Nov 22, 2012

rorystewart Me: Want to own this car but feel my annual income might be too low. I could technically afford it and still live my same life (albeit with far less $ going to savings), but I'm concerned about being judged by co-workers and peers as someone who spent more money on a car than he should at his income level.

Subjective question for you: Assuming someone has no money saved, and is financing the entire car (Performance), what is the minimum annual salary that person should have in your opinion?�

Nov 22, 2012

Discoducky With all other thing being equal, its still a hugely loaded question, but ill bite: 60K

Since its about half the total financed cost�

Nov 22, 2012

jerry33 That depends on how you finance it. Basically you do not want to be in a position where if something bad happens (RIF) you lose your car and/or house (assuming you're not renting). There is a thread here.�

Nov 22, 2012

napabill "what is the minimum annual salary"

$0. But, of course, I'm retired!�

Nov 22, 2012

rorystewart Thx for sharing!

Funny. I always thought that it was the opposite. Like your car should at least never be worth more than half of your annual salary. Thus 180K would be the bare minimum acceptable salary. As I think back about it, I cannot remember where I got that idea in my head though. This is one of the reasons I posted this thread. I am curious what the average opinion is on the matter.�

Nov 22, 2012

Velo1 There are too many variables to answer specifically, such as current debt load, number of kids still on the payroll, etc., but 60k sounded a bit low to me. I'd say something closer to 75k.

Toward co-workers or peers, just tell them you got huge tax credits, and there is the offset in annual expense for gas relative to your old car, minimal upkeep, etc. You know, just answer like a politician and use fuzzy math.

Whatever you do, run the financial numbers and make an objective decision. Good luck�

Nov 22, 2012

rlawson4 I would say at least 3X the price of the car. Of course other spending matters as well. Just an opinion�

Nov 22, 2012

dsm363 I can't really give a number but feel that if you are financing the entire cost of the car because you have to that's entirely different than if you are financing the entire cost of the car because the rates are so low it works out better for you. A financial advisor who is familiar with your exact financial situation could provide better advice too.�

Nov 22, 2012

Zythryn If financing, I don't see why you would upgrade to performance with all the options. Especially if concerned what others would think.

It also depends a lot on why you are buying it.

If you are buying it to stop damaging the next generation (either on environmental, financial, or national security) or to try to prevent deaths of soldiers being put in harms way, AND are not afraid to tell people, then I don't think there is any reason not to buy it.

As a matter of fact, if you can swing it, many would say it is your patriotic/moral duty to do so.�

Nov 22, 2012

bosgig Totally depends on your view towards financial margin of safety and your other debt and/or goals. Do you have a mortgage? Other debt payments? Risk to your job? Etc. So only you can answer this question. My advice: if you finance the entire thing, let's just call it $95,000 for lack of a better number (especially since the tax credit comes later) on a 5 year loan at 4%, you're looking at $1750/month. That's $21k/year. No way I'd do that on under $100k pretax. But that's me with my biases and preferences. Let's say you want your payment to be under 20% of your take home pay--I didn't work out the exact effective tax rate and I don't know your deductions, etc., but I'm guessing that's closer to $135k in pretax income. Personally I'd want the payment to be a lower percentage than that, but that's just an example. Just my two cents--again, depends on your comfort level with debt, job security, etc. Totally your call, as you know. I wouldn't worry about your co-workers. Just tell them you bought the stock the day of the IPO and have made some good dough off of it!�

Nov 22, 2012

Kevin Harney Of course YMMV but general rule of thumb is that your car payment should not be more than 25% of your take home pay.�

Nov 22, 2012

mknox Since a lot of US oil is produced domestically, and the largest source of oil imports is from Canada, I hope those US soldiers aren't planning an incursion into Canada. Seriously, I never subscribed to the theory that these wars are all about oil, and I think it trivializes the work that the US military takes on to ensure the security and freedoms that we enjoy. As an American (living in Canada), especially on this day, I am thankful and grateful for the sacrifices these brave men and women make on our behalf.�

Nov 22, 2012

Zythryn Please don't get me wrong. I in no way think that all wars we fight are strictly for oil. But I do believe some of our soldiers and citizens are put in harms way to protect and keep calm oil producing regions.

Why do we have the Navy stationed in the straights of Hormuz?

Why do you think we invaded Iran when the annexed a little tiny country which just happens to produce a huge amount of oil?

Are, maybe to 100% for oil, but even partly due to oil is too much expense in money and lives.

As for our trade deficit, I would rather, if we are going to loose money, that it go to Canada. But I would far rather have a healthy trade balance where we didn't have a deficit�

Nov 22, 2012

Zextraterrestrial Well, my highest pay(family) is/ will be this year, and very close to the price of my model S, if not a little less due to the P and all (damn u Tesla)

edit: war is stupid period�

Nov 22, 2012

CapitalistOppressor Lol.. maybe it's his patriotic duty to buy the 60kWh or 85kWh. But the Performance model? It is *definitely* the only choice for a true red blooded American..

- - - Updated - - -

In response to what income is required to purchase a Performance model? With sound household finances a lot of folks even making $50-60k could make the payments.

That said, I think it would be a horrible decision to make. When you buy an expensive car you are also buying expensive liability. That means, higher insurance costs and potentially devastating insurance deductibles for every scratch, parking lot dent and cracked windshield (to say nothing of a devastating accident). The cost of new tires alone (which you will replace with breathtaking frequency) is shocking, even if you are making a six figure salary. Do you seriously want to get into a situation where you are driving around your $100k car, with bald tires, dings, scratches and registration that's 6 months out of date because of unanticipated costs being piled on top of the hefty financial strain of the monthly loan payments?

And I'm not even mentioning the risk of some horrible design flaw where the battery spontaneously, and explosively, combusts and leaves a smoking crater in your driveway, and you are left with having to fill in the hole yourself as a bankrupt Tesla gets liquidated. Even if we set aside the wingnut scenario's, there could be some recall that crushes Tesla and leaves you with nothing.

Plus, the money you spend on any car over basic econobox transportation is just a sunk cost. In the case of a $100k car, it will be worth something like $10-15k in 6-8 years. Unless you think you can drive it (and maintain it) for 30 years that's a huge amount of money that could have made a substantial impact on your retirement.

Basically, I think the old rule applies here. If you are wondering what the cost is, it's probably too much.�

Nov 22, 2012

Omer I think no savings might be a bigger issue than income. Unless you are in a position where you have personal attributes that allow you to feel secure with no savings (ie you are finishing up your engineering PHD from Stanford in a field that's causing a huge bidding war among all the Valley tech firms for your services), I personally wouldn't consider any Tesla at all. If the desire for a Tesla is for environmental reasons, a Leaf or Volt can be leased in your area with CA incentives for $200 - $350 / month.

Either way, living in SF, cost of living is significantly higher than other areas of the country which should also play a roll in your income/purchase equation.�

Nov 23, 2012

mknox There are so many factors beyond income, with cost of living being the biggest IMHO. I'm at a point in my life where the kids are through college, the mortgage is paid off, I have good retirement savings and pension plans in place, a second income propery and so forth. My salary is good, but probably not even close to what some on these forums make, but with my cost of living expenses so (relatively) low, buying a Model S is easily do-able.�

Nov 23, 2012

Johann Koeber I find it interesting to read this thread.

Money means a lot of different things to different people.

To me a car is not an asset, but a liability. It does not put money in my pocket, nor does it appreciate in value (ok maybe very log term, but for the moment).

It is a liability because it takes money out of my pocket.

So - I will not borrow to buy liabilities. I borrow ONLY to buy assets. More rules apply.

My three rules for buying cars (take this a little tongue-in-cheek)

1 never finance, save up first

2 never spend more than 6 months of your net income on a car

3 its perfectly ok to get a Model SP as long as you stick to rules 1 and 2

I have seen so many people get into financial difficulties because of too much spending - not worth it. Not for a motor vehicle - not even a tesla.�

Nov 23, 2012

PRJIM

While in principle I agree with this, it may make sense to finance in some circumstances. In the US it is possible to obtain financing for a vehicle at an interest rate of around 1%. It may make sense to finance at these low interest rates, as it is cheaper than using your own money.�

Nov 23, 2012

Kevin Harney I said 25% earlier but this article puts it at 10% to 15% for ALL of your total automotive expenses !! Yikes....�

Nov 23, 2012

kevincwelch But only if you are using your money and investing it in something that gives you a return on something higher than that 1%. Otherwise, you still are spending more money on something that will ultimately depreciate and lose you money. Whether you spend it up front or over five years, financing at 1% results in spending more money.

Of course, most Americans cannot outright purchase their cars and they do have to finance a portion of it. The Model S doesn't fit that bill, and unless you planned on buying a similarly priced gasoline vehicle, the Model S doesn't save you money in many cases.

Sent via Tapatalk.�

Nov 23, 2012

jerry33 The one thing that hasn't been mentioned in this thread yet is that you're not purchasing a $80,000 car, you're purchasing a $40-$50K car and pre-paying for fuel.�

Nov 23, 2012

Kevin Harney That fits in with your total auto costs being 10-15%. Less on gas and maintainence equals more on the car itself.�

Nov 23, 2012

kevincwelch Well...not for me. I spend only $1200 annually in gas. Even if I kept the car for 10 years - and I probably won't - that's only $12000 in gas. I can't imagine with the inflated cost of gas that I would even approach $40000 in gas.

At least over the next 4 years, the Model S certainly won't be cheaper to maintain - we've had that thread!

Maybe for others. ..

This purchase is for me: reduce dependency and promote alternative fuels. (And get something cutting edge.)

Sent via Tapatalk.�

Nov 23, 2012

dsm363 Me too. This car will never pay for itself, not even in 30 years but I got it for other reasons as well. Still a great car.�

Nov 23, 2012

stopcrazypp It's a loaded question because it depends on your other expenses (do you also have a mortgage, how much you spend on living expenses, your spending on recreation, etc.). Obviously the amount you spend on financing the car must be such that you have money left over after all your other expenses. But the suggested 10-15% to auto expenses seems to be a safe amount.

From bosgig's calculation for the $95k version of $1750/month or $21k/year that corresponds to $120k-210k per year. Basically you must be able to safely fit $21k/year extra in spending into your current budget.�

Nov 23, 2012

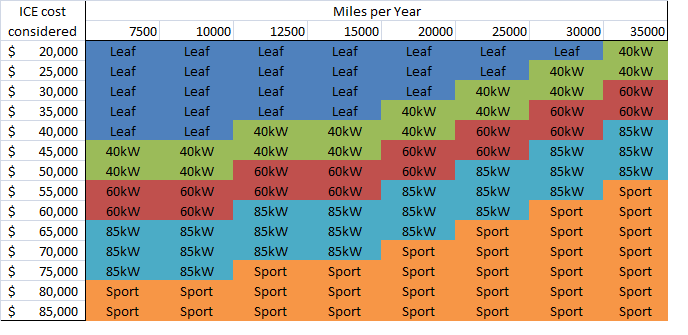

richkae I made this chart to illustrate a similar point.

It shows which EV would be the same or less monthly cost ( fuel + monthly payment ) as an ICE based on the ICE sticker price. Financing is assumed to be 4% for 5 years, and ICE fuel cost is $4 per gallon and 20mpg.

( Nobody would compare a Leaf to a 20mpg premium burning car , but the focus of this chart is the Model S, and thats a valid comparison for the S. Also note that the Model S cost considered is unoptioned and I have factored the $7500 credit into the price. )

The short answer: drive more!

�

�

Nov 23, 2012

jerry33 I've spent $6,475 over the last 143,000 miles in fuel (9 years and 1 month, $719.50/year) so the Model S won't be saving me any money either. Maintenance is equal to the Model S so that's a wash.

Supporting the technology and U.S. manufacturing, having something that's cool, not going to a gas station, and not going to the dealer for service are the drivers for me. Also driving will be fun again when you don't have to worry about fuel costs.

- - - Updated - - -

Are we talking Fisker here? �

�

Nov 23, 2012

richkae No, I was thinking other "premium" sedans.�

Nov 23, 2012

jerry33 I didn't realize there were other premium burning cars. �

�

Nov 23, 2012

richkae LOL.

"premium" both as in luxury - and premium burning - as in the gasoline that costs 30 to 40 cents per gallon more than regular.

But I guess the Fisker gets all 3.�

Nov 23, 2012

yobigd20 Geez. For me, it will definitely pay for itself. I was driving a Range Rover, averaging 19mpg, and I drive approximately 30000 miles a year. RR's require premium fuel, which is about $4/gallon. (probably be up over $5 next summer). By my calculations, 30000miles/19mpg=1578 gallons per year. At $4/gallon, that's $6315 a year I'll be saving (it's probably more than that actually, because my monthly credit card statement shows between $600-$700 at the gas station each month). If I keep the car 10 years that's $63k in fuel savings, lol. For me, the choice is a no-brainer. I'll never drive an ICE vehicle again.�

Nov 23, 2012

Omer You drive a RR averaging 19mpg 30,000 miles/year? Even before the Model S, there have been plenty of cars you could have purchased that would have been free due to the fuel savings.�

Nov 23, 2012

PRJIM The big elephant in the room is the possible battery replacement cost- due to diminished capacity. A good chunk of your pre-paid fuel costs may have to go towards this future cost.�

Nov 23, 2012

Sousaphil

I largely agree with your conservative approach to car buying, but not completely.

1) A car is an asset. Depreciating, for sure, but still an asset. It gets me to work where I generate my income. Furthermore, the Tesla brand halo helps the personal brand (I'm the guy at the office who has foresight now), so it's more than just transportation.

2) There's nothing wrong with financing a vehicle, especially with rates as low as we see now. If I had the cash to buy a Model S outright, I'd still finance a significant portion of it, because I feel like I can invest it and have a bigger return than the interest rate I'd be paying. Instead of sinking $100K into the car, I'd put $40 into the car and use $60 as a down payment on a rental property.

3) 6 months of income isn't a bad rule of thumb, but it doesn't take cost of living into account. If someone has a very inexpensive mortgage (or has their house paid off), they can afford much "more" car.

Those 3 quibbles aside, one definitely should do some "Worst case scenario" calculations to see what could reasonably happen to your monthly finances.�

Nov 23, 2012

dhrivnak I too subscribe to the belief that one should not spend more than 1/2 their salary in cars. I believe that is Dave Ramsey's rule. Dave Ramsey wrote the "Total Money Makeover" and had a daily radio talk show about finances. Because cars go down in value, yes even Teslas, it is not a good idea to borrow money to buy a depreciating asset. You come out ahead by saving up first. Of course there can be exceptions and with today's low interest rates financing part of the car can make sense but I would never consider 100% financing a depreciating asset.

I wanted a Tesla well before they ever went into production. But I knew I could not afford one. Then used ones came on the market and I could swing a lightly used one. It took some patience and delayed gratification, but also save me a lot of money.�

Nov 23, 2012

kevincwelch

+1 on this sentiment.

Sent via Tapatalk.�

Nov 23, 2012

GenIIIOwner This is a nice chart, but you may drive 25,000mi/year mostly on the freeway where the infrastructure is not yet there.�

Nov 23, 2012

Arnold Panz Right on. The thread topic question is based on a faulty premise, and its a common misperception to focus on income instead of wealth. Who is "wealthier", someone who makes $100,000 a year and saves $20,000/year, or someone who makes $500,000/year and spends $600,000/year (ie, is in debt)? The person spending $600k probably has a lot of cool stuff, or takes great vacations and eats at nice restaurants, but the first person is in a much better position to afford anything (including an 85kWh Model S) than the second person.

In other words, the most important factor is whether or not you are living below your means (whatever your income) and can afford the payments, not what your income is. I know people making six figures who definitely can't afford an expensive car, and others who make much less who live frugally and could much more easily afford the car.�

Nov 23, 2012

Johann Koeber Thanks for discussing, this is an emotional decision, but prudent finances help keep you out of trouble in good times and in bad.

My answer to 1

Ok, in many areas of the US public transport is not an option, unlike most of Europe. But low cost cars would be. It gets you to work, lets you make money and save up. You could be the guy at the office who the foresight not to be caught in consumer debt and keeps more of his paycheck.

My thought on 2

So you are suggesting an arbitrage, like a credit swap. That would be ok, if you know what you are doing.

Good thought. With my (you call it conservative, I call it prudent) system, monthly finances don't take a big hit.

My opinion on 3

They can afford much more savings and the quicker they will have saved up the purchase price of the car.

By my rules, I would not buy a bigger house for myself than I can afford, i.e. pay outright. Rental properties is a different question.

Those 3 quibbles aside, one definitely should do some "Worst case scenario" calculations to see what could reasonably happen to your monthly finances.

I never subscribed to the idea of taking out loans for consumption purposes. Income producing assets is another thing.�

Nov 23, 2012

dailydriver I'm not, but this post made me laugh.:smile:�

Nov 23, 2012

bosgig I agree that wealth is more important than income in general for a decision like this. But in this case we were asked to make two explicit assumptions: 1) that the person has no savings, and 2) that the entire purchase price will be financed.�

Nov 23, 2012

Johann Koeber Call me short witted:

The person would need to have such an income that she could save the purchase price of the car during the time from ordering it to payment due (about 6 months - currently).�

Nov 23, 2012

Alexander My take home income is 40K and I'm finalizing my order now. I'm getting the base model with the 85kWh battery. My bank already approved the loan as long as I sell my car and pay off the loan on it. You save up enough money, and put enough down, you can buy anything.�

Nov 23, 2012

Arnold Panz ^^^Right on!!^^^

Save on the small stuff and you can afford the big stuff, and always live below your means. My parents were raised during the Depression and drilled this into our heads.�

Nov 23, 2012

brianman I'm confused by this phrasing.�

Nov 23, 2012

dsm363 I assume he means no tech package, leather seats or pano roof...etc�

Nov 23, 2012

Omer

For most people being able to pay for something doesn't always translate to it being financially prudent. Your situation with the MS is very unique. The value proposition for BEV is obviously tightly tied to miles driven and you sir are the king there (I'm actually rooting for you to end up with the S just to see the miles rack up)!�

Nov 24, 2012

jat I think it is silly to compare the price of the car with your annual salary. First, a car is not an asset -- you would do better burying money under a rock compared to buying a car just for an investment (there are exceptions, such as collector's items). What you should care about is the ongoing costs of having the car -- property tax, maintenance, fuel, etc. In that regard, even a $100k Model S is reasonably cheap (if you live in a state with high property taxes on cars it may not be).

Now buying the car in the first place is more relevant -- if you have money sitting around to buy the car, your house is paid off, etc, then you can afford a Model S on a retired income. If you are already straining to make payments on your house and other things, then you probably shoudln't buy it even if you make $250k.�

Nov 24, 2012

johnnyS I have always believed in paying cash for a car. However with the model S one can justify financing the tax rebate and gas savings. I have been setting aside $5000 per month this year and I still am short of my purchase price. Like many on this board I am far enought along in life that many of our financial goals are in sight.�

Nov 24, 2012

KenEE It's your money and it's still a (fairly) free country so you can spend your money as you wish.

BUT. since you asked.. Rule of thumb is your car payment should be about 10% of your income or equivalent.

So we'll say 5 yr loan at 4% for a 50k S and a 100k S.

Its about 900/mo for the 50k S and 1800/mo for the 100k S so that would be an income of $9,000 - $18,000 or roughly 100k/yr - 200k/yr.

This seems low to me, but then I have three kids in private school and a house payment. (I couldn't imagine spending half a year's salary on a car!)

But then I'm getting the loaded MSP because its a free country and I have the money and most of all I and my family want one. �

�

Nov 24, 2012

srram

Calling a car an asset is a stretch IMO. An asset is something that puts money in your pocket. A liability takes money out.A car does not put money in your pocket.

Agree with your second point. The way I see it is I can take my free cash and easily generate returns greater than the ~2% loan you can get.

I can definitely afford the 85kwh from a cash flow perspective, but I think the 60kwh meets my needs nicely. I'll stick with that, and load it up.�

Nov 24, 2012

Odenator Another rule of thumb by Suze Orman: if you have to finance the car for more than 3 years to afford the monthly payments, then the car is too expensive to purchase.�

Nov 24, 2012

Robert.Boston I'd underscore the words "have to": there are sound reasons to carry some debt even when you could pay the debt off from your financial assets.�

Nov 25, 2012

jkirkebo If you finance 100%, then I agree. Otherwise you'd be upside down far too long. If you on the other hand have a 25% downpayment I see no problem in financing over the period you usually keep new cars. For me that would be around 8 years. I'd rather pay a lot less over 8 years and put the excess into savings every year than pay a lot over 3 years and then nothing the following 5 years (with no savings the first three years and lots the last 5).�

Nov 25, 2012

brianman No. My house puts no money in my pocket, but it's certainly an asset. My wallet puts no money in my pocket (though it holds it) and it's certainly an asset.

Perhaps you're intending a different word than 'asset'.�

Nov 25, 2012

stopcrazypp He's half right. I think he's referring to the fact that an "asset" should be able to produce value (doesn't have to be money directly). He's wrong in that a house, car, wallet, etc. all fit that criteria because they are all useful in some way (you can live in a house, drive a car, carry things in your wallet; this is all part of the produced value of those assets). Plus the definition of asset explicitly allows for depreciation and for the value that you get out of that asset to be lower than what you spent to acquire it.�

Nov 25, 2012

Jointguy Average individual income in US is 25K

Average new car price in US is 30K�

Nov 25, 2012

brianman Incorrect. An asset does not have to "produce value", but rather have value. Example: many precious metals don't "produce value" but are just traded in coin form.�

Nov 25, 2012

Jason S Average person buys used car. :tongue:�

Nov 26, 2012

KenEE Not sure where you get those numbers.

Avg household income is about $50k - – USATODAY.com

Avg amount spent on new car is $15k-$25k - What is the average amount of money that is spent on new cars? | CarInsurance.org

So it's about 50% or less.

So your back to $100k yearly income for a stripped S and $200k for a loaded S.�

Nov 26, 2012

DavidM Years ago, I would look at beautiful multi-million dollar homes and wonder how much income would be required to purchase such a home. Then it hit me - most folks don't purchase a million dollar home based on income. Most folks use the cash (equity) from the sale of a previous (expensive) home, along with a modest loan. Therefore, the loan that many people have on the average million dollar home is somewhat the same as the loan someone might have on a $500K home (maybe a $400K loan).

Likewise with a Model S purchase. I suspect a small percentage of Model S buyers will just write a check. However, many will sell a valuable (paid off) 2 to 4 year old car, for $30K - $40K, and either finance the rest, or write a check for the rest (or some combination thereof). Anyone who is putting $10K down on a $80K car is living beyond their means.�

Nov 26, 2012

bosgig DavidM--Agree with your comments, with the possible exception that someone may choose to tactically take out a large loan strictly as a rate-driven cost of funds decision, not as a needs-based financing decision. I think at the end of the day if a person is stretching to buy this car (or a particular version of it), and putting himself in a financially vulnerable position as a result, he shouldn't buy the car. Everyone should be able to make this decision for him/herself. There's no magic formula.�

Nov 26, 2012

Nikoli ...and the S is not your average car.�

Nov 26, 2012

Kraken Ok, I'm finaling going to chime in.

I feel simlar to the OPs for this and the "OK d, so there is one really poor person buing this car" thread. Mainly I feel this way based on my age (26), and the fact that I have only purchased one car in the past for 14k, and my wife bought a used one for a couple thousand. That being said, there is a lot more to think about. This decision is entirely situation dependent, and each person is on their own.

I realize our income is well above what some people are saying is necessary to purchase the fully loaded car, while it is slightly less than what others are saying is necessary. But a big part of this decision is that you only live once.

If you have a positive cash flow, you can (like we are) save up over the period you are waiting for a down payment. We have a house we've put money into for the last year, and that is where all of our cash flow is going. But by pushing the last couple of major projects off until we have to pay for the car, we are going to create a down payment. At that time, we will have to look at the loan options available. If the loan options are for a large enough value at a low enough interest rate, we may reduce our down payment so we can utilize some of that money towards the projects in our house (and enjoy them before we are forced to move for our jobs and rent our house). Personally, I'm fine with paying a few thousand extra in interest if I feel the car is worth it to me (not in resale value), since first and foremost I am buying it to drive it. In our case, if we had to finance it all, we could pay the payments entirely with a pay raise we receive in the spring. This would allow us not to change our current habits, yet still pay for the car. (My enter key stopped working or something, so I'm going to continue in a second post rather than continue to make this paragraph a novel).

- - - Updated - - -

Also, your tax situation could change the cost of the car dramatically. For us, we are just above the cut off (in the non-bush tax cuts) from 15 and 28% taxes. Depending on which tax things congress cuts, we might be able to go below the cutoff for the 15% by deducting the sales tax of the car (if congress doesn't nix it). That would mean that purchasing the car might save us $8,700 in taxes on top of the $7500 credit. Also for the full $7500 credit (assuming no investments/mortgage/other deductions), an individual has to have a $53,800 taxable income and a married couple filing jointly would need to have $57,600. This is based on $50,000*.15=7500 and the individual personal exemption is $3,800 per person. Bottom line, everyones situation is different, there might be other ways the car pays for itself, and if you don't understand your own taxes and the proposed changes in congress GET INFORMED. Our taxable income (between 60-80k) could see a significant change in tax. We could go from about 8k/year in taxes to 28k in taxes/year depending on what changes congress makes (to be fair, i should state our taxable income could increase to nearly 100k with certain changes to deductions).�

Nov 26, 2012

kinddog household income is a figure that adds up the income of everyone in the house. these days, both parents are working more often than not, so the $25k average individual is $50k combined.

- - - Updated - - -

i find these financial justification threads funny. i wonder if the same thing happens on BMW or Mercedes forums? probably not.

here's the deal... there is absolutely no way to justify the purchase of this car. it is a luxury item, an absolute non-necessity. plenty of cars will get you from point A to B for a fraction of what the Tesla cost. it is a colossal waste of money for ANYONE. this includes me, who will be stroking a check for it. i don't care if you have $3,000 in the bank, or $3 million.

i really get peeved with the whole "YOLO" argument (you only live once). that's right, you only live once, so don't F up your whole future by financially crippling yourself when you are 25 years old to pay for a luxury car that YOU DO NOT NEED. the entire country was going YOLO for the past decade and it resulted in the financial crisis of 2008. how quickly we forget.�

Nov 26, 2012

SigGuy While I fundamentally agree with most of what you've said here, I do think the YOLO argument does enter into decisions like this, it's just a matter of how much weight YOLO should receive in the decision process. And given that you're buying a Model S and that, as you've stated, nobody NEEDS anything more than a car to get you from A to B, what OTHER than YOLO is your reason?�

Nov 26, 2012

DavidM Well, I'm an old school finance guy. So I get confused when you consider taking a large loan (tactically) to finance a depreciating asset. I guess if you had $80K sitting in a money market account (earning zip), and this fabulous safe investment comes along that pays a guaranteed 10%, while at the same time, you could borrow the $80K on a home equity loan for 4%, it might make sense. But if you know something that pays a guaranteed 10%, let me know, because I want to jump on that.�

Nov 26, 2012

bosgig Being an old school finance guy myself, I look at it this way: I could pay off my mortgage, but I don't. Why? Because 3 3/8% interest on a 30 year loan, before considering the interest deduction, is cheap money. I'd rather carry the loan and invest the capital. I see this as no different, except for the deductibility. Perhaps I wasn't clear in what I meant by the word "tactically". Hopefully rorystewart has figured out what he's going to do by now!!�

Nov 26, 2012

DavidM Yeah, I can't believe how low interest rates are on mortgages. However, the homes on both sides of me are empty because the owners got in over their head. I'm sure they did the math, but then life threw them a curve ball. If you own something, then nobody can take it away from you.

Rorystewart - If he's seriously considering financing the whole thing, I might advise him to save up over the next 2 1/2 years and be first in line for the Gen III. Even with an upgraded battery in Gen III, he would still come in below a base Model S.�

Nov 26, 2012

KenEE Yes but the households don't usually buy two new cars at the same time. They alternate. (wife gets the new one this time, husband next...) So you're back to typical household spending half or less of their annual income on a new car.

Nobody has to be average, but I'm pretty sure the OP and many others want to know how much people typically spend on a new car. Personally I would never spend that much of my income on a car,(and I fancy myself a car guy), but luckily our household income is many times a loaded S.�

Nov 26, 2012

Robert.Boston It's not about return, it's about liquidity. I can easily borrow to finance part of a new car, and I have the leisure to shop around and find good rates. If instead I've liquidated various assets to buy the car, I've reduced my flexibility in responding to unforeseen financial curveballs. I don't think there's "free money" around; otherwise I would take out a home equity loan and invest it in that asset. But I do worry about running my liquidity too low.�

Nov 27, 2012

bosgig @rorystewart--My final thoughts on the subject. Debt is not by definition evil. But people get in trouble when they don't use it prudently and conservatively. If you're taking out a big loan to buy a car that you know you really can't afford, and you're putting yourself in a financially vulnerable position to do so, then don't do it. Only you know the answer to that based on your income and expenses. And Robert.Boston is correct--liquidity needs to play a role in this decision. You can own your house outright, but if you can't pay the real estate taxes. . .�

Nov 27, 2012

Yggdrasill This is not an easy question. But I have one suggestion for those who are trying to stretch their money as far as possible - make a budget projecting costs and income a few years into the future. It should be as realistic as possible, if not pessimistic.

This is what I do, so I know which bills are due to be paid in August 2014, or whenever, and I have some idea about their size, because I've been doing this for several years, which means I have a fairly good statistical basis. When you maintain full control over your finances, you end up being able to do great things.

Now, for my sake, I know that if I want to, I can buy a fully loaded Model S. But that is not how I prioritize it, because if I did buy a Model S, I wouldn't have enough money to build my own house. I know this because I have projected the costs of both options, and they are incompatible at this current point in time. This is perhaps not surprising when one considers my income (around $130k this year, but more normally around $100k), and the size of the project I am committed to. The house will probably cost $750k-$1M, of which $250k will be equity. When the house is finished it'll be 8 years since I graduated college, at which point I started out with $30,000 in student loans and no job experience. And I haven't had any help from parents or the like.

The impact of being in control of one's finances simply can't be overstated.�

Nov 27, 2012

cinergi Yes, differing definition of asset. Bank will consider your primary home an asset. Some people do not: Rich Dad Poor Dad - Wikipedia, the free encyclopedia (see Definition of assets)�

Nov 27, 2012

brianman So what do you call something that has intrinsic value but doesn't "put money in your pocket"? Not an asset? Never heard of such nonsense until now.�

Nov 27, 2012

vfx Don't forget that a car has an emotional aspect for many people and that and electric car and it's statement for some of who they are and what they believe. Planet saving, war ending, US supporting is very important. Yes they might buy a Volt or Spark (even a US built Leaf) but they might also just believe Tesla (not BMW or Mercedes you mentioned) is doing it best and right (and may also have stock) so they are supporting a company that may OLO (only live once) in our lifetime.�

Nov 27, 2012

Zextraterrestrial 42

...�

Nov 28, 2012

NeverEnough Haha.�

Dec 4, 2012

Dino Saver I realize I may be being overly conservative, but I'm still apprehensive about making the purchase. Yes, I love the car. And my current ride has ~90k miles on it, so I'm due for an upgrade in the next 1-3 years. I have a short commute and rarely go for long drives, the gas savings are modest, so I'm thinking about the 40Kwh pack. A $60k (all-in) car is surely not unreasonable with a >$400k income and a house that's halfway paid off (in my early 40s), but I've saved very little for my young kids' 3 colleges and the numbers for 4-yr privates are shocking. And if I lost my job, it's not easily replaced (I'm in an industry that lives financing-to-financing). Am I being ridiculously conservative here or are early adopters truly that much more aggressive about buying these expensive cars? I'm not sure I gain much waiting by a year or more for another bonus b/c the novelty of being the first guy with a Tesla isn't what's "driving" my purchase. I'm trying to avoid the temptation of buying it b/c it's cool, since it's a helluva price tag for that aspect and I shouldn't care about that anyway. I dreaded receiving the "It's Time..." email and now that it's here, I'm just not sure. I enjoy the insight on this board, so maybe someone will talk me in (or out!) of this. Cheers!�

Dec 4, 2012

Zextraterrestrial Buy car now - figure out $$ later :biggrin:

I might be close to 100k this year - family income and hope I can get my wife a Tesla in a couple/few years

I will still be making the close to the same $$ as this year since I had a good chunk of OT in the last few months to my happy D-Day!

Hopefully my wife will be more into jewelry fabrication by then/ selling designs and have an income.

Can't wait for the next cars!�

Dec 4, 2012

Kevin Harney IMHO it sounds like you should wait. But the only reason I say that is because your post sounds like whether or not you can afford it and whether or not you are TOO conservative or not you seem to be of the conservative mind set to wait. Your post makes it sound like you are really unsure and the fact that things COULD go south is really bothering you. I say since you view yourself as conservative you should err on the side of caution. That being said if I was in your position I would probably get it because I am less conservative and my job etc is more stable. I guess I am reading between the lines that you would prefer to wait �

�

Dec 7, 2012

EVNow You are comparing apples to oranges - when you compare average household incomes & average new car prices.

You should checkout the average household income of people who buy new cars. A lot of lower income people don't buy new cars.

BTW, avg new car price is about $28k (including SUVs etc).�

Dec 8, 2012

Al Sherman Nobody wants to see Tesla's sell more than an owner/reservation holder. Having said that, I'm pretty conservative (re:cheap) financially. Just my humble opinion but; I feel that financing is OK if you CAN afford to buy the car outright and it's more of a judgement decision about finances. If you don't have and keep the cost of the car you shouldn't buy it. I know that is contrary to all of our dreams. I just think someone in tis situation would be better off waiting for the dream to be more affordable.�

Apr 1, 2013

bhuwan Advice in this thread is great for entertainment purposes ,but any serious advice needs to come from a Financial Adviser.�

Apr 1, 2013

deonb That may be a good rule of thumb to decide whether you can afford it, but don't actually do that. My Tesla financing is 2.75% at 8 years. My house financing is 3.5% (fixed rate).

So why do anything less than the maximum term on a car? Rather pay the extra $$ against your higher interest items first and take the longest term you can get on things that have a lower interest rate.

(Well, watch out for prepayment penalties etc. etc.)�

Apr 1, 2013

Merrill Do not care for Suze Orman, she gives out information as if this is the only way you should do something. Nothing in this world, especially investing is cut and dry. She has no room for thinking any other way except hers.�

Apr 2, 2013

AudubonB I am finding this thread a tad disconcerting, as I also am an old-school guy. But, not to sound too much like a financial priss, I'll limit my comments.

Asset or not? I say we should consider a Tesla to be a highly depreciating asset. First, a sound evaluation of the cost of operation need include the cost of replacing the battery pack; second, it is a luxury car from a firm with very little history and a balance sheet less akin to Mercedes or Ford than to DeLorean; and third...as I hope we all agree, we HOPE in 5 and in 10 years the price of new EVs will be very, very much lower than what they are now. All of which means that we as pioneers will be taking it on the financial chin.

I took those factors into consideration when I placed my order: this is a $95,000 expense I shall never recoup....except emotionally. As I am not one to have spent my life purchasing expensive toys, this represents an extreme change for me. I am very grateful my lifestyle - which includes decades of living well below my means - has enabled me to be able to make this purchase.�

Apr 2, 2013

kinddog So many factors that go into this beyond salary, that it's a truly arbitrary and fruitless discussion.

also depends on:

- net worth (how much liquid cash/investments you own compared to the debt you have)

- expenses

- goals

- future income potential

- market performance

I could be 35 years old, make $400,000 per year, but have a $1M mortgage, 4 kids to put through college, $150,000 in student loans, and a wife whose job it is to go to Niemann Marcus and buy dumb sh*t. In this instance, I can not afford a P85 Tesla.

~OR~

I could be 35 years old, make $60,000 per year, have a paid off house, $500,000 in my %2�

Apr 2, 2013

Merrill You do not buy an expensive luxury car as an investment. Any brand vehicle depreciates big time as soon as you take delivery, I have had many nice cars, they are rewards for working hard and as I see it life is to short not to have some fun once in a while. I retired fairly young, but not because I have tons of money, but because of the above. At my age,you cannot take it with you, so spend it on a Tesla Model S!!!!�

Apr 2, 2013

AC1K i guess ill chime in....

im 30yrs old, i only make $58ish CAD a year and im putting down a deposit in June for a Black Model S Performance 85kW max spec except the jump seats (i dont have kids)

the P85 costs $125K+ in canada because we always get the shaft when it comes to car pricing.

so i guess you could do it with my salary, i expect to pay off the car in 2 years after all the paperwork has gone through and im driving the car (ive already been able to pay off the approx price of the tesla in the last 2 years because my mortgage was $111K Dec 2011 and now its under $30K)

the first thing you should do is pay off your house though and that's what i intend to do come June.

5K downpayment to the car, and whatever time in between the deposit and delivery i will shove every dollar i make into the down payment of the car with the addition of selling my current car, genesis coupe (which was paid off 2 years into the financing term, this rapid payment is what triggered the idea that i could do it on a larger scale such as my house)

most of you are wondering how im doing this, its actually quite simple, you just dont dick around with your money, dont buy useless crap, dont smoke, drink, do drugs, go to stupid events like parties or bars, etc. Dont even drink coffee, ive weened myself off coffee after highschool and alcohol half way through college.

cut all useless things leaching at your paycheck and find ways to optimize utility bills.

- i only have internet at home, no phone, tv, sat, etc, etc.

- i stopped getting hair cuts and just started shaving my head (so much easier to manage)

- reduce water consumption, take shorter showers, reduce dishwasher usage, etc (some months i can get away with 2x M� of water usage, my neighbors use well over 12x M� )

- hyper mile your existing car, i have a genesis coupe 2010, its rated for 17MPG in the city and 26MPG on the highway, i can current achieve 25MPG in normal day to day driving

- don't drive anywhere unnecessary, i can make my car last 1 month on tank by not going unnecessary places

- i havent gone on vacation for oh i dunno, 12 years?

- ZERO carry over balance on all credit cards, i use my CCs alot but they are always paid in the grace period, infact i over pay my CC and keep a credit ontop of the credit incase of emergencies (has come in handy before when my POS fridge and dishwasher died at the same time)

- i was on Rogers wireless for my cell, what a complete rip off, switched to wind, pay $36.75 tax in every month, i save $450 dollars each year.

- this next one may kill some people but i was able to get away with $480 of food for 9 months, but i have to thank the company i work at for that, i get catered meals every day for lunch

and alot of other times i will work for food, ill help people move, help people with computer problems, etc and they usually feed me as payment lol

- dont have any relationships, i understand this is more or less impossible with people but its pretty self explanatory, if i didnt go out with the last 2 girls i would be in a model s RIGHT NOW.

- everything you come across has a price tag, one mans trash is another mans treasure, i buy and sell like crazy on kijiji to make money, i fix computers mainly and sell them off. i have access to the erecycling bins in a large building so i usually salvage stuff (you wont believe what people throw away, perfectly good dell workstations is one example)

i understand most of you will not go to such lengths, but with the tesla model S, i feel that its the only way to actually make a difference in this world, and all these sacrifices will be worth it when i can kick the addiction to gas/fossil fuels. if i am able to squeeze money from somewhere, ill invest i tesla as well.

please forgive any typos, this ultra book keyboard is a POS.

edit: oh and when i do get it, ill probably turn into one of those annoying fan boys, my city will KNOW ABOUT TESLA.�

Apr 3, 2013

ddruz AC1K - I admire your frugality and your sacrifices to help the environment and make a statement. Following your modus operandi, however, you can accomplish the same things by getting an 85 kWh non-performance without every option. You might be able to put the money saved to better use than the marginal utility it will buy you in a Model S.�

Apr 3, 2013

mknox AC1K - Very interesting rationale. I was thinking, however, that you could still achieve your goal of getting off fossil fuels with something like an iMiEV since you're so frugal with your use of the car...�

Apr 3, 2013

AC1K i had to look up frugal so i wouldn't be inaccurate in this statement, i dont think im frugal because buying a Tesla P85 is the farthest thing from "thrifty" or "sparing" and spending 260% of my normal paycheck this year doesn't quite line up with "restrained use of money" :biggrin:

as far as i know, there is no 85kW performance in Calgary and there needs to be one so people can see it first hand.

Since Feb ive been spouting how great Tesla is and how fast the far can go so it would be wrong not too get one.

also these reasons would sway me to go with a loaded P85 as well

- whenever i buy a new car, it must be an upgrade not a downgrade or there would be no point in getting a new vehicle.

- the new vehicle must beat the old one, so it must be faster, it must have more features, it must be more technologically advance, etc and in the case of the Tesla, the MSP will beat it in all aspects

- my current car genesis coupe gets a 0-60 of 5.5s as rated by motor trend, no electric vehicle for under $1M can beat it except the tesla (i want a rimac concept one but thats way too crazy)

- i wont sacrifice my sunroof or the upgraded stereo so that would mean i would have to get both those options in the Tesla.

- i currently have HIDs so i would have to get the tech package

I got the genesis to prove a point to my old manager who told me it was stupid to get it and that i should get a Jetta instead (yeah right, i freaking hate vw and their Mexican made cars). Also alot of other people said Hyundai was crap and it has no resale, blah blah blah The Genesis coupe has been the best car ive ever had, never got a ticket in it even though i have 300HP under my foot, never got curb rash on my rims, ultra reliable, not a single mechanical glitch of any kind, it has 300+HP but uses regular gas and regular oil!, after 4 years of ownership i've lost around $10K of value, my friend's Audi A4 lost more in 10 months. Whos laughing now right?

oh and uhh that manager later got fired for being "incompatible" at various client sites (its really bad when they say, we like your company, but we dont like her)�

Apr 3, 2013

Al Sherman You should probably marry the manager and let her drive the Genesis.�

Apr 3, 2013

AC1K she is single, but shes twice my age and i hate her lol

i still cant believe she told me not to buy that car and to get a jetta instead, and this is when she was driving an Audi A4 wagon (or whatever its called, a3? i dunno)�

Không có nhận xét nào:

Đăng nhận xét