1/1/2015

guest Yes it's possible. �

�

1/1/2015

guest Can someone share more info on this? PM me please if needed.�

1/1/2015

guest E-mailed you privately.�

1/1/2015

guest It seems like Elon's creditors have good reason to give him such a favorable credit line. They and their friends (investors, advised customers) own shares in his companies. If Elon has to sell shares to pay down some of his debt it could very well reduce the value of the stock they own. It's a catch22 that Elon has cleverly negotiated.�

1/1/2015

guest Check your PMs, Dave.�

1/1/2015

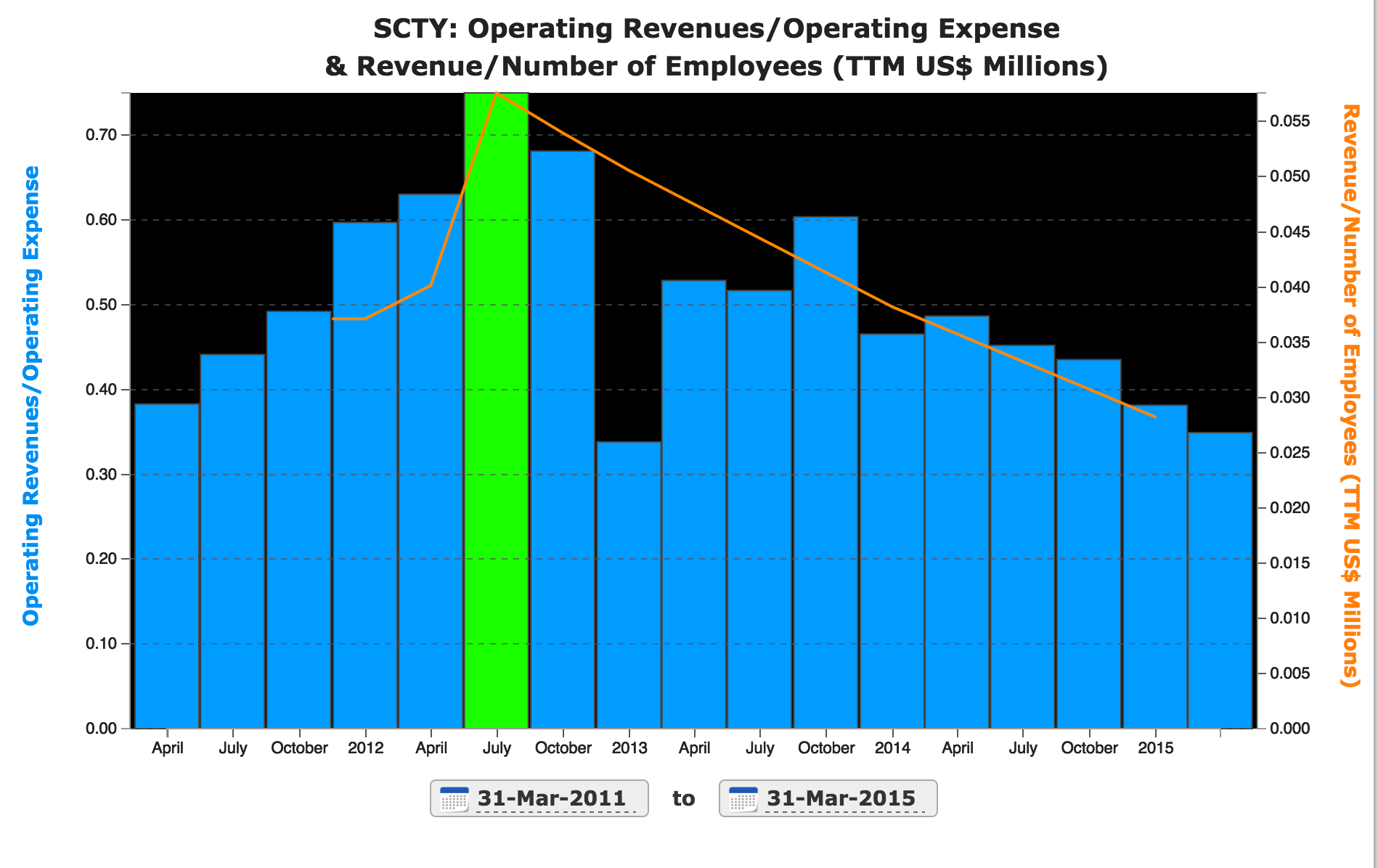

guest Another article came out today questioning the leasing model. Someone sold their house with a solar lease, then the buyer came back to renegotiate the deal, since he wasn't aware that solar lease would last another 15-16 years. The seller had to give him $10,000 because of the solar lease agreement. Just another data point to add what I have been saying this whole time; buying a solar system is an asset, while entering into a solar lease is a liability - difference between the two is measured in tens of thousands of dollars:

http://www.npr.org/2014/07/15/330769382/leased-solar-panels-can-cast-a-shadow-over-a-homes-value�

1/1/2015

guest Whenever I come to this thread to learn about SCTY, I find you criticizing the lease model, or something else, like you are on a crusade. I'm starting to feel that it kills any other conversation that may take place.

(Maybe a thread specifically for discussing the lease model?)�

1/1/2015

guest

The argument could be made that this is a Tesla forum and other companies should not have a designated thread at all. But since this is the investor section, and SolarCity is being discussed by investors, it seems only reasonable to point out the concerns about the risks of the company for investors. Leasing is a primary component in the SolarCity model so its discussion is more than warranted - it is vital.

Sleepyhead has engaged in this debate when others were promoting the benefits of leasing and denying or ignoring the faults. I have no holding in SCTY and never have, but I do read the thread. I don't see why the promotion of SCTY as an investment should be permitted on this forum and no challenge allowed to the thesis. Usually sleepy's posts have come in response to other statements, but when they seem isolated, it's only because he came across more support for his argument or was presenting something he failed to include earlier. Those comments are sort of "wit of the staircase" to which most of us succumb.

�

1/1/2015

guest Is your point that there shouldn't be too many threads?�

1/1/2015

guest My point was that sleepyhead has every right, and arguably a responsibility, to point out the flaws in the SCTY model as far as investors might be concerned.

You seemed to want a separate thread for an aspect of SCTY. This is something to which I totally disagree. Since this is the investor section and SCTY has a thread, all discussions related to SCTY should remain here, especially when it concerns valuation and risk. The leasing model carries a lot of risk should potential customers become better informed about the ways in which they could afford to buy a system as well as the risk to lowering the value of their property if they think they might be selling within ten years or so of starting a lease.�

1/1/2015

guest Yes, I don't want a single topic to dominate the thread. To me it is just one of many questions to discuss as long as the installed systems actually convert solar to electricity.�

1/1/2015

guest Again, I refer to the fact that this is the investor section. Converting solar to electricity is what SolarCity customers seek, but at prices they can afford. Leasing is something that should concern SCTY investors and sleepyhead may argue that it is the central concern against the current valuation. But I think sleepyhead can defend himself and offer his own reasons for providing data related concerns for SCTY in the investor section of a thread dedicated to SCTY.�

1/1/2015

guest Well, I'm hereby disclosing that I own some SCTY. There you go. As far as I'm concerned, SCTY can lease and/or sell in whichever way they please.�

1/1/2015

guest I guess all threads relating to Model S accidents, power train and other issues should be moved to the investor thread. TSLA investors need to be concerned of those, too.�

1/1/2015

guest

That's fine. I'm sure every investor in SCTY hopes the company is successful, and if leasing is a path to that success, good for them. Any company that contributes to the global solar array is doing something positive for the environment.

I own a large amount of TSLA and I hope for success with that company. I don't disclose any fault I find with the company or product because I am not looking to encourage those who want to see the company fail. However, I do want to know about those concerns so that I can make an informed decision about risks vs reward. If I were considering SCTY as an investment, and in the past I have, I would want to know about the drawbacks of the lease program as it could affect the stock price.

We all hope our investments are successful. Sometimes we make errors in judgment, sometimes we miss the obvious. When the error is an oversight, that's too bad. When the error is because we bury our head and hide from what is obvious, that is gambling that others also won't see the obvious and we become big losers of our own making. On the other hand, sometimes what seems obvious is not actually so clear. The naysayers who oppose TSLA for any number of reasons are the ones I believe who are blind or gambling that enough of the investing world will miss what we see as clear. So by the same token, SCTY investors may be the ones who see the bigger picture that others can't. Only time will reveal the entirety of the pictures.

- - - Updated - - -

Yes, that would suit me fine. I don't read the threads in the other sections so I am not as well informed on every aspect of TSLA as perhaps is possible from reading the full forum. I guess it is up to the mods to decide what thread is relevant to each section. And then, they have to decide what subject in each thread should be moved to some other thread or tossed out entirely.�

1/1/2015

guest Mod Note: We tolerate Solar City discussion because of the obvious link(s) to Tesla. I can see the point about wanting space for a wider discussion but at the same time we need to consider how messy that will make the Investor Section where primary discussion revolves around TSLA. No promises that we'll change anything but I'll put it to the other moderators and admins for consideration; in return please give us until a week after TMC Connect (workloads for many folk are high right now).�

1/1/2015

guest I agree with this 100%. Sleepy's post have been extremely valuable to myself (who has some skin in the game) in understanding what could be the major hamartia in solarcity's business model.�

1/1/2015

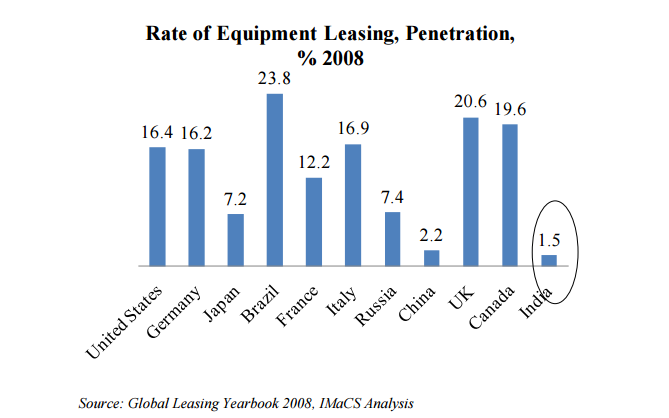

guest There are few important questions:

1) What is the SCTY price per watt installed? If it is smaller than what could do small installers - SCTY is doing good. Because on the long run SCTY(and other big players) will squeeze those small players out of the market.

2) What is SolarCity's expenses per customer acquired(per watt ordered)?

Answer to the first question - most likely yes, economy of scale for panel/inverters purchase, specialized teams of inspectors/system designers(paperwork)/installers could be used way more efficiently if company have sizable amount of orders.

I'm not sure how effective SCTY customer acquisition efforts are. But reading Yelp/solar forums it looks like SCTY do use aggressive tactics. Which is rather good.

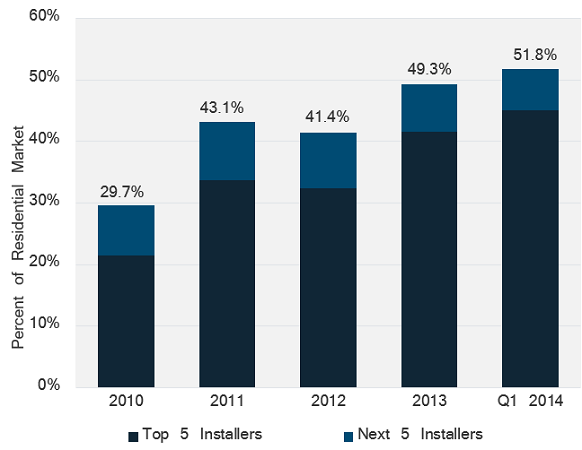

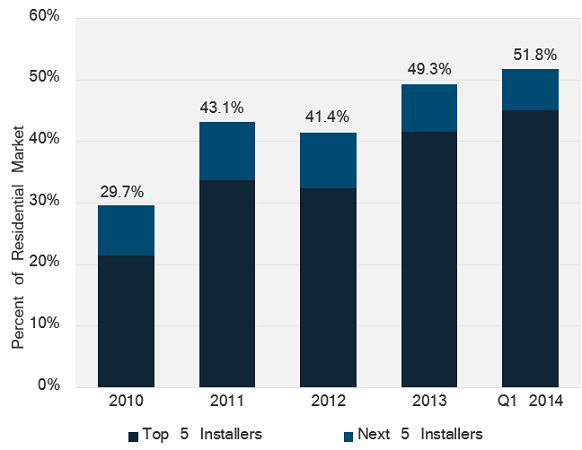

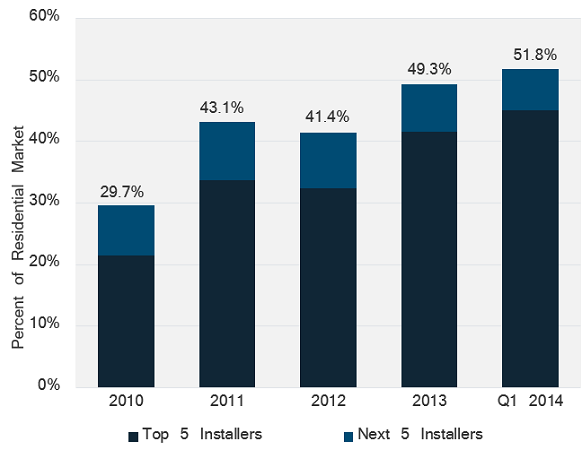

And efforts seems to pay out:

Market share of top US installers are growing fast, and SCTY is doing even better.

As for what is better - lease or purchase, it is quite an idiocy to generalize for 100% of the market. Both have advantages and disadvantages. Doesn't matter if we are talking about solar lease or purchase, car lease or purchase, or factory/industrial space or office space lease or purchase. Each case is different and depends on what offers are available on the market.

Talking specifically about residential solar prepaid lease vs outright purchase the first one should be much cheaper. Not only that, but in case of purchase customer had to purchase insurance, and pay retail insurance rates against things like hail, vandalism, etc for his solar system. Add inverter replacement costs(paying retail price for inverter, paying certified electrician for one time job) in 10-12 years. Even more important - one should add maintenance expenses, if panel gone bad, it is customer problem to remove it, send it to manufacturer, get replacement and pay for installing it in case of purchase. And if the lease was chosen, it is installer problem.

Overall one is not better than other, it is all depends. But pointing potential problem with lease while keeping quite about what purchase really mean in terms of hidden expenses down the road is plain wrong.

Anyhow I think pressing lease model is a right move for SCTY right now. As long as SCTY is able to install, maintain solar systems cheaper than competitors SCTY is in the great position. If sales instead of leasing would become more profitable SolarCity would be able to switch easily.�

1/1/2015

guest Many things I wanted to respond to in this thread and will try to do so over the next few days, as long as this thread doesn't grow out of control that I can't keep up.

Definitely buying a system is the way to go. I will admit that a lease can make sense for certain situations, but I would imagine that buying is the way to go for over 90% of home owners, possibly a lot more than 90%. E.g. I bought my system and it will save me over $100 a month for the next 25+ years (probably 40 years) after factoring in costs of the system and 0% increase in utility rates (highly conservative estimate). A lease might save me $30 a month, so the leasing company gets 90% of the benefit, while the consumer gets 30% (I know it adds up to 110%, because leasing creates an additional benefit of MACRS). I will expand on this topic a lot more later when I have more time.

As far as GTAT (sorry for going off topic for a second here), I will try to write something up in the "other investments" thread, but there is so much to write about. In the mean time, I recommend reading some of Matt Margolis articles on seeking alpha or his website, such as this article he posted today:

GTATs Hyperion Technology is Laser Focused on Cancer

He is just a regular dude that posted on yahoo message board, where he learned a lot, did a ton of legwork, and ran with it. He now tries to sell a research product for about $100/month at PTT research. I would never recommend paying for that unless you have hundreds of thousands of dollars in GTAT or MU (only 2 stocks he writes about now). He posts most of his stuff to the public about a week after releasing it to paid subscribers anyway, so no reason to pay because his info is not really market moving that you need it now.

Word of caution on Matt, is that he extrapolates everything into best possible case and subtracts ~20% to be "conservative" and comes up with a PT of $87.50 by next June (GTAT is at $15 right now). He is a little exuberant, so be careful. But his research is really good.

GTAT just had a 30% decline last week due to some analysts manipulating the stock, since it started running away from them and on 4th of July weekend a sapphire 4.7" iphone screen was leaked out and GTAT was poised for take-off. It appears that some research analysts colluded to "downgrade" to hold while keeping PT's steady for some extremely bogus reasons; not unlike GS downgrade of TSLA. A bunch of shorts had to close their positions and UBS had some autocallable securities due last week that lost them more money the higher GTAT went.

What I am trying to say is due your research quickly on this stock, because it may turn out that this is a great buying opportunity on this pullback. Apple should unveil iphone6 in just 2 months, so a huge catalyst could be on the way. Their will be many leaks and other possible catalysts at any time.

In the mean time, GTAT is a momo stock like TSLA and it can pull back hard during a market correction like other momo stocks.

(Shameless plug) We have a very good discussion of GTAT on our TCI website and the GTAT thread has picked up a lot of steam and useful information of the past month. rsk has some extremely useful input on this topic. I recommend reading over the thread if you are seriously interested in investing in GTAT. Note: there are huge risks investing in GTAT, but I have more than half my money in that stock (sorry JASO, still love you but you are now second):

GT Advanced Technologies Inc. (GTAT) | The Contrarian Investor Discussion Board

And to go back on topic GTAT was originally a solar equipment provider, but has since diversified into sapphire (huge potential after signing huge deal with Apple, who invested $578m in GTAT to build out sapphire capacity), Hyperion (this could be a major game changer in slicing stuff really thin; oh, and BTW it can also cure cancer - no joke, read the article posted above), LED, power electronics, other stuff.]

GTAT has this really cool Merlin technology that will allow you to make solar cells that are 0.7% more efficient, use 80% less silver, save money on paste, and allow you to make 50% lighter modules that will be more flexible and have better longevity; it also uses cheaper copper instead of silver.

Sorry for going off-topic - if you guys have any GTAT questions, please ask them in the "other investments" thread and I will try to respond. It is a high risk/ extremely high reward stock.

Now back on topic and I will be talking SCTY now.

GTAT also supplies solar equipment and it is possible that SCTY will be buying some equipment from them to build out Silevo.

- - - Updated - - -

It is actually only ~$300 more per month, since you are saving about $130/month due to solar generation. And I mentioned in my post that I got "no.3" rebate check by the time my second payment was due. So at worst, you might have to do about $300x2, i.e. you need an extra $600 before 3 and 4 kick in. If you can't afford $600, then you should probably rethink the Dave Ramsey thing :smile:

Also, I am recommending a 5-year loan that essentially costs you very little per month ~$60, but then you can enjoy free electricity after year 5 for 20-30 years, with only minimal maintenance costs due to long warranties.

A lease on the other hand is like taking out a loan for 20-years for something that you don't even own. You will continue making payments for 20 years. It is really not much different than taking out a loan to buy a system. I am offering a tiny bit of short-term pain for 5 years and then 20 years of freedom, while a lease is just 20 years of less than normal pain, but still pain.

I laid out the math in one of my previous posts and showed how you personally can save as much as $20,000 over then next 20 years when buying a system compared to leasing.

I have more to say about the leasing model and why I am not a fan of it. The biggest reason I am not a fan is that the leasing companies are pocketing the majority of the benefit of you going solar, while the customer gets screwed and only gets ~30% (depending on your lease offer, and what generous rebates and incentives are offered in your city/state) of the benefit he could get if he bought a system instead.�

1/1/2015

guest "Other investments" thread sounds good to me.�

1/1/2015

guest 1) I find sleepyhead's numbers for outright purchases to be very optimistic. He is very savvy with this stuff, so he can find best possible deal(s) out there. But an average person may not come anywhere close to sleepy's numbers.

2) (no offense but) except for a few solar geeks, nobody knows what $/W means. Let alone comparing different quotes based on this.

An average consumer at best, if at all, knows Cents/kWh.

SolarCity competes with utilities on that metric. When SolarCity goes out and says: "lets pull up your electricity bill, this is the rate you are paying, we can reduce this by x%. meanwhile you will be reducing pollution and contributing to the planets well being." its very appealing to most people.

As much as people here would like, the comparison of $/W is highly irrelavent, which no body really knows or understands.

3) Lets says sleepyhead turns out right and the lease model entirely dies away, that doesn't in any way mean death to SolarCity. They started out by selling systems outright and by many accounts they still do.

Musk said they will produce and install in the order of "tens of gigawatts per year". At that scale, starting from now, the potential growth is so much, the exact mechanics of the sales: lease vs cash-sales vs financed-sales is largely irrelevant.

It so happens that leasing produces the best longterm shareholder value AND currently, consumers are appreciating this model. Thus, it makes complete sense for solarcity to focus on this model. If it doesn't work over time, they can very easily adapt to a different model.

4) Solarcity has become the most vertically integrated player out there and becoming more so every passing quarter. The economies of scale + execution efficiency will, in time, make this company very valuable. I have no doubts about that.

In closing I want to say this:

I have been reading this thread for a long time. No one, I mean absolutely no one, predicted that solarcity will get into panel manufacturing. But solarcity did it and very clearly explained why they are doing it. The management sees far ahead of anyone here and they are ever focussed on growing the company at a phenomenal rate for decades to come. They see obstacles, they will come up with ever more profitable solutions. I trust Musk's vision and Rive brothers' execution.

I have a large position in solar city (together with Tesla). None of the bear arguments here have swayed me a single bit.. (they did make me research and think a lot though).

- - - Updated - - -

Finally, the thing about leasing companies eating away tax benefits meant for the end consumer. Well, we can argue the same about rental homes, can't we? Homeowners get to take mortgage interest tax deduction, which the end consumer would have enjoyed if they bought a home instead of renting one.

Is renting out homes un-ethical?�

1/1/2015

guest Mod Note: some posts got quarantined in snippiness.�

1/1/2015

guest seems to me that the liability issue could be solved with an option to buy-out the solar install on some sort of pro-rated basis over time. Sure it still wouldn't be as good of a deal as an initial purchase but it could be wrapped up in the selling price of the house. It does transfer some risk to the original owner, but taking out a loan (assuming you could get one) to install a system also entails risk - in fact the same risk as the original owner needs to recoup his install costs (be it cash or loan) when selling the house.

I think this would not cause an issue to the securitization model as it would be similar to a mortgage pre-pay. I seriously doubt that the current SCTY bonds are valued much on cash flows past twenty or thirty years anyways.�

1/1/2015

guest Talk on the street is scty coming out with a 200mln abs this/next week.

- - - Updated - - -

The first one came out Nov 13, 13 for 54.5mln

The second one on Apr 2, 14 for 70mln

The latest is for 200mln.

I believe there was some prior management guidance on this. So not sure if this will be market moving.

To get a feel for why this is important for scty, you might want to read this old article:

SolarCity Corp (SCTY) Could Issue Larger Asset-Backed Securities in 2014�

1/1/2015

guest Here it is

SolarCity Announces Pricing of Third Securitization (NASDAQ:SCTY)�

1/1/2015

guest spot on

�

1/1/2015

guest As per Raymond James Energy Daily Update newsletter SCTY's cost of capital through tax equity funds is in the range of 8% to 11%, which I believe is currently the main source of financing the projects.

These ABS sales significantly lower the cost of capital and thus improve retained value.

A few bears speculated that the tax credit expiry in 2017 is a death blow to scty. It turns out, solarcity is looking far ahead and effectively turning "problems" into "opportunities".

They are not only solving the potential issue of lack of funding but are actually lowering the cost of funding!

Similar thing happened with panels. By getting into manufacturing through silevo, they are not only solving the potential issue of lack of enough panels, but they are using the opportunity to further lower the total cost of installations (not just panels).

A number of "risks" pointed by bears are technically risks. But the bears are significantly underestimating the management's ability to address these and go much beyond.�

1/1/2015

guest In case you are wondering, the latest ABS had a weighted average cost of capital of 4.32%

Here is the reference SolarCity Raises $201.5 Million in Bonds Backed by Panels - Bloomberg

That's an improvement of 518bps compared to raising capital through tax equity funds!�

1/1/2015

guest According to reports from GTM research, third party ownership accounts for 2/3 of all residential solar installations in year 2013. The ratio stays the same in 2014 so far.�

1/1/2015

guest

http://www.buffalonews.com/business/solarcitys-prospects-upbeat-as-cuomo-sees-more-state-incentives-20140728�

1/1/2015

guest The whole state of NY needs lots of manufacturing jobs!�

1/1/2015

guest I have to agree with David. There's just so much things that cheap electricity can do so demand won't be an issue. For example, there're many places in the world that have severe water problem. With cheap electricity, we can simply produce fresh water from sea.�

1/1/2015

guest Or, for example with cheap electricity it would be possible to produce gasoline out of air and waterUsing more than century old F-T process that was and is used on industrial scale since world war 2.

�

1/1/2015

guest cool! Similarly, chemical engineers should be able to find a way to produce jet fuel etc economically and more environmental- friendly...�

1/1/2015

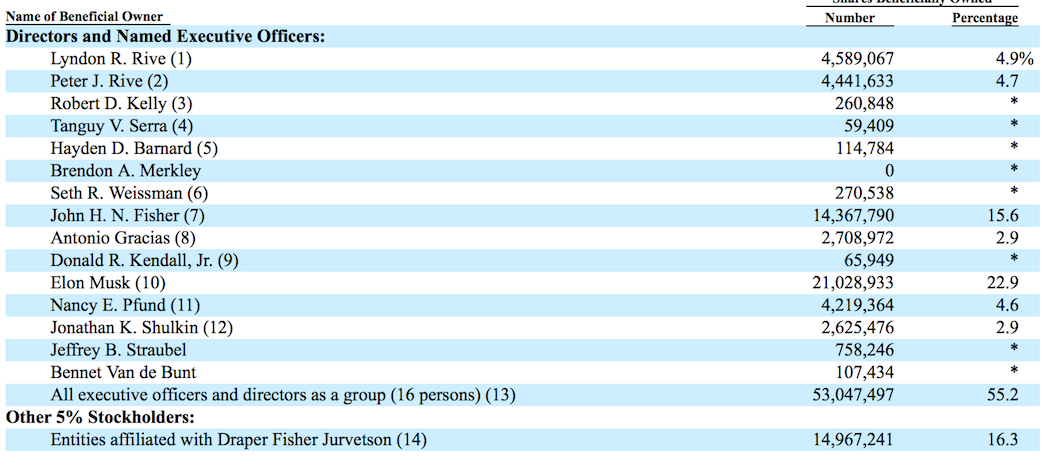

guest More significant insider selling going on with SCTY. Peter Rive sold 135,000 shares of the stock on July 30th at $74.00, for a total value of $9,990,000.

I said it before, I'm saying it again, this really doesn't sit right with me. They are making so much money selling their shares. Presumably significant dilution is coming to fund their solar panel factory. If it were not Elon being Chairman and JB being a Board Member I think this stock would be valued at a fraction of what it is today.�

1/1/2015

guest Debunking the FUD around SCTY's insider sales

I really wish people would do more research before making claims such as this.

Alright, let�s review Peter Rive�s holdings and selling.

1. 12/12/12 filing, SolarCity - Initial Statement of Beneficial Ownership

Peter Rive has 2,952,378 common shares.

option to purchase 1,000,000 shares (2009-2019 incentive plan)

option to purchase 1,000,000 shares (2011-2021 incentive plan)

2. 6/11/13 filing, SolarCity - Statement of Changes of Beneficial Ownership

Peter Rive sold 220,743 shares at $14 (137 Ventures exercised option to buy shares from previous 12/30/11 agreement). Amount: $3.09 million.

Total shares held: 2,731,635 plus option to buy 2,000,000 shares (incentive plans through 2021)

3. 12/19/13 filing, SolarCity - Statement of Changes of Beneficial Ownership

Peter Rive sold 40,000 shares (from 8/29/13 Rule 10b5-1 plan) for $56/share, total amount $2.24 million.

Total shares held: 2,691,625 shares plus option to buy 2,000,000 shares (incentive plans through 2021)

4. 7/31/14 filing, SolarCity - Statement of Changes of Beneficial Ownership

Peter Rive exercised option to buy 30,200 shares at $1.62/share and then sold 135,000 shares at $74/share (from 3/24/14 Rule 10b5-1 plan), total amount sold: $9.99 million

Total shares held: 2,586,835 shares plus option to buy 1,969,200 shares (incentive plans through 2021)

5. Regarding his option to buy more shares (from incentive plans), 1.65 million out of the roughly 2 million shares are exercisable currently. Meaning, the requirements have been met and he can exercise those shares whenever he chooses. (More info on # shares and option held: SolarCity - Definitive Proxy Statement)

Ok, so let�s now look at what this means.

1. SolarCity was founded in 2006. That�s 8 years ago, and founders have every right to raise some cash especially after their company has gone public.

2. Since going SCTY went IPO, Peter Rive has sold voluntarily only 175,000 shares (40k shares on 12/19/13 and 135k shares on 7/31/14, he sold 220k shares but it was an agreement from 2011 with 137 Ventures).

3. Let�s put this into perspective, after 7-8 years since the company was founded Peter Rive sells 175,000 shares but still has over 4.5 million shares. That�s like 3.7% of his holdings. Not much at all.

4. His recent sale is from a 3/24/14 10b5-1 plan and I would actually expect some more sales from this. I think it�s totally normal and acceptable for Peter Rive to sell 5-10% of his holdings, or even up to 15%. That�s fine and causes no concern for me.

5. Let�s look at this from another perspective. Let�s say your Peter Rive with an annual salary of $275,000 and no other bonuses. $275,000 is not much for the Bay Area, especially after taxes. So most of your compensation is in the form of stock - some from being a founder and some from incentive plans. Now you�ve worked on the company for 8 years and haven�t made much money in terms of salary over those years. Almost all your gains are stock gains. So, when are you going to sell a bit of your stock to take that money and do other things with (ie., build a custom house, buy a private jet, go places, do things, etc)? Sure you could wait another 5-10 years, but that�s not typical. It�s totally reasonable for you to want to sell 5% of your stock holdings to raise some cash so you can use that money for various things. It�s a lifestyle upgrade that�s been put on hold for many years, and now after 8 years the company is doing well and you feel it�s time to take the 5% off the table so you can have tangible benefits in your lifestyle. Totally makes sense.

It�s quite confusing to me that people would be shocked that a founder liquidates less than 5% of his shares after 8 years of working on the company. Guys, this is how it works. Founders liquidate shares over time. It�s a reality. Now, Elon is quite an anomaly and I don�t think it�s fair to expect other CEOs or founders to never share their shares and to take up line of credits to buy more.

If anything SolarCity has one of the largest and strongest insider holdings of any company out there. A whopping 70% (!!!) of the common shares are held by the Directors, Executives, and entities affiliated with the Directors.

Elon has roughly 23% ownership in the company, but there are other groups with large holdings that have been very committed to SolarCity from the early years and have held on to the vast majority of their position until now. This shows amazing commitment.

Now, it�s only natural that these entities will liquidates their holdings slowly over time. It�s just reality as some of these entities are venture capital firms that need to return capital to their investors as well. So don�t be surprised that over time that these insider entities share more and more shares over time. It�s just not realistic for insider holdings to remain at 70% over the long-term. Over the next few to several years it�s only logical and practical for insider holdings to drop to under 50% and eventually end up at around 30% or so, IMO.

However, for insider holdings to be at an incredible 70% currently is testament to how strongly the insiders believe in the growth and future of the company.

If anything, if you look at the insider activity the most glaring fact is not that some insiders sell some shares occasionally to raise cash, but rather that insiders are religiously keeping that vast majority of their holdings in SCTY and insider holdings remain at a incredible 70%.

Think about that again. Insiders hold 70% of the common shares of SCTY. How is that not incredibly bullish. Even if it was 40-50% it still would be super bullish.�

1/1/2015

guest

source: 4/24/14 sec filing, SolarCity - Definitive Proxy Statement�

1/1/2015

guest Brendon Merkley's been on board since last autumn. He SHOULD own some shares outright! That's not right.�

1/1/2015

guest SolarCity - Statement of Changes of Beneficial Ownership

Looks like Brendon Merkley (EVP, Process Engineering) has an option to purchase 150,000 shares at $52.79 (date exercisable 12/2/14, date expiration 12/15/23).�

1/1/2015

guest Yes, that appears to be correct, Dave. I reiterate, though: he should own some outright. I have no truck with senior management or board members of any company that fail to show that simple show of support for and courtesy to the shareholding public. When such a person is hired and he is granted in-the-money options, as is the case here, it is even more distasteful to me. Long-term readers of my posts do know I am the cranky old-timer here, with old-time beliefs....�

1/1/2015

guest Hmmm, I'm not sure if I'm getting exactly what you're saying.

Brendon Merkley is not on the board of directors, but rather is a newly hired EVP of Process Engineering. If he was a board member, then yes I would agree that he ought to buy shares to show his support. But as a hired executive, I don't get the mandate for him to use his personal money to buy shares of the company. SolarCity granted him at-the-money options when he was hired back in Dec 2013. So that's part of his compensation and incentive package, and gives him a vested stake in the company and its future.

Overall, I like the board and the executive team to have a decent stake/ownership in the company since it aligns their interests with shareholders and allows them to have a longer-term view. However, in Brendon Merkley's case, we don't know his personal finances and I'd much rather have him join the executive team with at-the-money options as part of his incentive/compensation package (ie., 150k shares in this case), rather than him buying a few thousand shares when he was hired from his personal money because it'll look good to shareholders. In my view, him holding options that were at-the-money when issued (issued Dec 2103 but exercisable starting Dec 2014) is pretty much the same as him holding stock outright.

Maybe I'm missing your point, but I'm not seeing the mandate for a newly hired executive to own shares outright from the outset. Would love to hear more of your thoughts though.�

1/1/2015

guest Have any of you heard of quality of service issues with SolarCity?

Looking them up on Yelp - SolarCity - San Mateo, CA | Yelp

There are many negative reviews, and I did come across a critique of SolarCity in this regard, but couldn't find it now.

I'd admit that for this reason I'm somewhat skeptical of SolarCity, plus the fact that the cost of entry is very low for new companies doing the same. i.e NRG is now competing with them directly.

This is the exact opposite of my impression of Tesla which I invested in, where the costumer satisfaction is considered astounding, and the barrier to entry even for established car companies into the EV market in a meaningful way is high. The leaf cost Nissan some imaginary figure of around 6 billion $ to bring to production.

If you got the same impression, wouldn't it be better for them to outsource the servicing? They seem to have enough on their plate and I'm not sure why it makes sense to be so vertically integrated in the home solar business to begin with.

I'd like to hear also if you think I got this wrong. Its a first impression and not based on substantial research.

Thanks,

Daniel�

1/1/2015

guest Here is the mentioned critique - Tesla Motors And SolarCity: Moving Beyond Musk Obsession

Thanks,

Daniel�

1/1/2015

guest First, Dave, I am aware that the world - and most fundamentally, the US corporate world of 2014 - mostly thinks quite differently from me. With that, MY perspective is:

* that a senior executive brought in last fall is no longer "newly hired" (H*ll, that makes him an old-timer by today's corporate standards of race-around).

* that all senior executives of a publicly held company - and board members too, of course - have a moral and even a fiduciary responsibility to the shareholding public of owning shares outright.

* that compensation packages these days are so bloated that no such person has the ability to claim personal finances as a reason for not fulfilling this duty.

* that a compensation package that included those 150k share option is that much more reason that he should cowboy up and purchase real shares. NOTHING an executive can do is more demonstrative that he has faith in the organization that he works for than this action.

Those are my reasons. They also should give you good insight as to why I have spent the past two decades ensconcing, entrenching, embedding myself in a remote part of this remote state. O tempora! O mores!�

1/1/2015

guest Thanks for the explanation. So, is there a minimum number of shares you want executives to own outright from the outset? For example, if Brendon Merkley purchased 1,000 shares would that be satisfactory? Just curious, since rather than him purchasing a trivial amount of shares outright from the outset I'd rather have him take a comparatively lower salary than the industry and take on a significant stock incentive plan that will align his interests with the long-term future of the company (which SolarCity did by giving him ATM options when they brought him on).�

1/1/2015

guest Large scale.

Soft costs are primary cost driver.

Subsidies will be cut significantly.

Cheap backup on the horizon.

Vertical integration provides the opportunity to gain competitive advantage in an increasingly tough, but rapidly growing market. There are potentially huge amounts of money to be made. Imagine panels+battery in every building.�

1/1/2015

guest As usual, people with negative experiences are very much more vocal. I had Solar City install a system on my house. The process went very well and I haven't required any service as solar systems pretty much never need service. I am satisfied.

Another point, after the installation, the city inspector who does only solar systems as they are coming online so rapidly, told me "Solar City always does the installation to code just the way we like it, I never have to call them back out to fix anything. Other guys have to come back sometimes several times." I did not ask him who the "other guys" are.�

1/1/2015

guest Yelp review issue came up many times before on this thread. Several commentators, with first hand experience, said Yelp skews ratings based on if businesses pay Yelp or not. I actually started investing in SCTY after hearing/reading a number of *very* positive reviews. I believed, and still believe, customer satisfaction is their biggest strength.

'Low barriers to entry' topic comes up here a lot. Let me give a good answer on this one:

1] Even a high school grad can create a website with a shopping cart. So how come Amazon grew to be so big?

How hard is it to sell random stuff in a box store? Then how come Walmart became so big?

How hard is it to make and sell hamburgers? Well, how did McDonald's become so big?

What about coffee? Any idiot can make coffee and sell it. What made Starbucks so big?

The answer to all these questions is

a) Being at the forefront of an emerging trend -and/or-

b) Business acumen + execution efficiency, typically translating into economies of scale

2] It's not that easy for someone, even with a lot of capital, to sort of become as big as SolarCity in one shot. It takes time to create a network/hierarchy of competent people, (software) systems, business processes etc. Just because NRG can or will dump a bunch of capital, doesn't mean they will automatically race ahead of solar city.

3] The size of the market is HUMONGOUS. Will write a detailed post, with data, in a followup. There is enough for everyone who wants to succeed.

4] GE is a 250+ Billion dollar company. It makes more money in Energy industry, one way or another, than in any other industry. The head guy has this to say about SolarCity:

At the World Energy Innovation Forum at the Tesla factory in Fremont, Calif. this week, the CEO of GE, Jeff Immelt, said during an onstage interview that GE had focused so intently on how bad the solar panel business was that they �missed SolarCity.� �My God I wish I had thought of that,� said Immelt.

Reference: Immelt: I Wish I Had Thought Of SolarCity - Business Insider

- - - Updated - - -

Care to show your valuation model?�

1/1/2015

guest Dave -

Certainly buying 1,000 shares is infinitely superior to owning none. 2,000 shares would be twice as good as 1K...and so on. But as to answering the important question of what is the appropriate amount, I confess I do not know. Now, this gentleman came to Solar City with a bit of baggage....and a "poaching" lawsuit. That has brought upon a countersuit, so, in this one case, we might surmise a bye is in order until the jumping-ship mess is resolved.�

1/1/2015

guest I think what I'm getting at is that Brendon Merkley effectively owns shares outright via his ATM option signing bonus. Let me explain a bit further.

When he signed on with SolarCity, as compensation they could have given him a high salary, cash signing bonus, a stock/option plan, etc. In Brendon's case, he and SolarCity opted for the option/stock package as part of (or all of) the signing bonus, which implies to me that they probably didn't give him a large cash signing bonus and his salary probably isn't exorbitant either. So, in this case Brendon is choosing to opt for equity in SCTY as a large part (or all) of his signing compensation package.

His option/stock package was given to him in Dec 2013 when he joined SCTY and gives him the option to purchase 150k shares at $52.xx anytime between Dec 2014 and Dec 2023. So, in effect SolarCity gave (and Brendon choose to receive) $52 strike Dec 2023 LEAPS. Market value for these options back when he joined SCTY would be at least $25 (probably more since they expire in 2023. I for one would love to buy $52 strike SCTY LEAPS that expire in 2023 for $25.). So, at $25 market value the option to buy 150k shares is worth approximately $3.75 million. Note from what I can tell this isn't an incentive plan with milestones but it like a signing bonus where he's able to exercise the options starting Dec 2014.

I think my point is Brendon Merkley decided to choose equity in SCTY for his signing bonus, and that equity (basically $52 strike 2023 LEAPs) is in all practically the same as holding 150,000 SCTY shares. While he could have taken a large cash signing bonus, he probably didn't and by taking the equity grant he choose to become a vested stakeholder in SCTY's future.

I, for one, who much prefer him taking the 150k option grant than him purchasing 10k shares on his own when he was hired. The 150k option grant gives him a much bigger stake in the future of SCTY (practically the same as him holding 150k shares) and aligns his interest much more with the long-term future of company.�

1/1/2015

guest These are some data points that highlight the growth potential for SCTY:

****

Snippets from Bloomberg New Energy Finance (BNEF)'s 2030 Market Outlook report

By 2030, the world�s power mix will have transformed: from today�s system with two-thirds fossil fuels to one with over half from zero-emission energy sources. Renewables will command over 60% of the 5,579GW of new capacity and 65% of the $7.7 trillion of power investment.

Rooftop solar PV will dominate, taking up a fifth of the capacity additions and investment to 2020.

A small-scale (meaning, rooftop) solar revolution will take place over the next 16 years thanks to increasingly attractive economics in both developed and developing countries, attracting the largest single share of cumulative investment over 2013-26.

The Americas region will invest $1.3 trillion in 557GW of new power generating capacity through 2026. Renewable energy technologies will account for two-thirds of the new capacity over that period.

Small-scale solar will be the most important form of renewable energy, accounting for 18% ($231bn) of all investment in power-generating capacity in the region over 2013-26. In the US alone, a 27-fold growth of rooftop PV installations will give it a 10% share of the US capacity mix.

About the report:

Published annually, the analysis pulls together the expertise of over 65 technology and country-level experts from 11 Bloomberg New Energy Finance offices worldwide, taking nine months to complete.

About Bloomberg New Energy Finance:

With unrivalled depth and breadth, we help clients stay on top of developments across the energy spectrum from our comprehensive web-based platform. BNEF has 200 staff based in London, New York, Beijing, Cape Town, Hong Kong, Munich, New Delhi, San Francisco, S�o Paulo, Singapore, Sydney, Tokyo, Washington D.C., and Zurich.

Reference:

http://bnef.folioshack.com/document/v71ve0nkrs8e0

***

From Green Tech Media (GTM) research report: U.S. Residential Solar Financing, 2014-2018

The share of third-party ownership (TPO) of residential solar, which has grown from 42 percent of the market in 2011 to 66 percent in 2013, will peak in 2014 at 68 percent. Beginning in 2015, the expansion of residential solar loan programs and alternate financing mechanisms such as property-assessed clean energy programs will drive the trend line back toward direct ownership, while the share of TPO will fall to 63 percent by 2018.

(63% market share for third party ownership is still a LOT by the way)

All portions of the residential market will experience rapid overall growth.

About the report:

The report provides a comprehensive update on the vendor landscape as well as innovation in both both consumer finance and project finance. In addition, the report provides an outlook on the total addressable U.S. residential market, the share of third-party ownership versus direct ownership, and the market size by ownership type with forecasts to 2018.

About GTM:

GTM Research, a division of Greentech Media, provides critical and timely market analysis in the form of research reports, data services, advisory services and strategic consulting. GTM Research�s analysis also underpins Greentech Media�s webinars and live events. Our coverage spans the clean energy industry including the solar power, smart grid, energy storage, energy efficiency and wind power sectors. Our analyst team combines diverse backgrounds in investment banking, engineering, information technology, strategic consulting and regulatory sectors. Our analysts are widely known across the industry and speak regularly at industry events all over the world. GTM Research is based in Boston with offices in New York and San Francisco.

Reference:

Market Share for Leasing Residential Solar to Peak in 2014 : Greentech Media

****

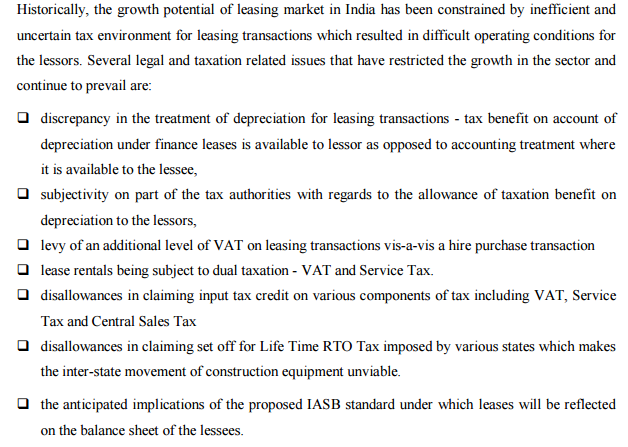

What about SolarCity's Market Share?

"Our U.S. Residential Solar Market Share Was the Equivalent of the Next 14 Competitors Combined in the Most Recent Data Available for Q3 2013"

Data from GTM Research - U.S PV Leaderboard.

Reference: SolarCity - Events Presentations -> 26th Annual ROTH Conference Presentation -> Page 8

****

So putting it all together:

Globally renewable sources will continue to grow phenomenally. In US, rooftop solar will dominate the growth. Within, the rooftop solar business, third party ownership will continue to dominate. Within this space SolarCity happens to be the biggest player by far.

As you can see this data is from two leading authorities in market research in this space.

****

Now lets see some management guidance into the long term:

"Even if the solar industry were only to generate 40 percent of the world�s electricity with photovoltaics by 2040, that would mean installing more than 400 GW of solar capacity per year for the next 25 years. We absolutely believe that solar power can and will become the world�s predominant source of energy within our lifetimes"

> Written by Elon Musk, Peter Rive and Lyndon Rive

Reference: Solar at Scale

**

"we expect in the future to build solar panel plants that are an order of magnitude bigger than any plants that exist in the world today to assure we're taking maximum advantage of scale, and then we intend to put a lot of effort into R&D on the panel side as well as into the mounting hardware, which we already own and into inverter technology in partnership with Tesla, as well as battery pack technology to provide an overall solution that gives someone electric power at a price that is less than if they were drawing it from fossil fuels burned over the grid; that's really the key threshold. And obviously the demand grows exponentially as the price drops and you can imagine that it really grows at an enormous pace if we're able to compete with grid-powered electricity with no government incentives and that's really the goal, and that has to be the goal in order for the world to have sustainable energy future."

> Musk's introductory remarks in the Silevo conference call.

Reference: SolarCity - Events Presentations -> Silevo conference call webcast

**

"Yeah, so absolutely one day we want to go international. But just in the markets that we service today, it�s about half the U.S. population. If you look at the adoption that we�ve had, we have 45,000 customers. 45,000 customers, you can see just with your eye. So we could expand almost infinitely for the next 10 years just in the market that we are in without having saturation. So we�re absolutely interested in international expansion, but the markets that we�re in, it�s a massive market to expand in."

> Lyndon Rive, Mar 2013

Reference: SolarCity CEO talks the future of solar power - Fortune

This whole interview is very insightful by the way. A must read for SolarCity investors.

**

"The market is insanely huge and sometimes the biggest challenge is to remain focused on what we are doing here because it is exciting to move into new markets. However, I have to finish this job before I can do that job. The market expansion is essentially going to be infinite in our lifetimes with distributed solar. Countries are starting to realize the benefit of this. For now, we are focused solely on the US."

> Lyndon Rive, Sep 2012

Reference: Distributed Solar: Unalloyed Growth Story? Discussion on the rooftop solar market at the Chadbourne global energy and finance conference in June - Chadbourne & Parke LLP - Publications

- - - Updated - - -

I'll post some comprehensive stuff on two other widely discussed/confused topics in subsequent weeks.

1) Profitability (or lack there of)

2) When there is Tesla, why invest in SolarCity�

1/1/2015

guest I remember a CEO once quoting a study that indicated on average a happy customer will tell 3 people their positive experience with a company but an unhappy one will tell 14 others their negative experience�

1/1/2015

guest Not sure of the content of all of the previous 81 pages, but the economics of our SolarCity PV system were a complete no-brainer.

Early in 2013 we leased a 7.5 kW system for 20-years with one, repeat: ONE, up-front payment of $8k. Even with our 85-kWh Model S charging every night, and some pretty absurd net-metering here in Texas (Green Mountain Energy's plan: the first 500 kWh is paid back at 100%; all power pushed back onto the grid after that 500 kWh is paid back to us at 50%, YES 50%. I WANT A RESIDENTIAL TESLA BATTERY YESTERDAY!), we end up with a credit bill or a small token payment (i.e. less than $20) every month, for a 3,500 square foot house with 4 bedrooms and 3 bathrooms.

So let's see:

1. No more gasoline $ given to those that want us dead; our Tesla is mostly powered by the sun.

2. No more electric bills, for the most part.

3. Massive reductions in our GHG emissions.

4. And a future Tesla residential battery (NOW PLEASE!) so that we'll eventually push #2 to a full credit every month.

all for ONE payment of $8k in 2013.

And we'll enjoy full warranty coverage, and monitoring of performance, from SCTY for the next 20 years.

I pitch the SolarCity/Tesla to anyone who has a cm of common sense and gives a damn about leaving the planet just a little bit better than how we entered it.

And this is far more painless than dealing with a local "Ma and Pa" Solar Company where they work out of a pickup truck and may, or may not, show up for repairs and will never monitor a single kWh of output...which makes SolarCity a very, very compelling company and an investment as well.

Hence, our lease of a SolarCity PV system, and purchase of SCTY stock at about the same time, BECAUSE IT WAS A NO-BRAINER.

As the ad copy said about 40 years ago, "Ask the man who owns [leases] one."�

1/1/2015

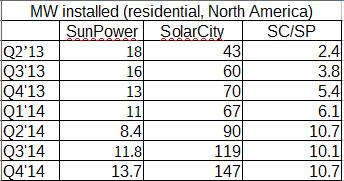

guest Just read on Raymond James Energy Daily update that per GTM Research:

In residential sector, for 1Q14

- SolarCity is leading with 29% market share.

- Followed by Vivint at 2nd place with 9% share.

- Sunrun/REC solar combination may be close to the second position.

In terms of market share data coming from SCTY management, we only saw it upto 3Q13. So this is a good data point as in it's the latest we can get.

Btw, SCTY market share was

32% in 3Q13

26% in 2Q13

20% in 1Q13

20% in 4Q12

19% in 3Q12

16% in 2Q12

12% in 1Q12

So it seems to have stabilised at around 30% for now.�

1/1/2015

guest Vivint IPO

Vivint Solar makes confidential IPO filing - report - PV-Tech�

1/1/2015

guest thanks for the info.. what happens if you move within 20 years? thanks�

1/1/2015

guest I had a Solar City lease and ended up moving within the first year.

They have a very smooth process for a lease transfer to the new home buyer. It was pretty simple for all parties. Of course, it does require educating the new buyer on the system benefits, lease obligation, and they have to qualify. But if they are paying cash for the home or getting a mortgage, they can most likely qualify for the lease.�

1/1/2015

guest Business is good, "We experienced unprecedented demand in the quarter with triple-digit year-over-year growth in all our key operating metrics"

SolarCity Announces Second Quarter 2014 Financial Results (NASDAQ:SCTY)�

1/1/2015

guest "218 MW Booked", when is the last time scty release their backlog?�

1/1/2015

guest Up 2.50 in after-hours. Clearly the market's happy with the report.�

1/1/2015

guest where is sleepyhead and his mom and pop shops will destroy Solarcity theory?�

1/1/2015

guest I remember that the booking was 130+MW last quarter�

1/1/2015

guest yep, "MW Booked of 136 MW for an annualized run rate of 544 MW Over 80% residential", demand is shooting through the roof, literally.�

1/1/2015

guest Interesting tidbit from today's earnings conference call:

Analyst: We�re starting to hear more about solar loan products. What�s your view on solar loans? How might they impact the economics of your business if you were to add them to your product offering?

Lyndon Rive: I think solar loans have a lot of potential. We are testing different products on the solar loan side. We�ve always been a financial leader in this space. Once we have come up with the absolute best product out there we�ll make a big announcement of what it will look like.�

1/1/2015

guest If you accept SolarCity's retained value calculation (which covers NPV over a 30 year cash flow period), they get $1.72 per watt. They booked 218 MW in the quarter. This means they added $375 million in the quarter, or if we annualize this, $1.5 billion.

The market cap of the company is $6.8 billion.

I realize there are risks, i.e. competition and a declining government subsity (from 30% down to 10%?), but given the focus they have on owning the supply chain (similar to Tesla), does this valuation not grab you all as incredibly low?

I'm early on in my research, but I liked what I saw enough to invest following the Silevo acquisition. It seems to me this is a potential multi-bagger. DaveT, I liked your piece on how to get outsized returns. As a former sell side analyst I can assure you that what Dave wrote is exactly true. The Street focuses very short term, and I feel the short term nature of the market is exactly why we're able to sit back, take a long term focus, and earn better returns on growth companies.�

1/1/2015

guest When they say "booked 218 MW" does that mean that they intend to build that in the future, or they did indeed build 218 mw this past quarter?�

1/1/2015

guest booked means backlog.�

1/1/2015

guest I don't see why this is such a great achievement- it means tons of demand but does that mean that they will be able to install all 218 MW? I'll have to go read their conference call but I don't get why you are so excited, FrozenCanuck.�

1/1/2015

guest That's not quite correct:

Previous backlog + orders booked - deployments = new backlog.�

1/1/2015

guest This might sound harsh, but where I come from thick skin is required for investing. Instead of jumping to conclusions and interpreting what I wrote as being "excited" (emotions are not useful when investing), just actually go read the conf call transcrpit or listen to the replay and then come back. Booked = signed contracts. It's an indicator of near-term future installations.

Back to the topic ...�

1/1/2015

guest

You are right. this "booked" number explains the retained value leap this quarter, since backlog is included in the retained value calculation.�

1/1/2015

guest Hello FrozenCanuck, A fellow SolarCity enthusiast here. I appreciate your sentiment. SCTY actually reported $1,291mln Retained Value for previous quarter and $1,804mln for the latest. Thus they added $513mln in the quarter, bringing the annualized number to $2Bln change.

I am not sure if Retained Value can be interpreted as deferred-earnings though. I am not sure if that is what you are alluding to. Given your background, what's the best way you see this metric can be interpreted as?�

1/1/2015

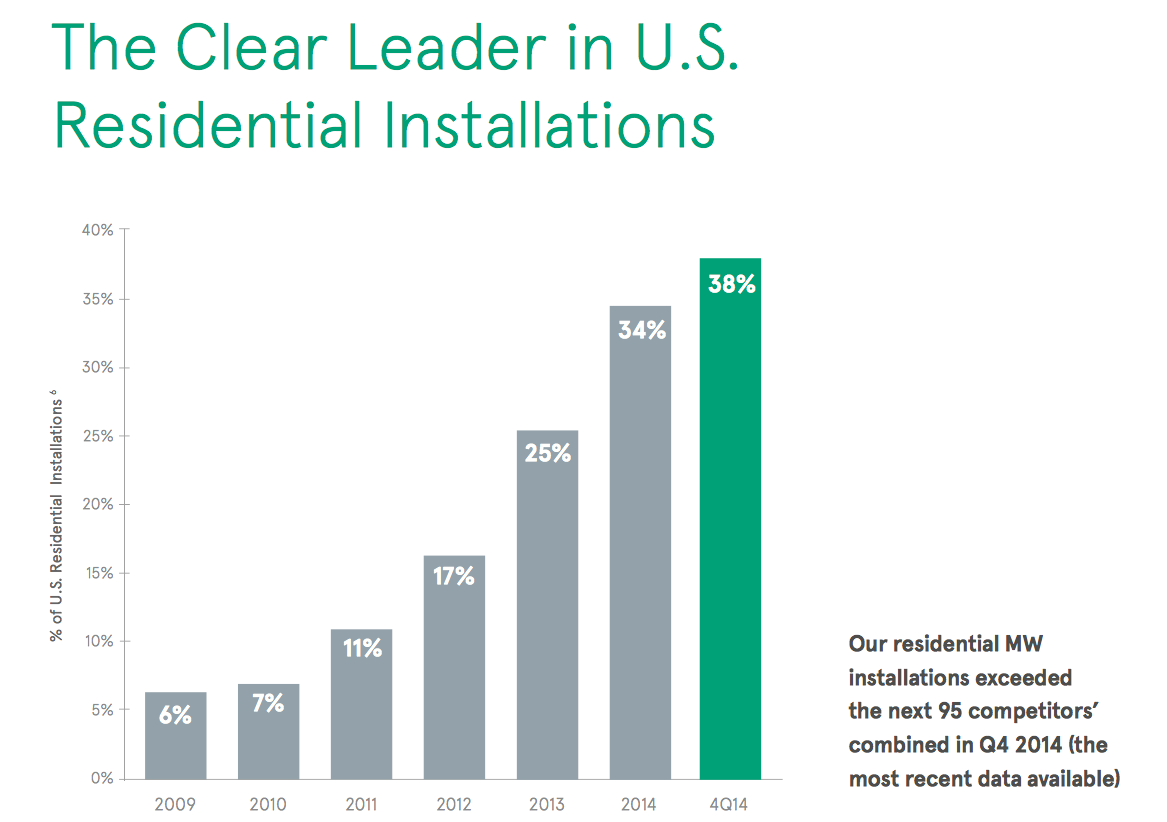

guest The one thing I truly appreciate in this quarter's presentation is how they broke down their cost structure and gave full detail. Page 8 of the deck. Or the supplemental document for full detail.

Looking at some comments on this thread one would think SCTY's operating expenses are so high, given their "bloated corporate structure", that their bankruptcy is imminent. These seemingly deliberate vengeful remarks are truly appalling!

Thank goodness, they explained it out and tied it all back to the real financial reports.

Turns out,

Installation Costs are $2.29/W

Sales Costs are $0.48/W

G&A Costs are $0.26/W

--------------------------

Total Costs are $3.03/W

While they accumulated $2.32/W of retained Value for Shareholders.

This is an incredible business that abundantly pays off in the long run.

Note: There are many idiotic articles on Seeking Alpha talking about reported EPS and such. They don't understand the basics of this business. The entire operating expenses (Sales + GA) are recorded in one shot, while Revenues are recorded over 120 quarters!! Of course the EPS will be negative. It doesn't matter!�

1/1/2015

guest Let's just leave out the deliberately provocative statements.�

1/1/2015

guest With hypergrowth companies, I often find that the more simple the analysis, the easier it is to analyze a stock's potential. So I'd rather have a simple, easy to understand (and track) model versus highly complex forecasts and variables. I can be off by a wide margin on actual outcome, but if the upside potential is enormous that's OK.

So in keeping with that logic, here's ONE way of looking at SolarCity.

They want to have 1 million customers by 2018. They've said this several times, and they most recently said they're on track to achieve it after adding 30,000 new customers to the backlog last quarter. They are going to need to ramp that 30k per quarter massively to hit the goal, but let's assume they do.

Each customer has an average retained value of $14k.

So if they get to 1 million customers they'll achieve retained value of $14 billion.

They'll still be growing at that point (very low market penetration), so it stands to reason we might still put something like a 2-3 multiple on this number, giving you a potential market cap of $28-42 billion.

Keep in mind I'm throwing out an uber-simple model for now. This model suggests that, within 4 years, we could be looking at something in the vicinity of a 5-bagger.

Thinking way longer term, what's to stop SolarCity from having an installed base of 5 million or even 10 million customers? The economics will obviosly change, so the retained value probably wouldn't be as high anymore (per customer), but why can't this happen?

This is why I'm so interested in the idea of owning as much of the supply chain as possible. I think it's critical to their leadership in the industry.�

1/1/2015

guest @FrozenCanuck, Appreciate your comments. I actually believe they will hit the 1mln mark by mid-2017 itself. They have consistently grown around 100% rate for many years and there are no signs of slowing down. At that pace mid-2017 is doable. Of course there are risks to it, primarily if their financing avenues don't scale at the same pace. But looking at the trend, it seems achievable.

Relating to your long term view, Lyndon Rive said multiple times that they will expand into other countries either this year or next. So that should make the 5mln or 10mln customer marks that much more achievable. He is also on record saying that he wants to grow SolarCity to become the largest energy company in the world (it's on youtube somewhere). In my view they are clearly setting up the company in a way to achieve ambitious goals like that.

After all, in Musk's big vision, Tesla addresses consumption side of the energy equation, while SolarCity addresses the production side. There is nothing to indicate SolarCity's long term goals would be small.

On the flip side though, I have some trouble equating Retained Value directly to Market Cap. Ideally growth in Retained Value should directly correspond to growth in Book Value (Shareholder Equity) as SolarCity puts all the contracts on the Assets side of the Balance Sheet. But that doesn't seem to be happening. I am not sure why. Do you have any insights into this?�

1/1/2015

guest Ok - the retained value on contracts is not the same as retained earnings. The value should flow into earnings over a long time, at which point it lands on the balance sheet and you'll see it as asset / equity.

It seems reasonable to me to look at market cap as a direct function of retained value, provided you believe the value is real. The contracts that create this retained value should translate into actual earnings, right? And since they are already present value calculations, it's a simple way to look at discounted cash flow of current contracts.

Then investors will have to adjust for future growth, risks of the company making poor investments, etc.

It's an unusual one for me. I'm used to looking at companies that don't have 20 year contracts on cash flow, but are more like Tesla or Apple, and just sell products in-quarter and generate earnings. I'm probably in very good company here, so let's figure this out together.�

1/1/2015

guest My understanding of retained value is that it goes beyond the contracts that have been signed with the current customers (of 20 years) and assumes that 90% of those customers will remain in the lease terms for another 10 years, which can add 29% or so over the value of the contracts signed. I would have preferred that the company calculated retained value as the value that they have actually signed people up for (20 years) and not included a speculative portion- that way there would be unexpected pleasant upside in 20 years. When I think of their retained value, i drop it by a third for the above reason.

Since demand doesn't seem to be a problem now, it seems that money to pay for installations or the number of crews installing each day are the limiting factors. To me, the fact that the quarter will be cash flow negative isn't a problem unless it prevents them from installing booked systems because there isn't enough money.�

1/1/2015

guest Adding customers to the backlog isn't necessarily a healthy indicator. In a rapid growth environment it needs to be considered together with the average time metric between booking and deployment.�

1/1/2015

guest I reached out to Investor Relations at one point and I got an answer very much in-line with what you are saying. But here is my beef with this: looking at the latest 10Q document, Balance Sheet on page 3, they already have a line item saying "Solar energy systems, leased and to be leased � net" with $2Bln as asset. So it makes me think that the future revenue is already recorded as asset. So I am missing the connection when you/investor-relations says that value will flow into earnings over time and then land's into assets. To me it feels like its already in assets.

I understand retained value intuitively. I am just unable to put it together with any of the financial statements.

I have access to two research reports. Both of them strongly support valuation through retained value.

1) JP Morgan - direct quote from latest report - "We believe retained value is the most appropriate way to value this stock since it provides a present value of future cash flows on a net basis."

2) Raymond James -direct quote from latest report - The #1 question we�ve heard from investors as part of our coverage of SolarCity over the past year and a half surrounds the �right� valuation method and how to think about the many variables. To state the obvious, SolarCity will not have positive earnings, or even EBITDA, anytime soon. A revenue multiple is theoretically viable, but we agree with management that a discounted cash flow (DCF) approach is the most relevant one. The starting point for DCF is the metric entitled �retained value based on discounted forecast of net cash to SolarCity�: $1.80 billion as of 2Q14.

So everything points to saying that Retained Value is the best way to look at this company. I only wish I can better understand it's connection to 'shareholder equity' as they both seem to imply the same concept.�

1/1/2015

guest I completely agree that retained value is the best way to look at this company, but how this translates into stock price is the big question. It is possible for this metric to be the best way to value the company, and simultaneously be overvaluing the retained value.

What if the value of the solar energy systems, leased and to be leased, is the cost of building the system, and different from the retained value: the retained value would be the money that then comes in from the system?�

1/1/2015

guest SolarCity reports both numbers actually. A pure contract value and the one with speculated future renewal.

For the previous quarter - see deck, page 10

Retained Value under Energy Contract - $840 mln

Total Retained Value (with renewal) - $1,291 mln

For the latest quarter - see deck, page 11

Retained Value under Energy Contract - $1,245 mln

Total Retained Value (with renewal) - $1,804 mln

So just with a mere quarter lag the pure retained value grew to be as much as the total retained value. I can afford to stay 3months longer in the stock for the desired Retained Value �

�

1/1/2015

guest Morgan Stanley initiated SolarCity (SCTY) coverage with Equal-Weight and target $92�

1/1/2015

guest First, thanks for the quotes from the two reports. I'd love to read them if you can send them to me, dropbox them, whatever.

Second - and I have not fully explored this yet, but I think the assets you are seeing are the result of SolarCity actually owning the equipment they've installed on people's roofs. This asset has a value, and there is something on the liability/equity side of the balance sheet to offset this because they had to raise the cash to build these systems somehow, which is an ongoing issue.

Imagine you and I started a business putting vending machines in stores. We have to buy the machines, and we own them. They sit as an asset on our balance sheet. Say the stores have 20 year contracts with us so we know the $5k machine is going to return $20k over its life. We generate the money up over that period of time, but the asset sits on our balance sheet (and is depreciated) right from the start.

Make more sense? I hope that's an adequate explanation.

- - - Updated - - -

Does anyone actually have full PDFs of analyst coverage reports? I used to have easy access to these when I was a sell side analyst but I exited the biz a few years ago. I'd love to read some of the reports. Usually they focus on the short term, but the initiation pieces are often full of useful info.�

1/1/2015

guest That makes complete sense. Thanks for explaining this out. I have been looking for this answer since a while. Really appreciate it.

After looking at this enough, I see that Retained Value is really the only real way to value this company. It totally explains why management chose to highlight this metric in quarterly presentations.

Unfortunately the source that I read those two reports from has become completely uptight about redistribution. But I have some good news which I just remembered.

Deutsche Bank released a very elaborate initiation report in Jan. It's 63 pages long and is quite comprehensive. You can get a copy of it by going to dbresearch.com -> Contact link at the top -> fill out the form. They usually respond back in a few days. The title of the report is "Still Early Innings of Distributed Generation Era; Initiating with a BUY" written by Vishal Shah published 15 January 2014.

If you want faster response, drop me your email id in a private message.

They have somewhat of an elaborate model for valuation but at the bottom of it, it still is based on Retained Value.

- - - Updated - - -

There are quite a number of skeptics who question the 6% usage for the NPV calc of Retained Value. Here is an interesting tidbit from the Deutsche Bank report:

�

1/1/2015

guest With all the back and forth comments on owning vs. leasing months ago, thought this was an excellent article: Would You Rather Own or Lease Your Rooftop Solar?

�

1/1/2015

guest +1. Well-balanced article.�

1/1/2015

guest I expect cost of the systems to go up over time (if not stay steady). It's very unlikely they will go further down over the course of years. My reasons are

1) More EV driving will mean greater electricity needs. My very rough guess is that an EV doubles the system size for an average user.

2) As net-metering gets pared down, or alternative means of charging solar users for grid usage gains traction, batteries will become an inevitable solution. So adding in the cost of batteries will increase the overall system cost.

As long as SolarCity is able to lower electricity prices (including everything: panels, batteries, grid connection fees etc), they will be able to continue to grow at a very rapid pace. That's what Musk says too.

One can argue that if consumer lending of solar systems grows rapidly then more people might be interested in financing. But I'd contend, given SolarCity's scale, their financing costs would be lower than that of consumers. Same holds with respect to everything else: cost of panels, labor costs, pretty much everything else. Scale should enable them to be the lowest cost provider and still be reasonably profitable. Sort of like becoming the WalMart of Solar.. Ofcourse, SolarCity is not there yet. But the objective is to get there. Meanwhile keep picking the low hanging fruit and continue to expand scale (sort of same exact thing Tesla is doing).�

1/1/2015

guest Interesting that this rating isn't shown on BBG.

just had a look at <ANR>. The ratings/PTs are in descending order.

Roth Capital - buy - $98

Credit Suisse - outperform - $97

GS - buy/attractive - $96

Cannacord - buy - $95

Deutsche Bank - buy - $90

Baird - neutral - $83

JPM - overweight - $83

Raymond James - outperform - $80

all PTs published between 08/08 and 08/21 !�

1/1/2015

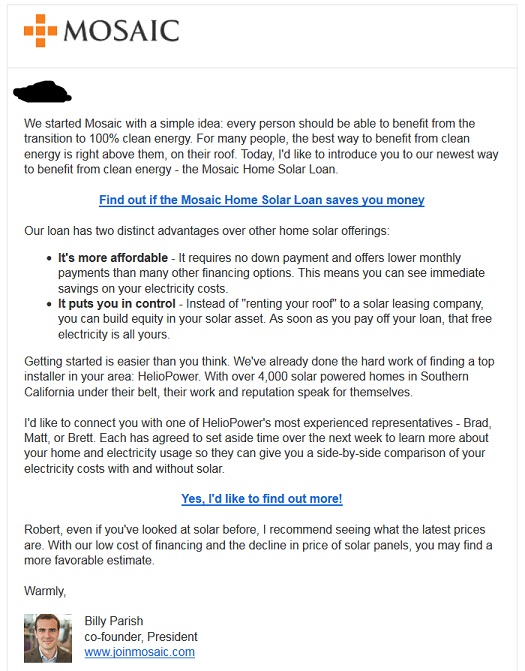

guest Mosaic now doing direct lending for home solar installations. Targeting "solar leasing companies", whomever they might be :wink:

�

�

1/1/2015

guest Thank you for the full page ad. They have been doing this since a few years and their scale seems to be barely in the order of a few million dollars.

Mosaic Inc. - Wikipedia, the free encyclopedia.

This should give Mosaic a run for their money

SolarCity to Introduce Solar Financial Products for Individuals, Institutions of All Sizes | SolarCity�

1/1/2015

guest Not an ad, I should have provided more info. I received this in an e-mail yesterday. Thought that I would post it here to let everyone know that Mosaic is making this push. I have invested in the solar crowd funding model that Mosaic uses for maybe a bit over a year. Currently a small amount in three different properties. Not being able to put up solar panels myself, I wanted to be able to help make it happen in any case, and the return is about 4.5% on the funds invested. I believe that their lending to homeowners directly is a new activity for them. Preciously, they pooled investors money to put in solar installations in various facilities.

RT�

1/1/2015

guest Interesting that for such a volatile stock, SCTY has traded essentially flat around $70 for 2.5 months. Anyone who follows it closely care to comment on this current stability?�

1/1/2015

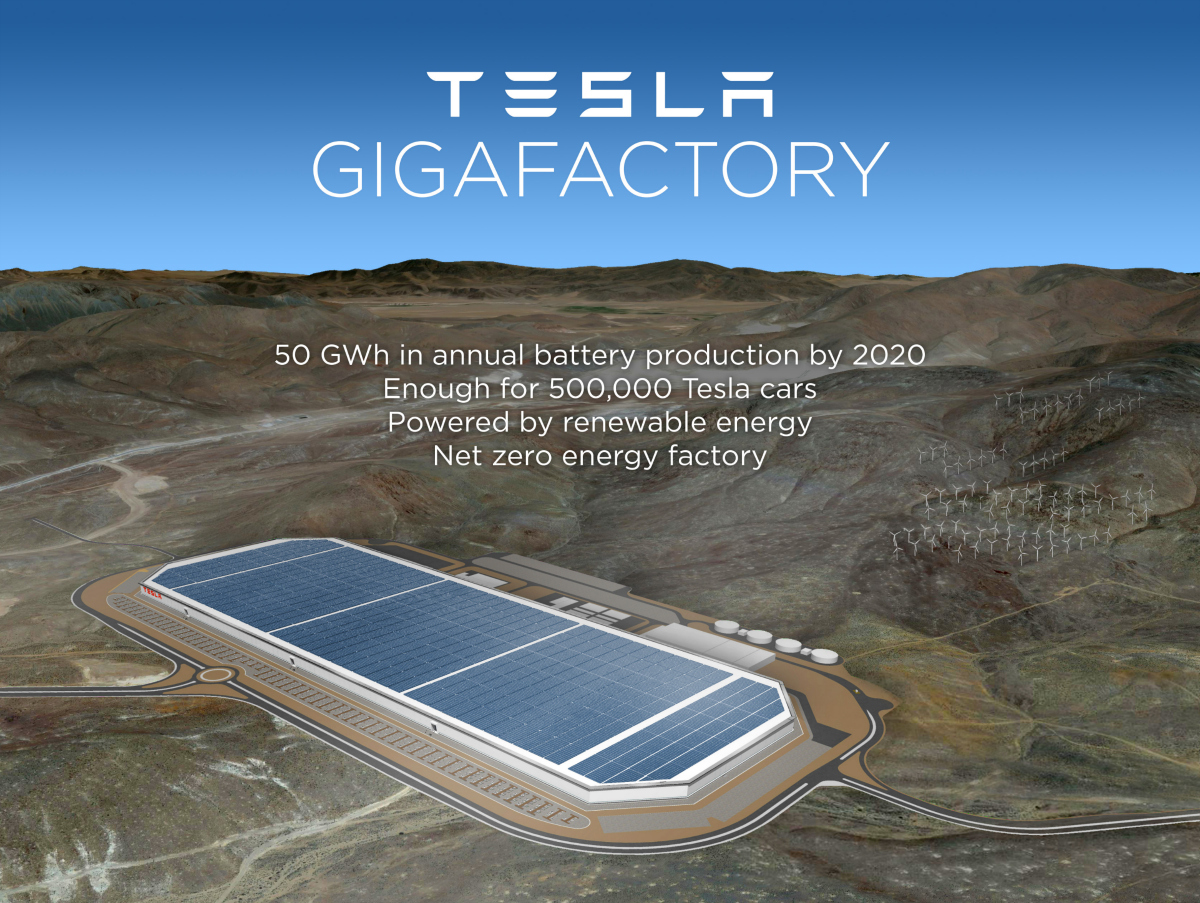

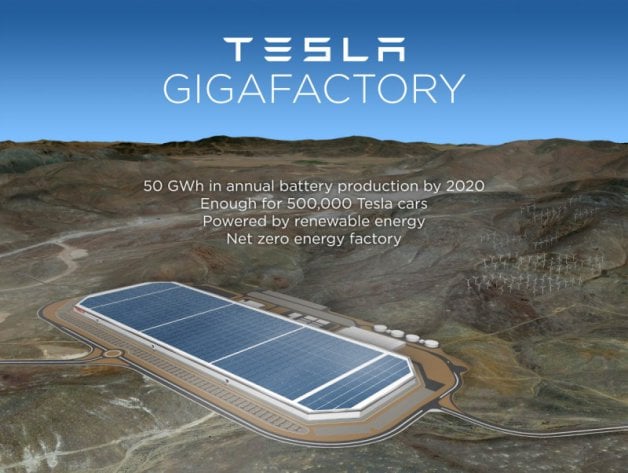

guest a lot of scty solar panels on the roof

�

�

1/1/2015

guest why is there wind energy on the hill? Who even supplies wind energy that tesla would tap into? If they have that many solar panels, why go for a wind farm?�

1/1/2015

guest Simplistic answer, wind still works after sunset.

We can debate the cost/benefit, but one fact remains, wind is 24x7 to some , ehem, degree. (no pun intended.)�

1/1/2015

guest STCY two new PTs

here we go.�

1/1/2015

guest SCTY is up over 5% during mid-session today, despite the overall market being down. Any ideas why?�

1/1/2015

guest My guess is GF bill passage in Nevada.�

1/1/2015

guest http://www.streetinsider.com/Corporate+News/SolarCity+(SCTY)+Amends+Silevo+Merger/9826394.html�

1/1/2015

guest They'll use solar, wind and geothermal. I'm sure that the rooftop won't supply them with enough energy.�

1/1/2015

guest Especially at night.�

1/1/2015

guest Well, I figured they might be able to rig up some battery storage to help with that. It's the total power generation from the rooftop solar that's the big problem.

- - - Updated - - -

Probably, but not necessarily. This will be a large industrial installation for a power-hungry facility in the middle of a very sunny desert, so they could consider favoring more expensive high efficiency panels over cheaper SCTY ones.�

1/1/2015

guest Might best hold off on such conjecture until we learn the specs. of the panels their new acquisition, Silevo, put forth.�

1/1/2015

guest What's to prevent SolarCity from obtaining or producing top quality solar panels for the huge industrial project of a related company?�

1/1/2015

guest I think it's the fact that trina solar said that they have overwhelming demand and can't meet it. All solars liked that.�

1/1/2015

guest This morning it has been announced that SolarCity will be added to the NASDAQ Q-50 Index prior to the market open next Monday, September 22. The index is designed to track the performance of securities that are next-eligible for inclusion into the NASDAQ 100 Index.

Link: http://www.nasdaq.com/press-release/quarterly-changes-to-the-nasdaq-q50-index-20140915-00181�

1/1/2015

guest Any idea why SCTY is tracking down with TSLA this morning?�

1/1/2015

guest The market.�

1/1/2015

guest Link to this morning's article on SolarCity website: New SolarCity Product Makes it Possible for Businesses to Significantl

New SolarCity Product Makes it Possible for Businesses to Significantly Increase Solar Output From Each Rooftop

8:00a ET September 16, 2014 (GlobeNewswire)

SolarCity (Nasdaq:SCTY) unveiled a new product in its Zep Solar line of solar products today--a flat roof solar mounting solution that is twice as fast to install and can generate significantly more solar electricity from each rooftop than alternatives for the commercial market. ZS Peak makes it possible for far more businesses, schools and other organizations to install solar power on their buildings and immediately pay less for solar electricity than they pay for utility power, and will significantly expand the addressable market for commercial solar.

Like the revolutionary Zep residential solar systems, ZS Peak provides an innovative snap-together system to simplify and accelerate installation. SolarCity estimates that ZS Peak can increase generation capacity on flat roof buildings by 20-50 percent per building and do so without requiring any penetrations. The system's dense, east-west layout structure will allow SolarCity to fit up to 20 percent more solar panels on standard roofs and up to 50 percent more panels on lightweight roofs, such as those commonly found on warehouses. The increase in panels per roof is particularly valuable in the commercial market, as conventional flat-roof solar systems typically power less than half of a commercial building's load.

ZS Peak's east-west orientation not only allows installers to fit more solar panels on each roof than standard south-facing systems, it also captures peak power production throughout a longer period of the day. By lengthening power production time and eliminating the typical mid-day spike of standard solar systems, SolarCity can also make more efficient use of solar inverters to further reduce costs for customers. ZS Peak has so significantly improved on the aerodynamics of conventional systems that it can be installed as a lightweight, non-penetrating system on many roofs that would otherwise require the solar panels to be bolted down.

SolarCity is currently installing its first project with ZS Peak and expects to begin installing the product in volume in January. Businesses and other organizations interested in SolarCity's services can contact the company directly at 1-888-SOL-CITY (1-888-765-2489) for a free, no-obligation solar consultation or visit SolarCity online.�

1/1/2015

guest Thanks for posting that SC press release. I would love that system on my house roof. It would be perfect because it is non-penetrating and lightweight. SC won't install on my roof because it has a 1.5" hard polyurethane foam layer with an elastomeric top coat, supported by 2x4" tongue-in-groove and 4x10" beams on a 6' spacing. SC says they don't want to deal with foam roofs because they might leak even though I've offered to sign a liability release. They also said (this was just last month) that their mounting system was not compatible with my roof structure, even though earlier this year they had installed a PV system on a neighbors roof that is the same structural type as mine (but not the same top surface).�

1/1/2015

guest You're welcome. Oh my, and you live in the same town as SolarCity. I got the impression that this new system is only for business customers. Perhaps if you keep knocking on their door, they will relent and accept you as a customer.

Meanwhile, it appears that the system is what could win the bidding to install solar panels on Tesla Motors' huge battery factory being built in Nevada. Of course the fact that the two companies share the same board chairman is helpful.

�

�

1/1/2015

guest This energy storage system put up today in NE Germany just made the news on ZDF, the link from the TV channel:

Startseite - ZDF Mediathek

WEMAG AG - Batteriespeiche

�

1/1/2015

guest Another interesting article

Musk Solar Strategy Used as Model for Record Investments - Bloomberg

Can be viewed through bull eyes or bear eyes�

1/1/2015

guest SCTY price action makes no sense to me, it went down with tsla yesterday, today stays down even tsla jumped.�

1/1/2015

guest MarketWatch Bulletin

NASA awards $6.8 bln contract to Boeing, SpaceX to send astronauts into space

09/16/2014 04:14:29 PM

_____________________________

I realize it is not a direct SolarCity story, but any positives for a Musk related enterprise can be helpful.

- - - Updated - - -