Mar 16, 2016

DNAinaGoodWay What would a M3 lease for, do you think? Given the $1k deposit, probably another what, $2-3k at ordering, assuming no upgrades, and $7500 fed credit off the top (they do that, yes?), and 12k miles per year on a 3 year lease. The residual will probably be better than what other EVs bring. Think it could be $300/month or less?�

Mar 16, 2016

Max* Considering a base 70 ($70k) lease starts at $772 for 12k miles, I would guesstimate that a base Model 3 ($35k) would be half, or roughly $386/month.�

Mar 16, 2016

JimmyAZ If the Model 3 lease is based on my Model S lease, Tesla will happily be keeping your $7500 Federal Tax Credit. You only get that if you purchase the vehicle.�

Mar 16, 2016

tga Well, the leasing company keeps it, not Tesla per se.�

Mar 16, 2016

engle Actually, what happens -- based on my Model X lease -- is the leasing company, US Bank in my case, gets the $7,500 tax credit as the owner of the vehicle. Then, they add the $7,500 credit to the residual value of the X, which otherwise is 52%, 51% or 50% of the price for 10K, 12K or 15K miles per year. So, effectively it reduces the lease payments by $208.33 per month.

Just don't lease if you plan to buyout at the end, or you'll end-up paying an extra $7,500. Finally, the current lease "money factor" is 0.0017 x 2,400 = approx 4.08% interest. Unless you lease for a monthly business write-off, it probably makes more sense to finance the purchase at 1.99% today from Alliant or another credit union. Of course, who knows what the money factor and interest rates will be at the end of 2017 in Tesla Time!�

Mar 17, 2016

DNAinaGoodWay I was planning on lease to own, but that would rule that out. But now I'm hearing that current Tesla customers and employees will get first dibs, effectively putting me out past the end of fed credits, unless something changes, so I guess I'll be waiting for some future CPO. Maybe into the 2020's things will evolve such that a M3 is in the $20k range.�

Mar 17, 2016

tga Agreed. The point I was trying to make was Tesla doesn't keep the tax credit, since they aren't the owner, the leasing company is (as you pointed out).�

Mar 17, 2016

JimmyAZ Good to know! Yes the point I was making was similar. Just that the customer doesn't get that money as a benefit. I would never buy out my lease for a Tesla as a rule either. I see these cars as cell phones. They're a snapshot of technology in a point in time. My S isn't and can never be fully autonomous. So I'll lease a new one every three years until something better comes along. Plus it's so nice being able to afford a lot more car and only paying for the amount of car you're leasing. This was my first lease and it's been a great experience so far.�

Mar 18, 2016

Borgholio Would it be possible to get the lease and have them not bother with the tax credit? I would plan on leasing to own so I would rather not have to deal with a substantially higher residual when I'm done with the lease.�

Mar 18, 2016

tga Well, then you'd just be paying more/month. Either pay more each month or at the end...�

Mar 18, 2016

Lobstahz The Model 3 will be my first lease, potentially my last (?). I'm generally a buy CPO and drive into the ground kind of person, and CPO is generally a very good bang for your buck. The difference in this case is that the market for cars is shifting and changing extremely quickly at this point and likely will continue to for the next 5 years if not longer. The general mantra of buy and drive into the ground is fine when the technology and product aren't improving much. Look at a 2002-2005 car, pretty much nothing new and "gotta have it" between then and now. EVs are changing that.

I don't think we'll start to plateau in EV car tech until we have 4x motors, 1 for each wheel. Once that's achieved all of the fancy diffs, open diff, limited slip, torsen AWD, haldex AWD, torque vectoring, etc, won't really matter as you will be able to do it in software. And at that point when I have 4x motors I will go back to buy and drive into the ground, but not before.

This situation reminds me of smartphone adoption. It used to be (late 2000's early 2010's) that every year smartphones got "so much better" than the last year. But now they've essentially plateaued and you can get most anything and it will be pretty darn good. I think we're in that aggressive evolution curve and if I buy and hold there will be a significant improvement that I'd be kicking myself for missing out on.�

Mar 21, 2016

ggnykk The $7500 credits doesn't cut off to $0 dollars after 200,000 cars. It is a gradual decreases over time.�

Mar 21, 2016

ggnykk Great insights! Can you explain more in regards to this statement "current lease "money factor" is 0.0017 x 2,400 = approx 4.08% interest"? Leasing a car needs to pay interest rate in addition to the monthly payment?�

Mar 22, 2016

dgpcolorado Sort of: the lease payment includes the interest charge. The money to buy the car comes from the leasing company so you need to pay interest on the money being lent to you, just as with a regular car loan. The difference is that you are only paying for part of the car: the total cost minus the down payment and the residual value. With a regular purchase loan your payments cover the whole cost less the down payment. But you still have a car when you are done with the payments, unlike with a lease. With a lease you are just renting the car for a time, usually three years.

Leasing interest rates, the "money factor," also tend to be higher than interest rate on a purchase loan.�

Mar 22, 2016

ggnykk Thanks for the explanation. Just a follow-up question, is the leasing interest applicable to only part of car (the total cost minus the down payment and the residual value)? or applicable to the whole cost just like financing a car through loan? I would assume it is the first case, but just want to double check.

If it is the first case, I think 4% "leasing interest" that you pointed out earlier, isn't worse than the 1.9% interest of a financing loan. You are paying 4% of a smaller dollar amount versus a 1.9% of a whole dollar amount for a car. Maybe leasing is still a better option since you don't own a car that is "out-dated" after 3 years.�

Mar 23, 2016

pmich80 It would probably come out to the same amount of interest. If you're leasing your monthly payments could be $400 of which $20 could be interest payments whereas if you were purchasing the car your monthly payments would be $700 of which $20-$25 would be interest. Obviously in this case the 2nd option would be a lower interest rate but the interest amounts are the same. The difference is you own the car at the end of the term.�

Mar 23, 2016

pmich80 To get a rough idea, I live in Canada and i assume the Model 3 will start at $47,000 here and i'll probably option it up to $60,000. In Ontario we get a tax credit of $13,000 or ($14,000 if the M3 is considered a 5 seater). How much would this tax credit theoretically decrease my monthly payment on a lease?

Secondly at $60,000 what would you assume the residual value of the car to be after 3 or 4 years and i guess the tax credit added on to the residual correct? I'm trying to determine what my monthly costs would be on a lease would be. Aiming for anything around $500..max $600.�

Mar 23, 2016

dgpcolorado I'm way out of my depth with regard to how things will work in Canada, but if it follows the pattern used with USA leases the tax credit is added to the residual, thus reducing the "capitalized cost" and the monthly payments. [They don't have to do it this way, a better approach from the customer point of view would be to add the tax credit to the down payment, which would lower the capitalized cost and also lower the buyout price.]

What the residual value will be is an interesting question. For the Model S it tends to be around 51%, or a bit higher with lower mileage (kilometerage? is there such a word?) three year leases. Will the Model 3 get the same residual value as the higher priced S? I'm guessing that it will be a bit lower. But, assume 50% for three years @15,000 miles (24,000 km) per year. The numbers might look like this:

Cost = C$60,000

Residual = $30,000

Down payment = $6000

Tax credit = $14,000 (yes, the 3 will have five seats)

So, $60,000 - $6000 - ($30,000 + $14,000) = $56,000 - $44,000 = $12,000

That $12,000 capitalized cost, thanks to the generous tax credit, would make for a mighty attractive lease. I haven't the faintest idea of what lease interest rates are like in Canada but if it was at the current USA rate of 4.08%, the payments would be around $355/month, not including some small lease-only fees.

FWIW. These are just guesses on my part, based on incomplete information.�

Mar 23, 2016

pmich80 Wow.. that'd be incredible of that were the case. I hope you're right. I may end up getting the fully loaded performance version if that's the case.I know this is a rough guide but that makes perfect sense. Interest rates are incredibly low in Canada right now too. (4% even seems high). The combination of 50% residual value coupled with a $14,000 tax credit (either added as a down payment or attached to the residual) really makes leasing an attractive offer. More likely though, I'll end up settling for a much lower down payment than $6,000. Possibly $3,000 instead.

�

Mar 23, 2016

dgpcolorado That actually makes a lot of sense. In general it is best to go with the lowest down payment � zero, if possible � on a leased car because if you crash it you will lose the money you have in it. The insurance company will pay off the lease but you will get nothing.�

Mar 23, 2016

UncleMoose Please let me know if anyone finds anything wrong in the following (or if I should post it somewhere else):

The following is based on Internal Revenue Bulletin - November 30, 2009 - Notice 2009-89.

The up to $7500 Federal tax credit does not end when the 200,000th Tesla is sold. The wording on the IRS site is that the "credit phases out for a manufacturer's vehicles over the one year period beginning with the second calendar quarter after the calendar quarter in which at least 200,00 qualifying vehicles manufactured by that manufacturer have been sold for use in the United States." The phase out mentioned above is defined that the cars "are eligible for 50 percent of the credit in the first two quarters of the phase out period and 25 percent of the credit if acquired in the third or fourth quarter of the phase-out period."

So if I read that right I think it would work this way:

If Tesla hits the 200,000 mark in the 4th quarter of 2017, then anyone who gets the title to their Tesla by March 31st of 2018 gets the full credit, anyone who gets it between April 1 2018 and September 30th 2018 gets 50%, and October 1 2018 to March 31st 2019 gets 25%.�

Mar 23, 2016

Max* That's not exactly true.

The insurance company will pay for the car minus depreciation. If you put down more money than the car depreciated you will get a check from the leasing company.

For example, you put down $20k for a lease, and you crash on day 1, but the car only depreciated $10k, you'll get a check for $10k. Now, if you put down $1k for a lease, and the car depreciated by $5k, you get nothing back and the gap insurance (included in the lease) will take care of the remaining $4k.�

Mar 23, 2016

dgpcolorado Yes. I'm talking about driving it off the lot � instant depreciation � and getting into a crash fairly soon after. Then you lose what you put into the car. It happens, although I would hope that it is a fairly low probability event, and it might be worth considering for those who are leasing.�

Mar 23, 2016

Max* My point was that -- it depends how much money you put down vs. how much the car depreciated, it's not as cut and dry as "you lose what you put into the car".

I could do a 1-payment lease and crash it as I'm pulling out of the lot, and still have the leasing company cut me a check.�

Mar 23, 2016

ggnykk So Model S depreciate 49% in 3 years? it is very high. Typically, ICE cars depreciate around 50% in 5 years, not 3 years.�

Mar 23, 2016

ggnykk There are extensive discussion thread on this topic, just do a quick search (icon on right upper corner)�

Mar 24, 2016

Max* It's not an EV vs. ICE thing, it's a luxury car vs. standard car thing. Luxury cars depreciate much faster early on than non-luxury cars. Model S is a luxury car, the Model 3 will also be a luxury car.�

Mar 24, 2016

Az_Rael The tax credit is also a factor right now. That instantly depreciates all EVs by $7500 once they drive off the lot. As soon as it is no longer available, the depreciation rate should settle down some.�

Mar 24, 2016

Rookie

Can you please elaborate 'just don't lease if you plan to buyout at the end, or you'll end-up paying an extra $7,500" ? Why would we need to pay that money ?

BTW I have been a lurker for too long. This is my first post to wonderful community of TMC.

Thanks in advance�

Mar 24, 2016

tga Imagine you lease an ICE car for $45,000, that has an expected end-of-lease (residual) value of $25,000. Assume the fair market value at the end of the lease is $25,000 (so they guessed right on the residual value). Your payments are based on financing $20,000. For an EV, the residual is boosted by the value of the tax credit. The residual then becomes $32,500, so you are only financing $12,500.

Ignoring interest and TVM, both situations are equivalent from the leasing company's perspective. In the first case, they get $20k in payments from you, and $25k when the car is sold at the end of the lease. In the second case, they get $7.5k from the government, $12.5K from you, and $25k when the car is sold.

The problem is, if you decide to buy the car at the end of the lease, you don't pay fair market value - you pay the pre-arranged residual price. For the ICE, you pay $25k for a car worth $25k. But in the EV example, you're stuck paying $32.5k for a car worth only $25k (but the leasing company is happy, because they're $7500 ahead of the game).

You're better of giving back the car and buying an equivalent car in the used market.�

Mar 27, 2016

engle Exactly! I wonder if Tesla would allow one to return their leased vehicle and buy the exact same VIN back from them CPO? Also, I read my US Bank X lease and it says in paragraph #22:

"If you do not exercise your Purchase Option, you must return the Vehicle to us at the time and place we specify. If you fail to return the Vehicle, you must continue to make your Monthly Payment to us on a month-to-month basis as approved by us, but in no circumstance can the Lease Term continue for more than 6 months beyond the scheduled Lease termination date."

IIRC, my Mercedes lease agreements contained equivalent language.

PS. I'd wanted to buy our X outright since we have a low VIN and keep it, but my wife insisted on leasing to avoid technological obsolescence in 3 years if the range is significantly higher, or fully autonomous driving requiring new sensors is available, etc., etc. So far (first 5 days) I just love it!!! Our Mercedes ICE has been permanently kicked out of the garage waiting for its lease to end! LOL�

Mar 27, 2016

Rookie @tga

Thanks a lot for your reply. I am a novice in buying /leasing car thingy. So your kind elucidation was very helpful.�

Mar 27, 2016

Rookie Thanks to engle to for sharing your story�

Mar 28, 2016

pmich80 I'm still trying to wrap my head around it because it sounds too good to be true. If in Canada, the car sells for $50,000 and the residual value is half of that after 3 years, $25,000 and then we add back the Ontario tax credit of $14,000 to the residual value I would arrive at $39,000. I would then only be on the hook for $11,000+interest for 3 year lease? only $300/month? Geeeez... I might as well go for the top model PXXD as long as it's under $75,000 (to get the full $14,000 credit)

Speaking of which, when a car's MSRP is noted, does it include the price of any added options and taxes when it's calculated or is it just the base model? Need to carefully stay under $75,000 MSRP.�

Mar 29, 2016

dgpcolorado You need to check with Canadian Tesla owners and make sure that leases are available. Also check to see how the tax credit is factored into a lease. It might be different from how they do it in the US.�

Apr 2, 2016

Infoe Great writeup I understood all this already but you expressed it perfectly.

My only non understanding is (and I guess my accountant knows so I dont need to worry) but like to understand is how does the lease when owning a business benefit on the tax schedule?

Is it a personal lease that is used for business use? Or must it be leased in name of business?�

Apr 2, 2016

redi FWIW, I think Tesla historically marketed the MS "price" as the net of the sticker price minus the tax credit.

Is the "base" $35k M3 really a sticker of $42.5K? This would make a difference in the base lease or purchase since nobody gets a tax credit or a $35K car.�

Apr 2, 2016

Trev Page The EVIP rebate is calculated with only MSRP in mind. Options don't count against the cap.

If you think you're going to get a Model 3 for $300 a month lease in Ontario I've got a nice bridge to sell you.

If you lease a car that sells for $50k and you want to use the $14K rebate to reduce your capital cost calculation you will have to put up the rebate out of pocket up front since the rebate is paid back to you, not the lessor. You pay yourself back after you take delivery and submit your paperwork. So net is $36K. Residual you'd better figure is 50% after 36 months so monthly cost is $500 and that's before interest (figure 4% because you know, Canada) and our much loved 13% HST tax. You're very close to $600 a month which coincidentally is about half a base Model S lease cost per month. Go price out a Model S on the Canadian site and look at the lease rate and divide by half. Not 100% accurate given the different rebate amounts but it's a helpful guide.

I know this calculation very well because when I leased my Lincoln Mkc last year it was $50K and I reduced the capital cost with a trade in which came very close to what the rebate would be in Ontario. Residual is pretty much 50% as well, add in .05% interest (I wish we could get that for Teslas) then add tax. That's how it's done here.

Good luck!!�

Apr 2, 2016

Trev Page Model 3 is priced at $35K US *before* any potential tax credits. Tesla has made it very clear from the beginning with Model 3 that pricing would always be quoted this way given that the tax credit gradually expires once they reach 200,000 sales in the US.

Given the enormous preorders on this car everyone should really be doing their calculations based on the real $35K cost so as to not be disappointed should you not qualify orbrake delivery before the cap is reached. Just good financial planning.�

Apr 2, 2016

pmich80 Thanks for your input. So essentially it doesnt matter what options are put into the Model 3, it will still qualify for the full Ontario rebate ($14,000 potentially).

As regards to the lease payments, while the actual payments will be north of $600 for a $50,000 car, the truth is when you get the $14,000 rebate cheque, you can essentially draw from that lump sum to subsidize the monthly payment down to $300 out of your own pocket (once you receive the cheque) eg. $300 out of pocket plus $14,000/36 = $388 Therefore $688 monthly payments. Obviously theres those taxes you mention and the interest rate to add in as well. But i assume my math checks out.

How long does the rebate take from when you submit it .. 2 months or so

Personally im going to aim for a monthly payment of $500-600/month out of pocket plus draw against the rebate (or put up $14,000 up front as a down payment) to keep it at that. Figure that would allow me to option it to $75,000�

Apr 2, 2016

Trev Page If you can cough up the $14k up front you'll be better off than using it after to help pay for the monthly cost because it reduces the amount you're financing and thus saving on interest and less tax. In Ontario at least, the tax you pay is only on the monthly payment and not on the whole amount of the car value.

You can use the rebate either way to finance the car but I'm going to reduce the capital cost because it's a depreciating asset and why should you pay more than you should??

Rebates come in the mail anywhere from 2 weeks to 3 months. Depends on their backlog I guess.�

Apr 2, 2016

Trev Page Here's the link to the PDF for the EVIP program.

http://www.forms.ssb.gov.on.ca/mbs/ssb/forms/ssbforms.nsf/GetFileAttach/023-2096E~3/$File/2096E_Guide.pdf

I've read it very carefully and based on the requirements Model 3 should easily qualify for the full $14K rebate. The max claimable amount is $13K but cars with 5 or more seats get an extra $1000. The BMW i3 for example gets the full $13K but since it only has 4 seats it can't qualify for the $1000 extra.

The Chevy Bolt should also qualify for the full $14K by the way.�

Apr 2, 2016

pmich80 I do have funds ready to go. I've been saving for years for my next car but have never pulled the trigger because I've been so uninspired. I;m still rocking my 2001 Sentra in the meantime. Ill definitely take your advice and put it into the down payment so the interest paid over the length of the term will be less. Then I;ll reinvest the funds when I get the rebate back.

The Model 3 definitely will seat 5 so we get the extra $1,000 rebate. I;ll take a look at the form.

MSRP

MSRP is the base value of the each model and trim level exclusive of options, taxes, PDI and freight.

Model 3 will definitely be under the 75K then. Awesome.�

Apr 5, 2016

machzy I can't believe how lucky ON folks have it. $14k tax rebate! that's incredible. That's like 40% off a brand new car!

I'm in NS and we have 0 EV tax incentive programs but I'm thinking that since the Model 3 is probably two years out anyways, I should talk to some government people to see if we can get anything here.

Any ideas on where anyone would start for something like that?�

Apr 27, 2016

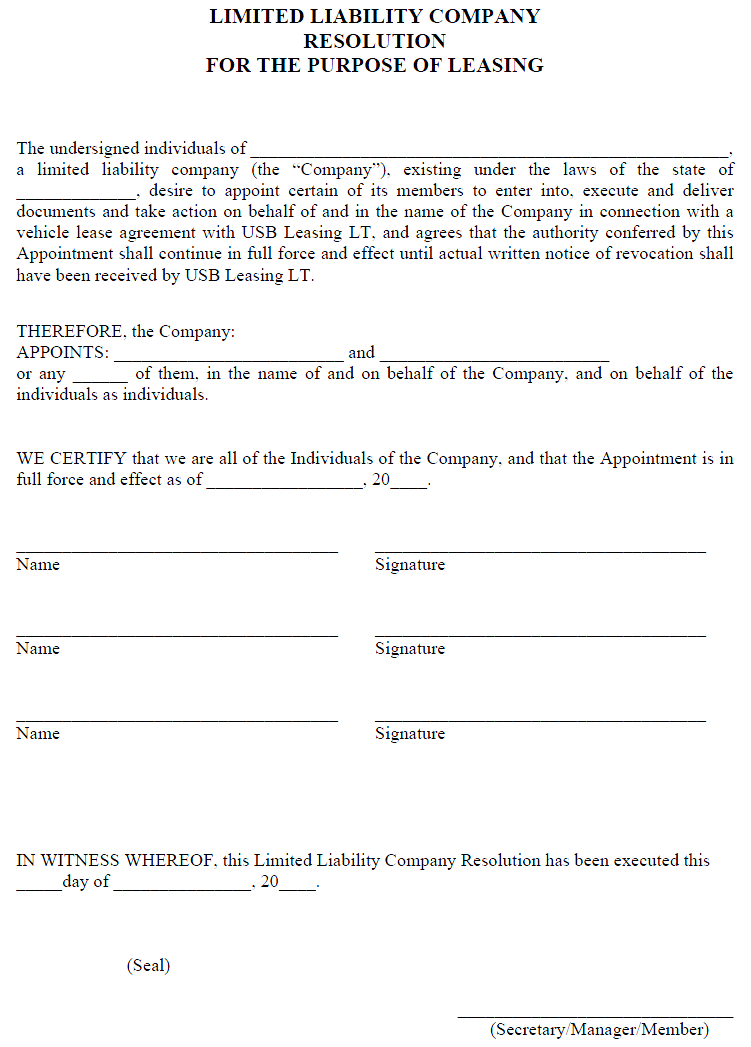

engle Disclaimer: I'm not a CPA so verify this with your tax adviser.

In the USA CA Tesla Leasing paperwork, there are 2 forms for business leasing use:

If the vehicle is leased in the name of the corp. or LLC, then the appropriate form is used, since the corporate tax return will take the deduction for % of business usage.

- Corporate Borrowing Resolution for the Purpose of Leasing

- Limited Liability Company Resolution for the Purpose of Leasing

Otherwise, if the business is a sole proprietorship (Schedule C), the lease is done in the name of the proprietor as a personal lease. The lease payments for the business use percentage, which is calculated based upon a log of (annual business mileage / total mileage driven), are deducted on Schedule C under "Car and truck expenses".

My guess is for a general partnership filing Form 1065, the Tesla would be leased in the name of the general partner who will be primarily operating the vehicle?

Here's the LLC form - the Corp. form looks very similar:

�

�

May 1, 2016

Bounou The price is actually 43750$ according to current exchange rates, the CAD has been steadily climbing up for a while now.�

May 15, 2016

Chopr147 My plan is/was to buy the M3 with low finance option. But, seeing how quickly the 2013 Model S has become "old" due to new upgrades,better options etc.... I may look into a lease if only because I may want a new one every 3 yearsNow i have to re-evaluate

�

May 15, 2016

TravelSD80 I too planned on buying my first M3. But depending on how autonomous the initial M3s will be, and other features, I may lease my first M3 then after that is up buy a M3 and keep it longer. I generally keep my cars 8-10 years, but my Acura ICEs haven't advanced much whereas Tesla is constantly innovating. I'll have a better idea after the second announcement on how I will finance my M3.�

May 16, 2016

engle While supercharging my X in San Mateo on Saturday, I spoke with a very friendly member of the autopilot team who works on computational modeling R&D. I noticed the S he was driving had metal, unpainted, ultrasonic sensors on it. I forgot to check his front camera - I was near the end of a long roundtrip road trip to Ukiah and I was a bit dehydrated. Hope I'll run into him or one of his colleagues again!

Anyway, one of his comments to me was: [1]

"There is lots of low-hanging fruit in the EV space" - meaning there are many innovations that are relatively easy to accomplish from an engineering viewpoint, since EV technology is still in it's infancy, compared to 100+ years of ICE. My personal take on it is a 2026 (2021?) will make a 2016 seem quite obsolete. I'm happy I leased my X.

It does cost more in interest, which is ~4% now based upon the money factor, compared to 1.49% lowest I've seen reported for loans.

While I was there, another Tesla employee with his girlfriend(?) stopped by to supercharge his company weekend loaner.

My theory is the autopilot/autonomous team has free use of test and production vehicles over the weekend so they can drive Alpha and R&D code in the real world.

[1] At the beginning of our chat, I specifically asked him not to mention anything to me that's Tesla Proprietary, and he did not. As we all know, sales is kept totally in the dark about the pipeline. I did learn that, unlike the big fruit company building a spaceship, there isn't a firewall between projects internally among engineering.�

May 16, 2016

Chopr147 Good point. No need to make a decision since the delivery is so far off anyway. I'll just take the wait and see approach as well�

May 17, 2016

Tiberius Leasing is generally a bad idea unless you want a brand new car every three years. And if you're worried about the payment, you probably shouldn't be getting a new car that often.

Be smart. Buy the model 3, get the tax credit, enjoy it for 6+ years.�

May 17, 2016

engle If you have a business, leasing a 3 is better because you can write-off most of the lease payments based upon percentage of documented business use. The 3 isn't heavy enough for accelerated depreciation on the purchase. With a lease, you still have the option to pay it off and keep it after 36 months.�

May 18, 2016

Tiberius Like I said, generally. OP didn't mention using it for business use so I doubt that is a factor.�

Jun 19, 2016

tfna I spoke with the Ontario Ministry of Finance and if you lease, you receive the rebate in annual and equal increments.�

Jun 19, 2016

tfna I'd disagree, at least for the Canadian side of things. Leasing is akin to a sound business decision for personal use insofar as tech goes, because of the rate of change of inmovation in the ev space - more specifically teslas. The premise of leasing is that ownership costs are fixed over a duration; most commonly 3 or 4 years. If this were $200k farm equipment machinery that was financed, the resale value could be a swing of $50k in 36 months, making it a very unstable exit price if and when you want to unload the item. The same holds true for cars. Accident repair? There goes half the value of the claim. Needs change? You lose taxes + $5k on trade value at the minimum on a loan that hasn't been paid nor the full utility of the car has been captured if one doesn't stick to the 6 year term. Lease buyouts are basically an options contract that negate the benefits of financing as those benefits are not mutually exclusive.�

Jun 19, 2016

Tiberius My original post said that its a bad idea unless you wanted to switch cars every few years. Your make it sound like that's your plan.

Like most people who've grown out of their immature 20s, the idea of paying off a car and driving it for several years is more appealing than the newest shiny model. You lose resale value when you finally decide to sell, but the money you've saved by not having payments for several years more than makes up for it.

Having a lease just leaves the back door opened to get screwed. I know that sounds jaded but typical cars dealers will rake you over the coals if given the chance (here in the US at least).

Afterall, it's not like we're talking about expensive farm equipment, lol.�

Jun 19, 2016

tfna We're not in total disagreement, but the statement that 'leasing is generally a bad idea ' is not a bad idea at all in any case when compared to a new finance. I'd argue that financing pre-owned at half the value in 3 years and riding it out for 10 years makes way more sense, if one is optimizing for average yearly cost of ownership. Even moreso, one can buy a 90s honda or toyota for $500 now and have no payments for 10 years whatsover. The point is, if it's strictly about the economics, financing new sucks more than leasing. But people buy new for all sorts or reasons. Many of them not necessarily frugal, but sometimes exclusive. Namely, the model 3. In this case, I'm sure we all hope this car magically falls somewhere in between the two.�

Jun 19, 2016

Scannerman Are you certain that Tesla does not adjust the lease cost downward, taking into consideration the Federal Incentive, which they receive?

That would seem to me to be a safe assumption.

Scannerman�

Jun 20, 2016

dgpcolorado Yes and no. Yes they do use the tax credit to lower the lease payments by adding it to the residual value. But no, if you were to buy the car off-lease you would pay the residual value plus the tax credit, losing it to the lease company. If one leases and turns in the car at lease-end, the tax credit will be a benefit. Leasing-to-own is not practical compared to buying the car outright and Tesla's finance people will tell one that right upfront when discussing financing options.

Whether this will change by the time that the Model 3 is released remains to be seen. I, for one, can't qualify for anymore than a small fraction of the tax credit because my income is much too low. I expect that a lot of Model 3 buyers are in for a rude surprise if they are counting on getting the tax credit.�

Jun 20, 2016

tga I call BS on this oft-repeated mantra. There's really nothing magic about EV's or Tesla's in particular that will advance faster than ICE cars (except batteries; see below). All cars, regardless of drivetrain, will have autopilot, etc. That tech will improve regardless of drivetrain.

An yes, batteries will get better. So what? If an 200 mile (or 85 mile) EV is good enough for you now, chances are it will be in the future. So what if batteries double in capacity in x years? If you don't need it now, you probably won't need it in the future.

Now if you plan to get a new car in 2-3 years (and you meet the specific parameters of the lease), leasing may be better, since the exit price is known. But if you are getting new cars every 2-3 years, you probably aren't worried about getting the best value for you money, anyway.

You can't make a blanket statement like that. Leasing is not always better. We could come up with tons of hypothetical situations where one is worse than the other.�

Jun 20, 2016

EVNow Too simplistic.

Cars (or any product for that matter) have constraints. Some of them get lifted over time. Typical example is Bluetooth. Cars from the last decade didn't somehow become less useful - but were simply not good enough because of new possibilities involving rapid innovation in an entirely new area - phones.

I've been driving 1 80 mile EV for 5 years - but I've been waiting for a 200 mile EV so that I can drive further than I can now.

Similarly, 3 would have better AP in future years. That would be greatly helpful.�

Jun 20, 2016

Tiberius This conversation is making me wonder if there's a big difference in how leases work between our two countries.�

Jun 21, 2016

tga You just made my point. Advances like Bluetooth are completely orthogonal to the type of drivetrain.�

Jun 21, 2016

Chopr147 I am looking into the MS and am torn between lease or buy. A 60d just may be like todays 80 mile range of the future.�

Jun 21, 2016

dgpcolorado Even if you buy, as opposed to lease, you can trade-in the car if you want to get the latest and greatest. Leases have some constraints, such as mileage limitations (although you can just pay for miles over) as well as some added fees that purchasing does not have. Interest rates on leases also tend to be a bit higher than those available on purchases.

Overall, though, buying versus leasing often comes out pretty close to a wash. If you do not qualify for much of the tax credit then leasing may beat purchase plus trade-in (or selling the car yourself). If you plan to keep the car more than a typical lease term (usually three years) or put a lot of miles on it then purchasing may well be more practical than leasing.�

Jun 21, 2016

EVNow Yes - but range isn't.

I'd buy an EV when it has AP and 3 hours of freeway range in winter +30% buffer. Until then, they will be on lease (unless it is too expensive compared to buy option).

But I should say - unlike some broad statements in some of the above posts - lease vs buy doesn't have a universally true answer. It depends on a lot of factors - including psychological ones.�

Jun 22, 2016

Chopr147 Thanks for info. I am going to buy, probably in the next few days I will order it. Between the Fed $7500 and NY $2000 I'm getting nearly $10,000 in credits. Which I plan on putting right onto the loan after the tax returns�

Jun 22, 2016

Tiberius Wait, you haven't reserved one yet? If I'm reading that right, I'd bet the farm you won't get the $7,500. Would be nice but DO NOT plan on it.�

Jun 22, 2016

Chopr147 Look up. We're talking about a Model S.�

Jul 12, 2016

Rookie Any thoughts on buy back policy on Teslas? And would it available on Model 3?�

Jul 13, 2016

182RG The guarantee is dead.

Tesla Kills Resale Guarantee Program!�

Jul 13, 2016

cronosx It's dead.. but it seems it's not needed at all since 99% of the time you'll get a better deal selling it directly, so maybe you shouldn't worry too much�

Jul 14, 2016

Rookie Ohh man!! damm . Though I can understand from Tesla's POV that they gotta maintain the balance sheets. But this was a good policy for reassuring first time customers for a brand new model.

But would that hold true for Model 3. Because Model S is a premium sedan and the customers would be willing to buy used cars at good price. But for model 3 the customer base would be a bit more of middle class. I hope the trend continues.�

Jul 14, 2016

cronosx I don't see why not.. i would say that for the model 3 it will be even better, after if you have the money then you'll likely wont the "best" the market has to offer, so later tech etc.. while for a model 3 it's probably using less money possible.. so why not an used model if it help you spending less?

the market will see.. and of course what the competitor will do as well.. but i'm not overly worried�

Aug 11, 2016

Jskillz860

How does it increase the residual value of the car if you opt to buy when the lease is over, you're still getting the tax credit but only it's coming out of your lease payments as the lease company is getting the 7,500 dollars plus your lease payments. So how can they add the 7,500 to the value of the car at the end. It doesn't make any sense at all�

Aug 11, 2016

Jskillz860 So here is the issue I'm having here, what is being said is them at of you lease car and opt to buy at the end the residual value will increase by 7,500 (if that is the tax credit you get), how can the residual value increase it doesn't make any sense to me. The lease company is getting the tax credit as a part of your lease payments and subtracting it from them. Think if there wasn't a tax credit. You would pay more on the lease. And finance the rest at the end. So how can they increase the value at the end 7,500 dollars of they have already recieved the 7,500 tax credit, they would be double charging you the 7,500 dollars. The residual should not increase at the end of the lease. Please explain of I am not looking at this correctly�

Aug 11, 2016

dgpcolorado No, it doesn't make any sense. But until they change how they do things, it is what it is: leasing to buy is not currently a cost effective strategy.�

Aug 11, 2016

Jskillz860 So the lease company charges a 7,500 dollar fee at buyout for the tax credit that they already recieved?�

Aug 11, 2016

dgpcolorado That's the way it is currently structured according to the Tesla finance representative I spoke with. Perhaps it will change by the time the Model 3 comes out. I hope so.�

Aug 11, 2016

Jskillz860 Yeah that is like robbery, I'm guessing people sign without realizing? That's crazy�

Aug 11, 2016

Az_Rael It's OK if you can't qualify for the full tax credit yourself, and you don't intend to buy the car after the lease.

Many Volt owners ended up with leases structured this way when they didn't have enough in taxes to claim the federal credit. So they would often turn the car in once the lease was done, then buy a different used Volt on the open market (for much cheaper usually). That way they still got to take advantage of the $7500 credit (in the form of a lower lease payment)

So it CAN work if you realize all the limitations before going in.�

Aug 12, 2016

dgpcolorado It is generally understood that people who lease do so to turn the car in at the end of the lease. The tax credit is a big help in lowering lease payments for those who do so.�

Aug 13, 2016

Jskillz860 Correct but from what I'm reading on here the lease company is charging an additional 7,500 dollars when turning the car in. After they already recieved the 7,500 dollars for the tax credit, I could understand if you recieved the tax credit money and then they charge you. But from what I've read they are getting double�

Aug 13, 2016

tga I think you misunderstand it - the leasee only pays if they keep the car, because the residual value is (artificially) inflated. Some numbers might make it clearer:

Say you have a $25,000 ICE, with a residual value at the end of the lease of $15,000. Assume all residual values are equal to fair market value, so the leasing company sells the car for the residual. With the ICE, you "use" $10k of value during the lease. The lease payments have to total to $10k (plus interest).

Use the same numbers, but make it an EV instead. To pass along the tax credit, the leasing company needs to reduce the total lease payments (before interest) to $2500 ($25000-$15000-$7500). They can either reduce the "purchase price" at the front end to $17500, or artificially inflate the residual in the contract to $22500; both have the same net effect. It's probably easier to do the later, since the residual is a guess, anyway (and easier to explain to stockholders and accountants then "giving away" a part of the purchase price).

If the leader gives back the car, the leasing company sells at a paper loss (since fair market value for the EV is $7500 less than what was listed as the residual in the financing contract), but they already got $7500 in the tax credit, so they are made whole.

However, if the leasee keeps the car, they are obligated by the financing contract to pay the full, inflated residual negotiated when the car was originally purchased. In that case, the leasee gets screwed, and the leasing company gets an extra $7500.

Which is why you should never use a lease to finance-to-own an EV.�

Aug 13, 2016

Jskillz860 Ok I understand it but it still sucks and is unfair if you purchase the vehicle, it shouldn't make a difference. If the person buying the car after your lease isn't paying the 7,500 then you shouldn't have to either of you choose to buy. That is ridiculous. I agree in that case that leasing to buy an EV isn't a good option�

Aug 13, 2016

Jskillz860 Has anyone had paint protection film done in the past? Is it worth it and what's the cost�

Aug 14, 2016

dgpcolorado When the lease residual includes a federal tax credit. Once the federal tax credit expires all this concern about inflated residuals will become moot.�

Không có nhận xét nào:

Đăng nhận xét