Apr 2, 2013

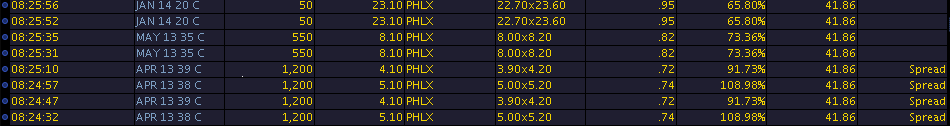

luvb2b there's a pattern of trading which indicates a large player is using options to hold on to a rolling naked short position. looks like maybe millions of shares.

since the sec has tightened up their naked short rules it's harder for funds to put on naked shorts. but this guy has figured out a loophole.

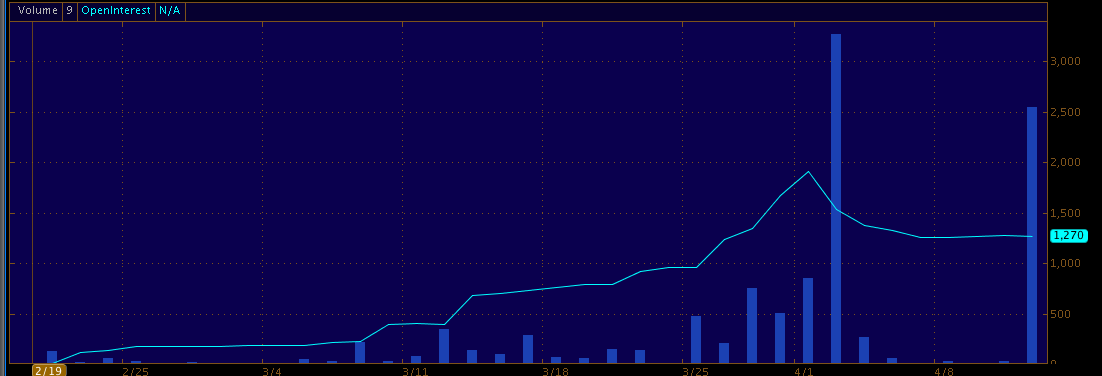

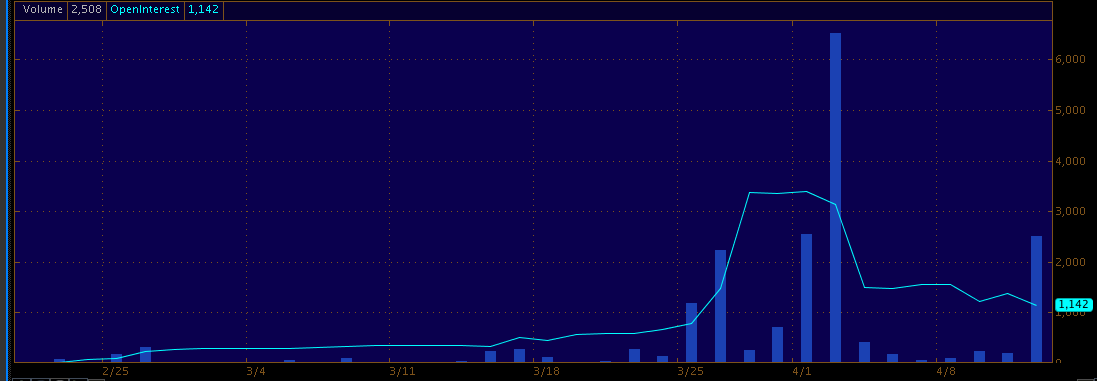

what you want to look at is a good trading history of the june 25 calls, the april 35 calls or the april 37 calls. he's most obvious in the june 25 calls, but does come along now and again in the april calls (as he did today in the april 37s).

so this guy, say he wants to short like 500,000 tesla, but he can't find that many shares to borrow. and even if he could, he doesn't want to pay the 80% carrying charge (see my other post).

so instead what he does is pre-arrange a trade with a market maker where he sells a huge number of deep in the money calls at a discount to intrinsic value. like for example today he sold 2800 of the april 37 calls. when the stock was above 44, he sold a bunch of the 37 calls at $7. this particular guy always does the trades on the psx.

the market maker on the other side is happy to buy them because the market maker hedges by shorting tesla above 44 ahead of the trade, and then immediately exercises the calls to neutralize the market maker's position.

the reason you know this is happening is because the open interest doesn't change. the june 25's this has happened every few days for a couple weeks now. you'll see today 2,200 of the june 25 calls traded. watch tomorrow the open interest won't change. if the calls weren't getting exercised, the open interest would have to increase. it never does on these trades.

so anyway, the market maker exercises the calls. now what happens is the shorter goes into the exercise pool and gets assigned on most or all of the calls. tomorrow his position will show that he's short 500,000 tesla shares.

now he's got 3 days to locate the shares (t+3 settlement). he won't pay carrying charges until settlement. but the trade will never settle because he can't find the shares and again, he doesn't want to pay the carrying charge.

so a couple days later, he has to buy back the shares and repeat the options trade. the shares he naked shorted would probably show up on the fails-to-deliver data, but since he covers them they won't do a buy in.

i'm pretty sure this is illegal, and whoever is facilitating this trade is likely also committing a crime.

i'm highlighting this just to show how desperately the shorts are trying to hang on to their positions. paying 85% carrying charges, finding clever ways to short naked, etc. these are all signs of sheer desperation and i kinda think these guys will get forced out of their positions before this up-move has ended.

--- added

wow just seeing today this guy is doing huge size... oh my god... over 1.5 million shares i didn't even get into the out months (like june 25's). who is this guy i wonder? every trade on the psx...

apr 35 calls qty 2000: [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:45-10:51a est

apr 36 calls qty 2400: [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:45-10:50a est

apr 37 calls qty 2800: [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:46-10:50a est

apr 38 calls qty 6200: [email�protected] / [email�protected] / [email�protected] - times 10:50-10:51a est.

apr 39 calls qty 3000: [email�protected] / [email�protected] / [email�protected] - times 10:51a est

jun 25 calls qty 2200: [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:54a est

jun 33 calls qty 1200: [email�protected] / [email�protected] / [email�protected] - times 9:57-9:58a est

jun 35 calls qty 3200: [email�protected] / [email�protected] / [email�protected] - times 9:56-9:57a est

total contracts: 23,100 = 2,310,000 shares, representing about 2% of the company. that's a monster position.

we know these aren't rolls or spreads because the open interest is too low. no one has this many contracts to close so they must be new opening positions. important to note as if tomorrow the open interest doesn't change much you'll know all these options were exercised.

apr 35 calls oi 478

apr 36 calls oi 599

apr 37 calls oi 728

apr 38 calls oi 3147

apr 39 calls oi 1538

jun 25 calls oi 543

jun 33 calls oi 574

jun 35 calls oi 1608�

Apr 2, 2013

Johan If you are right then yes this is illegal and whichever market maker is in on it will be in trouble. Amazing that you've found this pattern. This coupled with your great in-depth analyzis in the last few weeks makes me want to ask: Can I (please) mirror your portfolio? �

�

Apr 2, 2013

Nicu.Mihalache luvb2b, thanks for sharing your insight

if Elon's trilogy tonight is just about SC at restaurants and a cash infusion in any form to finance that, I think shorts will get an easy out tomorrow - I really hope it's not (only) that because I am still very long TSLA (but sold a few Apr. $44 calls 30 min ago in the neighborhood of $2 - bought last week at 5c each)

�

Apr 2, 2013

luvb2b this guy can mess around in regular hours trading, but in after hours there is no options market. the stock will be free to roam. with this kind of activity i would suspect he can hold it down intraday but the gaps will be murder.�

Apr 3, 2013

luvb2b Fails-to-Deliver Data confirming naked shorts

the sec fails to deliver data for the first half of march is out, and you can see the naked shorting is starting to show up here. i'll post an update with the updated open interest in the options i highlighted yesterday. i fully expect to see very little in terms of changes.

SETTLEMENT SYMBOL QUANTITY (FAILS) DESCRIPTION PRICE

20130301 TSLA 252,996 TESLA MTRS INC COM STK (DE) 34.83

20130304 TSLA 290,744 TESLA MTRS INC COM STK (DE) 34.65

20130305 TSLA 192,257 TESLA MTRS INC COM STK (DE) 35.58

20130306 TSLA 90,868 TESLA MTRS INC COM STK (DE) 36.65

20130307 TSLA 159,159 TESLA MTRS INC COM STK (DE) 37.69

20130308 TSLA 166,030 TESLA MTRS INC COM STK (DE) 38.23

20130311 TSLA 113,858 TESLA MTRS INC COM STK (DE) 38.47

20130312 TSLA 88,255 TESLA MTRS INC COM STK (DE) 39.1

20130313 TSLA 64,112 TESLA MTRS INC COM STK (DE) 39.12

20130314 TSLA 73,235 TESLA MTRS INC COM STK (DE) 38.98�

Apr 3, 2013

luvb2b here are the updates to open interest. recall the huge size that traded in the deep in the money options yesterday? we would expect that to show as open interest today, assuming all the options had not been exercised.

here are the suspicious trades from yesterday april 2, 2013. all of them were on the psx. i threw out the june 35 calls as the exchange confirmed it's a bad print.

apr 35 calls qty 2000: [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:45-10:51a est

apr 36 calls qty 2400: [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:45-10:50a est

apr 37 calls qty 2800: [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:46-10:50a est

apr 38 calls qty 6200: [email�protected] / [email�protected] / [email�protected] - times 10:50-10:51a est.

apr 39 calls qty 3000: [email�protected] / [email�protected] / [email�protected] - times 10:51a est

jun 25 calls qty 2200: [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:54a est

jun 33 calls qty 1200: [email�protected] / [email�protected] / [email�protected] - times 9:57-9:58a est

total contracts: 21,900 representing 2.19 million shares of tesla valued at around $90 million.

here's the open interest yesterday with --> indicating the open interest today. notice how none of the contracts show an increase in open interest that even remotely resembles the volume traded in that contract?

apr 35 calls oi 478 --> 169 today

apr 36 calls oi 599 --> 245 today

apr 37 calls oi 728 --> 419 today

apr 38 calls oi 3147 --> 1497 today

apr 39 calls oi 1538 --> 1376 today

jun 25 calls oi 543 --> 542 today

jun 33 calls oi 574 --> 380 today�

Apr 3, 2013

Martini Every time I think I might dabble in options trading, I read a post like this and realise that I have no idea what I am doing. Back in the mattress you go, retirement fund!�

Apr 3, 2013

Teslawisher Right there with ya!�

Apr 3, 2013

SebastianR Very interesting indeed. Now who do you think is doing such a thing?�

Apr 3, 2013

luvb2b imo has to be a large hedge fund. yesterday those options account for 1/3rd of tesla's volume. the notional value of that position is $100 million. it's not a retail investor.

the sophisticated nature of the trade plus the fact that it requires cooperation from a market maker to implement also point to a hedge fund suspect.

today he is back at it, check the trades in the june 32 and 33 calls. 1400 contracts each. i'll note the open interest and the trades later today and you'll see again tomorrow, the options he traded will never show up in the open interest.

if my theory is correct, the behavior is illegal. this trader is effectively shorting with no intent of ever delivering shares. the market maker helping him also would be running afoul of sec rules.

it's going to continue until some regulator is alerted and checks out what's going on. i'd call tesla i.r. but they don't have a phone number.�

Apr 3, 2013

v12 to 12v Just call Tesla's HQ and ask for ir.�

Apr 3, 2013

luvb2b i guess i would be more aggressive contacting tesla but the last thing i want to see is tesla get involved in a fight with short sellers.

elon can be a bit of a hothead and i could see where he would get pissed off if he knew naked shorting was going on. the last thing i want to see as a shareholder is the ceo/company fighting shorts. every company i've seen that has fought shorts has always been a disaster to own.�

Apr 3, 2013

mitch672 I agree, but if there is illegal activity going on, the hedge fund and market maker should be disciplined.

The SEC doesn't have the resources to find all violations on their own, I'm sure you could report it anonymously to their enforcement people. Tesla doesn't need to be involved (and probably shouldn't be)

Stocks being manipulated like this realy irks me.�

Apr 3, 2013

luvb2b i contacted them already. there's just so few staff, so many complaints, and this thing is pretty darn complicated. the sec will need a push in the right direction to get it figured out. imo the best hope is a wsj or barron's heist of my research and some good investigative reporter digging into it to get to the bottom of what's going on.

it's always possible that i'm wrong. but i have been over this pattern a few times now and talked it over with the occ and several options desks, and they all agree the pattern points to the behavior i am suggesting. the high cost of shorting. lack of shares to borrow, and near zero time premium in deep in the money calls all drives this activity.

here's an excerpted discussion from this barron's article:

http://online.barrons.com/article/SB50001424053111904184504577518792352585660.html#articleTabs_article%3D2

"NEGATIVE" IS SHORT for "negative rebate." For most stocks, professional short sellers get a rebate on part of the fee they pay the prime broker for borrowing stock for them. But when the stock is in short supply and tough to borrow (often because many people are shorting it), as Overstock's was for years, the shorts pay a premium, called the negative rebate, to the broker. It can bring the total fee up to 35% of the share price. Thus, if a stock were trading at $10, it would have to fall below $6.50 before a short sale turned profitable.

A 35% fee is steep, and it's even steeper if the prime brokers didn't actually borrow the stock. The possibility of this happening was discussed in a deposition taken in the suit by Marc Cohodes, a short seller whose $1.5 billion hedge fund, Copper River Partners, was a Goldman client.

In the portion of his deposition quoted in the released filing, Cohodes questions whether Goldman had borrowed the Overstock shares his firm was shorting, and alleges that Goldman later helped put his fund out of business to hide improper conduct. Cohodes wouldn't speak with Barron's; Goldman denies his allegation.

In another e-mail, a Goldman hedge-fund client remarks that his firm would ask "to short an impossible name, expecting full well not to receive it and [be] shocked to learn that [Goldman's representative] can get it for us."

Where would such hard-to-get inventory come from? Read in conjunction with subsequent regulatory actions against options market-makers, the Overstock brief appears to indicate that Goldman and Merrill got it from options traders that used a complicated trading technique called a reverse conversion (not in itself illegal) and involving naked short sales and puts and calls, to create fictitious shares.

One of these market makers, SBA Trading, was run by a trader named Scott Arenstein until the American Stock Exchange shut it in 2007. Without admitting or denying guilt, Arenstein and his firm settled Amex charges of Regulation SHO violations by agreeing to pay $5 million in penalties and accepting being barred from the securities industry for five years. According to the Amex disciplinary decision, Arenstein had shorted stocks and then failed to deliver them.�

Apr 3, 2013

qwk I'm sure that since you posted this here, word will get back to Elon pretty quickly. This forum is monitored very heavily by Tesla.

- - - Updated - - -

Welcome to the stock market. The SEC does very little, and thus the illegal activities and corruption are very widespread.�

Apr 3, 2013

avatar Wow. This is incredible.

Can one of the mods change the title of this thread to something that calls out that we think illegal activity is going on? We need to shout so that TSLA management is aware of this and brings regulators in.�

Apr 3, 2013

luvb2b i'm a firm believer that markets can only be manipulated for short periods of time. as i mentioned in another thread, all my research points to substantial revenue and earnings beats this quarter.

it seems like the majority of people don't understand it at all. and i guess the shorts are part of that group.

i bitch and moan about shorts, but it's as much about understanding the daily trading dynamic as anything else. all i really want is tesla to put some good earnings numbers and show us margins are going increasingly towards 25% without credits and the share price will take care of itself.

yeah, that guy shorted 2+ million shares yesterday... but guess what? that means there were $100m worth of buyers around to take the other side. people want an excuse to own tesla, and the best excuse is profits.�

Apr 3, 2013

ElSupreme I think the 'Naked Tesla Short' will get someone's attention.

At least the 'Naked' part will.�

Apr 3, 2013

avatar I am a little in awe reading your analysis.What is your day job if you don't mind telling us?

�

�

Apr 3, 2013

luvb2b lol puhhhleeeze. i have a significant position in tesla. with a lot of my eggs in this basket, let's just say i watch the basket carefully.

and keep in mind that i might be wrong about the whole thing. for me, the trading pattern and surrounding facts point to the conclusion i put forth. but that doesn't mean there isn't another logical explanation i don't know.

imo this is a matter that should be handled quietly by the regulators. i don't want to see tesla become the next overstock.com.

it is interesting to follow because you get an idea of how desperate the shorts have become to find ways to stay short or hang on to their positions, even when shares aren't available and costs are so high. if tesla is the real deal, this guy is going to get buried, along with all the non-naked shorts who are paying 10c a day for the privilege of staying short.

you guys watch sports at all? for example basketball... is it better to get obsessed with the referees policing the other team's tactics - pulling jerseys or hard picks etc. - or is it better to understand how the other team plays and the way the refs are calling the game and then play accordingly? i say the latter. the refs will referee. the dirty players will be dirty. that's life.

i already mentioned the fouls to the referees once, and now i'm just trying to understand my opponent and figure out how to play my game to win.�

Apr 3, 2013

K Hall Andrew Carnage....I love that quote.�

Apr 3, 2013

EarlyAdopter Is there anything one could do to counter or thwart the trade? Get in between the bids and market maker for instance.�

Apr 3, 2013

luvb2b the guy moved $100 million of shares like this in a day. he's a steamroller. i'm an ant. no thank you.

these trades are probably being executed off the floor of the exchange anyway, so not much can be done about it.�

Apr 3, 2013

v12 to 12v Freudian slip?�

Apr 3, 2013

hcsharp Did you see this in the Wed. Seeking Alpha Options Brief?

�

Apr 4, 2013

luvb2b most of the time these analysts have no idea what's going on. the details of the report are accurate but very incomplete.

the guy put this trade on around 10:04a est yesterday (4/3). it was part of a combination of closing out 5000 of the april 40/45 call spreads the guy had put on a few days ago. look at the prints on a chart you'll see what i mean. as far as options volume being high, this one player accounts for 19,000 of the contracts traded yesterday, and they are relatively small money trades as you'll see below.

whoever did these trades is most probably a short, and from the looks of things a complete moron who got lucky because of the earnings announcement.

the reason i know that is that when he put on the april 40/45 call spread a few days back (maybe 3/28?), he did the april 40 calls for about 55-60c and sold the april 45s for 3c. i'm saying that from memory of seeing it.

that's just stupid. who cares about the 3c? just leave the upside open. it would cost him probably 1/4-1/2c in commissions for that leg, and another 1/4-1/2c to close it out. so at the end he's hardly even going to make 2c ($10,000) by selling the april 45s. as it was his april 45s screwed him big time because they ended up becoming 50 baggers at the highs and kept him from easily unloading his entire position.

but this guy never really wanted to be long, he was most likely just hedging his short position or trying to find a place to get short. so what does he do?

he does a spread trade, simultaneously closing out 5000 of his april 40/45 call spreads, and then opening 4500 of the jun 35/30 put spreads at 10:04a est, moments before the stock broke to the morning lows at $40.62. the combination of these two trades would have resulted in delta hedging selling of roughly 250,000-300,000 shares, which is part of why the initial morning spike down was so severe.

i'd write the report as "size players betting against tesla were closing out long tesla hedges and initiating new short positions near the lows today. with the stock $10% higher a day ago, what were these people doing then? is the announcement of leasing so negative that it should warrant getting scared out and shorting 10% below yesterday's price, which was primarily driven by report of a positive earnings surprise?

as for this being a "large bet"... it's not really that big. the trader started with less than $300k in the trade when he did the 40/45 call spread, and then by taking profits on that side and putting on the 35/30 puts he cashed out around 1/3rd of that. so in the end, does a $200,000 trade even warrant this much discussion?

i posted somewhere else, understanding these things is just part of understanding my opponents. my confidence is usually increased when i see someone doing something this stupid. yes he made money, but he basically just lucked out because tesla gave him an upside earnings surprise�

Apr 4, 2013

DonPedro It was the butler who did it�

Apr 4, 2013

luvb2b April 3rd update

updating trades from yesterday below. another interesting pattern is i notice our friend is doing these trades about every 5 business days. the jun 25 calls have been his favorite for those who want to see it, just pull up the price/volume/open interest chart.

march 5th, march 12th, march 19th, march 25th, and april 2nd are his trade dates. he usually does his thing before 1pm est.

will try to keep a diary for reference for a few days.

here are the suspicious trades from yesterday april 3, 2013. all of them were on the psx.

jun 32 calls qty 1400: [email�protected] / [email�protected] / [email�protected] / [email�protected] times 10:25-10:26a est, 10:59a est

jun 33 calls qty 1400: [email�protected] / [email�protected] / [email�protected] / [email�protected] times 10:26-10:30a est, 10:59-11:00a est

here's the open interest yesterday with --> indicating the open interest today.

jun 32 calls oi 341 --> 341 today

jun 33 calls oi 380 --> 380 today

here are the suspicious trades from yesterday april 2, 2013. all of them were on the psx. i threw out the june 35 calls as the exchange confirmed it's a bad print.

apr 35 calls qty 2000: [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:45-10:51a est

apr 36 calls qty 2400: [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:45-10:50a est

apr 37 calls qty 2800: [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:46-10:50a est

apr 38 calls qty 6200: [email�protected] / [email�protected] / [email�protected] - times 10:50-10:51a est.

apr 39 calls qty 3000: [email�protected] / [email�protected] / [email�protected] - times 10:51a est

jun 25 calls qty 2200: [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:54a est

jun 33 calls qty 1200: [email�protected] / [email�protected] / [email�protected] - times 9:57-9:58a est

total contracts: 19,800 representing 1.98 million shares of tesla valued at around $90 million.

here's the open interest yesterday with --> indicating the open interest today.

apr 35 calls oi 478 --> 169 today

apr 36 calls oi 599 --> 245 today

apr 37 calls oi 728 --> 419 today

apr 38 calls oi 3147 --> 1497 today

apr 39 calls oi 1538 --> 1376 today

jun 25 calls oi 543 --> 542 today

jun 33 calls oi 574 --> 380 today�

Apr 5, 2013

jeff_adams Stupid noob question.

Besides hedge fund guy trying to hold his short position and not take a financial bath doing it, what damage is he doing to the stock and long investors? Does the high stock trade volumes signal stock volatility? He's cheating the system for his own gain, but who is losing money because if it?�

Apr 5, 2013

kenliles Not if the Market Maker and the Fund-Trader are one in the same

- - - Updated - - -

on the good side- it cuts the call time premium if you're on the buy side; doesn't look like we're getting much pullback buying opportunity though�

Apr 5, 2013

luvb2b several things happen that are damaging:

first, he is robbing the people who are buying and expecting to get delivery of good shares. the trades are being executed with no intent to ever deliver shares against them. it's happening indirectly because it's the market maker who is getting the naked short put on for him, and the position gets transferred by the same day option exercise. the end result is it is just as if this player sold the shares naked short.

second, he is robbing the people who are long and able to earn money loaning out there shares. by circumventing the system he avoids paying the short charge.

third, by supplying the market with phony shares he is depressing the price level below where it would otherwise be with only legitimate longs and shorts.

finally, he is exaggerating volume and volatility in the stock. unless he is in cahoots with the market maker, his position has to get bought in every 5 days or so: if he trades today, he's assigned on the options and short tomorrow, supposed to deliver shares 3 days later, and supposed to be bought in next day if he can't deliver so that's five days i think). i suspect he would time his buy-in coincident with when he's shorting those options to minimize price impact. this last part is the thing i have the hardest time with. how exactly does he keep rolling this naked short along? sec rules would require a buy-in if he can't deliver shares. the buy-in would move the stock higher and wreck his trade. the only way to avoid that is to coordinate the buy-in with the initiation of the options position. as i mentioned a few days back, his activity basically accounted for 1/3rd of the daily share volume on a 6 million share day. almost $100,000,000 of tesla shares that didn't exist to sell or borrow got sold that day - where would the price have been without that? that's pretty significant if you ask me.�

Apr 5, 2013

kenliles clearly he is the market maker, the trader is in the firm,

either literally or figuratively thru fungible asset�

Apr 5, 2013

luvb2b well looks like he's back. this time he's spreading around in smaller blocks, but same pattern. i wonder if he reads this board or he's noticing someone asking questions.

anyway, so let's note the trades and the corresponding open interest.

here are the suspicious trades from april 5, 2013. once again, all of them were on the psx. look at the times. so close together you know it's the same guy. just spreading across different strikes to hide his footprint.

apr 33 calls qty 500: [email�protected] [email�protected] / [email�protected] / [email�protected] / [email�protected] times 12:46-12:47p est, 1:38-1:39p est

apr 34 calls qty 400: [email�protected] / 100 @7.20 / [email�protected] / [email�protected] times 12:47-12:48p est, 1:39p est

apr 35 calls qty 640: [email�protected] / [email�protected] / [email�protected] / [email�protected] times 12:47-12:48p est, 1:40-1:41p est

apr 37 calls qty 2000: [email�protected] / [email�protected] / [email�protected] / [email�protected] times 12:48p est, 1:40p est

jun 31 calls qty 200: [email�protected] / [email�protected] / [email�protected] / [email�protected] 12:49a est, 1:42p est

that represents almost 374,000 shares on a day where the day's volume is just 1.6 million. almost 25% of the daily share volume. pretty big again.

here's the open interest will update later how it changed

apr 33 calls oi 76

apr 34 calls oi 78

apr 35 calls oi 159

apr 37 calls oi 513

jun 31 calls oi 43

here are the suspicious trades from yesterday april 3, 2013. all of them were on the psx.

jun 32 calls qty 1400: [email�protected] / [email�protected] / [email�protected] / [email�protected] times 10:25-10:26a est, 10:59a est

jun 33 calls qty 1400: [email�protected] / [email�protected] / [email�protected] / [email�protected] times 10:26-10:30a est, 10:59-11:00a est

here's the open interest yesterday with --> indicating the open interest today.

jun 32 calls oi 341 --> 341 today

jun 33 calls oi 380 --> 380 today

here are the suspicious trades from yesterday april 2, 2013. all of them were on the psx. i threw out the june 35 calls as the exchange confirmed it's a bad print.

apr 35 calls qty 2000: [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:45-10:51a est

apr 36 calls qty 2400: [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:45-10:50a est

apr 37 calls qty 2800: [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:46-10:50a est

apr 38 calls qty 6200: [email�protected] / [email�protected] / [email�protected] - times 10:50-10:51a est.

apr 39 calls qty 3000: [email�protected] / [email�protected] / [email�protected] - times 10:51a est

jun 25 calls qty 2200: [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:54a est

jun 33 calls qty 1200: [email�protected] / [email�protected] / [email�protected] - times 9:57-9:58a est

total contracts: 19,800 representing 1.98 million shares of tesla valued at around $90 million.

here's the open interest yesterday with --> indicating the open interest today.

apr 35 calls oi 478 --> 169 today

apr 36 calls oi 599 --> 245 today

apr 37 calls oi 728 --> 419 today

apr 38 calls oi 3147 --> 1497 today

apr 39 calls oi 1538 --> 1376 today

jun 25 calls oi 543 --> 542 today

jun 33 calls oi 574 --> 380 today�

Apr 5, 2013

avatar That is a big deal. It is quite incredible that no one is doing anything about it. I am pretty sure Elon would want to expose this guy but I'm not sure if anyone in TSLA management has even noticed this.�

Apr 5, 2013

luvb2b first off, who's going to notice? unless you happen to be looking and see this. i saw it purely by accident as the guy did similar trades twice in a week in a expiration/strike i was watching.

second, there's no conclusive proof of what's happening. there's a logical explanation that i put forth, but there may be another logical explanation that we don't know.

third, even if the company knew, having elon involved in something like that would be a total distraction. as i said before, every management that i know that got involved in a fight with short sellers ended up failing their business. if he executes, the stock will rise and this clown will get his head ripped off. i'd rather have elon focus on execution and try to get the regulators do their job.�

Apr 5, 2013

jeff_adams I would agree this is not Elon's fight.

Silly question, but is there an investigative reporter or show on Bloomberg News (or something similar) that might want to score some brownie points on a slow news day? Even if no one is caught, I bet they stop doing it if there is a report of unusual activity on Telsa shorts. Wasn't there a gal named Greta (lawyer) that liked to look into things like this?�

Apr 6, 2013

renim http://online.wsj.com/public/resources/documents/MarkopolosTestimony20090203.pdf

The federal SEC missed Madoff, they will miss this.

refer it to a state level agency.�

Apr 8, 2013

luvb2b updating with open interest today from the suspicious volume options friday. as usual, you can see all the open interests stayed the same or declined from friday to today. the april 33 calls are especially interesting to note, because the open interest starting out was just 76 contracts. with 5 blocks of 100 trading, if there were any offsetting trades you would still expect open interest of 176 contracts or more. with no change, obviously all of the 500 contracts had to be exercised.

followed up calling some desks today, and confirmed that psx is actually the philadelphia stock exchange (i thought maybe it was the pacific which is nyse/arca). if the guy holds true to his pattern he should be back at it tomorrow. that's exactly 1 week from his april 2nd activity.

here are the suspicious trades from april 5, 2013. once again, all of them were on the psx. look at the times. so close together you know it's the same guy. just spreading across different strikes to hide his footprint.

apr 33 calls qty 500: [email�protected] [email�protected] / [email�protected] / [email�protected] / [email�protected] times 12:46-12:47p est, 1:38-1:39p est

apr 34 calls qty 400: [email�protected] / 100 @7.20 / [email�protected] / [email�protected] times 12:47-12:48p est, 1:39p est

apr 35 calls qty 640: 160@6.20 / 160@6.20 / 160@6.20 / 160@6.20 times 12:47-12:48p est, 1:40-1:41p est

apr 37 calls qty 2000: 500@4.20 / 500@4.20 / 500@4.20 / 500@4.20 times 12:48p est, 1:40p est

jun 31 calls qty 200: 50@10.20 / 50@10.20 / 50@10.20 / 50@10.20 12:49a est, 1:42p est

that represents almost 374,000 shares on a day where the day's volume is just 1.6 million. almost 25% of the daily share volume. pretty big again.

here's the open interest on april 5 and how it changed to april 8 (the next trading day)

apr 33 calls oi 76 -> 76

apr 34 calls oi 78 -> 78

apr 35 calls oi 159 -> 157

apr 37 calls oi 513 -> 342

jun 31 calls oi 43 -> 43

here are the suspicious trades from yesterday april 3, 2013. all of them were on the psx.

jun 32 calls qty 1400: 350@9.30 / 350@9.30 / 350@9.20 / 350@9.20 times 10:25-10:26a est, 10:59a est

jun 33 calls qty 1400: 350@8.30 / 350@8.30 / 350@8.20 / 350@8.20 times 10:26-10:30a est, 10:59-11:00a est

here's the open interest yesterday with --> indicating the open interest today.

jun 32 calls oi 341 --> 341 today

jun 33 calls oi 380 --> 380 today

here are the suspicious trades from yesterday april 2, 2013. all of them were on the psx. i threw out the june 35 calls as the exchange confirmed it's a bad print.

apr 35 calls qty 2000: 500@8.90 / 250@8.90 / 250@8.90 / 500@9 / 500@9 - times 10:45-10:51a est

apr 36 calls qty 2400: 600@7.90 / 300@7.90 / 300@7.90 / 600@8 / 600@8 - times 10:45-10:50a est

apr 37 calls qty 2800: 350@6.70 / 350@6.70 / 700@6.70 / 700@7 / 700@7 - times 10:46-10:50a est

apr 38 calls qty 6200: 1550@5.70 / 1550@5.70 / 3100@5.70 - times 10:50-10:51a est.

apr 39 calls qty 3000: 750@4.90 / 750@4.90 / 1500@4.90 - times 10:51a est

jun 25 calls qty 2200: 275@18.90 / 275@18.90 / 550@18.90 / 550@18.90 - times 10:54a est

jun 33 calls qty 1200: 600@10.90 / 300@10.90 / 300@10.90 - times 9:57-9:58a est

total contracts: 19,800 representing 1.98 million shares of tesla valued at around $90 million.

here's the open interest yesterday with --> indicating the open interest today.

apr 35 calls oi 478 --> 169 today

apr 36 calls oi 599 --> 245 today

apr 37 calls oi 728 --> 419 today

apr 38 calls oi 3147 --> 1497 today

apr 39 calls oi 1538 --> 1376 today

jun 25 calls oi 543 --> 542 today

jun 33 calls oi 574 --> 380 today[/QUOTE]�

Apr 8, 2013

Zzzz... 1) The guy sells deep in the money calls at a discount to intrinsic value to MM.

2) Market maker shorts Tesla shares to get money.

3) MM exercise calls right away with intention to cover MM's short position when MM get shares back.

4) MM had to wait 3 days caring short position over those days.

Next thing I'm not sure what happens. You say: "so a couple days later, he has to buy back the shares and repeat the options trade. the shares he naked shorted would probably show up on the fails-to-deliver data, but since he covers them they won't do a buy in".

So 5) would be guy buying back shares on open market to cover calls he sold to MM? Right?

Then why you say that it would show up in fails-to-deliver data? Have he delivered shares? Have he covered calls he sold? I mean if yes, he effectively shorted position for 3 days and then had to buy them on open market to cover. Or I'm missing something?

And how come you claiming that this scheme somehow is the way to avoid paying short interest? I mean for MM to buy those calls discount to intrinsic value of calls had to be bigger then short interest MM had to pay to carry on short position, right? Or MM would loose money on transaction. So this short in my understanding still paying short interest, but he do it in weird way...

Disclaimer: I do not personally touch option trading, but genuinely interested in how option market works. Excuse me if I misunderstood of whats going on.�

Apr 8, 2013

luvb2b i won't pretend that i know exactly how this works. i do know it's very fishy the way thousands of these contracts trade and then never show up in the open interest. i have a theory that i think fits. but who knows until someone really investigates right?

you almost got the first sequence right, although i think the sequence is like this:

1) rogue trader arranges to sell deep in the money calls at a discount to where MM can get short shares executed.

2) Market maker shorts Tesla shares and buys options from rogue trader. print is posted on phlx.

3) MM exercise calls right away, effectively covering MM's short position. note: mm can naked short as they are exempted from normal rules.

4) rogue trader enters the assignment pool for the respective options that night and is short the next morning without having to borrow shares.

yes that's correct, he would be buying back shares. but with algorithmic trading he could do this a pretty sneaky way. for example, with the shares he's planning on keeping naked short he could peg the options trade with the market maker relative to the volume weighted average price over a certain time range, and then simultaneously enter an order with a different broker to buy shares at the volume weighted average price over the same or very similar time range. the market maker would run a short at the vwap algorithm on their hedge shares, the other broker running a buy at vwap algorithm for the rogue's buy order. the two algorithms would be on opposite sides of the market, executing the order in small bits and pieces. his net fills on the two orders would be almost identical, he'd pay some commissions like 0.6c-1c per share or something, and no large prints of shares would ever hit the tape.

in the process, he would have covered his naked short, and then the next day he'd get assigned on the call options and it would start all over again.

i think so because of the timing of the trades. the first place i noticed this was in the june 25 calls. the volume spiked every week starting may 5th, with no corresponding increases in open interest. note march 5, 12, 19, 25, and april 2. i'm not an expert on brokerage back office but my understanding is it goes something like this:

tues march 5th (t-1): rogue goes short deep in the money options instead of stock

weds march 6th (t): rogue is assigned on the short calls and wake up short a bunch of tsla. and still hold some calls which didn't get assigned to rogue. rogue is required to deliver the shares on day t+3.

thur march 7th (t+1): nothing, hold short. rogue pretends to look for shares to deliver. haha.

fri march 8th (t+2): again nothing

sat/sun march 9th/10th is a weekend.... so conveniently rogue has avoided the short charges for fri-sun nights.

mon march 11th (t+3): rogue is supposed to deliver shares but doesn't. i think this is supposed to trigger a failure to deliver, and these shares then show up on the sec list. the firm holding the account may deliver what shares they have on customer's behalf.

tues march 12th (t+4): shares that couldn't get delivered have to be bought in on this day (i think). so this is the day he repeats the trade.

and lo and behold there's the volume again on tues march 12th. and tues mar 19th. i think he switched to monday the week of mar 25th because of a shorter good friday week. then it's back to work tues apr 2. the next scheduled date we should see him is tuesday april 9th. tomorrow!

if i got it right he should never be around on mondays because then he could get caught paying the fri-sun night short charges. of course i didn't see anything today that matches him.

the market maker has an exemption. he's allowed to naked short for the purpose of making markets.

my understanding is that short charges only apply after shares are delivered. so the rogue trader in my march 5th example above, even if the broker delivers some shares for him he won't start paying charges until march 11th when the shares are delivered. if he just shorted stock he'd start paying on march 8th. so this tactic buys him at least 3 days free. by repeating the strategy on the 12th, his worst case is that he pays for some shares for for 1 or 3 days (not sure which). compare to paying for all the shares for all 7 days of the week. it's a big savings, and perhaps it also gives him a chance to short when no shares are available.

i know my theory sounds a bit insane. but just consider if he had a 250,000 share short position it costs him almost $18000 per day at 65% borrowing rates to hold it. over a week that $126,000. over a month $500,000. just scale up for larger positions.

and i still can't find another explanation for why thousands upon thousands of deep-in-the-money calls keep trading on the philadelphia options exchange and never show up in open interest the next day.�

Apr 8, 2013

Zzzz... The very moment I read first quote, the scheme started to make sense. Basically MM carry short position for a guy, but MM do not have to pay short interest!

That sucks, and the system is screwed. (While I have not understood why the guy saving on short interest only for 3 days, not for whole week, but those are nuances).

WAG from the noob, may be cuz calls were actually "exercised", right away the day calls were sold and from the point of particular software they might simply not counted toward open interest. Could be a bug, or even technicality that depends on how you define OI.

It makes perfect sense. At least in my mind.�

Apr 8, 2013

Johan But either way, I mean even if this trader is using this scheme to in essence carry a short position without paying (or at least paying less) interest for it, he is still loosing money as the stock goes up? Or do you imply that by repeating this manouvre all the time he just continues to carry the same short position "for free" until he chooses to in essence close it?�

Apr 8, 2013

Zzzz... Yes, that is correct. He is loosing money if stock goes up, and making money if it goes down.

Short had to cover one loop of trade. Doesn't matter if he initiated next loop before or after(probably after) closing previous one. So he should be squeezed eventually. Or exit with a loss, unless stock go down.

IMO. But wait for luvb2b opinion �

�

Apr 8, 2013

Causalien What if the trader is just trading 100 lots of option 10 times per day really fast without actually holding any position overnight? It'd make sense as a Martingale strategy, the volume would show up high while the open interest would be zero since everything is exercised and covered the same day?�

Apr 8, 2013

kenliles I know this is all conjecture on possible theory- but why do you guys think the trader is rogue? The most likely in my mind is the trader is the MM, going short in guise of making market�

Apr 8, 2013

luvb2b correct that he loses money as it goes up.

what he avoids is two things. the first is paying the borrowing charges for borrowing real shares. in this sense, he carries the positon "for free". thats a huge savings recently.

the second, more important thing - he avoids borrowing, selling, and delivering real shares. in effect he is cheating the buyers who buy from him because they will not receive shares at settlement in exchange. that's what i think is happening, and that is naked shorting, which is now illegal. in a legitimate short sale, the short borrows real shares and essentially gives the long lender a collateralized iou. the buyer is buying real shares and expects delivery of real shares. this guy is short circuiting the whole process.

zzz is correct, if the stock keeps rising he will eventually give up and cover. as hard as this guy has been working on this i am sure he would be part of the recent propaganda war against tesla in the media.

- - - Updated - - -

generally the blocks that are put up are quite large. you can see from my lists of trades that 100 is actually on the small side. the problem with your theory is that generally the trades are at the same price (other than when they are seconds apart) so there is no economic gain or loss in the trades. also the trade sizes are large and being moved on the bid side of the spread all the time. so how do you sell and buy a huge position on the bid at the same price on big size hours apart? a virtual impossibility.

kenliles, i am using the term rogue to mean "thief", not rogue trader as in the sense of nick leeson.�

Apr 8, 2013

jeff_adams What's to stop this trader from staging a Tesla "crisis" to depress the stock so he can get out of his desperate position? That would be very concerning.�

Apr 8, 2013

Zzzz... Post deleted per request �

�

Apr 8, 2013

luvb2b my experience is that he will try something. it may have been that recent media blitz. it may be something else. if my research is correct he only has about a month left. that's the date for the next earnings release i expect to be better than most expect.

my experience is you want these desperate shorts in the stock. several awesome stock moves i have been involved in have had desperate shorts. in one stock they tried filing a lawsuit about some stupid thing. they had been buying puts for weeks ahead of that event. and guess what? that was the bottom. these games are just part of the stock market and probably have been since the beginning of stock markets.

when the desperate shorts finally get blown out of their position, a short term top will be close at hand.

all i really want is to force this guy to pay for the "priviliege" of being short.�

Apr 8, 2013

PureAmps Getting caught up on TMC, and came across this thread. Interesting theory, my only question is why go to all this trouble? What is the maximum return this trader could realize for this level of effort/risk?

I've actually never understood the large short interest in TSLA in general. It makes very little sense from an investment point of view as a standalone trade. The maximum return on a short position is 100% plus any rebate rate. And that is if the stock goes to zero. Given TSLA's negative rebate rate, there is very little to be made by holding a short position in the stock. Even trading in/out of a short position would give negligible returns and require incredible luck on timing. Adding options to the mix and playing with T+3 settlement windows just adds a huge amount of risk. So what is the reward?�

Apr 8, 2013

MikeL Safe to say a lot of people figured that TSLA WOULD go to zero. One of the most shorted stocks ever! So the risk seemed small even if the return on the downside is limited (can't go below 0). If luvb2b is right, this guy got in big short over the course of weeks & months and is now in trouble to the tune of several tens of $millions and is illegally maintaining his desperate situation as the price refuses to drop.�

Apr 8, 2013

kenliles Got it thanks. Makes more sense�

Apr 8, 2013

PureAmps Oh, I don't doubt that some people had an investment thesis that TSLA would go to zero. The only problem is that reality is getting in the way of that theory, and has been for some time. Yet short interest remains high. Tomorrow Nasdaq will release the latest short interest stats through end of March, we'll see if there is any material change. The more interesting stats won't be released until 4/24 which will include data through mid-April including the 4/1 "gap open" which may have involved some short covering. Not sure why they can't report this daily...�

Apr 8, 2013

MikeL I see. My response was my general theory about this one individual, luvb2b's suspect. Other than pure gambling, I don't get the short interest either, but then I'm not really much of an investor (in stock(s)) or a gambler. I just want to own a piece of Tesla, oh, and a Model X!�

Apr 9, 2013

Nicu.Mihalache There is some kind of daily info about shorting here

April 2013 Reg SHO Daily Files

But it's not about the short interest, just the short activity during the day. And only on two exchanges, so lots of transactions are not included. I have even charted that data at some time, but could not detect clear patterns (if anyone is interested, I can collect data automatically for long periods of time). Usually the short activity is 33-50% of the transactions.�

Apr 9, 2013

Norbert Is "short volume" the number of new shorts in that day, or new-shorts + covered-shorts ?

(I guess new-shorts minus covered-shorts would be interesting, being negative when more cover than are new, but that's probably not what that number means.)�

Apr 9, 2013

Nicu.Mihalache No, it's total short activity - it's never negative. That's why it is not so interesting, you could not add it up in any way to guess the present short interest.�

Apr 9, 2013

luvb2b today is tuesday. more of these trades happen on tuedays vs any other day.

as usual i will look for the volume in deep in the money trikes around mid day.�

Apr 9, 2013

luvb2b He's Back. He's Bad. And He's BIG.

i have been informed that now there is an investigation ongoing on these trades. meanwhile this morning's selloff appears to be largely this crooked trader.

note the prints so far. total volume in tesla is only 563,000 shares, which means virtually the entire day's selling is accounted for by these suspicious options trades. as usual all trades going off on the psx. note the open interest (oi), which is too small for it to be closing of positions.

apr 33 calls qty 200: [email�protected] / [email�protected] - times 10:15 est oi 76

apr 34 calls qty 200: [email�protected] / [email�protected] - times 10:15 est oi 76

apr 35 calls qty 310: [email�protected] / [email�protected] - times 10:15 est oi 154

apr 36 calls qty 250: [email�protected] / [email�protected] - times 10:16 est oi 112

apr 37 calls qty 700: [email�protected] / [email�protected] - times 10:17 est oi 341

may 35 calls qty 1100: [email�protected] / [email�protected] - times 10:17 est oi 529

may 33 calls qty 250: [email�protected] / [email�protected] - times 10:17 est oi 117

jun 25 calls qty 1100: [email�protected] / [email�protected] - times 10:18 est oi 1100

jun 32 calls qty 700: [email�protected] / [email�protected] - times 10:18 est oi 341

jun 33 calls qty 700: [email�protected] / [email�protected] - times 10:19 est oi 333

total volume thus far in these options is 5,510 contracts, which is more than 90% of today's volume.

this guy is having significant market impact.

�

Apr 9, 2013

Johan Yes at times down 2.5%. That's real impact.�

Apr 9, 2013

Curt Renz Are those times correct? That's a quarter hour before the stock markets open for regular trading.�

Apr 9, 2013

luvb2b oops thanks! wrong time zone. anyway if you have any options software it's easy to see the prints, or you can see last trades on nasdaq.com. just look in the section for the philadelphia options exchange (pho):

http://www.nasdaq.com/aspxcontent/options2.aspx?symbol=TSLA&selected=TSLA&qm_page=24644&qm_symbol=TSLA#.UWQtrJMQba4�

Apr 9, 2013

Curt Renz Actually, they may be correct since EST is the same as CDT.

- - - Updated - - -

I see you changed the times to EST. Did you mean EDT?�

Apr 9, 2013

luvb2b omg. lol. ok all of those posts are new york time. how about that? maybe i should change all the est to et.�

Apr 9, 2013

Curt Renz Despite the need for time zone tweaking, I very much appreciate your information. What makes you think that there is an investigation?�

Apr 9, 2013

Zzzz... Could someone approach SEC?

Or at least Elon? I mean Elon have lots of lawyers and connections and financially very interest in resolving this situation? Just simple lawsuit at market maker would stop this scam...

He is basically making market maker to do naked shorts because he found a loophole in the system...�

Apr 9, 2013

luvb2b i had contacted them already. i spoke to someone, but kinda get the feeling they would move slowly if at all.

an inquiry i sent off the other day got a reply from a real person indicating something to that effect. i let that person know that the guy was basically in process doing his thing today. hopefully they can put a stop to it.

by my calculations he did almost 2 million shares worth a week ago. so unless he's covered 1.5 million shares since then, he would still have about 1.5 million shares worth of this stuff left to do today if he's trying to hold on to that whole position. i guess we'll see if other prints get thrown up today or tomorrow.�

Apr 9, 2013

Zzzz... Ok, I understand. But the sooner situation gets resolved - the better for all.

Elon have tons of financial advisers, market experts and lawyers. And connections. I could personally try to draw his attention to the situation. This is true that this scheme is a quite complex one, but I think I could try to explain him basics and point to the facts/findings posted here by luvb2b. Would be up to him to decide what could be done and what is in the best interest of Tesla.

If someone think this is a good idea and know Elon's Tesla email - please PM me. Or may be luvb2b...

luvb2b: the second quote in your post do not belong to me..�

Apr 9, 2013

luvb2b wow he's moving the whole position from last week, or that's what it seems.

note the prints so far. more than the entire day's selling is accounted for by these suspicious options trades. as usual all trades going off on the psx. note the open interest (oi), which is too small for it to be closing of positions.

apr 33 calls qty 600: [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:15, 11:29 et oi 76

apr 34 calls qty 600: [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:15, 11:29 et oi 76

apr 35 calls qty 950: [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:15, 11:29-11:30 et oi 154

apr 36 calls qty 730: [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:16, 11:30 et oi 112

apr 37 calls qty 2100: [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:17, 11:31 et oi 341

may 33 calls qty 730: [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:17, 11:34 et est oi 117

may 35 calls qty 3300: [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:17, 11:35 et oi 529

jun 25 calls qty 3300: [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:18, 11:35-11:36 et oi 540

jun 32 calls qty 2100: [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:18, 11:39 et oi 341

jun 33 calls qty 2100: [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:19, 11:39 et oi 333

total volume thus far in these options is 16,510 contracts representing 1.65 million shares. tesla's only traded 880,000 shares today. so i have no idea what's going on.

i'd say these are spreads, but as i mentioned the open interest never changes and there is no closing of a position going on. what economic benefit would there be in a spread where both sides immediately exercise?

as i said before, this guy is having significant market impact. you can really see it in the tesla call volume, which is now over 20,000 contracts.

�

Apr 9, 2013

Johan The benefit could be he/they manipulate the stock price for short term ups/downs where someone else acts accordingly with real stock, going in and out of short term either long or short positions according to how they know the price will swing as a result of these trades?�

Apr 9, 2013

Causalien Another part I do not get.

Which rich trader manages to have this amount of capital and be this sophisticated in options yet has no notion of routing his trades through different exchanges? Either it is a hft, or it can only be done in that exchange.�

Apr 9, 2013

DonPedro Note that the trades you report started at 10.15am. By that time, the stock price was already down by about $1. At the time I write this, the stock price is about the same level as when these trades were executed. So the trades cannot be the reason for the $1 drop (but they could be responsible for preventing a rebound).�

Apr 9, 2013

luvb2b i'm pretty sure these trades aren't actually going through the trading floor. the executions are being done off the floor and then the prints get reported through the philly exchange. i'm assuming they use philly because there is no per contract charge for customer trades there. see:

http://www.interactivebrokers.com/en/accounts/fees/PHLXoptfee.php

- - - Updated - - -

the typical way these trades are done is the market maker puts on the hedge position and then reports the block on the tape. i think the selling you saw all morning is the hedge being put in place, and then the blocks are reported after the market maker is comfortable with his hedge.

could you imagine if it happened the other way? if the options trade was reported on the tape and the market maker didn't complete his hedge? he'd be forced to compete with everyone else who would be trying to front run his hedge trades.

for those who can't see the prints, you can see the volumes clearly on nasdaq.com page for tsla options:

http://www.nasdaq.com/aspxcontent/options2.aspx?symbol=TSLA&selected=TSLA&qm_page=13682&qm_symbol=TSLA#.UWRBzpMQba4

�

�

Apr 9, 2013

DonPedro @luvb2b: Agreed. So we don't know, and it could very well be this guy driving the price down. In that case is offering people taking long positions a lower entry price than they would otherwise had access too. �

�

Apr 9, 2013

vgrinshpun You are absolutely right ... Just increased my position today (apparently did not bought enough shares to counter this guy...)

�

Apr 9, 2013

avatar Man - this sucks. Feels like we should tweet this thread to Elon or someone at the SEC....�

Apr 9, 2013

DonPedro I did too, at 40.73.�

Apr 9, 2013

Teslawisher I also submitted a note to SEC. Plus, with how much Tesla monitors this board, my guess is that merely due to the thread title, they know about this.�

Apr 9, 2013

luvb2b as much as this sucks short term, it will suck even more later if elon and the management team take their eye of the ball and turn their attention to something like this.

as i mentioned earlier, i know these trades are in the process of being reviewed by a regulator. if there's something amiss, hopefully the regulators are going to put an end to it very quickly.

haha as i wrote that i realized i used regulators and quickly in the same sentence.�

Apr 9, 2013

avatar I reluctantly agree. I hope the "tsunami" of pain Elon promised shorts is coming in May.�

Apr 9, 2013

DonPedro Based on luvb2b's figures on shorting costs, it seems that many shorts have covered now. Obviously most have covered with substantial losses (double-digit percentages). The holdouts are mostly way out of the money. The winners: Longs who have taken profits at the 40-45 levels.

I don't know if this counts as a "tsunami", but the shorts are certainly already in pain.�

Apr 9, 2013

luvb2b i'm trying to figure out where he is rolling out of his short from last week. according to the trades i noted tuesday last week, he did 2 million shares this way.

now today in the options he did at least 1.5+ million shares more. once those calls are exercised he'll be short 1.5+ million shares.

but now the question remains, what will happen to those 2 million short shares from last week? did he locate, borrow, and deliver those shares? in that case that's not a naked short.

if he didn't deliver the shares, then he should have to buy them back in. there hasn't been enough volume today to accomplish that. not even close. it wouldn't make sense to have been buying them in yesterday and then sell them today at a lower price.

the only other thing i can think is maybe the rogue trader bought some calls to open and sold some other deep in the money calls to open. if the trader exercises the buy-to-open side to cover his short and the sell-to-open side is exercised by the market maker to create a new short, then the trader wouldn't have to cover in the open market. however in that case you'd have very little market impact because the market maker would be doing 2 sides of a spread.

so wtf is going on around here.�

Apr 9, 2013

luvb2b words escape me now. i haven't seen anything quite like this before. the volumes in the deep in the money calls expanded again at the end of the day. the pattern was a little bit different in that the prints when posted were on the ask side of the spread. i don't know if they were executed on the bid and then posted late, or something else. for the first time i'm seeing odd sized prints - how about that 666 print in the jun 33 calls?

size is just breathtaking. volume of deep in the money calls traded on the philly represent 2.22 million shares, nearly 50% above tesla's day volume of 1.7 million.

apr 33 calls qty 752: [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:15, 11:29, 3:47 et oi 76

apr 34 calls qty 752: [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:15, 11:29 et oi 76

apr 35 calls qty 1258: [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:15, 11:29-11:30, 2:48 et oi 154

apr 36 calls qty 986: [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:16, 11:30, 2:48 et oi 112

apr 37 calls qty 2100: [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:17, 11:31 et oi 341

may 33 calls qty 964: [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:17, 11:34, 2:50 et est oi 117

may 35 calls qty 3300: [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:17, 11:35 et oi 529

jun 25 calls qty 6596: [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:18, 11:35-11:36, 2:50 et oi 540

jun 32 calls qty 2782: [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:18, 11:39, 2:52 et oi 341

jun 33 calls qty 2766: [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] / [email�protected] - times 10:19, 11:39, 2:52 et oi 333

total volume is 22,256 contracts, representing over 2.2 million shares.

�

Apr 9, 2013

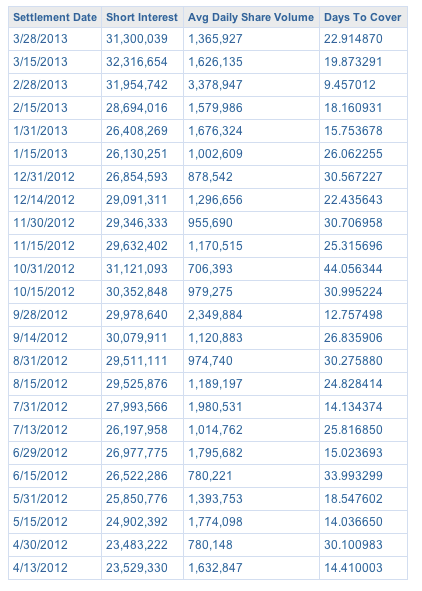

PureAmps FWIW, TSLA's latest short interest data is now available: Tesla Motors, Inc. (TSLA) Short Interest - NASDAQ.com

No material change in short interest in the month of March. We'll have to wait for the April data to see if there was any substantial covering recently.

�

�

Apr 9, 2013

jeff_adams Did you happen to check SolarCity's stock? Does it have similar activity?�

Apr 9, 2013

jed-99aggie I have attempted to comprehend this thread after re-reading it, I am only assured that I know practically nothing about options trading. So after tracking along with this topic for a few days, I do have one question that I was wondering could pose as a possible/partial explanation.

In this separate thread, it speaks of some brokerage firms providing their investors (long) with a share borrow model. Is it possible that these shares, available to borrow, could constitute an available pool of shares that these "rolling" option contracts are being traded against?

Willing to let someone borrow your Tesla shares?

Given that it appears that each stock holder is contacted directly by their brokerage house, how are these borrowed shared registered?

@luvb2b - thanks for your insight on this and for bringing this thread forward for our further understanding.�

Apr 9, 2013

luvb2b in the category of a picture is worth a thousand words:

�

�

Apr 9, 2013

vgrinshpun Looks like full scale last ditch attack on Tesla - see post below copied from the Tesla Motors Enthusiasts Forum:

larno | April 9, 2013 cfr DonS & scaesare

So are we to conclude that there is no more backlog for the US (all reservations that have finalized have been/are being produced)?

That might certainly explain the announcement of the 'financing product' (aka the leasing) for the Model S. It would then also imply that demand for the Model S in the US has stagnated, or even dropped.

I would expect the sales to follow a typical 'hype cycle', but more in the form of the video game hype cycle, avoiding the 'Trough of Disillusionment'

�

�

Apr 9, 2013

luvb2b don't follow solarcity, but in 20+ years i've never seen anything so difficult to understand in the options world.

- - - Updated - - -

but then why bother with the options? just borrow those shares and short them. no need for an extra step. and of course if he borrows the shares he pays the borrowing costs, which are horrible.

today's activity doesn't fit well with any of my explanations. i am pretty well lost too now. i called a friend who had been an options market maker for a while, and even he had no idea.�

Apr 9, 2013

kenliles jeff- I don't Option SCTY - but do have some stock, so I follow it and check the Options from time to time;

Answer to your ? is No- nothing even close to this kind of thing happening there; Trade volumes are well below Open Interest with rare exceptions;

Bid-Ask pretty wide but normal for low volume Option listing like SCTY or TSLA (as opposed to an APPL for example);

I see no sign of any correlation over there�

Apr 9, 2013

Zzzz... Ok, if someone "big guy" sells 20,000 calls(2M shares) to market maker. Obviously not an individual investor but someone who have direct access to floor...

Market maker hedges by selling naked shorts and exercise calls right away.

3 days passed. No shares delivered.

One or two more days passed. Shares show up(as we saw) in failed to deliver data. By law MM is about to have to take actions or whatever(please collaborate) against party that sold him calls.

But "big guy" not interested in delivering shares. Next thing - big guy sells new 20,000 calls to MM again! Market maker "transfer" short position he has hedged previous calls with to new contracts. And MM quietly marks previous calls as delivered. MM exercise new calls.

Repeat loop.

1) This way "big guy" had to sell new calls every week. Explains huge volume of option trading we see each week.

2) "Big guy" do not need to buy shares on open market. Explains low day trading volume.

3) Market maker technically protected. At any time MM got call contracts that are exercised and is waiting for delivery of shares. Also MM position is hedged.

A perfect rolling naked short without need to pay "TSLA Cost to Borrow", except to sell calls to MM at discount to intrinsic value of a stock... And sure "big guy" will need to have a buddy on MM side, but all MM's accounts are holding correct sums, all positions are hedged and all contracts are in place...

luvb2b, what do you think?

- - - Updated - - -

And btw, it explains another inconsistency.

Trades were done on March 5th, March 12th, March 19th, March 25th, and April 2nd.

Four out of five of those days TSLA were up. So no huge positions were shorted on those days...�

Apr 10, 2013

DonPedro Whoever is doing this must be quite hell-bent on it, and would have to follow the stock very closely. If so, the idea of that person not reading this forum is rather absurd. So: Would you keep doing the same thing if someone were on to you? Or would you change your MO (either to be able to keep your short position, or to obfuscate your trading pattern and create some sort of plausible story for what you have done)?�

Apr 10, 2013

Johan +1. Not implausible. Luvb2b also mentioned word of an ongoing/iminent investigation. Surely the person doing this, in collusion with the Market Maker, knows of this as well.�

Apr 10, 2013

CapitalistOppressor I've spoken to folks with both large and small short positions. They all read TMC forums and it would be the opposite of shocking if this guy is paying attention to this thread.

Frankly, all of the smart money has research staff monitoring TMC, or else they are failing the essential test of smartness and should not be considered as such.�

Apr 10, 2013

luvb2b the problem now is that he's become so big that he would cause tesla to show up on the reg sho threshhold list. which it has not.

2 million shares is more than 2% of the float. even a quarter of these shares being fails-to-deliver would put him on the reg sho list, which only requires a 0.5% fail-to-deliver rate.

i thought about this sort of thing too. except several problems - first, i have watched these trades go off and they usually go off after the stock is down a bit. it does look like the market maker is hedging out at least part of this beforehand. second, if it's two unrelated parties, i think the share volume has to show up as a trade. even if the trade is done in a dark pool i think it has to be reported on the consolidated tape somewhere, and therefore get counted into volume. we're not seeing big enough block trades on these days to account for this guy.

i suppose one possibility is that the trader is somehow affiliated with the market maker, so positions might be transferred internally without trade reporting? and then maybe they don't report the shares failed to deliver? but this makes no sense either, because the options get exercised against each other and offset the trade internally. so why even bother to put that on an exchange, just do it as an internal accounting entry.

i understand your explanation. i was thinking that way as mentioned above, but can't quite make it work.

as far as no big shorts on those days, that's not necessarily true. shorts sell into a rally quite often, and generally when i watched those trades go off it was towards the lows of the day. for example the stock would go up, and then reverse as if someone was selling into it, and then the prints would show up.

i dunno man. hoping that one of the regulators will get back to me with an explanation.

they said they are looking into it, but historically the philly has been the dirtiest exchange out there. they were cited in the past for not having adequate policing.

http://www.sec.gov/news/press/2006/2006-84.htm

- - - Updated - - -

right, and some of the patterns have changed in the last week. some of the blocks are smaller. they are spreading across more strikes. the time of day has gotten later on some of the prints.

but no matter what they do, it's hard to hide this stuff. they have to go into deep in the money strikes where the time premium is near zero. otherwise they'll start putting up big prints well outside of where the options are trading and it will definitely arouse more suspicion. so as a daily check one just has to run through the first few expirations with strikes that are a few dollars or more in the money.

the jun 25 calls are the most glaring. once a week this trade gets done in good size with no increase in open interest. he can try to move to the jun 32/33s as he has, but that doesn't really hide him much.

all you have to do is look to the deep in the money strikes. look for prints that are near zero or negative intrinsic value (i.e. zero time premium), and then check open interest one day to the next. if the open interest doesn't change with big volume in the contract, then where are all those traded options contracts going?

- - - Updated - - -

so let me clear the wording. i know the trades are being reviewed and investigated. but that doesn't mean there's a formal investigation ongoing. i hope you understand the subtle difference.

i don't know why it would take them more than a day or two to review this stuff. especially with the huge volume that went off yesterday. but the regulators move real slow. so who knows.�

Apr 10, 2013

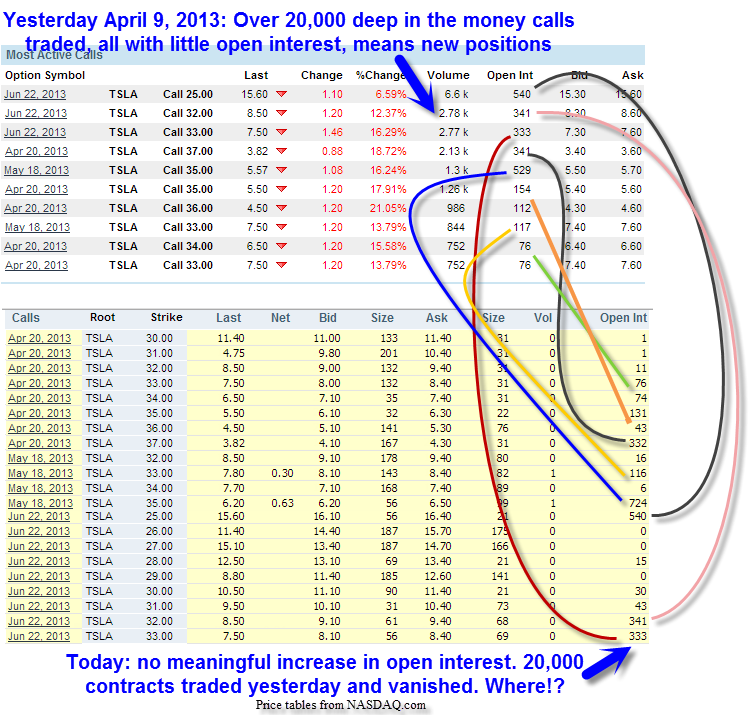

luvb2b Updated Open Interest

updating open interest from yesterday - no changes as usual. 20,000 deep in the money calls trade on one exchange. open interest changes by a total of less than 200 contracts in those series. wtf. the picture below shows the most actives table from yesterday and then matches to the open interest off today's quote board. price tables are copied/pasted from nasdaq.com.

stock sure has an easier time going up when there aren't two million phantom shares being sold into it.

�

�

Apr 10, 2013

kenliles well he/it certainly isn't happy with price action today�

Apr 10, 2013

GenIIIBuyer Due to time value of options, it's very rare to have options exercised before expiration. Even so, if 333 contracts are open. Then 2,000 are traded and exercised. Every person short that contract should have a 2,000/2,333 chance of getting exercised.

Anyone short these calls getting assigned early?�

Apr 10, 2013

Citizen-T luvb2b,

Thanks for your diligence on this. I made a big bet yesterday buying calls based on your thesis. I assumed that the 3% decline was largely due to this the "phantom shares" as you called them and that buyers would come in to pick up the pieces today. Worked out nicely as you can see.�

Apr 10, 2013

Lloyd On the other side, buying calls and selling short is very expensive. I don�t get it. Short term naked short that doesn�t pay to borrow? Goofy�

Apr 10, 2013

DonPedro The moral of the story is: Sell Monday afternoon, buy Tuesday afternoon.�

Apr 10, 2013

Causalien So, what happens to the other side of the trade. The one who "buys" the shares that this particular guy naked shorted? Wouldn't that person be able to then turn around and lend it out at 80% interest for nothing?�

Apr 10, 2013

luvb2b if it's a naked short then the person who bought the shares never would get delivery. and therefore he could not lend out his shares.�

Apr 10, 2013

luvb2b An Alternate Explanation

i had made a few calls about this trade, and today one of my buddies called me back with a plausible explanation.

several other observations are important at this point:

1. the trades are always happening in deep in the money options that have some open interest.

2. i was wrong about how settlement works with the options exercise. if i am long a call and i exercise today, it's just like i bought the stock today. the shares will settle t+3. meaning with trades done on tuesday the shares will settle on friday: tues= t+0, weds = t+1, thur = t+2, fri = t+3.

3. my brokers are telling me a lot of these prints are getting posted as spread trades.

ok, so here's the alternate theory.

there's a guy larry. he's short a lot of tesla. the short charges are killing him, but he knows this is a good trade and wants to hang on.

larry's buddy moe is short too. and he's feeling the pinch of the short charges as well.

and oh this third guy curly. curly luvs tesla and he's playing long by owning the may 35 and june 25 calls, which he bought from a market maker named shemp. for the sake of argument, we'll say curly is long the entire open interest of 500 contracts in both the may 35 and june 25 calls and the market maker is short the entire open interest of 500 calls of may 35's and june 25's.

larry and moe are tired of curly yukking it up, so they hatch a plan. they're going to trade with each other in the may 35 and june 25 calls. they agree to exercise the contracts immediately, and to price the contracts at parity with each other on the trades. since the options trade at zero intrinsic value, it's going to be easy. on tuesday with tesla trading at $41, larry sells the may 35 / june 25 spread to moe, 3000 contracts a side, and at a $10 credit. after the trade, their positions look like this:

larry's positions:

long 3000 june 25s

short 3000 may 35s

short 500,000 tesla (for example)

moe's positions:

short 3000 june 25s

long 3000 may 35s

short 600,000 tesla (for example)

now larry and moe both exercise the long side of their calls. since the total open interest for the options counting all the 3 stooges is 3500 contracts, they each will get assigned on (3000/3500) x 3000 = 2,571 of their short call options. that will leave each short 429 calls, larry short the may 35s and moe short the june 25s. each will also end up having bought net 42,900 tesla, but since the shares come from an options exercise they will never hit the tape.

the next day, their positions look like this:

larry:

short 429 may 35s

short 457,100 tesla

moe:

short 429 june 25s

short 557,100 tesla