Apr 16, 2015

Robert.Boston Based on the job descriptions Tesla posted for stationary storage, I'm confident that Tesla is developing its own version of the Ideal Power device.�

Apr 16, 2015

Newb thanks for the hint. I've just browsed through those job postings. Here's an interesting quote from one of those:

"As electric cars are only as clean as the grids that charge them, Tesla has also developed a business unit built on top of the same vehicle powertrain technology to allow for increasing levels of renewable generation on the grid. Furthermore, the suite of grid-connected battery systems developed by Tesla also performs a variety of high value functions for utilities, businesses, and residential customers. Stationary Storage will be a multi-billion dollar per year business unit in the near term and the fast-growing team is adding top team members for engineering, business, and sales." Source: https://chc.tbe.taleo.net/chc01/ats/careers/requisition.jsp?org=TESLA&cws=1&rid=25581

...did I read that correctly as "multi-billion dollar per year business unit [for Tesla]" and not "multi-billion dollar per year market" ? ...and "in the near-term"...:love:

@jhm: Yep, the stationary storage prices in Germany are quite high but given that current utility power costs about $0.25-0.30 per kwh (+ monthly fee of around $5-10 per household), the math for a PV system with storage is still slightly positive for houses with a high power consumption (return on investment after 7-15 years depending on the exact numbers).�

Apr 16, 2015

atang Good Research @Newb, energy points flowing to you!�

Apr 16, 2015

EV2BFREE In the picture provided of the current testing system(in this thread), this system from Schneider Electric was included. You think that they are going to develop their own inverter charger even though they use one from an outside company now?�

Apr 16, 2015

GregTexas I though when this story about Bloom Boxes aired on 60 minutes our energy problems were solved. $3,000 and you can produce all the electricity your home can handle.

https://www.youtube.com/watch?v=zxyKlTDHAyU�

Apr 16, 2015

ecarfan Yes and that was years ago. Since then I have heard little about that product. But of course it uses natural gas as an energy source, so not renewable, and not a good long term solution. But better than coal.�

Apr 16, 2015

drinkerofkoolaid Regarding Teslaenergy.com

https://westernthought.files.wordpress.com/2013/04/packaging-erin-west.pdf�

Apr 16, 2015

Gerasimental Great find. That's certainly how it reads. Makes me a little more optimistic that Elon might announce some very large contracts already in place along with the product announcement on April 30. There's been lots of media talk about TM's cash burn and about maybe running out before Model 3 launch and I feel this is one of the big things holding the stock back. This could easily put an end to that once and for all.�

Apr 16, 2015

Robert.Boston I did post this info a while back, and I was surprised it didn't attract more notice. But, yes, it's a big deal.�

Apr 16, 2015

AndreN Unfortunately the home Bloom Box would only put out power at a 1kw rate. That won't even run a hair dryer, let alone a clothes dryer (5kw) or charge a Model S (10kw). So you'd need Tesla stationary battery storage to stock up power all night to use during peaks in the daytime.�

Apr 16, 2015

aronth5 I definitely noticed your post and was also surprised so few made note of it. Tesla's job postings have always been a good barometer of their future direction. I'm definitely anxious to see what the announcement means beyond the residential market as noted by this:

"Furthermore, the suite of grid-connected battery systems developed by Tesla also performs a variety of high value functions for utilities, businesses, and residential customers"�

Apr 16, 2015

jhm "Multi-billion per year unit." Let's see. 15 GWh @ $200 to $400 per kWh is $3B to $6B in annual revenue. Targeting 30% GM implies $900M to $1800M in gross profit. Assuming 20% SGA, R&D and the rest leaves us with $300M to $600M net income. This unit could add $6B to $12B in market cap to Tesla by 2020.

This unit also helps us put a price on the Gigafactory as a whole. Let's suppose that the the stationary unit uses 30% of the Gigafactory and is worth that fraction. If it was worth more, then Tesla would build more capacity. So this is conservative. Let's also be conservative and assume the unit is worth a $6B market cap. Thus, the Gigafactory is worth $20B conservatively. That's not a bad five-year return for a $5B investment.

Of course, the bigger value enabled by the Gigafactory is the automotive unit. With cars there is about $1200 revenue per kWh and at 30% GM, this is around $360 gross profit per kWh. Contrast that opportunity to stationary where gross per kWh is $60 to $120. So it is definitely worthwhile to support automotive, but the return on stationary needs to be large enough to make the investment in capacity. There is little point to subsidizing stationary capacity on the back of automotive. That is to say, stationary needs to be an attractive business on a stand alone basis, and the valuation above suggests that it is.

Other ways that stationary supports the auto business is that grid ties storage makes power and charging infrastructure cheaper and greener. Today a Toyota exec made foolish comments about the power demands of ultra fast charging, 500 kW, and suggested that grids could not support this. Well, of course, they can, but use of stationary storage to buffer power makes this capacity much more affordable. Consider a Supercharger station some day with a 1MW 2MWh battery. It would be able to deliver 300 mile range charges in 12 minutes for 2 cars at a time for upto 20 charges in 2 hours without a recharge. Drawing only 200 kW for charging, it deliver 48 100kWh charges per day. As Tesla drives the cost down to $100/kWh, such a massive battery would cost around $200,000. It could also provide peak shaving for nearby business or the grid to generate supplemental income. This kind of solution allows the power demands of increasing EV penetration to scale in a low cost way. It should not be necessary for utilities to add capacity to support a massive fleet of EVs. If Tesla needed to roll out one of these per 1000 cars sold, that alone could generate demand for 1 GWh of stationary in a year selling 500,000 cars. So Tesla pretty much needs to work this out for itself, and figuring this out may as well market the solutions wherever they can. Hense, the stationary unit is pretty integral to the whole company, as anticipated in the Secret Master Plan.�

Apr 16, 2015

EV2BFREE jhm,

I would argue that the selling of these packs for stationary storage allows the gigafactory to be up and running without the model 3 in full production. They could delay the Model 3 by a few months and still have a use for the battery packs that the gigafactory creates. The factory could start at 50% of packs for stationary storage and 50% for the Model S/X....then transition slowly to 70% ModelS/X/3 and 30% for stationary storage. This would give Tesla a lot of flexibility regarding the gigafactory.�

Apr 16, 2015

jhm Yes, I totally agree. I'm not sure exactly how they'll use this flexibility, but stationary gives Tesla a lot of options for how to ramp up production and maintain high utilization of the Gigafactory. It the auto business is slow to ramp up, stationary can surge ahead. If auto surges ahead and needs capacity , production of stationary can be sacrified.

Another interesting angle is how to manage upgrades in cell technology. Suppose an new higher density cell goes into production and need lines with new tooling. While the new cell capacity ramps up it is introduced into specific models and versions first. But what to do with older lines that may just be a few years old? The old cell output is not needed so much for autos. So Tesla can direct that capacity into stationary products. So while the latest technology may only be cutting edge for auto for a few years, the production lines for that generation of technology can continue production for many more years. This gets the most out of tooling investments. It allows Tesla to constantly roll forward new technology.

So options and flexibility are good.�

Apr 17, 2015

austinEV I agree that the stationary storage business is great for flexibiblity in that it can absorb just about any extra cells or manufacturing capacity.

However, what is our official theory on what cells they are launching with? If they are battery constrained why launch this product at all? I have suggested that Panasonic has an output which is not up to automotive ratings, is that the party line? Bears will, quite rightly, point out that if they were supply constrained they would not be able to launch this product as much as they might like to.�

Apr 17, 2015

surfside elon has tweeted previously that stationary storage will use different cells than automotive (so they would not eat into model s/x sales).

surfside�

Apr 17, 2015

jhm My personal theory is that Tesla now has a new higher density cell for the Model X and that they have begun to place emerging capacity into the 70D. It's a theory waiting for confirmation. In the meantime, bears can dismiss it. But I don't think it is baked into the price right now so shorts are bearing the risk of disbelief.

At any rate, one consequence of this theory is that the production capacity for the incumbent cells need a new market, ergo, stationary launches now.�

Apr 17, 2015

austinEV I had forgotten that, thank you. I figured this was a dumb question, and it was

As long as we are offering theories: It could be that one or more other cell makers have excess capacity. When Tesla came along, the industry was in a slump due to the decline of the laptop, and TM soaked up that capacity, but only from Panasonic. Is it possible there are other suppliers that cannot or will not meet the automotive spec that TM has, but has cell capacity? This launch need not involve Panasonic's output at all.�

Apr 17, 2015

Gerasimental That's consistent with qualifying further cell suppliers this year, of course. I always thought it seemed odd to basically 'mix and match' cells from two different suppliers and use them in the same product. Would each pack be mixed Samsung SDI and Panasonic cells, or would some cars come with packs of SDI cells and others with packs of Panasonic cells? Both seem non-ideal.

If, however, Stationary Storage (I hate that I can't bring myself to use an acronym, must find a solution. StaSto maybe?) uses cells form a different supplier to the cars, then the flexibility mentioned above is lost.�

Apr 17, 2015

austinEV The flexibility comes in by assuming that the stationary products can use auto or consumer cells, from panasonic, gigafactory or 3rd party cell makers. The stationary business soaks up whatever is available from the GF or spot market.�

Apr 22, 2015

SBenson Randy Carlson of Seeking Alpha is one of the rare people worth following on SA.

His comments regarding residential storage aggregation and deriving additional economic value are worth reading (and discussing).

Just to provoke interest, pasting a snippet here:

He has a number of related comments starting here:

Randy Carlson's Comments (Page 2) | Seeking Alpha

and here

Randy Carlson's Comments (Page 3) | Seeking Alpha

Especially under the title : What Will The New Tesla Product Be And How Much Will It Cost? Here's My Best Guess

- - - Updated - - -

Storage can be as lucrative as cars in terms of end product $/kWh.

$100K ASP for Model S with a rough weighted average of 75kWh.

$13K revenue for 10kWh for home storage (per leaked reports).

They are very comparable.

Most people including Deutsche seems to think storage is less lucrative than cars. But that may not be the case.�

Apr 22, 2015

JRP3 I think that's been assumed but I don't think Tesla has ever actually outlined this as part of their plan beyond a vague possibility. They may not feel the labor involved in reconfiguring a vehicle pack into the format they seem to be currently using is worthwhile. Of course there also won't be enough significant volume of used packs to make it viable for another 15 years or so.�

Apr 22, 2015

Rarity JB Straubel mentioned in one of his recent videos (in the Q&A) that Tesla was not intending to use old cells in stationary storage. His rationale was that once the cells were degraded, several years would have passed and the energy density and cost for new cells would be greatly improved. E.g., that 50 kWh pack with used cells to which you refer would be competing against a 150 kWh pack with new, cheaper cells in the same volume (my example, not his).�

Apr 22, 2015

Brentt

56,000 sq ft is a drop in the bucket for a large data center, some are close to a million square feet, and having 20-40 MW of instant backup would not only

be useful it would also help reduce the overall footprint by buying and storing green energy when it's available.�

Apr 23, 2015

Newb There's going to be a large battery conference in Germany next week. The agenda is interesting in itself because based on that you can easily draw a map of research institutes and firms involved in battery technologies and their respective focus:

Battery Day / Battery Power 2015

http://www.battery-power.eu/fileadmin/content/Downloads/Programm/2015/Agenda_Batteryconference_2015_lr.pdf

I wish I had time to go there but maybe someone else from TMC will attend the conference?

In any case, if Tesla is looking for talented battery guys in Europe, they should be looking out there first. There's many students and early-stage researchers presenting posters, too.�

Apr 23, 2015

jhm That's right. Cells may become obsolete before they are fully degraded. At some point the value of recoverable materials becomes greater than the use value, and recycling is the optimal disposition.

- - - Updated - - -

If that is the power requirements of a data center, it certainly make sense to collocate. The basic point I am trying to make is that it makes more sense to locate storage close to the end user to minimize transmission and technical losses on stored power. So if a data center or any other industrial user need 20 MW, then by all means, they should have that scale of storage on or near site. I expect that the Gigafactory itself will be a candidate for such a system.�

Apr 23, 2015

jhm I noticed that JB said the 1MW storage at the Fremont plant can cover about 10% of its peak demand. They want to add another MW soon. I wonder what would be optimal, probably not more that the difference of peak to average demand, unless they want serious backup. If they are only running 2 8-hour shifts, perhaps their average is around 7MW. So 2-3 MW storage may be optimal for peak shaving.�

Apr 23, 2015

Lloyd Also this article from Motly Fool......

General Electric Isn't Letting Tesla Motors Win the Energy Storage War (GE, TSLA)

�

Apr 23, 2015

jhm Many will pilot. Few will fly.�

Apr 23, 2015

jhm The CA PUC study is interesting, but limited. They basically have a financial model that they apply to various use cases and scenarios. The most promising use cases are ancillary services to handle frequency and distributed (substation) storage with 2 hour duration. The better return on distributed storage confirms my assertion that it is generally better to locate storage close to use. The use case can also be made better when incentives are in place to reward frequency service as well. Basically this combines the benefits of ancillary service with substation back up. So run 22b and 23 move in the right direction, and it is unfortunate that the researchers did not combine these. Anyway, there model is available for Tesla to use.

In any case, Tesla can test different configurations in this model and determine optimal configurations for each use case. Of course, Tesla probably has its own models for such testing.

The limitation to this methodology is that it is strictly pro forma. Real world conditions will need to be tested. So while the break even cost per kWh or kW calculation are promising, actual utilities will not likely be willing to pay thatuch. They will need a little more margin for error and upside potential. Thus, these are strictly upper bounds on demand under ideal conditions. Naturally, utilities will want to pay less for batteries. Moreover, competition among suppliers will give them opportunities to do so. To get any serious volume in this market, Tesla will have to offer batteries at a fraction of the breakeven hypothetical prices.�

Apr 23, 2015

ScepticMatt My prediction is that molten salt batteries with their piss-poor energy density will go nowhere, Durathon or otherwise.

Seems like even GE isn't convinced, which is why they started using outsourced lithium batteries for their 8 MWh project.�

Apr 23, 2015

jhm As You Await Teslas A Battery Presentation From Tesla CTO JB Straubel | CleanTechnica

CleanTechnica found this very nice quote.

The key issue here is this "tight linkage between cost and volume". When you reach critical cost thresholds unexpected markets open up. You cannot look a past trends to extrapolate past these crossing-points. There is a discontinuity that can elude even "experts."

This is one reason why we should not be looking at current prices of stationary storage and expect that Tesla will take those markets at those price points. If $1500/kWh was the right price for stationary storage, that market would have already taken off. We need to find the price point that will open up a 30 GWh stationary market. I suspect that price is well less than $400.�

Apr 23, 2015

vgrinshpun I suspect that the price is much higher than $400/kWh. According to the yesterday's Deutsche Bank note "The breakeven point to replace a peaker plant with stationary storage is estimated at $842/kWh (EPRI Study)" So Tesla is in a truly unique position to have a luxury to pick the selling price that optimizes demand and their ability to meet it. It looks like they have a huge window to work with - somewhere between $300 and $800/kWh.

Given that for foreseeable future their ability to generate profit is coupled to their ability to produce/source the batteries, I think that their strategic planning should achieve parity between automotive and stationary profit per kWh.

The best case scenario automotive profit: ASP x Net Margin / Battery Capacity. According to Deepak Ahuja Tesla's goal is to eventually have net margin of around 15%. So potential automotive profit would be: 100,000*0.15/85 = $177/kWh.

Now if we assume cost of the battery pack production at the GF to be $150/kWh, and throw additional $50/kWh to cover R&D and SGA expenses, the total battery pack cost would be at about $200/kWh.

So Tesla needs to price their stationary storage battery packs at $377/kWh, which is well below the $840/kWh threshold. Even is we assume Tesla's all in battery pack cost of $300/kWh, they can still make the same profit as automotive if they sell stationary storage at $477kWh and above, still well below $842/kWh threshold.

So I think that Tesla is about to morph in much, much more valuable company. I believe that in order to account for the stationary storage the stock PT should be multiplied by 50/35=1.43. So if Tesla automotive business is properly valued at $250 per share, to account for stationary storage, one would need to value the company at 250*50/35 = $359.�

Apr 23, 2015

doggusfluffy I think $359 would constitute extraordinary. :wink:

I'll chip in with my WAG, I hope it compliments this wealth of ideas and hasn't already been churned to death. I think the Tesla Home Battery will visually resemble a Supercharger. Maybe not hollow but not visually like the white rectangle box they tested with SolcarCity. Since we're assuming a lower density cell a larger but thinner footprint might be ideal. Perhaps even a Tesla Home Deluxe with solid snake module in the future? Anyway...I think it will indeed be unique and look cool in your garage, maybe have a low night light effect, perhaps glossy white and trimmed in red.

Elon Musk says Tesla will unveil a new kind of battery to power your home | The Verge�

Apr 23, 2015

yesla Like if the unit is the exact shape and size of the hole in the SC?? ;p that'd be cute.�

Apr 23, 2015

Runarbt Of course, finally a use for all those cut out from supercharger production.:-D�

Apr 23, 2015

jhm Vgrinshpun, I think you missed my point. I'm not talking about how much profit Tesla may need to price into this. That is the supply side. What I am talking about is the demand side. How big is the market at $800 per kWh? Maybe 1 GWh. How about $400? 10 GWh. $200? 100 GWh. $100? 1000 GWh. I'm just making this up to illustrate a demand curve. So if Tesla wants to address a $4B market $400 is low enough, but if they want to reach a $20B market they've got to press the price down to $200. In the short run, they can go after a small market priced at say $500, but longer term with the gigafactory Tesla will want to sell 15 GWh per year. So the demand question is, how low will they need to take the price? The supply question is whether they can be sufficiently profitable at that price. Tesla has the opportunity to follow an experience curve strategy. As they double their cumulative production they will be able to drive down the cost and price by 10 to 15 percent. As they drive down the price the size of the addressable market grows which sustains the ability to double cumulative production.

This is very much the sort of path that SolarCity is on. They know that as they drive down both their cost per W and the price they offer to customers, they are able to enter new markets. So they are relentless in driving down their installed cost per W, and this is what enables them to keep doubling their customer base every year. It's not just a matter of beating the competition or hitting some predetermined profit metric, it's about constantly expanding the addressable market.�

Apr 23, 2015

doggusfluffy HAHA, or molded to match the FOB. :smile:�

Apr 23, 2015

Brentt There could also be a large demand for stationary and mobile energy in military applications.

I can see a big benefit of being able to fly or truck into the battle zone a 30MW system that is

powered up, and ready to go that produces zero sound and emissions.�

Apr 23, 2015

doggusfluffy jhm, wouldn't the stationary business model resemble the Tesla car strategy? High value, low volume to start and transition into high volume over time? I still wonder if this business won't more resemble Boeing with massive pre-orders booked in advance all at one time.

One of the truly great pieces of cinema...

hudsucker proxy clip - YouTube�

Apr 23, 2015

vgrinshpun I did get your point. I think that you are seriously underestimating demand - and that was the point I was trying to demonstrate. Stationary storage has many advantages over a gas fired peaking power plant - from the greatly reduced maintenance to a far superior load response time - this could improve stability of the grid, which is s big consideration. So my point is that your assumption that one need to drive cost much lower than break even point ($842/kWh per the EPRI study) might not be correct.

This is similar to a comparison between an ICE and a Tesla EV: once cost parity is achieved, EV inherently wins hands down: "not a fair fight". So explosion of demand does not require cost to be much lower than an ICE. As soon as cost parity is achieved, an EV competes with ICE not by offering lower price, but by offering much superior overal experience.

There are many examples of this. Condider flat screen TVs. As soon as they reached cost parity with tube TVs, the demand went way up: nobody in their mind would buy a tube TV over a flat screen TV given the same cost.

In summary I believe that as soon as stationary storage is available at a cost that is slightly lower than the break even cost, there will be explosion of the demand.

That I believe what JB had in mind. The demand is not characterized by the demand curve - it is more like a step function.�

Apr 24, 2015

jhm There are big differences between auto markets and battery markets. With batteries it pretty much comes down to the economic value that can be created by the device. But with cars there are quite alot of hedonistic value that customers perceive and are willing to pay for. Batteries are also more of a single component rather than a complex system. So it is more comparing the memory in your smartphone to the smatphone itself. So batteries are much closer to being commodities than are cars.

it's a bit ambiguous to say what "higher value" means. Price for the whole system, price per kWh, size in kWh are posible meanings. I don't think that gross size of the application is the right way to look at this. Rather the price per kWh seems to be the key issue determining which applications are economical for the customer. Similatneously we may see small scale and large scale applications. So the range of economical applications at $800 is fairly limited, but at $400 many more applications start to make sense. Once $400 becomes available, however, the $800 applications will use $400 batteries instead, unless there are very special attributes required. So this is very different from autos. Tesla will still sell a lot Model S even after the Model 3 is widely available. With batteries it will be a continuous process of driving prices per kWh down much like we see with producing solar panels.�

Apr 24, 2015

Lessmog I'm not sure about the time scales here. At present, GM is somewhere around 25-30% and ASP around 100k (net margin escapes me just now) but what CFO Ahuja was talking about was "eventually", ie after M3, GF and large volumes, right? By then, ASP will be lower due to M3 costing only 1/3 to 1/2 of MS or MX.

In that case, your napkin calculations may need a little tweak. Other than that, I stand in awe, sir! :smile:�

Apr 24, 2015

doggusfluffy

I was thinking of it in terms of market demand and how much stationary supply Tesla can muster before the GF comes online. If an $800 application is available to order in 2015, it might make sense in a market like Hawaii for example. Even knowing the same battery application might cost $600 in 2017 or $400 in 2020 it would still make sense today @ $800. Maybe high value was the wrong analogy.�

Apr 24, 2015

jhm Yeah, we're on the same page. It's essentially a bidding process. Start high and drop the price over time as needed to unlock more sales and to keep competitors at bay.�

Apr 24, 2015

vgrinshpun Actually, after M3 comes into the picture both ASP and kWh will go down, so the result will not change much. Most importantly, though, I was intentionally taking the case of the maximum per kWh profit for automotive segment. The point I am trying to get across is that we have a unique situation which makes stationary storage an absolute killer of a potential profit machine for Tesla. The paradox is that while there is some work to do to drive the price point of the batteries down to make EVs outright cost competitive with ICE, in case of grid storage the price point of the batteries is **already** well below the parity threshold.

It is inertia, **not cost** that keep grid storage from massive large scale adoption. So the grid storage opportunity that lies in front of Tesla is enormous, yet nobody really put a price on it. I suspect that a lot of analysts do not understand it, and those who do just stupefied by the enormity of it and wait in awe and disbelief until somebody provides external confirmation for them, just to make sure that they did not go crazy...�

Apr 24, 2015

austinEV How much money do you have to have to be a hedge fund with it's own analyists? Lets pool some money, get a TMC hedge fund. Then the first call on every earnings call will be "first question is from vgrinshpun at TMC partners, your line is open". �

�

Apr 24, 2015

vgrinshpun For those not familiar, with EPRI, it stands for Electric Power Research Institute, a very reputable organization created in the wake of Great Northeastern Blackout in November of 1965, and funded by members, mainly electric utilities.

To give some background to the stationary storage vs. peaking plant breakeven price of $842/kWh that was quoted by Deutsche Bank, EPRI did a lot of work in this area and recently released a software titled Energy Storage Valuation Tool (ESVT) in an effort to help utilities to understand the cost effectiveness of utility-scale energy storage deployment.

The benefits of the utility scale storage are many, and it's deployment can be advantageous not only on the basis of cost effectiveness of, say, replacement of the peaking power plant, but because it allows for unique grid enhancement benefits. For those interested in more details, EPRI in collaboration with Department of Energy (DOE) prepared a comprehensive Electricity Storage Handbook available for a no fee download.

- - - Updated - - -

Ha, I am on the telephone for all of the ERs for the past couple of years, and very often had an urge to really ask some questions, but never did...�

Apr 24, 2015

jhm When you look at one specific sort of application (say, peakers) in one electrical market (say, southern California ), then it really is like a stair step demand curve. Do we know how big this is? How many new peakers are installed each year in SoCal? How about peakers in Georgia? That's a different market, so the electricity and real estate prices are different, and there is a different regulatory environment. So all this means there is a different breakeven price for battery peakers plants in Georgia. So there are about 50 different markets just in the US, and they all have their own breakeven price and they are all installing new peakers capacity at different rates. When you put all these little stairs tepid demand curves together for the US, you get a combined demand curve with 50 little steps in it. Open this up to the global market, and you get a curve with a thousand little steps to it, and that is just for one application. Any other sort of application, say, peak shaving at commercial facilities like Wal-Mart or Tesla's factories, and you get a whole new multi-step demand curve. Actually, here it may even be smoother. The current price of a 200 kW unit may be low enough for a Wal-Mart store to install 1, but not low enough to install 2, due to diminishing returns. Next year when the price is lower, that store may find it compelling to install a second unit, but not a third. And so it goes year after year.

So I would be delighted if I have underestimated the demand for battery peakers plants. For the most part peakers plants are a very old fleet, heavily depreciated, and basically kept in operation for occasional use. So the comparison between a new battery peakers plant and a fully depreciated peaker plant comes down to the cost of fuel and operations on the old to a huge capital cost on the new. So if you absolutely needed to add new peaker plants, batteries may win hands down. But if you can make do on your old peakers for a few more years, you'll delay on the new battery plant and wait for the price to come down. So there's a big gap here between operating dollars and capital expenditures. One way to mediate this is for Tesla to build plants and lease them. I'm not sure I want Tesla in that business though. But if Tesla were to become a merchant power producer with full access to the wholesale electricity market, it could do something quite clever. It could equip Supercharger stations with a mini-peaker capacity, say 1 to 5 MW per station. Having hundreds of these throughout a market could supply upwards of 1 GW of peak capacity, and pay for all those "free" charging sessions. But if we are waiting for old peakers in semi retirement to be replaced with brand new battery peakers, my suspicion is we'll have to wait a long time.�

Apr 24, 2015

Familial Rhino Here is Cory Johnson trying, and failing, to find a crack in Tesla's battery storage plans:

Can Tesla Turn Battery Tech Into a Commodity? - Bloomberg Business�

Apr 24, 2015

eloder That's a very, very good point.

That reminded me of the anti-missile laser weapon tests. The only current downside to the laser systems, versus firing expensive interceptor rockets? Power. Ironically a Tesla battery could help power weapons of the future. Rather than having gigantic excess generation available onboard, the battery could be kept charged, and discharged to fire off the weapon. I'm not sure if the Tesla battery could generate enough power for the laser weaponry, but I'm sure it'd be better than whatever system is set up now.�

Apr 24, 2015

jhm Should Tesla become a utility?

Vgrinshpun, inertia is a very good term for the problem I see with stationary. So I think we may be closer in our thinking. The practical question for Tesla is how to overcome inertia. Making great products and cutting costs only goes so far in the face of massive inertia in an industry that is heavily regulated and does not want its economics turned upside down. At some point, Tesla may need to contemplate actually becoming a power producer and competing head to head with other producers in the power markets. How would Tesla and SolarCity shareholders feel about owning a JV utility? What would be the smartest way to enter this market and not run afoul of heavy regulations? What are the alternatives that allow Tesla's batteries be just as disruptive as they can be?

Tesla was not able to disrupt the auto industry by designing and producing battery pack to sell to automakers. It had to market the whole car to unlock the potential of a battery electric drivetrain. Likewise selling battery packs to utilities might not suffice to disrupt the utility market. They may need to become a utility to disrupt that market. If there really is, say, $1000 of benefit to be derived from a utility battery, then they can give the industry an ultimatum: you can buy our batteries for $800 and retain the upside, or we will install the battery in our own utility and extract $1000 or more from the power market for ourself. Buy our product or lose marketshare. I think Musk is crazy enough to pull this off.�

Apr 24, 2015

Lessmog @jhm & @vgrin,

Thanks a lot guys! I find this powerful thread very fruitful and meaty, and I hope it will enable us to milk the market and kill some beeers ;-)

The thanks are meant seriously, though.�

Apr 24, 2015

SebastianR I think it is not even about needing power in actual combat but more about saving supply costs: There is a guy that claims the US spends about 20 billion(!) USD on Air Con in Afghanistan alone.

Now, I'm deeply skeptic if that number holds in reality (and then Air Conditioning is not the only need for power) but even if we cut this number in half, we still have a ton of places / applications (i.e. a huge market) where energy storage makes a lot of sense.�

Apr 24, 2015

Foghat Utility company... It all depends on what is the core business of Tesla Motors. Is it cars or batteries? If brand recognition as the most innovative car company gets confused with your local energy provider, this might might a problem it quality lags or market leadership drops in one or the other business. Secondly, batteries are not enough to be an energy provider or utility. They will need energy producing assets. This may be a massively capital intensive endeavor that could take away from the automotive division ability to grow itself.

It appears Tesla may keep its focus on the auto business while selling stationary storage solutions as a piece of its cost reduction roadmap. Sell low margin energy storage in order to preserve/improve automotive margins at competitive retail prices. This low margin strategy also extends to energy storage products for all other modes of transpo(except rockets). Surprisingly, the lowest margins possible will open markets faster and thus fill gigafactory demand sooner as well as give the supply chain greater visibility on orders(which further reduced costs). The end result might be tesla makes far more money as auto company selling batteries rather then if they attempt to be a utility and an auto company at the same time. Also, it might be also advantageous to tesla to allow Solarcity to take on the energy/utility piece as they are deeply involved in producing and deploying distributed energy assets already.�

Apr 24, 2015

doggusfluffy Agreed, and I would also like to echo this sentiment. I was feeling a bit of that crazy disbelief to be honest at the sheer magnitude, given how the market has reacted.�

Apr 24, 2015

Lessmog Still 15 minutes to go this week ...

Market is deluded. Unfortunately, market also sets the price. Or fortunately, depending ... :wink:�

Apr 24, 2015

daniel Ox9EFD Hi does anyone know if Tesla talked to utilities yet? from the talk by JB I get they did, but is there any more specific information about what utilities (perhaps Hawaii?),

Also, would Tesla work directly with the utility or through a integration company?

Thanks�

Apr 24, 2015

Robert.Boston Electricity doesn't understand state borders. In the US most of the electric demand is in one of the seven Regional Transmission Operators' markets, which determines the cash flow to all transmission-level resources. The southeast, northwest, and desert SW are the only areas outside of these markets. By having fewer, more robust markets, we can better price resources like storage.�

Apr 24, 2015

jhm Thanks, Robert. I still don't get why the RTO level would be the best place to put storage. On the utility side, frequency regulation and distributed storage seem to create more economic value. Intuitively, I don't know why I would want to submit stored energy to transmission losses. Moreover, I want to place some value on reliability of service to end users. So highly distributed storage pays transmission costs when charging, but is reliable and locally available when discharging. It seems that rate arbitrage should work just as well whether centralized or distributed.�

Apr 25, 2015

Gerasimental IMO, if it's meant to be stationary then the more inertia the better!�

Apr 25, 2015

Matias If grid storage is allready competitive now (as it obviously is, if peaking power plant costs more than 800$/kWh), why aren't utilities then using them?

GE has offered them without success. I believe GE is very trusted name, so that can't be the problem.�

Apr 25, 2015

nwdiver The same reason solar PV doesn't make up a larger percentage of their fleet... Tesla storage is going to compete with RETAIL... utility storage needs to compete with WHOLESALE. A peaker is cheaper than batteries but Wal-Mart can't exactly install a peaking plant in the parking lot...�

Apr 25, 2015

Robert.Boston We may be talking past each other. All I was trying to say is that, in most of the country, there isn't a "utility side." If you're behind the meter (retail) then you can't be paid for regulation or storage. If you're in front of the meter, it's the RTO, not the utility, that needs to pay you. It may be possible (indeed, necessary if EPSA isn't overturned by the SCOTUS) for the distribution utility to bundle retail customers and offer that bundle to the RTO market, but it will be the RTO that is the paymaster in the end. It's a very different market structure than you have in Georgia, James.�

Apr 25, 2015

doggusfluffy Tesla's $13,000 battery could keep your home running in a blackout | Technology | The Guardian

�

Apr 25, 2015

daniel Ox9EFD Saw the article. I hope it's false. That price is something like twice what it should be. Lets say $180 x 10 = 1800 for the batteries, inverter and battery management another 600, another 1000 for administrative and installation, another 25% profit that gets you to 4250.

I could see even 6000 if they actually pay much more for the batteries, or if they want to cover hefty R&D costs with more profit. But 13k? No way.

It's just not disruptive at that price.�

Apr 25, 2015

MorrisonHiker I agree. When i first heard of stationary storage a few months ago (searching for the articles now), I thought the article mentioned MUCH cheaper prices like $1500-$3000. If they want to sell like hotcakes and be competitive, I think they would have to come in under $5000. Otherwise, it would be cheaper to just get a natural gas generator, such as Generac. I guess it depends on the customer though. Customers with solar would prefer the battery but other customers who are just trying to be prepared for power outages could just go the Generac route (assuming they have natural gas) if the Tesla battery ends up costing $13k�

Apr 25, 2015

Thumper If you buy a generator for earthquake preparedness, like me, a battery pack would be preferable. I have a generator, but in an earthquake, gas lines are perhaps even more likely to be interrupted than electrical lines. A battery pack is also faster and easier to connect for short term outages. Any time there is an interruption, I wonder is it coming right back on, is it worth connecting and starting the generator and throwing the transfer switch. A battery is just one quick switch on or off.�

Apr 25, 2015

Johan In fact a battery won't even be "one quick switch" - it will be seamless. You won't notice the power is out unless you look out the window. Your TV won't turn off, your computer won't either.

But now with early generation home batteries I think if the only use case is emergency power it will be too pricey. A generator will be be better: cheaper investment, can run for days on end as long as you've stockpiled some fuel.

No, the use case will be battery+solar (or other renewable) at first.�

Apr 25, 2015

jhm Sorry, I was launching off in a different direction. It not clear to me how Tesla should insert itself into the utility market. It is such a strange, highly regulated market. There seems to be a huge wall between wholesale and retail that undermined much of the benefits that batteries could supply. I really like the idea of aggregated customer side storage, but it seems unworkable within many current regulatory frameworks.

So this leaves me thinking that Tesla's stationary focus should be behind the meter. Deliver solutions that enable ratepayers minimize their power bills. This will effectively take marketshare from the utilities, in the same sort of way that rooftop solar takes share. This will increasingly undermine the economics of utilities, but when they put more cost onto ratepayers, they will drive more customers away. Perhaps this death spiral will reach a crisis point leading to regulatory reform. If thing rooftop has been moving in this direction, and now stationary will boost the progression.�

Apr 26, 2015

MorrisonHiker You bring up a good point about earthquakes but most parts of the world don't really have to consider earthquakes. Living in the Plains and Rocky Mountain states for most of my life, the only time the power has ever gone out for more than a few minutes has been due to weather such as tornadoes or heavy snow. These weather related incidents can knock out power lines but would almost never affect natural gas lines. While I am interested in Tesla batteries for home storage, there's no way I'd pay anywhere near $13500 for a device that I would probably need for a couple minutes per year, if that. By the way, the natural gas Generac generators that I was referring to are tied into your household electrical system and automatically provide power instantly if the electricity goes out, just as a battery backup would. I wasn't referring to a small, portable generator which would require a manual switchover.

While I am interested in vehicle to grid technology, I don't know if Tesla is interested in that market at this time. Vehicle to grid is great because you wouldn't need an (unused) generator or big backup battery sitting around as you already have that battery in your car.

I can see Tesla's battery being useful for homes with solar or those interested in peak shaving. It will be interesting to see what this week's announcements bring!�

Apr 26, 2015

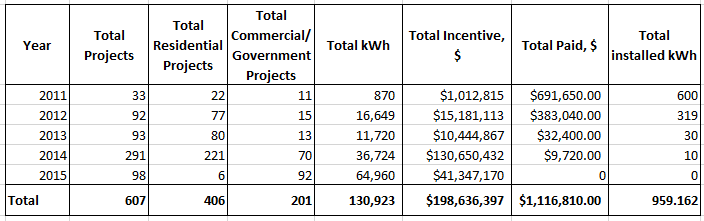

vgrinshpun I've spent some time perusing the data from the California Self-Generation Incentive Program site (SGIP) (thanks a lot to our members Wishing_for_S and Bonaire for pointers in the Short Term TSLA Price Movements thread).

The results are really fascinating. Here are some salient points for the Forum to ponder. Data come from the SGIP Handbook and the spreadsheet containing data for all of the projects

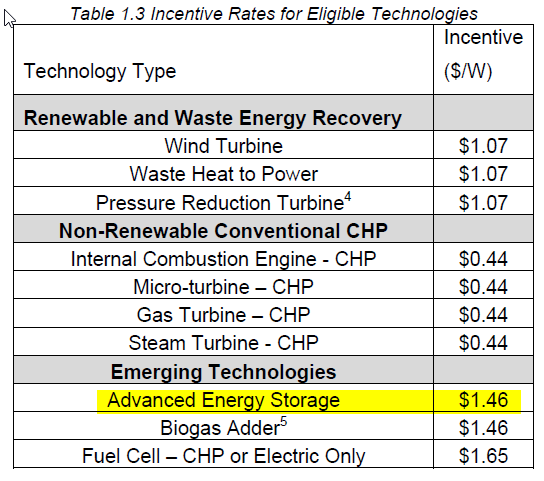

- The incentive for advanced Energy Storage in 2015 is whopping $1460/kW, or taking into account that Tesla kWh rating is twice the kW rating, $730/kWh. This incentive is obviously for installed kWh, so, as a wag, assuming that cost of equipment is equal to roughly half of the total installed cost, the incentive is $365/kWh of the battery. This incentive is phased out at 10% per year, i.e. in 2016 the incentive would be 90% of the 2015 amount. The incentive rate is also reducing as capacity of the system exceed 1MW - 50% for installations larger than 1MW but smaller than 2MW, and 25% for systems between 2MW and 3MW.

- The SGIP incentive is paid to the Host Customer, but can be assigned by the customer to the installer or equipment manufacturer, presumably in lieu of payment for equipment/installation.

- Tesla has a total of 607 storage projects being registered as part of SGIP in various stages. Of this total there are 201 Commercial/Government projects, while the rest are residential.

- Residential projects are all 5kW/10kWh, while commercial/government projects vary from 20kW to 3,000kW (40kWh-6,000kWh).

- During the first year of Tesla storage batteries participating in the program - 2011 (!) - majority of projects were residential, with only 11 being Commercial (are those the 11 Wall Mart stores referred to in the article by CleanTechnica?). With every year the quantity of commercial/residential installations participating in the program grew steadily, culminating with 92 out of total 98 in 2015.

- The total kWh of all Tesla projects with application in SGIP program is 130,923 - yes, about 131MWh!

- The total incentive for all of the projects registered in SGIP is $199M, with $1.1M paid to date.

One thing that should be noted is that above data are for the projects in various stages of the SGIP program, with such an application ostensibly is being the first step in the planning of the project, but, nevertheless, these 131MWh worth of storage projects are clearly in Tesla pipeline.

One conclusion, which I actually came to even before perusing the above data, is that oncoming battery storage announcement/reveal event is going to be enormously important and will set the tone for the ER. The battery storage information during the ER might overshadow all other information, as it will hopefully provide enough data for analysts to start taking battery storage part of the business seriously, and start putting some additive numbers reflecting this part of the business into PT.

The summary of the information included in the SGIP spreadsheet is included below.

�

�

Apr 26, 2015

MikeC Great work, vgrin! Are you able to estimate profits using your models of Tesla's cost per kWh?�

Apr 26, 2015

vgrinshpun The SGIP data are indicative of the status of the project as far as the stage of SGIP application is concerned, so it is not possible to evaluate when all of those 607 projects totaling 0.13GWh are going to be installed and Tesla able to book the profits. That is why in my table above I included the totals for the projects that had SGIP incentive was paid so far. According to the SGIP rules the payment can't be made until the installation is verified during the Site visit.

Most importantly, the data gleaned from the SGIP Site are not inconsistent with my speculation up thread that we will not see Tesla stationary storage pricing less than $400-500 per kWh any time soon, and this will allow Tesla an incredible feat of pulling as much profit from the stationary storage, per kWh, as they make in the automotive segment, although the top line for stationary storage could be 2 times or more less that for the cars. In another words stationary storage will have much higher net margins.�

Apr 26, 2015

bonaire Is Tesla paid the incentive? That wouldn't make sense, shouldn't the system buyer get the incentive for the project?

presumably, solar city is the buyer for home systems and then leases it to the homeowner. For commercial, could be the same using the $1B in Credit Suisse money vehicle. But margins are based on what is left from the project costs that flow into Tesla. Solar city could pay them strongly due to the heavy incentive money of $1.75 per watt state incentives. CA is being very good to both companies and I have to think both are going to do as much as possible in those projects already on the SGIP project log as possible to garner the profit potential. But is it a little disturbing to hear one talk about battery prices dropping quickly and then reviewing some project costs and see that the projects hit numbers like $1000-2000 and higher per kWh? There may be loopholes and other advantages in the SGIP system that they can take advantage of now before any changes come to the system. I also think there is a chance of some projects outlined to be cancelled, while others are added. I noticed recent additions were 100 KW with a project price of $100,000. And $60,000 incentive. Wow, lot of incentive there. Compared to ZEV, it is huge. SGIP opened the door for battery storage and didn't factor in small, nimble and high powered Li-Ion being able to do things as cheaply as that. I hope they cancel some of the 2012 and 2013 projects which are $2000 per kWh (not KW, but kWh) and move to newer and cheaper project technology so more kWh are brought online per dollar. The 3000KW system logged in from 2012 could be done a lot cheaper than $12 million.�

Apr 26, 2015

vgrinshpun As I posted, the payment of the incentive is made to the Host Customer. Paragraph 2.5.5 (p.32) of the Manual linked in my post states the following:

Where are you getting $1.75 per watt? The $1.46 per watt that I mentioned in my post is included in the Manual (Para. 1.3, p10):

Regarding the project costs of $up to $2,000/kW, do not forget that this is total installed cost, not cost of batteries alone. The cost of batteries could easily be half of the total cost, i.e. $1,000 per kW. Then one has to remember that battery energy rating is twice the power rating for these Tesla batteries, so battery rated 1kW has energy rating of 2kWh. The final battery cost per kWh is therefore about $500.

Another thing that often is overlooked, it is not just the battery that Tesla sells, it is plug and play system with software that dispatches charge/discharge modes of the battery based on the load profile. This intelligence and learning capabilities that are built into the system definitely worth some $$!�

Apr 26, 2015

Bgarret "The incentive for advanced Energy Storage in 2015 is whopping $1460/kW, or taking into account that Tesla kWh rating is twice the kW rating, $730/kWh. This incentive is obviously for installed kWh, so, as a wag, assuming that cost of equipment is equal to roughly half of the total installed cost, the incentive is $365/kWh of the battery. This incentive is phased out at 10% per year, i.e. in 2016 the incentive would be 90% of the 2015 amount".. - ,Vringshpun

so if I'm reading this right, if Tesla started with about $200 million in leases for 2015 (pure guesstimate) then they would begin 2016 with $200million (x.9%) = $180 million in revenue + 100% of anything delivered and inspected in 2015....so if they connected another $400 million, that is the number they start with in 2016. If this is a lease, starting the year with a projected $400 million in additional high margin revenue from a revenue steam that is not only growing dramatically, but is recurring - that would be huge.

nice work Vring....well played Tesla�

Apr 26, 2015

vgrinshpun I do believe that when Tesla start "showing all their cards" as far as stationary storage is concerned, the Market will be mightily impressed.

According to the SGIP spreadsheet mentioned in my post, and as shown in posted summary, out of total of 131MWh of projects in the pipeline, only less than 1MWh worth of battery storage were already installed. I think that timing of the April 30th event is not incidental. I think that we might start to see some $$ for the battery storage start showing on the top line in Q1, so Tesla is planning to tackle all of the general information about their storage products during the event, so they can spend some time on the financials of this part of the business during the Q1 ER. I hope to see some measurable contribution from this to the bottom line, and, of course, storage battery guidance, if Elon decides to share it at this time, could be a watershed event.�

Apr 26, 2015

Foghat Bonaire,

I have the same question about who gets the incentives. I think Solarcity buys the battery from tesla, then installs their complete solar+storage on customers roofs. Walmart is a customer of Solarcity and uses solarcity's demand logic product. Therefore, I assume Solarcity gets the incentive, although I'm not sure if Walmart bought the demand logic product outright giving them the incentives.

im not sure manufacturers count in the incentive program, maybe if tesla leases the batteries, but that would also mean they would have to install it, which is solarcity's business typically.

Also, from my understanding, pug and play means the system can be integrated into any energy company ecosystem(grid, solar, wind, etc...) the stationary storage pack might require versatility to work with the host company's management software. Solarcity has demand logic, so tesla energy storage can plug and play in that ecosystem. Elon did talk about the storage pack will include a smart inverter, not not sure if that will be included this time around... a lot of unknowns, hope we get a few answers this Thursday.

as of right now, I think Solarcity and other installers/energy company might reap most of the incentives. Tesla benefits by being the lowest cost energy storage solution for these companies to choose as their primary energy storage supplier. If that's not the case, Tesla might announce Thursday they have an installation division to lease and install energy storage products themselves. Or, Solarcity leases the storage from Tesla and then offers PPAs only where tesla is owner/manufacturer, but not sure how this would complicate things with the added 20% that comes from buying for an in-state manufacturer.�

Apr 26, 2015

blakegallagher Have thought this might be the case for awhile. Felt very strong since JB did his Stanford presentation. Thanks for the strong analysis as always.�

Apr 26, 2015

Foghat Commercial - DemandLogic | SolarCity

The software running demand logic is Solarcity's as the linked product info material describes. As such, Tesla appears to play primarily a supplier role in this transaction. This might be the same relation to other buyers of tesla's products as well. I think tesla's business model might be to offer the best priced product, to compete on price with the likes of Stem and others. Since over 2/3 of all storage being installed today in California is manufactured by Tesla, they appear to have the most competitive prices in the state, which doesn't mean margins aren't very healthy given the substantial market share already.�

Apr 27, 2015

Johan Great analysis Vladimir and Bonaire!

One small detailed that I have been very happy about ever since I saw the first video and pictures of the stationary storage units is the fact that they are Tesla branded - with the same Tesla logo as the cars. This tells med that Tesla are absolutely planning on keeping the stationary storage businness in the company, and not budding off for now. Great for us investors. Also, as mentioned before teslaenergy.com redirects to teslamotors.com.�

Apr 27, 2015

bonaire the 1.46 is bumped to 1.75 by the program giving 20% more incentive to CA based vendors. Tesla is where?

this is how a home system buyer sees $8760 incentive off of 5000W. However, will they see it? They will lease from Solar City and really not be able to buy it unless they offer a buy option. Seems like a lot, but look at prior years, it was $12,000 on a $20,000 install. Now installs are written as an eligible price of $23K and change.

What I also see is that some recent project additions are on the waitlist. When they announce home storage on Apr 30, and Solar City says "available later this summer" I have to think that Tesla may cancel some old reserved monies from 2012-2013 project reservations which have not started to open up incentives for 2015 for new customer demand. Otherwise, it becomes something to put off until more reservable CA incentive money is made available. Of course, that is CA only - they can sell home systems anywhere as long as the installation price is good and people find value in it.�

Apr 27, 2015

jhm This is super, vgrinshpun. In your table, is this really in kWh, not kW? The ratio of incentive to kWh is $1517.20 by my calculation. Might this just be specific to Tesla installations?

It's interesting that the incentives taper of above 1 MW. Do we understand why this program is preferential to smaller projects?

Thanks for putting this report together.�

Apr 27, 2015

bonaire Taper is because a distributed storage and use system is best when distributed. By putting in a variety of multi MW systems, you still end up with less overall grid efficiency than by using many 10KW or smaller units. If the need is to cut down the peak demand curve on the grid mid to late afternoons in hot summer days, the requirement is to use less transmitted electricity and more stored energy at the usage-site. Higher daytime temperatures make transmission lines less efficient. If every office building had a 100KW system they could participate in some load shaving during the hours of employee activity of 2pm-6pm and then home systems could participate from 6pm-8pm. The other problem, though, is conformance with grid demand itself. On a cool day, with low AC needs - the demand curve is much flatter and so the need is to spread out the battery output over the whole 2pm-8pm window.

One thing really necessary is for office buildings to become involved in cooperative electricity demand reduction after 5pm once employees start to leave. Get employees to start turning off equipment like computers and monitors, at least, and lighting as well (or use auto-off light switching). To make a smart grid work, businesses and average people need to also be part of the solution.�

Apr 27, 2015

yobigd20 with the way the MS battery pack is designed, you'll probably be waiting 20 or 30 years before that happens.�

Apr 27, 2015

rallykeeper I admittedly quickly scanned, but still hadn't seen anything noted by anyone in this thread (maybe it's elsewhere on TMC?).

I got my email invite last night to the "Missing Piece" April 30 announcement. 8 pm in Hawthorne...

Graphic is of a white 3D rounded square that looks vaguely like an Apple Time Capsule (original version) or maybe a Wink basestation with Tesla emblazoned in the middle.

Here's the device...

�

�

Apr 27, 2015

Lloyd How about a whole house inverter, allowing Generator, PV/wind, Car (V to Grid or V to house) or other battery storage, and Grid if desired. Thus, allowing you to disconnect from your utility, or minimize the use of your utility. Smart, knowing the TOU schedule to maximize the self power generation usage to it's best ability.�

Apr 27, 2015

30seconds Now that would be the missing piece!�

Apr 27, 2015

yobigd20 honestly if that's what it is and it supports all that, i'm sold. seriously.�

Apr 27, 2015

Ingenieur I think before calculating all these 100s of Millions, please check that the total budget for 2015 is 77 Mio ( http://www.cpuc.ca.gov/NR/rdonlyres/9E029D5B-3144-4FD4-925E-3B95FE9CAF3C/0/2015SGIPHandbookV1_Final.pdf ) Page 8, 25% of which reserved for Non-Renewable stuff like Gas Generators. So we have ca 58 Mio potential funding split between multiple parties, is that really worth all this excitement and analysis?

Or do i read it wrong?�

Apr 27, 2015

Lessmog Now, I must apologise first off that I don't have time to dig deep into the material.

But I much doubt that all of the profit will come from Gov't subsidy.

Rather, most of it will be added value and a changed balance vis-a-vis grid&utilities.

If so, the subsidy is only grease to slide over the threshold easier.

That's my take, anyway. We'll see in a few days. Or months.�

Apr 27, 2015

Newb I know that most of you are concentrating on the US (or even CA only) market, but don't forget that Tesla has become a global player now. They have a perfect distribution network in the biggest and most important markets of the world. As posted further up thread, retail prices of home battery storage for residential solar in Europe amounts to about $1,500 to $2,500 per kwh. I've already posted examples of Bosch or RWE or Samsung systems. Here's one more: Solarworld SunPac Lion 5 kwh currently costs about $11,000 retail: SolarWorld : SunPac LiOn

To remind you: Germany is one of the frontrunners in solar: "The country has been the world's top PV installer for several years and still leads in terms of the overall installed capacity, that amounts to 38,458 megawatts (MW) by February 2015, ahead of China, Japan, Italy, and the United States[SUP]"[/SUP] (Solar power in Germany - Wikipedia, the free encyclopedia)

"Germany set a world record for solar power production with 25.8 GW produced at midday on April 20 and April 21, 2015." (Source: see above)

There's about 1.5 million residential PV systems at present. The feed-in tariffs are coming down year by year. Stationary storage is starting to gain momentum. Virtually every big solar installer has a battery storage system on offer by now.

The thing is, even at those retail price levels ($2,000 per kwh battery storage), there's a ROI after 10-20 years for residents, depending on energy consumption, PV system and so on. Remember that a kwh from the grid costs about $0.30 in Germany.

Now imagine Tesla Energy to start selling a 10kwh home battery for half the price of all of its competitors (let's say $10,000 for the 10kwh) in the German market. They are even eligible for a rebate because German government is supporting residential storage with a rebate of up to 3,000 euros (~ $3,200). => This is a market, Tesla will conquer in an instant, once they realize the potential. And I'm sure they will enter it with the home battery soon enough.

That's just a wag, but I think Tesla will be battery-supply constrained for the next 10 years, folks. They better start building GF #2 and #3 now.�

Apr 27, 2015

stevejust Yes. Jay Squyres probably already posted the photos from his trip about a month ago to Oncor's test lab in Lancaster, TX somewhere on this forum. They've already got a 400 kWh Tesla battery there they've been testing out. We have a deregulated market here in TX, so Oncor is the distributor, and we buy energy from any one of about 40 or so electric companies, ranging from TXU, Reliant and NRG, to small companies no one's ever heard of.

It's interesting that Oncor is considering spending a whole lot of money on battery backups. And we know from their test lab Tesla is already one of the batteries they're considering.�

Apr 27, 2015

vgrinshpun Thanks, got it. It is on p.78 of the Manual, Bill AB 2267 approved back on 9/28/2008.

- - - Updated - - -

The Summary Table includes kWh, not kW. kWh are obtained by multiplying kW by two, to account for the fact that Tesla battery kW rating is based on 2hr discharge.

While double checking my math, however, I discovered a typo in the formula used for calculation of total kWh in 2014. The correctly calculated total kWh in 2014 is 73,448, not 36,724. The updated table:�

Apr 27, 2015

vgrinshpun Good Job, Deutsche Bank - you are the second to put some preliminary $$ on the stationary storage business - potentially a $100 adder to the PT is mulled! The first, of course was Andrea James of Dougherty with the estimate that stationary storage side of the business could add up to $70 to the PT.

Just to be clear, though, nobody actually changed the PT, for now there is just speculation on potential for this part of the business. I believe this will change post the April 30th announcement or the ER, when some numbers will start to show up in the Q1 financials.

Just to add some color (to borrow the analyst's favorite word), I did some additional take on the SGIP spreadsheet, which revealed that out of total of 23 projects that were completed, the SGIP payment for four projects totaling 219 kWh were made in Q4 2014, while SGIP payment for the other 19 projects, including 8 residential (total 80kWh) and 11 Commercial (660kWh Wall Mart stores?) were made in Q1 2015.

So my theory is that the timing of the April 30th event is not incidental - the Q1 2015 report might show the stationary storage revenue as a separate line item (very small), signalling a new stage in the evolution of the Company. Could be very significant - come on Tesla - time to reveal some of your cards!�

Apr 27, 2015

sundaymorning I must admit, you are peddling with some very interesting speculation. btw, I'm a fan of your work here, keep up the wonderful things that you do.�

Apr 27, 2015

vgrinshpun You might be missing the fact that Tesla, as always, is being very smart in their tactic. They put a "stake" for a total of 607 projects, spread-out over 5 years, starting with 2011. For the purpose of the SGIP program the money for the incentive payment are reserved at the time when application was accepted, and count against that year. For example the following is breakdown of the total of 23 Tesla projects with incentive paid to date (in Q4 2014 and Q1 2015):

- 10 incentive payments were made against 2011 Budget,

- 9 payments - against 2012 Budget,

- 3 payments - against 2013 Budget

- 1 payment - against 2014 Budget

Most importantly, though, you might be missing the fact that major significance of this data is **not** in revealing the scope of the California incentives, but revealing some data on the Tesla stationary storage business, which indicate that this part of the business will be immensely profitable for TM, with **much** higher gross and net margins than the automotive business.

See my previous post for more details. Based on the data from the SGIP spreadsheet TM is currently selling their stationary storage product at around $1000/kWh, with the incentive of $1,752/kW. Since this incentive is for total cost of the system, including installation, the portion that goes toward the equipment could be approximately half of the total. Then, taking into account that Tesla kW rating is for a two hour discharge rate, the battery portion of the incentive payment accounts for about $438/kWh. So when Cali incentives are phased out, Tesla might need to lower the price to $1000/kWh - $438/kWh = $532/kWh. As seen from the post that I linked above, even after all of the incentives are phased out the potential profits are immense.

So the main takeaway from the SGIP data is that TM has additional very scaleable business with enormous earning potential.�

Apr 28, 2015

SBenson Sorry if I missed, but why would people want to buy/lease batteries which are so expensive instead of buying generators?�

Apr 28, 2015

Jonathan Hewitt Generators are only good when the power is out due to high cost of running them. Batteries can be used for much, much more.�

Apr 28, 2015

Foghat Vgrinshpun,

It is interesting that incentives has gone down to 1 payment, while Tesla has maufactured 70% of all installed storage in CA under the SGIP. I can only conclude Solarcity has received the incentives since in 2014 it is estimated they have installed multiple units for Walmart, a few units for BJ's Wholesale, and hundreds of home storage units. Also, in 2013, Solarcity had 65 SGIP applications where Tesla had 3 payments received. http://www.greentechmedia.com/articles/read/Lesson-Learned-From-SolarCitys-First-Home-Energy-Storage-Installs

Moreover, Solarcity documents suggest Solarcity will take on the third party role in future SGIP applications, where Tesla takes on the manufacturer role. Solarcity controls/services customers energy management system, tesla does not.

Page 6, Solarcity 10-K

Grid Control / Energy Storage Systems . We are also developing proprietary battery management systems built on our solar energy monitoring communications backbone. These battery management systems are designed to enable remote, fully bidirectional control of distributed energy storage that can potentially provide significant benefits to our customers, utilities and grid operators. The benefits to our customers of energy storage coupled with a solar energy system may include back-up power, time-of-use energy arbitrage, rate arbitrage, peak demand shaving and demand response. The benefits to utilities and grid operators may include more stable grid management and improved up-time. We believe that advances in battery storage technology, steep reductions in pricing and burgeoning policy changes that support energy storage hold significant promise for enabling deployments of grid-connected energy storage systems.

Page 8, Solarcity 10-K:

As of December 31, 2014, SolarCity and its wholly-owned subsidiaries had 22 patents issued and 108 pending applications with the U.S. Patent and Trademark Office, and its subsidiaries also had 11 patents issued and 62 pending applications with foreign patent and trademark offices. These patents and applications relate to various SolarCity technologies, such as solar cells, installation and mounting hardware, financial products, monitoring solutions and related software. Our issued patents start expiring in 2025. SolarCity intends to continue to file additional patent applications. �SolarCity,� �SolarCity and Sun logo,� �SolarGuard,� �SolarLease,� �PowerGuide,� �SolarStrong,� �SunRaising,� �PowerSavings Plan,� �Rooftop Rewards,� �Solar Made Simple,� �Energy Explorer,� �Zep Solar,� �Zep Compatible,� �Zepulator,� �Zep Groove,� �Silevo,� and �Triex� are among SolarCity�s registered trademarks in the United States and, in some cases, in certain other countries. SolarCity�s other unregistered trademarks and service marks in the United States include: �Better Energy,� �SolarBid,� �SolarWorks� and �DemandLogic.�

Page 4 Tesla 10-K:

We design, develop, manufacture and sell high-performance fully electric vehicles, advanced electric vehicle powertrain components and stationary energy storage systems. We also produce and sell stationary energy storage products for use in homes, commercial sites, and utilities.

Page 6 Tesla 10-K:

We began selling our home systems in 2013 and our commercial and utility systems in 2014. We plan to ramp sales of these products in 2015.

Thus, Tesla's primary business model is storage sales, not primarily ownership/lease as that appears to be where Solarcity is heading. SGIP incentives will primary benefit Solarcity directly. Tesla benefits by increased sales of storage through market expansion as a result of continuous cost/price point reductions.

�

Apr 28, 2015

austinEV Just posted this in the "event" thread when it really belongs here:

(Someone asked why they are doing this when they always said they were battery constrained)

This is a KEY question. The only reason I haven't been rattling cages about this, is that Musk clearly said it was a different battery. Without that statement, I would (and so would the market) be saying that Panasonic has gotten ahead of the car factory and they are bottlenecked at the car factory or (god forbid) demand. So this battery supply is either:

1) Capacity from Panasonic but not the car stuff. Batteries that are functional but do not meet the auto spec. Maybe panasonic's output is 2% bad, 80% auto and 18% functional but not to auto spec. Panasonic had these stacking up and came to TM with a request for help to market these. This COULD also explain the 70D offerings (more cells of lesser density) as well. Also maybe they have multiple factories and for some reason or another some facilities just cannot make the special auto battery.

2) Capacity from other makers, Samsung for instance. It might be hard to qualify the other suppliers and/or they may not want to invest in TM's spec when they are about to come online with their own massive capacity in a few years. So TM is finding a good market for these other suppliers they could not quite get into their cars.

3) This IS the auto quality output from Panasonic. They invested in their output based on TM's projections and their supply is online and kicking ass. Panasonic rings up Elon and says "hey you need to take all this output. You having a bottleneck in your plant is not our problem". having excess batteries with good density is a good problem to have so they announce the storage business. This way they can assure Panasonic they can take their output at virtually any rate, since the storage market at $500/kWh is nearly unlimited.

So I will be looking for insight in the 30th event and the earnings call to settle this question. What are these batteries, where are they coming from, you used to be battery constrained if you are not what IS constraining you, how do you answer the critics who say you have a demand problem when you are seemingly finding a new market for your constraining part?�

Apr 28, 2015

JRP3 My guess is that Panasonic has some older production lines that can't put out the higher density auto cells but can produce the stationary storage cells. I don't think the 70D has lesser energy dense cells since it's efficiency seems to be higher than any other Model S.�

Apr 28, 2015

uselesslogin Don't forget this tweet from December 2013:

Elon Musk on Twitter:�

Apr 28, 2015

austinEV Thanks for digging up the tweet.

"Should mention that the battery cells used for this are 200 Wh/kg vs 250 for Model S. No short term supply constraint."

That is what I was referring to as Musk's statement. So my #3 should not be right. So the question is what is the source for those cells. Also I note that 200/250=80% and 70/85=82%. I have not kept up with the 70 pack speculation but it is possible but not necessary that the 70 cars could also have these cells.

But I still want to hear if the 250 Wh/kg cells are the limiting factor in Model S production. If not, what is?�

Apr 28, 2015

vgrinshpun Just in case you missed it, the GreentechGrid article quoted and linked in your post is almost two years old, so any SGIP stats coming from it are out of date.

In reality, Tesla is the direct beneficiary of the SGIP program because SG incentive is tied to the size of installed battery storage system, which is manufactured by Tesla. The incentive reduces cost of the system for the buyer, whether the buyer is a Host Customer (homeowner) or System Owner (Solar City leasing system to homeowner). The bottom line is that Tesla would probably not be able charge $1000/kWh without the incentive. It is important to note though, that, as I posted before, even without the incentive stationary storage will be immensely profitable to Tesla. What this incentive, that will be phased out at 10% per year, does is helping Tesla with the initial hump of the expenses associated with building the new business.

Most importantly to your point, though, the focus of my discussion was not who physically gets the credit and/or owns the storage system (Host Owner, System Owner or Third Party), but what the data gleaned from SGIP spreadsheet tells us about Tesla's nascent stationary grid storage business.�

Apr 28, 2015

jhm That's interesting, but it does not explain the difference in efficiency: 292 Wh/mile for the 70D vs. 315 Wh/mile for the 85D. The two cars would have roughly the same weight.�

Apr 28, 2015

Foghat Right, in the end, someone receives the credit which ultimately makes it more affordable for the end user to buy/lease. This incentive enables the market to grow, thus allowing storage costs to come down. In theory, as those costs come down, the incentive fades away proportionately and we have a thriving market place on its own two feet.�

Apr 28, 2015

ItsNotAboutTheMoney 4) Tesla is having difficulty getting Panasonic's cell partners to invest in the Gigafactory. With the China market failure and the Model X delays, they're not confident in Tesla, so Tesla is bringing forward the full launch of the home storage unit to sweeten the deal and regain confidence.�

Apr 28, 2015

vgrinshpun Well, interesting theory, except it would not be consistent with Tesla starting registering stationary storage with the California SGIP all way back in 2011. Stationary storage was in the strategic planning for years, assuming that it is tactical response to problems with Panasonic is in contradiction with written and video records.�

Apr 29, 2015

jhm Elon Musk Bulks Up Tesla Batteries in Leap Beyond Cars to Grid - Bloomberg Business

�

Apr 29, 2015

Robert.Boston That's an extraordinary thing to hear from the mouth of an electric utility spokesman. If Tesla's figured out a way of working with the utilities, that's a huge win.�

Apr 29, 2015

32no Kurt Kelty, Director of Battery Tehnology at Tesla Motors, says that there is trouble with Japanese suppliers.