 of the space being used for the MS right now)�

Oct 28, 2013

hershey101 There is no way they are already using 1/4th of the factory... 1/4*400,000 = 100,000 Model S/year... I don't think we will see that for 2-3 more years so...�

Oct 28, 2013

chillong Elon mentioned 1/4 at his recent EU tour...�

Oct 28, 2013

fjm9898 I was just using the number that some one said Elon said. So how am i off base if that is what Elon said?

Also your not looking at this correctly. Just because Elon said 1/4 doesnt mean 1/4 of the production capacity. Elon meant 1/4 of the facility's space is used. Their current line could pump out 35k cars next year possible on 2 shifts. What about on 3 shifts? 50k? What is some of the facility already has equipment in place getting ready for Model X production? Model X on 3 shifts be 50k run rate? That could easily be 100k cars at 1/4 facility Space, so yes 100k on 1/4 = 400k.

Furthermore, how much extra space is being used there for other things? R&D, offices and test equipment. NUMMI was quoted up to 500k production rate but that might of purely been on how it was being used for production of vehicles only. Tesla is using it for more then just a factory.

1/4 doesnt mean they are at 1/4 possible production rate. 1/4 means they are currently utilizing 1/4 of the facility's space.�

Oct 28, 2013

hershey101 Okay, fair enough...�

Oct 28, 2013

Robert.Boston When do we start seeing Parts as a profit center? I know Elon stated that Service was supposed to be break-even, but that doesn't limit profit potential for non-warranty work, e.g. collision repair. I don't have any sense of how important this revenue source might be, but I'm sure the margins can be great.�

Oct 28, 2013

smorgasbord Yeah, let's be real clear about what Tesla got/didn't get as part of the NUMI factory deal. They got land, some big buildings, and some equipment that was too big to be moved/sold cost-effectively. Some of that equipment, like the stamping machines, just needed new dies to be immediately useful. But mostly it was either empty space or space that Tesla emptied to make way for robots and other newer technology. So while there's plenty of space to put machines, the real effort and cost is in the machines, pipelines, and training.�

Oct 28, 2013

ggr Actually the stamping machines were bought cheap from somewhere near Detroit, and had to be moved and installed.�

Oct 28, 2013

ssq FWIW, I was told I couldn't get a S60 until Feb 1st week, they are booked/sold out until Jan 2014. I take that as a great sign for sales but not so sure how production is coping up so far..�

Oct 28, 2013

NStar Great to know. I was just told that I could still get S85 this year if I ordered now. I have some concern because I see from the delivery thread that people confirmed at late Sept. are expecting delivery early Dec. this seems to suggest the number of orders placed in Oct. are less than before. Also there are posts speculating that the fire put a dent in demand in Oct. because the number of VIN's assigned this month decreased quite much. But at least we know the priority is still on S85/P85 suggesting the demand is still strong enough. Supposedly a lot of US buyers who are considering buying will want to take delivery by the end of 2013 so that they get the $75K tax credit soon instead of having to wait another year.�

Không có nhận xét nào:

Đăng nhận xét