1/1/2015

guest Everything he said was absolutely true, however he needs to be more aware of how he represents this new energy dynamic. Having a battery in your basement and selling juice to the grid via SCTY is a wonderful thing, but it's not being portrayed in a way that's palatable to the average consumer(let alone appealing). Lyndon talks as if he's making a case in front of a utility commission, even when there are cameras rolling and he's talking to reporters. That's not good when we're looking for consumer sentiment to drive policy and tech adoption.

At the 57:30 mark that I noted above he tries to articulate the benefits of a distributed model for smoothing, but it comes out as "You gotta give control of that storage to the grid, you gotta have the utility be able to use that so they can load balance everything..." That is not a consumer-centric portrayal of the new energy dynamic we advocate, it's closer to a sound-bite for a Heritage Foundation attack ad. So the very thing that will set consumers free can be portrayed as shackles if you're not crafting and articulating your message properly.�

1/1/2015

guest One man who knows very little about the SCTY model just moved the stock downward 30%, so I don't think the results of the historically uninspiring 1st quarter will be able to move the needle much. The inputs into the algorithms need to be rosier before attacks like this bounce off the stock and allow it to move higher.

Here's a chart from the Bloomberg Chanos article. This is the data that's in every algorithm right now, that either needs to drift in the other direction or(most importantly) sentiment needs to wake up and realize the value of the SCTY model. If a few comments from Chanos have this much effect, the average analyst is unlikely to finally gain clarity on May 10th. That being said my predictions for price movement have been wrong pretty much every quarter, maybe that's a good sign.

![[?IMG]](https://assets.bwbx.io/images/i9VUGhaxS2t0/v2/-1x-1.jpg) �

�

1/1/2015

guest This is getting ridiculous.

Down 10% per day over three days, about 30% down since Monday's close and still no circuit breaker kicking in? Also, no specific bad news recently, just some overall market decline and this Chanos BS this week. Effectively, any actual bad news for this ER is already well priced in.�

1/1/2015

guest So, has SEC also been privatized? (By whom?) �

�

1/1/2015

guest Trumped, pumped, and dumped�

1/1/2015

guest Makes sense - but already?

Did you all see that clip of Ted Cruz turning his wife's other cheek? It was tweeted by the New York Daily News: https://t.co/m3zu9k5j5J�

1/1/2015

guest Chanos knows what he's doing, if he can get some downward action the algos will do the rest for him as the stock ticks below certain levels. It's absurd the amount of money he made this week on a self-fulfilling set of disinformation, but that's just part of market dynamics.

Waiting for the 2018 calls to get cheap.....�

1/1/2015

guest Saw that yeah

His kids knew what was coming and how to deflect apparently - experience

�

1/1/2015

guest FWIW

a brief note on one of my favorite financial types, Philip Falcone, in the 90's he helped kick start the Iron Ore powerhouse known as FMG.

anyway he had some colourful interaction with the SEC after winning a short squeeze against Goldman Sachs

SEC hits real short squeeze | OtcShortReport Blog

SEC.gov | Philip Falcone and Harbinger Capital Agree to Settlement

something different seems to have with SCTY recently, the interest rate that the Financial companies charged for shorting shares skyrocked, but the interest paid by Financial companies for those same shares did not skyrocket, effectively it seems that the Financial companies this time simply made off like bandits, and weaker shorts transferred their wealth to the stronger shorts. The Longs were mostly on the sidelines for all of this activity (some got a nice 'dividend' but nothing like what they deserved).�

1/1/2015

guest correction - Philip Falcone, in the 00's he helped kick start the Iron Ore powerhouse known as FMG.�

1/1/2015

guest Did analysts and investors forget the only reason SolarCity lowered guidance last quarter was to provide conservative guidance, due to the uncertainty about if the ITC would get renewed? SolarCity emphasized that if the ITC was extended, the guidance would end up being far too conservative.

Although completely unscientific, I've seen 5 SolarCity vehicles in the past week, on the East Coast. I'll take this as a good sign.�

1/1/2015

guest I don't think that is or will be a major concern, it should be easy to crush their projected +18% yoy 1Q install guidance. I would hope so anyway.

The bigger concerns are cash flow, trajectory of costs and ease/cost of finance. It's gonna be interesting for sure, this should be the last wild quarterly call then it's onward and upward.�

1/1/2015

guest SolarCity was very clear that if the ITC was extended, installations in 2016 would be significantly higher than the revised guidance.

Additionally, this has been completely missed by the media. This partnership will significantly reduce customer acquisition costs.

RESAAS Services Inc. (via Public) / SolarCity Joins the RESAAS Marketplace

For more info on RESAAS Services Inc.

http://m.marketwired.com/press-release/resaas-surpasses-300000-verified-real-estate-professionals-cnsx-rss-1974693.htm�

1/1/2015

guest I believe overall 2016 guidance was maintained at 1.25GW installed, but 1Q was revised down to something tiny due to the impact of ITC uncertainty. Did the math when it was announced and I think it penciled out to an 18% increase over installs from 1Q last year.

So in effect....overall guidance was maintained, but pushed back later in the year.�

1/1/2015

guest Correct. However SolarCity emphasized that if the ITC was extended, SolarCity's guidance would almost certainly be far too low. I vaguely recall Lyndon laughing when asked about that, then saying something like they were preparing for the storm, to be full prepared for a scenario where the ITC wasn't extended.�

1/1/2015

guest Nice to see green for the first time in a long while.

The announcement of utility scale solar seems like a positive:

SolarCity Launches Utility and Grid Services (NASDAQ:SCTY)�

1/1/2015

guest All I can say is the stock price has a lot more room to go up, than down.�

1/1/2015

guest What's the deal with the put to call ratio? There looks to be crazy high bias for puts. Thoughts?

There is an 8-10:1 premium for puts. And 100-300% IV. No wonder the stock is acting strange.

Even though I'm still not convinced he's short more than a handful of shares, Chanos is crazy if he doesn't cover today.�

1/1/2015

guest I thought IVs main input is recent stock price volatility? In which case these high numbers are justified, no?�

1/1/2015

guest Sort of. Yahoo published some article saying someone places a large bullish bet. I think the opposite is true and someone might simply be hedging since the June put:call ratio is very high.

Look at the price for $40 calls vs. $20 puts. $40 calls are .30 and $20 puts are $3. This only makes sense if the market is pricing in the probability of a $10 being equal to the probability of a $10 move down.

Or it could simply be that the 30% drop in one week caused by noise from Chanos has caused calls to be irregularly priced, making it possible for Chanos to buy calls and cover his short.�

1/1/2015

guest Not really. That is the historical volatility. IV is the implied volatility, meaning the option premium agreed upon between the buyers and sellers on the date of the transaction reflects the current uncertainty of the market about the likelihood that the stock will be in the money on the expiry date. IOW, the input for the IV is the current option price (hence the name), and is therefore forward-looking.

Edit: I dug up and old post of mine about IV that contains more detail.�

1/1/2015

guest You are quite correct, of course. It is quite possible that they have a supremely profitable financing scheme and have managed to keep it opaque enough that nobody else can clone it. If you're right, then it's a great investment. I am not comfortable say8ing that they're right.

But not the rates.

That's the lack of competitive advantage which I worry about.

So basically you're saying they're going to be able to charge a premium because people are lazy, won't do their homework, and will want a "turnkey" solution. OK; that makes sense. I don't see why that can't be cloned by, well, anyone, including local installers. The financing is harder to clone.

Um.... yes?

I live in New York. Our utilities were already required to divest from production, years ago. All the power plants are "merchant plants". Utility-scale wind and solar can sell into this market with great success, as you might expect.

Transmission charges have already been raised to cover transmission costs where I live. Transmission costs are at 4 cents -- it might go up to 7, maybe, but probably won't go up at all. There's also a flat service charge per month of $15/month for having a grid connection at *all*, and *this* actually is fairly likely to go up.

Add 4 cents for transmission to future utility solar at 4 cents or less, and you have 8 cents/kwh. Good luck beating that with rooftop solar. Rooftop solar has some value due to grid-independence, but it's actually going to be quite tough for rooftop solar to compete with the grid on price.

Now, if you can go completely off grid and cut the monthly "grid access fee", you have a better value proposision. But *here*, to go off grid you need to be able to ride out a snowstorm: SCTY is simply not selling a system which will do off-grid in the Northeast, and has no plans to do so, as far as I can tell.

In territories like NY where the transmission operator has completely divested from generation, I see residential retail-level PPAs dying completely because they will be more expensive than grid power. Perhaps looking at different utility territories is giving us different perspectives. I think of the NY model as being the future, but it's possible that stupidity will reign in other states...

The battery business is another matter entirely; I see the battery business as competing with the cost of *upgrading your electrical service*. Most people's heavy electrical loads don't last long. A big enough battery could be an alternative to upgrading to 400 amp service, and for *that'* a battery is quite competitively priced. But Tesla owns the value in the batteries, not SCTY...�

1/1/2015

guest Service doesn't need to be upgraded for momentary loads. The reason to upgrade service would be a large continuous load such as running two central ACs while charging two EVs.

It is interesting that Tesla Energy has apparently started selling batteries directly to consumers. I didn't expect this approach, and I'm not sure what this change in strategy indicates.�

1/1/2015

guest Maybe momentary is the wrong word. Not long-term.

Been there, done that.

I'm talking *big* short-term loads like the startup of a geothermal pump. It uses rather little power in steady state, but the startup load is massive, and it was blowing my parents' main breaker until they upgraded. There's a surprisingly large number of things like that, often associated with heating and cooling. Many of them are probably reschedulable (which helps with making sure they don't *all happen at once*) but most of them are not actually set up to be rescheduled. Adding a battery is a way to do it which requires less work than replacing all the heating and cooling equipment with "smart" equipment.�

1/1/2015

guest Whether SolarCity's earnings report contains positive or negative data I fully expect it to be spun negatively by the media. To this end Chanos and other shorts will aggressively attack in a full out effort to collapse the share price. I'm not complaining, only solidifying my long term view. Optimism, pessimism, f$&k that, as god is my witness I'm hell bent on seeing this happen......�

1/1/2015

guest I am 90% certain it will plunge yet again. If not for some stupid amateurish Doha panic trades I would have been sitting pretty right now, but I'm out of ammo. I'm going to ride it down into the teens like I always do but I am just as confident things will turn around in the next year or 2. or 3 or 4. �

�

1/1/2015

guest Joe Stack (Analyst - RBC) said:

And are you willing to provide an update to those initial targets?

Elon Musk (Chairman and CEO) said:

Not yet. Maybe in one or two earning calls from now I think we'll be able to shed more light on that. But yes, as JB was saying, we're going to make sure Tesla Energy is not constrained by vehicle needs. The growth rate of Tesla Energy is, on a [too soft to hear] basis, going to be far greater than the growth rate in cars.

2017 LEAPs?�

1/1/2015

guest Maybe it is just wishful thinking, but Elon mentioned little to nothing at the TSLA ER call last week about Tesla Energy and batteries. Then SCTY ER was moved out a week later than usual. I'm wondering (or hoping) if there will be some positive battery news that has been saved for tonight's er?�

1/1/2015

guest There is no other entity operating in all viable markets who can touch the SCTY value proposition. Their only real PPA competition is slowly dying or has already died. Turns out there were no short cuts.

I would say the truth is a lot closer to the exact opposite, within a couple years anyone will be able to negate all the up front cost components and take tax credits at POS. What they won't be able to insert into a business model is the stability of being the front-runner since the beginning. Thanks to Elon as a spiritual and financial backstop, SCTY isn't going anywhere. Could that be said about other PPA operators? Why would I choose Vivint or SUNE or a local installer over SCTY for my PPA needs? Half the boxes aren't checked with the other guy's offerings.

Standing relatively alone in the PPA marketplace for 2017-18 will be invaluable to future revenue streams.�

1/1/2015

guest SCTY ER: Like Christmas four times a year.

I hope the boys can keep this ship afloat. Since SCTY financial reporting has reached ludicrous mode there may be no where to go.�

1/1/2015

guest Leaving the snippiness aside, I agree with this bit

- "SCTY financial reporting has reached ludicrous mode"

and this bit

- "there may be no where to go".

Regardless of what happens in the ER, anyone having even a passing interest in SCTY should take a close look at Hancock deal and all info around it.

For the longest times, the belief has been that SCTY does make very fat profits, it just so happens the profits are stuck in very long term future cash flows. This is really the basis for a multi-billion dollar valuation.

For the first time ever Hancock deal actually exposes that the long/bull premise is fundamentally flawed. SolarCity doesn't make any profits even after accounting for all of the future contracted cashflows. The stock slide of more than 30% around the Hancock deal announcement is not fluke. It is simply more people realizing what's going on.

The bolded part, I thought would be the circumstance if ITC deal wasn't reached. It's shocking to find that SCTY is in that predicament today.

Chanos' recent comment is "The problem with SolarCity is they�re losing money on every installation". I believe he is actually correct. And I also believe he is doing a full cashflow analysis (of the contracted portions), not just upfront cashflows. Don't brush off Chanos lightly. He is very highly regarded as a financial/accounting genius. He apparently cracked Enron before it imploded. That does take a genius. After all SolarCity is primarily a financial firm with a gazillion SPEs and SPVs. It is sort of a bank, without any banking regulations, and the management going amok with whatever they want.

On the contrary I believe Chanos is getting Tesla wrong. Yes, he may have a point or two with respect to finances. But Tesla's core strength is not financing. It is the product, the technology, the leadership and such. Chanos hasn't built a reputation for himself in analyzing such traits. So I'm not sold on his thesis with respect to Tesla. But I do feel that he got SolarCity right. He will stay short until it goes to low single digits and eventually gets taken private (to save Musk from an embarrassing public bankruptcy).�

1/1/2015

guest Want to add, generally SCTY short-interest goes down when stock goes down (as traders cover at lower prices). But this time around since Hancock deal came out, as stock went down, the short interest went UP. So essentially shorts are emboldened by that new piece of info.

Hancock deal was either a distressed trade because SCTY badly needed money -or- it is what the true value of these cashflows is. Either case, it doesn't bode well for SCTY.�

1/1/2015

guest I'm most interested in reestablishing customer acquisition cost trends. The financial fallout from Arizona has obscured those numbers.

As a solar construction company they have plenty of opportunity to bid jobs. If the PPA decline continues, the question is whether SCTY can morph into a different kind of company.

I don't expect much from today's ER except obfuscation.�

1/1/2015

guest The Hancock deal does shed quite a bit of light on potential profitability. The residential(70%) portion of the offering was essentially financed at $3.24/W after most everything has been sold or otherwise monetized. Installing at $2.60/W including absolutely absurd customer acquisition costs therefore becomes a fairly clear indication of today's profit off each install and what tomorrow will look like. Yes, these guys are installing in a mature California market at scale, but every other market might as well be in it's infancy. The costs to install will only remain so fat until some major markets getup to scale.

The 2016 install cost goal of $2.35/W(mixed I believe) paints a more pleasant picture when overlayed with the revenue/W they've been able to generate within this most recent offering. In basic terms, if you can maintain something like $3.25/W as the output of your model, how is that anything other than an accelerating cash machine as costs quickly plummet from $2.67 to $2/W?

That being said, I agree that this quarter will be nothing more than worsening inputs for the algos and should cause a dip. This pattern has repeated so many times now that the dip might be mostly priced in, who knows. I'll be interested to see how all the new grid/Tesla Energy products are positioned.�

1/1/2015

guest Mule, The $2Bil market cap and $5.4Bil enterprise-value is not based on future profits.

It is very much rooted in the assumption that SC is making big margins "today" AND the assumption that it has already bankrolled piles of these profits with all the installs they made so far in what used to be called Retained Value.

If word gets out adequately that they are not making profits nor they ever made them, the stock will be sub-$5 or worse, they are already insolvent.

A month or two ago, in exchanges with jhm I said, I believe SC is solvent but has liquidity issue. But now it's becoming clear that they may not be solvent at all. This is a far worse realization.�

1/1/2015

guest It'll all work itself out within this calendar year no doubt. Pretty clear to me that if you can generate $3.24/W on residential installs as the #1 player and no one is able to drive down your premiums over the medium term.....you got something pretty sweet.

As long as they maintain their model and differentiation at all cost, they'll make a killing when cost and revenue finally cross paths. Who's going to jump into this market and displace SCTY? Certainly not the no-sales SUNE model or the all-sales Vivint model.

On an install basis they should show a profit this year right? $3.24/W - X = Y provides more than enough room to work and should be pretty clear to investors.�

1/1/2015

guest I may be proven wrong, but I'm very bullish going into earnings. GL everyone.�

1/1/2015

guest Human sentiment will show signs of coming around, but the algos will easily overpower to the downside on increased debt.�

1/1/2015

guest So how long is normal to wait? I thought it'd be up at 1:01pm PST?�

1/1/2015

guest 214MW installed vs much lower guidance +40% y-o-y�

1/1/2015

guest I was wrong, I purchased a truckload of short term calls. /sigh Glad for those of you who called it correctly.�

1/1/2015

guest Lowered 2016 guidance from 1.25GW to 1-1.1GW.

Not sure why this wasn't revised last quarter when 1Q16 was revised downward.�

1/1/2015

guest Sales costs up to $.87/W, that's a LOT and very surprising. Building out these new markets is expensive.

Edit: Pardon me. NINETY-SEVEN cents. Eating the cost of Nevada I assume? Would have liked to see sales cost without the NV shutdown.�

1/1/2015

guest New zero-down loan options from SCTY, 10yr 3%, 20yr 5% with all the tax credit retained by the customer. Might have to peak at that if rates are <$3/W as mentioned on here previously, but I doubt they'll beat out my local installer.�

1/1/2015

guest Looks like I called the sales cost rise a few weeks ago. I guess they're not all on pure commission.

Overall there looks like a lot of positive stuff so the -20% seems a bit surprising. I like to read the ER, guess the move and then check the after hours quote. Until the reduced guidance I thought it was going to be a big move up despite the sales costs.

My take aways are:

- Exceeded 180MW target by a lot but whole year installs will be under 1.25GWh

- Costs up a shocking 19% per watt but due to temporary sales costs spike and should drop fast later this year

- PPA contracts can be sold for $3.24 minimum + SCTY retains ~$.33 worth of extension and 5% ownership to cover maintenance, so they're profitable now.

- In the future contracts will likely be sold for more while costs decline to $2.25 by year end.

- State by state regulations are still a huge unknown

Unless SCTY is tricking me with their complex math, it looks like there is growing evidence their business model works. If they really get close to $2.25/watt costs by years end that seems quite profitable.

I'd like to hear SBenson's take.�

1/1/2015

guest Most important thing from the conference call.

1) SolarCity does not have a cash problem.

2) Once Tesla Energy is fully online, and the Powerwall is being mass produced, Solarcity will resume hyper growth mode.

3) Chanos is wrong.�

1/1/2015

guest The price action is very un-surprising. The slide desk is dense. I only took a cursory look and couldn't tell anything. In good old times there was just one metric to look at - RV and how that is progressing. Now we all know that it was just a lie. oh well, here I go again... In any case, the issue is - as an investor (or a potential investor) I don't even know what to look at or how to validate or value the business model anymore. In every single report Raymond James used to put a phrase like "Valuing SCTY is more of an art than science". It actually slowly progressed into becoming Abstract Art... Just as a pure academic exercise I will spend a day or two on it late this week. Will post if I find anything interesting.�

1/1/2015

guest I could do without the guidance yo-yo'ing.

Feb16: Revise 1Q16 down to 180MW and maintain 2016 at 1.25GW

May16: Install 214MW in 1Q16 and revise 2016 down to 1-1.1GW

What good did the under-guiding 1Q16 do? None. They will easily hit the 1.25GW mark for 2016 and I'm pretty sure they know it. The more guidance transparency the better IMO.

Chanos will continue to be "correct" until he's not. He made a boatload of money, will cover at some point and then dive back in if he feels it's profitable. His commentary on fundamentals means nothing, he's sowing uncertainty and reaping the harvest each quarter. If you can't overcome a little bit of disinformation then either your valuation is fair based on execution or you're not expressing your value proposition properly.

I'll continue to bet on the Musk/solar combo obviously, but timing this thing for profit will continue to be a challenge. 1/3 of install costs are customer acquisition. Eating all the NV costs is a fair excuse, but a change of sales tactic is overdue. I have some thoughts on this, but will save them for next week.�

1/1/2015

guest Wonder if Musk open up his check book again.�

1/1/2015

guest I believe/hope you are absolutely correct. Unfortunately, Chanos is still correct on his short position for today and made crap load of $ right now. Hope he decides to let it ride and give it all back eventually. Either way, he gets to pound his chest and tell the world how credible he is for now... Chanos can have my scty calls that I lost today and suck it..... It's so funny I'm more mad about him making $ on his short scty than me losing 5 figures on my scty call options...�

1/1/2015

guest In my view, if Chanos doesn't cover his short tomorrow he's 100% crazy. The sentiment on TMC has never been more bearish. I'll be shocked if this end down anywhere near the after hours low. All this proves is that too many simple minded investors don't understand SolarCity's long term business strategy.�

1/1/2015

guest Additionally, Chanos is a pathetic and disgusting parasite, who is worse than Donald Trump. He exists to boast on TV, and to cause harm to companies by misrepresenting the truth. If he was struck by lightning tomorrow, I would throw a party.�

1/1/2015

guest Agreed. This week's calls are toast for me, but I'm buying back in... but a little longer term options though, lol.�

1/1/2015

guest Don't be so soft on him.�

1/1/2015

guest There's plenty to fret about this quarter, but install costs continue to drop year over year. A big drop for install costs on the November call would make me feel much better about my 2017/18 calls, we should see it continue to drift down this summer.

Don't worry about sales cost, most everyone is feeling that pinch in the US. 98% of consumers have completely incorrect information in their heads regarding the economic value of solar, all it takes is time to eat away at that. People aren't going to need 30 hours of hand holding to go solar a year from now.

Once logic and connection overpowers the disinformation machine the vast majority of that sales cost disappears. That's about $.60/W that SCTY can mine for profits. Then the gigafactory comes online.... Then these second tier markets get up to scale.....

Interested to see the Elon purchases next week and perhaps hear someone address the weird guidance numbers.�

1/1/2015

guest I despise Chanos, and all that he stands for. That said, today he bested me. Got to give the Devil his due.

But, a big Kim Kardashian But, I'm in for the long haul.

I'll be back.�

1/1/2015

guest I'm right there next to you, except...

But, a big Jay Lo But...

I won't be buying weekly calls for a while though... Just leaps mam, just the leaps...�

1/1/2015

guest I'll gladly take it a step further. If Chanos's gasoline vehicle got into a horrible accident and exploded with him in it, I'd throw an even bigger party. He's a cancer.

If I was a screenwriter, perhaps I would use him as the inspiration for a story about a parasite analyst who wakes up one morning as a giant cockroach. The story would end with the entire city running him out of town. Or perhaps him being hit by a passing freight train while being run out of town? The final scene would be a person in a Tesla driving by the incident and laughing.

Just for fun, this comes to mind. Obviously nothing borrowed from Kafka.

�

1/1/2015

guest I was similarly destroyed. I think I'll be sticking to LEAPS for a while. I am not looking forward to the red in my account from my weeklys once the opening bell rings.�

1/1/2015

guest I'm happy to see that SolarCity is righting the ship. They have made solid progress toward becoming cash positive. They are now monetizing 98% of cost. It was a disappointment to see sales cost climb to $0.97/W. Management believes this is transitory and will be rectified by Q3. So sales cost is about $0.50/W too high. As that is resolved, the monetization level will easily be above 100% and retained value will be a driver of cash.

Further it will be exciting to see grid services evolve. This has the potential to add 15 to 30 percent to existing customer derived revenue. This will substantially change the investment thesis for SolarCity. Full cost monetization moves the company to cash positive growth with long-term retained value. That's workable, but grid services will add near term profits to sweeten the whole deal for investors.

So my outlook is that SolarCity continues to have a few more difficult quarters as these pieces come together. It may be worth accumulating at very low prices through the summer, but early fall buying may be the best timing. No doubt this stock will be very sensitive to the election cycle. So be careful about bidding up the price anytime before election day.�

1/1/2015

guest SCTY drop continues pre-market, 52-week low and even lowest point since IP in sight....Will shorts cover?�

1/1/2015

guest SCTY opens at 1776, very appropriate.�

1/1/2015

guest Agree- this is the early stage of the transition I've been watching to see (disclosure: I have a very small, long stock position in SCTY). The earliest monetization the better from my perspective. They still hyperbole the belief that better monetization prices should come later- I disagree in general. Solar-Storage is a self competing economic over the 20 year term of these contracts. There' nothing but lower prices for contracts of today imo. [Also not a fan of YieldCos for the same reason)- Now that they are making this transition- I'll be accumulating slowly over the next months if they continue this transition- My investment will be inversely proportional to the contracts they hold instead of sell�

1/1/2015

guest Insane volume this morning.�

1/1/2015

guest 666 would be more approriate�

1/1/2015

guest So SCTY is taking its quarterly beating. Look at a one year chart. Same thing happened right after the last two ERs. It is now back to the level it was at in February. If the price holds at this level, it could indicate that things have bottomed out.

I for one am more optimistic about SolarCity today than three months ago. I see that the company is responding to challenges and setting a new course.

Even short-term traders should be able to see the potential for the price to return to the $30s within a few months. Even shorts may want this price to return so that they can short into next ER all over again.�

1/1/2015

guest At some point customer acquisition cost can either drown the organization or destroy the business model from within. Monetizing all the way out to 20 years is an amazing step and a huge positive, but sales cost is going to come down industry-wide some day soon and SCTY needs to be ready for it.

It's all well and good to pay a sales force $.55/W when you have no other choice, but Germans pay about $.02/W in sales cost. Some day very soon local US installers are going to have that level of demand and if SCTY is still quoting prices with $.55/W in sales cost.....well that's just not good. We can't have a scenario where $2/W installs with a 30% credit are being sold to people who would be much happier under a PPA if it were leaner.

I'm sure SCTY has a solution to this and can just eat the sales cost as they wind down their door-to-door model in late 2017, but it worries me. Sales cost(at least as it's included in new pricing) MUST be less than half of the 2015 average in relatively short order. Relative to the work these guys have already done to get the business model where it is today, these concerns may seem minuscule. But these are my concerns.

Anyone have thoughts on price points for 2018 LEAPS? $60's, $70's, $80's, $90's? I just want to put in a $.12 order on something and let it sit a few weeks. $70's at $.12 perhaps?�

1/1/2015

guest This is clearly the number you identify with. You must be delighted today, in your deep and abiding hatred of everything SolarCity. Congrats Mr. 60606 (666) your short position must have paid off handsomely today. Did you close it or are you expecting another 25% drop in short order? What is your prediction for when SCTY goes to zero? 1year? Two months?�

1/1/2015

guest I just got Jan18 20s at 5.25. Kind of feels like stealing.�

1/1/2015

guest Is anyone willing to provide a short summary from the conference call or does anyone have a link to the transcript?�

1/1/2015

guest Completely agree- In fact I don't believe acquisition costs will even take the same form 10 years from now; 'Panels' will be sheets, sub-layered with super-capacitive integrated storage. I'm a fundamental believer that Solar-Storage will enter self-destructive accelerated stages (ala semi-conductor). It will soon (a few years) be it's own (and only) competitor- and unlike fossil based power has virtually no bottom to it's cost. Power will be a near-free commodity in 20 years imo.

The entire profile of the business will modify over that time frame. SCTY will have to be very nimble. I'll stay acutely and cautiously invested.�

1/1/2015

guest I like that buy. On way to play scty is to assume that Musk can only let it get so bad before intervening. One way to look at solarcity strategically is that they will spend a few years right sizing the company. Once they turn cash flow positive it may be possible to put an accurate value on the contracts they hold.�

1/1/2015

guest More SCTY for me this morning at a cheap price. I love earnings!

�

1/1/2015

guest Averaging down has worked well for many here. Cough.�

1/1/2015

guest Me too, though sadly not that many shares. I helped my girlfriend set up at a brokerage acct so she should profit as well. Now I REALLY need them to do well. �

�

1/1/2015

guest Bought some shares here, probably from Chanos. Oh well, time will tell.

Thank you kindly.�

1/1/2015

guest I agree that SolarCity absolutely must get a grip on sales cost. Consider that they were just about $10M short of being cash positive (on their metric that allows for project financing). Now consider the impact has sales cost just been $.10/W lower. On 214 MW, that would have saved $21.4M in cash outflows. So $0.97/W on sales cost totally screwed up what could have been an amazing turn around. Had they kept sales cost below just $0.45/W, they would have been cash positive to the tune of about $90M. And with that kind of turn around, we could have seen the share price launch back up.

Long-term, I don't know where sales cost should go. That depends a lot on what competitors are willing to spend to grab market share. But short-term, whatever they can trim off of sales costs will make big difference for cash and share price.�

1/1/2015

guest Edit: Sorry, wrong company

SolarCity (SCTY) Lyndon Rive on Q4 2015 Results - Earnings Call Transcript�

1/1/2015

guest I don't know too much about what their operational plan was for Nevada, but having to drop shovels and walk out was clearly a punch in the financial nuts. Perhaps that was to be a vital piece in the shift to more efficient sales process.

Taking the long view I applaud them for taking the hit and just leaving the state entirely. I some ways I wish more public companies would make such principled decisions that maybe aren't the best thing for stock prices. As an investor waiting for profits.........

So long as they stay on par with local installer's sales costs they are fine, and as of today they are fine. As I've said a bunch of times, that dynamic is going change at some point and when it does it will happen overnight. When the time comes, SCTY better be ready to pivot away from giving sales guys $100k in commissions.�

1/1/2015

guest Buying a ton here. Should clarify, bought a ton at $16.60. It might go lower, but far to many people are comparing SolarCity to SunEdison, and ViventSolar and are failing to mention any of the factors that make SolarCity unique. Even the analysts didn't seem to understand why SolarCity is fundamentally different from other "solar companies". Solacity is more than a solar company! Also, SolarCity has access to close to unlimited capital.

SolarCity isn't borrowing money to burn through cash and doesn't lose money on every PPA. SolarCity is investing the cash it received into solar ASSETS. There is a very low chance that a large number of Salacity customers will default, and there is a very high probability that many of them will renew. Additionally, once battery storage enters the equation, every SolarCity customer will buy one. This will force the utilities to work with SolarCity on net metering, or something like it, that provides reasonable compensation to people with solar for energy. SolarPanel installation offsets utility infrastructure costs.

As Lyndon put it, unless the utilities ignore the existence of Solar, and continue to expand the current infrastructure without calculating for Solar, the utilities are responsible for any added costs to customers. If utilities include solar in the equation, it results in a reduced costs of energy to customers.

Once the Solar Panels have been fully paid for, customers with PPAs can renew at a significantly reduced rate. Almost all the money SolarCity will bring in from these customers will be profit, and SolarCity's margins will be extremely high. This will provide SolarCity will a lot of flexibility when it comes to charging less than the utilities.

100% certain we hear from Lyndon or Elon any day now. Also, the Gigafactory event is in 2-3 weeks. Anyone know the date?�

1/1/2015

guest I bought today at $16.88. There's a good chance there will be more opportunities this low this year, but there could also be some spikes up to $25-$30 that could be an opportunities for profit.�

1/1/2015

guest I'm torn on strategy, but am going to be patient for a couple weeks. LEAP prices are always slow to adjust to these mega-drops in share price. Looking for a dip down to $17-18ish in about 3 weeks if the share price floats back up. Gonna buy my last chunk of 2018 LEAPs and move on to other things for the summer. Been following this waaaay too close for the last 6 months.�

1/1/2015

guest Chanos is a horrible, disgusting, piece of garbage that isn't worthy of anyone' time. He deserves to get eaten by a pack of wolves, pooped out, then fed through a wood chipper. Despicable lying parasite.�

1/1/2015

guest I'm torn short term as well. Chanos will probably be out calling for single digits soon I imagine on the squawk box circuit. Energy bill should progress on Wednesday after they vote down the Iran amendment according to this. With my luck I would buy a strangle and the SP will linger until expiration.

Overnight Energy: Senate Dems block energy, water bill a third time

�

1/1/2015

guest The Jan18 30s @ 3.30 look like a deal right now, they were trading @11 as recently as April 21st�

1/1/2015

guest Today was accumulation, not short covering. Maybe a little short covering, but I'm fairly sure most of it was accumulation. Short covering doesn't usually create a straight line throughout the entire day.

My thoughts, the drop to $18 was due to the "miss". The rest of the drop was panic selling, and margin calls.

1) Liquidity concerns are BS.

2) Chanos is a chad who enjoys receiving credit for misrepresenting facts.

3) Every time Solar City has fallen to ~$17 it has seen plenty of buyers. I'll remind you that many analysts had price targets of $80-$100 6 months ago. The only thing that has changed is the market sentiment, and the price of oil.�

1/1/2015

guest I agree, aside from the last 15 minutes of the day. That definitely looked like covering for that little recovery.�

1/1/2015

guest I have ser

I'm not convinced. Usually flat movement after a very big drop with significant volume indicates accumulation. I think the last 10 minutes was short covering, and traders who were short exiting stage left, after making 30-50% in 3 weeks. Seriously, every headline today was basically saying SolarCity is doomed, and Elon is a liar. Manipulation?

Either SolarCity will go bankrupt or it won't. I trust Elon and Lyndon 10000% more than I trust Chanos.

If SolarCity succeeds, it is worth $100-300 long term. If SolarCity goes bankrupt, SolarCity's assets and portfolio are likely worth $1-2 billion. At $1.5 the market is basically not pricing in anything.

Chanos = The Gary The Rat of financial Analysts

�

1/1/2015

guest But he does provide for good buying opportunities; but your description sounds better �

�

1/1/2015

guest Not that it matters, but I think we are saying the same thing.

Me: I agree it was accumulation today aside from the last 15 minutes, which looked like short covering.

You: I'm not convinced. It looked like accumulation until the last 10 minutes, which looked like short covering.

Maybe there's just vehement disagreement re: 3:45-3:50PM today?�

1/1/2015

guest I have so many shares and LEAPS... I am hyperventilating for sure. Any chance this sees 90 before Jan of 2018? LOL.

Drinker of Koolaid, you cannot fault Chanos for anything. If SCTY is a real company with a bright future and big profits as so many of us believe, none of this will matter.

If not and he is right... well then he is right.�

1/1/2015

guest I would rather live a single day as Elon Musk, today included, than a lifetime as Jim Chanos.

Traxila, 8 months is a long time, especially the next 8 months. President Clinton and progress at SolarCity's Riverbend project could change the stock's outlook.�

1/1/2015

guest I would say $90 in Jan2018 is a near certainty and up until this quarter I would have said Jan2017 would be 50/50. After this abysmal quarter I'll still say 30/70 for $90 by Jan2017 due to the near lock for Clinton and a more desperate fossil industry forcing Congress into give and take on energy legislation.

"Solar" is going to change a LOT this summer as consumers become more educated.�

1/1/2015

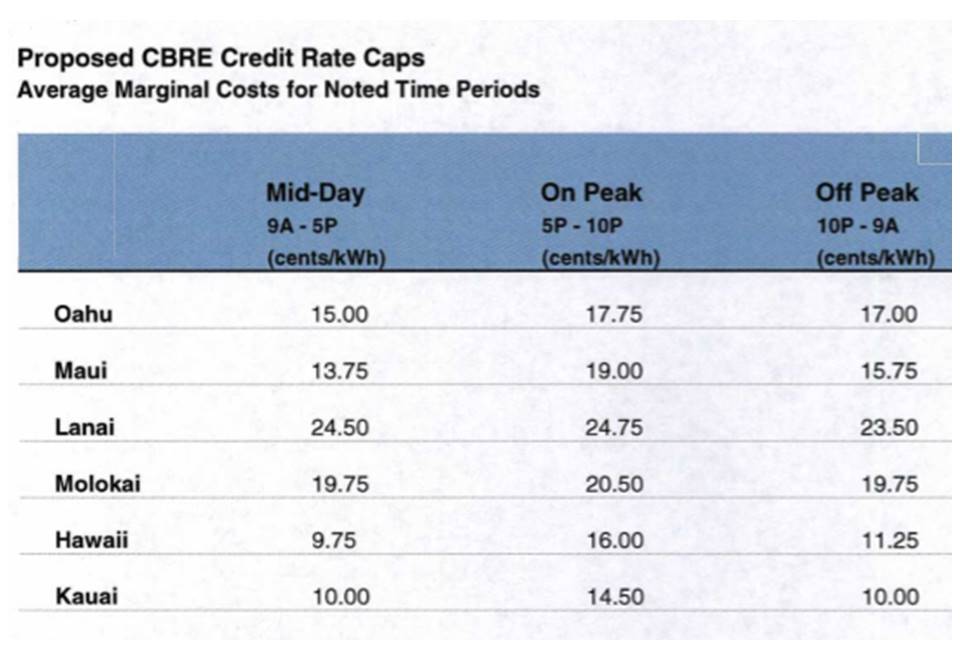

guest ![[?IMG]](http://www.eia.gov/todayinenergy/images/2016.03.01/main.png)

'Solar. Planned utility-scale solar additions total 9.5 GW in 2016, the most of any single energy source. This level of additions is substantially higher than the 3.1 GW of solar added in 2015 and would be more than the total solar installations for the past three years combined (9.4 GW during 2013-15). The top five states where solar capacity is being added are California (3.9 GW), North Carolina (1.1 GW), Nevada (0.9 GW), Texas (0.7 GW), and Georgia (0.7 GW). These values reflect utility-scale solar capacity additions, and do not include any distributed generation (i.e., rooftop solar)'

Kinda cute isn't it, Nevada is now 3rd in the country for solar additions, I wonder why.

on a separate note '3.676 cents per kWh' is the new industry benchmark for California utility solar

http://www.cityofpaloalto.org/civicax/filebank/documents/50920�

1/1/2015

guest If the company goes bankrupt the shares will be worthless. There are a lot of hyper bulls in this thread that also says things that imply limited understanding of the investing world. I know my post will be disliked in this bullish echo chamber and I have said it before here, but I urge anyone reading not to bet the farm on SCTY, it's a risky investment there is no doubt about that. It's a bet on residential solar which is a business model with no guarantee of ever gaining significant traction (it does compete against utility scale which is 1/3rd the price).

Like traxila said let's wind down the comments about Chanos. I know you are angry about losing money but repeatedly talking about how you would be happy if he died, come on now (also are there no mods watching this thread?). Even at this point the bulls in this thread are as bullish as ever, try to be realistic. The growth is slowing down quickly and the costs are rising, even in spite of the massive rise in customer acquisition spending the growth is slowing, this is a huge warning sign. It looks like the low hanging fruit has dried up and their growth is about to peak and turn south, which makes sense as there is a huge difference in viability of residential solar in the US due to both sun hours and regulation.

My point is that it is easy to fall in love with a stock, that is just how the human mind works. Confirmation bias is not our friend when it comes to investing so be careful and don't martingale.�

1/1/2015

guest I have often made the same statement in the TSLA related threads. The temptation of easy money can draw people into short-term trading and options, both of which are extremely dangerous for the retail investor.

I've strongly advised people NOT to invest retirement funds in individual stocks. A mix of stock and bond index-based mutual funds is generally the wisest path for money that will be needed in the future.

Either SCTY succeeds or it doesn't. What has yet to come into play is the effect of Tesla Energy products combined with SolarCity arrays. It is entirely possible that residential solar won't be as big a play as some thought, but that doesn't preclude SolarCity from transitioning its business more to the commercial sector, especially if corporate customers see big savings from a Solar & PowerPack setup. So: stay calm, don't bet the farm, and plan on holding shares for a long time rather than trying to make $ off trades and options.�

1/1/2015

guest The thing with the Powerwall is though that it will only make it more expensive for the customer. The only reason why residential solar is viable right now is that in some states you can just use the grid as a free battery, all you pay for is the electricity from the panels. The only reason for a SCTY customer to get a Powerwall with the solar panels is if the utility starts to demand it because of the loss they are currently taking. If that were to happen SCTY wouldn't be able to compete at all, the current price from SCTY is something like 13 cents/kwh right? If you added a Powerwall to the deal the total price would exceed 20c/kwh, noone would pay that.�

1/1/2015

guest This will be a huge year for solar. Utility solar had declined last year, so there does seem to be a little catch up to do.

It's very exciting to see how low cost of solar is going. Internationally, Dubai has seen a utility scale PPA go for 2.99 c/kWh. Fossil fuels are getting priced out of the market all over the globe.

While I am impressed with utility solar, I remain convinced that distributed solar will play a huge role in the future. As the cost of generation comes down, the costs of transmission and distribution stick out as irreducible. So even with utility solar at 2 c/kWh, why should all grid participants put up with an additional 8 c/kWh for T&D to deliver that power. Properly valuing distributed energy assets can drive that T&D cost down to 4 c/kWh or less. This is the direction the whole system needs to go and it depends on integrating the expertise of distributed installers such as SolarCity.

The difficulty is that the utilities do not really want to embrace this change just yet. They still want an exclusive 10% rent on a system capable of 12 c/kWh average.

But the utilities will have to change. Just by loading up on GWs of solar, the utilities are committing themselves to making changes in how they manage the generation, transmission and distribution of power. They must make investments that integrate solar and wind into the mix. If they don't, then their costs get pushed onto ratepayers and rooftop solar becomes more compelling. If they do make these invesents, then it becomes more difficult to argue that distributed solar imposes incremental costs upon that system while utility solar does not. And finally, those costs are largely T&D costs. SolarCity is offering services to the grid that reduce those costs and the cost of balancing consumption and production.

So it is well and good, if utilities can acquire solar as cheap as 2 c/kWh. What SolarCity is offering are solutions to minimize the cost of distributing solar and other energy wherever it may originate. The first step to minimizing T&D costs is to reduce the distance from generation to consumption. Distributed solar does that. The second step is the minimize the peak load the transmission system must carry and reduce congestion. Distributed batteries help in many ways. The third is to improve stability and reliability while cutting redundancies. The combination of smart inverters, solar and batteries help in this direction. SolarCity is extremely well positioned to offer these solutions from behind-the-meter. Utilities simply are not allowed to do that. Thus, there is regulatory arbitrage to be had by utilities and SolarCity working together, exchanging value they are distinctly positioned to create. Moreover, this is value that distributed solar can create which utility solar cannot. Utility solar can compete on the price of remote wholesale generation, while SolarCity can compete on value created in distribution. These are two very distinct niches, so there is no a priori reason why one would exclude the other.

So longer-term this ecosystem and SolarCity's place in it will take shape, but the friction of present situation obscures this future. SolarCity has had to fight just to find a way into the market. The problem is no with SolarCity's business model; rather it is with a regulatory environment that is rigid and uncompetitive. SolarCity is quite capable of adapting its business to whatever it takes to break in. They are like the weed that finds a crack in the pavement to take root. What is needed is a more open ecosystem, and SolarCity is actually a big part of what is changing the system. They are the weeds that break up the whole parking lot, so that all sorts of new things can take root as well.�

1/1/2015

guest I agree that distributed solar will play a huge role in the future, I come from a state where 25% of residences have rooftop solar. But the cost savings to the grid are basically a mirage, (except for reduction of peak aircon load, which could've been supplied by utility solar anyway). Until a home actually disconnects from the grid, it is adding costs to the grid, one way or another, due to that cost burden, the payment for rooftop solar will be reduced to trend towards either wholesale price of solar or the TOU midday rate (these are effectively closely related, to a large extent (but not complete extent) they are same thing)). Think of solar as an alternate form of energy efficiency, not as a power source itself.

I've bought 2 solar PV systems, one about 8 years ago, one recently. Pre subsidy, the first was around US $5 per watt?, the second was around US $1 per watt. After-subsidy it was much better than that. Solar is great, but to me Solarcity is quite reprehensible when they sell PPA to the asset rich, income poor (ie the elderly), if there is an escalation clause. Its also why I think of SCTY as having a terrible business plan, they have high FICO grade customers, but seriously sub prime backing assets. Overtime, USA retail customers will trend towards what business customers pay, fixed + variable + demand charge. with big blocks of midday solar causing the midday to the cheapest time of day. Its also demonstrates the most probity. (Ie business customers pay that way because it is the most cost defensible way to apportion the electricity bull)

Solar power is co-ordinated by an extraterrestrial energy source called the sun. In the USA $1 of utility solar buys about 3x as much solar energy as a $1 of SCTY solar. Its really quite a simple and somewhat binary proposition.�

1/1/2015

guest look at today's net demand, California ISO - Todays Outlook and consider what would've happened if California had a nice breeze occurring while the sun was shining.

next year solar = this years solar + wind�

1/1/2015

guest I think the goal is to pair 100% of the PV systems with batteries, let the utilities optimize the battery loads in this new era of cooperation...assuming they want to ultimately keep those customers connected to their grids. More home batteries to the party.

Nissan and Eaton develop home energy storage solution

�

1/1/2015

guest I'm looking for another large stock purchase by Elon here. Last time I bought he did so I'm fully expecting him to do the same now �

�

1/1/2015

guest On May 2nd and 3rd, when SCTY came back down from the mid 30 to 30, I sold Puts with 25 strike and 5/13 expiration. $25 was well below the 200 day, and if I remember right, the 50 day, and at or below the bottom BB. I thought I was safe. I'm glad to see some recovery this morning. I just hope we reclaim $25 soon so I can get out and just stick to TSLA....�

1/1/2015

guest You chastise people for not understanding the investment world, then turn around and deny the reality already playing out in front of us? Residential solar(distributed geneneration) is clearly the future to anyone with a decent understanding of energy markets and human nature. The future of energy is in the consumer's hands, not the utility. From here on out utilities will be.....a utility.�

1/1/2015

guest Senate votes down Iran amendment to energy spending bill

�

1/1/2015

guest Holy crap these are in the money already. That didn't take long. These could be quite valuable in a year or so.�

1/1/2015

guest To me, rooftop solar isn't about supporting a distributed generation business model or trying to get ROI. It's just about the failure of federal policy, state policy, and the utilities to build and offer clean energy solutions. In the absence of those solutions, my only option is to go rooftop solar, which I wouldn't do if I could buy clean energy from the utility.

In the past, I have stated that I like the idea of installing load balancing batteries with rooftop solar as I can understand how the utility doesn't like the idea of having to balance solar with net metering. However, on the other hand, if you think of clean energy as a necessary part of our future, a rooftop solar install can be looked at almost as a subsidy to the utility as the installer is committing 10's of thousands of dollars to install solar capacity that the utility should have been installing for us in the first place. So maybe I shouldn't be so kind (to the utilities) as to expect consumers to pay for their own load balancing.

Anyway, it would be interesting to see a breakdown of reasons for why people install rooftop solar. Might give some insight for investors.�

1/1/2015

guest We're rebounding off the $16.50 low of the post-ER drop (-25%) yesterday after stabilizing. The +13% today looks like a combination of long-term investors scooping up more shares at an attractive price and possible short covering. Shorts would be smart to lock in profits now (I'm looking at you, Chanos), as SCTY is oversold and should not have gone down this low. We were down ~30% the week prior to ER and any bad ER results should've been priced in already (instead of an additional -25% slide).�

1/1/2015

guest Residential solar is still a very small part of the energy mix, and it is only viable if you can use the grid as a free battery there is no way around that. I believe I have written this before in this thread but I might as well write it again as it is pretty simple why residential solar just isn't viable today. The cost of electricity consists of 3 things, the generation of the power itself, balancing the supply and demand and the distribution. The 2 last parts actually make up more than 50% of the total cost and it all adds up to around 12c/kwh today for the utility.

For residential solar to be viable it has to compete against this cost, that is around 12c/kwh. That is simply not possible when generating the power alone from residential solar is the same cost (12c/kwh) as the total cost from utilites. It is true that if you went completely off grid the distributing part of the cost structure would go away, but even talking about this scenario makes no sense unless battery costs fall to something like 1/3rd of todays cost because it would add a huge amount of cost the balancing your production and consumption. Because if you wanted to go off grid you would need a large battery and probably a diesel backup generator for the winter months.

So residential solar under the current model has a cost structure of 12c/kwh for generation + around the same amount for distribution as you need to use the grid for it to work and an even higher cost in balancing the load as solar is more clumpy in output. That means that if everyone were to switch to residential solar tomorrow the cost would end up at least 8c/kwh higher (the added cost of generation), probably more than 10c/kwh higher. The gap to make residential solar viable in a level playing field environment is just massive.�

1/1/2015

guest I talked about Elon buying half jokingly half seriously. We'll see soon enough as he would have to file with the SEC.�

1/1/2015

guest I suggested to my wife (as she handles the stock in the family) to buy when it had dropped to about $21. Not sure if she did or not. I don't see SolarCity going out of business. They could be a good long term investment, IMO. They've got the right pieces in play.�

1/1/2015

guest Just FYI, most companies impose a trading blackout lasting until 2-3 business days following ER. Then the company has 2 business days to file the Form 4 to cover the transaction, so we may not have an answer until Friday or next week.�

1/1/2015

guest The legacy grid was not optimized to integrate intermittent renewables. There is plenty of friction as the system converges to something optimized for renewables. A lot of legacy cost is being shifted to ratepayers, but utilities like to blame the renewables.

In the long run, the grid will be managed around maintaining a suitable state of charge in batteries widely distributed across the grid. So transmission and centralized generation will mostly be about keeping the batteries charged at the lowest cost, rather than real-time supply-demand management as is currently the case. When the grid mostly exists to keep batteries charged at lowest cost capacity requirements are much lower. An analogy here is that of milkmen making daily deliveries of milk before the days of refrigeration. This was an expensive distribution system. Deliveries had to be made daily. But once electric refrigerators became common place, the milkman did not need to come as frequently. Eventually, the whole distribution system disappeared as families could get milk with their weekly groceries and keep it fresh all week. To be sure, electricity is at much higher frequency than milk delivery, but the same principle holds. Storage changes how inventory is managed. It's hard for people to imagine what this grid would look like because it does not yet exist. But try to imagine what the food supply was like before refrigeration. Try to imagine any commodity without the ability to store or stockpile it. Matching real-time production to real-time consumption is very costly. Matching real-time production to what is needed to restock inventory over the next 36 hours allows for huge logistical efficiency gains. Even just 1 hour of system wide storage would radically change the economics of production and delivery. It would pretty much eliminate the need for peaking plants for anything but occasional back-up, not regular daily use. It would substantially compress the spread between daily max and min spot prices.�

1/1/2015

guest -

Case in point: Germany had so much renewable energy on Sunday that it had to pay people to use electricity.

According to this article, last year in Germany the average renewable mix was 33%.�

1/1/2015

guest San Francisco is requiring new homes have solar pre-installed...today. Wait until the costs are roughly the same as any modern appliance like furnace, water heater, air conditioning or having a refrigerator as jhm illustrated above.

Looks like the Energy bill is back on track...plus a picture of Kate.

�

1/1/2015

guest You make some good points, but I think it's an overly pessimistic analysis. First, I think the aspect of self generation and energy safety is perceived as a major benefit of home solar plus storage. Especially in the next decade I believe this will become a standard feature of new homes in many affluent countries. If climate change becomes noticeably more pronounced people with disposable incomes will increasingly choose safety.

Second, solar and wind are going to be the main path to decarbonize. Home solar plus some battery may just need to be close to the cost of utility solar/wind plus transmission. Denmark may be largely decarbonized with nuclear, but most of the world isn't going that route. The process of decarbonization in the U.S will probably continue to provide incentives for home solar, even if the approach isn't entirely rational.�

1/1/2015

guest Yes, and national companies can not profitably install home appliances. This is one of my primary arguments for solarcity as a stupid business model.�

1/1/2015

guest Yes, you've made this point a thousand times. My apologies if I offend, but that's quite a linear outlook on a system that is literally changing by the month. You talk as if the cost variables of today are set in stone yet the whole industry is in it's infancy for 90% of consumers. You talk about cost as if Germans haven't been installing residential solar at $2/W for three years now, we have a full dollar per Watt to shave yet and that just at the cost levels of maybe 2 years ago. At scale, we should be installing at $1.90/W right now with all parties making enough profit. That is certainly more likely to become reality than for the whole country to insist on keeping the entire energy supply on the other side of a meter just to save $.45/W.

Having purely utility-owned energy production is done. Once your energy source turns to something that can't be hoarded this becomes an inescapable reality.

A utility will be just that moving forward....a utility. It's already happened in Germany and multiple states in the US are following their lead. Now community solar at what we consider "utility scale" will certainly seen quite a bit, but it won't be run by a utility. Third party renewable energy companies like SolarCity will run the production operation and the utility can balance the load.

We're breaking up monopolies here and the savings will be massive.�

1/1/2015

guest First of all Denmark doesn't get any power from nuclear, at all. We do get a lot of our power from wind, the highest percentage in the world I believe, and we have the largest wind turbine producer Vestas. You are implying that we need residential solar to move away from fossil fuels but that makes no sense. Utility scale solar is 1/3rd the cost of residential solar, the choice is obvious. While residential solar is more than 50% more expensive than status quo, utility scale solar has become as cheap as fossil fuels, and in some places even cheaper which is why most of new planned production capacity this year is solar. The solution to move away from fossil fuels and save money in the progress is here today and it is utility scale solar and wind.�

1/1/2015

guest I apologize if I offend but you make zero sense. Even at $2/watt residential solar isn't viable as you would still need the grid so the only difference would be the generated electricity would be twice as expensive compared to utility scale solar. Residential solar would have to become cheaper than utility scale for it to make sense, or trashing the grid completely and let everyone handle their own system and this just isn't realistic even 10 years from now (to do cheaper than a grid solution).

It really is simple math and it just doesn't add up in favor of residential solar. But please try to explain how residential solar will become viable using math.�

1/1/2015

guest As noted earlier, math is not always required, so long as the cost is tolerable. Sometimes it comes down to politics and ideologies.

Utility doesn't install solar --> I install my own solar�

1/1/2015

guest Utilities do install solar, more than half the planned capacity additions this year is solar. Utilities chooses the lowest cost solution, pretty sure they are also required to do that. As utility scale solar becomes cheaper and cheaper, the utlities will install more and more.�

1/1/2015

guest I'm not seeing it in my neck of the woods. I need to do more research to try to figure out what's planned in the future, but right now it looks like this:

http://www.kcpl.com/~/media/Images/Kcpl/About_KCPL/Company_Overview/GenerationMix.jpg

Also, lowest cost solution is often not the best metric when choosing solutions that impact people's safety and security.�

1/1/2015

guest Fun to watch. The forecasted peak demand is about 30 GW. Net demand at 11AM is down to 18GW, a little lower than early morning.

The peak tomorrow is forecasted at 32 GW. So imagine if this ISO had 32 GWh of battery capacity under its influence. The peak of 32 GW (after sundown) could be reduced by 8 GW from storage and the bulk of 32GWh spread out around this peak. So net demand gets capped at 24GW. It seems this would go a long ways towards minimizing the use of peak power plants. Moveover, these batteries can be charged when there is least need for baseload power, so base load or intermediate load plants do not need to ramp down or suffer low demand. This supports the price for baseload and maximizes its utilization. So the whole duck curve problem is resolved with about 1 hour of storage (1 hour times peak demand 32 GW).

So much of our hand wringing is brushed aside once storage gets to the 1 hour scale and beyond. Of course, it will take more than a couple of Gigafactories to build this out globally, but there are plenty of battery makers willing to step up as this market cracks open. But then there are all the legacy issues about what to do with some 8 GW of peaking capacity that only gets used a couple of hours each year if that. The basic answer is that we stop adding new peaking capacity and stop replacing at retirement. It's the same problem facing coal plants. It may take a decade just to build up 1 or 2 hours of storage, so that allows for a decade or so of depreciation. I think in five year's time, we'll have a very different view of how a grid should function, what's needed and what's no longer needed.�

1/1/2015

guest Here's what the German energy picture looked like on Sunday. Ask yourself how the very rational German regulatory bodies will handle this.

Germany had so much renewable energy on Sunday that it had to pay people to use electricity

�

1/1/2015

guest I don't think critics have been completely proven wrong here. I think it's highly likely that we will need a massive infusion of energy storage for everyone to get primarily on solar. However, I am bullish on the future prospects for battery storage, especially with Tesla's work on the Gigafactory. Pumped storage can help in certain places too where the environment allows; any utilities doing that yet?�

1/1/2015

guest I don't view SolarCity as merely installers. If you are talking about their new New York business model they are a solar utility, selling electricity directly to consumers cheaper than the utility. They will be design, manufacture, install, manage and maintain and bill clients in an end to end chain. I think of them as having an agile business model capable of adapting to a chaotic market and scale will benefit their operation with the regulatory clarity they mentioned.�

1/1/2015

guest Holy cow, that's a lot of coal, even for 2013! Keeping the Koch brothers in politics, is this? No wonder you want out of a system you never chose to be a part of.�

1/1/2015

guest This article was posted in another thread, but thought this statement was relevant with the current discussion going on in here right now:

Tesla Supplier Sees `Extreme Growth' Making Utilities Smarter

�

1/1/2015

guest

For this stock to still have upside solarcity needs a competitive advantage. What the barrier to entry in any of solarcity's businesses? The primary reason investment in renewable companies generally suck is the commodity nature of the business. Revenue is easy in business - just buy a lot of gas stations. The hard part is ROI. Good ROI needs IP or other barriers to entry.

Storage will likely be commodity-like too. I don't see why it would be different than making or installing PV.�

1/1/2015

guest Oil and gas are commodities. Yet Exxon is a pretty impressive company and does alright by their investors.�

1/1/2015

guest Electricity generation capacity has a lifetime of something like 40 years, only recently has the transition to solar and wind begun as it is only recently renewables has become competetive on price. The transition to 100% solar and wind won't happen overnight, that is just impossible. It will probably happen in 15-20 years.�

1/1/2015

guest Over the last decade in the US, massive coal capacity has been shut down and largely replaced with natural gas. This trend was already in place by 2013. Natural gas is extremely cheap in the US, ~$2/MMBtu.�

1/1/2015

guest I know, but even here at this historical low price it still translates to 3-4c/kwh I believe, which is comparable to current solar prices in top US locations. Someone in this thread linked to a project in California at something like 3.7c/kwh I believe it was.�

1/1/2015

guest Exxon has created many barriers to entry and also established IP.

I have never worked in solar or similar. Yet today I could sell and install solar systems.

What would be my odds of success if starting a deep water drilling business? Fracking also sounds interesting. I'll start by digging some holes in the backyard. Anyone know what I put in the hole to force oil out?�

1/1/2015

guest Any thoughts on the price action today? Maybe some large buyers (funds, elon?) picking up shares in the morning driving the price up and then a gradual return the more normal boost we'd expect based on oil going up?

We might see morning boosts the next fews mornings if parties are establishing positions.�

1/1/2015

guest Why don't you write some battery aggregation code and go into business as a DER aggregator? That ought to be pretty easy, don't ya think?�

1/1/2015

guest Yes I do, as application programming is my primary technical skill. There are literally hundreds of firms, big and small, in this space. If SCTY has some success in this space it will be due to the right strategy, not their ability to implement tightly defined specifications.

There is an enormous difference in the challenge of implementing DER aggregation compared to something like autonomous car. Not only is DER aggregation straightforward, but doesn't produce defensible IP.

Since I have never fracked or drilled in the arctic, these areas seem like a pretty big deal.�

1/1/2015

guest Fracking and drilling are pretty straight forward, which is why we see everyone fracking today and not just the one or two companies who developed the technology. The barrier to entry isn't the IP, it's the vast capitol requirements, which incidentally are also the biggest challenge for companies like SCTY.�

1/1/2015

guest Is this the end of the centralised energy network?

This is a nice illustration of grid economics. Western Australia is very spread out with lots of remote, sparsely populated areas. Most of the network is unprofitable to operate and the WA government must subsidize the network to the tune of $500 per family (per year, I suspect).

![[?IMG]](http://reneweconomy.com.au/wp-content/uploads/2016/04/sean-mc-goldrick-western-power-developing-a-microgrid-solution-to-support-the-kalbarri-community-in-wa-3-638.jpg)

So the network operator is experimenting with microgrid and thinly connected modular grid concepts. Some communities will be completely islanded.

So it's always been an unprofitable idea to operate a grid here, but distributed generation and storage technologies are bringing to light alternatives that may prove more economical.

This is one reason why it is very important to consider the locational value of distributed energy. Certainly a state like Nevada faces the same challenges as Western Australia. There are lots of remote little communities more than 60 miles from the nearest grocery store. (I've actually visited several of these communities.) Maintaining 60 miles of power lines to serve a dozen families just cannot make economic sense. So NV Energy stands to reduce costs spread out to all customers encouraging solar and batteries and working toward detached or thinly connected microgrid solutions.�

1/1/2015

guest Western Australia is about 2.646 million km�

Nevada is about 286,367 km�, so Nevada is about 10x smaller than WA.

Both have a similar population, Nevada is just marginally more populous

A lot of WA is beyond the electricity grid & a lot of WA is on the edge of the grid, I once lived in a town south of Kalgoorlie, back then the company had its own natural gas turbines, so I doubt that, that town was even connected to the WA power grid back then. For WA, a significant amount of grid defection would reduce grid costs for those remaining.�

1/1/2015

guest I haven't seem much interest by utilities in my area to even think about installing renewable/clean energy. The only effort they have put forth is due to mandates by law, and even the laws have been under attack.

Five years later, Missouri still grappling with renewable law

The sole law in question is the Renewable Energy Standard (RES). Lets take a peek at the Kansas City Power and Light (KCP&L) RES compliance plan for 2016. (note: KCP&L is actually KCP&L Greater Missouri Operations Company and is referred to as "GMO" in the plan)

2.1.2 SOLAR COMPLIANCE

GMO anticipates that the acquisition of Solar Renewable Energy Credits (SRECs),principally from GMO retail customers that have received rebates for solar facility installations, will be sufficient for compliance with the Missouri solar energy requirements for the 2016 to 2018 RES Compliance Plan period. The SRECs will be transferred to GMO from qualified customer-generator�s operational solar electric systems as a condition of receiving the solar rebate, a change institutedwith Missouri House Bill 142 becoming law on August 28, 2013.SRECs produced from these solar electric systems will be transferred to GMO for a period of 10 years.?

Tell me I'm reading this wrong -- but it sounds like KCP&L is using solar installed by 3rd parties to meet their own solar energy requirements. In other words, they are doing nothing, and intend to continue doing nothing for the foreseeable future.

http://psc.mo.gov/CMSInternetData/Electric/Renewable%20Energy/2015%20Reports/2016%20KCPL%20Greater%20Missouri%20Operations%20Renewable%20Energy%20Standard%20Compliance%20Plan%20EO-2016-0283.pdf�

1/1/2015

guest Solar competes at the retail level. Utilities cannot compete without "regulatory capture".

Regulatory capture is a form of government failure that occurs when a regulatory agency, created to act in the public interest, instead advances the commercial or political concerns of special interest groups that dominate the industry or sector it is charged with regulating.[1] When regulatory capture occurs the interests of firms or political groups are prioritised over the interests of the public, leading to a net loss to society as a whole. Government agencies suffering regulatory capture are called "captured agencies".�

1/1/2015

guest Seems like there are better environments for renewable energy outside Missouri so they import it, which I don't see the problem in, beside of course it being a negative for the Missouri economy.�

1/1/2015

guest Residential solar is wholesale energy production on the roof of someones home as long as they still rely on the grid. Try going off grid and see how the rooftop solar model holds up against the utility rate.�

1/1/2015

guest I doubt it has little to do with the physical environment. It's pretty flat, mostly crop land. Lots of wind and sun. I suspect the political environment is inhibiting renewables.

I would add that Missouri is not a big coal producer, less than 0.04% of total US production. So they are importing coal from other states when they could be creating new jobs within the state to install and maintain wind and solar assets.�

1/1/2015

guest Customers make retail decisions.

When utilities are held accountable for environmental impact we will have a level playing field.�

1/1/2015

guest And when utilities give up state protected monopoly status...�

1/1/2015

guest

Yeah, I don't see anything wrong with refined sugar besides of course that it can rot kid's teeth, lead to obesity and generally just isn't good for a person's health.�

1/1/2015