Aug 7, 2013

sub Couldn't help myself. Let the speculation begin.

�

Aug 7, 2013

twinklejet Thread title squatter you!�

Aug 7, 2013

sub Sorry, did it more for the laugh at this point but maybe it will get the discussion moving once everyone recovers from today.�

Aug 8, 2013

aronth5 So while you were at it why not also start a thread titled "Q4 2014 results - projections and expectations":smile:�

Aug 8, 2013

sub ouch, guess that's what I get for having a sense of humor. Back to taking life to serious I guess.�

Aug 8, 2013

Krugerrand The smiley face at the end of sentence indicated aronth5 was joking.�

Aug 8, 2013

NigelM So, what's your analysis say about Q3?�

Aug 8, 2013

SebastianR I say

a) increase guidance of 21k units a year to 23.5k units

b) increase guidance about Europe (Norway)

c) news about China

d) GM on track to reach 26.7% at the end of Q4

e) additional details on Model X

f) GenIII pushed one year to make more money on Model S/X �

�

Aug 8, 2013

austinEV

I think this is spot on. The traffic lately about battery constraint has pointed out that Gen III just may not be possible due to supply. But, put another way, Gen III isn't really the smart play for Tesla due to the constraint. I was out for my evening run and in my delerium I realized how smart/easy it would be to announce a 2 door sport coupe on a smaller frame with AWD and a tiny backseat. Basically a lighter, smaller less practical model S with serious spring in it's step. Would it sell 500k a year? No, but thats the point. You can sell it for 90k at high margins RIGHT NOW at lowish volumes. And the investment cost would be miniscule, lacking any of the model X challenges. And by that logic, you can do a new roadster too. Basically stop and make money on the Model S/X/C, while battery partners spin up their factories.�

Aug 8, 2013

Right_Said_Fred Maybe Tesla can reach 23.5k in 2013 and 26.7% at the end of Q4 but they wouldn't give that als guidance after Q3. What is there left to surprise if they do that? If they are confident they will reach those numbers they will raise guidance to something like 22k and 25.5%. Save the potential for an upside result and minimize the chance of a disappointment.�

Aug 9, 2013

twinklejet What, no numerical predictions yet? In that case I'll be the first to call $1000! :wink:�

Aug 9, 2013

sub Apologies if I missed that.

- - - Updated - - -

Not sure my opinion would help anyone, I'm out gunned significantly in this forum. I did get the sense that Elon was playing games/under promising significantly on the cc.�

Aug 10, 2013

NigelM Mod Note: some posts went here - Executive-Stretch-Model-S�

Aug 14, 2013

TSLAopt We are halfway through the quarter...I believe VINs north of 20k should be getting assigned this week. I will guess optimistically 6k-7k deliveries for Q3 with 20% margin excluding ZEV credits. This is my guess...would like to hear if anyone else has any guesses yet now that we're at the halfway point�

Aug 14, 2013

sub I think it's not an issue of how many cars are produced, I think everyone here believes they are above 500 a week since Elon stated this fact. The wild card again seems to be the euro deliveries correct? I'm guessing 20% GM, no idea on ZEV, I'll leave that to those smarter than myself, lots of them here.�

Aug 22, 2013

uselesslogin Using Sleepyhead's spreadsheet and a 16% gross margin before CAFE/GHG credits and assuming $20 million in ZEV credits and 6,000 cars delivered with a $96k ASP and making a couple other adjustments I get $0.17/share. owever, non-gaap earnings are is also $0.05/share fully excluding ZEV credits so maybe Tesla will emphasize that they no longer need ZEV credits to be profitable.

Anyway, in my mind the 2 big questions are what is the street looking for most, and how much ZEV can we expect? Hopefully the street will be happy to see that Tesla does not need ZEV credits to be profitable and they will be happy if they get halfway to the 25% gross margin goal. If Tesla can get to 21% instead of 19% in my model that adds $0.09 cents/share and would be a much more positive report.

I realize there is still a month left in the quarter so things may change between now and then. But everything hinges on margin this time. I have no idea how to figure out gross margin improvements other than to have faith Tesla will deliver.�

Aug 22, 2013

NigelM 20077�

Aug 22, 2013

Theshadows We got vin 2025x on 8/15. On the vin forum if they didn't skip any numbers the vin posted before ours was 100+ vins per day.

With the recent crash test news it almost has to be higher than that now.�

Aug 22, 2013

NigelM Is your delivery date confirmed? The reason I quoted 20077 was that is TMC's highest reported VIN in the update thread with a delivery confirmed still in Q3. There's higher VINs already but deliveries=revenue so relevance to this thread is essentially delivery date.�

Aug 22, 2013

sleepyhead NigelM - What was the last VIN # delivered in Q2; or approximately which number excluding outliers?�

Oct 11, 2013

maekuz I am not so sure if we should be posting those numbers here. Every decent analyst will look up this page on a daily basis. Maybe we could close this section to the public or something in that order?

- - - Updated - - -

Their numbers were too low if i remember correctly...�

Oct 11, 2013

Mario Kadastik I'm all for making the threads private somehow. Right now we're doing all the work for the analysts and while we do get paid because we know it before they do and can use it, it'd still be better if they'd go digging around randomly and then Tesla surprises themWith regard to not playing with this release I think it's relatively impossible for Tesla not to exceed Q2 numbers. If it just matches them we're on track to ~20.5k deliveries. Same for Q4. However we do know that Q3 and now Q4 will have higher weekly rates meaning that it will exceed (we just don't know how much) and therefore the guidance is likely to increase. If TSLA delivers 6k cars we're at 16k this year and only need 5k more to match the updated 21k number. More likely Q4 is at least as much as Q3 so 22-23k.

�

Oct 11, 2013

AlMc Making threads private: Not a bad idea but not going to happen most likely. Also, Sleepy hit Q2 ER and guidance perfectly and either no analysts saw it or used it as it appears they were all caught off guard. I think many analysts look as this forum and think we are all zealots (which we may be) that thinks TM/Musk can do no wrong so they are leery about putting their client's money on the line based on what they read here.

The TM forum VIN accumulation thread is not private. cfOH wanted to keep it open and I respect his wishes. There are multiple sources of this info if analysts/individuals want to use it.�

Oct 11, 2013

maekuz My numbers say Europe contributed 18% of the global sales in Q3. That's not peanuts. �

�

Oct 11, 2013

DonPedro There is not strong reason to believe that the percentage you refer to will stay constant. So this method has little merit.�

Oct 11, 2013

uselesslogin Yeah the whole issue in my head is what does the market really expect? I guess though if I look at the analyst estimates I see from one source they are $.06. This is clearly wrong. So if that is the estimate going around right before earnings maybe I will buy some options. I mean I do expect at least 4 times that number and that would make an impressive story for people not paying attention.�

Oct 11, 2013

Mario Kadastik I meant peanuts with regard to total car sales in EU �

�

Oct 11, 2013

kevin99 Nice perspective. What company you think is at the most risk being disrupted? In another word is there a Nokia or blackberry analogy being disrupted by Apple?�

Oct 11, 2013

Mario Kadastik Kevin's fishing for a shoort, kevin's fishing for a shoort (read in a child singing voice). Sorry, couldn't resist �

�

Oct 11, 2013

kevin99 One way to make this precious private is to share by Google Docs and set the permissions level.

Then share the URL to the spreadsheet privately.

It would be nice that this forum require login to protect some content.�

Oct 11, 2013

maekuz its the volkswagen group, sadly. They got no EV-Game.�

Oct 11, 2013

marvinat0rz Toyota strikes me as a very big target. But it doesn't seem to likely that Tesla will grow big enough to become a real threat there before someone finally realizes it's time to put some effort into electrics as well.�

Oct 11, 2013

spacekadet Toyota already buys EV powertrains from Tesla for their RAV4s.�

Oct 11, 2013

dhrivnak Yes but a VERY small number. We are talking hundreds for the year so far.�

Oct 11, 2013

kevin99 I want to stay away from trading and focus on just business.Imagine in 5 years and we look back at the rear mirror, isn't another perfect storm coming that nobody sees it? Start reading where Blackberry was at 5 years ago.

As I view Tesla as 100 times of Apple, in term of product scale (think model S vs iPhone, in term of ingenuity, price, difficulty of making it), therefore it will be 100 times harder to dodge a perfect storm, if a target does exist.�

Oct 11, 2013

tslafan123 Did any one study the correlation between cfOH's VIN assignment rates vs actual deliveries in the past few quarters?

Jefferies report says that we should be looking at VIN assignment rates as of early September because it takes about a month to deliver the car.

I'm seeing all kinds of wild projections for Q3. But, this logic sounds a bit more reasonable.�

Oct 11, 2013

AlMc Basically using VINs to predict actual deliveries is a bit of a 'crap shoot'. Some US customers (particularly close to the factory) get a VIN one day and two weeks later have a car. Some Europeans get their VINs and do not see the car for months. Higher profit cars are pushed out quicker than lower profit ones (read P85+ vs 60) even though the '60' has an earlier assigned VIN.

So, at best it is a guesstimation.�

Oct 11, 2013

Tasmanian Devil kevin99: Nice perspective. What company you think is at the most risk being disrupted? In another word is there a Nokia or blackberry analogy being disrupted by Apple?

I agree with makeuz here about VW being in danger. I think in the oncoming EV-revolution we will see a few casualties, not only in Germany.

Hard to predict of course, but I`d say any company not planning a decent all electric car within say the next 3 years will have a very hard time.

Any company without a decent all electric car within the next 10 years is probably doomed.�

Oct 11, 2013

Convert2013 I think we need to stop with these VIN # based car sales predictions in this forum. Analysts are writing articles on them now which can drive the stock up with high hopes and then have a serious reversal if Tesla announces sales less than the VIN # based predictions in this forum. It's for our own good.�

Oct 11, 2013

ckessel I think trying to hide information is always a losing proposition. Either the numbers are good and it causes an appropriate stock move or they're bad and the stock makes an entirely appropriate correction.�

Oct 11, 2013

TSLAopt I thnk there's a chance we're setting ourselves up for dissapointment. There may be a whole crapload of cars in transit to Europe at the end of the quarter or maybe they are now randomly skipping VINs to throw us off in the future, etc. I don't think we should count on the VINs as an absolutely valid measurement for an estimate of how many they're even building anymore. Having said this I'm long 200% still and hope I'm wrong, but at the same time am worried that we're getting over zealously carried away here. We are all drinking the kool aid and put a bunch of us in a room together and who knows what kind of predictions we'll start making beyond reality.�

Oct 11, 2013

ckessel Quite possibly, but I don't think that's a good reason to start hiding information. If we're wrong, we'll be disappointed, oh well.

I'll drown my incredibly brief misery in a beer and go watch football �

�

Oct 11, 2013

Theshadows I think the use of vins is reliable right now. I don't see them trying to throw us off by making vins higher than they really are, they already know we use them and making them higher would certainly lead to negative sentiment. I also see it as a way to communicate to the faithful and diligent ones to empower them to get some benefits for investing so much time evangelizing the company. Until Tesla changes to a scrambled algorithm I think the numbers will be reliable. My feelings are until they scramble them, they want us to have them.�

Oct 11, 2013

TSLAopt I hope this is true but feel there is a chance it is not, that's all. I would estimate it at 20-30% chance they already started scrambling the VINs somehow and will let everyone know on the conference call so we don't rely on it anymore. This 20-30% chance I believe is considerable.�

Oct 11, 2013

vgrinshpun https://scontent-a-lga.xx.fbcdn.net/hphotos-prn2/1394462_641833972506348_1648309761_n.jpg�

Oct 11, 2013

DaveT In Q1, VINs were very reliable and those who relied on those benefited greatly.

In Q2, VINs were not reliable since TSLA introduced European production and skipped around with VINs. Those who relied on VINs for Q2 projections did not provide very accurate predictions. In fact, most of them overshot. Some of us relied on weekly and quarterly production numbers coming out of factory, and that provided for the most accurate projections.

In Q3, I don't see how VINs will be reliable. We have no clue regarding the following:

1. How many cars on are the boat

2. How many VINs have been skipped

3. How many VINs were assigned but not finished at the factory (ie., end of Q2 there were a bunch of European cars not finished)

I can see how VINs might help with giving us a sense of production ramping up (ie., increasing number of VINs issued weekly) but I don't see it reliable in projecting how many cars were produced in Q3.

To me the most accurate data will be any numbers out of the factory from factory tours. But I haven't heard much in recent weeks regarding this.�

Oct 11, 2013

maekuz I didnt use the VINs but rather gathered the registration numbers for July, August and September in every country. I did find a quite good source for USA registrations which seems a bit more accurate than the Autodata numbers. Per definition registrations are deliveries, so i reckon that this data will provide a much better result than the VIN based method. But I wont post that Excel sheet here because of said analysts. Anyone interested in these numbers can shoot me a PM and i will send you the compiled registration data.�

Oct 11, 2013

JRP3 http://wallstcheatsheet.com/stocks/is-tesla-selling-more-cars-than-everyone-thinks.html/

Funny thing, the trolls on Seeking Alpha, instead of trying their previous tactic of predicting low sales numbers, are now trying to pretend every outrageously high prediction is "baked into the stock price" so any thing less will be a "disappointment."�

Oct 11, 2013

sleepyhead Just for the record, I believe that the more information we make public the better for TSLA stock and for us investors.

If we keep this information private and to ourselves, then the rest of the world will be playing a guessing game and the stock will not be trading on fundamentals and it will trade with huge volatility.

The more information that we make public, the more stable the share price will be and the less stress we will have to endure as investors.

I feel like 3 months ago I was the only person in the world who knew that solar would take off and after a good Q2, the solar stocks started tanking because Wall St. didn't get solar. If more people, including Wall St., had all the information that I had in my head then I wouldn't have to wait so long for these solar stocks to get properly valued; still waiting...

I think it is pretty straightforward:

1. Elon shares information that he knows only the biggest Tesla fans will now how to compile and take advantage of, whether it be VIN assignments, or some seemingly random comment made during a Q&A session in some speech he gave in Montana.

2. We interpret the information and compile it for every other Tesla maniac to learn.

3. We buy stock and options.

4. About a week later the smart institutions start buying shares based on this information.

5. Four weeks later some media starts picking up on the info and so do some of the analysts.

6. Wall St. and the general public start understanding and the share price continues going up.

The people who benefit most in this scenario is us. Therefore, we should share this information.

Now please help me share the word on solar. Feel free to forward the links in my signature to anyone you know. I am that confident on my calls.

More articles to come. Next one might even be on Tesla �

�

Oct 11, 2013

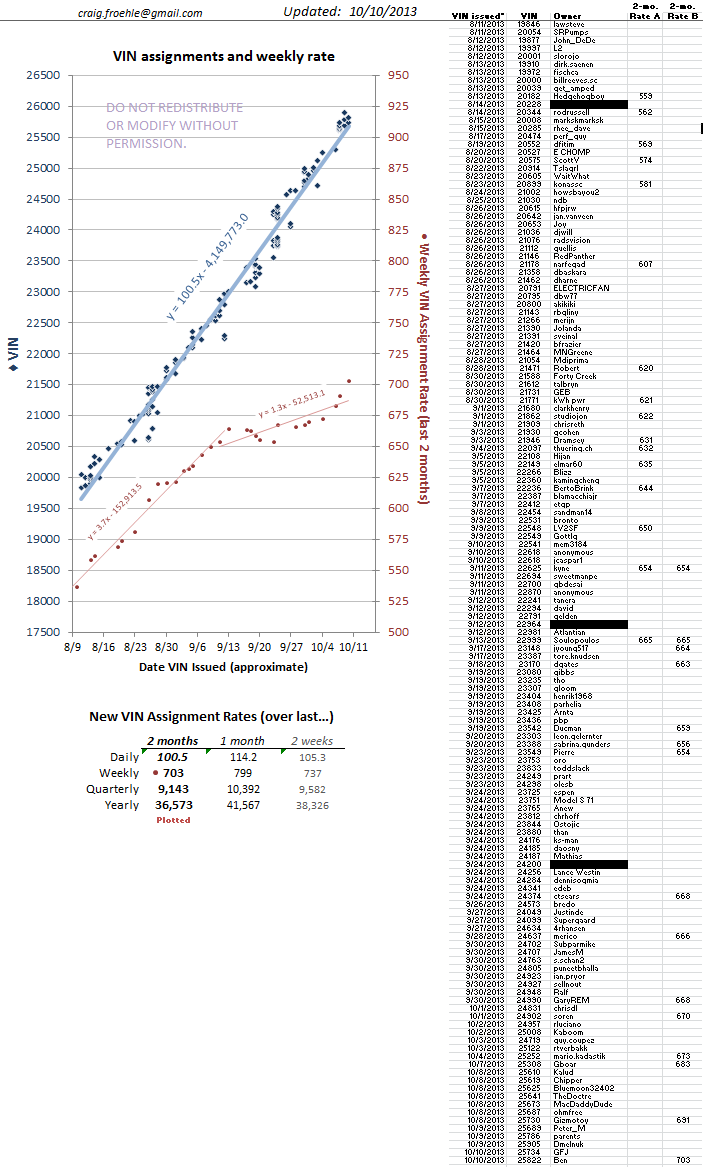

Theshadows When I look at Craig's chart I don't see many holes like we were seeing Q2. It also makes sense that they are delivering EU cars early in the quarter so they don't have that many in transit at the end if the quarter. It looks like very few people in the US are getting cars right now. My guess is that's because most of the ones coming off the line are heading for Europe.

Here is Craig's chart from the teslamotors website. �

�

Oct 11, 2013

sub

Do you know for sure everyone here is not an analyst? I'm not of course, just saying. Post away!�

Oct 11, 2013

AlMc Whether VINs are discussed here or on the TM site, they are discussed openly enough that analysts can find them with minimal effort. We all know (or should know) that VINs assigned do not equal immediate sales and that there are several things that influence the relationship of #of VINs to # of sales. Until we have monthly sales figures from TM it is basically an educated crap shoot. Most of the people who frequent these threads know this fact.�

Oct 11, 2013

Robert.Boston From a purely technical POV, we don't have a capability here on TMC to create limited-access threads. We have a lot of visitors on TMC, but limiting access to registered users wouldn't accomplish anything because registration is free.�

Oct 11, 2013

Citizen-T Open, free, accessible information is the best way to combat FUD. There is an awful lot of FUD out there, let's put as much information out there as we can.�

Oct 11, 2013

sleepyhead Exactly. You guys complain that there is a lot of FUD out there but don't want to share all of the information we have here. Can't have it both ways.

Transparency is the best solution.�

Oct 12, 2013

Mario Kadastik Reading through it I have to agree with Sleepy. The FUD factor is probably the biggest reason that this data should be shared. Firstly of course amongst ourselves, but once we formulate the picture well enough and have probably taken advantage of this knowledge we shouldn't only just have it public I think we should in fact encourage people with the knowhow also to dissipate it on blogging sites like SA etc. Yes, there are tons of trolls, but getting the positive message out in tandem with all the short FUD articles helps to balance it out and pull analyst attention to those details. While I originally was a proponent of making it private it was mostly driven by the virtual entitlement we sometimes feel for the small community who's in the know and wants to use the information for our own advantage I feel that Sleepy's reasons are good points to reverse my position. And heck, who am I to advocate this much anyway, only been around a couple of months. And kicking myself for it as I've been investing and playing TSLA for 1.5 years and how the heck did I not come to check this forum earlier than when I started to seriously consider buying the car (duh).�

Oct 12, 2013

Sunnyday Amen. Viva transparency. More, better information, widely disseminated, benefits shareholders.�

Oct 12, 2013

StapleGun There was suggestions to make the forum private in the past, and if that had happened many of us wouldn't be here now. Possibly including Craig who joined in July, and has provided incredible information which we all could have lost out on. I am very grateful for anyone who choses to share their research on this board (Sleepy, Craig, CapOp, etc...) as they have no requirement to do so.

That said, I did find this article interesting as it shows what someone who just glances at the data might falsely infer.

Tesla Motors Inc (TSLA) Could Blast Past Guidance

�

Oct 12, 2013

mrdoubleb I've seen versions of this article a couple of times during the past few days and it is strating to worry me a bit. As one of the comments notes, VINs are no longer sequential - probably in order to prevent what is happening right now.

The reason why I am a bit worried is, that if the mainstream media starts to run with this, pretty soon expectations will be for a 10k Q3. So when we do recieve the actual numbers (personally expecting 6000 sold, another 500-800 produced but serving as a loaner/on a boat to Europe), the market will be disappointed - even if they will beat guidance.�

Oct 12, 2013

Convert2013 Yeah. I've noticed the articles are now coming out in droves and this is what I mentioned earlier. Perhaps can be rectified by some sort of pre-earnings release or real analysis from analysts at the big boys with price targets. The VIN# analysis thread discussions are confusing many of the less brighter analysts and they are producing junk reports. Perhaps the MODERATORS can change the name of the thread to clearly read "Speculative XYZ..." or something similar to warn any analyst peeping in. Just like the shorts have been feeding inaccurate articles all these months, we don't want to be yet another regular source of easily confusable information that eventually generates inaccuracies for the public/investors.�

Oct 12, 2013

Jackl1956 I am obsessed Tesla Motors, as well as TSLA (Q3 included). It has been impossible to stay abreast with the sheer volume of articles and analyst reports. At first, I tried to convince myself to take an objective approach. I would read both the positive and negative articles, in an effort to discern the reality. An honest effort at due diligence has given me a headache.

The notion that Tesla has produced or delivered 9,000 cars is inane. I am convinced that they have substantively exceeded guidance. True believers (myself included), shorts, and analysts will be left to their own anecdotal evidence.

My wife and daughter both work at the Century City Mall. Once or twice a week I pick one of them up in front of the Tesla Motors store. My anecdotal evidence is floor traffic of the Century City Mall Tesla store. I'm all in on Q3. Place your bets gentlemen.�

Oct 12, 2013

bareyb When are they going to release the Q3 report? I thought it was supposed to be on the 6th...�

Oct 12, 2013

borat99 No official date announced yet. Tentatively November 6th.�

Oct 12, 2013

bonnie November 6th is only a date that was guessed at by some analysts. And we're not even close to that date yet.�

Oct 12, 2013

Vger Like many maturing companies with complicated and rapidly changing financials, Tesla reports in the SECOND month after the end of the quarter, and the date is not yet predictable (its phase and day or the week shifts Q to Q). They will announce it about two weeks before the intended date.�

Oct 12, 2013

RobStark I think this largely describes the American Midwest and American South.

Most people know the American Midwest produces lots of cars but.....

Tennessee has Nissan and Volkswagen.

Kentucky has GM's Bowling Green and Toyota in Georgetown.

South Carolina has BMW.

Alabama has Hyundai,Honda and Mercedes Benz.

Texas has GM's SUV plant in Arlington and Toyota in San Antonio.

Mississippi has Nissan and Toyota.

Georgia has Kia.

In the American South buying local can mean buying a Ford or GM SUV. Or a German or Asian CUV.�

Oct 12, 2013

maekuz I changed my mind and you can find the Model S registrations attached: View attachment 131012_Tesla_Fundamentals.xlsx

Please note that the numbers are far from perfect and i rather see it as a method to counter-check the VIN-based approach. Any feedback and input from all of you is highly appreciated, whether its updated numbers or countries i forgot or other reasons why the number might be to high or to low. I am pondering in particular if there could be reasons why a registration might not be a delivery in Tesla Motors books (apart from being a lease i mean).

In my opinion it looks like a real blow-out quarter even though its not that ridiculous high number from that troubling value walk article. Guidance is "slightly over 5,000 cars delivered" and i think we are looking at something like a 30% beat of that guidance.

Last but not least thank you all for your PMs and postings. I hope this helps.�

Oct 12, 2013

AlMc Thanks. Your figure correlates well with Craig's projections based on his VIN number collection, graphing and regression analysis. My guestimation was 6,500 so I like your numbers as it supports mine :wink:�

Oct 12, 2013

EV2BFREE Thank you for the info, it was very reliable last quarter. I would like to know your take on the Average Sales Price for the Model S in the most recent quarter(Q3). I would assume just about all of the deliveries overseas would be of the P85+ or P85s version because those are the cars that are built first. I will be looking through the Q2 report to see if they have any estimations that would be regarding the mix of the different models and check back with my findings.�

Oct 12, 2013

AlMc Most of European delivers would be SigS, 85P and 85P+�

Oct 12, 2013

StapleGun Thanks for sharing! Seeing more methodologies used to make estimates never hurts.

Your data is heavily reliant on the USA projections. The Detroit Free Press link is using autodata estimates which have not been very reliable in the past, and I cannot access the autoline report (paid content) so I'm curious where that data comes from. Although I think this has produced a reasonable estimate, I'm still going to rely more on the VIN analysis when placing my Q3 bets. However this type of modeling will become more important in the future as sales are spread more evenly across even more countries.�

Oct 12, 2013

maekuz As for the US data: July numbers are a autodata estimates but the numbers for august and september seem to be actual registration data. The autoline numbers can be found via the links i included in the excel sheet. The numbers are reported in their video news and they even provide a transcript. Autoline quotes ward automotive as source who claim to use registration data.

I think the results of the registration data match quite well with the several VIN-based estimates posted here on the board.

I for one will go in with 6500 Model S deliveries for Q3 results which is a tremendous beat by way over 1,000 cars. I think the Wallstreet whisper number might be around 5,800 so we should be good after the Q3 call.�

Oct 13, 2013

Benz Wow, it's getting more and more likely that the Model S deliveries in Q3 2013 are way above 6,000 (what I was hoping for), and if it really appears to be around 6,500 than that would be really awesome. I am already looking forward to the Q3 2013 Earnings Conference Call of next month.�

Oct 13, 2013

Ludus The main problem meme with over optimism is the notion that the VIN numbers are sequential and if current delivery VINs are X it strongly implies that deliveries for the quarter are really X minus 2nd quarter totals. Can anyone explain what's really known about VIN numbers?

I think getting the simple facts better circulated would help counter expectations that production has doubled, which of course could lead to people finding otherwise spectacular 3rd quarter production (like 6500) disappointing.�

Oct 13, 2013

StapleGun As you said, the autoline site links to this wards auto page which is the paid content I was referring to. I did not see any sources listed though. Where did you see that they use registration data for these? Autodata estimated 1950 for August so we at least know the numbers are not coming from there.�

Oct 13, 2013

Theshadows If you go to the teslamotors forums, the vin forum they also have approximated gaps. They have outlined the larger gaps. And they could mean that vins were skipped or just that the people that got assigned those vins don't spend time in any forums. Which is going to be more likely as we transition out of the early adopters phase.�

Oct 13, 2013

AlMc I am one that believes that the delivery amount will be close to 6,500 this quarter. However, I do agree that I could be wrong. Since TM does not reveal delivery figures weekly/monthly then everyone is left to speculate on the actual numbers. My prediction is based on some postings about actual European deliveries on this forum and trying to use VINs assigned to speculate on US delivery numbers. I could be way off and I doubt anyone is listening to one person's questimation to invest their money. Just one person's 2 cents/opinion. Everyone has to do their own due diligence.�

Oct 13, 2013

cfOH I did a gap analysis on the VIN data I've been collecting and see no reason to believe that Tesla has methodically skipped a large number of VINs recently, and certainly not regularly. The gaps (spaces between reported VINs) are distributed approximately geometrically, which is what you'd expect if they were random. If there was a purposive big gap, it would've showed up quite readily.

Now, it's possible that Tesla has skipped a SMALL number (e.g., <100) VINs once...I don't think my dataset is large enough to detect something that small and limited to a single instance. But, even if that has happened, it's not going to affect VIN assignment rate estimates much at all...the rest of the user-submitted data would drown it out (technically speaking ;-) ).

I don't have enough VIN assignment data from Q2 to use Q2 production/delivery figures as a guide for converting "VINs assigned" to "cars delivered." But, once we get Q3 data, I'll be in a much better position for guesstimating Q4 numbers. If I'm a masochist, I'll add a "cars delivered" estimator to my chart. [gets the aspirin]�

Oct 13, 2013

AlMc Craig...You are the MAN :biggrin: I will be sending a shipment of enteric coated aspirin to Ohio along with a pair of worn, but still useable Michelin Pilot tires! I will see if Lola will donate a worn pair as well!

But in all seriousness...Thanks for all your efforts. Al�

Oct 13, 2013

Convert2013 I think 6000 + is reasonable for Q3. Organic growth has really begun to take off from around the middle of summer so likely a larger number than 6K.�

Oct 13, 2013

sleepyhead Thanks for your effort.

Anything we can do to spread the truth on Tesla will lead to a fair valuation of the company and less volatility in the stock price.�

Oct 13, 2013

DaveT Can you share more about your VIN analysis? When in the process does Tesla assign a VIN and how long after is the car produced and then delivered? Does it vary by model? How long after an assigned VIN are European customers receiving their cars? Also, what's your best guess with Q3 production based on your VIN analysis, and can you share how you reach that number?�

Oct 14, 2013

DonPedro Just a reminder to everyone: Whatever you think the Q3 production figure is, you have to subtract the cars in transit to Europe before you have a number for deliveriese. (Or more precisely, the increase in cars-in-transit).

Also, I have seen no discussion of the train that was derailed in Texas, resulting in the totalling of a number of TMS that were on their way to Europe. I have no idea how many cars were affected - a couple of guys on the Norwegian forum were affected, but didn't seem like a huge number.

Elon has previously guided that they would exit 2013 with a production rate of maybe 24k/year (from memory). I think that doing that rate on average in Q3 would be a great result. That would mean a production of 6k cars (despite the first week of July being off). If EU-bound cars are 1k, then that would mean 5k deliveries. I would be impressed by that number. I think 6-6.5k figures being circulated here would be completely breakout results, and I am very skeptical of those levels.

EDIT: I think we will be quite astonished on the Average Sales Price (ASP). European cars tend to be very high specced on average.�

Oct 14, 2013

Mario Kadastik I think the train wreck is not a problem. You can consider them instant deliveries because insurance pays for them and Tesla had to remanufacture the car again. If the crash was for batteries only, well then the cars were delayed, but the cost in the crash is recovered so any profit from equipment on the train would be doubled.�

Oct 14, 2013

smorgasbord It's almost a certainty that they skipped between the Sig and Production series - that was reported on TMC contemporaneously at the time back when almost everyone getting a Model S was on TMC. But, probably just about hundred, and like you say, doesn't really affect anything, especially if we look at the delta from last quarter.�

Oct 14, 2013

ItsNotAboutTheMoney I think that with production constraints, that's a reasonable point as they'd be more likely to insure at a value that covers lost profit. It would depend on premiums. In the future, if Tesla gets beyond constraints they'd lower their premium and only insure for cost.�

Oct 14, 2013

Buran Ok, I'll chip in my estimated deliveries for Q3: 6100. I have tracked VINs, not in terms of assignment, but in terms of actual deliveries, as I think this (surprise) captures deliveries better ;-)

Was very close on deliveries in Q2, but it is more uncertain now due to the EU pipe. I have actually subtracted almost 1000 cars net increase of the delivery pipeline in Q3 and some additional loaners.

Finally, it is rather complex to estimate actual average this Q due to the late arrival of VINs to EU. You see this clearly in the different cluster of data points in the graph, you also see clearly the batching going on (blue circles).

I'm fairly certain of 6100, as this seem to be a reasonable surprise to continue the momentum toward some 23000 deliveries for the year (what my data point at right now). Notice the progressively higher surprises Q to Q. You cant reasonably expect more progress than this. However, it might be even better if the pipe to EU is really well managed. I.e., the EU cars delivered in Q3 were (very strategically) mostly batched (i.e., built) in the middle of Q3, so it might be that fewer are in the pipe!

Also, I believe that the ASP will be great, my guess is 95kUSD, leading to non GAAP revenue of 664 m (GAAP 523).

For the bottom line I only think there will be very slight non-GAAP profit, and a GAAP loss on par with Q2, due to the rapid expansion of everything, and associated increasing costs. I also think Elon et al. were very cautious of us expecting to much of a profit for Q3 in the Q2 conference call. I think they will make it, but not by much. So, on average, unless there is surprise again in the revenue figures (I have been to conservative with these before) the market is now quite on par. (Yahoo finance say average (non-GAAP) revenue will be 533m). I don't expect a huge surprise this time, which is also reasonable, as the market now have had a full year of surprises to digest, they should be better at estimating Tesla's books by now.

/Buran

Additional legend for the figure:

Black vertical lines = Qs

Black horizontal lines =Guidance delivery

Green horizontal lines, past time = actual delivery

Green horizontal lines, future time = my estimates

Black trend lines: Top = naked eye linear regression based on my feeling of how much is end of the Q rush.

Black trend lines: Bottom = Same slope as top line, centered on EU deliveries

Black trend lines: Mid = Same slope as top and bottom line, placed at 2/3 US deliveries, and 1/3 EU deliveries (reported balance between them at TMC as far as I can judge)�

Oct 14, 2013

uselesslogin I feel compelled to mention the train derailed in Nebraska and not Texas. Although I could imagine most people in Norway wouldn't know the difference between Texas and Nebraska. For that matter many Americans who live on the coasts don't know the difference either.�

Oct 14, 2013

DonPedro Actually, many Norwegians would know (when you like in a small country, geography abroad becomes more important). However, the following article was posted on the forum along with the laments from those who lost their cars: http://www.usatoday.com/story/news/nation/2013/09/25/train-texas-amarillo-crash/2867843/

I assume that someone just google-newsed this and thought it was a good fit. Actually, I was wondering a bit about the train route, but just assumed there was some logic in going via the Gulf of Mexico or something like that.�

Oct 14, 2013

Chickenlittle I like your logic, the train wreck helped them realize cash quicker.�

Oct 14, 2013

uselesslogin Ah, I see. This is the derailment I had heard of:

http://columbustelegram.com/news/local/train-derails-in-merrick-county/article_3e1fb644-23ae-11e3-8064-001a4bcf887a.html

That one actually makes more sense since it wouldn't make much sense for Teslas going from the San Francisco area to the port of New York to go through Texas. Actually, someone who would seem to be the husband of a Tesla employee posted a pretty convincing "fictional" story about electric motorcycles and the state of Bebraska and country of Borway on the Tesla forums that essentially confirmed that was the train. However, he has since deleted that post.�

Oct 14, 2013

StapleGun Excellent data and analysis Buran!

I'm intrigued by the big clump of non-EU VINs in the 21000-23000 range right before the Q3 line. Looks like a dead give-away that they rushed out quite a few cars in the US just before the end of the quarter, but there's also a similar smaller clump of EU deliveries too. To me this all looks like a very calculated effort to maximize Q3 numbers. I agree with most of your estimates but I think 1000 cars in-transport is too high.

Also, I haven't heard much about the loaner situation lately but if they are still consistently sold out then it shouldn't have much of an effect on the quarterly numbers.�

Oct 15, 2013

RationalOptimist There's one wrinkle in using VIN data to estimate Q3 revenues that hasn't been talked about much. Most people seem to be making the assumption that VINs are issued just before production of the car. So if production + delivery = average of 3 weeks in US, they assume that VIN issued between first week of June and first week of Sept are an approximate proxy for Q3 deliveries (less some number for net increase in European cars in transit, which many are pegging at 1000.) This gives sales estimates of 7,000 or higher for the quarter, which suggests a massive earnings blowout.

But there's no guarantee that issuance of a VIN means production about to start. It may simply mean that a car is scheduled for production. If demand is increasing faster than production is scaling up, it may well be that the time period between VIN and production is increasing. That would mean that sales numbers will fall further and further behind VIN issuance. On Craig's thread over at Tesla Motors, there are signs that for both Americans and (especially) Europeans, the time between VIN issuance and production is lengthening to as much as 2 months. If so, that's an amazing story on demand acceleration, but may not fully translate to sales.

It's legitimate to be excited about the acceleration in demand and production... but we shd be wary in our assumptions of how many of those VINs will make it into Q3 sales. (I'm long Tesla, and still believe Q3 will be terrific. Just concerned that some are getting overexcited.)�

Oct 15, 2013

AlMc Agreed. The Q3 production levels are very much a guestimation. Will be interesting to see the actual number.�

Oct 15, 2013

Mario Kadastik I think you are basing this somewhat on what I wrote there and it's true. I got assigned a VIN on Oct 4th and according to Tesla it's likely my car will enter production end of December / early January. This means that there's 2-3 month difference between VIN assigned to actual production start for some EU deliveries. The same goes for a friend of mine who's ordered an S60 in May, got the VIN a few weeks before me and his estimate is end of November/early December production start. So at least some EU VINs will be assigned months before cars even enter production. Not sure how profound an effect it is though.�

Oct 15, 2013

maekuz This is what i feared, see paragraph 4: Twitter / valuewalk: More pain for the shorts! $TSLA ...

The whisper number for Q3 may be at unreachable heights now.�

Oct 15, 2013

Mario Kadastik Well if all the investors take this is pure truth, then the play for earnings changes. We just have to hedge the day of earnings or 1-2 days before because such news should cause a serious run up pre-earnings so it'll be a buy the rumor sell the news type of play. Tesla will correct the understanding of people in the ER and once everyone settles back the run will continue. It's just a question mostly of wether the run up to earnings will be the main action or after ER. If you're already invested now, then it hardly matters which one will be realized �

�

Oct 15, 2013

vgrinshpun I would not be concerned about this at all. This is all but forgone conclusion that Q3 production is above 7,000 units as the average production in Q3 exceeded 600 cars/week. The unknown is total deliveries in Q3, as discussed extensively on this Forum.�

Oct 15, 2013

AlMc I am long and on the optimistic side of average for my production numbers for Q3, but 7K seems high even for me.�

Oct 15, 2013

vgrinshpun Well, just consider the information that is out on this forum. In one of the deliveries threads there were reports about production reaching 600 cars/week by the beginning of Q3. Several posts also reported 700 cars/week starting first half of September. Given 12 production weeks in Q3, and making very conservative assumption of average production of 600 cars/week yields 7,200 cars produced in Q3.�

Oct 15, 2013

AlMc Be nice if you are correct.....we shall see�

Oct 15, 2013

fjm9898 take into account cars in transit to the EU and that cars produced in Q3 is different then cars delivered from that 7,200 and i see the actual numbers more in the 6,500 range. i hope i am wrong and alot of the optimistic people out there are right, but will we will only truly know from the ER�

Oct 15, 2013

Benz Maybe I am being a bit conservative, but I think that even if the total number of deliveries in Q3 2013 appear to be 6,000 then that would be a great success on it's own already, because that would mean that they managed to realise an increase of 20% compared to Q2 2013. That would be a good sign of progress already. And any number above 6,000 deliveries would mean that they managed to realise an increase even higher than 20%. That would be awesome. I am really looking forward to the Q3 2013 Earnings Conference Call of next month.�

Oct 15, 2013

vgrinshpun Of course quantity of delivered cars will be less than produced, but I would caution against calling it "actual numbers" as you might condition yourself for not seing forest behind the trees.

I undersatnd why there is a focus on delivered cars, as this contributes to the bottom line in the reported quarter, but with so much of Tesla buzz linked to the future prospects of the company, one can argue that quantity of produced cars is a more important number to consider. It indicates that demand is strong and growing by leaps (every car produced is sold before it entered production) and that Tesla, in spite of prior public statements about difficulties of scaling production quickly, nevertherless was able to keep up with the demand, as indicated by the fact that the wait time did not increase during the Q3.

As the "pipeline primed" with vehicles produced but not delivered yet, starting with Q4 we will see a close match between the cars produced and delivered, similarl to what was observed during the Q2 (5454 cars produced, 5150 delivered). In fact if Tesla wants, they can really blow the lid off the pressure cooker by front loading Q4 production with European delivery cars (there are indications that they are doing just that - just browse through the deliveries threads on this Forum), and delivering 1000 MORE cars that they produced in Q4. The average production in Q4 is likely to be around 750 cars/week for a total of 9000 produced + 1000 produced but not delivered in Q3 = 10,000�

Oct 15, 2013

fjm9898 I would agree with you but the Street can be a cruel place. If analysis start to up their predictions to 7,000 cars and only realize 6,500 then that is a loss even though they produced more then last quarter. With the street you have to beat on all fronts to get a ER win, and even if you do, you might not get it. I am just saying be cautious. We all know Tesla is making more cars and doing better, just dont get to pie in the sky.�

Oct 15, 2013

DaveT Just a heads up guys. Q3 ER is unique in that Tesla should be announcing FY 2014 guidance. So, for previous quarters it was all about # cars sold, revenue, profit, etc... but for Q3 ER it will be all about guidance for 2014. Actual Q3 numbers won't mean as much as they did in previous quarters.

There's also the possibility that Tesla could pre-announce FY 2014 guidance before Q3 ER as well.

Here's my initial thoughts on FY 2014 guidance and it's affect on the stock price (this will change depending on the current price of the stock but are my current thoughts at $185-190):

FY 2014 guidance below 35,000 cars sold - disappointing, stock takes a hit

FY 2014 guidance at 35,000 cars sold - pretty good, can sustain stock price growth

FY 2014 guidance between 35,000-40,000 cars sold - very good, should bump up stock price

FY 2014 guidance above 40,000 cars sold - complete blowout, stock goes to $250+�

Oct 15, 2013

Convert2013 Elon has already said he expects to sell 40K cars in 2014...�

Oct 15, 2013

vgrinshpun There is more, listening to Elon public statements, I came to believe that the internal Tesla thinking is that the initially planned maximum production for Model S/X platform of 100K cars/year will need to be increased in order to meet the anticipated demand. This will require advanced planning and allocation of capital for the additional equipment and installation. Because the decision will have to be made in advance in order to allow time for upgrading the factory, we might learn about this pretty soon, may be Q4 ER or even Q3. This will also require that Tesla rethink their planning for future factories, as such a strong demand for the Model S/X platform should bode extremely well for the Gen III platform. Tesla will need to scramble with new factories as space remaining after adding second line for Model S/X platform will reduce capacity available for Gen III to may be 300K from originally planned 400K, all while indications are that demand could be much higher than the originally planned capacity of 400K.�

Oct 15, 2013

ModelS8794 I recall him saying they'd want to exit 2014 at a 40k production runrate. that is very different from expecting 40k sales in 2014.�

Oct 15, 2013

Larken Trying to gauge the demand and the number of vehicles sold and produced is a very good way to guess how the stock will react and where it will move. But let's not forget that TSLA is not only about the # of cars sold. Elon is a Master on playing the stock and we all know Elons rabbit hat is very deep. I am sure that he has many more positive catalysts, besides the number of vehicles, that will push the share price further up and these will be released with perfect timing. So even if some analysts are setting a very high number on delivered cars and Tesla won't match that, we will most certainly have other great news.�

Oct 15, 2013

RationalOptimist Correct. To my knowledge he's never got close to suggesting 40k sales in 2014, though at the shareholder meeting, I believe he did indicate global demand at that level. One of the biggest milestones of Q3 earnings may be the news that he's reached that annual production run-rate a full year earlier than promised.�

Oct 15, 2013

spacekadet Hi everyone,

What's your prediction for earnings per share for Q3? It looks like the street's estimate is $0.12/share... I'm sure it'll be higher, but will it be a blowout?�

Oct 15, 2013

Clprenz To my most conservative estimate: $.43 a share, I felt great about Q1, I felt good about Q2, I feel amazing/extremely excited. I put some of my first bets when the Tesla Fire happened. I bought some NOV 16 $175 calls, I'm already seeing great gains�

Oct 15, 2013

TSLAopt TSLA (Tesla Motors, Inc.) – Q3 2013

the above link gives an idea of what people who may not be drinking the kool-aid like us think the Q3 earnings will be. Looks like average is around 22 cents per share�

Oct 15, 2013

SciGuy13 Don't you think that if the public sentiment/perception about Q3 production was getting wildly out of hand that Musk would tweet (within SEC rules) something to tamp things down. It is not in Tesla's best interests for the public to be expecting way more than he knows they will deliver.

Somehow I think he is smiling and enjoying all this talk about Q3 production knowing full well he is going to beat even the wild estimates in the public domain.�

Oct 16, 2013

marvinat0rz Model S will not be the best-selling car in Norway in October and November. This is in line with what people were expecting.

Dagens N�ringsliv report that 43 cars are registered this far into October (halfway), in contrast to 616 for all of September. Tesla expects to sell 2000 cars in 2013 (according to local representative), and the waiting list to get a car is five months.

http://bil.aftenposten.no/bil/2000-Tesla-til-Norge-i-ar-53425.html

Nice quote from the reporter: "Performance-wise, Tesla offers champagne and caviar for the price of a hot dog and a beer." Probably also worth to note that this story is on the front page of at least two Norwegian online newspapers today (free publicity)�

Oct 16, 2013

ModelS8794 This is circumstantial evidence that tesla batched European and US production to maximize 3Q deliveries and minimize inventory in transit. If transit times - i guess I mean time between VIN assignment and delivery so not just transit - are 45 days (I think that's the case but not sure) then we should expect Norway deliveries to get hot and heavy again in first or second week of November and on through December.�

Oct 16, 2013

marvinat0rz Good observation. I had the feeling that there was some information in this large delivery discrepancy, but couldn't quite put my finger on it.�

Oct 17, 2013

DonPedro I am a bit disappointed if this is true. I've always felt that it is operationally and culturally wrong for companies to "game" the quarterly results. In this case they are trying to avoid a one-off effect that could be reasonably explained in the earnings call. They are just postponing the problem to the next quarter, so they have to keep doing it.

Hopefully it does not entail a lot of disruption to what should be a smooth operation. But certainly the EU delivery specialists that were very busy in September must be quite idle now? I am sure that this is not the most optimal way to run the company from a long term value perspective, unless they are raising equity soon and therefore need to pump the share price (which I am quite sure they don't).�

Oct 17, 2013

DonPedro Re. Q3 and Q4: Tesla previously guided that deliveries in Norway would be 800 (Q3+Q4). Now Norwegian Tesla rep says ~2,000 in local press: http://bil.bt.no/bil/2000-Tesla-til-Norge-i-ar-53425.html#.Ul_1-1BkNMU

...which makes Norway deliveries almost 15-20% of total in Q3+Q4?�

Không có nhận xét nào:

Đăng nhận xét