1/1/2015

guest Yeah but that was the plan to begin with so when they said they can produce more within the same building I guess it's kind of open for interpretation and mine was that it was about volumetric efficiency. But now that I think about it, that totally qualifies as jumping to conclusions �

�

1/1/2015

guest The cells are being made by Panasonic employees running machines supplied by Panasonic. Yet somehow this puts Tesla in a superior financial position? I do think Panasonic probably does have next gen. equipment with their IP in the building. I don't think Musk has convinced Panasonic that they should run their business as a non-profit to benefit Tesla.

Panasonic would want to shift risk to Tesla, so the terms of the cell sale is probably cost plus. Tesla also bought enough years of production that the machines became a capital lease for Tesla.�

1/1/2015

guest But who's IP are they using? Initially it was Panasonic, but as I understand it the chemistry is all Tesla's now.

We don't know the nature of the contract between Panasonic and Tesla. It could be similar to the relationship between Apple and Foxconn where Apple owns all the IP and Foxconn just does the manufacturing. Or you're right and Panasonic holds all the cards.�

1/1/2015

guest Some seem to think one or the other has to have the upper hand. There is such a thing as a mutually beneficial partnership. Elon Musk has always given the impression of being very fair; ie. the entire Nevada deal, releasing patents, willingness to partner with others in the SuperCharger Network, etc...�

1/1/2015

guest Have to quote Elon here in re: Nevada, "The House always wins..."

BTW it was edifying to hear Elon's perspective of the Nevada deal, and makes a lot of sense. Most of the criticism in state only looked at the numbers, but never seemed to go into details.�

1/1/2015

guest

Lithium ion is probably maturing as a technology, and every competent company knows how to make decent EV cells. How to make those cells inexpensively, and how to use the cells effectively are likely the key. Every major innovation goes through a phase where experts have insider knowledge that then becomes common knowledge. Like the early days of PC, where people questioned whether IBM clones were as good as IBM PCs. Everyone reverse engineers everyone else stuff, and pretty soon a lot of people are expert.

I expect the key parts of the deal with Panasonic is capital expenditure and risk. Panasonic is not going to bet the company on Tesla. Tesla needs massive capital investments (on or off their balance sheet) to exploit their opportunity.�

1/1/2015

guest At the shareholder meeting I remember JB or someone saying that there are parts of the GF that have to kept sealed off because of Panasonic's proprietary machinery.�

1/1/2015

guest Yes.

Tesla is also involved though with the innovations that led to the fact that they can get 3x the production from the same factory footprint.

Panasonic signed on to the project a short time after they stated that they were convinced that the 30% reduction figure given by Tesla was a conservative estimate. They are not stupid, and I'm sure that they can see from the TE demand, and the M3 demand that the GF is going to be a mint.

I'm sure that Tesla is treating them well and that they consider their relationship with Tesla to be mutually beneficial.�

1/1/2015

guest I have an idea, about how Tesla plans to get from 30% to 50% and (I think I have posted the timing information before) part of the reason they are confident that they can ramp cell production very quickly:

Tesla and Panasonic will be using custom cell manufacturing equipment at the GF, and that will have a big impact on the cost reductions. Producing the custom equipment for the first production line will cost much more, and take much longer, than building six additional production lines (assuming 7 phases). This explains both the added 20% cost savings, and is part of the reason they are confident that they can ramp cell production for both the M3 and TE.

�

1/1/2015

guest Tougher California rules may knock Toyota off eco-car perch- Nikkei Asian Review

The state has gradually tightened emissions regulations since they were first put into place back in 1990. It decided in 2012 to stop counting hybrids as zero-emissions vehicles as of 2018 -- an edict covering the Prius.�

1/1/2015

guest Why would they ever have been counted as zero emission vehicles? 100% of their energy comes from creating emissions. Strange definition of the word "zero"�

1/1/2015

guest It's California, so "zero emissions" for them means "no smog in the Los Angeles basin".�

1/1/2015

guest Hybrids run on gasoline...they create smog...�

1/1/2015

guest Related only to general surrounding issues to tech companies like Tesla-

None-the-less interesting and good to know as background knowledge

U.S. court backs landmark Obama internet equal-access rules - Reuters

U.S. court backs landmark Obama internet equal-access rules�

1/1/2015

guest I hope DaveT, and others chime in.

Clearly the current fair value, at the close on Friday June 17, was (check the SP) $215.43.

What you want to know of course is the future value, which depends on future events. Figuring that out is difficult because there are several interrelated factors, and those factors are not black and white. Between now and whenever you think Tesla will produce over 100k M3's I think it could be a bumpy ride.

The main determinant of SP is income. In the past that has mostly meant auto production, but in the very near future TE will start having a huge impact on earnings.

AT the 2016 shareholders meeting Elon said that (he said this was highly speculative) that he thinks that the revenue from TE will be equal to the revenue from cars, and that it will grow faster. Below I use half of Elon's projected numbers for car production to generate some rough estimates. If the M3 slips that should be more likely to trigger an increase in TE (leftover cells). That should be the revenue equivalent to about 220k cars in 2017, 250k in 2018 and 350k in 2019.

I think the worst case is that Tesla is 4-5 months late with Model 3 production and produces about half of Elon's projections, so zero in 2017, and roughly 200k in 2018. Plus conservative MS-MX numbers of 120k in 2017 and 140k (total 340k) in 2018. For 2019 I'll use Elon's 500k figure of 500k total.

2017 totals 120k cars plus the equivalent revenue of 220k cars = 340k

2018 totals 340k cars plus the equivalent revenue of 250k cars = 590k

2019 totals 500k cars plus the equivalent revenue of 350k cars = 850k

I am very confident that they will do better that, but not confident to depend on that for use as an investment (need a Plan B). My absolute worst case, for planning is that Tesla is 12 months late with Model 3 production and produces about half of Elon's projections, so about 50k M3, at the end of 2018 (total about 190k) and about 250k M3 (total about 400k) by end of 2019.

2017 totals 120k cars plus the equivalent revenue of 220k cars = 340k

2018 totals 190k cars plus the equivalent revenue of 250k cars = 440k

2019 totals 400k cars plus the equivalent revenue of 350k cars = 750k

One estimate for SP, based higher vehicle deliveries, and not considering the impact of Tesla Energy Storage (TE):

The following was posted on Jan 6, 2014. about 2 years before the M3 reveal, and the accelerated ramp plans were announced.

Articles/megaposts by DaveT

So we should have the revenue equivalent in 2017 of at least 340k cars by 2017, (with zero M3!) 440k by 2018 and 750k by 2019.

Using half of DaveT's numbers for:

340k gets us to an SP of $315 by 2017

$407 based on 440k, by 2018

and over $630 (based on 750k or 850k) by 2019.�

1/1/2015

guest [Edit: Mitch posted this in the short term thread, and I liked the idea of continuing discussion of the moat over here. Not intended as a direct reply to the fair value discussion.]

Yes, the multiple visions, especially the depth of alignment among them...what's good for Mars is great for TM, and eventually superb for TSLA.

For example, Elon has said that the Mars vision requires, in spades: 1) lots of money; and 2) new ability to manufacture large complex objects by redirecting engineering focus onto the manufacturing process, utilizing physics' first principles (density, volume, & velocity of an assembly line).

His personal contribution to #1 is in considerable degree a function of maximizing TSLA SP in whatever timeframe he sees (10-15 years?) as realizable for TM (TA+TE) and jumpstart Mars funding. #2 is a steroid injection for #1, and a requirement for Mars.

Understanding the intertwined & aligned visions like these can help an investor add a few more pixels to the resolution of one's thesis imagery, which is of course refined as stuff happens (or doesn't). After Q1 the market would basically like to put Elon in time out until "proven" production & financial performance. What he sees instead is the need & ability to lay the groundwork for performance at levels that don't compute when viewing through that market's limited lens. That's all fine and dandy for idealists and dreamers, but it's these interwoven visions that ensure sufficient willingness, coupled with demonstrated competency (engineering & business), to take on whatever obstacle blocks realization of the vision.

An engineer's biggest strength and most vulnerable weakness both, is a singular focus on engineering. If you take that focus and place it on integrated, well-thought-out vision(s), and then apply your unmatched engineering competence as a tool to realize that vision, you have Tesla Motors' secret sauce. Daimler just unveiled their vision, a comparison reveals one measure of the depth and breadth of the TM moat.

As DaveT pointed out in his megapost thread, for 2015 and early this year TM looked more like his Tesla 1.0 or 1.5, but for me this understanding points to significant evidence of Tesla 3.0 becoming a reality...and that's not even close to the ceiling.�

1/1/2015

guest ![[?IMG]](https://staticseekingalpha.a.ssl.fastly.net/uploads/2016/6/14499292_14663935852486_rId13.png) �

�

1/1/2015

guest The long-term fundamentals of TSLA will change profoundly thanks to the merger with SCTY.

This is what Morgan Stanley outlined in a great note back in February 2014 (very visionary looking back):

Source: Tesla's Next Trillion Dollar Industry

- SCTY merger will check the "electric utility" side box.

- Gigafactory 1-3 (one each NA, Europe, Asia) will seal the "battery" part.

Now what about the autonomous vehicle side?

I think another merger with a AI car company makes sense to speed things up. The worst thing would be to waste precious time and let legacy car companies pick up car AI / autonomous vehicle start-ups once they realize they are late in the game. Tesla should seal the deal and spend a few billion $ on the most promising ventures in this area in 2016 (spend billions to make trillions, see chart for huge TAM size! Another no brainer!).

Finally, Tesla should start building new car factories in Europe and China asap to be able to meet the huge demand for these AI cars. Luckily, the China factory MOU has already been signed:

Tesla looking to build a factory in China

And all of that is achieved while maintaining the new "cash is king" mantra and with minimal dilution. The new CFO and Musk work hand in hand.

What's left? Analysts "getting" the new Tesla.

I think Morgan Stanley will soon raise their PT on Tesla now that the grand strategy outlined in 2014 is being executed like clockwork only two years later.

Since Musk himself mentioned that the "new Tesla" (see chart above) could be worth a trillion $ over time I think four-digit price targets ($1000 to $2000 is my conservative estimate) for Tesla will soon follow by the smart sell-side on Wall Street.�

1/1/2015

guest I've counted 61,263 discussions here on TMC. So there are 61,262 threads left where you can share your sarcasm. Perhaps you can post one joke every 10 messages, this will keep you busy til the Gigafactory opening.�

1/1/2015

guest I'm serious. My post above discusses the SCTY x TSLA merger and creating new revenue opportunities and synergies - therefore altering Tesla's fundamentals at the core. Please add to the discussion how this alters Tesla's fundamentals going forward, thanks.

PS: Unfortunately, Morgan Stanley seems to have flip-flopped on the 2014 note as of today:

Tesla (TSLA) target price cut 26% by Adam Jonas from Morgan Stanley following SolarCity deal

(Details discussed in the link)

This is very strange since the same analysts at Morgan Stanley so accurately predicted the possible synergies between solar, batteries and EVs back in early 2014 (see chart above). I'm disappointed.�

1/1/2015

guest So much hypocrisy. I'll pass, thank you.�

1/1/2015

guest They also have this thing called "Partial Zero Emission Vehicles" PZEV which is an oxymoron. Lots of run of the mill Subarus have this badge (with a green leaf).�

1/1/2015

guest I'm reading between the lines...Jonas is ambitious and conveying to be a bigger fan of autonomous driving than solar at this time for better or worse. He sees the future with Uber and worries this puts it off into the future.

I'm more surprised about tftf. What is your take? Sorry if I missed it.�

1/1/2015

guest Here it is, in Feb 2014: http://seekingalpha.com/article/2049833-teslas-new-markets-pricing-utopia

Then, in Jan 2015: http://seekingalpha.com/article/2818826-teslas-latest-sales-projection-for-2025-is-next-to-impossible-to-achieve

Then, in Feb 2016:Tesla's Last Hype Bullet For Years To Come Is About To Be Fired: The Model3 Unveiling In March 2016 - Then Reality (Hard Numbers And Execution) Will Finally Take Over - Tales From The Future

Then, in May 2016: A Tale Of Two EV Battery Makers: Daimler Versus Tesla (Continued From BYD Versus Tesla) - And Revisiting Tesla's Crazy 2018 Plans - Tales From The Future

Same short thesis since 2013.

That's enough free SEO juice for a hypocrite.�

1/1/2015

guest They were _never_ ZEVs. They were PZEVs. The key additional requirement for a PZEV is zero evaporative emissions. Since gasoline evaporates easily, eliminating them was seen as a big deal.�

1/1/2015

guest Or you could just have had a quick look at my signature instead of posting so many links not directly related to the topic (well my old February 2014 article is maybe useful concerning Tesla's long-term fundamentals).

But the question remains the same: Morgan Stanley's report note from 2/2014 added billions of $ in market value (while I'm just being sarcastic) instantly - based on proposed synergies between solar/distributed power, batteries and EVs/autonomous cars.

Now that TSLA is executing on this very strategy (proposed SCTY merger), MS is downgrading TSLA two years later.�

1/1/2015

guest @9837264723849 - Yeah, I'm familiar and I have been reading tftf's comments that seem to be either dry sarcasm or maybe something else

@tftf - What is your take? Or are you still of the same opinion that 9837264723849 displayed?�

1/1/2015

guest If anybody could send me the full research note I'd appreciate it.�

1/1/2015

guest If you read the note, it's clear that the concern is not the benefits of the merger itself, but because SCTY's current cash burn will add to TSLA's funding issues. That is, it's a downgrade on risk.�

1/1/2015

guest Cash burn is pure FUD. Listen to the conference call:

SCTY will be cash-flow positive very soon. Elon Musk said so on the call!

Here's the transcript with EM discussing SCTY becoming a net cash generator in just 3-6 months:

What more do we need to know? Elon Musk, the chairman of SCTY, says SCTY will generate cash within 3-6 months.

I doubt anyone writing a "note" has more inside knowledge.

Only the Internet is rumor-mongering about a "bailout" or "cash burn". Clearly trying to damage the proposed merger.

I'm glad Elon Musk firmly answered the cash-flow question on the SCTY call!�

1/1/2015

guest tftf, since you are on this thread, implicitly confirming you are still a short holder, I would be most intertested in your opinion on my post here Tracking short interest

I have the feeling I am overlooking something, so for a change I would be interested in hearing your opinion, as you can give feedback

from a short holders point of view.�

1/1/2015

guest I'm not short SCTY, but have been in the past. Closed my last position back in November 2015. Borrowing costs too high now and the stock has already fallen quite a bit.

But SCTY could go the way of SUNE (now SUNEQ). A good comment on SA about the merger:

"If Tesla had an independent board it would've waited to buy SCTY out of receivership".�

1/1/2015

guest I�ve been caught up in life events but found a window to post (although I�ve been following along with occasional likes!). Thought I would voice my thoughts regarding Tesla-SolarCity as I�ve received some behind the scenes pressure from long-time friends on this board to voice my perspective. Decided to put it here as it relates more to Tesla as SolarCity applies to it.

Lots of good posts and I generally have agreement with parts of many; However, I�d like to offer a alternative view (read bias) than currently in the other threads

A White noPaper

I�ll start with a warning and set of assumptions that I�m not particularly inclined to defend in discussion, as I�m time limited and have done so in the past ad-nauseam. So I�ll list them first and for those that disagree- I invite you to just save time and skip the rest.

[Also, this is from someone biographically with a deep history in technical R&D thru product development (Aerospace generally) and investment bias of long view companies (Apple, Disney, Google, Amazon type and Tesla of course)]

The conclusory elements (concluded long ago) for my Tesla investment thesis:

Assumptive Principles of Musk-World:

1) Tesla exists to fulfill one man�s vision (but now joined in vision by others like JB)- which was never about �making cars� (ala GM)- it was and is solely about the cheapest possible sustainable energy for humanity

2) Elon stated (and proven) operational core- fundamental 1st principles will guide strategic decisions;

-Hence disallowing all past and current industry segmentations to exist for Tesla

(disruptive across industries if needed to achieve the objective)

3) Strategic decisions will always serve the primary mission and operative

-Hence target ONLY the long-term (decades) consideration for core strategic decisions

(Solar City for current discussion example)

4) Tesla objective relative to the stated core goal above:

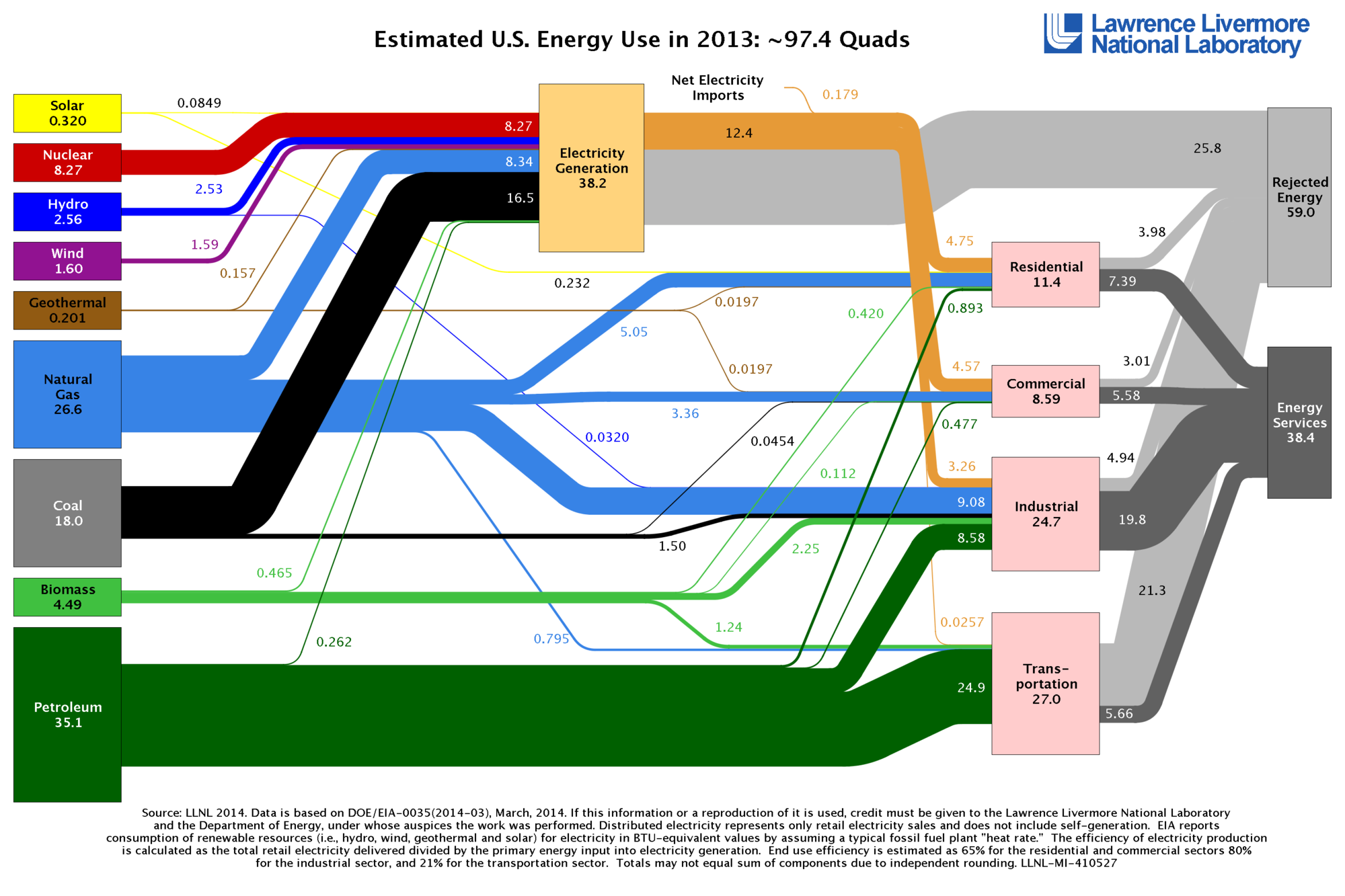

To eliminate carbon based fossil fuels as a source of energy from the marketplace ASAP. Transportation and Electricity Generation are BY FAR and simultaneously the largest and most inefficient conversion of those fuels to useful (human) energy

5) Humanity is first priority

-Hence �the customer comes first� defines the solution�s vertical integration from start to end.

i.e. Solutions both start and end with the individual human customer

Assumptive Conclusions for this discussion:

6) SolarCity is a separate company from Tesla in name only- it serves as a temporary strategic placeholder for the benefit of Tesla Energy, largely due to Musk time constraints.

7) The price of retail Electrical Power (read: rate of Electrical Energy used by humanity for it�s own purposes) is scheduled to approach (near)zero over the next 20 years, regardless of what (Power)Utilities do or don�t do, exist or don�t exist. Note I�m using Power here rather than Energy to denote inclusion of the rate of human Energy use on any time scale.

Above are my own conclusions based on my knowledge, due diligence, research and experience. They inform my investment decisions regarding Tesla. If you're strongly convinced they are not correct, I would just skip this post, assume the rest of it is based on the wrong conclusions, and won�t relate to your investment thesis- unfairly, I won�t be able to currently engage in discussions of those base assumptions (sorry- been there done that- and I�m exercising my 0th amendment rights of no-speech and it�s associate Pursuit of Happiness)

The Cadence of Elon

I think there is generally (including on this board) a cognitive dissonance of the Tesla dynamic relative to investments. It�s an unfair generalization that doesn�t apply to all but severe enough to create an addressable concern in my mind. When investing in Tesla, you�ll be best served IMO to contextualize your decisions in a world defined by Principles 1-5 above. It doesn�t matter what you or I think is actually correct, best, agree with- disagree with, etc. We aren�t and will never make, or have significant influence on, any primary strategic decision of Tesla. So it�s a fool�s errand to anticipate Tesla from a world constructed to conform with your past experience, life objectives, intellectual prowess, etc. It isn�t going to happen given 1-5 above. Your investment thesis for Tesla is served best to conform to Musk-Worldview, it�s stated objectives, and it�s operational character. [Note: I�m saying nothing about voicing opinion, but regardless of opinion investment decisions should frame inside Musk-World)

You�re investment thesis should constantly place your mind into that world described by 1-5 above and always ask yourself what would Elon do under those objectives?

The man in charge of your Tesla investment is hell bent on getting humanity to Mars. And in the meantime change the way humanity exists on Earth. If Earth isn�t considered a boundary for him, why would ANY boundaries (existing or fabricated) be placed on the Tesla mission in his world?

Industry segments, product segments, market segments, political segments, technology segments, manufacturing segments, social segments- Have you seen any of those come to play in any core strategic decision he ever made?

He doesn�t see those boundaries and neither should you for your Tesla investment. Issues of $1B funding here and $1B funding there are simply bothersome perturbations in the ether for the primary decision maker of your Tesla investment dollars. As they should be given the objective clearly stated (and proven by events thus far)- Right or wrong isn�t at issue here- nor is our own belief - we are not in control or in position to influence - we can only invest or not.

If you do invest in this venture, move yourself to the world of Elon -

You're going to Mars in 20 years. And Principles 1-5 above is how you�re going to get there.

It�s The Big Long - there�s nothing short, quick or small about it.

To be successful, Your Tesla investment must match The Cadence of Elon.

In that spirit I�m going to enter Musk-World to paint a picture of TeslaEnergy-SolarCity - even for things we already know and have discussed to help contextualize and inform what to expect:

Replace the Grid not the Fuel

Principle 4 (Eliminate Carbon Fuels) alone creates a solution that sells Solar Panels to Utilities both directly and indirectly through the end consumer of Power. Note in today�s world selling a consumer Solar Panels is financially viable only by using the Utility grid as storage/balancing/billing/support - (via Net Metering) Powering the Utility. This is the same as selling to the Utility itself with an indirect financial model that flows through the Consumer who perhaps unwittingly assumes the added risks of 1) decades long fixed price of Power and 2) unknown value effect of shelter asset, in exchange for what is currently a reduced Price of Power consumed. This is effectively a sale to the Utility using the consumers existing assets as a financial intermediary leverage against the future.

This fosters the PPA/Leases used by Solar City, is a sale to consumers in name only, couples both the physical and financial relationships to the current Power Utility Structure (requiring their full approval and cooperation) and current Industry delineations; And does not provide a vertically integrated solution as a consumer first start-end.

As such, concurrently violates Principles 1,2,3, and 5 to accomplish 4, and so is not a Musk-World solution, accordingly rejected by this investor as anything but temporary (I held a VERY tiny position in SCTY uncorrelated to Tesla, which I recently eliminated in exchange for more TSLA).

It is what the normal current business world would adopt and hence given Elon�s limited resource while he�s solving the bigger user of carbon fuels (mobility), Solar City serves as a placeholder to temporarily operate and build some momentum into that space. This is what drove my Conclusion 6 long ago. It is part of the eventual Tesla solution, but not currently part of the company- to be continued at a later time.

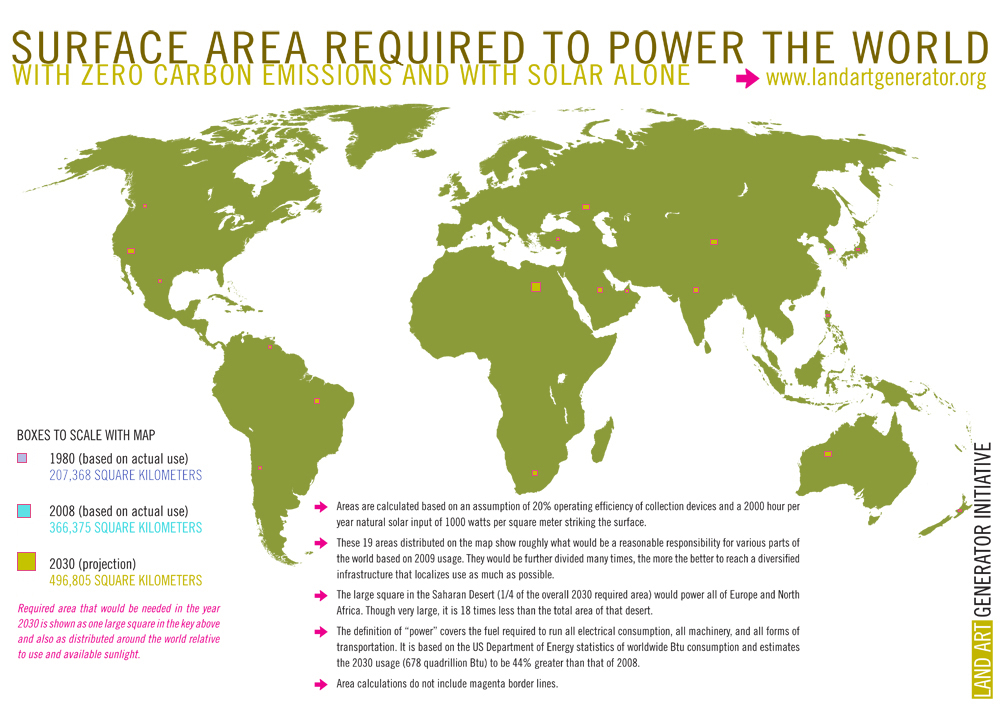

A Musk-World solution must incorporate Principles 1-5. The only conforming solution must replace the Grid between the Power source and the customer. The conceptual view in Musk-World is not that the Grid and it�s obvious advantages is eliminated- It�s simply redefined according to 1st Principles and as such replaced as part of the vertically integrated solution Power to the human-consumer (in both senses of that equation).

As such, the Grid is the celestial fusion reactor distributing Power directly at no cost to every human individual world wide. Cloud computing for Power. It�s the view of the Grid you would have from Mars.

Of course we all know this factually- but the Musk-World distinction is it defines the integral solution (technically and business) - crossing all current Industrial and Commerce boundaries and most importantly REQUIRES the consumer based solution to transform:

Power from a Service to a Product

That�s the key disruptive from a Musk-World view- financial, technological, relationship to consumer and all the business infrastructure required to secure it�s success is the Tesla mission to accomplish. This by definition means SolarCity (or certainly it�s equivalent) was always part of Tesla.

The transformation of mission in consumer-first speak:

With the right Product I can self-service my Power- and so the cost to produce the product becomes the long term Tesla quest, not the cost to produce the Power.

Photon grid receptors are by definition inside the vertically integrated Tesla Power Product (incorporating storage/support) connecting each Consumer to the new (photon)Grid directly.

The Tesla solution is a product that converts quantum level grid photons to electrical potential for all uses. The Tesla mission for the coming decades, to deliver this product solution at the lowest possible cost through innovation that vertically spans the grid source of photons with customer acquisition and support.

The technology of the product conversion and storage is an extension of the semi-conductor fundamentals of research, development, and manufacturing. The product will take the form of a single but multilayer sheeting, largely manufactured by 3D printing and related [again we are in 10+ year forward here_ aka the cadence of Musk World].

The single sheet layering will contain multi-junction multi-wavelength grid photon reception and conversion to free electrons, super capacitors doped into the same sheet to receive and store the free electrons; solid state inversion for delivery and a sink path to ground as safe discharge of excess energy balances input and output. Other than small micro-grids for high density populations, there is no 'market' for electrons as supply massively swamps any demand.

The analogy against current product structure (and extended technology/manufacturing basis) is best served by the cloud networked computer. The outer sheet layers converting photon to electrical is the CPU/GPU and the SuperCapacitance storage layer is Memory.

The Tesla mission per vertical integration principle provides all technology fundamentals to product design to material sourcing to manufacturing to production to customer acquisition to sales/marketing to product service to virtual upgrades.

Note: Conceptually this begins with fundamental sourcing of Grid-photons (fuel) for the consumer all the way through Power available for use by any device (most especially, Tesla�s own human mobility end-product). This resolves the original Primary Objective: to remove carbon fuels from the two largest human use cases (Power production and Mobility)

Think Apple / Intel / GE / DuPont / GM / Utility cross industries - I suspect Panasonic to play a strong on going partnership role in both LiIon (bridge to SuperCap), PV along with the partnerships with the University research personnel etc. (again Elon always colors outside the lines)

In Musk-World, there was never going to be a �solar industry� which by definition maps to current Utility grid - instead, Solar is simply a piece part in the BOM of the Tesla Power Product solution. And only a layer of it in that.

This requires SolarCity to become the opposite of a PowerCo, YieldCo, Owner/Seller of power in any form as a service or commodity. Power is destined to become a personal appliance product. Rated for use like any refrigerator or A/C unit.

Price of Power underwrites, but Pricing Power is the Mission

The wrong Asymptote-

The current Price of Power in non-inflated dollars has been essentially constant for decades (relative to the disruption of this discussion). Not surprisingly, since the delivery mechanism scales to any use at roughly the same cost per user and with guaranteed returns. This has induced one of the most indelible investment assumptions in history as Power Utilities� stability and return are considered among the safest and dependable available. The consistent and guaranteed Price of Power underwriting these investments. The associated Solar intrusions produce attractive funding, locking in confident forward assumptions extending 20 years, historically a small time frame relative to the Utility history of return.

This requires of course a continuation of Power delivered as a grid service for decades to come. This ~12c kWh (for discussion reference) has become understandably ingrained in consumer, investor, and utility mind set as largely unassailable.

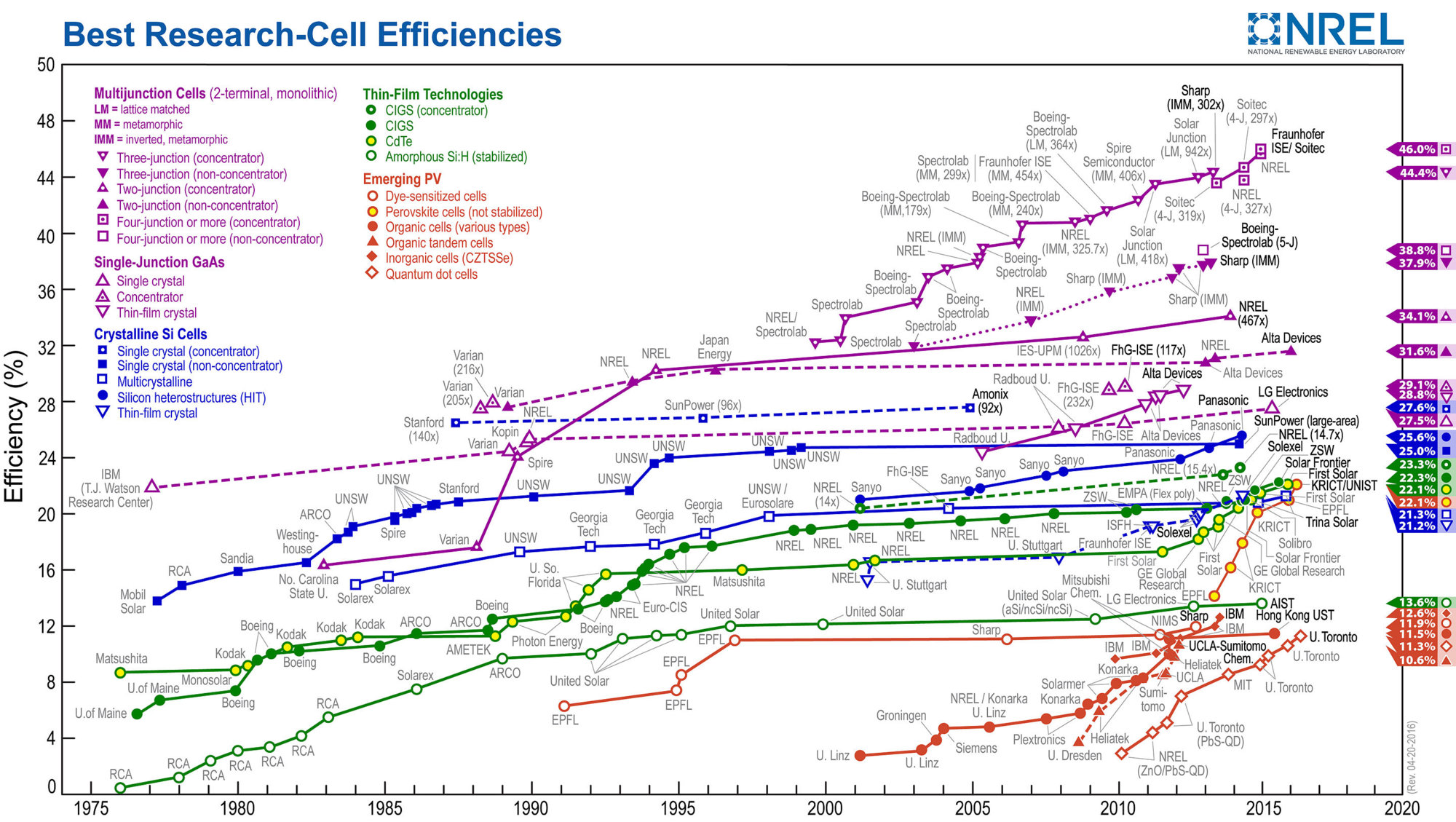

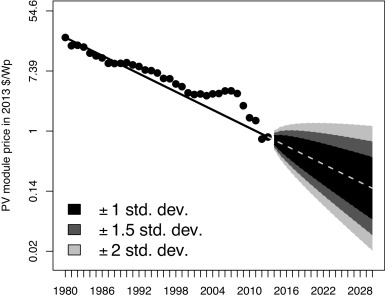

Delivery of Power as a product of course disrupts en masse. And is more importantly driven by a wholly different set of rules (Moore's law for example). The most important of which is, there are no rules. It's defined solely by the technology/manufacturing development path as an extension of semi-conductor advancement. Those advancements equally attacking all aspects of product definition- install cost, service requirement, longevity, materials, efficiency, etc. There is no effective safe-bet bottom support from 1st principles.

Current lab technologies (already baked in) flowing to the marketplace schedules a household roof sheeting (both conversion and storage) for a total price of a current appliance ($2000-$3000) and with performance lifetime of 20+ years, requiring almost no service cost. Installation costs similar to roof replacement currently recurring every 15 years or so. All in, on the order of 1/10 of current Pricing per kWh (near free).

How predictable is technological progress?

The Tesla Power Product replacing the oil-based roof, will install as a structural, architectural part of the home or business, with install costs built in to the normal roof replacement cycle but costing less than a current roof costs today; and of course like today simply amortized as part of the structure asset itself. [Note, although less efficient, building structures and automobile paint layers will also accomplish photon conversion for same price as current paint- It's in the paint!]

Price of Power near zero- melted into cost of the structure itself, permanently eliminates all current Utility based- distribution costs- balancing costs- fuel generation costs- system costs- grid maintenance costs- service costs- meter costs- billing costs- regulatory costs. (Think EV vs ICE on a massive scale). More importantly, NONE of these costs impose themselves as barriers to the technology based product solution development. Like the super computer in your pocket, with its cost per FLOP and MBPS, the cost per KWh will asymptotically approach zero. And render Utility based power obsolete and unviable- Solar based or otherwise. We have now entered this funnel, and is is an inevitability. Safely sinking all the excess power will be an important element.

SCTY 2.0 is the product based solution set

Goals are inapposite to 20 year PPA/Lease

Elon knows all of this of course and so

Finally, how does this resolve into meaningful consideration of Tesla's absorption of SolarCity?

Key recognition of two elements.

One: The objective of TeslaEnergy-SolarCity (TESC - SCTY 2.0) is inapposite with the long term PPA/lease financing, which by definition underwrites against the wrong asymptote price of power over the financing term;

Two: Assumes Power as a Service not a Product.

The successful TESC development of Product Power will drive to the lowest cost possible in order to gain the best Pricing Power with all customers. This is inapposite of long term price lock-in that underwrites using fixed current value of power. The market value of a PPA/Lease under the TESC objective is known to be a financial loss assuming it�s successful at it�s own objective; It�s therefore a disservice to the customer obligated to it when the mission of the seller is to effectively make it worthless to both the original customer and any potential buyer of the PPA/Lease.

I believe this is the transition they are currently making with the new financing product, new personnel, leading into the pending merger. I would recommend continual questioning and monitoring to validate this. In my view SCTY 1.0 should be working to offload all current PPA/Leases to the �currently clueless� financial institution fund investors (poetic justice imo).

SCTY 2.0 should eschew all financial vestiges of 1) ownership of the power (the value of which is destined to be near zero by TESC�s own mission), ownership of the financing underwritten by the Price of Power, and 3) all sales based on that financial relationship with the customer.

SCTY 2.0 should sell product with Pricing Power, for cash, bank loan financing, or other equivalent financing mechanisms. I believe this is exactly what they have in mind. For years I've warned investors away from investments in YieldCos, Utilities, owners of power, bonds and other instruments of these for this very reason. And also why I've kept my SCTY investment very low in anticipation of this corrective action that I believe will occur as part of this merger.

Epilogue:

Sun God to Sun Grid

Of course years from now, we humans will arrogantly congratulate ourselves for our prowess in achieving near free power as part of our homes and businesses.

In reality it's a small feat in our evolution. Truthfully, we are just catching up to our plant-life friends who figured out how to convert free photons for self energy long before we even arrived on the evolutionary scene.

And the irony of ironies, our fist solution was to look down - extract the decomposition of our teachers (without somehow looking up) and burn it (must have been our ridiculous obsession with fire I guess- thanks King Louie)

After cooking and choking ourselves with our first solution, our second solution finally applied the teachings of our plant-life friends to convert ground chemicals gladly provided by Mother Earth to construct photon-receptor canopies integral with our own shelter.

Tesla is The Photosynthesis of Mankind

The new mantra for TeslaEnergy

I Am Groot

I might suggest we try to limit arguing about semantic drivel

(reminds me of a Norman Rockwell group of old men)

Instead, Let�s

Come Together�

Because�

In The End�

the Light We Take is Equal to the Light We Make

(tm Lennon/McCartney/Harrison/Starr�)

Celebrate the music we make- the truly unique achievements of humanity-

the rest is just a discovery of what's already there

Postcript:

My home planet is Mars (been accused of this for years)

RocketMan now residing in Mars city of Musk-ville

Elon says Hi; just Tweeted:

"Save Mother Earth-Life - there are no Beatles on Mars�"

tweet 2

"It�s not Rocket Science-"

tweet 3

"So what if it is? Photons aren�t real anyway�"

peace and good fortune��

1/1/2015

guest ![[?IMG]](https://lh3.googleusercontent.com/blogger_img_proxy/AEn0k_uDd5Th3r8fh5V3hsl8s1f8jAtUrhBaAGKA4foR7NMjKVoCcCUCaAFHkEEhqym02Zg9IwxjmmXXuYOJ7GP5E6U=s0-d) �

�

1/1/2015

guest Nice write up. I would agree with most, however I do not think you have really mapped out the near term. Currently the technology to make energy a product isn't cheap enough to do so.

So how does one get from here to there? This is another feature of Elon that I think many investors do not understand or at least want to agree with. Elon is on a mission as you point out, so (in my opinion) he is aggressive at using whatever finanicals tools that will accelerate said mission. PPAs, customer deposits, tax credits, ZEVs, state negotiations, convertible debt, follow on financing, whatever, doesn't matter.

He didn't create any of these things, but is very adept at using them to further his goals. Especially to bridge technology improvements or cost improvements delivered by scale. That is usually why these things exist in the first place. My opinion is that as long as Tesla, SCTY, SpaceX is continuing to deliver on the master plan then he should use these tools aggressively.

This is part of the package when investing in Elon. Deal with it.�

1/1/2015

guest Good thing its a long weekend to read this thing...�

1/1/2015

guest @kenliles : Best post I have read in my entire time on this forum.

Thank you. Ken !!�

1/1/2015

guest This is an excellent point. It took the Chinese a little while to realize that the biggest economic gain from producing solar panels was to be derived from installing them domestically. Now China is the biggest installer of solar and wind in the world, and this is enabling the country to slash import bill for coal.

So when it comes to the battery race, will they see this as merely an export opportunity? I don't think so. I think that they will see this as a huge domestic opportunity to cut all fossil fuel imports at a rapid pace. Not that right now China is stockpiling oil into a national strategic petroleum reserve at maximum pace. They hope to have a 90 day supply against their daily oil imports. This is around 590M barrels. The basic motivation seems to be to protect their economy from oil supply disruptions and price swings. They are currently importing at maximum physical capacity to fill this beast up. So consider the opportunity China has to reduce oil imports by electrifying transportation. If is is worth tens of billions of dollars to stockpile oil, it is also worth serious government investment in EVs. Ultimately, the ability to slam out EVs will give the country much more security from oil disruptions than a SPR ever could. So massive battery factories have enormous strategic value for China, much more value than just exporting a cheap commodity.�

1/1/2015

guest Great job, Ken. I've always thought that to understand Tesla, one needs to have the imagination of science fiction. And you have demonstrated that principle here.

I do think that SolarCity and its PPAs are consistent with the longterm vision. The thought that solar systems installed today will be obsolete in the future has never troubled me as it seems to trouble you. We all know, I suspect, that the Model S that Tesla sells today will also be obsolete in the future. But these are the products that can be deployed today. The financial question is how much value can be derived from them before they are so obsolete that we cast them aside for something new. The beauty of a PPA for customers today is that they enjoy savings all along the way to obsolencence, while the PPA provider absorbs the risk of obsolencence. However, absorbing this risk is not really a potential loss for SolarCity if they are the entity positioned to profit from offering the new product that brings about obsolencence. Similarly, when Tesla make the Model S obsolete, it is right there making money on the new product. However, when consumers position themselves to absorb the risk of a purchased solar system, they simply cast aside a sunk cost, whether they saved money or not. It's fine if a consumer wishes to do that, but there is no moral superiority in a solar installer that eschews offering PPA financing. Indeed, it is quite gracious for SolarCity and Tesla to spare the PPA customer the risk of obsolencence. Sure, in twenty years the customer replaces the roof with whatever the state of the art solar system is at the time, no questions asked. Morever, this does not trouble me as a SolarCity investor, because TESC is well positioned to offer and profit from that upgrade. What the renewal term offers is an option against the posibility that the state of the art in 20 years is not really worth transitioning to for another 5 or 10 years. Consider that risk for awhile. If the products do not advance quickly enough then SolarCity is actually worth less in the future than if it had completely obsoleted a 20 year old system. So anyone worried about the value of the renewal term is contemplating a scenario where the technology is progressing very slowly.

So I don't mean to get into weeds here. The basic point is that our greatest hope is that everything Tesla and SolarCity are making today will become rapidly obsolete. Staying at the head of the curve is the only way to create lasting value for shareholders. And for this we need a vision that takes us to Mars and back.�

1/1/2015

guest I'm seeing how the PPA agreement can go badly against a consumer, and thus gets to Ken's point. If the PPA were adjusting annually up and down, by as much as 2.9% based on what the provider's price does, then it would be Solar City absorbing the risk of the cost of energy going down during the PPA. With a 2.9% annual escalator built into a 20 year contract, on a product whose cost is going towards 0 - that's all profit to Solar City and bad news for the consumer (should that scenario play out).

And it doesn't need to go to 0 to be bad for the consumer. All the cost of electricity needs to do is stay flattish for the next 20 years, instead of increasing as it has in the past (and which increase tends to be baked into the financial justification that makes these systems work), while the PPA is going up, and consumers have a higher cost of energy to look forward to in the latter end of the contract.

I agree with the larger societal point, that installing all we can now, and obsolete it and be installing different and way better stuff in 10/20/30 years is entirely to the good. But that escalator clause looks to me as well, like the clause that shifts the PPA from an unalloyed good for the consumer and Solar City, and shifts all the risk of technology change to the consumer, and all the benefits to Solar City. (I know that I wouldn't sign a PPA with escalator in it, and I know I wouldn't recommend it to somebody else; that core realization keeps me from investing in Solar City).

The bigger picture - Ken said it and has been thinking about it way more than me. The idea that energy is going to zero though, is something I've been thinking about for awhile. I don't see that idea baked into the markets. I didn't think about how that will change the utility industry.

How does the world economy change when the energy "tax" we pay, to varying degrees, to live, work, and produce things goes down to ~0? That looks deflationary to me during the transition as the current energy systems get taken out, and deflationary economies tend to freak people out.�

1/1/2015

guest Do the Solar City PPA contracts have an adjustment clause?�

1/1/2015

guest Contracts have an adjustment clause.

The consumer has three options

1. Assume that your utility company will adopt whatever mix of carbon and renewables they want and pass savings to you. Cost of power increases limited by local regulatory body.

2. Buy a solar system now, pay upfront/ financing and assume maintenance & obsolescence risk, reduce carbon footprint. Cost of power mainly paid upfront, but maintenance risk still.

3. Solarcity PPA. No upfront, no maintenance risk, assume risk that this is less expensive than #1 or #2 above, reduce carbon footprint. Usually net monthly savings vs current bill. Cost of power increase limited.

In each case the consumer is assuming risk regarding the future price of energy. I think the PPAs are a very nice option for those who do not want to assume the cost of an upfront option.

In many ways this is similar to buying/ leasing a car. The best financial outcome is to buy upfront and keep the car running for 20 years. However leasing is very popular as many people do not want to assume maintenance risk, do not have the money to buy a car outright or just generally are willing to pay more for less commitment.

I can't say that I personally have ever leased a car, but since consumers have a choice of financing options I don't think that they are being ripped off either. People have a variety of reasons behind their decisions.�

1/1/2015

guest Do you know the terms of the Solar city PPA? Are there adjustments to the price paid for power delivered to the utility or is it just net metering and pay prevailing rate for excess used?�

1/1/2015

guest Customer (PPA) does not see the net metering, that goes to solarcity.

Customer enters into a baseline cost + max yearly adjustment for a fixed term. Solarcity is responsible for power delivery, maintenance and basically everything else

https://www.solarcity.com/sites/default/files/sc-contract-resi-ppa-2.9.pdf�

1/1/2015

guest Thanks for posting the agreement.

It seems like a really bad deal. You pay 0.16 plus 2.9% increase per year for all the electricity generated by the system for 20 years so you're paying about 0.30 at the end. Plus, you don't gain any ownership or tax credit. I assume you have to pay the power company for any excess usage.

Compare to my self financed system which will pay for itself in 6 years ( sooner as electricity rates increase) then free power after that.�

1/1/2015

guest It's a bad deal compared to buying upfront and assuming all maintenance costs, but not everyone wants to do that.

Plus I don't think they have actually taken the increases, it's a ceiling not an automatic adjustment�

1/1/2015

guest I agree with Ken entirely.

My unhappiness with the TSLA-SCTY merger proposal arises primarily from only one thing: the refinancing poses a risk of transferring the profit potential from current stockholders to someone else.

It's quite possible for Musk to accomplish his goals while wiping out current stockholders; and also quite possible to accomplish them while severely diluting current stockholders. In which case, great for the human species, not so great for the stockholders.

I want to see a plan for refinancing SCTY's debt (thus eliminating the risk of bankruptcy, which transfers corporate ownership from stockholders to bondholders), without severe dilution to the stockholders. That's all. Hopefully Musk will present said plan in the next few weeks after completing due diligence.�

1/1/2015

guest Not really, since solarcity leaves the risk of regulatory changes with the customer. Solarcity is by no means a power company.�

1/1/2015

guest This information appears a bit outdated (it still mentions the MyPower loan), but it does note "Customers can choose a lease or PPA with no upfront cost and with payments escalating at a set rate, typically 2.9% per year, or they can select a lease or PPA that has some upfront cost and no annual increase in payments."

No idea what "upfront cost" would be necessary, though.�

1/1/2015

guest (Background: I agree with your post fundamentals, and regardless of whatever happens TSLA-SCTY, that's essentially the future.)

So, you're saying, Musk has to go and buy the silly SCTY 1.0 garbage in order to own SCTY 2.0, even though we all (you, me, him) know that SCTY 1.0 is going away and is (using your word) inapposite of SCTY 2.0, and I'm saying, why not just do SCTY 2.0 in-house to TSLA while SCTY 1.0 goes away? Obviously, I fail to understand the financing behind converting SCTY 1.0 (shedding itself as its metamorphosis, nearly a reincarnation) to SCTY 2.0.

I oppose merging them for very nearly the identical reason you state that they would be merged; that the current system of SCTY is a silly one financially and doesn't match the goals of TSLA. How would it assist the overall goal to grab SCTY 1.0 when TSLA could grow a new division of sorts called TSLA Solar, get a partnership with SCTY 1.0's manufacturing division, R&D, installation, provisioning, etc. (everything but their stupid financials and pushy sales and horrible service), and just do SCTY 2.0 in-house to TSLA completely? That's been my point all along. Can SCTY prove to us they're going to shed their stupid crap to merge into TSLA? Is a merger (ok, TSLA buying SCTY) an excuse to shed the "old way of doing business" just to get to the rather thin part of SCTY's R&D & manufacturing (and provisioning, installations, etc.)? Are they going to state that outright? Do they have to? Do we KNOW they will stop trying to sink all their money into the pits? That's why I've bashed SCTY's goals as "on a Mission from God" because they don't really have a business model based on any foundations of your own (as you point out with the change in solar collection prices you predict).

My post is messy, which is prettymuch what I think of them bamboozling us with this without guaranteeing they won't keep going on with the crap, and doom the primary mission of TSLA.�

1/1/2015

guest Ok, I let those brain cells get dusty (actually, I didn't). Let me think this through. SC (1.0) finances PV panels, and plays that silly board game with the utility bill and the payments for the loans on the panels. That's the problem: those brain cells never got dusty. I don't know what's in SC 1.0's contracts with the customers: who owns the panels? Who's obligated for the payments of the panels? If it is the customer, does that mean liens on their homes for the value of the panels once there's not enough money to pay for the financing through utility savings (i.e., default)*?

* If the customer doesn't want to make up for the excess costs associated with the failure of the financing of their panels, and would rather just give the middle finger to SC's financier (I assume a a packaged loan buyer serviced by some random service company run by ex-con's in New York State, and suddenly, they send more end-of-life gangs to take over the homes of those who selected Solar City 1.0 as their service provider, killing the debtors and taking their homes through the liens).�

1/1/2015

guest I think I am unaware that this is the same reason I oppose it; I claim it's because I don't want it to bankrupt and/or alter the mission of TSLA, but if TSLA keeps on mission, then is my opposition simply that this would remove profit from the TSLA shareholders? Is that your worry? That the profitability of TSLA is lower if it pulls in the electrons used by the cars directly from the sun (with local storage), but more in line with the goals of the company, and the TSLA shareholders end up investing in this via the buyout of SCTY's prior business dealings, and ends up with no profit? Floating the SCTY panel market position just long enough to bring a full package to market, rather than bringing the full package to market themselves.

Neroden, this would buy out Elon Musk's SCTY shares, and he would be financially OK, especially since he bought in to both companies at pretty good share prices, and the TSLA shareholders who bought in at around current prices wouldn't see the future growth due to Tesla Energy and Tesla Motors due to the losses incurred putting to rest the old business model of Tesla Solar's predecessor (SCTY). So am I worried that my own investment is going nowhere good rather than my own interest in the success of Tesla's mission?

So, this would be the dilution neroden is mentioning? And if so, who is making that money that neroden said is being made?�

1/1/2015

guest If SCTY is cash flow positive there is no reason to think that you can somehow buy 2.0 without 1.0. Why would SCTY do that deal?

The PPAs in the 1.0 model are self-financing at this point. Basically they are similar to rental properties in which the property owner is SCTY, the mortgage is held by wall st. and the homeowner is the renter. Once the mortgage is paid off then SCTY owns it outright. The anticipated PPA payback period is 13-15 years, with solar sytems lasting quite a bit longer than that representing a lot of free cash flow to SCTY.�

1/1/2015

guest He definitely wants the Silevo factory (mentions it repeatedly in the conference call). I strongly suspect there's no way to get it other than buying the whole company.

Well, basically you stop selling the non-pre-financed PPAs and leases. That part's quick. The slow part is refinancing the $3 billion in outstanding debt. This is also where the TSLA stockholders potentially get diluted (by new stock issued to raise that $3 billion), or lose the company to bondholders in a bankruptcy (worst case).

We do not *know*. However, there are specific statements from SolarCity execs within the last few months that they are trying to move over to loan-based financing rather than leases/PPAs. That's good enough for me.�

1/1/2015

guest It's interesting that Musk is so interested in manufacturing solar cells. In the past, he has described it as no more complicated than making drywall. He must like Silevo's technology.

*sugar* Elon Says - Transcript - Computer History Museum Presents: An Evening With Elon Musk�

1/1/2015

guest He was talking about "Standard Efficiency Panels ", silevo panels are thirty percent and Elon has recently had some revolutionary insights about and taken a renewed interest in manufacturing.

And I think a big part of silevo's technology advantage is manufacturing efficiency and Elon can improve on that process.�

1/1/2015

guest Where did you get that data?

Efficiency | Silevo

�

1/1/2015

guest Where do you get $3B that needs to be refinanced? From what I see there is about $1.6B in asset backed financing that is non-recourse and doesn't need any refinancing, about $400M in a revolver which is basically used as short term financing to bridge to PPAs, so that doesn't need any refinancing (since it is a revolver), and about $1.1B in recourse hold solar and convertibles. That last $1.1B is the only part I see that would need refinancing and not even all of it in the short term as some of the solar bonds are 10yr terms�

1/1/2015

guest A bit fresher link perhaps?

SolarCity Unveils World�s Most Efficient Rooftop Solar Panel�

1/1/2015

guest OK, but still not 30%:

�

1/1/2015

guest I think the point is not that they are far above the best other panels, but that they are on-par with the top of the top (SPWR X series are too 22-23% efficient) while being far cheaper to manufacture. If they cost 20-30% less per kWh to produce than for example SPWR, then that gives a far edge bringing them comparable in price to cheap chinese panels while beating them handily in efficiency (usual panels are 16-17% efficient).�

1/1/2015

guest Are SolarCity/Silevo high efficiency solar panels production ready? When do we see them in mass quantity?�

1/1/2015

guest I was wrong. I thought Elon said 30%, but he said 30% more efficient than cheap Chinese panels.�

1/1/2015

guest Some of that is fully 20-year financing, but a bunch of it needs refinancing sooner or later because the term of financing is too short. Yes, even some of the asset-backed non-recourse stuff needs refinancing eventually. It may be called non-recourse, but it's going to turn out to be recourse when push comes to shove, same as all the "non-recourse" debt the banks issued through "special purpose vehicles". The good news about it is that being asset-backed (aka collateralized) it *ought to be* relatively easy to refinance it.

I believe you're correct that only ~$1.1 billion needs refinancing in the *short term* (before 2018). A lot of it will still need refinancing. 10 years isn't long enough financing when the income stream is coming in over 20 years, unless the homeowners were overcharged by a factor of 2, which I think they weren't.

I need to go back and look at the page listing what years the debt needs refinancing.�

1/1/2015

guest No need to ever refinance the asset backed systems. Once the ABS is paid off (12-14 yrs), the system has no negative cash implications other than maintenance. All cash flows to SCTY at that point, no debt on the system.�

1/1/2015

guest Soooooo you're saying the upfront cost of the system is fully paid for in 12 years, out of 12/20 of the homeowner's payments? If so, the homeowners *are* getting ripped off.

See, there's a problem here. SCTY spends $X to build a system. They get an income stream of $Y per year for 20 years. The inherent profit -- and the amount by which the homeowners are being gouged -- depends on the difference between the value of $X and of the income stream $Y.

They then issue some sort of bond backed by the system to recover $X upfront. There are a few ways this could be done.

The standard corporate bond charges interest of $Z every year, but has to be refinanced in full for the face value of $X (balloon payment) at the end of the term.

A "mortgage style" bond attempts to pay down the principal over time, and at the end of the term, it's worthless. Are you saying that the ABS issued by SCTY are of this sort? Because I thought they were of the standard corporate bond style.�

1/1/2015

guest Homeowner has the choice of buying system. It's a choice. Just like leasing a car or renting / leasing a house instead of buying. Are you ripped off if you decide to rent a house & live in it for 15 years instead of buying?

Yes the SCTY ABS is similar to a pool of mortgages for a mortgage backed security. The payment term is estimated by the bond rating agency & they estimate 12-14 years depending on the scenario.

This is all above board and was mapped out by various agencies as a way to accelerate uptake of solar. Lots of reports available.

People may not agree with these programs, but similar to ZEV credits, carpool lane stickers, tax credits, etc. they are put in place to encourage early adoption of technologies prior to that technology being self sustaining from market standpoint. Without these incentives solar (and wind) would have NEVER gotten this cheap this fast!�

1/1/2015

guest If the homeowner has paid off the entire cost of the panels -- plus a reasonable rate of interest, since the people buying the ABS do demand interest -- in 14 years, and yet the homeowner continues making mandatory lease payments for another 6 years, the homeowner *is* being ripped off. That's a terrible deal. The homeowner was overcharged by at least 42%. Is this seriously what's going on in these deals?!?

This isn't how mortgages, or mortgage-backed securities work. When you have 30-year mortgages, you have 30-year MBS. The duration mismatch is really suspicious.

I had assumed that the overcharging of homeowners wasn't that severe. I figured the duration mismatch indicated that the ABS were, effectively, only partial financing.�

1/1/2015

guest You're forgetting what these markets looked like before SolarCity showed up with their PPA model, your options were to pay $3.50-5/W for an install or take the PPA @ 15% less than the grid. The zero-down no-hassle model clearly sped up adoption in new solar markets, hence SCTY is the #1 installer nationwide. The SCTY model is about doing whatever's necessary to accelerate adoption in the US, even if that means elaborate financing and $1/W in sales effort. That doesn't mean their PPA offering will always need to be as complex.

SolarCity LOSES MONEY on every single PPA install they make in my market(Philadelphia's western suburbs), and that's by design. They set their price point 15% below the grid and stick to it. In the ramp up period it's wildly unprofitable(see: accumulated debt), but once to scale it's quite obviously an untouchable cash cow.

There is a certain percentage of the market that values quality, certainty and simplicity over absolute lowest price. That will always be the case. That percentage obviously varies, but I don't see it moving significantly off a 50/50 ratio.

That's the beauty of SCTY's differentiation and it's even more beautiful as part of TSLA. They offer a product/service that no one else can provide and they eventually receive a very nice premium for that unique value proposition.�

1/1/2015

guest Aaaargh. They just need to make this financing much, much, much clearer.

If what's going on with the older ABS is that the homeowner with an old PPA is effectively on a very-high-interest-rate loan (much higher than the rate being received by the ABS buyers), and the homeowners have taken this because they couldn't find low-interest-rate loans, that's fine. That business model is dead going forward, because low-interest-rate loans are available from banks now. But it's fine for the old stuff *if that is in fact what's going on*. It's very hard to tell, unfortunately.�

1/1/2015

guest To be honest I assumed you knew more about what the backend of these financial instruments looked like, but it seems like we're on equal footing here. That level of opacity makes you uneasy, I'm less concerned. We know the inputs, we know the outputs, there's plenty of fat for everyone to get a piece and still stay below the grid on price. What's the problem?

I applaud you for being repulsed by financial uncertainty, but treating this like a bubble is overkill IMO. As sales cost is whittled to nothing all these products will function smoothly and the weaker ones will simply be weeded out by the market.

You still don't seem to differentiate between a consumer buying an array on their own and simply signing a PPA contract and going about their business. There is a massive difference and doesn't even take into account the brand(SCTY or TSLA). I like the idea of SCTY/TSLA offering streamlined loan packages with a high premium and also a competitive PPA. I mean, what happens in 2 years when you need to augment your array with a battery component? A lot of people would just rather pay the premium and have a full-service evolving solution. Hell, if they had been installing in PHL, I would have considered a SolarCity PPA and I'm a solar nut.�

1/1/2015

guest I've read enough SCTY documentation to realize that they're using at least six different types of financial instruments, and I can't tell in what proportions. Basically each deal seems to have different terms (many of which are "confidential"). This means it's hard to make a generalization or analyze it

In the long run I believe people will not pay a 42% premium for the convenience. I believe the pricing has to approach parity (or drop because having PPAed panels reduces your house value).�

1/1/2015

guest Why do you say that?

Does that validate Elon's statements that aesthetically pleasing panels would add value to a house?

Thanks!�

1/1/2015

guest For me the jury is still out on PPA increasing/reducing the value of a home at resale. I see it as much more likely that grid prices will increase as energy production decentralizes, but I also don't think this "home value" theory is a big factor.

You say 42% premium because installs are $2.75/W now, but just a year ago they were $3.75/W in non-CA markets and 2 years ago they were $4-5/W+ in places like New Jersey. At that point SCTY was likely equivalent in "price" if you rationalize the time value of that up front money, etc/

As costs come down, PPA offerings will be much more flexible. Contract duration can become variable, minuscule down-payments to negate rate increases over the contract term, etc.

Fully 1/4 of total costs will disappear under TSLA, some of that is savings from further market maturation/effiencies, but that majority is from sales costs dropping drastically. That is a huge difference maker when you can also pile the 30% tax credit into the equation. As things get cheaper across the board and solar becomes mainstream, price differences will increasingly become secondary. Remember, everyone is saving money here from day 1.

PPA up until now has been about allowing early adopters to "go solar" for zero-down in a tough financing environment, moving forward it'll be about simplicity and mass adoption. The margin relative to local financed installs(quality installs) will narrow greatly and still be wildly profitable. That's the beauty of it.�

1/1/2015

guest PPA might continue but the terms will have to change. If utility prices are stable or going up, rooftop solar will be undercutting it by so much that it would be unreasonable to tie the contract in with current utility pricing. SolarCity could enjoy the gravy until it runs out but Elon probably won't let that happen since it's not going to be a fair deal for the customer. That's more of a thought about medium term developments. Short term unless banks really start liking making money on rooftop solar loans (why wouldn't they?) they'd have to continue with existing scheme.�

1/1/2015

guest Even if the homeowner decides to pay for the solarcity system upfront, solarcity will be able to aggregate production & storage and sell it to the utility because of the control software and integrated battery. They will be able to offer the homeowner a split of the proceeds while making money off the aggregation and delivery services.�

1/1/2015

guest Bluntly, I'm counting on this. (Now long SCTY on merger anticipation -- I got in some time *after* the merger announcement.) I still don't think the rooftop PPAs are good business, unless they're prefinanced by a third party bank, because I think the market will drive the price of PPAs down to equivalency with bank loans, and it's not worth it for SolarCity or TSLA to take on the financing.

I'm counting on the drop in sales costs and the efficiencies of the Silevo factory making SCTY competitive in the paid-up-front and loan-from-bank solar businesses, which it isn't right now.

This is a fascinating point. I guess the way this would work is this. The homeowner installs the integrated Tesla solar panels + batteries, owned by the homeowner. The homeowner is then given the option to allow the utility to decide when the batteries feed energy into the grid and when they recharge. If the homeowner chooses to take this option (rather than retaining personal control over the batteries), the homeowner gets paid. Tesla aggregates a group of homeowners with the solar + battery systems who've signed up for the deal, within the same subgrid, and offers it to the utility company as a "virtual battery" under their control; the utility company pays Tesla for the "load smoothing" and Tesla distributes the payments to the homeowners (after subtracting a management fee). The homeowners can back out of the deal after 5 years (or whatever).

This is probably a deal which a lot of people (not everyone) would accept. If you don't feel that you need to maintain total control over when your battery charges and discharges... you just get paid. It feels like getting royalty checks; a lot of people would just sign up.�

1/1/2015

guest Don't think of the grid as it exists now, think about what is the most efficient grid and plot the path to get there

Australian Mini-Suburb �Tesla Town� Project with Powerwalls gives a glimpse into future sustainable communities

How the Grid Was Won: Three Scenarios for the Distributed Grid in 2030

How Arizona�s Biggest Utility Is Modeling the Customer of the Future in Its �Rate Design Laboratory��

1/1/2015

guest We won't have the most efficient grid.

People prioritize control and self-sufficiency over efficiency. Therefore we will have a grid which is less than the most efficient.

I've been trying to pay attention to these control issues. They're the reason V2G isn't happening, for example.�

1/1/2015

guest Two things

1. Maybe we should change the title of the thread to drop the "motors"

2. While I was waiting for SMP2 I put down some thoughts

Basics

- In 10 years, maybe 2 x 100kWh cars in driveway

- House with 5Khw solar generating capacity

- Battery with 10kWh

- Software

What does it allow

- A connected system of solar, cars & house can modulate power use, use the house & battery to buffer local grid, provide power back to the grid based on grid needs, to smooth demand fluctuations from larger drains (A/C, pool, car charging)

o Software can control A/C, pool and other high need systems by turning off or delaying charging, can also determine if to use grid, house battery or even car batteries if really needed

- Battery acts as grid buffer when cars plug in (esp. at 6pm when there may be a �use spike�)

o Software can automatically control car charging based on driving patterns (i.e,. keep at 60-70% levels, charge at 2am, charge to 90% on a mid-day Sunday)

o Software can control car charging based on grid events (over and undersupply, real time pricing)

- The software can learn the use patterns of the household and the local grid and modulate w/o too much input

- Telsa can aggregate households to provide larger services back to utility. Homeowners can opt it for payment (if they own their own system), or if they have leased system it is part of the deal with tesla

- This allow Telsa to provide service level to homeowner & utility no matter what the brand of solar panel on the house is or what EV is sitting the driveway�

1/1/2015

guest Except Elon and JB have been pretty clear and consistent about not wanting to allow the car to discharge into the house/grid for a number of reasons.�

1/1/2015

guest At this point in time, I think there's plenty to be said for viewing TSLA has a story stock, similar to 2013, after taking a two-year breather. The SCTY merger, SMP2, and GF grand opening are all purposely aligned to launch TE, a business poised to match TA revenues in relatively quick order and likely exceed TA margins.

SMP2 will set the table for TE sizzle, & the Gigaparty will reveal the rapid movement in TE from sizzle to steak.

We already have strong evidence that Q3 TA (and beyond) is poised to serve some long-awaited steak, & usher in renewed prognosis for TA 2.0+. M3 pencils down announcement will support this.

The SCTY merger may very well set the stage for a short squeeze, supporting a SP lurch / re-evaluation. Plenty of discussion on this in ST thread.

All in all, TSLA may very well be primed for a refresh all its own, with the merger bote as its trigger. Not sure that will wait another year or two for M3 steak to appear on the menu.�

1/1/2015

guest I'm not sure if the merger vote will be a ST plus or minus. But I agree that TE will provide a substantial catalyst before the M3 launch/ramp. I also think that the bumpy ride will continue until at least we are close to the M3 launch/ramp.�

1/1/2015

guest EM will turn 60 in 2031. He will likely have planned to be in route to Mars around then. So it seems reasonable to work under the assumption that he plans to realize everything in todays plan part deux by then.

Todays market cap is $33.63B.

If TA + TE = $1trillion in round numbers, as he had roughly estimated recently, it seems reasonable that adding in Tmobility + Tlogistics would probably double that. A $2trillion mkt cap in 2031 represents 31% CAGR.

Staggering, yet seemingly within his reach.�

1/1/2015

guest Re-posting here from ST thread, as it is probably more relevant to the Medium-Long term:

http://phys.org/news/2016-07-china-midea-snares-near-stake.html

Anybody think this might be relevant to future China factory?

The robots that build the cars in Fremont are all KUKA. Not sure about GF.�

1/1/2015

guest I think this is more relevant:

China Ends Some Electric Vehicle JV Mandates -- Will That Woo Tesla? | Stock News & Stock Market Analysis - IBD

�

1/1/2015

guest I have been worried about climate change, but this takes it to a different level. Sorry folks, didn't mean to scare anybody here.

How climate change is rapidly taking the planet apart�

1/1/2015

guest For people who have been paying attention like us, the baseline scenario (most likely scenario, default) is now human extinction. It does make me feel better about not having kids. It's rather disconcerting for the first few years after you realize it. Once you've adjusted, you go "oh well, let's see whether we can make it out of that scenario, even though it seems unlikely".�

1/1/2015

guest Don't get me wrong I'm all for green energy and basically anything large or small that makes this planet a better place to live, but sometimes I wonder if the dialogue was so weak on climate change for so long, that now that it's sort of a mainstream idea it's swung too far the other way with the dire predictions, it actually kind of reminds me of the nuclear cold war type stuff from way back. I mean have kids if you want to, it's looking like most coal and oil type stuff is going to be obsolete in most countries within twenty years, that makes me pretty dang optimistic.�

1/1/2015

guest It's all relative right? Right now, the effects of what we are doing won't be felt for decades and then you have to add on at least 20 more years + decades after that. So it's really not about us anymore, it's about how we want to leave this planet for future generations. I feel sorry for my 5 year old....it makes me sad and depressed at times, but then this is why I'm such a champion on Elon and his companies.

What about if the people in the medieval times knew this stuff and didn't do anything about it because they were so focused on the short-term profits....we probably wouldn't be here today. So here we are, do you screw over future generations?�

1/1/2015

guest The following should be cross-filed under the "Machines That Make The Machines" category.....

I would have filed this sooner but am under my normal debilitating Lack Of Internet Bandwidth summer madness..

About four weeks ago we hosted someone who works for a certain German company....its products intrigued me so I <innocently>...

asked "So, for example, those controls might go into a KUKA-type robotic machine..."

"Oh!" was the reply. "Yes, KUKA is one of our biggest customers".

That was my entry to some fine knowledge-gaining; eventually I said "You are aware, of course, that the Chinese are buying KUKA?"

There was a slam-stunned silence - that was absolutely not what my guest wanted to hear.

We do , on occasion, get valuable guests here. It's not all just retired accountants from Midwestville. �

�

1/1/2015

guest Great thing about Tesla led by Elon Musk is that if China tried to restrict selling best KUKA industrial robots to Tesla, Elon would assign a team to design and build their own. Then bring out 2.0 version better than KUKA. Tesla will need a lot of these in rampup to several million vehicles per year.�

1/1/2015

guest If people in medieval times knew about fossil fuels I'd like to think that climate change would have been figured out centuries ago and we'd just have an Earth thermostat. But yeah I wasn't saying that we shouldn't do clean energy etc., just that I think that as of now it's looking pretty good. To put it in perspective, when my Grandpa was 5 he lived a few blocks from a creek which petroleum was regularly dumped into for decades and started smoking and drinking when he was not much older, oh and there was that Great Depression thing and he came of age just in time to get shot a few times in WWII and spending a few nights trying to get out of Germany after escaping a POW camp. When my parents were growing up it was before either Clean Air Acts had passed, and their parents smoked cigarettes and drank while pregnant, in the house, in the car etc. Now we worry about little things like the "Great Recession" and whether our cars should be gas or electric, things look pretty good for your 5 year old �

�

1/1/2015

guest Not a lot of meat from the presentation yesterday on the gigafactory : there is a capital raise coming and 25% target gross margin on Model 3 for a yearly gross margin of $5B. Bull case : subtract $3B for SG&A and interest expenses leaves $2B to fund R&D and further expansion. Bear case : Tesla has never once reached lofty gross margin goals and is struggling to reach 25% on a much more expensive car. Meanwhile, just $2.5B in SG&A is counting on some very aggressive non-linear scaling of costs to run the company as it moves from spending $1.2B to deliver 60k cars (Q1 annualized) to $2.5B to deliver 500k cars (in 2018).�

1/1/2015

guest Respectfully disagree with this.