Apr 29, 2015

jhm What if the battery was also the inverter for the solar system? Even if this could not fully qualify for ITC, I think it could be cost effective to design a stationary unit that would also double as a solar inverter.�

Apr 29, 2015

Theshadows It all depends on how it is used. If you are peak shaving and you have a system that is sized correctly it will be hard to say it's not charged from solar (at least with the outback radian system) even if it is AC coupled.

I agree that putting one solar panel on a roof and hooking a 10kwh battery bank to it isn't going to fly. But a 7-8kw solar array will absolutely qualify. In the most extreme cases at least partially.

I have prospects and past customers lined up waiting for this announcement that have no intentions of using the pack for peak shaving. They want it to go off grid. Not like building a cabin in the woods, but installing the system at their home with solar and disconnecting their utility service.�

Apr 29, 2015

Robert.Boston See the article linked upthread. Batteries linked with solar are ITC-eligible, with enough caveats to make one glad one isn't a tax attorney.�

Apr 29, 2015

bonaire You mean something like the SMA TL inverter model? Or the Enphase AC module inverter with onboard battery?

- - - Updated - - -

You are in PA and are taking people off the grid? Why? Rates in PA are reasonable from the grid. Even PECO is under .17/kWh. For off grid, ITC is fine. But I am seriously thinking there will major tax abuse in states like CA and NY. Are they sizing batteries large enough for 3-5 days of power during multi-day cloudy events? Generator as well in case SOC drops too low? This sounds like a rare occurrence and some folks surely are willing to spend a lot to feel like they are advancing by being off the grid. A whole house off grid system can be quite a hobbyist delight. Are they prepared for the usual plans of inverter replacement after 10-15 years, battery replacement over the course of the same time (more often with lead acid) and why haven't they considered existing technologies on the market already, such as other inverters and Lithium batteries which are not Tesla? Do you have a price list for Tesla packs yet in areas which have no heavy incentives? I am familiar with PA hving a small battery program in their sunshine program.�

Apr 29, 2015

Theshadows No, full blown battery backup systems. Someone that wants a battery based solar system to use for backup if the power goes out completely qualifies for the full tax credit, no questions asked as long as they are not peak shaving. The solar panels are the primary charge source for the batteries. They are only charged from the grid when they get dangerously low. You can even turn the grid charger portion off then there are no questions at all where the charge is coming from.�

Apr 29, 2015

Theshadows Short-Term TSLA Price Movements - 2015

People buy Tesla's when it's not necessary either.

2-3 days autonomy and they have to use backup generators. It won't pass code with out an auto standby generator. However we have had two customers turn the auto standby off. They want to consciously pull the cord to use the generator. They have a light that goes off when the power drops too low then they enter super conserve mode. No tv's, no computers, on fans, etc until the light comes back on.

Most of our customers now are not going solar for the financial payback. Most of our trade area has rates of .08-.13, favoring the low side of that. They are doing it because they care about the environment.

They also no longer qualify for Srecs after they unplug.

This is OT and should be moved somewhere better fitting. Sorry.�

Apr 30, 2015

eloder

Posting from the short-term thread for discussion here: http://www.teslamotors.com/presskit/teslaenergy

That price is definitely a game changer.�

Apr 30, 2015

Robert.Boston Agreed. The incremental cost of going from 7 kWh to 10 kWh is $500, or $167/kWh. That's any amazing price for batteries. I'm going to need to make some inquiries about grid-scale batteries.�

Apr 30, 2015

dhanson865 It's not a capacity change, its an overprovisioning change. I believe both products have the same amount of cells but one is optimized for weekly cycling and one is optimized for daily.

If you are going off grid you want the 7 kWh because it is setup to survive the power draw every night and charge every day.

If you are staying on grid you want the 10 kWh because you don't have to stress it as much and you get a larger reserve for outages.

Similar to how SSDs are over provisioned. Spare capacity reserved for wear leveling/reliability.

The other possibility is one has less cells but more heatsink/cooling capacity.

Since they are stackable you get overlapping capacities

Weekly

10, 20, 30, 40, 50, 60, 70, 80, 90

Daily

7, 14, 21, 28, 35, 42, 49, 56, 63

assuming I'm not too tired to type the powers of 7.�

Apr 30, 2015

kenliles Solar+SuperCapacitorBattery = (Near)Free in 20 years;

No grid, No distribution, No losses; (Near)No Cost

CapCost in today's $s:

~ $3000 total amort over 20 years (Near-Free)�

Apr 30, 2015

blakegallagher I do not think this is correct. Did you see that somewhere or hear Elon say it or your own reasoning? If that was the case I dont think their would be a price difference. If they had the same number of cells they would not charge you 500 bucks less for the 7KWh PowerWall�

Apr 30, 2015

Ocelot Is there any way to view the presentation now? I went to the tesla website under presentations as am used to listening to the cc after it is done, but the presentation is not listed.�

Apr 30, 2015

blakegallagher I dont think so Ocelot Did you see this linked upthread Press Kit | Tesla Motors Info in video left out of there was.... the home battery is available in different colors, The whole event was powered off of the batteries which had been charged by the solar panels on the roof. I dont remember if they repost the live events but someone there normally gets a pretty decent video�

Apr 30, 2015

Ocelot thanks, for the link and info blake. will check back tomorrow after work and hopefully be able to find some video.�

Apr 30, 2015

Foghat The $3.5k is for the battery only. That's the price to installers, not retail to home owners. After the installer (like Solarcity), retail price offered to home owner. Once installed, installers like Solarcity get the SGIP incentives in CA if available... Presumably this SGIP incentive is rolled into the lease cost so they can do their $0 down lease package deal. ITC for solar install, SGIP incentive for the battery(in CA).�

Apr 30, 2015

CapitalistOppressor

I don't think it's a cell count issue. Probably just more cooling and more durable power electronics.

Also, aside from cell count the other possibility is a different chemistry. But I'm even more skeptical of that option because the economics kinda suck. Functionally though it might fit the pricing and stated performance differences better than the alternatives. If I was going try to develop an argument one way or another, cell chemistry is where I would start spending mental energy first.

Honestly though I don't care. As an investor I think that the light duty backup battery is probably an edge case for the near term. The initial opportunity is much more in the commercial market, and the deep cycling battery is much closer to what will be used in that market.

And if they can build big boxes for ~$500/kWh they blow else out of the water.�

May 1, 2015

blakegallagher The Powerwall is available in 10kWh (kilowatt hours) optimized for backup applications or 7kWh optimized for daily use applications. Both can be connected with solar or grid and both can provide backup power. The 10kWh Powerwall is optimized to provide backup when the grid goes down, providing power for your home when you need it most. When paired with solar power, the 7kWh Powerwall can be used in daily cycling to extend the environmental and cost benefits of solar into the night when sunlight is unavailable.

Directly from Tesla is where you got it. My apologies there.�

May 1, 2015

larmor Will the powerwall product be available overseas? I ask, since, from my experience with Pakistan, there is a huge problem with energy distribution and supply, and the supply is not keeping pace with demand. The infrastructure is lagging behind. And there are huge homes there as well as numerous mills and factories, and software development houses.

I think the more compelling argument for a powerwall product is for emerging markets... Thoughts?�

May 1, 2015

Theshadows Probably not yet.

This is one of the great things about this product that not many people know about.

We want it in the USA so we can make our lattes at noon cheaper and so we can watch tv (no kidding, that is second on the list when I ask customers what loads they want backed up, first is the fridge.) and use our play stations when the power goes out.

Other countries want it so they can have running water and lights to read. And there are so many countries that want it for those reasons.

The demand for this product is so massive.

I want to see the installation manual so I can create the materials take-off for it so I can start offering it to our customers. I hope I can get through to my Tesla contact tomorrow.

The thing is when you do get access to it your country will see a massive shift. Just like the countries that had their lives changed overnight when cell phones became affordable and they instantly had communication with the world. Other countries will be impacted to this extent too.�

May 1, 2015

Theshadows You know which other company this is going to hurt? GNRC.

And it looks like they just had ER and had a miss.�

May 1, 2015

Treker56 Great question - I have friends in Lahore who are very much interested in this. I think India and other third world countries will benefit from these very much as well.

�

May 1, 2015

CapitalistOppressor Wall Street Journal appears to be reporting that the utility scale packs will retail for ~$250/kWh, which is well in line with cell costs once you do your markup for a finished pack at a retail price.�

May 1, 2015

Enadler I for one will be curious to see if Elon divulges expected margins for this new product on the earnings call next week.�

May 1, 2015

dalalsid So I don't see any details of software control of this system for power price arbitrage. Just that it can do it. Does it come with an app? How does it work?�

May 1, 2015

EchoDelta I work in international development related projects and have assisted microgrid entrepreneurs and prepaid electricity setups in Asia and Africa. A 10kWh battery can power a village. You would still be competing against clunkier battery tech (space is not a problem) but systems that are modularly repairable, (smaller parts that can be swapped in and out), and direct DC output (no need for going through AC to charge phones and power led lamps) and cheaper. But it's a dynamic marketplace; and Elon has acquaintances that are working in it.�

May 1, 2015

Ampster Software control would be in the separately purchased inverter.

Presumably the installer would provide the integration and setup.�

May 1, 2015

ItsNotAboutTheMoney Right: the Internet connectivity of the battery is so that remote management software ISO/utility/whoever can get information about the battery to determine what to do.

- - - Updated - - -

Maybe Pakistan. �

�

May 1, 2015

uselesslogin One thing I really liked about this event though. One probably would not be surprised that I talk about Tesla a lot yet I do not own one. So I have been telling a few of my coworkers I can now afford a Tesla...

...battery

(rimshot)�

May 1, 2015

cluster Question: Is Powerwall/Powerpack eligible to any federal and/or state incentives? particularly for commercial and industrial use?

I came across the following website, but found myself clueless.

Database of State Incentives for Renewables - DSIRE�

May 1, 2015

aznt1217 Man... are you kidding. I could always afford a Tesla

....Jacket.... and now... a battery.

In all seriousness, I liked the event and I thought Elon did really well given his usual presentations. This was significantly smoother and the message and severity of carbon emissions was really driven home with that chart that went parabolic. I mean seriously people need to understand that. The one thing I would have changed is when they had that White Home Battery Reveal, I would done a slide out of a bunch of the batteries in different colors behind it (Apple Style) to make it look consumer friendly.�

May 1, 2015

hockeythug NPR piece. JB talks a little about the potential for utility companies.

http://www.npr.org/blogs/thetwo-way/2015/05/01/403529202/tesla-ceo-elon-musk-unveils-home-battery-is-3-000-cheap-enough�

May 1, 2015

Buran Something that I don't think have been brought up with regard to the battery cost in the new products, that also perhaps tells us something on their product strategy:

1) Given prising, the upper boundary of pack cost (treating the whole power wall product as pack cost) is either 350 USD/kWh, or 429 USD/kWh, you can also hype on the cost difference, indicating 167 USD/kWh cell cost. This might seems low, but we know that Tesla probably by the cells for around or lower than 200 USD/kWh, so not impossible. The cells are not exactly the same as for MS, these could be cheaper than the automotive grade ones. But the 429 USD/kWh seem to be way to high pack cost, doesn't make sense, and makes it not possible to estimate cell cost based on difference. The 7kWh version is not reliable. Why?

2) Despite the argued difference in application (backup vs daily cycling), from a production point of view it makes no sense to have two types of cells. The rest of the product must be very similar or the same.

3) Also, the 3kWh difference is really so small that it might not make sense to design two manufacturing processes, it is quite common to have the same hardware in electronics, but reduce capacity on some versions to have a range of products and be able to charge more for the high end version.

4) We know that harder cycling lead to more rapid decline in capacity.

How to resolve all this? My take is that the products are actually the same, just two different deals to diversify the product line. Both contain 10 kWh, but the 7kWh version is constrained to 7kWh to give margin for more rapid degradation, but still have a 10 year warranty. The spare capacity could be gradualy brought online during the 10 year guarantee period.

With regard to the battery cost:

Hence, the 167 USD/kWh estimate can be disregarded, the 429USD/kWh can be disregarded, and the estimate based on 10kWh for 350 USD is the more accurate one at pack/product level. Also makes it possible to a better pack and cell cost estimate: Assume 25% margin, and you have 260 USD/kWh at pack level, very reasonable, and then assume pack integration and electronics adding 50% above cells (quite high overhead for small amount of kWh) and you arrive at about 175 USD/kWh at cell level, which is also very reasonable.

And finally, add a lower pack integration overhead and slimmer margins for utility and you could well have the above quoted 250 USD/kWh for the utility deal.�

May 1, 2015

CapitalistOppressor Except in this case Tesla is charging less for the high end version.

Make no mistake, the 7kWh battery is the more capable battery by a lot, with a potential ROI likely far higher than the 10kWh version (I haven't done the math, but we are talking ~2,500 cycles, vs ~500 cycles over a 10 year period. No way that a mere 43% increase in size is able to match the generating capacity of a battery capable of being used 5 times as much).

Didn't you just say that they are the same packs? Why are you basing your analysis on the higher price? You should be doing your calculations based on $300/kWh using this logic since the 7kWh system is actually nominally 10kWh in your scheme and is just $3,000.

Honestly, the mental gyrations needed to justify Tesla using the same number of cells in the two packs is just unsustainable. The per cell cost is easily the primary cost driver for these systems, and 10kWh system requires a ~43% increase in cell count over a 7kWh system.

That's like $600 in extra costs (assuming Panasonic is delivering these cells at ~$200/kWh) being buried in a product that Tesla is offering at a $500 discount. Where are the manufacturing efficiencies to be gained that can offset costs at that scale? The only time Tesla did something similar was when they canceled the 40kWh version of the Model S and offered the 60kWh battery with a 40kWh software limit. And that was a one time thing done for a known number of cars that would also have required extensive engineering to produce aside from the reduced cell count.

In contrast to that exception, the 85kWh battery coincidentally uses ~42% more cells than the 60kWh battery, so by this logic it also would make sense to have just manufactured the 85kWh battery exclusively.

Fundamentally these products offer ~500 cycles for the 10kWh system and ~2,500 cycles for the 7kWh system. While you can achieve that performance by increasing cell count and reducing depth of nominal discharge, the costs required don't make any sense. And if you do want to do that, why not just have a single product with a switch that changes modes and just charge $3,500? Why use smoke and mirrors just to reduce your revenue?

It makes more sense that there is are physical differences in the power electronics and cooling at a minimum. And the idea that the additional costs associated with manufacturing packs using cells with two different chemistries will somehow be more expensive than increasing your cell count by 43% just isn't something I can see as likely.�

May 1, 2015

eloder http://indefinitelywild.gizmodo.com/how-the-tesla-battery-will-benefit-marijuana-growers-1701582831

Interesting story about medical (and less legal forms) of marijuana growers can stand to benefit given real-world numbers and energy use with simply using peak shaving on energy, no panels.

Six month RoI.

I don't run a business, but six months sounds like an incredibly good business decision. I can't imagine that other businesses would be that much different in being able to save from peak loading alone on tiered plans.�

May 2, 2015

hiroshiy https://www.youtube.com/watch?v=yKORsrlN-2k

Try this one.�

May 2, 2015

Newb On the short-term thread someone said that most analysts and media outlets are just puzzled what to make out of the Tesla Powerwall unveiling. Well, they will understand soon enough, once the order books are shown.

I'm really shocked how inexpensive stationary storage has just become, especially for residential rooftop solar. Just to make you understand, here's a table I made for comparable home battery packs which you can buy today in Germany in connection to PV solar system on your rooftop (I've translated euro prices in $ for comparison's sake) :

Anyone caring to do this for U.S. retail prices?

Tesla Powerwall

7kwh daily cycle

Bosch Powertec . BPT-S 5 Hybrid 6.6 / Saft Batteries

RWE Storage Eco 9.0

Samsung SDI ESS All-in-one

IBC Solar SolStore 5.0 Li / LG Chem price of the pack excluding inverter $3,000 $11,330* $9,030* $4,300* $5,430* est. price for inverter $2,300 incl. in the pack incl. in the pack incl. in the pack incl. in the pack total price for pack+inverter $5,300* $13,630** $11,330** $6,600** $7,730** kwh (usable) 7 6.6 7 3.6 4,8 price per kwh (pack level excl. inv) $429

$1,717 $1,289 $1,222 $1,131 Weight (battery pack excl. inv) 220lbs 400lbs* 310lbs* 100lbs* 270lbs* Weight in lbs per kwh 31.4 60.6 44.3 27.8 56,2 Guarantee 10 years full guarantee 5-year full guarantee 2-year full guarantee & 10-year "time value" / "current value" guarantee 2-year full guarantee & 7-year "performance guarantee" 2-year full guarantee & 7-year "time value" / "current value" guarantee *my own estimates based

on the assumed $2,300 & 130lbs inverter

**actual retail price

Source for pricing: click Source for pricing: click Source for pricing: click Source for pricing: click

I'm just stunned. Even if Tesla increased European prices vis-a-vis U.S. prices by 20%, it's still less than 1/2 price compared to the competition.

And here's the kicker: You can get a subsidy of up to 3,000 Euro from the government for pairing your PV rooftop system with a home battery.�

May 2, 2015

Gerasimental Thanks for compiling this info!

What are the others even doing? Over $1500/kWh, really?! What on earth else do they put into those products to make them so expensive?

Would be good to see how many of their products the others have sold. While I don't think this will be a hugely profitable product for Tesla, it could be a fantastic way to spread word of mouth about the company. I have high hopes that this will generate massive interest in Germany which will also lead to more awareness of TM and generate demand for Model S3X.

With regard to the �3000 subsidy. Is this an EU or a German subsidy? I'm guessing this is separate from the long-standing solar subsidies that were scrapped a while ago?

In fact, I'm not sure why I said that about the profitability. I guess I just see commercial/utility scale as the big cash cow here, with this more as an image/marketing thing (and of course part of Elon's big vision). But then, even at a pack-level cost of 300$/kWh, the Powerwall's pricing allows for substantial margins.�

May 2, 2015

ZachShahan Great job, Newb! Yes, I think it's pretty well known that Samsung SDI was the leader in lithium-ion batteries for stationary storage. But I hadn't searched out the prices.

Note that all-in prices are now out from SolarCity. "The pricing options consist of a nine-year lease plan at $5000, or the customers can buy the battery pack for $7,140 flat."http://www.businessfinancenews.com/22305-solarcity-corp-offers-tesla-motors-inc-powerwall-battery-for-5000/

$5,000 matches what Tesla reportedly told the press during the Q&A. But I assumed that was to buy it. $7,140 is not so hot (obviously), but it's still the best on the market by a good margin ($1,020/kWh).

Also note that Tesla's reported utility-scale price is $250/kWh, which is quite competitive for such an application: https://twitter.com/elonmusk/status/594186544174366720

As Elon says, that's where the big market is. That's what will really drive revenue to Tesla Energy. Exciting times.

That said, don't assume that Tesla is the only one bringing a competitive new product to the utility-scale storage market. Eos Energy is reportedly at $160/kWh for a liftime of 30 years (Tesla = 10? 15?) and a roundtrip efficiency of 75% (Tesla = 92%): Eos Energy Storage Secures $15 Million Via Private Placement With AltEnergy | CleanTechnica

It is winning pilot project contracts and has received a good bit of private investment: Eos energy storage Archives | CleanTechnica

And there are others that have not been so forthcoming with their prices but are potentially disruptive: Ambri, Amprius, Alevo, Aquion, ViZn... 42 Battery Storage Companies To Watch | CleanTechnica

That said, utilities and power plant developers are going to be cautious. Lithium-ion is quite well proven in the field (not just the lab), and the buyers will probably use a variety of energy storage providers for awhile in order to hedge their bets and learn more about the offerings.

And all of this ignores branding (quite big) and connections (Tesla has them).

All in all, I expect to see Tesla get a huge portion of the residential and commercial markets, and a good portion of a very large utility-scale storage market (which is nascent at the moment). Fun times for Tesla fans & shareholders! �

�

May 2, 2015

Newb cheers.

I think it all comes down to Tesla's superiority in cost/kwh on every level (cell/pack). They're market and technology leader in automotive battery packs, now TM is just transferring this to home, business and utility scale batteries.

It's a fairly new incentive: https://www.kfw.de/Download-Center/F%C3%B6rderprogramme-%28Inlandsf%C3%B6rderung%29/PDF-Dokumente/6000002700_M_275_Speicher.pdf

And here's a nice calculator for the total maximum subsidy:

Speicherförderung

By the way, I need to adjust the table above since prices for high-quality inverters (e.g. SMA Solar) are actually higher than the assumed $1,100, rather around twice the price. Here are the numbers which will be closer to reality (again, prices in $ but for German retail customers):

Anyone caring to do this for U.S. retail prices?

Tesla Powerwall

7kwh daily cycle

Bosch Powertec . BPT-S 5 Hybrid 6.6

RWE Storage Eco 9.0

Samsung SDI ESS All-in-one

IBC Solar SolStore 5.0 Li / LG Chem price of the pack excluding inverter $3,000 $11,330* $9,030* $4,300* $5,430* est. price for inverter $2,300 incl. in the pack incl. in the pack incl. in the pack incl. in the pack total price for pack+inverter $5,300* $13,630** $11,330** $6,600** $7,730** kwh (usable) 7 6.6 7 3.6 4,8 price per kwh (pack level excl. inv) $429

$1,717 $1,289 $1,222 $1,131 Weight (pack excl. inv) 220lbs 400lbs* 310lbs* 100lbs* 270lbs* Weight in lbs per kwh 31.4 60.6 44.3 27.8 56,2 Guarantee 10 years full guarantee 5 years full guarantee 2-year full product guarantee & 10-year "time value" / "current value" guarantee 2-year full product guarantee & 7-year "performance guarantee" 2-year full product guarantee & 7-year "time value" / "current value" guarantee *my own estimates based

on the assumed $2,300 & 130lbs inverter

**actual retail price

Source for pricing: click Source for pricing: click Source for pricing: click Source for pricing: click

- - - Updated - - -

Thanks for the link to the SolarCity prices for the 10kwh pack. It's quite different to the 7kwh, though.

The current integrated battery systems (including inverter) in Germany are priced around $1,500-2,000/kwh. Tesla Powerwall 7kwh + SMA solar inverter are at $780/kwh which is about 1/2, as I already mentioned above. This is a disruptive change in this market.

Tesla is in no need to advertise this or to educate anyone about this, since their order books will fill up very quickly - every rational homeowner in Germany or elsewhere simply must do their math given those numbers. Want to save money on energy? Start with a simple excel spreadsheet.

EDIT: Just added an LG Chem home battery pack aval. in Germany.

EDIT 2: Added product guarantee statements.�

May 2, 2015

blakegallagher Thanks Newb for the great chart. I was wanting to do the same thing with some of the Generators on the market. In Texas I was seeing a whole lot of Generac (?) generators that were installed to come on in the even of power failure and they look very expensive. They are about the size of Very small car (think Chevy Spark) It was not quite as tall but about the right width and length. A lot of bears are saying no one is going to pay this for a generator but even a nice portable generator can approach the price that installers get the Tesla Powerwall for.�

May 2, 2015

Newb I'd love to see such a chart with actual U.S. retail prices for energy storage, both Lithium-based and alternative. My intention was to show that as with long-range EVs, especially in Europe, there is no real competition for Tesla in the home battery market either.�

May 2, 2015

ZachShahan Thanks. Yes, I think you've nailed it now. $2,300 looks like a much better estimate for the inverter, and the addition of the guarantee terms is great!

If no one else beats me to it, I plan to do a comparison for the US market for a CleanTechnica article. Also, I got a lot of emails before the announcement from residential and utility-scale energy storage companies offering to comment on the news (before the news was out...). I'm now asking them to answer questions regarding price and some other matters -- many of them don't show prices on their websites. I'm not expecting to get much from them, but we'll see.

Btw, mind if I use your table in the CleanTechnica piece?

- - - Updated - - -

I'm planning to for a CleanTechnica article. Though, I've got a lot on my plate in the coming couple of days, so will have to wait for a bit. And if someone beats me to it, I'm happy to save the time.�

May 2, 2015

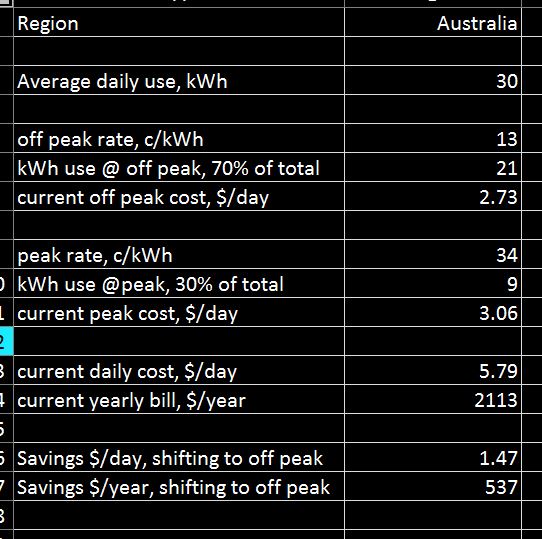

Auzie This is how Powerwall works out for Australian electricity prices:

Assumptions:

Ave household usage 30kWh

There is at least 7kWh usage at peak rate available to shift to off-peak rate with Powerwall. Such load is likely to be available for high usage households, say higher than 25kWh/day.

Daily load shift of 7kWh from peak to off-peak rate can provide $494/year bill saving if we factor in 0.92 efficiency.

All numbers in AUD.

�

�

May 2, 2015

jhm So this looks about breakeven on load shifting if you have to buy an inverter too. Are there other rate plans available? Perhaps there are TOU plans that would give you wider spread. But even at breakeven, it could be a no cost way just to get backup power. And of course those with solar panels may find it truly cost effective, and the solar inverter can get double duty.

One thing for investors to keep in mind is this PowerWall does not have to be a money saver for all households at this point. Basically, this product will be supply constrained until the Gigafactory is up to capacity. So in the meantime, we may as well get a solid gross margin on those use cases where the greatest savings are possible. By 2020 this product could drop from $3000 to $2000 (inverters and solar become cheaper too), and all along the way new use cases become compelling.�

May 2, 2015

Auzie There are multitude of rate plans but it is quite difficult to get rates quoted, there is a lot of fluff talk on providers websites, but I found only one that put actual rates up. I pay a flat rate of 24c/kWh, with some fluff talk about summer and winter rates etc, but lets keep it simple.

The rates that I put up are illustrative, rates from other providers in Australia are likely to be similar. What really matters is the differential between off-peak and peak for households with no solar.

Households with solar will have different economics.

For this product to be economical, a household needs to have 7kWh/day of usage @ peak rates available to shift to off-peak rates.

Off peak hours are 11pm to 7am, all power consumed during this time is at off-peak rates (hours may vary).

Peak hours are 7am to 11pm, all power consumed during this time is at peak rates.

Household charges PW (Powerwall) at off-peak rates during off-peak hours and discharges PW during peak hours, thus realizing the savings due to rates differential.

If we assume electricity consumption ratio peak/off peak to be 0.3/0.7, then it is safe to assume that the households need to consume at least (7/0.3)*0.7+7 = 24kWh/day in order to have 7kWh consumption during peak rate hours. I would say that Tesla team sized up their PW about right for the average western household.

Households with a consumption lesser than 24kWh/day are less likely to be in a market for this product due to worsening economics.

Lets say that the differential between peak and off-peak rate is X in c/kWh.

Load shifting happens every day, 0.92 efficiency. We want 10 year return on $5,000 capital for installed PW.

X x 7 x 365 x 0.92 = 5000 / 10

X = 21.3c

We need a rate differential of 21.3c (USD) to get 10-year return on installed PW.

�

May 3, 2015

Matias Tesla says "92% round-trip DC efficiency". So this excludes at least DC-AC efficiency. But does it also exclude AC-DC efficiency?�

May 3, 2015

Auzie If losses are higher, then it is easy to scale back calculations accordingly. I was curious about the potential and the order of savings, hence rough calculations.

Storage economics do not seem attractive in households without solar, in households with low daily kWh use and in regions with low peak/off-peak differential.

I will check my employers electricity rates tomorrow. Economics of load shifting are likely to be better for commercial users.�

May 3, 2015

Newb Sure, go ahead, you can use the table (of course, I'd appreciate a reference to the TMC thread). Looking forward to read the piece. So far I have no clue about cost of energy storage systems in the U.S.

�

May 3, 2015

jhm This looks like a good calculation. Certainly one can adjust the round trip efficiency if they like. But also this can modified to account for the value of backup, incentives and residual value after 10 years. Let suppose that suppose that the you are personally willing to pay $5/month for the assurance of backup, that your government gives say a 10% tax credit and that residual value is at least $300 in recoverable materials of recycled. This is an adjustment to $5000 of $1400 = 5�120 + 0.1�5000 + 300. So the net cost is $3600 and an LCOE of 14.09 c/kWh with 100% round trip efficiency. It seems that adjusting for less than 100 efficiency should depend on the rate you are charging at, not necessarily the rate differential. To account for inverter inefficiency, suppose 85% efficiency. Thus LCOE (.85) = LCOE(1) + 0.15/0.85 � rate_charge. So assuming 11 c/kWh charging rate, I get a LCOE of 16.03 c/kWh at 85% efficiency. So the 11c base rate added about 2c for round trip losses.

So if you have an opportunity to charge at a really low rate, then the cost of round trip inefficiency gets really small. My utility offers plans that have off peak rates 10 pm to 7 am that are under 5 c/kWh, peak at around 15 c and super peak in summer at 20 c. So this is near breakeven. However given that I have an EV that needs about 10 kWh per day, I could also charge that at night as well. Without the PW this rate plan did not make sense for an EV alone because while I could save money charging the car at night the rest of my power bill could go up relative to the flat rate plan I am currently on. But adding a second PW could tip the scale. Also adding second EV or solar could change the economics as well.

It would be very smart marketing for Tesla to do the math on local utility rate plans and configurations of EVs and solar to determine the best rate plans and how it nets out. My utility's rates are not so transparent, despite public notification requirements. While the tariffs are published it is very hard to figure out the formulas to apply all of them.�

May 3, 2015

Buran CO. first, I totally agree on the cycling issue, this might not be a viable solutions, and I have not done the math either. It might very well be that the more frequently cycled 7kWh system really need another cell. So, all of the following disregard this, and I leave for someone to do the math on cycling.

But this does makes sense from a technical point of view as discussed in the storage technical thread (e.g., to achieve same voltage and amperage for same electronics parts). And, I think you overestimate the cost implications of giving away these 3 extra kWh for free from a business point of view. Below is more detailed table on the cost side. If you assume 25% margin on the 10kWh battery, you end up with half that, 12.5% margin, for the "7 is really a 10kWh pack" case. The cost difference, assuming the same cells, is 375 USD, not 600 USD, if my estimate of about 175 USD/kWh at cell level is correct.

Sure, there are many reasons to not sell the 7kWh pack with this discount, and loose this margin. It is a clear risk that the 7kWh version will sell best, since this is intended to be paired with PVs. But it might be the case that the engineering of two different products with the same voltage etc does not makes sense. They need to solve the cycling issue somehow, this could be a solution. And, it definitely makes sense to just by one type of cell to really realize volume, if this is a possibility. The importance of giving Panasonic confidence on deliveries of a given cell type should not be underestimated. Managing just 1 for the cars and 1 for stationary storage seem very attractive to me.

10kWh 7kWh 7 kWh is 10 kWh case Price, USD 3500 3000 3000 Capacity, kWh 10 7 10 USD/kWh - Product level 350 429 300 Margin, % 0,25 0,25 0,125 Maring, USD 875 750 375 Cost of prod, USD 2625 2250 2625 USD/kWh - Pack level 263 321 263 Share of Pack overhead (50% overhaed) 0,33 0,33 0,33 Pack overhead, USD 866 743 866 Remaining cell cost, USD 1759 1508 1759 USD/kWh - Cell level 176 215 176

Finally, the consumer power wall product is just one aspect of this new business. I would say the industry and grid and utility scale products is the real game changer, and this is what will drive revenue generation for the moment. The grid benefits are apparent, and the real kicker as Elon mentioned on twitter. The much smaller battery packs in the Power wall products is a game changer to, but currently not low enough in cost to generate demand for all PV home systems. And, this is important in turn, Tesla might very well choose to accept lower margins on these PV storage versions, to foster growth as fast as possible in this particular segment as it holds great long term potential.�

May 3, 2015

trils0n Great chart Newb, thanks. I'd like to see footprint/dimensions or volume added to the chart, if that would be possible.�

May 3, 2015

Matias Do you guys have any info regarding price for new peaking power plant USD/kWh and USD/kW?�

May 4, 2015

Robertj Tesla Batteries in New Zealand / power company States

Vector has formed a partnership with Tesla to bring its revolutionary home and business batteries to New Zealand.

The utility company's bosses were at the Los Angeles launch of Tesla batteries, touted as being able to fundamentally change the world energy market.

Mackenzie said that the potential benefits for customers in New Zealand were considerable.

"For some communities, communal renewables and storage systems make a great deal of sense.�

May 4, 2015

Bgarret Its going to take a while for people to get this, for one reason, because of articles like this:

Tesla faces competition for customers, subsidies - Yahoo Finance

With this "analysis" -

On the contrary, Tesla is far from the only company offering such systems, and industry insiders say the cost of a Tesla system, which starts at $3,000 for a home storage battery pack, is in line with the rest of the market.

how did the author/reporter arrive at this conclusion - well, he just asked AES & Coda.

thanks again Newb for actually running numbers...

Note: I posted a comment referencing Newb's numbers and it was deleted...funny.�

May 4, 2015

jhm Very nice. I've also heard that SolarCity has recently entered NZ as well. I think this may be the first international expansion for SolarCity.

In any case, PowerWall and PowerPack will have an immediate global footprint and flow first into those markets that can make best use of them. So I love to see these reports.�

May 4, 2015

Newb cheers. Need to digest that quote again:

"On the contrary, Tesla is far from the only company offering such systems, and industry insiders say the cost of a Tesla system, which starts at $3,000 for a home storage battery pack, is in line with the rest of the market. []

Established and deep-pocketed energy and technology players like Samsung SDI Co Ltd, LG Chem Ltd and Saft Groupe SA are just a few of the names marketing products similar to Tesla's - small batteries to pair with solar panels at homes and businesses"

Yeah, and again here are the numbers for those deep-pocketed energy and technology players offering their similar products in the retail market of the biggest solar power producer in the world, namely Germany:

And that Tesla's competitors are far behind is actually no surprise, if you think about it in relation to the BEV market: The most cost-effective battery packs (per kwh) are in the Model S, followed by Nissan Leaf (LG Chem) and BMW i cars (Samsung SDI) - the same ranking of technology leadership and cost-effectiveness with home batteries obviously.

- Saft Groupe (e.g. in Bosch Power Tec) ~$1,700/kwh

- Samsung SDI ESS ~$1,200/kwh

- LG Chem (e.g. in IBC Solar) ~$1,100/kwh

- Tesla Powerwall ~$450/kwh

�

May 4, 2015

jhm Nice. So what happens when these other players are forced to offer better batteries and cheaper prices for stationary than they currently put into cars? In stationary, the batteries compete head to head. So Tesla is forcing these players to build better batteries. This should improve the batteries going into autos as well.�

May 4, 2015

Gerasimental Smart energy storage with AGL - AGL - Energy in Action

AGL, an Australian energy company also just launched a home storage battery. No details on their website at all, but this article claims they are offering a 6kWh system aimed at customers with 3-4.5kW of solar power installed. Still, nothing on price, chemistry, size, cycling, etc.

Update: In fact I just found some details on their site after all.

-7.2kWh battery that cycles through 6kWh

-Designed for 5000 cycles or 10 years, whichever happens first.

-5 year warranty

-3kW maximum discharge, i.e. 2C rate.

-Dimensions: 672mm x 384mm x 682mm

-Mass: 140kg

-Comes in a bundle with PVs but no indication of power electronics being included.

Source: http://aglsolar.com.au/wp-content/uploads/2015/05/Power-Advantage2.pdf�

May 4, 2015

Newb @trils0n: I could research and provide the dimensions for the storage systems but it's hard to tell how big the inverters are which are included in the systems, and so on. Thus, it would make it difficult to compare the actual battery packs. Just checked the Bosch Power Tec Hybrid system and it's 597mm (width) x 1,693mm (height) x 706mm (depth), regardless of the battery size (4.4-13.2 kwh).

Tesla Powerwall is 860 mm (width) x 1300 mm (height) x 180 mm (depth)�

May 4, 2015

Bgarret And then THIS quite shoddy piece of journalism starts getting republished in the great FUD echo chamber that is financial media...if you say it enough, does it become fact?

Will Tesla (TSLA) Stock be Affected by Battery Business Competition? - TheStreet�

May 4, 2015

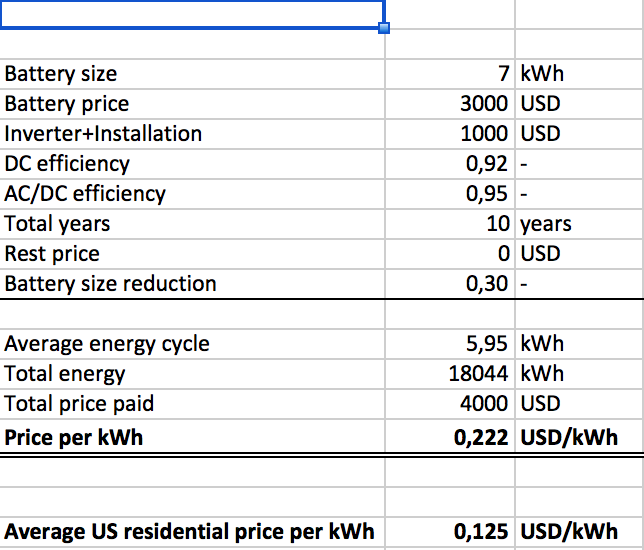

erha I'm trying to look at the numbers for energy storage, and so far I'm only getting confused. Elon and JB (and a lot of people on this forum) seem really, really excited for energy storage. However, I can't really make the numbers add up.

I took a screenshot of my spreadsheet where I end up with 22 cents per stored kWh. (I assume a linear decrease in capacity of the battery and that the battery is worth 0 USD after 10 years. Putting in a couple of hundred dollars here, og assuming zero decrease in capacity doesn't make a huge change.)

The average electricity price in the US is about 12.5 cents. A combination of solar cells and battery is, as far as I can see, not financial viable at all. I tried to find rates for peak and off-peak, but couldn't find any good numbers. Can the difference be more than 22 cents?

UPDATE: I did this really fast, so there might be some errors in the calculations. The efficiencies are quite confusing for example. They are part of the total energy number. If you set all efficiencies to 100 % you end up with 18.4 cents/kWh, so it really doesn't matter that much.�

May 4, 2015

Robert.Boston Moderator's Note

There's is an excellent thread on this very subject (financial viability of PowerWall) over in the Energy, Environment & Policy section. I considered moving it over here, but it got started there by @wk057, who has installed a 191 kWh home storage system using Tesla Model S cell blocks, who is not a regular over here in the Investors forum. Rather than duplicate that discussion here, let's keep the financial analysis from a BUYER'S perspective in that other thread. Let's use this thread to discuss implications for Tesla and TSLA.�

May 4, 2015

Newb @erha: Thanks for the spreadsheet. I've got a comment on the underlying assumptions of your calculation: The battery will have a lifetime of 15-20 years, i.e. 5-10 years more than in your assumption, depending on the cycles, of course. Tesla's conservative estimate is that it will make "more than 3,000 cycles". So 3,000 is somewhat the guaranteed bottom line while 4,000 or even 5,000 cycles are likely, I'd reckon.

With your average cycle of 5,95 kwh and 4,000 cycles you end up with 23.800 kwh which is 16,8 ct/kwh. With 5,000 cycles you're at 29,750 kwh at 13,4 ct.

Your average US residential price per kwh is also underestimating the differences within the U.S.. Here's an interesting chart which shows that retail prices for electricity in Hawaii, New England states, Middle Atlantic and California are higher than the 13,4 ct and 16,8 ct respectively: EIA - Electricity Data

Current retail prices for electricity in Germany amount to $0.28-0.35/kwh.

@Robert: I think it's also important for investors to understand if Powerwall and Powerpack are viable businesses or not. And if so, where the potential customer bases are. Obviously, there are stark differences in retail prices for electricity from utilities across the U.S..�

May 4, 2015

bonaire What is the capacity after 3000 cycles and is the full state of charge to be used or is there a buffer on both ends (kinda like how they did the Volt)?

Many US states do not have a delta between day and night rates and the daily peaks are not every-day but a few days per year thus relying on regional "peaker plants" which are natural-gas fed extensions to the base load architecture of the grid power generators. Always keep in mind that batteries are not energy generators but actually energy users. Something like 15% of the energy used to charge them is lost during the charge/discharge cycle, more if you charge faster and draw faster. Advocating for batteries to help load shaving is one thing but batteries are net energy consumers. Standby power is a value in areas with a lot of power failures like India, Caribbean and other locales.�

May 4, 2015

Foghat I think the key to the market for tesla's powerwall is retail sales through its sales channels. That really boils down to Tesla's partners to effector deliver a great customer experience at attractive price points. Right now, Solarcity is the vast majority of powerwall's retail prospects.As such, I believe, the best indicator of powerwall success is to monitor solarcity's sales and customer response.

To me it feels like the solar panel industry back in 2007. You can produce a great panel, but if the larger market isn't buying, then you have a great product no one is buying. There has to be a compelling retail offer to make this really work, in my opinion.�

May 4, 2015

techmaven Using a slightly higher cost for the install + inverter ($1,500), and adjusting for just inverter efficiency assuming the battery is charged using solar, the cost of the Tesla Powerwall is $0.195/kWh if it lasts 10 years, but only $0.10/kWh if it lasts 20 years. Going with 15 years, that's $0.13/kWh. Add to that the cost of your solar install on a per kWh basis. If you can get solar installed for $0.15/kWh, then the total could be $0.28/kWh. If you pay more than $0.28/kWh at peak times, then this could be worth it to you. The more Powerwalls you install, the more the installation cost and the inverter costs are spread out per kWh (inverter costs do not go up linearly per kWh and install costs are also a small increment per additional Powerwall).

If you use it for arbitrage with time of use rates (ToU), then you have to factor in the charging inefficiency loss, but still, if the difference between peak and super-off peak is more than, say, 15 cents, then it is worth it. Some people, especially businesses have to pay some hefty demand charges during the afternoons that do not show up on the "average price per kWh" numbers thrown about.

Here's the latest residential electricity pricing:

EIA - Electricity Data

Where I live, the price is too low for this generation of Powerwall to be economically interesting. But in Hawaii, it's almost 31 cents per kWh. Throw in the fact that this is actually backup too - most other backup solutions are essentially dead cost unless it is used. If it isn't used, then it's just dead money. I think there will be plenty of takers for this generation, enough to be production constrained. We'll see what gross margins Tesla has for this solution. It's probably priced about right... too high for those of us that have very low electricity rates, but low enough to attract customers that pay high demand charges, have intermittent power, or have high electricity prices. Once the Gigafactory starts up and the cost drops again, we go from interesting to a few specific situations that is still a humungous market to vastly more situations.�

May 4, 2015

bonaire techmaven, there is a chain-reaction approach to CA LoadShaving.

If CA businesses load shave, fewer annual GWh are imported into the state. I think it is 30% of CA used electricity is imported, as of 2013. It is a lot of energy and certainly dwarfs the planned SGIP projects overall, including the non-A.E.S. projects like natural gas generators and others.

If CA can self-generate enough (though, they are losing Hydro right now, fast) then importing drops and then external AZ and OR/WA generators selling to CA will lower their demand. That in turn lowers demand overall outside of the state. Every kWh saved in peak load in CA translates to extra capacity outside of the state. States surrounding CA have their own challenges, however. Lake Mead is drying up and Hoover Dam is going to have to shut down if water heights drop a bit futher. That is over 2 GW of power 24x7. Take a lot of solar to make up for something like Hoover Dam. 15-20 GW of solar arrays is quite large and maybe 35-45 Billion in costs at $2.5/W. And, with that much solar - do we use US-sourced solar or cheap-out and rely on China to provide such modules?�

May 4, 2015

FluxCap Great analysis, man.�

May 4, 2015

jhm In awe of Elon Musk's wonderwall – a utility killer | Business Spectator

Interesting article from Australia on Tesla's potential to be a utility killer.�

May 4, 2015

Bgarret This is an older article from scientific American about cell phone towers in India and globally - the numbers are staggering and I think Tesla just hit a price point that in 2013 they were hoping for by 2020.

Why Cellular Towers in Developing Nations Are Making the Move to Solar Power - Scientific American�

May 4, 2015

vgrinshpun

The California SGIP spreadsheet is updated weekly, so I decided to check what changed in two weeks since I downloaded the spreadsheet originally. There was total of 4 added commercial projects with total of 3,200kWh of battery capacity. The power ratings of these projects are 1000kW, 300kW, 200kW and 100kW�

May 5, 2015

Gerasimental Thanks for digging and sharing again. 3,200kWh at 1600kW rated power, all in multiples of 100kW, certainly sounds very Tesloid.�

May 5, 2015

30seconds Interesting read on slicing the economics of power wall by market

Tesla Battery Economics: On the Path to Disruption�

May 5, 2015

Matias Yobigd20 has info regarding pricing of powerwall

http://www.teslamotorsclub.com/showthread.php/46526-Powerwall-and-The-Missing-Piece-Event/page90?p=997966&viewfull=1#post997966�

May 5, 2015

ZachShahan

Your post/question brings up several points for me all at once:

1) I think the presentation from Elon was spot on, but I also think people who don't know the market well are going to be confused by it... That's a lot of people. (See point #2 below.) And that may even have a bit of a backfire effect when people get turned off to the idea of storage and then don't realize in 2 or 3 years that it has gotten much cheaper. Let's hope not...

2) Yeah, these Powerwalls don't yet make sense for the average home. They're not going to save most people money. But Tesla isn't saying they will and it isn't targeting the average home. SolarCity's first blog about this was focused on Hawaii. The price of electricity there is sky high, and I've seen that solar can save the average homeowner there over $60,000 over 20 years. The main utility company has been blocking rooftop solar connections for years, because it doesn't want to lose its massive profits (the argument it puts forth is that the grid can't handle that level of intermittent solar power, but don't buy it until the penetration level is 20-30%, which it isn't close to). With Powerwall, SolarCity can now offer homeowners who go solar a way around the utility which will still save them a ton of money.

3) There are similar stories in Australia, Germany, and California -- all markets that Tesla has said it is initially targeting. As battery costs come down, the markets where this is competitive will increase, but these markets already offer a lot of room for sales. Furthermore, Tesla is offering its battery systems through sites like Treehouse where offgridders can also purchase them, since they are generally now the best option for that market.

4) As others have noted, the home unit is a great marketing tool. It's utility-scale offering is *really* competitive, and i think that's where it has the most potential for revenue. A *lot* of utilities could benefit from Tesla's storage offering. That said, I think this market is also riskier. There are some other battery startups quoting really low prices (Alevo - $100/kWh; Eos Energy - $160/kWh;... Others with potentially breakthrough technology are expected to be marketing their products soon... we'll see). Whether these competitors are legit is another question, but that is where the risk comes from. Even so, Tesla's product is proven, cheap, and will come down in cost. That has me very excited. And I'm quite sure Tesla will have a healthy revenue stream from this market. Look at how it's doing in California already.

5) I don't care who you are (general "you," not you specifically), you don't know who's going to lead in the energy storage market. But Tesla is looking like a decent bet.

fun times.

Update: Oh yeah, 6) I don't think most people will buy these with cash. Either through a lease or loan, they will finance them via a small monthly payment.

- - - Updated - - -

Surprisingly great article from Gizmodo... and turns out it was a repost.

The very last line is hugely wrong, but looks like the author found that out based on the updates at the top of his piece: http://rameznaam.com/2015/04/30/tesla-powerwall-battery-economics-almost-there/

- - - Updated - - -

Thanks. Definitely! Always do. �

�

May 5, 2015

bonaire The best (better?) way to handle Hawaii is to get Panasonic to actually make the PowerWall in Japan and ship in large numbers to Japan now before the GF is done. The price is actually too low for the benefit that can be found in Hawaii. Those with Grid Tied arrays can cut the cord sooner rather than later. Many homes are small and 20 kWh (2 units) would work fine in many cases. If they can get two units at $7000 plus inverter @ $2K plus labor at $1k, it is a viable solution as long as they have a dump circuit for once the batteries are full (like a water heater).�

May 5, 2015

jhm I like this idea of manufacturing PWs in Japan. I wonder if Japan might be a good market too. Then of course there is Australia and lots of Pacific islands to ship batteries to. The Indian subcontinent would be better reached from Japan than Nevada.�

May 5, 2015

daniel Ox9EFD If Tesla is not constrained for the type of batteries that go into the power pack, this means Panasonic is not constrained. Could we talk about the possibility of Tesla giving permission to Panasonic to get into the power pack business too? It would make perfect sense for selling to Japan, since Japan has a foot in solar, as well as remote Islands.

It could be like the Nissan-Renault alliance, both sell cars but they divide market share.�

May 5, 2015

jhm Japan Plans to Pump $700 Million Into Energy Storage : Greentech Media

Japan is subsidizing energy storage to the tune of $700M. All levels, residential, commercial, and industrial.�

May 5, 2015

daniel Ox9EFD It would be funny if Tesla shipped packs to Japan. Those batteries would make some round trip...�

May 5, 2015

jhm Hawaii May Be Closer to Achieving a 100% Renewable Grid Than You Think : Greentech Media

Another useful article on Hawaii's path to 100% renewable energy. Note as of 2013 71% of power was generated from oil. It should be informative to see how Hawaii incorporates batteries. Each island has its own separate grid and distinct energy mix.

HECO has an RFP for a 200 MW storage instalation. Tesla could get that with 400 MWh for about $100M. We'll see.�

May 5, 2015

32no Here's what Peter Rive (CTO) had to say about Stationary storage during the Q1 SCTY conference call:

"As many of you know, we announced new versions of our solar battery systems in all of our business units: commercial and government, microgrids, and residential. We're seeing great growth in commercial and microgrid offerings and the new Tesla batteries are helping to widen the addressable markets where we can offer those systems. On the residential side, our fully installed solar battery system costs are about 1/3rd of what they were a year ago. We expect costs to decline further as manufacturing scales, and over the next 5 to 10 years, these cost reductions will make it feasible to deploy batteries by default with all of our solar power systems. Our solar back-up battery system will sell for $5000 as an add on to a lease or a PPA, which is comparable to other backup generator options. It is important to note that the Tesla price of $3500 doesn't include the inverter, permitting, installation, management software, and electrical equipment to wire the circuits that need to be backed up. All of those things are included in our turn-key service in our solar battery systems. Interestingly, the residential backup generator market is actually larger than solar, with over 3.5% of residential customers having back-up generators. The industry leader in this space had over a billion dollars in revenue last year, and had seen a 12% compound annual growth rate over the past 10 years. Now extending the appeal of SolarCity to the traditional market is interesting, but it's a small part of the strategic interest we have in batteries. Batteries spread throughout the distribution system can lower the costs of maintaining the grid and new market structures designed to take full advantage of this benefit appear likely in several states. Our products, and by that I mean the contracts (?) as well as the management software is grid services ready and as these markets develop, there's a 50/50 revenue share model embedded in the contracts that we have with our customers. Now, we're not in the position to estimate what these revenues could be, but it's interesting to note that in California, its currently estimated to cost $190 per kW per year to meet new peak loads. The other strategic options that batteries make available to us are hedges against bad policy outcomes, with examples being changes in net metering and solar penalties like high fixed (?) charges. As always, Hawaii is a postcard from the future, the high electric rates there make economic now what will be affordable in other markets with further cost reductions. As a result, we will be offering a 0 down lease in Hawaii next year that will give customers the ability to go completely off grid. With that said, I want to reinforce that customers removing themselves from the grid is a bad policy outcome. There's so much value in distributed energy resources, so we're hopeful that utility business models will adapt to embrace solar with batteries rather than penalize adoptions, which in turn will encourage good defections (???)."

The questions marks represent me second guessing myself on what word he actually said, which was hard to discern at times.�

May 5, 2015

Foghat it will be interesting to see how DERs play out in that 200MWs, meaning powerwall installs at houses and business.�

May 5, 2015

jhm Thinking through the HECO 200 MW storage project, while the battery may cost $100M, the total installed cost could easily be twice that, $1000/kW. Amortized over 10 years works out to $8.33/kW/month for depreciation alone. Financing and maintenance add to this.

As an alternative, suppose HECO offered $7.5/kW/month for aggregated behind-the-meter storage. HECO would avoid financing and instalation costs. It would also avoid various operational risks and difficulties in siting the plant. An owner of a Powerwall unit would qualify for 3 kW for $22.5/month in rebates on their power bill. Over 10 years, this stand by rebate would be worth $2700. Additionally, the PW owner would gain other benefits of ownership to help reduce their power bill and home back up. I think this could be attractive to all participants.

For Tesla, this could mean the sale of 66,667 PW units, which would yield $200M to $233M in revenue. This is twice the revenue as the Powerpack route direct to the utility.SolarCity would score big on this as well. Moreover, such a program could continue to grow well past the 200 MW target.�

May 5, 2015

jhm Thanks, 32no. This transcript is very helpful.

One little note, $190/kW/year capacity is $15.83/kW/month. This is substantially more than the $10 I've seen tossed about or the $8.33 I just used in my post above. It is so important that DERs get a cut of that. Tesla PPs @ $250/kWh is so much cheaper than $16/kW/month. It's not even funny. Tesla deserves a big chunk of that market, even if they have to build, lease and operate it themselves. I'm expect that Tesla can roll out fully installed capacity for less than $1/W, which is pretty damn cheap.

The other thing that stands out for me is that back up generators is such a big market. 3.5% of households and industry leader has over $1B in revenue. If I were looking for something to short, I'd smell blood here. SolarCity and Tesla have a huge opportunity to take market share. Even for those who want to keep a generator, adding a PW can improve the level of performance. For example a 2 kW generator coupled with a PW can deliver upto 5kW peak as needed and supply 48 kWh per day for as long as fuel lasts. There is no need to make this an either/or proposition; both can work together. But I think that many will find the battery to be the better value, and the generator nonessential.�

May 5, 2015

Foghat i think we have be clear with how the business works:

Tesla sells batteries. That's it. The rest is on the installer or utility to make it work within their system (CTO Peter Rive noted in32no. post). So tesla makes money on sales, utilties/installers make money on the energy the battery stores and discharges (as well as the t&d savings)�

May 5, 2015

vgrinshpun I've been doing research on the Oncor grid storage proposed project and found a lot of interesting information worth sharing here. Unfortunately I did not have as much time, so for now I�ll post few snippets, with more to follow.

Firstly I wanted to correct my mistake of assuming that Oncor plan to install 5GW of distributed battery storage would translate to the installed 10GWh battery capacity. This was based on Tesla�s battery technical data indicating that power rating of the battery is half of it�s capacity rating, i.e. a 100kWh pack can discharge at 50kW meaning that the battery pack full discharge at rated power takes two hours. After glancing through The Brattle Group Report that was commissioned by Oncor to justify the expense of installing the grid storage, the battery packs proposed for this project require lower power rating than the Tesla batteries � 1/3 of their kWh capacity.

So the Oncor project will require 15 GWh capacity (not 10GWh as I assumed earlier) and ability to discharge at only 5kW (3 hour discharge). 15GWh of Tesla batteries will have higher discharge capability of 7.5GW, but this capability would not be fully utilized because Oncor requires only 5kW.

It is also interesting to note that this huge project will be a bellwether not only as far as technical matters are concerned, but in terms of regulations as well. As I posted before, this project is subject to the legislative approval, because Oncor is a distribution company and is allowed to neither own the batteries, nor pay for them, nor sell stored power to the grid. So to proceed with this project Oncor needs lawmakers to pass a bill making changes to the regulations.

According to Dallas Business Journal article there was no corresponding bill filed during the latest legislative session. The Oncor project, however has influential backer, Sen Troy Fraser who chairs the Natural Resources and Economic Development committee. Senator indicated that the proposal lost traction this year because batteries are not cost effective yet� Obviously, this was before the Tesla Energy announcement, so the circumstances will be much different next time.

I believe that Oncor proposed 2018 schedule for deployment was established in close cooperation with Tesla, and Oncor most likely knew about the battery pricing ($250kWh) well in advance of the public announcement. In fact I believe that the whole Brattle Group Report was based on Tesla pricing information.

Another interesting point is why Oncor is proposing this project and why generation companies oppose it. Texas has very large wind generation capacity, about 15% of the total installed generation capacity. Variability of wind generation presents a significant problem for a distribution company like Oncor because it threatens stability of the grid, potentially leading to brownouts and blackouts. Installation of the storage, especially on such a massive scale (the proposed 5GW is approximately 7% of the total generation capacity of Texas) allows to address any grid stability issues. Such a project, however, is seen as a threat by the power generating companies, as it potentially cuts into their income from operating the peaking plants and renders these assets useless.

I also wanted to address some of the technical details that I mentioned in the passing before, namely that Tesla batteries not only could successfully compete with peaking plants on cost, but also have very important operational advantages. I am an electrical engineer by trade, and although I do not have direct experience working in transmission and distribution business, I do have a natural understanding of these advantages, but recognize that without some visual aids the significance of the operational advantages offered by the batteries might not be fully appreciated.

So I found several slides from the Strategen Presentation during the 2014 Western Power Summit in Las Vegas which illustrate the advantages of using batteries as a grid storage.

�

�

May 5, 2015

Gerardf Great post. I ran into the Brattle report as well and I agree that it seems written with Tesla PowerPack and Tesla pricing in mind, and remembered this post about the Oncor pilot. Tesla Batteries in DFW, Oncor Micro-Grid

I think there are many utilities worldwide who noticed the 250/kWh pricepoint that Elon stated and are putting this number in their speadsheets as we speak. My feeling is that as soon as a first Utility signs a deal, other will soon follow. I would not be surprised for Elon to announce in the ER that one or more letters of intent have been signed already. The first GigaFactory's production years might soon be fully booked and other utilities will be eager to secure production output levels that will require a second GigaFactory tot fullfill. I guess Germany with a big need to stabalize the grid because of their large deployment in windenergy wil be a good candidate.

Some analysts will very soon put the numbers in a spreadsheet to calculate the potential WW utilitiy revenues and GM for Tesla over the next 5 years.

Like the oportunity for utilities, I think an other opportunity is also underestimated, large UPS. Not only do we see references to Amazon, but just listening around the past days I have ran into several companies who mention that are very interested in 50 or 100 kWh UPS systems and first calculations show Tesla undercuts alternatives by a big margin. Even on the Benelux forum I read about people who compare quotes they have on the table at their companies now and might now look into a Tesla based solution. There must be very many such 'large-UPS' opportunities.�

May 5, 2015

Johan Thanks for that great transcript 32no, also very good posts vgrin, jhm and gerard.

With regards to the benefits of batteries compared with peak generation plants (most commonly both in the US and EU natural gas) it's very clear that kW and kWh rating is only one part of the puzzle, and that the chargeability, almost instanteneous ramp up and down and overall flexibility has tramendous value as well.

In fact, I would wager that even in the abscence of renewables such as wind or solar it could make a lot of sense to build a NG plant with a smaller output coupled with a large battery and run this plant near 100% operations continously instead of building a larger plant with a much higher maximum capacity (for peaks) but on average running such a plant at only say 30-50% of capacity.

Edit: I see that I just described a "hybrid fossil power plant". For arguments sake let's call it a "plug out hybrid" �

�

May 6, 2015

Gerardf Utilities as a partner in GigaFactories

I have been wondering about Elon's statements about the "GigaFactory as a product" during last weeks presentation.

After doing some very basic calculations it is very clear to me that the energy storage market at utilities is a very big one, the price breakthrough to $ 250,-- / kWh for large storage projects as announced last week will open the floodgates.

Here in Europe we have to import most of our energy, and specially in countries like Germany there is a big political incentive to get independent from natural gas providers like Russia. This already resulted in major installations of solar and windenergy, and also in one large utility divesting in "old energy generation" and even selling these plants, effectively splitting up the company. This however had a destabilizing effect on the grid and more often Germany has trouble offloading excess energy to other countries on sunny & windy days.

The demand might very well get so big the next years that the utilities will want to secure storage production capacity and secure costs levels for these multiyear projects. One way would be for them to become GigaFactory partners.

I can imagine GigaFactories to be funded by Joint Ventures around Tesla, a Li-ion partner (Panasonic, LG, Samsung, etc) and one or more large utilities. In this setup Tesla could claim / commit to a percentage of production output for the Model-3 and a significant percentage is committed for storage systems to be installed at the utility JV members, leaving a percentage for other customers where the JV can make some extra profit. Actually these other customers could well be other makers of EV's, who are about to get in trouble to find LiIon production resources once they have to compete with the Model-3. In such a setup the GigaFactory will indeed have become a Tesla Product.�

May 6, 2015

Robert.Boston Moderator's Note

In case you didn't notice, there is now a new subforum for Tesla Energy:

Tesla Motors Forum > Tesla Motors > Tesla Energy

Discussions re Tesla Energy as it relates to investors is still appropriate here. I'm going to be a little more assertive in moving analyses of Tesla Energy's offerings from a customer's perspective ?into an appropriate thread in the new subforum.�

May 6, 2015

jhm Yes, this is how big utilities need to approach this. Oncor will want to lock in good pricing on about 15 GWh of PowerPacks and install that over perhaps 5 year. So an off-take agreement may be the smartest way to do that.

Here's a hypothetical off take agreement. Customer pays $84M upfront for a contract to buy upto 1 GWh of Powerpacks per year for no more than $210/kWh for the next 5 years. Given that Tesla wants to grow at 50% per year, it has a very high targeted return on assets. So this off-take agreement fronts some of the capital needed in such a way that it is comparable to selling 1 GWh per year for five years at $250/kWh with no money upfront. So Tesla financially indifferent with or without the off take agreement. It is beneficial to both buyer and seller, however, to lock in terms and reduce future supply and demand concerns. Now the utility may be in a good position to finance the upfront payment. For example, an amortizing five-year loan at 6% works out to less than $20/kWh. Thus, the combined financed cost to the customer is a mere $230/kWh. The off take agreement enables the utility to save $20/kWh off $250/kWh through more efficient financing.

Essentially, the off take aggrement provides Tesla with upfront capital to build out more capacity, whether at Gigafactory 1 or beyond. This greatly aids Tesla to expand on a positive cash flow basis. Moreover, my model suggests that Tesla can still achieve a 26% GM on the batteries sold at $210/kWh under the terms of the OTA. Tesla is also protected from price competition down to $210/kWh. A price competitor would have to offer an equivalent battery below that price to convince the OTA buyer not to exercise its call option. On the other hand if the buyer backs out and the going price is say $230/kWh, then Tesla can sell $20 above the contract price of $210. Now if Tesla is able to drive the full price below $210 over this time period, this is not a risk to Tesla. Say Tesla drive the price from $250 to $200 over the next 5 years. So toward the end of the contract the OTA buyer is able to buy at $200 below $210. This is not a loss to Tesla because they have in fact driven the cost down to that they can offer such a fully loaded price. Both Tesla and the OTA buyer are benefiting more than expected under this scenario. So the only real risk is that some competitor can sharply undercut Tesla on a fully loaded basis, which looks highly unlikely at this point.�

May 6, 2015

Yonki Well I think this info applies to investors, since it seems like TSLA might be shooting themselves in the foot:

I signed up immediately Thursday night (to be able to buy energy cheap at night for use during the day), but on Monday I was contacted by SolarCity who said that they were responding to my Powerwall signup. I told them I can't go solar because my roof is 99% covered by trees, and they responded that "you can only get the battery if you get solar."

Has anyone else had this experience? It's a great way to discourage an enthusiastic group of people. I can see why SolarCity might only be interested if there's a solar component, but I signed up (I thought) with Tesla,not SC...

[this was a paraphrasing of my post in the Short Term Price thread]�

May 6, 2015

aznt1217 yes, but you don't only get the battery through solar city you can get it through the other partners.�

May 6, 2015

Yonki Sure, but what is the mechanism for anyone to follow-up with me now? I enthusiastically signed up, Tesla forwarded my info to SolarCity, and I got a phone call from Solar City who told me "no". Is another partner going to call me now?

Instead of saying "You can't get a battery unless you have solar", SC should have referred me to one of Tesla's partners that will do exactly that.�

May 6, 2015

Newb hmmm, you're right. Not very well organised process there. On the reservation pop-up window there's a box like "I�m interested in having solar panels installed", did you untick it? It may well be that there's an automated backend filter/push-mail system, so that SolarCity gets all the reservations with this box ticked.�

May 6, 2015

yobigd20 I also got a call from SolarCity with a message that solarcity is not available in my area so I guess if you can only buy the PowerWall with solar then I can't buy the PowerWall. That's great (not) but I don't want the PowerWall from solarcity at solarcity's $7k marked up price. I want the PowerWall directly from tesla at $3k. I don't want to be contacted by solarcity. I don't want even want solarcity's solar panels anyway as I am going to use a different vendor. So far their execution of this isn't very good.�

May 6, 2015

austinEV Well they won't even be in production for a while, so they have time to clean up their act. You aren't actually being inconvenienced yet.�

May 6, 2015

yobigd20 right. I don't plan on purchasing until after I get my tax refund in 2016 anyway. enough time to plan and save.�

May 6, 2015

Yonki I can't recall, it probably was ticked. I am potentially interested in solar (once I get some old dying trees removed), but I was expecting to talk Powerwall, not solar...�

May 6, 2015

daniel Ox9EFD Article very relevant to this thread:

Tesla's New Battery Doesn't Work That Well With Solar - Bloomberg Business

Takeaways -

1. The 10 kwh is intended for backup only and doesn't have the cycle life for daily use,

2. the 7 kwh that actually has the cycle life for daily use (grid defection) - will not be offered by SolarCity, expect in Hawaii, next year.

3. The reason given is that the 7 kwh is not economic in most regions.

I think Tesla is not clear enough with the 10 kwh not being fit for daily use. But regarding people wanting the 7 kwh anyway, they should go to a different installer.�

May 6, 2015