Oct 28, 2013

ssq On a related note and possibly a silly question+wrong forum, is there any way to claim the tax credit early/before ? I guess not, but curious.. more so since the federal tax credit is more or less guaranteed. Underlying assumption is that the withholding rate on paychecks overpays applicable tax (=hefty tax refund)

�

Oct 28, 2013

smorgasbord Maybe some were, but at the Oct 2011 Factory Tour I spoke with a former NUMI employee whom Tesla rehired to run the stamping line that he said he had run for over a decade previously. This is the row closest to the door on the right as you walk into the second building.�

Oct 28, 2013

Citizen-T You could change your withholdings from your paycheck to offset the tax credit.�

Oct 29, 2013

kenliles I think you're both right- my recollection is they refurbished many of the existing ones, and purchased-shipped the big ones from Detroit area- something about needing the largest ones produced for the single piece body parts if I remember right�

Oct 29, 2013

brianstorms Whoa there, think ya meant $7.5K tax credit. If it were $75K Tesla would be selling millions of these things! �

�

Oct 29, 2013

Citizen-T So, I was just looking at the analyst expectations for the quarter on Yahoo Finance. The one thing I don't get is that it says the average EPS expectation is for $0.11. This seems too low given that last quarter EPS was $0.20. Am I missing something or do analysts on average really expect that a decrease in ZEV credits and increase in Superchargers/Service Centers will cut that much into their earnings?

I'm looking for something like $0.25-$0.30 EPS.�

Oct 29, 2013

fjm9898 I think that is exactly what it it. In the past they have guided (i think Q1 CC) that Q3 would be the start of the major decline in ZEV Credits. DB and Andrea have around 5500 cars so even if we get 5900, 400 cars does not make up the 10-15cents (20-25ish) over their 11 cents we are expecting here.

hey but i am not going to complain if they expect only 11 cents and we blow it out of the water.�

Oct 29, 2013

hershey101 We know deliveries were around 5800-6000. They will probably guide for 22K for the year and not sure if they will give next year guidance or not but if they do, its going to be 35K.. I'm looking for a non-GAAP EPS of about $0.15 on 20% gross margins which is better than the street, but I think not blowout.

I don't see how people are getting EPS of $0.25+, ASP above 100K is not accurate IMO, neither is expenses being less than significantly 100M.�

Oct 29, 2013

ModelS8794 I think some are inadvertently double-counting ZEV by using a higher ASP and then adding in ZEV revenue on top. I calculated last qtr ASP around $94k ex-ZEV, this quarter looks to rebound given 1) no 40kwh sales, 2) Sig sales in Europe, and 3)price increases flowing through. But I also think $100k+ ASP estimates are off base if they are meant to be ex-ZEV.�

Oct 29, 2013

Citizen-T But, guidance last quarter was that the reduction in ZEV credits would be offset by improvements in gross margin. So the net is really just how many cars they delivered versus how much expenses have increased. Yes?�

Oct 29, 2013

fjm9898 True.

I also remember some people thinking expansion would be more expensive then it is. but once gain Elon guided to keep in line with income profits and not burn cash. So ya not to sure. Maybe their ASPs are weak along with some shooting for only 5250?

But like i said. i will take their 11cents all day long. rather have them under then up with us.

EDIT:

LNKD drops as Guidance is weak. Seems to be a common theme this earning season. I hope Elon doesnt sand bag guidance and by keeping 35k.�

Oct 29, 2013

ckessel I don't think 35k is sandbagging. They're short of 600/week now. They'd need to average 700/wk for all of 2014 to hit 35k. Tesla went from 400->600 in 2013 and it's been a fairly linear progression near as it's possible to tell from deliveries and VIN assignments. I don't see any reason to believe it won't be another linear progression from 600->800 in 2014. Elon has stated 800/week is the goal for the end of 2014.�

Oct 29, 2013

TSLAopt yes, I think guidance of 35k cars next year is what he will say and I think they will do much more than that. Each quarter next year will be a nice Easter Egg. I hope one of the Analysts asks the question "you mentioned recently that by the end of next year you will have enough batteries per week for 1200-1500 cars per week...wouldn't that imply a much higher volume than 35k cars for next year if you are not demand constrained?"...ths reminds me...We need to start a new thread called "Questions we want analysts to ask Elon on the conference all"�

Oct 29, 2013

fjm9898 True but in my mind that is him sandbagging. They can see things we cant, so a goal of 35k means that is probably going to get revised upwards. So i just hope 35k doesnt look to small to the market and they make us pay for it.

The reason why i think ramp up can happen faster in 2014 then it has in 2013 are that these constraints are going to get solved. As they stated in the last CC that only a small % of suppliers were holding them back. When those chains holding them down get broken, they could be off to the races as they could add a 3rd shift. Its only something that Elon knows.�

Oct 29, 2013

mrdoubleb So maybe one of you knows more about this, but here is what I think I understand...

There is ramping through efficiency and there is ramping through adding more lines. I fully understand why Tesla didn't want to add more lines until their process achieved a certain level of efficiencey. But what's that level? What's reasonable?

Can we seriously expect that they can, say, go to 800/week just by fine tuning the process? Because once we hit the top of what they can achieve with that, ramping production simply becomes an excercise of how many lines they want to/can add to double, triple, etc. the output. (Assuming supplier issues are resolved).�

Oct 29, 2013

fjm9898 See my comment above yours. Efficiencies get them more GM as well as upping production. Supplier constraints hold back the production rate as well (larger demand on those suppliers also bring cost of goods down which in turn ups GM as well). Once they reach full efficiency and supply constraints are solved, you will see them add a 3 shift to the line.�

Oct 29, 2013

StapleGun I think this is going to be the biggest surprise in Q3. In Q1 almost all of the cars delivered were ordered before the $2500 price increase, and it was mostly after the initial P85 spike. In Q2 nearly all of the ~730 US 40kwh cars were delivered which really pushed down ASP. This quarter we will see the full effect of the $2500 price increase, no 40kwh cars, the second price change (increase) will be mostly in play, the first full quarter with the performance plus option, and we have the spike of highly equipped cars from the first wave of EU deliveries. Everything is lining up for a high ASP this quarter.

I have collected quite a bit of data about the cars delivered in the US and created this graph showing the percentage of cars delivered with each base configuration type (40, 60, 85, and P85) plotted per 1000 VINs (0-22000). The second chart shows the base ASP if all cars were sole using the current price tiers ($59,900, $69,900, $79,900, and $89,900 respectively). This is the average price with no other options, which should give a good indication of relative ASP trends over time regardless of absolute price changes. Q3 is roughly in the 10k-16k VIN range, and Q3 are roughly VINs 16k+. VINs aren't 100% accurate but the important trends and spikes here are well contained with the quarter boundaries.

I'm not real positive on delivery numbers for this quarter yet but I'm confident ASP will be $4k-6k more than Q2.

NOTE: The second chart should say "40-60-85-P85 Configurations".

�

�

Oct 29, 2013

brianman @StapleGun - Nitpick on the graphs.

The first graph references "P85 kWh" while the second references (P)"85+". These are different configurations.�

Oct 29, 2013

Convert2013 Great job Staplegun. Your paragraph is very logical.�

Oct 30, 2013

mershaw2001 Staple and others, can we assume that all foreign deliveries were averaging over 100k because they only ship the optioned out ones first?�

Oct 30, 2013

sub This should help

Panasonic And Tesla Reach Agreement To Expand Supply Of Automotive-Grade Battery Cells - Yahoo Finance�

Oct 30, 2013

NStar I agree. the expected decrease in ZEV credit has huge impact on EPS. It was 51M for Q2 (dropped from 68M for Q1) and zero has been assumed for Q4 in the guidance. It seems not unreasonable for analysts to assume a 25M drop for Q3.

In Q2 shareholder letter it was also guided that �While we expect production to increase from Q2, a considerable number of vehicles produced during the quarter will be in transit to European markets at the end of Q3. As a result, we plan to deliver slightly over 5,000 Model S vehicles in Q3 ��.

If we assume $3K-4K ASP increase over say 5100 vehicles in Q3 it won�t be able to offset the 25M ZEV decrease yet. So the total auto sales revenues will actually be less in Q3 than Q2 if analysts really follow the guidance.

Then the Q2 shareholder letter also guided significantly higher R&D expense and higher SG&A expenses in Q3. According to the guidance the Q3 EPS really should drop from Q2 even the analysts expect moderate beat on the delivery.�

Oct 30, 2013

NStar I don�t really think the ~$100K ASP estimate double-counted ZEV. For example, we know for Q2 the GAAP Auto Sales Revenues are $401,535 and Deferred Revenues due to lease accounting are $146,812. So total non-GAAP Auto Sales Revenues are $401,535 + $146,812 = $548,347. This includes $51,000 ZEV credits. So the estimated ASP in Q2 is ($548,347 - $51000)/5150 = $96.6K without knowing the details about other revenues not directly associated with car sales(mostly some other non-ZEV regulatory credits). Adding $3-4K expected ASP increase in Q3 we get $100K.

However I do see in Q2 ER call transcript that Deepak mentioned that these other regulatory credits were included in gross margin because of good visibility and in Q2 they were up roughly $18 Million. If I understand this correctly we should take the $18M out of the Q2 revenue and calculate the Q2 ASP as $93.1K instead of $96.6K. This is close to your $94K estimate.

I�m not sure how to accurately estimate these other regulatory credits for other quarters though. In Q2 shareholder letter it says ASP slightly declined during the quarter. If I can still assume $18M other credits in Q1, then Q1 ASP will be $95.8K which can be considered slightly higher than the $93.1K Q2 ASP.

If we also assume $18M other credits in Q3 then it effectively adds $3K-$3.6K per car for 5000-6000 deliveries. This is roughly the difference between the $96.6K and $93.1K ASP number (calculated without vs. with taking the $18M into account). So I think it�ll still be roughly correct if we just don�t differentiate the other regulatory credits from car sales, use the higher $96.6K number as estimated Q2 ASP, and add some to get ~$100K as estimated Q3 ASP.�

Oct 30, 2013

DonPedro Remember that ZEV credits have 100% GM. We don't know whether ZEV will fall by $20M or $40M, but it will be very substantial. They have also guided a "significant" increase in R&D costs, which also hit the bottom line directly, as will possibly some other cost categories. To maintain last quarter's EPS, they would have to increase automotive GM by for instance $30-50M. That would be an impressive outcome.

- - - Updated - - -

I don't think they changed the order of shipping to get high-ASP cars delivered first. However, the cars delivered in the EU in Q3 had all been ordered several years ago, i.e. by hardcore TMS fans. Most were Sigs, and most were thoroughly optioned (P85+/P85). On the other hand, they would also have the pre-2013 discount ($2.5k).�

Oct 30, 2013

Citizen-T I get that, but then how do you make the math work out so that the guidance holds? I mean, they said that the two would offset...I don't know how else to interpret that. Maybe ZEVs aren't going to drop that much after all?�

Oct 30, 2013

DonPedro They guided to non-GAAP profitability. That means $0.01 EPS or better. The street expects $0.11 as you pointed out, which beats the guidance.

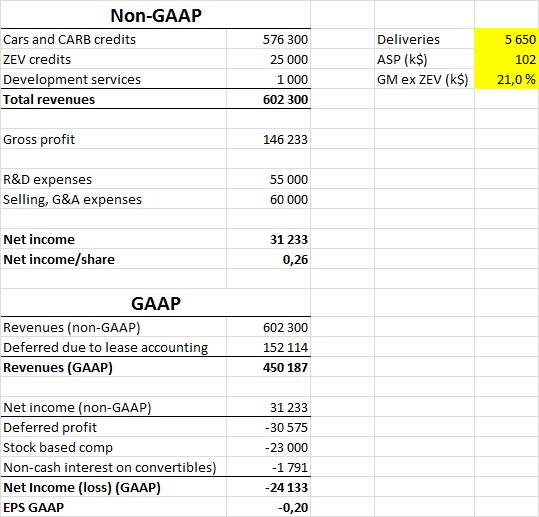

My own projection currently shows $0.30 non-GAAP, based on $25M ZEV credits (half of Q2), 5,900 deliveries @ $101k ASP, 21% GM and $55M R&D costs.�

Oct 30, 2013

vgrinshpun There is an additional data point on Model S/X production expansion over the next four years:

�With this agreement, the two companies update and expand their 2011 arrangement to now supply nearly 2 billion cells over the course of four years. The lithium-ion battery cells purchased from Panasonic will be used to power the award winning Model S as well as Model X, a performance utility vehicle that is scheduled to go into production by the end of 2014.�

http://www.benzinga.com/pressreleases/13/10/n4033490/panasonic-and-tesla-reach-agreement-to-expand-supply-of-automotive-grad

Assuming 80% / 20% split between 85kWh / 60kWh modles, the 2 billion cells are enough to build approximately 300,000 Model S/X cars over four years (2,000,000,000 / (7104*0.8+5014*0.2) = 299,132)

To re-cap data points:

- Panasonic restarting idled lines at Suminoe (Osaka Perfecture) plant by the beginning of 2014 with the corresponding annual production rate of 300M cells (equivalent to annual rate of more than 40,000 MS/year)

- Elon stated that sometime in 2014 Panasonic will supply enough batteries to provide for production of at least 1200 MS/week (or approximately 60,000 MS/year.

- The as designed maximum production capacity of the Model S/X line is 100,000 cars/year.

- The total quantity of cells provided by Panasonic will be 2,000,000,000, enough for 300,000 Model S/X cars.

Based on the above, my prediction that Tesla has the following production plans:

2014: annual prod. rate in the beginning � 40,000 cars; end � 60,000 cars � 50,000 cars produced

2015: annual prod. rate in the beginning � 60,000 cars; end � 80,000 cars � 70,000 cars produced

2016: annual prod. rate in the beginning � 80,000 cars; end � 90,000 cars � 85,000 cars produced

2017: annual prod. rate in the beginning � 90,000 cars; end � 100,000 cars � 95,000 cars produced

Total 4 year production � 300,000 cars

Regarding the guidance during in the Q3 ER, it will likely to be understated at 40,000 cars, .

I am also looking forward for Elon to provide more details on increasing gross margin above 25% in future quarters. This is something that was hinted to in Q2 shareholder�s letter and should be achievable with greater certainty given improved production outlook.

�Further execution on our cost reduction roadmap is expected to continue to improve non-GAAP automotive gross margin to our target level of 25% (excluding ZEV credits) in Q4 this year. We are cautiously optimistic that a number above that level may be achievable in future quarters".�

Oct 30, 2013

Convert2013 Good stuff and reasonable analysis. I still expect a deal with Samsung, LG, etc medium term for diversification purposes to get further price advantages and to reduce risk of production bottle necks due to various potential issues having a single source supplier for such high volume production. Those numbers you have are based on just the Panasonic contract and "mostly" US demand for Model S & X. The Europe and China (wild card) contributions can easily increase those numbers by end of 2014/early 2015 where they will need a 2nd supplier or modify the contract with Panasonic, IMO.

Here's the statement that leaves it open to another battery supplier contract which they will likely announce in the medium term future:

"Tesla is in talks with Samsung, LG, and other manufacturers, and will continue to discuss future supply with them and to evaluate their technology,"�

Oct 30, 2013

vgrinshpun The press release did not mention that the increase in Panasonic cell production will "mostly" cover US demand. Although I agree that some time in future there could be improvement in demand that will require further increase in production, the information as it stands right now indicates that this increase in production will address worldwide demand for Model S/X.�

Oct 30, 2013

tslafan123

All these projections are NOT accounting for any improvements in cell technology though!

If cells are going from 3.1 Ah to 4.0 Ah right away, we can expect about

- 387K cars (if kWh is kept constant, getting more range)

- more than 387K cars (if EPA mileage is kept constant, kWh per car reduced)�

Oct 30, 2013

FluxCap DaveT, any thoughts old buddy?�

Oct 30, 2013

DonPedro It is hard to know whether the Panasonic deal covers all battery supply for the period, or just part of it. They could buy batteries from LG/Samsung as well. The number of cells could also be the agreed minimum number, with a potential to increase. As such, the number is more of a floor for expected demand than a "most likely" projection.

Having said that, I don't think this discussion belongs in the Q3 thread.�

Oct 30, 2013

vgrinshpun Good point, but I do not think that there is currently any indication that increased capacity cells will be used in Model S/X before they are put in Gen III car.

- - - Updated - - -

Agree that these production numbers are minimum, with potential to increase.

The point of posting it here was reiterating my prediction for guidance of 40,000 cars in 2014 during the Q3 ER Report.�

Oct 30, 2013

pfq1982 I wonder if they might have hit 25% gross margin in September. They had a lot of high ASP cars produced and on the boats in August for Sept. delivery. These hit (Norway etc.) at the same time as the quarter-end production push for US cars. And if you look at the wait time on P cars like Tex's, we saw ultra short wait times in order to squeeze them into Sept. (wait times which have now blown back out, so it's not a demand problem). Someone correct me if I'm wrong, but these cars also had the high-margin price increases. So Tesla should have massively levered their Sept. factory overhead with delivery count (conversely, August gross margin would be lower), and Sept. average ASP should be very high.

Unless shipping costs are very high, or we are still waiting for some part cost milestones to kick in, I'm starting to think Tesla might have a very nice surprise on the margin side.�

Oct 30, 2013

sub Take this info for what it's worth, but an owner posted in a thread that he ran into a tech servicing a supercharger and they tech implied they hit 25% GM for Q3. Posting invade anyone missed it. Yes I understand it's not the highest quality source.�

Oct 30, 2013

DaveT I thought the tech might have implied 25% GM in Q4 (any day now) rather than Q3.

Here's the thread link fyi: Chat with a Tesla Supercharger repair tech

- - - Updated - - -

I would imagine that Tesla would secure at least one or two secondary suppliers (ie., Samsung or LG) as well.

- - - Updated - - -

For Q3, I'm still sticking with my estimates from prior:

Q3 production is 520 cars/week (avg of 490 and 550) x 12 weeks = 6240 cars produced minus 200-500 on boat/transit to Europe minus 200 loaners/store cars minus 100 cars U.S./Canada transit = 5440-5740 cars delivered in Q3

I know I'm on the low side of people here for cars delivered, but I think Tesla has the chance to surprise of gross margin for Q3. Anything above 20% would be very, very good. Also, Tesla could surprise (or disappoint) with FY 2014 guidance. Right now, I'm hopeful that Tesla surprises with 20%+ gross margin and 35k cars delivered or higher on FY 2014 guidance, and that gives support to the stock price. I'm a bit cautious though. I got out of my aggressive short-term OTM calls and but I'm heavy in stock and deep ITM LEAPS (as well as deep ITM Dec/Jan calls bought a long time ago).�

Oct 30, 2013

clmason Do we know how many 40kWh S's were delivered in Q2?

If i recall correctly they were sold at negative margin. I'm not sure any of the Avg Sale price models have taken this into consideration. This along with the overall price increases, decoupling of options, and Performance+ addition, i think Average Sale price is underestimated by many and likewise Product Margin is being underestimated.

I'm optimistic that November and December will be good months for TSLA shares. Icing on the cake --> guidance towards 30% product margin.�

Oct 30, 2013

Convert2013 With FB and SPWR providing a mix of good and bad news on their ERs today, I don't see the same happening for Tesla for Q3 and Q4/ 2014 guidance. One potential negative: Warranty costs for Q3 and more for Q4 could be higher as there are more cars on the road now and not sure how that will affect their bottom line.�

Oct 30, 2013

StapleGun Good catch. Just added a note to the original post, they both were meant to say P85.

I haven't done much research about absolute pricing but NStar's post earlier was a good summary. I can confidently say Q3 ASP will be considerably higher than Q2 though, probably 3%-5% higher. There was about 1400 EU deliveries, a good portion of these still have earlybird pricing, but that is trumped by the fact that they are all 85kwh and a higher than normal proportion will be P85/P85+ with lots of options.�

Oct 31, 2013

DonPedro Here is my spreadsheet that you can use to make your own non-GAAP and GAAP projections for Q3, based on your assumptions for deliveries, ASP, GM and so forth:

https://www.dropbox.com/s/1im2p7hrkfy1mb3/TSLA%20Q3%20projection.xlsx

It is currently completed with the figures that come out of my latest swing of sentiment, which is down on deliveries and up on GM and ASP (5,750, 21.5% and $102k, respectively). Gives a non-GAAP EPS of $0.30 and GAAP of -$0.17.

Note that the non-GAAP ----> GAAP method involves a fair bit of guesswork. If you want to dig into those assumptions, here is the method I have employed:

* I have assumed that 35% of US sales are covered by lease accounting in Q3, up from 29.5% in Q2 (I expect an increase because the lease accounting did not exist at the start of Q2).

* I have further assumed that GM of the deferred sales was 0.9% less than the average, this will be the same in Q3.

* I have also assumed that recognition of deferred revenues from Q2 is still so small that it is covered by the two items above (there could be a little upside to the GAAP figures here)

* Stock based comp is guesstimated at $23m, just based on the optics of the three previous quarters: $12.5m - $15m - $19m

* Non-cash interest on the convertibles is assumed to be the same as in Q2 ($1.8m - this could be too low due to full-quarter effects)�

Oct 31, 2013

CarGuy1340 Q4 Margins

I would speculate Tesla wants to avoid delivering any S60's in Q4 to help make their 25% GM target...

- - - Updated - - -

View attachment 34311 [/QUOTE]

Great research Staplegun! One question, these are the base prices and not optioned prices? How do you think about the option price increases in August?�

Oct 31, 2013

techmaven Overall, I would agree. I confirmed my order and was one of the last to do so under the old pricing scheme in August. However, I could choose delivery well into 2014 and my DS commented that quite a few people still have older configurations on order. I wanted my car ASAP and it was delivered at the very end of Q3 with a VIN just under 20,000. Therefore, the second price increase is in play, but I don't think it would have taken much effect in Q3. A friend did choose to go with the new pricing scheme and his was delivered the same weekend with a VIN just over 20k.�

Oct 31, 2013

StapleGun The total number of 40kwh cars sold is very close to 730, and I believe the vast majority (>80%) were delivered in Q2.

Yes, these are base prices. I don't have much data on options so I can't really speculate on that. However the August price change should have very little effect in Q3. A small percentage of the Q3 cars delivered will be under the new scheme and it's not a drastic difference. However, I think it's safe to assume this was a very calculated move to boost margins, so in Q4 and Q1 '14 these will probably boost ASP by 1-3%.

Thanks for the data. The increase went into effect on August 3rd and Aug/Sept. US deliveries were lower than normal due to the EU push (which were not under the new scheme). So your friend is probably one of very few that managed to order after Aug. 3rd and receive it in Q3.�

Nov 1, 2013

DonPedro Hmm, this actually reduces my outlook for the GM in Q3 a bit. My reasoning has been that if they are going from 14% in Q2 to 25% in Q4, the likely intermediate step should be 20% or 21% (since it always gets harder towards the end). However, if there is a "free" 1-2% boost in Q4, then they have to do less in each quarter on the cost side.

(On the other hand, of course, they may be planning to overperform and deliver a GM of >25% in Q4, but now I am just looking at guidance).�

Nov 1, 2013

DonPedro My final prediction ahead of Monday:

�

�

Nov 1, 2013

fjm9898 Don i can get behind that 5650 number 100%. like i said i was shooting for 5700 from the look of the deliveries table (tossed out 5800 as a hope for a higher number, but more i read i put myself at 5700)

i would put the low end at 5500 and high end at 5900. hence my 5700. But his history serves me i was off by ~150 last quarter. (so 5550?)

Don can you plug in my numbers real quick. (this would be my bottom)

ASP 99

GM 20

Cars 5550�

Nov 1, 2013

hershey101 Are we modeling expenses correctly?

They stated that R&D expenses would increase "significantly" and so would SG&A.. Last quarter they spent 100M with 52M in R&D... a 3M inc. in R&D doesn't seem "significant" to me... Maybe expenses should be $120M total?�

Nov 1, 2013

fjm9898 this thread got linked on SA - Tesla Motors Inc (TSLA): The Mother Of All Tesla Articles: A Complete Examination Of Tesla - Seeking Alpha�

Nov 1, 2013

austinEV Posted on the poll discussion as well, but here is my position on Q3. I am super long on stocks and Nov options. I think the recipe for a Q3 pop of 10% or more is simpler than people think. The stock is beaten down 20% from highs. So there is much less to worry about a "sell the news" reaction. That whole expression is "Buy on the rumor, sell on the news". There is no buying in anticipation so much less concern of a sell on good news. The number of cars sold, and profits are not going to be great but then again they aren't the main focus. What people will care about is the future. The earnings beat can come from any or all of these:

1) progress on 25%+ GM goal. I think they will beat on this and guide for Q4 meeting greater than 25% for the year. The end of the year is basically now so its easy for them to know.

2) international demand. They will mention something about deliveries and demand in Norway and Europe. Then China, China, China. All they have to do is breathe about "higher than anticipated" or "brisk demand" or "100k Beijing store visitors" or "working with potential partners in China to meet demand" or anything China flavored would be the headline for the next day.

3) Model X progress. They said essentially nothing about it on the Q2 call which was a real disappointment. This time they will have something to report, like first builds or waiting lists. A mention of real progress on Gen III would be great too, if just model or something. I doubt we will see a rendering until 2015 or so but who knows...

4) Supplier issues. Previously they have stated that they are supply constrained and not demand constrained. They could have long ago been running 24/7 to make more cars but could not for supplier constraint and would not want to until GM% was up. Now that GM% is near target, all they need is a few supplier issues to clear up and then they could bend the curve up in production to keep up with Europe demand and grow. If they DID this (sales higher than TMC consensus something crazy like 6k) the stock will go up 20%. If they talk about how its happening, almost as good. If they hint that they are down to the last few issues also very good.

If I am wrong and it goes down for no good reason then I will have lost half what I have made this year. Then I just hold my core stock position for a few years and make it back.�

Nov 1, 2013

Mario Kadastik Larken posted in the chat thread this Vid: Tesla-Chef Elon Musk im Interview - Frontal 21 - ZDFmediathek - ZDF Mediathek

the interesting to me part from so far what I've seen is Elon claiming, that Tesla is producing at an annual rate of 25-30k and they hope to double that by next year. So the original 800/week end of 2014 number (40k annualized rate) seems to be upgraded to 50-60k or ca 1000 cars / week rate by end of 2014. This is what EM also claimed battery availability to be going forward and is confirmed by the battery deal. So I think we'll see at the ER an upgrade on the 2014 guidance on total cars as well as the year end rate.�

Nov 1, 2013

uselesslogin And didn't he say Model X would be "about the same?" So in 2015 100,000+ cars may be possible.�

Nov 1, 2013

fjm9898 I had the day off today and i have been doing alot of reading and watching.

I have been a bear this last week on TSLA, but the more i read i cant see how TSLA is going to be a miss next week. Well besides Cramer just said he is a bull on earnings.. haha. I know there are alot of haters on Cramer but i am in a few stocks he is in ON MY OWN ACCORD, MU, KR, and CREE and they are all doing awesome this year, so i cant get on his case to much.

Anyway my point was i have flipped from being slightly bearish on the ER to being a bull. I pulled the last of my reserves and i will buy on any dip in the next two trading days before earnings. However i am 0-5 this ER season and all due to guidance issues which leads me to why i am going to be bullish on TSLA.

We all know we are going to make the 21k or more, EPS is going to be positive and most likely beat, at least by a little, but guidance is king this ER season. (Why i pulled out of short term SPWR) So why did i jump back to bull even though the stock has got the S kicked out of it this past month? (Emotion turned me bear like a pansy)

Ok getting the S kicked out if it was nice to give us pop room, we all know that. More importantly, Elon is a known sandbagger and i dont see any facts at all that prove otherwise that would cause this ER to be a flop. Sandbagging has become popular in the market but there are so many naysayers and Tesla is still so young and lack of eyes on the stock in the past they are not picking up on this yet. (Him being quoted at slight over 500 when we have a picture showing 570, he is just watching his ass)

Then the recent beat down and people getting the clue, VINS ARE NOT ACCURATE! Expectations are being lowered again and shorts are jumping on the bandwagon to try and kick TSLA in the teeth.

As much math as we have done on this forum and we are taking a very careful approach, we are going to beat EPS, by a little i suspect, its enough. As i said its about guidance.

Here are my ER assumptions:

Min MS sales - 5500. (My expectation 5700)

Min GM - 20% (My expectation 20%)

Min ASP - 99k (My expectation 100k)

Min EPS - 0.11 (My Expectation 0.14)

(EPS is based on my own guesses for ZEV credits, R&D, ect. They are a complete Wild Card at this point)

So Street has a current view of 0.11

I think we will have a very slight beat just to keep the street happy and Elon wont allow for a miss.

Here comes the guidance that will cause the pop. I think any combo of the following are possible: (the larger the combo plat the larger the pop)

Increase 2013 production guidance to 21.5k (not a big deal if he does or doesnt. I see the 21.5k number being tossed out and a possible of 22k actually coming close Q4, pending production ramp speed)

Elon will state he sees good demand of 45k+ MS world wide next year. (20k US, 15k Europe, 10k Asia with more Asia demand possible as they expand and get more exposure in the region)

Elon will probably sandbag and announce a goal of 40k MS next year, although i would like to hear 45k to keep the 100% growth in play. (WILD CARD - possible 1000 MX? since we still dont have any MX info as of yet, would be nice to get confirmation MX will ship Q4 2104)

Elon will announce supply chain problems are almost all fixed up, but have a few more to sort. (This is the big clue, I am going to expect Q1-Q2 2014 to see a pop in MS production that he is not going to tell us about once the last supply constraints are solved. This will allow production rate to move up quickly and allow for a 3rd shift, 5day work week, to keep GM up. This in turn will allow for a 45-50k MS production)

Elon will say 25% GM will be achieved and hint at a possible beat of 26-27% for Q4.

Super charger Expansion is on Schedule and possible increased rate in EU as MS demand will force the hand.

Pending the Combo, we could see anywhere between 180 and 200 end of next week.

Disclaimer:

TSLA will remain no larger then 25% of my portfolio.

I am expressing my opinions and mine alone. Do your own do diligence before making your trade choice (though i think we are all bulls here anyway)

Good Luck to us all.�

Nov 1, 2013

hershey101 Key point. They are "slightly" profitable, and "slightly" cash flow positive!

I'm not a finance guy, but that definitely sounds like a much bigger deal. I don't think the street has accurately priced in positive cash flow.�

Nov 1, 2013

NStar I'd like to add my speculation form another angle.

We know the guidance vs. actual delivery for the past 2 quarters were as follows:

Q1: 4500 vs. 4900

Q2: slightly over 4500 vs. 5150 (also guided 5000 production but some cars would be in transit to Europe for Q3)

Guidance for Q3 was slightly over 5000 production as a result of considerable number of vehicles being in transit to Europe at end of Q3

Based on above I feel Elon�s �sandbagging� strategy is being conservative to the extent that can allow a not-too-big but meaningful beat, like around 10-15%. This makes sense since if the guidance is low-balled too much it will cause some concern, and having a too big of earning beat due to low guidance is not healthy either (causing unrealistic expectations for future) .

He also seems to like to use the number of vehicles being in transit as a buffer zone to play safe. For example the Q2 guidance was actually lower than Q1 sales, and the reason he gave was the cars being in transit to Europe. That way he could adjust the number of cars to Europe at the end of Q2 based on actual production# to achieve the level of ER beat he liked. It turned out that there were very few cars shipped to Europe at end of Q2, and Tesla was able to beat the delivery# by 650 in Q2, which was great but probably not blow-out. So it looks like he did have to play with the number of cars in this �buffer zone� to get the ER results he liked.

Now the Q3 guidance almost feels like the exactly same strategy used as in Q2. It�s only slightly over 5000, which is not more than the 5150 Q2 sales. And the reason he gave was again (more) cars in transit to Europe. We also learned that there were still some cars shipped to Europe in Sept. but the number dropped very significantly from previous months. This had to be for the purpose of getting the sales# he liked, which I believe will be around 5600-5700 based on the above hypothesis (and it also matches the 570/week production rate we found out in early Q4). I don�t feel Q3 sales will be higher than 6000 (unless it�s a total surprise to Elon too) because in that case he should have given a Q3 guidance# better than actual Q2 sales, or not choose to reduce Sept. shipment to Europe by that much.

So I�ll speculate 5600-5700 Q3 sales, Q4 guidance similar to Q3 sales due to cars in transit to China, 2013 full year sales raised to 21.5K. I think there could be some upside potential but cannot imagine it can get much worse than this.�

Nov 2, 2013

DonPedro Keeping my other assumptions:

Non-GAAP EPS: $0.17

GAAP EPS: -$0.27

- - - Updated - - -

You're looking at GAAP R&D, and comparing it to assumptions of non-GAAP R&D. Non-GAAP R&D has followed the following trajectory the past 3 quarters: $68m ---> $47m ---> $44m. It is anyone's guess what a "significant increase" from these levels is - my sense is $55-60m.

I don't think they have guided anything on SG&A. The past 3 quarters: $31m ---> $41m ---> $50m. Since like a linear projection is right here, putting it at $59-60m.�

Nov 2, 2013

Mario Kadastik Not quite sure which thread to put it to as it has short and long term impact, but it looks like a huge amount of orders went from sourcing parts to In Production and it doesn't seem to have any geographic preference or when people were originally in queue. I see in the delivery sequencing thread and November delivery thread that people who had delivery targets in end of November and in December got to In Production yesterday. People in EU with January delivery dates got to in Production and so did my order. Yet two weeks ago Tesla told me that they expect my car to enter production end of December.

I have no clue what this means, the most obvious explanation is a software glitch that changed everyones status to In Production (that'd be a bummer) or that Tesla decided to favor TMC members and pulled a lot of people forward. Then again the other MS order in Estonia (an S60) also went into production as I found out last night over e-mail and he's not frequenting the forum. If this is really true, then it might indicate a serious rampup in November in production that might be gearing for a great end of year production rush. If indeed my car enters production now, then I will get it this year still and this would affect Q4 numbers a lot. As Q4 guidance is part of the Q3 ER, then this tidbit might be of interest. I guess we'll have to wait until one of us lucky upgrades gets through to Tesla to confirm that the car is INDEED in production until we all start celebrating, but if this really happened, then it may well mean that Tesla has solved supply issues to large part and can ramp up the production fast enough that they are pulling Dec-Jan deliveries forward.�

Nov 2, 2013

Benz That would be great news. But that would also have to mean that buyers who do not have a VIN assigned to them as yet, that they will soon be informed that a VIN has been assigned for their Model S. And a few of these people will post their assigned VIN's in Craig's NEW VIN THREAD: http://www.teslamotors.com/en_EU/forum/forums/new-vin-thread-please-post-your-newly-assigned-vins-here�

Nov 2, 2013

fjm9898 well Mario that would confirm one of my guidance statements above. If true then it came a bit quicker then i expected and push Q4 to be a blowout.

�

Nov 2, 2013

Convert2013 With exponentially growing organic demand just in the US alone and with China and Europe wild cards we will see how quickly they start hiring for 3rd shift and some weekend shifts in 2014. I think we all will be pleasantly surprised.�

Nov 2, 2013

abtsm Can somebody explain to me the two different diluted share count numbers in the Q2 shareholder letter? On Page 7 (GAAP income statement), they report 118,194 for "shares used in per share calculation, diluted" but on page 10, they use 130,503 for "shares used in per share calculation, diluted (GAAP and Non-GAAP)". In the 10Q, they use the 118,194 number.�

Nov 2, 2013

NStar I'm wondering if anyone in Bay area can go to Tesla factory RIGHT NOW and take a quick look at the number of cars in the parking lots. I suppose that can tell us if the there are weekend shifts or night shift. If yes it could also be a reason for the significant jump of cars in production mentioned in Mario�s post, and Q4 sales should be much higher than what estimated using the 570-600/week production rate. this will be an extremely important piece of information for Q3 ER where Q4 guidance will be given. I�m hoping someone can confirm or dismiss this.�

Nov 2, 2013

RichardL Friend of mine did a factory tour two weekends ago and they were not producing cars. Also, he was told there is no third shift.�

Nov 2, 2013

fjm9898 We know there is no 3rd shift yet. We are speculating when there will be one, meaning the supply constraints have been fixed. Once again we know they do not build cars on the weekend, once again due to supply constraints and trying to keep GM up.

Thanks for the update Richard for the factual evidence.

Like i said, we are after when its going to start happening. That is why i think its one of the guidnece things Elon will talk about. When the constraints are going to be cleared and when they are going to add a 3rd shift. They will not work weekends for 2 reasons, 1) they must keep GM up, so no OT and 2) they need the weekend time for mechanics to come in and preform the maintenance on the robots and other equipment.�

Nov 2, 2013

NStar My order was confirmed just 5 days ago and it's still in the "sourcing parts" stage. At least this is not a glitch that affects everyone.

Thanks for the info. But what Mario described could still be an indication of constraints being cleared allowing 3rd shift to be added as you suggested? I'm still hoping someone who lives close to the Tesla factory can quickly check it out.�

Nov 2, 2013

Jackl1956 There has been tremendous amount of speculation on both sides of this issue. I don't think Elon has a lying bone in his body. What you see, is what you get. I do not parse his statements, and I do not try to read between the lines. More and more, I simply take him at his word.�

Nov 2, 2013

brian45011 The 118.2 million is the average number of shares outstanding between the beginning and end of a quarter. GAAP was a loss; there can ne no dilution of shareholders' aliquots of profits if there are none. Non-GAAP showed a profit, hence the average number of shares outstanding was increased by assuming all vested options were exercised. The number of shares outstanding for month end following quarter end is shown on the 1st or 2nd page of the 10Q.�

Nov 2, 2013

justthateasy

If any of this is true and not the cause of a software glitch and they make mention of it during the conference call, I can see a scenario where TSLA rockets to 200+ by the end of the week.�

Nov 3, 2013

vgrinshpun From Tesla Motors Forums:

skymaster | October 20, 2013

When I took the tour on 9/11, the production "goal" was 600 per week. They were running 2 shifts per day with a goal of 60 cars per shift. I don't know how the production could have increased much in the last 5 weeks. The guide told me that it will be difficult to increase production from 600 to 800 cars per week.

Q3 earnings | Forums | Tesla Motors�

Nov 3, 2013

dmckinstry Yeh. After all, we're not talking about a Hummer here. Of course, not everyone could take advantage of a $75k credit.�

Nov 3, 2013

MikeC 600/week in mid-September and then 570/week in late October? Could production be going down??�

Nov 3, 2013

techmaven Certainly possible... end of quarter push with some overtime. For cars to be delivered by the end of the quarter, they would have had to been made at the factory in the beginning couple of weeks of September. It takes a week or two to make it to customers (delivery to the SC's, scheduling delivery appointments, paperwork, etc.). That pace might have been unsustainable across the entire quarter.�

Nov 3, 2013

vgrinshpun

Not sure - this is puzzling. It could be that production can fluctuate week to week. It could also be that either one of these two reports is not accurate.

BTW, does anybody still remember an article about Connecticut factory producing liners for the frunk and reports of it's planned ramp-up to produce 650 liners per week by early fall?

What's a 'frunk'? - News and information on Westfield and Mayville, NY - Westfield Republican | Mayville Sentinel News

"Jamestown Plastics' president Jay Baker disclosed Tesla wants 650 of the liners by early autumn."�

Nov 4, 2013

DonPedro I think it is reasonable to think that production could fluctuate somewhat from week to week. Some factors that could cause this:

* Operators unavailable (due to illness, training etc.)

* Minor retooling

* Equipment failure

* Short supply of certain parts

* Fluctuation in number of almost finished cars from the week before

* Use of overtime

* Simply having a good week vs. a bad week

The fact that they had a 600 cars/week target does not mean they made it. So one explanation could also be that after too many weeks of not making a 600 car target, they went down to 570.�

Nov 4, 2013

Mario Kadastik After a call with Tesla I can say the In Production is for real. However there's some further fine print. The In Production change means that the factory has been able to source all components for the car and it has moved from sourcing to production queue. It's now still queued for actual factory floor scheduling that depends on the factory throughput, patching and how many cars there are in similar queue in front of me, but it means those are the only constraints now.

What my take is from this massive change to In Production on Nov 1st and then over the weekend for others is that some kind of supplier issue was resolved in a major way allowing Tesla to finalize the sourcing of components for a lot of cars. This is of interest for investors because if that assumption is correct and Tesla was indeed able to resolve some final bottlenecks in supply, then now the only thing holding them back is the ramping up of their factory line. Once that goes high enough they can add 3rd shift and start preparing next line. We may as well hear on the Q3 CC about resolved supply issues and good guidance on ramp-up.�

Nov 4, 2013

fjm9898 thanks for checking up on this Mario.

If we are right, then it looks like one of my guidance scenarios were correct. I am almost 100% betting on a Q3 win nowI just hope Elon gives us the goods.

�

Nov 4, 2013

justthateasy

First of all, congratulations on your ordering status being accelerated. The sooner more people can own these awesome cars, the better!

This is also great news from an investor standpoint. News of this probably won't be out until after earnings release/conference call, which also means late Tuesday or early Wednesday when the mainstream news outlets pick it up thus triggering the market reaction. But yes, I can see TSLA rocketing very close to all time highs by the end of the week. (I originally said possibly 200+ by then but I prefer to set the bar a little lower and hope for surprise.)

Two things pre and post earnings. 1) If TSLA manages to find itself back around the 180s pre-earnings, I don't think we'll have too much to worry about after earnings so long as...... 2) News of this ramp up in production is featured during the conference call and not an afterthought.

With that, a raise in guidance is exactly the catalyst that's needed to bring momentum back to the stock price. I can see TSLA trading well above 200 before the end of the year.�

Nov 4, 2013

Convert2013 OEMs often test improved capacity and return back to demand output. Also end of quarter rush is common.�

Nov 4, 2013

Darren12 Just came across this article. Delivery numbers seem really optimistic (vs the numbers suggested by many of you guys)

Thoughts?

Tesla Motors Inc (TSLA) Q3 Earnings Preview: Analysts Are Optimistic�

Nov 4, 2013

DonPedro I got worried. I'm not sure they are beating these overoptimistic numbers.

- - - Updated - - -

The difference between US and International sales in the article is 620. Coincidence that there were 619 registrations in Norway in August? Or has someone just seen that one number and added it to the US sales? They didn't link source Thompson Reuter article/report either, so it is hard to verify what this really represents. I find it hard to believe that the article correctly represents analyst's opinions, actually.�

Nov 4, 2013

fjm9898 5580 is on par with that i have seen from Andrea James, DB and Baird. All three of them were quoted saying around 5500�

Nov 4, 2013

DonPedro Yes, but that was total, not just US. Maybe Valuewalk added international without understanding that.�

Nov 4, 2013

fjm9898 Ahh yes, my mistake. I think the English on this one is poor. This is my understanding of what they are saying by using two different words to explain those numbers:

They are getting "Deliveries" of 5580 (Cars recognized in Q3 Revenue) but "Sales" of 6200 in Q3 (Meaning 6200-5580 = 620 in transit)�

Nov 4, 2013

DonPedro Ah yes, that is probably the mistake they are making. They think that in-transit cars is the same as international sales. If I read it that way, the article makes sense.�

Nov 4, 2013

fjm9898 Just saw a Montly Fool article as well as another toss out the 6200 number. I hope people actually dont think that the actual consensus.�

Nov 4, 2013

Cameron Reverse psychology from the bears perhaps? I'm thinking if the rumor of them ramping up production is true, these numbers won't really matter as much anyways.�

Nov 4, 2013

JRP3 Some bears/shorts have definitely been trying to push unrealistically high sales numbers to suggest that anything less is a "miss". Rather transparent, hopefully not effective.�

Nov 5, 2013

Discoducky Because someone always asks, here is where to listen to the earning report starting at 2:30 PT http://ir.teslamotors.com/eventdetail.cfm?EventID=136162 (anyone can listen, don't be afraid)

And here's where the PDF Q3 report will be published (manically hit refresh) http://ir.teslamotors.com/�

Nov 5, 2013

StapleGun The time is almost here! My final predictions...

Deliveries: 5900 (I think they were over 570/wk for a few weeks in Sept.)

ASP: $100,500

GM: 20%

2014 guidance: 40,000

Wild-card: A more specific date will be given for the start of Model X production.�

Nov 5, 2013

AlMc Yes. everyone is waiting/watching http://video.cnbc.com/gallery/?play=1&video=3000214476�

Nov 5, 2013

Mario Kadastik Can we get the latest Wall str consensus estimates posted here?�

Nov 5, 2013

Discoducky http://finance.yahoo.com/q/ae?s=TSLA+Analyst+Estimates T minus 2 hours

�

Nov 5, 2013

AlMc CNBC...for what it is worth: 5,700 deliveries (below 5,400, not good), 16- 20% GM, 21,000 yearly�

Nov 5, 2013

maekuz FWIW, here is my estimate:

Deliveries 6600

ASP (k$) 102

GM ex ZEV (k$) 21,5 %

EU deliveries 1.26

Non-GAAP

Cars and CARB credits 673.200

ZEV credits 25.000

Development services 1.000

Total revenues 699.200 0

Gross profit 169.953

R&D expenses 55.000

Selling, G&A expenses 60.000

Net income 54.953

Net income/share 0,45

GAAP

Revenues (non-GAAP) 699.200

Deferred due to lease accounting 185.031

Revenues (GAAP) 514.169

Net income (non-GAAP) 54.953

Deferred profit -38.116

Stock based comp -23.000

Non-cash interest on convertibles) -1.791

Net Income (loss) (GAAP) -7.954

EPS GAAP -0,07

@Don Pedro: Thank You very much for Your Excel-sheet! Its very helpful and greatly appreciated!

Disclosure: no position (out of cash)�

Nov 5, 2013

Citizen-T Wow. I hope you are right, but I think you are high.�

Nov 5, 2013

maekuz Well...i am on painkillers (backache) but i dont feel high. :-D /scnr

Granted, it surely feels like a very bullish estimate for me as well. In the end its the delivery number. I counted registrations in every country so it should be fairly accurate, but its really a test balloon. We will see shortly how this method is working out - if at all.

Good luck to every Tesla enthusiast!�

Nov 5, 2013

Citizen-T  �

�

Nov 5, 2013

farzyness Man - Reddit would have a field day with ya for miss-using that meme Citizen �

�

Nov 5, 2013

CapitalistOppressor You should not try to base any analysis off of this. Tesla spent 80% of the quarter assigning VIN's in a linear fashion and the other 20% assigning VIN's in vertical production bins. This quarter is 100% vertical production bins with backfill into the end of Q2 bins.

The bifurcation of Q2 into two different methods makes the proportion meaningless for Q3, and the backfill into Q2 might probably makes it problematic if we try to apply it to Q4. And to the extent that it works, Tesla will read these posts and change the ratio.

- - - Updated - - -

This +100

- - - Updated - - -

Based on my last analysis of Europe (which I admit is getting dated), Tesla's sales in Europe are just not consistent with 5,000-7,000 cars. Outside of a few bright spots (like Norway) their underlying sales rate has been pretty terrible as of 2 months ago when I last took a good look at this. Thanks to the waiting list they might get to 5,000 for 2013, but I just don't see 7,000 as being possible.

Frankly their sales infrastructure in Europe has been pretty terrible, and their move to correct that was belated at best. I'll admit that it's possible that there has been a turnaround since I looked at this, or that my analysis was flawed in the first instance, but until I see non-pathetic delivery numbers from the 3 major markets (Germany, France and Britain) I will continue to believe that Tesla (and Elon) were simply guilty of presuming that their sales success in California (which accounts for the lions share of their U.S. sales) would automatically translate into global success.

I think that it's foolish to assume that when the Tesla brand is damaged goods in the only English speaking country in Europe (where we might have a reasonable expectation that a U.S. cultural phenomenon will immediately translate), while one of the other two major markets is home to Tesla's primary competitors who can rely on "Made in Germany" sales tactics. And the third major market (and indeed much of the rest of Europe) shares the same currency and a common market with Tesla's German competitors.

If Tesla is going to succeed in Europe, it's my opinion that it will take a sustained sales effort far beyond what they have done in the U.S., and the available evidence is that their sales infrastructure and effort is still far inferior to what they have in the U.S.�

Nov 5, 2013

Andrew Tesla Motors, Inc. � Third Quarter 2013 Shareholder Letter

� Record 5,500 Model S deliveries

� Gross margin increased to 21% (non-GAAP) excluding ZEV credits

� Net income (non-GAAP) of $16 million

� Major WW expansion of service centers, stores and Superchargers

� Cash balance nonetheless increased by $49 million to $796 million

� Ramping production to meet growing demand in 2014

HTML: http://ir.teslamotors.com/secfiling.cfm?filingid=1193125-13-427630&CIK=1318605

PDF: http://files.shareholder.com/downloads/ABEA-4CW8X0/2762075965x7461698xS1193125-13-427630/1318605/1193125-13-427630.pdf�

Nov 5, 2013

CapitalistOppressor Excellent letter. Raised 2013 guidance to 21,500.�

Nov 5, 2013

DonPedro VIN method completely discredited.�

Nov 5, 2013

aznt1217 I really hope this ends up being excellent for us...�

Nov 5, 2013

CapitalistOppressor Maybe not for the stock. I am hedged against a move down though, so my primary concern was that they would demonstrate continued strength in the North American market, which they did, with ~4,500 deliveries despite stretching to fulfill ~1,000 European orders and filling that distribution pipeline.

- - - Updated - - -

I'm shocked that it was still debated at this late date. It was discredited starting after around the first week of June when they went to a different system for VIN assignment. Everyone should have been clear that they were skipping VIN's and randomly assigning into vertical production bins.�

Nov 5, 2013

brianstorms If you feel up to it, some additional sanity would be helpful in this live-blog of Tesla's earnings. Chris Ciaccia is not coming across as particularly clueful regarding US delivery numbers (oh no! demand dropping in US!)...

Feel free to chime in... http://www.thestreet.com/story/12094750/1/tesla-motors-q3-live-blog.html�

Nov 5, 2013

GenIIIBuyer It will be really difficult for Elon to not give strong hints to 2014 guidance on the call. Will be impressive if he can hold his tongue.�

Nov 5, 2013

Twiddler I agree. Cannot let the shorts win like this.�

Nov 5, 2013

DonPedro My sense is that they decided to stop pumping quarterly results, and rather do what's best for the long term. Fill the in-transit pipeline, invest in stores, R&D, loaners, etc. etc. As a long term investor, I appreciate that. They take a hit this quarter, and with a low-balled guidance for next quarter they set up a good comeback then. They also save the 2014 guidance for then.

Watch also how the stock will climb during the call - listening to Elon explain the progress is always so reassuring. �

�

Nov 5, 2013

GenIIIBuyer I think it's good to give them one quarterly win. Creates a stronger base of long-term shareholders, and wipes out some of the roll my winnings call buying 'shareholders.'�

Nov 5, 2013

Paul Carter Quick everyone hide their tongue depressors! :tongue:�

Nov 5, 2013

CapitalistOppressor Yes, my expectation is that they have a substantial number of vehicles in transit. There should be something like 300-500 in North America and a similar number in transit to Europe based on known weekly production rates in Q3 (I endorse DaveT's well thought out estimates, so somewhere ~6,300 total produced) and the number of vehicles that were likely in transit at the end of Q2.�

Nov 5, 2013

DonPedro Albeit the North American pipeline would be pretty similar in Q2 and Q3 (maybe 40-50 less in Q3). I believe they produced 6,050 cars. Say that 150 went to loaners and show rooms, and that 100 were in transit to Europe at the start of Q3. That makes the EU transit pipeline ~550. That is the figure I will use for Q4 projections.�

Nov 5, 2013

Mario Kadastik Interesting for me is that the Customer deposits number has slightly increased in comparison to end of year 2012. This means that even though they've delivered 15.5k cars including almost all signatures the deposits are at the same amount. So the Model X reservations as well as deposits for Model S are at least on par in the pipeline and considering that the mean deposit for MS is far lower now the Model X can be the only thing offsetting it. We have $140M deposits. Can someone estimate from the Model X tally how many Model S are around in that deposit queue...�

Nov 5, 2013

JRP3 So far it's down 10.9% in AH �

�

Nov 5, 2013

DonPedro I am puzzled. Elon is dropping one attractive info nugget after the other!�

Nov 5, 2013

Cameron Attractive news for long term investors, I guess not so much for the momentum/short term traders.�

Nov 5, 2013

DonPedro Yeah, probably that. I need to be in the former group 100%, not have one foot in the other camp. ;-)

Boom! Higher North American demand in Q3 than Q2. They are just piling it on.�

Nov 5, 2013

Mario Kadastik There are things that mean issues in short term like MX now mentioned volume in Q2 2015, not pulled forward. The battery constraint STILL there etc. So short term (Q4, Q1) I think we'll have issues with stock movements. But long term there are huge good news like the gigaplant and demand and cash flow with growth etc.

- - - Updated - - -

Ok, my webcast went silent just as the G&S question was finalized and I head "Alright, thank you...". Did anything else continue there or did they just slap on the formalities and stop?�

Nov 5, 2013

CapitalistOppressor Yes, the higher NA demand wasn't obvious just from the letter. Continued strong demand was though IMHO. I don't see what the market is doing right now as being justified, but then again the stock is based on psychology so who am I to complain?�

Nov 5, 2013

DonPedro Well, if they moved Model X forward that would create suspicion that Model S demand is soft... ;-)

Formalities and stop. The exact wording: "You may now disconnect and have a great day." I found that a bit funny. ;-)�

Nov 5, 2013

Sunnyday Q3 Conference call

Share your thoughts on the Q3 conference call - Tesla - Events Presentations

I'll start...

Batteries touched almost every aspect of everything significant during the quarter and their expectations going forward.

My notes:

1. Battery constraints - Elon's comment about starving North America to feed Europe was very telling. Battery supply is still a huge, unresolved issue. Even though Panasonic is stepping up, it's not enough to meet demand.

2. Production constrained, not demand constrained - Elon and team emphasized and reiterated several times during the call. I almost sensed disappointment and frustration at their realization that battery supply is holding them back for MS and MX. This could have been a massive blowout quarter if there were more batteries.

3. They're expecting 60% of their sales overseas - Plan on having more cars in transit in future quarters, further muting the near term delivery numbers, but also understanding their true growth. Boy, I wish they'd release monthly production numbers. Lacking that, VIN counting is the best we've got.

4. 2014 will be year of aggressive global expansion, even if they're supply constrained. Building a global sales and distribution platform, and doing it while maintaining cash flow positive (big deal!).

5. China coming, but will be supply constrained - Sounds like they'll ship cars to China around the July/August timeframe, just because they need to, but wait times there will increase dramatically as US, Europe, South Africa and the rest of the world compete for limited supply of cars. They've done a "soft launch," meaning they're there but they haven't made effort to promote their presence.

6. Giga factory - Elon all but confirmed that a giga factory is going to be built in North America, likely in partnership or a joint venture with someone (my guess: Panasonic). Will aim to produce as much capacity as sum total of what's produced today worldwide. It'll be a green factory, solar powered, with integrated cell pack recycling. They're investigating sites now. My guess: Probably west coast for the sake of logistics and solar radiation - http://www.nrel.gov/gis/images/eere_csp/national_concentrating_solar_2012-01.jpg

5. The mood seemed muted.

6. The next couple quarters will be all about laying the infrastructure for what comes next.

7. The questions were yielding great information in the answers. I wanted to hear more Q&A. Why'd they cut the call short to about 50 minutes? Why not go to 90 minutes? It annoyed me that one of the analysts said he'd take his question offline, while small investors don't have that access. TSLA should do a town hall with TM investors to answer questions at Questions For Q3 Conference Call

For long term longs, there's a lot here to bolster the long term story, with battery supply being the #1 execution risk.�

Không có nhận xét nào:

Đăng nhận xét