1/1/2015

guest albeit smaller than the mega-plants. SPWR like companies that can do both. They are recently moving a little into SCTY turf as well�

1/1/2015

guest I think that the bulk of the retained value gain is coming from cheaper financing. I know that SPWR said that a 1% reduction in interest rates would increase their retained value by $0.40/W from $1.75/W to $2.15/W.

So I imagine the higher retained value number is coming from SCTY's ability to issue ABS at ~4.5% interest rates.

So as long as SCTY is the only one getting such great interest rates then it will be a great deal for SCTY. They are essentially a bank: borrowing money at 4% and then lending it out (via a LEASE or PPA) at 12%. This is a great deal for them. Going off topic a bit, banks trade at roughly 1x book value, so if SCTY continues this "banking" model then you can throw out your 3x book value assumptions in valuing SCTY. If banks trade at 1x book value and utilities trade at 2x book value, then SCTY as a hybrid utility/bank company should trade at 1.5x BV in the future when the high growth period ends and normalizes around 10% per year. But I digress...

Once again, if SCTY is the only one issuing these ABS then it is a great stock, but if others are able to replicate this same ABS model (or similar crowdfunding, etc.) then margins will contract in the future and so would retained value.�

1/1/2015

guest good point.

when would you project that growth v. commodity-service line to cross-peak?

Given where we are in Solar DG with challenges remaining re: battery combo systems etc., it might be some time before SCTY becomes a JPM multiple. I would be inclined to sell TSLA before it becomes the next GM as well, so I'm guessing you believe the transition to occur fairly rapidly for SCTY? Could be right, financing is an easier nut to crack. The risk I guess is whether SCTY can build the brand faster than others. I agreed that is definitely a risk�

1/1/2015

guest I was asking for your opinion about other women taking risks of purchasing panels vs. leasing. I wasn't asking if you leased or paid for your system. That's great you paid for your system. I would buy one as well but I don't mind the hassle if it does eventually break down. Out of the first 10 women that come to mind, I do not believe any of them would buy a system if they were single.

The gender comment came up when I was saying that leasing is far from dead. Most of the men commenting strongly against leasing vs. buying were obviously not women. I would love to hear more opinions from any ladies reading these posts.

My step-mother actually retired from Detroit Edison. She actually repaired meters at your home. There is no way she would buy a system. She would lease it. She wants nothing to do with any maintenance or risks with buying something like this even though she's very familiar with electrical components.�

1/1/2015

guest a) The potential market size is so abnormally big and growing I have a hard time seeing solarcity coming into competitive pressure and going into lower margins. If anything they are the ones putting pressure on the competition by taking ever increasing market share!!

Feeling threatened by potential competition is the most far fetched idea really.

b) SCTY becoming JPM? Jesus!!

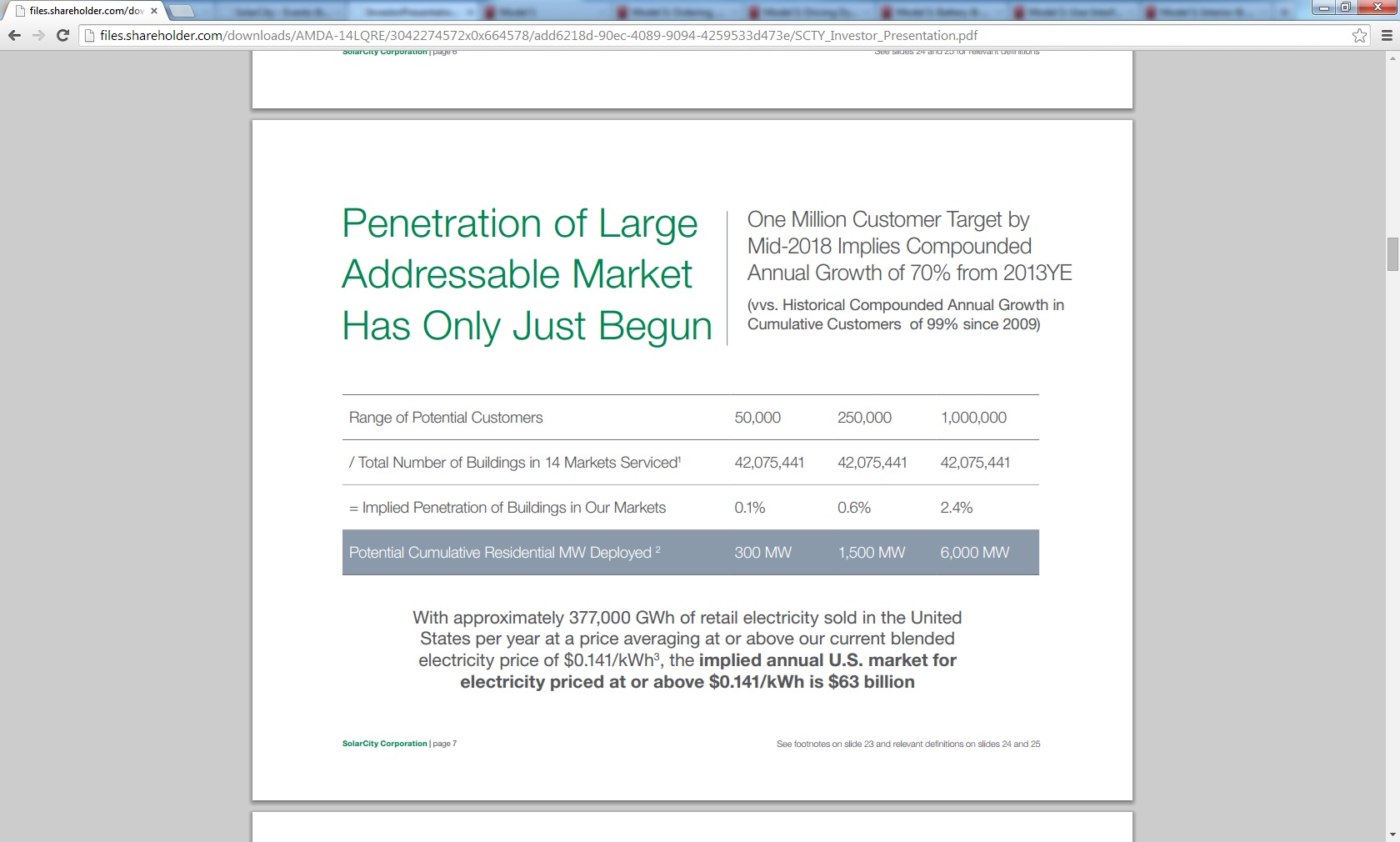

Even after hitting their 1mil customer target by 2018, which is 10X growth from now, they would still be holding only 4.3% market share counting only existing buildings in the 14 states they service!!

What about new buildings, What about other states, What about other countries. The opportunity is many orders of magnitude larger than where scty is now. This company could be growing for next 30 years and it might still not be done!

c) Just like P/E is usually a function of growth, P/B is simply a function of growth (in book value per share).

Utilities get P/B of 2 because they grow at a rate of 2% per annum. S&P gets 3 (2.7 to be more precise) because it grows bookvalue/share at 6.5% per annum.

So when scty is growing at 10% rate, it still deserves a P/B higher than S&P.�

1/1/2015

guest Obviously I'm one of the 'first 10 women that come to mind' when I thought about your question, so I think I'm a valid data point for this discussion. And since I'm single, you now know of one single woman who would buy a system (vs. lease). I know two other single women who have purchased, one woman (married) who leased.

I wanted to eliminate my power bill, not just reduce it. Leasing a system didn't let me reach that goal, so that option was a non-starter right from the beginning. Maintenance of the system was not the primary decision driver, pay off point was. I will be fully retired within 5 years and am actively eliminating expenses. Solar was an easy choice.�

1/1/2015

guest Another solar question - sorry, just trying to get every detail down. Should I get a little bigger system if I plan to get an EV in the future? I not only want to eliminate my electricity bill as much as possible, but want the EV charging to be offset as well. But since EV charging is at night, does it matter?

Thanks!�

1/1/2015

guest SPWR is trying to do everything - panel manufacturing, residential, commercial, utility-scale, all over the world, etc. I'd much rather prefer a CSIQ which IMO has a more disciplined/focused approach (build out the manufacturing capacity and then go big into utility-scale plants).

That said, SCTY remains the most focused on the existing highest margin in the residential/commercial solar industry (customer acquisition, financing, design, permitting, installation, follow-up products/referrals, etc). There's risk that these margins contract in the future but that risk can be largely outweighed if they can continue executing on their growth/expansion plans - both domestically and internationally. And also, they'll likely continue their vertical integration in a more thorough, faster and efficient manner than anybody else.�

1/1/2015

guest Yes, it matters. You want enough excess in the day to offset what you use in the evening. In my case, the excess I need to produce is smaller than what I need at night (for car or anything else), because I earn more for what I feed into the grid during the day and pay less for what I take out at night. I actively try to avoid using any power during peak hours and have shifted a lot of usage to the off-peak times.�

1/1/2015

guest Thanks for the info!�

1/1/2015

guest SCTY does not resemble a bank or any other kind of lending institution. They are more of a utility than a bank. They will never be in a position they are only growing by 10% a year until the point of near saturation in solar which is 20 years away. How does borrowing money to purchase solar panels to put on a roof = banking? It's not even close. The risk is taken on by the investors at 4.5%. SCTY isn't investing, they are borrowing. SCTY is the middleman who is also a servicer. A utility is buying natgas and then distributing electricity and servicing the lines. SCTY services the panels. Luckily the sun is free and that's why the utilities are trying to keep SCTY away from their lines. They do not want that solar energy fed back into the grid. They are earning a premium after generating electricity. The states cap what the utilities can charge. If everyone starts using panels then the electric company has to charge higher rates for the shrinking amount of electricity they are supplying. The problem is the price is capped so they can't raise pricing fast enough to cover maintenance of the lines. That is why they are lobbying to get rid of netmetering.�

1/1/2015

guest Single Female Data Point here. If I ever get around to buying a home, I plan to buy my solar system (with battery storage).

Happy Wednesday!�

1/1/2015

guest Or, no it doesn't matter. Ggies07, you're in TX but Bonnie is in CA so the true answer to your question may depend on your utility company and the supply pattern to your house. In my case (here in FL) I don't get cheaper electricity at night, it costs me the same all 24 hours of the day which means it makes no difference cost-wise what time I charge the cars. My solar system produces enough power during daylight hours to fulfill all our needs (cars included) 24/7; so obviously we have a net metering system whereby we over produce during daylight hours and every day the meter ticks backwards until the sun goes down and then it clicks forwards again. At the end of the year I want to come out as close to a net zero as possible.

Whether you use the TOU (time of use) rate will ultimately depend on what your powerco offers and you may need to do some individual calculations as I did. A good solar installer will sit down with you and work that out looking at your usage patterns etc.

Final BTW, I charge both cars at night at different times simply to keep total load to a minimum; extra cautious on safety, if you like. During the day there's A/C, washing machines, dryers, oven, pool pumps etc. running at various times.�

1/1/2015

guest Interesting. ..thanks for more info!�

1/1/2015

guest Here is an interesting blog post by Peter Rive:

Put Battery Storage in the Hands of Grid Operators�

1/1/2015

guest Not true everywhere. Here in FL our powerco has been running regular lotteries offering big incentives to residential customers and businesses to install PV systems. I'll explain in simple terms: Power demand has been increasing and the local monopoly has an obligation to supply, but the step cost to serve new customers is massive (build a new power plant); ergo, it makes sense for the powerco to persuade customers to install PV and it's even cost effective for them to incentivize customers to do it.

This is one area that I think SCTY is missing out on. I talked to them last year about my plans for our system but they told me they were focusing on states where (state!) incentives were available and there are none in FL. Florida has a horrible history when it comes to state incentives, they promised them in the past but then never funded the program so that thousands of folks were left without their rebate checks. These days no-one I know trusts our state lawmakers but I do know dozens of folks who have installed PV with incentives from our powerco.....business is booming for FL installers but SCTY isn't here.�

1/1/2015

guest Definitely interesting blog post.

It reminds me of what's going on in Hawaii. For those who aren't aware, it's quite fascinating:

A Solar Boom So Successful, It's Been Halted - Scientific American�

1/1/2015

guest If people really start to think about this, they will see Solarcity a little bit different... Maybe a lot different. Key is networked stationary storage. We will all see some utilities change their tune soon because it just makes good business sense. Instead of the utilities complaining of "cost shifting" they will be praising "cost savings" of PV+storage. And, Solarcity will be maybe the only one to benefit for a while...

- - - Updated - - -

I've recently read that Solarcity will expand to new states soon. They will accept lower margins and thus lower retained value by going to these states, however, the cumulative retained value growth will grow substantially by doing so. Maybe Florida is one of these states to be included.

also, when Solarcity begins to expand into new markets, will this affect how wall street values it? I think so, IMO. I think there are going to be a few different catalyst that will open some eyes to the real potential of Solarcity as an energy/utility hybrid company down the line here.�

1/1/2015

guest Seems almost criminal for Solar City not to be in the Sunshine State

I can see where SCTY would like to push the battery storage to the grid ops. But frankly given the path of battery cost coupled with panel/efficiencies now over-producing in daytime by an increasing margin/$- they're fighting their own expansion rate with that argument.

NigelM- for you're own situation, what circumstances of cost would persuade a battery added in lieu of net-metering? i.e. If net metering went away due to load balancing issues, or was reduced dramatically (as some states have proposed)�

1/1/2015

guest They sell the service angle, but i have installed 5 systems, oldest is 10 years. Other than a broken panel because someone backed into it with a tractor, there has been no service necessary whatsoever.�

1/1/2015

guest This is a very politically correct blog post.

But if battery technology becomes economically feasible, then I say screw the grid and I am going off the grid ASAP.

I will then install a rain collection system and for good measure dig a well that runs on a solar pump for irrigation water to grow my own organic garden.

The only cable that I will need to run to my house will be Google Fiber, although by then we might see super fast over the air internet.�

1/1/2015

guest Party at Sleepy's -- unlimited water, electricity and kale chips?

I can't wait to go off the electric grid myself. Probably why I won't lease a system.�

1/1/2015

guest It still fascinates me to this day how some people can divorce Solarcity from tesla enthusiasm when the same person (Elon) champions/promotes both with equal weight in achieving a sustainable future. CTO JB Straubel says the success of stationary energy storage with Solarcity brings success to Tesla motors by way of producing more batteries and thus reducing battery costs. JB said himself that energy storage through Solarcity is at a point where it's finally economically feasible for the consumer(demand logic press release) and excited by this milestone moment. Most of Elon's talks include discussions on Solarcity and solar. He is even on record that he thinks Solarcity might become bigger than Tesla.

With such endorsements, wouldn't it be a natural extension to be interested in solarcity's success as it is apart of the grand strategy of everything mr. Musk represents and aspires to achieve? I fail to see how there can be such a disconnect. Solarcity is a big part of Tesla's future.

this CPUC decision is very very significant. Half of all residential PV installs in the US were in California last year. Elon says he would like to see a sizable roll out of storage by late 2014 or early 2015 at the latest. With this decision, we might see that roll out start happening this summer. I think once The California utilities start seeing the network effect they will flip over backward from its massive potential. Remember the big problem with utilities and mass solar is the inability to aggregate all the PV systems. Networked storage solves that. This is big big big. Now it's just nailin down the economic model. Lyndon rive just put together a team solely dedicated to do that very thing.�

1/1/2015

guest Not sure if that was directed towards me, but I'm most definitely assuredly positively hoping for all of Elon's current ventures to succeed, including Solar City, as long as they are on a responsible path that does not overcharge people to get into renewable power. I personally might like to buy a solar system, not lease it, because I will probably sell my house within a few years and would not want a solar lease to complicate the affair. I would likely be happy to buy something from Elon someday if the price was competitive. Currently, my tiny urban roof isn't big enough to power my home. But yes, I would like Solar City to do well as long as they are advancing the end of fossil fuels in the best way possible.

More than that, I want electric power to be provided to everyone everywhere free of charge as directly from the sun as possible, and have that electricity completely and totally replace man-made combustion on this planet. So, eventually, I would like SolarCity and all privately-owned utility companies to die, because power should be a public good, paid for with taxes, run by and owned by the people, directly. Private ownership of utilities is a very inefficient way to do deliver them, which is why so many regulations exist to make them pseudo-public without being all the way public. Water, sewer, power, health care, armies, roads, infrastructure -- these things should all be public goods in my opinion.

Finally, although I want them to succeed, I still don't view Solar City's business as the world-altering no-brainer investment that is Tesla Motors, so I will probably not put my investment dollars there anytime soon.�

1/1/2015

guest Completely agree.

Here is an interesting article about Mosaic, who is using crowdfunding and giving out loans to RGSE customers to buy solar systems at 4.99% interest. These are the early stages of the solar financing revolution, and even though SCTY is a first mover in this arena, there aren't really any sustainable long-term first mover advantages for being the first to issue an ABS.

http://finance.yahoo.com/news/why-neighbors-finance-solar-panels-120000907.html

For those of you that were senselessly arguing with me that an owned solar system does not add any value to a house, that article has a link (in its last paragraph) that shows a Berkeley study that says that a house with a solar system sells for $17k more than one without a solar system:

http://newscenter.lbl.gov/news-releases/2011/04/21/bright-spot-for-solar/

Be careful SCTY investors when reading through this thread, some here make up their own "facts" to continue pushing their agenda.�

1/1/2015

guest Just FTR, I paid for my system using a LOC through my bank at 1.4%. Although I rarely use credit, at that level I would have been stupid not to.�

1/1/2015

guest I got a 3% loan to finance my solar system.

In the link to that youtube video that Citizen-T posted in the alternative energy thread Admirals Bank had 3.xx% - 5.xx% interest rates for solar loans.�

1/1/2015

guest I got my LOC prior to winning the rebate lottery, but I think what we're seeing is that (relatively) cheap money is available for residential PV. That's good news for all installers, including SCTY.�

1/1/2015

guest I can also point to similar studies on variety of topics that is against common sense. Like Global warming, Tesla and Yes, buying vs Leasing.

Doesn't mean the studies are correct. Doesn't mean they are "FACTS".

Essentially, it seems you have an agenda. I am just trying to offer counter arguments. Like I said, previously, I am currently not invested in anything (neither TSLA nor SCTY nor anything else), Just waiting for my Tesla to be delivered on May 3rd.

Regarding value, I did say previously that it increases the value of house, whether it is lease, prepay lease or owned. In states like NJ, MD and PA, The owned system's house will increase lot compared to other leases. In other states, The difference will be negligible, specially between Prepay and Owned. Only way for this to settle will be for 3 neighbors with similar houses to put their houses on market. One without Panels, One with Prepay Lease and One which has owned. I guarantee that, difference between 2nd and 3rd house will be minimal and between 1st and 3rd house will be no where near 17000.�

1/1/2015

guest This was probably mentioned before but am I right in assuming that with their lease agreements SCTY retains the right to the SRECs?

That's likely another positive for them but also an argument for the consumer of larger systems to buy rather than lease.

- - - Updated - - -

P.S. I'm putting my moderator hat on and asking that we leave out accusations of personal agenda etc. Next time around the whole lot will get moved to quarantine regardless of how valuable the rest of the posts are. You've been warned.�

1/1/2015

guest I think we're kicking around a headline number (the $0.03/kWh) without digging into details. If I figure out my net cost post rebates/tax credits and then work out the kWh cost over 20 years I come out to $0.0099/kWh and that doesn't account for any SRECs I might be able to sell. Less than $0.01 is no more valid a headline number than $0.03 because nobody would see the detail behind it.�

1/1/2015

guest Mod Note: I promised.....�

1/1/2015

guest NigelM, I agree with your comment that detail is important to discern actual cost/watt. Each contract is different with various subsidies from utilities and government alike. It appears difficult to present a boilerplate price as representative of all others given this type of market environment. I think if someone comes up with a website that aggregates all residential PV companies for consumers to compare/contrast offerings that could be helpful. Let me know if I've miss such a site that currently exists.�

1/1/2015

guest Here is a post of mine that got moved to another thread, but I thought is very important to show

http://www.solarcity.com/residential/solar-lease.aspx

For a typical 3-bedroom home with a current electricity bill of $200 per month, we might recommend a medium sized 4 kW solar system.

Your new solar system will generate enough electricity to offset what you are currently paying to the utility company from $200 down to $60 per month.

Your SolarLease payment would be $0 down and $110 per month. So you could actually save $30 per month from day one.

For those who don't know a 4 kW system will generate on average 400kWh - 500kWh per month. Now I am going to be very generous and use 600kWh for my assumption since it could be a sunny state such as Hawaii:

$110/600kWh = $0.18/kWh

This is an example taken directly from SCTY's website. If they were actually leasing systems for $0.03/kWh then don't you think that they would advertise that more to get people to sign up? Instead they give an example where the cost is $0.18/kWh. Since SCTY claims that it will save you $140/month off your bill, then they are using $0.23/kWh for the local electricity rate using my 600kWh estimate. Since these numbers are high, I would imagine that they are probably using an example for Hawaii.

I think from their presentations they said that avg. lease deal they give is around $0.12 - $0.14/kWh (can't recall exact number, but I am pretty sure it is in that range).�

1/1/2015

guest Right,

For NJ, MD and PA, Solarcity keeps the SREC.

And like I said, It is correct that for those 3 states, if you are planning to stay in your house for long time, It is far better to own the system. Heck, my Father In Law asked me for an advice on lease vs prepay lease and buying and also about the which panels to buy and Solarcity deals. Since, he is not going anywhere from his house, I asked him to buy the system and asked him to get SunPower panels (Just like sleepyhead) or if he waits few months, he might get cheaper and better panels then sunpower from Trina, Thought that is not guaranteed yet.

Is Trina Solar Trying to Beat SunPower at Its Own Game?

�

1/1/2015

guest From the article you linked:

However, the company just announced what it's calling High Efficiency Honey Ultra, a module that purportedly has a 24.4% efficiency rating. Considering that its current panels operate at around 16% efficiency, and SunPower's industry-leading panels are closer to 21% -- almost 32% more power output per panel than Trina's -- this could be a remarkable breakthrough for the company, if it could translate that module efficiency to a panel efficiency near 20%.

This guy has completely no idea what he is talking about. I think that The Motley Fool should be completely embarrassed for letting this fool write this article about solar panels. He is completely clueless, and there are more errors in that one paragraph than I can count (I did not read the rest of the article though):

1. Module and panel is the exact same thing. The author does not understand this.

2. The High Efficiency Honey Ultra module that TSL just created is a p-type mono module that was created in a lab under perfect conditions to break some meaningless record for p-type panels. I estimate that the module had roughly ~20% efficiency, but the actual production module of the exact same module will have roughly 17% - 18% efficiency at best.

3. The 24.4% that he is referring to is a cell that uses IBC technology (Interdigitated back contact solar cells). This IBC cell is completely different than the p-type mono cell used in the Honey Ultra Modules. The 24.4% has nothing to do with the Honey ultra module. This author is mixing up two completely different technologies.

There are very few people in this world that actually have a relatively good grasp of the solar industry. Most of the people that write about solar do not understand it at all. Most of the people that work in the solar industry do not understand it all. Most of the people in the utility industry do not understand it at all.

The solar industry is completely misunderstood and it will take a few years before people actually start getting it. Fortunately for us solar demand is growing so strong that people will need to start understanding it better in a very short period of time, because it is going to grow out of control and that is dangerous without understanding consequences.�

1/1/2015

guest Need an SCTY short term thread.. Anyway news today:

SolarCity Corp Recommences Connecting Energy Storage Systems�

1/1/2015

guest Sleepyhead - my question was missed yesterday. For those that buy, what happens with the utility that you are signed on with when their rates go up every year vs. a fixed rate for 20 years with Solarcity. Does it matter? Does the solar system produce enough energy that even with increases over the years you will always come out even or ahead?�

1/1/2015

guest If you have a net metering set-up your power produced and used is measured in units and only the net surplus/deficit at the end of the year is refunded/charged at whatever the prevailing rates are. In other words, as the rates from your powerco increase then so does the value of the power your solar system produces. If you get the calculations right you'll always come out even (although there is some degradation of panel performance over the years) and provided your power consumption doesn't increase. Leasing at a fixed rate might cost more in the long run but it also gives peace of mind to many folks.�

1/1/2015

guest Here is info directly from a SCTY presentation:

You can find it here:http://investors.solarcity.com/events.cfm

It is an up to date presentation. So we know that SCTY's avg. rate is $0.141/kWh.

It is not a very attractive rate like the $0.03 or $0.08/kWH being thrown around here.

�

1/1/2015

guest Sleepyhead,

Thanks for your thoughts on that article. To be fair to author, though, he/she also is skeptical of this new panels from Trina (Hence I said "not guaranteed yet") and advices to stay with SPWR (Though article is more for the stock)..

I certainly didn't know about p-type and IBC.. off to google to learn about it.

Thanks again.�

1/1/2015

guest See what NigelM said, but just know that any state can just pull the net metering plug at any time and then you are screwed.

California guaranteed net metering for 20 years with it's recent law change, but other states can do what they want. You will then need battery storage.

You are getting screwed whether you buy or lease. But it would be easier to sell your house with a paid for system than a lease if net metering goes away.

- - - Updated - - -

Sorry for my font in the previous post, but I can't edit it �

�

1/1/2015

guest Ggies07 (and anyone else), take a look at this very easy to search Database of State Incentives for Renewables and Efficiency (DISRE) for state by state rules, programs and laws.�

1/1/2015

guest That is what current energy companies are charging.. Not Solarcity..

�

�

1/1/2015

guest NigelM, great site...�

1/1/2015

guest You might be right, because it is poorly worded.

But I think that the slide says the we charge $0.141/kWh blended average cost, and that 377,000GWh of electricity gets sold in the US each year at a price above $0.141 (and the rest is sold below that price), so that is an addressable market.

That is how I understand it, I am fairly certain that is what they are saying here. But like I said it is poorly worded and I might be wrong.�

1/1/2015

guest Thanks guys! Yeah, I was just thinking if I bought a certain size system now, that in 10-20 years with the increases from utility if it would still be a benefit compared to leasing and locking in that rate.�

1/1/2015

guest Net metering will change. It's just a matter of how and what new form it will take. The original design didn't take into account millions of homes going solar. Thus far, Solarcity is seemingly the only one aggressively pursuing a new "net metering"business model(for a lack of a better term) with PV+networked energy storage. If anyone out there can provide me with another company equally moving forward like Solarcity, please let me know...�

1/1/2015

guest So if net metering goes away in the future, all that surplus energy that is produced does not go to your account and therefore you pay what? Only the amount of energy you use off the panels + the utility fee? So it's not a benefit anymore then? Well, I mean it is yes, you are still getting energy from the sun, just not at a better deal.�

1/1/2015

guest Right now if you pay $0.12/kWh then the utility pays you the same $0.12 for what you send out to the grid with net metering. Without net metering, they might pay you at wholesale energy prices of ~$0.05/kWh or avoided fuel cost at $0.03/kWh or maybe nothing. It is hard to say.

Net metering is like having free battery storage. But if it goes away and you have to install battery storage, then it is an extra cost for you. I would gladly go off the grid if I could, because utilities and politicians are going to try to screw us on solar anyway they can:

http://thinkprogress.org/climate/2014/04/16/3427392/oklahoma-fee-solar-wind/�

1/1/2015

guest Net metering will change, not necessarily go away. It is going to evolve. I think storage will create the ability for you as the owner/leasee to sell your stored energy in addition to your day time production. The grid has problems with the uncontrolled surging and tapering of solar, so storage could really benefit this area. Also, I've read that only about 10% of grid energy produced is used by the end user, so redirected distributed stored energy could really up this percentage significantly.

bottom line, net metering will evolve, retail rates will be adjusted, energy storage will be at the center of it all, IMO.�

1/1/2015

guest oh, i see. So if it ever went away or change, then you would still pay nothing for your electricity bills because of the panels, it's just that you would not get any extra back.

- - - Updated - - -

I see. Yeah, I remember someone else on hear saying net metering was not the best option, but some other form of payment, can't remember. What happens to people who are leasing panels, but can't afford a battery storage system?......Will there be no negative impact, they just won't reap the benefits like others that will have them?�

1/1/2015

guest No, that is not true that your bill would be $0. The only reason your bill is $0 (for illustration purposes) is because if you use 1000kWh and produce 1000kWh, it gets netted via net metering leading to $0 bill.

But if you generate all 1000kWh in the day (duh!) and lets say you use 0kWh during the day, but use 1000kWh all during the night then without net metering your solar panels are doing you absolutely no favor at all and the grid gets to keep all generated electricity for free.

With net metering you are paying 0.12, but the grid is paying you 0.12 as well for what you generate, so it offsets leading to $0 bill.

But if they take away net metering, and pay you $0.06/kWh instead then you are buying 1000kWh*0.12 = $120, while they are paying you 1000*0.06 = $60. So your bill is now $60 even though you generated 1000kWh and used the same amount.�

1/1/2015

guest Solarcity is developing a $0 PV+storage lease for residential. This is their optimal product. They are already doing it with their commercial demand logic product. Again, it will be important to keep our ears open on results and further developments in the q1 conf call, or q2 conf call. Remember, Elon said in his Amsterdam talk he is looking for late 2014/early 2015 for a ramped up energy storage roll out. Since this CPUC decision came so suddenly, might be earlier... Just going to have to see...

it it is interesting to note that Elon's energy storage ramp objective coincides with the 18650 Panasonic agreement ramp projections for 2014....�

1/1/2015

guest ooh, now I'm starting understand. Thanks! Well, I really don't know what to do on buying vs leasing. All you have given great arguments for both sides. My wife does not want to sign a 20 year contract nor take out a loan from the bank. I told her then I guess we use one of her bonuses at the end of the year after the tax deduction and she is still hesitant. haha. I've told her all I've learned from here, she is just being tricky me thinks!

- - - Updated - - -

Interesting.....�

1/1/2015

guest You could go off grid with your PV+storage. That will be an option. However, probably forgo the utility back up if you need more energy, also possibly forgo being able to sell PV and storage energy you don't use. Just going to have to see how Solarcity develops this since they will most likely be the first to do it. Also have to remember Solarcity could approach all utilities with their networked solar solution, sort of like a capacity builder/engineer for utilities to become more efficient agile companies. So need to imagine the same utility structure just Solarcity might be the single thread to connect them all. Then things get really interesting....�

1/1/2015

guest Does any one have a reference to the current market breakdown between leases vs purchases?

I know for scty it's 90%+ vs <10%. I am curious to know what the overall market split is. or even better what the market split is in the 14 states that solar city services in.�

1/1/2015

guest Watch this video, replace internet with networked energy storage and you might come to a similar conclusion where Solarcity is heading in the long run...

Elon Musk: How the Internet is Changing Humanity - YouTube

@HenryF, I don't think anyone releases that split. However, in general terms, the top two residential companies(Solarcity,vivint) are lease/ppa heavy... But, that probably didn't help you at all(sorry!). It would be great if someone secretly knows and would share that info here �

�

1/1/2015

guest This video has a thorough analysis of lease vs own debate in an overall market perspective.

It's from GTM Solar Summit 2014.

Solar Summit 2014: Opportunities and Threats in the Residential Solar Market, Recorded on 4/16/14 GreentechMedia on USTREAM. Conference�

1/1/2015

guest Here are all the videos to this year's Solar Summit. I think the video that shows up first is not one of solarcity's session, so you might have to explore videos to get to the "solar is mainstream" session...

Solar Summit 2014: GTM Research: Surveying the LatAm Solar Landscape, Recorded on 4/16/14 GreentechMedia on USTREAM. Conference�

1/1/2015

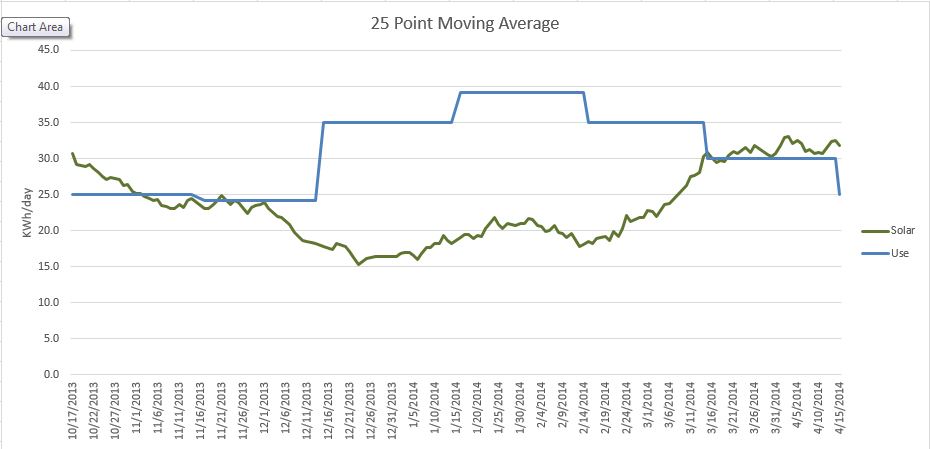

guest Going off grid is a LOT more expensive for the vast majority of people than purchasing an extra 25-100 KWh of batteries, which for me would only cover 2 very cold & cloudy days. If I were to truly go off grid I would likely need double the solar panels (far more than my annual usage, and larger than my roof) in addition to at least 100 KWh of battery back up. The issue for much of the country is that when you need power the most in the dead of winter, solar production reaches a minimum due to short days and heavy cloud cover. Below is a graph of my solar production for the first 7 months. While I produced more than I used in October and November, in December, January and February I ran a deficit of 1801 KWh. Now I am making more than I need and I am "banking" over 220 KWh/month. By June I should have a credit of nearly 1000 KWh to carry me through the summer as I predict in summer my usage will likely be above production during peak AC loads. The only way I can see getting trough winter is to roughly double my solar array and I do not have that much extra space and if I did that I would end up dumping power during the fall and spring. My connection fee to the grid is $7.21/month. That is relatively inexpensive compared to the cost of batteries and extra panels one would need to fully cover one's needs and be off grid.

�

�

1/1/2015

guest Interesting. There needs to be a way to connect to the grid such that you only use it when you run out and the grid can't detect your connection in any way. So you never provide to the grid (so no net metering) but if you need you use from the grid.�

1/1/2015

guest Here is a panel discussion on SolarWorld's trade dispute.

Assessing the Impact of the U.S.-China Solar Trade Case, Recorded on 4/15/14 GreentechMedia on USTREAM. Conference

Key takeaway: In most cases shouldn't have too much impact on DG market. Can be devastating to utility scale projects if things go in solarworld's favor.�

1/1/2015

guest HenryF, great discussions at that Solar Summit. Pretty much every issue we talk about here, but probably much more informed! I'm learning a lot sifting through them in my free time.

What I Learned About SolarCity's Business Model by Becoming a Customer (SCTY)

this article should fire up some own vs. lease/ppa, specifically Solarcity pre-paid ppa discussion. Also, the comments are pretty lively and informative as well.�

1/1/2015

guest

Thanks for the vid, great info and I'm checking out others....it seems like when we drill down to the first step in all of this is that people need to get on solar. I'm starting to see it doesn't matter how it's done, buying, leasing, or PPAs. People on here are on one side or the other, but most importantly after watching this video, people inside the industry see that it's going to be multiple ways of getting solar to people.

Thanks for the article and I didn't know it was Elon's idea for PPAs:

�

1/1/2015

guest An FYI post. a friend of mine works for BOA. They had a presentation from Circuit City a couple days ago he was telling me about. BOA is giving employees incentives to sign up for solar.

During the presentation my friend indicates Solar City indicated they will be charging 'roughly' 0.07 cents/KW hour. They presented as 'lease only' option�

1/1/2015

guest This is just a marketing fluff piece that is most likely orchestrated and paid for by SolarCity. The author doesn't actually own any SCTY (even though he does have positions in TSLA). But more importantly if you actually read the article carefully, by paying attention to the choice of words, you will see that it appears that the author did not sign the PPA with SCTY and he did NOT put the SolarCity system on his roof.

Other notes:

The author uses ~30,000kWh of energy per year, but the SCTY system will only get him 8,000kWh. If you look at the pictures, you can see that the reason is that his semi-southern facing roof is constrained and that is the maximum amount of panels that they can fit (25x250W=6.25kW). In his situation, he needs to go with a SPWR system and can get ~9kW system using X-series panels; and even about 8.3kW using older E-series panels. And you will get more production per nameplate capacity from SPWR as well. Where cheaper Chinese panels might do 1.4kWh (for some hyptothetical geographic area) per year per stated Watt, a SPWR panel might do 1.5kWh per year per stated Watt. And that spread gets a lot wider with degradation over time.

I would not be surprised to find out that this guy actually went with a SPWR system himself, because it would make a lot more sense in his case. But, I digress...

He recommends the pre-paid lease, and coincidentally it is the option that benefits SolarCity the most financially since they don't have to raise more capital, debt, or sign loan agreements with banks.

He says that the pre-paid lease is more beneficial then buying, because HE IS ONLY COMPARING THE BUY PRICE THAT SCTY OFFERED HIM! This just proves my point that SCTY will price the buy price such that it is not the best option to buy and makes the leases/PPA's look more attractive. SCTY is offering him roughly $4/W, when a local installer can probably do the exact same system for about $2.70/W.

Some of his numbers don't add up either, e.g. he says that the buy price is $15k after $9k federal credit. But $9k out of $24k is 37.5% and not 30%. So I assume that he lives in an area that has a $2k rebate for such system and then he gets 30% on remainder or roughly $7k in tax credit.

Now lets do the math using a local installer at $2.70/W:

6.25kW*$2.70 = $16,875

Subtract $2k rebate (these are most always done using system size and not cost) = $14,875

Tax Credit = 30% * $14,875 = ~4,500

So you can buy the exact same system for $10k or you can sign a 20-year pre-paid lease for $10k; both upfront payments.

When you buy the system, you have a life expectancy of 30 - 35 years (quoting Lyndon rive here) or you can lease the system for the same price for only 20 years.

I think that it is a pretty easy decision...

Still not impressed with this blatant SolarCity marketing add by Motley Fool.�

1/1/2015

guest S

So what do I do this time of year? As I have been able to "bank" 550 KWh from my Feb 17th low. That is a a lot of battery capacity of I were to store it all.�

1/1/2015

guest Thats what solarcity's aiming to help customers do in the future... Sell excess to the utilities at To-be-determined "retail" rate, as well as, buy energy energy from other local PV storage owners/leaseesfor the cheapest rate... It will be the new net metering for post/reduced subsidy future... I think this is what CFO Bob Kelly was referring to when he said Solarcity "4.0" as being the evolutionary end state...�

1/1/2015

guest

For someone who has electric heating, it will be tough to go off the grid any time soon, but it will happen in the future; although it will take a little longer. If you have gas heating, then it is a lot easier. But even with electric heating, here in Texas it will not be a problem at all; it just depends on geography.

Some time in the future, maybe 10, 15, or 20 years from now, you will be able to install a solar system on your roof for about $1.50/W and battery costs will be $100/kWh (about 8 years from now according to Elon). So, lets say that you can get a battery storage system installed for $150/kWh.

You can install a 10kW solar system and 100kWh battery system for $15k each or $30k total. So, without any government subsidies if you expect this system to last 20 years then you are paying roughly $120/month for all of your electricity needs.

Not everyone will be able to move off the grid, but for those who will have that option it becomes a no-brainer. As more people move off the grid, electricity prices will go up for others, which will lead to more people going off the grid; creating a utility death spiral.

BTW, there are very easy ways to lower your electricity usage: switch out all light bulbs to LED, insulate your home better, turn off the lights when you are not in the room, etc.�

1/1/2015

guest The more I listen to Solarcity talk about their methods,the more I see how they are trying to tailor their products toward specific consumer bases. Chris Tan in this video makes it clear they are developing lease for middle income (ie 50k) buyers that are on a tight budget, low disposable income, that would like to reduce their operational costs with minimal risk. He said if they develop a product that addresses this market, they can open a much bigger market segment then previously available... He said about 50 million homes. The market for ownership is big, but this market group seems key to mass adoption, therefore, important to develop a product aimed specifically to meet their needs.

Solar City talks sun! - YouTube

also, in this video, I see a continuation of solarcity's specificity in targeting particular market segments. In this clip, he says retirees that want to go solar don't necessarily benefit from ITC, so lease turns out to be best... Also, Solarcity turns away customers if they don't meet criteria, which means to me they see the market being so vast, they can be very particular with whom they engage and still compound growth... That bodes well for all solar companies since others can tailor their services to a specific group Solarcity doesn't and still see tremendous growth, like $0 down loans... Seems to be enough for everyone to succeed...�

1/1/2015

guest That was my suggestion for when net metering goes away.�

1/1/2015

guest Just curious, could Solarcity get into the Chinese energy market? Tesla currently making a splash, superchargers expected to be in the hundreds... Could Solarcity work its way in there too? DG grid management related to energy storage could be their core service/business working with Chinese module manufacturers and local utilities. Even if a fantasy, still fascinating possibility.�

1/1/2015

guest Electricity is very cheap in China. Solarcity first needs to get to states with no subsidies in the US.�

1/1/2015

guest Right, first develop PV+storage network here, scale it, show profit, etc... If they do this could almost represent the demonstration article to the rest of the world it is viable. I'm throwing a wild number out there, but could be there in about 4 years, right as the gigafactory ramping, as well as, china factory getting finished... Timing seems right on many levels...

update: Chinese power might be cheap, but it's super dirty... Main reason they are pushing so hard to go electric and solar right now... Is it better to do dirty, or invest a little more in near term and do clean?�

1/1/2015

guest Posted this in Long Term thread but I think this specifically relates to Solars and SolarCity as well, as Natural Gas is considered a cheaper alternative to Solar.

Is the U.S. Shale Boom Going Bust? - Bloomberg View�

1/1/2015

guest We're all about uncovering new methods for improving performancePlant Engineering

"The SunSpec-developed process has been used in one deal that involved packaging $54 million worth of power purchase agreements into bonds that were sold on the open market. The company offering those securities, Solar City, is paying investors 4.5% interest on its notes, which is roughly two percentage points less than it normally paid to borrow capital.

That two percentage point rate reduction is expected to cut roughly 50 cent per Watt off the cost of producing solar energy. That should, in turn, result in a lower cost of power to the end consumer."

interesting to know that ABS is projected to drop costs .50/watt... Seems pretty significant if Solarcity continues to offer them every quarter in the future...�

1/1/2015

guest In China, manufacturers themselves are doing utility scale projects. SolarCity can do residential projects but those don't take off until it makes financial sense. I'd really like to see solarcity compete with 11c/kWh power in the US first. This was an interesting find - 92.1% of New Electricity Capacity From Renewables In 1st Quarter of 2014 | CleanTechnica�

1/1/2015

guest It it seems to me the problem is not PV system deployment, especially utility scale in china(or the rest of the world). It's the problem of scaled intermittence stressing the grid. The key solution is storage. Tesla has created a pack that can scale up to utility level storage or scale down to residential storage. Also, in terms of production scale, gigafactory will produce more storage then any other company in the world. Solarcity will become the only company capable of networked storage grid operation. 1+1 gives you a powerful team in the global energy market... Maybe china will be cracked open in a few years as production capacity builds... Wouldn't be surprised if tesla also builds a gigafactory in addition to a manufacturing site there. China wants to have 5 mln electric cars by 2020, might be sooner then later if Model s is a success over 2014... and Solarcity might feel some of the tailwind...

Update: also have to remember, we have no idea what scaled DG looks like, I'm sure millions of inverters out there will create new problems no one could have anticipated, creating a new set of solutions that create new industries... I remember JB Straubel saying power electronics will prove to be a massive industry very soon... Any company that proves scalable efficiencies here will be extremely valuable to the broader market... Back in October JB even gave a brief to Stanford students encouraging them to go into the field, create start ups, etc...�

1/1/2015

guest Benzinga - Actionable Trading Ideas, Real Time News, Financial Insight

Goldman's Brian Lee feels Solarcity will forecast 120-130MWS for Q2, which is pretty aggressive... If that turns out to be the case, then they will crush all high end 2014 estimates, would install way over 525MWs.

i still think they will guide for 98-102MWs, maybe 100-104MWs at highest... Got to set realistic expectations to beat... But, I'd love to proven wrong in this case. This would be a huge jump and significant indicator of potentially over 100% compounded growth by year end if Brian's estimate is accurate.�

1/1/2015

guest YPE Smart Grid Panel Series: The California Grid Under... Tickets, San Francisco - Eventbrite

This should be an interesting panel discussion on Thursday(24APR). Might be a good introduction to how Solarcity will integrate DG storage with the grid...

update: it is interesting to note that solarcity's speaker Ryan Hanley was just working for PG&E 6 months ago doing grid integration with PG&E's speaker... Hmm... Could there be a possible PG&E/Solarcity partnership on the horizon?

How Californias Biggest Solar Utility Is Tackling the Grid Edge Challenge : Greentech Media

Ryan Hanley - working on Smart Grid Tech | US-Ireland Alliance�

1/1/2015

guest http://files.shareholder.com/downloads/SPWR/2953805480x0x747204/9ef07df3-5f08-48d9-837d-31fd6ee1cdc1/Q1_2014_Supplementary_Slides_Final.pdf

Interesting to read Sunpower installed only 11MWs of residential in Q1 and expects to do 95-100MWs in Q2... maybe I'm not reading it right, but that seems like a huge jump in residential numbers. If that's the case, they have shifted a good amount of resources to residential DG... will have to listen to the conf. call to learn more of the details. Exciting to see the big boys competing(Sunpower/Solarcity). Hopefully, most of the residential effort goes to the US, although it looks like they have good momentum in Europe...

update: they intend to grow residential lease "north of 50%" over 2013 numbers... over all google ITC + Sunpower cash investment will give them funds for the next "6-9 months."

I'm not feeling much of focus in the conf. call on residential area... not feeling a big fight with Solarcity on this front right now... just initial impression though... the slides show a big increase in residential, however, not hearing much from the management on the conf. call.

Still listening to the call... I think the CFO just said cash is doing better then lease right now... now the call has ended abruptly... okay... doesn't give me a strong impression on the lease effort... will have to see how competition with Solarcity pans out over the quarter. Really, didn't even talk about their residential outlook slide either... kind of strange after the big google PR yesterday...�

1/1/2015

guest @futureproof Thanks for the updates. Appreciate it. Will check the transcript once it's out on SA. Quite weird that they won't talk about it, after such a big PR splash. From news it wasn't even clear if Google will own the system/lease or if SPWR will.

Google initiative will lease solar panels to consumers�

1/1/2015

guest Ha, I just caught this from the link you posted... Lease payments should be "typically lower" then currently utility payment... Doesn't sound too competive to me, but could be just a real safe statement...

from memory, I think they said on the conf call google will be a tax equity investor(150m) and sunpower is going to investment 100m directly to lease installs... Overall, seems a little bit of a hype job, but who doesn't do that, right? Only hope this doesn't turn into a pump and dump post earnings... Might be a continuation with all solars if this turns out to be the case... Lots of money being made on the way up, lots of money being made on the way down... But over the entire year, should see most come in wih nice long returns...�

1/1/2015

guest They did discuss it in cc see transcript

- - - Updated - - -

I believe he said cash was a better deal for the consumer if they had the cash but they offer both to the customer�

1/1/2015

guest exactly, doesn't sound like they are promoting the big google lease deal in person... Added to which, they give a blah quote of "typically lower" payment quote from HenryF link.. Not much for a consumer to put confidence in... Indicates to me they don't see lease as a growing part of the business, but will do a PR push on it to get in on the popular conversation going around the net... Seemed to have helped push the stock higher, but there all kinds of reasons anyone could point to for the jump yesterday....

also, Google seemed to be competing for earth day sentiment as apple also highlighted its solar power assets over the past few days as they have with this pr of bringing affordable solar to the masses. Everyone benefits by putting this out when they did...�

1/1/2015

guest SunPower CEO: Extremely good Q1 - CNBC

Again, and it's really funny, Werner never once said the word lease, even after the talking heads brought up the google lease deal I think three times... He just said "residential is hot." He also said the company isn't really going to change its strategy, so I'm still holding to they don't think lease will do well for them into the future... This tells me Solarcity won't really be challenged by them in the lease market, which is good for Solarcity.

update: I just watched it again, he did say "lease partners" in his first response...�

1/1/2015

guest disagree. He stated they offer lease or sale. He also said in response to question of why they didn't raise guidance more that they can't book profit right away because of leasing. He also said they would maximize profits to shareholders by either selling leases or holding on to them depending on circunstances�

1/1/2015

guest Interesting Sunpower info....funny though, where I live in Texas, even if I wanted to lease from them, I can't because they don't offer it around here.....�

1/1/2015

guest We must be watching two different videos because I didn't hear him say that... Anyway, after all that was said yesterday, do you really think Sunpower sees leasing as a big part of their future strategy in residential DG? Do they offer any serious competition to Solarcity in the residential lease/ppa market?�

1/1/2015

guest SCTY price compression is like a spring loaded set up... Personally accumulating here again.

Catalysts:

*gigafactory announcement most likely in May/june

*official CPUC storage ruling in a couple weeks

*any Q1 numbers and Q2/YE guidance

*govt investigation results

*storage deployment updates, roll out announcements

*hit 1GW under management (can project numbers more accurately going into 2018)

*traditional utility partnerships

*bigger than $70 mln ABS offering

My feeling is SCTY stock will be north of $100 by FEB2015...

update: SCTY board and executives (including jervetson associated investors) own over 71% of all common stock (as well as own much of TSLA common shares). The float will be very small for a long time to come, so supply and demand in full effect. Again, volatility will be high, but long term appreciation will be significant... Old highs will be new bottom lows as we are currently seeing right now...�

1/1/2015

guest @tslas, been seeing an increase in "referral" social media from individuals and a major light bulb went off... If a whole block pools together and splits the referrals(like you did) then we might see a dramatic increase in lease ppas across solarcity's addressable market as this program expands. Seems like they can either use the money to pay off solar bill for many months or use it for other purposes... Seems like a very attractive value prop. for many home owners... Is this how ypu felt with bringing it up to your neighbors?�

1/1/2015

guest With short interest so high and insider ownership at 71% the short squeeze could be brutal. That's one of the main reasons I bought the stock aggressively when I did back at $33. I wish SCTY would drop more news on us piece by piece each week to keep the shorts at bay. It seems anytime the company is quiet the stock goes down a bit. Installations will increase during the summer and that should get the bulls more motivated to add to positions.�

1/1/2015

guest I appreciate your optimism. But as a general rule SCTY always falls after ER. Here are the price changes on each of the post ER days (starting from the latest):

-5.71%

-16.70%

-10.80%

-12.37%

-14.43%

The issue here is, faster they grow, the bigger the loss they show. As I said many times in this thread, this is due to messed up accounting. Operational Expenses are all recorded in the same period but bulk of the revenues are recognised over 120 quarters! That's a two orders of magnitude difference!!

Market doesn't fully get this. It sees a big loss and screams SELL!!

To make matters worse, this applies to guidance as well. If they increase the guidance in terms of MWs, they will also further lower the already negative eps.

I'm positioning myself to buy even more if it falls after ER. My time frame is 5+ years. This confusion is a tremendous buying opportunity who can see through all this in my opinion.

Keep in mind after several years of growth Operating Expenses will flatten out, while revenues and gross-profits continually go up as they are accumulative of existing contracts and new contracts. There will be a cut off point where there will be no turning back, the eps will continually grow forever almost with never a dip. Think about it, even when new installs come down to literally zero, the eps will be flat but won't dip! This is the end game for solarcity and that is what I'm in for.

That is the timeframe we should be willing to have if we want to invest in scty imho. Otherwise, the stock is just too wild and one could get washed away easily.

- - - Updated - - -

Curious, where did you get the 71% number from?�

1/1/2015

guest I like to look at Solarcity in loss/customer. That number is decreasing. The total loss is only growing because the number of customers are growing very fast. Once they cross over from loss/customer into profit/customer - things will change.�

1/1/2015

guest @HenryF, true, however, a lot of investors already know that since their is 71%+ shares out of circulation for a long time horizon... We all are late to realizing this... PV is only half of the solar equation. Storage completes the circuit sort of speak. Networked PV storage is the endgame that will truly revolutionize the energy industry and Solarcity will right there the whole way. Gotta have vision for this, some don't catch on till it's too late and then ego gets in the way of their better judgement. With the hardcore Elon investors, many shares won't see circulation for many years, so the more that jump on the boat, the less shares out there for a while and we all know what happens then. Elon stocks are more then just stocks to a large investment population out there. His companies are apart of a movement and that's hard for trader/broker/analyst type people to grasp...

- - - Updated - - -

Hit it right on the head... Remember what happened to tsla when Elon rolled out his five part trilogy?�

1/1/2015

guest SolarCity - Definitive Proxy Statement

Go to page 42...�

1/1/2015

guest @futureproof I see about 30% shares owned by Insiders and Jurvetson's fund owning 16%. That makes it 45% outstanding. Curious, where are you seeing 71%?�

1/1/2015

guest @henryf,53mln by execs and board, 15mln by DFJ assoc... 68mln in total. Approx 92mln total shares outstanding... Am I missing something? Just did a quick look so I could be off...

Are you looking at page 42 of the proxy or something else?

update: Rive bros and Elon own over 35% alone... So I'm thinking you didn't get to the proxy numbers yet...�

1/1/2015

guest @futureproof Thanks for the proxy link. I was looking at some tool which has outdated info.�

1/1/2015

guest No problem...�

1/1/2015

guest I wonder if there is any double counting between

John H. N. Fisher (7) --> 14,367,790

Draper Fisher Jurvetson (14) --> 14,967,241

Especially given this:

(7) Includes 7,440,718 shares held of record by Draper Fisher Jurvetson Fund IX, L.P., 70 shares held of record by Draper Fisher Jurvetson Fund IX Partners, L.P., 201,637 shares held of record by Draper Fisher Jurvetson Partners IX, LLC, 1,173,770 shares held of record by Draper Fisher Jurvetson Fund X, L.P., 50 shares held of record by Draper Fisher Jurvetson Fund X Partners, L.P., 35,864 shares held of record by Draper Fisher Jurvetson Partners X, LLC, 5,051,859 shares held of record by Draper Fisher Jurvetson Growth Fund 2006, L.P., 408,429 shares held of record by Draper Fisher Jurvetson Partners Growth Fund 2006, LLC, 53,247 shares held of record by the John H. N. Fisher and Jennifer Caldwell Living Trust dated 1/7/00, as amended and restated on 3/27/08, and 2,146 shares held of record by JHNF Investment LLC. John H. N. Fisher is one of several managing directors of the general partner entities of these funds that directly hold shares and as such Mr. Fisher may be deemed to have voting and investment power with respect to such shares. Mr. Fisher disclaims beneficial ownership with respect to such shares except to the extent of his pecuniary interest therein. The address for all entities above is 2882 Sand Hill Road, Suite 150, Menlo Park, California 94025.

(14) As of November 14, 2013, the reporting date of the most recent Schedule 13D/A filed with the SEC pursuant to the Exchange Act on November 16, 2013, entities associated with Draper Fisher Jurvetson were deemed to have shared voting and dispositive power with respect to 14,967,241 shares. The address of the entities associated with Draper Fisher Jurvetson is 2882 Sand Hill Road, Suite 150, Menlo Park, California 94025.�

1/1/2015

guest HenryF, I'm thinking the DFJ fund is diferrent from entities associated with DFJ...�

1/1/2015

guest Yes�

1/1/2015

guest Henry, I'd love to know if SCTY stock price was ever this close to the 200 day moving average when releasing earnings? I have a feeling as long as the price holds above the 200 day MA the shorts will start bailing. They will get bored and the earnings report could easily make them rush for the exits if it's even remotely positive. We're seeing a lot of negative news out on SCTY with lawsuits and value discussion. We're not seeing good news out of the company lately so this quiet time is keeping the stock down. I see a good ER coming and a short covering rally. With 71% of the stock held by insiders and 23% of it sold short, that spells trouble for the shorts in a big way on any strength, whether news related or ER.�

1/1/2015

guest Here in MA they by default SCTY does get the SRECs. HOWEVER, if you ask nicely, they will quote a system where the customer gets the SRECs.�

1/1/2015

guest Shares Outstanding[SIZE=-1][SUP]5[/SUP][/SIZE]:91.50M

% Held by Insiders[SIZE=-1][SUP]1[/SUP][/SIZE]:73.30%

% Held by Institutions[SIZE=-1][SUP]1[/SUP][/SIZE]:7.60%

Shares Short (as of Mar 31, 2014)[SIZE=-1][SUP]3[/SUP][/SIZE]:10.74M

Short % of Float (as of Mar 31, 2014)[SIZE=-1][SUP]3[/SUP][/SIZE]:49.90%

Short 49%? That can't be right? Holy cow talk about a short squeeze.�

1/1/2015

guest Unlocking Solar Energy's Value as an Asset Class | Alternative Energy Stocks

interesting article about yeildco and securitization. The articles discussion of retained value supports the point HenryF makes about truly understanding the best metrics to assess value and health of Solarcity...�

1/1/2015

guest Retained value is a really bad metric to use to value solar assets: it is garbage in, garbage out.

SUNE sees $0.48 of retained value for generation in years 21-30, but what if the panels don't work that long or degradation is a lot worse?

It seems like companies also use an arbitrary 6% discount rate, but why not 5% or 7%? A 1% change in discount rate will have a huge impact on retained value.

SPWR used to show retained value for its solar lease business as well, but has stopped doing it because it is a garbage metric. And SPWR's retained value per watt is a lot higher than SCTY, so they would have an incentive to use it to show that they are better. But they are coming up with different metrics to show to investors that are not misleading like retained value is.

SUNE builds projects so their projects will still be there after 20 years and producing energy, so their assumptions of retained value in years 21-30 is somewhat realistic.

SCTY on the other hand assumes that after 20-years all lessees will renew their leases with SCTY. This is a completely bogus assumption, because we have no idea what the world, and solar industry will like like in 20 years. If you take away this assumption and use a 7% discount rate instead of 6% then all of a sudden SCTY's retained value is half of what it claims.

Retained value is a just a way to mislead investors. Garbage in, garbage out.�

1/1/2015

guest futureproof - I am going to give you some really good investment advice for your personal benefit, so please don't take this the wrong way:

I think that you should be a little bit more open-minded in the solar sector. You are dangerously looking at everything with your SCTY-colored glasses on. SolarCity is a great company, and I am sure that they will do well in the future and continue to grow. But because Tom Werner, CEO of SunPower, did not use the word 'lease' in his CNBC interview does not mean that SPWR is no competition to SCTY. You are looking for holes, that don't exist, with the sole intent of spinning it into a SCTY positive. I don't think you are doing this intentionally, which makes it all the more dangerous for you as an investor. I would recommend that you look at the whole solar sector with an open mind, because if SCTY were to start falling apart (hypothetically speaking) then I am fairly certain that you would see it as a "buying opportunity" and that you would ride SCTY all the way down to $0.

There is 1 residential market, and it doesn't matter if you do lease, PPA, or cash sale; it is the same thing. Once a solar system goes up on a roof, it is over and that is one less potential customer. 99% of people don't have solar, and 99% of those have no idea if they would want a lease, PPA, or cash sale.

That said, SPWR just raised over $500m in a few short months to do "residential" solar systems. This is obviously all dedicated for leases, because you don't have to raise money to do cash sales, duh!

SPWR also said in their presentation that they will do 420MWp - 450MWp of residential in 2014, and this doesn't include DG or power plants. SCTY on the other hand will do 475MWp - 525MWp in 2014 in total, including DG and other. It doesn't matter if it is lease or cash sale, even though the vast majority will be lease, because it is direct competition to SCTY. SPWR's MWp is a lot more valuable than SCTY's MWp, because SWPR's 420MWp (low end) will produce more energy than SCTY's 525MWp (high end estimate).

Now lets not forget about other competitors: Vivint, Sunrun, RGSE, EON, NRG, other utilities, CSIQ, etc.

Everybody wants a piece of the residential market, because margins are too high and they are going to get squeezed in the future, especially when the 30% tax credit expires in a short 2.5 years.

Therefore, SPWR is going to do more in residential alone than SCTY will do in residential and DG combined in 2014. Then SPWR will do another 800MW in DG and power plants in 2014, and their growth rate is pretty impressive as well (it will double from 1GW to 2GW from 2013 to 2016). SPWR also has some potentially awesome C7 technology in its pocket that can increase growth rates exponentially.

So the real question is why is SPWR a $4.2b market cap, while SCTY is a $5.4b market cap?

IMO SPWR is a far better investment than SCTY, and I would be looking at them for the best risk/reward in solar. I am not saying that SCTY will not outperform them, but the risk is significantly higher in SCTY and they would have to retain what are IMO unsustainable growth rates in order to outperform SPWR as an investment.

This is just my honest opinion.

Good luck to everyone and happy investing!�

1/1/2015

guest VC Steve Jurvetson: Elon Musk is more capable than Steve Jobs was | VentureBeat | Entrepreneur | by Richard Byrne Reilly

Interesting article into the mindset/thoughts of a significant institutional investor in Solarcity... might help to understand the type of people/entities deeply embedded in Elon's ventures...

here's another(Antonio Gracias)...

Why one man invests millions in doughnuts and rocket ships | Voices

and another (JB Straubel)...

Tesla And Solar City Looking To 100% Renewable Grid Future | Inside EVs

and another(Elon himself on IPO day)...

Musk: SolarCity IPO Price Sought Wasn't Aggressive: Video - Bloomberg�

1/1/2015

guest Once again: high short interest does not mean that a short squeeze is imminent. Historically, stocks with high short interest underperform the market in general. This is a fact.

SCTY's short interest was at a record high of 11.3m shares as of trade date 3/10/14 with a stock price above $73. Since then the short interest has gone down to 9.6m as of trade date 4/10/14 and the stock has come crashing down to $55. Once again the shorts were correct in this case, made their money and exited their positions after riding the stock down 30% - 40%.

I have said this about short interest many times before, but when people look at high short interest all they see is an imminent short squeeze coming. Many times before, I warned about high short interest not being a good thing, and SCTY just proves my case here.

Same goes for TSLA: the short interest recently peaked on 2/25/14 with the stock at $248. Since then short interest has declined 20%, while the stock lost more than 20%.

High short interest does not mean that a short squeeze is coming.�

1/1/2015

guest i also believe i saw that spwr had 30,000 leases already. do you know the number for scty?�

1/1/2015

guest Haven't heard any public news on this yet... anyone got anything?

Also, JB Straubel is the keynote speaker at the 2014 Energy Storage Symposium May 21st...

2014 Silicon Valley Energy Storage Symposium

In addition to Solarcity news coming down the pike before then, should be interesting what he's going to highlight reference PV+ storage and the network effect...

And... Solarcity CEO Lyndon Rive and Nancy Pfund (4.6% Solarcity stakeholder) will speak at Fortune Brainstorm Green Conference 19-21May...

2014 Agenda | Fortune Conferences

Both conferences will be about a week after Solarcity's Q1 conf call, so might help keep SCTY in the positive news column going into June shareholder meeting (for all those interested in near term/post-quarterly stock performance).�

1/1/2015

guest I've never understood and have not participated in the Jobs-Musk conclusory of superior dialog. It can only be made from local perspectives. And drawing conclusions of 'capable' diminish one for the other unnecessarily. Elon has and will accomplish objectives Jobs could not; while concurrently Jobs' accomplishments in the use of technology applied to the Arts - Music, Animation, human communication and interaction, self fulfillment, etc. were different goals than Elon and required different (not lesser) skills. I see no point in concluding 'the best athlete' from 2 different sports. Neither man would condone those conclusions as I'm sure one would have equal respect for the other' accomplishments.�

1/1/2015

guest Here come the lawyers again. Same name Pomeranse firm that went after tesla. I think it's wrong advertising for clients by claiming how the target hurt them. I can see advertising the strength of a firm but not by claiming informing potential clients of the how they were hurt by the target without it being proved first. Are they immune to libel claims and damages if they encourage a case and lose? Would only seem fair since there can be damage by reducing share price.

And why are these ads published as stories? They are ads for clients. These firms get free advertising. If a news organization wanted to carry a story about these claims fine but these are just ads written by companies trying to get business�

1/1/2015

guest Thank you Sleepy for your contributions to this thread. I would assume that SCTY provides an incentive to renew the lease in 20 years, otherwise it would be a bit ludicrous to include any value from that. No? Do they really use 6% discount rate to calculate the retained value of the leases? Forgive my lack of experience with economics, but does that strike you as odd when they are almost certainly using a higher rate to determine whether to pursue the lease in the first place? Or doesn't that matter?�

1/1/2015

guest 6% is a fair discount rate and I have nothing against that number; SUNE also uses 6%. My problem is that 5% or 7% are also fair numbers, and if you change the discount rate by 1% then it will change the retained value by 10% - 20% if I had to guess.

Another problem is that 30% of the retained value comes from the assumption that customers will renew leases after 20 years. We don't know how the solar industry will look like in 20 years, so it is impossible to tell whether people will be renewing leases or not.

I think that retained value is not a good way to calculate the value of a watt installed. It is about as useful as a DCF is in valuing a company, i.e. garbage in, garbage out and extremely sensitive to inputs/assumptions.

If you take away the lease renewal assumption and increase the discount rate to 7% then all of a sudden SCTY's $1.50 retained value per watt will go down in half.�

1/1/2015

guest Nice Grid Offers a Glimpse into the Future for Solar PV Plus Energy Storage

a fascinating development in carros, France... The entire town will be run by PV+networked storage...�

1/1/2015

guest Taking another close look at the ownership in the proxy statement:

****

John H. N. Fisher (7) --> 14,367,790

Draper Fisher Jurvetson (14) --> 14,967,241

****

(7)

7,440,718 shares held of record by Draper Fisher Jurvetson Fund IX, L.P.,

70 shares held of record by Draper Fisher Jurvetson Fund IX Partners, L.P.,

201,637 shares held of record by Draper Fisher Jurvetson Partners IX, LLC

1,173,770 shares held of record by Draper Fisher Jurvetson Fund X, L.P.,

50 shares held of record by Draper Fisher Jurvetson Fund X Partners, L.P.,

35,864 shares held of record by Draper Fisher Jurvetson Partners X, LLC,

5,051,859 shares held of record by Draper Fisher Jurvetson Growth Fund 2006, L.P.,

408,429 shares held of record by Draper Fisher Jurvetson Partners Growth Fund 2006, LLC,

53,247 shares held of record by the John H. N. Fisher and Jennifer Caldwell Living Trust

2,146 shares held of record by JHNF Investment LLC.

John H. N. Fisher is one of several managing directors of the general partner entities of these funds that directly hold shares and as such Mr. Fisher may be deemed to have voting and investment power with respect to such shares.

Mr. Fisher disclaims beneficial ownership with respect to such shares except to the extent of his pecuniary interest therein.

The address for all entities above is 2882 Sand Hill Road, Suite 150, Menlo Park, California 94025.

****

(14)

As of November 14, 2013, the reporting date of the most recent Schedule 13D/A filed with the SEC pursuant to the Exchange Act on November 16, 2013, entities associated with Draper Fisher Jurvetson were deemed to have shared voting and dispositive power with respect to 14,967,241 shares. The address of the entities associated with Draper Fisher Jurvetson is 2882 Sand Hill Road, Suite 150, Menlo Park, California 94025.

****

It does very much look like these two entries overlap. The only reason for explicitly listing John Fisher (and not Steve Jurvetson for example), is that he is on the Board (where as Steve Jurvetson is not). I don't think John Fisher independently owns or has separate set of funds that own another set of 14mil+ shares separate from DFJ investments.

- - - Updated - - -

Hi, where did you find this information?�

1/1/2015

guest Finance.Yahoo.com�

1/1/2015

guest Given that SCTY is a recent IPO, it has limited 200-day-moving-average history. It only spans last two ERs actually.

ER Date Price 200-day-MA %Away %Fall Next Day

3/18/14 77.10 51.20 50 -5.71%

11/6/13 59.65 32.65 82 -16.70%