Apr 12, 2013

PureAmps Unfortunately, it is not possible to know this because the trades were performed within the price spread. There is clearly no economic value in putting a trade on and then immediately reversing it. There is also no economic value in those spreads as standalone positions either, as the max profit is break even. So the trades make no sense by themselves and are either intended to have some side effect or are trades executed for managing an existing prior position.

A few interesting notes from today's aftermath of those two spread trades.

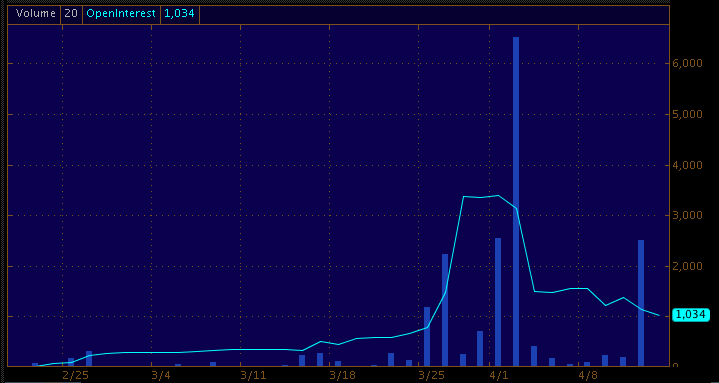

The Apr 38 calls chart from today:

Volume in the Apr 38 calls was low today at 20 contracts. None of which seem to come from our mystery trader. Open interest was reduced by 108 contracts from the prior day. Yesterday's volume was 2508, of which we know 2400 came from the mystery trader, and the remaining 108 was probably "normal" trading. Since the extra volume was 108 and the open interest was reduced by 108, it is safe to assume that those 108 were closing trades and reduced open interest. The additional 2400 were either exercised, per the the three stooges theory, or the transaction was reversed generating no open interest.

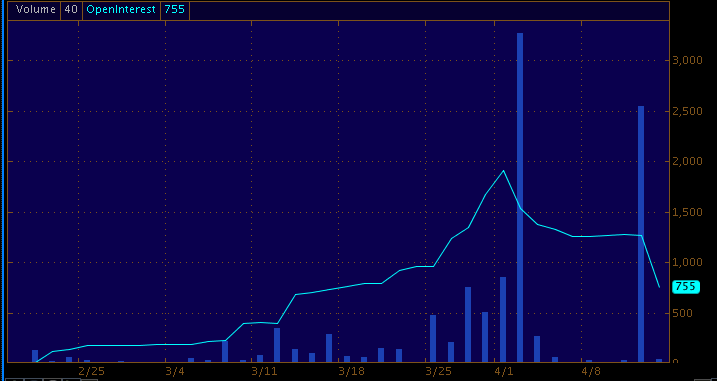

The Apr 39 calls chart from today:

Volume in the Apr 39 calls was low today at 40 contracts. None of which seem to come from our mystery trader. Open interest was reduced by 515 contracts. Yesterday's volume was 2551, of which was know 2400 came from the mystery trader, and the remaining 151 was probably "normal" trading. Hmm, now this is interesting...

So there is no longer an easy way to explain away the reduction in open interest. So what happened here? Certainly some portion of the 151 "normal" trades were closing transactions. Let's just assume they all were, that leaves us with 364 contracts closed that are unaccounted for. So what are the possibilities:

- Somebody long the contract exercised 364 contracts and purchased the shares. This could have been the mystery trader, or any other trader. Exercising calls before expiration is not common for non-dividend paying stocks, so this is definitely odd behavior.

- Some portion of the 2400 contracts executed by the mystery trader were closing transactions, that closed prior open interest. While possible, this is unlikely as it doesn't make a lot of sense that only 364 out of 2400 contracts were closing transactions.

So why would somebody exercise 364 contracts? Mostly likely, because they were forced to close out a spread by being assigned on a higher strike price. To the Apr 40 charts we go:

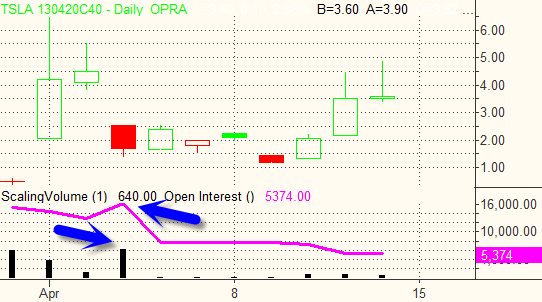

Wow, don't even know how to begin analyzing this one. Let's start with yesterday's volume: 857 contracts. Today's reduction in open interest: 1931. Oops there's 1074 contracts not accounted for by volume alone. Somebody's exercising. And I bet a portion of that 1074 were some traders long the 39 and short the 40. So they are assigned on the 40, have to turn around and exercise on the 39. This causes cascade ripples throughout the entire option market.

Now the more interesting day on the Apr 40 chart is 4/5, where we have a reduction in open interest to the tune of 8,403 contracts with prior day's volume of only 257 contracts. That is a lot of exercising going on there. I bet you a lot of stock from covered calls was handed over that day. To who I wonder....

I could continue like this through the the 42 strike price for the April calls, all full of suspicious activity. All with one thing in common there was large volume and increase in open interest on or about 3/25. We then have a "surprise" announcement on 3/31, a big gap up in the stock on 4/1 and huge profit taking every since.

It's almost like somebody knew something....�

Apr 12, 2013

luvb2b the short rebate acts like a dividend and motivates early exercise.

when would you exercise a call option in a stock with a daily dividend payout at a 50% annualized rate, but never goes ex dividend?

i think you missed some volume in those 40s. a large trader had At least 5000 of a 40/45 call spread that he closed out that day or the day before.�

Apr 12, 2013

Causalien Almost sounds like someone fund that has to report their position wants to build up a stealth position through options and corner the stock through exercise. I was surprised my covered call got exercised today.�

Apr 13, 2013

PureAmps Well, in the chart from TD Ameritrade there is no volume higher than 1000 contracts after 4/3 in the Apr 40 contract. If their charts have incorrect volume data then any analysis performed using those charts would be kind of useless. Since traders make all kinds of financial decisions based on those charts, I'd be surprised if they were missing data.

But if you can find details of that trade, please post it. It would be interesting to know why it didn't show up in the chart.

Exactly. Why would a trader exercise an option rather than just close the position and take the profit? Why accumulate a lot of stock through option exercise rather than just buy it on the open market? It's like somebody is *desperate* to acquire stock for a low price. Most likely somebody who has previously borrowed a lot of stock to sell short...�

Apr 13, 2013

Johan Not at all improbable. However, I would think that "aquring stock for a low price" would be the goal of any investor?�

Apr 13, 2013

avatar Is it possible someone wants to discretely acquire a large position of TSLA stock to reduce free float in the case of a short squeeze?�

Apr 13, 2013

luvb2b after comparing your charts to mine, i see the problem. your open interest graph is off by one day. generally the open interest that's reported by opra today is actually the open interest at the close of yesterday. your graph is taking the open interest reported today and saying that's the open interest of today. on my chart you'll see the open interest is dropping by the next close.

the big drop in open interest happens after the big voume on april 3rd. on the morning of april 3rd the open interest in the april 40 calls is 16,175. the next morning it's 7,772. the reason for the drop is that a large spread trader closed out 5000 april 40x45 call spreads on the 3rd. i thought i commented on this trade in real-time in another thread but i couldn't find it. also that morning a lot of people got freaked out by the non-exciting leasing announcement, so instead of waiting for the open of regular trading to sell, they exercised and sold that morning and in pre-market. check the premarket volume that day, it was huge. it was a lot easier to do that than trying to sell the april 40s that morning as the stock was collapsing. i know, because i was in the same dilemma.

someone else may have to try to explain it, apparently i'm not doing a good job.

they are exercising the calls because once the calls are far enough in the money they trade with zero time premium. at that point it's no longer economically rational to own the calls. that's because by exercising the calls and owning stock, many institutions can earn the full fee for lending the shares to shorts, earning 40-80% annualized calculated daily. on larger positions it's a lot of money. $500 a day on a 10000 share position for example. they are exercising to earn that profit, rather than carry the calls to expiration (thus sacrificing the opportunity to lend out the shares).

i think maybe the problem is you need to put pen to paper to understand how much profit there has been in lending the shares (or not having to pay to be short). it is 5-10c per share, per calendar day. on a thousand shares we're talking about $500 per week. if you owned 10 deep in the money calls, are you really going to choose to not exercise, and sacrifice the opportunity to earn an extra $500 per week? the only reason you'd do that is if you can't earn the fee to lend out the shares, or don't have enough cash to exercise.

what's the last stock you owned that paid a $500 weekly dividend on every 1000 shares, and never traded ex-dividend while doing it? it sounds like a fantasy.

- - - Updated - - -

trading monster call option positions and exercising them is not discreet.

in tesla an institution that really wanted a large position would go straight to buying the shares, because they could easily lend out those shares and earn extra 5-10c per share, per day.

i'm hard pressed to name another stock where an institution that bought a share for $37 would get paid $3 for a month. it's obscene!�

Apr 13, 2013

Causalien So it is basically a transfer of wealth from retail to brokerage firms so they can lend it out to whoever it is that is shorting Tesla big time. Because I know for sure I cannot get the same premium by lending it out myself.

Which means the brokers is willing to take the risk of stock potentially falling more than the premium, which means they know why it was shorted and deduct that the short won't work. Or is working in conjunction with the big short to gather more shares so they can be used on the next assault in tesla shares.�

Apr 14, 2013

luvb2b for sure retail longs are transferring wealth to their brokers. many of the retail agreements allow the broker to lend out shares without compensating the customer.

as for the brokers taking the risk of the stock falling more than the premium - yes and no. the market maker who owned the long stock+short deep in the money calls trade was delta hedging it. they did have some gap risk but are always adjusting the hedge as the stock moves up or down and cn manage the trade for profit in most conditions. the guys who steal this trade by exercising will do the same thing, or they are shorts who can save the full rebate for a little while.

no directional bet is involved in tesla to make profits on a long stock + short deep in the money call trade. it is a hedged position with zero upside as tesla rallies. there is major upside if the cost of shorting rises or stays high, but that doesn't always correlate to tesla going higher. this is not a strategy being used to "gather shares" for a secret long position. it is a strategy to gather fully hedged shares for the purpose of loaning to short sellers, which has recently had guaranteed daily payouts of 40-80% annualized. when the options eventually expire, the calls will most likely get assigned and the shares will be transferred on to whomever was long the calls.

here's a table which shows the cumulative profit per share from owning the stock, the cumulative profit per share from lending the shares, and the sum of the two. three scenarios to illustrate:

a. for an institutional player, owning a deep-in-the-money call allows him to capture the stock gain only ($8.46 since 3/17, or 24.0%).

Date Loan Rate Close Stock Gain Loan Interest Stock + Loan 17-Mar-13 -43.94% $ 35.29 $ 0.04 18-Mar-13 -44.88% $ 35.15 $ (0.14) $ 0.09 $ (0.05) 19-Mar-13 -49.04% $ 35.08 $ (0.21) $ 0.13 $ (0.08) 20-Mar-13 -49.85% $ 35.95 $ 0.66 $ 0.18 $ 0.84 21-Mar-13 -54.77% $ 36.01 $ 0.72 $ 0.24 $ 0.96 22-Mar-13 -59.51% $ 36.62 $ 1.33 $ 0.30 $ 1.63 23-Mar-13 -60.69% $ 36.62 $ 1.33 $ 0.36 $ 1.69 24-Mar-13 -60.69% $ 36.62 $ 1.33 $ 0.42 $ 1.75 25-Mar-13 -75.84% $ 37.53 $ 2.24 $ 0.50 $ 2.74 26-Mar-13 -85.35% $ 37.86 $ 2.57 $ 0.58 $ 3.15 27-Mar-13 -77.29% $ 38.16 $ 2.87 $ 0.66 $ 3.53 28-Mar-13 -82.66% $ 37.89 $ 2.60 $ 0.75 $ 3.35 29-Mar-13 -84.45% $ 37.89 $ 2.60 $ 0.84 $ 3.44 30-Mar-13 -84.45% $ 37.89 $ 2.60 $ 0.93 $ 3.53 31-Mar-13 -84.45% $ 37.89 $ 2.60 $ 1.01 $ 3.61 1-Apr-13 -83.00% $ 43.93 $ 8.64 $ 1.11 $ 9.75 2-Apr-13 -82.25% $ 44.34 $ 9.05 $ 1.21 $ 10.26 3-Apr-13 -82.24% $ 41.10 $ 5.81 $ 1.31 $ 7.12 4-Apr-13 -75.23% $ 42.01 $ 6.72 $ 1.39 $ 8.11 5-Apr-13 -60.92% $ 41.37 $ 6.08 $ 1.46 $ 7.54 6-Apr-13 -57.34% $ 41.37 $ 6.08 $ 1.53 $ 7.61 7-Apr-13 -57.34% $ 41.37 $ 6.08 $ 1.59 $ 7.67 8-Apr-13 -56.28% $ 41.83 $ 6.54 $ 1.66 $ 8.20 9-Apr-13 -49.97% $ 40.50 $ 5.21 $ 1.71 $ 6.92 10-Apr-13 -44.23% $ 41.86 $ 6.57 $ 1.76 $ 8.33 11-Apr-13 -38.97% $ 43.59 $ 8.30 $ 1.81 $ 10.11 12-Apr-13 -38.78% $ 43.75 $ 8.46 $ 1.86 $ 10.32 13-Apr-13 -38.72% $ 43.75 $ 8.46 $ 1.90 $ 10.36 14-Apr-13 -38.72% $ 43.75 $ 8.46 $ 1.95 $ 10.41 Total % Return (3/17-4/14) 24.0% 5.5% 29.5%

b. for an institutional player, owning the stock allows him to capture both the stock gain and the loan interest ($10.41 since 3/17 or 29.5%).

c. for an institutional player, owning the stock and being short a deep in the money call allows him to capture the loan interest only ($1.95 since 3/17, or 5.5%).

for an institutional player that wants direct price exposure to tesla's upside, (b) is clearly relative to (a). yeah, they can go out to near the money or out of the money strikes, but we're only considering deep-in-the-money here because that's where the suspicious activity is.

for an institutional player that doesn't want price exposure to tesla, they can choose scenario (c) which pays a very tidy sum but has relatively little direct price exposure to tesla. market makers fit into this category, and they when they hold tesla shares hedged with short calls, well these positions are generating 5% monthly gains with very little risk. that's why people are "stealing" them.�

Apr 15, 2013

PureAmps Yep, because I'm looking at a real-time chart which show's today's OI and volume. Since OI is not updated in real-time, the chart has a one-day skew for OI, since it shows OI as of the open.

No, you've explained your theory quite well.

But two people can look at the same data and draw two different conclusions. Without knowing more about the trader's entire position in TSLA (or entire portfolio for that matter), it is impossible to know what is really going on. I see this as somebody covering a short position, you see it as somebody creatively harvesting shares in a complex scheme to collect/avoid short interest. I think we both agree this is a highly unusual set of trades and circumstances.

But at the end of the day this is just a sideshow. Tesla's fate will be decided by building and selling tens (or even hundreds) of thousands of vehicles at a profit, not by the "shorts" or some "rogue" option trader. If they succeed at that over a long enough period of time, their stock will ultimately reflect the value of the company.�

Apr 15, 2013

luvb2b well said.�

Apr 16, 2013

luvb2b tuesday again, which means our friend should be back. let's see if i can predict where he will be today. if he's harvesting open interest, he'll be in the strikes that are (a) deep-in-the-money, (b) zero time premium, and (c) have meaningful open interest to "steal".

may 35 call, oi 468

may 36 call, oi 132

may 37 call, oi 713

may 38 call, oi 481

jun 32 call, oi 341

jun 33 call, oi 329

jun 34 call, oi 162

jun 35 call, oi 2,077

jun 36 call, oi 1,452

jun 37 call, oi 663

the best way to harvest open interest is to put the biggest trades on the strikes that have the deepest open interest. so jun 35, 36, 37 and may 37 calls should see especially heavy activity.�

Apr 16, 2013

DonPedro Offloaded a bit at open today (44.19), to see if I can pick it up cheaper in the afternoon due to this "Tuesday Morning Special" trading.�

Apr 16, 2013

luvb2b wow i don't have enough confidence about what he does to trade on him. i have more confidence that after he steals the open interest the market makers have to adjust hedges the next morning, so there may be a quick trade there tomorrow.�

Apr 16, 2013

DonPedro Primarily I am long. But I play with 20-30% of the position for fun (and so far a modest profit over being passive). Selling at 44.19 isn't looking so good so far today, but we'll see... �

�

Apr 16, 2013

luvb2b and here he comes... volume so far, and it's all on the phlx. imo it's becoming very clear now it's a harvesting trade. he's in all the strikes i predicted, and notice the volumes are roughly 4x of the open interest.

may 35 call, oi 468 [email�protected], [email�protected], [email�protected], [email�protected] times 11:31-11:33 et

may 36 call, oi 132

may 37 call, oi 713 [email�protected], [email�protected], [email�protected], [email�protected] times 11:32-11:34 et

may 38 call, oi 481

jun 32 call, oi 341 [email�protected], [email�protected], [email�protected], [email�protected] times 11:33-11:35et

jun 33 call, oi 329 [email�protected], [email�protected], [email�protected], [email�protected] times 11:35-11:36et

jun 34 call, oi 162 [email�protected], [email�protected], [email�protected], [email�protected] times 11:35-11:36 et

jun 35 call, oi 2,077 [email�protected], [email�protected], [email�protected], [email�protected] times 11:36-11:37et

jun 36 call, oi 1,452 [email�protected], [email�protected], [email�protected], [email�protected] times 11:36-11:37et

jun 37 call, oi 663�

Apr 16, 2013

avatar SO I'm curious. How is he affecting the price today? Is he causing the price to go up?�

Apr 16, 2013

luvb2b no, i think these guys don't really trade shares on the open market. they just trade spreads with each other and exercise, which means all the volume happens off the exchanges through the options clearing mechanisms.

i do think they are probably either shorts or stat-arb type hedge funds that are doing this trade. and i'm not sure at all if it's legal.

i am pretty sure the price impact will be tomorrow, when the options market makers find themselves screwed up on their hedges. that means right at the open the market makers will be in buying shares. exactly how many depends on how much total options volume goes by, how much open interest is stolen, and what kind of delta hedge they were holding.�

Apr 16, 2013

Teslawisher Don't the market makers see this pattern, that every week at the same time, they find themselves having to adjust their hedges? Anything they can do about it? Or, are they pretty much hands tied behind their backs? I can't imagine they find this situation beneficial to them.�

Apr 16, 2013

Nicu.Mihalache not sure it is related, there were two 150k share blocks traded today�

Apr 16, 2013

luvb2b those are conversions. without even looking i know one of those blocks line up with a trade in the may 60s. i assume the guy owned 150,000 tesla, and decided to sell 150,000 tesla, sell 1500 may 60 puts, and buy 1500 may 60 calls. the whole thing was done in chicago.

he's getting paid quite well to do this trade, nearly $250k to expiration i think.�

Apr 16, 2013

Johan What is he risking here? Nothing? Something surely... That I'm too inexperienced to figure out.�

Apr 16, 2013

luvb2b it sucks if you're a shemp market maker.

what shemp needs is someone on the opposite side of the call trade who wants to hold the deep in the money call. the only guys who are going to do that are some retail investors who can't get earn the share lending rebate. if they could earn the rebate and had the capital, they would buy the stock and possibly hedge with puts after earning enough rebate.

shemp can't find these guys just anywhere, but over time as he makes markets, he starts accumulating positions on the other side of them. that leaves shemp (market maker) long tesla shares to hedge being short tesla deep-in-the-money calls to retail investors who are long deep-in-the-money calls. it's a great position which allows shemp to earn a very nice carry on the share lending.

and of course larry & moe come along and steal that very valuable position right out from under their noses.

shemp could do the same thing to steal it back, but he has to find someone to collude with him. and since larry & moe do the trade on tuesday, they are guaranteed to earn the rebate for at least 3 nights because larry & moe's trades will settle friday. the soonest shemp could try to steal back the position would be monday, and he'd still miss 3 days of rebate.

it's a brilliant scheme. theft in broad daylight. never seen anything like it before.�

Apr 16, 2013

adiggs luvb2b - do you know of any other stocks / companies that are trading at similarly high levels for the short interest? I'm wondering if we might see this pattern in other companies with a high price to borrow shares for shorting. And then I wonder - once 'shemp' figures out what's happening to their position, what's to stop them from just not participating or making a market in the stock? I'm not an expert by any means, but that doesn't sound good for liquidity or anybody trading Tesla.�

Apr 16, 2013

luvb2b don't worry about shemp. lol.

he still makes money on the trade - the initial market he made allowed him to earn a slight profit in the bid/ask spread. it's just that the position turns into a cash cow if the option goes well in the money, and that's when larry & moe come and steal it.

i know there are other stocks with high short interest, and i suspect this isn't the first time larry & moe have been to the rodeo.

- - - Updated - - -

there are 2-3 very subtle risks that come up for a long term holder. they are really sort of unusual things:

1. the shares the guy was holding were most likely insured by sipc coverage as securities holdings. by selling the shares, he's collecting cash. that cash is probably held by the broker in a non-insured way, so one risk is if the broker fails, the cash he collected is at risk. this would be a major headache, but unlikely if he's using a very good firm.

2. if he takes the whole position to expiration, two other risks arise: first, if the stock closes too close to the 60 strike, he may not have a good handle of whether or not he'll get assigned on the short put. in that case he may find himself with more or less shares than he intended, or in a worst case twice as many shares as he wanted.

3. second risk if you go to expiration happens if the call finishes in the money on expiration friday. assume he exercises that call, and isn't paying attention a few minutes after the market closes. if tesla releases some bad news in those minutes and the stock nosedives below 60, the put holder will exercise his put. even though it looked like the put was out of the money at the close of trading on friday, the put holder exercises with the knowledge that the after-hours news will cause the stock to be below 60 on monday morning. in this case he'll find himself long twice as much tesla as he wanted while it's falling off a cliff. absolutely horrible place to be.

all 3 of the risks are pretty rare events. by not holding the position all the way to expiration the trader can eliminate 2 out of the 3 problems.

for a short term holder there's a another risk: if the cost of shorting increases further, the position of being long $60 calls/short $60 puts will underperform the common. in that situation you could have the stock go nowhere, the cost of shorting rise, and the value of the position fall.

most likely this trader is a long term holder who is looking to earn a nice extra kicker while maintaining full long exposure, not a short term trader.�

Apr 16, 2013

luvb2b here are the final updates, once again monster volume done this way, all on the philly. you guys notice the total call option volume in tesla today is 71,000 contracts. the trades i highlight below account for over 45,000 of the 71,000 traded call option contracts. these trades are representing 4.5 million shares of tesla, about 150% of the day's volume of 3 million, 4% of the total outstanding shares of the company, and 6-7% of the float. holy sh** that's big.

may 35 call, oi 468 vol 2936: [email�protected], [email�protected], [email�protected], [email�protected], [email�protected] times 11:31-11:33, 3:18 et

may 36 call, oi 132 vol 784: [email�protected], [email�protected], [email�protected], [email�protected], [email�protected] times 11:32-11:33, 3:18 et

may 37 call, oi 713 vol 2800: [email�protected], [email�protected], [email�protected], [email�protected] 11:32-11:34 et

may 38 call, oi 481 vol 2000: [email�protected], [email�protected], [email�protected], [email�protected] times 3:38-3:43 et

jun 32 call, oi 341 vol 2082: [email�protected], [email�protected], [email�protected], [email�protected], [email�protected] times 11:33-11:35, 3:18 et

jun 33 call, oi 329 vol 2058: [email�protected], [email�protected], [email�protected], [email�protected], [email�protected] times 11:35-11:36, 3:19 et

jun 34 call, oi 162 vol 1004: [email�protected], [email�protected], [email�protected], [email�protected], [email�protected] times 11:35-11:36, 3:19 et

jun 35 call, oi 2,077 vol 11,992: [email�protected], [email�protected], [email�protected], [email�protected], [email�protected] times 11:36-11:37, 3:19et

jun 36 call, oi 1,452 vol 5600: [email�protected], [email�protected], [email�protected], [email�protected] times 11:36-11:37et

jun 37 call, oi 663 vol 2800: [email�protected], [email�protected], [email�protected], [email�protected] times: 3:38-3:43et

i'm getting tired so i'll just abbreviate the trades in the april strikes. i didn't think they would work these strikes as they can only collect 3 days of interest, but apparently that's enough for them. volumes are the volumes for these goofy trades, not overall volume.

apr 34 calls, oi 261 vol 300

apr 35 calls, oi 1051 vol 710

apr 37 calls, oi 858 vol 1128

apr 38 calls, oi 3381 vol 5330

apr 39 calls, oi 630 vol 4060�

Apr 16, 2013

Johan Thank you for taking the time to explain this. My follow up question then would be: Why shouldn't I myself as a personal long investor do the same? I have 1500 TSLA that I consider my core long position that I will want to hold certainly beyond 2014. Right now today I could but 15 Jan2014 $60 Calls @$1.40 per contract and at the same time sell 15 Jan2014 $60 Puts @ $21.20 per contract making for a total payout of $29.700 on the options trade. At the same time I sell the 1500 TSLA shares for a total of $68.385. All in all I now have $98.085, no TSLA shares but a call contract for 1500 shares at $60. Now, please correct me if I'm wrong:

- If TSLA goes up the calls I own get more and more valuable and the puts I've sold loose more and more (intrinsic) value, if TSLA goes over $60 the puts have no intrinsic value any more and the calls get more and intrinsic value (in the money). In this scenario time value is my friend too, as we get closer to expiry. If there is a short squeeze or TSLA peaks for some other reason, I can get out of the put for next to nothing and then choose to either exercise the call option and buy TSLA way below market price, or to sell the call option for a high price.

- If TSLA goes down the calls become worthless more or less and the more TSLA drops the more the puts I've sold get in the money and hence I'm more in trouble. If TSLA drops to somewhere near $0 and the puts are exercised on me I will be forced to buy 1500 TSLA at $60 for a total of $90.000. That sucks, but it's still less than the $98.085 I got paid to do the whole trade in the first place. And this is the absolute worst case scenario (TSLA close to $0).

- If I close both positions simultaneously before expiry I'm not risking point 2 and 3 from your list above. If TSLA has dropped when I choose to close the calls will be more or less worthless i.e. I will get very little for them while it will cost me to close/buy back the puts, however as per above never more than I made on the trade initially. And if I'm in this position I can use whatever left to buy back TSLA shares, that are now cheaper than they were when I made the initial trade.�

Apr 16, 2013

PureAmps I was really hoping to quit this thread, but I keep getting sucked back in.

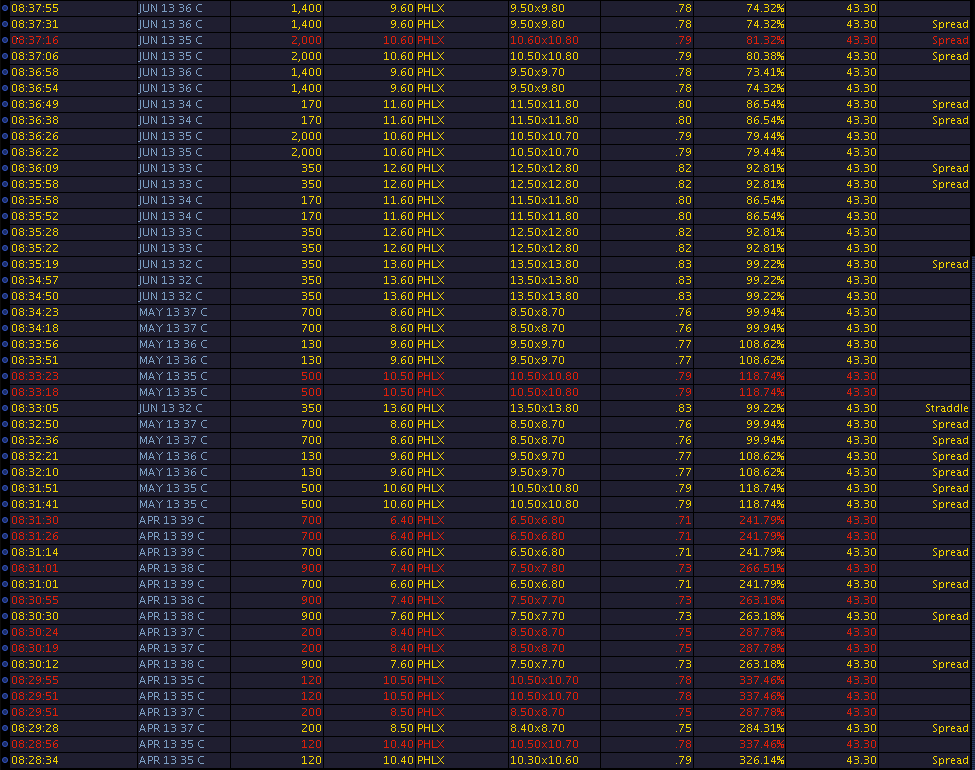

Following up on the trades luvb2b poster earlier, here's a snapshot of today's trades that makes it a little easier to understand (at least for me):

These are all trades of 100 contracts or more on the PHLX exchange during a few blocks of time when this trader appeared to be active (all times are in PDT):

The morning block (8:28am - 8:37am):

The afternoon blocks (Block A from 12:17pm - 12:19pm, and Block B from 12:38pm - 12:43pm):

So a few observations that I continue to see.

The trades in the morning block and the afternoon "B" block are always in pairs of the same contract size. This is highly unusual. Why execute trades of the same size within seconds of each other at the same price? Not enough bid/ask to fill the order? Seems dubious, since it is filled seconds later. Would love to hear theories...

The other oddity I noticed is many trades are marked with a spread condition (one even is marked as a straddle), yet there is no pairing transaction to be found. So this trader is using spread/straddle conditions on their orders, but not executing spread/straddle trades. Very odd....

Now the afternoon "A" block of trades is different. Here you have trades across multiple dates and strikes being executed within minutes of each other. Most of these trades were not executed in multiples of 10/50/100/etc. either, unlike the other blocks of trades. They are not paired, there is one order for each date/strike price combination.

Ok, now I give up...�

Apr 16, 2013

PureAmps It turns out the trade sizes in the afternoon "A" block trade are not so random after all. Those quantities are exactly twice the current open interest for each option contract. The only exception being the Jun 35 calls which traded at a size of 3,992 with an open interest of 2,077.�

Apr 16, 2013

kenliles I don't believe these are actual market trades because both sides of the 'trade' are being conducted by the same party (market maker or proxy of same); so IMHO the current theories are incorrect. Although the purpose might be to actually PREVENT the stealing of the MM spread position as luvb2b describes. Essentially the MM taking advantage of the (con)current short-squeeze/short-demand market condition for its own benefit, in the guise of its commission to create the market.

Disclaimer: I have no idea what I'm talking about so please hold no respect for this opinion. But there it is, that's what I currently believe.�

Apr 16, 2013

Causalien Looks like a hft pattern.�

Apr 17, 2013

luvb2b as you described it this would be an illegal trade, basically trading back and forth with yourself for the purposes of creating volume. no one in their right minds would do the trade in the kind of size it's being done. anyone with that much money will know the trade is illegal, and it will be very easily get flagged due to the large size. imo the notion that the trades are one person trading with himself is a complete non-starter.

in the 3 stooges game the market maker cannot prevent the theft of his long stock+short call position. if he enters some countering trade with someone else, all he can do is dilute how much of his position his stolen. he can't stop them.

at this point i can confirm that the "review" of these trades has stepped up one level. i'm pretty sure if it was something simple it would have been identified and stopped by now.

- - - Updated - - -

you kinda have the gist of it here, but your math is way way way off. until you get that down 100% i wouldn't consider doing the trade.

buy jan 2014 $60 calls for $1.40, sell jan 2014 $60 puts for $21.20 means you got an effective cost of buying tesla at:

$60 - $21.20 + 1.40 = $40.20.

if you sold your tesla shares at $45.50, sold the puts and bought the calls, and didn't encounter any unusual risks along the way, then yes theoretically you would end up $5 richer in january and still have your shares.

please don't take for granted my math is correct as i often make mistakes. make sure you work it out with your advisor / broker to make sure you understand how everything works.�

Apr 17, 2013

kenliles Thanks, I defer to your better judgement.

Looks like TSLA holding up remarkably well this morning given the market sell off. Hedges must in in buying on rebalance. If so, we may see a delayed pullback if we don't run out of sellers first�

Apr 17, 2013

Nicu.Mihalache I think the math is OK, once you understand that the sums like "$29.700" means $29,700 total from 15 pairs of long call / short put options etc. - it took me a while too to get it �

�

Apr 17, 2013

luvb2b i guess the whole point of developing theories is prediction right? you develop a theory, and then based on that theory you would have some predictions. you make observations to see if your predictions are accurate. based on the 3 stooges theory, yesterday morning i was predicting the strikes i expected to see the fishy trades, and mentioned that volume would be proportional to open interest. i didn't look to april strikes as i thought there wasn't enough time to expiration.

i posted the trades yesterday, so let's check the open interest to see if it vanished again. where is 4.5 million shares of open interest going? so far 3 stooges remains the best explanation to me.

apr 34 calls, oi 261 vol 300 ---> today's oi 50

apr 35 calls, oi 1051 vol 710 ---> today's oi 115

apr 37 calls, oi 858 vol 1128 ---> today's oi 142

apr 38 calls, oi 3381 vol 5330 ---> today's oi 392

apr 39 calls, oi 630 vol 4060 ---> today's oi 443

may 35 call, oi 468 vol 2936 ---> today's oi 439

may 36 call, oi 132 vol 784 ---> today's oi 121

may 37 call, oi 713 vol 2800 ---> today's oi 132

may 38 call, oi 481 vol 2000 ---> today's oi 158

jun 32 call, oi 341 vol 2082 ---> today's oi 318

jun 33 call, oi 329 vol 2058 ---> today's oi 308

jun 34 call, oi 162 vol 1004 ---> today's oi 153

jun 35 call, oi 2,077 vol 11,992 ---> today's oi 1,850

jun 36 call, oi 1,452 vol 5600 ---> today's oi 1,434

jun 37 call, oi 663 vol 2800 ---> today's oi 626

wow look at that! the open interest declined in every option series where the stooges were active yesterday. 4.5 million shares worth of options trades, and all of those and more vanish overnight. in some of these options there were no other trades except for the blocks on the psx. seeing the open interest declining in those series by odd amounts means that you are definitely getting options exercises taking place. also some of the trades yesterday were huge blocks. how about 2,992 of the june 35 calls. where did they go? imo, they had to be exercised.�

Apr 17, 2013

Causalien I didn't keep track, but do you have an idea how many has been exercised?�

Apr 17, 2013

luvb2b my post was basically saying that the 45,000 calls that the stooges traded were exercised yesterday, and then even more on top of that.�

Apr 17, 2013

ggr Continuing my series of naive questions: couldn't the original seller just buy them back to close their position? That would also reduce the open interest, wouldn't it?�

Apr 17, 2013

PureAmps I don't think that's a naive question at all. I think that is a very plausible explanation for a portion of the trades. It is unusual to be able to buy a security and then sell it back to the same price because of price spreads, but many of those transactions occurred within the spread.

However, we have evidence that there is some exercising occurring in those same contracts, and not all trades can be paired up in that way. I have still not heard a theory that can explain all of the behaviors seen in those trades.

- - - Updated - - -

Not really hft, but definitely very algorithmic. It could very well be somebody's tradebot having a little fun in the TSLA option market.

It is operating under some clear rules. For example, it swept the 35-39 strikes in the Apr expiration, but skipped over the 36 strike because OI was only in the 30s. It seems to have a cut-off of 100 contracts or more for open-interest. I suspect the strike range is driven by the option's delta, but haven't tried to determine a cutoff (but seems to be .7 or higher).�

Apr 17, 2013

Causalien @luvb2b

That's a $202million commitment in one day. Seriously, if this continues, my theory of someone using options to secretly corner the market like VW replay is more and more likely. Except this time, they learned the lesson that having options without the capital backing to exercise is not enough.

@PureAmps

Yeah, that's what it felt like when I see it. The only problem with this theory is that the algorithm is usually constant throughout the day. This one is in bursts. The only way to verify is to reverse engineer the trigger and monitor all options chains to see if it is indeed going on all the time. But the trades it is doing doesn't really make sense, you don't need to go ultra fast to feel out if there are hidden orders or not.. If we go with hft theory, I can only think of some robot bought a ETF that includes Tesla and the robot selectively do the reverse of the ETF trade because it wants to exclude TESLA from the ETF due to its volatility.�

Apr 17, 2013

luvb2b ggr, theoretically what you say is possible. however the evidence indicates that's not it. here's why:

(1) on some days the prints are so close together (minutes or seconds) that there's no consistent rational explanation why someone would get into 1000 contracts (which represent 100,000 shares) and then seconds later decide to flip out of it. and then repeat every tuesday.

(2) there have been days where some contracts trade 5 blocks of 100 contracts each with open interest of (say) 90 contracts. so you know the 100 contract blocks must be new activity, as no trader has 100 contracts to trade. with 5 blocks, only 4 could offset each other, implying open interest should go up by at least 100 contracts. instead the open interest doesn't change or declines, which means all traded contracts are getting exercised.

(3) the size of the trades is generally very large, consistently representing 25,000 to 150,000 shares per printed trade. if you've ever tried to move a position this large, you know you can't do it on a dime. even if a market maker let you get into it, he won't let you out moments later without exacting his pound of flesh.

(4) the regularity with which these trades happen and the way they happen regularly on tuesdays to make sure shares settle on friday before the weekend are not likely to be a day trader.

the 3 stooges theory means there is no corner going on. larry & moe trade a spread with each other. so effectively larry is buying from moe who is selling to larry who is forced to sell to moe who is buying from larry. got that? :smile:

when they trade a call spread with each other and both exercise one side, they can effectively offset hundreds of thousands of shares with each other, leaving themselves only the stock and open interest they seek to harvest from shemp. go back and work through the original 3 stooges post you'll see what i mean.

the one thing you can be sure of - this is most likely two mid-size hedge funds or equity derivatives desks (like maybe at banks) that are doing this trade. the amount of capital required to exercise so many calls on both sides means both parties have to have substantial trading capital. they also have to have access to get into the lending pools for tesla shares pretty easily. if it's illegal i'm very curious to see who the regulators identify as the culprits.

it can't be a corner, because we've seen millions of shares equivalent cross almost every week for a few weeks now. if there were a corner, these guys would have to file with the sec as soon as they got over 5.5 million shares. also you know these positions are not unhedged positions, because you couldn't even put on trades like these with the volume as low as its been. not sure how to explain it but think about trying to buy 4.5 million shares on a day when only 3 million shares trade. you can't do it.

one could spend an eternity trying to figure out an algorithm. you never will. the trades are being posted from off the floor, most likely posted manually. they really don't care when exactly the trades get posted, only that they hit the strikes that they want with the volume that they want.

the 3 stooges theory allows you to predict: (a) which strikes they will do, (b) how much relative volume they will do in each strike, (c) when they will do it, and (d) why they do it. i posted where they would trade and relatively how much before yesterday's open to demonstrate that. the theory is completely consistent with the observed facts which are: (a) high rate earned for loaning out shares, (b) tens of thousands of contracts trading with no change in open interest and little discernible price impact, (c) the absence of increases in the open interest the next day, (d) suspicious trades only in strikes with zero time premium and meaningful open interest, and (e) daily share volumes which are below the volume that would be implied by the suspicious options volume.

originally i started this thread thinking it was a naked short, but that theory was falling apart as the trading volumes increased because (a) high naked shorts would put tesla on the reg sho list which didn't happen, (b) there was no way to cover the shares to match the rolling of the short when volume was far below the options volume, and (c) there was no good explanation of how they covered the naked short to avoid appearing on the reg sho list.

unless an alternate theory is presented that is consistent with all the observed facts, i will stand by the stooges.

to me the meaningful remaining questions are (1) is it legal, and (2) are there ramifications of this activity that create predictable price patterns worth trading. the subject remains interesting to me because it's a fascinating use of the technicalities of options to steal valuable interest bearing positions out of someone else's account.�

Apr 17, 2013

PureAmps So why are these trades consistently performed in "pairs" of equal sizes? What purpose does it serve, do you think? The only other explanation I have is that it is intended to "appear" like an open/close or spread trade to mask the true intention of the trade.

Not a corner, but could be a cover of a short position. A very creative way to avoid buying shares on the open market and bidding the stock price up, reducing the effect of a short squeeze.

An eternity? I think you have stated the algorithm pretty well in your previous posts. They appear to be trading in-the-money calls with open interest. I'm just trying to figure out their criteria in a more precise manner. The trades could be posted manually or through a program, but given the sophistication of this trade I'd lean towards a program, or at least somebody has a spreadsheet model they are looking at carefully before punching in the trade. This is not a "seat of your pants" kind of trade...�

Apr 17, 2013

kenliles This seems like the natural motivation to me. And if this is the result (I don't quite see where the actual shares come from), then it damn well should be illegal as it changes the risk of going short in the first place, transfers the benefit of short covering from longs to neutral. And does in effect change the resulting trade price of e underlying stock by altering the demand- by trading 'off the board' with a non arms length collusive relationship. Since the MM must know this is happening, it seems like they would work to stop it, unless they are benefiting in some way. (Its this kind of crap that brought the real-estate market down - sorry for the vent)�

Apr 17, 2013

30seconds any other stocks with high costs to shorts where this pattern can be confirmed? If I've learned anything from my friends in that part of the business world is that if something works in one place then the next thought is to expand. could other stocks with large short vs % of float and days to cover also be subject to a harvest trade like this?�

Apr 17, 2013

PureAmps The stock they are acquiring is from the market maker's hedges and existing "retail" covered calls and spreads. If you look at how the trades have evolved over time, they began with huge volume the week of 3/25 and that volume was matched with corresponding increase in open interest. These are most likely long calls acquired, possibly as insurance, or in preparation for exiting the short position. These calls were most likely "sold" by the market maker. These shares if exercised would come from the market maker's inventory, which would have to be replenished via market operations at some point, possibly contributing to the "short squeeze".

The more recent trades seem to be designed to "shake the tree" and harvest the open interest of longs that are short calls in the form of covered calls or spreads. We have at least one data point on this thread confirming that covered calls were assigned before expiration. These shares would normally be unavailable to the short as they would be exercised by the market maker on expiration and go into the market maker's inventory. This is basically freeing up additional liquidity that wouldn't normally be available in the open market, and freeing it up sooner rather than later.

Again, this is all just speculation...�

Apr 18, 2013

luvb2b the exact sizes of the prints don't matter. they just put together some spread combination or some pairs of individual trades and cross them with each other. what matters to them is the total volume they can do in each contract relative to the open interest. that allows them to harvest proportionally an equal amount from various strikes.

the exercise of both sides of the spread results in a hedged position in larry & moe's accounts: long stock + short deep in the money call. if they are short, it does temporarily give them cover on part of the position: short stock cancels with long stock, leaving them short deep in the money calls. this position has some advantage in that it has the same delta as being short stock for small price moves, but allows them to save the cost of borrowing. as you said, if these positions are stolen from longs who are doing buy-writes in accounts with no lending of shares, it does temporarily free up more shares and make them available in the lending pool. freeing more shares for shorting and lowering the lending rate - both are advantages for short sellers. how many shares they get this way vs. what they steal from the market maker (who is already lending) makes a big difference. shares taken from a market maker who is already lending to earn the rebate won't change the available pool of short shares or lower the lending rate.

anyway the problem is at expiration the options get exercised and larry & moe go back to being short again. we'll see what happens here at the april expiration. they harvested a lot of open interest out of april, and i'm pretty sure if they're using as a temporary short cover you'll see a lot of tightness in the availability of shares and higher borrowing costs for shares next week.

usually a trading algorithm has a lot more details to it than what i posted. if you want to "forecast" their trades, here's a pretty good formula. try it out next week.

(a) wait til monday night.

(b) note all options strikes where calls are deep in the money and have meaningful open interest.

(c) watch trading closely on tuesday.

(d) trades will cross on phlx in the options identified in (b) on tuesday.

(e) volume in each strike will be proportional to the amount of open interest that's available. typically they need to do several multiples of the open interest in each strike to harvest effectively.

- - - Updated - - -

you're correct that you should see this elsewhere too. i've never seen a stock with borrowing costs so high for so long as tesla, so i have not seen it before.

basically the criteria you need are:

(a) high borrowing cost for shares

(b) an optionable stock

(c) speculators using deep in the money calls to be long shares, or a stock that moves higher quickly making many at-the-money options deep in the money.

(d) visible open interest in the deep in the money strikes, the evidence for (c) essentially

(e) the deep in the money calls trading with zero time premium

i suppose you could scan for such stocks and find where this stuff is happening. some hedge funds would be doing very well on these trades.�

Apr 18, 2013

Causalien I agree that hidden short covering is actually a better explanation based on occam's razor. Which also has the effect of a delayed rise in price, offsetting the side effect of covering a huge short where price runs up as you cover. But then, this will mean that the MM facilitating this will hurt a lot if the stock in turn goes back down... if they didn't hedge. BTW, maybe I missed this mentioned before, but has anyone went to the tick by tick of the actual order to see whether or not the orders landed on the bid or ask side? Are we so sure that it was a buy order? If not, I'll try to take some time to look at it if somebody has a time stamp. EDIT** If the HFT theory is true, then someone most definitely pointed their text scraping bot on this forum and our conversations in the past week might have triggered a rally. Not sure how they'd do it, the only way I can think of is to measure the ratio of positive to negative words on all posts that are mentioned in a day and to do an association with a number mentioned within 5 words from the sentiment in question. I'd like to test it out by getting everyone to mention a few words of positivity for a set amount of days, but SEC will probably slap someone.�

Apr 18, 2013

avatar I agree. this is frustrating. However it feels like they cannot stop the tsunami - only slow it. The price for TSLA has been gradually ascending (perhaps slower than it otherwise would). I wonder though if this guy is the only thing stopping a fully blown squeeze right now..�

Apr 18, 2013

Elshout As of 11:30 PDT TSLA is up $1.84 in a market down almost a percent. The shorts are getting their gonads squeezed and I love it!�

Apr 18, 2013

kenliles well relative to volume, this 'guy' IS the market right now;

the registered MM has no current relevance (except for what they are being forced to do by the new MM); nor do current traders, so I'd have to say yes to your excellent musing, and mission accomplished by the stooges (yuk-yuk);

this following is speculatory(but not by much - yes I know there's no such word):

I'd also say it introduces a whole new parameter of short squeeze characterization for all future investors to consider-

where apparently 'mutual-funds' become 'mutual-buds', create their own market, co-opt and replace the MM, becoming the new unregistered default MM...

until they clear their shorts of crapola, handing them unwashed back to the original MM and the rest of the market, namely us

@PureAmps- thanks for detailing the answer to my ? about where the stock accum is coming from- much appreciated�

Apr 22, 2013

luvb2b tomorrow is tuesday again, so our friends larry & moe should be back. i'll try to post where i expect to see them working tonight.�

Apr 22, 2013

blakegallagher Cant wait... thanks for staying at it Luvb2b it has been very interesting watching this progress.

�

Apr 22, 2013

TD1 If they should return tomorrow with a new naked short, how you think that would influence the stock if it would finish today at 49.90$ ?�

Apr 22, 2013

luvb2b the naked short theory was replaced by the 3 stooges theory (a couple pages back). 3 stooges fits the behavior better than the initial theory i posted. perhaps the thread title should be changed to the 3 stooges tesla options traders.

ok, here's what i expect tomorrow, look for volume in these strikes, proportional to the open interest. i posted tonight's open interest, but tomorrow morning's numbers will be the ones people will trade on. expect especially heavy activity in the may 40's, jun 40's and jun 38's as there's good open interest at those strikes.

may 35 call oi 436

may 37 call oi 123

may 38 call oi 130

may 39 call oi 282

may 40 call oi 2266

may 41 call oi 503

may 42 call oi 862

jun 32-40 calls, oi's 268, 304, 153, 757, 655, 616, 1651, 688, 9077 (respectively)�

Apr 23, 2013

Nicu.Mihalache luvb2b, just to say once more that I appreciate your efforts; and I completely agree with your scientific approach: look at the data, conceive a theory, make predictions, adjust or KILL the theory and start over - that last part of killing it instead of adding circles on circlesis most of the time the real key to great discoveries; it seems even Einstein made all possible (but intelligent) errors before coming up with his relativity theory

keep up the good work�

Apr 23, 2013

luvb2b thanks very much for the kind words.

here's the updated view on where the stooges will be working today, based on the morning's open interest figures:

may 35 call oi 436

may 39 call oi 208

may 40 call oi 1486

may 41 call oi 535

may 42 call oi 860

jun 32-40 calls, oi's 268, 304, 151, 575, 489, 310, 979, 675, 8947 (respectively)

the heaviest volume will come in the jun 40s, may 40s, jun38s, and may 42s. those jun 40s are kind of on the cusp, so if the stock goes down you may not see the stooges working there, on the other hand if the stock goes up the jun 41s and maybe the may 43s will also come into play.�

Apr 23, 2013

smorgasbord Here's a similar theory posted on Seeking Alpha:

�

Apr 23, 2013

luvb2b this theory that you linked is unrelated to the 3 stooges theory, which is very specifically addressing options that trade but then vanish from the open interest reports.

we are indeed seeing huge size in the series i mentioned today. will try to post a fuller update later.�

Apr 23, 2013

luvb2b huge size again!

as expected, monster volume trading thru the phlx in a bunch of strikes. i estimate total over 45,000 contracts this way again, representing 4.5 million shares. i think they have to stay under 5.5 million shares because that would trigger an sec filing (over 5% of the outstanding shares).

so more or less, they are maxxing out what they can do.

may 35 call vol 2,854 oi 427

may 39 call vol 1,416 oi 208

may 40 call vol 6,000 oi 1,486

may 41 call vol 2,000 oi 535

may 42 call vol 3,600 oi 860

jun 32 call vol 1,736 oi 268

jun 33 call vol 2,008 oi 304

jun 34 call vol 1,102 oi 151

jun 35 call vol 3,550 oi 575

jun 36 call vol 2,878 oi 489

jun 37 call vol 2,020 oi 310

jun 38 call vol 5,956 oi 979

jun 39 call vol 2,800 oi 675

jun 40 call vol 2,000 oi 8,947

i also see these guys in some further expirations now, sep, dec, and jan. too many strikes to post all, but how about this biggie:

jan 30 call vol 2,800 oi 676

with the exception of the jun 40 calls, all the volume is proportional to the open interest.

should be some rebalancing that market makers have to do tomorrow, although i wonder if they haven't figured it out enough to start rebalancing today. i guess we'll see how firm the stock is through the morning.�

Apr 23, 2013

Johan Follow up question: If the basic assumption here is that the two big stooges (who are trading all these deep in-the-money options with eachother every day) are doing this to stay short on TSLA but gradually switching their stock to options to be short on, to avoid lending charges, then at some point they will have exchanged their entire actual stock position to an equivalent, still short, position on a combination of calls and puts right? And there is still no sign of them slowing down the pace which must mean that they had a very large short position in actual TSLA stock to begin with? Now, they are trading in big volumes in the may calls. So in effect unless TSLA drops significantly in time for the may options expiration they will be sitting on a lot of worthless calls? My point being they are staying short only on option instead of stock (thereby avoiding high lending charge rates). But unless TSLA pulls back quite a lot they will be sitting with quite some losses come may?�

Apr 23, 2013

luvb2b the most likely candidates for the stooges are either shorts who can save borrowing charges or a larger player who can lend the shares and just earn yield from the long stock short call package.

regarding what happens to the calls, actually if you follow the open interest carefully what you'll see is those deep in the money calls are getting exercised away from them as the days go by. in some cases many got exercised away from them just 2 or 3 days later. but larry & moe don't care, by doing the trades on tuesday they guarantee the trades settle friday and that they can earn at least the 3 nights of weekend lending interest before anyone can exercise their position away.

as they get closer to expiration, they aren't sitting on worthless calls. they are sitting on deep in the money calls. those calls get exercised and converted to short shares. so if the stooge is a short, he's back to being short, and if the stooge is a lender doing a yield trade, his long stock offsets the call exercise.

if the stooges are shorts, they're getting killed anyway. they just save a couple bucks not having to pay 40%+ interest to borrow shares.

hope that makes sense.�

Apr 23, 2013

Johan Yes, it makes sense, thanks. The important thing that I just wanted to make sure is your sentence that I have bolded out above. Go TSLA! :biggrin:�

Apr 23, 2013

kenliles But they're getting killed less dead than most shorts by avoiding some of the carry interest. I suspect it's a combination play from an extreme short position. They pay less to stay short on the converted calls to short, and they keep the long dated dated calls in place as a hedge to reduce some of their over-short position.�

Apr 23, 2013

Causalien If they are short, the volume should be reducing as their margin gets reduced along the way. Is that the case!�

Apr 23, 2013

kenliles no- doesn't appear to be the case on the surface. But these are big players; hard to tell where they are relative to margin.�

Apr 24, 2013

luvb2b nope, the volume is a function of how much of the market makers/buy-writers position they can "steal". the most they can steal is the total open interest at any strike, and even if they do 4-5 times as much volume as the open interest, the end result only nets them about 80-85% of the open interest. so what i'm saying is that it takes a lot of volume to steal a few contracts.

- - - Updated - - -

so 45,000 contracts traded yesterday representing 4.5 million shares of open interest. does anyone even really question that the contracts vanished any more?

here's the updated open interest, as usual down at every strike!

may 35 call vol 2,854 oi 427 --> today's oi 427

may 39 call vol 1,416 oi 208 --> today's oi 82

may 40 call vol 6,000 oi 1,486 --> today's oi 1,238

may 41 call vol 2,000 oi 535 --> today's oi 509

may 42 call vol 3,600 oi 860 --> today's oi 845

jun 32 call vol 1,736 oi 268 --> today's oi 218

jun 33 call vol 2,008 oi 304 --> today's oi 294

jun 34 call vol 1,102 oi 151 --> today's oi 50

jun 35 call vol 3,550 oi 575 --> today's oi 544

jun 36 call vol 2,878 oi 489 --> today's oi 489

jun 37 call vol 2,020 oi 310 --> today's oi 305

jun 38 call vol 5,956 oi 979 --> today's oi 627

jun 39 call vol 2,800 oi 675 --> today's oi 605

jun 40 call vol 2,000 oi 8,947 --> today's oi 8847

jan 30 call vol 2,800 oi 676 --> today's oi 641

i'm wondering if i really need to pursue this any further? by now pretty much everyone should understand what's going on. perhaps someone else would care to do the predictions and outcomes for next week?

i contacted the regulator again, but they won't comment on the situation (which is typical). the last i know it did get referred up to a higher agency but no idea what else may come of it.�

Apr 24, 2013

Zzzz... She notices Tuesday unusual volume. But did not check details and history of this thing, I mean the fact that it is usual thing for TSLA on Tuesdays...

Are Tesla Motors Inc (TSLA) Bears Buying Options Insurance? | Daily Option Blog | Schaeffer's Investment Research

�

Apr 24, 2013

luvb2b like most people she's clueless to what's going on here. sometimes i wish it got more attention, so at least we could find out if it's legal to trade like this.�

Apr 24, 2013

imherkimer one or all of these stooges must come out of a whale that's too big to fail.

Because if the regulator investigated and prosecuted this sort of thing, he would say, if forced to answer the question:

"I am concerned that the size of some of these institutions becomes so large that it does become difficult for us to prosecute them..SOURCE: THE NEW REPUBLIC 2013-04-18 14:53:00�

Apr 24, 2013

DonPedro Why don't you tip her off? She seems very interested in reporting what is going on, and this would make a better story than the last 2-3 she's run.�

Apr 24, 2013

Lloyd http://www.schaeffersresearch.com/marketcenters/optionscenter/content/are+tesla+motors+inc+tsla+bears+buying+options+insurance/default.aspx?ID=115764

Article summarizing what this thread has found.�

Apr 24, 2013

DonPedro No.�

Apr 24, 2013

luvb2b ever talked to a reporter donpedro? it's no wonder that news stories generally mark the end of a move. they are generally so clueless as a bunch it's a miracle that any original investigative reporting ever gets done.

my first experience with this was back in 2004 when i had discovered evidence of ridiculous risk taking behavior at freddie mac & fannie mae. freddie had an accounting scandal back then, but you know what? after speaking to reporters from every major financial publication, none decided to go with it. a wall street journal editor told me that after he ran the story by several institutional contacts (who obviously would never want such a story public) the contacts told him that sure, there were shady things happening at fannie and freddie but it didn't matter because they were so big the government would bail them out.

i've had multiple other similar experiences since then, and therefore came to the conclusion that talking to the press is a waste of time. maybe if i was managing money or somehow the publicity mattered, it would be worth it to deal with these jokers.

as it is, it's not worth it all!�

Apr 24, 2013

DonPedro I deal with reporters from time to time in my day job, and my experiences are not so bad.�

Apr 24, 2013

Ocelot ..a bit off topic here, but the only "real" investigative journalism I read these days come from Rolling Stone magazine. Seriously pick up an issue. Nearly every issue has a great informative, well-researched piece. Here are some recent ones I have 'enjoyed'...

http://www.rollingstone.com/politics/news/gangster-bankers-too-big-to-jail-20130214

http://www.rollingstone.com/culture/news/the-brilliant-life-and-tragic-death-of-aaron-swartz-20130215

global warming..therefore tesla related....

http://www.rollingstone.com/politics/news/global-warmings-terrifying-new-math-20120719?link=mostpopular4

an informative older one..

http://www.rollingstone.com/politics/news/bank-of-america-too-crooked-to-fail-20120314�

Apr 24, 2013

luvb2b +1 to rolling stone. an exceptional publication.�

Apr 24, 2013

Thumper Mother Jones and Harpers also do real journalism.�

Apr 24, 2013

imherkimer +1 Rolling Stone Matt Taibbi is one of the best investigative journalists I have ever read. Really gets to the core.

"Griftopia" recommended great book!�

Apr 24, 2013

kenliles well they got that part right�

Apr 29, 2013

Elshout Shorts are really getting squeezed, TSLA up $3.43 at 1:03 EDT!�

Apr 29, 2013

deonb Do you mind to keep posting these trades until after the earnings announcement? As we assume it's a short seller, it would be good to know when this seller finally "gives up".

We have very few other indication on how much short covering activity is currently driving the stock, seeing that Nasdaq only publishes open short interest every 2 weeks.

�

Apr 29, 2013

DonPedro This is not the right request if you want to get real time on short interest. The "three stooges" trade won't tell you much about short interest. What will give you information on that are the borrowing rates and the anecdotal "shares available for shorting" information luvb2b (God bless him) posts in this thread.�

Apr 29, 2013

luvb2b right so it is probably a short seller, as he gets the most economic benefit, but it doesn't have to be a short. it could be a big investment house that can loan the shares out to their customers doing the trade.

the way the stooges theory works, the larry & moe characters could be shorts, big brokerage firms who can monetize the shares they get to lend, or even a stat-arb type hedge funds.�

Apr 30, 2013

luvb2b today is tuesday, so you should be seeing a bunch of activity again. especially with the move the stock has had, wow! a lot of strikes became deep in the money and with the lending rate over 50% larry & moe will get paid well to keep screwing shemp.�

Apr 30, 2013

luvb2b the stooges have gone absolutely wild today. check out the insane volume in the june $40 call, among others. huge volume in deep in the money may strikes. huge volume in deep in the money june strikes.

my guess is they are going to do about 45,000-50,000 contracts again today.�

Apr 30, 2013

DonPedro Holy macaroni. That is so... much more than my trading volume :-D�

Apr 30, 2013

kenliles Last week of their play before earnings report- where they may be betting their play will have to change (or not) in some way so they're doubling up this week... perhaps�

Apr 30, 2013

viperboy The June 22nd, $40 call:

[TR="class: qmmt_heading_bar, bgcolor: #EEEEEE"]

Option Volume [/TR]

[/TR]

[TR="class: qmmt_main"] Exchange Price Volume Time

?

PHO16.00 22.76 k 11:38

WOW�

Apr 30, 2013

deonb I know earlier there was a question about whether there were other stocks that behave this way.

I found the following - maybe it's worth seeing if this is also a Tuesday effect on them (I don't know of a way to look up historic open interest):

High Call Volume vs. Low Open InterestOptionCast | OptionCast

Here are the top 10 in case the site changes daily:

.

Ticker Company Name Expiry Call Strike Open Interest Volume [TR="class: rShim"][/TR]

.

QQQ PowerShares QQQ 13Jun 71 36404 114333 .

TSLA Tesla Motors Inc. 13Jun 40 6352 23275 .

PCS METROPCS COMM INC 13Nov 14 7 20422 .

QQQ PowerShares QQQ 13Jun 75 3345 15123 .

EFA iShares MSCI EAFE Index 13Dec 71 180 15000 .

MBI M B I A INC 13Jun 11 522 12155 .

PSX Phillips 66 13May 67.5 1818 10262 .

VIX CBOE VOLATILITY INDEX#index 13Oct 24 172 10250 .

YHOO YAHOO INC 15Jan 30 2506 10189 .

UA UNDER ARMOUR INC 13Jun 60 193 10050 .

�

Apr 30, 2013

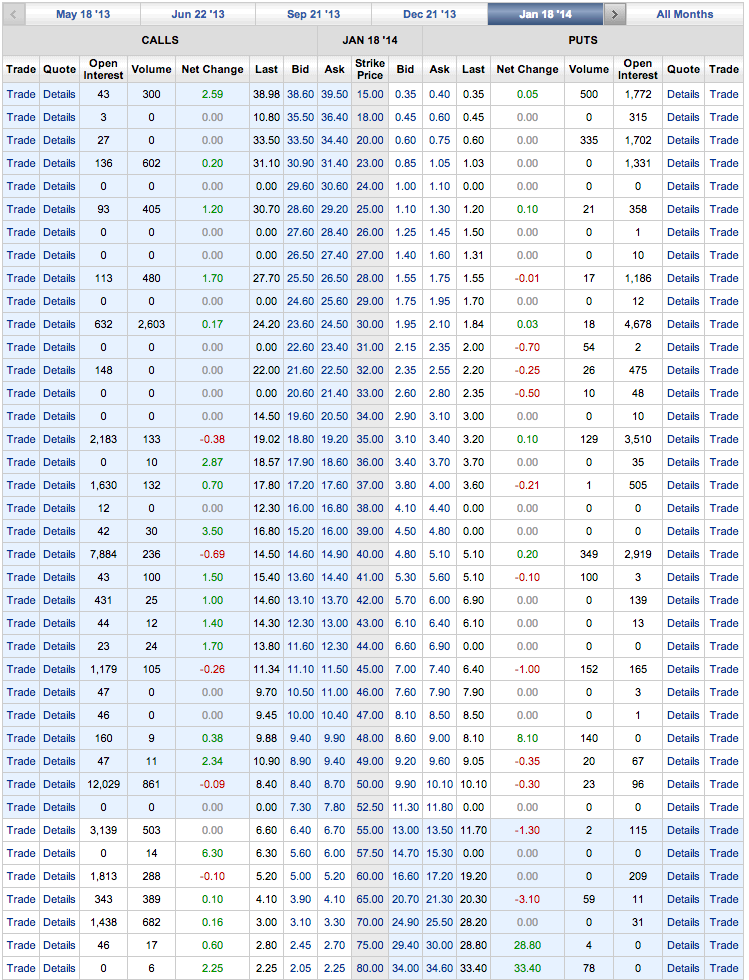

smorgasbord Take a look at the Open Interest for various Jan 2014 strikes - I've never seen anything like this:

For instance, the $35 Calls have an OI of 2,183, but the $34 and $36 Calls have an OI of zero. The $49 Calls jumped $2.34 in value, but the $50 Calls declined 9 cents.

I don't know what to make of this. Clearly some kind of programmed trading at specific strikes. Any got a good explanation?�

Apr 30, 2013

K Hall I bought a bunch of the Jan 40's when they were $3.00 about a month ago. Then I bought $45's and 50's and 55's as the stock kept running. The leverage is insane. I keep adding them to my IRA account as a long time play but the gains have been immediate.�

May 1, 2013

Nicu.Mihalache $35, $40 calls were available since Nov. 2011 or so. The intermediary strikes are newer, as the share price increased in this territory and we are approaching expiration, so more liquidity is needed.

Those price variations are compared to the last trade. There may have been no trade yesterday in $49 calls, therefore the price jumped compared to last week or earlier, there's nothing fishy here.�

May 1, 2013

DonPedro I'd say these are artifacts of lacking liquidity. The calls that jumped in value may last have been traded during yesterday's upturn, whereas the others were traded after it took a dip into the red.�

May 1, 2013

luvb2b usually in the longer dated options people doing large positions will do multiples of 5. that's because there tends be a bit more liquidity in those strikes as more people trade those 10's and 5's strikes. not surprising at all and i would even say somewhat common.�

May 7, 2013

luvb2b it's tuesday. expect the stooges to be out in force today. the stock's upward movement has put a lot of strikes in the money.�

May 7, 2013

DonPedro They are saving pennies on this trickery and losing dollars on the market moving against their short positions.

The persistence of this activity reduces the likelyhood of the "stooges" explanation being the right one, since many shorts are probably covering (with new shorters taking positions). However, in the absence of an alternative explanation this still looks like the best hypothesis.�

May 7, 2013

deonb They're back indeed today, May 39 to 45, Jun 32 to 41, Sep 34 to 38, with every strike in between. 33'611 contracts so far.�

May 7, 2013

luvb2b and all those as big blocks on the phlx right? that would be the stooges for sure.

- - - Updated - - -

it could also be a market maker or prop trading desk that can earn the full rebate for lending out the shares.�

May 7, 2013

deonb Actually I can't see which exchange. It would be better if you double-check this.�

May 7, 2013

luvb2b a quick glance shows me at least 20,000 contracts on phlx. nasdaq.com has a tool that will allow you to see volume by exchange, go to nasdaq.com quotes and then option chain.�

May 9, 2013

hobbes Looks like Elon got wind of the naked short, stooges or whoever is doing those tuesday trades:Tesla Surges After Posting Profit; Value Exceeds Fiat's - Bloomberg�

May 14, 2013

DJ Frustration Are they back to their naked shorting this Tuesday?�

May 21, 2013

deonb Sadness! They are playing around with September's today, but doesn't appear to impact the price. Probably cause the volume is now so low in comparison.

I'm going to miss my Tuesday PM buy-ins. Was like free money in the past.�

Feb 4, 2014

MuskForPresident You guys will probably enjoy reading this:

Florida Professors Experimented With a Little Naked Short Selling - Bloomberg

Florida Professors Experimented With a Little Naked Short Selling�

Feb 4, 2014

gym7rjm So they didn't say which security this was being done on. Is it possible that they were the culprits behind the fishy activity with TSLA last year?�

Feb 4, 2014

Johan I think luvb2b called this one and brought it to the SEC's attention. It all fits with TSLA last year.�

Feb 5, 2014

scriptacus If you click through to the linked settlement the securities are listed, but TSLA is not one of them. It does specify that it was "at least" the listed securities, which leaves some possibility that TSLA was one of them.�

Feb 5, 2014

deonb The SEC order is actually much clearer than the reporting on it.

http://www.sec.gov/litigation/admin/2014/33-9522.pdf

For the first time I'm finally understanding how this scheme worked!�

Feb 5, 2014

Mario Kadastik Ok, can someone tell me what is exactly illegal. For example if I buy puts for FB (or TWTR as an example) and then exercise them (or they expire ITM and get exercised) without having the stock I'm basically a naked short for the stock as I've not borrowed or shown where I can get it. Is that illegal or if I cover it immediately I'm ok? I've had it happen once accidentally (was traveling in China and mixed up the timezones so forgot that the market closed while I was sleeping and my FB puts got exercised). I covered them in next Mondays pre-market trading (and lucky I did as it went up a lot in regular trading). So the question is at which point does it become illegal?�

Feb 5, 2014

Causalien In the case where you bought puts. It expires worthless. Or... you can exercise them before expiration. Which basically means that your brokerage buys some stocks for you so it can be "exercised". This is an unlikely scenario since it is always more cost effective to just sell the puts with the premium if it is in the money. However, for one freak swan or another, some people do exercise and those who do are doing it for a strategic move to corner the market, as an arbitrage play when the greeks went out of whack or to simply scare people.

Now, where it might become illegal is if you naked sold puts. Basically, if you got exercised on a stock like TSLA and you don't have the money, you owe your broker money.

The other illegal action that is more problematic is when you sold naked calls. I had a lengthy talk with my brokerage on this process when the rolling naked short around last year's April was in progress. You are basically on the hook to find stocks to fulfill this demand. In a stock like TSLA during last april when there are no stock available to borrow. You are in for some rude awakening. This is the reason why cost to borrow went up so much. Someone demanded stock to be delivered, there are more shares out there than in existence (i.e. shares created out of thin air by naked shorters) and cash cannot be used to fulfill this request.�

Feb 5, 2014

Mario Kadastik Ok so in my case where I forgot and went short out of accident it wasn't illegal I guess. I do sell puts at times for some securities and do it on margin without having the full cover. However I do assume that I will buy it back and not let it get exercised. Now with the american style options the real risk is that someone exercises them before expiry meaning that I end up with the stock and margin call. I don't sell naked calls however, that's far far too risky though I have contemplated selling a straddle in case of some stocks during ER to benefit from the high IV and the imminent collapse the next day (assuming the stock doesn't really move as much). How is that considered? Let's assume some stock like MSFT has earnings on Thursday and I sell the ATM straddle. I guess if I just buy it back on Friday for profit/loss it's fine, but if someone decides to exercise their call or put in after hours post-ER, then I'm in deep ****?�

Feb 5, 2014

Causalien It's rare that you get stock assigned and then margin called. Usually it happens when the stock drops more than you have margin. In the case of TSLA, it is usually because brokerage only gives 5% (in my case) value for margin on TSLA stocks. So most of us who play TSLA options with stock components will realize sooner or later that we can't maneuver as much as our position sizes grow.

In your straddle case, you are in trouble IF you are in TSLA options. It is not such a big deal for most normal stock as it is not hard to borrow any other stock on the market. 80% cost to borrow a stock is rare. I've only ever seen it once in my life. Usually the broker will be able to borrow it for you (for your short call). However if they fail to do so, it is up to you to come up with the borrowed share within the 3 day settlement period. The broker is not obligated to find it for you.

The people in the article just continuously violate this period by reversing the trade and forcing the assignment of imaginary share back to cover the original demand for stock, but at any one time, both account have an outstanding violation of non delivery of stock. In this case, the SEC's charge is correct. As the violation is about subverting the "would be" penalty for non delivery instead of earning the payout of the cost to borrow... It is pretty stupid though as they could've just done the same thing with 2 year leap option without constantly violating the rule.�

Không có nhận xét nào:

Đăng nhận xét